GREAT PANTHER SILVER LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR ENDED DECEMBER 31, 2012

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 1 |

TABLE OF CONTENTS

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 2 |

This Management’s Discussion and Analysis (“MD&A”) prepared as of March 13, 2013 reviews the financial condition and results of operations of Great Panther Silver Limited (“Great Panther” or the “Company”) for the year ended December 31, 2012, and other material events up to the date of this report. The information in this MD&A is as at March 13, 2013 unless otherwise indicated. The following discussion should be read in conjunction with the annual audited consolidated financial statements and related notes for the year ended December 31, 2012.

The financial data included in the discussion provided in this report has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. All dollar amounts are in Canadian dollars, unless otherwise noted.

This MD&A contains forward-looking statements and should be read in conjunction with the risk factors described in the “Risks and Uncertainties” and “Cautionary Statement on Forward-Looking Statements” sections at the end of this MD&A, as well as “Description of the Business – Risk Factors” in the Company’s Annual Information Form (“AIF”) for the year ended December 31, 2012.

This MD&A also makes reference to Cash Cost per Ounce, EBITDA, and Adjusted EBITDA. These are considered Non-IFRS Measures. Please refer to the Non-IFRS Measures section of this MD&A for an explanation of these measures and a reconciliation to the Company’s reported financial results.

PROFILE AND STRATEGY

Great Panther Silver Limited is a primary silver mining and exploration company listed on the Toronto Stock Exchange trading under the symbol GPR, and on the NYSE MKT trading under the symbol GPL. The Company's current activities are focused on the mining of precious metals from its two wholly-owned operating mines in Mexico, Topia and Guanajuato, the development stage San Ignacio Project as well as the exploration project El Horcon. The Company is also pursuing additional mining opportunities within Latin America, with the goal of adding to its portfolio of mineral properties.

All of Great Panther’s assets in Mexico are held through Minera Mexicana el Rosario, S.A. de C.V. (“MMR”), a wholly-owned subsidiary acquired in February 2004. In 2005, the Company incorporated Metalicos de Durango, S.A. de C.V. (“MDU”) and Minera de Villa Seca, S.A. de C.V (“MVS”). These two operating subsidiaries of the Company are responsible for the day-to-day affairs and operations of the Topia and Guanajuato Mines, respectively, through service agreements with MMR.

The Company’s Topia Mine is located in the Sierra Madre Mountains in the state of Durango in northern Mexico and produces silver, gold, lead and zinc. The Guanajuato Mine Complex is located in the city of Guanajuato, in central Mexico, approximately 380 kilometres north-west of Mexico City, and produces silver and gold. Each mine has its own processing facility with capacity to support future expansion.

Great Panther’s development stage property, the San Ignacio Project, is approximately 20 kilometres by road from its Guanajuato processing plant. The Company also owns two exploration stage properties: the Santa Rosa Project, which is located approximately 15 kilometres northeast of Guanajuato, and the recently acquired El Horcon Project, located 60 kilometres northwest of Guanajuato.

Goals and Objectives

Great Panther's mission is to become a leading primary silver producer by acquiring, developing and profitably mining precious metals in Latin America.

The Company’s primary goal is that of profitable growth, as management feels this is the key to maximizing long-term shareholder value. Management’s specific objectives are to grow production and earnings from existing mining operations and realize positive cash flow while continuing to actively pursue the acquisition of new mining operations and exploration and development opportunities in Latin America.

Great Panther is committed to achieving the highest standards in Corporate Social Responsibility for its operations at every stage of project development, from early stage exploration to mature mining operations. The Company recognizes that the ability to generate long-term value for shareholders is firmly rooted in the manner in which the Company conducts itself, how employees are treated, how the Company interacts with the communities in which Great Panther operates, and how the Company respects the environment.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 3 |

Great Panther is committed to working diligently with its stakeholders to achieve the responsible development of the Company’s projects and operations, and to contribute to the sustainable development of the communities in which the Company works.

Key Performance Drivers

Great Panther’s ability to continue to successfully achieve its goals of increasing production while generating positive cash flow is dependent on a number of factors. These factors are regularly measured and monitored, with timely feedback provided about progress toward achieving our goals. The Company’s key performance drivers are the following:

Volume

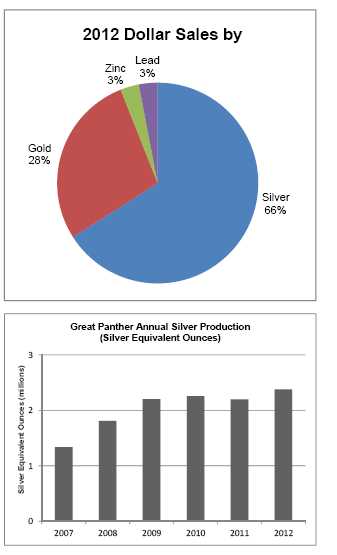

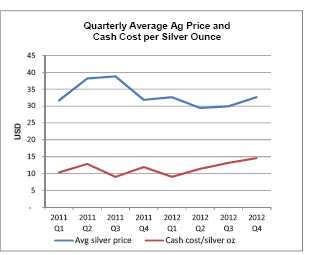

The Company operates two producing mines in Mexico -one in Guanajuato and the second in Topia. Since commencing operations at these two mines in 2006, Great Panther achieved continuous growth in metal production in excess of 20% per year until 2010 when the Company achieved record production of 2.3 million silver equivalent ounces (“Ag eq oz”).

For 2011, the Company increased mined and processed ore by 19%, however, final metal production was impacted by lower ore grades which limited metal production for the year to 2.2 million silver equivalent ounces. For 2012, Great Panther increased metal production by 8% to 2.4 million silver equivalent ounces, primarily by increased ore production and improved gold grades.

Fundamental to the growth in production is the increase in Mineral Resources through exploration of the mineralized zones in the existing mines and also through the exploration and/or acquisition of other projects. Great Panther is committed to seeking out new opportunities to grow and develop its business.

Resources

Definition of resources is essential to the future production capability of the Company. When Great Panther acquired its two mines in Mexico in 2005, there were no NI 43-101 compliant resources on either property. Over the past eight years, the Company has incurred $13.7 million and $18.3 million on mineral property exploration expenditures at Topia and Guanajuato, respectively, as it continues to build its internal and NI 43-101 compliant resources.

The Company plans approximately 30,000 metres of exploration drilling in 2013 to further define resources, look for vein extensions and test new targets.

For more details on the Company’s resources, refer to the “Resource and Exploration Update” section.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 4 |

Operating Costs

Attaining and maintaining a low unit operating cost structure has been critical to achieving profitability. Metal prices can be volatile as experienced through recent years. Having a low silver production cost base increases mine net earnings and allows the Company to remain profitable during times of low commodity prices.

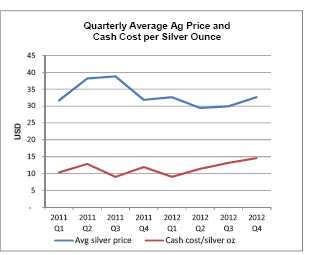

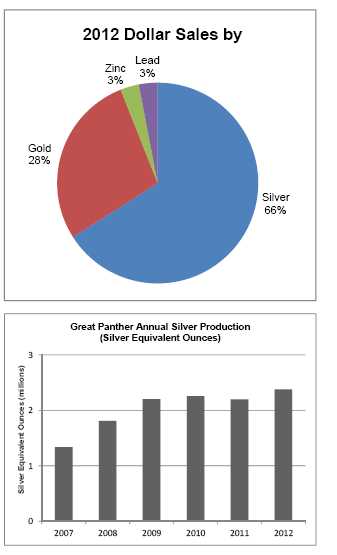

During 2012, the Company experienced an increase in unit operating costs per silver ounce produced relative to the prior year. The Company measures and reports these as cash cost per ounce of silver, net of by-product credits. Cash cost per ounce of silver is a common metric reported by companies in the mining industry however it is a non-IFRS measure.

The increase in cash cost per ounce of silver in 2012 was the result of an increase in site costs, a decrease in ore grades at Topia resulting from variability in mineralization, and increases in smelting and refining costs due to higher cost contracts. Please refer to the “Mine Operating Results” and “Non-IFRS Measures” sections of this document for a more detailed discussion of cash cost per silver ounce. The Company’s reported cash cost per silver ounce is also affected by changes in metal prices of non-silver by-products, specifically gold at Guanajuato and lead, zinc and gold at Topia, relative to the silver price.

Prices

One of the Company’s objectives is to provide shareholders with leverage to future increases in the price of silver. To this end, the Company does not engage in any hedging arrangements on silver prices. As a result, Great Panther’s share price tends to correlate very strongly with the price of silver. Additional leverage comes through the participation in the growth of the Company itself.

While the average price of silver for 2012 decreased by 11% on a year-over-year basis, it has fluctuated significantly in recent years, and it continued to be volatile in 2012 reaching a high of $37.23 in February and low of $26.67 in July1.

The Company’s financial results are very sensitive to the price of silver. The following table summarizes the effect of changes in the silver price on the Company’s 2013 revenue outlook, based on an assumed production of 2.5 million silver equivalent ounces2.

Revenue Sensitivity to Change in Silver Price (in 000's except for silver price per ounce)

| Silver price per ounce | US$20.00 | US$25.00 | US$30.00 | US$35.00 | US$40.00 | US$45.00 | US$50.00 |

| Guanajuato Revenue (USD) | $ 37,314 | $ 41,690 | $ 46,067 | $ 50,242 | $ 54,354 | $ 58,465 | $ 62,576 |

| Topia Revenue (USD) | $ 13,365 | $ 16,501 | $ 19,638 | $ 22,597 | $ 25,290 | $ 27,984 | $ 30,677 |

| | | | | | | | |

| Total Revenue (CAD) | $ 48,966 | $ 56,225 | $ 63,484 | $ 70,378 | $ 76,953 | $ 83,527 | $ 90,102 |

Assumes gold price of US$1,680 per ounce, and zinc and lead prices of US$0.85/lb.

The Company’s reported cash cost per silver ounce is affected by changes in metal prices of the by-products of silver, specifically gold at Guanajuato and lead, zinc and gold at Topia, relative to the silver price (refer to “Non-IFRS Measures” section for discussion of cash cost per silver ounce). The following tables summarize the effect of changes in prices of gold, lead and zinc on the Company’s 2013 estimated combined cash cost per ounce of silver based on an assumed production of approximately 2.5 million Ag eq oz:

__________________________________

1 London Spot Fix

2 2.5 million silver equivalent ounces represents the top of the Company’s production guidance range of 2.4 – 2.5 million silver equivalent ounces for 2013.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 5 |

Cash Cost per Payable Ounce of Silver: Sensitivity to Change in Gold Price

| Gold price per ounce | | US $1,500 | | | US $1,600 | | | US $1,700 | | | US $1,800 | | | US $1,900 | |

| Cash cost per ounce of silver (USD) | $ | 11.82 | | $ | 10.96 | | $ | 10.09 | | $ | 9.23 | | $ | 8.37 | |

Assumes silver price of US$28 per ounce, and zinc and lead prices of US$0.85 per pound.

Cash Cost per Payable Ounce of Silver: Sensitivity to Change in Zinc Price

| Zinc price per pound | | US $0.60 | | | US $0.70 | | | US $0.80 | | | US $0.90 | | | US $1.00 | |

| Cash cost per ounce of silver (USD) | $ | 10.66 | | $ | 10.50 | | $ | 10.33 | | $ | 10.22 | | $ | 10.11 | |

Assumes silver price of US$28 per ounce, gold price of US$1,680 per ounce, and lead price of US$0.85 per pound.

Cash Cost per Payable Ounce of Silver: Sensitivity to Change in Lead Price

| Lead price per pound | | US $0.60 | | | US $0.70 | | | US $0.80 | | | US $0.90 | | | US $1.00 | |

| Cash cost per ounce of silver (USD) | $ | 10.62 | | $ | 10.48 | | $ | 10.34 | | $ | 10.20 | | $ | 10.08 | |

Assumes silver price of US$28 per ounce, gold price of US$1,680 per ounce, and zinc price of US$0.85 per pound.

Capabilities to Deliver Results

Great Panther continues to emphasize three key elements of its business in order to achieve its goals and objectives. The Company believes that the emphasis of these three key elements will enable it to successfully execute its growth strategy.

People

One of Great Panther’s key strategies is to build the team that will help achieve the Company’s goals. This includes recruiting, training and developing the right people, as well as enhancing the productivity of the team by providing the tools and training needed to be effective.

The Company’s ability to attract and retain qualified employees is critical to its success. In addition to experienced key personnel, the Company looks for bright, hard-working individuals with positive attitudes, and is committed to providing its people with a great workplace and opportunities to grow with the Company.

As part of Great Panther’s commitment to its employees, the Company has a policy of granting stock options to all employees to build loyalty as well as align their performance with corporate goals and objectives.

Mining Operations and Exploration

Great Panther’s operations focus on silver mining, processing and exploration. The Guanajuato and Topia operations depend on the discovery of new mineralization and therefore the Company invests in the continued development of these properties. In 2013, the Company will be focused on the development of its San Ignacio Project which is approximately 20 kilometres by road from its Guanajuato processing plant.

The Company also owns two exploration stage properties: the Santa Rosa Project, located approximately 15 kilometres northeast of Guanajuato, and the recently acquired El Horcon Project, located 60 kilometres northwest of Guanajuato. New discoveries that are close to the existing operations mean that the time from discovery to production is reduced and capital requirements are lower as existing infrastructure can be utilized.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 6 |

The performance of the mining and processing operations builds on a sound base and continues to improve to new record levels. Great Panther is fortunate to have a highly experienced team of underground miners and metallurgists. The Company processed a record 230,120 tonnes of ore in 2012, a 6% increase from the prior year.

Mine development focuses on accessing near term production targets and providing underground drilling platforms for deeper exploration to ensure resources and mine life are extended. At Guanajuato, targets include Rayas, Santa Margarita, Los Pozos, Valenciana, Deep Cata and the Guanajuatito North Zone, as well as the recently discovered silver-gold veins at the San Ignacio Project.

The Company was successful at increasing throughput at Topia however the mine experienced a decline in average silver grades in 2012. While grade variability is expected to continue, the Company is taking steps to improve its mine planning activities which should result in better operating efficiency. Over the years, the Company has also been successful in adding resources at Topia through a combination of underground development and surface exploration drilling and will continue to invest in these activities in the future.

Ore processing at both operations is supported by metallurgical testwork programs under the direction of the Company’s Country Manager, Metallurgy. This, together with the local expertise, has resulted in continuous improvement in processing performance.

Location of Operations

Great Panther is focused on Mexico for several reasons. Mexico has consistently been the leading silver producing country in the world and has a rich mineral endowment and a long history of mining. This mining culture continues today and mining companies in Mexico typically enjoy strong support from all levels of government and from the local people.

As part of the North American Free Trade Agreement, Mexico has a stable political and economic environment in which to operate. In addition, due to the climate, most projects can be worked on throughout the year and many can be reached in a single day from Vancouver by flight. Great Panther’s Guanajuato mine is serviced by an international airport in Leon, only 30 minutes away by road.

Although there are more than 200 mining/exploration companies working in Mexico, Great Panther has the advantage of extensive experience in Mexico and has a broad base of contacts that benefits its mining operations, exploration programs and provides access to new opportunities. The Company’s executive team has extensive experience and knowledge of business in Mexico to capitalize on future opportunities.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 7 |

SIGNIFICANT TRANSACTIONS AND EVENTS AFFECTING OPERATIONS

During the year ended December 31, 2012, Great Panther continued to invest in its wholly-owned Mexican properties as part of its growth strategy to expand production and resources. Important developments in the Company’s business during the year are as follows.

On February 6, 2012, the Company announced the appointment of R. W. (Bob) Garnett, CA, ICD.D. as Independent Chairman of the Company's Board of Directors. Mr. Garnett has served as an independent Director of Great Panther since May 3, 2011 and is Chairman of the Audit Committee. Mr. Garnett replaced Kaare Foy, who retired after serving more than 18 years as a Director of the Company and almost eight years as Executive Chairman.

On May 9, 2012, the Company announced the completion of two Mineral Resource estimates for its Guanajuato Mine Complex and its San Ignacio Project in Guanajuato, Mexico. As San Ignacio is a satellite of the Guanajuato Mine Complex (20 kilometres by road), and any mineralization extracted from there will be processed at the Cata Plant, the Mineral Resource is considered part of the overall Guanajuato Operations. The new Measured and Indicated Mineral Resource at the Guanajuato Mine contains 5,649,000 ounces of silver equivalent. Inferred Mineral Resources are estimated at 2,503,000 Ag eq oz at the Guanajuato Mine and 6,894,000 Ag eq oz at San Ignacio. The new resource replaces production from the Guanajuato Mine Complex during the prior year and a half, and with the addition of San Ignacio almost doubles the overall resource base for Great Panther’s Guanajuato operations. The new estimate for San Ignacio increases tonnage by 35%, silver content by 29%, gold content by 51% and Ag eq oz by 53% over the previous estimate (refer to May 9, 2012 news release and the corresponding technical reports filed on SEDAR dated June 25, 2012 and June 26, 2012).

On June 28, 2012, the Company announced the re-election of Robert A. Archer, Kenneth W. Major and R.W. (Bob) Garnett and the election of new nominees John Jennings and J. Richard H. (Dick) Whittington as Directors of the Company. Former director John Kopcheff, of Australia, did not stand for re-election. John Jennings has almost three decades of experience in Canadian and international investment banking, having held positions at firms including BMO Nesbitt Burns, Lehman Brothers International, RBC Financial, HSBC Group and CIBC. Mr. Jennings recently joined Korn/Ferry International, the world’s largest executive search and talent management firm. Mr. Whittington is a mining engineer with over 35 years of experience in Canada and abroad. He was previously president, CEO and a director of PNG Gold, an advanced stage gold exploration company located in Papua New Guinea. Prior to this, he was president, CEO and a director of Farallon Mining, where he brought Farallon’s G-9 polymetallic zinc mine in Guerrero State, Mexico into production in less than four years. In November 2012, Mr. Whittington accepted the position of President and CEO of Northern Vertex Mining Corp. and resigned from the Board of Directors of Great Panther in January 2013.

On July 18, 2012, the Company announced a number of changes to its senior management structure. The changes included the separation of the President and CEO role, under which Mr. Robert Archer retained the role of CEO and Mr. Martin Carsky was appointed President of the Company. Mr. Carsky served as the Company’s Executive Vice President and CFO since May of 2011. Jim Zadra, CA, was appointed Chief Financial Officer of Great Panther after serving as Vice President, Finance since September 2011. Mr. Graham Parsons was promoted to the newly created role of Vice President, Operations based in Guanajuato, Mexico. Mr. Charles Brown was appointed to a newly created role as Senior Vice President, Corporate Development and his former position of Chief Operating Officer was eliminated. Mr. Parsons subsequently left Great Panther and was replaced by Mr. Juan Manuel Flores in March of 2013.

On August 21, 2012, the Company announced it had signed a definitive agreement for the purchase of a 100% interest in certain surface rights on its wholly-owned San Ignacio Project in Guanajuato, Mexico. A total of 19.4 hectares has been purchased, thereby allowing sufficient space for access to and construction of a portal for the development of a ramp, for waste dumps, and for auxiliary infrastructure. With the acquisition of the surface rights, the Company has proceeded with the application for permits required for the underground development. Permitting is expected to be completed by the end of the second quarter of 2013 and construction of a new portal and ramp is expected to begin shortly after the receipt of permits.

