Exhibit 99.1

Contents

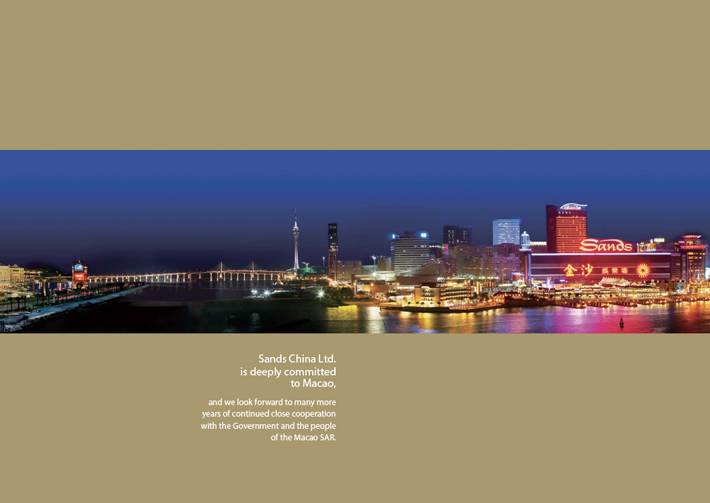

Sands China Ltd.

Overview

Introduction

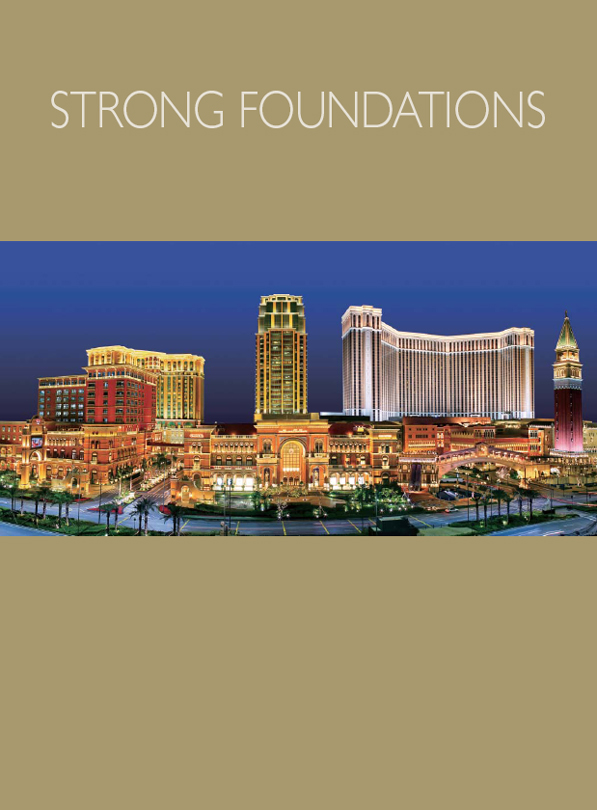

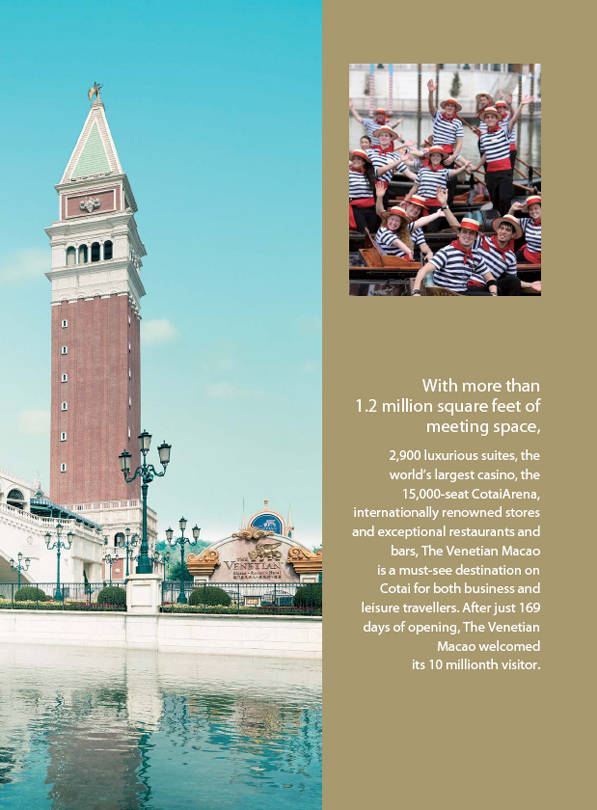

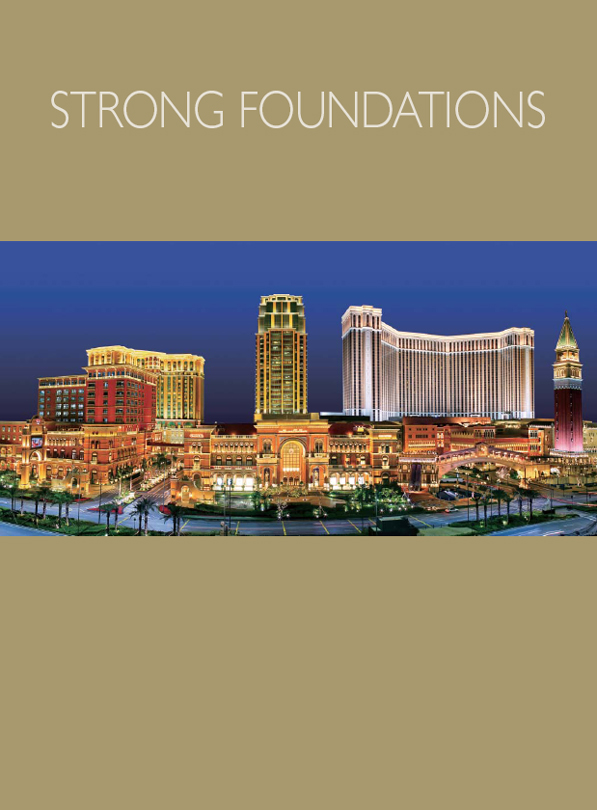

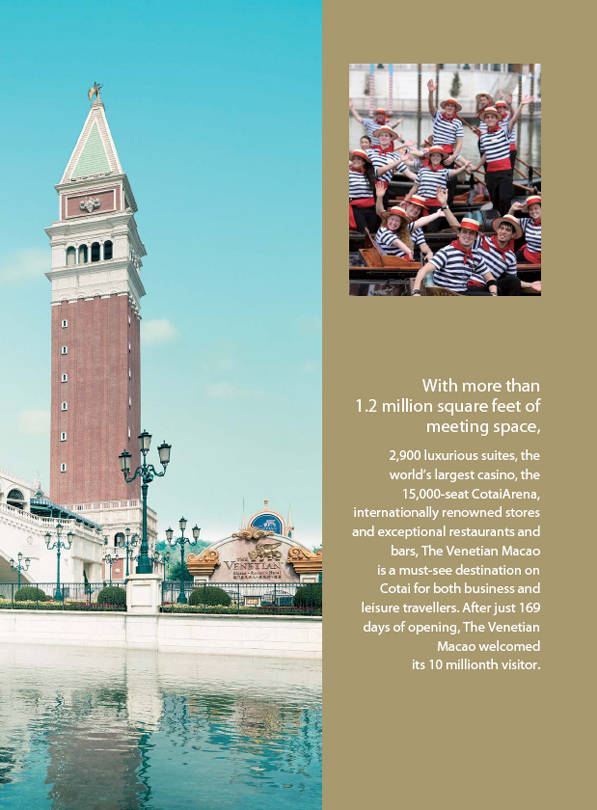

Sands China operates the largest collection of integrated resorts in Macao and is the market share leader in adjusted EBITDAR. With over 3,400 hotel rooms, 68 restaurants, 1.2 million square feet of retail, 1.2 million square feet of meeting space, 2 permanent theaters, a 15,000-seat arena and the world’s largest casino, Sands China is uniquely positioned to be a major driver of Macao’s economic diversification for years to come.

Financial Highlights

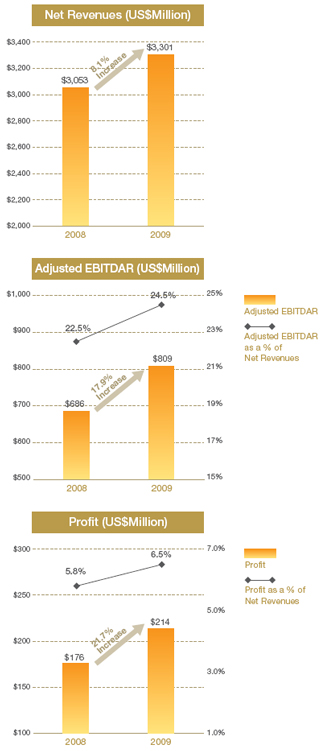

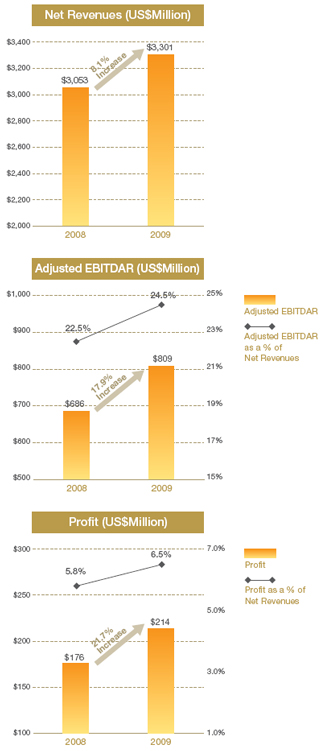

| | • | | Net revenues were US$3,301.1 million for the year ended December 31, 2009, an increase of US$247.8 million, or 8.1%, compared to US$3,053.3 million for the year ended December 31, 2008. |

| | • | | Operating expenses were US$2,931.1 million for the year ended December 31, 2009, an increase of US$171.8 million, or 6.2%, compared to US$2,759.3 million for the year ended December 31, 2008. |

| | • | | Adjusted EBITDAR for the year ended December 31, 2009 was US$809.0 million, an increase of US$123.0 million, or 17.9%, compared to US$686.0 million for the year ended December 31, 2008. Adjusted EBITDAR as a percentage of net revenues was 24.5% for the year ended December 31, 2009, an increase of 2.0 percentage points, compared to 22.5% for the year ended December 31, 2008. |

| | • | | Profit for the year ended December 31, 2009 was US$213.8 million, an increase of US$38.1 million, or 21.7%, compared to US$175.7 million for the year ended December 31, 2008. Profit as a percentage of net revenues was 6.5% for the year ended December 31, 2009, an increase of 0.7 percentage points, compared to 5.8% for the year ended December 31, |

2008.

2

Annual Report 2009

Overview

Highlights of 2009

Business

As the new Chief Executive Officer and President of Sands China Ltd., Steven Craig Jacobs acted swiftly to put a new management team in place, establish a new organizational structure, and drive new business strategies across the organization. Under his leadership, we:

| | • | | Launched a variety of new products and services in 2009 including: |

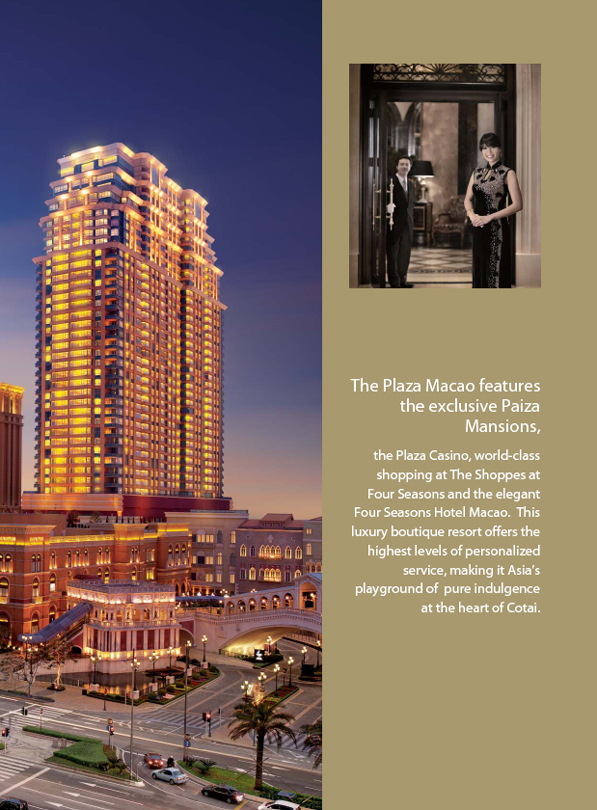

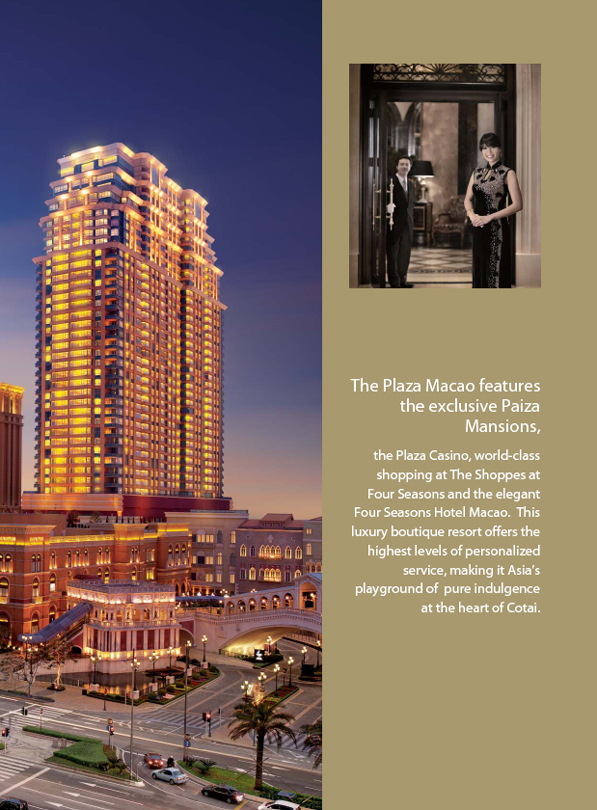

| | • | | The Paiza Mansions at The Plaza Macao |

| | • | | A Poker Room at The Venetian Macao |

| | • | | A high limit slot machine area at The Venetian Macao and Sands Macao |

| | • | | Successfully obtained new ferry routes and operating licenses to Tsim Sha Tsui, Kowloon and the Hong Kong International Airport in order to expand the reach of our transportation infrastructure and draw more visitors to Macao. |

| | • | | Successfully restructured our property operations and repositioned the Company’s brands. We removed more than US$300 million in operating expenses from our business and aligned our brands with their key customer segments. |

| | • | | Introduced a rolling credit program and were one of the first gaming concessionaires to implement a cap on junket commissions, an initiative endorsed by the Macao Government. |

| | • | | Successfully strengthened our balance sheet, setting the stage for growth both now and in the future. We achieved this by: |

| | • | | Negotiating new favorable loan terms with our existing lenders |

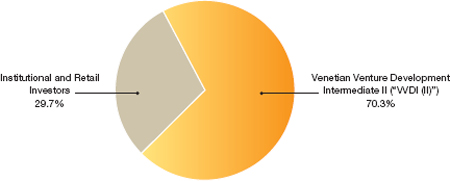

| | • | | Raising US$600 million through the sale of pre-IPO convertible bonds |

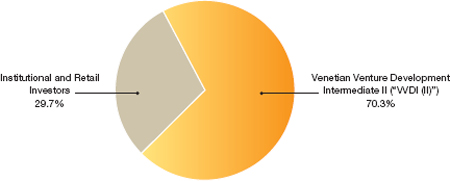

| | • | | Raising an additional US$2.5 billion through the listing of the Company’s shares on the Stock Exchange |

| | • | | Repaying and fully settling all inter-company loans, which improved our debt to EBITDAR ratio to below 3:1 |

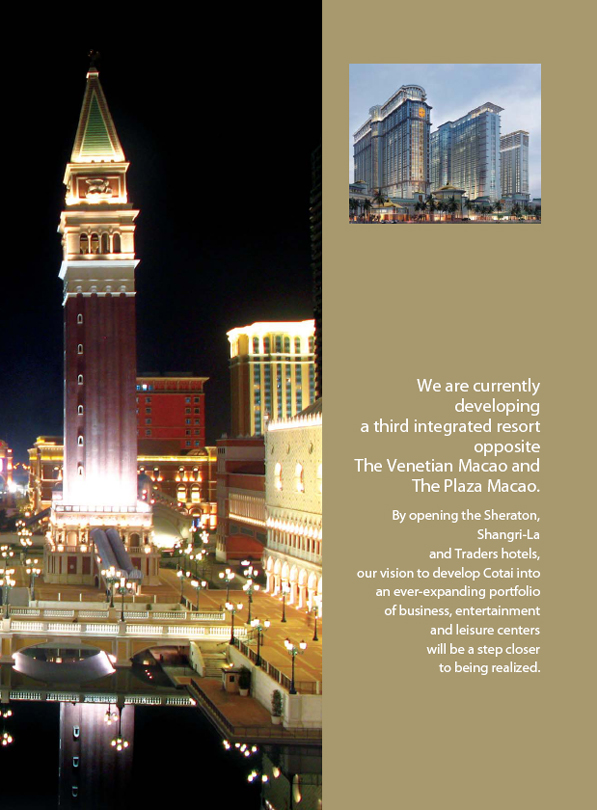

| | • | | Obtaining commitments from a group of banks and financial institutions for US$1.75 billion in debt financing for the construction of Parcels 5 and 6 (the first phase of which is expected to consist of two hotel towers with over 3,700 Sheraton, Shangri-La and Traders branded hotel rooms). |

| | • | | Meeting with the Macao Government, which reassured us that it would support all efforts to restart our development on Parcels 5 and 6, including ensuring that we would have sufficient gaming tables and slot machines to successfully open the development project. |

Attendance

Sands China’s properties are among the most visited destinations in Macao attracting families, business visitors and entertainment seekers from around the world. More than 30% of our hotel guests are families with children and business travelers attending corporate meetings, conventions, and exhibitions.

In 2009, all three of our properties, The Venetian Macao, the Sands Macao and The Plaza Macao, attracted a combined total of 35.2 million visitors or close to 100,000 visitors per day.

We achieved the highest attendance on record for a single day at The Venetian Macao, an astonishing 116,168 visitors on January 31, 2009.

During the October Golden Week (October 1–8, 2009), The Venetian Macao attracted 625,437 visitors.

3

Sands China Ltd.

Overview

Entertainment

Entertainment is at the heart of our business. In addition to our live entertainment, bar and restaurant venues, The Venetian Macao is home to ZAIA™, Cirque du Soleil’s only permanent show in Asia. The 15,000-seat CotaiArena™, also at The Venetian Macao, attracted more than 180,000 spectators in 2009 to witness some of the world’s leading acts live on stage in Macao. The CotaiArena™ hosted 34 public events during the year.

CotaiArena™hosted many of Asia’s hottest stars throughout 2009 including:

| | |

| A-Mei | | Rain |

| |

| Charlene Choi | | Sam Hui |

| |

| Eason Chan | | Sandy Lam |

| |

| Joey Yung | | S.H.E |

| |

| Kay Tse | | Wang Lee Hom |

The Venetian Macao also attracted international icons including Linkin Park, Lady Gaga, John Legend and Journey to Macao in 2009.

India’s world famous film awards were held at The Venetian Macao in June. The Indian International Film Academy (IIFA) chose The Venetian Macao as its host venue for the high-profile 2009 ‘Bollywood’ awards. IIFA attracted 42,000 Bollywood fans to The Venetian Macao and 600 million television viewers around the world.

Tennis legends Andre Agassi and Pete Sampras held court at CotaiArena™, attracting more than 10,000 people in October.

CotaiArena™was ranked as one of the top 100 arenas in the world by the live music industry publicationPollstar.

4

Annual Report 2009

Overview

Meetings, Incentives, Conventions & Exhibitions (MICE)

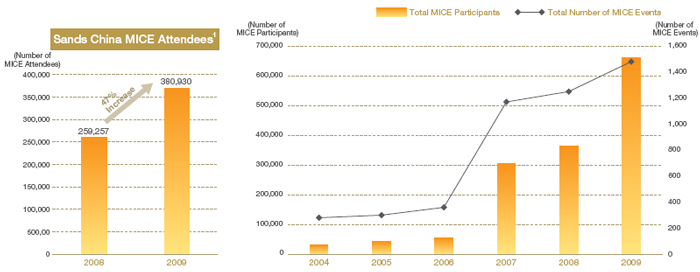

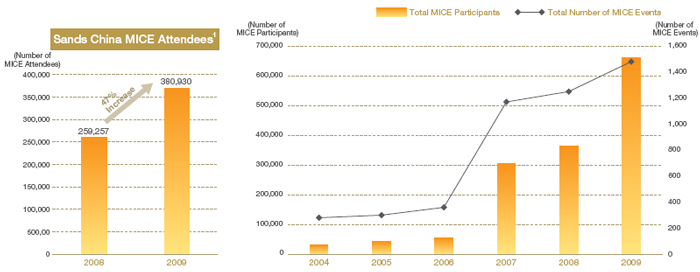

Sands China’s properties boast over 1.2 million square feet of MICE space specifically designed to meet the needs of meeting planners, corporate event and tradeshow organizers from around the world. The CotaiExpoTM is one of the largest exhibition centers in Asia and has hosted some of the region’s biggest tradeshows. Our experience and expertise in this industry continues to drive business and leisure tourism to Macao. The Venetian Macao attracted 380,930 participants and exhibitors to Macao for MICE events throughout the year.

Major events held throughout 2009 include:

| | • | | Macau International Jewelry & Watch Fair, January 10–13 |

| | • | | 11th Asia Pacific Life Insurance Council Congress, April 15–16 |

| | • | | Macau International Environmental Co-operation Forum & Exhibition (MIECF), April 2–4 |

| | • | | Macao International Trade & Investment Fair (MIF), October 22–25 |

MIECF 2009

MIECF, organized by the Macao SAR Government, the Macao Trade and Investment Promotion Institute (IPIM) and the Environment Council, attracted 6,000 delegates from around the world to The Venetian Macao.

MIF 2009

MIF, organized by IPIM, attracted 60,000 attendees to the CotaiExpo™at The Venetian Macao.

Awards

| | |

| Sands China’s properties, and in particular The Venetian Macao, continue to set the standard in customer service, MICE, business, and leisure travel. For two consecutive years — since the opening of The Venetian Macao in 2007 — we have received prestigious awards for being Asia’s leading integrated resort for business and leisure tourism. | |  |

Best MICE Hotel in Asia

CEI Asia 2009 Industry Award (Conference, Exhibition & Incentive Asia Magazine)

2008 Best Business Hotels

Travel & Leisure Magazine (awarded in 2009)

Best Meeting and Conventions Hotel in Macao

TTG China Travel Awards 2009 (Travel Trade Gazette China Magazine)

Best Hotel in Macao — Business Travel Poll Awards 2008

FinanceAsia (awarded in 2009)

Best Integrated Resort Award

20th TTG Travel Awards 2009 (Travel Trade Gazette Asia Magazine)

Best Business Hotel in Macao

2009 Business Traveller China Travel Awards

Top 5 Most Popular Hotels in Asia

HotelClub Awards Asia

IPO Award

International Financial Law Review Deal of the Year for 2009 for the Sands China IPO

Macao Green Hotel Award

The Macao SAR Environment Council

5

Sands China Ltd.

Chairman’s Statement

Sands China’s profit for the year ended December 31, 2009 was US$213.8 million, up from US$175.7 million in 2008, a dramatic increase of 21.7%.

Dear Shareholders,

On behalf of the Board of Directors (“the Board”) of Sands China, I am pleased to present to you our first Annual Report as a company listed on the Main Board of The Stock Exchange of Hong Kong Limited.

Business Review

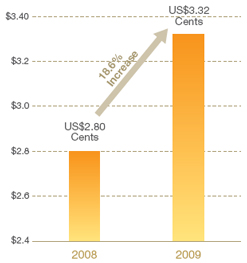

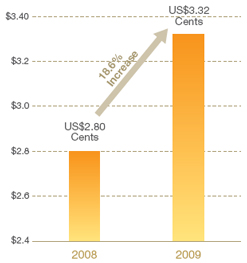

Sands China’s profit attributable to shareholders for the year ended December 31, 2009 was US$213.8 million, up from US$175.7 million in 2008, an increase of 21.7%. Earnings per share for the year ended December 31, 2009 was US$3.32 cents (HK$25.77 cents), up from US$2.80 cents (HK$21.69 cents) in 2008, an increase of 18.6%.

Adjusted EBITDAR for the year ended December 31, 2009 was US$809.0 million, an increase of US$123.0 million or 17.9% compared to US$686.0 million for the year ended December 31, 2008.

6

Annual Report 2009

Chairman’s Statement

In 2009, Sands China benefited from a number of key strengths that helped to differentiate our business from that of our competitors, including the following:

| | • | | We provided the highest quality integrated resort offerings, which include a diversified set of products and services, including substantial non-gaming amenities. That unique product offering enables us to target and attract a broad range of customers; |

| | • | | The diversification of amenities provided us with a substantially higher adjusted EBITDAR to sales percentage compared to casino-only operators, particularly at the high end of the market. This diversification enabled us to lead the market, by far, in adjusted EBITDAR generation; |

| | • | | We generated substantial cash flow and earnings from our existing operations; |

| | • | | We maintained an industry-leading development pipeline, including additional integrated resorts currently under development on Cotai; |

| | • | | We utilized established brands with broad regional and international appeal to market to potential customers; |

| | • | | We operated very efficiently to control our overall cost structure; |

| | • | | We maintained an experienced management team with a proven track record in both operations and development; and |

| | • | | We derived significant benefits from our on-going relationship with Las Vegas Sands Corp. |

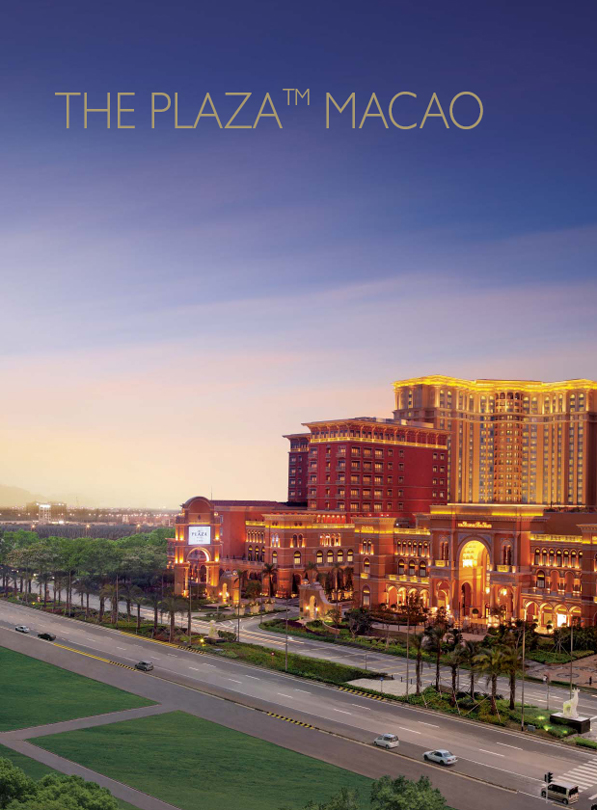

These business strategies resulted in strong financial and operating performance for our Group in 2009. The Venetian Macao welcomed 23.8 million visitors during 2009 and generated US$554.8 million (HK$4,302.3 million) in adjusted EBITDAR, an increase of 11.6% compared to the US$497.2 million (HK$3,853.5 million) in 2008. The Sands Macao welcomed 6.9 million visitors and generated US$243.4 million (HK$1,887.5 million) in adjusted EBITDAR in 2009, an increase of 13.5% compared to the US$214.4 million (HK$1,661.7 million) generated in 2008. In its first full calendar year of operation, the Four Seasons Hotel and Plaza Casino welcomed 4.5 million visitors and generated US$40.3 million (HK$312.5 million) in adjusted EBITDAR. The introduction during the year of our Paiza Mansions, luxurious accommodations of 3,500–17,000 square feet, contributed to a significant increase in adjusted EBITDAR at this property in the latter half of the year.

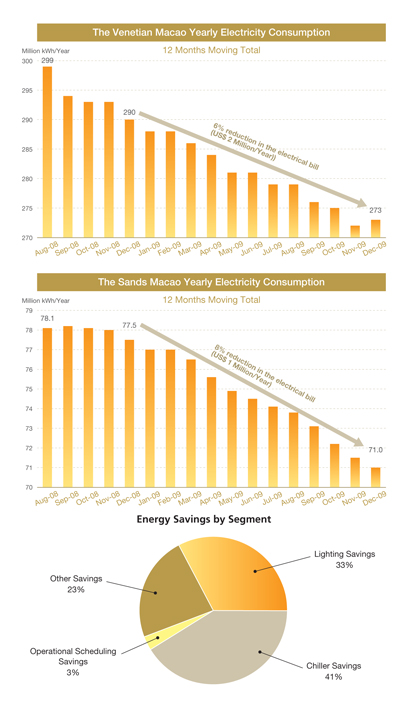

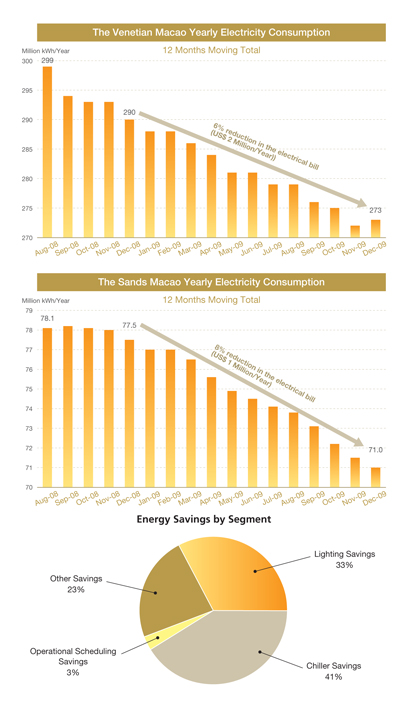

Prospects

Our cost savings and efficiency programs remained an important component of our operating strategy throughout 2009, and I am pleased to report that we were successful in implementing all of our identified cost savings initiatives by December 31, 2009. I believe that these initiatives will allow us to expand our adjusted EBITDAR margins in the future and will provide enhanced operating leverage in the months and years ahead.

7

Sands China Ltd.

Chairman’s Statement

We hosted 15 trade shows in 2009, which attracted more than 320,000 visitors to Macao and Cotai. In addition, we hosted 388 corporate groups, which brought an additional 60,000 delegates to Macao. Given current trade show and group booking trends, we are confident of strong growth in MICE visitation in 2010.

We substantially completed the construction of our Four Seasons-branded Apart-Hotel Tower in the fourth quarter of 2009. We feel that market conditions in Macao are favorable for the execution of our strategy and expect to begin to monetize this important asset in 2010.

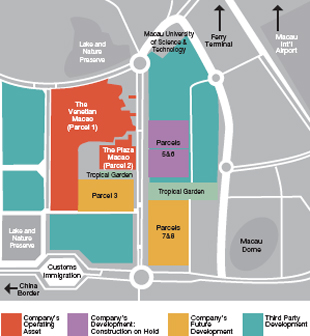

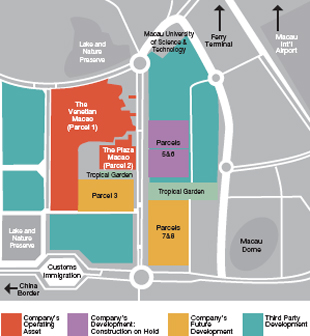

In November 2009, the Macao Government awarded a concession by lease for Parcels 5 and 6. We are now waiting for publication of the land concession in the official gazette.

After receiving commitments of US$1.75 billion of project financing in November 2009 (which we expect to close in April 2010), we were able to mobilize to recommence the construction of Parcels 5 and 6 of our Cotai Strip developments. We also expect to get into high levels of actual construction starting in April. We expect that it will take approximately 16 months to complete construction of Phase I, which will include 3,700 rooms from the Shangri-La, Traders and Sheraton hotel brands, and an additional six months to complete the adjacent 2,300 room Sheraton Tower hotel in Phase II.

The Macao Government granted us an extension of the development deadline under the land concession for Parcel 3 on Cotai on September 29, 2009. Under the terms of the land concession, we must now complete development of Parcel 3 by April 17, 2013.

Our CotaiJetTM ferry operation was issued a new 10-year license on January 14, 2010. The new license not only permits us to continue operating ferries between Macao and Hong Kong, but also permits us to offer additional routes to Macao from Hong Kong, including from the China Ferry Terminal in Kowloon and the Hong Kong International Airport. Opening these new routes and increasing capacity from Hong Kong to Macao will facilitate the growth of our MICE business by seamlessly linking Hong Kong to Cotai.

The process of becoming a listed company in Hong Kong was completed during the year, and provides the opportunity for Asian investors to participate in our future success through the ownership of shares in Sands China. Our business strategy is to continue to successfully execute our Cotai Strip developments and to leverage our integrated resort business model to create Asia’s premier gaming, leisure and convention destination. Our business strategies and development plans allow us to achieve strong growth and financial performance in the future. We look forward to reporting to shareholders at the Annual General Meeting and in the next interim and annual reports on the effective management of our company’s business and assets, and upon the continued delivery of value to you and other stakeholders.

|

| Sheldon G. Adelson |

| Chairman of the Board |

| Hong Kong, April 14, 2010 |

8

Annual Report 2009

Directors and Senior Management

Directors

Our Board of Directors consists of eight Directors, three of whom are independent Non-Executive Directors. The following table sets forth certain information concerning our Directors:

| | | | |

Name | | Age | | Title |

| Sheldon Gary Adelson | | 76 | | Chairman and Non-Executive Director |

| Steven Craig Jacobs | | 47 | | Chief Executive Officer, President and Executive Director |

| Stephen John Weaver | | 49 | | Chief Development Officer and Executive Director |

| Jeffrey Howard Schwartz | | 50 | | Non-Executive Director |

| Irwin Abe Siegel | | 69 | | Non-Executive Director |

| Iain Ferguson Bruce | | 69 | | Independent Non-Executive Director |

| Chiang Yun | | 42 | | Independent Non-Executive Director |

| David Muir Turnbull | | 55 | | Independent Non-Executive Director |

| | |

| | Chairman and Non-Executive Director |

| |

| | Sheldon Gary Adelson, 76, is the Chairman of our Board of Directors and Non-Executive Director. Mr. Adelson has been the Chairman of the Board of LVS, Chief Executive Officer and a Director of LVS since August 2004. Mr. Adelson has been Chairman of the Board, Chief Executive Officer and a Director of Las Vegas Sands, LLC (or its predecessor) since April 1988, when Las Vegas Sands, LLC was formed to own and operate the former Sands Hotel and Casino. Mr. Adelson has extensive experience in the convention, trade show and tour and travel businesses. Mr. Adelson also has investments in other business enterprises. Mr. Adelson created and developed the COMDEX Trade Shows, including the COMDEX/Fall Trade Show, which was the world’s largest computer show in the 1990s. COMDEX was sold to Softbank Corporation in April 1995. Mr. Adelson also created and developed the Sands Expo Center, which he grew into one of the largest privately owned convention and trade show destinations in the United States, before transferring it to LVS in July 2004. He has been President and Chairman of the Board of Interface Group Holding Company, Inc. since the mid-1970s and Chairman of the Board of LVS’s affiliate Interface-Group Massachusetts, LLC and its predecessors since 1990. Mr. Adelson was appointed Chairman and Non-Executive Director on August 18, 2009. |

| | |

| | Executive Directors |

| |

| | Steven Craig Jacobs, 47, is our Chief Executive Officer, President, Executive Director and Chairman of the LVSC Announcements Committee. Mr. Jacobs was President-Macao of LVS from May 2009 and has worked with LVS since March 2009. From 1994 through 2008, Mr. Jacobs served as the President and CEO of the Vagus Group Inc (“VGI”), an international management services company specializing in travel and hospitality. Through VGI, Mr. Jacobs assumed a variety of senior executive roles in companies including Louvre Hotels, U.S. Franchise Systems, Hyatt and Best Western International. Mr. Jacobs holds a Bachelor of Arts degree from Harvard University. Mr. Jacobs was appointed Executive Director on August 18, 2009. |

9

Sands China Ltd.

Directors and Senior Management

| | |

| | Stephen John Weaver, 49, is our Chief Development Officer and Executive Director. Mr. Weaver joined our Group in August 2005 and has served as the President of Asian Region since October 2006. He is responsible for overseeing all development and government relations activities in Macao, including real estate development transactions, retail mall leasing and other business development-related activities. He has broad experience in all elements of property development and business management, initially gained through 12 years of private practice as a property lawyer and subsequently in senior management positions with Savills and Jones Lang LaSalle. Mr. Weaver holds a Bachelor of Laws degree from Queensland University of Technology and a Master of Business Administration from the University of Southern Queensland, having completed the relevant correspondence courses of both universities. Mr. Weaver is a Solicitor of the Supreme Court of Queensland and the High Court of Australia. Mr. Weaver was appointed Executive Director on August 18, 2009. |

| | |

| | Non-Executive Directors |

| | Jeffrey Howard Schwartz, 50, is one of our Non-Executive Directors and a member of the Remuneration Committee. Mr. Schwartz has been Director of LVS since March 2009. He is the Chairman of the Board and co-founder of Global Logistic Properties, which controls the largest platform of logistics facilities in Asia. Mr. Schwartz was the Chief Executive Officer of ProLogis, listed on the NYSE, from January 2005 through November 2008, and served as the Chairman of the Board and Director of ProLogis from May 2007 through November 2008. Mr. Schwartz also served as a Director of ProLogis European Properties, a company listed on both the EuroNext and Luxembourg exchanges. Mr. Schwartz was President of international operations at ProLogis from March 2003 to December 2004, and was Asia President and Chief Operating Officer from March 2002 to December 2004. He had been associated with ProLogis in varying capacities since 1994. Mr. Schwartz was appointed Non-Executive Director on October 14, 2009. |

| | |

| |

| | Irwin Abe Siegel, 69, is one of our Non-Executive Directors and a member of the Audit Committee. Mr. Siegel has been a Director of LVS since February 2005. He was a Director of Las Vegas Sands, Inc. from February 2005 until July 2005. Mr. Siegel is a certified public accountant and was a partner (specializing in the hospitality industry) in the international accounting and consulting firm of Deloitte & Touche LLP from 1973 to 2003, when he retired. From 1996 through 1999, Mr. Siegel served as the Chief Executive Officer of Deloitte & Touche LLP’s operations in the former Soviet Union. Mr. Siegel has been working as a business consultant since 2003. Mr. Siegel has served on the boards of Directors of many charitable and civic organizations and is the immediate past President of the Weinstein Hospice in Atlanta, Georgia, U.S.A. Mr. Siegel was appointed Non-Executive Director on October 14, 2009. |

10

Annual Report 2009

Directors and Senior Management

| | |

| | Independent Non-Executive Directors |

| |

| | Iain Ferguson Bruce, 69, is one of our independent Non-Executive Directors, Chairman of the Audit Committee and a member of both the Remuneration Committee and LVSC Announcements Committee. Mr. Bruce joined KPMG in Hong Kong in 1964 and was elected to its partnership in 1971. He was the senior partner of KPMG from 1991 until his retirement in 1996, and served as Chairman of KPMG Asia Pacific from 1993 to 1997. He has been a member of the Institute of Chartered Accountants of Scotland since 1964 and is a fellow of the Hong Kong Institute of Certified Public Accountants. He is also a fellow of The Hong Kong Institute of Directors and a member of The Hong Kong Securities Institute. Mr. Bruce is currently an independent Non-Executive Director of Paul Y. Engineering Group Limited, Tencent Holdings Limited, Vitasoy International Holdings Limited and Wing On Company International Limited, all listed on the Stock Exchange. Mr. Bruce is also a Non-Executive Director of Noble Group Limited, listed on the Singapore Exchange Limited; of China Medical Technologies, Inc., listed on NASDAQ; and of Yingli Green Energy Holding Company Limited, listed on the New York Stock Exchange. Mr. Bruce is a steward of The Hong Kong Jockey Club, an independent Non-Executive Director of Citibank (Hong Kong) Limited, and is Chairman of KCS Limited. Mr. Bruce was appointed independent Non-Executive Director on October 14, 2009. Mr. Bruce has over 44 years of experience in the accounting profession and possesses the accounting and related financial management expertise required under rule 3.10(2) of the Listing Rules. |

| | |

| | Chiang Yun, 42, is one of our independent Non-Executive Directors and a member of the Audit Committee. With over 15 years of private equity investment experience, Ms. Chiang is one of the four founding managing partners of Pacific Alliance Equity Partners, the private equity division of Pacific Alliance Group. Prior to the founding of Pacific Alliance Equity Partners, Ms. Chiang was a Vice President of AIG Global Investment. In addition to currently sitting on the boards of five separate portfolio companies, Ms. Chiang was also a Board member of two listed companies in Hong Kong and Thailand, namely China-Hongkong Photo Products Holdings Limited and C.P. Seven Eleven Public Company Limited. Ms. Chiang obtained her Executive Master of Business Administration degree from The Kellogg Graduate School of Management of Northwestern University and Hong Kong University of Science and Technology, and her Bachelor of Science degree, cum laude, from Virginia Polytechnic Institute and State University, or Virginia Tech. Ms. Chiang was appointed independent Non-Executive Director on October 14, 2009. |

11

Sands China Ltd.

Directors and Senior Management

| | |

| | David Muir Turnbull, 55, is one of our independent Non-Executive Directors, Chairman of the Remuneration Committee and a member of the LVSC Announcements Committee. Mr. Turnbull graduated from Cambridge University in 1976 with a Bachelor of Arts degree with honors in Economics, and subsequently obtained a Master of Arts degree. He joined the Swire Group upon graduation and held a variety of senior management positions during his 30 years with the group, including Chief Executive Officer of Cathay Pacific from December 1996 to December 2004. Mr. Turnbull also held a number of positions in companies listed on the Stock Exchange, including Chairman of Swire Pacific Ltd. and Cathay Pacific Airways Ltd. from January 2005 until January 2006; Chairman of Hong Kong Aircraft Engineering Company Ltd. from March 1995 until August 2006; Non-Executive Director of the Hongkong and Shanghai Banking Corporation from January 2005 until December 2005; Non-Executive Director of Air China Ltd. from May 2005 until December 2005; and Non-Executive Director of Hysan Development Co. Ltd. from May 2005 until January 2006. In July 2008, Mr. Turnbull was appointed Executive Chairman of Pacific Basin Shipping Company, listed on the Stock Exchange, and has served as an independent Non-Executive Director since May 2006. In July 2006, he was appointed independent Non-Executive Director of Green Dragon Gas Limited, a company listed on the Alternative Investment Market, a sub-market of the London Stock Exchange. In November 2008, he was appointed as the Chairman of Seabury Aviation and Aerospace Asia (Hong Kong) Ltd, a subsidiary of Seabury Group LLC. Mr. Turnbull was appointed independent Non-Executive Director of the Company on October 14, 2009. |

| | |

| | Special Adviser to the Board |

| |

| | Michael Alan Leven, 72, is Special Adviser to our Board. Mr. Leven is the President and Chief Operating Officer of LVS and its wholly-owned subsidiary, Las Vegas Sands, LLC, having been appointed April 1, 2009. Mr. Leven has been a member of LVS’s Board of Directors since August 2004. Mr. Leven has served as the Chief Executive Officer of the Georgia Aquarium since September 2008. From January 2006 through September 2008, Mr. Leven was the Vice Chairman of the Marcus Foundation, Inc., a non-profit foundation. Until December 2006, Mr. Leven was the Chairman, Chief Executive Officer and President of U.S. Franchise Systems, Inc., the company he founded in 1995 that developed and franchised the Microtel Inns & Suites and Hawthorn Suites hotel brands. He was previously the President and Chief Operating Officer of Holiday Inn Worldwide, President of Days Inn of America, and President of Americana Hotels. On account of his extensive prior experience in the gaming and hospitality industries, we appointed Mr. Leven to be Special Adviser to the Board on October 14, 2009. Mr. Leven will attend and participate in meetings of the Board, and be provided notice of meetings of the Board together with materials to be considered by the Board. However, Mr. Leven’s role is only advisory and he does not have the right to vote at any such meetings or to direct any course of action to the Directors, and he will be required to observe the same duties of confidentiality and fidelity to our Company as a Director would be subject to. Mr. Leven will not receive any compensation from us (or LVS) in connection with his role as Special Adviser to the Board. |

12

Annual Report 2009

Directors and Senior Management

Senior Management

| | |

| | Steven Craig Jacobs, 47, is our Chief Executive Officer, President and Executive Director. |

| | |

| | Stephen John Weaver, 49, is our Chief Development Officer and Executive Director. |

| | |

| | Toh Hup Hock, 44, is our Chief Financial Officer. He is currently a Director of some of our PRC, Cayman, Macao and Hong Kong subsidiaries. Mr. Toh joined our Group in April 2007 after a 15-year career with General Electric Company (“GE”). During his tenure at GE, Mr. Toh held a number of Chief Financial Officer and similar positions in Asia, including for GE Lighting Asia, GE Consumer Products Asia, GE Consumer & Industrial Asia and GE Plastics Greater China. Mr. Toh holds a Bachelor of Science in Accounting from Murdoch University and a Masters in Business Administration from the University of Queensland. Mr. Toh is a full member of CPA Australia. |

| | |

| | Luis Nuno Mesquita de Melo, 46, is our General Counsel and Joint Company Secretary. Mr. Melo holds a law degree from the University of Lisbon’s Faculty of Law. Mr. Melo originally joined VML as an Associate General Counsel in September 2005, and became Senior Vice-President and General Counsel of VML in September 2008. In October 2008, Mr. Melo became a Director of VML and all of its Macao subsidiaries. Prior to joining our Group, he was a lecturer at the University of Lisbon Law School from 1985 to 1990. Mr. Melo joined the Macao Government in 1990 as a lawyer for the Legislative Modernization Commission, working extensively in revising and modernizing the Macao legal system and legislation in preparation for the Administration handover from Portugal to the PRC. He also held various advisory roles to the Legislative Assembly of Macao, including legal adviser to the President, from 1992 to 1997, and the office of Assistant (legal affairs) to the Minister of Economy of Portugal in 1997. In addition, he was also in private practice and was a partner of the law firm J.A. Pinto Ribeiro & Associados from December 1997 to 2005, and was a founding partner of Augusto Mateus & Associados, Sociedade de Consultores Lda., a company engaged in economic and consultancy studies and entrepreneurial development and restructuring strategies. |

| | |

| | Ho Siu Pik, 46, is the Joint Company Secretary of the Company. Ms. Ho is a Director of the Corporate Services Division of Tricor Services Limited and an Associate Member of both the Institute of Chartered Secretaries and Administrators and the Hong Kong Institute of Chartered Secretaries. Ms. Ho has over 20 years of experience in the company secretarial area. She is currently the Joint Company Secretary of China Molybdenum Co., Ltd., a company listed on the Stock Exchange. |

13

Sands China Ltd.

Industry Overview

Overview of Macao

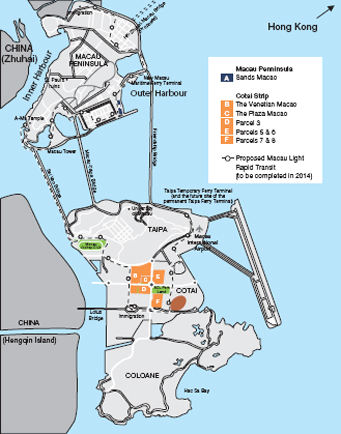

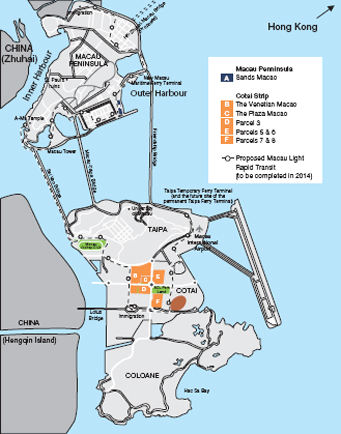

The Macao Special Administrative Region was established on December 20, 1999 following more than 400 years of administration by Portugal. Macao is located on the southeast coast of mainland China to the west of Guangdong Province. Macao consists of the Macao peninsula and the islands of Taipa and Coloane and the reclaimed area of Cotai. Three bridges link the Macao peninsula to Taipa, while the two islands are connected by the land reclamation area known as Cotai.

Macao is the only region in China to offer legalized casino gaming and its casinos have historically offered little in the way of non-gaming facilities. Macao’s gaming industry was previously controlled pursuant to a monopoly, which formally ended in 2002 when the Macao Government launched an international tender process and granted three concessions to Galaxy, SJM and Wynn Macau. The Macao Government subsequently and successively authorized three subconcessions. In December 2002, Galaxy, the Macao Government and VML, our subsidiary, entered into the Subconcession Contract, which allows us to develop and operate gaming facility projects in Macao independently from Galaxy. The two other Subconcessionaires are Melco Crown and MGM Grand Paradise. The awarding of these six concessions ushered in a new era and saw the introduction to Macao of integrated resorts with significant non-gaming facilities.

Following the liberalization of its gaming laws, Macao has become the largest gaming market in the world based on casino gaming revenue, surpassing Las Vegas in 2006 and growing by over 110% between 2006 and 2009, based on information published by the DICJ and the Nevada Gaming Control Board. The growth in the gaming market in Macao has contributed to the strong growth of Macao’s GDP.

Tourism and gaming account for the majority of Macao’s GDP. For the year ended December 31, 2009, tourism GDP totaled US$18.5 billion, representing 87.3% of Total GDP. Of the tourism GDP, gaming GDP accounted for US$14.7 billion, or 79.4%, of such expenditures. The following table illustrates Macao’s total GDP, tourism GDP and gaming GDP from 2004 to 2009:

| | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | (US$ in millions, except percentages) | |

| | | | | | |

Total GDP | | 10,279 | | | 11,524 | | | 14,214 | | | 18,682 | | | 21,483 | | | 21,168 | |

Year-on-year Change, nominal | | — | | | 12.1 | % | | 23.3 | % | | 31.4 | % | | 15.0 | % | | (1.5 | )% |

| | | | | | |

Tourism GDP(1) | | 7,881 | | | 8,409 | | | 10,162 | | | 13,946 | | | 17,422 | | | 18,478 | |

Tourism GDP as a % of Total GDP | | 76.7 | % | | 73.0 | % | | 71.5 | % | | 74.7 | % | | 81.1 | % | | 87.3 | % |

| | | | | | |

Gaming GDP(2) | | 5,375 | | | 5,788 | | | 7,023 | | | 10,225 | | | 13,383 | | | 14,673 | |

Gaming GDP as a % of Tourism GDP | | 68.2 | % | | 68.8 | % | | 69.1 | % | | 73.3 | % | | 76.8 | % | | 79.4 | % |

14

Annual Report 2009

Industry Overview

Macao Total GDP, Tourism GDP and Gaming GDP

Source: DSEC. Converted from MOP at the Exchange Rate.

| (1) | Defined as tourism expenditures of non-residents of Macao. |

| (2) | Defined as gaming expenditures of non-residents of Macao. |

Proximity to Significant Population Mass

Macao is centrally located in the Asian region, which is home to more than three billion people.

The map below shows the approximate travel times to Macao from key gateway cities in Asia.

15

Sands China Ltd.

Industry Overview

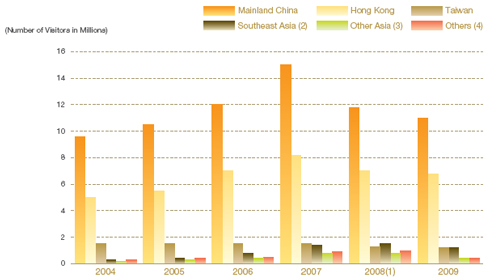

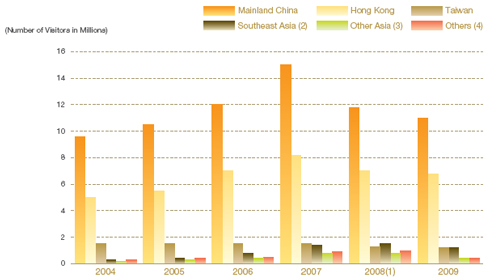

Visitors traveling to Macao generally come from mainland China, Hong Kong and Taiwan. According to the DSEC statistics, 81.4% of visitors to Macao during 2009 came from mainland China and Hong Kong. Since July 2003, residents from mainland China have been allowed to apply for a visa to visit Macao and Hong Kong on an individual basis under the facilitated individual travel (“FIT”) scheme. Following implementation of the FIT scheme, the number of mainland Chinese tourists has increased significantly and mainland China has become one of Macao’s most important markets for tourism. According to the Macao Yearbook 2008, by the end of 2007, the FIT scheme had been extended to residents of all of Guangdong Province, Beijing, Shanghai and other major cities that may be approved from time to time. Although total visitation in Macao declined in 2009 as a result of the visa restrictions imposed in 2008, recent disruptions in the global financial markets and the outbreak of swine flu, we expect that visitation from mainland China, Hong Kong and Taiwan will continue to be strong because of a growing middle class with a strong desire for entertainment.

We believe that the increasing appeal of Macao, led primarily by the development of world-class integrated resorts, investments in non-gaming facilities, economic growth throughout Asia, and expanding infrastructure development, will enable Macao to attract visitors from an increasingly wider radius. The following table presents information on visitor arrivals to Macao by place of residence from 2004 to 2009:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008(1) | | | 2009 | |

| | | Visitors | | % | | | Visitors | | % | | | Visitors | | % | | | Visitors | | % | | | Visitors | | % | | | Visitors | | % | |

| | | (in millions) | |

| | | | | | | | | | | | |

Mainland China | | 9.5 | | 57.2 | % | | 10.5 | | 55.9 | % | | 12.0 | | 54.5 | % | | 14.9 | | 55.1 | % | | 11.6 | | 50.6 | % | | 11.0 | | 50.5 | % |

Hong Kong | | 5.1 | | 30.3 | % | | 5.6 | | 30.0 | % | | 6.9 | | 31.6 | % | | 8.2 | | 30.3 | % | | 7.0 | | 30.6 | % | | 6.7 | | 30.9 | % |

Taiwan | | 1.3 | | 7.7 | % | | 1.5 | | 7.9 | % | | 1.4 | | 6.5 | % | | 1.4 | | 5.3 | % | | 1.3 | | 5.7 | % | | 1.3 | | 5.9 | % |

Southeast Asia(2) | | 0.3 | | 1.6 | % | | 0.4 | | 2.1 | % | | 0.7 | | 3.2 | % | | 1.2 | | 4.4 | % | | 1.5 | | 6.4 | % | | 1.3 | | 6.2 | % |

Other Asia(3) | | 0.2 | | 1.3 | % | | 0.3 | | 1.7 | % | | 0.4 | | 1.9 | % | | 0.6 | | 2.2 | % | | 0.7 | | 3.3 | % | | 0.7 | | 3.3 | % |

Others(4) | | 0.3 | | 2.0 | % | | 0.4 | | 2.3 | % | | 0.5 | | 2.3 | % | | 0.7 | | 2.7 | % | | 0.8 | | 3.4 | % | | 0.7 | | 3.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Total | | 16.7 | | 100.0 | % | | 18.7 | | 100.0 | % | | 22.0 | | 100.0 | % | | 27.0 | | 100.0 | % | | 22.9 | | 100.0 | % | | 21.8 | | 100.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

16

Annual Report 2009

Industry Overview

Visitor Arrivals to Macao by Place of Residence

Source: DSEC Visitor Arrivals by Place of Residence.

| (1) | On February 24, 2009, the DSEC amended its methodology for the computation of visitor arrivals by excluding visitors such as imported workers and foreign students. Therefore, the number of visitor arrivals in 2008 was revised from 30.2 million to 22.9 million. The DSEC did not revise the figures published for previous years, which affects the year-on-year comparability of the data above. To allow a direct comparison of year-on-year visitor arrivals prior to 2007, the number of arrivals in 2008 would total 30.2 million. |

| (2) | Includes Philippines, Indonesia, Malaysia, Singapore, Thailand and other Southeast Asian countries. |

| (3) | Includes India, Japan, South Korea and other East and South Asian countries not already listed separately. |

| (4) | Includes the Americas, Europe, Oceania, Africa and the Middle East. |

Regional Economic Growth

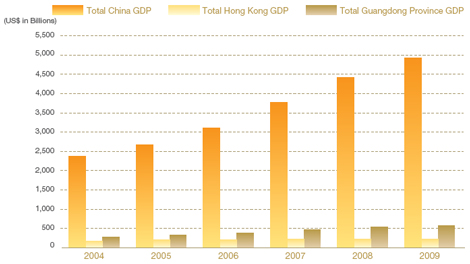

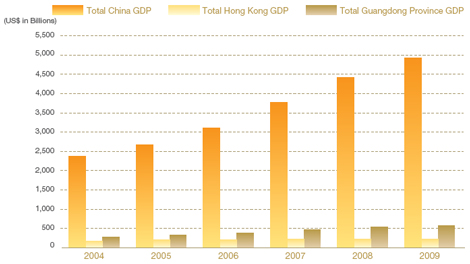

In 2009, China’s GDP (in current prices) totaled US$4.9 trillion (RMB33.5 trillion) compared to US$2.3 trillion (RMB15.7 trillion) in 2004, representing a CAGR of 16.0%. In addition, regional Chinese economies surrounding Macao, such as Guangdong Province, have also exhibited substantial growth.

We believe that the continuing strong economic performance of the economies of mainland China, particularly Guangdong Province, and Hong Kong, will help support future development of tourism and gaming projects in Macao. The following table illustrates the annual growth rate of GDP for mainland China, including Guangdong Province, and Hong Kong from 2004 to 2009:

17

Sands China Ltd.

Industry Overview

| | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2004 | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | (US$ in billions, except percentages) | |

| | | | | | |

Total China GDP | | 2,337 | | 2,679 | | | 3,098 | | | 3,762 | | | 4,396 | | | 4,903 | |

Year-on-year Change, nominal | | — | | 14.6 | % | | 15.7 | % | | 21.4 | % | | 16.9 | % | | 11.5 | % |

Total Hong Kong GDP | | 167 | | 178 | | | 190 | | | 208 | | | 216 | | | 211 | |

Year-on-year Change, nominal | | — | | 7.0 | % | | 6.7 | % | | 9.5 | % | | 3.8 | % | | (2.3 | )% |

Total Guangdong Province GDP | | 276 | | 317 | | | 383 | | | 454 | | | 522 | | | 571 | |

Year-on-year Change, nominal | | — | | 15.0 | % | | 20.8 | % | | 18.6 | % | | 14.8 | % | | 9.4 | % |

China, Hong Kong and Guangdong Province GDP

Sources: National Bureau of Statistics of China, Statistics Bureau of Guangdong Province and Hong Kong Census and Statistics Department. Converted from Hong Kong dollars and RMB at the Exchange Rate.

18

Annual Report 2009

Industry Overview

Accessibility of Macao

Visitors from southeastern China, Hong Kong, Taiwan and other locations in Asia can reach Macao relatively quickly using a variety of methods. One of the major means of transportation to Macao from Hong Kong is the ferry service, including our CotaiJetTM ferry service, which commenced operation in late 2007. Ferry service between Hong Kong and Macao operates 24 hours a day and takes approximately one hour, with departures occurring at 15- to 30-minute intervals during peak times. Visitors from more distant locations in Asia can take advantage of short travel times by air to Macao, Zhuhai, Shenzhen, Guangzhou or to Hong Kong (followed by a car, ferry or helicopter trip to Macao). Several airline carriers currently fly directly to Macau International Airport from many major cities in Asia. In 2009, several airlines announced plans for new direct routes to Macao from countries such as South Korea and Japan.

We believe that improved transportation to and within Macao will also contribute to growth in visitation and mass market gaming. According to the National Development and Reform Commission, the PRC Government has expressed support for a more open, modern and integrated transportation system within the region, as indicated in its Outline of the Plan for the Reform and Development of the Pearl River Delta (2008–2020). The PRC Government’s plan lists as transportation priorities the Hong Kong-Zhuhai- Macao Bridge, the eastern passage between Shenzhen and Hong Kong, the loop expressway of the Pearl River Delta, the Zhongshan-Shenzhen passage across the estuary of the Pearl River and a number of railways. Below is a summary of certain announced infrastructure improvement projects:

| | • | | The new Taipa Ferry Terminal, which is expected to be completed by 2012, will be the second permanent ferry terminal in Macao, together with the existing terminal on the Macao peninsula. It is expected to have sixteen 400-passenger berths, three 1,200-passenger berths and a heliport; |

| | • | | The proposed Hong Kong-Zhuhai-Macao bridge, which is expected to be completed in 2015 or 2016, will link Hong Kong’s Lantau Island to Zhuhai via Macao, and would reduce travel time by car from central Hong Kong to Macao from 4.5 hours to only 40 minutes; |

| | • | | The proposed Guangzhou-Zhuhai High Speed Railway, which is expected to be completed by 2015, will result in travel time between Guangzhou and Macao of 40 to 50 minutes; |

| | • | | The proposed Macao Light Rapid Transit, which is expected to commence construction in June 2010 and be completed in 2014, will link the ferry terminals to key locations via 12 stops on the Macao peninsula and 11 stops on Cotai and Taipa; and |

| | • | | The addition of new routes and air service between key feeder markets and the Macau International Airport, and the Zhuhai Airport. |

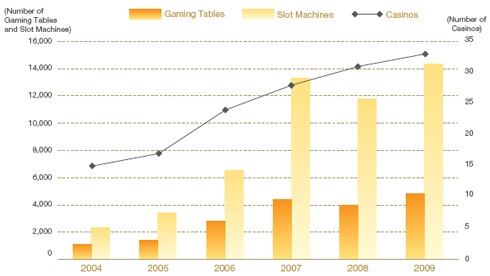

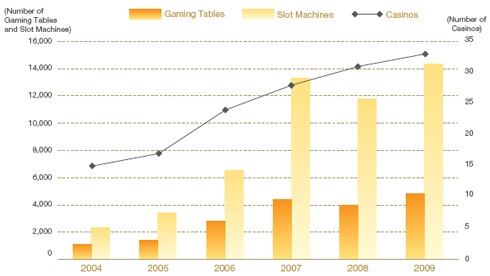

Macao’s Casino Gaming Industry

According to the DICJ, as of December 31, 2009, the Macao gaming market had 33 gaming facilities, 23 of which are located on the Macao peninsula. The Macao peninsula is connected to mainland China and was historically the only gaming destination in Macao. The 33 gaming facilities vary greatly in terms of size of operations and amenities offered. The majority of casinos on the Macao peninsula were constructed prior to the implementation of the concession system in 2002 and are characterized by casinos spread across multiple floors with very few non-gaming amenities. Following the opening of the Sands Macao in 2004, more facilities on the Macao peninsula have begun to introduce more modern casinos and non-gaming amenities, in an attempt to broaden the appeal of Macao to a wider audience. Cotai is an area of new gaming development in Macao and features large-scale, integrated resorts. These facilities tend to have more significant non-gaming and leisure areas than many of those on the Macao peninsula.

19

Sands China Ltd.

Industry Overview

The table below shows the year-on-year change in the number of casinos, gaming tables and slot machines in Macao for the periods indicated:

| | | | | | | | | | | | | | | | | |

| | | As of December 31, | |

| | | 2004 | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | | | | |

Casinos | | 15 | | 17 | | | 24 | | | 28 | | | 31 | | | 33 | |

Year-on-year Change | | — | | 13.3 | % | | 41.2 | % | | 16.7 | % | | 10.7 | % | | 6.5 | % |

Gaming Tables | | 1,092 | | 1,388 | | | 2,762 | | | 4,375 | | | 4,017 | | | 4,770 | |

Year-on-year Change | | — | | 27.1 | % | | 99.0 | % | | 58.4 | % | | (8.2 | )% | | 18.7 | % |

Slot Machines | | 2,254 | | 3,421 | | | 6,546 | | | 13,267 | | | 11,856 | | | 14,363 | |

Year-on-year Change | | — | | 51.8 | % | | 91.3 | % | | 102.7 | % | | (10.6 | )% | | 21.1 | % |

Number of Casinos, Gaming Tables and Slot Machines in Macao

Source: DICJ.

20

Annual Report 2009

Industry Overview

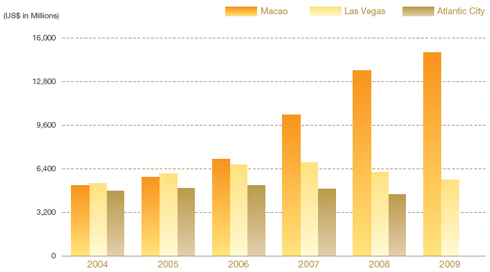

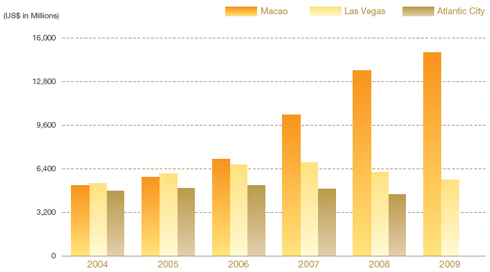

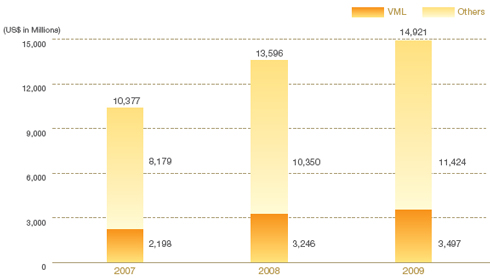

Following the liberalization of Macao’s gaming industry, total gaming revenue in Macao increased from approximately US$5.4 billion in 2004 to approximately US$15.0 billion in 2009, a CAGR of 22.6%. These revenues are generated primarily by casino gaming, consisting of table games and slot machines, and to a lesser extent, by non-casino gaming activities, including greyhound racing, horse racing, sports lotteries and instant lotteries. The following table sets forth gaming revenues in Macao for 2004–2009:

| | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2004 | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | (US$ in millions, except percentages) | |

| | | | | | |

Casino Gaming Revenue | | 5,172 | | 5,756 | | | 7,078 | | | 10,378 | | | 13,597 | | | 14,921 | |

Year-on-year Change | | — | | 11.3 | % | | 23.0 | % | | 46.6 | % | | 31.0 | % | | 9.7 | % |

Non-casino Gaming Revenue | | 267 | | 136 | | | 112 | | | 103 | | | 132 | | | 127 | |

Year-on-year Change | | — | | (49.0 | )% | | (17.4 | )% | | (8.1 | )% | | 27.8 | % | | (3.8 | )% |

Total Gaming Revenue | | 5,439 | | 5,892 | | | 7,190 | | | 10,481 | | | 13,728 | | | 15,048 | |

Year-on-year Change | | — | | 8.3 | % | | 22.0 | % | | 45.8 | % | | 31.0 | % | | 9.6 | % |

Source: DICJ. Converted from MOP at the Exchange Rate.

In 2006, casino gaming revenue in Macao surpassed that of Las Vegas, making Macao the largest gaming market in the world as measured by casino gaming revenue. In 2009, Macao’s casino gaming revenue was more than twice as large as that of Las Vegas. The following table shows the casino revenue of Macao compared to that of Las Vegas and Atlantic City from 2004 to 2009:

| | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | CAGR

2004–2009 | |

| | | (US$ in millions, except percentages) | |

| | | | | | | |

Macao | | 5,172 | | 5,756 | | 7,078 | | 10,378 | | 13,597 | | 14,921 | | 23.6 | % |

Las Vegas | | 5,334 | | 6,034 | | 6,688 | | 6,828 | | 6,126 | | 5,550 | | 0.8 | % |

Atlantic City | | 4,738 | | 4,957 | | 5,167 | | 4,889 | | 4,500 | | N/ANote | | — | |

Sources: DICJ, Nevada Gaming Control Board and New Jersey Casino Control Commission. Macao gaming revenue converted from MOP at the Exchange Rate.

Note: 2009 figures for Atlantic City only available for the nine months ended September 30, 2009: US$3,026 million.

21

Sands China Ltd.

Industry Overview

Casino Revenues

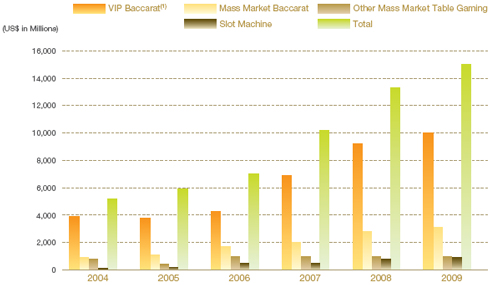

Mass Market, Premium Players and VIP

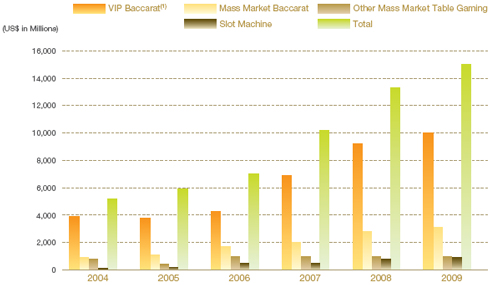

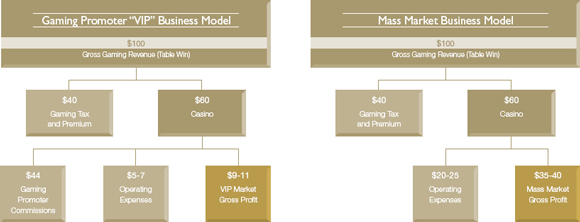

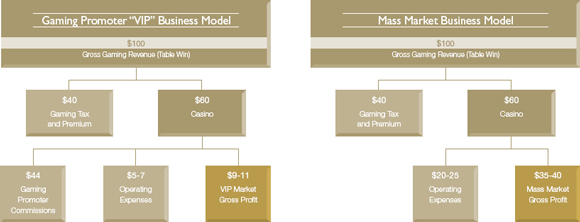

The Macao gaming market consists of three segments: mass market, VIP and premium players. Historically, gaming operators in Macao focused on VIP players; however, gaming operations have now begun to focus on the fast-growing and more profitable mass market and premium segment:

| | • | | Mass Market Players.The mass market segment consists of both table games and slot machines played on public mass gaming floors for lower stakes. The mass market segment is generally viewed as a higher-margin component of the overall gaming market compared with the VIP segment due to the commission costs of operating the VIP segment. Mass market gaming revenues have grown significantly since the introduction in 2004 of casino properties that cater to the mass market. According to the DICJ, from 2004 to December 31, 2009, mass market table and slot operations have grown at a CAGR of 24.7% and 59.0%, respectively. Mass market table and slot operations accounted for approximately 27.7% and 5.4%, respectively, of total casino gaming revenue in Macao for the year ended December 31, 2009. |

| | • | | Premium Players.Premium players are players brought in through the direct marketing efforts of the gaming operators. They select VIP rooms based on their relationship with or preference for a particular gaming operator. As such, premium players have potentially higher margins compared to VIP players. Like VIP players, premium players typically receive various forms of complimentary services from gaming operators. |

22

Annual Report 2009

Industry Overview

| | • | | VIP Players.VIP players in Macao are typically wealthy individuals who play mostly in dedicated VIP rooms or designated gaming areas. VIP players are sourced by Gaming Promoters. Many VIP players in Macao rely on Gaming Promoters to make travel and other arrangements for them to play at a particular casino or gaming area, provide concierge services and arrange their purchases of chips. Gaming Promoters also often extend credit to VIP players that they source and bring to the casinos or gaming areas. In accordance with general industry practice, Gaming Promoters typically commit to certain casino-specified minimum rolling chip purchases per VIP room per month. In return for their services, the gaming operator typically pays a commission to the Gaming Promoter based on either gaming wins or losses or the rolling chip volume of the VIP players they direct to the casinos or gaming areas. The obligation to pay commissions to Gaming Promoters means that although this segment accounts for a large proportion of total gaming revenues, margins are lower than those of the mass market segment. VIP players typically receive various forms of complimentary services, including transportation, accommodation and food and beverage services from the Gaming Promoters or casinos. These complimentary services also affect the margins associated with the rolling chip segment of the business. |

The following table shows Macao casino gaming revenue from 2004 to 2009:

| | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2004 | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | (US$ in millions, except percentages) | |

| | | | | | |

VIP Baccarat(1) | | 3,723 | | 3,608 | | | 4,598 | | | 6,970 | | | 9,222 | | | 9,979 | |

Year-on-year Change | | — | | (3.1 | )% | | 27.4 | % | | 51.6 | % | | 32.3 | % | | 8.2 | % |

Mass Market Baccarat | | 748 | | 1,306 | | | 1,489 | | | 2,064 | | | 2,658 | | | 3,187 | |

Year-on-year Change | | — | | 74.7 | % | | 14.0 | % | | 38.7 | % | | 28.8 | % | | 19.9 | % |

Other Mass Market Table Gaming | | 622 | | 686 | | | 735 | | | 894 | | | 1,010 | | | 942 | |

Year-on-year Change | | — | | 10.3 | % | | 7.1 | % | | 21.7 | % | | 13.0 | % | | (6.7 | )% |

Slot Machine | | 80 | | 156 | | | 257 | | | 449 | | | 707 | | | 813 | |

Year-on-year Change | | — | | 95.3 | % | | 64.2 | % | | 75.1 | % | | 57.3 | % | | 15.0 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | |

Total | | 5,172 | | 5,756 | | | 7,078 | | | 10,378 | | | 13,597 | | | 14,921 | |

| | | | | | | | | | | | | | | | | |

| | | | | | |

Year-on-year Change | | — | | 11.3 | % | | 23.0 | % | | 46.6 | % | | 31.0 | % | | 9.7 | % |

Source: DICJ. Macao gaming revenue converted from MOP at the Exchange Rate.

| (1) | Includes revenue from both VIP and premium players. |

23

Sands China Ltd.

Industry Overview

Macao Casino Gaming Revenue by Segment

Macao’s Hotel, Convention and Retail Industries

Prior to the liberalization of the Macao gaming industry, many of the casino properties were gaming-centric facilities that contained a relatively limited offering of non-gaming amenities. Conversely, recent developments have consisted of larger properties that offer a variety of non-gaming services such as high quality hotel room options, retail and dining areas, MICE space and entertainment amenities in addition to traditional gaming areas. According to statistics reported by the DSEC, visitor spending on non-gaming services accounted for 23.8% and 20.6% of total visitor spending on services in Macao for 2008 and 2009, respectively. We expect that, over time, non-gaming services will represent a larger percentage of total visitor spending in Macao, similar to the trend in Las Vegas.

The Macao Hotel and Convention Market

According to the Macao Statistics and Census Service, there were 59 hotels, containing approximately 18,647 rooms, in operation in Macao as of December 31, 2009. This represented an increase from 39 hotels, containing approximately 8,608 rooms in operation as of December 31, 2004. We believe that the introduction of additional high quality hotels, in combination with MICE space, will continue to enhance Macao’s reputation as a world-class tourist and business destination, contribute to an increase in the average length of stay and further broaden the customer base.

24

Annual Report 2009

Industry Overview

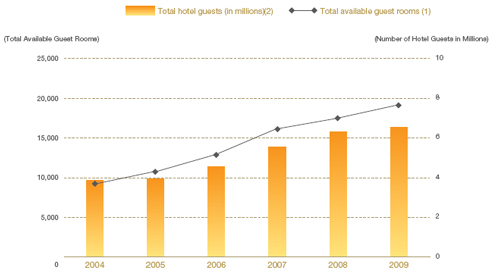

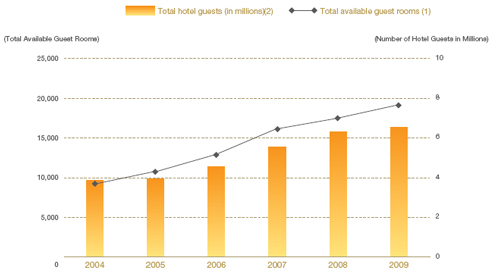

Following the opening of The Venetian Macao, Macao’s first integrated resort, and other new developments, overnight hotel visitation increased from 23.7% of total visitation in 2004 to 30.9% at the end of 2009, with an average length of stay of 1.5 nights in 2009. The following table shows total available guest rooms, total hotel guests, average length of stay, occupancy and Average Daily Rate statistics for the Macao hotel market from 2004 to 2009:

| | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | | | | |

Total available guest rooms(1) | | 9,168 | | | 10,872 | | | 12,978 | | | 16,148 | | | 17,490 | | | 19,216 | |

Total hotel guests (in millions)(2) | | 4.0 | | | 4.1 | | | 4.7 | | | 5.7 | | | 6.5 | | | 6.7 | |

Average length of stay (nights) | | 1.2 | | | 1.2 | | | 1.2 | | | 1.3 | | | 1.4 | | | 1.5 | |

Occupancy (%) | | 75.6 | % | | 70.9 | % | | 72.3 | % | | 77.2 | % | | 74.5 | % | | 71.6 | % |

ADR (US$)(3) | | — | | | 78 | | | 85 | | | 98 | | | 104 | | | 122 | |

Macao Hotel Market Statistics

Source: DSEC and Macao Government Tourist Office. Converted from MOP at the Exchange Rate.

| (1) | Total available rooms as of year end. Includes both hotel rooms and guest houses. |

| (2) | Includes guests that stay in hotel rooms and guest houses. |

| (3) | Based on three-, four- and five-star hotels in Macao. |

25

Sands China Ltd.

Industry Overview

We believe the average length of stay in Macao will continue to rise and Macao will ultimately develop into a hotel market similar to Las Vegas. According to the “2009 Las Vegas Visitor Profiles Study” published by the Las Vegas Convention and Visitors Authority, visitors in 2009 stayed on average 3.6 nights in Las Vegas. Convention facilities in Macao are still limited in size as compared to the regional convention markets. The largest convention facility in Macao is located at The Venetian Macao, which opened in August 2007 and contains 1.2 million square feet of meeting, convention and exhibition space. According to the Macao Government Tourist Office, meeting and convention attendance in Macao has grown at a CAGR of 81.6% from 2004 to 2009.

Despite a global downturn in MICE business, Macao experienced growth in this sector in 2009. According to the DSEC, a total of 1,485 MICE events were held at various venues in Macao in 2009, comprising 1,405 meetings/conferences and 80 exhibitions. These events were attended by 660,881 participants, and the average length of stay by visitors attending these events was 2.0 days. Other venues in Macao often host a larger number of public and non-trade events. Sands China, meanwhile, is the preferred host for commercial groups. The following table shows the number of MICE events and participants in Macao from 2004 to 2009:

| | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2004 | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | | | | |

Total Number of MICE Events | | 278 | | 305 | | | 360 | | | 1,177 | | | 1,240 | | | 1,485 | |

Year-on-year Change | | — | | 9.7 | % | | 18.0 | % | | 227.0 | % | | 5.4 | % | | 19.8 | % |

Total MICE Participants | | 33,501 | | 43,531 | | | 57,089 | | | 301,979 | | | 364,320 | | | 660,881 | |

Year-on-year Change | | — | | 29.9 | % | | 31.1 | % | | 429.0 | % | | 20.6 | % | | 81.4 | % |

Macao MICE Events and Participants

Source: DSEC.

26

Annual Report 2009

Industry Overview

According to the National Development and Reform Commission’s Outline of the Plan for the Reform and Development of the Pearl River Delta, the region will seek to grow its convention and exhibition industries through the creation and global marketing of specialized conventions and exhibitions, and through increased cooperation between Macao, Hong Kong and the Pearl River Delta. We expect future developments to create a critical mass of high quality accommodations and other amenities, which we believe will enable Macao to develop into a leading MICE destination.

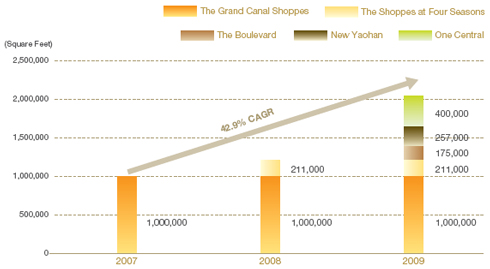

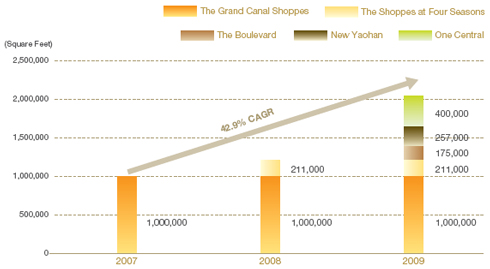

Retail Market

The retail market in Macao is growing and becoming an increasingly important part of the Macao economy. Retailers benefit from Macao’s luxury goods tax-exemption (like Hong Kong but unlike mainland China), making Macao a relatively attractive and inexpensive place to shop for mainland Chinese visitors. Existing large-scale retail areas total approximately 2,043,000 gross square feet and include:

| | | | | | | |

Opened | | Retail Area | | Property | | Square Footage(1) | |

| | | |

| 2007 | | The Grand Canal Shoppes | | The Venetian Macao | | 1,000,000 | |

| 2008 | | The Shoppes at Four Seasons | | The Plaza Macao | | 211,000 | |

| 2009 | | The Boulevard | | City of Dreams | | 175,000 | (2) |

| 2009 | | New Yaohan | | New Yaohan | | 257,000 | |

| 2009 | | One Central | | One Central, Macao | | 400,000 | |

Macao Large Scale Retail Areas

| (1) | Square footage for The Grand Canal Shoppes and The Shoppes at Four Seasons represent net square footage. Square footage for The Boulevard, One Central, and New Yaohan represent gross square footage. |

| (2) | Includes both phases. Currently, only Phase I (85,000 square feet) is open. Phase II (90,000 square feet) is expected to open in the future. |

27

Sands China Ltd.

Industry Overview

Based on our management’s experience, we believe that the build-out of integrated resorts on Cotai will drive retail spending in a manner similar to that experienced in Las Vegas following the opening of integrated resorts and related retail facilities such as The Grand Canal Shoppes at The Venetian in Las Vegas. The following table illustrates the growth in total shopping spending by visitors to Macao from 2004 to 2009:

| | | | | | | | | | | | |

| | | For the year ended December 31, |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 |

| | | (US$ in millions, except percentages) |

| | | | | | |

Total shopping spending(1) | | 1,409 | | 1,457 | | 1,906 | | 2,224 | | 2,638 | | 1,760 |

Source: DSEC Visitor Expenditure Survey. Converted from MOP at the Exchange Rate.

| (1) | Shopping spending as calculated by the DSEC consists of spending for clothing, jewelry, local food products, cosmetics, electrical equipment, shoes, handbags, wallets and others. |

Competition

The gaming operators in Macao currently consist of the six Concessionaires or Subconcessionaires. As of December 31, 2009:

| | • | | VML, our subsidiary, operated three gaming facilities: The Venetian Macao, the Sands Macao and the Plaza Casino at The Plaza Macao; |

| | • | | Galaxy operated five gaming facilities in Macao, including StarWorld Hotel, and is developing the Galaxy Mega Resort, which is adjacent to The Venetian Macao; |

| | • | | Melco Crown operated three gaming facilities, including the Altira and City of Dreams, a property located opposite to The Venetian Macao; |

| | • | | MGM Grand Paradise Limited operated one gaming facility, the MGM Grand Macau; |

| | • | | SJM operated 20 gaming facilities in Macao, including the Lisboa and the Grand Lisboa; and |

| | • | | Wynn Macau operated one gaming facility, the Wynn Macau. |

28

Annual Report 2009

Industry Overview

In addition, some of these gaming operators have planned or are currently developing projects that will increase future casino supply and intensify competition. The Macao market also faces competition from casinos located in other areas of Asia and from other major gaming centers worldwide. The relative scale of our properties and gaming operations and those of the other operators is shown in the table below:

| | | | | | | | | | | | | | | | | | |

| | | Number of Casinos

As of December 31, | | Gaming Tables(1)

As of December 31, | | Slot Machines(2)

As of December 31, |

Operator | | 2007 | | 2008 | | 2009 | | 2007 | | 2008 | | 2009 | | 2007 | | 2008 | | 2009 |

| | | | | | | | | |

VML | | 2 | | 3 | | 3 | | 1,450 | | 1,202 | | 1,128 | | 5,134 | | 4,260 | | 4,251 |

Other | | 26 | | 28 | | 30 | | 2,925 | | 2,815 | | 3,642 | | 8,133 | | 7,596 | | 10,112 |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Total | | 28 | | 31 | | 33 | | 4,375 | | 4,017 | | 4,770 | | 13,267 | | 11,856 | | 14,363 |

| | | | | | | | | | | | | | | | | | |

Source: DICJ.

| (1) | Includes VIP rooms and mass market gaming tables. |

| (2) | As of December 31, 2007, 2008 and 2009, VML had 4,237, 3,445 and 3,491 slot machines, respectively, which were active on the floor. |

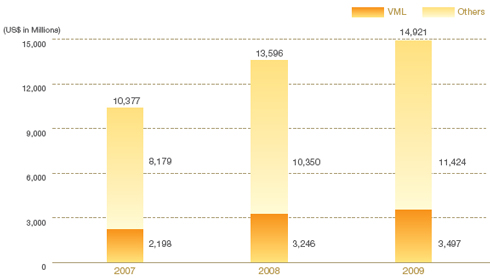

Based on publicly available data shown in the following table, we estimate that our three existing Macao properties enjoyed approximately 23.9% and 23.4% of the share of Macao gaming revenue for the years ended December 31, 2008 and 2009, respectively. This market share exceeded that of several of our competitors in Macao.

| | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2007 | | | 2008 | | | 2009 | |

Company | | Gaming

Revenue | | % | | | Gaming

Revenue | | % | | | Gaming

Revenue | | % | |

| | | (US$ in millions, except percentages) | |

| | | | | | |

VML | | 2,198 | | 21.2 | % | | 3,246 | | 23.9 | % | | 3,497 | | 23.4 | % |

Others | | 8,179 | | 78.8 | % | | 10,350 | | 76.1 | % | | 11,424 | | 76.6 | % |

| | | | | | | | | | | | | | | |

| | | | | | |

Total | | 10,377 | | 100.0 | % | | 13,596 | | 100.0 | % | | 14,921 | | 100.0 | % |

| | | | | | | | | | | | | | | |

29

Sands China Ltd.

Industry Overview

Macao Gaming Revenues

Source: DICJ.

This industry overview is for your general information and is included in this annual report solely to update certain related information disclosed in our Prospectus. We may determine not to update general information relating to our industry in future years.

30

Annual Report 2009

Business Overview

We are the leading developer, owner and operator of integrated resorts and casinos in Macao as measured by adjusted EBITDAR for the years ended December 31, 2008 and 2009. We are the largest operator of integrated resorts in Macao, which contain not only gaming areas but also meeting space, convention and exhibition halls, retail and dining areas and entertainment venues. We believe that our integrated resorts are unique to Macao and differentiate us from our competitors. VML, our subsidiary, holds one of six concessions or subconcessions permitted by the Macao Government to operate casinos or gaming areas in Macao. Macao is the largest gaming market in the world as measured by casino gaming revenue and is the only location in China offering legalized casino gaming.

We own The Venetian Macao, the Sands Macao and The Plaza Macao. We also own CotaiExpo, one of the largest convention and exhibition halls in Asia; Macao’s largest entertainment venue, the CotaiArena; and one of three major high speed ferry companies operating between Hong Kong and Macao. Our luxury and mid-market retail malls feature over 380 shops with well-known retail brands such as Calvin Klein, Cartier, Chanel, Esprit, Gucci, Hermès, Louis Vuitton, Nike and Prada, as well as the MALO CLINIC Spa, one of Asia’s largest medical and beauty spas. As of December 31, 2009, our properties featured 3,554 suites and hotel rooms, 19 Paiza Mansions, 1,128 table games, 3,491 slot machines, over 60 different restaurants and food outlets, as well as other integrated resort amenities.

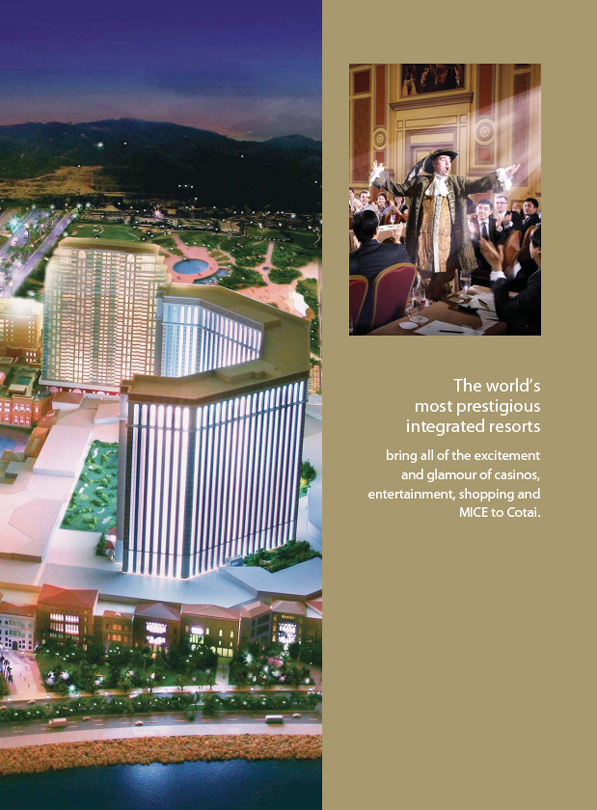

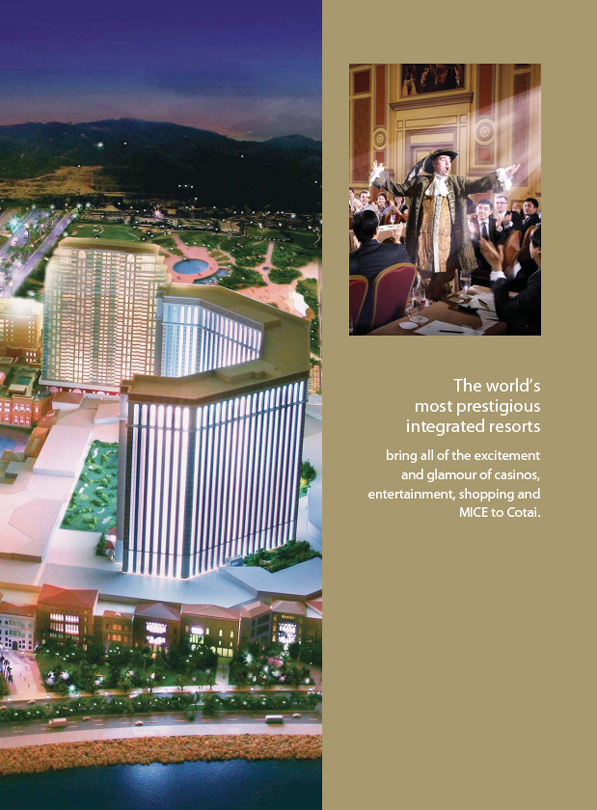

Our business strategy is to develop Cotai and to leverage our integrated resort business model to create Asia’s premier gaming, leisure and convention destination. Our ultimate plans for Cotai include five interconnected integrated resorts, which leverage a wide range of branded hotel and resort offerings to attract different segments of the market. When completed, we expect our Cotai Strip development to contain over 20,000 hotel rooms, over 1.6 million square feet of MICE space, and over 2.0 million square feet of retail malls, theaters and other amenities. We believe our business strategy and development plan will allow us to achieve more consistent demand, longer average length of stay in our hotels and higher margins than more gaming-centric facilities.

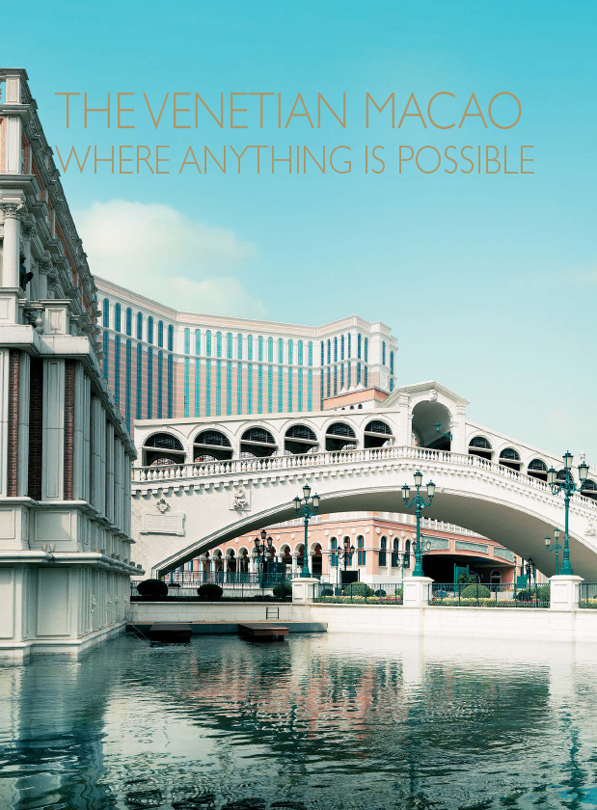

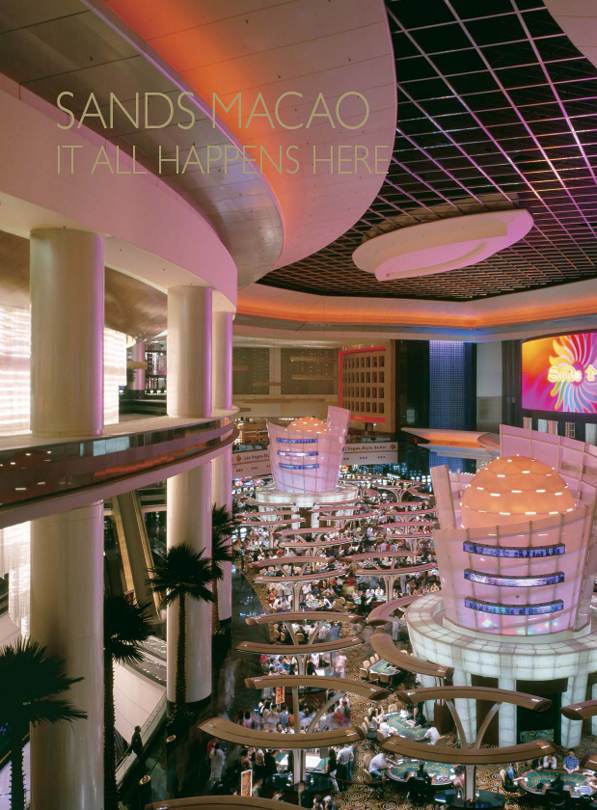

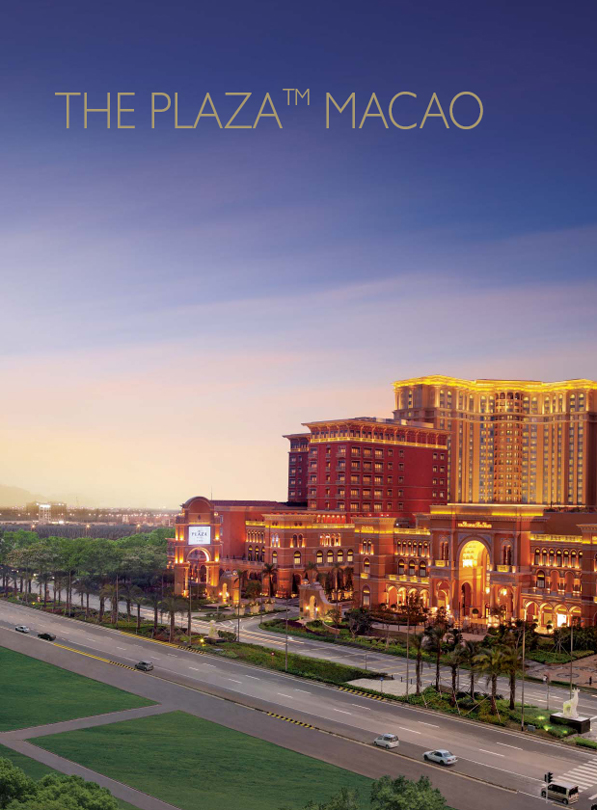

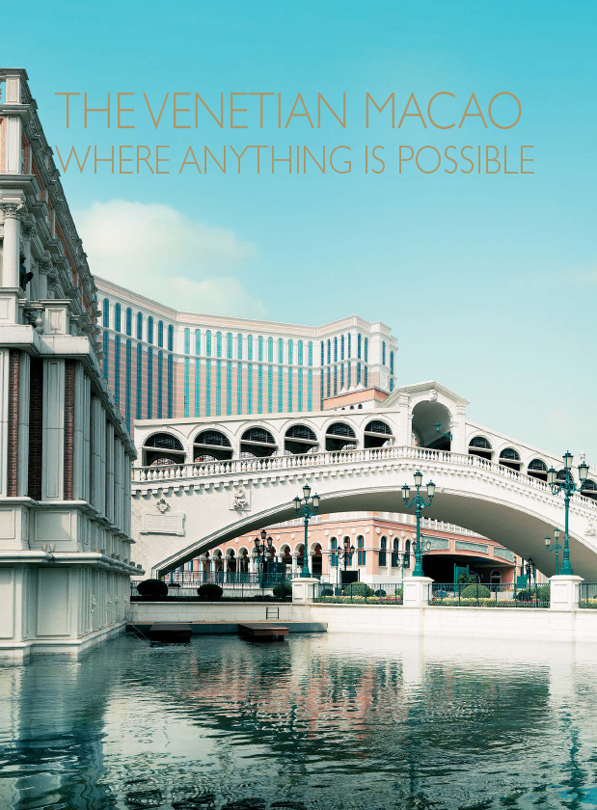

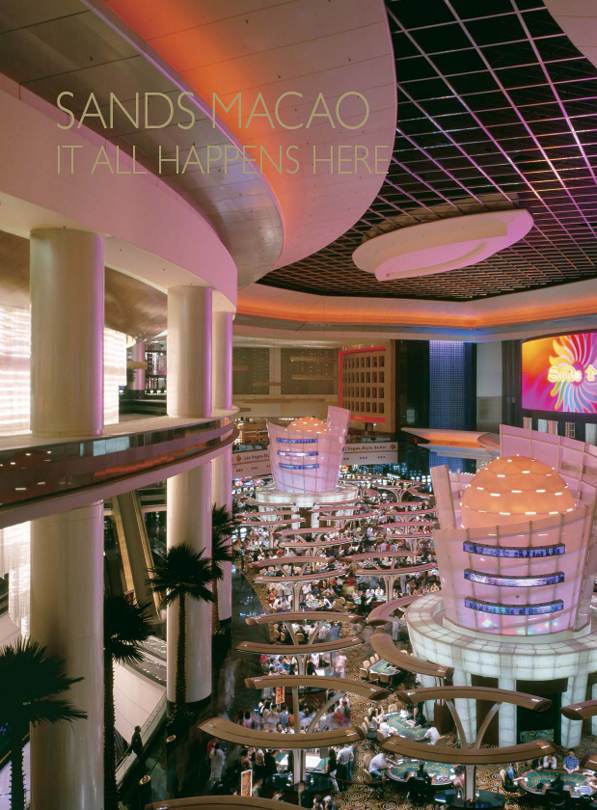

In May 2004, we opened the Sands Macao to target the mass market segment. The Sands Macao was the first Las Vegas-style casino in Macao, and currently contains a mix of gaming areas for mass market, VIP and premium players, and entertainment and dining facilities. In August 2007 we opened Macao’s largest integrated resort, The Venetian Macao, and in August 2008 we opened The Plaza Macao, a boutique luxury integrated resort featuring a Four Seasons Hotel, The Shoppes at Four Seasons and the Plaza Casino. In July 2009, we completed and introduced our ultra-exclusive Paiza Mansions at The Plaza Macao. These Mansions are individually designed and are made available by invitation only.

Key Strengths

We believe that we have a number of key strengths that differentiate our business from that of our competitors, including:

| | • | | Diversified, high quality integrated resort offerings with substantial non-gaming amenities; |

| | • | | Substantial cash flow from existing operations and a significant development pipeline; |

| | • | | Established brands with broad regional and international market awareness and appeal; |

| | • | | An experienced management team with a proven track record; and |

| | • | | Significant benefits from our on-going relationship with LVS. |

31

Sands China Ltd.

Business Overview

Business Strategies

Building on our key strengths, we seek to enhance our position as the leading developer and operator of integrated resorts and casinos in Macao by continuing to implement the following business strategies:

| | • | | Developing and diversifying our integrated resort offerings in Cotai to include a full complement of products and services to cater to different market segments.Our ultimate plans for Cotai include five integrated resorts, MICE space, additional retail, dining and entertainment facilities and a range of hotel offerings to cater to different segments of the market. We plan to diversify our existing base of five-star hotel rooms on Cotai with four- and three-star hotel rooms. After completion of our remaining integrated resorts in Cotai, we expect to have, among others, Sheraton, Shangri-La and Traders branded hotel rooms. We intend to leverage the recognition and the sales, marketing and reservation capabilities of these premier hotel brands to attract a new segment of customers to our properties. We believe our partnership with renowned hotel management partners, our diverse integrated resort offerings and the convenience and accessibility of our properties will further increase the appeal of our properties to both the business and leisure customer segments. |

| | • | | Leverage our scale of operations to create and maintain an absolute cost advantage.Management expects to benefit from lower unit costs due to the economies of scale inherent in its operations. Opportunities for lower unit costs include, but are not limited to lower utility costs; more efficient staffing of hotel and gaming operations; and centralized laundry, transportation, marketing and sales, and procurement. In addition, our scale allows us to consolidate certain back office functions and, where appropriate, to relocate these functions to Zhuhai, China. Zhuhai labor rates are approximately one third of those in Macao. |

| | • | | Focus on the high-margin mass market gamingsegment, while continuing to provide luxury amenities and high service levels to our VIP and premium players.Our properties cater not only to VIP and premium players but also to mass market customers, which comprise our most profitable gaming segment. We believe that the mass market segment will continue to be a fast-growing segment as a result of the introduction of more high-quality gaming facilities and non-gaming amenities into the market. As of December 31, 2009, our properties contained approximately 849,000 square feet of gaming space, consisting of 3,491 slot machines and 1,128 table games, 761 tables of which were dedicated to mass market play. Our management estimates that our mass market table revenues typically generate a gross margin that is approximately four times higher than that of our typical VIP player table revenues. Additionally, because mass market players do not receive extensive complimentary services, including provision of hotel rooms, meals or other products or services, they contribute significantly to our non-gaming revenues. At the same time, we are focused on growing our share of the premium players segment via direct marketing efforts and by leveraging our Paiza brand and luxury amenities that enable us to differentiate our properties from those of our competitors, who typically rely more on Gaming Promoters for their VIP players. To attract premium players, we offer them accommodations in our exclusive Paiza suites and Paiza Mansions, complete with private gaming and concierge services. Our management estimates that our premium player table revenues generate a gross margin that is approximately 1.0 to 1.5 times higher than our typical VIP player table revenues. |

32

Annual Report 2009

Business Overview

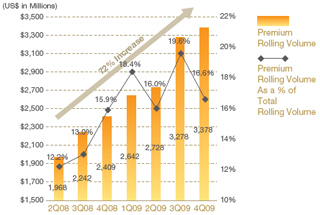

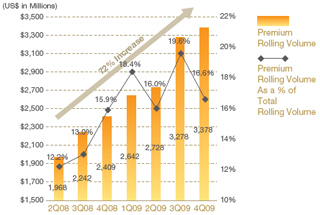

Strategy to Grow Premium (Direct) Rolling Volume

| | | | |

Increasing Premium Direct Rolling Volume | | | | Luxury Paiza Facilities Catering to VIPs |

| | • | | 64 Paiza suites and 19 Paiza Mansions offered exclusively to VIP and premium players |

| | • | | Private gaming and concierge services complete the ultra-exclusive luxury experience |

| | | |

|

Our higher margin premium rolling play has grown 72% over the last 6 quarters

Comparison of VIP to Mass Market

Mass Market Gross Margin approximately 4x Higher than VIP

33

Sands China Ltd.

Business Overview

| | • | | Monetize our non-core assets to reduce netinvestment through the sale of retail malls and the sale or co-operativization of luxury apart-hotels.Our integrated resorts include retail facilities and apart-hotels. These assets can be sold to increase our financial flexibility and improve our returns on invested capital. The sale of these assets does not diminish the ability of the retail facilities and apart-hotels to attract traffic to our properties. Below is a description of our retail malls and the apart-hotel tower as well as the potential methodologies to monetize the apart-hotel: |

Retail Malls:

We have existing retail malls at The Venetian Macao (The Grand Canal Shoppes) and The Plaza Macao (The Shoppes at Four Seasons) and additional malls planned at our other Cotai Strip projects. We plan to sell these retail malls when we believe market conditions support appropriate and optimized valuations. In connection with any future negotiation with respect to the sale of the retail malls, we will endeavor to maintain operational influence in the form of product positioning and certain consent and approval rights through binding agreements that would be entered into with any purchaser of the retail malls, which could include approval of the classes and types of stores permitted in the retail mall. In addition, as part of our negotiations with the potential buyers, we will endeavor to require the buyer to commit to operating the retail malls in accordance with the “Venetian” theme or another applicable up-scale or high-end theme, and at a level of quality and service which would continue to complement our adjoining properties.

Apart-Hotel:

We have substantially completed the construction of an apart-hotel tower, which is anticipated to be branded and serviced by Four Seasons, and we expect to complete the fit-out by the fourth quarter of 2010. We plan to monetize this apart-hotel tower through the sale of exclusive rights to use individual apart-hotel units under a cooperative scheme subject to fulfilling all legal requirements. However, we will continue to consider and review all options available to monetize this asset.

Other Operations

As part of our goal of driving visitation to Cotai and improving the customer experience in Macao, we have made targeted investments to help develop Macao’s transportation infrastructure. Our transportation operations consist of our high-speed CotaiJet ferry service between Hong Kong and Macao, airplane service available for VIP and premium players, CotaiShuttle bus service, CotaiLimo™ service and a travel agency.

CotaiJet Ferry Services

In November 2007, we launched our high-speed CotaiJet ferry service between Macau Ferry Terminal in Hong Kong and Taipa Temporary Ferry Terminal near our Cotai Strip development. In 2009, our CotaiJet ferry services provided an average of approximately 40 daily round trip sailings. With our 14 ferries, we have the ability to run ferries on 15-minute intervals as needed to meet demand. We transferred approximately 9,700 passengers per day for the year ended December 31, 2008 and approximately 13,400 passengers per day for the year ended December 31, 2009, a year-on-year increase of 38%.

The CotaiJet service is fully managed and operated on our behalf by Cotai Chu Kong Shipping Management Services Co., Ltd. of Hong Kong, using catamarans owned by our wholly-owned indirect subsidiaries. Each custom-built catamaran has the capacity to carry more than 400 passengers and operates at top speeds of approximately 42 knots.

We operate our passenger ferry service pursuant to a 10-year license granted to us by the Macao Government on January 14, 2010, replacing the Ferry Agreement in place between the Macao Government and Cotai Ferry Company Limited (“CFCL”) prior to that date.

34

Annual Report 2009

Business Overview

Airplanes

Through a Shared Services Agreement with LVS, we have access to a fleet of 14 corporate configured airplanes, three of which are currently stationed full-time in Asia. All airplanes are owned by various entities controlled by our Controlling Shareholder and are operated by Sands Aviation LLC, an affiliate of our Company. We can deploy these airplanes to bring VIP and premium players from around the globe to our properties in Macao.

CotaiShuttle Bus Service

We operate a fleet of 102 (79 owned, 23 rented) complimentary shuttle buses that transport passengers between our properties and from the New Macau Maritime Ferry Terminal, the Taipa Temporary Ferry Terminal (“TTFT”) and the Macau International Airport to our properties every five to ten minutes during peak periods. These shuttle buses are also supported by an additional 30 coaches to serve increased demand. The CotaiShuttle also runs to and from two border checkpoints with mainland China, the Gongbei Border Gate and the Lotus Bridge, transporting visitors directly to and between our properties every five to eight minutes during peak periods. Certain bus service routes, such as those from the New Macau Maritime Ferry Terminal and TTFT, and between our properties, run 24 hours per day and help us direct visitors to our properties. Based on our operational data, our management estimates that over 10.0 million passengers arrived at The Venetian Macao, the Sands Macao and The Plaza Macao on our complimentary shuttle bus service in the year ended December 31, 2009. In addition, a free shuttle bus service operates between our Cotai properties and the City of Dreams to enhance the overall Cotai experience. All of these routes maintain a regular schedule, although exact operating hours are dependent on the specific route. Most routes operate for at least 16 hours every day.

CotaiLimo