Exhibit 99.3

GREAT PANTHER SILVER LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

| PROFILE | 3 |

| HIGHLIGHTS | 4 |

| SIGNIFICANT EVENTS | 5 |

| OVERALL PERFORMANCE - OPERATIONAL AND FINANCIAL HIGHLIGHTS | 6 |

| SELECTED ANNUAL INFORMATION | 16 |

| SUMMARY OF SELECTED QUARTERLY INFORMATION | 17 |

| RESULTS OF OPERATIONS | 19 |

| OUTLOOK | 25 |

| METAL PRICE SENSITIVITIES | 26 |

| LIQUIDITY AND CAPITAL RESOURCES | 27 |

| TRANSACTIONS WITH RELATED PARTIES | 29 |

| CRITICAL ACCOUNTING ESTIMATES | 29 |

| CHANGES IN ACCOUNTING POLICIES | 30 |

| FINANCIAL INSTRUMENTS | 30 |

| SECURITIES OUTSTANDING | 30 |

| NON-GAAP MEASURES | 30 |

| INTERNAL CONTROLS OVER FINANCIAL REPORTING | 37 |

| CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS | 38 |

| CAUTIONARY NOTE TO U.S. INVESTORS | 40 |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 2 |

MANAGEMENT'S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the annual audited consolidated financial statements of Great Panther Silver Limited (“Great Panther” or the “Company”) for the year ended December 31, 2017 and the notes related thereto, which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, and the most recent annual Form 40-F/Annual Information Form (“AIF”) on file with the US Securities and Exchange Commission (“SEC”) and Canadian provincial securities regulatory authorities.

All information in this MD&A is current as at February 22, 2018, unless otherwise indicated. All dollar amounts are expressed in US dollars ("$", or “USD”), unless otherwise noted.

This MD&A contains forward-looking statements and should be read in conjunction with the Cautionary Statement on Forward-Looking Statements section at the end of this MD&A.

This MD&A contains references to non-GAAP measures. Refer to the section entitled «Non-GAAP Measures» for explanations of these measures and reconciliations to the Company’s reported financial results.

Some tables contained in this MD&A may not sum exactly, due to rounding.

PROFILE

Great Panther Silver Limited is a primary silver and precious metals producer and exploration company listed on the Toronto Stock Exchange trading under the symbol GPR, and on the NYSE American trading under the symbol GPL. The Company’s wholly-owned mining operations in Mexico are the Topia Mine (or “Topia”), and the Guanajuato Mine Complex (the “GMC”) which comprises the Company’s Guanajuato Mine, the San Ignacio Mine (or “San Ignacio”), and the Cata processing plant. The GMC produces silver and gold concentrate and is located in central Mexico, approximately 380 kilometres north-west of Mexico City, and approximately 30 kilometres from the Guanajuato International Airport. The Topia Mine is located in the Sierra Madre Mountains in the state of Durango in northwestern Mexico, producing concentrates containing silver, gold, lead and zinc and earning revenue from custom milling of third-party material at its processing facility.

On June 30, 2017, Great Panther completed the acquisition of the Coricancha Mine Complex (“Coricancha”) in Peru. Coricancha is a gold-silver-copper-lead-zinc mine located in the central Andes of Peru, approximately 90 kilometres east of Lima, and has been on care and maintenance since August 2013. Coricancha has a 600 tonnes per day processing facility along with supporting mining infrastructure. The Company is conducting evaluations of the underground mine and infrastructure, as well as undertaking technical and environmental studies with a view to restarting the operation. In addition, the Company recently updated Coricancha’s Mineral Resource Estimate and expects to release further technical studies in the second quarter of 2018. Depending on the outcome of the Company's evaluations, development and capital investments in support of a restart of the mine could commence in 2018.

The Company’s exploration properties also include the El Horcón, Santa Rosa, and Plomo projects in Mexico; and the Argosy project in Canada. The El Horcón project is located 100 kilometres by road northwest of Guanajuato, Santa Rosa is located 15 kilometres northeast of Guanajuato, and the Plomo property is located in Sonora, Mexico. The Argosy property is located in the Red Lake Mining District in northwestern Ontario, Canada.

The Company continues to evaluate additional mining opportunities located in the Americas. Additional information on the Company, including its Annual Information Form, can be found on SEDAR atwww.sedar.com and EDGAR atwww.sec.gov/edgar.shtml or on the Company’s website atwww.greatpanther.com.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 3 |

HIGHLIGHTS

Highlights of fiscal year 2017 compared to fiscal year 2016

| · | Metal production increased 2% to 3,978,731 silver equivalent ounces (“Ag eq oz”); |

| · | Silver production decreased 3% to 1,982,685 silver ounces; |

| · | Gold production increased 1% to 22,501 gold ounces; |

| · | Cash cost1 increased by $2.11 to $5.76; |

| · | Cash cost per Ag eq oz1 increased by $1.76 to $12.11; |

| · | AISC1 increased by $4.08 to $15.07; |

| · | Revenue increased 3% to $63.7 million; |

| · | Mine operating earnings1 before non-cash items were $22.0 million, a decrease of 21%; |

| · | Adjusted EBITDA1 decreased to $6.0 million, compared to $16.5 million; |

| · | Net income totaled $1.3 million, compared to a net loss of $4.1 million; |

| · | Cash flows from operating activities, before changes in non-cash net working capital was $6.4 million, compared to $16.0 million; |

| · | Cash and short-term deposits remained relatively unchanged at $56.9 million at December 31, 2017 from $56.7 million at December 31, 2016; and |

| · | Net working capital decreased to $66.0 million at December 31, 2017 from $66.6 million at December 31, 2016. |

Highlights of the fourth quarter 2017 compared to fourth quarter 2016, unless otherwise noted:

| · | Metal production increased 21% to 1,065,773 Ag eq oz; |

| · | Silver production increased 12% to 514,218 silver ounces; |

| · | Gold production increased 14% to 5,931 ounces; |

| · | Cash cost1 increased by $1.42 to $7.25; |

| · | Cash cost per Ag eq oz1 increased by $2.70 to $13.18; |

| · | AISC1 decreased by $1.72 to $14.72 |

| · | Revenue increased 39% to $17.4 million; |

| · | Mine operating earnings1 before non-cash items were $5.0 million, an increase of 11%; |

| · | Net loss totaled $1.9 million, compared to $1.5 million; |

| · | Adjusted EBITDA1 amounted to $0.9 million, compared to $1.4 million; and, |

| · | Cash flows from operating activities, before changes in non-cash net working capital was $0.6 million, compared to $1.1 million. |

| 1 | See section entitled «Non-GAAP measures» in this MD&A |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 4 |

SIGNIFICANT EVENTS

On April 13, 2017, the Company announced that Elise Rees, FCPA, FCA, ICD.D, had joined the Company’s Board of Directors.

In June 2017, the Company announced that it had successfully completed the commissioning phase of the refurbished processing plant at Topia and that the plant was operating at planned capacity. Milling operations had been suspended from early December 2016 until early April 2017 to facilitate the construction of a tailings filtration plant, the execution of plant upgrades, and the transition to a new tailings handling facility (the “Topia Project”). In December 2017, SEMARNAT (the Mexican environmental permitting agency) granted the Company all permits for the construction and operation of the new Phase II tailings storage facility (“TSF”) at its Topia Mine. The Company is utilizing the existing Phase I TSF during the construction of Phase II.

In June 2017, surface drilling at San Ignacio confirmed the continuation of strong gold-silver mineralization along strike of the current mine workings.

On June 30, 2017, the Company completed the acquisition of the Coricancha Mine Complex from subsidiaries of Nyrstar N.V. (“Nyrstar”).

On August 16, 2017, James Bannantine was appointed President and Chief Executive Officer of the Company, succeeding Robert Archer. Mr. Archer remains on the Board of Directors.

In August 2017, the Company announced the results of the exploration drilling program conducted at Coricancha and focused on three main veins – Wellington, Constancia and Colquipallana, in addition to a new exploration target, the Animas vein. Highlights included Wellington hole Cori-15-003, which intersected 10.46g/t Au, 388g/t Ag, 1.64% Cu, 0.53% Pb and 2.86% Zn over a true width of 0.53 metres, and Constancia hole Cori-15-013 that intersected 22.64g/t Au, 83g/t Ag, 0.19% Cu, 1.12% Pb and 2.30% Zn over a true width of 0.41 metres.

On December 20, 2017, the Company completed an updated Mineral Resource Estimate in accordance with National Instrument 43-101 for Coricancha, with an effective date of December 20, 2017. The Measured and Indicated (“M&I”) tonnes and grades in the estimate compare well with those from the Historical Resource Estimate of 2012. The M&I Mineral Resource was estimated at 24.2 million Ag eq oz and the Inferred Mineral Resource was estimated at 28.4 million Ag eq oz. The Company is completing optimization studies and is evaluating alternative mining methods to improve productivity, and to reduce dilution, costs and project risk. The Company plans to release additional technical studies for the project in the second quarter of 2018.

On January 25, 2018, the Company provided an update to the Mineral Resource at the GMC, with an effective date of August 31, 2017. Compared to the previous update which had an effective date of August 31, 2016, M&I Mineral Resources increased by 91% to 13,619,794 Ag eq oz due to increases in both resource categories at both San Ignacio and Guanajuato Mines. Specifically, M&I Mineral Resources increased by 110% to 11,362,323 Ag eq oz and 31% to 2,257,472 Ag eq oz at the San Ignacio Mine and Guanajuato Mine, respectively, compared to the previous update. Inferred Mineral Resources at the GMC remained essentially unchanged at 6,997,306 Ag eq oz.

On February 22, 2018, Great Panther regretfully announced the passing away of Mr. Kenneth W. Major, who served as Director of the Company since March of 2011, including distinguished service as Chair of Safety, Health and Environment Committee in addition to service on other committees of the Board of Directors. Ken graduated from McGill University with a bachelor's degree in metallurgical engineering and established an over 40-year career in the mining industry. He was a founder/partner of Rescan Engineering Ltd. which was later acquired by Hatch. During his career, he provided engineering, operations and management services to major mining companies. Ken was the recipient of the Art MacPherson Comminution Award, a peer recognition awarded by the Canadian Mineral Processors ("CMP"), in recognition of his outstanding contribution in the field. In 2018, he received the Lifetime Achievement Award by from the CMP for his enduring contributions to mineral processing.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 5 |

OVERALL PERFORMANCE - OPERATIONAL AND FINANCIAL HIGHLIGHTS

| | | Q4 2017 | | Q4 2016 | | Change | | 2017 | | 2016 | | Change |

| OPERATING RESULTS | | | | | | | | | | | | | | | | | | | | | | | | |

| Tonnes milled (excluding custom milling) | | | 98,396 | | | | 92,869 | | | | 6 | % | | | 373,709 | | | | 376,739 | | | | -1 | % |

| Ag eq oz produced1 | | | 1,065,773 | | | | 883,772 | | | | 21 | % | | | 3,978,731 | | | | 3,884,960 | | | | 2 | % |

| Silver production – ounces | | | 514,218 | | | | 460,571 | | | | 12 | % | | | 1,982,685 | | | | 2,047,260 | | | | -3 | % |

| Gold production – ounces | | | 5,931 | | | | 5,206 | | | | 14 | % | | | 22,501 | | | | 22,238 | | | | 1 | % |

| Payable silver ounces | | | 516,078 | | | | 488,428 | | | | 6 | % | | | 1,937,702 | | | | 2,010,252 | | | | -4 | % |

| Ag eq oz sold | | | 1,038,023 | | | | 883,348 | | | | 18 | % | | | 3,793,516 | | | | 3,742,733 | | | | 1 | % |

| Cost per tonne milled2 | | $ | 116 | | | $ | 86 | | | | 35 | % | | $ | 106 | | | $ | 88 | | | | 20 | % |

| Cash cost2 | | $ | 7.25 | | | $ | 5.83 | | | | 24 | % | | $ | 5.76 | | | $ | 3.65 | | | | 58 | % |

| Cash cost per Ag eq oz2 | | $ | 13.18 | | | $ | 10.48 | | | | 26 | % | | $ | 12.11 | | | $ | 10.35 | | | | 17 | % |

| AISC2 | | $ | 14.72 | | | $ | 16.44 | | | | -10 | % | | $ | 15.07 | | | $ | 10.99 | | | | 37 | % |

| AISC per Ag eq oz2 | | $ | 16.89 | | | $ | 16.35 | | | | 3 | % | | $ | 16.87 | | | $ | 14.29 | | | | 18 | % |

| (in 000’s, unless otherwise noted) | | Q4 2017 | | Q4 2016 | | Change | | 2017 | | 2016 | | Change |

| FINANCIAL RESULTS | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | $ | 17,384 | | | $ | 12,515 | | | | 39 | % | | $ | 63,746 | | | $ | 61,881 | | | | 3 | % |

| Mine operating earnings before non-cash items2 | | $ | 4,962 | | | $ | 4,476 | | | | 11 | % | | $ | 21,994 | | | $ | 27,728 | | | | -21 | % |

| Mine operating earnings | | $ | 3,755 | | | $ | 2,411 | | | | 56 | % | | $ | 17,689 | | | $ | 22,022 | | | | -20 | % |

| Net income (loss) | | $ | (1,918 | ) | | $ | (1,498 | ) | | | -28 | % | | $ | 1,290 | | | $ | (4,118 | ) | | | 131 | % |

| Adjusted EBITDA2 | | $ | 904 | | | $ | 1,376 | | | | -34 | % | | $ | 6,009 | | | $ | 16,519 | | | | -64 | % |

| Operating cash flows before changes in non-cash net working capital | | $ | 618 | | | $ | 1,119 | | | | -45 | % | | $ | 6,369 | | | $ | 15,975 | | | | -60 | % |

| Cash and short-term deposits at end of period | | $ | 56,888 | | | $ | 56,662 | | | | 0 | % | | $ | 56,888 | | | $ | 56,662 | | | | 0 | % |

| Net working capital at end of period | | $ | 65,965 | | | $ | 66,560 | | | | -1 | % | | $ | 65,965 | | | $ | 66,560 | | | | -1 | % |

| Average realized silver price per oz3 | | $ | 16.86 | | | $ | 14.99 | | | | 12 | % | | $ | 17.11 | | | $ | 17.15 | | | | 0 | % |

| Average realized gold price per oz3 | | $ | 1,292 | | | $ | 1,073 | | | | 20 | % | | $ | 1,291 | | | $ | 1,267 | | | | 2 | % |

| Earnings (loss) per share – basic and diluted | | $ | (0.01 | ) | | $ | (0.01 | ) | | | | | | $ | 0.01 | | | $ | (0.03 | ) | | | | |

| 1 | Silver equivalent ounces are referred to throughout this document. For 2017, Ag eq oz are calculated using a 70:1 Ag:Au ratio and ratios of 1:0.0559 and 1:0.0676 for the price/ounce of silver to lead and zinc price/pound, respectively, and applied to the relevant metal content of the concentrates produced, expected to be produced, or sold from operations. Comparatively, in 2016, Ag eq oz are calculated using a 70:1 Ag:Au ratio and ratios of 1:0.0504 and 1:0.0504 for the price/ounce of silver to lead and zinc price/pound, respectively, and applied to the relevant metal content of the concentrates produced, expected to be produced, or sold from operations. |

| 2 | The Company has included the non-GAAP performance measures cost per tonne milled, cash cost, cash cost per Ag eq oz, AISC, AISC per Ag eq oz, mine operating earnings before non-cash items, cost of sales before non-cash items and adjusted EBITDA throughout this document. Refer to theNon-GAAP Measures section of this MD&A for an explanation of these measures and reconciliation to the Company’s reported financial results in accordance with IFRS. As these are not standardized measures, they may not be directly comparable to similarly titled measures used by others. |

| 3 | Average realized silver and gold prices are prior to smelting and refining charges. |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 6 |

MINING OPERATIONS

Consolidated operations

| | | 2017 | | 2016 |

| | | FY | | Q4 | | Q3 | | Q2 | | Q1 | | FY | | Q4 | | Q3 | | Q2 | | Q1 |

| Tonnes mined1 | | | 370,017 | | | | 97,407 | | | | 87,974 | | | | 92,578 | | | | 92,058 | | | | 378,121 | | | | 98,867 | | | | 94,310 | | | | 100,219 | | | | 84,725 | |

| Tonnes milled | | | 373,708 | | | | 98,396 | | | | 94,080 | | | | 98,576 | | | | 82,656 | | | | 376,739 | | | | 92,869 | | | | 95,282 | | | | 99,905 | | | | 88,683 | |

| Custom milling (tonnes) | | | – | | | | – | | | | – | | | | – | | | | – | | | | 5,125 | | | | 1,202 | | | | 1,197 | | | | 1,199 | | | | 1,527 | |

| Total tonnes milled | | | 373,708 | | | | 98,396 | | | | 94,080 | | | | 98,576 | | | | 82,656 | | | | 381,864 | | | | 94,071 | | | | 96,479 | | | | 101,104 | | | | 90,210 | |

| Production | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (ounces) | | | 1,982,685 | | | | 514,218 | | | | 532,803 | | | | 569,229 | | | | 366,435 | | | | 2,047,260 | | | | 460,571 | | | | 510,491 | | | | 536,726 | | | | 539,472 | |

| Gold (ounces) | | | 22,500 | | | | 5,931 | | | | 5,848 | | | | 5,543 | | | | 5,178 | | | | 22,238 | | | | 5,206 | | | | 5,423 | | | | 6,010 | | | | 5,599 | |

| Lead (tonnes) | | | 1,291 | | | | 441 | | | | 442 | | | | 405 | | | | 3 | | | | 1,033 | | | | 213 | | | | 248 | | | | 290 | | | | 282 | |

| Zinc (tonnes) | | | 1,757 | | | | 551 | | | | 562 | | | | 638 | | | | 6 | | | | 1,496 | | | | 315 | | | | 324 | | | | 433 | | | | 424 | |

| Ag eq oz | | | 3,978,731 | | | | 1,065,773 | | | | 1,080,483 | | | | 1,102,290 | | | | 730,185 | | | | 3,884,960 | | | | 883,772 | | | | 953,632 | | | | 1,037,728 | | | | 1,009,828 | |

| Sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Payable silver ounces | | | 1,937,702 | | | | 516,078 | | | | 552,218 | | | | 524,411 | | | | 344,995 | | | | 2,010,252 | | | | 488,428 | | | | 442,277 | | | | 601,449 | | | | 478,098 | |

| Ag eq oz sold | | | 3,793,516 | | | | 1,038,023 | | | | 1,082,451 | | | | 992,058 | | | | 680,984 | | | | 3,742,733 | | | | 883,348 | | | | 864,605 | | | | 1,148,467 | | | | 846,313 | |

| Cost metrics | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cost per tonne milled2 | | $ | 106 | | | $ | 116 | | | $ | 116 | | | $ | 103 | | | $ | 88 | | | $ | 88 | | | $ | 86 | | | $ | 86 | | | $ | 86 | | | $ | 95 | |

| Cash cost | | $ | 5.76 | | | $ | 7.25 | | | $ | 5.82 | | | $ | 5.67 | | | $ | 3.54 | | | $ | 3.65 | | | $ | 5.83 | | | $ | 3.30 | | | $ | 1.72 | | | $ | 4.20 | |

| Cash cost per Ag eq oz2 | | $ | 12.11 | | | $ | 13.18 | | | $ | 12.37 | | | $ | 11.47 | | | $ | 10.99 | | | $ | 10.35 | | | $ | 10.48 | | | $ | 10.99 | | | $ | 9.67 | | | $ | 10.49 | |

| AISC2 | | $ | 15.07 | | | $ | 14.72 | | | $ | 13.75 | | | $ | 14.93 | | | $ | 19.55 | | | $ | 10.99 | | | $ | 16.44 | | | $ | 11.97 | | | $ | 7.19 | | | $ | 9.25 | |

| AISC per Ag eq oz2 | | $ | 16.87 | | | $ | 16.89 | | | $ | 16.42 | | | $ | 16.37 | | | $ | 19.10 | | | $ | 14.29 | | | $ | 16.35 | | | $ | 15.43 | | | $ | 12.54 | | | $ | 13.35 | |

| 2 | Refer to theNon-GAAP Measuressection of this MD&A for an explanation of these measures and reconciliation to the Company’s reported financial results in accordance with IFRS. |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 7 |

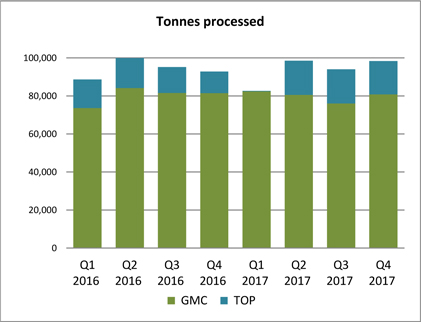

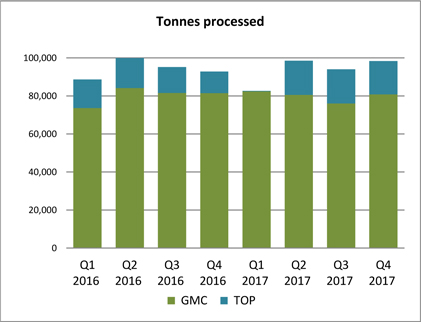

Tonnes Milled

Ore processed for the year ended December 31, 2017 decreased by 1% compared to the prior year. Although milling operations at the Topia Mine were suspended from early December 2016 to early April 2017 to facilitate plant upgrades and the transition to a new tailings handling facility, the Company continued to mine and stockpile ore to mitigate the impact of the suspension of processing.

The Company processed 98,396 tonnes of ore during the fourth quarter of 2017, a 6% increase from 92,869 tonnes compared to the fourth quarter of 2016. The fourth quarter of 2016 reflected the suspension of processing at Topia in December.

Compared to the third quarter of 2017, the throughput during the fourth quarter of 2017 increased by 5% which can be attributed to more ore mined and processed from San Ignacio.

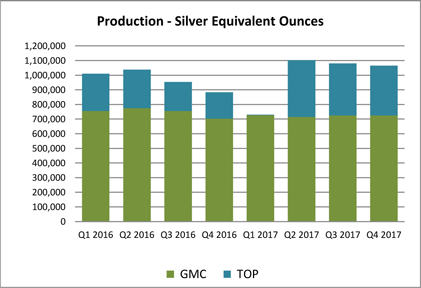

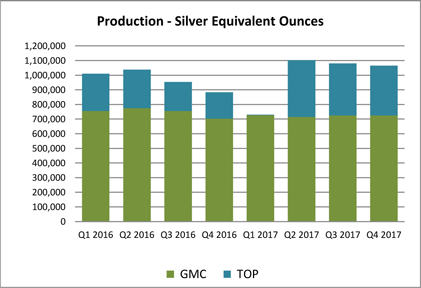

Metal Production

Metal production for the year ended December 31, 2017 increased by 2% compared to the prior year despite a 1% decrease in tonnes milled. This was due to a higher proportion of production from the higher grade Topia Mine.

Metal production increased 21% compared to the fourth quarter of 2016, predominantly due to the 54% increase in mill throughput at the Topia Mine which mainly resulted from the temporary suspension in processing at the Topia plant in December 2016.

Metal production decreased 1% compared to the third quarter of 2017 despite an increase in tonnes milled by 5%, due to lower ore grades at both GMC and Topia.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 8 |

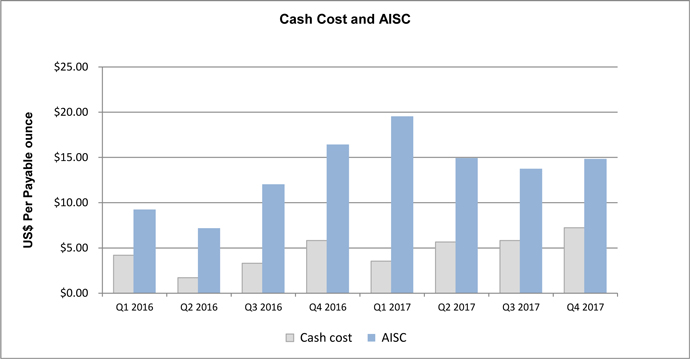

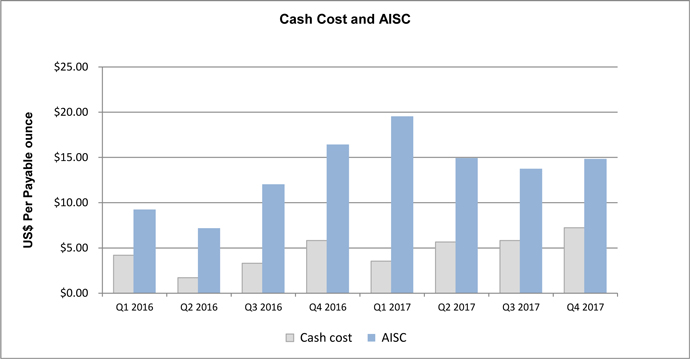

Cash Cost and AISC

Cash cost for fiscal year 2017 was $5.76 compared to $3.65 in fiscal 2016.

The increase of $2.11 was due to the impact of higher Mexican peso (“MXN”) production costs at both operating mines ($4.79/oz effect) (refer to discussion on increase in production costs in the Results of Operations section). These factors were partly offset by higher by-product credits associated with higher volumes sold and higher realized average prices for gold, lead and zinc ($1.75/oz effect), the strengthening of the USD relative to the MXN which reduced cash operating costs in USD terms as these are predominantly incurred in MXN ($0.63/oz effect) and lower smelting and refining charges ($0.59/oz effect).

Cash cost per Ag eq oz for fiscal 2017 was $12.11 compared to $10.35 in fiscal 2016.

The increase of $1.76 over 2016, was due to the impact of higher MXN production costs, but was partly offset by lower smelting and refining charges, higher silver equivalent ounces sold which had the effect of decreasing fixed production cost on a per-unit basis, and the strengthening of the USD relative to the MXN which reduced cash operating costs in USD terms.

All in sustaining cost for fiscal 2017 was $15.07 compared to $10.99 in fiscal 2016.

The increase of $4.08 compared to the prior year was primarily due to the increase in cash cost described above ($2.11/oz effect). In addition, increased general and administrative (“G&A”) expenses and share-based compensation expenditures and higher exploration, evaluation, and development costs ("EE&D") costs at the operating mines contributed to the increase in AISC ($1.92/oz effect). A significant portion of the higher G&A costs was attributed to a non-recurring charge which accounted for about $0.44 per payable ounce. These factors were partly offset by the decrease in sustaining capital expenditures ($0.20/oz effect).

All in sustaining cost per Ag eq oz for fiscal 2017 was $16.87 compared to $14.29 in fiscal 2016.

The increase of $2.58 over 2016, was mainly attributable to the $1.76 increase in cash cost per Ag eq oz, the increase in G&A expenses, the increase in EE&D costs at the operating mines, and the increase in share-based compensation expense. These factors were partly offset by the decrease in sustaining capital expenditures.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 9 |

Guanajuato Mine Complex

| | | 2017 | | 2016 |

| | | FY | | Q4 | | Q3 | | Q2 | | Q1 | | FY | | Q4 | | Q3 | | Q2 | | Q1 |

| Tonnes milled | | | 319,963 | | | | 80,896 | | | | 76,076 | | | | 80,535 | | | | 82,456 | | | | 320,903 | | | | 81,518 | | | | 81,602 | | | | 84,134 | | | | 73,649 | |

| Production | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (ounces) | | | 1,386,964 | | | | 332,203 | | | | 341,636 | | | | 348,130 | | | | 364,995 | | | | 1,473,229 | | | | 347,415 | | | | 383,598 | | | | 366,943 | | | | 375,273 | |

| Gold (ounces) | | | 21,501 | | | | 5,606 | | | | 5,471 | | | | 5,247 | | | | 5,177 | | | | 21,627 | | | | 5,071 | | | | 5,306 | | | | 5,817 | | | | 5,433 | |

| Silver equivalent ounces | | | 2,892,068 | | | | 724,643 | | | | 724,630 | | | | 715,423 | | | | 727,372 | | | | 2,987,074 | | | | 702,351 | | | | 755,008 | | | | 774,160 | | | | 755,555 | |

| Sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Payable silver ounces | | | 1,404,696 | | | | 341,069 | | | | 369,663 | | | | 349,836 | | | | 344,128 | | | | 1,477,695 | | | | 359,947 | | | | 335,817 | | | | 450,167 | | | | 331,764 | |

| Ag eq oz sold | | | 2,892,243 | | | | 731,403 | | | | 769,485 | | | | 710,795 | | | | 680,560 | | | | 2,954,567 | | | | 684,864 | | | | 708,366 | | | | 927,800 | | | | 633,537 | |

| Average ore grades | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (g/t) | | | 151 | | | | 144 | | | | 155 | | | | 150 | | | | 155 | | | | 163 | | | | 149 | | | | 164 | | | | 159 | | | | 179 | |

| Gold (g/t) | | | 2.41 | | | | 2.48 | | | | 2.54 | | | | 2.32 | | | | 2.30 | | | | 2.43 | | | | 2.25 | | | | 2.36 | | | | 2.52 | | | | 2.58 | |

| Metal recoveries | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver | | | 89.2 | % | | | 88.5 | % | | | 89.8 | % | | | 89.5 | % | | | 88.8 | % | | | 87.9 | % | | | 88.7 | % | | | 88.9 | % | | | 85.3 | % | | | 88.5 | % |

| Gold | | | 86.9 | % | | | 87.0 | % | | | 88.1 | % | | | 87.2 | % | | | 85.0 | % | | | 86.4 | % | | | 85.9 | % | | | 85.8 | % | | | 85.2 | % | | | 89.0 | % |

Metal production

The tonnes of ore processed for the year ended December 31, 2017 remained consistent with the prior year, and metal production (in Ag eq oz terms) at the GMC for the year ended December 31, 2017 decreased 3%. The decrease reflected the impact of lower silver and gold grades which was partly offset by the higher metal recoveries for both silver and gold.

During the fourth quarter of 2017, the GMC processed 80,896 tonnes, a decrease of 1% compared to the fourth quarter of 2016. Metal production, however, increased 3% reflecting the impact of higher gold grades and recoveries. Increased throughput during the fourth quarter of 2017, compared to the third quarter of 2017, made up for lower head grades and recoveries encountered in the quarter.

Cash cost

| | | 2017 | | 2016 |

| | | FY | | Q4 | | Q3 | | Q2 | | Q1 | | FY | | Q4 | | Q3 | | Q2 | | Q1 |

| Cost per tonne milled1 | | $ | 92 | | | $ | 99 | | | $ | 96 | | | $ | 91 | | | $ | 83 | | | $ | 78 | | | $ | 77 | | | $ | 76 | | | $ | 76 | | | $ | 83 | |

| Cash cost1 | | $ | 4.32 | | | $ | 5.65 | | | $ | 3.75 | | | $ | 5.44 | | | $ | 2.48 | | | $ | 0.85 | | | $ | 4.27 | | | $ | 0.15 | | | $ | (1.19 | ) | | $ | 0.61 | |

| Cash cost per Ag eq oz1 | | $ | 11.58 | | | $ | 12.49 | | | $ | 11.58 | | | $ | 11.78 | | | $ | 10.41 | | | $ | 9.48 | | | $ | 9.51 | | | $ | 10.05 | | | $ | 8.97 | | | $ | 9.56 | |

Cash cost for the GMC for the year ended December 31, 2017 was $4.32, a $3.47 increase over the prior year. The increase is primarily due to the impact of higher MXN production cost and lower silver and gold grades. These factors were partly offset by the effect of lower smelting and refining charges and higher by-product credits associated with higher volumes of gold sold as well as higher realized average gold prices. In addition, the strengthening of the USD relative to the MXN reduced cash operating costs in USD terms as these are predominantly incurred in MXN.

Cash cost for the GMC was $5.65 in the fourth quarter of 2017, compared to $4.27 during the fourth quarter of 2016. The increase was primarily a result of higher MXN production costs (mainly due to higher contractor rates and mining of narrower vein widths), the strengthening of the MXN against the USD which had the effect of increasing production costs in USD terms and the effect of lower payable silver ounces. These factors were partly offset by an increase in gold by-product credits associated with higher volumes of gold sold as well as higher realized average gold prices and lower smelting and refining charges.

| 1 | Refer to theNon-GAAP Measuressection of this MD&A for an explanation of these measures and reconciliation to the Company’s reported financial results in accordance with IFRS. |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 10 |

Cash cost per Ag eq oz for the GMC for the year ended December 31, 2017 was $11.58, an increase of $2.10 over the year ended December 31, 2016. This was primarily a result of higher MXN production cost, and the effect of lower payable silver ounces. These factors were partly offset by the decrease in smelting and refining charges and the strengthening of the USD against the MXN which had the effect of reducing production costs in USD terms.

Cash cost per Ag eq oz during the fourth quarter of 2017 was $12.49, an increase of $2.98 over the fourth quarter of 2016. The primary factors were the increase in MXN production costs and the strengthening of the MXN compared to the USD. These factors were partly offset by an increase in sales volumes and the decrease in smelting and refining charges.

AISC

| | | 2017 | | 2016 |

| | | FY | | Q4 | | Q3 | | Q2 | | Q1 | | FY | | Q4 | | Q3 | | Q2 | | Q1 |

| AISC | | $ | 9.17 | | | $ | 10.38 | | | $ | 7.90 | | | $ | 10.89 | | | $ | 7.59 | | | $ | 5.20 | | | $ | 10.88 | | | $ | 5.58 | | | $ | 2.22 | | | $ | 2.72 | |

| AISC per Ag eq oz | | $ | 13.94 | | | $ | 14.69 | | | $ | 13.57 | | | $ | 14.46 | | | $ | 13.00 | | | $ | 11.66 | | | $ | 12.98 | | | $ | 12.62 | | | $ | 10.62 | | | $ | 10.66 | |

AISC for the year ended December 31, 2017 increased to $9.17 compared to the year ended December 31, 2016, primarily due to the above-noted increase in cash cost. In addition, there was an increase in sustaining EE&D expenditures mainly due to increased exploration drilling at San Ignacio to increase mineral resources.

AISC for the fourth quarter of 2017 of $10.38 remained consistent when compared to the fourth quarter of 2016. While cash cost per Ag eq oz increased as noted above, it was offset by lower sustaining EE&D expenditures and capital expenditures.

AISC per Ag eq oz for the year ended December 31, 2017 increased to $13.94 compared to the prior year, primarily due to the above-noted increase in cash cost per Ag eq oz and increase in sustaining EE&D expenditures.

AISC per Ag eq oz for the fourth quarter of 2017 increased to $14.69 compared to the fourth quarter of 2016, primarily due to the above-noted increase in cash cost per Ag eq oz, which was partly offset by lower sustaining EE&D expenditures and capital expenditures.

GMC Development

A total of 12,002 metres of development were completed at the GMC during the year ended December 31, 2017, compared to 9,540 metres of development in 2016.

The Company completed 22,207 metres of exploration drilling at the GMC during 2017, compared to 15,685 metres in 2016. Drilling at the Guanajuato Mine totaled 4,322 metres, and was focused on the Cata, Promontorio and Valenciana mines. This compares to 7,200 metres of drilling at the Guanajuato Mine in 2016. At San Ignacio, total drilling amounted to 17,885 metres for the year, compared to 8,458 metres in 2016.

The majority of mine development during the fourth quarter was focused on the San Ignacio Mine. A total of 3,351 metres of development was completed during the fourth quarter of 2017.

The Company’s fourth quarter 2017 drill program at the GMC included 4,538 metres which was focused on San Ignacio, with the objective of improving the resource definition in these areas.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 11 |

GMC Permitting

In a February 2016 meeting, the Mexican national water authority, CONAGUA, required that the Company make formal applications for permits associated with the occupation and construction of the TSF at the GMC. Following the meeting, the Company filed its applications and CONAGUA carried out an inspection of the TSF and requested further technical information which the Company submitted. In December 2017, the Company also filed with the Mexican environmental permitting authority, SEMARNAT, an amendment to the environmental impact statement reflecting the proposed normal TSF construction activities. This is under review by the regulator, and once approved, will satisfy a requirement by CONAGUA for the processing of its permits. The Company believes its current tailings footprint can be maintained and can support operations at the GMC until at least 2020. The Company also believes, based on its meetings and other communication with CONAGUA, that it will be able to obtain all the above noted permits as required, with no suspension of the GMC operations. While the Company is confident that it will obtain the tailings permits, the Company cannot provide complete assurance that it will complete the review process with CONAGUA without any actions that may suspend its operations. The Company cannot assure that the tailings permits will be obtained or renewed on reasonable terms, or at all. Delays or a failure to obtain such required permits, or the issuance of permits on unfavourable terms or the expiry, revocation or failure by the Company to comply with the terms of any such permits, if obtained, could limit the ability of the Company to expand the tailings facility and could adversely affect the Company’s ability to continue operating at the GMC. In either case, the Company’s results of operations could be adversely affected.

Since the February 2016 meeting with CONAGUA, the Company has also discovered through its own undertakings that additional CONAGUA permits may be needed in connection with water discharge and water use at the GMC TSF and at San Ignacio. The Company is assessing technical options and whether it requires an additional water use permit. The Company believes that it will be able to address or mitigate the need for any necessary water discharge and use permits without any impact to its operations, but the Company cannot provide complete assurance that there is no risk in this regard.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 12 |

Topia Mine

| | | 2017 | | 2016 |

| | | FY | | Q4 | | Q3 | | Q2 | | Q1 | | FY | | Q4 | | Q3 | | Q2 | | Q1 |

| Tonnes milled | | | 53,745 | | | | 17,500 | | | | 18,004 | | | | 18,041 | | | | 200 | | | | 55,836 | | | | 11,351 | | | | 13,680 | | | | 15,771 | | | | 15,034 | |

| Custom milling tonnes | | | – | | | | – | | | | – | | | | – | | | | – | | | | 5,125 | | | | 1,202 | | | | 1,197 | | | | 1,199 | | | | 1,527 | |

| Total tonnes milled | | | 53,745 | | | | 17,500 | | | | 18,004 | | | | 18,041 | | | | 200 | | | | 60,961 | | | | 12,553 | | | | 14,877 | | | | 16,970 | | | | 16,561 | |

| Production | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (ounces) | | | 595,721 | | | | 182,015 | | | | 191,167 | | | | 221,099 | | | | 1,440 | | | | 574,030 | | | | 113,156 | | | | 126,892 | | | | 169,783 | | | | 164,199 | |

| Gold (ounces) | | | 999 | | | | 325 | | | | 377 | | | | 296 | | | | 1 | | | | 612 | | | | 136 | | | | 117 | | | | 192 | | | | 167 | |

| Lead (tonnes) | | | 1,291 | | | | 441 | | | | 442 | | | | 405 | | | | 3 | | | | 1,033 | | | | 213 | | | | 248 | | | | 290 | | | | 282 | |

| Zinc (tonnes) | | | 1,757 | | | | 551 | | | | 562 | | | | 638 | | | | 6 | | | | 1,496 | | | | 315 | | | | 324 | | | | 433 | | | | 424 | |

| Ag eq oz | | | 1,086,663 | | | | 341,129 | | | | 355,853 | | | | 386,867 | | | | 2,814 | | | | 897,886 | | | | 181,421 | | | | 198,624 | | | | 263,568 | | | | 254,273 | |

| Sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Payable silver ounces | | | 533,006 | | | | 175,009 | | | | 182,555 | | | | 174,575 | | | | 867 | | | | 532,557 | | | | 128,481 | | | | 106,460 | | | | 151,282 | | | | 146,334 | |

| Ag eq oz sold | | | 901,273 | | | | 306,620 | | | | 312,966 | | | | 281,263 | | | | 424 | | | | 788,166 | | | | 198,484 | | | | 156,239 | | | | 220,667 | | | | 212,776 | |

| Average feed grade | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (g/t) | | | 376 | | | | 352 | | | | 362 | | | | 414 | | | | 255 | | | | 354 | | | | 349 | | | | 322 | | | | 367 | | | | 373 | |

| Gold (g/t) | | | 0.89 | | | | 0.95 | | | | 0.97 | | | | 0.74 | | | | 0.28 | | | | 0.56 | | | | 0.63 | | | | 0.49 | | | | 0.59 | | | | 0.55 | |

| Lead (%) | | | 2.58 | | | | 2.68 | | | | 2.63 | | | | 2.45 | | | | 1.60 | | | | 1.96 | | | | 2.03 | | | | 1.92 | | | | 1.93 | | | | 1.97 | |

| Zinc (%) | | | 3.47 | | | | 3.35 | | | | 3.33 | | | | 3.73 | | | | 3.40 | | | | 2.82 | | | | 2.97 | | | | 2.46 | | | | 2.87 | | | | 2.96 | |

| Metal recoveries | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver | | | 91.7 | % | | | 91.8 | % | | | 91.1 | % | | | 92.0 | % | | | 87.6 | % | | | 90.4 | % | | | 88.8 | % | | | 89.7 | % | | | 91.3 | % | | | 91.0 | % |

| Gold | | | 65.3 | % | | | 60.8 | % | | | 67.1 | % | | | 68.6 | % | | | 65.7 | % | | | 60.6 | % | | | 59.4 | % | | | 54.3 | % | | | 64.0 | % | | | 62.9 | % |

| Lead | | | 93.1 | % | | | 94.1 | % | | | 93.5 | % | | | 91.8 | % | | | 88.7 | % | | | 94.4 | % | | | 92.5 | % | | | 94.6 | % | | | 95.2 | % | | | 95.0 | % |

| Zinc | | | 94.2 | % | | | 93.8 | % | | | 93.8 | % | | | 94.9 | % | | | 92.7 | % | | | 95.1 | % | | | 93.4 | % | | | 96.0 | % | | | 95.7 | % | | | 95.1 | % |

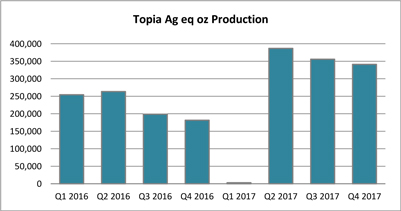

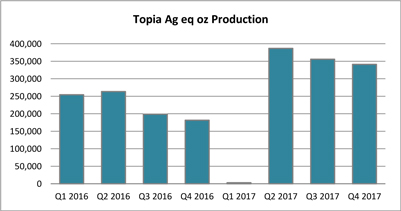

Metal Production

Mill throughput for Topia (excluding tonnes milled for third parties) for the year ended December 31, 2017 decreased 4% compared to the prior year. This was mainly due to the suspension of milling operations for the first quarter of 2017 to complete plant upgrades and a new tailings handling facility (the “Topia Project”).

Mill throughput for Topia (excluding tonnes milled for third parties) in the fourth quarter of 2017 increased by 54% compared to the fourth quarter of 2016 reflecting the temporary suspension of milling operations noted above which commenced in early December 2016.

Metal production at Topia for the year ended December 31, 2017 increased 21% compared to 2016 despite the decrease in tonnes milled. The increase was primarily attributable to the improvement in average ore grades of feed material and in silver and gold recoveries. These factors were partly offset by the lower lead and zinc recoveries.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 13 |

Metal production in the fourth quarter of 2017 increased 88% compared to the fourth quarter of 2016. The increase was primarily attributed to the higher mill throughput (reflecting the impact of the Topia Project on fourth quarter 2016 processing) and improvement in average ore grades of feed material and metal recoveries.

Cash cost and AISC

| | | 2017 | | 2016 |

| | | FY | | Q4 | | Q3 | | Q2 | | Q11 | | FY | | Q4 | | Q3 | | Q2 | | Q1 |

| Cost per tonne milled2 | | $ | 190 | | | $ | 194 | | | $ | 199 | | | $ | 157 | | | | nm | | | $ | 143 | | | $ | 146 | | | $ | 144 | | | $ | 136 | | | $ | 148 | |

| Cash cost2 | | $ | 9.53 | | | $ | 10.35 | | | $ | 10.01 | | | $ | 6.15 | | | | nm | | | $ | 11.43 | | | $ | 10.19 | | | $ | 13.25 | | | $ | 10.35 | | | $ | 12.32 | |

| Cash cost per Ag eq oz2 | | $ | 13.79 | | | $ | 14.82 | | | $ | 14.31 | | | $ | 10.70 | | | | nm | | | $ | 13.62 | | | $ | 13.83 | | | $ | 15.27 | | | $ | 12.59 | | | $ | 13.27 | |

| AISC2 | | $ | 14.98 | | | $ | 11.70 | | | $ | 10.71 | | | $ | 10.78 | | | | nm | | | $ | 15.31 | | | $ | 18.56 | | | $ | 19.52 | | | $ | 11.49 | | | $ | 13.34 | |

| AISC per Ag eq oz2 | | $ | 17.01 | | | $ | 15.59 | | | $ | 14.72 | | | $ | 13.58 | | | | nm | | | $ | 16.24 | | | $ | 19.25 | | | $ | 19.54 | | | $ | 13.38 | | | $ | 13.97 | |

Cash cost for 2017 was $9.53 compared to $11.43 in 2016.

The decrease was primarily the result of higher by-product credits, due to higher volumes of gold, lead and zinc produced and sold as well as due to higher realized metal prices for these by-products. Lower smelting and refining charges and the strengthening of the USD against the MXN also contributed to the decrease. These factors were partly offset by the higher MXN production costs due to an increase in mining contractor unit costs, higher operations and maintenance costs for the tailings handling facility and higher mine overhead costs.

Cash cost per Ag eq oz for 2017 was $13.79 compared to $13.62 in 2016.

The increase was primarily due to the higher MXN production costs but mostly offset by higher Ag eq oz sales volume.

AISC for 2017 was $14.98 compared to $15.31 in 2016.

The decrease was primarily due to the higher by-product credits, lower smelting and refining charges and the strengthening of the USD against the MXN. These factors were partly offset by the higher MXN production costs, higher sustaining EE&D expenses and higher capital expenditures.

AISC per Ag eq oz for 2017 was $17.01 compared to $16.24 in 2016.

The increase was primarily due to higher sustaining EE&D expenses and capital expenditures. These factors were partly offset by the higher Ag eq oz sales volume.

Cash cost for the fourth quarter of 2017 was $10.35 compared to $10.19 for the fourth quarter of 2016.

The increase was primarily the result of higher production costs in MXN terms (due to an increase in mining contractor unit costs, higher operations and maintenance costs for the tailings handling facility and higher mine overhead costs), the strengthening of the MXN against the USD and higher smelting and refining charges. These factors were partly offset by greater by-product credits due to higher volumes of gold, lead and zinc produced and sold as well as due to higher realized metal prices for these by-products. Increased sales volumes also contributed to the decrease in the cash cost per silver payable ounce.

Cash cost per Ag eq oz for the fourth quarter of 2017 was $14.82 compared to $13.83 for the fourth quarter of 2016.

The increase was primarily due to an increase in production costs, the strengthening of the MXN compared to the USD and higher smelting and refining charges. These factors were partly offset by an increase in Ag eq sales volumes.

| 1 | Milling operations at Topia were suspended for the duration of the first quarter of 2017. Tonnes milled and metal produced were incidental and related to the testing of plant upgrades. As a result, the Company considers its usual non-GAAP disclosures for the Topia Mine, such as cost per tonne milled, cash cost, cash cost per Ag eq oz, AISC and ASIC per Ag eq oz, to be not meaningful (“nm”). |

| 2 | Refer to theNon-GAAP Measuressection of this MD&A for an explanation of these measures and reconciliation to the Company’s reported financial results in accordance with IFRS. |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 14 |

AISC for the fourth quarter of 2017 was $11.70 compared to $18.56 for the fourth quarter of 2016.

The decrease was primarily due to the higher by-product credits and lower sustaining capital expenditures. The sustaining capital expenditures in the fourth quarter of 2016 related to work associated with the new tailings filtration plant and certain plant upgrades. Increased sales volumes also contributed to the decrease in AISC per silver payable ounce. These factors were partly offset by the higher production costs in MXN terms, the strengthening of the MXN against the USD, and higher smelting and refining charges.

AISC per Ag eq oz for the fourth quarter of 2017 was $15.59 compared to $19.25 for the fourth quarter of 2016.

The decrease was primarily due to the lower sustaining capital expenditures, partly offset by the higher cash cost per Ag eq oz.

Topia Development

For the year ended December 31, 2017, underground development totaled 5,167 metres, compared to 7,118 metres in 2016. The majority of the development was carried out at the Argentina, 15-22, San Miguel and Recompensa mines.

Underground development for the fourth quarter of 2017 was 1,552 metres, compared to 1,833 metres in the 2016 comparative period, and focused on the same mines as noted above.

The Company completed 2,485 metres of surface exploration drilling during 2017 compared to nil in 2016.

TSF Permitting Status

On December 18, 2017, the Company announced that SEMARNAT, the Mexican environmental authority, had granted all permits for the construction and operation of the new Phase II TSF. Construction of the Phase II TSF is currently underway and the Company will continue to utilize the Phase I TSF until completion of the Phase II TSF.

Reviews by the regulatory authorities dating back to 2015, coupled with permitting work undertaken by the Company in connection with the expansion of the Topia TSF, have led to a broader review by PROFEPA (the Mexican environmental compliance authority) and the Company of all the Topia operations’ permitting status and environmental compliance, including the historical tailings dating back to the period prior to Great Panther’s ownership, and clarification of land titles. Devised as a cooperative management strategy, the Topia Mine has been accepted into a voluntary environmental audit program supported by PROFEPA. The audit commenced during the second quarter of 2017 and work on any mitigation measures that may arise from the audit will extend beyond 2017. The Company anticipates that it will be able to address any potential gaps in existing compliance through a mitigation plan; however, the Company cannot provide complete assurance that these reviews will not lead to a future suspension of operations. If the environmental or technical reviews identify any non-compliance of the existing facility, there is no assurance that Mexican regulatory authorities will agree to any mitigation plan proposed by the Company.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 15 |

SELECTED ANNUAL INFORMATION

The following table sets out selected annual financial results which have been prepared in accordance with IFRS, except as noted:

| (in 000’s, unless otherwise noted) | | 2017 | | 2016 | | 2015 |

| Revenue | | $ | 63,746 | | | $ | 61,881 | | | $ | 56,218 | |

| Average realized silver price ($/oz) | | | 17.11 | | | | 17.15 | | | | 15.11 | |

| Average realized gold price ($/oz) | | | 1,291 | | | | 1,267 | | | | 1,110 | |

| Production costs | | | 41,752 | | | | 34,153 | | | | 37,802 | |

| Mine operating earnings | | | 17,689 | | | | 22,022 | | | | 4,366 | |

| Net income (loss) | | | 1,290 | | | | (4,118 | ) | | | (7,157 | ) |

| Basic and diluted loss per share | | | 0.01 | | | | (0.03 | ) | | | (0.05 | ) |

| Adjusted EBITDA | | | 6,009 | | | | 16,519 | | | | 7,138 | |

| | | | December 31, 2017 | | | December 31, 2016 | | | December 31, 2015 |

| Cash and short-term deposits | | | 56,888 | | | | 56,662 | | | | 13,685 | |

| Total assets | | | 121,880 | | | | 89,441 | | | | 51,553 | |

| Total non-current liabilities | | | 24,895 | | | | 5,600 | | | | 6,713 | |

| Working capital | | | 65,965 | | | | 66,560 | | | | 25,477 | |

Total assets at December 31, 2017 increased $32.4 million from those at December 31, 2016 due mainly to the acquisition of Coricancha which had the effect of increasing the Company’s assets by $26.5 million (mainly comprised of exploration and evaluation assets of $13.5 million, reimbursement rights of $11.0 million and inventories of $1.6 million).

Non-current liabilities totalled $24.9 million at December 31, 2017, compared to $5.6 million at December 31, 2016. The increase is due to the $23.7 million reclamation and remediation provision related to Coricancha which was acquired during 2017.

Please refer to the Results of Operations section for a discussion of the changes relating to earnings.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 16 |

SUMMARY OF SELECTED QUARTERLY INFORMATION

| (000’s, except per-share amounts) | | Q4 2017 | | Q3 2017 | | Q2 2017 | | Q1 2017 | | Q4 2016 | | Q3 2016 | | Q2 2016 | | Q1 2016 |

| Revenue | | $ | 17,384 | | | $ | 18,260 | | | $ | 15,731 | | | $ | 12,371 | | | $ | 12,515 | | | $ | 15,631 | | | $ | 19,596 | | | $ | 14,139 | |

| Production costs | | | 12,422 | | | | 12,092 | | | | 10,313 | | | | 6,926 | | | | 8,039 | | | | 8,400 | | | | 9,509 | | | | 8,204 | |

| Mine operating earnings before non-cash items1 | | | 4,962 | | | | 6,168 | | | | 5,418 | | | | 5,445 | | | | 4,476 | | | | 7,231 | | | | 10,087 | | | | 5,935 | |

| Amortization and share-based compensation | | | 1,207 | | | | 1,362 | | | | 953 | | | | 783 | | | | 2,065 | | | | 1,159 | | | | 1,256 | | | | 1,225 | |

| Mine operating earnings | | | 3,755 | | | | 4,806 | | | | 4,465 | | | | 4,662 | | | | 2,411 | | | | 6,072 | | | | 8,831 | | | | 4,710 | |

| Net income (loss) for the period | | | (1,918 | ) | | | (666 | ) | | | 833 | | | | 3,040 | | | | (1,498 | ) | | | 2,130 | | | | (1,332 | ) | | | (3,418 | ) |

| Basic and diluted earnings (loss) per share | | | (0.01 | ) | | | (0.00 | ) | | | 0.00 | | | | 0.02 | | | | (0.01 | ) | | | 0.01 | | | | (0.01 | ) | | | (0.02 | ) |

| Adjusted EBITDA1 | | | 904 | | | | 1,482 | | | | 1,489 | | | | 2,134 | | | | 1,376 | | | | 4,738 | | | | 7,545 | | | | 2,860 | |

The following paragraphs describe the trends in results over the quarters presented and the factors that have contributed to these trends.

Trends in revenue over the last eight quarters

Revenue varies based on the quantity of metal sold, metal prices, terms of sales agreements and, for periods prior to the third quarter of 2016, foreign exchange rates. The climate in Mexico allows mining and exploration activities to be conducted throughout the year, and there are no notable variations due to seasonality.

Revenue increased from the first quarter of 2016 to the second quarter of 2016, generally due to rising metal prices. Metal prices, and silver in particular, declined through to the fourth quarter of 2016 which primarily accounted for the decline in revenue quarter over quarter. During 2017, silver prices averaged about $17 per ounce, ranging from $15.00 per ounce to $18.50 per ounce during the year.

Milling operations at Topia were suspended from December 2016 until April 2017 to allow for upgrades to the processing facility. This resulted in the large decrease in revenue in the first quarter of 2017. Revenues subsequently increased starting in the second quarter of 2017 as operations at the Topia Mine resumed.

Trends in net income over the last eight quarters

The variance in production costs is due primarily to the costs of mining operations. Mining costs increased as a result of mining narrower veins, which caused more waste material to be mined, and added to bolting, anchoring, and hauling costs. Further, there were rate increases in 2017 for mining contractors. Plant costs at Topia increased slightly due to the operation of the dry tails filter press at Topia. On-site administrative costs were fairly steady, with additional costs being incurred for security and safety.

The relationship between the MXN (in which the bulk of the Company’s production costs and EE&D expenses are incurred) and the USD (in which the Company’s results are reported) has a significant impact on production costs, which in turn affect cost of sales, mine operating earnings and net income (loss). Furthermore, the majority of the Company’s administrative expenses are denominated in Canadian dollars ("CAD"). The Company enters into foreign currency forward contracts from time to time in order to manage its exposure to fluctuations in these exchange rates and, consequently, foreign currency gains or losses may arise when marking these forward contracts to market at each reporting date. During the first quarter of 2017, the Company recorded approximately $1.8 million in foreign exchange gains related primarily to the foreign currency contracts. During the first two quarters of 2016, the Company had incurred foreign exchange losses of approximately $4.7 million per quarter.

| 1 | The Company has included the non-GAAP performance measures, cost of sales before non-cash items, mine operating earnings before non-cash items, and Adjusted EBITDA throughout this document. Refer to theNon-GAAP Measures section of this MD&A for an explanation of these measures and reconciliation to the Company’s reported financial results in accordance with IFRS. As these are not standardized measures, they may not be directly comparable to similarly titled measures used by others. |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 17 |

Foreign exchange gains and losses also arise from the translation of foreign currency denominated transactions and balances into the functional currencies of the Company and its subsidiaries. The Company funds its Mexican subsidiaries through USD and CAD loans, and a significant portion of the Company’s working capital is denominated in USD.

EE&D expenses also vary significantly from quarter to quarter as a function of the Company’s planned mine development and exploration activities. Exploration and evaluation expenditures have increased subsequent to the acquisition of Coricancha. In the third and fourth quarters of 2017, the Company incurred approximately $2.6 million per quarter on EE&D; it had averaged approximately $1.7 million per quarter in EE&D expenses in the previous six quarters.

General and administrative costs are fairly steady from quarter to quarter; although there were non-recurring G&A costs relating to changes in senior management in the third quarter of 2017.

A significant contributor to the loss in the second quarter of 2016 was an impairment charge of $1.7 million related to Coricancha (the purchase of which was subsequently renegotiated and then completed on June 30, 2017).

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 18 |

RESULTS OF OPERATIONS

Year ended December 31, 2017

Revenue

| | | FY 2017 | | FY 2016 | | Change |

| | | GMC | | Topia | | Total | | GMC | | Topia | | Total | | |

| Sales quantities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (ounces) | | | 1,404,696 | | | | 533,006 | | | | 1,937,702 | | | | 1,477,696 | | | | 532,556 | | | | 2,010,252 | | | | -4 | % |

| Gold (ounces) | | | 21,251 | | | | 587 | | | | 21,838 | | | | 21,093 | | | | 424 | | | | 21,517 | | | | 1 | % |

| Lead (tonnes) | | | – | | | | 1,135 | | | | 1,135 | | | | – | | | | 942 | | | | 942 | | | | 20 | % |

| Zinc (tonnes) | | | – | | | | 1,257 | | | | 1,257 | | | | – | | | | 1,023 | | | | 1,023 | | | | 23 | % |

| Silver equivalent ounces | | | 2,892,243 | | | | 901,273 | | | | 3,793,516 | | | | 2,954,567 | | | | 788,166 | | | | 3,742,733 | | | | 1 | % |

| Revenue (000’s) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver revenue | | $ | 24,129 | | | $ | 9,016 | | | $ | 33,145 | | | $ | 25,287 | | | $ | 9,188 | | | $ | 34,475 | | | | -4 | % |

| Gold revenue | | | 27,432 | | | | 755 | | | | 28,187 | | | | 26,749 | | | | 521 | | | | 27,270 | | | | 3 | % |

| Lead revenue | | | – | | | | 2,741 | | | | 2,741 | | | | | | | | 1,808 | | | | 1,808 | | | | 52 | % |

| Zinc revenue | | | – | | | | 3,853 | | | | 3,853 | | | | | | | | 2,318 | | | | 2,318 | | | | 66 | % |

| Ore processing revenue and other | | | – | | | | – | | | | – | | | | | | | | 410 | | | | 410 | | | | -100 | % |

| Smelting and refining charges | | | (2,195 | ) | | | (1,985 | ) | | | (4,180 | ) | | | (2,955 | ) | | | (2,323 | ) | | | (5,278 | ) | | | -21 | % |

| Impact of change in functional currency1 | | | – | | | | – | | | | – | | | | 750 | | | | 128 | | | | 878 | | | | -100 | % |

| Total revenue | | $ | 49,366 | | | $ | 14,380 | | | $ | 63,746 | | | $ | 49,831 | | | $ | 12,050 | | | $ | 61,881 | | | | 3 | % |

| Average realized metal prices and foreign exchange rates | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (per ounce) | | | | | | | | | | $ | 17.11 | | | | | | | | | | | $ | 17.15 | | | | 0 | % |

| Gold (per ounce) | | | | | | | | | | $ | 1,291 | | | | | | | | | | | $ | 1,267 | | | | 2 | % |

| Lead (per pound) | | | | | | | | | | $ | 1.10 | | | | | | | | | | | $ | 0.87 | | | | 26 | % |

| Zinc (per pound) | | | | | | | | | | $ | 1.39 | | | | | | | | | | | $ | 1.03 | | | | 35 | % |

| CAD/USD | | | | | | | | | | | 1.29 | | | | | | | | | | | | 1.32 | | | | -2 | % |

| MXN/USD | | | | | | | | | | | 18.93 | | | | | | | | | | | | 18.63 | | | | 2 | % |

During the year ended December 31, 2017, the Company earned revenues of $63.7 million, compared to $61.9 million in 2016. The increase in revenue relative to the prior year was primarily attributable to increases in the average realized metal prices of gold, lead and zinc. This accounted for a $2.0 million improvement in revenues while the effect of lower smelting and refining charges, which are netted against revenue, had an estimated positive impact of $1.1 million. These factors were partly offset by the impact of third party ore processing revenue which declined by about $0.4 million. In addition, revenue during the prior year included a $0.9 million favourable effect of foreign exchange rates which did not recur in 2017 following the change in functional currency to US dollars on July 1, 2016.

| 1 | The change in functional currency was accounted for on a prospective basis, with prior period comparative information translated to the USD at the foreign exchange rates on July 1, 2016. The July 1, 2016 exchange rates differ from the historical exchange rates used to calculate the previously-disclosed cost per tonne milled, cash cost and AISC metrics, requiring an adjustment in the reconciliation for the prior-period comparatives. |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 19 |

Production Costs

Production costs for the year ended December 31, 2017 were $41.8 million, an increase of 22% over the same period in 2016. This was predominantly attributable to higher mining costs at both of the Company’s operating mines ($7.3 million effect), primarily driven by mining narrower veins at the GMC and increased contractor rates, as well as increased processing costs at Topia associated with the change to the processing of dry tailings. The increase in metal sales volumes ($0.5 million effect) and certain non-recurring charges related to land use payments at Topia ($0.3 million effect) also contributed to the increase in production costs. These factors were partly offset by the strengthening of the USD relative to the MXN which reduced production costs in USD terms as these are predominantly incurred in MXN ($0.5 million effect).

Mine Operating Earnings

| (000’s) | | FY 2017 | | FY 2016 | | Change | | Change% |

| Revenue | | $ | 63,746 | | | $ | 61,881 | | | $ | 1,865 | | | | 3 | % |

| Production costs | | | 41,752 | | | | 34,153 | | | | 7,599 | | | | 22 | % |

| Mine operating earnings before non-cash items1 | | $ | 21,994 | | | $ | 27,728 | | | $ | (5,734 | ) | | | –21 | % |

| Amortization and depletion | | | 3,878 | | | | 5,436 | | | | (1,558 | ) | | | –29 | % |

| Share-based compensation | | | 427 | | | | 270 | | | | 157 | | | | 58 | % |

| Mine operating earnings | | $ | 17,689 | | | $ | 22,022 | | | $ | (4,333 | ) | | | –20 | % |

| Mine operating earnings before non-cash items (% of revenue) | | | 35% | | | | 45% | | | | | | | | | |

| Mine operating earnings (% of revenue) | | | 28% | | | | 36% | | | | | | | | | |

Mine operating earnings before non-cash items for 2017 decreased by $5.7 million as a result of the $7.6 million increase in production costs which was partly offset by the above-noted increase in revenue of $1.9 million.

Amortization and depletion were lower for 2017 compared to 2016, as the Phase I TSF at Topia was fully depreciated at December 31, 2016. This factor was partly offset by the impact of the Company starting the amortization of the tailings filtration plant at Topia which was commissioned in the second quarter of 2017.

General and administrative expenses

G&A expenses for the year ended December 31, 2017 were $7.8 million compared to $5.8 million in 2016. Approximately, $1.1 million of the increase was associated with the transition to a new President and CEO in August 2017. These costs were comprised of primarily non-recurring charges such as a retirement salary and benefits package during a transition period, executive search fees, and relocation costs. Share-based compensation expense in G&A also increased by $0.2 million, in part, reflecting the management transition. Other increases in G&A were attributed to other recruitment costs and increases in salary and benefit expense, increases in audit fees and consulting fees, travel expenses, board fees and regulatory fees.

Exploration, evaluation, and development expenses

EE&D expenses for the year ended December 31, 2017 were $9.5 million compared to $6.1 million in 2016. Approximately $1.4 million of the increase was attributed to an increase in exploration drilling at the Guanajuato, San Ignacio and Topia mines. In addition, EE&D expenses included all Coricancha project and other costs as the Company has not made a decision to restart production and therefore is not capitalizing costs related to evaluation, development or exploration. These expenditures totaled $2.8 million for the year including $2.3 million since closing the acquisition on June 30, 2017. The Company also incurred $0.7 million more in corporate development expenditures as it continues to seek other acquisitions in the Americas.

| 1 | The Company has included non-GAAP performance measures such as mine operating earnings before non-cash items, throughout this document. Refer to theNon-GAAP Measures section of this MD&A for an explanation of these measures and reconciliation to the Company’s reported financial results in accordance with IFRS. As these are not standardized measures, they may not be directly comparable to similarly titled measures used by others. |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 20 |

Impairment

The Company did not incur any impairment charges in 2017. A $1.7 million impairment charge was recognized during the year ended December 31, 2016 related to the termination of the then-active Coricancha option agreement.

Finance and other income

Finance and other income for the year ended December 31, 2017 amounted to $2.4 million, compared to finance and other expense of $11.0 million for the year ended December 31, 2016.

The change was primarily attributable to foreign exchange gains and losses, as the Company recorded foreign exchange gains of $2.3 million for the year ended December 31, 2017, compared to a $11.1 million foreign exchange losses in prior year, an increase of $13.4 million. The 2016 loss was related predominantly to unrealized losses on the revaluation of foreign-denominated assets and liabilities, including certain intercompany loan balances, in the first half of 2016 prior to the change to USD functional currency. The 2017 gains were related primarily to the realized foreign exchange gain of $2.1 million resulting from forward contracts to purchase Mexican pesos to fund operating expenditures in Mexico.

Finance and other income also increased as a result of a $0.6 million increase in interest income as a result of higher interest rates and higher cash balances, and a $0.2 million increase in proceeds from disposal of plant and equipment. These factors were partly offset by an increase of $0.8 million in accretion of reclamation provisions, primarily attributable to Coricancha.

Tax expense

For the year ended December 31, 2017, income tax expense remained unchanged at $1.5 million, compared to 2016.

Income tax expense for the year ended December 31, 2017 was predominantly attributable to an accrual for special mining duty payable in Mexico, which is charged at 7.5% of an adjusted taxable net income, as well as an accrual for Mexican withholding taxes.

Net income (loss)

Net income for 2017 amounted to $1.3 million, compared to a net loss of $4.1 million in 2016.

The improvement in net income was primarily due to the $13.4 million increase in finance and other income. The Company changed its functional currency from Canadian dollars to US dollars in 2016, and upon the change on July 1, 2016, significant foreign exchange differences associated with large intercompany balances were recorded. This represented the main component of the foreign exchange losses during 2016.

In addition, the net loss for the year ended December 31, 2016 reflected a $1.7 million impairment charge taken in connection with the termination of an option to purchase Coricancha (the purchase of which was subsequently renegotiated and completed on June 30, 2017). These factors were partly offset by the $4.3 million decrease in mine operating earnings, a $3.4 million increase in EE&D expenditures and a $2.0 million increase in G&A expenses, of which approximately $1.1 million represents non-recurring expenditures as discussed above.

Adjusted EBITDA

For the year ended December 31, 2017, adjusted EBITDA was $6.0 million, compared to $16.5 million in 2016.

The decrease in adjusted EBITDA was due to a $5.7 million decrease in mine operating earnings before non-cash items, a $3.2 million increase in EE&D expenses (net of changes in non-cash share based compensation and changes in estimate of reclamation provisions), and a $1.9 million increase in G&A expenses before non-cash items. These factors were partly offset by a $0.3 million increase in other income.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 21 |

Three months ended December 31, 2017

Revenue

| | | Q4 2017 | | Q4 2016 | | Change |

| | | GMC | | Topia | | Total | | GMC | | Topia | | Total | | |

| Sales quantities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (ounces) | | | 341,069 | | | | 175,009 | | | | 516,078 | | | | 359,947 | | | | 128,481 | | | | 488,428 | | | | 6 | % |

| Gold (ounces) | | | 5,576 | | | | 207 | | | | 5,783 | | | | 4,642 | | | | 110 | | | | 4,752 | | | | 22 | % |

| Lead (tonnes) | | | – | | | | 421 | | | | 421 | | | | - | | | | 247 | | | | 247 | | | | 70 | % |

| Zinc (tonnes) | | | – | | | | 438 | | | | 438 | | | | - | | | | 274 | | | | 274 | | | | 60 | % |

| Silver equivalent ounces | | | 731,403 | | | | 306,620 | | | | 1,038,023 | | | | 684,864 | | | | 198,484 | | | | 883,348 | | | | 18 | % |

| Revenue (000’s) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver revenue | | $ | 5,709 | | | $ | 2,992 | | | $ | 8,701 | | | $ | 5,277 | | | $ | 2,046 | | | $ | 7,323 | | | | 19 | % |

| Gold revenue | | | 7,205 | | | | 269 | | | | 7,474 | | | | 4,973 | | | | 127 | | | | 5,100 | | | | 47 | % |

| Lead revenue | | | – | | | | 1,035 | | | | 1,035 | | | | - | | | | 540 | | | | 540 | | | | 92 | % |

| Zinc revenue | | | – | | | | 1,429 | | | | 1,429 | | | | - | | | | 769 | | | | 769 | | | | 86 | % |

| Ore processing revenue and other | | | – | | | | – | | | | – | | | | - | | | | 91 | | | | 91 | | | | -100 | % |

| Smelting and refining charges | | | (532 | ) | | | (723 | ) | | | (1,255 | ) | | | (704 | ) | | | (604 | ) | | | (1,308 | ) | | | -4 | % |

| Total revenue | | $ | 12,382 | | | $ | 5,002 | | | $ | 17,384 | | | $ | 9,546 | | | $ | 2,969 | | | $ | 12,515 | | | | 39 | % |

| Average realized metal prices and FX rates | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver (per ounce) | | | | | | | | | | $ | 16.86 | | | | | | | | | | | $ | 14.99 | | | | 12 | % |

| Gold (per ounce) | | | | | | | | | | | 1,292 | | | | | | | | | | | | 1,073 | | | | 20 | % |

| Lead (per pound) | | | | | | | | | | | 1.11 | | | | | | | | | | | | 0.99 | | | | 12 | % |

| Zinc (per pound) | | | | | | | | | | | 1.48 | | | | | | | | | | | | 1.27 | | | | 17 | % |

| USD/CAD | | | | | | | | | | | 1.251 | | | | | | | | | | | | 1.345 | | | | 7 | % |

| USD/MXN | | | | | | | | | | | 18.95 | | | | | | | | | | | | 20.01 | | | | 4 | % |

Revenues were $17.4 million in the fourth quarter of 2017, compared to $18.3 million in the third quarter of 2017 and $12.5 million in the fourth quarter of 2016. The decrease from the previous quarter was primarily due to lower sales volumes ($0.8 million effect) and lower metal prices ($0.1 million effect).

Compared to the fourth quarter of 2016, revenue increased due to an increase in precious metal prices ($2.5 million effect) and higher metal sales volume ($2.4 million effect), as detailed in the table above.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 22 |

| (000’s) | | Q4 2017 | | Q4 2016 | | Change | | Q3 2017 | | Change |

| Revenue | | $ | 17,384 | | | $ | 12,515 | | | $ | 4,869 | | | | 39 | % | | $ | 18,260 | | | $ | (876 | ) | | | –5 | % |

| Production costs | | | 12,422 | | | $ | 8,039 | | | | 4,383 | | | | 55 | % | | | 12,092 | | | | 330 | | | | 3 | % |

| Mine operating earnings before non-cash items1 | | $ | 4,962 | | | $ | 4,476 | | | $ | 486 | | | | 11 | % | | $ | 6,168 | | | $ | (1,206 | ) | | | –20 | % |

| Amortization and depletion | | | 1,096 | | | $ | 1,987 | | | | (891 | ) | | | –45 | % | | | 1,244 | | | | (148 | ) | | | –12 | % |

| Share-based compensation | | | 111 | | | $ | 78 | | | | 33 | | | | 42 | % | | | 118 | | | | (7 | ) | | | –6 | % |

| Mine operating earnings | | | 3,755 | | | $ | 2,411 | | | | 1,344 | | | | 56 | % | | | 4,806 | | | | (1,051 | ) | | | –22 | % |

| Mine operating earnings before non-cash items (% of revenue) | | | 29 | % | | | 36 | % | | | | | | | | | | | 34 | % | | | | | | | | |

| Mine operating earnings (% of revenue) | | | 22 | % | | | 19 | % | | | | | | | | | | | 26 | % | | | | | | | | |

| G&A expenses | | $ | 1,802 | | | $ | 1,662 | | | $ | 140 | | | | 8 | % | | $ | 2,485 | | | $ | (683 | ) | | | –27 | % |

| EE&D expenses | | | 2,568 | | | | 1,286 | | | | 1,282 | | | | 100 | % | | | 2,652 | | | | (84 | ) | | | –3 | % |

| Finance and other expense (income) | | | 459 | | | | 694 | | | | (235 | ) | | | –34 | % | | | (50 | ) | | | 509 | | | | –1018 | % |

| Tax expense | | | 844 | | | | 267 | | | | 577 | | | | 216 | % | | | 385 | | | | 459 | | | | 119 | % |

| Net income (loss) | | $ | (1,918 | ) | | $ | (1,498 | ) | | $ | (420 | ) | | | –28 | % | | $ | (666 | ) | | $ | (1,252 | ) | | | –188 | % |

Production Costs

Production costs were $12.4 million in the fourth quarter of 2017, compared to $12.1 million in the third quarter of 2017 and $8.0 million in the fourth quarter of 2016. The increase was attributable to higher mining costs at both GMC and Topia and the weakening of the USD against the MXN which had the impact of increasing MXN production costs in USD terms.

Production costs for the fourth quarter of 2017 increased by $4.4 million compared to the fourth quarter of 2016. The increase was attributable to a greater proportion of production from the higher cost Topia Mine, higher mining costs at the GMC due to higher contractor rates and mining of narrower widths, and a 4% stronger MXN against the USD ($3.0 million effect). In addition, metal sales volumes increased by 18% which increased production costs by $1.4 million.

Mine Operating Earnings

Mine operating earnings before non-cash items were $5.0 million in the fourth quarter of 2017, compared to $6.2 million in the third quarter of 2017 and $4.5 million in the fourth quarter of 2016.

Relative to the third quarter of 2017, mine operating earnings before non-cash items decreased by $1.2 million mainly due to a $0.9 million decrease in revenue and a $0.3 million increase in production costs.

Mine operating earnings before non-cash items increased by $0.5 million relative to the fourth quarter of 2016 as revenue increased by $4.9 million but was mostly offset by the $4.4 million increase in production costs.

General and administrative expenses

G&A expenses were $1.8 million in the fourth quarter of 2017, compared to $2.5 million in the third quarter of 2017 and $1.7 million in the fourth quarter of 2016. The decrease was mainly due to a one-time G&A charge of $1.1 million during the third quarter of 2017.

G&A expenses for the fourth quarter of 2017 increased by $0.1 million mainly due to increased business development and related activity.

| 1 | The Company has included the non-GAAP performance measures, cost of sales before non-cash items and mine operating earnings before non-cash items, throughout this document. Refer to theNon-GAAP Measures section of this MD&A for an explanation of these measures and reconciliation to the Company’s reported financial results in accordance with IFRS. As these are not standardized measures, they may not be directly comparable to similarly titled measures used by others. |

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 23 |

Exploration, evaluation and development expenses

EE&D expenses were $2.6 million in the fourth quarter of 2017, compared to $2.7 million in the third quarter of 2017 and $1.3 million in the fourth quarter of 2016.

The Company incurred $0.9 million of expenditures related to Coricancha during the quarter ended December 31, 2017. Coricancha was acquired on June 30, 2017. The Company will continue to expense costs associated with the ongoing care and maintenance of Coricancha and any project costs associated with evaluating the return of Coricancha to production until such time as a positive decision is made to restart the mine.

EE&D expenses increased by $1.3 million in the fourth quarter of 2017 compared to the same period in 2016 mainly due to an increase in spending at Coricancha partially offset by a reduction in exploration drilling at San Ignacio and changes in reclamation estimates recorded in EE&D. Compared to the third quarter of 2017, EE&D expenses decreased by $0.1 million due to decrease in spending at Coricancha partly offset by the increase in costs associated with corporate development activities and an increase in exploration drilling at San Ignacio.

Finance and other expenses (income)

Finance and other expenses were $0.5 million in the fourth quarter of 2017, compared to nil in the third quarter of 2017 and $0.7 million in the fourth quarter of 2016.

Finance and other income (expense) primarily reflects interest income or expense and foreign exchange gains and losses. During the quarter ended December 31, 2017, the Company recorded a foreign exchange loss of $0.3 million compared to $0.7 million in the fourth quarter of the 2016, as a result of a decline in the USD value of foreign currencies held by the Company.

Net income (loss)

Net loss was $1.9 million in the fourth quarter of 2017, compared to $0.7 million in the third quarter of 2017 and $1.5 million in the fourth quarter of 2016.

Compared to the net loss of $0.7 million for the third quarter of 2017, the change was primarily due to a $1.2 million decrease in mine operating earnings, a $0.5 million decrease in finance and other income and a $0.5 million increase in income tax expense. These factors were partly offset by a $0.7 million decrease in G&A expenses and a $0.1 million decrease in EE&D expenses.

Compared to the net loss of $1.5 million for the fourth quarter of 2016, the increase in net loss was largely due to a $1.3 million increase in EE&D expenses, a $0.6 million increase in income tax expense and a $0.1 million increase in G&A expenses. These were partly offset by a $1.3 million increase in mine operating earnings and a $0.2 million decrease in finance and other expense.

Adjusted EBITDA

Adjusted EBITDA was $0.9 million in the fourth quarter of 2017, compared to $1.5 million in the third quarter of 2017 and $1.4 million in the fourth quarter of 2016.

Adjusted EBITDA decreased by $0.5 million in the fourth quarter of 2017 compared to the same period in 2016. The decrease reflected a $0.9 million increase in EE&D expenses (net of changes in non-cash share based compensation and changes in estimate of reclamation provisions) and a $0.1 million increase in G&A cash expenses. These factors were partly offset by a $0.5 million increase in mine operating earnings before non-cash items.

Adjusted EBITDA decreased by $0.6 million compared to the third quarter of 2017. The decrease reflected a $1.2 million decrease in mine operating earnings before non-cash items and a $0.2 million gain on sale of equipment recorded in the third quarter of 2017. These factors were partly offset by a $0.7 million decrease in G&A cash expenses and a $0.1 million decrease in EE&D expenses.

GREAT PANTHER SILVER LIMITED Management’s Discussion & Analysis | Page 24 |

OUTLOOK

| Production and cash cost guidance | | FY 2018 Guidance | | FY 2017 Actual |

| Total silver equivalent ounces1 | | 4,000,000 – 4,100,000 | | | 3,978,731 | |

| Cash cost2 | | $5.00 – $6.50 | | $ | 5.76 | |

| AISC2 | | $12.50 – $14.50 | | $ | 15.07 | |

For 2018, the Company expects production to be in the range of 4.0 to 4.1 million Ag eq oz (at a 70:1 silver to gold ratio). Cash cost per silver ounce guidance for 2018 is $5.00 to $6.50 and the AISC guidance range is $12.50 to $14.50. While these represent the Company’s best estimates at the current date, it is advised that cash cost and AISC are very sensitive to the Mexican peso foreign exchange rate and metal prices through the computation of by-product credits.

The following provides the Company’s guidance for capital expenditures and EE&D expenses for the year ended December 31, 2018: