UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| x | | Soliciting Material under Rule 14a—12 |

Trade Street Residential, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a—6(i)(1) and 0—11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0—11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | (5) | | Total fee paid: |

| ¨ | | Fee paid previously with preliminary materials: |

| | |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or |

| | (1) | | Amount Previously Paid: |

| | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | (3) | | Filing Party: |

| | |

| | (4) | | Date Filed: |

| | |

December 2013

2 This presentation has been prepared by Trade Street Residential, Inc . (“the “Company” or ‘Trade Street”) solely for informational purposes based on its own information, as well as information from public sources . This presentation has been prepared to assist interested parties in making their own evaluation of the Company and does not purport to contain all of the information that may be relevant . In all cases, interested parties should conduct their own investigation and analysis of the Company and the data set forth in this presentation and other information provided by or on behalf of the Company . Except as otherwise indicated, this presentation speaks as of the date hereof . The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof . Certain of the information contained herein may be derived from information provided by industry sources . The Company believes that such information is accurate and that the sources from which it has been obtained are reliable . The Company cannot guarantee the accuracy of such information, however, and has not independently verified such information . This presentation contains forward - looking statements . You can identify forward - looking statements by the use of forward - looking terminology such as “ believes, ” “ expects, ” “ may, ” “ will, ” “ will likely result, ” “ would, ” “ could, ” “ should, ” “ seeks, ” “ intends, ” “ plans, ” “ projects, ” “ estimates, ” “ anticipates ” “ predicts, ” or “ potential ” or the negative of these words and phrases or similar words or phrases . You can also identify forward - looking statements discussions possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives . Statements regarding the following subjects are forward - looking by their nature ; our business and investment strategy ; our expected operating results ; completion of acquisitions ; our ability to successfully implement proposed acquisition, lease and management structures ; our ability to obtain future financing arrangements ; our expected leverage levels ; our understanding of our competition ; market and industry trends and expectations ; anticipated capital expenditures ; and use of the net proceeds of this offering . Additionally, the following factors could cause actual results to vary from our forward - looking statements : general volatility of the capital markets and the market price of our common stock ; performance of the multifamily sector and real estate industries in general ; changes in our business or investment strategy ; changes in market conditions within the multifamily sector and the availability of multifamily acquisitions ; our ability to satisfy closing conditions and obtain regulatory, lender and other rulings, approvals and consents ; availability, terms and deployment of capital ; availability of and our ability to attract and retain qualified personnel ; our leverage levels ; our capital expenditures ; our ability to satisfy the requirements for qualification and taxation as a REIT for federal income tax purposes ; changes in our industry and the market in which we operate, interest rates or the general U . S . or international economy ; and the degree and nature of our competition . The forward - looking statements contained in this presentation reflect our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us . These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us . If a change occurs, our business, prospects, financial condition, liquidity and results of operations may vary materially from those expressed in our forward - looking statements . You should carefully consider all risks before you make an investment decision with respect to our common stock . We disclaim any obligation to publicly update or revise any forward - looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes . This communication is being made in respect of the proposed backstopped rights offering (the “rights offering”) and direct eq uit y investment involving the Company and certain affiliates of Senator Investment Group LP (“Senator”). The Company has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC ”) for the rights offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more com ple te information about the Company and the rights offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov . Alternatively, the Company will arrange to send you the prospectus if you request it by calling 1 - 786 - 248 - 5200. The registration statement relating to the rights offering has not yet become effective and no securities may be sold nor may of fers to buy be accepted prior to the time the registration statement becomes effective. The Company intends to commence the rights offering promptly after the registration statement has been declared effective by the SEC . The terms and conditions of the rights offering will be made available to the Company’s stockholders once the rights offering has commenced. The Company has not yet set a record date for the rights offerin g. A copy of the prospectus relating to the rights offering meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and additional materials relating to the rights offering will be mailed to stockholders of record of the Company shortly after the record date. Stockholders will then also be able to obtain a copy of the prospectus from the subscription agent for the rights offering. This presentation does n ot constitute an offer to sell or the solicitation of an offer to buy the securities discussed herein, and there shall not be any offer, solicitation or sale of these securities in any state in which such offer, solicitation or sal e would be unlawful prior to registration or qualification under the securities laws of any such state. In connection with the proposed transaction, the Company has filed with the SEC, but not yet distributed to stockholders, a p rel iminary proxy statement and will mail or otherwise disseminate the proxy statement and a form of proxy to its stockholders when it is finalized. Stockholders and investors are encouraged to read the proxy statement (a nd other relevant materials) regarding the proposed transaction carefully and in its entirety when it becomes available, and before making any voting decision, as it will contain important information about the transact ion . Stockholders and investors will be able to obtain a free copy of the proxy statement, when available, as well as other filings made by Company regarding Trade Street Residential, Inc. and the proposed transaction at the SEC's website at http://www.sec.gov and the Company's website at www.tradestreetresidential.com . Additionally, the Company and its directors and executive officers may be deemed, under SEC rules, to be participants in the sol icitation of proxies from the Company’s stockholders with respect to the approval by stockholders of the issuance of shares of the Company’s common stock to Senator pursuant to that certain Standby Purchase Agr eem ent between the Company and Senator. Stockholders may obtain information regarding the names, affiliations and interests of such individuals in the Company's registration statement on Form S - 11 and pre liminary proxy statement filed in connection with the proposed transactions filed with the SEC on November 12, 2013. These documents may be obtained free of charge from the SEC's website at www.sec.gov and the Compan y's website at www.tradestreetresidential.com. Forward Looking Statements and Other Disclosures

3 Overview of Capital Raise Issuer Trade Street Residential, Inc. / NASDAQ Ticker: TSRE Total Capital Raise $150 million consisting of: » A rights offering of $ 100 million to existing shareholders (the “Rights Offering”) and » A private placement of $ 50 million of common equity to investment entities managed by Senator Investment Group LP (the “Direct Purchase”) Subscription Rights Existing stockholders will receive subscription rights, at no charge, to purchase 1.3775 shares, at each holders’ election, of the Company’s common stock for each share currently owned. These rights will be transferrable and subject to o ver - allotment privileges as discussed in the S - 11 Common Stock Price for Rights Offering and Direct Purchase $6.33 per whole share, payable in cash (the “Common Stock Price”) Backstop Commitment The Rights Offering will be fully backstopped by investment entities managed by Senator Investment Group LP pursuant to a Standby Purchase Agreement (the “Backstop”) Management Participation Michael Baumann and David Levin agree to participate on a share for share basis in the Rights Offering at the Common Stock Price based on the amount of common equity that each individual owns Use of Proceeds Committed property acquisition pipeline Repayment of certain indebtedness General corporate purposes and future acquisitions Timing The Backstop and Direct Purchase are subject to approval by the Company’s stockholders and satisfaction of certain customary closing conditions. The Rights Offering and Direct Purchase are expected to close early in the first quarter of 2014

4 The proceeds of the offering will be used for the following key purposes: Sources and Uses Estimated Sources and Uses ($ in thousands) » Property acquisition pipeline » Repayment of certain indebtedness » General corporate purposes, including future acquisitions (1) Includes anticipated prepayment costs Post rights offering, the Company will have approximately $81.3 million of unencumbered assets as well as approximately $10.3 million of cash from dispositions which it could use selectively for acquisitions Rights Offering 100,000$ Private Placement 50,000 Cash offering expenses (2,500) Net Proceeds 147,500 Payoff variable rate debt (1) (29,967) Paydown identified asset debt (1) (16,575) Cash for pipeline acquistions (99,179) Remaining for general corporate purposes 1,779$

5 Allows current common equity holders to participate in the transaction while providing certainty of execution through Senator’s Backstop Commitment » Existing stockholders will receive subscription rights, at no charge, to purchase 1 . 3775 shares, at each holders’ election, of the Company’s common stock for each share currently owned » Certain members of management are participating in the Rights Offering further aligning management with all shareholders Proceeds from rights offering fund the existing acquisition pipeline and repay indebtedness » The Company intends to partially use the proceeds to fund the cash component of three acquisitions under contract, which will reduce the weighted average age of the portfolio to 11 years Significantly improves the Company’s balance sheet and financial flexibility » On a pro forma basis, the Company will have a weighted - average debt maturity of 9 years and a weighted average interest rate on debt of 4 . 1 % ( 1 ) » Debt will be comprised 94 % of fixed rate debt and 6 % of floating rate debt ( 1 ) » Minimal near - term debt repayment requirements (including amortization) until 2018 and beyond » Creating a strong balance sheet to withstand market cycles Improves coverage ratios and other leverage metrics Places capital on the balance sheet to fund future growth Transaction Rationale (1) As of September 30, 2013, on a pro forma basis after giving effect to the Rights Offering Transaction and the use of the net pro ceeds therefrom

