UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21622

Thrivent Financial Securities Lending Trust

(Exact name of registrant as specified in charter)

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Address of principal executive offices) (Zip code)

John L. Sullivan

625 Fourth Avenue South

Minneapolis, Minnesota 55415

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 844-5704

Date of fiscal year end: October 31

Date of reporting period: October 31, 2008

Item 1. Report to Stockholders

Annual Report

OCTOBER 31, 2008

Thrivent Financial

Securities Lending Trust

Table of Contents

THRIVENT FINANCIAL SECURITIES LENDING TRUST

William D. Stouten, Portfolio Manager

The Trust seeks to maximize current income, to the extent consistent with the preservation of capital and liquidity, and maintain a stable $1.00 per share net asset value by investing in dollar-denominated securities with a remaining maturity of 397 calendar days or less.

Our conservative investment philosophy worked well during this period’s market turmoil. Maintaining a short weighted average maturity and holding liquid securities allowed us to shrink the portfolio over 50% during the market’s dramatic volatility. We have significantly increased the percentage of government agency debt and asset-backed commercial paper (which can be quickly liquidated using the Fed’s Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility) to keep the portfolio liquid and prepared for continued stress in the financial markets. We continue to maintain a defensive portfolio stance, focusing less on yield and more on conservative investments and improving liquidity.

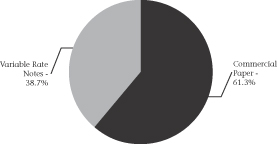

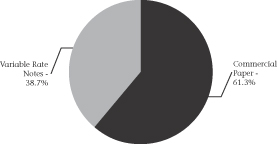

Portfolio Composition

(% of Portfolio)

| | | | |

Thrivent Financial Securities Lending Trust As Of October 31, 2008* | | |

7-Day Yield | | 2.52% | | |

7-Day Effective Yield | | 2.56% | | |

| | | | |

| Average Annual Total Returns** |

For the Period Ended October 31, 2008 | | 1-Year | | Since Inception,

9/16/2004 |

Total Return | | 3.38% | | 4.09% |

| * | Seven-day yields of the Thrivent Financial Securities Lending Trust refer to the income generated by an investment in the Trust over a specified seven-day period. Effective yields reflect the reinvestment of income. Yields are subject to daily fluctuation and should not be considered an indication of future results. |

| ** | Annualized Total returns represent past performance and reflect changes in share prices, the reinvestment of all dividends and capital gains, and the effects of compounding. The returns shown do not reflect taxes a shareholder would pay on distributions or redemptions. |

| | Past performance is not an indication of future results. Investing in a mutual fund involves risks, including the possible loss of principal. The prospectus contains more complete information on the investment objectives, risks, charges and expenses of the investment company, which investors should read and consider carefully before investing. |

| | An investment in the Trust is not insured or guaranteed by the FDIC or any other government agency. Although the Trust seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Trust. |

1

Shareholder Expense Example

(Unaudited)

As a shareholder of the Trust, you incur ongoing costs, including management fees and other Trust expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2008 through October 31, 2008.

Actual Expenses

In the table below, the first line provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid during Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

In the table below, the second line provides information about hypothetical account values and hypothetical expenses based on the Trust’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Trust’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Trust and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical example that appears in the shareholder reports of the other funds.

| | | | | | | | | | | | |

| | | Beginning Account

Value 5/1/2008 | | Ending Account Value

10/31/2008 | | Expenses Paid During

Period 5/1/2008-

10/31/2008* | | Annualized Expense

Ratio | |

Thrivent Financial Securities Lending Trust | | | | | | | | | | | | |

Actual | | $ | 1,000 | | $ | 1,013 | | $ | 0.25 | | 0.05 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,025 | | $ | 0.26 | | 0.05 | % |

| * | Expenses are equal to the Trust’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/366 to reflect the one-half year period. |

| ** | Assuming 5% total return before expenses. |

2

| | | | |

| | | | | PricewaterhouseCoopers LLP 225 South Sixth Street Suite 1400 Minneapolis, MN 55402 Telephone (612) 596 6000 |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Trustees of Thrivent Financial Securities Lending Trust:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Thrivent Financial Securities Lending Trust (the “Trust”) at October 31, 2008, the results of its operations for the year then ended, changes in its net assets for each of the two years in the period then ended and financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2008 by correspondence with the custodian, provide a reasonable basis for our opinion.

December 16, 2008

3

Thrivent Financial Securities Lending Trust

Schedule of Investments as of October 31, 2008

| | | | | |

Principal

Amount | | Commercial Paper (61.3%)a | | Value |

| Asset-Backed Commercial Paper (0.4%) | | | |

| $10,000,000 | | GOVCO, Inc. 2.600%, 1/28/2009 b | | $ | 9,936,444 |

| | | | | |

| | Total Asset-Backed Commercial Paper | | | 9,936,444 |

| | | | | |

| |

| Banking-Domestic (4.4%) | | | |

| | Branch Banking and Trust Company | | | |

| 100,415,000 | | 0.100%, 11/3/2008 | | | 100,415,000 |

| | J.P. Morgan Chase & Company | | | |

| 8,000,000 | | 2.740%, 12/8/2008 | | | 7,977,471 |

| | | | | |

| | Total Banking-Domestic | | | 108,392,471 |

| | | | | |

| |

| Banking-Foreign (6.2%) | | | |

| | BNP Paribas Financial | | | |

| 3,422,000 | | 0.250%, 11/3/2008 | | | 3,421,952 |

| | BNP Paribas Paris | | | |

| 100,000,000 | | 0.250%, 11/3/2008 | | | 100,000,001 |

| | DnB NORBank ASA | | | |

| 30,000,000 | | 2.700%, 12/22/2008 | | | 29,885,250 |

| | Svenska Handelsbanken AB | | | |

| 20,000,000 | | 3.250%, 5/26/2009c | | | 20,000,000 |

| | | | | |

| | Total Banking-Foreign | | | 153,307,203 |

| | | | | |

| |

| Consumer Cyclical (1.9%) | | | |

| | Toyota Credit Puerto Rico | | | |

| 6,000,000 | | 2.530%, 11/25/2008 | | | 5,989,880 |

| 30,000,000 | | 2.580%, 12/15/2008 | | | 29,905,400 |

| 10,000,000 | | 2.700%, 3/23/2009 | | | 9,893,500 |

| | | | | |

| | Total Consumer Cyclical | | | 45,788,780 |

| | | | | |

| |

| Education (3.8%) | | | |

| | Northwestern University | | | |

| 25,000,000 | | 2.600%, 11/17/2008 | | | 24,971,111 |

| | Yale University | | | |

| 25,000,000 | | 2.670%, 12/9/2008 | | | 24,929,542 |

| 24,000,000 | | 2.670%, 12/10/2008 | | | 23,930,580 |

| 20,000,000 | | 2.670%, 12/11/2008 | | | 19,940,667 |

| | | | | |

| | Total Education | | | 93,771,900 |

| | | | | |

| |

| Energy (1.0%) | | | |

| | Total Capital | | | |

| 25,000,000 | | 2.250%, 11/21/2008 | | | 24,968,750 |

| | | | | |

| | Total Energy | | | 24,968,750 |

| | | | | |

| |

| Finance (20.1%) | | | |

| | Barton Capital Corporation | | | |

| 10,000,000 | | 2.000%, 12/11/2008b | | | 9,977,778 |

| | Chariot Funding, LLC | | | |

| 20,970,000 | | 0.150%, 11/3/2008b | | | 20,969,825 |

| 19,250,000 | | 2.600%, 11/7/2008b | | | 19,241,658 |

| 18,633,000 | | 3.000%, 11/13/2008b | | | 18,614,367 |

| 30,000,000 | | 3.000%, 11/14/2008b | | | 29,967,501 |

| 11,858,000 | | 2.700%, 12/11/2008b | | | 11,822,426 |

| | Ciesco, LLC | | | |

| 30,000,000 | | 2.250%, 12/2/2008b | | | 29,941,875 |

| | Enterprise Funding Corporation | | | |

| 26,736,000 | | 2.897%, 11/18/2008b | | | 26,697,279 |

| 10,000,000 | | 2.760%, 11/19/2008b | | | 9,986,200 |

| | Falcon Asset Securitization Corporation | | | |

| 25,435,000 | | 3.200%, 11/18/2008b | | | 25,396,565 |

| 30,000,000 | | 3.100%, 11/19/2008b | | | 29,953,500 |

| | Jupiter Securitization Corporation | | | |

| 10,000,000 | | 0.200%, 11/3/2008b | | | 9,999,889 |

| 25,000,000 | | 3.700%, 11/12/2008b | | | 24,971,736 |

| 24,200,000 | | 3.000%, 11/19/2008b | | | 24,163,700 |

| 30,000,000 | | 3.100%, 11/20/2008b | | | 29,950,917 |

| | Old Line Funding Corporation | | | |

| 15,000,000 | | 2.600%, 2/20/2009b | | | 14,879,750 |

| | Ranger Funding Company | | | |

| 30,000,000 | | 2.720%, 12/9/2008b | | | 29,913,867 |

| | Thunder Bay Funding, Inc. | | | |

| 8,900,000 | | 3.200%, 11/18/2008b | | | 8,886,551 |

| 20,000,000 | | 2.000%, 12/3/2008b | | | 19,964,444 |

| 23,071,000 | | 2.000%, 12/4/2008b | | | 23,028,703 |

| 5,000,000 | | 2.780%, 12/15/2008b | | | 4,983,011 |

| | Victory Receivables Corporation | | | |

| 11,886,000 | | 2.900%, 11/12/2008b | | | 11,875,468 |

| | Yorktown Capital, LLC | | | |

| 30,000,000 | | 2.650%, 11/18/2008b | | | 29,962,458 |

| 30,000,000 | | 2.720%, 12/9/2008b | | | 29,913,867 |

| | | | | |

| | Total Finance | | | 495,063,335 |

| | | | | |

| |

| U.S. Government (21.8%) | | | |

| | Federal Home Loan Bank Discount Notes | | | |

| 30,000,000 | | 2.250%, 1/12/2009 | | | 29,865,000 |

| 6,000,000 | | 2.250%, 1/20/2009 | | | 5,970,000 |

| 13,255,000 | | 2.500%, 2/13/2009 | | | 13,159,269 |

| | Federal Home Loan Mortgage Corporation Discount Notes | | | |

| 25,000,000 | | 2.330%, 11/10/2008 | | | 24,985,438 |

| 15,000,000 | | 2.350%, 11/20/2008 | | | 14,981,396 |

| 25,000,000 | | 2.480%, 11/24/2008 | | | 24,960,389 |

| 25,000,000 | | 1.420%, 12/9/2008 | | | 24,962,528 |

| 22,500,000 | | 2.700%, 12/15/2008 | | | 22,425,750 |

| 5,000,000 | | 1.250%, 12/16/2008 | | | 4,992,187 |

| 7,500,000 | | 2.660%, 12/22/2008 | | | 7,471,738 |

| 25,000,000 | | 1.250%, 12/23/2008 | | | 24,954,861 |

| 60,000,000 | | 1.875%, 12/29/2008 | | | 59,818,749 |

| 32,980,000 | | 1.565%, 12/30/2008 | | | 32,895,435 |

| 4,929,000 | | 2.300%, 2/9/2009 | | | 4,897,509 |

| | Federal National Mortgage Association Discount Notes | | | |

| 25,000,000 | | 2.380%, 11/10/2008 | | | 24,985,125 |

| 60,000,000 | | 2.285%, 11/17/2008 | | | 59,939,066 |

| 3,475,000 | | 1.220%, 12/8/2008 | | | 3,470,643 |

| 38,650,000 | | 2.258%, 12/15/2008 | | | 38,543,321 |

| 30,000,000 | | 2.500%, 12/16/2008 | | | 29,906,250 |

| 7,500,000 | | 2.700%, 12/24/2008 | | | 7,470,188 |

| 25,000,000 | | 1.500%, 12/30/2008 | | | 24,938,542 |

| 25,000,000 | | 2.210%, 1/20/2009 | | | 24,877,222 |

| 12,047,000 | | 2.200%, 2/2/2009 | | | 11,978,533 |

| 15,000,000 | | 1.900%, 2/17/2009 | | | 14,914,500 |

| | | | | |

| | Total U.S. Government | | | 537,363,639 |

| | | | | |

| |

| U.S. Municipal (1.7%) | | | |

| | Alaska Housing Financing | | | |

| 15,197,000 | | 2.730%, 12/5/2008 | | | 15,157,817 |

| 16,211,000 | | 2.730%, 12/10/2008 | | | 16,163,056 |

The accompanying Notes to the Financial Statements are an integral part of this schedule.

4

Thrivent Financial Securities Lending Trust

Schedule of Investments as of October 31, 2008

| | | | | |

Principal

Amount | | Commercial Paper (61.3%)a | | Value |

| U.S. Municipal (1.7%) - continued | | | |

| | California State Public Works Board Lease Revenue Bonds | | | |

| $10,000,000 | | 2.800%, 11/12/2008 | | $ | 10,000,000 |

| | | | | |

| | Total U.S. Municipal | | | 41,320,873 |

| | | | | |

| | Total Commercial Paper | | | 1,509,913,395 |

| | | | | |

| | | | | | |

Principal Amount | | Variable Rate Notes (38.8%)a | | Value | |

| Banking-Domestic (15.4%) | | | | |

| | Bank of America Corporation | | | | |

| 10,000,000 | | 2.998%, 11/6/2008d | | | 10,000,000 | |

| | Bank of America NA | | | | |

| 15,000,000 | | 4.350%, 1/3/2009d | | | 15,000,000 | |

| | Bank of New York Company, Inc. | | | | |

| 25,000,000 | | 4.304%, 11/10/2008c,d | | | 24,999,968 | |

| 25,000,000 | | 4.578%, 11/10/2008c,d | | | 25,000,000 | |

| | Barclays Bank plc NY | | | | |

| 10,000,000 | | 3.253%, 11/12/2008d | | | 10,000,000 | |

| | Bear Stearns & Company, Inc. | | | | |

| 10,000,000 | | 3.852%, 12/30/2008b,d | | | 9,977,941 | |

| | Branch Banking and Trust Company | | | | |

| 10,000,000 | | 3.213%, 12/4/2008d | | | 10,000,000 | |

| | Deutsche Bank AG/NY | | | | |

| 20,000,000 | | 3.414%, 12/22/2008d | | | 20,000,000 | |

| | Deutsche Bank NY | | | | |

| 25,000,000 | | 2.961%, 11/21/2008d | | | 24,983,020 | |

| | J.P. Morgan Chase & Company | | | | |

| 10,000,000 | | 3.254%, 12/22/2008d | | | 10,001,164 | |

| | Rabobank Nederland NV/NY | | | | |

| 35,000,000 | | 2.784%, 11/17/2008c,d | | | 34,999,999 | |

| | Royal Bank of Canada NY | | | | |

| 15,000,000 | | 3.104%, 11/17/2008c,d | | | 15,000,000 | |

| 10,000,000 | | 3.215%, 1/2/2009d | | | 10,000,000 | |

| | US Bank NA | | | | |

| 30,000,000 | | 3.845%, 11/3/2008d | | | 30,000,000 | |

| | Wachovia Bank | | | | |

| 10,000,000 | | 2.990%, 11/25/2008d | | | 10,000,000 | |

| 10,000,000 | | 4.418%, 1/5/2009d | | | 10,000,000 | |

| | Wells Fargo & Company | | | | |

| 30,000,000 | | 0.380%, 11/3/2008d | | | 29,935,746 | |

| 20,000,000 | | 4.060%, 11/3/2008d | | | 20,003,900 | |

| 35,000,000 | | 4.428%, 11/18/2008d | | | 35,000,000 | |

| | Wells Fargo Bank NA | | | | |

| 25,000,000 | | 4.145%, 11/5/2008d | | | 25,000,000 | |

| | | | | | |

| | Total Banking-Domestic | | | 379,901,738 | |

| | | | | | |

| |

| Banking-Foreign (0.8%) | | | | |

| | ING Bank NV | | | | |

| 10,000,000 | | 3.726%, 12/29/2008c,d | | | 10,000,000 | |

| | Societe Generale | | | | |

| 10,000,000 | | 3.285%, 12/4/2008c,d | | | 10,000,000 | |

| | | | | | |

| | Total Banking-Foreign | | | 20,000,000 | |

| | | | | | |

| |

| Basic Industry (2.0%) | | | | |

| | BASF Finance Europe NV | | | | |

| 50,000,000 | | 4.513%, 12/19/2008c,d | | | 50,000,000 | |

| | | | | | |

| | Total Basic Industry | | | 50,000,000 | |

| | | | | | |

| |

| Brokerage (2.1%) | | | | |

| | Merrill Lynch & Company, Inc. | | | | |

| 30,000,000 | | 4.438%, 11/17/2008d | | | 30,000,000 | |

| 21,000,000 | | 3.435%, 11/21/2008d | | | 21,000,000 | |

| | | | | | |

| | Total Brokerage | | | 51,000,000 | |

| | | | | | |

| |

| Consumer Cyclical (6.4%) | | | | |

| | Acts Retirement-Life Communities, Inc. | | | | |

| 175,000 | | 8.000%, 11/6/2008b,d | | | 175,000 | |

| | American Honda Finance Corporation | | | | |

| 25,000,000 | | 2.924%, 11/5/2008c,d | | | 25,000,000 | |

| 10,000,000 | | 2.924%, 11/5/2008c,d | | | 10,000,000 | |

| 7,000,000 | | 2.910%, 11/20/2008c,d | | | 7,000,000 | |

| 25,000,000 | | 2.961%, 11/26/2008c,d | | | 25,000,000 | |

| 10,000,000 | | 4.949%, 1/14/2009c,d | | | 10,000,000 | |

| | Toyota Motor Credit Corporation | | | | |

| 30,000,000 | | 0.740%, 11/3/2008d | | | 30,000,000 | |

| 25,000,000 | | 0.800%, 11/3/2008d | | | 25,000,000 | |

| 25,000,000 | | 0.800%, 11/3/2008d | | | 25,000,000 | |

| | | | | | |

| | Total Consumer Cyclical | | | 157,175,000 | |

| | | | | | |

| |

| Consumer Non-Cyclical (0.5%) | | | | |

| | Procter & Gamble Company | | | | |

| 12,000,000 | | 2.844%, 12/9/2008d | | | 12,000,000 | |

| | | | | | |

| | Total Consumer Non-Cyclical | | | 12,000,000 | |

| | | | | | |

| |

| Finance (4.5%) | | | | |

| | General Electric Capital Corporation | | | | |

| 30,000,000 | | 0.400%, 11/3/2008d | | | 30,003,260 | |

| 25,000,000 | | 4.160%, 11/10/2008d | | | 25,000,000 | |

| 25,000,000 | | 3.315%, 11/24/2008d | | | 25,000,000 | |

| | Procter & Gamble International Funding SCA | | | | |

| 30,000,000 | | 3.029%, 11/19/2008d | | | 30,068,710 | |

| | | | | | |

| | Total Finance | | | 110,071,970 | |

| | | | | | |

| |

| Insurance (0.6%) | | | | |

| | Allstate Life Global Funding Trust | | | | |

| 15,000,000 | | 3.454%, 12/22/2008d | | | 15,000,000 | |

| | | | | | |

| | Total Insurance | | | 15,000,000 | |

| | | | | | |

| |

| U.S. Government (6.5%) | | | | |

| | Federal Home Loan Bank | | | | |

| 30,000,000 | | 0.580%, 11/3/2008d | | | 30,000,000 | |

| 30,000,000 | | 0.665%, 11/3/2008d | | | 30,000,001 | |

| 30,000,000 | | 0.850%, 11/3/2008d | | | 30,000,000 | |

| 15,000,000 | | 4.038%, 1/5/2009d | | | 14,998,966 | |

| | Federal Home Loan Mortgage Corporation | | | | |

| 30,000,000 | | 3.306%, 12/26/2008d | | | 29,996,823 | |

| | Federal National Mortgage Association | | | | |

| 25,000,000 | | 3.306%, 12/26/2008d | | | 25,072,402 | |

| | | | | | |

| | Total U.S. Government | | | 160,068,192 | |

| | | | | | |

| | Total Variable Rate Notes | | | 955,216,900 | |

| | | | | | |

| | Total Investments (at amortized cost) 100.1% | | $ | 2,465,130,295 | |

| | | | | | |

| | Other Assets and Liabilities, Net (0.1)% | | | (3,231,547 | ) |

| | | | | | |

| | Total Net Assets 100.0% | | $ | 2,461,898,748 | |

| | | | | | |

The accompanying Notes to the Financial Statements are an integral part of this schedule.

5

Thrivent Financial Securities Lending Trust

Schedule of Investments as of October 31, 2008

| a | The interest rate shown reflects the yield, coupon rate or, for securities purchased at a discount, the discount rate at the date of purchase. |

| b | Denotes investments that benefit from credit enhancement or liquidity support provided by a third party bank or institution. |

| c | Denotes securities sold under Rule 144A of the Securities Act of 1933, which exempts them from registration. These securities have been determined to be liquid under the guidelines established by the Fund’s Board of Trustees and may be resold to other dealers in the program or to other qualified institutional buyers. As of October 31, 2008, the value of these investments was $266,999,967 or 10.8% of total net assets. |

| d | Denotes variable rate obligations for which the current yield and next scheduled reset date are shown. |

| | | |

Cost for federal income tax purposes | | $ | 2,465,130,295 |

The accompanying Notes to Financial Statements are an integral part of this schedule.

6

Thrivent Financial Securities Lending Trust

Statement of Assets and Liabilities

| | | | |

As of October 31, 2008 | | Securities

Lending Trust | |

Assets | | | | |

Investments at cost | | $ | 2,465,130,295 | |

Investments in securities at market value | | | 2,465,130,295 | |

Investments at Market Value | | | 2,465,130,295 | a |

| |

Cash | | | 2,394 | |

Dividends and interest receivable | | | 3,416,176 | |

Prepaid expenses | | | 13,561 | |

Total Assets | | | 2,468,562,426 | |

| |

Liabilities | | | | |

Distributions payable | | | 6,509,003 | |

Accrued expenses | | | 43,223 | |

Payable to affiliate | | | 111,452 | |

Total Liabilities | | | 6,663,678 | |

| |

Net Assets | | | | |

Capital stock (beneficial interest) | | | 2,461,820,225 | |

Accumulated undistributed net realized gain/(loss) | | | 78,523 | |

Total Net Assets | | $ | 2,461,898,748 | |

| |

Shares of beneficial interest outstanding | | | 2,461,820,225 | |

| |

Net asset value per share | | $ | 1.00 | |

a | Securities held by this fund are valued on the basis of amortized cost, which approximates market value. |

The accompanying Notes to Financial Statements are an integral part of this schedule.

7

Thrivent Financial Securities Lending Trust

Statement of Operations

| | | | |

For the year ended October 31, 2008 | | Securities

Lending Trust | |

Investment Income | | | | |

Dividends | | $ | 7,568,416 | |

Taxable interest | | | 157,809,150 | |

Total Investment Income | | | 165,377,566 | |

| |

Expenses | | | | |

Adviser fees | | | 2,185,411 | |

Accounting and pricing fees | | | 54,730 | |

Audit and legal fees | | | 23,957 | |

Custody fees | | | 121,237 | |

Insurance expenses | | | 31,870 | |

Printing and postage expenses | | | 3,354 | |

Transfer agent fees | | | 39,087 | |

Directors’ fees | | | 2,315 | |

Other expenses | | | 19,527 | |

Total Expenses Before Reimbursement | | | 2,481,488 | |

| |

Less: | | | | |

Reimbursement from adviser | | | (45,968 | ) |

Custody earnings credit | | | (11,440 | ) |

Total Net Expenses | | | 2,424,080 | |

| |

Net Investment Income/(Loss) | | | 162,953,486 | |

| |

Realized and Unrealized Gains/(Losses) | | | | |

Net realized gains/(losses) on: | | | | |

Investments | | | (11,491,113 | ) |

Net increase from payments by affiliates | | | 11,570,196 | |

| |

Net Realized and Unrealized Gains/(Losses) | | | 79,083 | |

| |

Net Increase/(Decrease) in Net Assets Resulting From Operations | | $ | 163,032,569 | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

8

Thrivent Financial Securities Lending Trust

Statement of Changes in Net Assets

| | | | | | | | |

| | | Securities Lending Trust | |

For the periods ended | | 10/31/2008 | | | 10/31/2007 | |

Operations | | | | | | | | |

Net investment income/(loss) | | $ | 162,953,486 | | | $ | 240,254,977 | |

Net realized gains/(losses) | | | 79,083 | | | | (304 | ) |

Net Change in Net Assets Resulting From Operations | | | 163,032,569 | | | | 240,254,673 | |

| | |

Distributions to Shareholders | | | | | | | | |

From net investment income | | | (162,953,486 | ) | | | (240,254,975 | ) |

Total Distributions to Shareholders | | | (162,953,486 | ) | | | (240,254,975 | ) |

| | |

Capital Stock Transactions | | | | | | | | |

Sold | | | 19,268,663,607 | | | | 26,503,576,886 | |

Redeemed | | | (21,857,953,773 | ) | | | (25,573,445,553 | ) |

Capital Stock Transactions | | | (2,589,290,166 | ) | | | 930,131,333 | |

| | |

Net Increase/(Decrease) in Net Assets | | | (2,589,211,083 | ) | | | 930,131,031 | |

| | |

Net Assets, Beginning of Period | | | 5,051,109,831 | | | | 4,120,978,800 | |

| | |

Net Assets, End of Period | | $ | 2,461,898,748 | | | $ | 5,051,109,831 | |

| | |

Capital Stock Share Transactions | | | | | | | | |

Sold | | | 19,268,663,607 | | | | 26,503,576,886 | |

Redeemed | | | (21,857,953,773 | ) | | | (25,573,445,553 | ) |

| | | | | | | | |

Total Capital Stock Share Transactions | | | (2,589,290,166 | ) | | | 930,131,333 | |

| | | | | | | | |

The accompanying Notes to Financial Statements are an integral part of this schedule.

9

Thrivent Financial Securities Lending Trust

Notes to Financial Statements

As of October 31, 2008

(1) ORGANIZATION

Thrivent Financial Securities Lending Trust (the “Trust”) was organized as a Massachusetts Business Trust on August 4, 2004 and is registered as an open-end management investment company under the Investment Company Act of 1940 (the “1940 Act”). The Trust commenced operations on September 16, 2004. All transactions in the Trust are with affiliates of the Trust.

Under the Trust’s organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust enters into contracts with vendors and others that provide general damage clauses. The Trust’s maximum exposure under these contracts is unknown, as this would involve future claims that may be made against the Trust. However, based on experience, the Trust expects the risk of loss to be remote.

(2) SIGNIFICANT ACCOUNTING POLICIES

(A) Valuation of Investments – Securities are valued on the basis of amortized cost (which approximates value), whereby a portfolio security is valued at its cost initially, and thereafter valued to reflect a constant amortization to maturity of any discount or premium. The market values of the securities held in the Trust are determined once per week using prices supplied by the Trust’s independent pricing service. Investments in open-ended mutual funds are valued at the net asset value at the close of each business day.

(B) Federal Income Taxes – The Trust intends to comply with the requirements of the Internal Revenue Code which are applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. The Trust, accordingly, anticipates paying no Federal income taxes and therefore no Federal income tax provision was recorded.

In June 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48 – Accounting for Uncertainty in Income Taxes (FIN 48), an interpretation of FASB Statement 109 that requires additional disclosures with respect to the tax effects of certain income tax positions, whether those positions were taken on previously filed tax returns or are expected to be taken on future returns. These positions must meet a “more likely than not” standard that, based on the technical merits of the position, would have a greater than 50 percent likelihood of being sustained upon examination. In evaluating whether a tax position has met the more likely-than-not recognition threshold, management of the Trust must presume that the position will be examined by the appropriate taxing authority that has full knowledge of all relevant information. The Trust adopted the provisions of FIN 48 on April 30, 2008, as required by the U.S. Securities and Exchange Commission for mutual funds.

FIN 48 requires management of the Trust to analyze all open tax years, as defined by the statute of limitations, for all major jurisdictions. Open tax years are those that are open for examination by taxing authorities. Major jurisdictions for the Trust include Federal, Minnesota, Wisconsin, and Massachusetts, as well as certain foreign countries. As of October 31, 2008, open Federal, Minnesota, Wisconsin and Massachusetts tax years include the tax years ended October 31, 2005 through 2008. The Trust has no examinations in progress and none are expected at this time.

As of October 31, 2008, management of the Trust has reviewed all open tax years and major jurisdictions and concluded that the adoption of FIN 48 resulted in no effect to the Trust’s tax liability, financial position or results of operations. There is no tax liability resulting from unrecognized tax benefits related to uncertain income tax positions taken or expected to be taken in future tax returns. The Trust is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next 12 months.

(C) Recent Accounting Pronouncements – In September 2006, the FASB issued FASB Statement No. 157 – Fair Value Measurements (FAS 157). The objective of this statement is to improve the consistency and comparability of fair value measurements used in financial reporting. FAS 157 defines fair value, establishes a framework for measuring fair value in accounting principles generally accepted in the United States (“US GAAP”), and expands disclosures about fair value measurements. FAS 157 is effective for fiscal years beginning after November 15, 2007. Management of the Trust is currently evaluating the impact that FAS 157 will have on the Trust’s financial statements.

(D) Custody Earnings Credit – The Trust has a deposit arrangement with the custodian whereby interest earned on uninvested cash balances is used to pay a portion of custodian fees. This deposit arrangement is an alternative to overnight investments. Earnings credits are shown as a reduction of total expenses on the Statement of Operations.

(E) Distributions to Shareholders – Net investment income is distributed to each shareholder as a dividend. Dividends from the Trust are declared daily and distributed monthly. Net realized gains from securities transactions, if any, are distributed at least annually after the close of the fiscal year.

(F) Accounting Estimates – The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

10

Thrivent Financial Securities Lending Trust

Notes to Financial Statements

As of October 31, 2008

(2) SIGNIFICANT ACCOUNTING POLICIES (continued)

(G) Other – For financial statement purposes, investment security transactions are accounted for on the trade date. Interest income is recognized on an accrual basis. Discount and premium are amortized over the life of the respective securities on the interest method. Realized gains or losses on sales are determined on a specific cost identification basis. U.S. GAAP requires permanent financial reporting and tax differences to be reclassified to trust capital. No reclassifications were necessary at October 31, 2008.

(3) FEES AND COMPENSATION PAID TO AFFILIATES

(A) Investment Advisory Fees – The Trust has entered into an Investment Advisory Agreement with Thrivent Financial for Lutherans (“Thrivent Financial” or the “Adviser”) under which the Trust pays a fee for investment advisory services. The annual rate of fees under the Investment Advisory Agreement is calculated at 0.045% of the average daily net assets of the Trust.

The Adviser has agreed to voluntarily reimburse the Trust for all expenses in excess of 0.05% of average daily net assets. This voluntary expense reimbursement may be discontinued at any time.

(B) Other Fees – The Trust has entered into an administrative contract with Thrivent Financial pursuant to which Thrivent Financial provides certain accounting personnel and services. For the year ended October 31, 2008, Thrivent Financial received aggregate fees for accounting personnel and services of $51,504 from the Trust.

Each Trustee who is not affiliated with the Adviser receives an annual fee from the Trust for services as a Trustee and is eligible to participate in a deferred compensation plan with respect to these fees. Each participant’s deferred compensation account will increase or decrease as if it were invested in shares of a particular Thrivent Mutual Fund.

Trustees not participating in the above plan received $1,697 in fees from the Trust for the year ended October 31, 2008. No remuneration has been paid by the Trust to any of the officers or affiliated Trustees of the Trust. In addition, the Trust reimbursed certain reasonable expenses incurred in relation to attendance at the meetings.

(C) Indirect Expenses – The Trust may invest in other mutual funds. Fees and expenses of those underlying funds are not included in the Trust’s expense ratio. The Trust indirectly bears its proportionate share of the annualized weighted average expense ratio for the underlying funds in which it invests.

(4) OTHER TRANSACTIONS WITH AFFILIATES

On September 15, 2008, the Adviser purchased $17,800,196 of the Fund’s securities at amortized cost. The Fund realized a loss of $11,570,196 for the difference between the amortized cost of the securities and the market value as of that date, but at the same time also recognized a loss recovery in the same amount. In the accompanying Statement of Operations, the loss is reflected in “Net realized gains/(losses) on Investments,” and the loss recovery is reflected in “Net increase from payments by affiliate.” There was no impact to the total return as a result of this transaction.

(5) FEDERAL INCOME TAX INFORMATION

Distributions are based on amounts calculated in accordance with the applicable federal income tax regulations, which may differ from U.S. GAAP. To the extent that these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal tax-basis treatment; temporary differences do not require reclassifications.

During the year ended October 31, 2008, and the year ended October 31, 2007, the Trust distributed $162,953,486 and $240,254,975 from ordinary income, respectively. At October 31, 2008, undistributed ordinary income for tax purposes was $85,379. Also at October 31, 2008, the Trust utilized a $560 capital loss carryover.

11

Thrivent Financial Securities Lending Trust

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | |

| | | FOR A SHARE OUSTANDING THROUGHOUT EACH PERIOD* | |

| | | | | Income from Investment Operations | | Less Distributions

From | | | |

| | | Net Asset

Value,

Beginning of

Period | | Net

Investment

Income/(Loss) | | Net Realized

and Unrealized

Gain/(Loss) on

Investments(a) | | Total from

Investment

Operations | | Net

Investment

Income | | | Net Realized

Gain on

Investments | | Total

Distributions | |

| SECURITIES LENDING TRUST | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended 10/31/2008 | | $ | 1.00 | | $ | 0.03 | | $ | — | | $ | 0.03 | | $ | (0.03 | ) | | $ | — | | $ | (0.03 | ) |

Year Ended 10/31/2007 | | | 1.00 | | | 0.05 | | | — | | | 0.05 | | | (0.05 | ) | | | — | | | (0.05 | ) |

Year Ended 10/31/2006 | | | 1.00 | | | 0.05 | | | — | | | 0.05 | | | (0.05 | ) | | | — | | | (0.05 | ) |

Year Ended 10/31/2005 | | | 1.00 | | | 0.03 | | | — | | | 0.03 | | | (0.03 | ) | | | — | | | (0.03 | ) |

Year Ended 10/31/2004(c) | | | 1.00 | | | — | | | — | | | — | | | — | | | | — | | | — | |

(a) | The amount shown may not correlate with the change in aggregate gains and losses of portfolio securities due to the timing of sales and redemptions of fund shares. |

(c) | Since inception, September 16, 2004. |

| * | All per share amounts have been rounded to the nearest cent. |

The accompanying Notes to the Financial Statements are an integral part of this schedule.

12

Thrivent Financial Securities Lending Trust

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | |

| | | RATIOS / SUPPLEMENTAL DATA |

| | | | | | | | Ratio to Average Net Assets** | | | Ratios to Average Net Assets

Before Expenses Waived,

Credited or Paid Indirectly** | | | |

Net Asset Value, End of

Period | | Total

Return(b) | | | Net Assets, End of

Period (in

millions) | | Expenses | | | Net Investment

Income/(Loss) | | | Expenses | | | Net Investment

Income/(Loss) | | | Portfolio

Turnover Rate |

| $ | 1.00 | | 3.38 | % | | $ | 2,461.9 | | 0.05 | % | | 3.36 | % | | 0.05 | % | | 3.36 | % | | N/A |

| | 1.00 | | 5.46 | % | | | 5,051.1 | | 0.05 | % | | 5.33 | % | | 0.05 | % | | 5.33 | % | | N/A |

| | 1.00 | | 4.93 | % | | | 4,121.0 | | 0.05 | % | | 4.82 | % | | 0.05 | % | | 4.82 | % | | N/A |

| | 1.00 | | 2.91 | % | | | 3,864.6 | | 0.05 | % | | 2.89 | % | | 0.05 | % | | 2.89 | % | | N/A |

| | 1.00 | | 0.22 | % | | | 3,942.3 | | 0.05 | % | | 1.80 | % | | 0.05 | % | | 1.80 | % | | N/A |

(b) | Total investment return assumes dividend reinvestment and does not reflect any deduction for sales charges. Not annualized for periods less than one year. |

| ** | Computed on an annualized basis for periods less than one year. |

The accompanying Notes to the Financial Statements are an integral part of this schedule.

13

Additional Information

(unaudited)

PROXY VOTING

The policies and procedures that the Trust uses to determine how to vote proxies relating to portfolio securities are attached to the Trust’s Statement of Additional Information. You may request a free copy of the Statement of Additional Information or the report of how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 by calling 1-800-847-4836. You also may review the Statement of Additional Information or the report of how the Trust voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 at the SEC web site (www.sec.gov).

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS

The Trust files its Schedule of Portfolio Holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. You may request a free copy of the Trust’s Forms N-Q by calling 1-800-847-4836. The Trust’s Forms N-Q also are available on the SEC web site (www.sec.gov). You also may review and copy the Forms N-Q for the Trust at the SEC’s Public Reference Room in Washington, DC. You may get information about the operation of the Public Reference Room by calling 1-800-SEC-0330.

14

Board of Trustees and Officers

The following table provides information about the Trustees and Officers of the Trust. In addition to serving as a Trustee of the Trust, each Trustee also serves as:

| | Ÿ | | Director of Thrivent Series Fund, Inc., a registered investment company consisting of 41 portfolios that serve as underlying funds for variable contracts issued by Thrivent Financial for Lutherans (“Thrivent Financial”) and Thrivent Life Insurance Company and investment options in the retirement plan offered by Thrivent Financial; and |

| | Ÿ | | Trustee of Thrivent Mutual Funds, a registered investment company consisting of 29 series. |

The 29 series of Thrivent Mutual Funds, 41 portfolios of Thrivent Series Fund, Inc. and Thrivent Financial Securities Lending Trust are referred to herein as the “Fund Complex.” The Statement of Additional Information includes additional information about the Trustees and is available, without charge, by calling 1-800-847-4836.

Interested Trustee (1)

| | | | | | | | |

Name, Address and Age | | Position

with Trust and

Length of Service (2) | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee | | Principal Occupation

During the Past 5 Years | | Other Directorships

Held by Trustee |

Pamela J. Moret 625 Fourth Avenue South Minneapolis, MN Age 52 | | President from 2004 until

November 2008; Trustee

from 2004 until

December 2008 | | 71 | | Executive Vice

President, Strategic

Development, Thrivent

Financial since 2008;

Executive Vice

President, Marketing

and Products, Thrivent

Financial from 2002

until 2008 | | Director, American Public

Media and affiliates;

Director, Luther Seminary |

Independent Trustees (3) |

Name, Address and Age | | Position

with Trust and

Length of Service (2) | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee | | Principal Occupation

During the Past 5 Years | | Other Directorships

Held by Trustee |

F. Gregory Campbell 625 Fourth Avenue South Minneapolis, MN Age 68 | | Trustee since 2004 | | 71 | | President, Carthage

College | | Director, Optique Funds,

Inc., an investment

company consisting of

four portfolios; Director,

Kenosha Hospital and

Medical Center Board;

Director, Prairie School

Board; Director, United

Health Systems Board |

15

Board of Trustees and Officers

| | | | | | | | |

Name, Address and Age | | Position

with Trust and

Length of Service (2) | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee | | Principal Occupation

During the Past 5 Years | | Other Directorships

Held by Trustee |

Herbert F. Eggerding, Jr. 625 Fourth Avenue South Minneapolis, MN Age 71 | | Trustee since 2004 | | 71 | | Management consultant to

several privately owned

companies | | None |

| | | | |

Noel K. Estenson 625 Fourth Avenue South Minneapolis, MN Age 69 | | Trustee since 2004 | | 71 | | Retired | | None |

| | | | |

Richard L. Gady 625 Fourth Avenue South Minneapolis, MN Age 65 | | Trustee since 2004 | | 71 | | Retired; previously Vice

President, Public Affairs

and Chief Economist,

ConAgra, Inc.

(agribusiness) | | None |

| | | | |

Richard A. Hauser 625 Fourth Avenue South Minneapolis, MN Age 65 | | Trustee since 2004 | | 71 | | Vice President and

Assistant General

Counsel, Boeing Company

since 2007; President,

National Legal Center for

the Public Interest from

2004 to 2007; General

Counsel U.S. Department

of Housing and Urban

Development from 2001

to 2004; Partner, Baker &

Hostetler, from 1986 to

2001 | | None |

| | | | |

Connie M. Levi 625 Fourth Avenue South Minneapolis, MN Age 69 | | Chairperson beginning in

2009; Trustee since 2004 | | 71 | | Retired | | None |

| | | | |

Douglas D. Sims 625 Fourth Avenue South Minneapolis, MN Age 62 | | Trustee since 2006 | | 71 | | Retired; previously Chief

Executive Officer of

CoBank from 1994 to

2006 | | Director, Keystone

Neighborhood Company;

Director, Center for

Corporate Excellence |

| | | | |

Edward W. Smeds 625 Fourth Avenue South Minneapolis, MN Age 72 | | Chairman and Trustee

from 2004 until

December 2008 | | 71 | | Retired | | Chairman of Carthage

College Board |

16

Board of Trustees and Officers

| | | | | | | | |

Name, Address and Age | | Position

with Trust and

Length of Service (2) | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee | | Principal Occupation

During the Past 5 Years | | Other Directorships

Held by Trustee |

Constance L. Souders 625 Fourth Avenue South Minneapolis, MN Age 58 | | Trustee since 2007 | | 71 | | Retired; previously

Director from 1983 to

September 30, 2007,

Executive Vice President

from 2001 to 2007, AML

Compliance Officer from

2003 to 2007, Chief

Financial Officer from

2000 to 2005, Chief

Administrative Officer

from 2000 to 2005 and

Treasurer from 1992 to

2005 of Harbor Capital

Advisors, Inc.; Director

from 1992 to 2007,

President from 2000 to

2007 and AML

Compliance Officer from

2003 to 2007 of Harbor

Services Group, Inc.;

Director from 1992 to

2007, Executive Vice

President from 2001 to

2007, Chief Compliance

Officer from 2004 to

2007, AML Compliance

Officer from 2003 to

2007, Supervisory

Registered Principal

from 2000 to 2007,

Interim President from

2002 to 2003, Treasurer

from 2000 to 2005 and

Secretary from 2000 to

2005 of Harbor Funds

Distributors, Inc.;

Vice President from

2000 to 2007, Chief

Financial Officer from

2000 to 2005 and

Treasurer from 1992 to

2005 of Harbor Funds | | None |

17

Board of Trustees and Officers

Executive Officers

| | | | |

| | |

Name, Address and Age | | Position with Trust and Length of Service (2) | | Principal Occupation During the Past 5 Years |

Pamela J. Moret 625 Fourth Avenue South Minneapolis, MN Age 52 | | President from 2004 until November 2008 | | Executive Vice President, Strategic Development, Thrivent Financial since 2008; Executive Vice President, Marketing and Products, Thrivent Financial from 2002 until 2008 |

| | |

Russell W. Swansen 625 Fourth Avenue South Minneapolis, MN Age 51 | | President since November 2008; previously, Vice President since 2004 | | Senior Vice President and Chief Investment Officer, Thrivent Financial since 2004; Managing Director, Colonnade Advisors LLC from 2001 to 2003 |

| | |

David S. Royal 625 Fourth Avenue South Minneapolis, MN Age 37 | | Secretary and Chief Legal Officer since 2006 | | Vice President — Asset Management, Thrivent Financial since 2006; Partner, Kirkland & Ellis LLP from 2004 to 2006; Associate, Skadden, Arps, Slate, Meagher & Flom LLP from 1997 to 2004 |

| | |

Katie S. Kloster 625 Fourth Avenue South Minneapolis, MN Age 43 | | Vice President Investment Company and Investment Adviser Chief Compliance Officer since 2004 | | Vice President and IC and IA Chief Compliance Officer, Thrivent Financial since 2004; Vice President and Controller, Thrivent Financial from 2001 to 2004 |

| | |

Gerard V. Vaillancourt 625 Fourth Avenue South Minneapolis, MN Age 41 | | Treasurer and Principal Financial Officer since 2005 | | Vice President, Mutual Fund Accounting since 2006; Head of Mutual Fund Accounting, Thrivent Financial from 2005 to 2006; Director, Fund Accounting Administration, Thrivent Financial from 2002 to 2005 |

| | |

Janice M. Guimond 625 Fourth Avenue South Minneapolis, MN Age 44 | | Vice President since 2005 | | Vice President, Investment Operations, Thrivent Financial since 2003; Manager of Portfolio Reporting, Thrivent Financial from 2003 to 2004; Independent Consultant from 2001 to 2003 |

| | |

Karl D. Anderson 625 Fourth Avenue South Minneapolis, MN Age 47 | | Vice President since 2006 | | Vice President, Products, Thrivent Financial |

| | |

Brian W. Picard 4321 North Ballard Road Appleton, WI Age 38 | | Vice President and Anti-Money Laundering Officer since 2006 | | Director, FSO Compliance Corp. BCM, Thrivent Financial since 2006; Manager, Field and Securities Compliance, Thrivent Financial from 2002 to 2006 |

| | |

Kenneth L. Kirchner 4321 North Ballard Road Appleton, WI Age 42 | | Assistant Vice President since 2005 | | Director, Mutual Funds Operations, Thrivent Financial since 2004; Manager, Shareholder Services, Thrivent Financial from 2003 to 2004 |

| | |

Mark D. Anema 625 Fourth Avenue South Minneapolis, MN Age 47 | | Assistant Vice President since 2007 | | Vice President, Accumulation and Retirement Income Solutions, Thrivent Financial since 2007; Vice President, Strategic Planning, Thrivent Financial from 2004 to 2007; Insurance Practice Engagement Manager, McKinsey and Company from 1999 to 2004 |

18

Board of Trustees and Officers

| | | | |

| | |

Name, Address and Age | | Position with Trust and Length of Service (2) | | Principal Occupation During the Past 5 Years |

James M. Odland 625 Fourth Avenue South Minneapolis, MN Age 53 | | Assistant Secretary since 2006 | | Vice President, Office of the General Counsel, Thrivent Financial since 2005; Senior Securities Counsel, Allianz Life Insurance Company from January 2005 to August 2005; Vice President and Chief Legal Officer, Woodbury Financial Services, Inc. from September 2003 to January 2005; Vice President and Group Counsel, Corporate Practice Group, American Express Financial Advisors, Inc. from 2001 to 2003 |

| | |

John L. Sullivan 625 Fourth Avenue South Minneapolis, MN Age 37 | | Assistant Secretary since 2007 | | Senior Counsel, Thrivent Financial since 2007; Senior Counsel, Division of Investment Management of the Securities and Exchange Commission from 2000 to 2007 |

| | |

Todd J. Kelly 4321 North Ballard Road Appleton, WI Age 39 | | Assistant Treasurer since 2004 | | Director, Fund Accounting Operations, Thrivent Financial |

| | |

Sarah L. Bergstrom 625 Fourth Avenue South Minneapolis, MN Age 31 | | Assistant Treasurer since 2007 | | Director, Fund Accounting Administration, Thrivent Financial since 2007; Manager, Fund Accounting Administration, Thrivent Financial from 2005 to 2007; Manager, Mutual Fund Tax Reporting, Thrivent Financial from 2004 to 2005; Supervisor, Mutual Fund Tax Reporting, Thrivent Financial from 2002 to 2004 |

| (1) | “Interested person” of the Trust as defined in the 1940 Act by virtue of positions with Thrivent Financial. Ms. Moret is considered an interested person because of her principal occupation with Thrivent Financial. |

| (2) | Each Trustee generally serves an indefinite term until her or his successor is duly elected and qualified. Officers serve at the discretion of the board until their successors are duly appointed and qualified. |

| (3) | The Trustees other than Ms. Moret are not “interested persons” of the Trust and are referred to as “Independent Trustees.” |

19

This report is submitted for the information of shareholders of

Thrivent Financial Securities Lending Trust. It is not authorized for

distribution to prospective investors unless preceded or accompanied

by the current prospectus for Thrivent Financial Securities Lending

Trust, which contains more complete information about the Trust,

including investment objectives, risks, charges and expenses.

Item 2. Code of Ethics

As of the end of the period covered by this report, registrant has adopted a code of ethics (as defined in Item 2 of Form N-CSR) applicable to registrant’s Principal Executive Officer, Principal Financial Officer and Principal Accounting Officer. No waivers were granted to such code of ethics during the period covered by this report. A copy of this code of ethics is filed as an exhibit to this Form N-CSR.

Item 3. Audit Committee Financial Expert

Registrant’s Board of Trustees has determined that Herbert F. Eggerding, Jr., an independent trustee, is the Audit Committee Financial Expert.

Item 4. Principal Accountant Fees and Services

The aggregate fees billed by registrant’s independent public accountants, PricewaterhouseCoopers LLP (“PwC”), for each of the last two fiscal years for professional services rendered in connection with the audit of registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $13,353 for the year ended October 31, 2007 and $0 for the year ended October 31, 2008. The $0 in audit fees for the fiscal year ended October 31, 2008 is the result of a change in PwC’s billing cycle.

The aggregate fees PwC billed to registrant for each of the last two fiscal years for assurance and other services that are reasonably related to the performance of registrant’s audit and are not reported under Item 4(a) were $0 for the year ended October 31, 2007 and $0 for the year ended October 31, 2008. The aggregate fees PwC billed to registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser for assurance and other services directly related to the operations and financial reporting of registrant were $0 for the year ended October 31, 2007 and $0 for the year ended October 31, 2008.

The aggregate tax fees PwC billed to registrant for each of the last two fiscal years for tax compliance, tax advice and tax planning services were $4,490 for the year ended October 31, 2007 and $5,311.01 for the year ended October 31, 2008. The aggregate tax fees PwC billed to registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser for services directly related to the operations and financial reporting of registrant were $0 for the year ended October 31, 2007 and $0 for the year ended October 31, 2008.

The aggregate fees PwC billed to registrant for each of the last two fiscal years for products and services provided, other than the services reported in paragraphs (a) through (c) of this item, were $0 for the years ended October 31, 2007 and October 31, 2008. The aggregate fees PwC billed to registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser for products and services provided, other than the services reported in paragraphs (a) through (c) of this item, were $0 for the years ended October 31, 2007 and October 31, 2008.

| | (e) | Registrant’s audit committee charter, adopted in August 2004, provides that the audit committee (comprised of the independent Trustees of registrant) is responsible for pre-approval of all auditing services performed for the registrant. The audit committee also is responsible for pre-approval (subject to the de minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Securities Exchange Act of 1934) of all non-auditing services performed for the registrant or an affiliate of registrant. In addition, registrant’s audit committee charter permits a designated member of the audit committee to pre-approve, between meetings, one or more audit or non-audit service projects, subject to an expense limit and notification to the audit committee at the next committee meeting. Registrant’s audit committee pre-approved all fees described above that PwC billed to registrant. |

| | (f) | Less than 50% of the hours billed by PwC for auditing services to registrant for the fiscal year ended October 31, 2008 was for work performed by persons other than full-time permanent employees of PwC. |

| | (g) | The aggregate non-audit fees billed by PwC to registrant and to registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser for the fiscal years ending October 31, 2007 and October 31, 2008 were $1,582 and $1,500 respectively. |

| | (h) | Registrant’s audit committee has considered the non-audit services provided to the registrant and registrant’s investment adviser and any entity controlling, controlled by, or under common control with registrant’s investment adviser as described above and determined that these services do not compromise PwC’s independence. |

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

| | (a) | Registrant’s Schedule of Investments is included in the report to shareholders filed under Item 1. |

| | (b) | Not applicable to this filing. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders

There have been no material changes to the procedures by which shareholders may recommend nominees to registrant’s board of trustees.

Item 11. Controls and Procedures

(a)(i) Registrant’s President and Treasurer have concluded that registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) are effective, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) Registrant’s President and Treasurer are aware of no change in registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, registrant’s internal control over financial reporting.

Item 12. Exhibits

| | (a) | The code of ethics pursuant to Item 2 is attached hereto. |

| | (b) | Certifications pursuant to Rules 30a-2(a) and 30a-2(b) under the Investment Company Act of 1940 are attached hereto. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | |

Date: December 29, 2008 | | | | THRIVENT FINANCIAL SECURITIES LENDING TRUST |

| | | | | | |

| | | | By: | | /s/ Russell W. Swansen |

| | | | | | Russell W. Swansen |

| | | | | | President |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | | | | | |

Date: December 29, 2008 | | | | | | |

| | | | By: | | /s/ Russell W. Swansen |

| | | | | | Russell W. Swansen |

| | | | | | President |

| | | |

Date: December 29, 2008 | | | | | | |

| | | | By: | | /s/ Gerard V. Vaillancourt |

| | | | | | Gerard V. Vaillancourt |

| | | | | | Treasurer |