Exhibit 99.1

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

TECHNICAL REPORT ON THE 2021 MINERAL RESERVES AND MINERAL RESOURCES OF THE TUCANO GOLD MINE, AMAPÁ STATE, BRAZIL

PREPARED BY GREAT PANTHER

MINING LIMITED

Report for NI 43-101

Effective Date - July 31, 2021

Report Date - June 7, 2022

Qualified Persons:

Carlos H. B. Pires, B.Sc. Hons., FAusIMM (CP)

Fernando A. Cornejo, M.Eng., P.Eng.

Nicholas Winer, B.Sc. Hons., FAusIMM

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

DATE & SIGNATURE PAGE

This NI 43-101 Report on the Tucano Gold Mine Mineral Reserves and Mineral Resource as of July 31, 2021 is submitted to Great Panther Mining Limited and is effective as of July 31, 2021.

Qualified Persons | Responsible for |

Signed “Carlos H. B. Pires” Signed By: _____________________________ Carlos H. B. Pires, B.Sc. Hons., FAusIMM (CP) QP for Great Panther Mining Limited Date: June 07, 2022 | Chapters 1, 10, 11, 12, 14. |

Signed “Fernando Cornejo” Signed By: _____________________________ Fernando A. Cornejo, M.Eng., P.Eng. QP for Great Panther Mining Limited Date: June 07, 2022 | Chapters 1, 2, 3, 13, 15, 16, 17, 18, 19, 20, 21, 24, 26. |

Signed “Nicholas Winer” Signed By: _____________________________ Nicholas Winer, B.Sc. Hons., FAusIMM QP for Great Panther Mining Limited Date: June 07, 2022 | Chapters 1, 2, 3, 4, 5, 6, 7, 8, 9, 12, 20, 24, 25, 26, 27. |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

CERTIFICATE OF QUALIFIED PERSON

I, Carlos H. B. Pires, B.Sc. Hons., FAusIMM (CP), am the author of this report "Technical Report on the 2021 Mineral Reserves and Mineral Resources of the Tucano Gold Mine, Amapá State, Brazil", (the "Technical Report") dated June 7, 2022 with an effective date of July 31, 2021 (the "Effective Date") prepared for Great Panther Mining Limited, do hereby certify that:

1. I am Master Geologist of the Tucano Gold Mine of Estrada do Taperebá, SN, Pedra, Branca do Amapari - AP, Brasil.

2. I am a graduate of the School of Geology at UNESP - Sâo Paulo State University, Brazil, in 2005 with a Bachelor of Science degree with Honors degree. I completed a post-graduation in 'Geostatistics in Deposit Evaluation' through the Universidad de Chile (Chile - 2010) and in a Citation Program in Applied Geostatistics in 2017 with accreditation by the University of Alberta.

3. I am a practicing geologist registered with the AusIMM - The Australasian Institute of Mining and Metallurgy (Membership No. 320120). I have practiced my profession continuously for more than 14 years since graduation. Relevant experience for the purpose of the Technical Report is:

| a. | More than 14 years of experience in mineral resource evaluation for Gold and Copper, involvement in projects from the exploration to operations phase, MRMR evaluations, peer Reviews and consulting activities. In addition to Great Panther Mining, Serabi Gold, Mineração Caraíba, Yamana Gold, (BrioGold / LeaGold), Snowden and AngloGold Ashanti are some companies that I have worked for. I joined the Tucano Gold Mine in August 2019 as Master Geologist. |

| b. | I have worked on the Tucano deposits since 2019 carrying out Mineral Resources Evaluation in all aspects, including: Modelling, Estimation, Database Management, QA/QC evaluation, Reconciliation and Resource Modelling, from Short Term to Long Term. |

4. I have read the definition of "qualified person" set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a "qualified person" for the purposes of NI 43-101.

5. I am an employee of Tucano Gold Mines, based on-site and have visited the Tucano Gold Mine multiple times.

6. I am responsible for Sections 10, 11 and 14 and co-responsible for Sections 1 and 12 of the Technical Report.

7. I am not independent of the Tucano Gold Mine pursuant to Section 1.5 of the Instrument by virtue of my employment.

8. I have been involved with the property that is the subject of the Technical Report as a Master Geologist since August 2019.

9. I have read NI 43-101, and the Technical Report has been prepared in compliance with NI 43-101 and Form 43-101F1.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

10. At the Effective Date of the Technical Report, to the best of my knowledge, information, and belief, the Technical Report contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

Signed and sealed “Carlos H. B. Pires”

________________________________

Carlos H. B. Pires, B.Sc. Hons., FAusIMM (CP)

DATED this 7th day of June, 2022

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

CERTIFICATE OF QUALIFIED PERSON

I, Fernando A. Cornejo, M.Eng., P.Eng., am the author of this report "Technical Report on the 2021 Mineral Reserves and Mineral Resources of the Tucano Gold Mine, Amapá State, Brazil", (the "Technical Report") dated June 7, 2022 with an effective date of July 31, 2021 (the "Effective Date") prepared for Great Panther Mining Limited, do hereby certify that:

| 1. | I am Chief Operating Officer of Great Panther Mining Limited, of 1330-200 Granville St., Vancouver, Canada, V6C 1S4. |

| 2. | I graduated with a Bachelor Degree in Chemical Engineering, from Universidad Nacional de San Agustin, Arequipa, Peru in 2001 and a Masters Degree in Chemical Engineering from Ecole Polytechnique de Montreal, Canada in 2005. |

| 3. | I am registered as a Professional Engineer in the Province of Ontario (Reg.# 100170042). I have practiced my profession since 2001 in a range of operational, technical, and mineral processing consulting roles in Canada, Brazil, Mexico, and Peru. My relevant experience for the purpose of the Technical Report is nineteen years’ experience in operational and processing consulting roles in four continents, with a strong focus in Brazil and Mexico over the last eight years. |

| 4. | I have read the definition of "qualified person" set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43- 101) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a "qualified person" for the purposes of NI 43-101. |

| 5. | I visited the Tucano Gold Mine multiple times with my last personal inspection occurring from March 28 to March 31, 2022. |

| 6. | I am responsible for Sections 13, 15, 16, 17, 18, 19 and 21 and co-responsible for Sections 1, 2, 3, 20, 25 and 26 of the Technical Report. |

| 7. | I am not independent of the Issuer applying the test set out in Section 1.5 of NI 43-101. |

| 8. | I have had been involved with the property that is the subject of the Technical Report since July 2019. |

| 9. | I have read NI 43-101, and the Technical Report has been prepared in compliance with NI 43-101 and Form 43-101F1. |

| 10. | At the Effective Date of the Technical Report, to the best of my knowledge, information, and belief, the Technical Report contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Signed and sealed “Fernado Cornejo”

________________________________

Fernando A. Cornejo, M.Eng., P.Eng.

DATED this 7th day of June, 2022

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

CERTIFICATE OF QUALIFIED PERSON

I, Nicholas Winer, B.Sc. Hons., FAusIMM, am the author of this report "Technical Report on the 2021 Mineral Reserves and Mineral Resources of the Tucano Gold Mine, Amapá State, Brazil", (the "Technical Report") dated June 7, 2022 with an effective date of July 31, 2021 (the "Effective Date") prepared for Great Panther Mining Limited, do hereby certify that:

1. I am Vice President of Exploration of Great Panther Mining Limited, of 1330-200 Granville St., Vancouver, Canada, V6C 1S4.

2. I graduated with a Bachelor of Honours Degree in Geophysics and Geology, from Macquarie University, Sydney, Australia in 1986.

3. I am a practicing geologist registered as a Fellow with the AusIMM - The Australasian Institute of Mining and Metallurgy (Membership No. 334232). I have practiced my profession continuously for 38 years since my graduation. My relevant experience for the purpose of the Technical Report is:

| (a) | More than 17 years of experience in regional and near mine exploration, including definition of geologic resource models for Archean, Proterozoic and Tertiary aged Gold and Copper / Gold deposits as employee of BHP Minerals (BHP), 7 years with AngloGold Ashanti (AGA) on Archean and Proterozoic Gold and Mesozoic Copper / Gold Deposits and 6 years with Horizonte Minerals for Archean and Proterozoic Gold deposits and Lateritic Nickel deposits. |

| (b) | Since 1996, I have held senior positions with international companies including, Country Exploration Manager with BHP, Exploration Manager Brazil, VP Exploration Colombia and VP Exploration South America for AGA, and COO for Horizonte Minerals. Since June 2020 I have been Vice President Exploration for Great Panther Mining. |

| (c) | My first involvement with the Tucano deposits was in 1996 prior to its discovery when in the capacity of Brazil Exploration Manager, BHP negotiated a JV over the regional tenement package covering the majority of a 90km stretch of the Vila Nova Belt in which the Tucano Deposit is centred. BHP carried out extensive regional geophysical and regional geochemical programs until mid-1998. |

| (d) | In 1999 as Exploration Manager for AGA Brazil, the focus was on the resource definition and PFS studies on the Tucano Gold Mine. (AGA’s Amapari Project). |

| (e) | From 2001 to 2017, I was a partner in Mineracao Vale dos Reis who held title to tenements in the region that were the subject of a Joint Venture with Mineracao Serra da Canga. (controlled by the Tucano Mine). Mineracao Vale dos Reis was sold to the Tucano Mine in 2017. |

| (f) | Between April and May 2020, I provided consulting services to Great Panther Mining focused on the Tucano Exploration potential and in May was nominated Vice President Exploration. During Covid19 restrictions my focus has been centred on the regional and near mine exploration potential and continued improvements to technical protocols for exploration and resource modelling. |

4. I have read the definition of "qualified person" set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101") and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a "qualified person" for the purposes of NI 43-101.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

5. I have visited the Tucano Gold Mine multiple times with my last personal inspection occurring from March 14 to March 30, 2022.

6. I am responsible for Sections 4, 5, 6, 7, 8, 9, 24 and 27 and co-responsible for Sections 1, 2, 3, 12, 20, 25 and 26 of the Technical Report.

7. I am not independent of the Tucano Gold Mine pursuant to Section 1.5 of the Instrument.

8. I have been involved with the property that is the subject of the Technical Report as Vice President of Exploration, Great Panther since May 2020.

9. I have read NI 43-101, and the Technical Report has been prepared in compliance with NI 43-101 and Form 43-101F1.

10. At the Effective Date of the Technical Report, to the best of my knowledge, information, and belief, the Technical Report contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading.

Signed and sealed “Nicholas Winer”

_________________________________

Nicholas Winer, B.Sc. Hons., FAusIMM

DATED this 7th day of June, 2022

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

CONSENT OF QUALIFIED PERSON

Pursuant to Section 8.3 of

National Instrument 43-101 Standards of Disclosure for Mineral Projects

To: British Columbia Securities Commission

Alberta Securities Commission

Financial and Consumer Affairs Authority of Saskatchewan

Manitoba Securities Commission

Ontario Securities Commission

Financial and Consumer Services Commission (New Brunswick)

Nova Scotia Securities Commission

Office of the Superintendent of Securities Office Newfoundland and Labrador

Office of the Superintendent of Securities (Prince Edward Island)

I, Carlos H. B. Pires, B.Sc. Hons., FAusIMM (CP), consent to the public filing of the Technical Report, titled "Technical Report on the 2021 Mineral Reserves and Mineral Resources of the Tucano Gold Mine, Amapá State, Brazil", dated June 7, 2022 with an effective date of July 31, 2021 (the "Technical Report") by Great Panther Mining Limited (the "Issuer").

I also consent to the public filing by the Issuer of extracts from, or a summary of the Technical Report, in the news release issued by the Issuer on April 26, 2022 (the "News Release"). I certify that I have read the News Release filed by the Issuer and that it fairly and accurately represents the information in the Technical Report.

Signed on June 7, 2022.

Signed and sealed “Carlos H. B. Pires”

_________________________________

Carlos H. B. Pires, B.Sc. Hons., FAusIMM (CP)

Qualified Person (QP) for Great Panther Mining Limited

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

CONSENT OF QUALIFIED PERSON

Pursuant to Section 8.3 of

National Instrument 43-101 Standards of Disclosure for Mineral Projects

To: British Columbia Securities Commission

Alberta Securities Commission

Financial and Consumer Affairs Authority of Saskatchewan

Manitoba Securities Commission

Ontario Securities Commission

Financial and Consumer Services Commission (New Brunswick)

Nova Scotia Securities Commission

Office of the Superintendent of Securities Office Newfoundland and Labrador

Office of the Superintendent of Securities (Prince Edward Island)

I, Fernando A. Cornejo, M.Eng., P.Eng., consent to the public filing of the Technical Report, titled "Technical Report on the 2021 Mineral Reserves and Mineral Resources of the Tucano Gold Mine, Amapá State, Brazil", dated June 7, 2022 with an effective date of July 31, 2021 (the "Technical Report") by Great Panther Mining Limited (the "Issuer").

I also consent to the public filing by the Issuer of extracts from, or a summary of the Technical Report, in the news release issued by the Issuer on April 26, 2022 (the "News Release"). I certify that I have read the News Release filed by the Issuer and that it fairly and accurately represents the information in the Technical Report.

Signed on June 7, 2022.

Signed and sealed “Fernado Cornejo”

_________________________________

Fernando A. Cornejo, M.Eng., P.Eng.

Qualified Person (QP) for Great Panther Mining Limited

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

CONSENT OF QUALIFIED PERSON

Pursuant to Section 8.3 of

National Instrument 43-101 Standards of Disclosure for Mineral Projects

To: British Columbia Securities Commission

Alberta Securities Commission

Financial and Consumer Affairs Authority of Saskatchewan

Manitoba Securities Commission

Ontario Securities Commission

Financial and Consumer Services Commission (New Brunswick)

Nova Scotia Securities Commission

Office of the Superintendent of Securities Office Newfoundland and Labrador

Office of the Superintendent of Securities (Prince Edward Island)

I, Nicholas Winer, B.Sc. Hons., FAusIMM, consent to the public filing of the Technical Report, titled "Technical Report on the 2021 Mineral Reserves and Mineral Resources of the Tucano Gold Mine, Amapá State, Brazil", dated June 7, 2022 with an effective date of July 31, 2021 (the "Technical Report") by Great Panther Mining Limited (the "Issuer").

I also consent to the public filing by the Issuer of extracts from, or a summary of the Technical Report, in the news release issued by the Issuer on April 26, 2022 (the "News Release"). I certify that I have read the News Release filed by the Issuer and that it fairly and accurately represents the information in the Technical Report.

Signed on June 7, 2022.

Signed and sealed “Nicholas Winer”

________________________________

Nicholas Winer, B.Sc. Hons., FAusIMM

Qualified Person (QP) for Great Panther Mining Limited

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Contents

| DATE & SIGNATURE PAGE | i |

| CERTIFICATE OF QUALIFIED PERSON | ii |

| CERTIFICATE OF QUALIFIED PERSON | iv |

| CERTIFICATE OF QUALIFIED PERSON | v |

| CONSENT OF QUALIFIED PERSON | vii |

| CONSENT OF QUALIFIED PERSON | viii |

| CONSENT OF QUALIFIED PERSON | ix |

| 1. | SUMMARY | 1-1 |

| 1.1 | Introduction | 1-1 |

| 1.2 | Terms of Reference | 1-1 |

| 1.3 | Project Setting | 1-1 |

| 1.4 | Mineral Tenure, Surface Rights, Royalties and Agreements | 1-2 |

| 1.5 | Geology and Mineralization | 1-3 |

| 1.5.1 | Urucum - TAP C TREND | 1-4 |

| 1.5.2 | TAP AB | 1-4 |

| 1.6 | History | 1-4 |

| 1.7 | Drilling and Sampling | 1-5 |

| 1.8 | Data Verification | 1-5 |

| 1.9 | Metallurgical Test Work | 1-6 |

| 1.10 | Mineral Resource Estimation | 1-7 |

| 1.11 | Mineral Resource Statement | 1-9 |

| 1.12 | Mineral Reserve Estimation | 1-10 |

| 1.13 | Mineral Reserve Statement | 1-12 |

| 1.14 | Mining Methods | 1-14 |

| 1.14.1 | Open Pit | 1-14 |

| 1.14.2 | Underground | 1-16 |

| 1.15 | Recovery Methods | 1-17 |

| 1.15.1 | Project Infrastructure | 1-17 |

| 1.16 | Environmental, Permitting and Social Considerations | 1-18 |

| 1.16.1 | Environmental Considerations | 1-18 |

| 1.16.2 | Closure and Reclamation Planning | 1-18 |

| 1.16.3 | Permitting Considerations | 1-18 |

| 1.16.4 | Social Considerations | 1-19 |

| 1.17 | Markets and Contracts | 1-19 |

| 1.17.1 | Capital Cost Estimates | 1-19 |

| 1.18 | Operating Cost Estimates | 1-20 |

| 1.19 | Economic Analysis | 1-21 |

| 1.20 | Risks and Opportunities | 1-21 |

| 1.21 | Interpretation and Conclusions | 1-22 |

| 1.22 | Conclusions and Recommendations | 1-22 |

| 2. | INTRODUCTION | 2-1 |

| 2.1 | Introduction | 2-1 |

| 2.2 | Terms of Reference | 2-2 |

| 2.3 | Qualified Persons | 2-2 |

| 2.4 | Site Visits and Scope of Personal Inspection | 2-3 |

| 2.5 | Effective Dates | 2-3 |

| 2.6 | Information Sources and References | 2-3 |

| 2.7 | Previous Technical Reports | 2-3 |

| 3. | RELIANCE ON OTHER EXPERTS | 3-1 |

| 3.1 | Introduction | 3-1 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| 3.2 | Mineral Tenure, Surface Rights, and Royalties | 3-1 |

| 3.3 | Environmental, Permitting and Social | 3-1 |

| 3.4 | Taxation | 3-2 |

| 4. | PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| 4.1 | Introduction | 4-1 |

| 4.2 | Property and Title in Brazil | 4-2 |

| 4.2.1 | Overview | 4-2 |

| 4.2.2 | Mineral Title | 4-2 |

| 4.2.3 | Surface Rights | 4-4 |

| 4.2.4 | Water Rights | 4-5 |

| 4.2.5 | Government Mining Taxes, Levies or Royalties | 4-6 |

| 4.2.6 | Fraser Institute Survey | 4-6 |

| 4.3 | Project Ownership | 4-7 |

| 4.4 | Agreements | 4-11 |

| 4.5 | Royalties and Encumbrances | 4-11 |

| 4.6 | Permitting Considerations | 4-12 |

| 4.7 | Environmental Considerations | 4-13 |

| 4.8 | Social License Considerations | 4-14 |

| 4.9 | Significant Risk Factors | 4-16 |

| 4.10 | QP Comments on “Item 4; Property Description and Location” | 4-16 |

| 5. | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY | 5-1 |

| 5.1 | Accessibility | 5-1 |

| 5.2 | Climate | 5-2 |

| 5.3 | Local Resources and Infrastructure | 5-3 |

| 5.4 | Physiography | 5-4 |

| 5.5 | QP Comments on “Item 5; Accessibility, Climate, Local Resources, Infrastructure and Physiography” | 5-7 |

| 6. | HISTORY | 6-1 |

| 6.1 | Exploration History | 6-1 |

| 6.2 | Production History | 6-1 |

| 7. | GEOLOGICAL SETTING AND MINERALIZATION | 7-1 |

| 7.1 | Regional Geology | 7-1 |

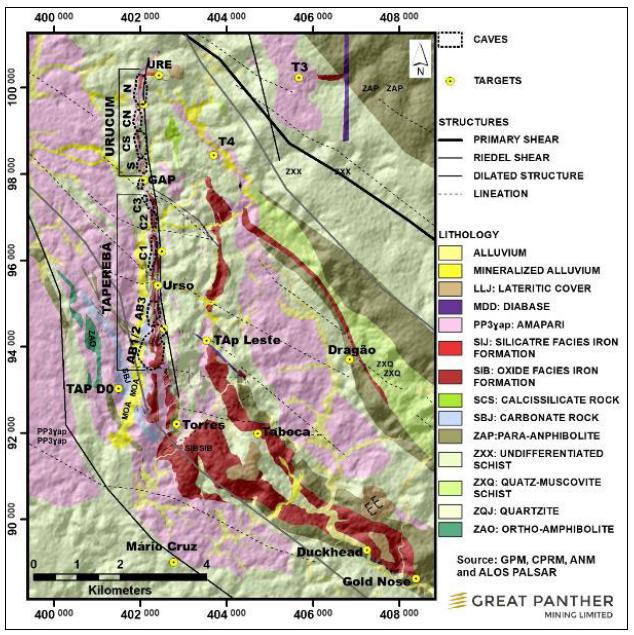

| 7.2 | Project Geology | 7-3 |

| 7.2.1 | Weathering | 7-3 |

| 7.2.2 | Lithologies | 7-4 |

| 7.2.3 | Structure | 7-7 |

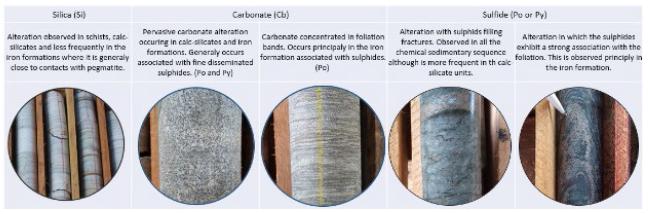

| 7.2.4 | Alteration | 7-9 |

| 7.2.5 | Mineralization | 7-9 |

| 7.3 | Deposit Descriptions | 7-11 |

| 7.3.1 | Urucum and TAP C Deposits | 7-12 |

| 7.3.2 | TAP AB | 7-13 |

| 7.3.3 | Urucum East (“URE”) | 7-14 |

| 7.3.4 | Duckhead | 7-15 |

| 7.4 | Prospects/Exploration Targets | 7-15 |

| 7.5 | QP Comments on “Item 7: Geological Setting and Mineralization” | 7-16 |

| 8. | DEPOSIT TYPES | 8-17 |

| 8.1 | Overview | 8-17 |

| 8.2 | QP Comments on “Item 8: Deposit Types” | 8-18 |

| 9. | EXPLORATION | 9-19 |

| 9.1 | Grids and Surveys | 9-20 |

| 9.2 | Geological Mapping | 9-22 |

| 9.3 | Geochemical Sampling | 9-23 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| 9.4 | Geophysics | 9-24 |

| 9.4.1 | Airborne | 9-24 |

| 9.4.2 | Ground Geophysics | 9-25 |

| 9.5 | Data Reviews | 9-28 |

| 9.5.1 | Geophysical Interpretation | 9-28 |

| 9.6 | QP Comments on “Item 9: Exploration” | 9-28 |

| 10. | DRILLING | 10-1 |

| 10.1 | Introduction | 10-1 |

| 10.2 | Drill Methods | 10-1 |

| 10.2.1 | Auger | 10-1 |

| 10.2.2 | Rotary Air Blast (“RAB”) | 10-1 |

| 10.2.3 | RC | 10-4 |

| 10.2.4 | Diamond Drilling | 10-5 |

| 10.3 | Logging Procedures | 10-5 |

| 10.3.1 | Auger, RAB and RC | 10-5 |

| 10.3.2 | Drill Core | 10-5 |

| 10.3.3 | Recovery | 10-6 |

| 10.3.4 | Collar Surveys | 10-6 |

| 10.3.5 | Downhole Surveys | 10-6 |

| 10.3.6 | Grade Control | 10-6 |

| 10.3.7 | Sample Length/True Thickness | 10-6 |

| 10.4 | Drilling Since Database Close-out Date | 10-7 |

| 10.5 | QP Comments on “Item 10: Drilling” | 10-7 |

| 11. | SAMPLE PREPARATION, ANALYSES, AND SECURITY | 11-1 |

| 11.1 | Sampling Methods | 11-1 |

| 11.1.1 | Geochemical | 11-1 |

| 11.1.2 | Auger | 11-1 |

| 11.1.3 | RAB | 11-1 |

| 11.1.4 | RC | 11-1 |

| 11.1.5 | Core | 11-1 |

| 11.2 | Metallurgical Sampling | 11-2 |

| 11.3 | Density Determinations | 11-3 |

| 11.4 | Analytical and Test Laboratories | 11-3 |

| 11.5 | Sample Preparation and Analysis | 11-4 |

| 11.6 | Quality Assurance and Quality Control | 11-4 |

| 11.6.1 | Legacy | 11-4 |

| 11.6.2 | Quality Assurance and Quality Control Reporting | 11-4 |

| 11.6.3 | Great Panther | 11-5 |

| 11.7 | Databases | 11-12 |

| 11.8 | Sample Security | 11-13 |

| 11.9 | QP Comments on “Item 11: Sample Preparation, Analyses, and Security” | 11-13 |

| 12. | DATA VERIFICATION | 12-1 |

| 12.1 | Internal Data Verification | 12-1 |

| 12.2 | External Data Verification | 12-1 |

| 12.3 | QP Comments on “Item 12: Data Verification” | 12-3 |

| 13. | MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 |

| 13.1 | Introduction | 13-1 |

| 13.2 | Metallurgical Testwork | 13-1 |

| 13.2.1 | Testwork | 13-1 |

| 13.2.2 | Results | 13-2 |

| 13.3 | Plant Performance | 13-4 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| 13.3.1 | Plant Throughput | 13-4 |

| 13.3.2 | Metallurgical recoveries and Oxygen | 13-4 |

| 13.3.3 | Cyanide Consumption | 13-4 |

| 13.3.4 | Deleterious Elements | 13-4 |

| 14. | MINERAL RESOURCE ESTIMATES | 14-1 |

| 14.1 | Introduction | 14-1 |

| 14.2 | Exploratory Data Analysis | 14-1 |

| 14.3 | Geological Models | 14-2 |

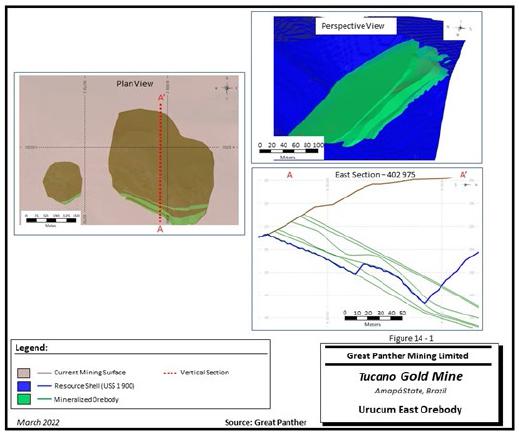

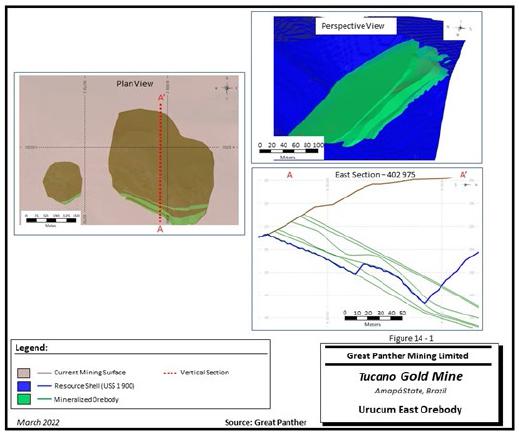

| 14.3.1 | Urucum East | 14-2 |

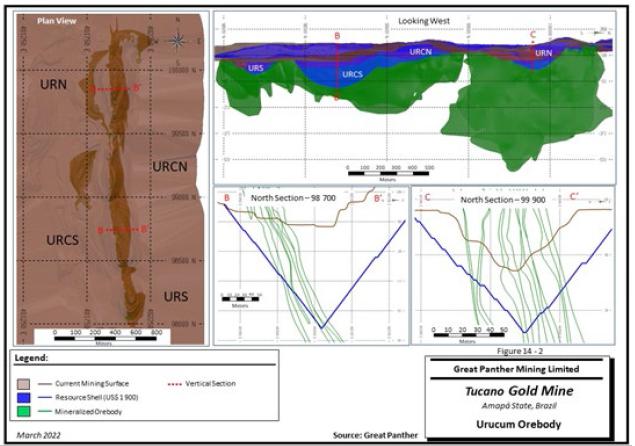

| 14.3.2 | Urucum | 14-3 |

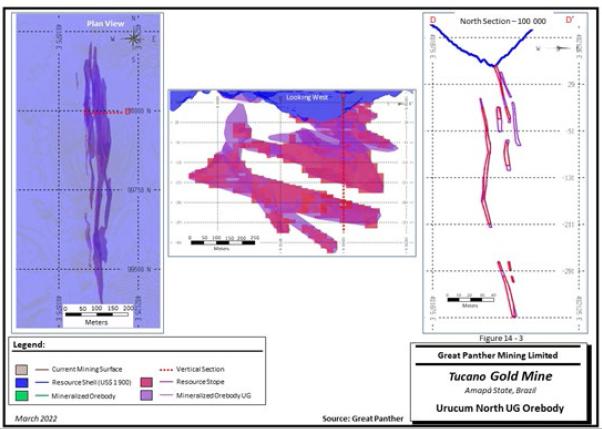

| 14.3.3 | TAP C | 14-5 |

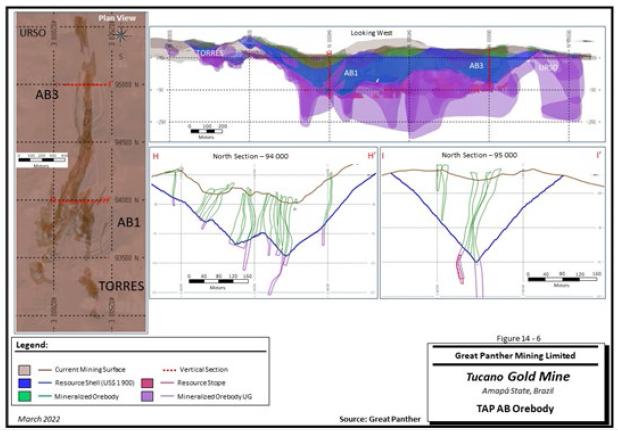

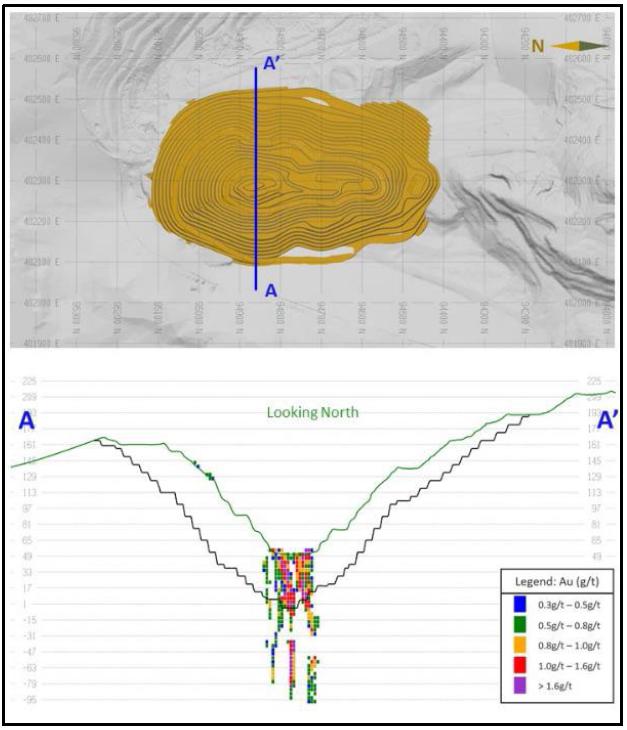

| 14.3.4 | TAP AB | 14-6 |

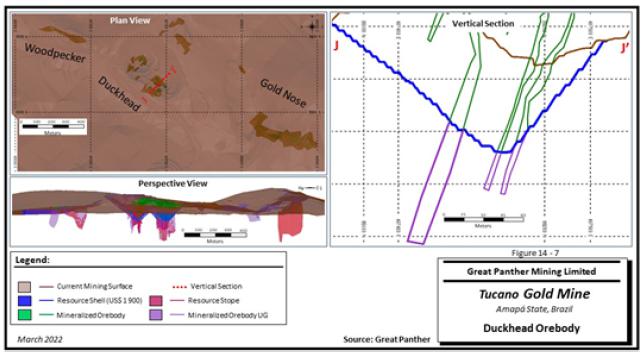

| 14.3.5 | Duckhead | 14-7 |

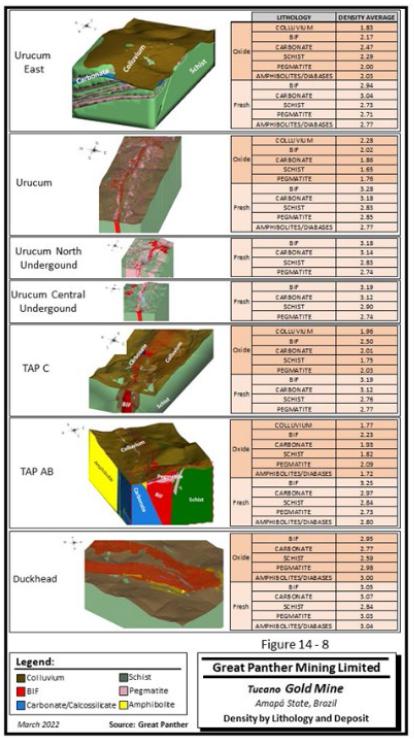

| 14.4 | Density Assignment | 14-7 |

| 14.5 | Grade Capping/Outlier Restrictions | 14-9 |

| 14.6 | Composites | 14-10 |

| 14.7 | Variography | 14-10 |

| 14.8 | Estimation/Interpolation Methods | 14-10 |

| 14.9 | Block Model Validation | 14-14 |

| 14.9.1 | Urucum East Open pit | 14-14 |

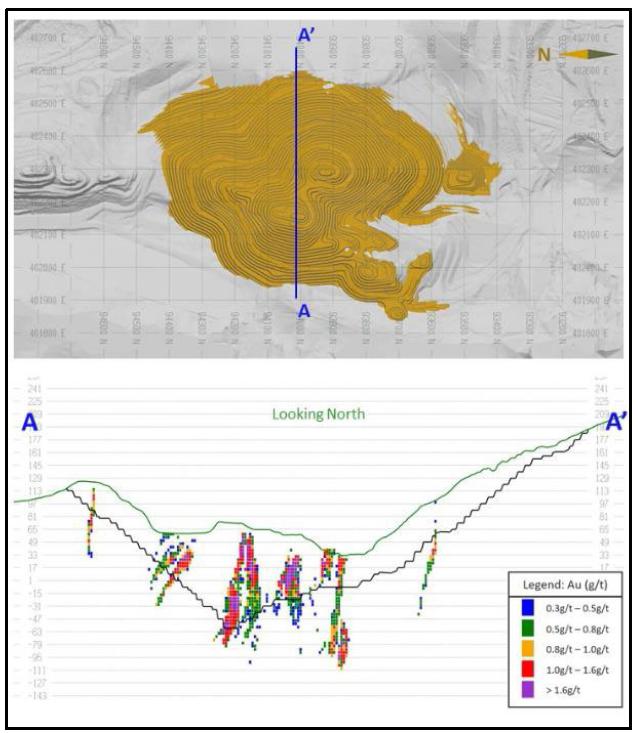

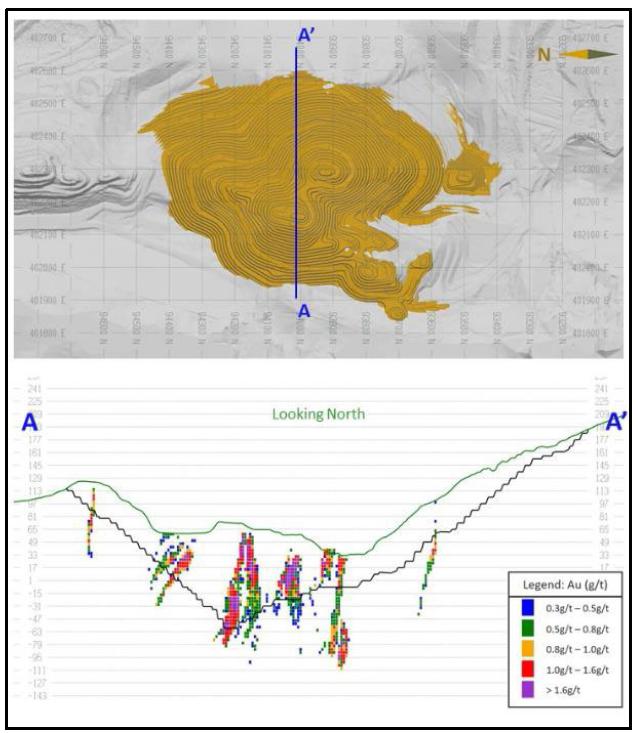

| 14.9.2 | Urucum Open pit | 14-15 |

| 14.9.3 | Urucum North / Urucum Central Underground | 14-15 |

| 14.9.4 | TAP C Open pit | 14-15 |

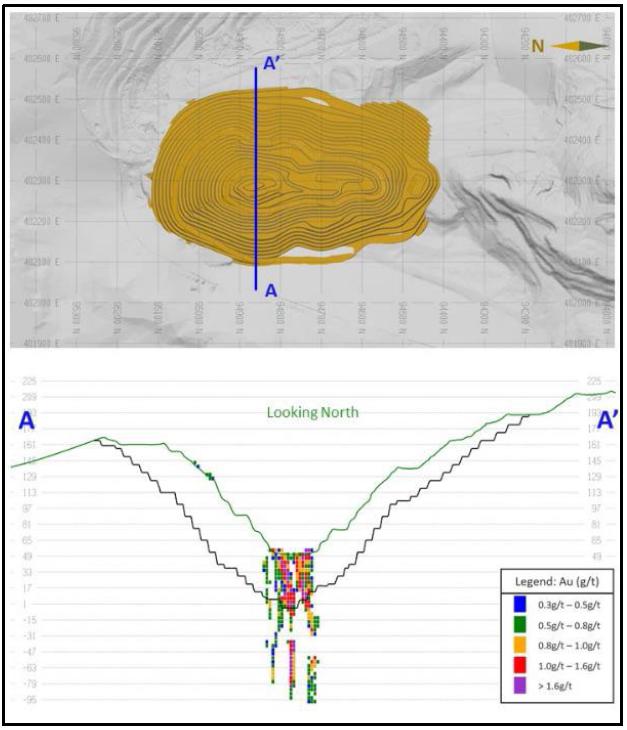

| 14.9.5 | TAP AB Open pit | 14-16 |

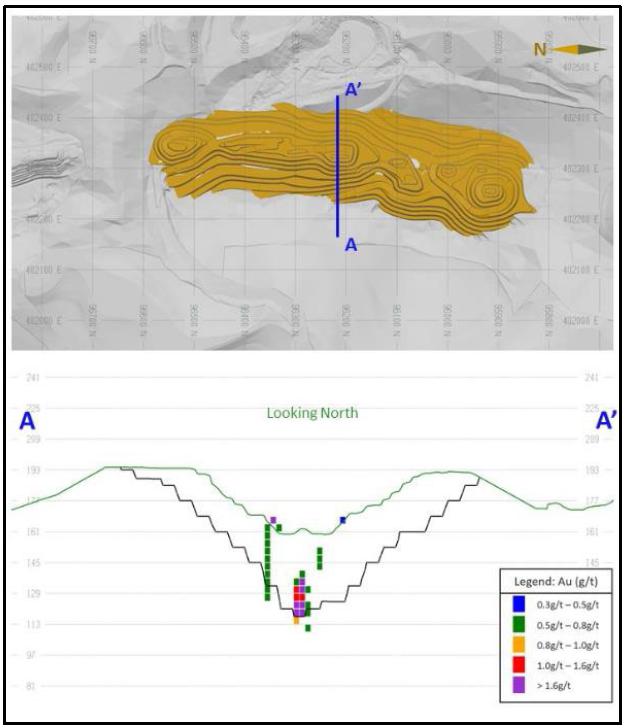

| 14.9.6 | Duckhead Open pit | 14-16 |

| 14.10 | Classification of Mineral Resources | 14-16 |

| 14.11 | Reasonable Prospects of Eventual Economic Extraction | 14-18 |

| 14.11.1 | Urucum East Open pit | 14-18 |

| 14.11.2 | Urucum Open pit | 14-18 |

| 14.11.3 | Urucum North, Urucum Central Underground | 14-19 |

| 14.11.4 | TAP C Open pit | 14-20 |

| 14.11.5 | TAP AB | 14-20 |

| 14.11.6 | Duckhead | 14-21 |

| 14.12 | Stockpiles | 14-22 |

| 14.13 | Mineral Resource Statement | 14-22 |

| 14.14 | Factors That May Affect the Mineral Resource Estimate | 14-24 |

| 14.15 | QP Comments on “Item 14: Mineral Resource Estimates” | 14-24 |

| 15. | MINERAL RESERVE ESTIMATES | 15-1 |

| 15.1 | Summary | 15-1 |

| 15.2 | Open Pit Mineral Reserves | 15-2 |

| 15.2.1 | Dilution And Extraction | 15-2 |

| 15.2.2 | Cut-Off Grade | 15-3 |

| 15.2.3 | Open Pit Optimization Parameters | 15-4 |

| 15.3 | Underground Mineral Reserves | 15-7 |

| 15.3.1 | Cut-Off Criteria | 15-7 |

| 15.3.2 | Mso Estimates | 15-8 |

| 15.3.3 | Mining Recovery Factors | 15-9 |

| 15.4 | Comparison To Previous Estimates | 15-9 |

| 16. | MINING METHODS | 16-1 |

| 16.1 | Overview | 16-1 |

| 16.2 | Open Pit | 16-1 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| 16.2.1 | Geotechnical Considerations | 16-1 |

| 16.2.2 | Hydrogeological Considerations | 16-2 |

| 16.2.3 | Open Pit Designs | 16-3 |

| 16.2.4 | Mine Operations | 16-11 |

| 16.2.5 | Production Schedule | 16-11 |

| 16.2.6 | Grade Control and Production Monitoring | 16-12 |

| 16.2.7 | Contractor Responsibilities | 16-16 |

| 16.2.8 | Equipment | 16-16 |

| 16.3 | Underground | 16-17 |

| 16.3.1 | Geotechnical Considerations | 16-18 |

| 16.3.2 | Hydrogeological Considerations | 16-18 |

| 16.3.3 | Mining Method Selection | 16-18 |

| 16.3.4 | Design Assumptions and Design Criteria | 16-19 |

| 16.3.5 | Mine Operations | 16-19 |

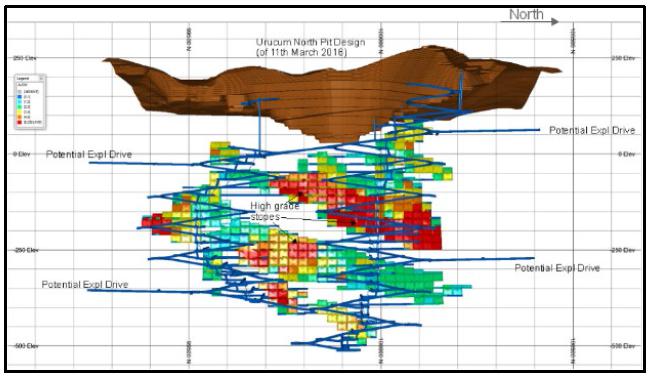

| 16.3.6 | Production Schedule | 16-20 |

| 16.3.7 | Ventilation | 16-21 |

| 16.3.8 | Underground Infrastructure Facilities | 16-23 |

| 16.3.9 | Blasting and Explosives | 16-24 |

| 16.3.10 | Mining Equipment | 16-24 |

| 16.4 | QP Comments on “Item 16: Mining Methods” | 16-24 |

| 17. | RECOVERY METHODS | 17-1 |

| 17.1 | Introduction | 17-1 |

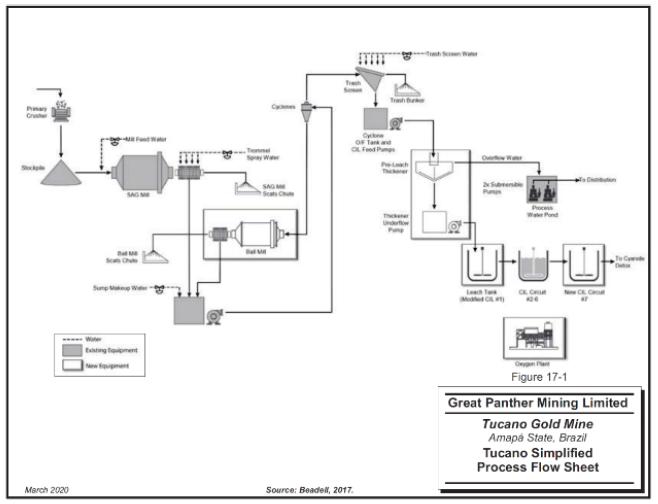

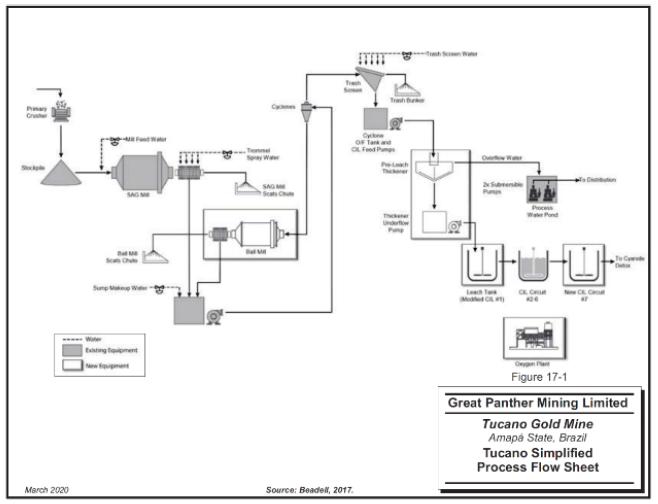

| 17.2 | Process Flow Sheet | 17-1 |

| 17.3 | Plant Design | 17-1 |

| 17.3.1 | Crushing and Stockpiling | 17-1 |

| 17.3.2 | Milling, Classification and Pre-Leach Thickening | 17-2 |

| 17.3.3 | Hybrid CIL | 17-3 |

| 17.3.4 | Tailings | 17-4 |

| 17.3.5 | Elution | 17-4 |

| 17.3.6 | Carbon Regeneration | 17-4 |

| 17.3.7 | Electrowinning and Gold Recovery | 17-5 |

| 17.4 | Energy, Water, and Process Materials Requirements | 17-5 |

| 17.4.1 | Energy | 17-5 |

| 17.4.2 | Water | 17-6 |

| 17.4.3 | Process Consumables | 17-6 |

| 18. | PROJECT INFRASTRUCTURE | 18-1 |

| 18.1 | Introduction | 18-1 |

| 18.2 | Road and Logistics | 18-3 |

| 18.3 | Stockpiles | 18-3 |

| 18.4 | Waste Rock Storage Facilities (“WRSF”) | 18-3 |

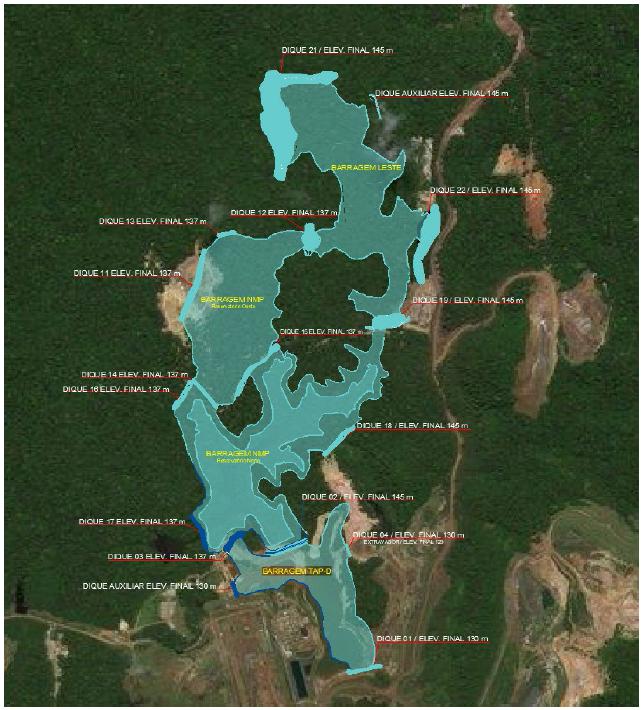

| 18.5 | Tailings Storage Facilities (“TSF”) | 18-5 |

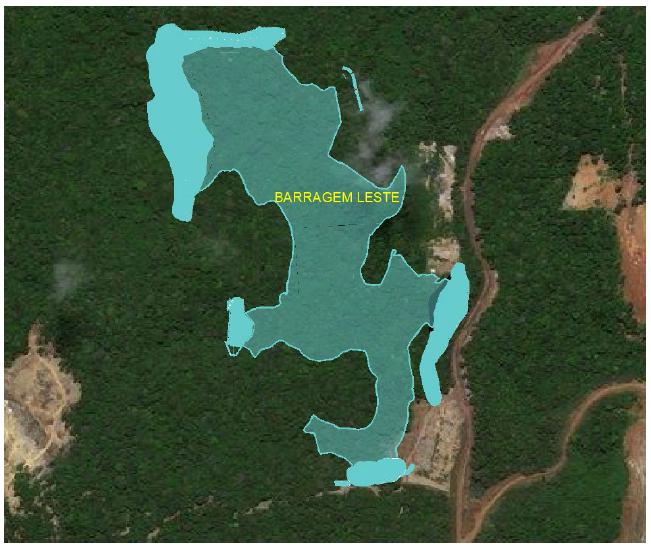

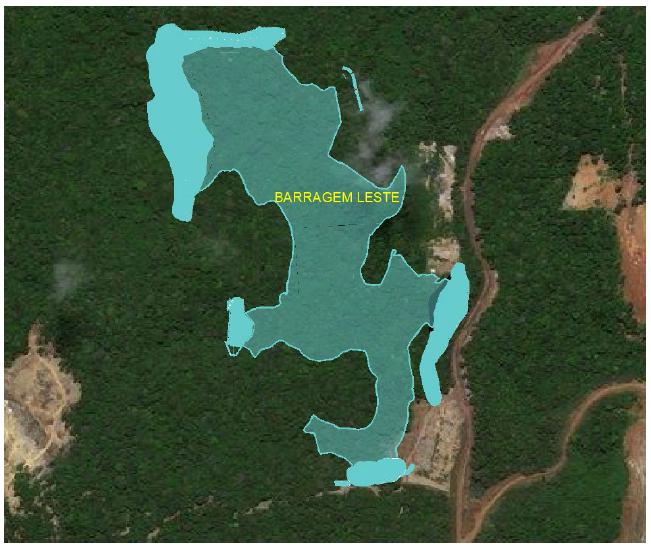

| 18.5.1 | East Dam, Phase 1 and 2 | 18-5 |

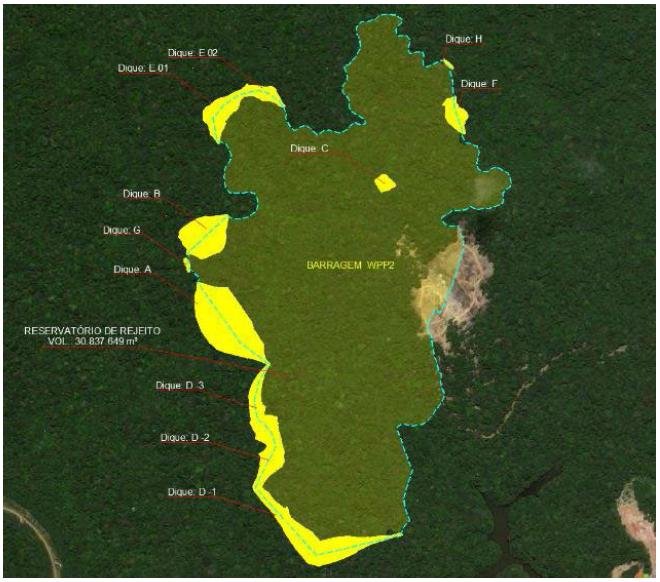

| 18.5.2 | Future storage capacity | 18-6 |

| 18.5.3 | Conclusions | 18-11 |

| 18.6 | Water Management | 18-11 |

| 18.7 | Camps and Accommodation | 18-11 |

| 18.8 | Power and Electrical | 18-12 |

| 19. | MARKET STUDIES AND CONTRACTS | 19-13 |

| 19.1 | Market Studies | 19-13 |

| 19.2 | Commodity Price and Exchange Rate Projections | 19-13 |

| 19.3 | Contracts | 19-13 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| 20. | ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT | 20-1 |

| 20.1 | Baseline and Supporting Studies | 20-1 |

| 20.2 | Environmental Considerations/Monitoring Programs | 20-1 |

| 20.3 | Closure Plan | 20-2 |

| 20.4 | Permitting | 20-3 |

| 20.5 | Considerations of Social and Community Impacts | 20-3 |

| 21. | CAPITAL AND OPERATING COSTS | 21-1 |

| 21.1 | Introduction | 21-1 |

| 21.2 | Capital Cost Estimates | 21-1 |

| 21.2.1 | Open Pit | 21-1 |

| 21.2.2 | Underground | 21-1 |

| 21.2.3 | Closure | 21-2 |

| 21.2.4 | Capital Cost Summary | 21-2 |

| 21.3 | Operating Cost Estimates | 21-2 |

| 21.3.1 | Open Pit | 21-2 |

| 21.3.2 | Underground | 21-4 |

| 22. | ECONOMIC ANALYSIS | 22-1 |

| 23. | ADJACENT PROPERTIES | 23-1 |

| 24. | OTHER RELEVANT DATA AND INFORMATION | 24-1 |

| 25. | INTERPRETATION AND CONCLUSIONS | 25-1 |

| 25.1 | Introduction | 25-1 |

| 25.2 | Mineral Tenure, Surface Rights, Water Rights, Royalties and Agreements | 25-1 |

| 25.3 | Geology and Mineralization | 25-1 |

| 25.4 | Exploration, Drilling and Analytical Data Collection in Support of Mineral Resource Estimation | 25-2 |

| 25.5 | Metallurgical Testwork | 25-2 |

| 25.6 | Mineral Resource Estimates | 25-3 |

| 25.7 | Mineral Reserve Estimates | 25-3 |

| 25.8 | Mine Plan | 25-4 |

| 25.9 | Gold Recovery | 25-4 |

| 25.10 | Infrastructure | 25-4 |

| 25.11 | Environmental, Permitting and Social Considerations | 25-5 |

| 25.12 | Markets and Contracts | 25-5 |

| 25.13 | Capital Cost Estimates | 25-6 |

| 25.14 | Operating Cost Estimates | 25-6 |

| 25.15 | Economic Analysis | 25-6 |

| 25.16 | Risks and Opportunities | 25-6 |

| 25.16.1 | Risks | 25-6 |

| 25.16.2 | Opportunities | 25-7 |

| 25.16.3 | Forward-looking Statements | 25-8 |

| 25.16.4 | Information Concerning Estimates of Mineral Resources | 25-10 |

| 26. | RECOMMENDATIONS | 26-1 |

| 26.1 | Geology and Mineral Resource | 26-1 |

| 26.2 | Mining and Mineral Reserves | 26-2 |

| 26.3 | Underground Mining | 26-2 |

| 26.4 | MINERAL PROCESSING | 26-3 |

| 27. | REFERENCES | 27-1 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Tables

| Table 1-1: Drilling Supporting the 2021 MRMR Estimation | 1-5 |

| Table 1-2: Input Parameters, Open Pit Cut-off Grades | 1-8 |

| Table 1-3: Input Parameters, Underground Cut-off Grades | 1-8 |

| Table 1-4: Tucano Mineral Resource Estimate as of July 31, 2021 | 1-10 |

| Table 1-5: Open Pit Marginal Grade Estimate | 1-11 |

| Table 1-6: MSO Parameters for Underground Cut-off Estimation | 1-12 |

| Table 1-7: Tucano Mineral Reserves Estimate as of July 31, 2021. | 1-13 |

| Table 1-8: Open Pit LOM Production Schedule | 1-15 |

| Table 1-9: Open Pit and TSF Capital Cost Estimates | 1-20 |

| Table 1-10: Underground Capital Cost Estimates | 1-20 |

| Table 1-11: Annual Open Pit Operating Cost Estimates | 1-21 |

| Table 1-12: Annual Underground Operating Costs | 1-21 |

| Table 2-1: Responsibilities of Qualified Person and Experts | 2-2 |

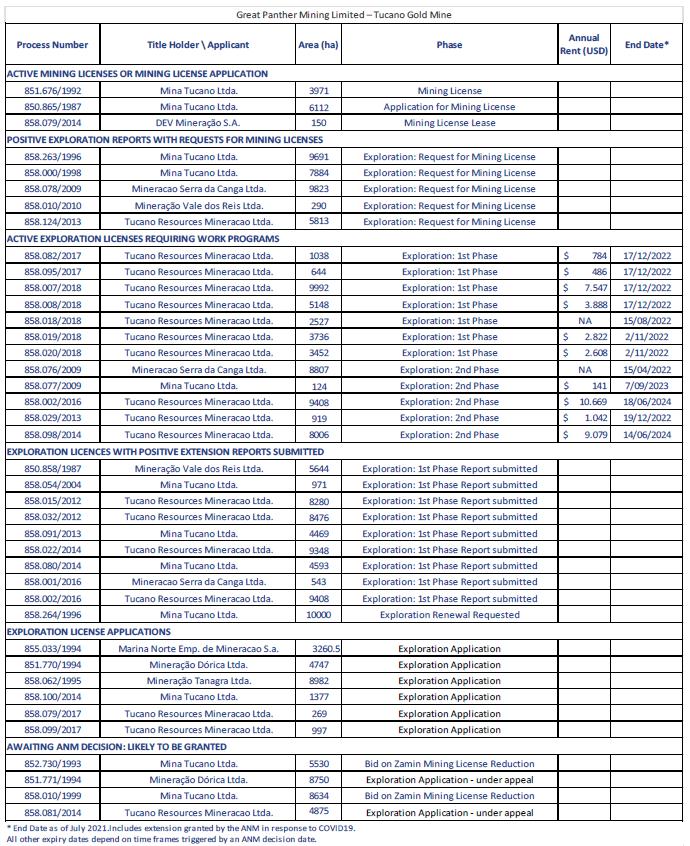

| Table 4-1: Mining and Exploration Licenses | 4-10 |

| Table 4-2: Permits for Key Mining Areas | 4-12 |

| Table 4-3: Exploration License Environmental Permitting | 4-14 |

| Table 5-1: Monthly Rainfall (mm), 2008 - 2021 | 5-2 |

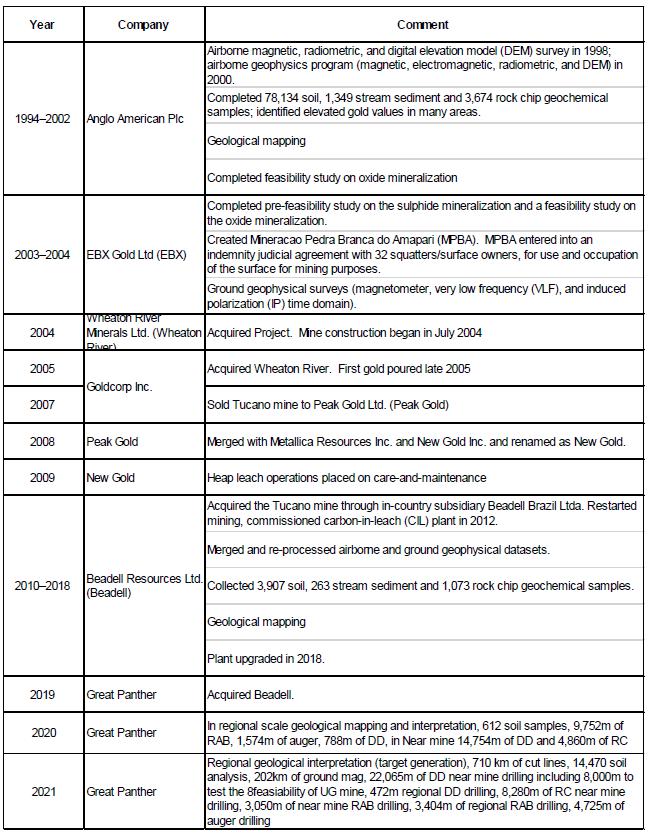

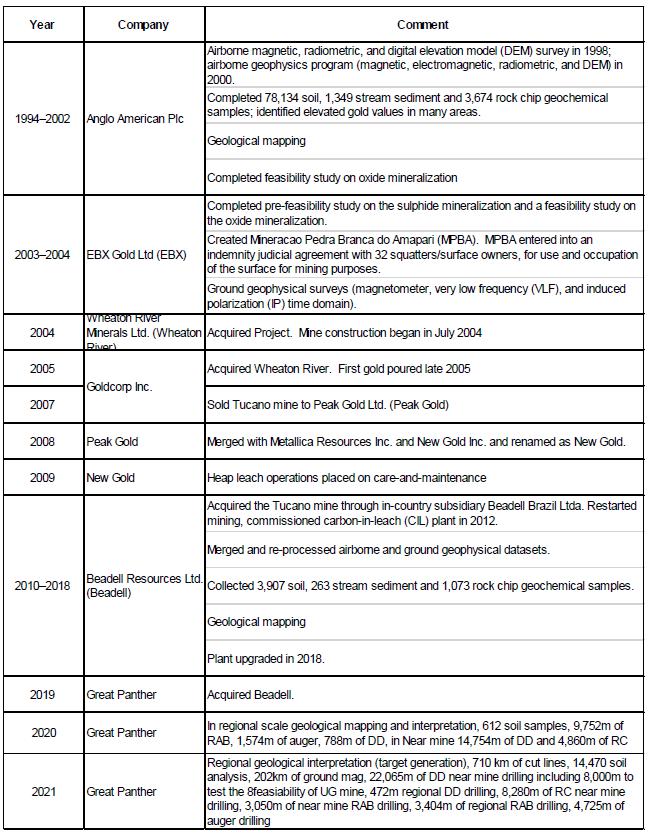

| Table 6-1: Ownership and Exploration History | 6-3 |

| Table 6-2: Historical Gold Production from the Tucano Mine | 6-4 |

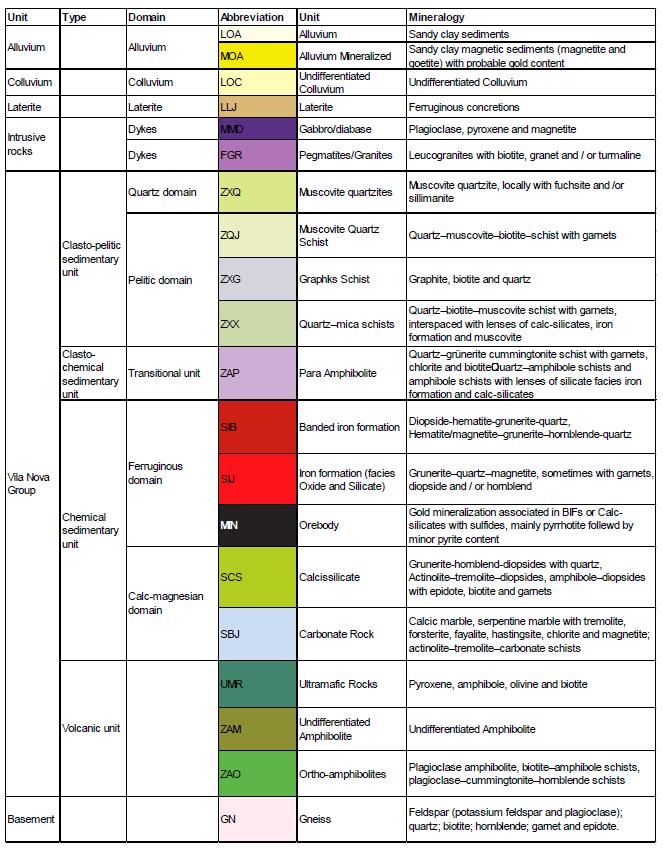

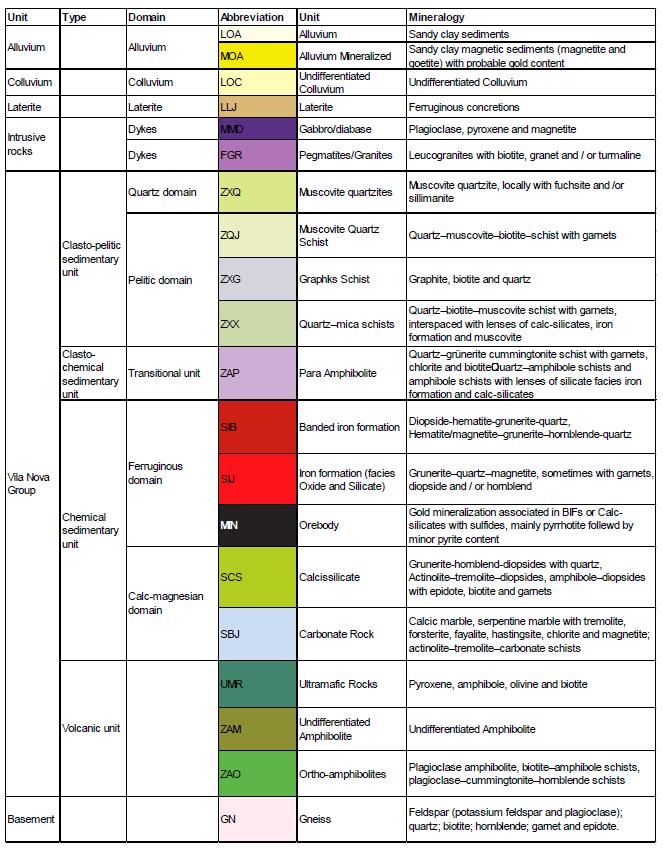

| Table 7-1: Tucano Mine Lithology Units | 7-5 |

| Table 7-2: Structural History within the Tucano Mine | 7-8 |

| Table 7-3: Dimensions of Tucano Mineralized Zones | 7-10 |

| Table 10-1: Drilling Supporting the 2021 MRMR Estimation | 10-1 |

| Table 10-2: Drilling by Deposit | 10-3 |

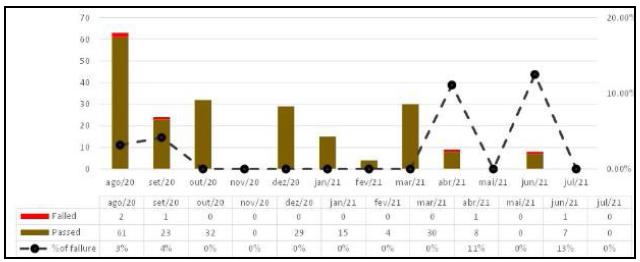

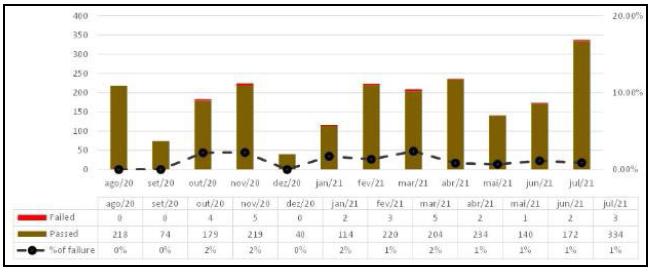

| Table 11-1: Summary of QA/QC Sample Frequency | 11-5 |

| Table 11-2: Analysis of Results of CRM Samples, SGS Geosol | 11-8 |

| Table 14-1: Search Criteria, Urucum East | 14-11 |

| Table 14-2: Search Criteria, Urucum Open Pit | 14-11 |

| Table 14-3: Search Criteria, Urucum North Underground | 14-12 |

| Table 14-4: Search Criteria, Urucum Central Underground | 14-12 |

| Table 14-5: Search Criteria, TAP C | 14-13 |

| Table 14-6: Search Criteria, TAP AB | 14-13 |

| Table 14-7: Search Criteria, Duckhead | 14-14 |

| Table 14-8: Pit Shell Inputs, Urucum East | 14-18 |

| Table 14-9: Pit Shell Inputs, Urucum | 14-19 |

| Table 14-10: Urucum North and Central Underground Parameters. | 14-19 |

| Table 14-11: Pit Shell Inputs, TAP C | 14-20 |

| Table 14-12: Pit Shell Inputs, TAP AB | 14-21 |

| Table 14-13: Mineable Shape Inputs, TAP AB | 14-21 |

| Table 14-14: Pit Shell Inputs, Duckhead | 14-22 |

| Table 14-15: Mineral Resource Estimates | 14-23 |

| Table 15-1: Mineral Reserve Estimate with effective date of July 31, 2021. | 15-1 |

| Table 15-2: Dilution and Mineral Extraction Estimates | 15-3 |

| Table 15-3: Marginal Grade Estimates for Open Pits | 15-4 |

| Table 15-4: Pit Optimization Results | 15-5 |

| Table 15-5: LG Pit Shell Selection Criteria | 15-6 |

| Table 15-6: Underground Cut-Off Grade Parameters | 15-7 |

| Table 15-7: MSO Parameters | 15-8 |

| Table 15-8: Comparison of Current and Previous Mineral Reserve Estimate | 15-9 |

| Table 16-1: Geotechnical Design Recommendations | 16-2 |

| Table 16-2: Pit Slope and Ramp Parameters | 16-3 |

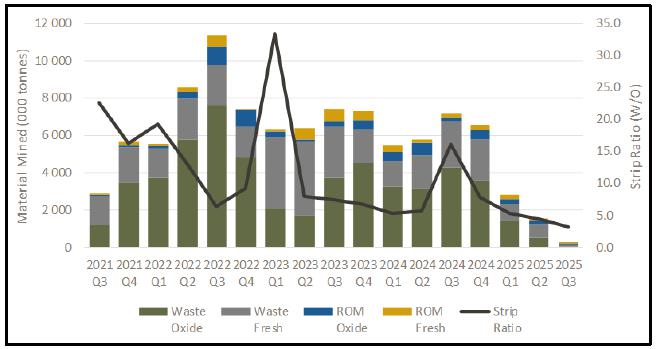

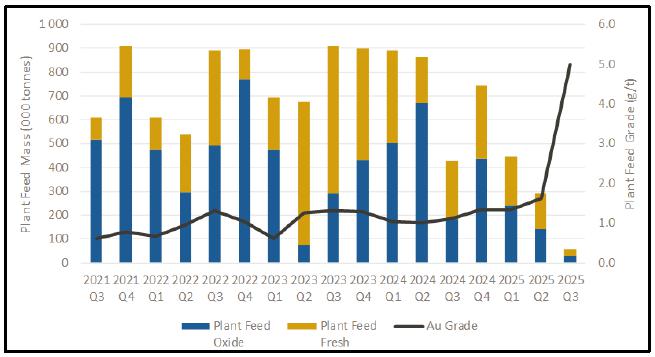

| Table 16-3: Tucano LOM Open Pit Production Schedule | 16-13 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| Table 16-4: Mining Fleet | 16-17 |

| Table 16-5: Underground Production Schedule | 16-21 |

| Table 16-6: Underground Equipment | 16-24 |

| Table 21-1: Open Pit Capital Costs for LOM | 21-1 |

| Table 21-2: Underground Capital Cost Estimates | 21-2 |

| Table 21-3: Open Pit Operating Cost Estimate | 21-3 |

| Table 21-4: Underground Operating Costs by Major Area | 21-5 |

| Table 21-5: Underground Operating Costs by Year | 21-5 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Figures

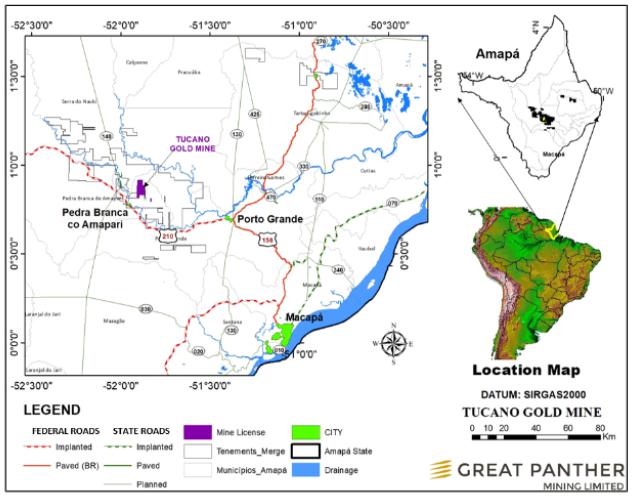

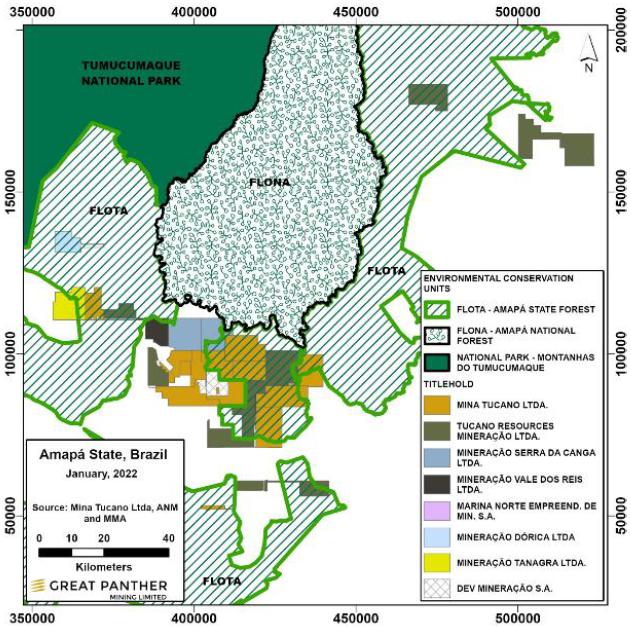

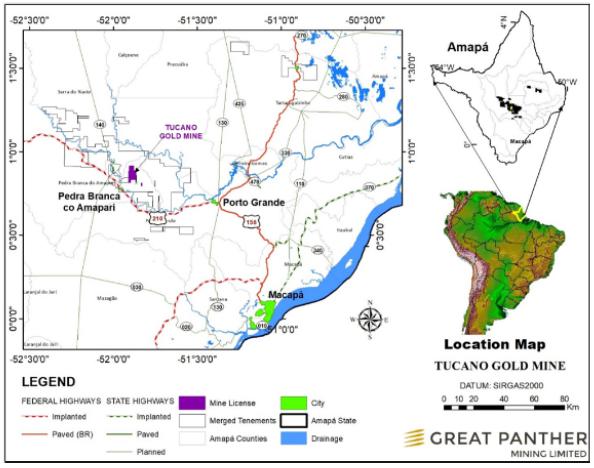

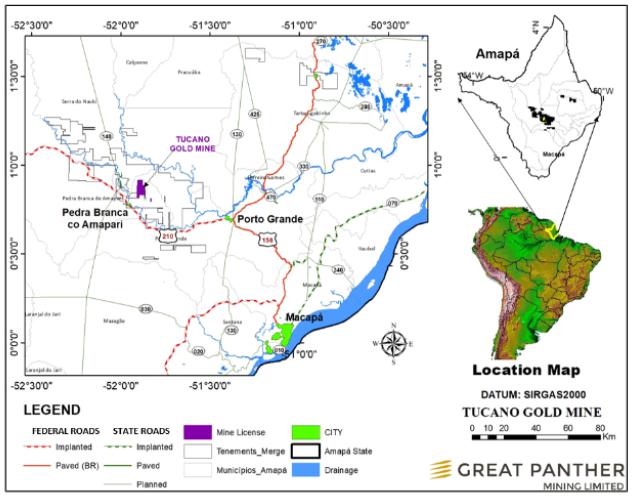

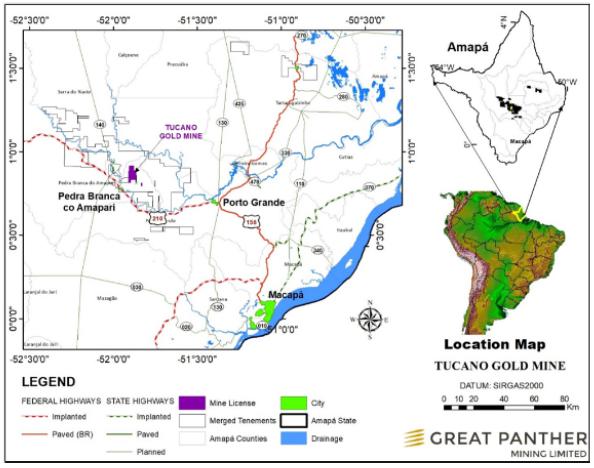

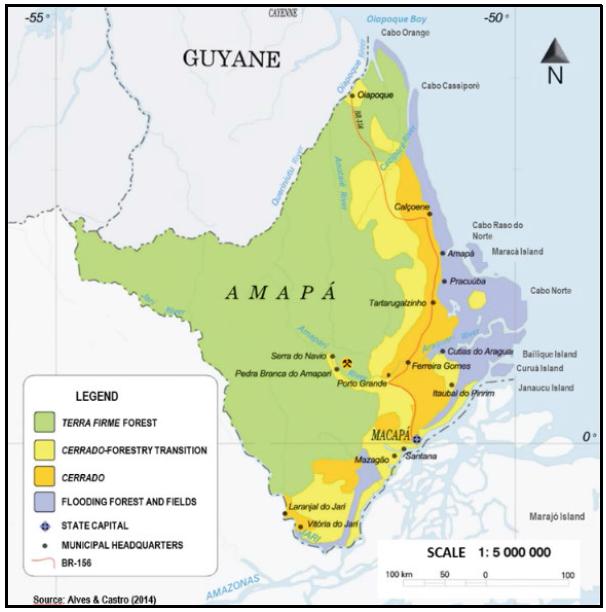

| Figure 2-1: Tucano Project Location Plan | 2-1 |

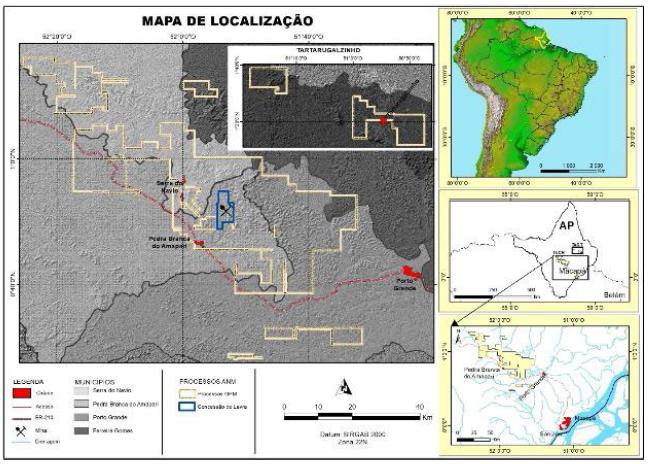

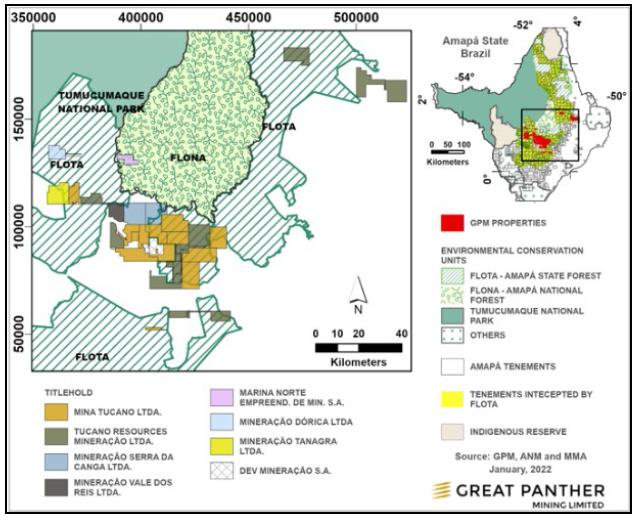

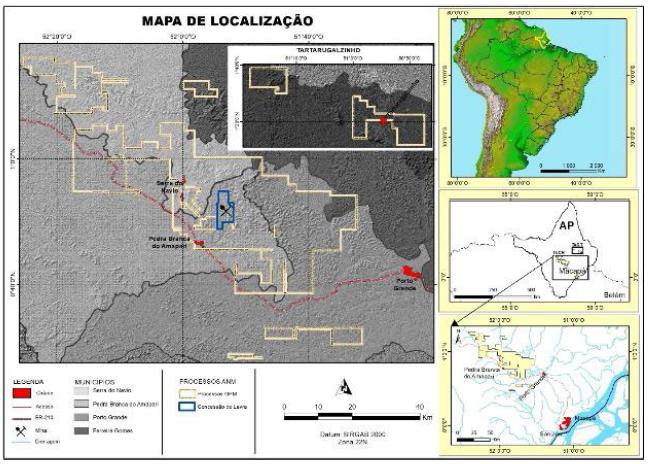

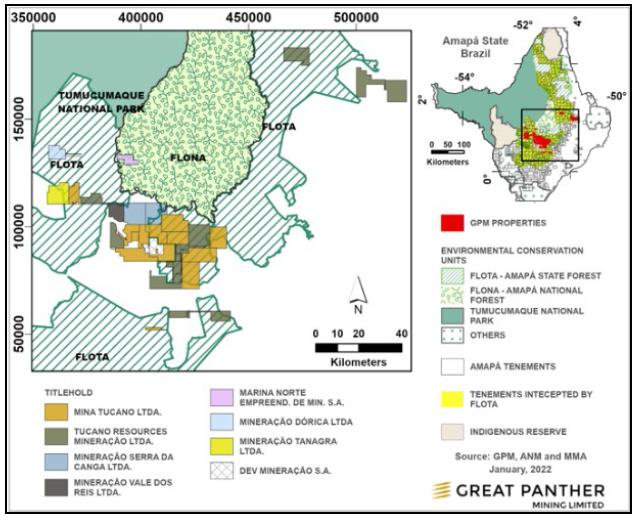

| Figure 4-1: Tucano Area of Interest Location Map | 4-1 |

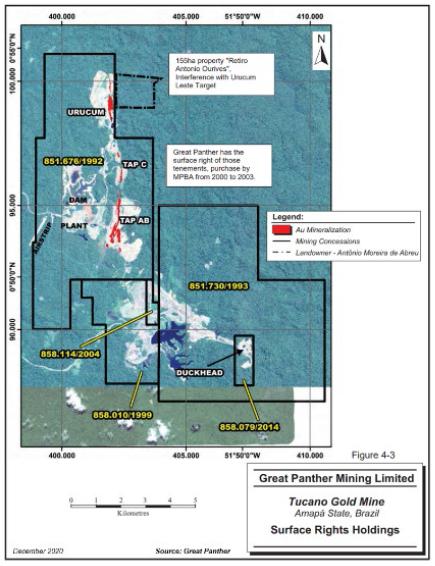

| Figure 4-2: Surface Rights | 4-5 |

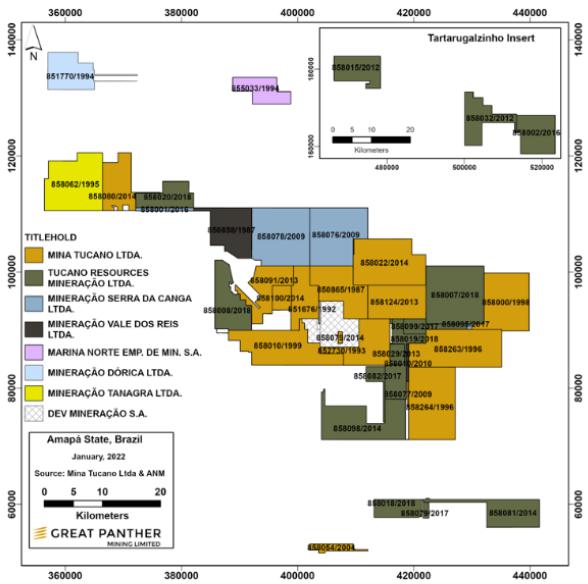

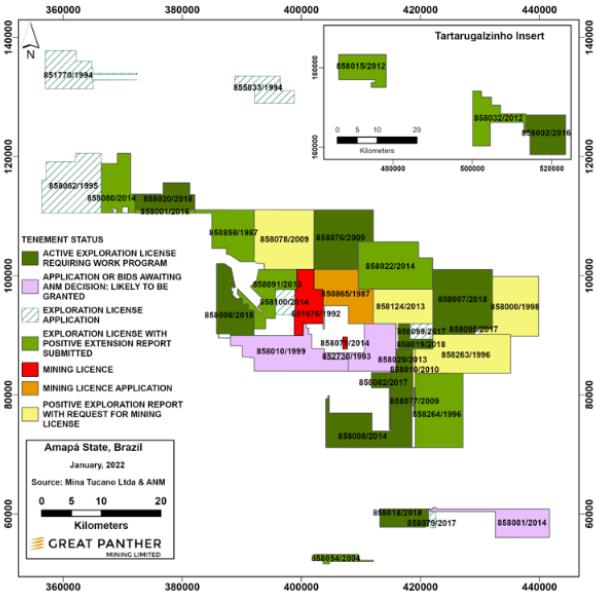

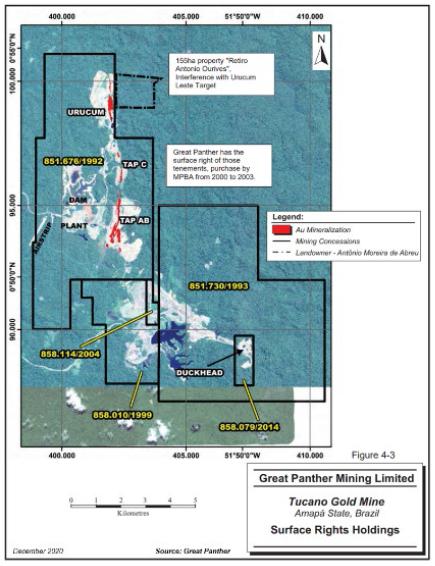

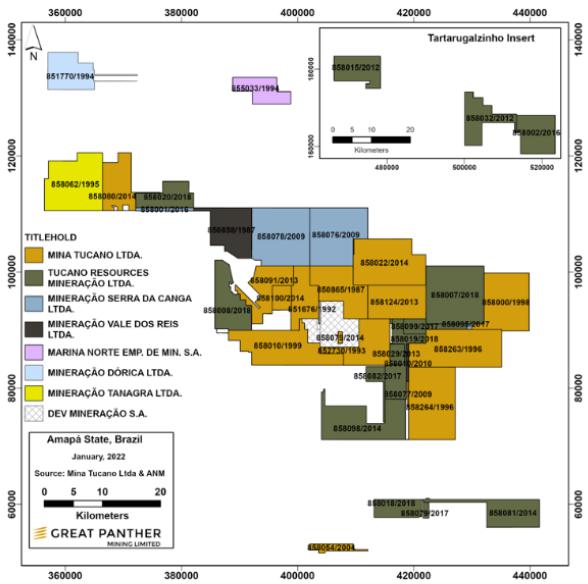

| Figure 4-3: Mineral Tenement Ownership | 4-8 |

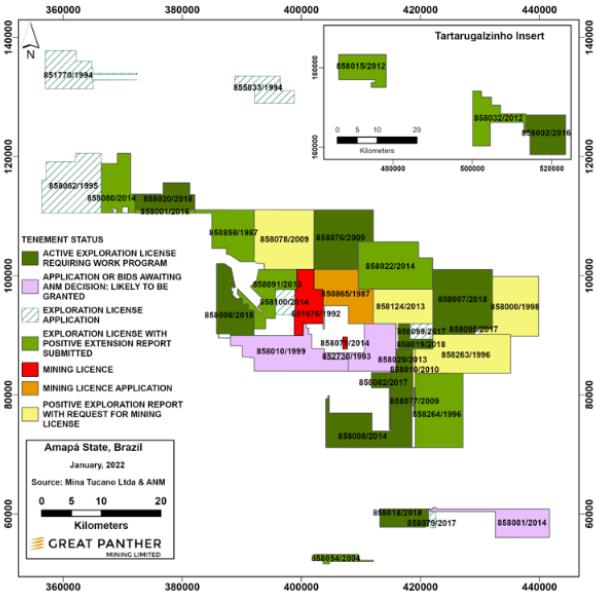

| Figure 4-4: Mineral Tenement Status | 4-9 |

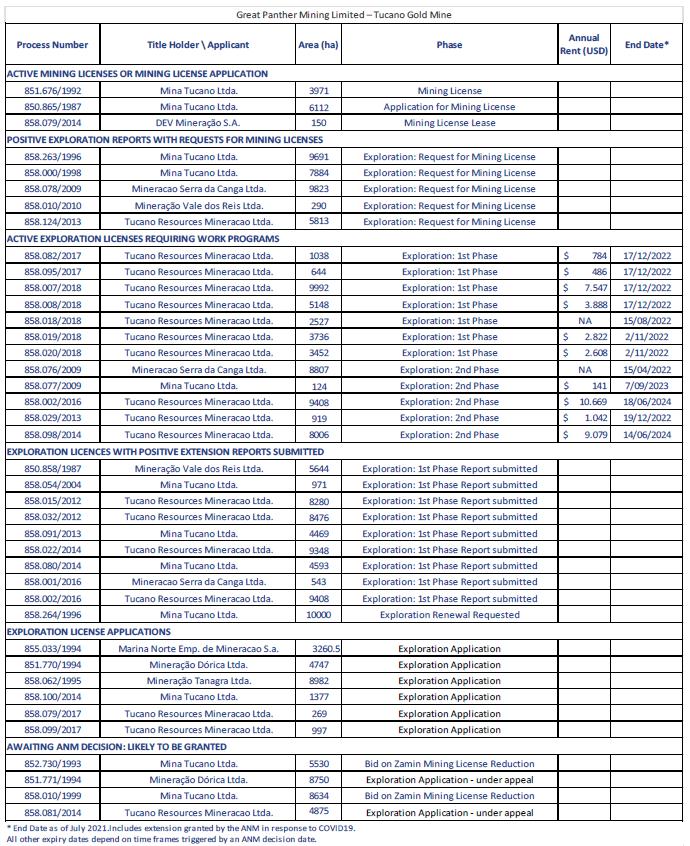

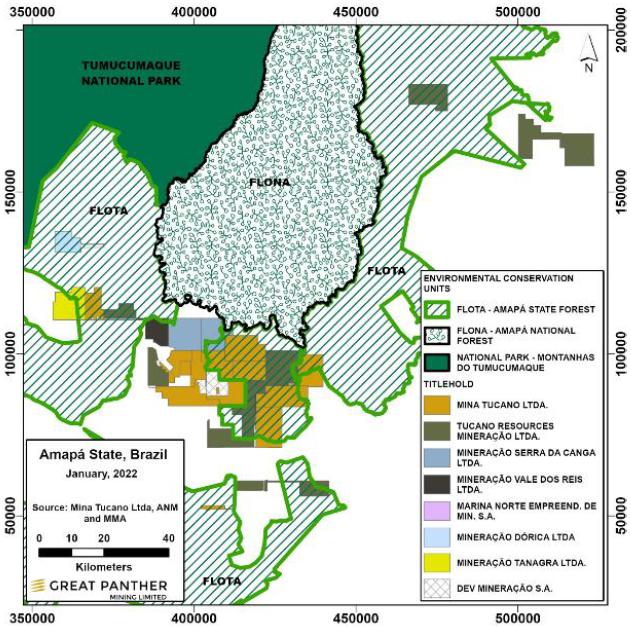

| Figure 4-5: Environmental Areas and Tucano Exploration Permits | 4-15 |

| Figure 5-1: Location and Access | 5-1 |

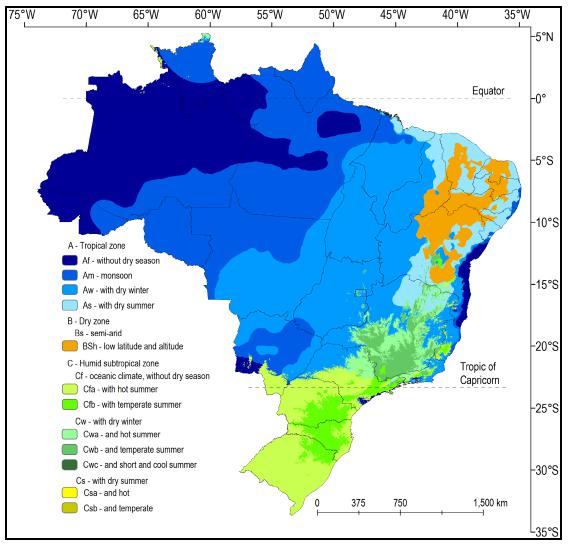

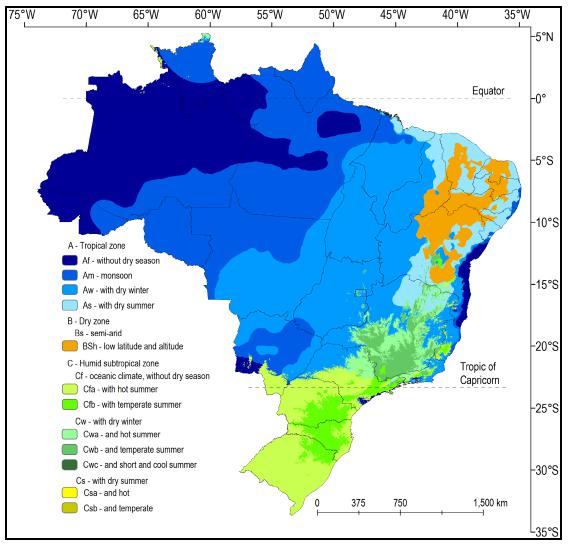

| Figure 5-2: Climate Classification | 5-3 |

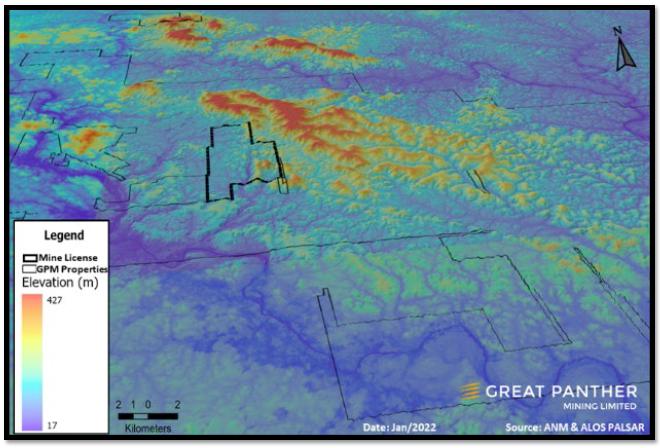

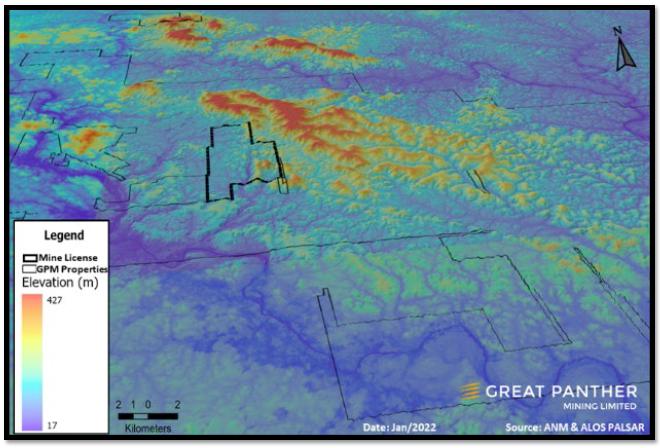

| Figure 5-3: Tucano Digital Elevation Model | 5-4 |

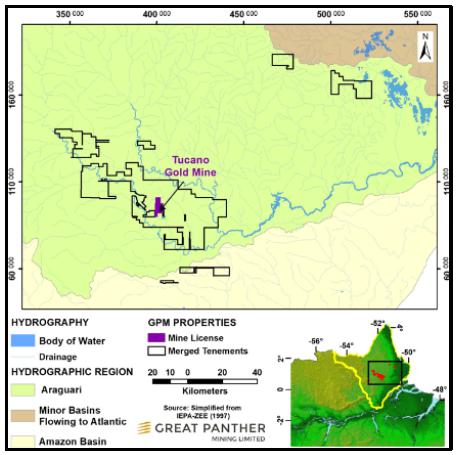

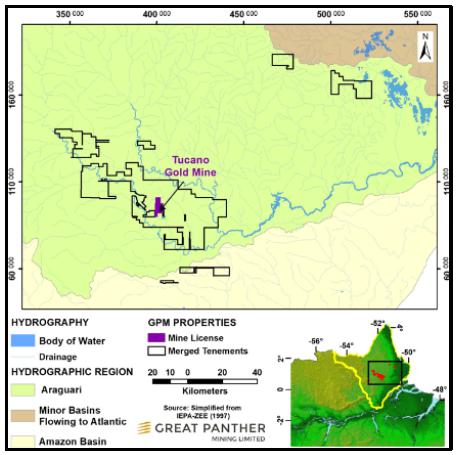

| Figure 5-4: Central Amapá State - Hydrographic Regions | 5-5 |

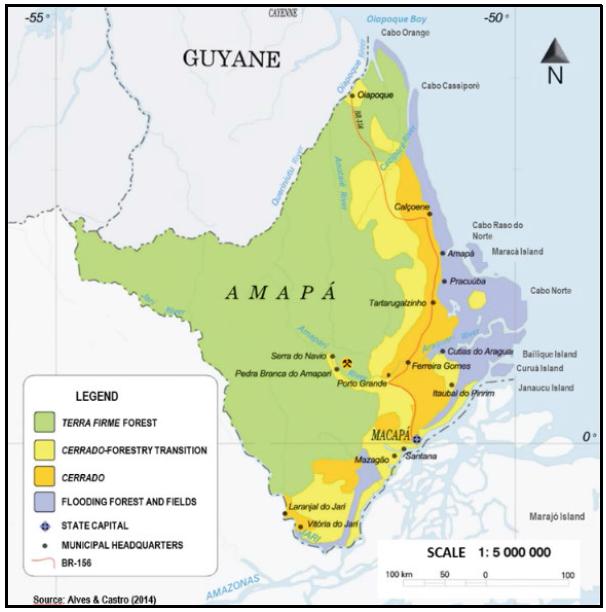

| Figure 5-5: Ecosystems of the State of Amapá | 5-6 |

| Figure 5-6 Exploration Licenses and the FLOTA | 5-7 |

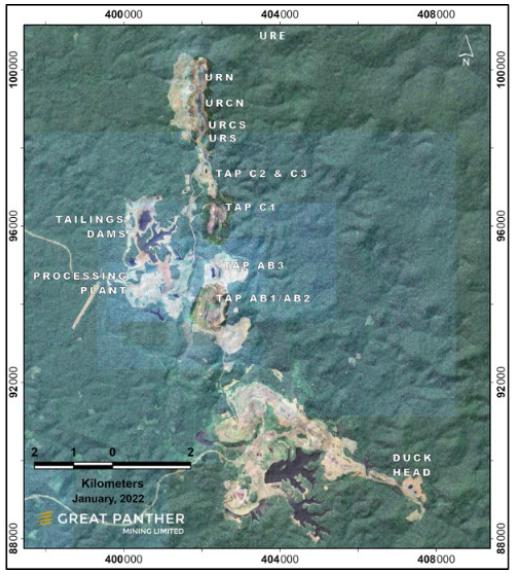

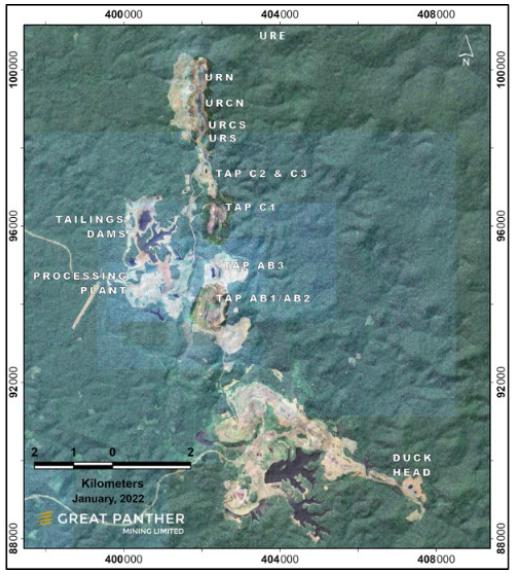

| Figure 6-1: Tucano Mine Sequence Target Locations | 6-2 |

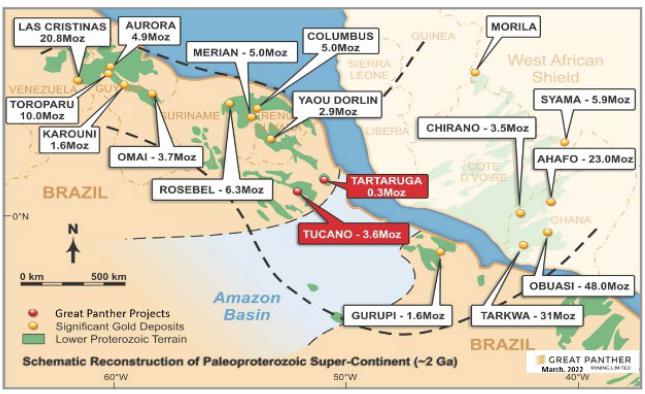

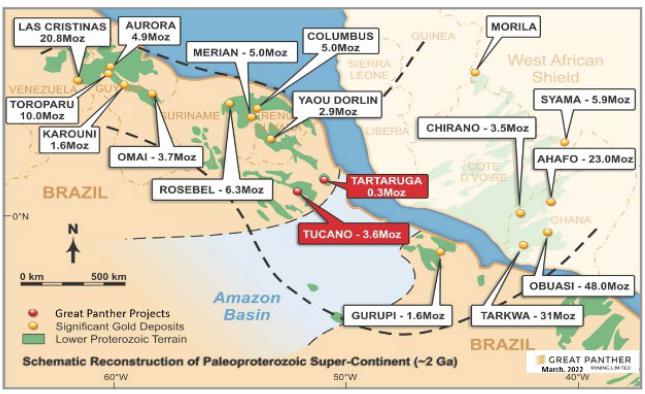

| Figure 7-1: West Africa - NW South America: Gold Deposits and Resources | 7-1 |

| Figure 7-2: Tucano Regional Geologic Setting | 7-2 |

| Figure 7-3: Tucano Weathering profile | 7-3 |

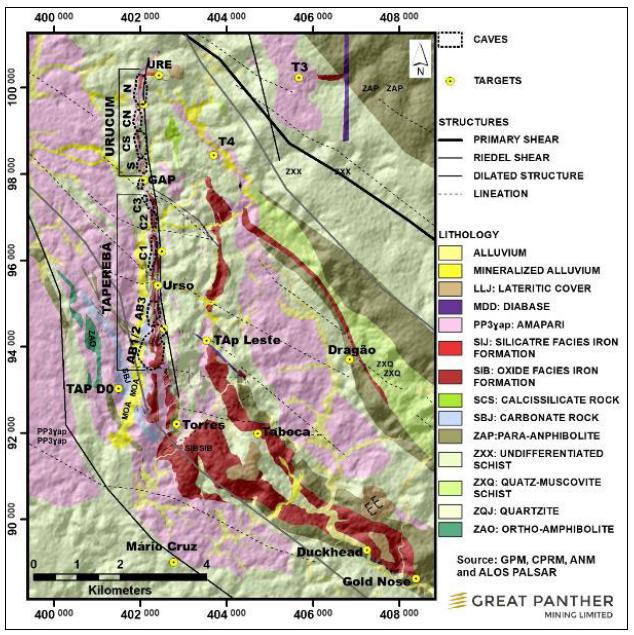

| Figure 7-4: Tucano Mine Sequence Geology Map | 7-6 |

| Figure 7-5: Photo Indicating Plunge Lineation | 7-7 |

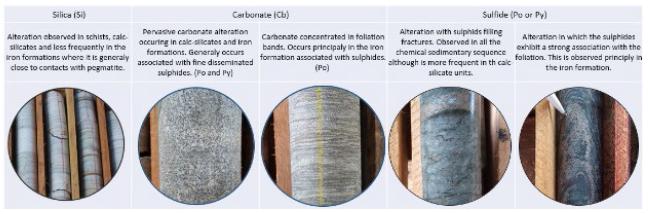

| Figure 7-6: Photos of Core Illustrating Alteration Styles | 7-9 |

| Figure 7-7: Tucano Mine Sequence and Key Deposits | 7-11 |

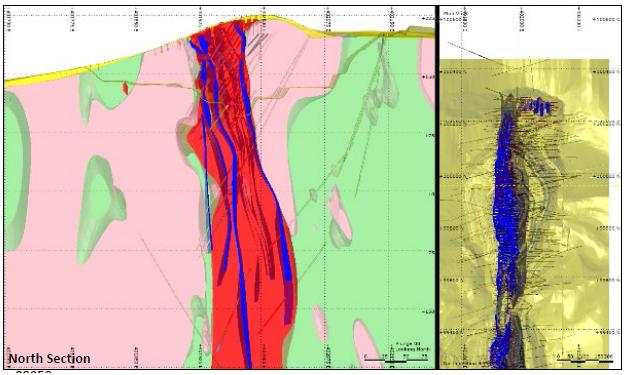

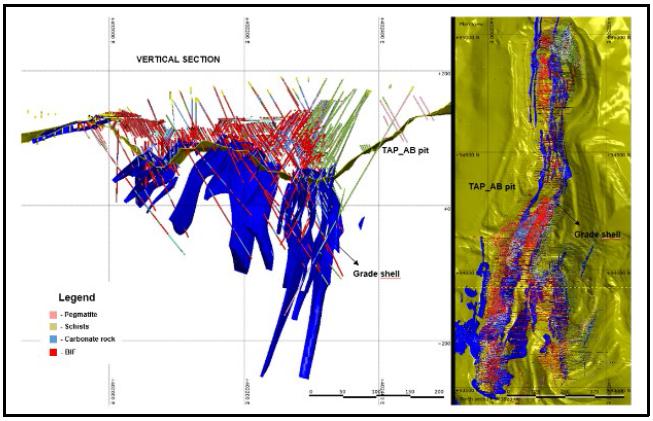

| Figure 7-8: Urucum North -Typical Section | 7-12 |

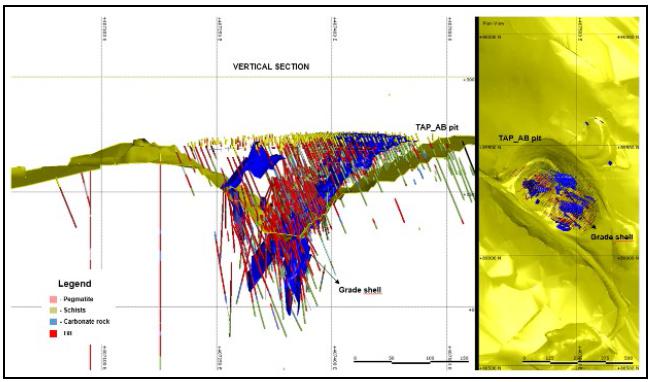

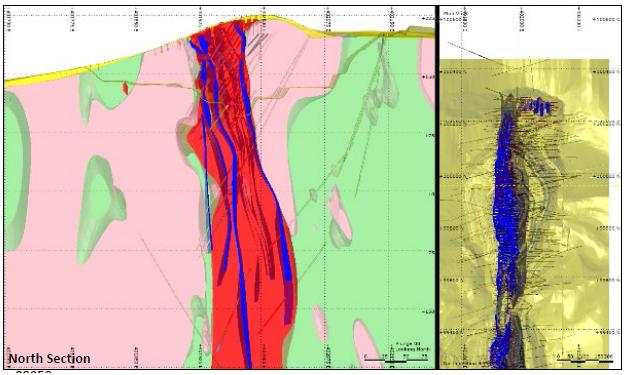

| Figure 7-9: TAP C - Typical Section | 7-13 |

| Figure 7-10: TAP AB - Typical Section | 7-14 |

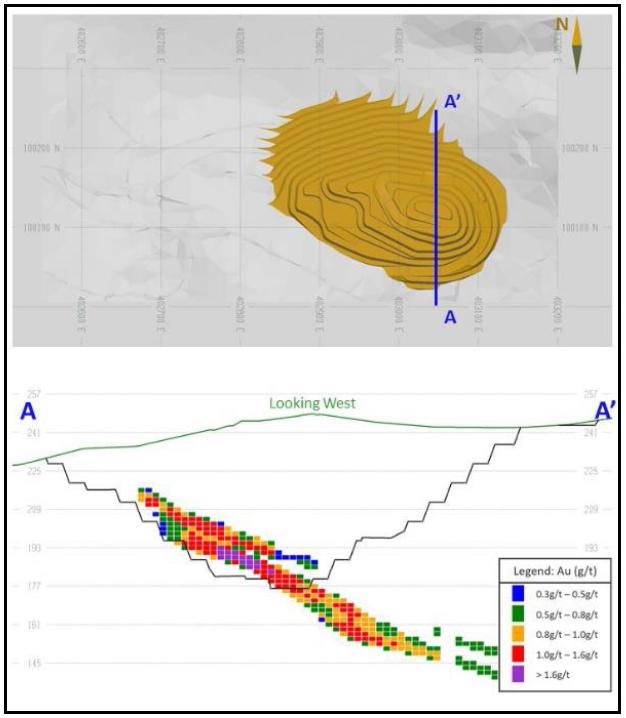

| Figure 7-11: Duckhead - Typical Section | 7-15 |

| Figure 8-1: Reconstruction of the Guiana Craton and West Africa Shield | 8-18 |

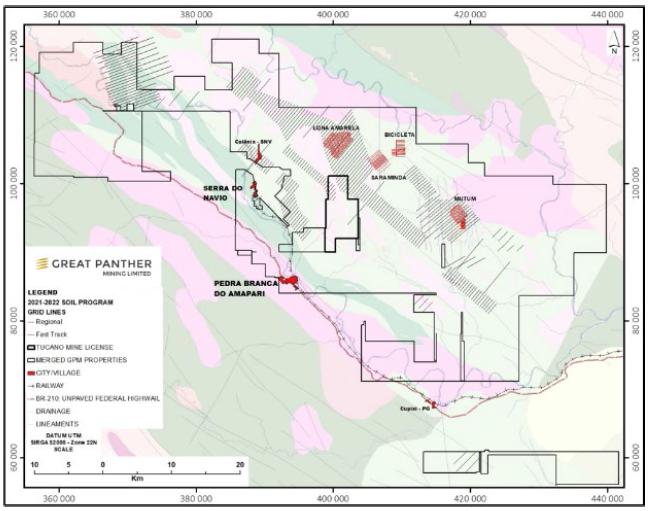

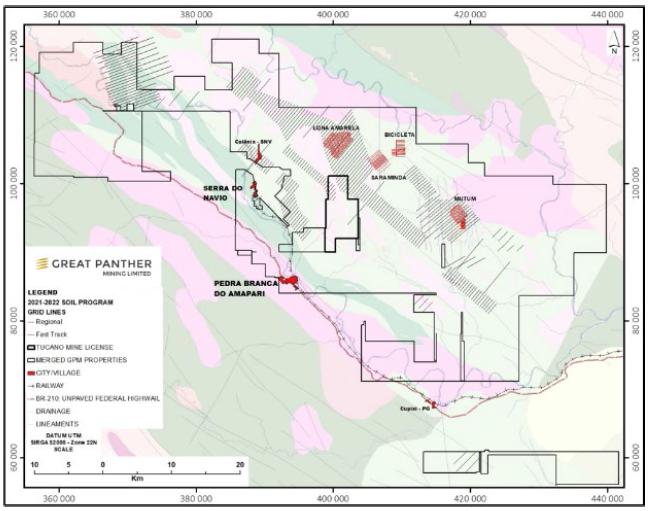

| Figure 9-1: Tucano - Regional Soil grids | 9-21 |

| Figure 9-2: Tucano AOI and ALOS PALSAR DEM | 9-22 |

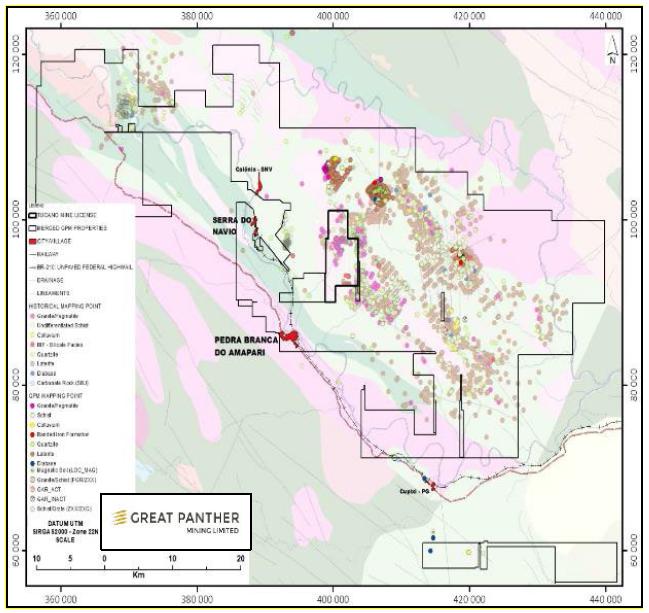

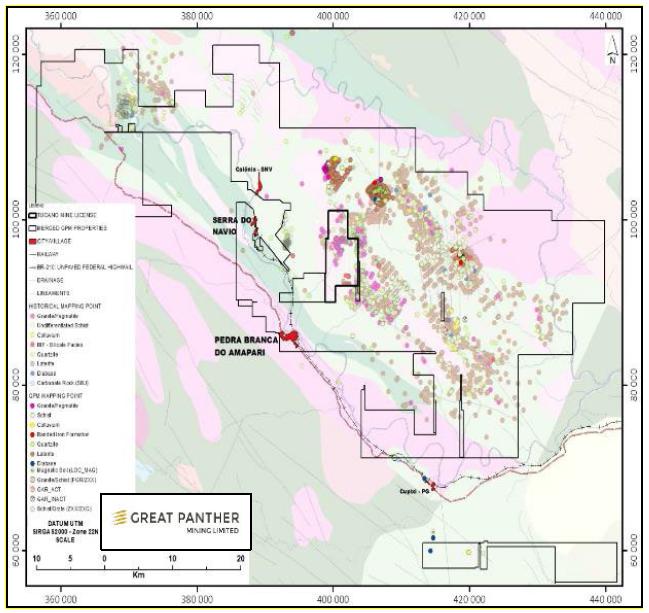

| Figure 9-3: Tucano Regional Geological Mapping Points | 9-23 |

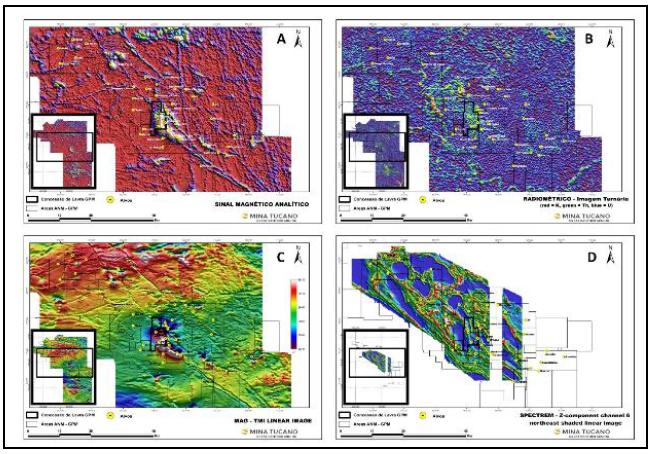

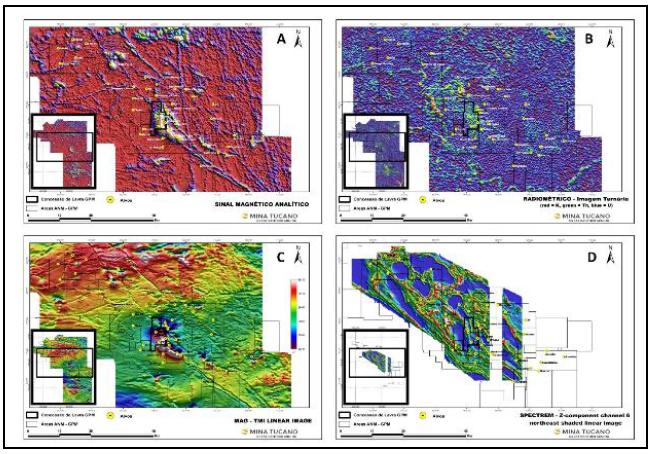

| Figure 9-4: Tucano Aerogeophysics. A:Analytic Signal; B:Radiometric; C:Total Magnetic Intensity; D:Spectrem | 9-26 |

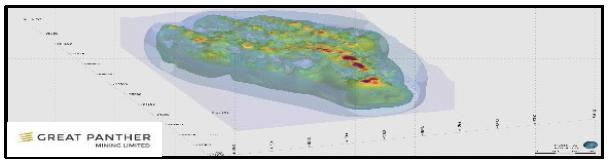

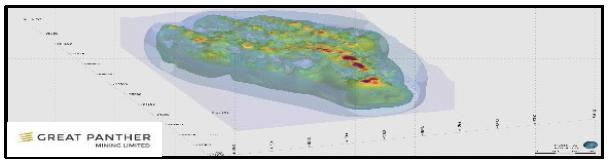

| Figure 9-5: Magnetic Inversion over the Mutum Trend - 3D Model | 9-27 |

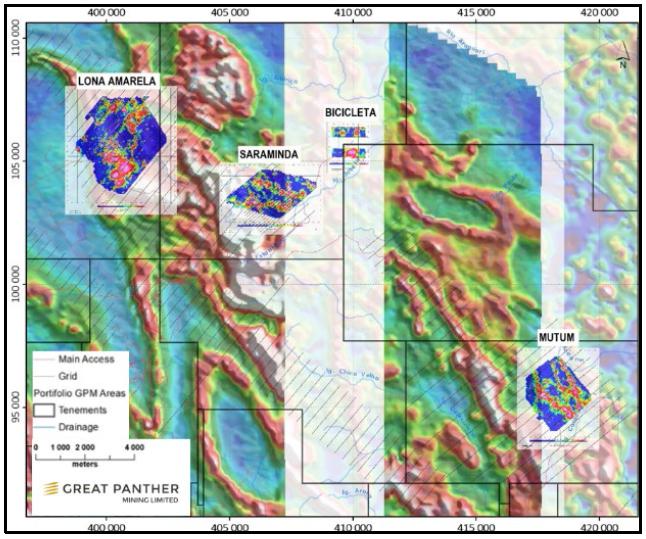

| Figure 9-6: Ground Geophysics on Fast Track Targets over Spectrem Conductivities | 9-27 |

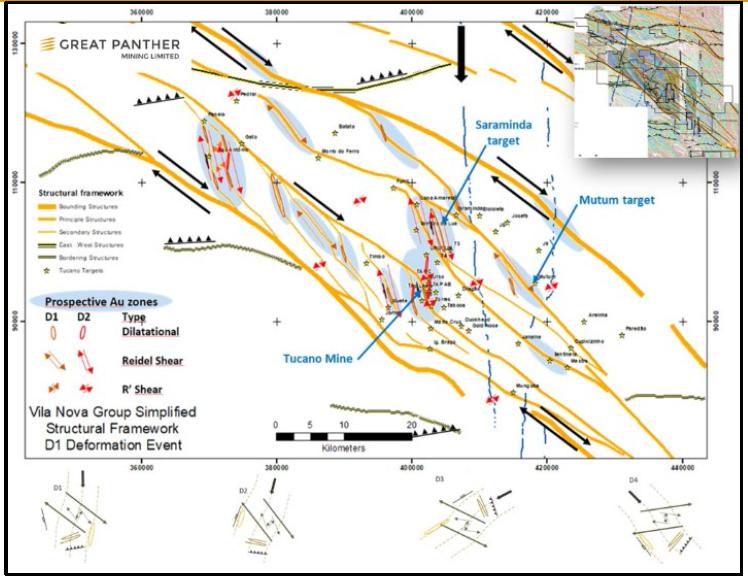

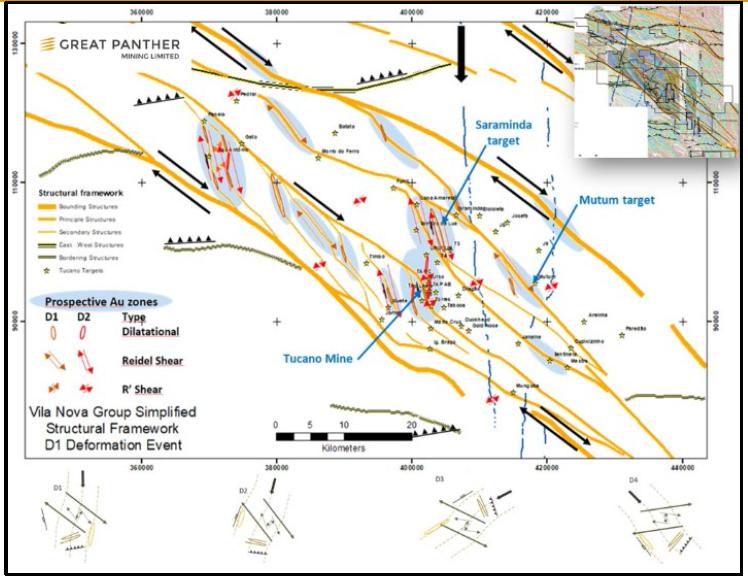

| Figure 9-7: Interpretation of Regional Aerogeophysics - Structures and Deformational Events | 9-29 |

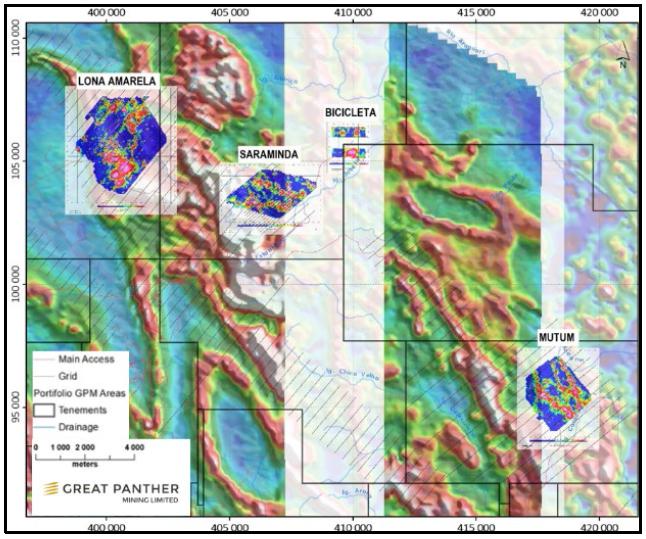

| Figure 9-8: Geophysical Interpretation - Tucano Prospective Areas | 9-30 |

| Figure 9-9: Airborne Conductivity Image (Spectrem) | 9-31 |

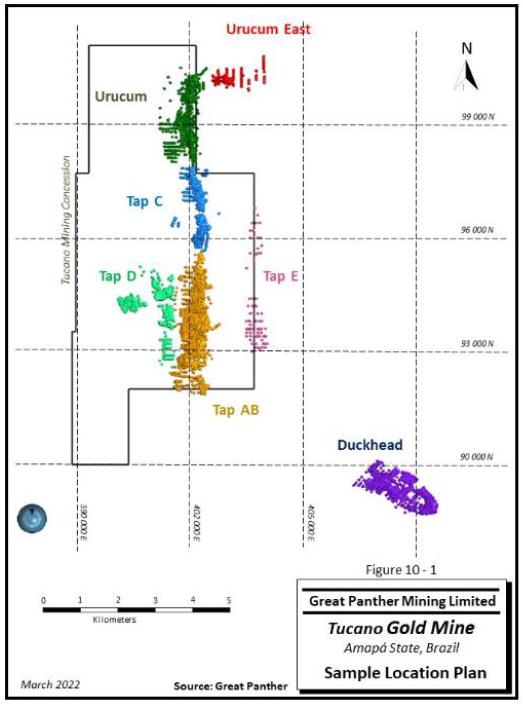

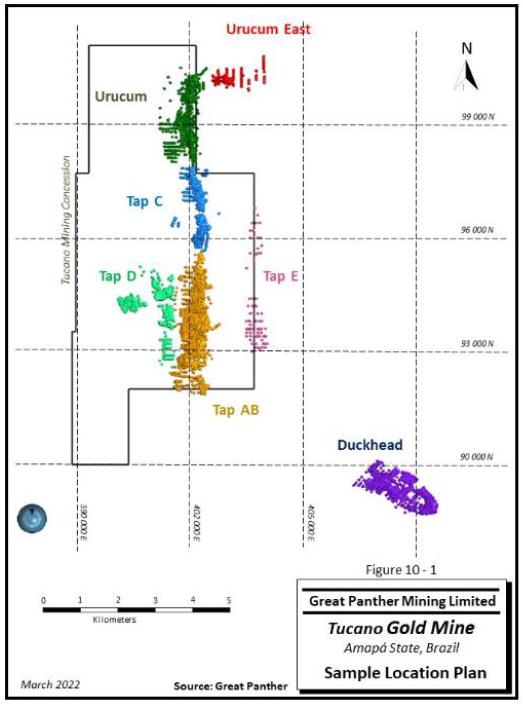

| Figure 10-1: Plan Illustrating Drillhole Coverage | 10-2 |

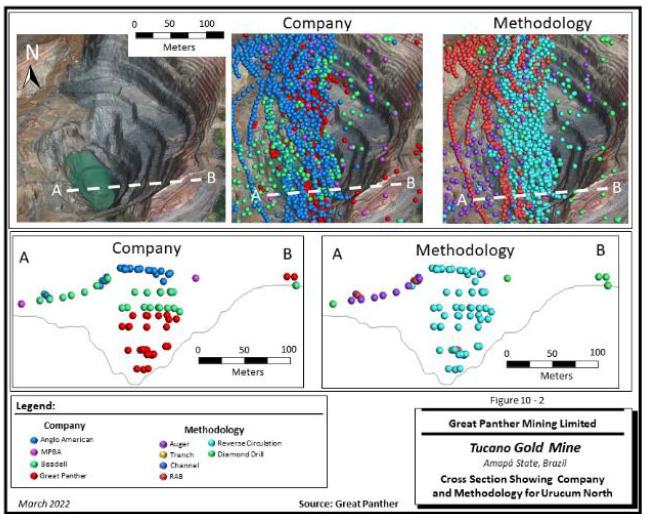

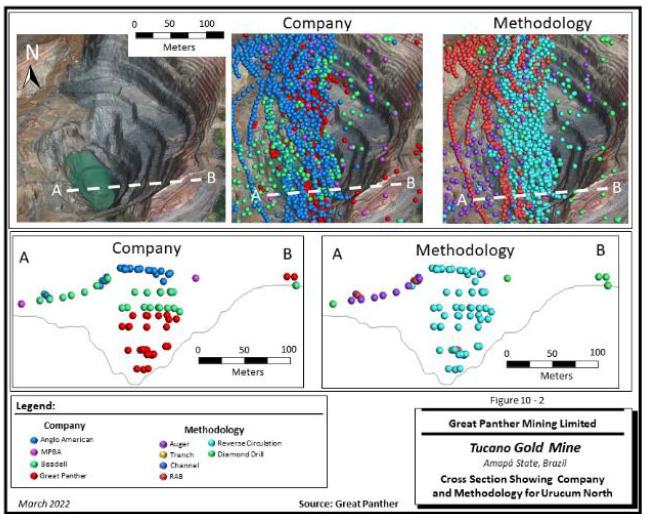

| Figure 10-2: Urucum North - Illustration of the Evolution of Drill Programs by Company and Type. | 10-4 |

| Figure 10-3: Typical Drill Cross-Section, TAP AB | 10-8 |

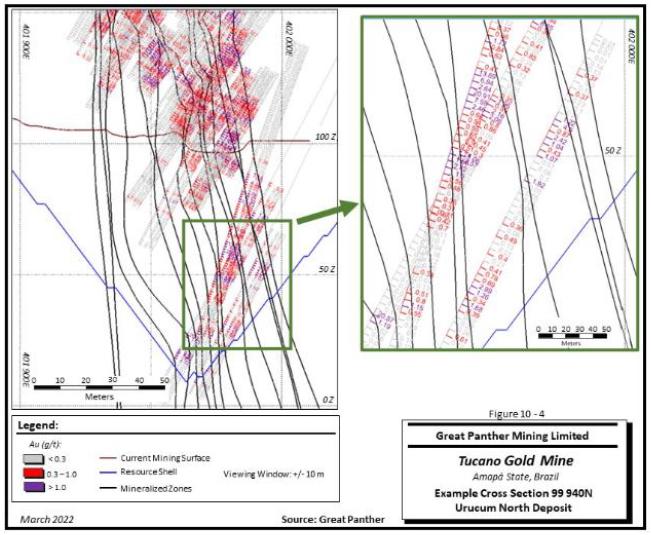

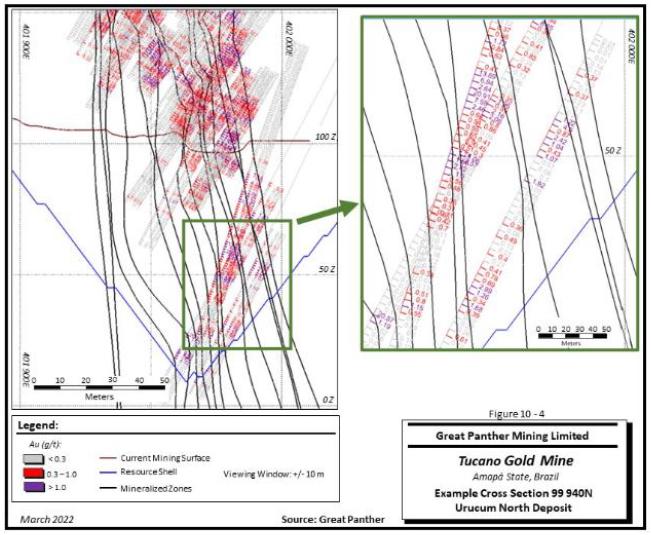

| Figure 10-4: Typical Drill Cross-Section, Urucum | 10-9 |

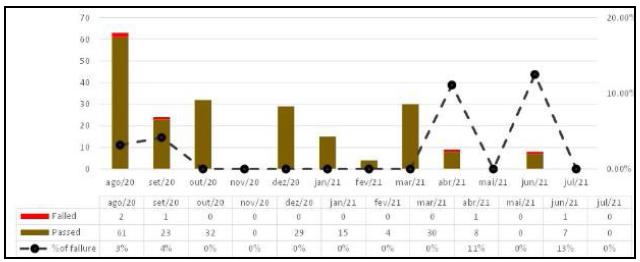

| Figure 11-1: : CRM Samples Submitted to the SGS Geosol Laboratory | 11-6 |

| Figure 11-2: CRM Samples Submitted to the Tucano Laboratory | 11-6 |

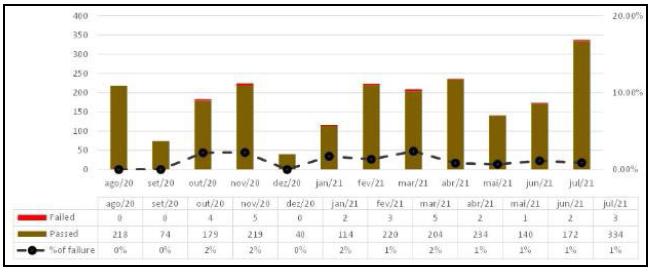

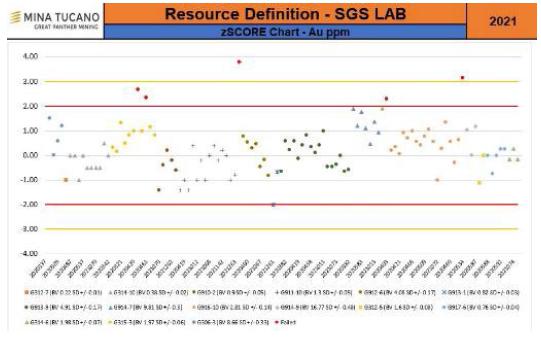

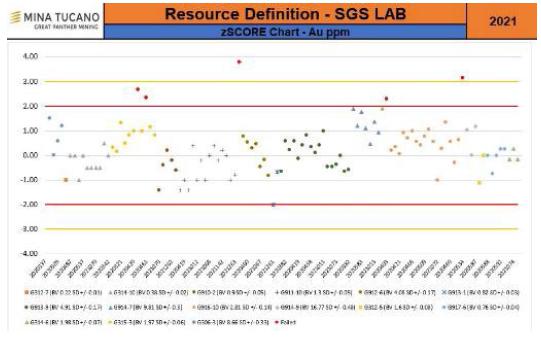

| Figure 11-3: z-Scores for CRMs sent to SGS Geosol Laboratory | 11-7 |

| Figure 11-4: z-Scores for CRMs sent to Tucano Laboratory | 11-7 |

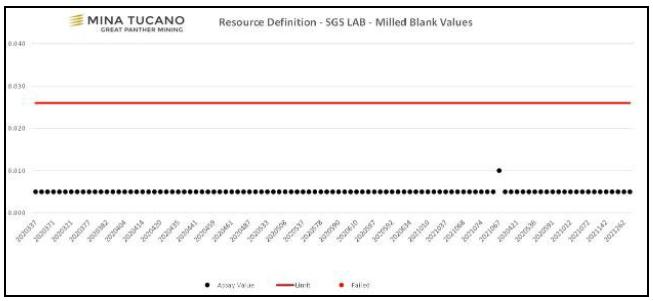

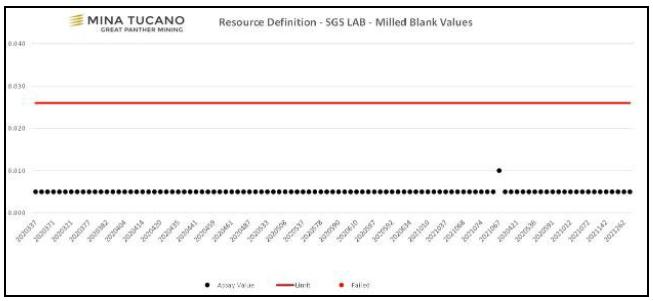

| Figure 11-5: Blank Sample Results - SGS Geosol Laboratory | 11-9 |

| Figure 11-6: Blank sample Results - Tucano laboratory | 11-9 |

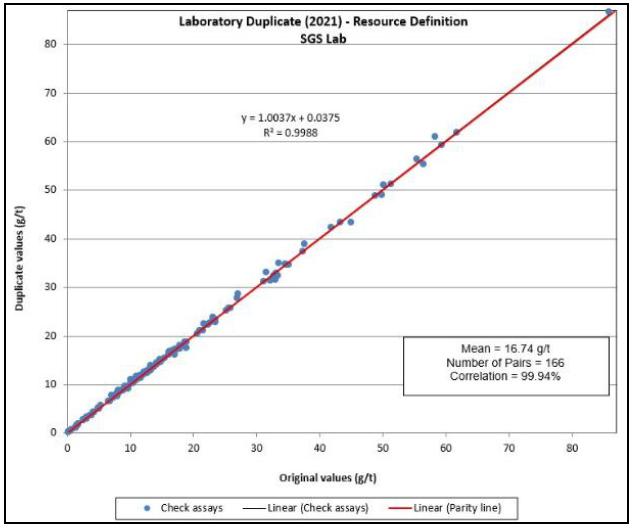

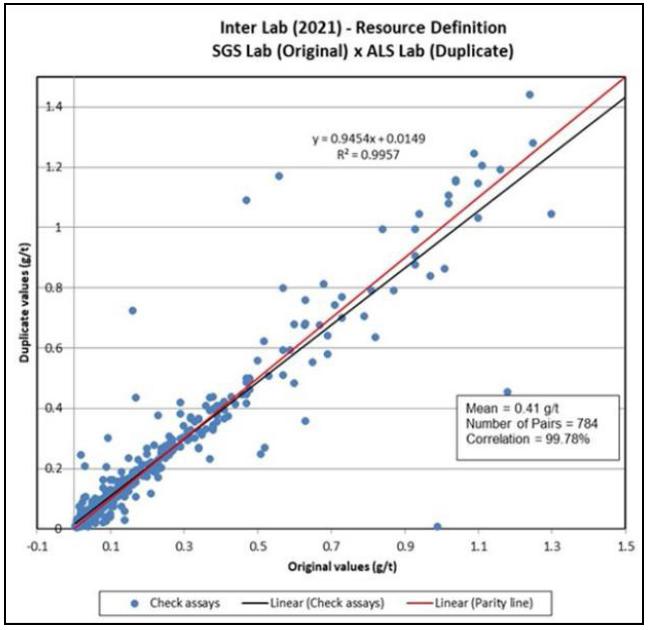

| Figure 11-7: Laboratory Duplicate Samples - SGS Geosol Laboratory | 11-10 |

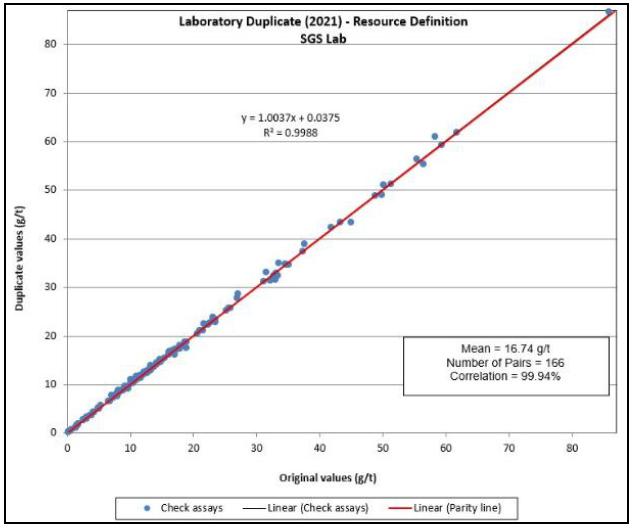

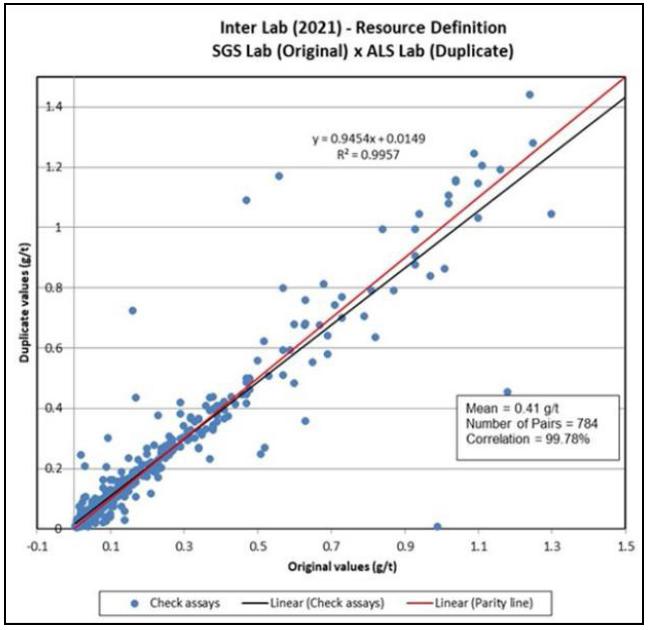

| Figure 11-8: Laboratory Duplicate samples - Tucano Laboratory | 11-11 |

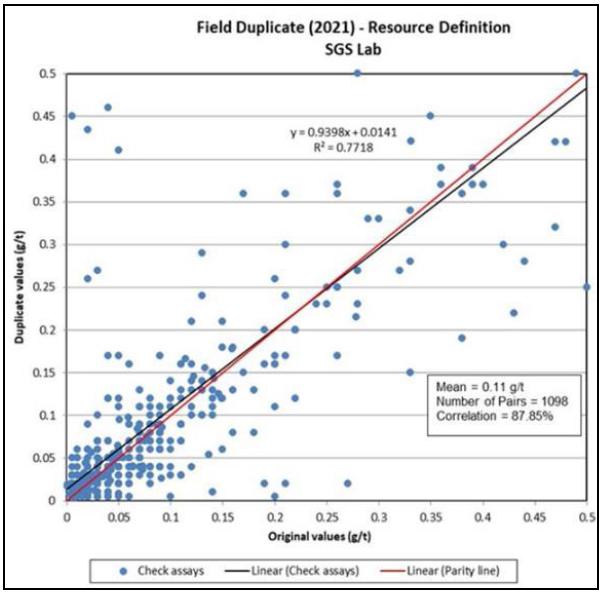

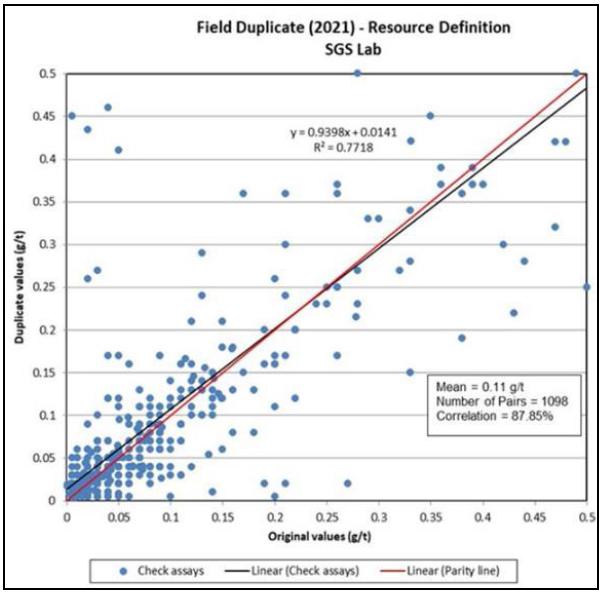

| Figure 11-9: Field Duplicate Samples - SGS Geosol Laboratory | 11-12 |

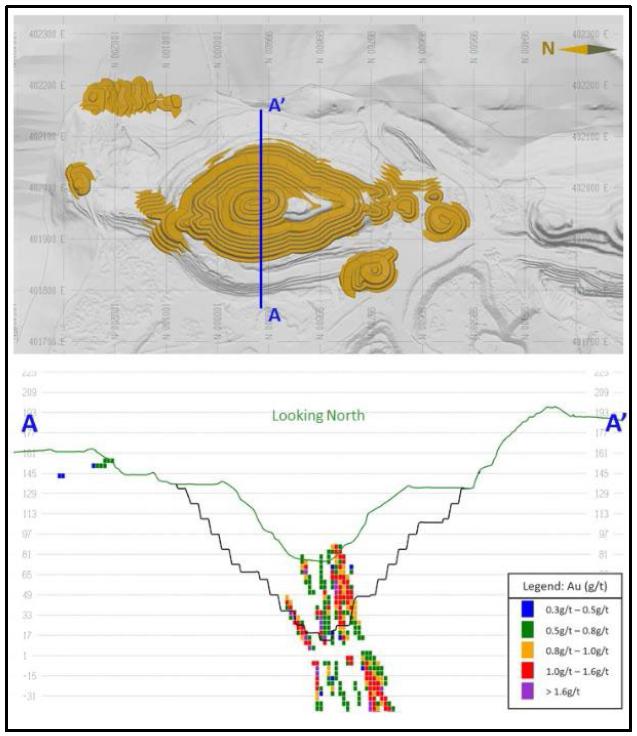

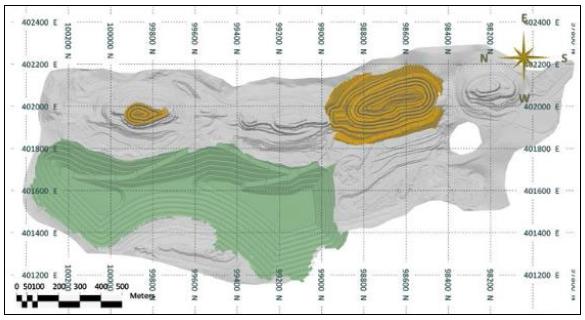

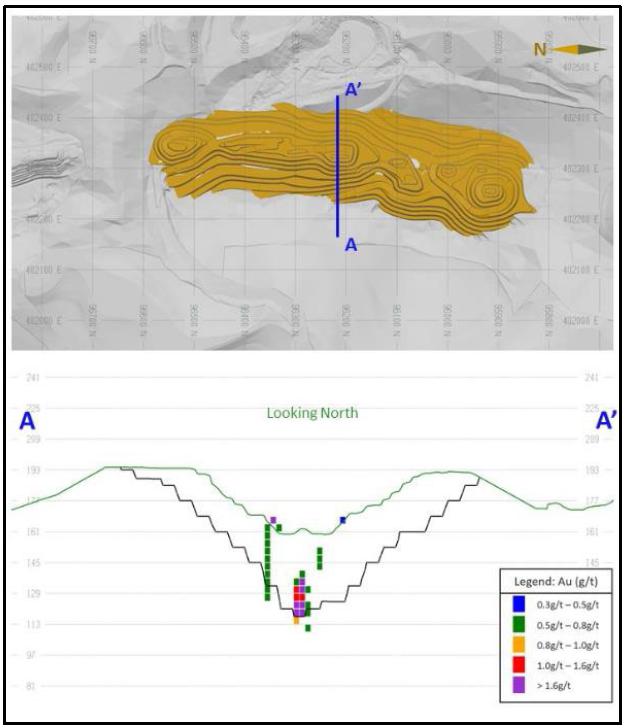

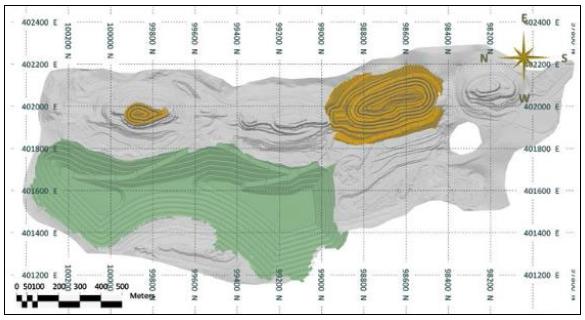

| Figure 14-1: Urucum East Orebody | 14-2 |

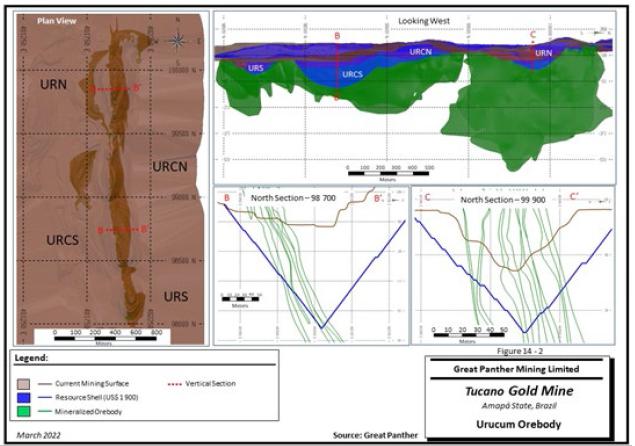

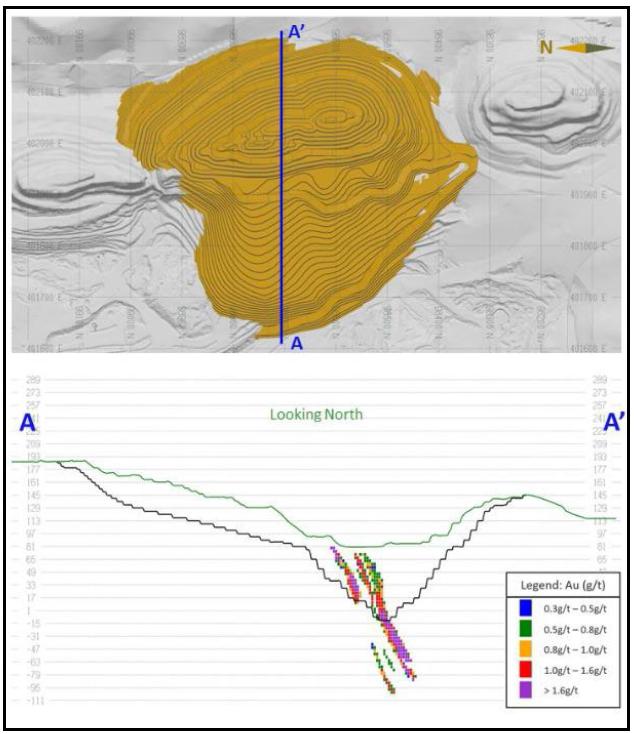

| Figure 14-2: Urucum Open Pit Deposit | 14-3 |

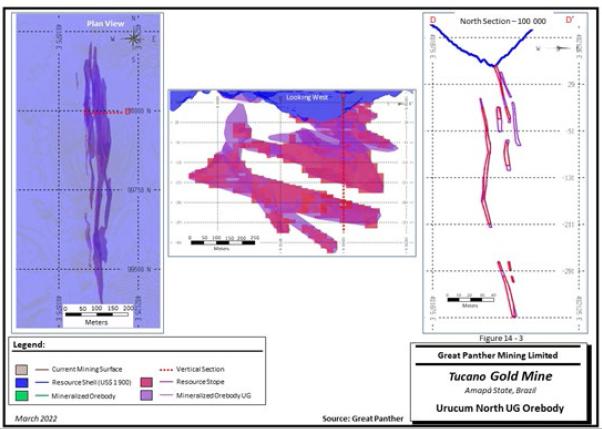

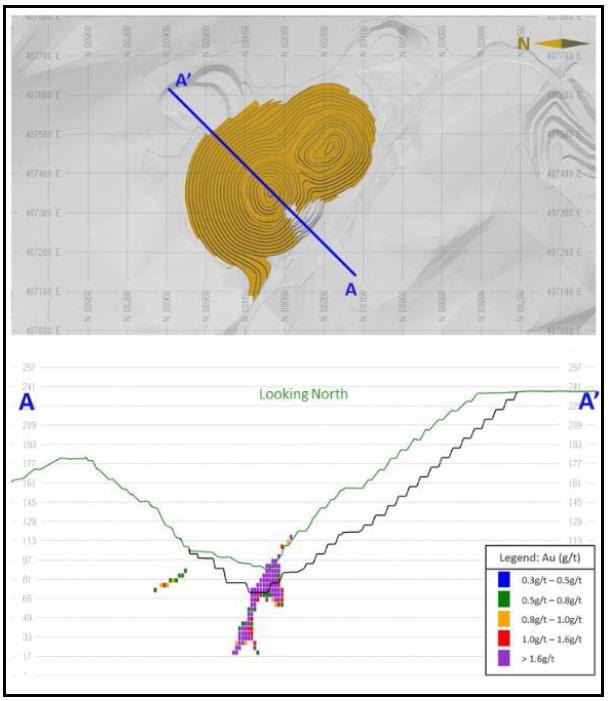

| Figure 14-3: Urucum North Underground Deposit | 14-4 |

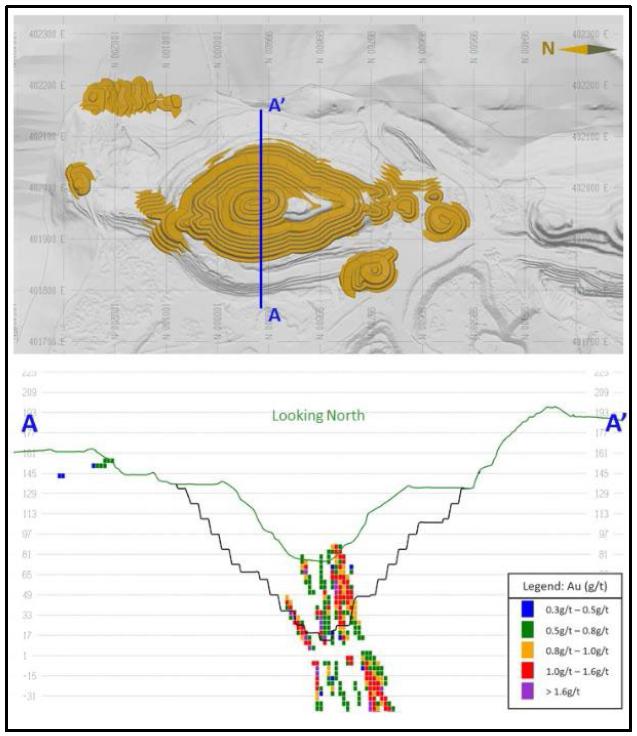

| Figure 14-4: TAP C Open Pit Deposit | 14-5 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

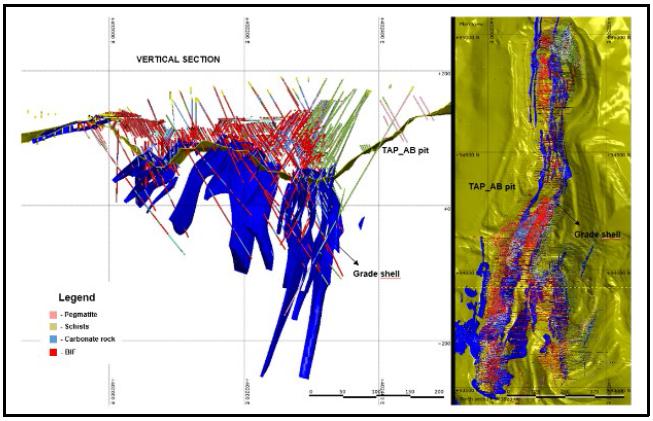

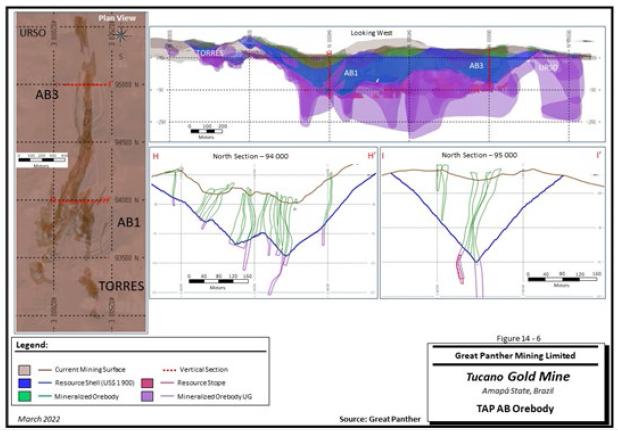

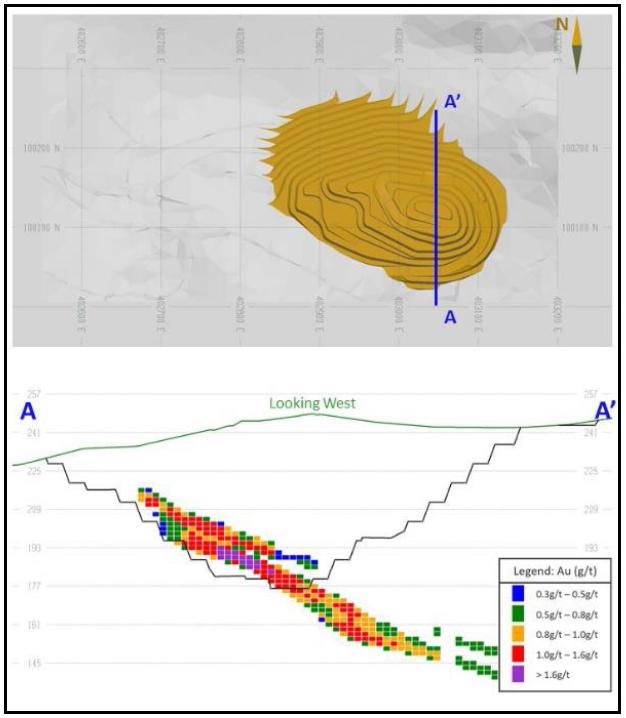

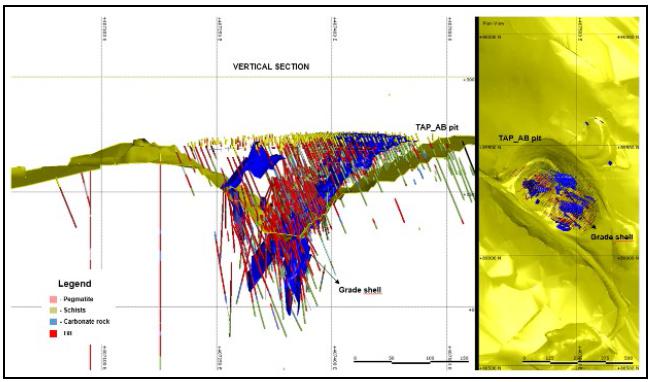

| Figure 14-5: TAP AB Open Pit Deposit | 14-6 |

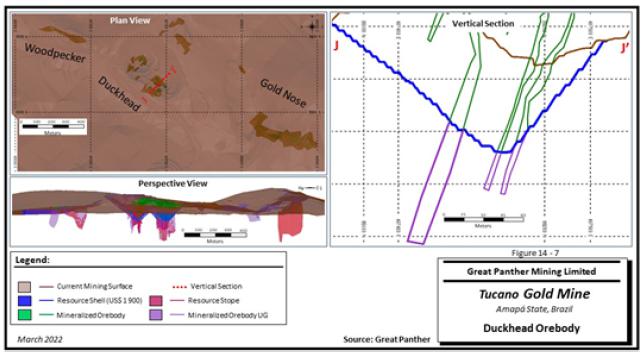

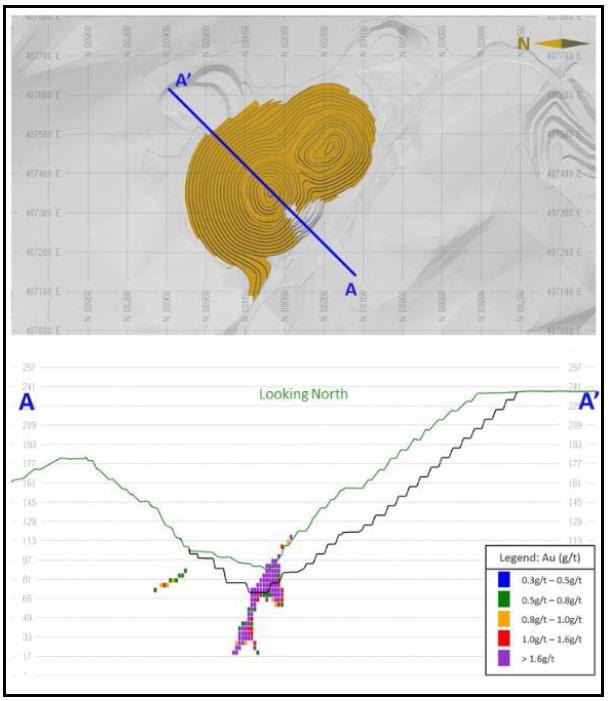

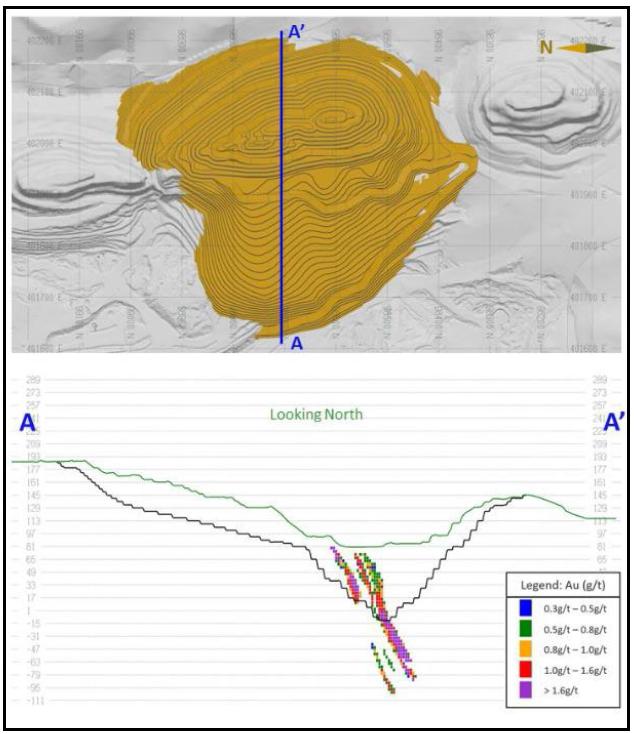

| Figure 14-6: Duckhead Open Pit Deposit | 14-7 |

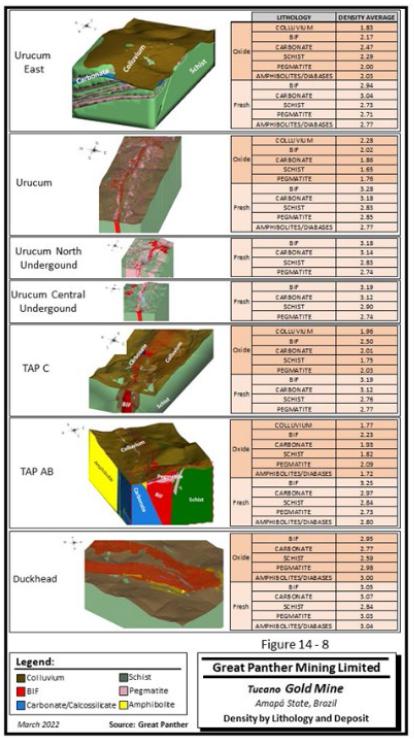

| Figure 14-7: Average of Density Separated by Deposit | 14-8 |

| Figure 16-1: Ultimate Pit Layout, TAP AB1 | 16-4 |

| Figure 16-2: Ultimate Pit Layout, TAP AB3 | 16-5 |

| Figure 16-3: Ultimate Pit Layout, TAP C1 | 16-6 |

| Figure 16-4: Ultimate Pit Layout, Urucum North | 16-7 |

| Figure 16-5: Ultimate Pit Layout, Urucum Central South | 16-8 |

| Figure 16-6: Ultimate Pit Layout, Urucum East | 16-9 |

| Figure 16-7: Ultimate Pit Layout, Duckhead | 16-10 |

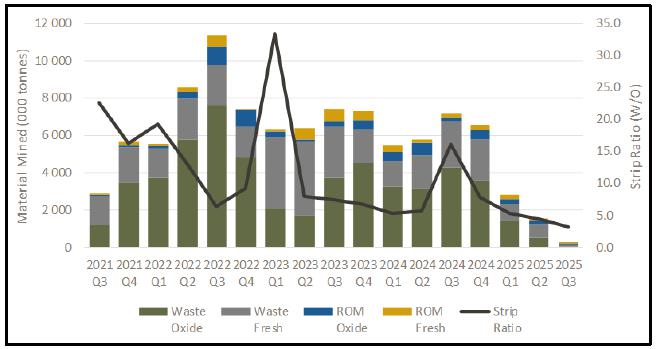

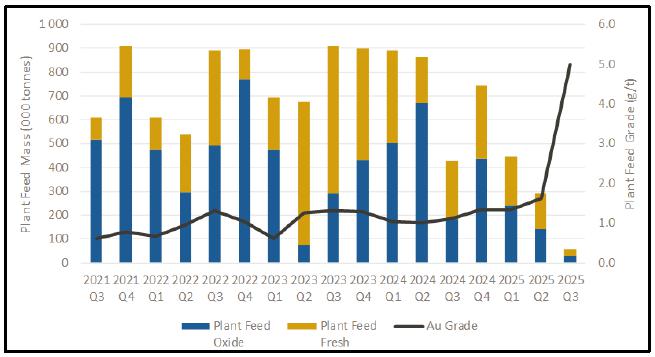

| Figure 16-8: LOM Material Mined by Type | 16-15 |

| Figure 16-9: LOM Plant Feed Material by Type | 16-16 |

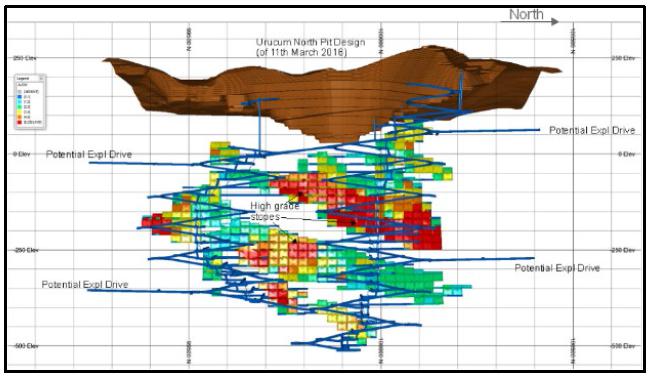

| Figure 16-10: Cross-Section Urucum North Underground | 16-20 |

| Figure 16-11: Schematic, Primary Ventilation System | 16-22 |

| Figure 17-1: Tucano Mineral Process Flowsheet | 17-2 |

| Figure 18-1: Tucano Mine Surface Infrastructure Layout Plan | 18-2 |

| Figure 18-2: WRSF Layout, TAP AB | 18-4 |

| Figure 18-3: WRSF Layout, Urucum | 18-4 |

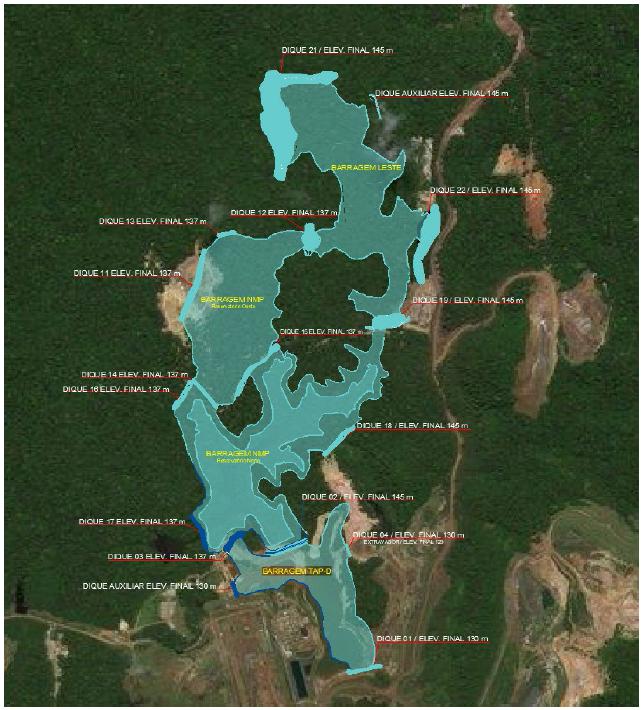

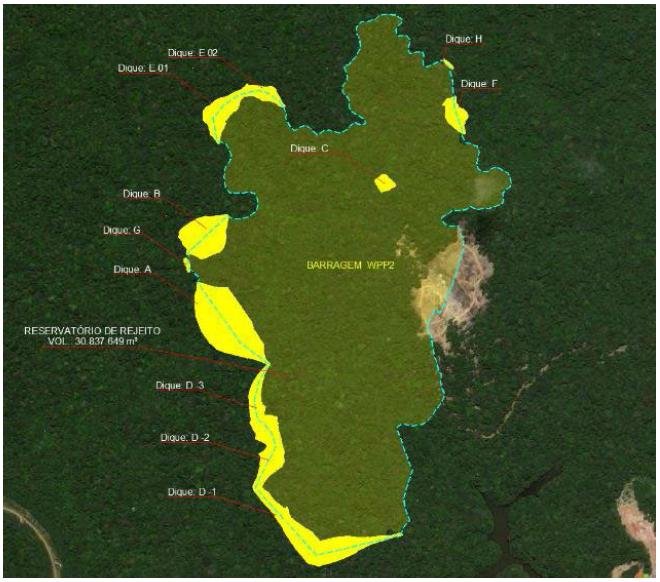

| Figure 18-4: Overview of TAP D, NMP, WPP1 and East Dam tailings facilities | 18-7 |

| Figure 18-5: East Dam extension. (EL. 145 m) | 18-8 |

| Figure 18-6: WPP at 8 years | 18-9 |

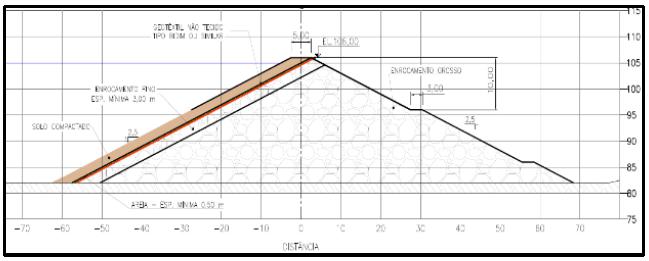

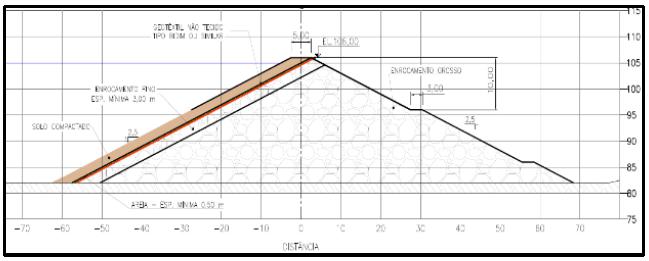

| Figure 18-7: Typical Cross-Section of WPP Embankment | 18-10 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

The Tucano gold mine is an established, operating mine that produced 328,632 oz gold since Great Panther acquired it in 2019. The mine is an open pit operation with multiple pits along a 7-kilometre strike length. The ore is processed at a central hybrid CIL plant with ore feed being a blend that averages 30% oxide and 70% fresh rock. Studies are currently underway to implement an underground operation beneath the Urucum North (“URN”) pit on the northern end of the mine sequence.

The Report was prepared to support the disclosure in Great Panther´s news release dated April 26, 2022, entitled “Great Panther Announces Updated Mineral Reserve and Mineral Resource Estimates for the Tucano Gold Mine”.

Units used in the Report are metric units unless otherwise noted. Monetary units are in United States dollars (US$) unless otherwise stated. The currency in Brazil is the Real (BR$).

Mineral Resources and Mineral Reserves are reported in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (the 2014 CIM Definition Standards). Mineral Resources and Mineral Reserves were estimated in accordance with the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (November 2019) (the 2019 Best Practice Guidelines).

The following serve as the qualified persons for specific report chapters outlined in Chapter 2 which collectively form this Technical Report as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) and in compliance with Form 43-101F1:

| • | Mr Nicholas Winer, FAusIMM, Vice President Exploration, Great Panther Mining |

| • | Mr Carlos Henrique Barbosa Pires, FAusIMM (CP), Master Geologist specialized in Mineral Resource estimation, Mina Tucano Ltda. |

| • | Mr Fernando Cornejo, M. Eng., P. Eng., Chief Operation Officer, Great Panther Mining |

The Tucano Gold Mine in Amapá State, Brazil (the Tucano Operations or the Project) is located in Amapá State, Brazil, at latitude 0.85°N and longitude 52.90°W, approximately 200 km northwest of Macapá, the state capital. Road access from Macapá to the Project is via a 100 km long sealed road from Macapá to Porto Grande, then 75 km by unsealed road to Pedra Branca do Amapari, and finally 17 km of unsealed road to the mine site.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

The Tucano Operations are serviced by a 1,100 m airstrip located approximately 800 m from the main entrance gate to the mine. Charter flights from Macapá to Tucano take approximately 50 minutes. A helipad was constructed near the CIL plant and is used to transport product and for emergency transport of personnel.

The Project area has an equatorial climate. The wet season occurs from January to June; however, rainfall events in the drier months are still frequent. With appropriate planning, mining and exploration activities can be conducted year-round.

The nearest accessible communities to Tucano are the towns of Pedra Branca do Amapari (17,625 population) and Serra do Navio (5,577 population) which are 17 km from Tucano and approximately 175 km and 200 km from Macapá, respectively.

The majority of the workforce are transported by bus from Serra do Navio, Pedra Branca, and other small surrounding communities. Professional staff commute weekly from Macapá or other cities in Brazil on a fly-in-fly-out basis. Personnel, bulk materials, fuel, and other supplies are brought to site by road from Macapá.

The topography within the operations area ranges from 90-320 meters above sea level (“masl”), consisting of river valleys and low hills. The process plant is at an elevation of about 143 masl. Vegetation in the region is dominated by native forest. There are settlement areas for subsistence agriculture established along or close to the main Porto Grande - Serra do Navio access. Along the access and within the settlement areas there has been significant clearing of the forest.

| 1.4 | Mineral Tenure, Surface Rights, Royalties and Agreements |

The Project is owned by Great Panther through its wholly-owned Brazilian subsidiaries; Mina Tucano Ltda, Tucano Resources Mineração Ltda, Mineração Serra da Canga Ltda and Mineração Vale dos Reis Ltda

The Project consists of 39 mineral tenures, totalling 197,283 ha. The tenures are controlled 100% by Great Panther, through its Brazilian subsidiaries, except for the cases of a mining lease agreement with DEV Mineração S.A. covering the Duckhead deposit and 49% participation through Marina Norte Emprendimentos de Mineração S.A. on a non-contiguous, 3260 hectare exploration license application. The active Tucano mine operations are within mining concession 851.676/1992, wholly owned by Great Panther through Mina Tucano Ltda. The reserves in URE and Duckhead are, respectively, in the mining concession application 850.865/1987 and covered by a mining lease agreement in the name of Mina Tucano Ltda. (858.079/2014) excised from a mining concession for iron ore, held by DEV Mineração S.A.(“DEV”). The lease is registered in the Mines Department (ANM) and governed by a private contract between Mina Tucano Ltda. and DEV.

Great Panther holds all surface rights required to support the life-of-mine (LOM) plan. Where exploration activities are conducted in areas where some form of third party surface right exists, Great Panther may secure access through a combination of rights-of-way, leases and disturbance compensation agreements. The majority of Great Panther exploration tenure covers uninhabited tracts of land that belong to the State.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Royalties are payable to:

| • | The federal government under a Compensation royalty for the Exploitation of Mineral Resources; which is 1.5% for gold. |

| • | The State of Amapá, governed by a royalty for the Control, Monitoring, and Supervision of Research Activities, Mining, Exploration and Exploitation of Mineral Resources. This is based on the grams of gold produced multiplied by an index. The current index is BR$ 3.8204 multiplied by a factor of 0.4. Great Panther negotiated a reduced factor of 0.25 from 2020. |

| • | The municipalities of Pedra Branca do Amapari and Serra do Navio, under an agreement for community development under which Tucano contributes up to a 1% royalty over the gross proceeds from gold sales. |

| • | Certain former tenure holders who were partners in Mineracao Vale dos Reis, which is a commodities royalty that is levied at 0.75% of commodity sales revenue, less transport and insurance expenses. The royalty is payable on 13 exploration mineral areas, should production be initiated within their limits. |

| 1.5 | Geology and Mineralization |

The Tucano deposits are examples of structurally controlled orogenic, Proterozoic gold deposits. They are hosted by iron formations and flanking calc-silicate units in a greenstone sequence with a large number of pre/syn and post mineralization intrusions.

The Tucano Operations are hosted within the Vila Nova Greenstone sequence, part of the Maroni-Itacaiunas mobile belt of the Guyana Craton.

The principal deposits at Tucano form a 7 kilometre long lithologic-structural corridor referred to as the mine sequence. From north to south the deposits are Urucum (North (“URN”), Central North, (“URCN”), Central South, (“URCS”) and South, (“URS”), Tapereba (TAP C and TAP AB). Duckhead and Urucum East (“URE”) are associated with fold hinges within the mine sequence, off the main north-south structure.

The mineralization zone is generally decametric (~50 to +100 m) in width being made up of a series of 1 - 8 m wide, steeply dipping, sub-parallel, economically mineralized lenses, hosted in iron-rich formations, particularly magnetite iron formations, banded iron-formation (BIF) and iron-rich carbonate formations. Quartz veining is rarely present, and veins are defined by the continuity of grades within zones of strong sulphide and /or carbonate alteration, generally within or near the contact of iron formations and the calc-silicate unit. Pyrrhotite is the main sulphide in the northern and central parts of the trend while pyrite dominates in the south.

A suite of late post-mineralization pegmatite has been emplaced throughout the mine sequence in various orientations. Gold remobilization can occur at or near the pegmatite contact but is not common.

Gold mineralization is primarily hosted in iron-rich formations, particularly magnetite iron formations, banded iron-formation (BIF) and iron-rich carbonate formations, with other host rocks containing lesser quantities of gold. Higher grades are associated with the more intensely hydrothermally altered BIFs and iron-rich carbonate units bounding and intercalated with the BIFs. High sulphide concentrations are generally associated with higher gold grades but higher gold grades can occur without significant sulphides.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

1.5.1 Urucum - TAP C TREND

Deposits along the Urucum - TAP C Trend are emplaced within the north-south trending, multiply deformed mine sequence, bounded to the west by the Amapari Granite. Gold mineralization at Urucum and TAP C is predominantly stratabound within the BIF / iron formations and is characterized by disseminated pyrrhotite within the strong foliation. Elevated gold values can also be found in strongly altered but sulphide poor zones. Mineralization is commonly associated with pervasive silicification, but quartz veining is markedly absent.

1.5.2 TAP AB

Mineralization lenses in TAP AB are similar in style to those described above for Urucum and TAP C. However, TAP AB contrasts with the above in several aspects related to weathering, dominant sulphide and structure. TAP AB mineralization is hosted in similar chemical sediments as the northern parts of the mine sequence. However, the mine sequence is more deeply weathered. Drillholes have shown that the oxidation in the mineralized zone can extend to 300m. It is not clear if this is structurally related (more porous shear zone), lithology/alteration related (mixture of carbonate and sulphide alteration with weaker pervasive silicification) or due to a deeper conductive/oxidizing source that may be driving an SP cell (electric self-potential) that accelerates weathering in the more sulphide rich and / or porous, structurally deformed mineralization zone.

At TAP AB, the sulphides are dominantly pyrite, with gold mineralization commonly associated with concentrations of 5-10% pyrite. This contrast to Urucum and TAP C where pyrrhotite dominates.

Structurally the northern part, TAP AB3, consists of two sub-parallel north-south orientated mineralization packages, an eastern and western sequence, both dip steeply to the east similar to the northern zones at Urucum and TAP C. At the southern end of TAP AB3 they are truncated by a late, sinistral, NW structure.

In TAP AB2 the mineralization packages continue with a more SSW orientation. In TAP AB1 the western zone suggests that it is part of an overturned anticline with a steep west dipping eastern limb, and moderately (~40°) dipping western limb, hosted by a carbonate sequence. The eastern zone is steeply dipping and appears to be tightly folded at the southern end of TAP AB1 resulting in repetition of the lithologies and associated mineralization within the TAP AB1 pit.

Exploration and mine development prior to Great Panther’s acquisition of the Project was conducted by Anglo American plc, AngloGold Ashanti Ltd, EBX Gold Ltd, Wheaton River Minerals Ltd., Goldcorp Inc., Peak Gold Ltd., New Gold Inc., and Beadell Resources Ltd (Beadell). Work completed included: geological reconnaissance; regional geological and regolith mapping; geochemical surveys (rock chip, soil and stream sediment); airborne geophysical surveys (magnetic, radiometric, and digital elevation model (DEM)); ground geophysical surveys (magnetometer, very low frequency, and induced polarization time domain); auger, rotary air-blast (RAB), air core, reverse circulation (RC) and core drilling, mineral resource and mineral reserve estimates, and mining studies. Open pit mining operations feeding a heap leach operation ran from 2004-2009. Open pit mining operations feeding a carbon-in-leach (CIL) plant commenced in 2012.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Great Panther acquired Beadell in 2018 and has operated the mine continuously since that time. Great Panther has focused on confirmation and expansion of the resources and reserves in the current deposits and has initiated programs to evaluate underground mining within the Tucano Operations and in parallel developing the regional exploration potential.

Table 1-1 summarizes drilling supporting the mineral reserves and mineral resources estimations for the Project as of July 31, 2021 (the 2021 MRMR Estimation). Drilling that supports the Mineral Resource estimation process is primarily restricted to grade control RC drilling and resource definition RC and diamond drilling.

Table 1-1: Drilling Supporting the 2021 MRMR Estimation

| Great Panther Mining Limited - Tucano Gold Mine |

| Database Totals |

| Company | Year | Rotary Air Blast | Reverse Circulation | Diamond Drilling |

| Nº Holes | Drill Metres | Nº Holes | Drill Metres | Nº Holes | Drill Metres |

| Legacy | Pre-2010 | 18,675 | 93,983 | 6,761 | 220,534 | 1,117 | 159,376 |

| Beadell | 2010 -2018 | 3,867 | 35,906 | 9,751 | 435,685 | 460 | 87,985 |

| Great Panther | 2019-2021 | 921 | 10,062 | 1,638 | 75,809 | 170 | 38,836 |

| | Total | 23,463 | 139,952 | 18,150 | 732,028 | 1,747 | 286,198 |

All drillholes are logged with special attention paid to core drillholes which are logged for lithology, alteration, mineralization, structure and geotechnical characteristics. (weathering, RQD, resistance etc). Drill core recoveries are in general excellent with average recoveries of 95% to 98% attained, depending on the deposit.

All drillhole collars are surveyed using a Leica 407 Total Station GPS and RC and diamond drillholes are surveyed using a Reflex Ez-North Seeking Gyro.

Data verification completed by Great Panther includes a review of the methods and practices used to generate the resource database. This includes but was not limited to a review of drilling, sampling, analysis, and data entry processes. The verification included a review of the QA/QC methods and results, standard database validation tests, and several site visits. The review of the QA/QC program and results are presented in Section 11.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Verification of the database was completed by external third parties, including: Maxwell Geoservices Ltd (database and quality assurance and quality control (QA/QC); 2012-2017; AMC Consultants (data verification in support of the 2018 Technical Report); Roscoe Postle Associates (data verification in support of the 2019 Technical Report and 2020 Technical Report). No material issues that would impact resource estimates have been identified. Much of the mineralization related to data generated prior to 2017 has been mined out.

Great Panther selected a number of drill holes to verify the described methods and practices. On these drill holes the following reviews were made:

| • | Visit to the core handling facility and a review of drill core collection, markup, logging, sampling, storage and security practices. No significant issues were found. |

| • | Review of core logs for several drill holes during site visits. No significant issues were found. Significant improvements had been made since the 2020 Technical Report. |

| • | Visits to and review of procedures at the Tucano sample preparation facility, the Tucano fire-assay laboratory and the Certified SGS Geochemistry laboratory in Belo Horizonte. No issues were identified. |

| • | Reviewing the drill hole traces in three-dimensional (3-D), level plan, and vertical sections. No unreasonable geometries were found. |

| • | Querying the database for missing or repeated data, unique headers, duplicate holes, and gaps or overlapping intervals. Ensuring that the total depth recorded in each drill hole database table was consistent. No issues were identified. |

| • | Accuracy of geological interpretations and grade interpretations on section and plan, and in geological models. No unreasonable geometries were found. |

As a result of the data verification, the QP concludes that the Project data and database are acceptable for use in Mineral Resource and Mineral Reserve estimation and can be used to support mine planning. Several recommendations for improvement have been made.

| 1.9 | Metallurgical Test Work |

Tucano is an established operating mine. Metallurgical test programs are not routinely required. In the case of a specific necessity the sample procedure is defined to best resolve the issue and is reported in the relevant study report. There were no metallurgical test programs carried out during the period since the effective date (September 30, 2020) of the previous technical report.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| 1.10 | Mineral Resource Estimation |

Mineral Resources are reported for the TAP AB, TAP C, Urucum, URE and Duckhead deposits, assuming open pit mining methods. Mineral Resources are estimated assuming underground mining methods for the URN, with small resources at TAP AB and URC. Mineral Resources are also estimated for stockpiled material.

Block models use selective mining unit (SMU) sizes that vary by deposit and assumed mining method. Parent cell sizes range from 8 x 20 x 20 m (URN underground) to 3 x 5 x 4 m (TAP AB, TAP C and Urucum open pits). Sub-cells range from 1 x 5 x 2.5 m (URN underground) to 0.625 x 2.5 x 1 m for the smaller URE deposit and Duckhead underground).

Modelling was conducted using commercially available Leapfrog and MineSight software. Variography was performed using Isatis and estimations with Datamine. Resource pits were generated using Hexagon Mine Plan Economic Planner.

Statistical analysis was conducted on a domain-by-domain basis. Mineralization wireframes were constructed as applicable to each deposit. All domains had hard boundaries for estimation purposes. Assays were capped prior to compositing and grade estimation, based on the exploratory data analysis. Assays were composited to 2 m.

For deposits potentially amenable to open pit mining methods, the following models were constructed:

| • | Primary topographic surfaces and the cut-and-fill surface topographies were used to generate updated in situ and backfill domains; |

| • | Digital models of the nominal top of the fresh rock were constructed using available information obtained from drill holes and mining activities; |

| • | Mineralization wireframes were constructed using cut-off grades and minimum mining thicknesses as applicable to the deposit; |

| • | As applicable, structural trend surfaces were generated. |

For deposits potentially amenable to underground mining methods, the following models were constructed:

| • | Crown Pillar surfaces were constructed, separating open pit material from underground; |

| • | Mineralization wireframes were constructed using cut-off grades and minimum mining thicknesses as applicable to the deposit. |

Densities were applied either as lithology type averages into the block models or interpolated using nearest-neighbour (“NN”) methods.

Variography was completed for the deposits. Where individual wireframes had insufficient data the variography was applied to a domain.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Depending on deposit, estimation could be conducted in three passes (TAP AB, URN underground, Duckhead), two passes (Urucum open pit) or one pass. (URE). Interpolation methods included inverse distance weighting to the third power, ordinary kriging and NN.

Confidence categories were assigned using either, or a combination of, estimation pass number, distances to the nearest drill hole and mineralization characteristics.

Mineralization considered potentially amenable to open pit mining methods was constrained within conceptual Lerches-Grossmann (“LG”) shells generated in the Hexagon Mine Plan Economic Planner using US$1900/oz Au and the cost and recovery parameters summarized in Table 1-2. Selected cut-off grades were 0.30 g/t Au for oxide material and 0.40 g/t Au for fresh rock. Open pit Mineral Resources were depleted using a topographic surface as at July 31, 2021.

Table 1-2: Input Parameters, Open Pit Cut-off Grades

| Great Panther Mining Limited - Tucano Gold Mine |

| Parameter | Units | Value |

| Gold Price (Base Case) | US$/oz Au | 1,900 |

| Exchange Rate | R$/US$ | 5.00 |

| Mining Cost | Units | Value |

| - Oxide | US$/t | 2.15 |

| - Fresh Rock | US$/t | 2.68 |

| Processing Cost | Units | Value |

| - Oxide | US$/t | 11.42 |

| - Fresh Rock | US$/t | 13.91 |

| General and Administration Cost | US$/t | 6.04 |

| Gold Recovery | | 88% |

| Pit Discard Cut-off Grade | Units | Value |

| - Oxide | g/t Au | 0.30 |

| - Fresh Rock | g/t Au | 0.40 |

| Overall wall slope Angle | | |

| - Oxide | Degree | 36° - 40° |

| - Fresh Rock | Degree | 47°-52° |

Table 1-3: Input Parameters, Underground Cut-off Grades

| Great Panther Mining Limited - Tucano Gold Mine |

| Item | Unit | Value |

| Cut-off grade for MSO stope shapes (before dilution added) | g/t Au | 1.6 |

| Minimum mining width | m | 2 |

| Dilution skin width - total | m | 1 |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| Stope height 1 | m | 20 |

| Stope height 2 from base | m | 15 |

| Stope height 3 from base | m | 10 |

| Stope increment - strike length | m | 25 |

| Minimum transverse pillar width | m | 10 |

| Include inventory within pit “reserve” pit design * | Flag (1/0) | yes |

| Conduct stope-adjacency smoothing | Flag (y/n) | no |

| Reference X start for stope shape grid & extent | Easting | m | 401880 | 200 |

| Reference Y start for stope shape grid & extent | Northing | m | 99310 | 1075 |

| Reference Z start for stope shape grid & extent | Elevation | m | -590 | 800 |

| Maximum weathered rock inside stope shape | WEATH=5000 % | 10 |

| Block model: "urucum_ug_resources2015_v17" | Version | date | ugv17d #| 8Oct2015 |

Mineralization considered potentially amenable to underground mining methods was constrained within potentially mineable shapes using Mine Stope Optimizer (MSO) software, using the assumptions in Table 1-3. The cut-off grade used to report the estimate is 1.6 g/t Au for fresh rock and 2.1 g/t Au in oxide mineralization. A 30 m thick zone underneath the resource shell acts as a crown pillar, separating the open pit and underground Mineral Resource estimates.

| 1.11 | Mineral Resource Statement |

Measured and Indicated Mineral Resources are reported inclusive of those Measured and Indicated Mineral Resources that were converted to Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Mineral Resource estimates have an effective date of July 31,2021.

The Qualified Person for the Mineral Resource estimate is Mr Carlos Henrique Barbosa Pires, F.AusIMM (CP). The Mineral Resource estimates are tabulated in Table 1-4.

Factors that may affect the Mineral Resource estimates include: metal price and exchange rate assumptions; changes to the assumptions used to generate the gold cut-off grade; changes in local interpretations of mineralization geometry and continuity of mineralized zones; changes to geological and mineralization shapes, and geological and grade continuity assumptions; density and domain assignments; changes to geotechnical, mining and metallurgical recovery assumptions; changes to the input and design parameter assumptions that pertain to the geostatistical block model estimation, changes to the input and design parameter assumptions that pertain to the conceptual pit constraining the estimates; changes to the input and design parameter assumptions that pertain to the conceptual mineable shapes constraining the estimates; and assumptions as to the continued ability to access the site, retain mineral and surface rights titles, maintain environment and other regulatory permits, and maintain the social license to operate.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Table 1-4: Tucano Mineral Resource Estimate as of July 31, 2021

| Location/area | Measured | Indicated | Total Measured and Indicated | Inferred |

| Tonnes | Gold | Contained | Tonnes | Gold | Contained | Tonnes | Gold | Contained | Tonnes | Gold | Contained |

| grade | gold | grade | gold | grade | gold | grade | gold |

| (000s) | (g/t) | (000s oz) | (000s) | (g/t) | (000s oz) | (000s) | (g/t) | (000s oz) | (000s) | (g/t) | (000s oz) |

| Open pit | 5,651 | 1.20 | 217 | 18,863 | 1.17 | 711 | 24,514 | 1.18 | 928 | 1,476 | 1.10 | 52 |

| Underground | 0 | 0.00 | 0 | 2,493 | 4.41 | 353 | 2,493 | 4.41 | 353 | 5,306 | 2.73 | 466 |

| Stockpile | 1,400 | 0.50 | 22 | 0 | 0.00 | 0 | 1,400 | 0.50 | 22 | 0 | 0.00 | 0 |

| Total | 7,051 | 1.06 | 240 | 21,355 | 1.55 | 1,064 | 28,407 | 1.43 | 1,303 | 6,782 | 2.37 | 518 |

Notes:

1. Mineral Resources are classified using the 2014 CIM Definition Standards.

2. Mineral Resources are inclusive of Mineral Reserves.

3. Mineral Resources are reported with an effective date of July 31, 2021.

4. Since the effective date (September 30, 2022) of the previous technical report, new drilling results are available for the TAP AB, TAP C, and Urucum open pit resources.

5. Mineral Resources are estimated at various cut-off grades depending on mining method, mineralization style and haulage distances.

6. Mineralization wireframes were generated at 0.3g/t Au for open pit resources except for URCN where a 0.5g/t wireframe was used. Underground resources were calculated within a 1.6g/t Au wireframe. The minimum wireframe width is three metres.

7. Mineral Resources are estimated using a long-term gold price of US$1900/oz and a US$:BR$ forex of 1:5.

8. The Company's mineral resource were prepared by Mr. Carlos Henrique Barbosa Pires, FAusIMM (CP), a full-time Tucano employee and a qualified persons as defined by NI 43-101.

9. Numbers may not add due to rounding.

10. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Mineral resources are subject to infill drilling, permitting, mine planning, mining dilution and recovery losses, among other things, to be converted into mineral reserves. Due to the uncertainty associated with inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to indicated or measured mineral resources, including, as a result of continued exploration.

| 1.12 | Mineral Reserve Estimation |

Mineral Reserves were converted from Measured and Indicated Mineral Resources. Inferred Mineral Resources were set to waste.

The mine plan assumes open pit and underground mining using conventional mining methods and equipment.

Mineral Reserves are estimated, assuming open pit mining methods, for TAP AB, TAP C, Urucum, URE, and Duckhead. Mineral Reserves are estimated assuming underground mining methods for the URN underground project.

Pit optimisations were carried out using the MS Economic Planner module in the commercially available MinePlan software. The sequence of pit shells obtained from optimisations were analysed to define a practical mining sequence for the ultimate pit designs. Internal, external, and operational dilution were included in the models.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

Table 1-5: Open Pit Marginal Grade Estimate

| Great Panther Mining Limited - Tucano Gold Mine |

| Parameters | Units | URN | URCS | Tap AB1 | Tap AB3 | Tap C1 | DH | URE |

| Revenue |

| Gold Price | Us$/Oz Au | 1,650 | 1,651 | 1,652 | 1,653 | 1,654 | 1,655 | 1,656 |

| Exgange Rate | Us$/R$ | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 | 5.0 |

| Gold Payable | % | 99.95% | 99.95% | 99.95% | 99.95% | 99.95% | 99.95% | 99.95% |

| Refining Carges | R$/Oz Au | 120.46 | 120.46 | 120.46 | 120.46 | 120.46 | 120.46 | 120.46 |

| Royalties | % | 2.85% | 2.85% | 2.85% | 2.85% | 2.85% | 2.85% | 2.85% |

| Avg Process Recovery | % | 88% | 88% | 88% | 88% | 88% | 88% | 88% |

| Net Revenue | R$/Oz Au | 6,943 | 6,943 | 6,943 | 6,943 | 6,943 | 6,943 | 6,943 |

| Operating Cost |

| Grade Control | R$/t | 3.78 | 3.78 | 3.78 | 3.78 | 3.78 | 3.78 | 3.78 |

| Extra Ore Haulage, Oxide | R$/t | 2.51 | 2.15 | -0.87 | -0.61 | 1.07 | 8.68 | 2.36 |

| Extra Ore Haulage, Fresh | R$/t | 1.50 | -1.01 | -0.63 | -0.91 | 0.02 | 6.11 | 3.40 |

| Crusher Feed | R$/t | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 |

| Processing, Oxide | R$/t | 57.08 | 57.08 | 57.08 | 57.08 | 57.08 | 57.08 | 57.08 |

| Processing, Fresh | R$/t | 69.57 | 69.57 | 69.57 | 69.57 | 69.57 | 69.57 | 69.57 |

| G&A | R$/t | 30.20 | 30.20 | 30.20 | 30.20 | 30.20 | 30.20 | 30.20 |

| Break Even CoG, Oxide | g/t Au | 0.47 | 0.47 | 0.46 | 0.46 | 0.46 | 0.50 | 0.46 |

| Break Even CoG, Fresh | g/t Au | 0.53 | 0.52 | 0.53 | 0.52 | 0.53 | 0.56 | 0.54 |

| Marginal CoG, Oxide | g/t Au | 0.42 | 0.42 | 0.41 | 0.41 | 0.42 | 0.45 | 0.42 |

| Marginal CoG, Fresh | g/t Au | 0.48 | 0.46 | 0.47 | 0.46 | 0.47 | 0.50 | 0.48 |

A marginal cut-off grade was calculated for each block individually based on its fresh rock/oxide rock content and distance from the block to the plant. The marginal cut-off grades were derived based on a gold price of US$1,650/oz Au for all open pit deposits and operating costs sourced

from the current operations between May 2020 and April 2021, and mining contracts at a US$/R$ exchange rate of 1:5. Inputs to the cut-offs are summarized in Table 1-5

Underground operations are assumed to be conducted using either up-hole retreat or longitudinal retreat, longhole open stoping (Avoca) methods. Stope shapes were developed using the commercially available Mine Stope Optimizer (MSO) software. Design assumptions included:

| • | The typical stope height was 20 m (i.e., same as the sublevel interval), although some stopes near the upper resource boundaries were 10-15 m in height; |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

| • | Stope lengths for up-hole retreat were 50 m, whereas Avoca stopes were continuous without pillars; |

| • | Cut-off grade of 2.4 g/t Au; |

| • | Planned dilution of 0.5 m footwall plus 0.5 m hanging wall; |

| • | Minimum mining width of 2 m plus 1 m of dilution; |

| • | Minimum pillar distance between parallel lodes of 10 m; |

| • | Stope increment strike length of 25 m; |

| • | Isolated stopes requiring excessive development were not included in mine designs. |

Ore losses were applied to the stope tonnes after the MSO stope shapes were generated (after subtracting the ore development tonnes).

Mineral Reserves were estimated using an incremental cut-off grade of 2.4 g/t Au, based on the parameters summarized in Table 1-6.

Table 1-6: MSO Parameters for Underground Cut-off Estimation

| Great Panther Mining Limited - Tucano Gold Mine |

| Area | Item | Units | Value |

| Revenue | Production rate | t/d | 1,500 |

| Gold price | US$/oz | 1,250 |

| Metallurgical recovery | % | 93 |

| Doré payable | % | 99.95 |

| Exchange rate | $R/US$ | 3.8 |

| Refining cost | $R/oz | 77.78 |

| Royalties | % | 3.14 |

| Ore value | US$/g | 35.55 |

| Operating costs | Mining | US$/t | 50.00 |

| Milling | US$/t | 25.00 |

| G&A | US$/t | 10.00 |

| Total | US$/t | 85.00 |

| Cut-off grade | g/t Au | 2.4 |

Note: Incremental costs do not include development or contractor equipment leasing costs

| 1.13 | Mineral Reserve Statement |

Mineral Reserves are reported using the 2014 CIM Definition Standards. The estimate has an effective date of July 31, 2021.

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

The Mineral Reserve estimate for the Project is presented in Table 1-7. Mineral Reserves were prepared by Mr. Felipe Fernandes, who is the Open Pit Advisor for Great Panther Mining, and subsequently reviewed and approved by GPM’s COO, Mr. Fernando A. Cornejo.

Factors that may affect the Mineral Reserve estimates include: changes to the gold price assumptions; changes to pit slope and geotechnical assumptions; changes to the assumptions used to derive the stope outlines and the mine plan that is based on those stope designs; unforeseen dilution; changes to hydrogeological, pit and underground dewatering assumptions; changes to inputs to capital and operating cost estimates; changes to operating cost assumptions used in the constraining pit shell; changes to operating cost assumptions used in the constraining MSO designs; changes to pit designs from those currently envisaged; changes to stope designs from those currently envisaged; and changes to modifying factor assumptions, including environmental, permitting and social licence to operate.

Table 1-7: Tucano Mineral Reserves Estimate as of July 31, 2021.

| Location/area | Proven | Probable | Total Proven and Probable |

| Tonnes | Gold | Contained | Tonnes | Gold | Contained | Tonnes | Gold | Contained |

| grade | gold | grade | gold | grade | gold |

| (000s) | (g/t) | (000s oz) | (000s) | (g/t) | (000s oz) | (000s) | (g/t) | (000s oz) |

| Open pit | 2,278 | 1.44 | 105 | 6,951 | 1.07 | 240 | 9,229 | 1.16 | 346 |

| Underground | 189 | 3.78 | 23 | 1,976 | 4.17 | 265 | 2,164 | 4.13 | 288 |

| Stockpile | 1,400 | 0.50 | 22 | 0 | 0 | 0 | 1,400 | 0.50 | 22 |

| Total | 3,867 | 1.21 | 151 | 8,927 | 1.76 | 505 | 12,793 | 1.59 | 656 |

Notes:

| 1. | Mineral Reserves were classified using the 2014 CIM Definition Standards. |

| 2. | Mineral Reserve Estimates as of July 31, 2021 |

| 3. | Open pit Mineral Reserves are estimated within designed pits above marginal cut-off grades that vary from 0.40 g/t Au to 0.45 g/t Au for oxide ore and 0.46 g/t Au to 0.50 g/t Au for sulphide ore. Underground Mineral Reserves were estimated using a cut-off grade of 2.4 g/t Au. |

| 4. | Mineral Reserves are estimated using an average long-term gold price of US$1,650/oz and a Brazilian Real (R$):US$ exchange rate of R$5.00:US$1.00. |

| 5. | Mineral Reserves incorporate estimates of dilution and mineral losses. |

| 6. | A minimum mining width of 20 m was used for open pit Mineral Reserves and 3 m was used for underground Mineral Reserves. |

| 7. | Average metallurgical process recovery: 91.5%. |

| 8. | Numbers may not add due to rounding. |

| 9. | Numbers may not add due to rounding. |

Tucano Gold Operations Amapá State NI 43-101 Technical Report | June 7, 2022 |  |

1.14.1 Open Pit

The mining method for the open pit operations is via conventional open pit mining with the operations strategy based on the use of a mining contractor. Since 2015, U&M Mineração e Construção S.A. (U&M), has provided Tucano with contract mining services, equipment and labour. In 2022, Minax Transportes e Construções Ltda (“Minax”) was contracted to provide mining services. Initially Minax will operate in parallel with the existing contractor that is scheduled to cease activities at the end of year 2022. Minax will continue through the current LOM plan. Mobilization of the new mining contractor began in Q1 2022 and will continue until end of Q2 2022. The new contractor is a Brazilian company using a new mining fleet, which will contribute to an improvement in overall mine performance.

In addition to earthmoving responsibilities for both waste and ore, the contractors are responsible for production drilling, pre-shear drilling, pit dewatering, ore re-handle, crusher feed, maintenance and supervision of their fleet of equipment. Six pits will be mined in the current LOM plan. TAP AB, TAP C and Urucum (URN &URCS) are currently in operation. Duckhead will be reactivated while URE is undergoing permitting.

Dewatering of pits, in particular the two deepest pits, Urucum and TAP AB, involves pumping from sumps and drainage channels in the pit bottom. Where required, relatively minor pit design revisions are made to incorporate intermediate elevation pit sumps and water collection/diversion ditches on pit highwalls.