6 Experienced multifamily management team with extensive market knowledge Differentiated multifamily REIT business model focused on SE mid - sized markets Stable current portfolio performance Strong internal and external growth opportunities Attractive in - place long - term indebtedness with minimal near - term maturity Disciplined underwriting and risk management expertise Investment Highlights

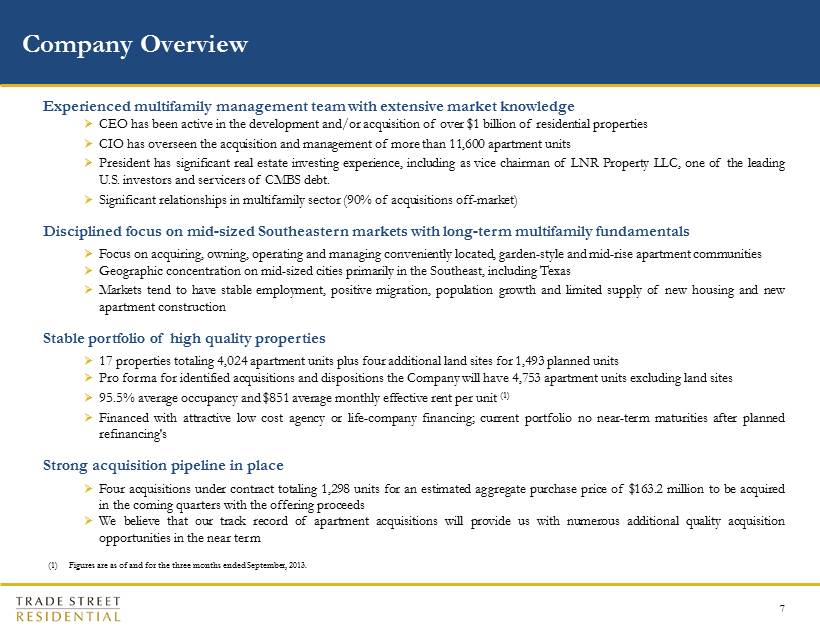

7 Experienced multifamily management team with extensive market knowledge » CEO has been active in the development and/or acquisition of over $ 1 billion of residential properties » CIO has overseen the acquisition and management of more than 11 , 600 apartment units » President has significant real estate investing experience, including as vice chairman of LNR Property LLC, one of the leading U . S . investors and servicers of CMBS debt . » Significant relationships in multifamily sector ( 90 % of acquisitions off - market) Disciplined focus on mid - sized Southeastern markets with long - term multifamily fundamentals » Focus on acquiring, owning, operating and managing conveniently located, garden - style and mid - rise apartment communities » Geographic concentration on mid - sized cities primarily in the Southeast, including Texas » Markets tend to have stable employment, positive migration, population growth and limited supply of new housing and new apartment construction Stable portfolio of high quality properties » 17 properties totaling 4 , 024 apartment units plus four additional land sites for 1 , 493 planned units » Pro forma for identified acquisitions and dispositions the Company will have 4 , 753 apartment units excluding land sites » 95 . 5 % average occupancy and $ 851 average monthly effective rent per unit ( 1 ) » Financed with attractive low cost agency or life - company financing ; current portfolio no near - term maturities after planned refinancing's Strong acquisition pipeline in place » Four acquisitions under contract totaling 1 , 298 units for an estimated aggregate purchase price of $ 163 . 2 million to be acquired in the coming quarters with the offering proceeds » We believe that our track record of apartment acquisitions will provide us with numerous additional quality acquisition opportunities in the near term Company Overview (1) Figures are as of and for the three months ended September, 2013.

8 Multifamily Fund Investor Publicly Traded REIT March 2008 Formation of Trade Street Property Fund I, which invests in development, redevelopment and acquisitions of real estate projects in the Southeast July 2003 Formation of BCOM Real Estate Fund, which invests in high quality multifamily residential and mixed use properties in the Southeast Company History 2003 - 2011 2012 - 2013 May 2013 Completion of $63.5mm Initial Public Offering of Trade Street Residential (NASDAQ: TSRE) June 2012 Reverse merger and asset contribution of Trade Street Property Fund I and BCOM Real Estate Fund into Feldman Mall Properties (PINK: FMLP) November 2013 Announcement of $100.0 million backstopped rights offering to existing investors and $50.0 million common equity investment by investment entities managed by Senator Investment Group LP

9 Experienced and Proven Leadership • Michael Baumann • Chairman & CEO • 25 years experience » Founder and CEO – Trade Street Residential, Inc . » Active in the development and/or acquisition of over $ 1 billion residential properties » B . A . – University of Miami ; Juris Doctorate – South Texas College of Law » CFO – Trade Street Residential, Inc . » CFO – Branch Properties, LLC ( 13 years) » Certified Public Accountant and Certified Financial Planner » CIO – Trade Street Residential, Inc . » Active in approximately $ 1 . 4 billion of acquisitions representing in excess of 11 , 600 units » B . S . – Liberty University • Richard Ross • CFO • 30 years experience • Ryan Hanks • CIO • 10 years experience • Heather Straub • Director, Property Operations • 20 years experience » Director, Property Operations – Trade Street Residential, Inc . » VP of Operations – Riverstone Residential Group and The Bainbridge Companies » Experience in managing upwards of 10 , 000 units Over 100 years of combined multifamily investment and operating experience • David Levin • President & Vice Chairman • 30 years experience » President and Vice Chairman (Board Member) – Trade Street Residential, Inc . » Vice Chairman at LNR Property, LLC and managed the Miami real estate investment and asset management division for Lennar Corp . (NYSE : LEN) » Former Managing Director and department co - head of Bear Sterns RE Group Picture to follow

10 0 100 200 300 400 500 600 700 800 Multifamily Permits (in thousands) Several ongoing demographic, fiscal and social trends support a strong multifamily sector, including : » Decrease in home ownership rates » Increase of the Echo Boomer effect » Limited new supply in target markets These favorable economic and demographic conditions led to the following : » Multifamily industry experienced historically low vacancy levels » Ability to raise rents at higher rates than inflation U.S. Population Ages 20 - 34 Population ages 20 - 34 Multifamily Building Permits Source: U.S. Census Bureau 60.0 62.0 64.0 66.0 68.0 70.0 Home Ownership Rate (%) Home Ownership Rate Source: U.S. Census Bureau Attractive Multifamily Industry Dynamics Demand Drivers Limited Supply Homeownership Rates Echo Boomer Population Source: US Census Bureau 30,000,000 35,000,000 40,000,000 45,000,000 50,000,000 55,000,000 60,000,000 65,000,000 70,000,000 Source: US Census Bureau Source: US Census Bureau

11 Talison Row Charleston, SC Estates at Millenia Orlando, FL Creekstone at RTP Durham, NC • Portfolio Highlights Fountains Southend Charlotte, NC Portfolio Highlights

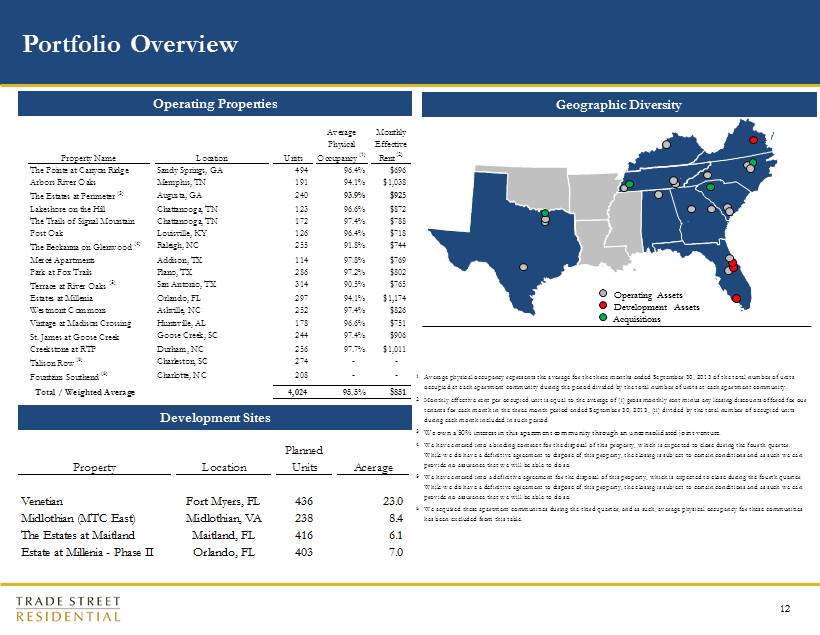

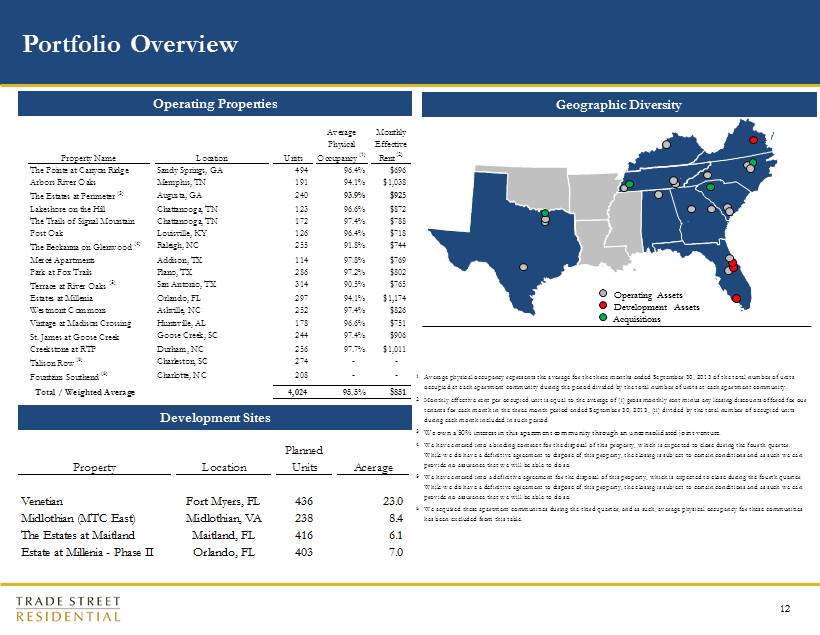

12 Operating Properties Development Sites Operating Assets Development Assets Acquisitions Portfolio Overview Geographic Diversity Location Planned Units Acerage Venetian Fort Myers, FL 436 23.0 Midlothian (MTC East) Midlothian, VA 238 8.4 The Estates at Maitland Maitland, FL 416 6.1 Estate at Millenia - Phase II Orlando, FL 403 7.0 Property 1 2 3 4 5 6 We have entered into a definitive agreement for the disposal of this property, which is expected to close during the fourth quarter. While we do have a definitive agreement to dispose of this property, the closing is subject to certain conditions and as such we can provide no assurance that we will be able to do so. We acquired these apartment communities during the third quarter, and as such, average physical occupancy for these communities has been excluded from this table. Average physical occupancy represents the average for the three months ended September 30, 2013 of the total number of units occupied at each apartment community during the period divided by the total number of units at each apartment community. Monthly effective rent per occupied unit is equal to the average of (i) gross monthly rent minus any leasing discounts offered for our tenants for each month in the three month period ended September 30, 2013, (ii) divided by the total number of occupied units during each month included in such period. We own a 50% interest in this apartment community through an unconsolidated joint venture. We have entered into a binding contract for the disposal of this property, which is expected to close during the fourth quarter. While we do have a definitive agreement to dispose of this property, the closing is subject to certain conditions and as such we can provide no assurance that we will be able to do so. Property Name Location Units Average Physical Occupancy (1) Monthly Effective Rent (2) The Pointe at Canyon Ridge Sandy Springs, GA 494 96.4% $696 Arbors River Oaks Memphis, TN 191 94.1% $1,038 The Estates at Perimeter (3) Augusta, GA 240 93.9% $925 Lakeshore on the Hill Chattanooga, TN 123 96.6% $872 The Trails of Signal Mountain Chattanooga, TN 172 97.4% $788 Post Oak Louisville, KY 126 96.4% $718 The Beckanna on Glenwood (4) Raleigh, NC 255 91.8% $744 Mercé Apartments Addison, TX 114 97.8% $769 Park at Fox Trails Plano, TX 286 97.2% $802 Terrace at River Oaks (5) San Antonio, TX 314 90.5% $765 Estates at Millenia Orlando, FL 297 94.1% $1,174 Westmont Commons Ashville, NC 252 97.4% $826 Vintage at Madison Crossing Huntsville, AL 178 96.6% $751 St. James at Goose Creek Goose Creek, SC 244 97.4% $906 Creekstone at RTP Durham, NC 256 97.7% $1,011 Talison Row (6) Charleston, SC 274 - - Fountains Southend (6) Charlotte, NC 208 - - Total / Weighted Average 4,024 95.5% $851

13 Maintain disciplined focus on target markets » Disciplined investment focus on mid - sized cities and suburban submarkets of larger cities » Geographies with strong economic and demographic drivers, reduced competition from larger multifamily REITs and limited supply of new housing and apartment construction Hands - on approach to property management » Internally managed and “hands - on” approach to property management » Tight cost controls Allocate capital efficiently through disciplined acquisition program and strategically recycling capital » Increase scale in current markets and create new footholds in favorable markets » Focus on portfolio impact (e . g . , property management improvements, branding or cross - selling opportunities) » Target acquisition profile : $ 10 to 50 million, 150 to 500 units, less than 10 years old, high stabilized yields » Exit non - strategic markets and sell older, fully stabilized assets » Recycle proceeds to upgrade asset base and decrease portfolio age Selectively pursue development » In - house oversight team with extensive experience and proven execution in development and leasing » JV development structure allows developer to control project and transfer property to Company upon stabilization Maintain a conservative balance sheet with sufficient flexibility for growth Go - Forward Business Strategy Create a collection of high - quality assets providing consistent, growing cash flow

14 Domestic migration trends show Southeastern U . S . states experiencing the most drastic increases over the last ten years, as well as the most recent year - over - year comparison » Majority of our target markets » Plan for continued growth within these markets Positive net migration brings many benefits to the local economy : » Larger workforce » Diversification of skill sets » Institutional and government spending Focus on markets with strong employment drivers that demonstrate the following characteristics : » Recent corporate relocation » Newly built production plants/facilities » Established Fortune 500 companies » Non - service dependent markets » Attractive state income taxes Source: NewGeography.com / U.S. Census Bureau. * Blue bars indicate Trade Street target markets. Growing Target Markets Net Domestic Migration – 2001 to 2009* Net Domestic Migration – 2010 to 2011* - 200,000 400,000 600,000 800,000 1,000,000 1,200,000 - 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000

15 Miller Creek at Germantown Memphis, TN The Avenues at Craig Ranch McKinney, TX Acquisition Pipeline Estates at Wake Forest Wake Forest, NC Acquisition Pipeline Acquisition Pipeline (1) ($ in thousands) (1) No assurance can be given that these transactions will close. Planned acquisitions to be funded with offering proceeds and in dic ated debt (2) The Company has a loan commitment for Miller Creek and has agreed to terms with a lender with which it has an extensive track re cord for loans on Wake Forest and Craig Ranch Acquiring Class - A, institutional - quality assets that reduce the overall portfolio age to 11 years The Aventine Greenville Greenville, SC Pro Forma Required Anticipated Property Location Year Built Units Purchase Price Debt (2) Equity Closing Date Miller Creek at Germantown Memphis, TN 2013 330 43,750$ 26,250$ 17,500$ Q1 2014 The Estates at Wake Forest Wake Forest, NC 2013 288 37,250 18,625 18,625 Q1 2014 The Avenues at Craig Ranch McKinney, TX 2013 334 42,375 21,187 21,188 Q1 2014 The Aventine Greenville Greenville, SC 2013 346 41,866 - 41,866 Q1 2014 Total 1,298 165,241$ 66,062$ 99,179$

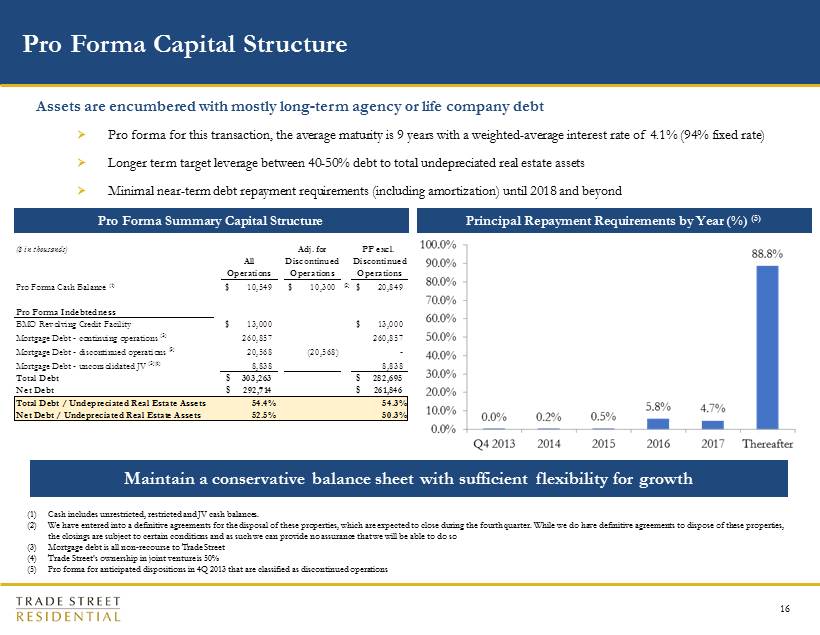

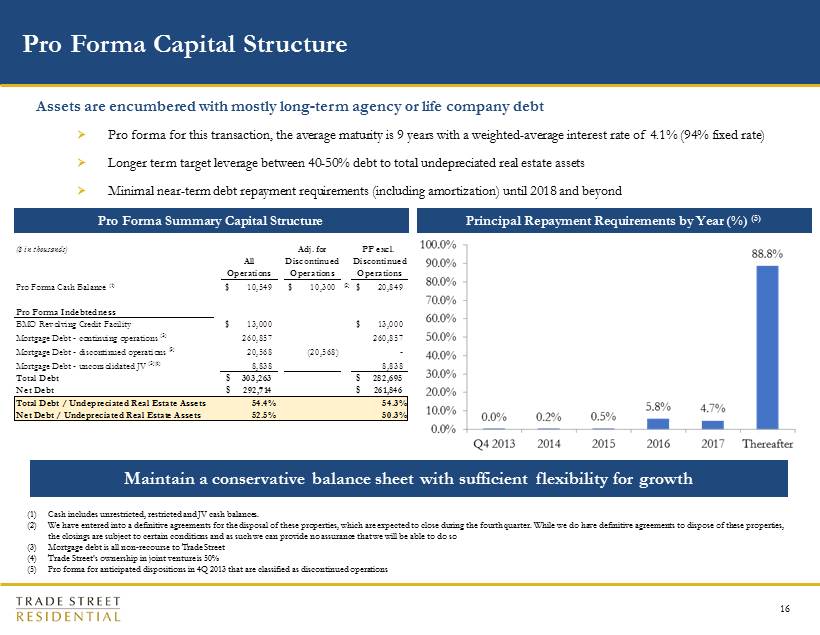

16 Assets are encumbered with mostly long - term agency or life company debt » Pro forma for this transaction, the average maturity is 9 years with a weighted - average interest rate of 4 . 1 % ( 94 % fixed rate) » Longer term target leverage between 40 - 50 % debt to total undepreciated real estate assets » Minimal near - term debt repayment requirements (including amortization) until 2018 and beyond Pro Forma Capital Structure Pro Forma Summary Capital Structure Principal Repayment Requirements by Year (%) (5) Maintain a conservative balance sheet with sufficient flexibility for growth (1) Cash includes unrestricted, restricted and JV cash balances. (2) We have entered into a definitive agreements for the disposal of these properties, which are expected to close during the fou rth quarter. While we do have definitive agreements to dispose of these properties, the closings are subject to certain conditions and as such we can provide no assurance that we will be able to do so (3) Mortgage debt is all non - recourse to Trade Street (4) Trade Street's ownership in joint venture is 50% (5) Pro forma for anticipated dispositions in 4Q 2013 that are classified as discontinued operations ($ in thousands) Adj. for PF excl. All Discontinued Discontinued Operations Operations Operations Pro Forma Cash Balance (1) 10,549$ 10,300$ (2) 20,849$ Pro Forma Indebtedness BMO Revolving Credit Facility 13,000$ 13,000$ Mortgage Debt - continuing operations (3) 260,857 260,857 Mortgage Debt - discontinued operations (3) 20,568 (20,568) - Mortgage Debt - unconsolidated JV (3)(4) 8,838 8,838 Total Debt 303,263$ 282,695$ Net Debt 292,714$ 261,846$ Total Debt / Undepreciated Real Estate Assets 54.4% 54.3% Net Debt / Undepreciated Real Estate Assets 52.5% 50.3%

17 Experienced multifamily management team with extensive market knowledge Differentiated multifamily REIT business model focused on SE mid - sized markets Stable current portfolio performance Strong internal and external growth opportunities Attractive in - place long - term indebtedness with minimal near - term maturity Disciplined underwriting and risk management expertise Investment Highlights

18 DRAFT