On September 5, 2012, the Company completed the purchase of a 100% interest in the El Horcon Silver-Gold Project (“El Horcon”) in Jalisco State, Mexico for total cash consideration of US$1.6 million. El Horcon is a past producing mine and covers 7,908 hectares in 17 contiguous mining concessions and is located 60 kilometres northwest of the Company’s Guanajuato Mine Complex. Its location allows for the potential for it to become a satellite mine for the Company’s Guanajuato operations. The Company has applied for permits for a Phase I drill program to delineate a resource and expects to commence drilling before the end of the second quarter of 2013.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 8 |

As of the date of this MD&A, the Company had not fully secured mineral property titles for approximately 5,000 of its 7,908 hectares related to the El Horcon Project. Certain of the Company’s title claims have been cancelled due to what the Company believes is an administrative error on the part of the government agency which manages mineral claims in Mexico. The Company is currently in the process of attempting to reinstate the claims. Neither the status of the claims or the process to reinstate the claims has affected the Company’s currently planned permitting and drilling programs. The Company expects to be successful in reinstating the claims and therefore has not recorded any provision against the carrying value of the El Horcon Project.

The following events took place after the end of 2012:

On January 14, 2013, the Company announced an update to the ongoing mineral resource development at the Company's 100% owned Topia Silver-Gold-Lead-Zinc Mine in Durango, Mexico. The 2012 Measured & Indicated Mineral Resources total 156,000 tonnes at 806g/t silver, 1.47g/t gold, 6.48% lead and 4.29% zinc (5.60 million silver equivalent ounces). In addition, the estimate includes 273,000 tonnes of 837g/t silver, 0.8g/t gold, 5.7% lead and 3.9% zinc (9.54 million Ag eq oz) in the Inferred category. Although the total number of ounces was reduced from the 2011 estimate, the updated Resource Estimate reflects a more robust model and a better reconciliation to mine production. See the “Resource and Exploration Update” section for further details.

On February 5, 2013, the Company announced that underground drilling programs at the Company’s wholly owned Guanajuato Mine Complex were successful in intersecting high grade silver-gold mineralization in the historic Valenciana Mine area and discovered two new zones of silver-gold mineralization in the Guanajuatito Mine area. The drilling at Valenciana included an intercept of 2,900g/t silver and 26.00g/t gold over 1.30 metres, while the two new discoveries at Guanajuatito are highlighted by intersections of 1,010g/t silver and 6.67g/t gold over 1.10 metres and 1,460g/t silver and 4.79g/t gold over 1.15 metres.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 9 |

FOURTH QUARTER AND FISCAL YEAR 2012 HIGHLIGHTS

| Highlights | | | | | | | | | | | | | | | | | | |

| (in 000s except ounces, amounts per share and | | | | | | | | | | | Year Ended | | | Year Ended | | | | |

| per ounce) | | Q4 2012 | | | Q4 2011 | | | Change | | | Dec 31, 2012 | | | Dec 31, 2011 | | | Change | |

| Revenue | $ | 17,789 | | $ | 17,520 | | | 2% | | $ | 61,139 | | $ | 57,818 | | | 6% | |

| Gross profit (Earnings from mining operations) | $ | 3,318 | | $ | 6,032 | | | -45% | | $ | 19,206 | | $ | 26,916 | | | -29% | |

| Net income (loss) | $ | (1,285) | | $ | (1,419) | | | 9% | | $ | 5,510 | | $ | 11,506 | | | -52% | |

| Adjusted EBITDA1 | $ | 3,800 | | $ | 6,265 | | | -39% | | $ | 16,893 | | $ | 24,723 | | | -32% | |

| Earnings (loss) per share – basic | $ | (0.01) | | $ | (0.01) | | | 0% | | $ | 0.04 | | $ | 0.09 | | | -56% | |

| Earnings (loss) per share – diluted | $ | (0.01) | | $ | (0.01) | | | 0% | | $ | 0.04 | | $ | 0.08 | | | -50% | |

| Silver ounces produced | | 453,934 | | | 354,754 | | | 28% | | | 1,560,040 | | | 1,495,372 | | | 4% | |

| Silver equivalent ounces produced2 | | 672,690 | | | 545,294 | | | 23% | | | 2,378,603 | | | 2,200,013 | | | 8% | |

| Silver payable ounces | | 446,077 | | | 425,225 | | | 5% | | | 1,472,269 | | | 1,332,262 | | | 11% | |

| Total cash cost per silver ounce (USD)3 | $ | 14.58 | | $ | 11.92 | | | 22% | | $ | 12.24 | | $ | 10.84 | | | 13% | |

| Average realized silver price (USD)4 | $ | 31.94 | | $ | 30.86 | | | 3% | | $ | 30.93 | | $ | 34.71 | | | -11% | |

Fiscal Year 2012 Financial and Operational Highlights (Compared to Fiscal Year 2011)

Revenues totalled $61.1 million for the year ended December 31, 2012, an increase of 6%;

Net income was $5.5 million for 2012, a decrease of 52%;

Cash-flow from operating activities was $13.1 million for 2012, compared to $19.1 million;

Cash position at year end was $25.9 million, inclusive of short term investments, compared to $39.5 million;

Net working capital at year end was $44.5 million, compared to $53.8 million;

Processed ore for 2012 totaled 230,120 tonnes, a 6% increase;

Record metal production was achieved for 2012 of 2,378,603 silver equivalent ounces (“Ag eq oz”), an 8% increase;

Silver production for 2012 increased 4% to 1,560,040 ounces;

Gold production for 2012 increased 36% to a record of 10,924 ounces;

Cash cost per silver ounce for 2012 increased 13% to US$12.24;

__________________________________

1 “Adjusted EBITDA” is a non-IFRS measure in which standard EBITDA (earnings before interest, taxes, depreciation and amortization) is adjusted for share-based payments expense, foreign exchange gains or losses, and non-recurring items. The Company has updated its definition of adjusted EBITDA and has restated 2011 comparative figures presented above and elsewhere in this MD&A to reflect the exclusion of interest income. The Company does not consider these changes to be material. Refer to the “Non-IFRS Measures” section for the definition and a reconciliation of standardized and adjusted EBITDA to the financial statements.

2Silver equivalent ounces in 2012 were established using prices of US$28 per oz, US$1,680 per oz, US$0.85 per lb, and US$0.85 per lb for silver, gold, lead and zinc, respectively, and applied to the recovered metal content of the concentrates that were produced by the two operations.

3“Cash cost per silver ounce” is a non-IFRS measure and is used by the Company to manage and evaluate operating performance at each of the Company’s mines and is widely reported in the silver mining industry as a benchmark for performance, but does not have a standardized meaning. Refer to the “Non-IFRS Measures” section.

4Average realized silver price is prior to treatment, refining and smelting charges.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 10 |

Average silver grades at Guanajuato for 2012 were unchanged at 199g/t, while average gold grades increased to 2.02g/t from 1.52g/t;

Topia average silver grades for 2012 decreased to 345g/t from 400g/t; and

Guanajuato maintained strong metallurgical recoveries 2012 of 90.2% and 91.5% for silver and gold respectively.

Fourth Quarter 2012 Financial and Operational Highlights (Compared to Fourth Quarter 2011)

Revenues totalled $17.8 million for the three months ended December 31, 2012 (“Q4 2012”) compared to $17.5 million for the three months ended December 31, 2011 (“Q4 2011”), an increase of 2%;

Net loss for Q4 2012 was $1.3 million, compared to a net loss of $1.4 million in Q4 2011;

Cash-flow from operating activities was $4.5 million for Q4 2012, compared to $9.9 million for Q4 2011;

Processed ore for Q4 was 67,659 tonnes, representing an increase of 30%;

Metal production for Q4 2012 was 672,690 Ag eq oz, a quarterly record and an increase of 23% over Q4 2011;

Silver production for Q4 was 453,934 ounces, an increase of 28%; and

Gold production for Q4 was 2,826 ounces, an increase of 24%.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 11 |

MINE OPERATING RESULTS

Consolidated Operations

| | | | | | | | | 2012 | | | | | | | | | | | | | | | 2011 | | | | | | | |

| | | FY | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | �� | FY | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| Tonnes milled | | 230,120 | | | 67,659 | | | 58,307 | | | 52,956 | | | 51,198 | | | 216,181 | | | 52,170 | | | 53,375 | | | 56,643 | | | 53,993 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Production | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (ounces) | | 1,560,040 | | | 453,934 | | | 371,857 | | | 374,723 | | | 359,526 | | | 1,495,372 | | | 354,754 | | | 343,768 | | | 386,210 | | | 410,640 | |

| Gold (ounces) | | 10,924 | | | 2,826 | | | 3,015 | | | 2,354 | | | 2,729 | | | 8,016 | | | 2,281 | | | 1,494 | | | 1,931 | | | 2,310 | |

| Lead (tonnes) | | 962 | | | 289 | | | 226 | | | 245 | | | 202 | | | 941 | | | 212 | | | 222 | | | 266 | | | 241 | |

| Zinc (tonnes) | | 1,478 | | | 446 | | | 369 | | | 351 | | | 312 | | | 1,314 | | | 327 | | | 294 | | | 348 | | | 345 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver equivalent ounces1 | | 2,378,603 | | | 672,690 | | | 592,586 | | | 555,721 | | | 557,606 | | | 2,200,013 | | | 545,294 | | | 484,550 | | | 562,944 | | | 607,225 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver payable ounces | | 1,472,269 | | | 446,077 | | | 314,146 | | | 395,405 | | | 316,641 | | | 1,332,262 | | | 425,225 | | | 364,684 | | | 193,914 | | | 348,439 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash cost per silver ounce (USD)2,3 | $ | 12.24 | | $ | 14.58 | | $ | 13.16 | | $ | 11.42 | | $ | 9.05 | | $ | 10.84 | | $ | 11.92 | | $ | 9.02 | | $ | 12.85 | | $ | 10.33 | |

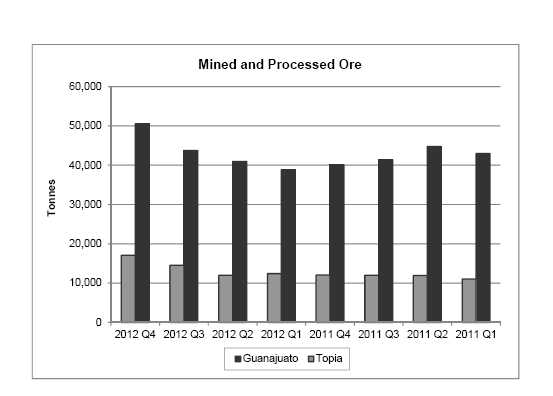

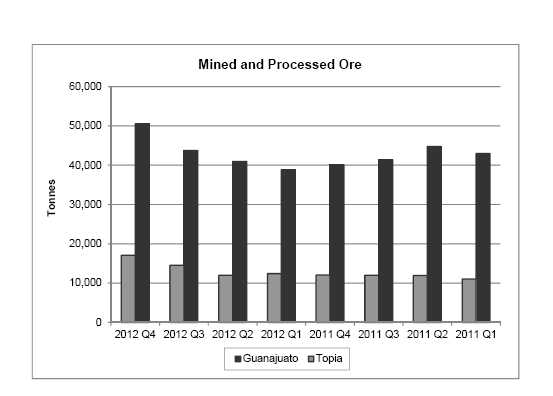

Total processed ore for the year ended December 31, 2012 was 230,120 tonnes, an increase of 6% over the prior year, with increases realized at both of the Company’s mines. The Guanajuato Mine Complex achieved an increase of 3% in throughput, and the Topia mine achieved a 19% increase in throughput as a result of increased mining activity.

Processed ore for the consolidated operations for the fourth quarter of 2012 was 67,659 tonnes, an increase of 16% compared to the third quarter of 2012, and an increase of 30% compared to the fourth quarter of 2011. The increase in throughput over the third quarter of 2012 included an increase of 17% at Topia as ore stockpiled due to water shortages in the first half of 2012 was processed during the second half of the year. The Guanajuato Mine Complex achieved a 16% increase in throughput over the third quarter due in part to the move from a six to seven day per week workweek. The increase in throughput over the third quarter of 2012 included a 42% increase at Topia and a 26% increase at Guanajuato.

Overall metal production for the year ended December 31, 2012 was a record 2,378,603 Ag eq oz, representing an increase of 8% over the prior year. The increase is attributable to increases in mined ore and throughput at both mines and increased gold grades at the Guanajuato Mine Complex. Overall metal production for the fourth quarter of 2012 was a quarterly record of 672,690 Ag eq oz, an increase of 14% from the third quarter of 2012 and an increase of 23% compared to the fourth quarter in 2011. The increased metal production is primarily the result of higher mined ore and throughput at both operations and higher average gold grades at Guanajuato.

Consolidated cash cost per silver ounce was US$12.24 for the year ended December 31, 2012, a 13% increase compared to US$10.84 for the year ended December 31, 2011. The increase is attributable to higher site costs and lower grades at Topia which resulted in higher unit production costs. In addition, the Company saw an increase in overall smelting and refining charges as a result of higher contractual charges for the Topia concentrates. The higher unit production costs and smelting and refining charges were offset somewhat by higher by-product credits as a result of higher gold production at Guanajuato.

Consolidated cash cost per silver ounce of US$14.58 for the fourth quarter increased from US$11.92 in the fourth quarter of 2011. Cash cost per silver ounce at Topia increased due to lower grades which resulted in higher unit production costs, and increased smelting and refining charges. Cash cost per silver ounce at Guanajuato increased in the fourth quarter due to higher unit production costs.

_________________________

| 1 | Silver equivalent ounces in 2012 were established using prices of US$28 per oz, US$1,680 per oz, US$0.85 per lb, and US$0.85 per lb for silver, gold, lead and zinc, respectively, and applied to the recovered metal content of the concentrates that were produced by the two operations. |

| 2 | “Cash cost per silver ounce” is a non-IFRS measure and is used by the Company to manage and evaluate operating performance at each of the Company’s mines and is widely reported in the silver mining industry as a benchmark for performance, but does not have a standardized meaning. Refer to the “Non-IFRS Measures” section. |

| 3 | Cash cost per silver ounce for the second quarter of 2011 presented in the table has been restated from amounts previously reported to reflect the application of correct foreign exchange rates. |

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 12 |

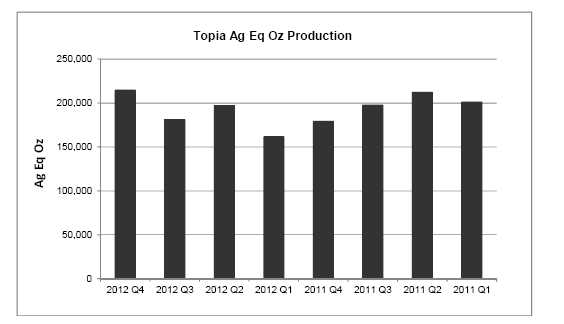

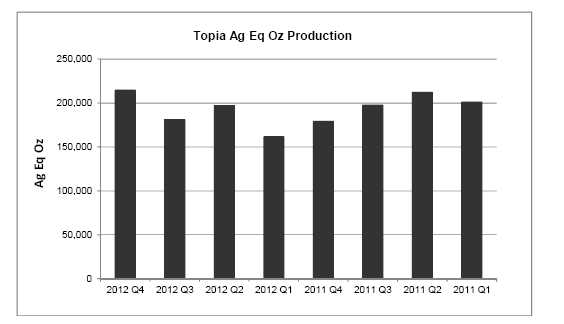

Topia Mine

Mill throughput for Topia for the year ended December 31, 2012 was 56,098 tonnes of ore, an increase of 19% over the 46,968 tonnes processed in the year ended December 31, 2011. Ore processed in the fourth quarter of 2012 was 17,109 tonnes of ore, representing an increase of 17% compared to the third quarter of 2012 and also a 42% increase over the fourth quarter of the prior year. Throughput increased over the fourth quarter of 2011 as a result of increased mining activity and processing which was stockpiled in the first half of 2012 when drought conditions caused water shortages and limited the Company’s ability to process ore. Processing of the stockpiled ore commenced in the third quarter of 2012 and the stockpile was completely processed by year end.

Metal production at Topia for the year ended December 31, 2012 was 753,298 Ag eq oz, comprising 555,710 silver (“Ag”) oz, 574 gold (“Au”) oz, 962 lead (“Pb”) tonnes, and 1,478 zinc (“Zn”) tonnes. Metal production at Topia for the fourth quarter of 2012 was 214,598 Ag eq oz comprising 155,185 Ag oz, 171 Au oz, 289 Pb tonnes, and 446 Zn tonnes. Metal production on a Ag eq oz basis increased 19% compared to the third quarter of 2012 as a result of higher throughput and higher grades for all metals. Production on an Ag eq oz basis increased 20% in the fourth quarter of 2012 compared to the fourth quarter of 2011 due mainly to increased throughput and higher gold, lead and zinc grades.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 13 |

Topia Mine Production Data

| | | | | | | | | 2012 | | | | | | | | | | | | | | | 2011 | | | | | | | |

| | | FY | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | FY | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| Tonnes milled | | 56,098 | | | 17,109 | | | 14,593 | | | 11,992 | | | 12,404 | | | 46,968 | | | 12,056 | | | 12,004 | | | 11,895 | | | 11,013 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Production | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (ounces) | | 555,710 | | | 155,185 | | | 131,865 | | | 148,439 | | | 120,221 | | | 535,882 | | | 117,182 | | | 137,707 | | | 143,774 | | | 137,219 | |

| Gold (ounces) | | 574 | | | 171 | | | 149 | | | 140 | | | 114 | | | 500 | | | 136 | | | 147 | | | 124 | | | 93 | |

| Lead (tonnes) | | 962 | | | 289 | | | 226 | | | 245 | | | 202 | | | 941 | | | 212 | | | 222 | | | 266 | | | 241 | |

| Zinc (tonnes) | | 1,478 | | | 446 | | | 369 | | | 351 | | | 312 | | | 1,314 | | | 327 | | | 294 | | | 348 | | | 345 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver equivalentounces1 | | 753,298 | | | 214,598 | | | 180,627 | | | 196,658 | | | 161,415 | | | 789,610 | | | 179,008 | | | 197,688 | | | 212,108 | | | 200,806 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver payable ounces | | 503,559 | | | 129,802 | | | 129,101 | | | 137,884 | | | 106,772 | | | 453,569 | | | 119,155 | | | 113,297 | | | 108,487 | | | 112,630 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average ore grade | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (g/t) | | 345 | | | 319 | | | 316 | | | 424 | | | 326 | | | 400 | | | 345 | | | 420 | | | 418 | | | 420 | |

| Gold (g/t) | | 0.55 | | | 0.57 | | | 0.55 | | | 0.56 | | | 0.45 | | | 0.41 | | | 0.44 | | | 0.47 | | | 0.40 | | | 0.33 | |

| Lead (%) | | 1.86 | | | 1.86 | | | 1.69 | | | 2.18 | | | 1.71 | | | 2.13 | | | 1.85 | | | 2.02 | | | 2.34 | | | 2.32 | |

| Zinc (%) | | 2.91 | | | 2.87 | | | 2.78 | | | 3.21 | | | 2.73 | | | 3.05 | | | 2.97 | | | 2.67 | | | 3.18 | | | 3.42 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Metal recoveries | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver | | 89.4% | | | 88.4% | | | 89.0% | | | 90.7% | | | 90.5% | | | 88.7% | | | 87.7% | | | 85.0% | | | 89.9% | | | 92.3% | |

| Gold | | 57.9% | | | 54.1% | | | 57.8% | | | 64.3% | | | 64.0% | | | 80.1% | | | 79.2% | | | 80.4% | | | 81.6% | | | 79.0% | |

| Lead | | 92.3% | | | 91.0% | | | 91.4% | | | 93.6% | | | 94.1% | | | 94.0% | | | 95.0% | | | 91.4% | | | 95.5% | | | 94.1% | |

| Zinc | | 90.6% | | | 90.7% | | | 90.9% | | | 91.2% | | | 92.1% | | | 91.7% | | | 91.3% | | | 91.9% | | | 92.2% | | | 91.5% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Concentrate grades | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lead | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (g/t) | | 8,409 | | | 7,493 | | | 8,997 | | | 8,708 | | | 8,757 | | | 8,837 | | | 8,528 | | | 9,205 | | | 8,463 | | | 9,167 | |

| Gold (g/t) | | 7.48 | | | 7.19 | | | 8.60 | | | 7.35 | | | 6.88 | | | 6.97 | | | 8.05 | | | 8.80 | | | 6.27 | | | 4.93 | |

| Lead (%) | | 49.86 | | | 48.69 | | | 52.82 | | | 48.79 | | | 49.80 | | | 52.77 | | | 52.83 | | | 50.31 | | | 53.33 | | | 54.61 | |

| Zinc (%) | | 10.48 | | | 11.48 | | | 10.33 | | | 10.49 | | | 9.16 | | | 8.84 | | | 9.78 | | | 10.68 | | | 8.65 | | | 9.46 | |

| Zinc | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (g/t) | | 715 | | | 779 | | | 692 | | | 735 | | | 636 | | | 656 | | | 619 | | | 640 | | | 674 | | | 687 | |

| Gold (g/t) | | 1.62 | | | 1.65 | | | 1.74 | | | 1.38 | | | 1.68 | | | 1.63 | | | 2.07 | | | 1.66 | | | 1.44 | | | 1.40 | |

| Lead (%) | | 1.72 | | | 1.77 | | | 1.75 | | | 1.67 | | | 1.68 | | | 1.35 | | | 1.26 | | | 0.83 | | | 1.50 | | | 1.68 | |

| Zinc (%) | | 51.31 | | | 50.66 | | | 50.02 | | | 51.71 | | | 53.45 | | | 53.93 | | | 53.60 | | | 55.49 | | | 52.89 | | | 54.08 | |

_____________________

| 1 Silver equivalent ounces in 2012 were established using prices US$28 per oz, US$1,680 per oz, US$0.85 per lb, and US$0.85 per lb for silver, gold, lead and zinc, respectively, and applied to the recovered metal content of the concentrates that were produced by the two operations. |

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 14 |

Average grades of ore processed from Topia in the year ended December 31, 2012 were 345g/t Ag, 0.55g/t Au, 1.86% Pb and 2.91% Zn, which represent decreases of 14%, 13% and 5% for Ag, Pb and Zn, respectively, and an increase of 34% for Au over the year ended December 31, 2011. The average grades of ore processed from Topia in the fourth quarter of 2012 were 319g/t Ag, 0.57g/t Au, 1.86% Pb and 2.87% Zn, which represent increases of 1%, 4%, 10%, and 3% for Ag, Au, Pb and Zn, respectively over the third quarter of 2012. Compared to the fourth quarter of 2011, these average grades represented an 8% and 3% decrease for Ag and Zn, respectively, and an increase of 30% and 1% for Au and Pb, respectively.

Plant metallurgical performance for the full year of 2012 included metal recoveries of 89.4% for Ag, 57.9% for Au, 92.3% for Pb and 90.6% for Zn. Plant metallurgical performance was satisfactory in the fourth quarter of 2012 with metal recoveries of 88.4% for Ag, 54.1% for Au, 91.0% for Pb and 90.7% for Zn.

Topia Mine Cash Cost per Silver Ounce

| | | 2012 | | | 2011 | |

(in 000s of CAD except per

ounce amounts or noted

otherwise) | |

FY | | |

Q4 | | |

Q3 | | |

Q2 | | |

Q1 | | |

FY | | |

Q4 | | |

Q3 | | |

Q2 | | |

Q1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | $ | 11,943 | | $ | 3,478 | | $ | 3,184 | | $ | 2,737 | | $ | 2,544 | | $ | 9,712 | | $ | 2,741 | | $ | 2,177 | | $ | 2,516 | | $ | 2,278 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Smelting and refiningcharges | | 3,536 | | | 953 | | | 898 | | | 948 | | | 737 | | | 1,755 | | | 262 | | | 481 | | | 455 | | | 557 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross by-product revenue1 | | (4,407 | ) | | (1,194 | ) | | (1,187 | ) | | (1,076 | ) | | (950 | ) | | (3,885 | ) | | (684 | ) | | (1,056 | ) | | (1,051 | ) | | (1,094 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of custom milling | | (302 | ) | | (130 | ) | | (44 | ) | | (63 | ) | | (65 | ) | | (378 | ) | | (118 | ) | | (92 | ) | | (102 | ) | | (66 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash operating costs | $ | 10,770 | | $ | 3,107 | | $ | 2,851 | | $ | 2,546 | | $ | 2,266 | | $ | 7,204 | | $ | 2,201 | | $ | 1,510 | | $ | 1,818 | | $ | 1,675 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash operating costs (USD) | $ | 10,787 | | $ | 3,135 | | $ | 2,870 | | $ | 2,517 | | $ | 2,265 | | $ | 7,286 | | $ | 2,167 | | $ | 1,541 | | $ | 1,879 | | $ | 1,699 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver payable ounces (000s) | | 504 | | | 130 | | | 129 | | | 138 | | | 107 | | | 454 | | | 119 | | | 113 | | | 108 | | | 113 | |

| Cash cost per silverounce2,3(USD) | $ | 21.42 | | $ | 24.15 | | $ | 22.23 | | $ | 18.26 | | $ | 21.21 | | $ | 16.06 | | $ | 18.19 | | $ | 13.60 | | $ | 17.32 | | $ | 15.09 | |

Cash cost per silver ounce for Topia for the year ended December 31, 2012 was US$21.42, an increase of 33% from the cash cost per silver ounce of US$16.06 for the year ended December 31, 2011, primarily as a result of lower silver grades in the year and increased smelting and refining charges.

Cash cost per silver ounce for Topia increased to US$24.15 in the fourth quarter of 2012 from US$22.23 in the third quarter of 2012 due to higher site costs and lower recoveries. Cash cost per silver ounce for Topia in the fourth quarter of 2012 increased by 33% to US$24.15 from US$18.19 in the fourth quarter of 2011. The increase is mainly attributable to lower silver grades as well as higher smelting and refining charges.

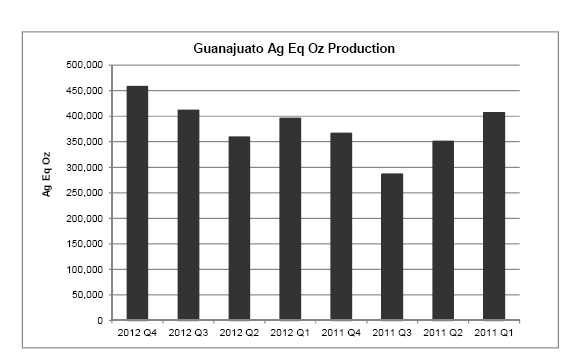

Guanajuato Mine Complex

Processed ore at Guanajuato for the year ended December 31, 2012 was 174,022 tonnes, an increase of 3% over the prior year. Processed ore at Guanajuato was 50,550 tonnes for the fourth quarter of 2012, an increase of 16% compared to the third quarter of 2012, and an increase of 26% compared to the fourth quarter of 2011. The increase over the same period from the prior year is due in part to the move from a six day to seven day per week workweek, which began in June 2012.

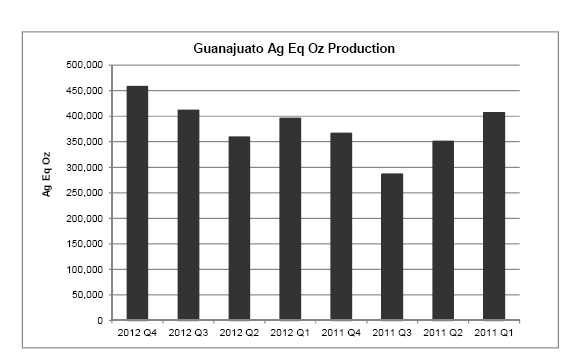

Metal production of 1,625,305 Ag eq oz for the full year 2012 represented an increase of 15% over the prior year due to both increased throughput and higher gold grades. The high grade Cata development and stoping from the 510 metre level, plus the successful recovery of crown pillars at the 390 and 470 metre levels by long-hole mining methods have contributed significantly to the increase in production for the year. Metal production of 458,092 Ag eq oz for the fourth quarter of 2012 represented an increase of 11% compared to the third quarter of 2012 and an increase of 25% over the same quarter in the prior year due primarily to increased throughput as a result of increases in mining activity.

_______________________

| 1 | Gross by-product revenue is defined as revenue from the by-products of silver, specifically gold at Guanajuato and gold, lead and zinc at Topia, net of the respective smelting and refining charges. |

| 2 | “Cash cost per silver ounce” is a non-IFRS measure and is used by the Company to manage and evaluate operating performance at each of the Company’s mines and is widely reported in the silver mining industry as a benchmark for performance, but does not have a standardized meaning. Refer to the “Non-IFRS Measures” section. |

| 3 | Cash cost per silver ounce for the second quarter of 2011 presented in the table has been restated from amounts previously reported to reflect the application of correct foreign exchange rates. |

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 15 |

For the year ended December 31, 2012, silver production was 1,004,331 ounces, representing an increase of 5% over the year ended December 31, 2011. Silver production for the fourth quarter of 2012 of 298,750 ounces was up 24% compared to the third quarter of 2012, and up 26% compared to the fourth quarter of 2011. Gold production for 2012 at Guanajuato was 10,350 ounces, a record and an increase of 38% over the prior year. Guanajuato’s gold production for the fourth quarter of 2,656 ounces, represented a decrease of 7% compared to the third quarter of 2012 and an increase of 24% compared to the fourth quarter of 2011. Development and production from Guanajuato’s gold-rich Santa Margarita area continues to contribute to higher gold production.

Average ore grades for the year ended December 31, 2012 were 199g/t Ag and 2.02g/t Au, as compared to 199g/t Ag and 1.52g/t Au for 2011. Average ore grades for the fourth quarter of 2012, of 206g/t Ag and 1.80g/t Au, represented an increase of 10% and a decrease of 23% over the Ag and Au grades, respectively, for the third quarter of 2012. Compared to the fourth quarter of 2011, the fourth quarter 2012 ore grades represent a 0.5% and 2% decrease from 207g/t Ag and 1.84g/t Au, respectively.

Metal recoveries at the Guanajuato plant remain strong due to the addition of a re-grind mill, commissioned in April 2012, which improved process control. For the year ended December 31, 2012, metal recoveries were 90.2% for silver and 91.5% for gold compared to 88.5% and 90.3%, respectively, in 2011. Additional improvements were also made to the crushing section of the plant during the year where a new double-deck screen was installed. Recoveries of 89.2% for silver and 90.9% for gold were achieved in the quarter ended December 31, 2012.

Guanajuato Mine Complex Production Data

| | | | | | | | | 2012 | | | | | | | | | | | | | | | 2011 | | | | | | | |

| | | FY | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | FY | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| Tonnes milled | | 174,022 | | | 50,550 | | | 43,714 | | | 40,964 | | | 38,794 | | | 169,213 | | | 40,114 | | | 41,371 | | | 44,748 | | | 42,980 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Production | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (ounces) | | 1,004,331 | | | 298,750 | | | 239,992 | | | 226,284 | | | 239,305 | | | 959,490 | | | 237,572 | | | 206,061 | | | 242,436 | | | 273,421 | |

| Gold (ounces) | | 10,350 | | | 2,656 | | | 2,866 | | | 2,213 | | | 2,615 | | | 7,516 | | | 2,145 | | | 1,347 | | | 1,807 | | | 2,217 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver equivalentounces1 | | 1,625,305 | | | 458,092 | | | 411,958 | | | 359,063 | | | 396,192 | | | 1,410,403 | | | 366,286 | | | 286,862 | | | 350,836 | | | 406,419 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver payable ounces | | 968,710 | | | 316,275 | | | 185,045 | | | 257,521 | | | 209,869 | | | 878,693 | | | 306,070 | | | 251,387 | | | 85,427 | | | 235,809 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average ore grade | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (g/t) | | 199 | | | 206 | | | 188 | | | 189 | | | 213 | | | 199 | | | 207 | | | 175 | | | 193 | | | 222 | |

| Gold (g/t) | | 2.02 | | | 1.80 | | | 2.22 | | | 1.82 | | | 2.30 | | | 1.52 | | | 1.84 | | | 1.12 | | | 1.38 | | | 1.75 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Metal recoveries | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver | | 90.2% | | | 89.2% | | | 90.9% | | | 91.1% | | | 90.1% | | | 88.5% | | | 89.1% | | | 88.4% | | | 87.4% | | | 89.2% | |

| Gold | | 91.5% | | | 90.9% | | | 91.9% | | | 92.3% | | | 91.2% | | | 90.3% | | | 90.3% | | | 90.1% | | | 90.8% | | | 91.5% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Concentrate grades | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (g/t) | | 10,284 | | | 9,912 | | | 10,845 | | | 10,641 | | | 9,917 | | | 10,099 | | | 10,910 | | | 9,280 | | | 10,485 | | | 9,797 | |

| Gold (g/t) | | 106 | | | 88 | | | 130 | | | 104 | | | 108 | | | 79 | | | 99 | | | 61 | | | 78 | | | 79 | |

_______________________

| 1 | Silver equivalent ounces in 2012 were established using prices of US$28 per oz, US$1,680 per oz, US$0.85 per lb, and US$0.85 per lb for silver, gold, lead and zinc, respectively, and applied to the recovered metal content of the concentrates that were produced by the two operations. |

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 16 |

Development and production in the lower levels of Cata yielded 61,775 tonnes grading 327g/t Ag and 1.58g/t Au and constituted 48% of total metal production for the year ended December 31, 2012. Ore development on the 525 metre level in Cata commenced in the fourth quarter of 2012. Production from the Santa Margarita area continues to add gold production with 34,538 tonnes averaging 5.31g/t Au and 60g/t Ag during the year. Further increases in gold production are expected from Santa Margarita with the development of ramp 151 at the 510 metre level.

Ore produced from Los Pozos totaled 43,905 tonnes at grades of 192g/t Ag and 0.82g/t Au. Further improvements in ore quality are expected in the first quarter of 2013.

Production in the Guanajuatito area for the year totaled 16,611 tonnes at grades of 168g/t Ag and 0.89g/t Au. Ramp development at Guanajuatito connected with the Valenciana mine at the 245 metre level.

During the third quarter of 2012 the Rayas Shaft was shut down to begin a renovation program to enhance the overall safety conditions and increase efficiency in terms of the ability and capacity to transport personnel. The rehabilitation work is expected to be completed by the end of the second quarter of 2013. In the interim, workers are accessing the mine via the main San Vicente Ramp.

A new tertiary crusher was not installed as planned in the last half of 2012 due to delays by the supplier. It is expected that installation will be completed by the end of the first quarter of 2013.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 17 |

Guanajuato Mine Complex Cash Cost per Silver Ounce

| | | 2012 | | | 2011 | |

| (in 000s of CAD except per ounceamounts or noted otherwise) | | FY | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | FY | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost of sales | $ | 20,920 | | $ | 7,639 | | $ | 4,382 | | $ | 5,608 | | $ | 3,291 | | $ | 15,763 | | $ | 6,128 | | $ | 4,405 | | $ | 1,677 | | $ | 3,553 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Smelting and refining charges | | 3,012 | | | 891 | | | 558 | | | 756 | | | 807 | | | 2,381 | | | 1,287 | | | 482 | | | 163 | | | 449 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross by-product revenue1 | | (16,698 | ) | | (5,187 | ) | | (3,686 | ) | | (4,334 | ) | | (3,491 | ) | | (11,062 | ) | | (4,514 | ) | | (3,171 | ) | | (1,248 | ) | | (2,130 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash operating costs | | 7,234 | | $ | 3,343 | | $ | 1,254 | | $ | 2,030 | | $ | 607 | | $ | 7,082 | | $ | 2,901 | | $ | 1,716 | | $ | 592 | | $ | 1,872 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash operating costs (USD) | | 7,234 | | $ | 3,370 | | $ | 1,265 | | $ | 1,997 | | $ | 602 | | $ | 7,162 | | $ | 2,901 | | $ | 1,749 | | $ | 613 | | $ | 1,899 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver payable ounces (000s) | | 969 | | | 316 | | | 185 | | | 258 | | | 210 | | | 879 | | | 306 | | | 251 | | | 85 | | | 236 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash cost per silver ounce2,3(USD) | $ | 7.47 | | $ | 10.66 | | $ | 6.84 | | $ | 7.75 | | $ | 2.87 | | $ | 8.15 | | $ | 9.48 | | $ | 6.96 | | $ | 7.17 | | $ | 8.05 | |

Cash cost per silver ounce for the year ended December 31, 2012 of US$7.47 represented an 8% decrease compared to the year ended December 31, 2011. The decrease in cash cost per silver ounce is mainly attributable to higher gold by-product revenues per silver payable ounce.

Cash cost per silver ounce at Guanajuato for the fourth quarter of 2012 was US$10.66, compared to US$6.84 realized in the third quarter of 2012 and US$9.48 in the fourth quarter of 2011. The increase was primarily due to increased site costs which translated to an increase in unit production costs.

RESOURCE AND EXPLORATION UPDATE

Topia Mine

During the fourth quarter of 2012 there were four surface holes drilled totaling 211 metres (5,499 metres in 40 holes in 2012). There also were 18 underground drill holes completed for a total of 657 metres in the fourth quarter (2,565 metres in 66 holes in 2012).

The surface drilling in 2012, along with fourth quarter development on the 1510 level at Durangueno has given a better understanding of the anastomosing nature of the San Gregorio, Oxidada, San Pablo, and Higueras veins. Surface drilling was also conducted along the south-west extension of the El Rosario vein. The shallow holes had good vein intersections while the deeper intersects were too low in the epithermal system. ST12-195 (El Rosario) had the widest intersection of any at Topia mine to date with a 3.4 metre intersection of barite breccia and excellent galena and sphalerite. Surface drilling during 2012 targeted the Argentina, Santa Cruz (hanging wall vein to Argentina), San Gregorio, Oxidada, Oxi, Higueras, El Rosario, Animas, and Australia veins.

Drilling during the fourth quarter of 2012 was conducted on the Madre, Argentina, Recompensa, Don Benito, and La Oliva veins.

On January 14, 2013, the Company announced the completion of the Mineral Resource estimate from the Topia Mine. This updated Mineral Resource estimate is valid as of June 30, 2012.

_____________________

| 1 | Gross by-product revenue is defined as revenue from the by-products of silver, specifically gold at Guanajuato and gold, lead and zinc at Topia, net of the respective smelting and refining charges. |

| 2 | “Cash cost per silver ounce” is a non-IFRS measure and is used by the Company to manage and evaluate operating performance at each of the Company’s mines and is widely reported in the silver mining industry as a benchmark for performance, but does not have a standardized meaning. Refer to the “Non-IFRS Measures” section. |

| 3 | Cash cost per silver ounce for the second quarter of 2011 presented in the table has been restated from amounts previously reported to reflect the application of correct foreign exchange rates. |

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 18 |

| Topia Measured, Indicated and Inferred Mineral Resources – June 30, 2012 |

| Tonnage

(t) | Ag

(g/t) | Au

(g/t) | Pb

(%) | Zn

(%) | Ag eq

(oz) |

| Measured | 60,400 | 801 | 1.65 | 6.73 | 5.20 | 2,230,000 |

| Indicated | 95,400 | 809 | 1.35 | 6.33 | 3.70 | 3,370,000 |

| Inferred | 273,000 | 837 | 0.8 | 5.70 | 3.90 | 9,540,000 |

The updated estimate represents a decrease over the resource reported in 2011 (see news release March 7, 2011), however a direct comparison of the present and past mineral resources is not accurate due to differing metal prices and minimum Net Smelter Return (“NSR”) values between the two dates. Aside from normal mine depletion, the decrease in mineral resources can be attributed to a combination of factors, some of which resulted in some pre-existing resource blocks being dropped out of the model. For example, 1) change in metal prices and less silver equivalent contribution from base metals, 2) increased costs and cut-off NSR, 3) increase in the mining dilution provision in the NSR calculation from 50 to 100%, 4) better reconciliation guiding metal capping, and 5) a demonstrated insufficient continuity of mineralization, which resulted in a portion of Inferred Mineral Resources from this area being removed. This overall decrease has been partially countered by some excellent exploration successes at El Rosario, San Pablo, Oxi, Oxidada, and Higueras.

Guanajuato Mine Complex

A total of 9,119 metres (42 holes) of underground drilling was completed in the fourth quarter of 2012 for a total of 29,254 metres (217 holes) for the year ended December 31, 2012. Fourth quarter drilling was completed at the Guanajuatito, Cata, Pozos, Santa Margarita, Valenciana, and San Cayetano (Rayas area) zones.

Drilling in the Guanajuatito area, in the northwest part of the Guanajuato Mine Complex, has intersected mineralization both to the northwest (GTTO NW), and to the southeast (GTTO SE) of the existing development, between the 100 and 245 metre levels. The GTTO NW zone is approximately 50 metres in strike length, 140 metres down the dip, and open to depth and upward. The GTTO SE zone is approximately 50 metres along strike, 70 metres down the dip, and open to depth.

Highlights of the drilling in the GTTO NW zone include 2.25 metres grading 380g/t Ag and 1.28g/t Au in UGG12-057, and 1.10 metres grading 1,010g/t Ag and 6.67g/t Au in UGG12-061 (within a wider interval grading 285g/t Ag and 2.61g/t Au over 4.40 metres). Drilling in the GTTO SE zone was highlighted by an intercept of 1.15 metres grading 1,460g/t Ag and 4.79g/t Au in UGG12-070.

In the Valenciana Mine area, remnants of old stope walls and pillars intersected in drilling above the 390 metre level include 7.45 metres grading 275g/t Ag and 2.47g/t Au in UGV12-039, 1.10 metres grading 299g/t Ag and 3.66g/t Au in UGV 12-050, and 1.30 metres grading 2,900g/t Ag and 26.00g/t Au in UGV12-051. Drilling below the 390 metre level has intersected new mineralization including 3.10 metres grading 624g/t Ag and 4.59g/t Au in UGV12-012.

The pillars and hanging wall and footwall stope walls are being tested mainly from drill stations on a new footwall ramp connecting the 320 Cata level (southeast side of the Valenciana deposit) to the 245 Valenciana level (northwest side of the Valenciana deposit). Drilling in 2013 will continue to test the old Valenciana Mine area that extends approximately 400 metres along strike and 280 metres on the dip.

Detailed exploration drilling northwest of the stoping on Veta Madre has intersected multiple zones. Drill hole UG12-172 intersected 1.2 metre grading, 382g/t Ag and 0.56g/t Au in the Contact zone, and 2.8 metre grading, 596g/t Ag and 1.35g/t Au in the Veta Madre zone. From the same location, drill hole UGC12-043 intersected 2.85 metre grading, 318g/t Ag and 5.97g/t Au in the Contact zone, and 2.10 metre grading 303g/t Ag and 0g/t Au in the Veta Madre zone.

Drilling at Santa Margarita down to the 510 metre level continues to improve ore definition of the multiple gold-rich veins and stockworks, hence guiding mine development.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 19 |

On May 9, 2012, the Company announced the completion of two Mineral Resource estimates at the Company’s Guanajuato Mine Complex and its San Ignacio Project in Guanajuato, Mexico (refer to May 9, 2012 news release and the corresponding technical reports filed on SEDAR dated June 25, 2012 and June 26, 2012, respectively).

The new Measured and Indicated Mineral Resource at the Guanajuato Mine Complex contains 5,649,000 Ag eq oz. Inferred Mineral Resources are estimated at 2,503,000 Ag eq oz at the Guanajuato Mine and 6,894,000 Ag eq oz at San Ignacio. For now, the Inferred resources are being reported separately as different parameters were used in their estimation.

The Measured and Indicated Mineral Resources of 5,649,000 Ag eq oz and Inferred mineral resources estimated at 2,503,000 Ag eq oz, are contained in the Cata Clavo, Los Pozos, Santa Margarita and Guanajuatito zones. The Guanajuatito zone, with its first estimate, has been greatly expanded from present mining on the 120 and 160 metre levels to the 390 metre level and is open to depth, illustrating that additional mineralization may be found and could add to inventory with systematic and focused drilling.

The new resource base replaces production from the Guanajuato Mine Complex during the past year and a half, and adds additional resources of the San Ignacio Project.

The updated Mineral Resource estimate for the Guanajuato Mine Complex is valid as of January 31, 2012.

| Guanajuato Measured, Indicated and Inferred Mineral Resources – January 31, 2012 (Cut-off 50 g/t Ag eq) |

| Tonnage

(Kt) | Ag

(g/t) | Ag

(oz) | Au

(g/t) | Au

(oz) | Ag eq

(oz) |

| Measured | 275.8 | 264 | 2,339,900 | 2.21 | 19,570 | 3,530,000 |

| Indicated | 232.6 | 122 | 909,781 | 2.66 | 19,890 | 2,119,000 |

| Inferred | 223.2 | 221 | 1,587,000 | 2.10 | 15,060 | 2,503,000 |

Exploration drilling is continuing at Cata Clavo, Santa Margarita, Rayas Deeps, and Guanajuatito. The programs are configured to explore down-dip extensions of the mineralized zones at 25- to 50-metre spacing. For 2013, the Company plans approximately 24,000 metres of exploration drilling at the Guanajuato Mine Complex.

San Ignacio Project

The San Ignacio Project covers approximately four kilometres of strike length on the La Luz vein system, which is parallel to, and five kilometres west of, the principal Veta Madre structure that hosts Great Panther's Guanajuato Mine Complex.

The property was part of the Guanajuato Mine purchase by Great Panther in 2005 from a mining cooperative called the “Sociedad Cooperativa Minero Metalúrgica Santa Fe de Guanajuato” which owned these since 1939. Due to the Company’s focus on the main Guanajuato Mine Complex, it did not commence any work at San Ignacio until 2010.

The Company did not conduct any drilling on San Ignacio in the third and fourth quarters of 2012 but completed 9,310 metres of drilling at the Project in the first half of 2012. Further surface drilling has been deferred, awaiting the completion of preliminary underground development on the Melladito, Intermediate, and Nombre de Dios zones.

During the first quarter of 2012, a total of 4,535 metres of drilling in 18 holes was completed on the San Ignacio Project. This was sufficient to infill, and to extend the combined strike length of the four dominant known veins to 700 metres. This includes the initial 73 drill holes and is the basis for the second version of the San Ignacio Mineral Resource estimate.

Highlights from section 1000N include an intersection from the Nombre de Dios 2 vein of 3.9 metres (2.99 metres true width) grading 195g/t Ag and 3.70g/t Au in ESI12-067. Fill-in hole ESI12-073 includes an intersection from the Intermediate vein of 4.30 metres (2.76 metres true width) grading 252g/t Ag and 3.97g/t Au, and an intersection from the Melladito vein of 4.70 metres (2.70 metres true width) grading 102g/t Ag and 1.95g/t Au.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 20 |

During the second quarter of 2012, surface drilling focused on an area from 300-400N and on an area from 0-200S. The drilling continued to extend the limits of the known mineralized zones beyond the resource model.

In the 300-400N area the mineralized Intermediate vein continues south of the model. Mineralization in the Nombre de Dios, Melladito, and Intermediate is typical with highly variable widths and grades in the structures. Highlights include 2.65 metres grading 533g/t Ag and 7.59g/t Au in the Intermediate vein and 1.15 metres grading 249g/t Ag and 2.99g/t Au in the Nombre de Dios vein. In addition, new but as yet irregular, high grade silver-gold veins between the Intermediate and Nombre de Dios vein structures have also been discovered. These zones returned intercepts of 794g/t Ag and 3.70g/t Au over 2.22 metres, as well as 422g/t Ag and 10.50g/t Au over 0.60 metres, and 131g/t Ag and 19.20g/t Au over 0.50 metres.

As noted above, the Company released an updated Mineral Resource estimate to March 31, 2012 for the San Ignacio Project on May 9, 2012 (refer to May 9, 2012 news release and the corresponding technical report filed on SEDAR dated June 26, 2012). This updated Mineral Resource estimate at San Ignacio supersedes the original estimate. The new Inferred Mineral Resource is estimated to contain 6,894,000 Ag eq oz in 826,000 tonnes averaging 121g/t Ag and 2.28g/t Au (using a 125g/t Ag eq cut-off). This updated estimate both fills in and expands the strike length of the mineralized zones to 650 metres. This estimate increases the tonnage by 35%, the silver content by 29%, the gold content by 51% and the Ag eq oz by 53% over the previous estimate. It should be noted that this estimate used only four of the seven previously identified zones, leaving three zones to be more thoroughly tested at a later date.

| San Ignacio Measured Mineral Resources – March 31, 2012 (Cut-off 125 g/t Ag eq) |

| | Tonnage | Ag | Ag | Au | Au | Ag Eq |

| | (Kt) | (g/t) | (oz) | (g/t) | (oz) | (oz) |

| Inferred | 826 | 121 | 3,205,000 | 2.28 | 60,700 | 6,894,000 |

El Horcon Project

On September 5, 2012, the Company completed the purchase of a 100% interest in the El Horcon Silver-Gold Project in Jalisco State, Mexico for total cash consideration of US$1.6 million. El Horcon covers 7,908 hectares in 17 contiguous mining concessions and is located 60 kilometres northwest of the Company’s Guanajuato Mine Complex, allowing for the potential to become a satellite mine for the Company’s Guanajuato operations. El Horcon is a past producing mine and the Company expects to commence a drill program before the end of the second quarter of 2013 to delineate a resource.

During the fourth quarter of 2012, exploration activities included the re-sampling of historical underground workings, geological mapping, and surface sampling of all veins and mineralized structures. In total, 1,187 samples have been submitted for assay and 16 underground workings have been geologically mapped and sampled. The majority of the sampling corresponds to surface exposures of veins and mineralized structures. Geological mapping has outlined multiple vein zones along a northwest trend of five kilometers. The baseline studies for the Ministry of Environmental and Natural Resources in Mexico (SEMARNAT) have been completed, along with the location of 24 drill sites, and the permit to drill at El Horcon has been submitted for approval.

A surface drill program is planned to commence before the end of the second quarter of 2013. It will consist of 30 drill holes for a total of 3,000 metres. The program is laid out along an 800 metre length of the Diamantillo vein, and will test the Diamantillo vein as well as various splays and nearby parallel structures and veins.

As of the date of this MD&A, the Company had not fully secured mineral property titles for approximately 5,000 of its 7,908 hectares related to the El Horcon Project. Certain of the Company’s title claims have been cancelled due to what the Company believes is an administrative error on the part of the government agency which manages mineral claims in Mexico. The Company is currently in the process of attempting to reinstate the claims. Neither the status of the claims or the process to reinstate the claims has affected the Company’s currently planned permitting and drilling programs. The Company expects to be successful in reinstating the claims and therefore has not recorded any provision against the carrying value of the El Horcon Project.

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 21 |

Santa Rosa Project

After the completion of a drill program (five drill holes totaling 1,653 metres) in the first quarter of 2012, no further drilling has been completed at Santa Rosa. A reassessment of the property and regional geology, involving geological mapping and sampling will be undertaken in order to better understand the structural controls on mineralization before planning another drill program.

SELECTED QUARTERLY INFORMATION

The following table sets out selected quarterly financial results which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) except as noted:

| (in thousands, except per share | | | | | | | | | | | | | | | | | | | | | | | | |

| amounts) | | Q4 2012 | | | Q3 2012 | | | Q2 2012 | | | Q1 2012 | | | Q4 2011 | | | Q3 2011 | | | Q2 2011 | | | Q1 2011 | |

| Revenue | $ | 17,789 | | $ | 15,286 | | $ | 14,439 | | $ | 13,625 | | $ | 17,520 | | $ | 16,278 | | $ | 8,560 | | $ | 15,460 | |

| Cost of sales (excluding amortization,depletion and share-based payments) | | 11,117 | | | 7,566 | | | 8,346 | | | 5,835 | | | 8,870 | | | 6,581 | | | 4,193 | | | 5,831 | |

| Earnings from mining operations1 | | 3,319 | | | 5,791 | | | 3,771 | | | 6,325 | | | 6,032 | | | 8,320 | | | 3,951 | | | 8,613 | |

| Net income (loss) for the period | | (1,285) | | | 1,758 | | | 354 | | | 4,683 | | | (1,419) | | | 3,415 | | | 2,501 | | | 7,009 | |

| Basic earnings (loss) per share | | (0.01) | | | 0.01 | | | 0.00 | | | 0.03 | | | (0.01) | | | 0.03 | | | 0.02 | | | 0.06 | |

| Diluted earnings (loss) per share | | (0.01) | | | 0.01 | | | 0.00 | | | 0.03 | | | (0.01) | | | 0.02 | | | 0.02 | | | 0.05 | |

| Adjusted EBITDA2 | | 3,800 | | | 4,961 | | | 3,691 | | | 4,441 | | | 6,265 | | | 7,752 | | | 2,833 | | | 7,874 | |

| Cash and cash equivalents (includingshort-term investments) | | 25,899 | | | 26,827 | | | 28,675 | | | 40,322 | | | 39,437 | | | 35,074 | | | 36,760 | | | 15,166 | |

| Total assets | | 116,729 | | | 114,057 | | | 110,717 | | | 110,024 | | | 102,944 | | | 95,513 | | | 91,938 | | | 66,154 | |

| Total non-current liabilities | | 8,193 | | | 5,569 | | | 6,128 | | | 5,997 | | | 3,978 | | | 1,758 | | | 1,917 | | | 1,901 | |

| Working capital | $ | 44,539 | | $ | 45,911 | | $ | 49,889 | | $ | 53,537 | | $ | 53,810 | | $ | 53,783 | | $ | 51,947 | | $ | 29,291 | |

Refer to the “Results of Operations” section for a complete discussion of the financial results for the quarter and year ended December 31, 2012.

____________________________

| 1 | “Earnings from mining operations” are defined as gross profit. |

| 2 | “Adjusted EBITDA” is a non-IFRS measure in which standard EBITDA (earnings before interest, taxes, depreciation and amortization) is adjusted for share- based payments expense, foreign exchange gains or losses, and non-recurring items. The Company has updated its definition of adjusted EBITDA and has restated 2011 comparative figures presented above and elsewhere in this MD&A to reflect the exclusion of interest income. The Company does not consider these changes to be material. Refer to the “Non-IFRS Measures” section for the definition and a reconciliation of standardized and adjusted EBITDA to the financial statements. |

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 22 |

SELECTED ANNUAL INFORMATION

The following table sets out selected annual financial results which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) except as noted:

| (in thousands, except per share amounts) | | | | | | | | | | |

| | | | 2012 | | | 2011 | | | 2010 | |

| Revenue | | $ | 61,139 | | $ | 57,818 | | $ | 42,206 | |

| Cost of sales (excluding amortization, depletion and share-based payments) | | | 32,864 | | | 25,475 | | | 21,161 | |

| Earnings from mining operations1 | | | 19,206 | | | 26,916 | | | 16,447 | |

| Net income for the year | | | 5,510 | | | 11,506 | | | 10,660 | |

| Basic earnings per share | | | 0.04 | | | 0.09 | | | 0.09 | |

| Diluted earnings per share | | | 0.04 | | | 0.08 | | | 0.09 | |

| Adjusted EBITDA2 | | | 16,893 | | | 24,723 | | | 15,068 | |

| Cash and cash equivalents (including short-term investments) | | | 25,899 | | | 39,517 | | | 13,967 | |

| Total assets | | | 116,729 | | | 102,944 | | | 55,451 | |

| Total non-current liabilities | | | 8,193 | | | 3,978 | | | 2,160 | |

| Working capital | | $ | 44,539 | | $ | 53,810 | | $ | 18,812 | |

QUARTERLY TRENDS AND MARKET DATA

The climate in Mexico allows mining and exploration activities to be conducted throughout the year. Therefore, revenue and cost of sales generally do not exhibit variations due to seasonality. The exceptions are periods of excessive drought which may limit mineral processing. The dry season in Mexico generally extends from October through April. The Company did experience water shortages at its Topia operations in the second quarter of 2012 as a result of unusually dry conditions which led the Company to limit processing and stockpile mined ore. The stockpiled ore was subsequently processed in the second half of 2012 as water shortages were alleviated. Revenue will vary based on the quantity of metal produced, metal prices and terms of sales agreements.

There can also be significant variances in the Company’s reported net income from quarter to quarter arising from factors that are often difficult to anticipate in advance or to predict from past results. For example, the granting of incentive stock options, which results in the recording of amounts for share-based payments can be quite large in any given quarter. Fluctuations in foreign currency, specifically the Mexican peso and US dollar against the Canadian dollar may also result in considerable variances in foreign exchange gains and losses due primarily to a significant intercompany loan which is re-valued for each period end. Fluctuations in the price of silver and gold, and to a lesser extent, lead and zinc, can also have a significant impact on the Company’s net income.

________________________

| 1“Earnings from mining operations” are defined as gross profit. |

2“Adjusted EBITDA” is a non-IFRS measure in which standard EBITDA (earnings before interest, taxes, depreciation and amortization) is adjusted for share- based payments expense, foreign exchange gains or losses, and non-recurring items. The Company has updated its definition of adjusted EBITDA and has restated 2011 comparative figures presented above and elsewhere in this MD&A to reflect the exclusion of interest income. The Company does not consider these changes to be material. Refer to the “Non-IFRS Measures” section for the definition and a reconciliation of standardized and adjusted EBITDA to the financial statements. |

| GREAT PANTHER SILVER LIMITED | |

| YEAR ENDED DECEMBER 31, 2012 | 23 |

The Company’s past quarterly mineral sales revenue is as follows: