UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number: 811-21622

Thrivent Financial Securities Lending Trust

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

James M. Odland, Secretary

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant's telephone number, including area code: (612) 340-7215

Date of fiscal year end: October 31

Date of reporting period: April 30, 2006

Item 1. Report to Stockholders

SEMIANNUAL REPORT

APRIL 30, 2006

THRIVENT FINANCIAL

SECURITIES LENDING TRUST

THRIVENT FINANCIAL SECURITIES LENDING TRUST

William D. Stouten, Portfolio Manager

The Trust seeks to maximize current income to the extent consistent with the preservation of capital and liquidity, and maintain a stable $1.00 per share net asset value by investing in dollar-denominated securities with a remaining maturity of one year or less.

During the six-month period ended April 30, 2006, the Federal Open Market Committee (FOMC) continued its tightening pattern by raising the fed funds rate at each FOMC meeting. The Trust’s weighted-average maturity was kept shorter than the peer group during the period to produce a yield that matched or exceeded the federal funds target rate throughout the period. We remain cognizant of the need to achieve a flexible yield, and will continue to manage the Trust with the liquidity necessary to thrive under both expected and unexpected interest rate changes in the federal funds target rate.

THRIVENT FINANCIAL SECURITIES LENDING TRUST FUND

AS OF APRIL 30, 2006*

| 7-Day Yield | 4.83% | |

|

| 7-Day Effective Yield | 4.94% | |

|

| |

| Average Annual Total Returns** | |

|

| | | Since Inception, |

| For the Period Ended April 30, 2006 | 1-Year | 9/16/2004 |

|

| Total Return | 3.95% | 3.33% |

|

* Seven-day yields of the Thrivent Financial Securities Lending Trust refer to the income generated by an investment in the Trust over a specified seven-day period. Effective yields reflect the reinvestment of income. Yields are subject to daily fluctuation and should not be considered an indication of future results.

** Past performance is not an indication of future results. Investing in a mutual fund involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company which investors should read and consider carefully before investing.

Annualized total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions.

1

Shareholder Expense Example

(Unaudited)

As a shareholder of the Trust, you incur ongoing cost, including management fees and other Trust expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2005 through April 30, 2006.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Trust's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical example that appears in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses | |

| | Account | Account | Paid During | Annualized |

| | Value | Value | Period* | Expense |

| | 11/1/2005 | 4/30/2006 | 11/1/2005 - 4/30/2006 | Ratio |

| |

| Thrivent Financial Securities Lending Trust | | |

| |

| Actual | $ 1,000 | $ 1,022 | $ 0.25 | 0.05% |

| Hypothetical** | $ 1,000 | $ 1,024 | $ 0.25 | 0.05% |

* Expenses are equal to the Trust's annualized expense ratio, multiplied by the average account value over the period, multiplied by 179/365 to reflect the one-half year period.

** Assuming 5% total return before expenses

2

| | SCHEDULE OF INVESTMENTS | |

| | |

| | AS OF APRIL 30, 2006 (UNAUDITED) | | |

| |

| |

| | Thrivent Financial Securities Lending Trust(a) | |

| |

| |

| Principal | | Interest | Maturity | |

| Amount | Certificates of Deposit – (2.2%) | Rate(b) | Date | Value |

|

| $14,400,000 | BNP Paribas Chicago | 4.790% | 12/27/2006 | $14,400,000 |

| 25,000,000 | Depfa Bank plc NY | 4.650 | 5/2/2006 | 25,000,000 |

| 10,000,000 | Depfa Bank plc NY | 4.970 | 6/19/2006 | 10,000,000 |

| 5,640,000 | Depfa Bank plc NY | 4.515 | 10/17/2006 | 5,640,000 |

| 17,310,000 | Dexia Bank NY | 4.525 | 11/17/2006 | 17,286,028 |

| 14,730,000 | Royal Bank of Canada NY | 4.750 | 12/4/2006 | 14,730,000 |

|

|

| | Total Certificates of Deposit | | $87,056,028 |

|

|

| |

| |

| Principal | | Interest | Maturity | |

| Amount | Commercial Paper – (67.0%) | Rate(b) | Date | Value |

|

| |

| Asset-Backed Commercial Paper – (2.3%) | | | |

| $45,000,000 | GOVCO, Inc. | 4.820% | 5/1/2006 | $45,000,000 |

| 27,000,000 | GOVCO, Inc. | 4.675 | 5/18/2006 | 26,940,394 |

| 15,000,000 | GOVCO, Inc. | 4.720 | 5/25/2006 | 14,952,800 |

| 5,000,000 | GOVCO, Inc. | 4.810 | 6/12/2006 | 4,971,942 |

|

|

| | Total Asset-Backed Commercial Paper | 91,865,136 |

|

|

| |

| Banking-Domestic – (6.0%) | | | |

| 30,000,000 | Credit Suisse First Boston NY | 4.860 | 5/19/2006 | 29,927,100 |

| 20,000,000 | Credit Suisse First Boston NY | 4.880 | 5/22/2006 | 19,943,067 |

| 25,000,000 | Louis Dreyfus Corporation | 4.790 | 5/11/2006 | 24,966,736 |

| 25,000,000 | Louis Dreyfus Corporation | 4.905 | 5/24/2006 | 24,921,656 |

| 10,000,000 | Louis Dreyfus Corporation | 4.940 | 5/31/2006 | 9,958,833 |

| 17,500,000 | Louis Dreyfus Corporation | 4.980 | 6/27/2006 | 17,362,012 |

| 50,000,000 | Rabobank USA Finance Corporation | 4.840 | 5/1/2006 | 50,000,000 |

| 2,400,000 | Rabobank USA Finance Corporation | 4.800 | 5/15/2006 | 2,395,520 |

| 4,863,000 | Societe Generale NA | 4.820 | 5/5/2006 | 4,860,396 |

| 27,500,000 | Stadshypotek Delaware, Inc. | 4.820 | 5/16/2006 | 27,445,187 |

| 4,375,000 | Steamboat Funding Corporation | 4.880 | 5/10/2006 | 4,369,750 |

| 25,000,000 | UBS Finance Corporation, LLC | 4.775 | 5/10/2006 | 24,970,156 |

|

|

| | Total Banking-Domestic | | | 241,120,413 |

|

|

| |

| Banking-Foreign – (0.4%) | | | |

| 3,500,000 | Bank of Ireland | 4.800 | 5/8/2006 | 3,496,733 |

| 2,450,000 | Bank of Ireland | 4.820 | 6/9/2006 | 2,437,207 |

3

| | SCHEDULE OF INVESTMENTS - CONTINUED |

| |

| | AS OF APRIL 30, 2006 (UNAUDITED) | | |

| |

| |

| Principal | | Interest | Maturity | |

| Amount | Commercial Paper – (67.0%) | Rate(b) | Date | Value |

|

| $7,600,000 | HBOS Treasury Services plc | 4.820% | 6/13/2006 | $7,556,245 |

| 1,200,000 | HBOS Treasury Services plc | 4.900 | 6/14/2006 | 1,192,813 |

| 2,525,000 | HBOS Treasury Services plc | 4.930 | 6/15/2006 | 2,509,534 |

|

|

| |

| | Total Banking-Foreign | | | 17,192,532 |

|

|

| |

| Brokerage – (3.3%) | | | |

| 30,000,000 | Citigroup Funding, Inc. | 4.810 | 5/1/2006 | 30,000,000 |

| 25,000,000 | Citigroup Funding, Inc. | 4.760 | 5/4/2006 | 24,990,083 |

| 30,000,000 | Citigroup Funding, Inc. | 4.760 | 5/8/2006 | 29,972,233 |

| 18,765,000 | Merrill Lynch & Company, Inc. | 4.780 | 5/8/2006 | 18,747,559 |

| 30,000,000 | Morgan Stanley Dean Witter & Company | 4.830 | 5/5/2006 | 29,983,900 |

|

|

| |

| | Total Brokerage | | | 133,693,775 |

|

|

| |

| Capital Goods – (0.2%) | | | |

| 7,000,000 | General Electric Capital Corporation | 4.750 | 5/9/2006 | 6,992,611 |

|

|

| |

| | Total Capital Goods | | | 6,992,611 |

|

|

| |

| Consumer Cyclical – (5.7%) | | | |

| 5,483,000 | Golden Funding, Corporation | 4.770 | 5/1/2006 | 5,483,000 |

| 25,214,000 | Golden Funding, Corporation | 4.820 | 5/12/2006 | 25,176,865 |

| 22,439,000 | Golden Funding, Corporation | 4.840 | 5/15/2006 | 22,396,765 |

| 15,237,000 | Golden Funding, Corporation | 4.780 | 5/16/2006 | 15,206,653 |

| 11,532,000 | Golden Funding, Corporation | 4.850 | 5/17/2006 | 11,507,142 |

| 30,000,000 | Toyota Financial Services de Puerto Rico, Inc. | 4.750 | 5/9/2006 | 29,968,333 |

| 30,000,000 | Toyota Financial Services de Puerto Rico, Inc. | 4.750 | 5/10/2006 | 29,964,375 |

| 30,000,000 | Toyota Financial Services de Puerto Rico, Inc. | 4.760 | 5/11/2006 | 29,960,333 |

| 5,000,000 | Toyota Financial Services de Puerto Rico, Inc. | 5.110 | 3/30/2007 | 5,000,000 |

| 55,000,000 | Toyota Motor Credit Corporation | 4.835 | 5/19/2006 | 54,867,042 |

|

|

| |

| | Total Consumer Cyclical | | | 229,530,508 |

|

|

| |

| Consumer Non-Cyclical – (1.4%) | | | |

| 17,165,000 | Cargill Global Funding plc | 4.800 | 5/1/2006 | 17,165,000 |

| 22,000,000 | Cargill Global Funding plc | 4.850 | 5/2/2006 | 21,997,036 |

| 17,600,000 | McCormick & Company | 4.800 | 5/1/2006 | 17,600,000 |

|

|

| |

| | Total Consumer Non-Cyclical | | 56,762,036 |

|

|

| |

| Education – (3.0%) | | | |

| 14,866,000 | Duke University | 4.610 | 5/1/2006 | 14,866,000 |

| 25,000,000 | Duke University | 4.781 | 5/4/2006 | 24,990,041 |

| 25,000,000 | Northwestern University | 4.780 | 5/5/2006 | 24,986,722 |

| 54,950,000 | Yale University | 4.780 | 5/1/2006 | 54,950,000 |

|

|

| |

| | Total Education | | | 119,792,763 |

|

|

4

| | SCHEDULE OF INVESTMENTS - CONTINUED |

| |

| | AS OF APRIL 30, 2006 (UNAUDITED) | | |

| |

| |

| Principal | | Interest | Maturity | |

| Amount | Commercial Paper – (67.0%) | Rate(b) | Date | Value |

|

| |

| Energy – (1.3%) | | | |

| $50,000,000 | Total Capital SA | 4.830% | 5/1/2006 | $50,000,000 |

| 2,000,000 | Total Capital SA | 4.950 | 5/24/2006 | 1,993,675 |

|

|

| |

| | Total Energy | | | 51,993,675 |

|

|

| |

| Finance – (39.0%) | | | |

| 15,000,000 | Amsterdam Funding Corporation | 4.860 | 5/15/2006 | 14,971,650 |

| 4,500,000 | Amsterdam Funding Corporation | 4.830 | 5/24/2006 | 4,486,114 |

| 18,750,000 | Amsterdam Funding Corporation | 4.900 | 6/12/2006 | 18,642,812 |

| 30,000,000 | Barton Capital Corporation | 4.760 | 5/3/2006 | 29,992,067 |

| 25,000,000 | Barton Capital Corporation | 4.760 | 5/9/2006 | 24,973,556 |

| 25,355,000 | Barton Capital Corporation | 4.750 | 5/15/2006 | 25,308,164 |

| 20,000,000 | Barton Capital Corporation | 4.810 | 5/18/2006 | 19,954,572 |

| 25,000,000 | Barton Capital Corporation | 4.880 | 5/22/2006 | 24,928,833 |

| 25,000,000 | Bryant Park Funding, LLC | 4.800 | 5/11/2006 | 24,966,667 |

| 7,000,000 | Bryant Park Funding, LLC | 4.840 | 5/16/2006 | 6,985,883 |

| 24,606,000 | Bryant Park Funding, LLC | 4.840 | 6/15/2006 | 24,457,134 |

| 5,269,000 | Bryant Park Funding, LLC | 4.860 | 6/23/2006 | 5,231,300 |

| 16,224,000 | Chariot Funding, LLC | 4.750 | 5/3/2006 | 16,219,719 |

| 20,000,000 | Chariot Funding, LLC | 4.770 | 5/12/2006 | 19,970,850 |

| 9,341,000 | Chariot Funding, LLC | 4.840 | 5/15/2006 | 9,323,418 |

| 14,243,000 | Chariot Funding, LLC | 4.850 | 5/16/2006 | 14,214,217 |

| 17,398,000 | Chariot Funding, LLC | 4.900 | 5/17/2006 | 17,360,311 |

| 20,000,000 | Chariot Funding, LLC | 4.880 | 5/18/2006 | 19,953,911 |

| 14,000,000 | Cintas Corporation | 4.770 | 5/8/2006 | 13,987,015 |

| 14,000,000 | Cintas Corporation | 4.780 | 5/9/2006 | 13,985,129 |

| 25,000,000 | Cintas Corporation | 4.810 | 5/12/2006 | 24,963,257 |

| 6,000,000 | Corporate Asset Finance Company, Inc. | 4.930 | 6/13/2006 | 5,964,668 |

| 5,000,000 | Corporate Receivables Corporation | | | |

| | Funding, LLC | 4.880 | 5/26/2006 | 4,983,160 |

| 25,000,000 | Corporate Receivables Corporation | | | |

| | Funding, LLC | 4.885 | 5/31/2006 | 24,898,229 |

| 25,000,000 | Corporate Receivables Corporation | | | |

| | Funding, LLC | 4.940 | 6/14/2006 | 24,849,056 |

| 25,000,000 | Edison Asset Securitization, LLC | 4.770 | 5/9/2006 | 24,973,500 |

| 3,780,000 | Edison Asset Securitization, LLC | 4.920 | 6/26/2006 | 3,751,070 |

| 13,731,000 | Falcon Asset Securitization Corporation | 4.820 | 5/12/2006 | 13,710,777 |

| 11,132,000 | Falcon Asset Securitization Corporation | 4.850 | 5/17/2006 | 11,108,004 |

| 30,000,000 | Falcon Asset Securitization Corporation | 4.900 | 5/22/2006 | 29,914,250 |

| 30,000,000 | Falcon Asset Securitization Corporation | 4.900 | 5/23/2006 | 29,910,167 |

| 30,000,000 | Falcon Asset Securitization Corporation | 4.960 | 5/31/2006 | 29,876,000 |

| 10,500,000 | Fountain Square Commercial Funding | | | |

| | Corporation | 4.750 | 5/15/2006 | 10,480,604 |

5

| | SCHEDULE OF INVESTMENTS - CONTINUED |

| |

| | AS OF APRIL 30, 2006 (UNAUDITED) | | |

| |

| |

| Principal | | Interest | Maturity | |

| Amount | Commercial Paper – (67.0%) | Rate(b) | Date | Value |

|

| $23,000,000 | Fountain Square Commercial Funding | | | |

| | Corporation | 4.840% | 6/16/2006 | $22,857,758 |

| 10,000,000 | Fountain Square Commercial Funding | | | |

| | Corporation | 5.000 | 7/5/2006 | 9,909,722 |

| 25,000,000 | Galaxy Funding, Inc. | 4.805 | 5/17/2006 | 24,946,611 |

| 20,000,000 | Galaxy Funding, Inc. | 4.805 | 5/18/2006 | 19,954,619 |

| 10,774,000 | General Electric Capital Corporation | 4.630 | 10/24/2006 | 10,530,125 |

| 25,000,000 | Grampian Funding, LLC | 4.780 | 5/2/2006 | 24,996,680 |

| 25,000,000 | Grampian Funding, LLC | 4.770 | 5/5/2006 | 24,986,750 |

| 30,000,000 | Jupiter Securitization Corporation | 4.850 | 5/17/2006 | 29,935,333 |

| 19,295,000 | Jupiter Securitization Corporation | 4.700 | 5/22/2006 | 19,242,100 |

| 25,000,000 | Jupiter Securitization Corporation | 4.930 | 5/26/2006 | 24,914,410 |

| 16,242,000 | Jupiter Securitization Corporation | 4.960 | 5/31/2006 | 16,174,866 |

| 7,837,000 | Kitty Hawk Funding Corporation | 4.850 | 5/15/2006 | 7,822,219 |

| 35,000,000 | Kitty Hawk Funding Corporation | 4.850 | 5/16/2006 | 34,929,312 |

| 23,000,000 | Kitty Hawk Funding Corporation | 4.900 | 5/17/2006 | 22,949,911 |

| 20,000,000 | Kitty Hawk Funding Corporation | 4.780 | 5/18/2006 | 19,954,856 |

| 10,000,000 | Kitty Hawk Funding Corporation | 4.910 | 5/24/2006 | 9,968,631 |

| 5,400,000 | Kitty Hawk Funding Corporation | 4.955 | 5/26/2006 | 5,381,512 |

| 25,000,000 | Nieuw Amsterdam Receivables Corporation | 4.780 | 5/4/2006 | 24,990,042 |

| 16,316,000 | Nieuw Amsterdam Receivables Corporation | 4.780 | 5/5/2006 | 16,307,334 |

| 25,999,000 | Nieuw Amsterdam Receivables Corporation | 4.820 | 6/15/2006 | 25,842,356 |

| 13,546,000 | Nieuw Amsterdam Receivables Corporation | 4.650 | 7/31/2006 | 13,386,778 |

| 21,500,000 | Old Line Funding Corporation | 4.805 | 5/16/2006 | 21,456,955 |

| 2,902,000 | Old Line Funding Corporation | 4.950 | 6/5/2006 | 2,888,034 |

| 25,000,000 | Old Line Funding Corporation | 4.930 | 6/15/2006 | 24,845,937 |

| 8,061,000 | Old Line Funding, LLC | 4.740 | 5/1/2006 | 8,061,000 |

| 23,113,000 | Old Line Funding, LLC | 4.740 | 5/10/2006 | 23,085,611 |

| 28,000,000 | Old Line Funding, LLC | 4.825 | 5/22/2006 | 27,921,192 |

| 4,231,000 | Park Avenue Receivables Corporation | 4.800 | 5/1/2006 | 4,231,000 |

| 25,000,000 | Park Avenue Receivables Corporation | 4.770 | 5/2/2006 | 24,996,688 |

| 2,250,000 | Park Avenue Receivables Corporation | 4.850 | 5/12/2006 | 2,246,969 |

| 5,450,000 | Park Avenue Receivables Corporation | 4.850 | 5/17/2006 | 5,438,252 |

| 30,000,000 | Park Avenue Receivables Corporation | 4.900 | 5/22/2006 | 29,914,250 |

| 11,175,000 | Ranger Funding Company | 4.840 | 5/15/2006 | 11,153,966 |

| 3,495,000 | Sheffield Receivables Corporation | 4.850 | 5/1/2006 | 3,495,000 |

| 24,395,000 | Sheffield Receivables Corporation | 4.920 | 5/12/2006 | 24,358,326 |

| 30,000,000 | Sheffield Receivables Corporation | 4.935 | 5/25/2006 | 29,901,300 |

| 25,000,000 | Sheffield Receivables Corporation | 4.960 | 5/26/2006 | 24,913,889 |

| 30,000,000 | Solitaire Funding, LLC | 4.780 | 5/10/2006 | 29,964,150 |

| 10,000,000 | Solitaire Funding, LLC | 4.660 | 5/12/2006 | 9,985,761 |

| 30,000,000 | Solitaire Funding, LLC | 4.890 | 5/23/2006 | 29,912,092 |

| 7,948,000 | Thames Asset Global Securitization, Inc. | 4.780 | 5/8/2006 | 7,940,613 |

| 10,000,000 | Thames Asset Global Securitization, Inc. | 4.850 | 5/15/2006 | 9,981,139 |

| 27,000,000 | Thames Asset Global Securitization, Inc. | 4.900 | 5/30/2006 | 26,893,425 |

| 12,700,000 | Thames Asset Global Securitization, Inc. | 4.800 | 6/7/2006 | 12,637,450 |

6

| | SCHEDULE OF INVESTMENTS - CONTINUED |

| | |

| | AS OF APRIL 30, 2006 (UNAUDITED) | | |

| |

| |

| Principal | | Interest | Maturity | |

| Amount | Commercial Paper – (67.0%) | Rate(b) | Date | Value |

|

| $7,045,000 | Three Pillars, Inc. | 4.910% | 5/17/2006 | $7,029,626 |

| 30,000,000 | Three Pillars, Inc. | 4.930 | 5/24/2006 | 29,905,508 |

| 25,000,000 | Thunder Bay Funding, LLC | 4.750 | 5/10/2006 | 24,970,312 |

| 15,280,000 | Thunder Bay Funding, LLC | 4.750 | 5/11/2006 | 15,259,839 |

| 14,500,000 | Thunder Bay Funding, LLC | 4.800 | 5/15/2006 | 14,472,933 |

| 25,262,000 | Thunder Bay Funding, LLC | 4.820 | 6/14/2006 | 25,113,179 |

| 6,083,000 | Triple A-1 Funding Corporation | 4.900 | 5/17/2006 | 6,069,753 |

| 10,000,000 | Tulip Funding Corporation | 4.790 | 5/2/2006 | 9,998,670 |

| 30,000,000 | Tulip Funding Corporation | 4.960 | 5/31/2006 | 29,876,000 |

| 10,789,000 | Yorktown Capital, LLC | 4.960 | 5/23/2006 | 10,756,297 |

|

|

| | Total Finance | | | 1,568,953,105 |

|

|

| |

| Insurance – (3.0%) | | | |

| 25,000,000 | Aquinas Funding, LLC | 4.890 | 5/23/2006 | 24,925,292 |

| 1,500,000 | Curzon Funding, LLC | 4.920 | 6/13/2006 | 1,491,292 |

| 5,000,000 | Curzon Funding, LLC | 4.915 | 6/29/2006 | 4,959,724 |

| 25,000,000 | Swiss Reinsurance Company | 4.840 | 5/5/2006 | 24,986,556 |

| 25,000,000 | Swiss Reinsurance Company | 4.645 | 5/10/2006 | 24,970,969 |

| 25,000,000 | Swiss Reinsurance Company | 4.900 | 5/24/2006 | 24,921,736 |

| 13,970,000 | Swiss Reinsurance Company | 4.635 | 10/20/2006 | 13,660,634 |

|

|

| | Total Insurance | | | 119,916,203 |

|

|

| |

| U.S. Municipal – (1.4%) | | | |

| 10,656,000 | Alaska Housing Finance Corporation | 4.781 | 5/3/2006 | 10,653,170 |

| 15,000,000 | Alaska Housing Finance Corporation | 4.790 | 5/9/2006 | 14,984,033 |

| 30,524,000 | Alaska Housing Finance Corporation | 4.800 | 5/11/2006 | 30,483,298 |

|

|

| | Total U.S. Municipal | | | 56,120,501 |

|

|

| |

| | Total Commercial Paper | | $2,693,933,258 |

|

|

| Shares or | | | | |

| Principal | | Interest | Maturity | |

| Amount | Other – (6.8%) | Rate(b) | Date | Value |

|

| |

| Time Deposits – (5.0%) | | | |

| $100,000,000 | Svenska Handlesbanke, Inc. | 4.875% | 5/1/2006 | $100,000,000 |

| 100,000,000 | Societe Generale | 4.850 | 5/1/2006 | 100,000,000 |

|

|

| | Time Deposits | | | 200,000,000 |

|

|

| |

| Mutual Funds – (1.8%) | | | |

| 61,085,000 | Barclays Prime Money Market Fund | 4.790 | N/A | 61,085,000 |

| 12,065,000 | Morgan Stanley Institutional Liquidity Fund | 4.760 | N/A | 12,065,000 |

7

| | SCHEDULE OF INVESTMENTS - CONTINUED |

| | |

| | AS OF APRIL 30, 2006 (UNAUDITED) | | |

| Shares or | | | | |

| Principal | | Interest | Maturity | |

| Amount | Other – (6.8%) | Rate(b) | Date | Value |

|

| 1,078,663 | Reserve Primary Fund | 4.740% | N/A | $1,078,663 |

|

|

| | Total Mutual Funds | | | 74,228,663 |

|

|

| |

| | Total Other | | | $274,228,663 |

|

|

| |

| Principal | | Interest | Maturity | |

| Amount | Public Corporate – (1.0%) | Rate(b) | Date | Value |

|

| Banking-Domestic – (0.8%) | | | |

| $22,890,000 | Citigroup, Inc. | 5.750% | 5/10/2006 | $22,896,701 |

| 5,000,000 | Citigroup, Inc. | 5.500 | 8/9/2006 | 5,010,121 |

| 3,735,000 | MBNA Corporation | 6.250 | 1/17/2007 | 3,773,203 |

|

|

| | Total Banking-Domestic | | | 31,680,025 |

|

|

| |

| Brokerage – (0.1%) | | | |

| 5,175,000 | Goldman Sachs Group, Inc. | 7.200 | 11/1/2006 | 5,234,084 |

|

|

| | Total Brokerage | | | 5,234,084 |

|

|

| |

| Finance – (0.1%) | | | |

| 5,580,000 | Household Finance Corporation | 7.200 | 7/15/2006 | 5,611,457 |

|

|

| | Total Finance | | | 5,611,457 |

|

|

| |

| | Total Public Corporate | | | $42,525,566 |

|

|

| |

| Principal | | Interest | Maturity | |

| Amount | U.S. Government – (0.3%) | Rate(b) | Date | Value |

|

| $5,370,000 | Federal Home Loan Mortgage Corporation | 4.875% | 2/26/2007 | $5,370,000 |

| 5,800,000 | Federal National Mortgage Association | 4.050 | 8/14/2006 | 5,800,000 |

|

|

| |

| | Total U.S. Government | | | $11,170,000 |

|

|

| |

| Principal | | Interest | Maturity | |

| Amount | Variable Rate Notes – (22.9%)(c) | Rate(b) | Date | Value |

|

| Banking-Domestic – (9.6%) | | | |

| $20,000,000 | Bank of America Corporation | 4.800% | 5/8/2006 | $20,000,000 |

| 30,000,000 | Bank of America Corporation | 4.810 | 5/10/2006 | 30,000,000 |

| 30,000,000 | Bank of America Corporation | 4.810 | 6/7/2006 | 30,000,000 |

| 25,000,000 | Bank of New York Company, Inc. | 4.839 | 5/10/2006 | 24,999,968 |

| 17,000,000 | Barclays Bank plc NY | 4.763 | 5/30/2006 | 16,996,600 |

8

| | SCHEDULE OF INVESTMENTS - CONTINUED |

| | |

| | AS OF APRIL 30, 2006 (UNAUDITED) | | |

| |

| |

| Principal | | Interest | Maturity | |

| Amount | Variable Rate Notes – (22.9%)(c) | Rate(b) | Date | Value |

|

| $10,000,000 | Dexia Credit Local NY | 4.770% | 5/5/2006 | $9,998,472 |

| 30,000,000 | Dexia Credit Local NY | 4.766 | 6/5/2006 | 29,998,030 |

| 50,000,000 | Fifth Third Bancorp | 4.930 | 5/23/2006 | 50,000,000 |

| 37,920,000 | HSBC USA, Inc. | 4.890 | 5/15/2006 | 37,920,000 |

| 34,000,000 | Royal Bank of Canada NY | 4.796 | 6/1/2006 | 34,000,000 |

| 25,000,000 | Royal Bank of Scotland NY | 4.750 | 5/5/2006 | 24,998,235 |

| 25,000,000 | Royal Bank of Scotland NY | 4.885 | 5/22/2006 | 24,997,681 |

| 18,670,000 | US Bank NA | 4.754 | 5/30/2006 | 18,668,470 |

| 34,000,000 | Wells Fargo & Company | 4.980 | 6/12/2006 | 34,005,368 |

|

|

| |

| | Total Banking-Domestic | | | 386,582,824 |

|

|

| |

| Banking-Foreign – (3.2%) | | | |

| 21,960,000 | Bank of Ireland | 4.893 | 5/20/2006 | 21,960,000 |

| 25,000,000 | BNP Paribas SA | 4.940 | 5/26/2006 | 25,000,000 |

| 37,500,000 | HBOS Treasury Services plc | 4.960 | 6/30/2006 | 37,498,744 |

| 20,000,000 | Royal Bank of Scotland plc | 4.919 | 5/22/2006 | 20,000,000 |

| 25,000,000 | Societe Generale | 4.796 | 6/2/2006 | 25,000,000 |

|

|

| |

| | Total Banking-Foreign | | | 129,458,744 |

|

|

| |

| Brokerage – (3.2%) | | | |

| 25,000,000 | Goldman Sachs Group, Inc. | 4.929 | 5/25/2006 | 25,000,000 |

| 25,000,000 | Goldman Sachs Group, Inc. | 4.869 | 6/1/2006 | 25,004,343 |

| 20,000,000 | Merrill Lynch & Company, Inc. | 4.880 | 5/5/2006 | 20,000,204 |

| 15,000,000 | Merrill Lynch & Company, Inc. | 5.052 | 5/11/2006 | 15,026,359 |

| 20,000,000 | Merrill Lynch & Company, Inc. | 4.860 | 5/25/2006 | 20,001,235 |

| 25,000,000 | Morgan Stanley | 4.870 | 5/1/2006 | 25,000,000 |

|

|

| |

| | Total Brokerage | | | 130,032,141 |

|

|

| |

| Consumer Cyclical – (1.7%) | | | |

| 25,000,000 | American Honda Finance Corporation | 4.850 | 6/13/2006 | 25,000,000 |

| 18,000,000 | American Honda Finance Corporation | 4.983 | 7/10/2006 | 17,999,641 |

| 25,000,000 | Toyota Motor Credit Corporation | 4.769 | 5/10/2006 | 24,999,842 |

|

|

| |

| | Total Consumer Cyclical | | | 67,999,483 |

|

|

| |

| Finance – (2.4%) | | | |

| 25,000,000 | Citigroup Global Markets Holdings, Inc. | 5.235 | 7/25/2006 | 25,009,544 |

| 4,000,000 | General Electric Capital Corporation | 4.960 | 5/1/2006 | 4,000,907 |

| 40,000,000 | General Electric Capital Corporation | 4.949 | 5/9/2006 | 40,050,682 |

| 25,000,000 | Union Hamilton Special Funding, LLC | 4.930 | 6/21/2006 | 25,000,000 |

|

|

| |

| | Total Finance | | | 94,061,133 |

|

|

9

SCHEDULE OF INVESTMENTS - CONTINUED

AS OF APRIL 30, 2006 (UNAUDITED)

| Principal | Interest | Maturity | |

| Amount | Variable Rate Notes – (22.9%)(c) | Rate(b) | Date | Value |

|

| Insurance – (0.6%) | | | |

| $25,000,000 | MBIA Global Funding, LLC | 4.840% | 5/15/2006 | $25,000,000 |

|

|

| | Total Insurance | | | 25,000,000 |

|

|

| |

| U.S. Government – (0.8%) | | | |

| 30,000,000 | Federal National Mortgage Association | 4.810 | 5/1/2006 | 29,994,048 |

|

|

| | Total U.S. Government | | | 29,994,048 |

|

|

| |

| U.S. Municipal – (1.4%) | | | |

| 11,175,000 | BRCH Corporation | 4.920 | 5/3/2006 | 11,175,000 |

| 45,000,000 | Texas State Public Finance Authority Revenue | | | |

| | Bonds | 4.870 | 5/3/2006 | 45,000,000 |

|

|

| | Total U.S. Municipal | | | 56,175,000 |

|

|

| | Total Variable Rate Notes | | | $919,303,373 |

|

|

| | Total Investments | | | |

| | (at amortized cost)100.2% | | $4,028,216,888 |

|

|

| | Other Assets and Liabilities, Net | (0.2%) | | (8,434,728) |

|

|

| | Total Net Assets 100.0% | | | $4,019,782,160 |

|

|

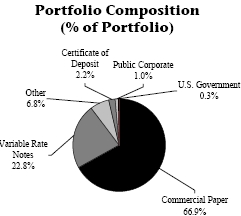

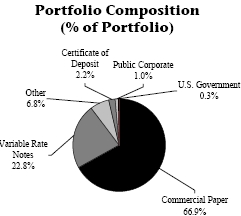

(a) The categories of investments are shown as a percentage of total net assets.

(b) The interest rate shown reflects the yield, coupon rate or, for securities purchased at a discount, the discount rate at the date of purchase.

(c) Denotes variable rate obligations for which the current yield and next scheduled reset date are shown.

(d) The cost for federal income tax purposes is $4,028,216,888.

The accompanying notes to the financial statements are an integral part of this schedule.

10

STATEMENT OF ASSETS AND LIABILITIES

AS OF APRIL 30, 2006 (UNAUDITED)

Thrivent Financial Securities Lending Trust

| Assets | |

| Investments at cost | $4,028,216,888 |

| Investments at value | 4,028,216,888 |

| Cash | 1,858 |

| Dividend and interest receivable | 6,374,772 |

| Prepaid expenses | 25,940 |

|

| Total Assets | 4,034,619,458 |

|

| |

| Liabilities | |

| Distributions payable | 14,680,043 |

| Accrued expenses | 28,576 |

| Payable to affiliate | 128,679 |

|

| Total Liabilities | 14,837,298 |

|

| |

| Net Assets | |

| Trust Capital (beneficial interest) | 4,019,783,763 |

| Accumulated undistributed net realized loss on | |

| investments and foreign currency transactions | (1,603) |

|

| Total Net Assets | $4,019,782,160 |

|

| |

| Net Assets | $4,019,782,160 |

| Shares of beneficial interest outstanding | 4,019,783,763 |

| Net asset value per share | $1.00 |

The accompanying notes to the financial statements are an integral part of this statement.

11

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED APRIL 30, 2006 (UNAUDITED)

Thrivent Financial Securities Lending Trust

| Investment Income | |

| Dividends | $2,138,341 |

| Taxable interest | 87,602,163 |

|

| Total Investment Income | 89,740,504 |

|

| Expenses | |

| Adviser fee | 902,548 |

| Accounting and pricing fees | 27,121 |

| Audit and legal fees | 11,697 |

| Custody fees | 42,893 |

| Insurance expense | 35,648 |

| Printing and postage fees | 480 |

| Transfer agent fees | 29,230 |

| Trustees’ fees | 1,589 |

| Other expenses | 10,620 |

|

| Total Expenses Before Reimbursement | 1,061,826 |

|

| |

| Less: | |

| Reimbursement from adviser | (57,823) |

| Custody earnings credit | (1,171) |

|

| Total Net Expenses | 1,002,832 |

|

| |

| Net Investment Income | 88,737,672 |

|

| |

| Realized and Unrealized Loss on Investments | |

| Net realized loss on investments | (1,601) |

|

| Net Realized and Unrealized Loss on Investments | (1,601) |

|

| |

| Net Increase in Net Assets Resulting From Operations | $88,736,071 |

|

The accompanying notes to the financial statements are an integral part of this statement.

12

STATEMENT OF CHANGES IN NET ASSETS

Thrivent Financial Securities Lending Trust

| For the periods ended | 4/30/2006 | 10/31/2005 |

| | (unaudited) | |

|

| Operations | | |

| Net investment income | $88,737,672 | $116,407,705 |

| Net realized gain/(loss) on investments | (1,601) | 77 |

|

| Net Increase in Net Assets Resulting | | |

| From Operations | 88,736,071 | 116,407,782 |

|

| Distributions to Shareholders | | |

| From net investment income | (88,737,672) | (116,407,707) |

| From net realized gains | 0 | (5,639) |

|

| Total Distributions to Shareholders | (88,737,672) | (116,413,346) |

|

|

| Capital Stock Transactions | 155,176,501 | (77,734,437) |

|

| Net Increase in Net Assets | 155,174,900 | (77,740,001) |

|

| Net Assets Beginning of Period | 3,864,607,260 | 3,942,347,261 |

|

| Net Assets End of Period | $4,019,782,160 | $3,864,607,260 |

|

The accompanying notes to the financial statements are an integral part of this statement.

13

NOTES TO FINANCIAL STATEMENTS

AS OF APRIL 30, 2006 (UNAUDITED)

Thrivent Financial Securities Lending Trust

A. Organization

Thrivent Financial Securities Lending Trust (the "Trust") was organized as a Massachusetts Business Trust on August 4, 2004, and is registered as an open-end management investment company under the Investment Company Act of 1940. The Trust commenced operations on September 16, 2004. All transactions in the Trust are from affiliates of the Trust.

Under the Trust's organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust enters into contracts with vendors and others that provide general damage clauses. The Trust's maximum exposure under these contracts is unknown, as this would involve future claims that may be made against the Trust. However, based on experience, the Trust expects the risk of loss to be remote.

B. Significant Accounting Policies

Valuation – Securities are valued on the basis of amortized cost (which approximates value), whereby a portfolio security is valued at its cost initially, and thereafter valued to reflect a constant amortization to maturity of any discount or premium. Mutual Funds are valued at the net asset value at the close of each business day.

Federal Income Taxes – The Trust intends to comply with the requirements of the Internal Revenue Code which are applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. The Trust, accordingly, anticipates paying no Federal income taxes and no Federal income tax provision was recorded.

Fees Paid Indirectly – The Trust has a deposit arrangement with the custodian whereby interest earned on uninvested cash balances is used to pay a portion of custodian fees. This deposit arrangement is an alternative to overnight investments.

Distributions to Shareholders – Net investment income is distributed to each shareholder as a dividend. Dividends from the Trust are declared daily and distributed monthly. Net realized gains from securities transactions, if any, are distributed at least annually after the close of the fiscal year.

Use of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

Other – For financial statement purposes, investment security transactions are accounted for on the trade date. Interest income is recognized on an accrual basis. Discount and premium are amortized over the life of the respective securities on the interest method. Realized gains or losses on sales are determined on a specific cost identification basis. Generally accepted accounting principles require permanent financial reporting and tax differences to be reclassified to trust capital. No reclassifications were necessary at April 30, 2006.

C. Investment Advisory Management Fees and Transactions with Related Parties

The Trust has entered into an Investment Advisory Agreement with Thrivent Financial for Lutherans (the "Adviser") under which the Trust pays a fee for investment advisory services. The annual rate of fees under the Investment Advisory Agreement are calculated at 0.045% of the average daily net assets of the Trust.

Each Trustee who is not affiliated with the Adviser receives an annual fee from the Trust for services as a Trustee and is eligible to participate in a deferred compensation plan with respect to these fees. Each participant's deferred

14

compensation account will increase or decrease as if it were invested in shares of the Thrivent Mutual Funds based on their choice.

Trustees not participating in the above plan received $730 in fees from the Trust for the six months ended April 30, 2006. No remuneration has been paid by the Trust to any of the officers or affiliated Trustees of the Trust. In addition, the Trust reimbursed certain reasonable expenses incurred in relation to attendance at the meetings.

The Adviser has agreed to voluntarily reimburse the Trust for all expenses in excess of 0.05% of average daily net assets.

D. Federal Income Tax Information

During the six months ended April 30, 2006, and the year ended October 31, 2005, Thrivent Securities Lending Trust distributed $88,737,672 and $116,413,346 from ordinary income, respectively.

| E. Trust Transactions | | |

| Transactions in trust shares were as follows: | | |

| |

| | Shares | Amount |

|

| For the Six Months Ended April 30, 2006 | | |

| Sold | 9,394,022,622 | $9,394,022,622 |

| Redeemed | (9,238,846,121) | (9,238,846,121) |

|

|

| Net Change | 155,176,501 | $155,176,501 |

|

| For the Year Ended October 31, 2005 | | |

| Sold | 21,908,591,039 | $21,908,591,039 |

| Redeemed | (21,986,325,476) | (21,986,325,476) |

|

|

| Net Change | (77,734,437) | $(77,734,437) |

|

15

FINANCIAL HIGHLIGHTS

PER SHARE INFORMATION (a)

Thrivent Financial Securities Lending Trust

| | Six | | |

| | Months Ended | | |

| | 4/30/2006 | Year Ended | Period Ended |

| | (unaudited) | 10/31/2005 | 10/31/2004 (e) |

|

| Net asset value: Beginning of Period | $1.00 | $1.00 | $1.00 |

| |

| Income from Investment Operations: | | | |

| Net investment income | 0.02 | 0.03 | 0.00 |

| Net realized and unrealized gain/(loss) on | | | |

| investments (b) | -- | -- | -- |

|

| Total from Investment Operations | 0.02 | 0.03 | 0.00 |

|

| |

| Distributions from: | | | |

| Net investment income | (0.02) | (0.03) | 0.00 |

|

| Total Distributions | (0.02) | (0.03) | 0.00 |

|

| |

| Net asset value: End of Period | $1.00 | $1.00 | $1.00 |

|

| |

| Total return (c) | 2.21% | 2.91% | 0.22% |

| Net assets: end of period (in millions) | $4,019.8 | $3,864.6 | $3,942.3 |

| Ratio of expenses to average net assets (d) | 0.05% | 0.05% | 0.05% |

| Ratio of net investment income to average net assets (d) | 4.42% | 2.89% | 1.80% |

| Portfolio turnover rate | N/A | N/A | N/A |

| |

| If the Fund had paid all its expenses without the adviser’s voluntary expense reimbursement, the ratios would |

| have been as follows: | | | |

| Ratio of expenses to average net assets (d) | 0.05% | 0.05% | 0.05% |

| Ratio of net investment income to average net assets (d) | 4.42% | 2.89% | 1.80% |

(a) All per share amounts have been rounded to the nearest cent.

(b) The amount shown may not correlate with the change in aggregate gains and losses of portfolio securities due to the timing of sales and redemptions of fund shares.

(c) Total investment return assumes dividend reinvestment and does not reflect any deduction for sales charges.

(d) Computed on an annualized basis for periods less than one year.

(e) Since Fund inception, September 16, 2004.

The accompanying notes to the financial statements are an integral part of this schedule.

16

ADDITIONAL INFORMATION

(unaudited)

PROXY VOTING

The policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities are attached to the Trust’s Statement of Additional Information. You may request a free copy of the Statement of Additional Information or the report of how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 by calling 1-800-847-4836. You also may review the Statement of Additional Information or the report of how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 at the Thrivent Financial web site (www.thrivent.com) or the SEC web site (www.sec.gov).

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

The Trust files its Schedule of Portfolio Holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. You may request a free copy of the Trust’s Forms N-Q by calling 1-800-847-4836. The Trust’s Forms N-Q also are available on the SEC web site (www.sec.gov). You also may review and copy the Forms N-Q for the Trust at the SEC’s Public Reference Room in Washington, DC. You may get information about the operation of the Public Reference Room by calling 1-202-551-8090.

17

This report is submitted for the information of shareholders of Thrivent Financial Securities Lending Trust. It is not authorized for distribution to prospective investors unless preceded or accompanied by the current prospectus for Thrivent Financial Securities Lending Trust, which contains more complete information about the Trust, including investment policies, charges and expenses.

18

Item 2. Code of Ethics

Not applicable to semiannual report

Item 3. Audit Committee Financial Expert

Not applicable to semiannual report

Item 4. Principal Accountant Fees and Services

Not applicable to semiannual report

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

Registrant's Schedule of Investments is included in the report to shareholders filed under Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment

Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders

There have been no material changes to the procedures by which shareholders may recommend nominees to registrant's board of trustees.

Item 11. Controls and Procedures

(a)(i) Registrant's President and Treasurer have concluded that registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) are effective, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There has been no change in registrant's internal controls over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, registrant's internal control over financial reporting.

Item 12. Exhibits

(a) Certifications pursuant to Rules 30a-2(a) and 30a-2(b) under the Investment Company Act of 1940 are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: June 29, 2006 | THRIVENT FINANCIAL |

| | SECURITIES LENDING TRUST |

| |

| |

| | By: /s/ Pamela J. Moret |

|

|

| | Pamela J. Moret |

| | President |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of |

| 1940, this report has been signed below by the following persons on behalf of the registrant and in the |

| capacities and on the dates indicated. | | |

| |

| Date: June 29, 2006 | By: /s/ Pamela J. Moret |

| |

|

| | Pamela J. Moret |

| | President |

| |

| |

| Date: June 29, 2006 | By:/s/ Gerard V. Vaillancourt |

| |

|

| | Gerard V. Vaillancourt |

| | Treasurer |