Exhibit 99.1

Exhibit 99.1

Sands China Ltd.

(Incorporated in the cayman Islands with limited liability)

Stock code: 1928

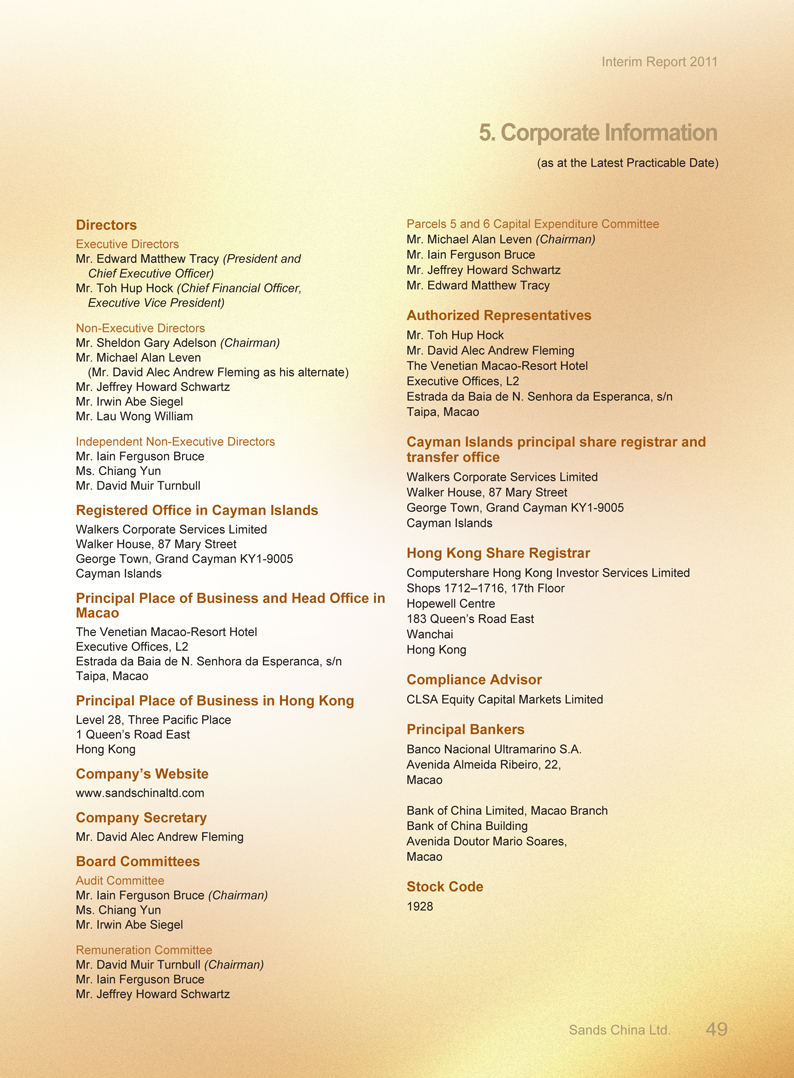

Sands China Ltd.

2011

Interim Report

This interim report is printed on recycled paper using soy ink

* For identification purposes only

Contents

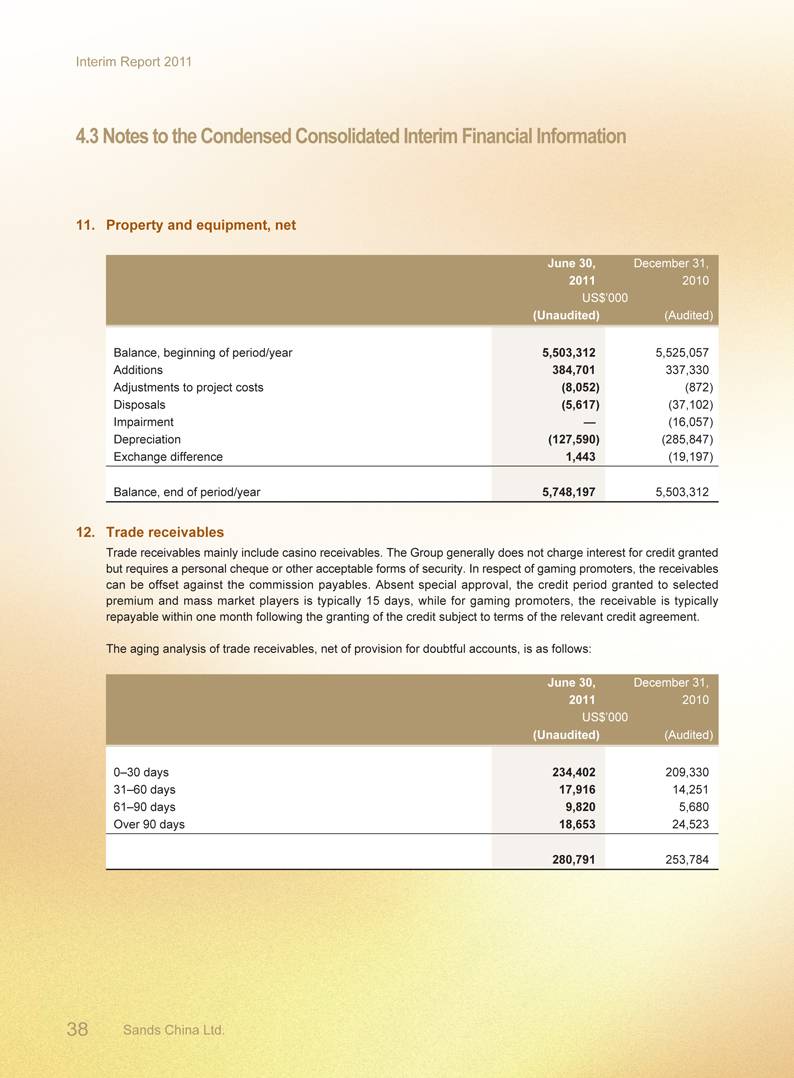

1. Overview 2

1.1 Financial Highlights 2

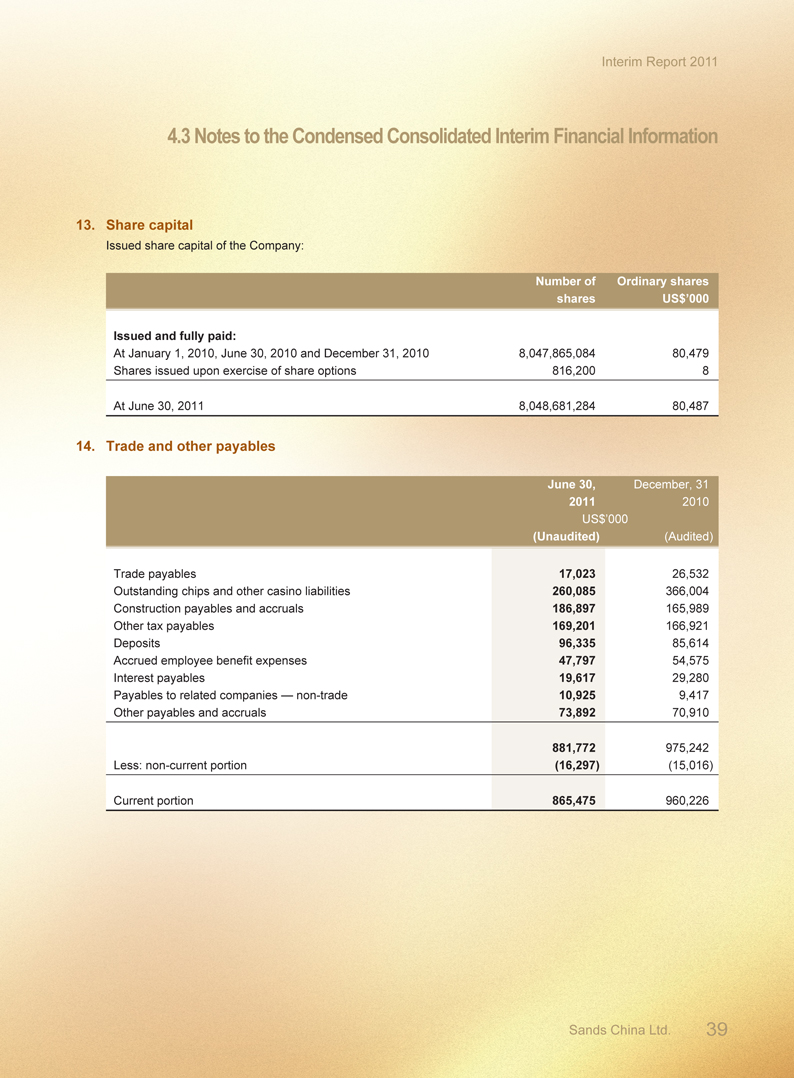

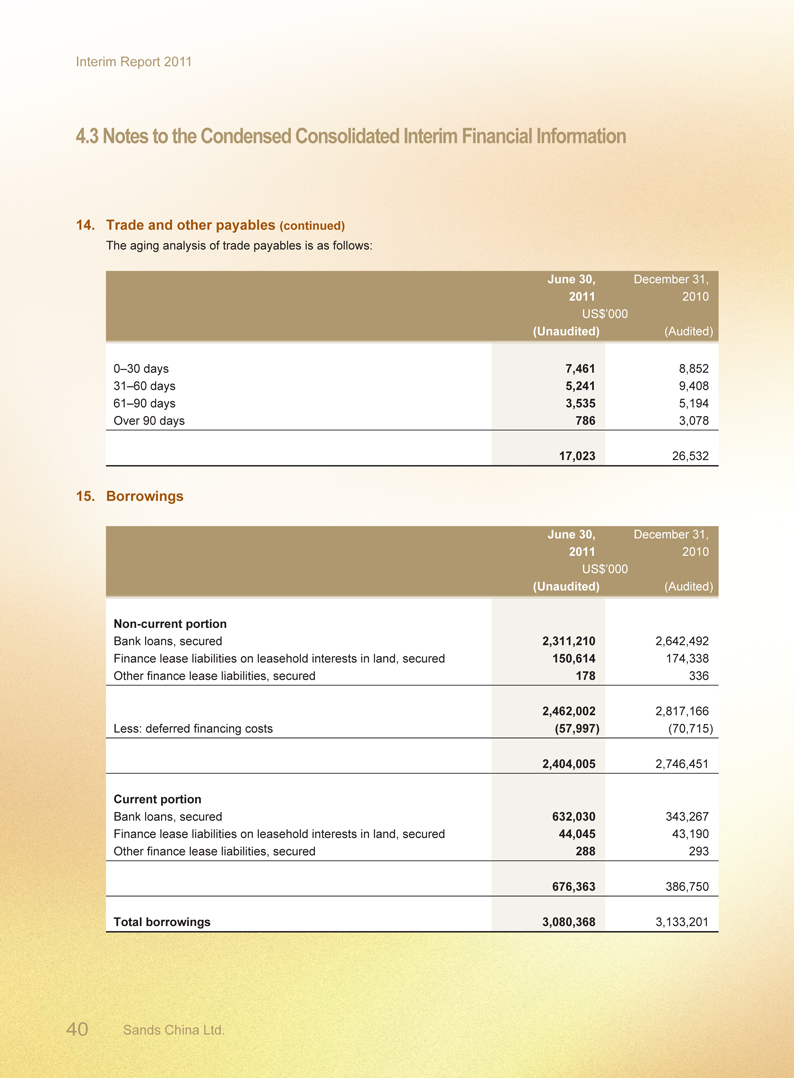

2. Management Discussion and Analysis 3

2.1 Results of Operations 3

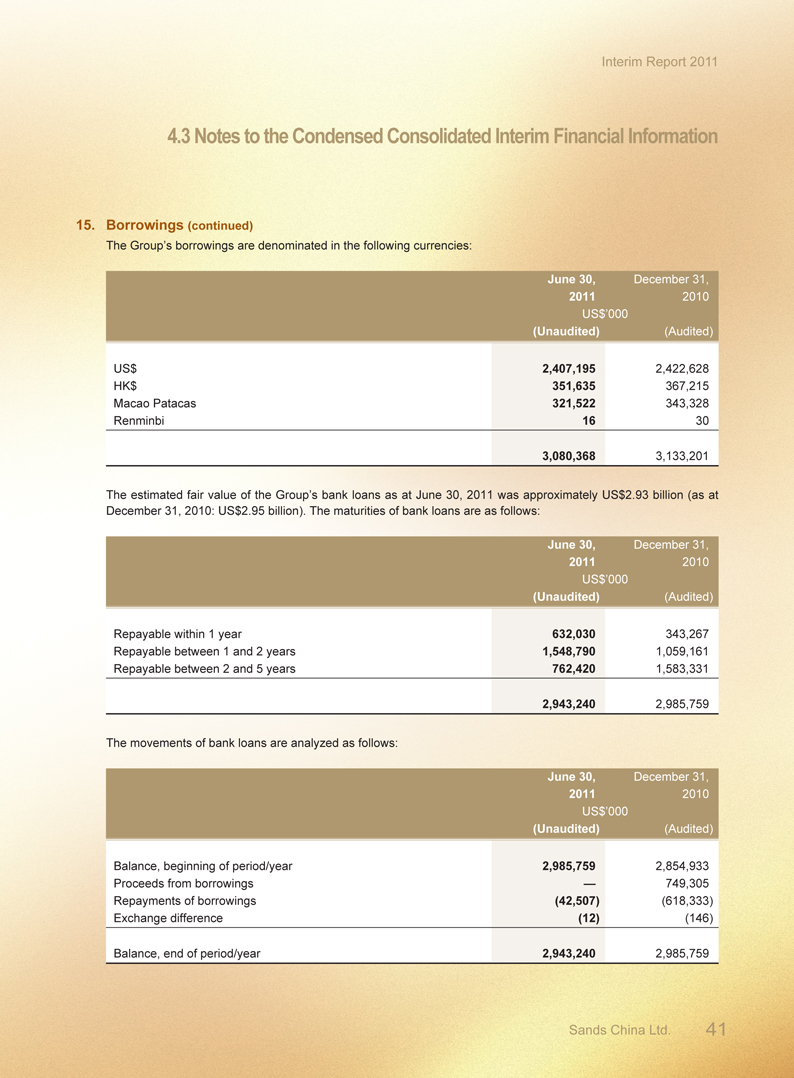

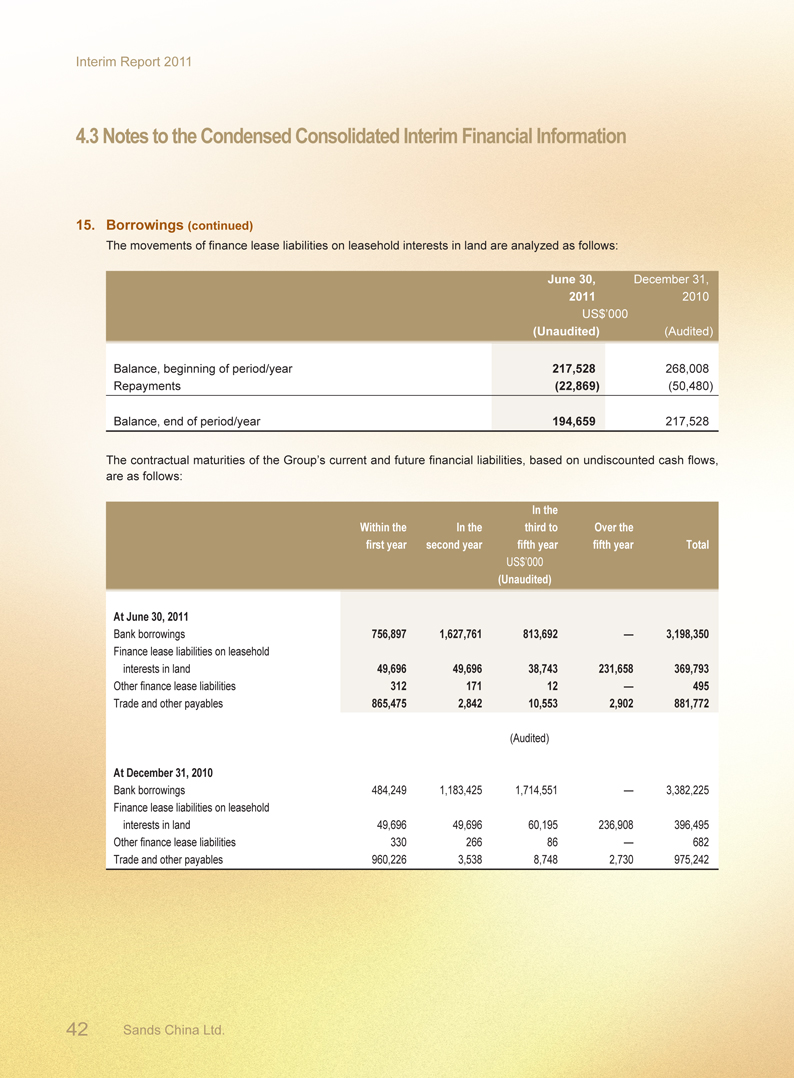

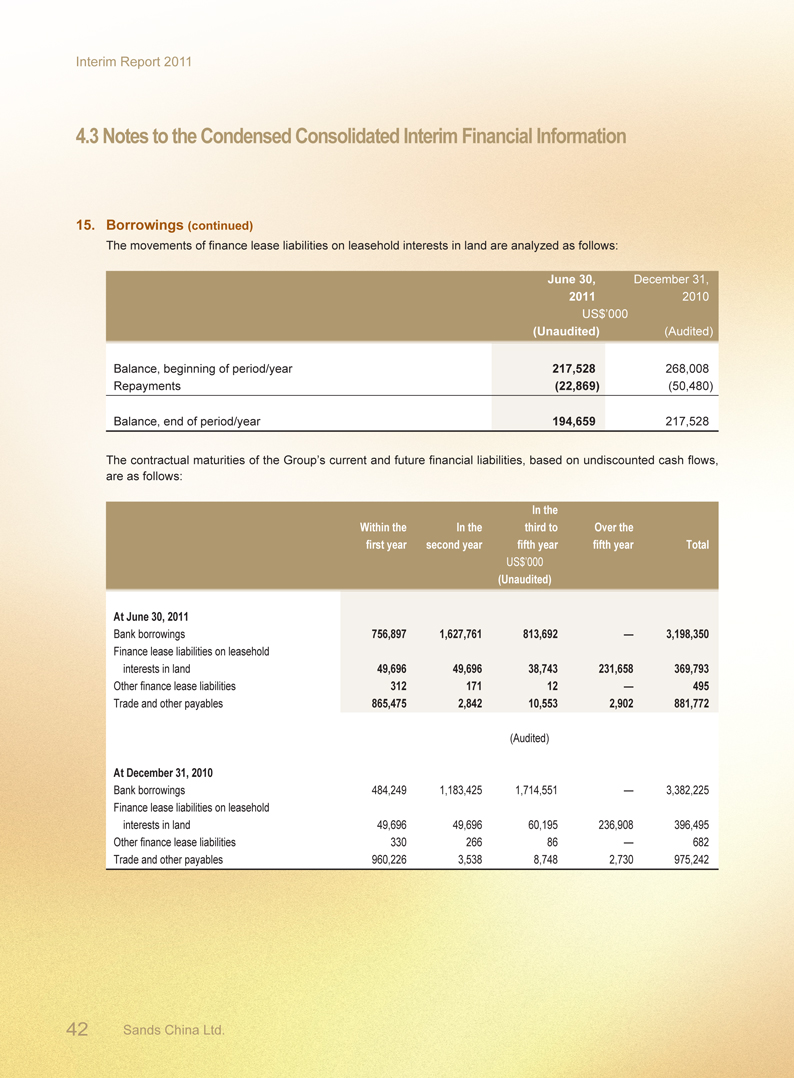

2.2 Liquidity and Capital Resources 9

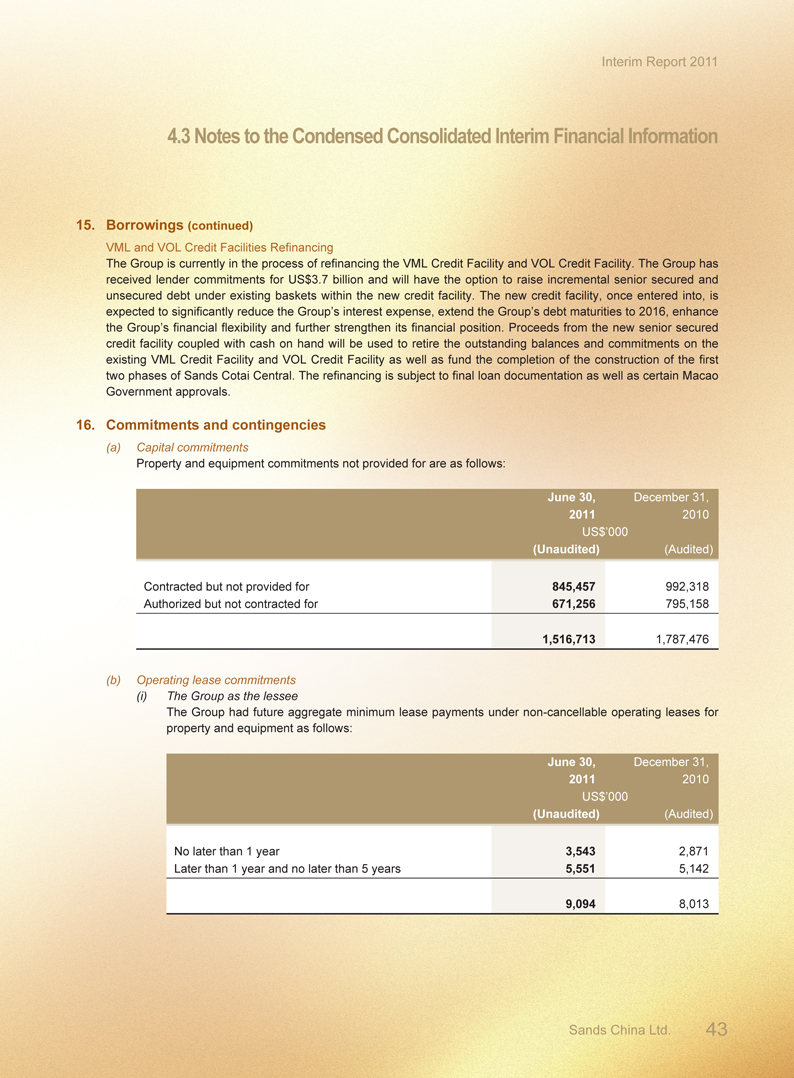

2.3 Capital Expenditures 10

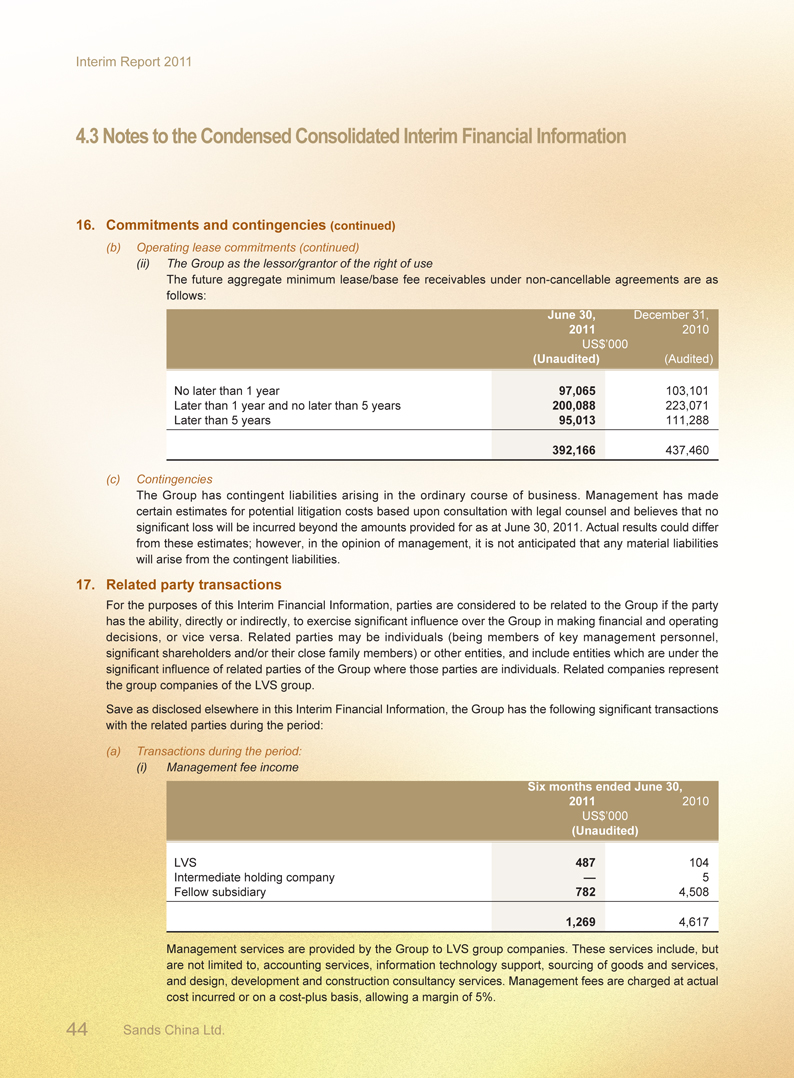

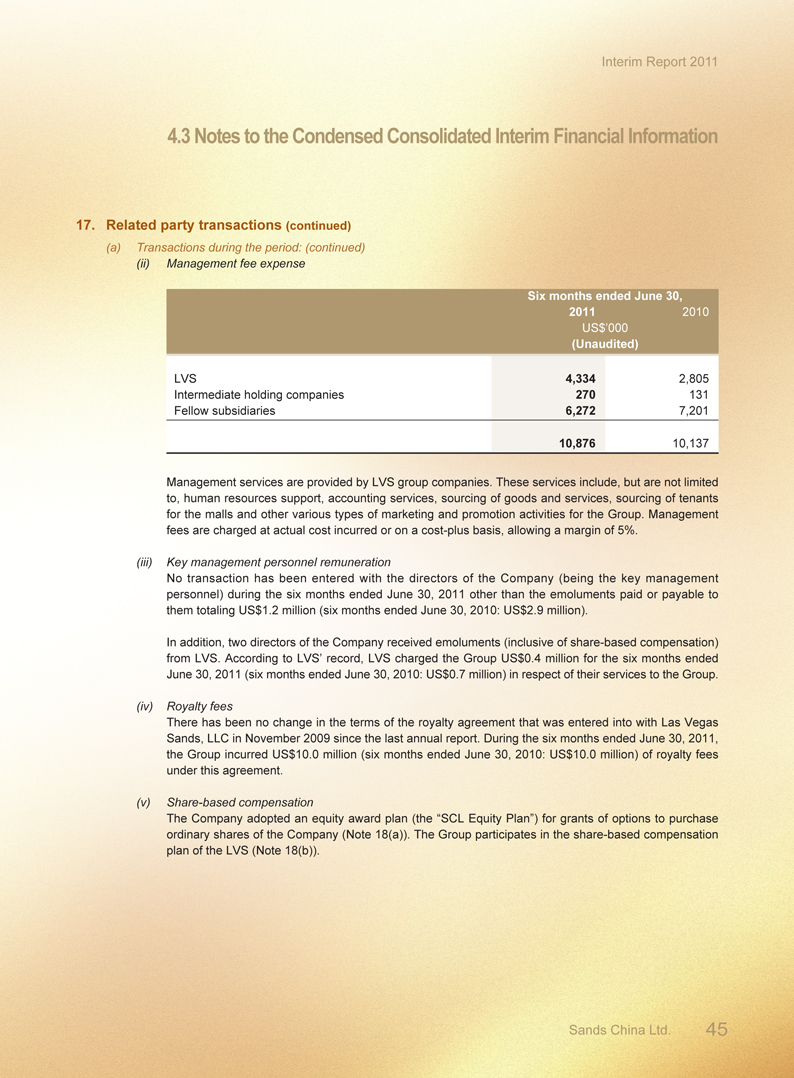

2.4 Capital Commitments 11

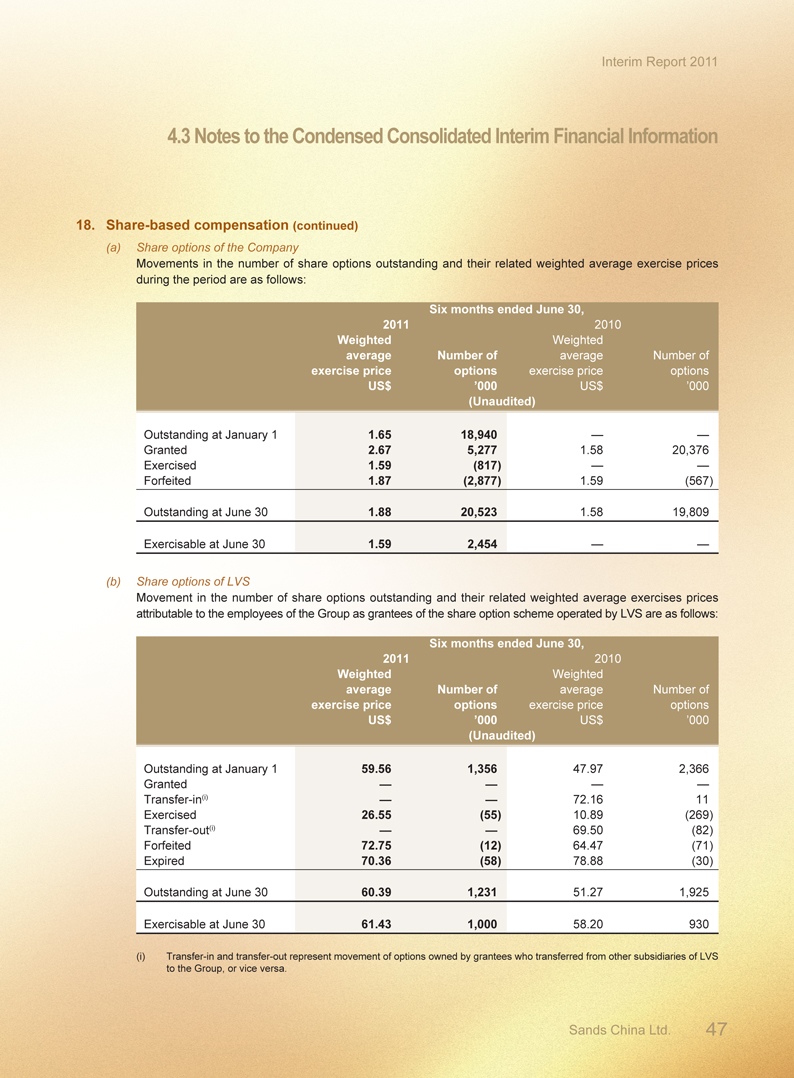

2.5 Interim Dividend 11

2.6 Pledge of Fixed Assets 11

2.7 Contingent Liabilities and Risk Factors 11

2.8 Capital Risk Management 12

2.9 Foreign Exchange Risk 12

2.10 Business Review and Prospects 13

3. Corporate Governance 14

3.1 Human Resources 14

3.2 Environment 14

3.3 Corporate Governance Practices 14

3.4 Code Provision 14

3.5 Model Code for Securities Transactions 14

3.6 Board and Board Committees Composition 15

3.7 Disclosure of Director’s Information 17

3.8 Audit Committee Review 17

3.9 Disclosure of Interests 17

3.10 Share Option Scheme 20

3.11 Purchase, Sale or Redemption of 21

the Company’s Listed Shares

4. Interim Financial Information 22

4.1 Report on Review of 22

Interim Financial Information

4.2 Condensed Consolidated 23

Interim Financial Information

4.3 Notes to the Condensed Consolidated 29

Interim Financial Information

5. Corporate Information 49

6. Contact Us 50

7. Glossary 51

Interim Report 2011

1. Overview

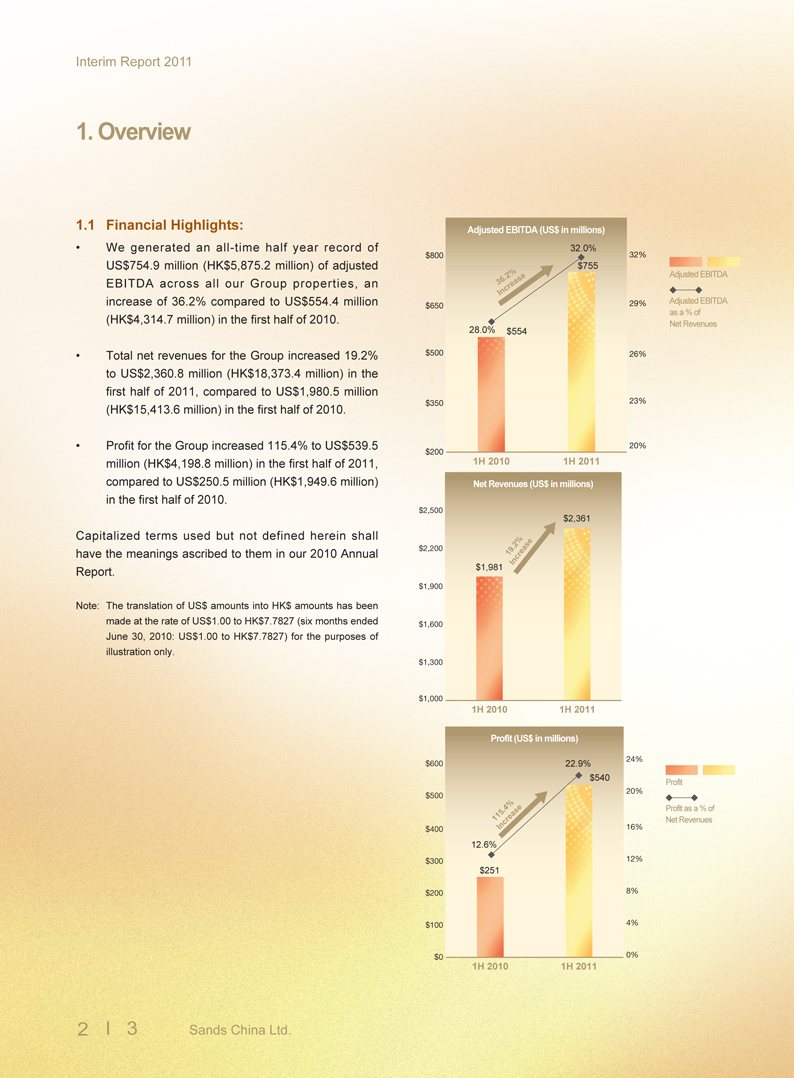

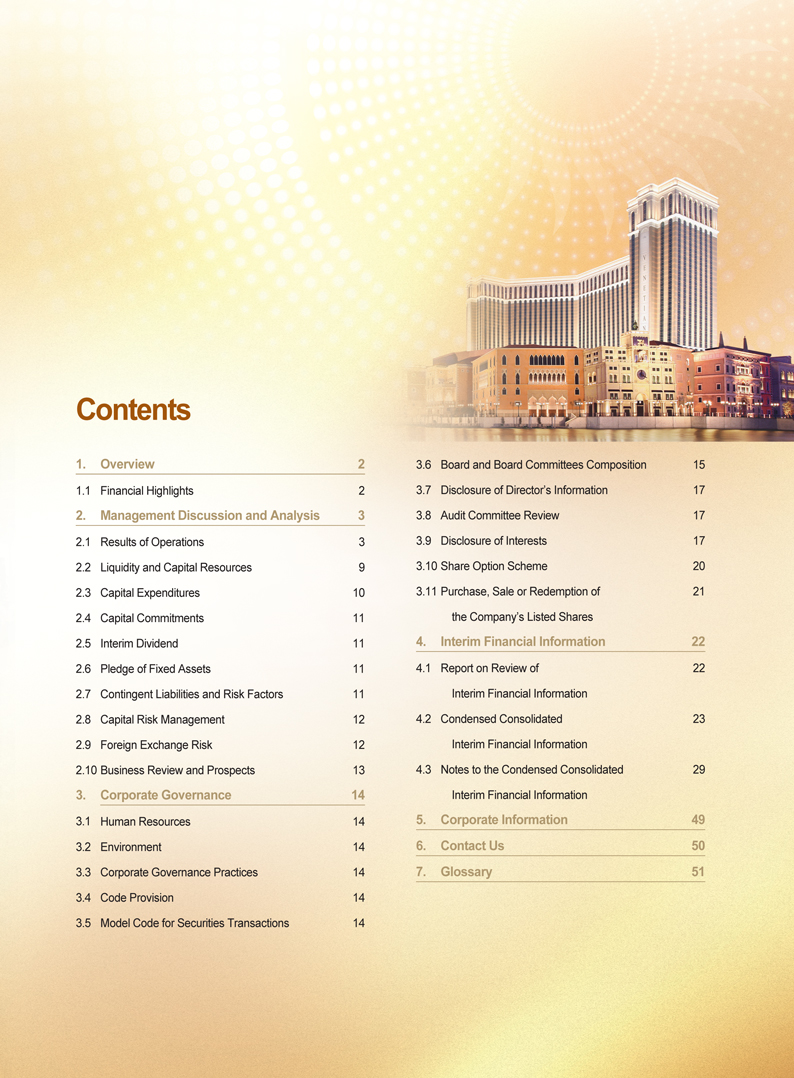

1.1 Financial Highlights:

• We generated an all-time half year record of

US$754.9 million (HK$5,875.2 million) of adjusted

EBITDA across all our Group properties, an

increase of 36.2% compared to US$554.4 million

(HK$4,314.7 million) in the first half of 2010.

• Total net revenues for the Group increased 19.2%

to US$2,360.8 million (HK$18,373.4 million) in the

first half of 2011, compared to US$1,980.5 million

(HK$15,413.6 million) in the first half of 2010.

• Profit for the Group increased 115.4% to US$539.5

million (HK$4,198.8 million) in the first half of 2011,

compared to US$250.5 million (HK$1,949.6 million)

in the first half of 2010.

Capitalized terms used but not defined herein shall

have the meanings ascribed to them in our 2010 Annual

Report.

Note: The translation of US$ amounts into HK$ amounts has been

made at the rate of US$1.00 to HK$7.7827 (six months ended

June 30, 2010: US$1.00 to HK$7.7827) for the purposes of

illustration only.

Adjusted EBITDA (US$ in millions)

32.0%

$800 32%

$755

. 2%

36 Increase

$650 29%

28.0% $554

$500 26%

$350 23%

20%

$200

1H 2010 1H 2011

Adjusted EBITDA

Adjusted EBITDA

as a % of

Net Revenues

Net Revenues (US$ in millions)

$2,500 $2,361

$2,200 . 2%

19 Increase

$1,981

$1,900

$1,600

$1,300

$1,000

1H 2010 1H 2011

Profit (US$ in millions)

24%

$600 22.9%

$540

20%

$500

. 4%

115 Increase 16%

$400

12.6%

$300 12%

$251

$200 8%

$100 4%

$0 0%

1H 2010 1H 2011

Profit

Profit as a % of

Net Revenues

Interim Report 2011

2. Management Discussion and Analysis

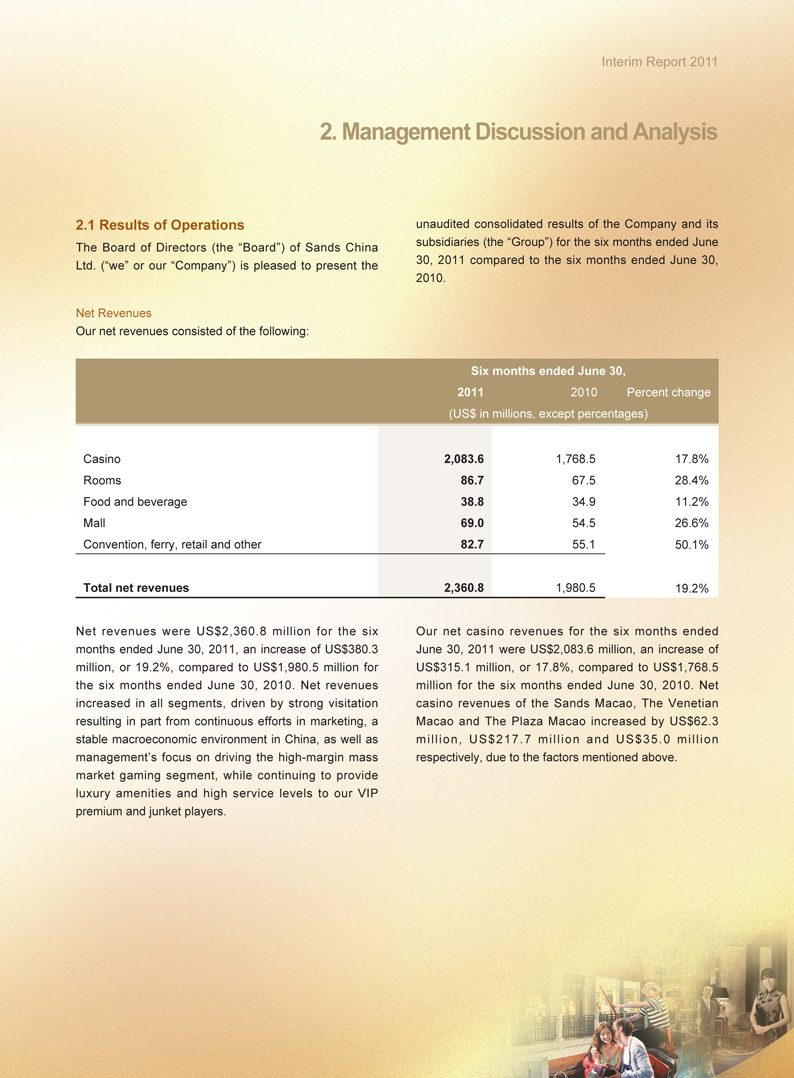

2.1 Results of Operations

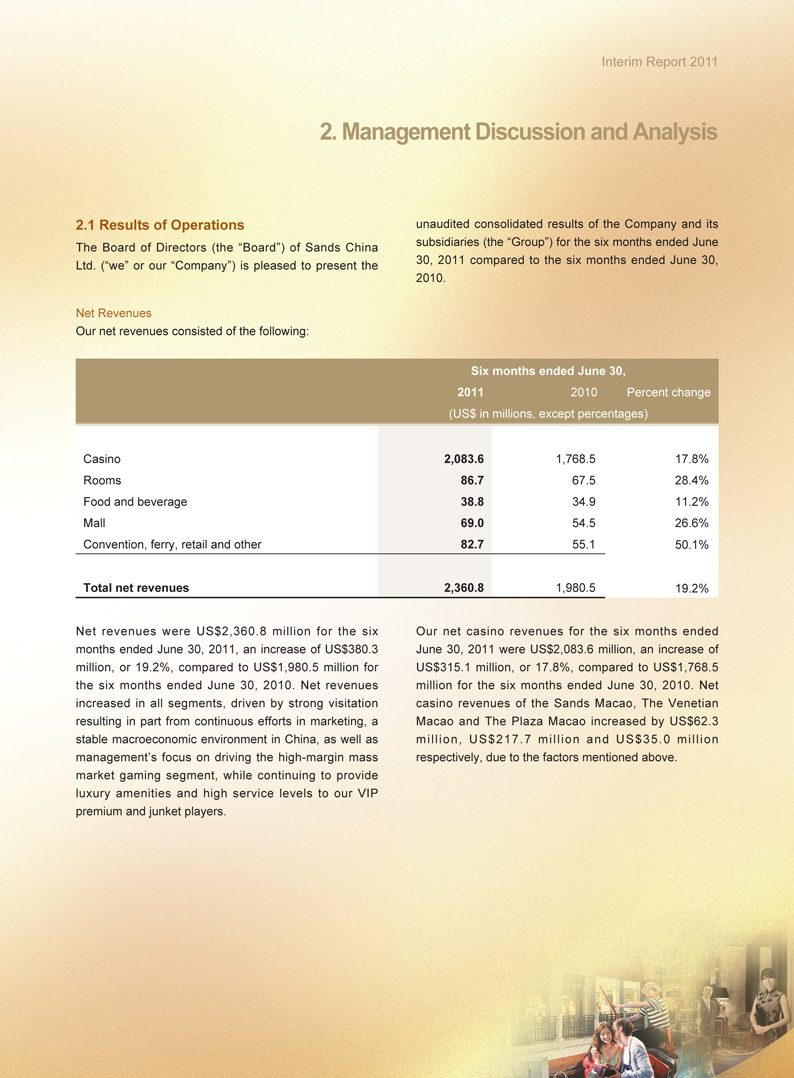

The Board of Directors (the “Board”) of Sands China Ltd. (“we” or our “Company”) is pleased to present the

Net Revenues

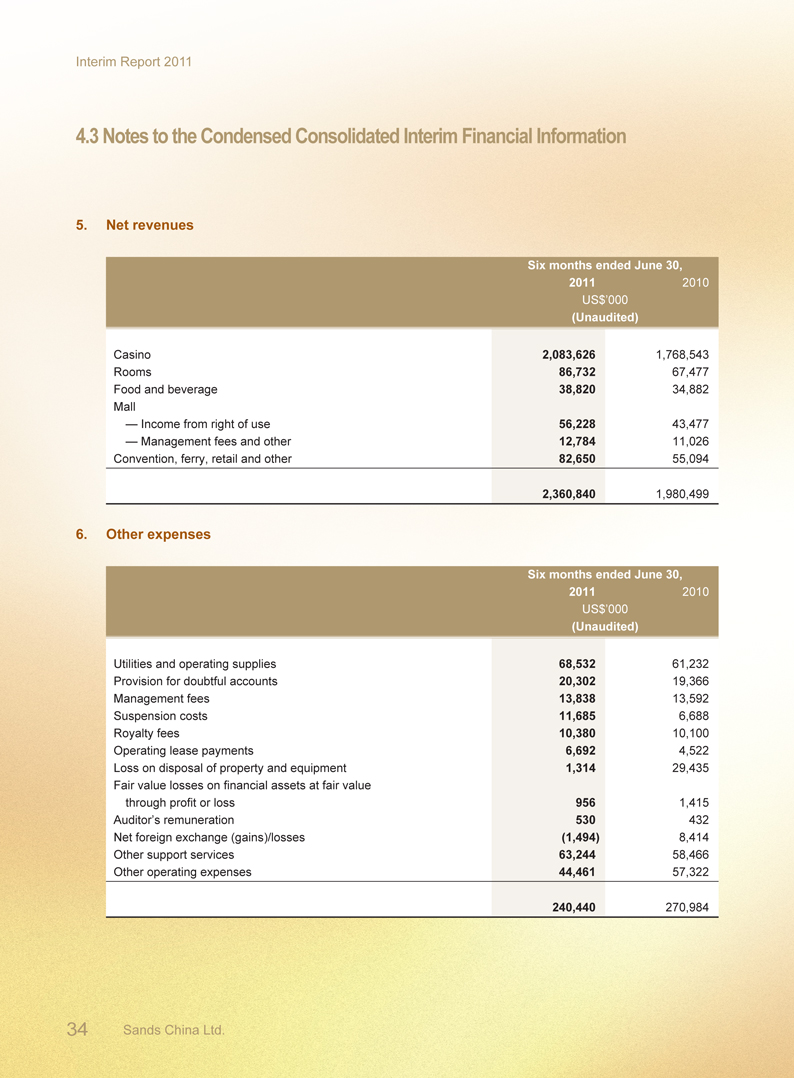

Our net revenues consisted of the following:

Six months ended June 30,

2011 2010 Percent change

(US$ in millions, except percentages)

Casino 2,083.6 1,768.5 17.8%

Rooms 86.7 67.5 28.4%

Food and beverage 38.8 34.9 11.2%

Mall 69.0 54.5 26.6%

Convention, ferry, retail and other 82.7 55.1 50.1%

Total net revenues 2,360.8 1,980.5 19.2%

Net revenues were US$2,360.8 million for the six months ended June 30, 2011, an increase of US$380.3 million, or 19.2%, compared to US$1,980.5 million for the six months ended June 30, 2010. Net revenues increased in all segments, driven by strong visitation resulting in part from continuous efforts in marketing, a stable macroeconomic environment in China, as well as management’s focus on driving the high-margin mass market gaming segment, while continuing to provide luxury amenities and high service levels to our VIP premium and junket players.

unaudited consolidated results of the Company and its subsidiaries (the “Group”) for the six months ended June 30, 2011 compared to the six months ended June 30, 2010.

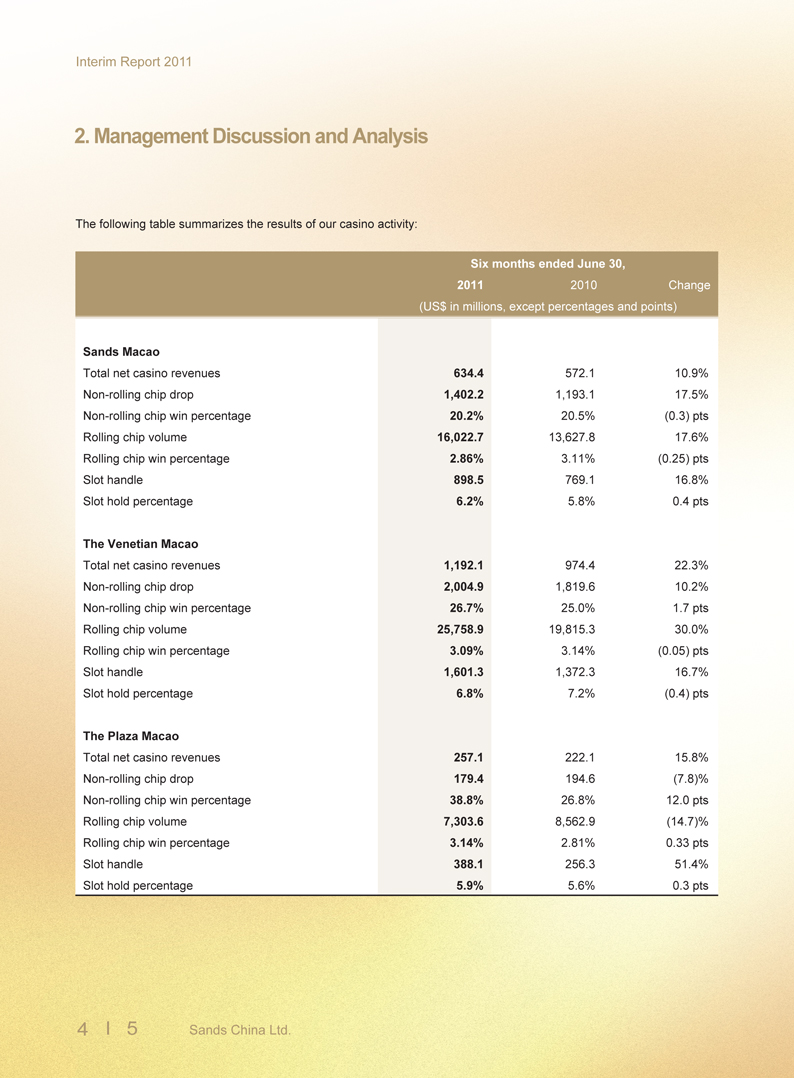

Our net casino revenues for the six months ended June 30, 2011 were US$2,083.6 million, an increase of US$315.1 million, or 17.8%, compared to US$1,768.5 million for the six months ended June 30, 2010. Net casino revenues of the Sands Macao, The Venetian Macao and The Plaza Macao increased by US$62.3 million, US$217.7 million and US$35.0 million respectively, due to the factors mentioned above.

Interim Report 2011

2. Management Discussion and Analysis

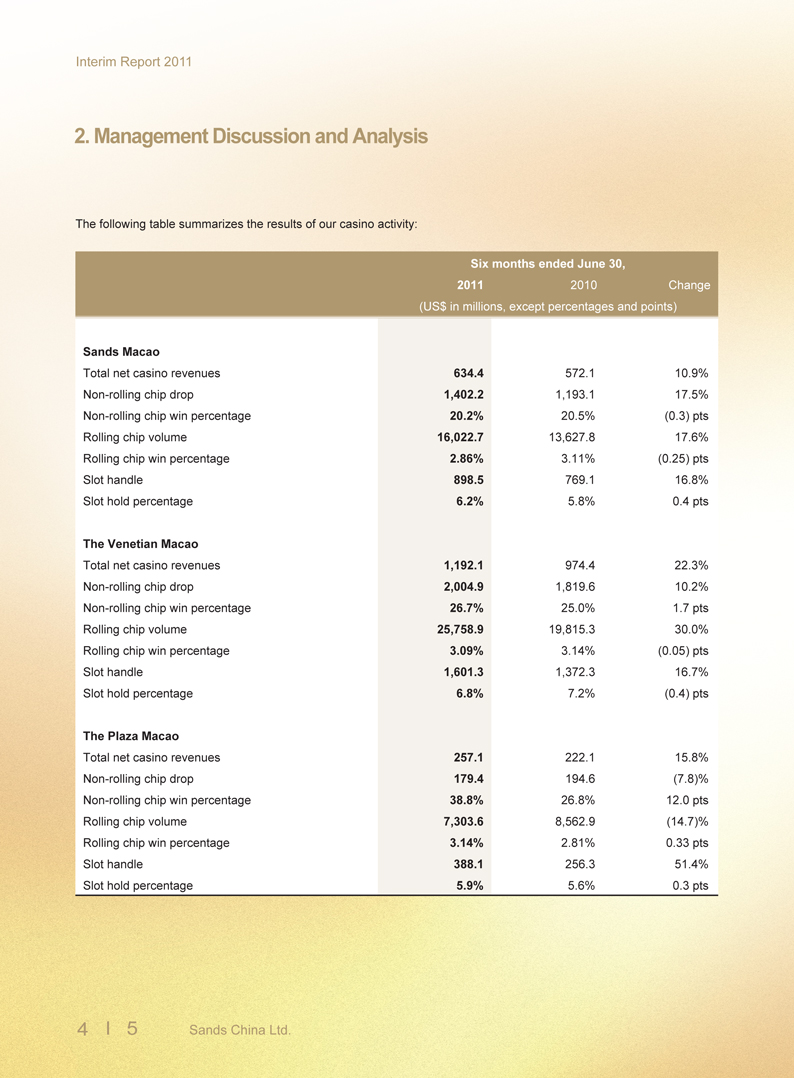

The following table summarizes the results of our casino activity:

Six months ended June 30,

2011 2010 Change

(US$ in millions, except percentages and points)

Sands Macao

Total net casino revenues 634.4 572.1 10.9%

Non-rolling chip drop 1,402.2 1,193.1 17.5%

Non-rolling chip win percentage 20.2% 20.5% (0.3) pts

Rolling chip volume 16,022.7 13,627.8 17.6%

Rolling chip win percentage 2.86% 3.11% (0.25) pts

Slot handle 898.5 769.1 16.8%

Slot hold percentage 6.2% 5.8% 0.4 pts

The Venetian Macao

Total net casino revenues 1,192.1 974.4 22.3%

Non-rolling chip drop 2,004.9 1,819.6 10.2%

Non-rolling chip win percentage 26.7% 25.0% 1.7 pts

Rolling chip volume 25,758.9 19,815.3 30.0%

Rolling chip win percentage 3.09% 3.14% (0.05) pts

Slot handle 1,601.3 1,372.3 16.7%

Slot hold percentage 6.8% 7.2% (0.4) pts

The Plaza Macao

Total net casino revenues 257.1 222.1 15.8%

Non-rolling chip drop 179.4 194.6 (7.8)%

Non-rolling chip win percentage 38.8% 26.8% 12.0 pts

Rolling chip volume 7,303.6 8,562.9 (14.7)%

Rolling chip win percentage 3.14% 2.81% 0.33 pts

Slot handle 388.1 256.3 51.4%

Slot hold percentage 5.9% 5.6% 0.3 pts

4 5 Sands China Ltd.

Interim Report 2011

2. Management Discussion and Analysis

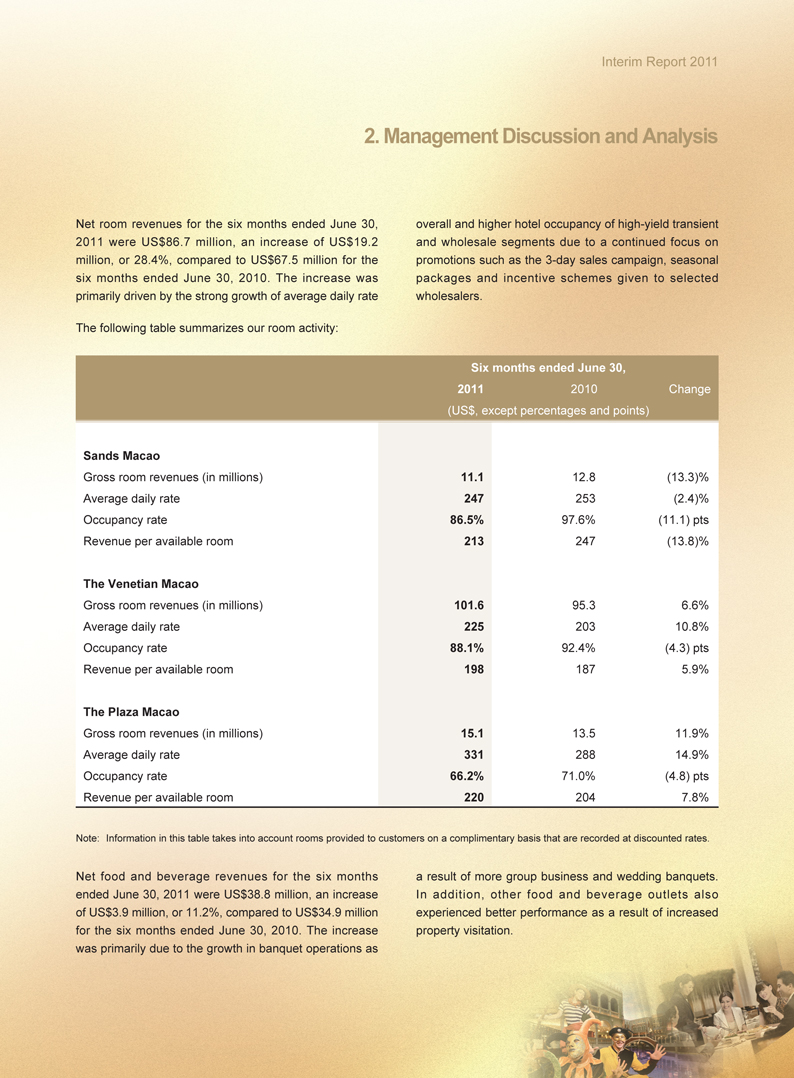

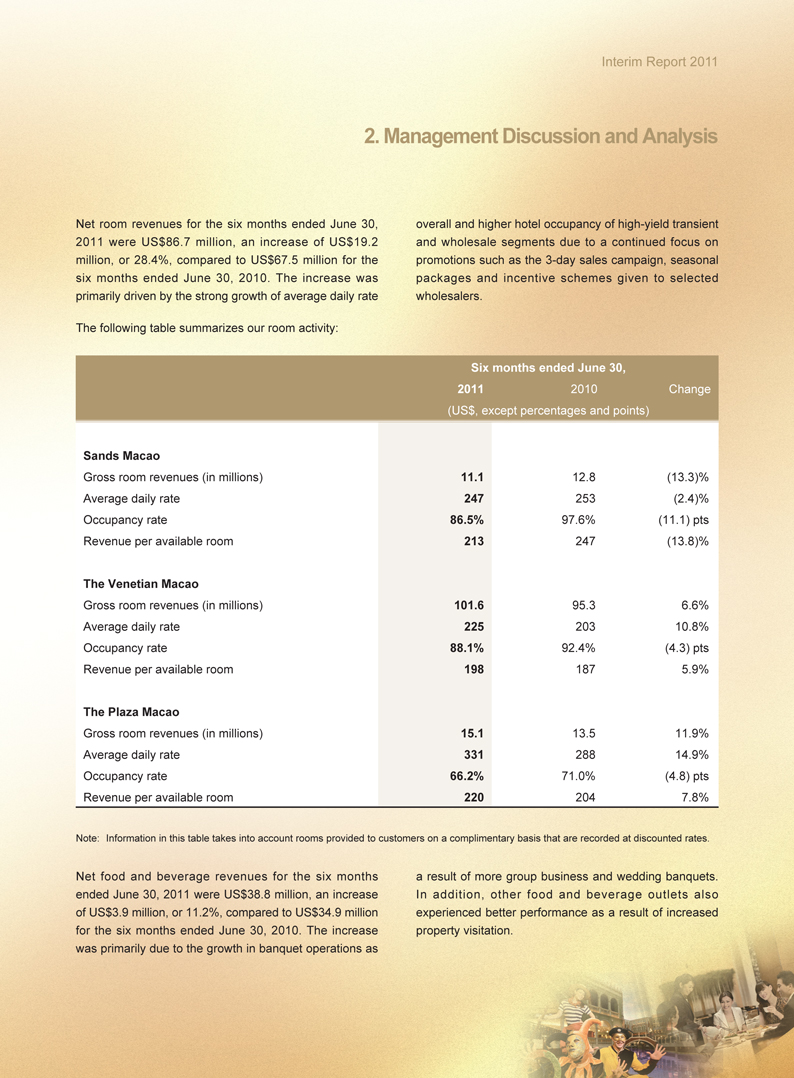

Net room revenues for the six months ended June 30, 2011 were US$86.7 million, an increase of US$19.2 million, or 28.4%, compared to US$67.5 million for the six months ended June 30, 2010. The increase was primarily driven by the strong growth of average daily rate

The following table summarizes our room activity:

Six months ended June 30,

2011 2010 Change

(US$, except percentages and points)

Sands Macao

Gross room revenues (in millions) 11.1 12.8 (13.3)%

Average daily rate 247 253 (2.4)%

Occupancy rate 86.5% 97.6% (11.1) pts

Revenue per available room 213 247 (13.8)%

The Venetian Macao

Gross room revenues (in millions) 101.6 95.3 6.6%

Average daily rate 225 203 10.8%

Occupancy rate 88.1% 92.4% (4.3) pts

Revenue per available room 198 187 5.9%

The Plaza Macao

Gross room revenues (in millions) 15.1 13.5 11.9%

Average daily rate 331 288 14.9%

Occupancy rate 66.2% 71.0% (4.8) pts

Revenue per available room 220 204 7.8%

Note: Information in this table takes into account rooms provided to customers on a complimentary basis that are recorded at discounted rates.

Net food and beverage revenues for the six months ended June 30, 2011 were US$38.8 million, an increase of US$3.9 million, or 11.2%, compared to US$34.9 million for the six months ended June 30, 2010. The increase was primarily due to the growth in banquet operations as

overall and higher hotel occupancy of high-yield transient and wholesale segments due to a continued focus on promotions such as the 3-day sales campaign, seasonal packages and incentive schemes given to selected wholesalers.

a result of more group business and wedding banquets. In addition, other food and beverage outlets also experienced better performance as a result of increased property visitation.

Interim Report 2011

2. Management Discussion and Analysis

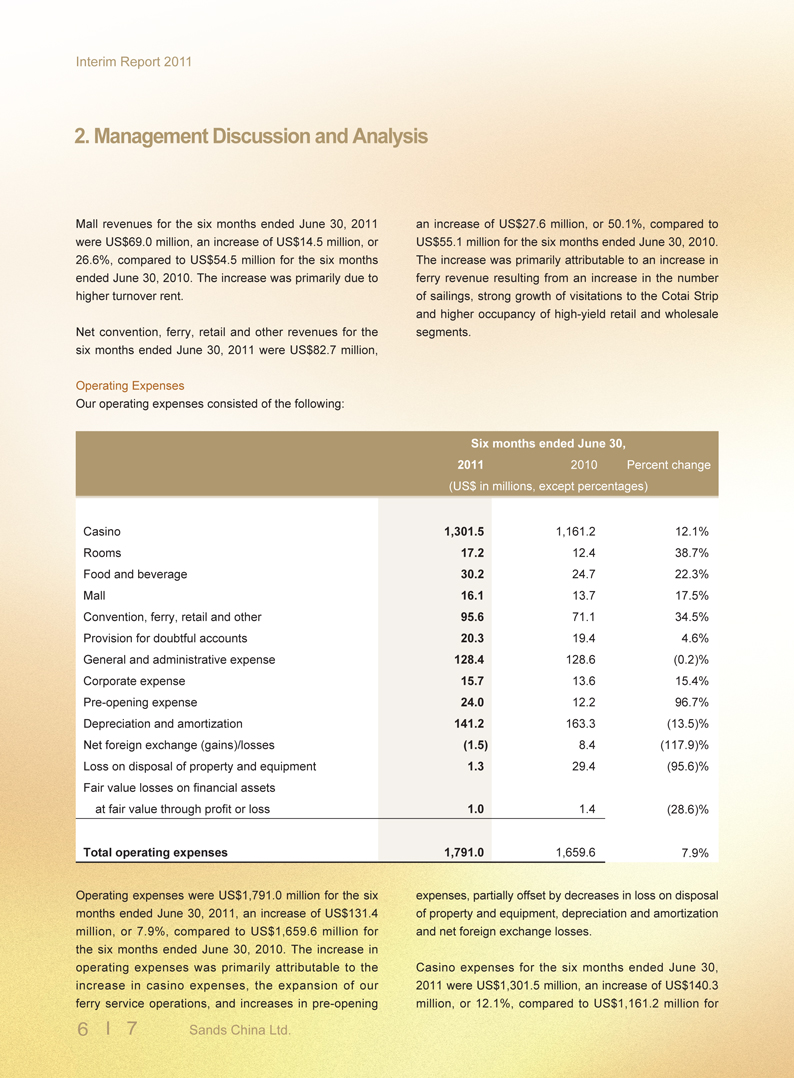

Mall revenues for the six months ended June 30, 2011 were US$69.0 million, an increase of US$14.5 million, or 26.6%, compared to US$54.5 million for the six months ended June 30, 2010. The increase was primarily due to higher turnover rent.

Net convention, ferry, retail and other revenues for the six months ended June 30, 2011 were US$82.7 million,

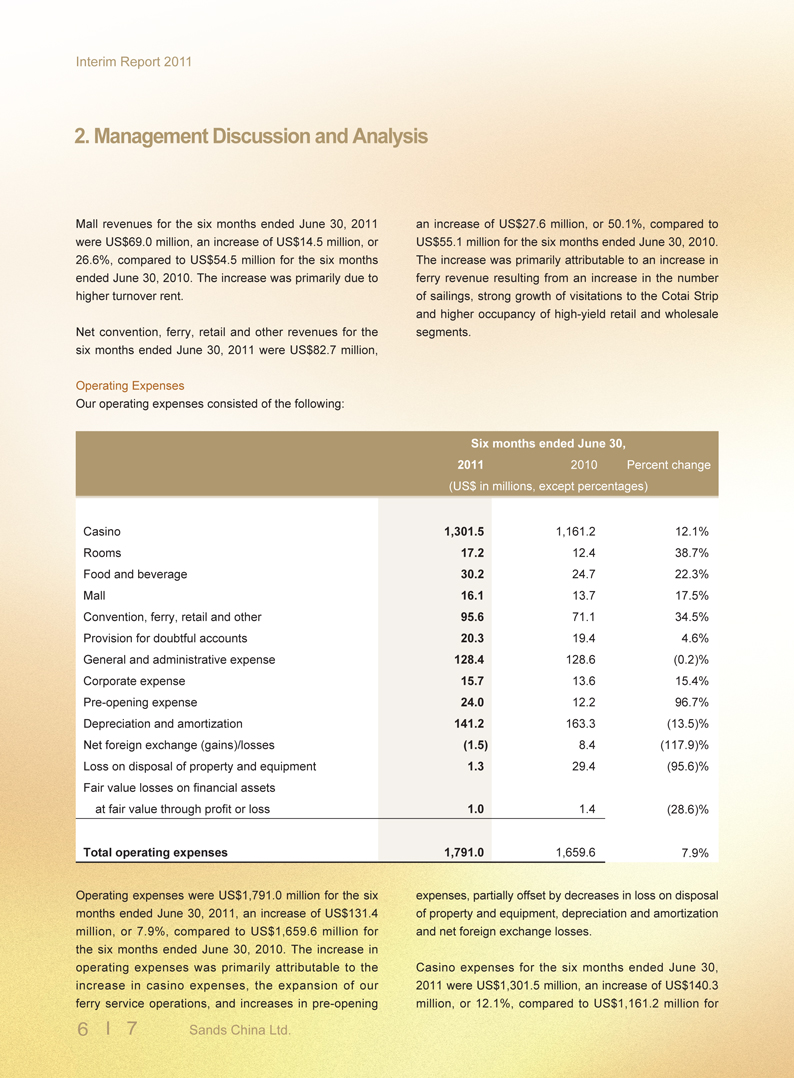

Operating Expenses

Our operating expenses consisted of the following:

Six months ended June 30,

2011 2010 Percent change

(US$ in millions, except percentages)

Casino 1,301.5 1,161.2 12.1%

Rooms 17.2 12.4 38.7%

Food and beverage 30.2 24.7 22.3%

Mall 16.1 13.7 17.5%

Convention, ferry, retail and other 95.6 71.1 34.5%

Provision for doubtful accounts 20.3 19.4 4.6%

General and administrative expense 128.4 128.6 (0.2)%

Corporate expense 15.7 13.6 15.4%

Pre-opening expense 24.0 12.2 96.7%

Depreciation and amortization 141.2 163.3 (13.5)%

Net foreign exchange (gains)/losses (1.5) 8.4 (117.9)%

Loss on disposal of property and equipment 1.3 29.4 (95.6)%

Fair value losses on financial assets

at fair value through profit or loss 1.0 1.4 (28.6)%

Total operating expenses 1,791.0 1,659.6 7.9%

Operating expenses were US$1,791.0 million for the six months ended June 30, 2011, an increase of US$131.4 million, or 7.9%, compared to US$1,659.6 million for the six months ended June 30, 2010. The increase in operating expenses was primarily attributable to the increase in casino expenses, the expansion of our ferry service operations, and increases in pre-opening

an increase of US$27.6 million, or 50.1%, compared to US$55.1 million for the six months ended June 30, 2010. The increase was primarily attributable to an increase in ferry revenue resulting from an increase in the number of sailings, strong growth of

visitations to the Cotai Strip and higher occupancy of high-yield retail and wholesale segments.

expenses, partially offset by decreases in loss on disposal of property and equipment, depreciation and amortization and net foreign exchange losses.

Casino expenses for the six months ended June 30, 2011 were US$1,301.5 million, an increase of US$140.3 million, or 12.1%, compared to US$1,161.2 million for

6 7 Sands China Ltd.

Interim Report 2011

2. Management Discussion and Analysis

the six months ended June 30, 2010. The increase was primarily due to the increase in total gaming tax as a result of increased gaming revenues.

Room expenses for the six months ended June 30, 2011 were US$17.2 million, an increase of US$4.8 million, or 38.7%, compared to US$12.4 million for the six months ended June 30, 2010. The increase is mainly driven by increases in payroll expenses and travel agent commissions as a result of increased room revenues, increased payroll rate and increased occupancy in high-yield transient and wholesale segments.

Food and beverage expenses for the six months ended June 30, 2011 were US$30.2 million, an increase of US$5.5 million, or 22.3%, compared to US$24.7 million for the six months ended June 30, 2010. The increase was primarily driven by increases in payroll expenses and cost of sales as a result of increased food and beverage revenues and increased payroll rate.

Mall expenses for the six months ended June 30, 2011 were US$16.1 million, an increase of US$2.4 million, or 17.5%, compared to US$13.7 million for the six months ended June 30, 2010. The increase was primarily attributable to increases in payroll expenses and repair and maintenance expenses as a result of increased payroll rate and increased mall business volume and revenues.

Convention, ferry, retail and other expenses for the six months ended June 30, 2011 were US$95.6 million, an increase of US$24.5 million, or 34.5%, compared to US$71.1 million for the six months ended June 30, 2010. The increase was primarily attributable to an increase in ferry expenses due to an increased number of sailings, partially offset by a decrease in entertainment events expenses mainly for Cotai Arena at The Venetian Macao.

General and administrative expenses were US$128.4 million for the six months ended June 30, 2011, a decrease of US$0.2 million, or 0.2%, compared to

US$128.6 million for the six months ended June 30, 2010. Management continued to focus on driving operational efficiencies throughout the various properties. The decrease in expense from savings was partially offset by an increase in payroll expenses as a result of increased payroll rate.

Corporate expenses were US$15.7 million for the six months ended June 30, 2011, an increase of US$2.1 million, or 15.4%, compared to US$13.6 million for the six months ended June 30, 2010. The increase was mainly driven by increases in legal and management fees.

Pre-opening expenses were US$24.0 million for the six months ended June 30, 2011, an increase of US$11.8 million, or 96.7%, compared to US$12.2 million for the six months ended June 30, 2010. The increase in pre-opening expenses was primarily related to costs associated with Sands Cotai Central (formerly known as Parcels 5 and 6), as we recommenced construction activities and prepared the property to open.

Depreciation and amortization expense was US$141.2 million for the six months ended June 30, 2011, a decrease of US$22.1 million, or 13.5%, compared to US$163.3 million for the six months ended June 30, 2010. The decrease was primarily due to the full depreciation of some assets during the six months ended June 30, 2011.

Net foreign exchange gains for the six months ended June 30, 2011 were US$1.5 million, primarily associated with US$ denominated debt held in Macao. This compares with net foreign exchange losses of US$8.4 million for the six months ended June 30, 2010.

Loss on disposal of property and equipment was US$1.3 million for the six months ended June 30, 2011, a decrease of US$28.1 million or 95.6% compared to US$29.4 million for the six months ended June 30, 2010. The decrease was primarily related to disposition of construction materials from construction sites at Sands Cotai Central during the six months ended June 30, 2010.

Interim Report 2011

2. Management Discussion and Analysis

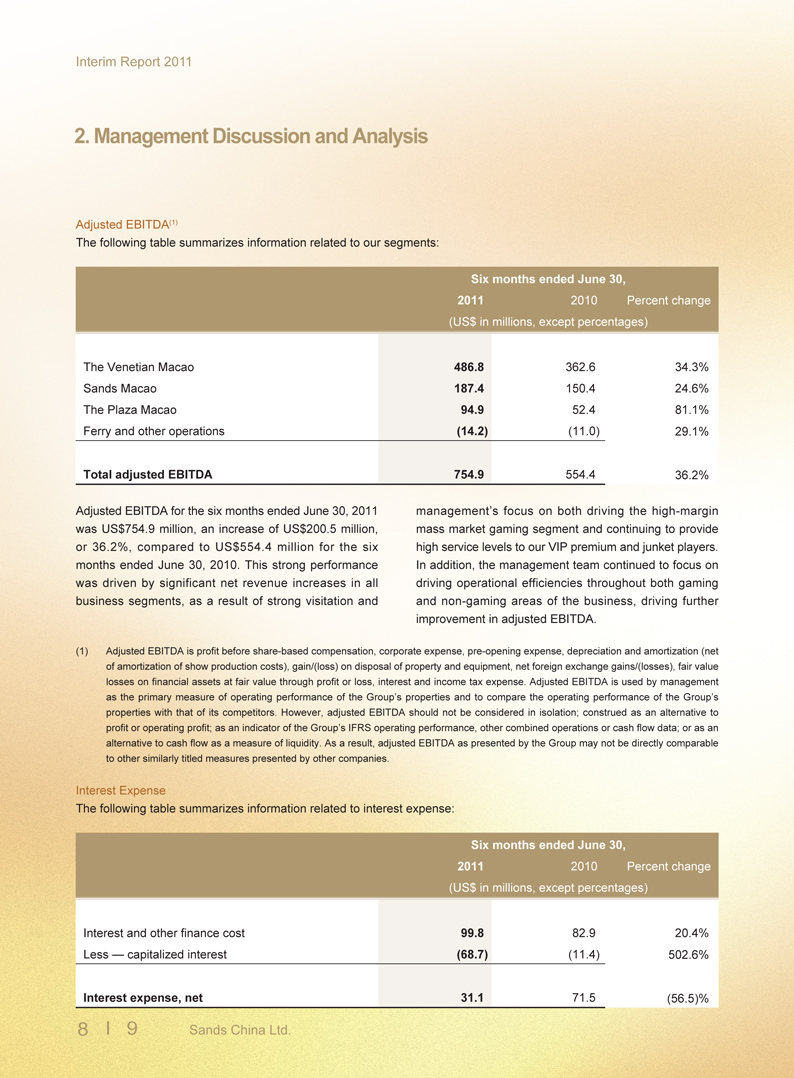

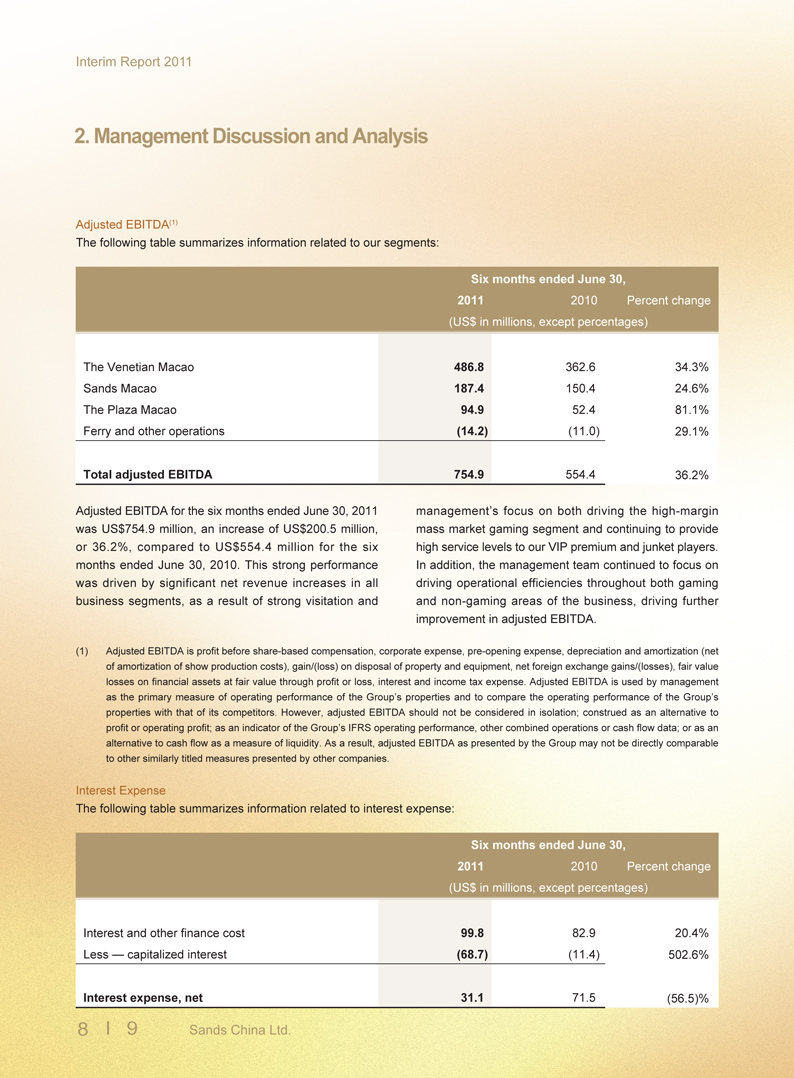

Adjusted EBITDA(1)

The following table summarizes information related to our segments:

Six months ended June 30,

2011 2010 Percent change

(US$ in millions, except percentages)

The Venetian Macao 486.8 362.6 34.3%

Sands Macao 187.4 150.4 24.6%

The Plaza Macao 94.9 52.4 81.1%

Ferry and other operations (14.2) (11.0) 29.1%

Total adjusted EBITDA 754.9 554.4 36.2%

Adjusted EBITDA for the six months ended June 30, 2011 was US$754.9 million, an increase of US$200.5 million, or 36.2%, compared to US$554.4 million for the six months ended June 30, 2010. This strong performance was driven by significant net revenue increases in all business segments, as a result of strong visitation and

management’s focus on both driving the high-margin mass market gaming segment and continuing to provide high service levels to our VIP premium and junket players. In addition, the management team continued to focus on driving operational efficiencies throughout both gaming and non-gaming areas of the business, driving further improvement in adjusted EBITDA.

(1) Adjusted EBITDA is profit before share-based compensation, corporate expense, pre-opening expense, depreciation and amortization (net of amortization of show production costs), gain/(loss) on disposal of property and equipment, net foreign exchange gains/(losses), fair value losses on financial assets at fair value through profit or loss, interest and income tax expense. Adjusted EBITDA is used by management

as the primary measure of operating performance of the Group’s properties and to compare the operating performance of the Group’s

properties with that of its competitors. However, adjusted EBITDA should not be considered in isolation; construed as an alternative to profit or operating profit; as an indicator of the Group’s IFRS operating performance, other combined operations or cash flow data; or as an alternative to cash flow as a measure of liquidity. As a result, adjusted EBITDA as presented by the Group may not be directly comparable

to other similarly titled measures presented by other companies.

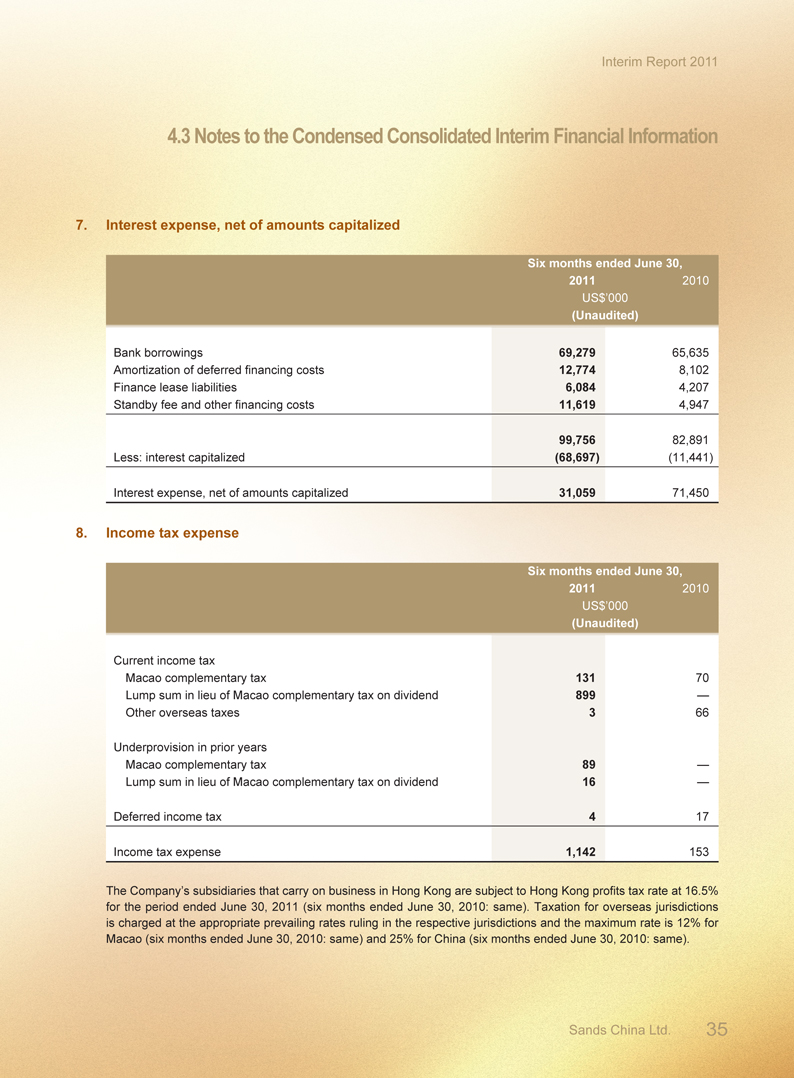

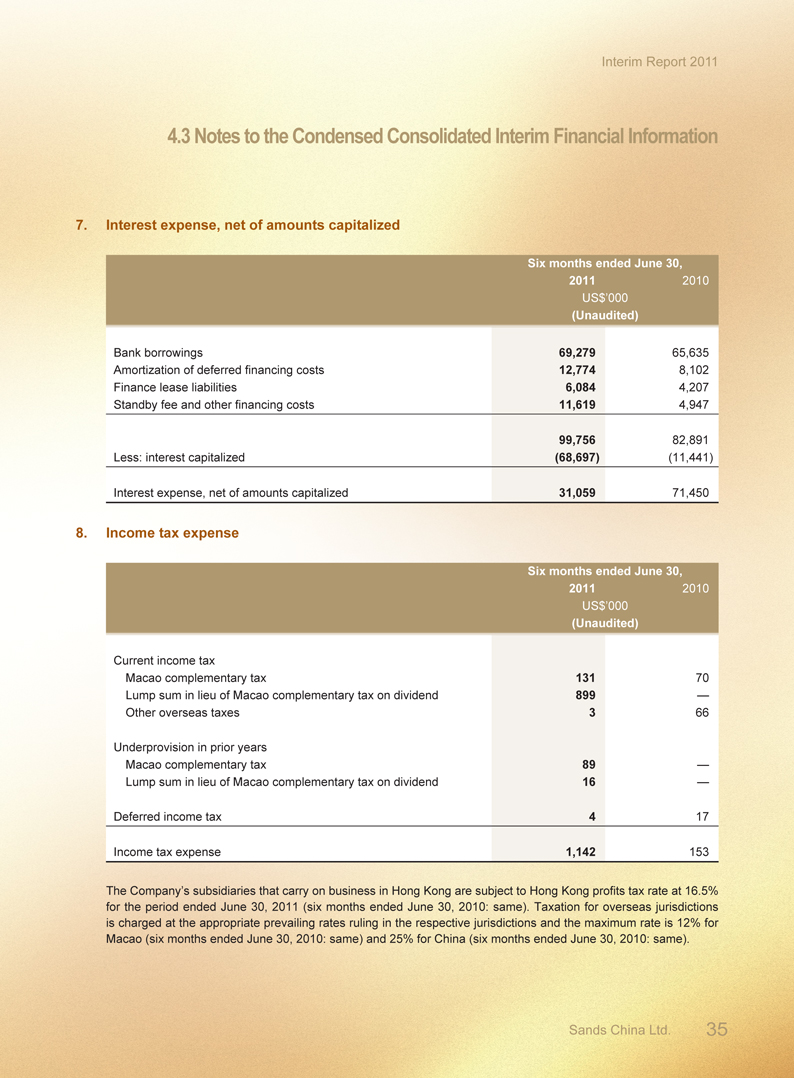

Interest Expense

The following table summarizes information related to interest expense:

Six months ended June 30,

2011 2010 Percent change

(US$ in millions, except percentages)

Interest and other finance cost 99.8 82.9 20.4%

Less — capitalized interest (68.7) (11.4) 502.6%

Interest expense, net 31.1 71.5 (56.5)%

8 9 Sands China Ltd.

Interim Report 2011

2. Management Discussion and Analysis

Interest and other finance cost for the six months ended June 30, 2011 was US$99.8 million, an increase of US$16.9 million, or 20.4%, compared to US$82.9 million for the six months ended June 30, 2010. The increase was a result of an increase in total outstanding borrowings primarily for the development of Sands Cotai Central. The US$57.3 million increase in capitalized interest was primarily due to the recommencement of construction activities at Sands Cotai Central in May 2010.

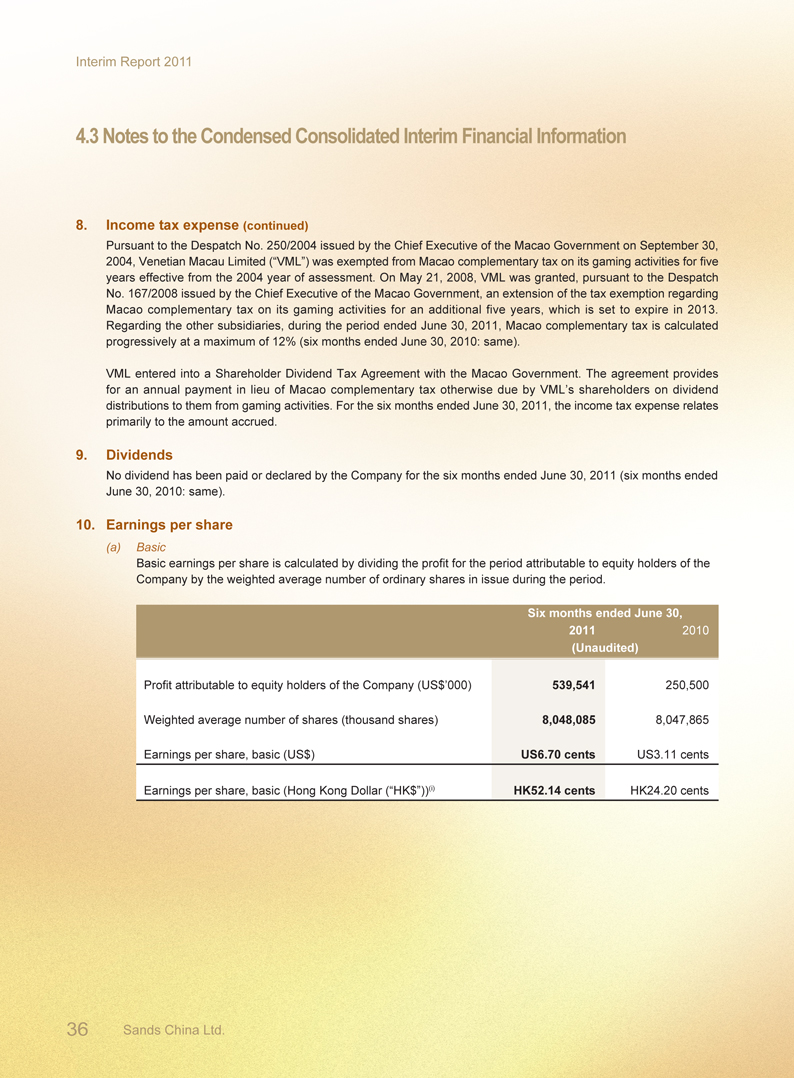

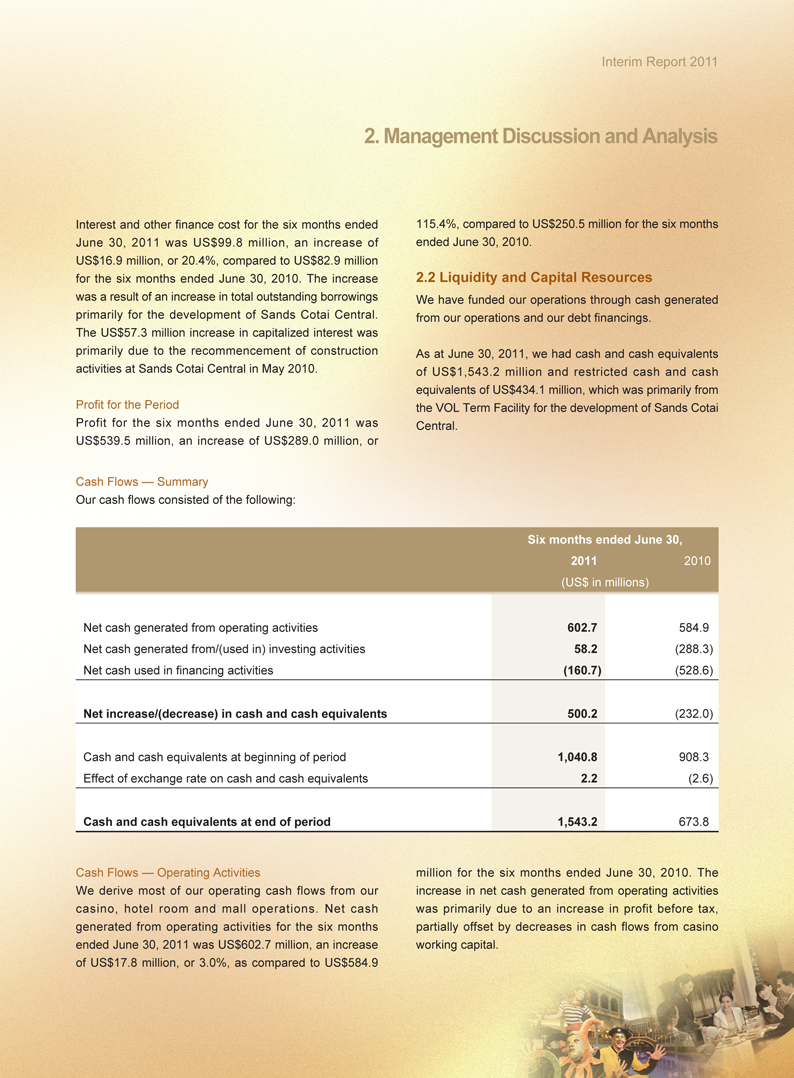

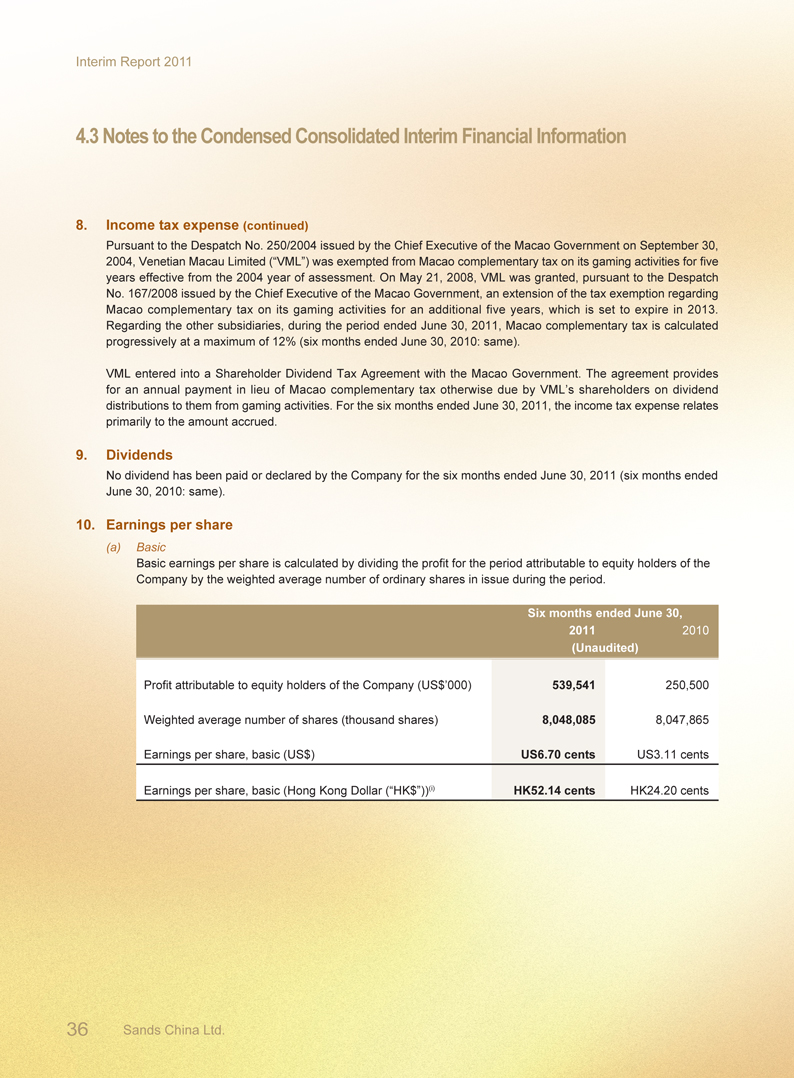

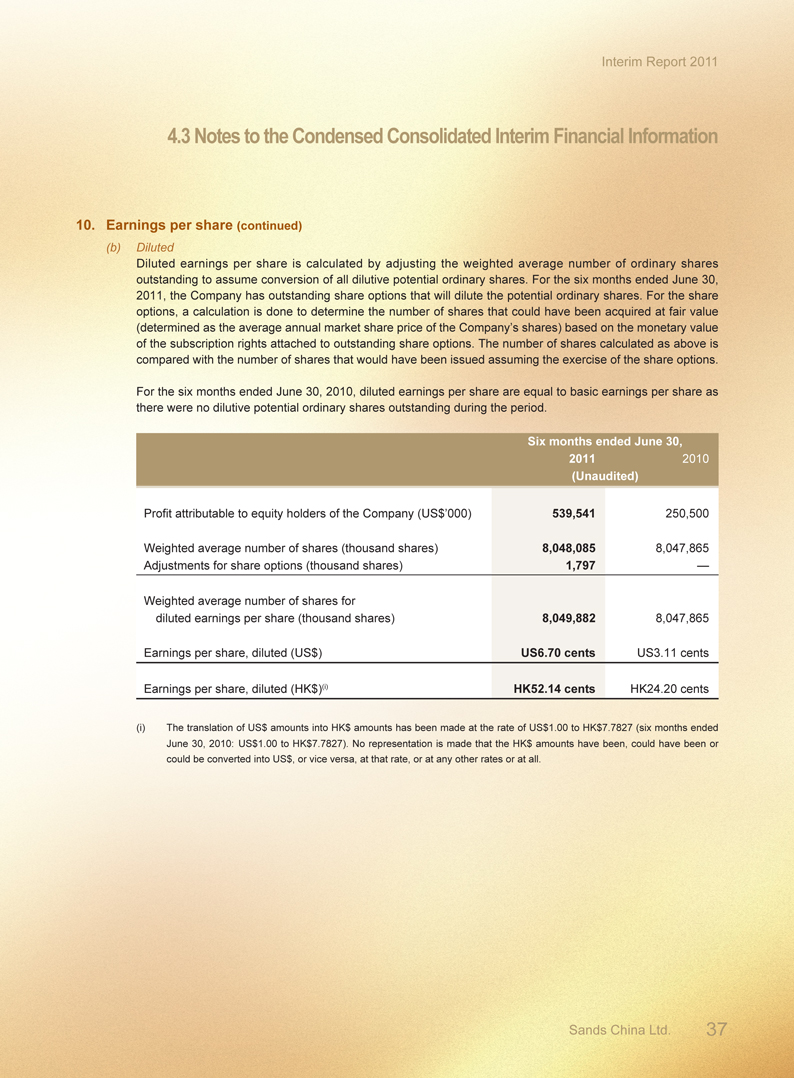

Profit for the Period

Profit for the six months ended June 30, 2011 was US$539.5 million, an increase of US$289.0 million, or

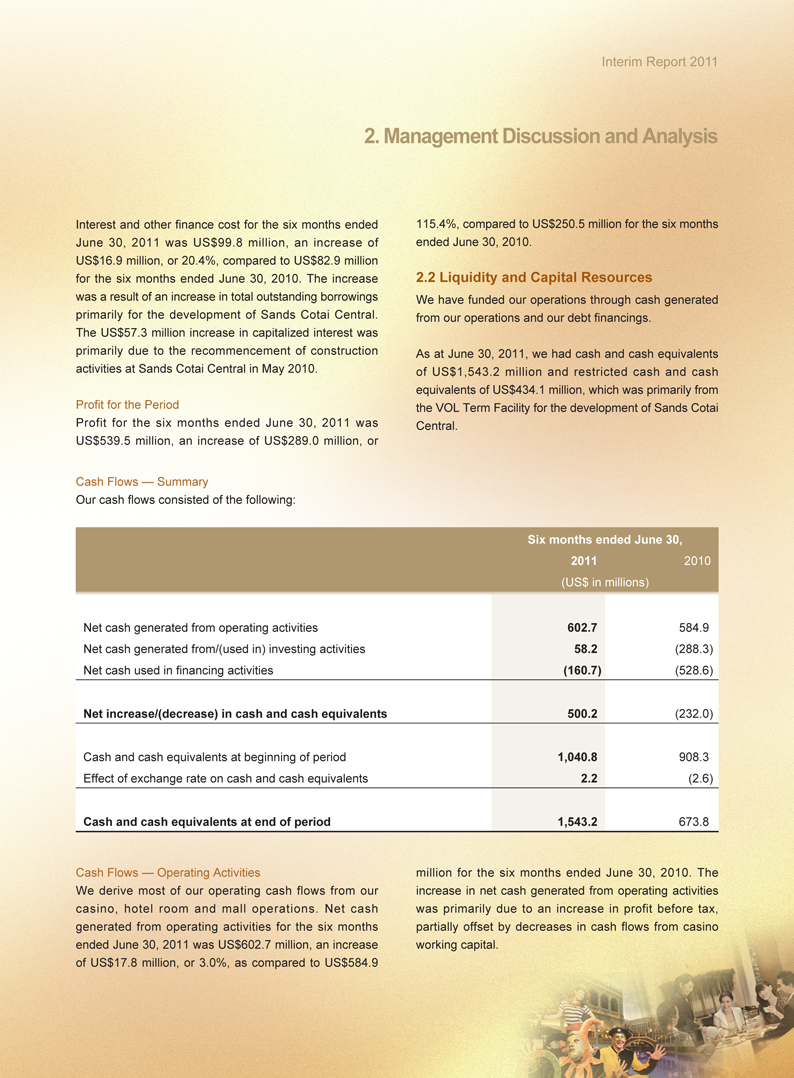

Cash Flows — Summary

Our cash flows consisted of the following:

115.4%, compared to US$250.5 million for the six months ended June 30, 2010.

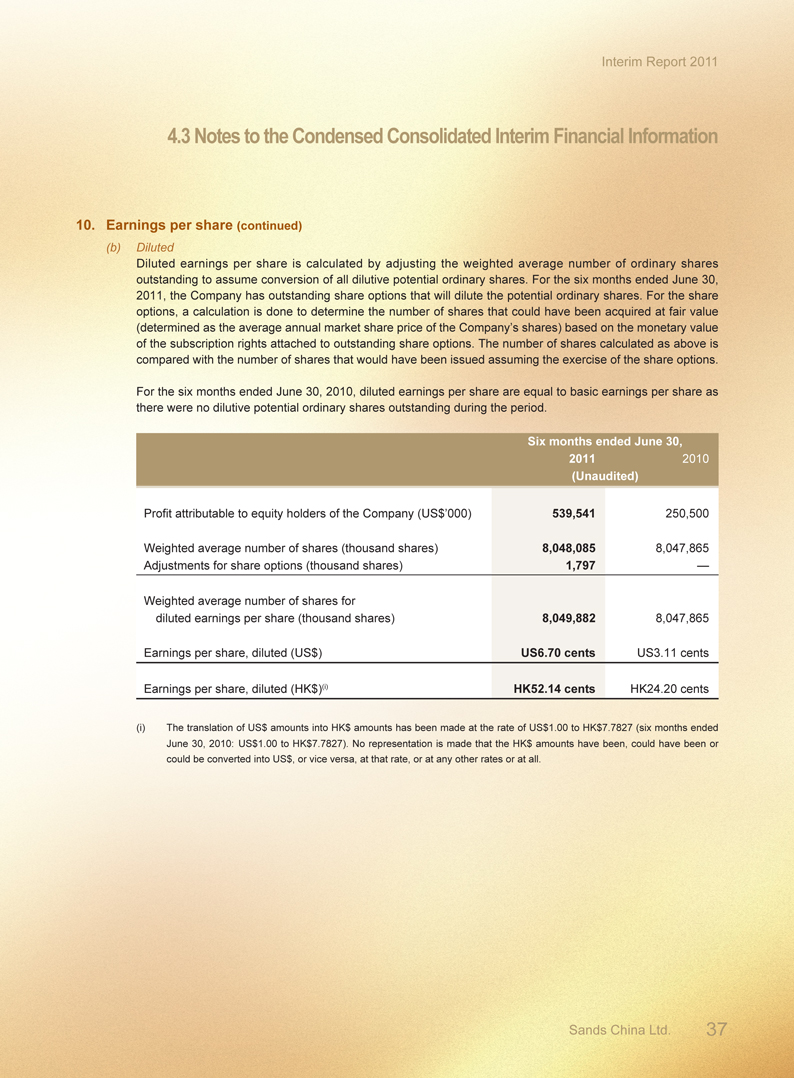

2.2 Liquidity and Capital Resources

We have funded our operations through cash generated from our operations and our debt financings.

As at June 30, 2011, we had cash and cash equivalents of US$1,543.2 million and restricted cash and cash equivalents of US$434.1 million, which was primarily from the VOL Term Facility for the development of Sands Cotai Central.

Six months ended June 30,

2011 2010

(US$ in millions)

Net cash generated from operating activities 602.7 584.9

Net cash generated from/(used in) investing activities 58.2 (288.3)

Net cash used in financing activities (160.7) (528.6)

Net increase/(decrease) in cash and cash equivalents 500.2 (232.0)

Cash and cash equivalents at beginning of period 1,040.8 908.3

Effect of exchange rate on cash and cash equivalents 2.2 (2.6)

Cash and cash equivalents at end of period 1,543.2 673.8

Cash Flows — Operating Activities

We derive most of our operating cash flows from our casino, hotel room and mall operations. Net cash generated from operating activities for the six months ended June 30, 2011 was US$602.7 million, an increase of US$17.8 million, or 3.0%, as compared to US$584.9

million for the six months ended June 30, 2010. The increase in net cash generated from operating activities was primarily due to an increase in profit before tax, partially offset by decreases in cash flows from casino working capital.

Interim Report 2011

2. Management Discussion and Analysis

Cash Flows — Investing Activities

Net cash generated from investing activities for the six months ended June 30, 2011 was US$58.2 million, which primarily consisted of a decrease of US$343.9 million in restricted cash and cash equivalents, offset by capital expenditures of US$291.9 million. Capital expenditures include US$278.8 million for Sands Cotai Central and US$13.2 million for our operations mainly at the Sands Macao, The Venetian Macao and The Plaza Macao.

Cash Flows — Financing Activities

For the six months ended June 30, 2011, net cash flows used in financing activities were US$160.7 million, primarily attributable to US$42.5 million for repayment of borrowings under our credit facilities, US$96.4 million for payment of interest, and US$23.0 million for payment of finance lease liabilities.

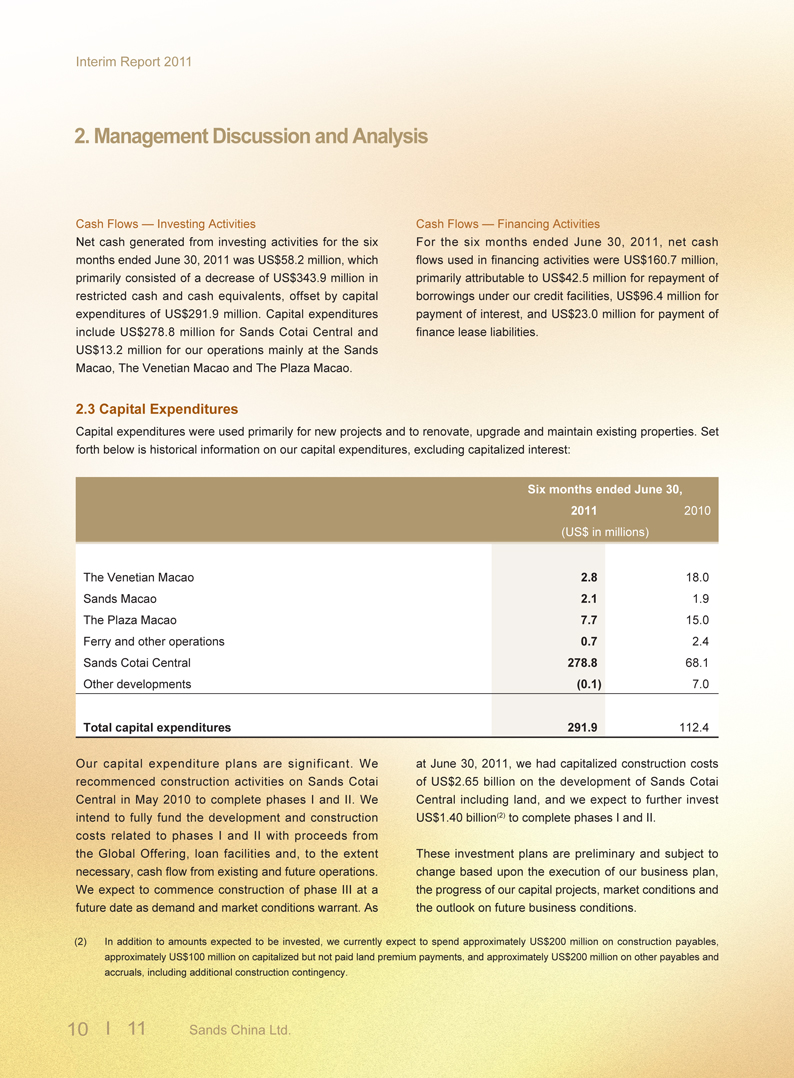

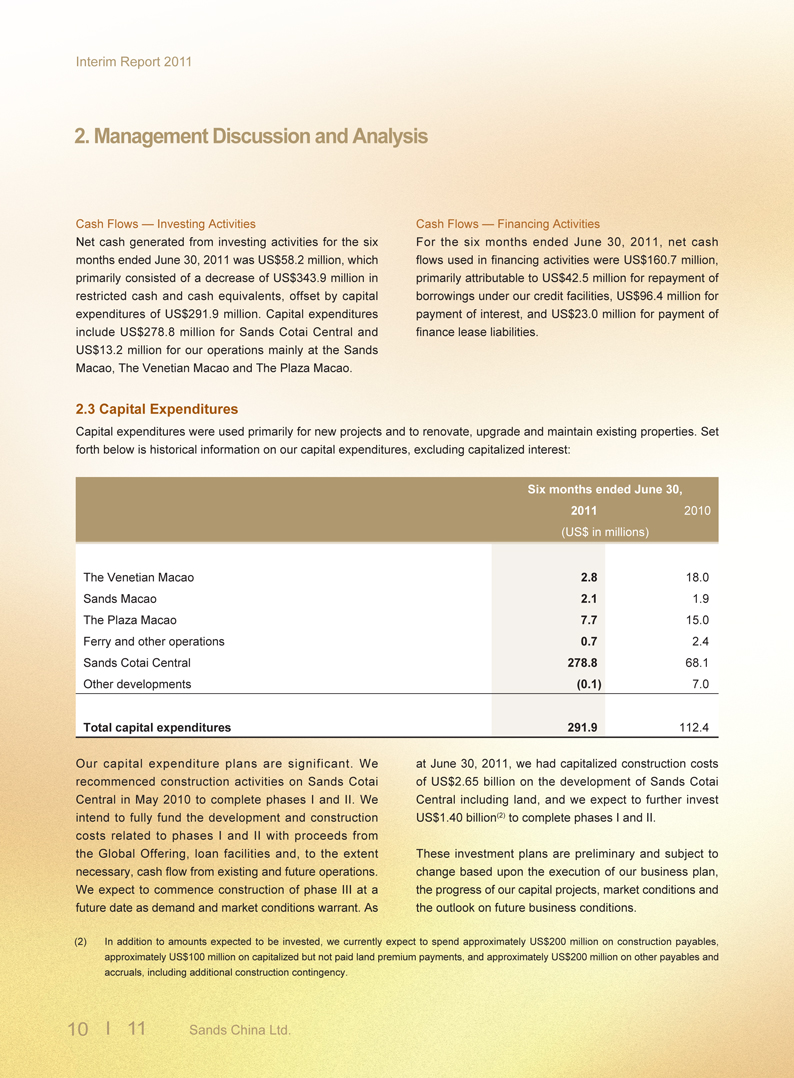

2.3 Capital Expenditures

Capital expenditures were used primarily for new projects and to renovate, upgrade and maintain existing properties. Set forth below is historical information on our capital expenditures, excluding capitalized interest:

Six months ended June 30,

2011 2010

(US$ in millions)

The Venetian Macao 2.8 18.0

Sands Macao 2.1 1.9

The Plaza Macao 7.7 15.0

Ferry and other operations 0.7 2.4

Sands Cotai Central 278.8 68.1

Other developments (0.1) 7.0

Total capital expenditures 291.9 112.4

Our capital expenditure plans are significant. We recommenced construction activities on Sands Cotai Central in May 2010 to complete phases I and II. We intend to fully fund the development and construction costs related to phases I and II with proceeds from the Global Offering, loan facilities and, to the extent necessary, cash flow from existing and future operations. We expect to commence construction of phase III at a future date as demand and market conditions warrant. As

at June 30, 2011, we had capitalized construction costs of US$2.65 billion on the development of Sands Cotai Central including land, and we expect to further invest US$1.40 billion(2) to complete phases I and II.

These investment plans are preliminary and subject to change based upon the execution of our business plan, the progress of our capital projects, market conditions and the outlook on future business conditions.

(2) In addition to amounts expected to be invested, we currently expect to spend approximately US$200 million on construction payables,

approximately US$100 million on capitalized but not paid land premium payments, and approximately US$200 million on other payables and

accruals, including additional construction contingency.

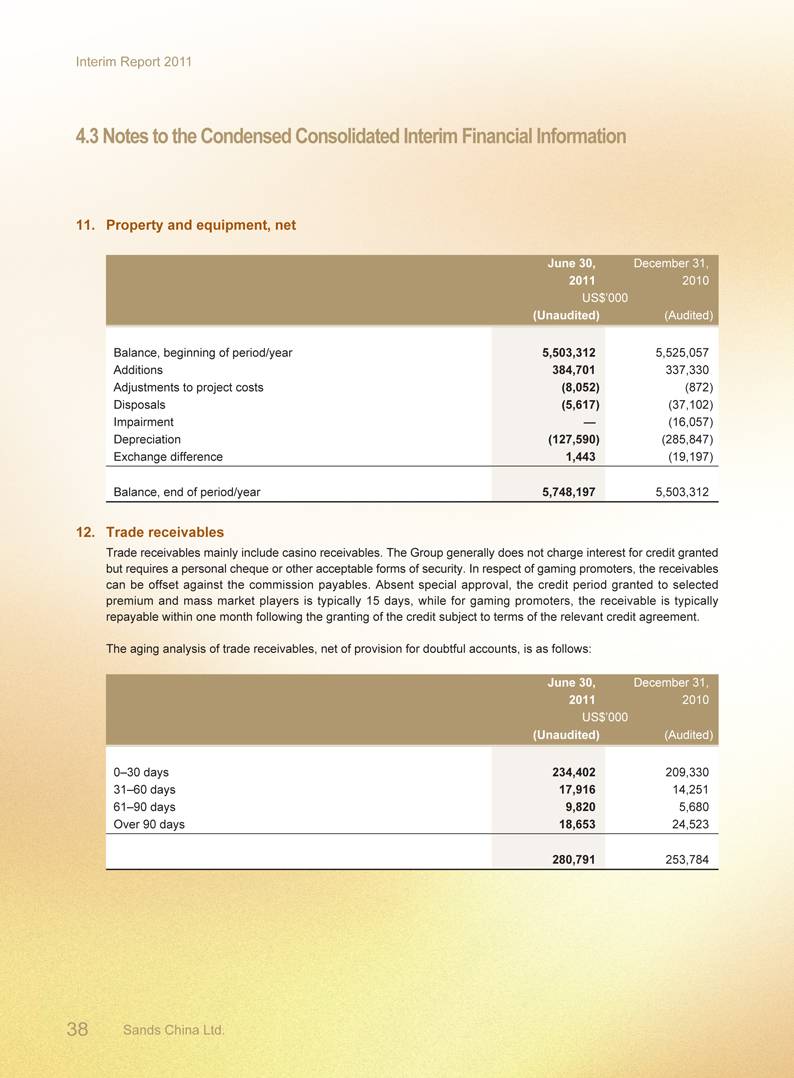

10 11 Sands China Ltd.

Interim Report 2011

2. Management Discussion and Analysis

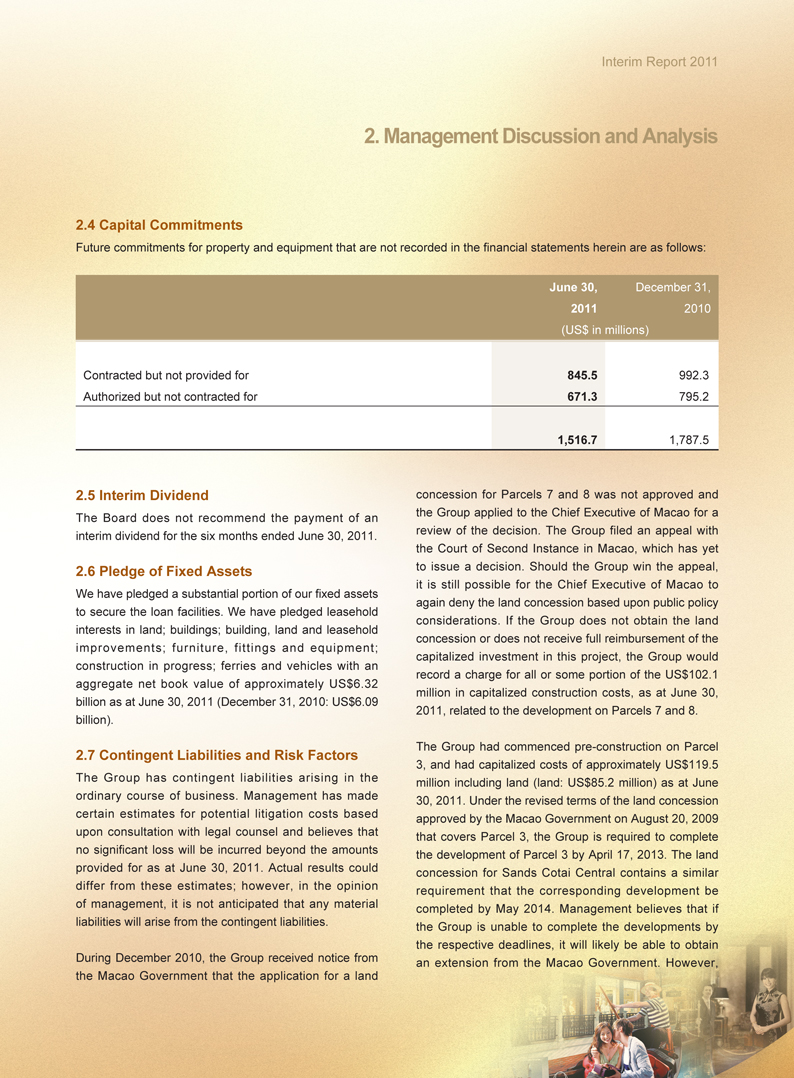

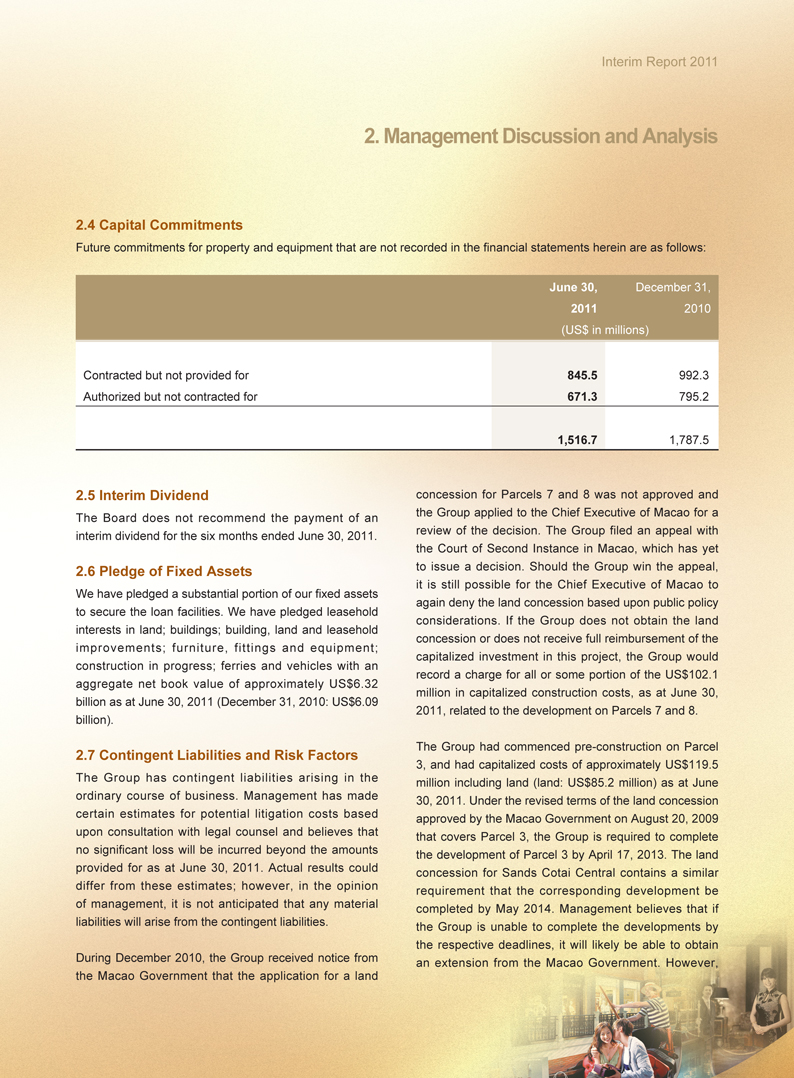

2.4 Capital Commitments

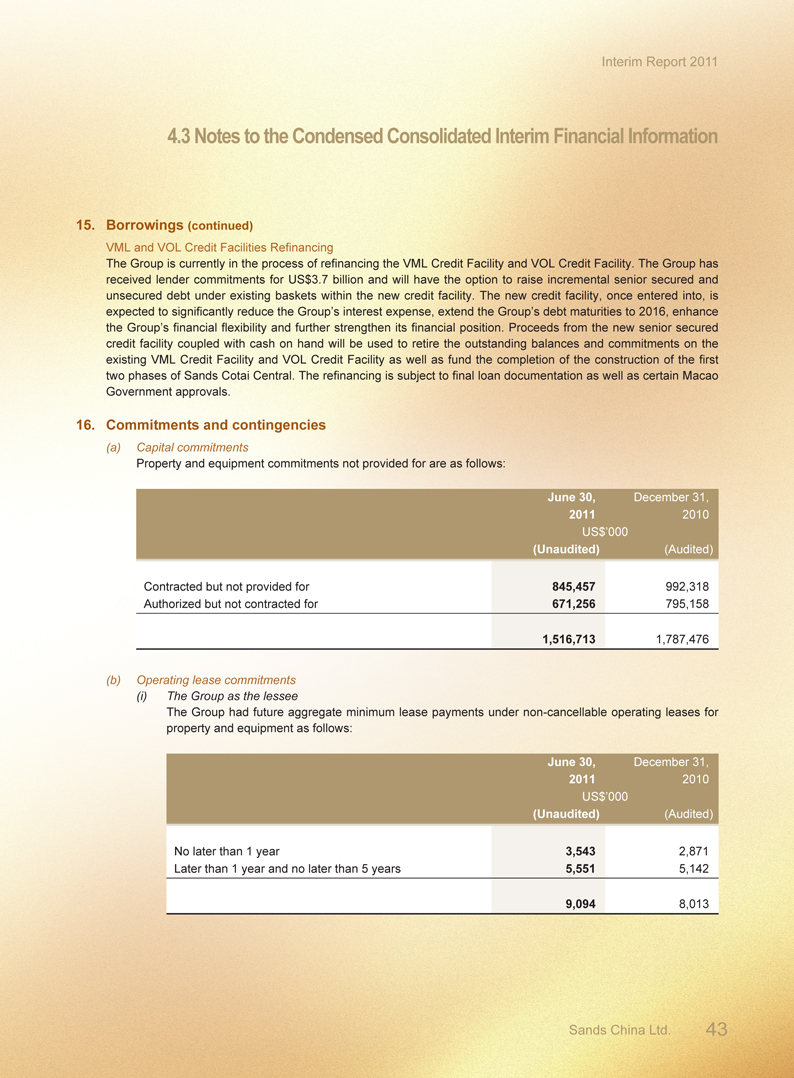

Future commitments for property and equipment that are not recorded in the financial statements herein are as follows:

June 30, December 31,

2011 2010

(US$ in millions)

Contracted but not provided for 845.5 992.3

Authorized but not contracted for 671.3 795.2

1,516.7 1,787.5

2.5 Interim Dividend

The Board does not recommend the payment of an interim dividend for the six months ended June 30, 2011.

2.6 Pledge of Fixed Assets

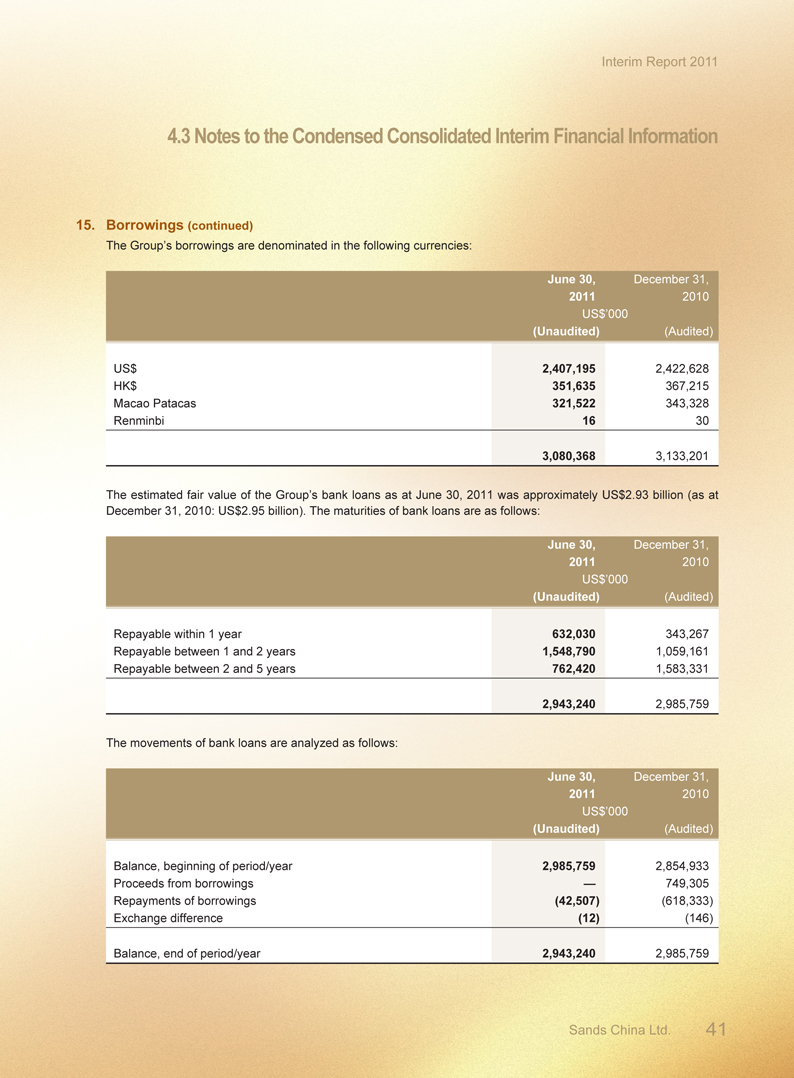

We have pledged a substantial portion of our fixed assets to secure the loan facilities. We have pledged leasehold interests in land; buildings; building, land and leasehold improvements; furniture, fittings and equipment; construction in progress; ferries and vehicles with an aggregate net book value of approximately US$6.32 billion as at June 30, 2011 (December 31, 2010: US$6.09 billion).

2.7 Contingent Liabilities and Risk Factors

The Group has contingent liabilities arising in the ordinary course of business. Management has made certain estimates for potential litigation costs based upon consultation with legal counsel and believes that no significant loss will be incurred beyond the amounts provided for as at June 30, 2011. Actual results could differ from these estimates; however, in the opinion of management, it is not anticipated that any material liabilities will arise from the contingent liabilities.

During December 2010, the Group received notice from the Macao Government that the application for a land

concession for Parcels 7 and 8 was not approved and the Group applied to the Chief Executive of Macao for a review of the decision. The Group filed an appeal with the Court of Second Instance in Macao, which has yet to issue a decision. Should the Group win the appeal, it is still possible for the Chief Executive of Macao to again deny the land concession based upon public policy considerations. If the Group does not obtain the land concession or does not receive full reimbursement of the capitalized investment in this project, the Group would record a charge for all or some portion of the US$102.1 million

in capitalized construction costs, as at June 30, 2011, related to the development on Parcels 7 and 8.

The Group had commenced pre-construction on Parcel 3, and had capitalized costs of approximately US$119.5 million including land (land: US$85.2 million) as at June 30, 2011. Under the revised terms of the land concession approved by the Macao Government on August 20, 2009 that covers Parcel 3, the Group is required to complete the development of Parcel 3 by April 17, 2013. The land concession for Sands Cotai Central contains a similar requirement that the corresponding development be completed by May 2014. Management believes that if the Group is unable to complete the developments by the respective deadlines, it will likely be able to obtain an extension from the Macao Government. However,

Interim Report 2011

2. Management Discussion and Analysis

no assurances can be given that an extension will be granted. If the Group is not able to meet the deadlines and those deadlines are not extended, the Macao Government has the right to unilaterally terminate the land concessions and the Group could lose its investment in, and right to operate, any properties developed under the land concessions for Parcel 3 and Sands Cotai Central without compensation to the Group.

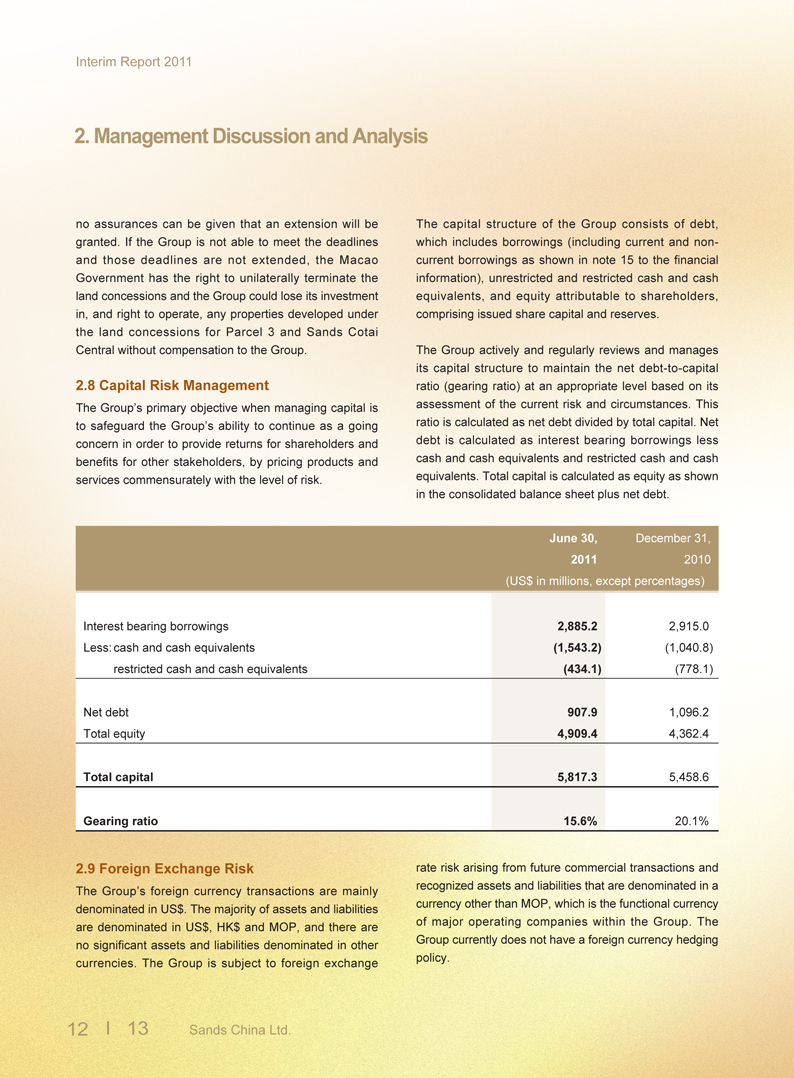

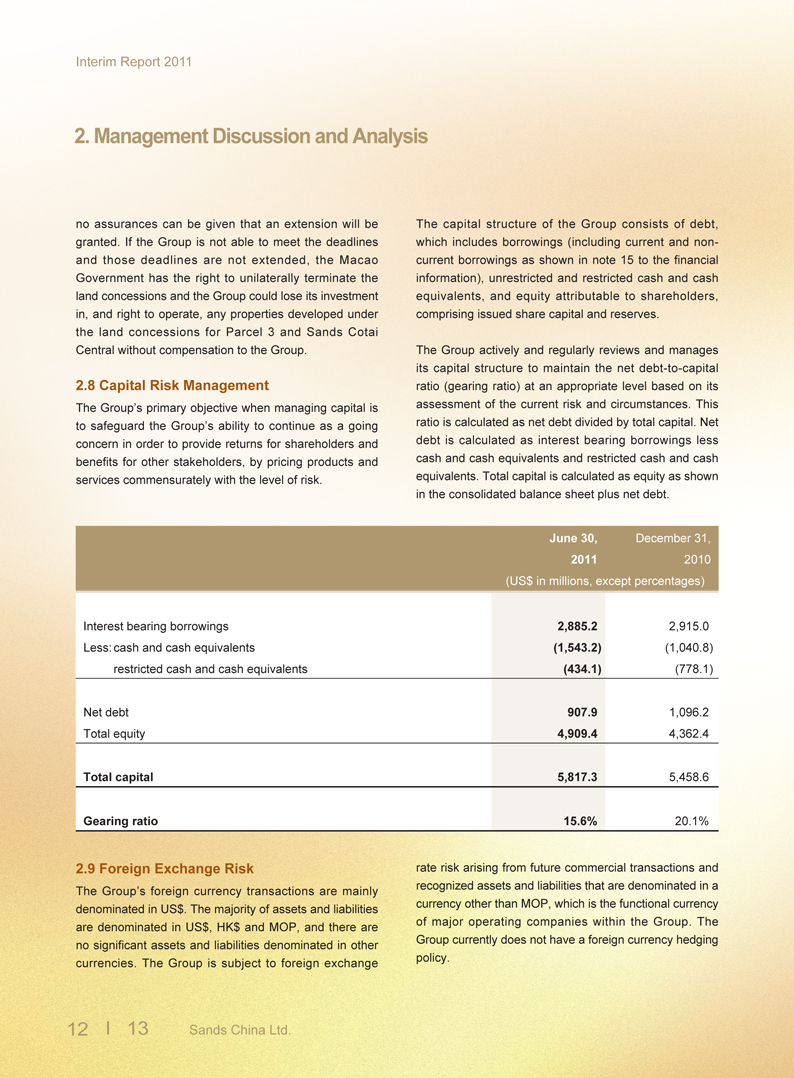

2.8 Capital Risk Management

The Group’s primary objective when managing capital is to safeguard the Group’s ability to continue as a going concern in order to provide returns for shareholders and benefits for other stakeholders, by pricing products and services commensurately with the level of risk.

June 30, December 31,

2011 2010

(US$ in millions, except percentages)

Interest bearing borrowings 2,885.2 2,915.0

Less: cash and cash equivalents (1,543.2) (1,040.8)

restricted cash and cash equivalents (434.1) (778.1)

Net debt 907.9 1,096.2

Total equity 4,909.4 4,362.4

Total capital 5,817.3 5,458.6

Gearing ratio 15.6% 20.1%

2.9 Foreign Exchange Risk

The Group’s foreign currency transactions are mainly denominated in US$. The majority of assets and liabilities are denominated in US$, HK$ and MOP, and there are no significant assets and liabilities denominated in other currencies. The Group is subject to foreign exchange

The capital structure of the Group consists of debt, which includes borrowings (including current and non-current borrowings as shown in note 15 to the financial information), unrestricted and restricted cash and cash equivalents, and equity attributable to shareholders, comprising issued share capital and reserves.

The Group actively and regularly reviews and manages its capital structure to maintain the net debt-to-capital ratio (gearing ratio) at an appropriate level based on its assessment of the current risk and circumstances. This ratio is calculated as net debt divided by total capital. Net debt is calculated as interest bearing borrowings less cash and cash

equivalents and restricted cash and cash equivalents. Total capital is calculated as equity as shown in the consolidated balance sheet plus net debt.

rate risk arising from future commercial transactions and recognized assets and liabilities that are denominated in a currency other than MOP, which is the functional currency of major operating companies within the Group. The Group currently does not have a foreign currency hedging policy.

12 13 Sands China Ltd.

Interim Report 2011

2. Management Discussion and Analysis

2.10 Business Review and Prospects

Our business strategy is to continue to successfully execute our Cotai Strip developments and to leverage our integrated resort business model to create Asia’s premier gaming, leisure and convention destination. The Company continues to execute on the strategies outlined in our 2010 Annual Report. These strategies have proven to be successful in the first half of 2011 and we are confi dent they will continue to be so throughout the rest of the year.

We are making solid progress on the development of our integrated resort on Parcels 5 and 6 on Cotai, which on August 5, 2011 we officially branded Sands Cotai Central. The Company is completing the construction of this integrated resort development in phases. Upon completion of phases I and II of the project, Sands Cotai Central is expected to feature approximately 5,800 hotel rooms, approximately 300,000 square feet of gaming space, approximately 1.2 million square feet of retail, entertainment and dining facilities, exhibition and conference facilities and a multipurpose theater.

Phase I of the project is expected to include two hotel towers, one of which will be managed by Sheraton International Inc. and Sheraton Overseas Management Co. (collectively “Starwood”) under its Sheraton brand, as well as completion of the structural work of an adjacent hotel tower to be managed by Starwood under its Sheraton Towers brand. The second hotel tower was to be managed by Shangri-La International Hotel Management Limited (“Shangri-La”); however, in March 2011, the Company and Shangri-La mutually agreed to terminate the hotel management agreement. This second hotel tower will now be managed by Hilton Worldwide and IHG (InterContinental Hotels Group) under their Conrad and Holiday Inn brands respectively.

The Company’s anticipated opening of phase I of Sands Cotai Central will be progressive starting in the first

quarter of 2012 with the opening of parcel 5, which will feature approximately 600 five-star Conrad rooms and suites along with approximately 1,200 four-star Holiday Inn rooms and suites. Parcel 5 will also open with a variety of retail offerings, more than 300,000 square feet of meeting space, several food and beverage establishments along with the approximately 106,000 square foot casino and VIP gaming areas. Phase I also includes the opening of the first hotel tower on parcel 6, which will feature approximately 2,000 Sheraton-branded rooms, along with the second casino and the remaining dining, entertainment, retail and meeting facilities, and is currently scheduled to open in the third quarter of 2012.

Phase II of the project, consisting of the second hotel tower on parcel 6, which will feature approximately 2,000 additional rooms and suites under the Sheraton Towers brand, is projected to open in early 2013. We expect to further invest US$1.4 billion(3) to complete phases I and II.

Phase III of the project is expected to include a fourth hotel and mixed-use tower to be managed by Starwood under its St. Regis brand and the total cost is expected to be approximately US$450 million. The Company intends to commence construction of phase III of the project as demand and market conditions warrant it.

On July 27, 2011, the Board was pleased to approve and announce the promotion of Mr. Edward Matthew Tracy to the position of President and Chief Executive Officer. Mr. Tracy served as the President and Chief Operating Officer of the Company from July 27, 2010 until July 27, 2011 and served as a special advisor on the Parcels 5 and 6 Capital Expenditure Committee from March 1, 2011 until July 27, 2011. Mr. Tracy has over twenty years of hands on management and development experience in the gaming and hospitality industry and we are confident in his ability to provide stability and deliver growth for the Company.

(3) In addition to amounts expected to be invested, we currently expect to spend approximately US$200 million on construction payables,

approximately US$100 million on capitalized but not paid land premium payments, and approximately US$200 million on other payables and

accruals, including additional construction contingency.

Interim Report 2011

3. Corporate Governance

3.1 Human Resources

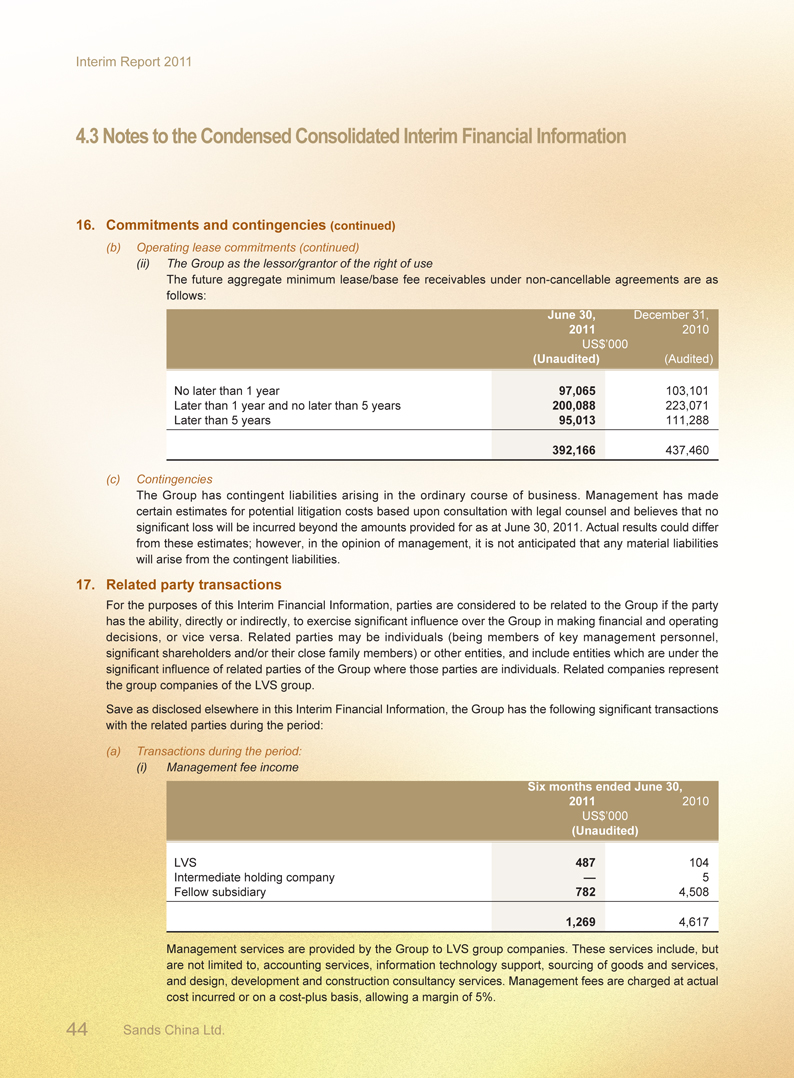

As at June 30, 2011, our team member profile was as follows:

Number of full-time team members: 15,322

Average age: 37

Average years of service: 3.97

Gender Ratio: Male 45.82%

Female 54.18%

Number of nationalities in management team: 36

Total number of nationalities: 51

Save as disclosed in this 2011 Interim Report, there have been no material changes to the information disclosed in

the 2010 Annual Report in respect of the remuneration of

the employees, remuneration policies, bonus and share

option schemes and staff development.

3.2 Environment

We recognize the impact our business has on the environment and we continue to strive to achieve the goals we have set ourselves in the areas of resource conservation and reducing our environmental foot print. We encourage and are grateful to those Shareholders who have elected to receive our annual and interim reports via electronic means, thereby reducing the need to print hard copies of our reports. Should you wish to start receiving an electronic copy of our annual and interim reports, please refer to page 50 of this report for more information.

To minimize the impact on our environment, this 2011 Interim Report is printed on recycled paper using soy based inks.

3.3 Corporate Governance Practices

The Company is committed to achieving and maintaining a sensible framework in the interests of monitoring the highest standards of corporate governance to safeguard the interests of shareholders and to enhance corporate value and accountability. In the Corporate Governance Report of April 13, 2011, which was published in our 2010 Annual Report, we reported that the Company has devised its own corporate governance principles and guidelines, which not only incorporate most of the

policies, principles and practices set out in the Code on Corporate Governance Practices (the “CG Code”) contained in Appendix 14 of the Rules Governing the Listing of

Securities (the “Listing Rules”) on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”), but also incorporates corporate governance best practices.

Except as disclosed below, the Company has fully complied with all the code provisions and certain recommended best practices set out in the CG Code throughout the six months ended June 30, 2011.

3.4 Code Provision

Code Provision D.1.2

Under code provision D.1.2 of the CG Code, functions reserved to the board and those delegated to the management should be formalized and periodic review should be conducted to ensure those arrangements remain appropriate to the needs of the Company. As noted in our 2010 Annual Report, such functions were formalized and adopted on March 1, 2011.

Code Provision D.2.1

Under code provision D.2.1 of the CG Code, board committees should be formed with specific terms of reference that deal clearly with the committee’s authority and duties. The Company formed the CEO Search Committee and the Transitional Advisory Committee on July 27, 2010, shortly after the removal of Mr. Steven Jacobs as the Company’s Chief Executive Officer, President and Executive Director. Written terms of reference for these two committees were not established at that time although the committees were provided with a clear mandate from the Board. These two committees functioned as advisory committees only and had no delegated powers or decision making authority from the Board. The CEO Search Committee and Transitional Advisory Committee were dissolved on February 14, 2011.

3.5 Model Code for Securities Transactions

As reported on page 56 of our 2010 Annual Report, the Company has devised its own securities trading code for securities transactions (the “Company Code”) by the Directors and relevant employees who are likely to be

14 15 Sands China Ltd.

Interim Report 2011

3. Corporate Governance

in possession of unpublished price-sensitive information of the Company on terms no less exacting than the Model Code for Securities Transactions by Directors of Listed Issuers as set out in Appendix 10 of the Listing Rules (the “Model Code”). Following specific enquiry by the Company, all Directors have confirmed that they have complied with the required standard set out in the Company Code during the six months ended June 30, 2011.

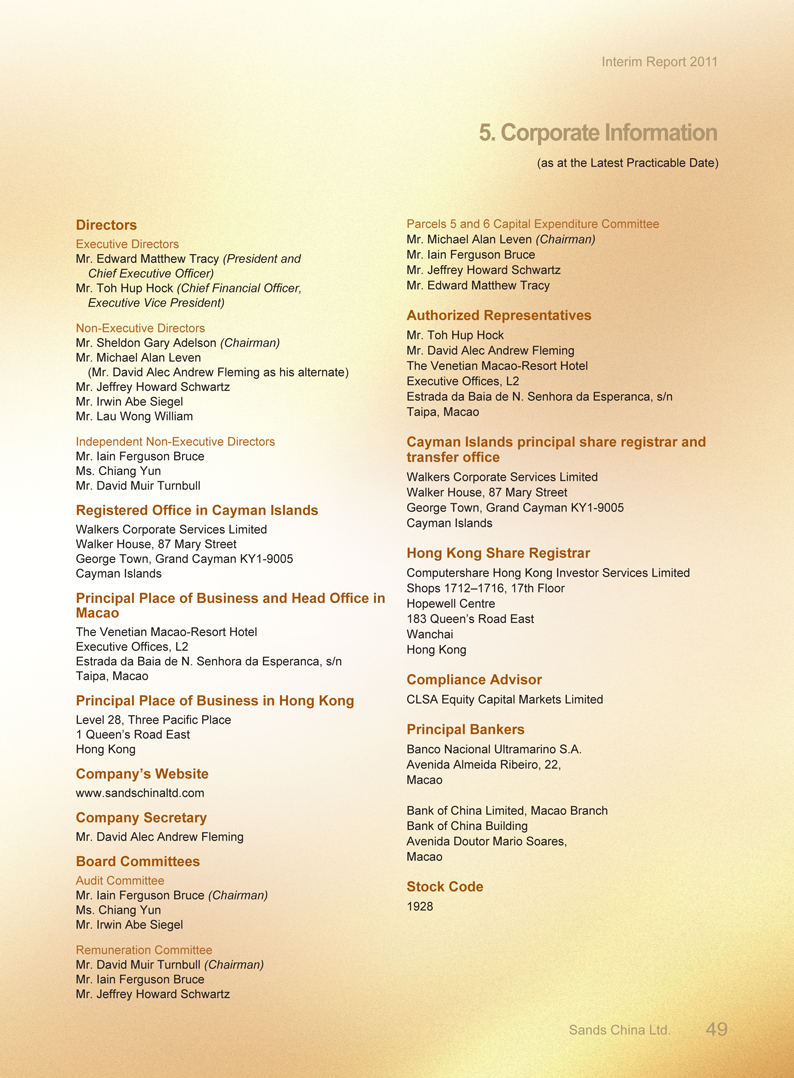

3.6 Board and Board Committees Composition

There were no changes to the composition of the Board during the first half of 2011; however, on July 27, 2011 the following changes were made:

Mr. Edward Matthew Tracy, the Company’s President and Chief Executive Officer from July 27, 2011, and the President and Chief Operating Officer from July 27, 2010 to July 27, 2011, was appointed an Executive Director with effect from July 27, 2011. As an Executive Director, Mr. Tracy does not receive any emoluments for his position on the Board and his appointment is not governed by a service contract. Mr. Tracy will serve as an Executive Director of the Company for an initial term of three years; however, he is subject to retirement by rotation and re-election at the annual general meeting of the Company in accordance with the articles of association of the Company.

Mr. Lau Wong William was appointed as a Non-Executive Director of the Company with effect from July 27, 2011. As a Non-Executive Director, Mr. Lau will receive directors’ fees amounting to US$75,000 per annum. The emoluments of Mr. Lau are determined by the Board with reference to his duties and responsibilities with the Company and the Company’s remuneration policy and are subject to review by the Remuneration Committee from time to time. His emoluments are covered by the letter of appointment issued by the Company and any subsequent revision approved by the Board. Mr. Lau was appointed for an initial term of three years commencing from July 27, 2011. He is subject to retirement by rotation and re-election at the annual general meeting of the Company in accordance with the articles of association of the Company.

Mr. Michael Alan Leven, the Company’s Acting Chief Executive Officer from July 23, 2010 until July 27, 2011, a Special Advisor to the Board from October 14, 2009 until July 27, 2010 and an Executive Director of the Company from July 27, 2010 until July 27, 2011, was redesignated as Non-Executive Director of the Company with effect from July 27, 2011. Mr. Leven will serve as a Non-Executive Director of the Company for a term of two years, and is subject to retirement by rotation and reelection at the annual general meeting of the Company in accordance with the articles of association of the Company. Mr. Leven will not receive any director’s fees/ emoluments for services provided to the Company in his capacity as a Non-Executive Director of the Company.

As at June 30, 2011, the composition of the Board was as follows:

Executive Directors Title Note

Michael Alan Leven Acting Chief Executive Officer Appointed July 27, 2010

(David Alec Andrew Fleming

as his alternate)

Toh Hup Hock Chief Financial Officer, Appointed June 30, 2010

Executive Vice President

Non-Executive Directors

Sheldon Gary Adelson Chairman Appointed August 18, 2009

Jeffrey Howard Schwartz Appointed October 14, 2009

Irwin Abe Siegel Appointed October 14, 2009

Independent Non-Executive Directors

Iain Ferguson Bruce Appointed October 14, 2009

Chiang Yun Appointed October 14, 2009

David Muir Turnbull Appointed October 14, 2009

Interim Report 2011

3. Corporate Governance

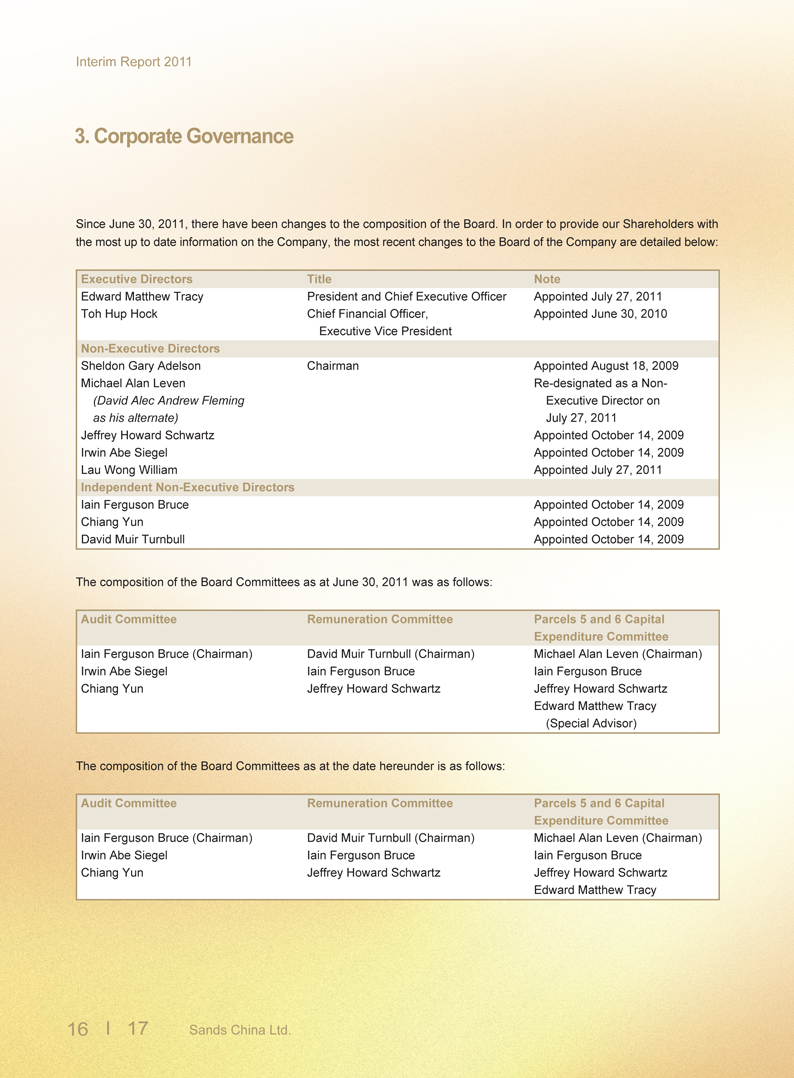

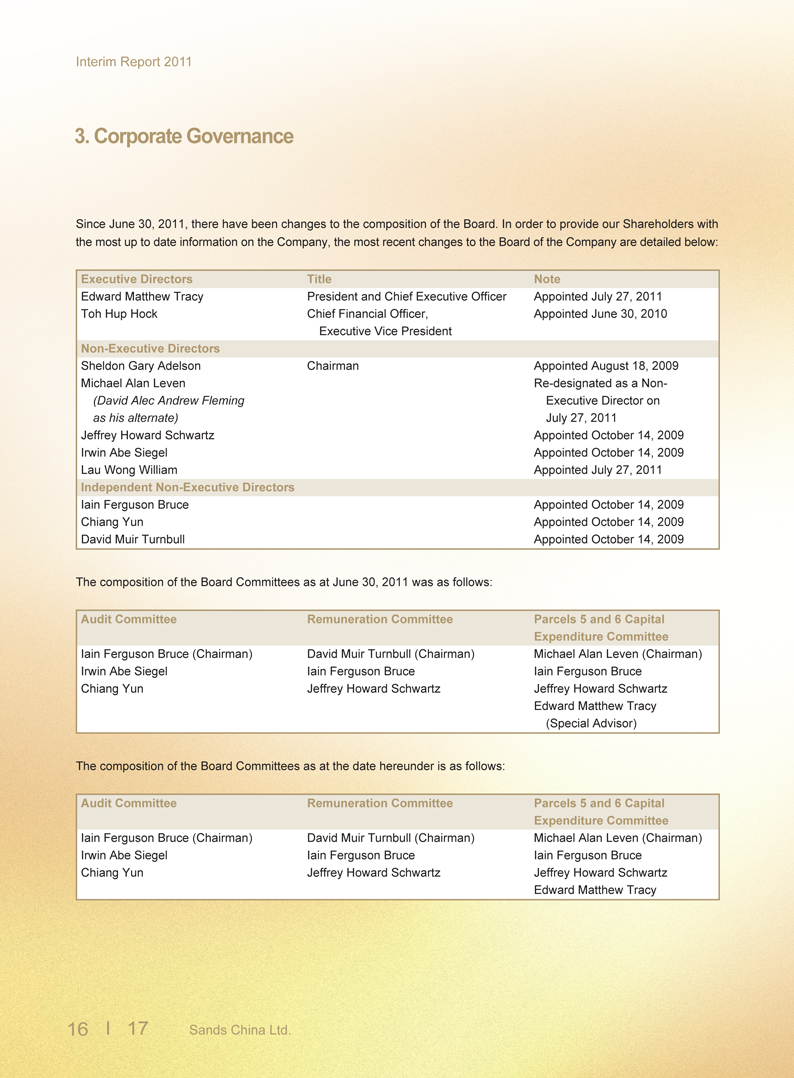

Since June 30, 2011, there have been changes to the composition of the Board. In order to provide our Shareholders with the most up to date information on the Company, the most recent changes to the Board of the Company are detailed below:

Executive Directors Title Note

Edward Matthew Tracy President and Chief Executive Officer Appointed July 27, 2011

Toh Hup Hock Chief Financial Officer, Appointed June 30, 2010

Executive Vice President

Non-Executive Directors

Sheldon Gary Adelson Chairman Appointed August 18, 2009

Michael Alan Leven Re-designated as a Non-

(David Alec Andrew Fleming Executive Director on

as his alternate) July 27, 2011

Jeffrey Howard Schwartz Appointed October 14, 2009

Irwin Abe Siegel Appointed October 14, 2009

Lau Wong William Appointed July 27, 2011

Independent Non-Executive Directors

Iain Ferguson Bruce Appointed October 14, 2009

Chiang Yun Appointed October 14, 2009

David Muir Turnbull Appointed October 14, 2009

The composition of the Board Committees as at June 30, 2011 was as follows:

Audit Committee Remuneration Committee Parcels 5 and 6 Capital

Expenditure Committee

Iain Ferguson Bruce (Chairman) David Muir Turnbull (Chairman) Michael Alan Leven (Chairman)

Irwin Abe Siegel Iain Ferguson Bruce Iain Ferguson Bruce

Chiang Yun Jeffrey Howard Schwartz Jeffrey Howard Schwartz

Edward Matthew Tracy

(Special Advisor)

The composition of the Board Committees as at the date hereunder is as follows:

Audit Committee Remuneration Committee Parcels 5 and 6 Capital

Expenditure Committee

Iain Ferguson Bruce (Chairman) David Muir Turnbull (Chairman) Michael Alan Leven (Chairman)

Irwin Abe Siegel Iain Ferguson Bruce Iain Ferguson Bruce

Chiang Yun Jeffrey Howard Schwartz Jeffrey Howard Schwartz

Edward Matthew Tracy

16 17 Sands China Ltd.

Interim Report 2011

3. Corporate Governance

3.7 Disclosure of Director’s information pursuant to Rule 13.51B(1) of the Listing Rules

Director’s Emoluments

The emoluments of Mr. Toh Hup Hock, as Executive Vice President and Chief Financial Officer of the Company, was increased to US$697,000 per annum with effect from March 1, 2011. Mr. Toh does not receive any director’s fee as an Executive Director of the Company.

Save as disclosed above, as at June 30, 2011, there is no other changes to the directors’ information as required to be disclosed pursuant to Rule 13.51B(1) of the Listing Rules.

3.8 Audit Committee Review

The Audit Committee has reviewed the accounting policies adopted by the Group and the unaudited condensed consolidated interim financial information

for the six months ended June 30, 2011. All of the Audit Committee members are Non-Executive Directors, with the Chairman and Mr. Siegel possessing the appropriate professional qualifications or accounting or related financial management experience. No member of the Audit Committee is a former partner of the Company’s existing external auditors.

3.9 Disclosure of Interests

Interests of Directors and Chief Executives

The interests of each of the Directors and Chief Executives in the shares, underlying shares and debentures of the Company and any of the Company’s associated corporations (within the meaning of Part XV of the SFO) as at June 30, 2011, as recorded in the register required to be kept under Section 352 of Part XV of the SFO or as the Company is aware, are set out in the table and explanatory notes below:

Approximate

Number of percentage of

Name of Director Company Nature of Interest Ordinary Shares shareholding interest

Sheldon Gary Adelson Company Interest in a controlled corporation 5,657,814,855(L) 70.3%

Toh Hup Hock Company Beneficial owner 1,078,000(L)(6) 0.01%

David Alec Andrew Fleming Company Beneficial owner 910,400(L)(8) 0.01%

Approximate

Associated Number of percentage of

Name of Director Corporation Nature of Interest Securities shareholding interest

Sheldon Gary Adelson LVS Beneficial owner 223,315,760(L)(1) 30.59%

Family Interest 201,115,235(L)(2) 27.55%

5,250,000(L)(3) 69.76%

Jeffrey Howard Schwartz LVS Beneficial owner 116,849(L)(4) 0.02%

Irwin Abe Siegel LVS Beneficial owner 53,302(L)(5) 0.01%

Toh Hup Hock LVS Beneficial owner 60,000(L)(6) 0.01%

Michael Alan Leven LVS Beneficial owner 2,763,612(L)(7) 0.38%

The letter “L” denotes the person’s long position in such securities.

Interim Report 2011

3. Corporate Governance

(1) This amount includes (a) 100 shares of LVS’s common

stock, (b) 45,596 shares of restricted stock of which 3,965

shares are vested, (c) 947,583 options to purchase 947,583

shares in LVS’s common stock of which 456,661 options

are vested and exercisable, (d) 170,242 shares of LVS’s

common stock owned by the Dr. Miriam and Sheldon G.

Adelson Charitable Trust over which Mr. Adelson, as trustee,

retains sole voting and dispositive power, (e) 42,373,838

shares of LVS’s common stock owned by the Sheldon G.

Adelson December 2008 Three Year LVS Annuity Trust

over which Mr. Adelson, as trustee, retains sole dispositive

control, (f) 22,869,067 shares of LVS’s common stock owned

by the Sheldon G. Adelson February 2009 Three Year LVS

Annuity Trust over which Mr. Adelson, as trustee, retains sole

dispositive control, (g) 23,806,069 shares of LVS’s common

stock owned by the Sheldon G. Adelson October 2009 Two

Year LVS Annuity Trust over which Mr. Adelson, as trustee,

retains sole dispositive control, (h) 26,188,785 shares of LVS’s

common stock owned by the Sheldon G. Adelson October

2009 Three Year LVS Annuity Trust over which Mr. Adelson,

as trustee, retains sole dispositive control, (i) 28,022,248

shares of LVS’s common stock owned by the Sheldon G.

Adelson June 30, 2010 Two Year LVS Annuity Trust over

which Mr. Adelson, as trustee, retains sole dispositive control,

(j) 23,518,397 shares of LVS’s common stock owned by the

Sheldon G. Adelson June 29, 2010 Two Year LVS Annuity

Trust over which Mr. Adelson, as trustee, retains sole

dispositive control, (k) 22,582,656 shares of LVS’s common

stock owned by the Sheldon G. Adelson September 28, 2010

Two Year LVS Annuity Trust over which Mr. Adelson, as

trustee, retains sole dispositive control, (l) 22,581,427 shares

of LVS’s common stock owned by the Sheldon G. Adelson

September 29, 2010 Two Year LVS Annuity Trust over which

Mr. Adelson, as trustee, retains sole dispositive control, and

(m) 10,209,752 shares of LVS’s common stock owned by the

Sheldon G. Adelson March 2011 Two Year LVS Annuity Trust

over which Mr. Adelson, as trustee, retains sole dispositive

control. Mr. Adelson and his wife together are entitled to

control the exercise of one-third or more of the voting power

at stockholders’ meetings of LVS. LVS’s interests in our

Company are set out below.

(2) This amount includes (a) 4,835,917 shares of LVS’s common

stock held by Dr. Miriam Adelson, (b) 12,692,516 shares

of LVS’s common stock held by the ESBT S Trust over

which Dr. Adelson, as trustee, retains sole voting control, (c)

7,342,516 shares of LVS’s common stock held by the ESBT

Y Trust over which Dr. Adelson, as trustee, retains sole voting

control, (d) 13,692,517 shares of LVS’s common stock held by

the QSST A Trust over which Dr. Adelson, as trustee, retains

sole voting control, (e) 13,692,517 shares of LVS’s common

stock held by the QSST M Trust over which Dr. Adelson,

as trustee, retains sole voting control, (f) 5,144,415 shares

of LVS’s common stock held by the Sheldon G. Adelson

2004 Remainder Trust over which Dr. Adelson, as trustee,

retains sole voting control, (g) 12,747,451 shares of LVS’s

common stock held by the General Trust under the Sheldon

G. Adelson 2007 Remainder Trust over which Dr. Adelson,

as trustee, retains sole voting control, (h) 12,747,450 shares

of LVS’s common stock held by the General Trust under the

Sheldon G. Adelson 2007 Friends and Family Trust over

which Dr. Adelson, as trustee, retains sole voting control, (i)

18,139,344 shares of LVS’s common stock owned by the

Miriam Adelson June 2011 Two Year LVS Annuity Trust over

which Dr. Adelson, as trustee, retains sole dispositive control,

(j) 13,707 shares of LVS’s common stock held by the Sivan

Ochshorn 2010 Grantor Trust over which Dr. Adelson retains

sole voting and dispositive control, (k) 12,566,710 shares of

LVS’s common stock owned by Adfam Investment Company

LLC over which Dr. Adelson, as co-manager, shares voting

and dispositive control with Mr. Adelson, and (l) warrants to

purchase 87,500,175 shares of LVS’s common stock that are

exercisable.

(3) Dr. Adelson holds 5,250,000 shares of preferred stock.

(4) This amount includes (a) 9,205 shares of restricted stock, of

which 7,273 shares are vested, and (b) 107,644 options to

purchase 107,644 shares in LVS’s common stock, of which

39,307 options are vested and exercisable.

(5) This amount includes (a) 500 shares of LVS’s common stock,

(b) 12,702 shares of restricted stock, of which 10,770 shares

are vested, and (c) 40,100 options to purchase 40,100 shares

of LVS’s common stock, of which 17,350 options are vested

and exercisable.

(6) This amount includes (a) 78,000 shares of the Company,

(b) 1,000,000 options to purchase 1,000,000 shares of

the Company, of which 250,000 options are vested and

exercisable, and (c) 60,000 options to purchase 60,000 shares

of LVS’s common stock, of which 37,500 options are vested

and exercisable.

(7) This amount includes (a) 115 shares of LVS’s common stock,

(b) 353,497 shares of restricted stock, of which 3,497 shares

are vested, and (c) 2,410,000 options to purchase 2,410,000

shares of LVS’s common stock, of which 2,406,000 options

are vested and exercisable.

(8) This amount includes (a) 400 shares of the Company, and

(b) 910,000 unvested options to purchase 910,000 shares of

the Company.

18 19 Sands China Ltd.

Interim Report 2011

3. Corporate Governance

None of the Directors or the Chief Executives had short positions in respect of shares, underlying shares and debentures of the Company and its associated corporations (within the meaning of Part XV of the SFO) as at June 30, 2011.

Save as disclosed above, so far as was known to any Director, as at June 30, 2011, none of the Directors or the Chief Executives of the Company had, pursuant to Divisions 7 and 8 of Part XV of the SFO, nor were they taken or deemed to have under such provisions of the SFO, any interest or short position in any shares or underlying shares or interest in debentures of the Company or any of its associated corporations (within the meaning of Part XV of the SFO) that were required to be notified to the Company and the Stock Exchange, or any interests which were required, pursuant to Section 352 of the SFO, to be entered into the register referred to therein, or any interests which were required, pursuant to the Model Code, to be notified to the Company and the Stock Exchange.

Number of

shares % of issued

Name of Substantial Shareholder Capacity/Nature of Interest interested share capital

Sheldon Gary Adelson Interested in a controlled corporation 5,657,814,885(L) 70.3%

Las Vegas Sands Corp. Interested in a controlled corporation 5,657,814,885(L) 70.3%

Las Vegas Sands, LLC Interested in a controlled corporation 5,657,814,885(L) 70.3%

Venetian Casino Resort, LLC Interested in a controlled corporation 5,657,814,885(L) 70.3%

LVS (Nevada) International Holdings, Inc. Interested in a controlled corporation 5,657,814,885(L) 70.3%

LVS Dutch Finance CV Interested in a controlled corporation 5,657,814,885(L) 70.3%

LVS Dutch Holding BV Interested in a controlled corporation 5,657,814,885(L) 70.3%

Sands IP Asset Management BV Interested in a controlled corporation 5,657,814,885(L) 70.3%

Venetian Venture Development Intermediate II Beneficial owner 5,657,814,885(L) 70.3%

The letter “L” denotes the person’s long position in such securities.

As at June 30, 2011, the Company had not been notified of any short positions being held by any substantial shareholder in the shares or underlying shares of the Company.

As at June 30, 2011, saved as disclosed above, none of the Directors nor the Chief Executives of the Company (including their spouses and children under 18 years of age) had any interest in, or had been granted, or exercised, any rights to subscribe for Shares (or warrants or debentures, if applicable) of the Company and its associated corporations within the meaning of the SFO.

Interests of Substantial Shareholders

The interests of Substantial Shareholders in the shares and underlying shares of the Company as at June 30, 2011, as recorded in the register required to be kept under Section 336 of Part XV of the SFO or as the Company is aware, are set out in the table below:

The Company had been notified of the following Substantial Shareholders’ interests in the shares as at June 30, 2011:

Interests of Any Other Persons

Save as disclosed above, as at June 30, 2011, the Company had not been notified of any persons who had interests or short positions in the shares or underlying shares of the Company, as recorded in the register required to be kept under Section 336 of Part XV of the SFO.

Interim Report 2011

3. Corporate Governance

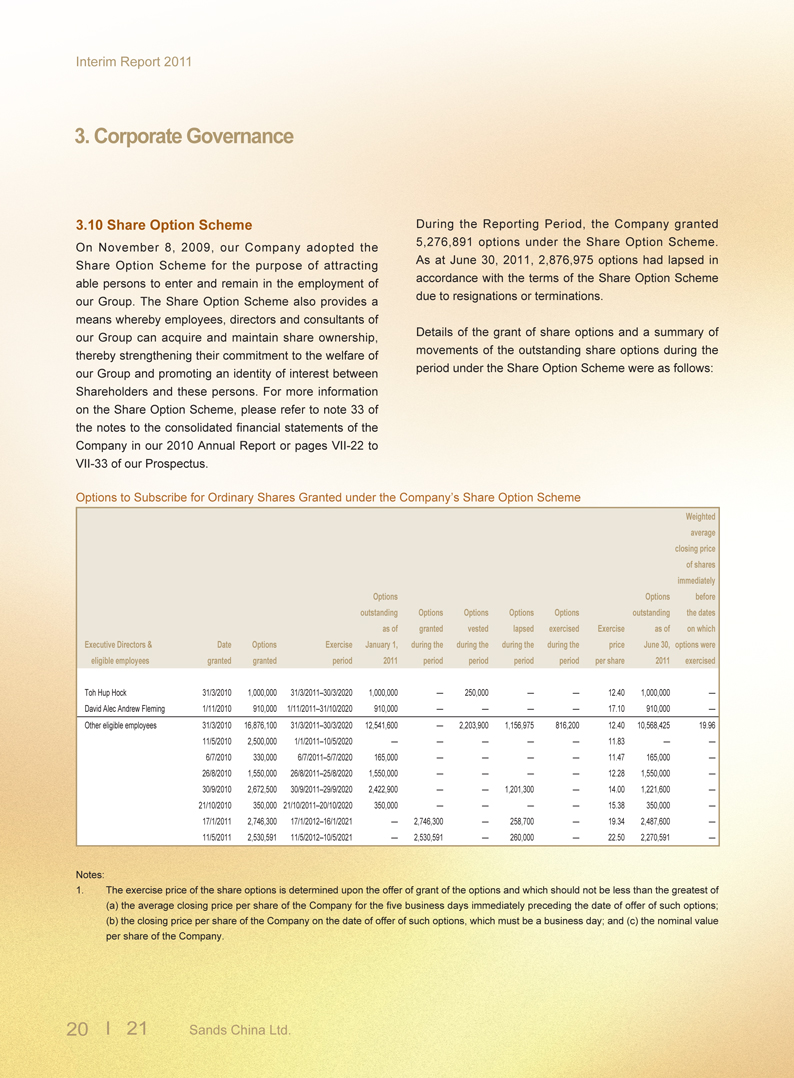

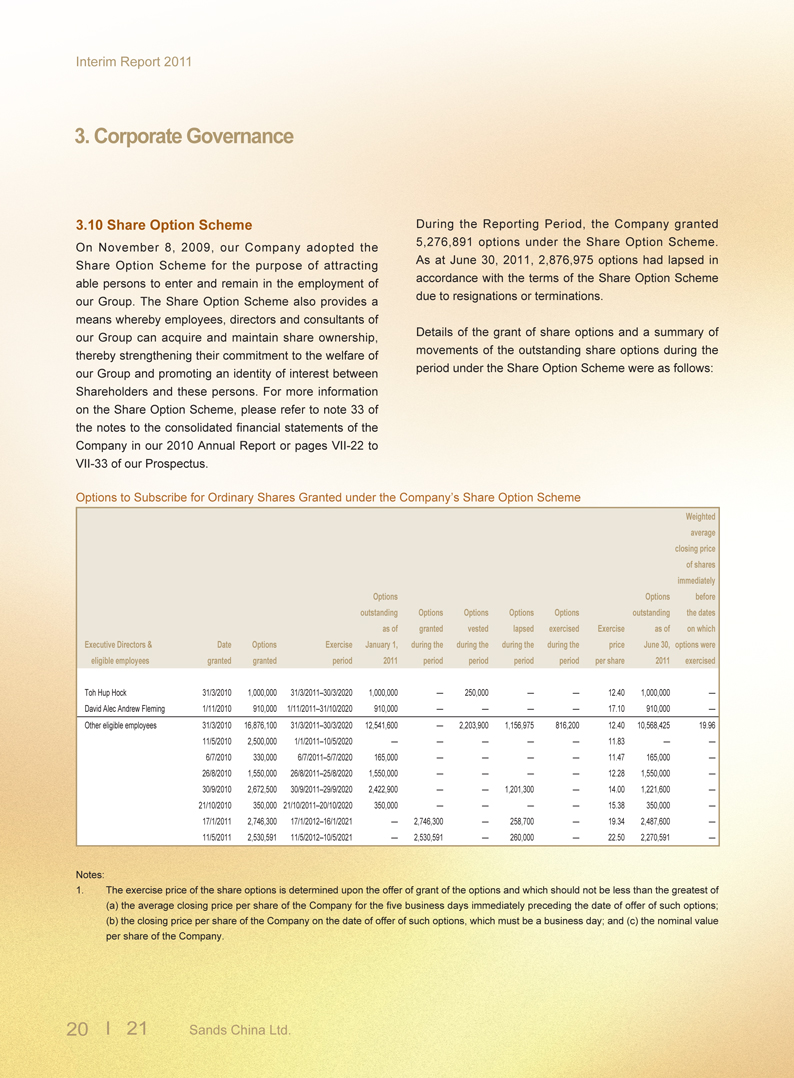

3.10 Share Option Scheme

On November 8, 2009, our Company adopted the Share Option Scheme for the purpose of attracting able persons to enter and remain in the employment of our Group. The Share Option Scheme also provides a means whereby employees, directors and consultants of our Group can acquire and maintain share ownership, thereby strengthening their commitment to the welfare of our Group and promoting an identity of interest between Shareholders and these persons. For more information on the Share Option Scheme, please refer to note 33 of the notes to the consolidated financial statements of the Company in our 2010 Annual Report or pages VII-22 to VII-33 of our Prospectus.

During the Reporting Period, the Company granted 5,276,891 options under the Share Option Scheme. As at June 30, 2011, 2,876,975 options had lapsed in accordance with the terms of the Share Option Scheme due to resignations or terminations.

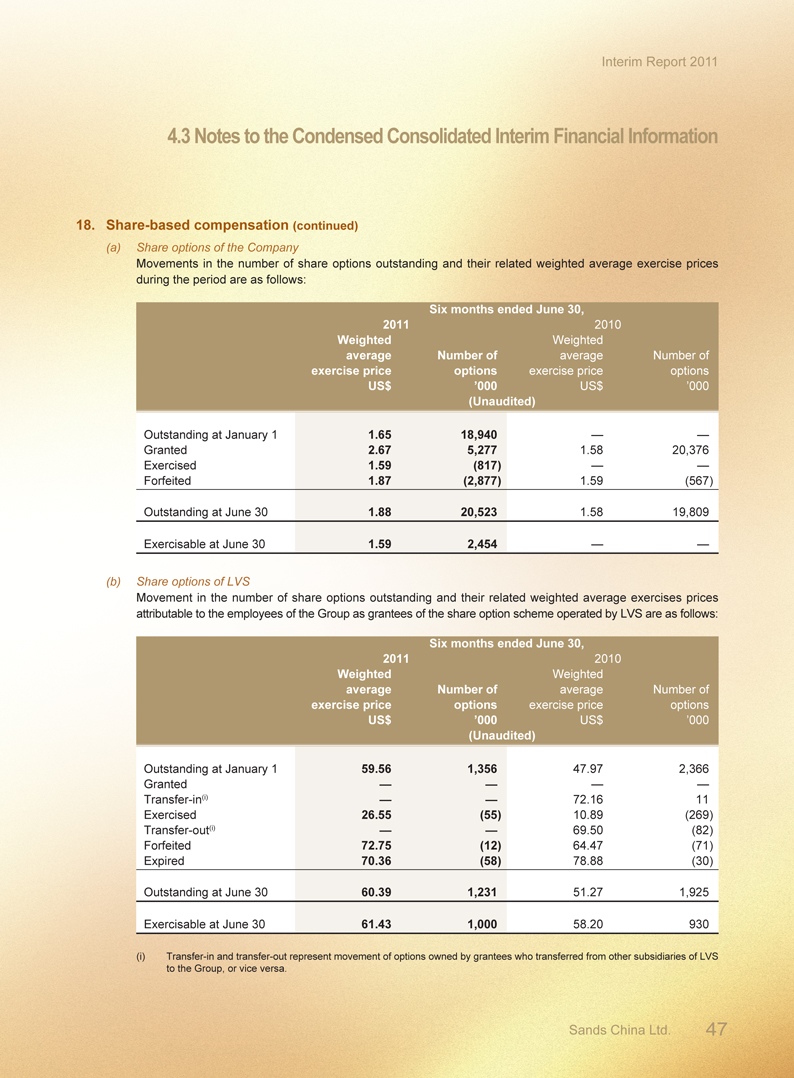

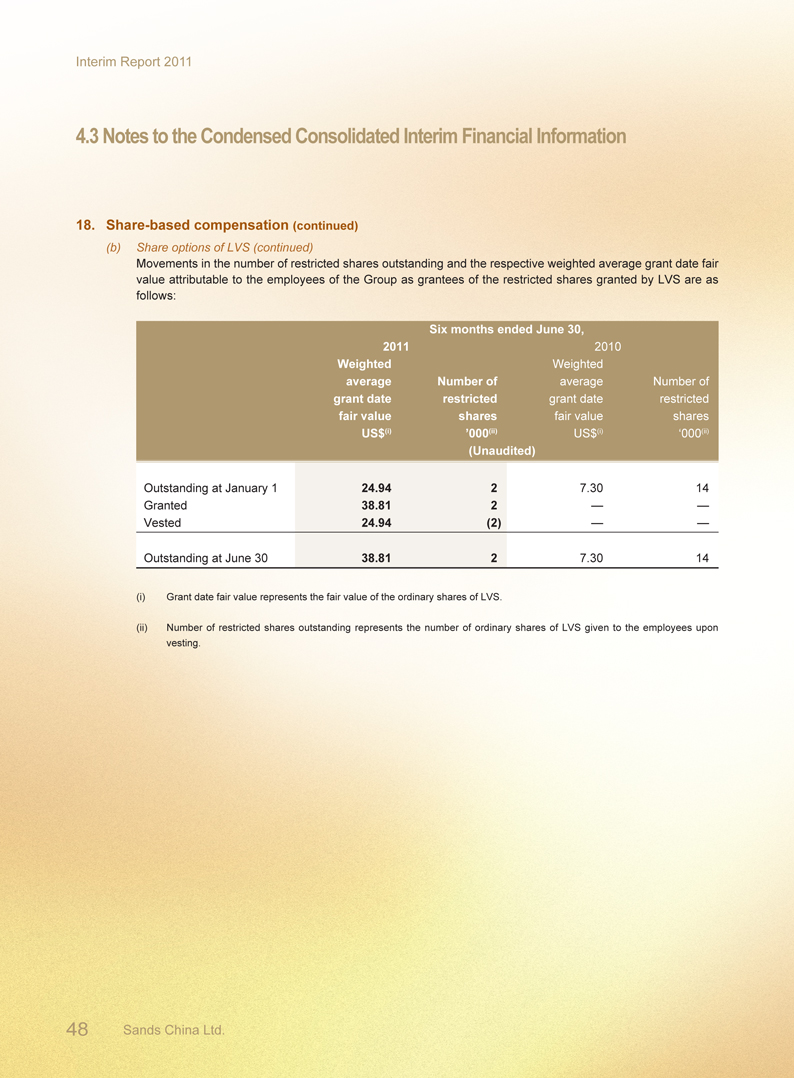

Details of the grant of share options and a summary of movements of the outstanding share options during the period under the Share Option Scheme were as follows:

Options to Subscribe for Ordinary Shares Granted under the Company’s Share Option Scheme

Weighted

average

closing price

of shares

immediately

Options Options before

outstanding Options Options Options Options outstanding the dates

as of granted vested lapsed exercised Exercise as of on which

Executive Directors & Date Options Exercise January 1, during the during the during the during the price June 30, options were

eligible employees granted granted period 2011 period period period period per share 2011 exercised

Toh Hup Hock 31/3/2010 1,000,000 31/3/2011–30/3/2020 1,000,000 — 250,000 — — 12.40 1,000,000 —

David Alec Andrew Fleming 1/11/2010 910,000 1/11/2011–31/10/2020 910,000 — — — — 17.10 910,000 —

Other eligible employees 31/3/2010 16,876,100 31/3/2011–30/3/2020 12,541,600 — 2,203,900 1,156,975 816,200 12.40 10,568,425 19.96

11/5/2010 2,500,000 1/1/2011–10/5/2020 — — — — — 11.83 — —

6/7/2010 330,000 6/7/2011–5/7/2020 165,000 — — — — 11.47 165,000 —

26/8/2010 1,550,000 26/8/2011–25/8/2020 1,550,000 — — — — 12.28 1,550,000 —

30/9/2010 2,672,500 30/9/2011–29/9/2020 2,422,900 — — 1,201,300 — 14.00 1,221,600 —

21/10/2010 350,000 21/10/2011–20/10/2020 350,000 — — — — 15.38 350,000 —

17/1/2011 2,746,300 17/1/2012–16/1/2021 — 2,746,300 — 258,700 — 19.34 2,487,600 —

11/5/2011 2,530,591 11/5/2012–10/5/2021 — 2,530,591 — 260,000 — 22.50 2,270,591 —

Notes:

1. The exercise price of the share options is determined upon the offer of grant of the options and which should not be less than the greatest of

(a) the average closing price per share of the Company for the five business days immediately preceding the date of offer of such options;

(b) the closing price per share of the Company on the date of offer of such options, which must be a business day; and (c) the nominal value

per share of the Company.

20 21 Sands China Ltd.

Interim Report 2011

3. Corporate Governance

2. The proportion of underlying shares in respect of which the above share options will vest is as follows:

Proportion of underlying

shares in respect of

which the above

share options will

Date vest is as follows:

Before the first anniversary of the date of grant of the option (the “Offer Anniversary”) None

From the first Offer Anniversary to the date immediately before the second Offer Anniversary One-quarter

From the second Offer Anniversary to the date immediately before the third Offer Anniversary Two-quarters

From the third Offer Anniversary to the date immediately before the forth Offer Anniversary Three-quarters

From the forth Offer Anniversary to the date immediately before the fifth Offer Anniversary All

Save as disclosed herein, no options were granted under the Share Option Scheme or any share option scheme of the Group as at June 30, 2011. The Company estimates the fair value of options granted using the Black-Scholes option-pricing model. The weighted average fair value of options granted during the Reporting Period, measured as at the date of grant, was approximately US$1.66.

Significant estimates and assumptions are required to be made in determining the parameters for applying the Black-Scholes option-pricing model, including estimates and assumptions regarding the risk-free rate of return, expected dividend yield and volatility of the underlying shares and the expected life of the options. These estimates and assumptions could have a material effect on the determination of the fair value of the share options and the amount of such equity awards expected to vest, which may in turn significantly impact the determination

of the share based compensation expense. The following

assumptions were used to derive the fair values:

Weighted average volatility 68.7%

Expected term (in years) 6.3

Risk-free rate 1.6%

Expected dividends —

3.11 Purchase, Sale or Redemption of the

Company’s Listed Shares

There was no purchase, sale or redemption of the

Company’s listed shares by the Company or any of its

subsidiaries during the six months ended June 30, 2011.

By order of the Board of Directors

Sands China Ltd.

Sheldon Gary Adelson

Chairman of the Board

Macao, August 29, 2011

Interim Report 2011

4.1 Report on Review of Interim Financial Information

To the Board of Directors of Sands China Ltd.

(incorporated in the Cayman Islands with limited liability)

Introduction

We have reviewed the interim financial information set out on pages 23 to 48, which comprises the consolidated balance sheet of Sands China Ltd. (the “Company”) and its subsidiaries (together, the “Group”) as at June 30, 2011 and the related condensed consolidated statements of income, comprehensive income, changes in equity and cash flows for the six-month period then ended, and a summary of significant accounting policies and other explanatory notes. The Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited require the preparation of a report on interim financial information to be in compliance with the relevant provisions thereof and International Accounting Standard 34 “Interim Financial Reporting”. The directors of the Company are responsible for the preparation and presentation of this interim financial information in accordance with International Accounting Standard 34 “Interim Financial Reporting”. Our responsibility is to express a conclusion on this interim financial information based on our review and to report our conclusion solely to you, as a body, in accordance with our agreed terms of engagement and for no other purpose. We do not assume responsibility towards or accept liability to any other person for the contents of this report.

Scope of review

We conducted our review in accordance with International Standard on Review Engagements 2410, “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”. A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the interim financial information is not prepared, in all material respects, in accordance with International Accounting Standard 34 “Interim Financial Reporting”.

PricewaterhouseCoopers

Certified Public Accountants

Hong Kong, August 29, 2011

PricewaterhouseCoopers, 22/F, Prince’s Building, Central, Hong Kong

T: +85222898888, F: +85228109888, www.pwchk.com

22 Sands China Ltd.

Interim Report 2011

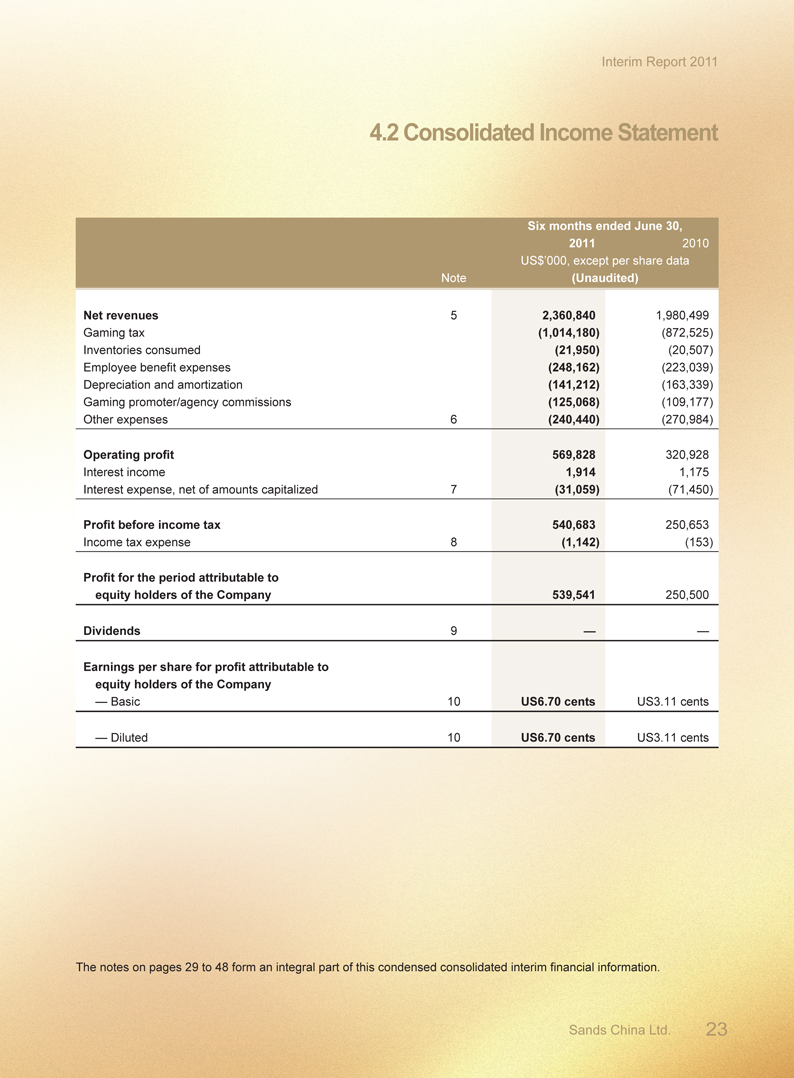

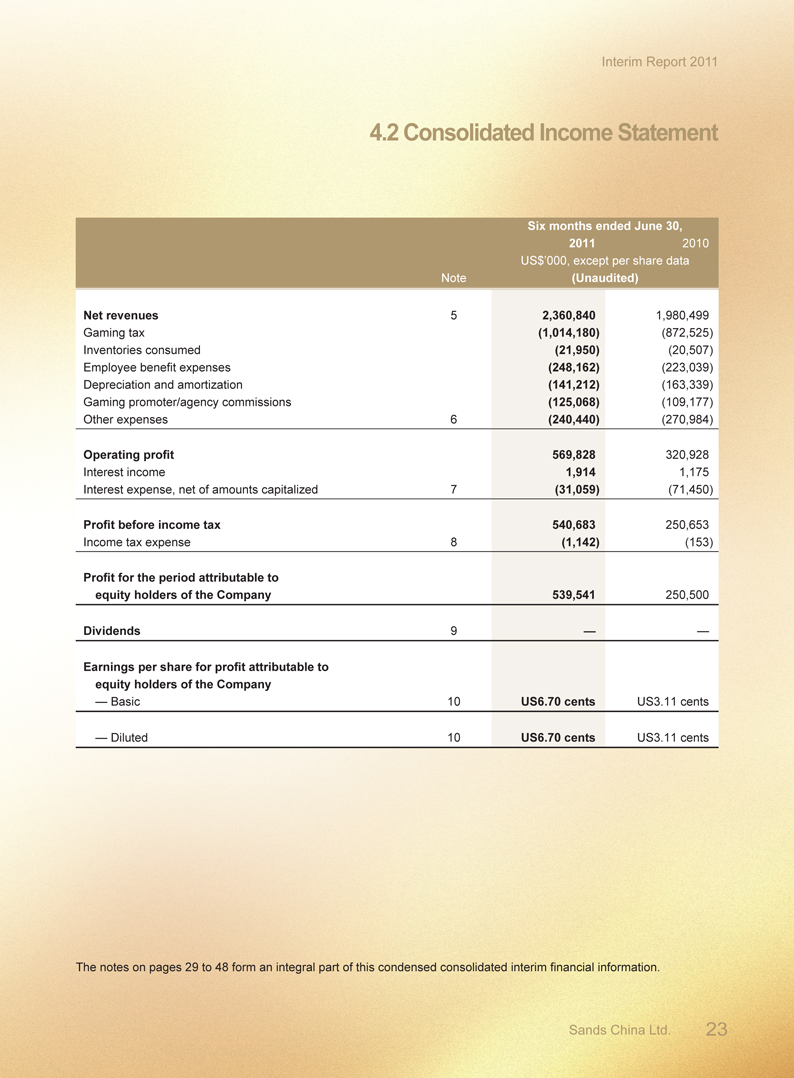

4.2 Consolidated Income Statement

Six months ended June 30,

2011 2010

US$’000, except per share data

Note (Unaudited)

Net revenues 5 2,360,840 1,980,499

Gaming tax (1,014,180) (872,525)

Inventories consumed (21,950) (20,507)

Employee benefit expenses (248,162) (223,039)

Depreciation and amortization (141,212) (163,339)

Gaming promoter/agency commissions (125,068) (109,177)

Other expenses 6 (240,440) (270,984)

Operating profit 569,828 320,928

Interest income 1,914 1,175

Interest expense, net of amounts capitalized 7 (31,059) (71,450)

Profit before income tax 540,683 250,653

Income tax expense 8 (1,142) (153)

Profit for the period attributable to

equity holders of the Company 539,541 250,500

Dividends 9 — —

Earnings per share for profit attributable to

equity holders of the Company

— Basic 10 US6.70 cents US3.11 cents

— Diluted 10 US6.70 cents US3.11 cents

The notes on pages 29 to 48 form an integral part of this condensed consolidated interim financial information.

Sands China Ltd. 23

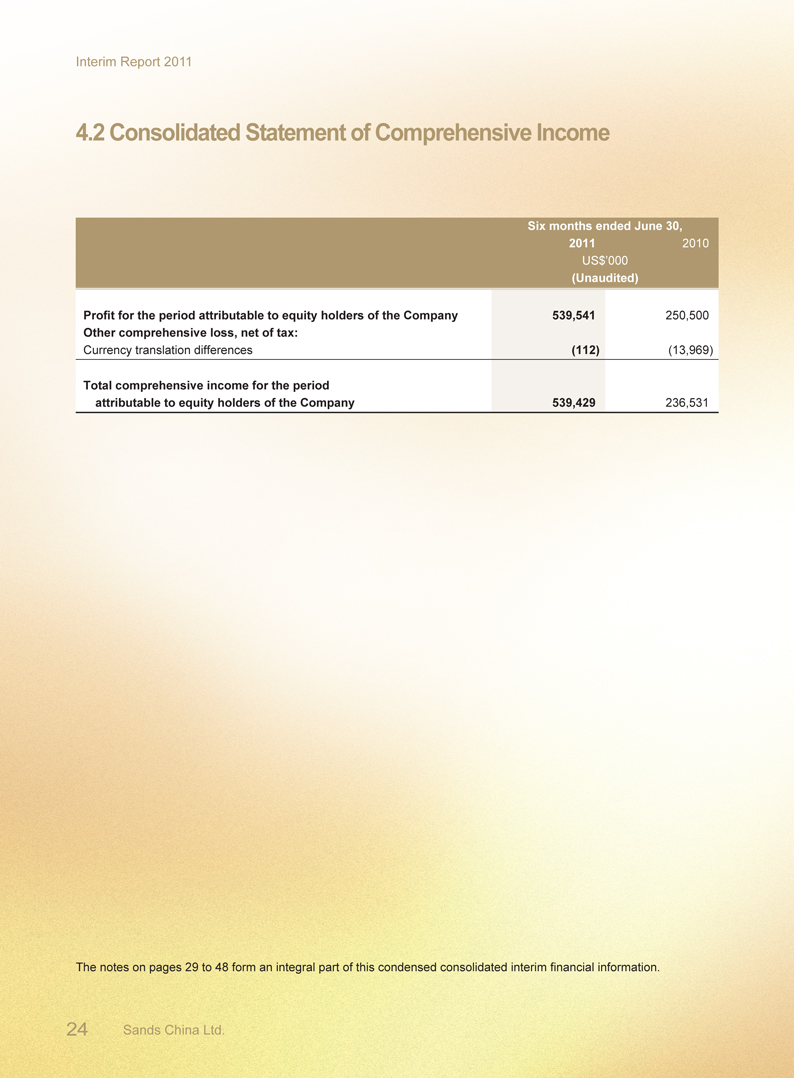

Interim Report 2011

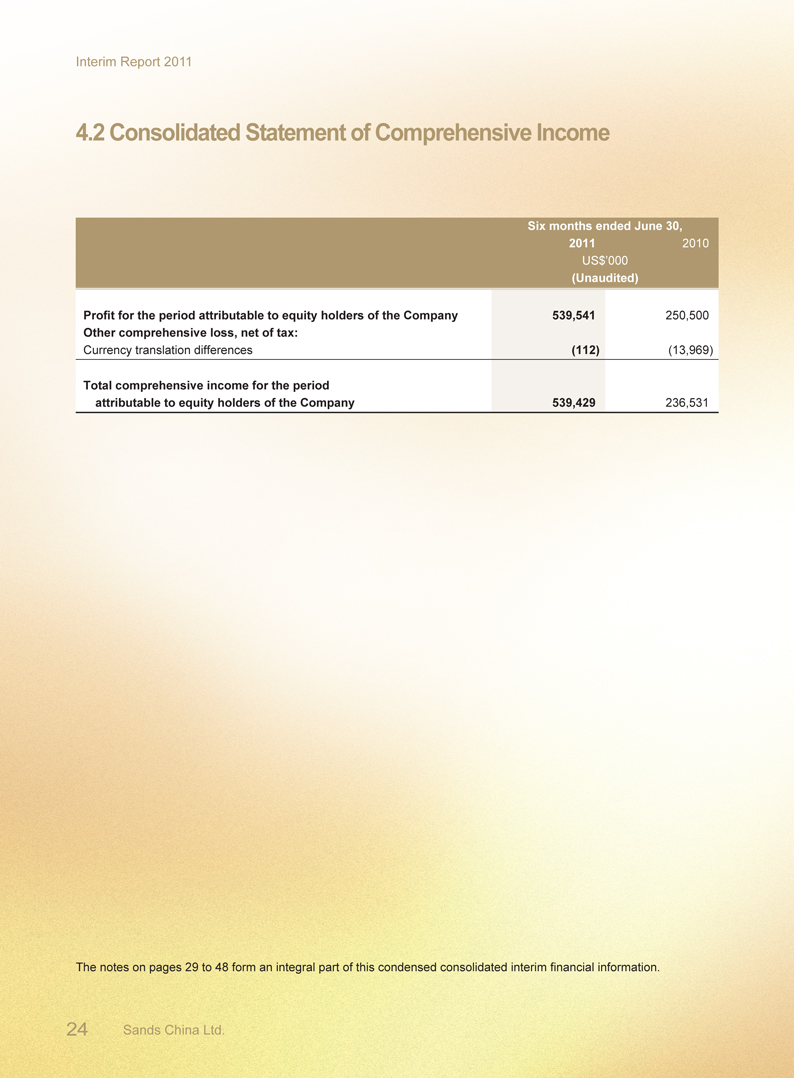

4.2 Consolidated Statement of Comprehensive Income

Six months ended June 30,

2011 2010

US$’000

(Unaudited)

Profit for the period attributable to equity holders of the Company 539,541 250,500

Other comprehensive loss, net of tax:

Currency translation differences (112) (13,969)

Total comprehensive income for the period

attributable to equity holders of the Company 539,429 236,531

The notes on pages 29 to 48 form an integral part of this condensed consolidated interim financial information.

24 Sands China Ltd.

Interim Report 2011

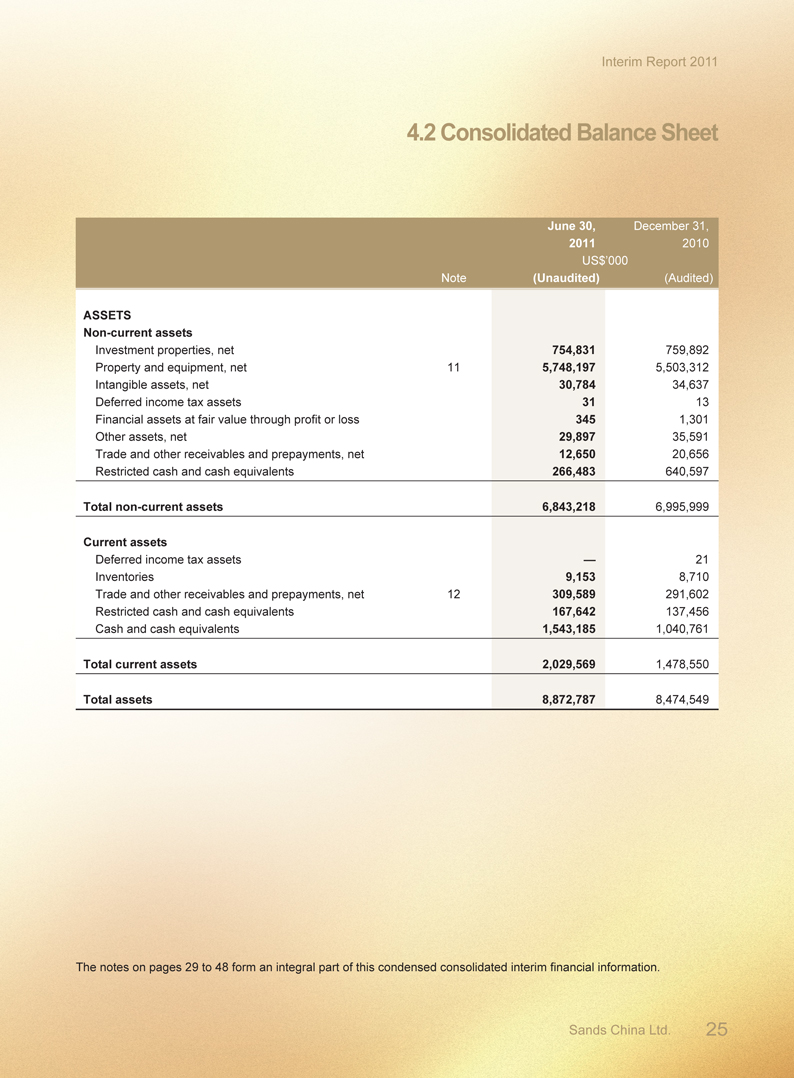

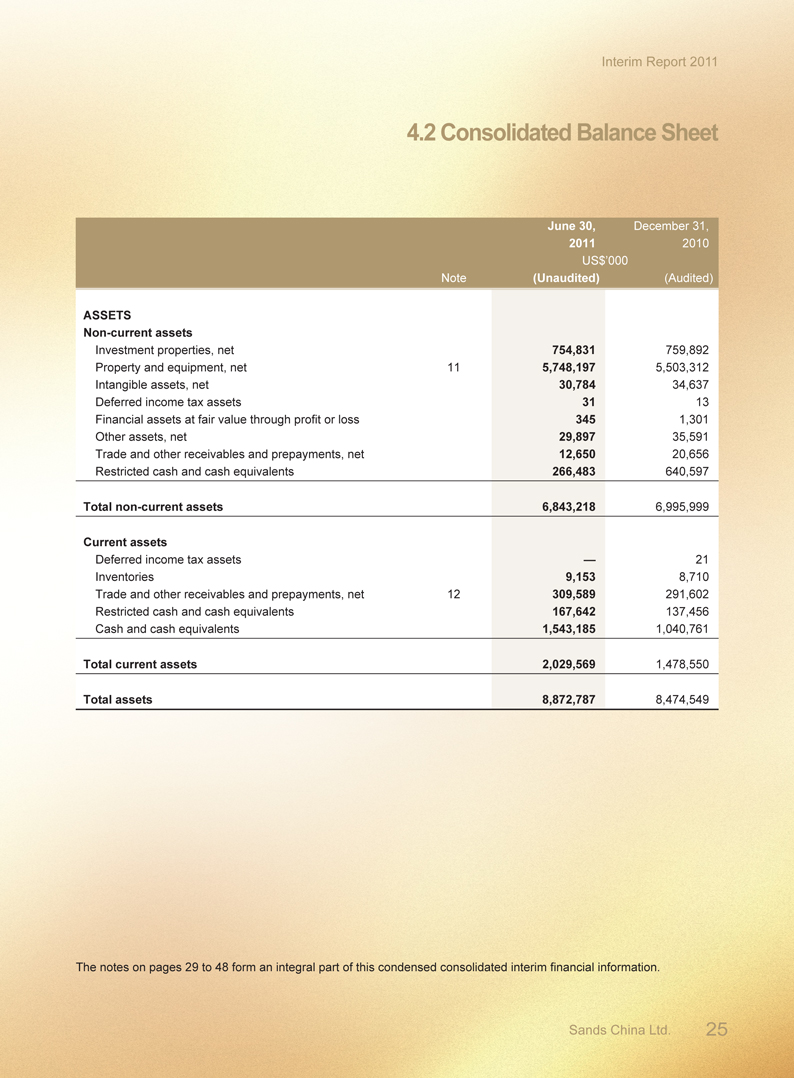

4.2 Consolidated Balance Sheet

June 30, December 31,

2011 2010

US$’000

Note (Unaudited) (Audited)

ASSETS

Non-current assets

Investment properties, net 754,831 759,892

Property and equipment, net 11 5,748,197 5,503,312

Intangible assets, net 30,784 34,637

Deferred income tax assets 31 13

Financial assets at fair value through profit or loss 345 1,301

Other assets, net 29,897 35,591

Trade and other receivables and prepayments, net 12,650 20,656

Restricted cash and cash equivalents 266,483 640,597

Total non-current assets 6,843,218 6,995,999

Current assets

Deferred income tax assets — 21

Inventories 9,153 8,710

Trade and other receivables and prepayments, net 12 309,589 291,602

Restricted cash and cash equivalents 167,642 137,456

Cash and cash equivalents 1,543,185 1,040,761

Total current assets 2,029,569 1,478,550

Total assets 8,872,787 8,474,549

The notes on pages 29 to 48 form an integral part of this condensed consolidated interim financial information.

Sands China Ltd. 25

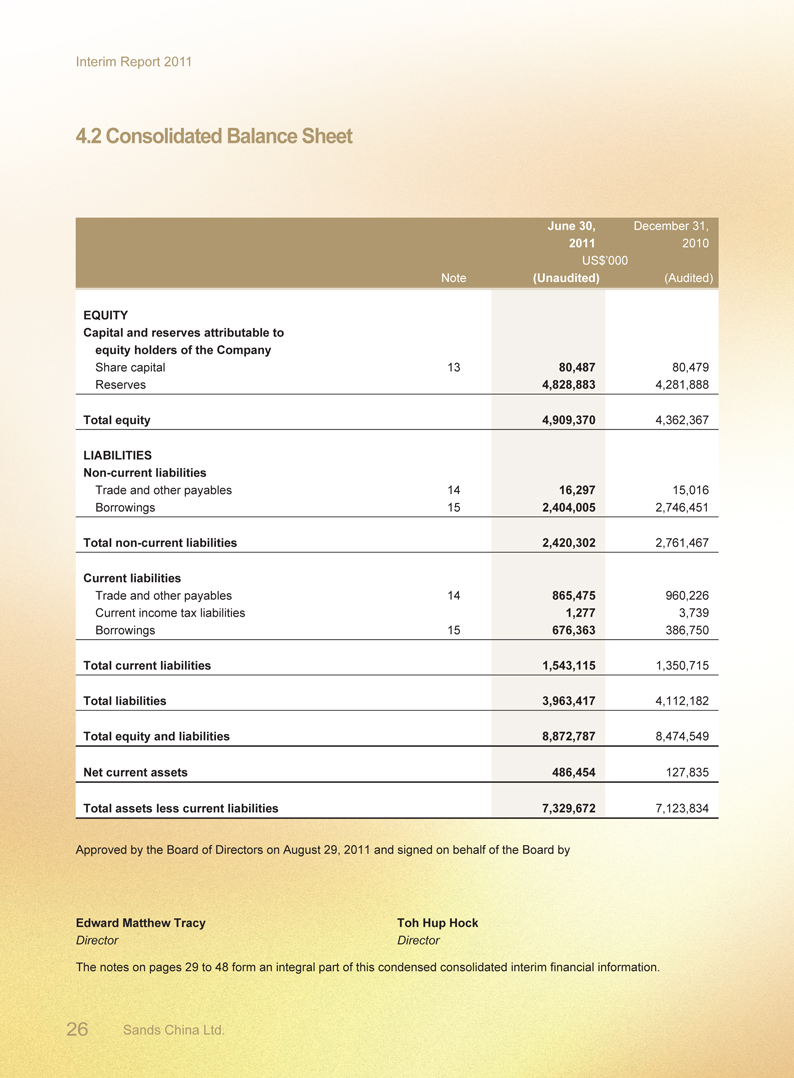

Interim Report 2011

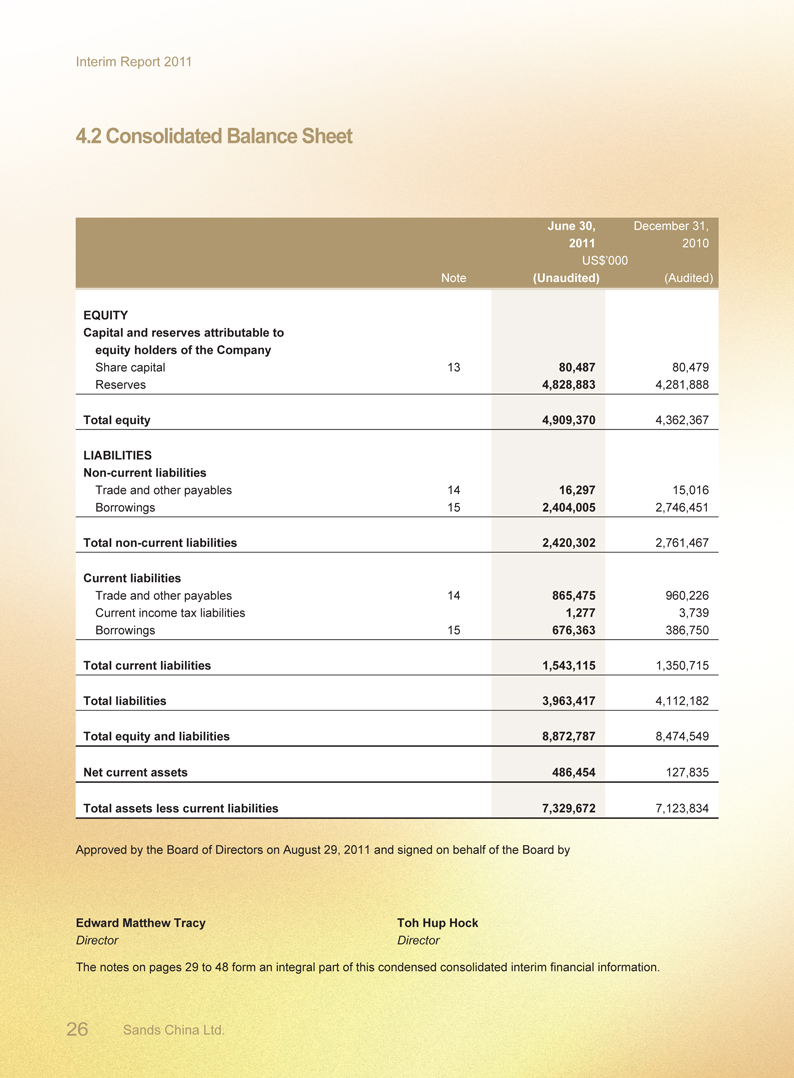

4.2 Consolidated Balance Sheet

June 30, December 31,

2011 2010

US$’000

Note (Unaudited) (Audited)

EQUITY

Capital and reserves attributable to

equity holders of the Company

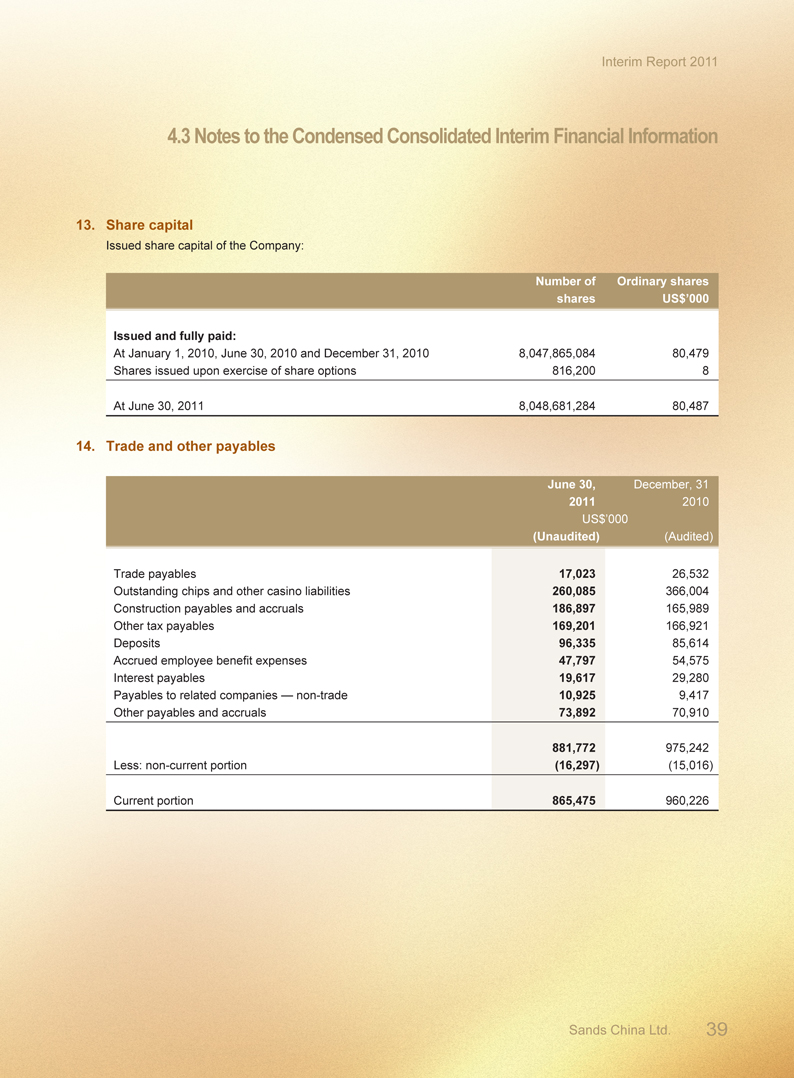

Share capital 13 80,487 80,479

Reserves 4,828,883 4,281,888

Total equity 4,909,370 4,362,367

LIABILITIES

Non-current liabilities

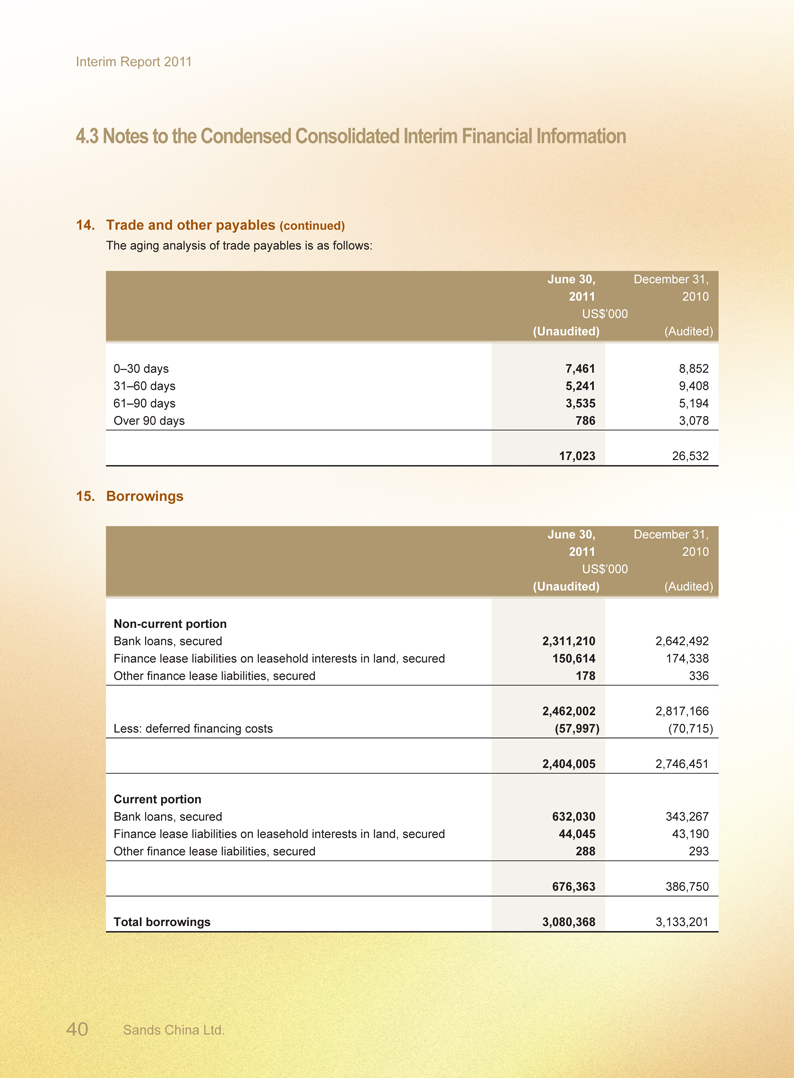

Trade and other payables 14 16,297 15,016

Borrowings 15 2,404,005 2,746,451

Total non-current liabilities 2,420,302 2,761,467

Current liabilities

Trade and other payables 14 865,475 960,226

Current income tax liabilities 1,277 3,739

Borrowings 15 676,363 386,750

Total current liabilities 1,543,115 1,350,715

Total liabilities 3,963,417 4,112,182

Total equity and liabilities 8,872,787 8,474,549

Net current assets 486,454 127,835

Total assets less current liabilities 7,329,672 7,123,834

Approved by the Board of Directors on August 29, 2011 and signed on behalf of the Board by

Edward Matthew Tracy Toh Hup Hock

Director Director

The notes on pages 29 to 48 form an integral part of this condensed consolidated interim financial information.

26 Sands China Ltd.

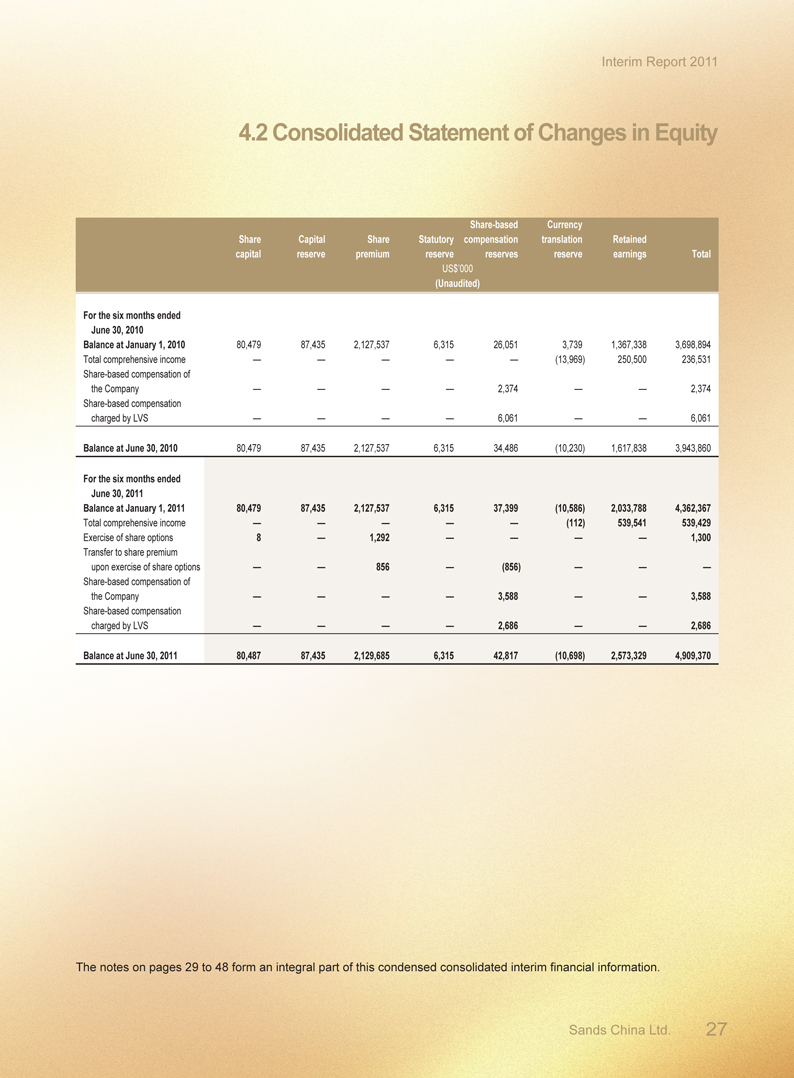

Interim Report 2011

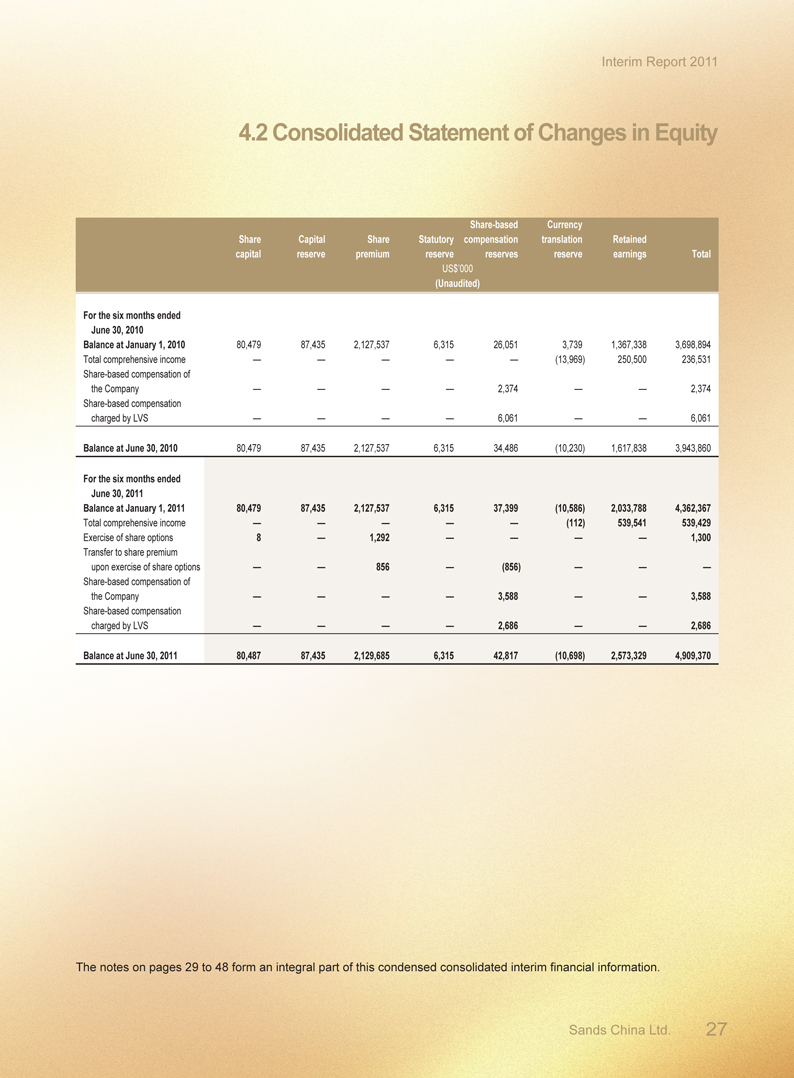

4.2 Consolidated Statement of Changes in Equity

Share-based Currency

Share Capital Share Statutory compensation translation Retained

capital reserve premium reserve reserves reserve earnings Total

US$’000

(Unaudited)

For the six months ended

June 30, 2010

Balance at January 1, 2010 80,479 87,435 2,127,537 6,315 26,051 3,739 1,367,338 3,698,894

Total comprehensive income — — — — — (13,969) 250,500 236,531

Share-based compensation of

the Company — — — — 2,374 — — 2,374

Share-based compensation

charged by LVS — — — — 6,061 — — 6,061

Balance at June 30, 2010 80,479 87,435 2,127,537 6,315 34,486 (10,230) 1,617,838 3,943,860

For the six months ended

June 30, 2011

Balance at January 1, 2011 80,479 87,435 2,127,537 6,315 37,399 (10,586) 2,033,788 4,362,367

Total comprehensive income — — — — — (112) 539,541 539,429

Exercise of share options 8 — 1,292 — — — — 1,300

Transfer to share premium

upon exercise of share options — — 856 — (856) — — —

Share-based compensation of

the Company — — — — 3,588 — — 3,588

Share-based compensation

charged by LVS — — — — 2,686 — — 2,686

Balance at June 30, 2011 80,487 87,435 2,129,685 6,315 42,817 (10,698) 2,573,329 4,909,370

The notes on pages 29 to 48 form an integral part of this condensed consolidated interim financial information.

Sands China Ltd. 27

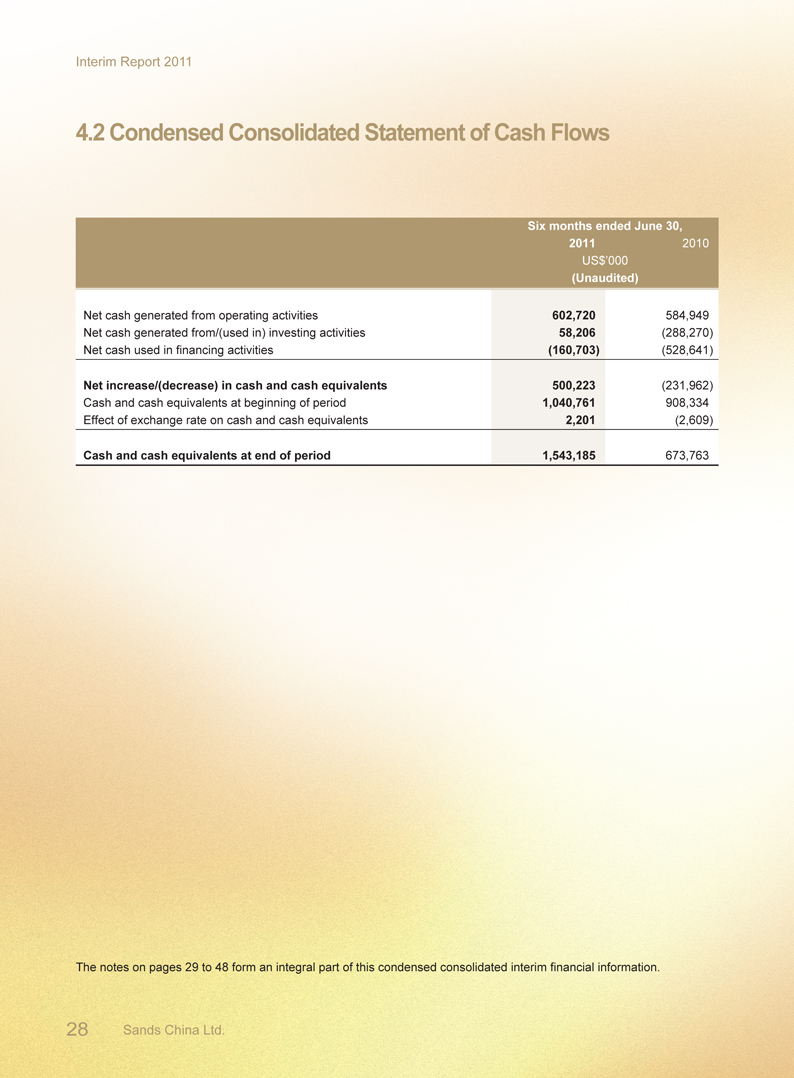

Interim Report 2011

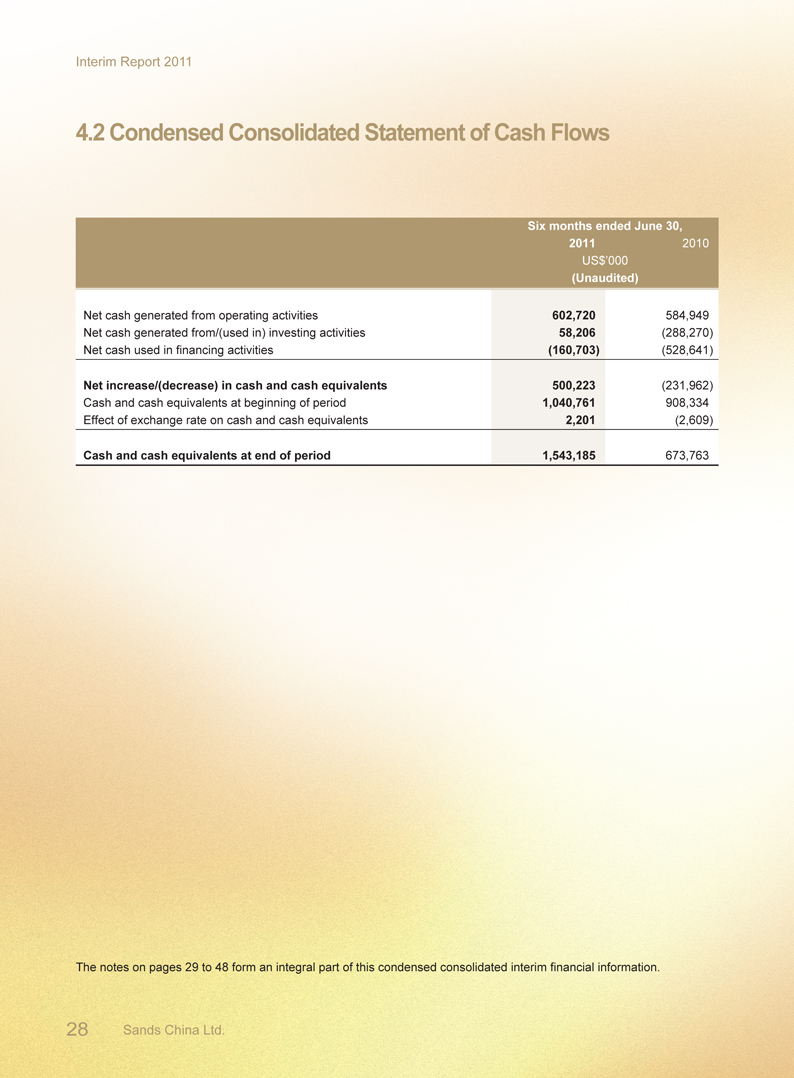

4.2 Condensed Consolidated Statement of Cash Flows

Six months ended June 30,

2011 2010

US$’000

(Unaudited)

Net cash generated from operating activities 602,720 584,949

Net cash generated from/(used in) investing activities 58,206 (288,270)

Net cash used in financing activities (160,703) (528,641)

Net increase/(decrease) in cash and cash equivalents 500,223 (231,962)

Cash and cash equivalents at beginning of period 1,040,761 908,334

Effect of exchange rate on cash and cash equivalents 2,201 (2,609)

Cash and cash equivalents at end of period 1,543,185 673,763

The notes on pages 29 to 48 form an integral part of this condensed consolidated interim financial information.

28 Sands China Ltd.

Interim Report 2011

4.3 Notes to the Condensed Consolidated Interim Financial Information

1. General information

Principal activities

Sands China Ltd. (the “Company”) and its subsidiaries (collectively the “Group”) are principally engaged in the

operation of casino games of chance or games of other forms, the development and operation of integrated resorts

and other ancillary services in the Macao Special Administrative Region of the People’s Republic of China (“Macao”).

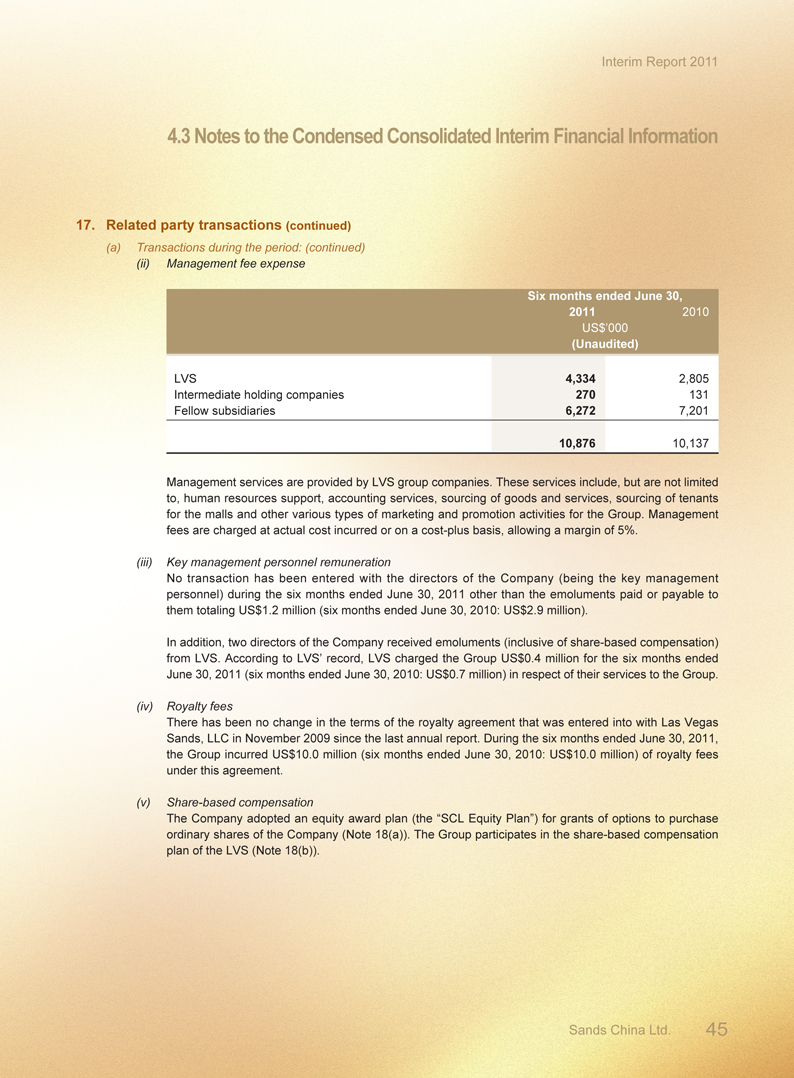

The Group’s immediate holding company is Venetian Venture Development Intermediate II (“VVDI (II)”). Las Vegas

Sands Corp. (“LVS”) is the Group’s ultimate holding company.

The Company was incorporated in the Cayman Islands on July 15, 2009 as an exempted company with limited

liability under the Companies Law, Cap 22 (Law 3 of 1961, as consolidated and revised) of the Cayman Islands. The

address of the Company’s registered office is Walkers Corporate Services Limited, Walker House, 87 Mary Street,

George Town, Grand Cayman KY1-9005, Cayman Islands. The Company’s principal place of business in Hong Kong

registered under Part XI of the Hong Kong Companies Ordinance is Level 28, Three Pacific Place, 1 Queen’s Road

East, Hong Kong.

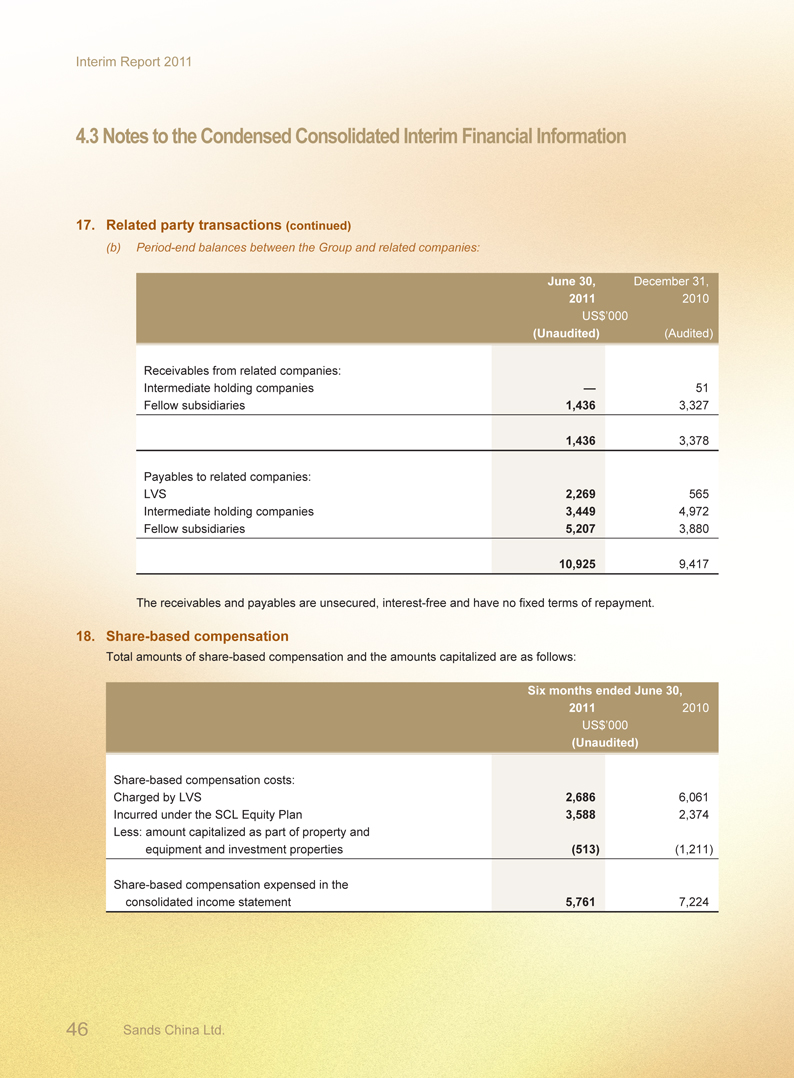

The Group owns and operates the Sands Macao, the first Las Vegas-style casino in Macao, pursuant to a 20-year

gaming subconcession.

The Group also owns and operates The Venetian Macao Resort Hotel (“The Venetian Macao”), which anchors the

Cotai Strip, the Group’s master-planned development of integrated resort properties in Macao.

In August 2008, the Group opened the Four Seasons Hotel, the Plaza Casino and the Shoppes at Four Seasons

(together with the Paiza Mansions, which opened in July 2009 and the apart-hotel tower, referred to as “The Plaza

Macao”). The Plaza Macao is located adjacent to The Venetian Macao.

The Group’s other ancillary services include ferry operations and other related operations.

The Company’s shares were listed on the Main Board of the Stock Exchange on November 30, 2009.

The unaudited condensed consolidated interim financial information (the “Interim Financial Information”) is presented

in United States dollars (“US$”), unless otherwise stated. The Interim Financial Information was approved and

authorized for issue by the Board of Directors of the Company on August 29, 2011.

This Interim Financial Information has not been audited.

2. Basis of preparation

The Interim Financial Information for the six months ended June 30, 2011 has been prepared in accordance with

the International Accounting Standard (“IAS”) 34 ‘Interim Financial Reporting’ issued by the International Accounting

Standard Board (“IASB”) and the applicable disclosure requirements of Appendix 16 to the Listing Rules. It should be

read in conjunction with the Group’s annual financial statements for the year ended December 31, 2010, which were

prepared in accordance with International Financial Reporting Standards (“IFRS”).

Sands China Ltd. 29

Interim Report 2011

4.3 Notes to the Condensed Consolidated Interim Financial Information

3. Significant accounting policies

Except as described below, the accounting policies adopted in the preparation of the Interim Financial Information for the six months ended June 30, 2011 are consistent with those adopted and as described in the Group’s annual financial statements for the year ended December 31, 2010.

During the period, there have been a number of new or revised standards, amendments to standards and interpretations that have come to effect, for which the Group has adopted such at their respective effective dates. The adoption of these new standards, amendments to standards and interpretations has no material impact on the results of operations and financial position of the Group. Amendment to IAS 34 “Interim Financial Reporting” is effective for annual periods beginning on or after January 1, 2011. It emphasizes the existing disclosure principles in IAS 34 and adds further guidance to illustrate how to apply these principles. Greater emphasis has been placed on the disclosure principles for significant events and transactions. Additional requirements cover disclosure of changes to fair value measurement (if signifi cant), and the need to update relevant information from the most recent annual report. The amendment does not result in additional disclosures to the Group.

Effective for annual periods

beginning on or after

IAS 1 (Amendment)

Presentation of Financial Statements

July 1, 2012

IAS 12 (Amendment)

Deferred Tax — Recovery of Underlying Assets

January 1, 2012

IAS 19 (Amendment)

Employee Benefits

January 1, 2013

IAS 27 (Revised 2011)

Separate Financial Statements

January 1, 2013

IAS 28 (Revised 2011)

Investments in Associates and Joint Ventures

January 1, 2013

IFRS 1 (Amendment)

Severe Hyperinflation and Removal of Fixed Dates

July 1, 2011

for First-time Adopters

IFRS 7 (Amendments)

Disclosures — Transfers of Financial Assets

July 1, 2011

IFRS 9

Financial Instruments

January 1, 2013

IFRS 10

Consolidated Financial Statements

January 1, 2013

IFRS 11

Joint Arrangements

January 1, 2013

IFRS 12

Disclosure of Interests in Other Entities

January 1, 2013

IFRS 13

Fair Value Measurements

January 1, 2013

The Group has not early adopted the following new or revised standards, amendments and interpretations that have been issued but are not yet effective for the period:

The Group will adopt the above new and revised standards, amendments and interpretations as and when they

become effective. The Group has already commenced the assessment of the impact to the Group and is not yet in a

position to state whether these would have a significant impact on the results of operations and financial position of

the Group.

4. Segment information

Management has determined the operating segments based on the reports reviewed by a group of senior

management to make strategic decisions. The Group considers the business from a property and service

perspective.

The Group’s principal operating and developmental activities occur in Macao, which is the sole geographic area that

the Group domiciles. The Group reviews the results of operations for each of its key operating segments, which are

also the reportable segments: Sands Macao, The Venetian Macao, The Plaza Macao, ferry and other operations and

other developments (on Parcels 3, 5, 6, 7 and 8 on Cotai).

30 Sands China Ltd.

Interim Report 2011

4.3 Notes to the Condensed Consolidated Interim Financial Information

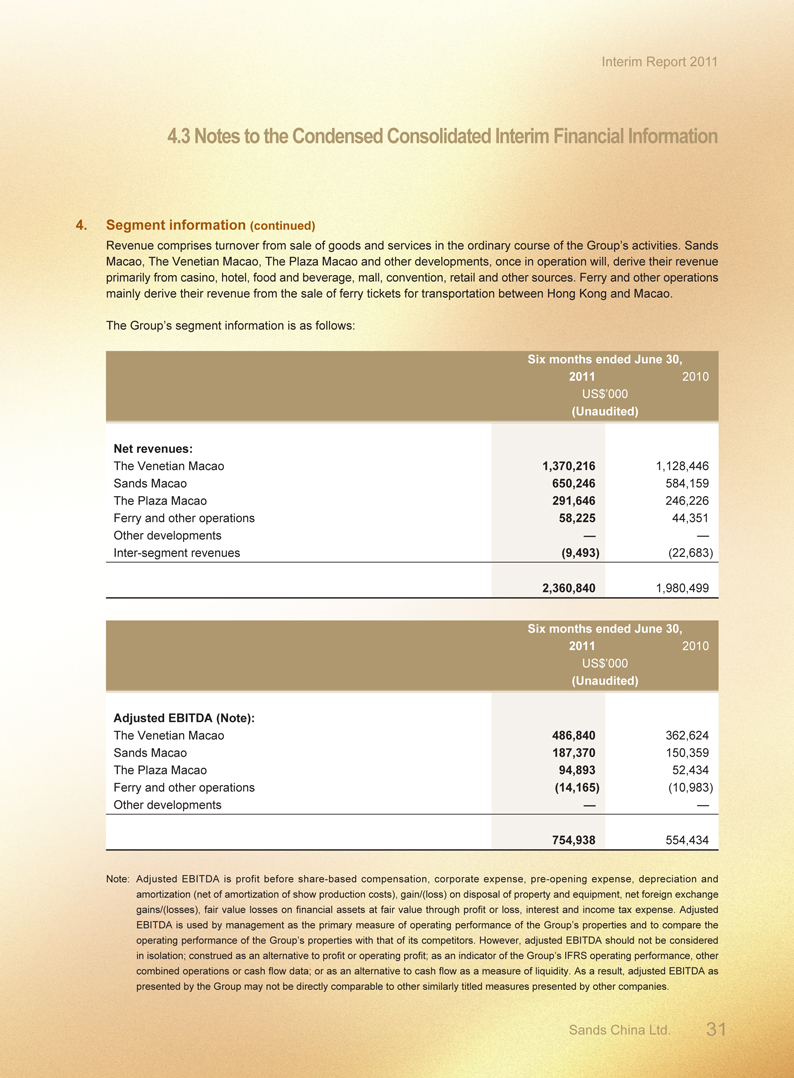

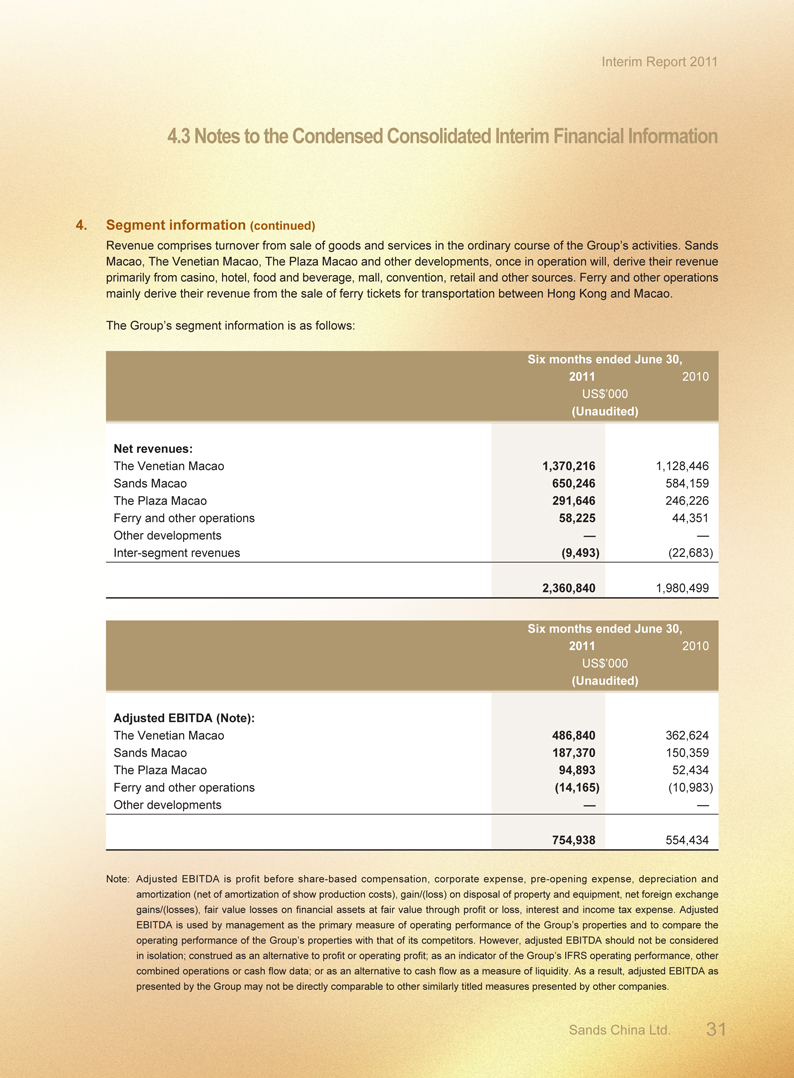

4. Segment information (continued)

Revenue comprises turnover from sale of goods and services in the ordinary course of the Group’s activities. Sands Macao, The Venetian Macao, The Plaza Macao and other developments, once in operation will, derive their revenue primarily from casino, hotel, food and beverage, mall, convention, retail and other sources. Ferry and other operations mainly derive their revenue from the sale of ferry tickets for transportation between Hong Kong and Macao.

The Group’s segment information is as follows:

Six months ended June 30,

2011 2010

US$’000

(Unaudited)

Net revenues:

The Venetian Macao 1,370,216 1,128,446

Sands Macao 650,246 584,159

The Plaza Macao 291,646 246,226

Ferry and other operations 58,225 44,351

Other developments — —

Inter-segment revenues (9,493) (22,683)

2,360,840 1,980,499

Six months ended June 30,

2011 2010

US$’000

(Unaudited)

Adjusted EBITDA (Note):

The Venetian Macao 486,840 362,624

Sands Macao 187,370 150,359

The Plaza Macao 94,893 52,434

Ferry and other operations (14,165) (10,983)

Other developments — —

754,938 554,434

Note: Adjusted EBITDA is profit before share-based compensation, corporate expense, pre-opening expense, depreciation and amortization (net of amortization of show production costs), gain/(loss) on disposal of property and equipment, net foreign exchange gains/(losses), fair value losses on financial assets at fair value through profit or loss, interest and income tax expense. Adjusted EBITDA is used by management as the primary measure of operating performance of the Group’s properties and to compare the operating performance of the Group’s properties with that of its competitors. However, adjusted EBITDA should not be considered in isolation; construed as an alternative to profit or operating profit; as an indicator of the Group’s IFRS operating performance, other combined operations or cash flow data; or as an alternative to cash flow as a measure of liquidity. As a result, adjusted EBITDA as presented by the Group may not be directly comparable to other similarly titled measures presented by other companies.

Sands China Ltd. 31

Interim Report 2011

4.3 Notes to the Condensed Consolidated Interim Financial Information

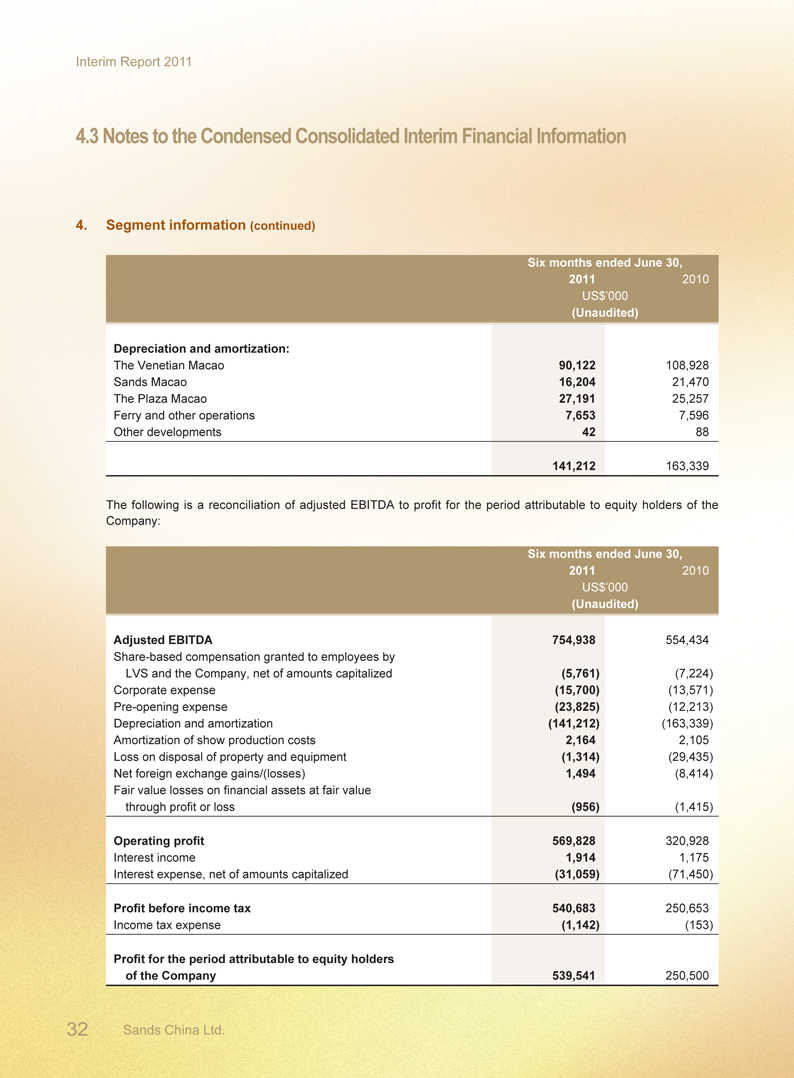

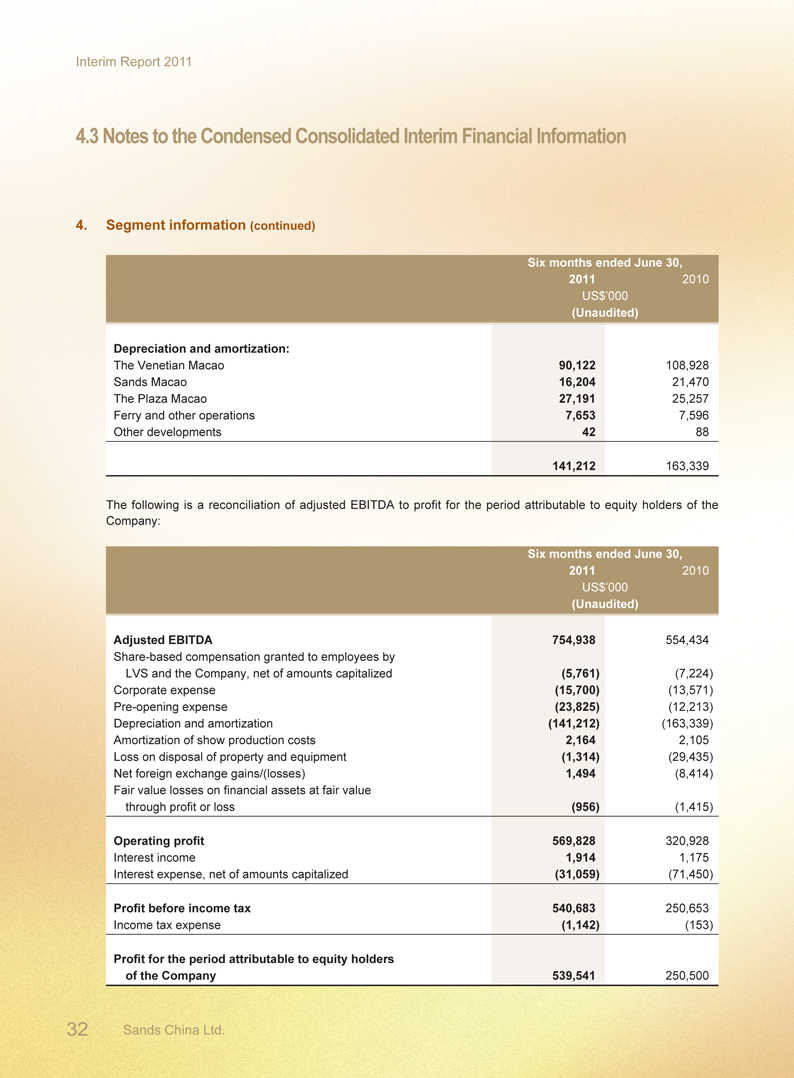

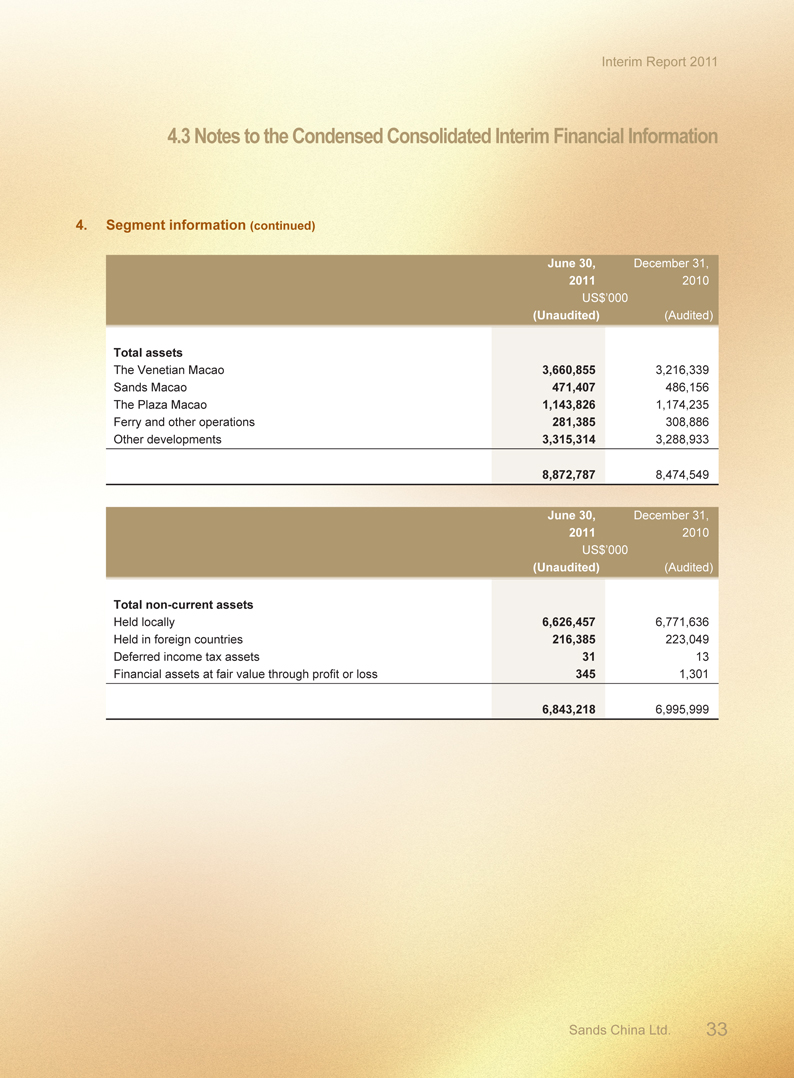

4. Segment information (continued)

Six months ended June 30,

2011 2010

US$’000

(Unaudited)

Depreciation and amortization:

The Venetian Macao 90,122 108,928

Sands Macao 16,204 21,470

The Plaza Macao 27,191 25,257

Ferry and other operations 7,653 7,596

Other developments 42 88

141,212 163,339

The following is a reconciliation of adjusted EBITDA to profit for the period attributable to equity holders of the Company:

Six months ended June 30,

2011 2010

US$’000

(Unaudited)

Adjusted EBITDA 754,938 554,434

Share-based compensation granted to employees by

LVS and the Company, net of amounts capitalized (5,761) (7,224)

Corporate expense (15,700) (13,571)

Pre-opening expense (23,825) (12,213)

Depreciation and amortization (141,212) (163,339)

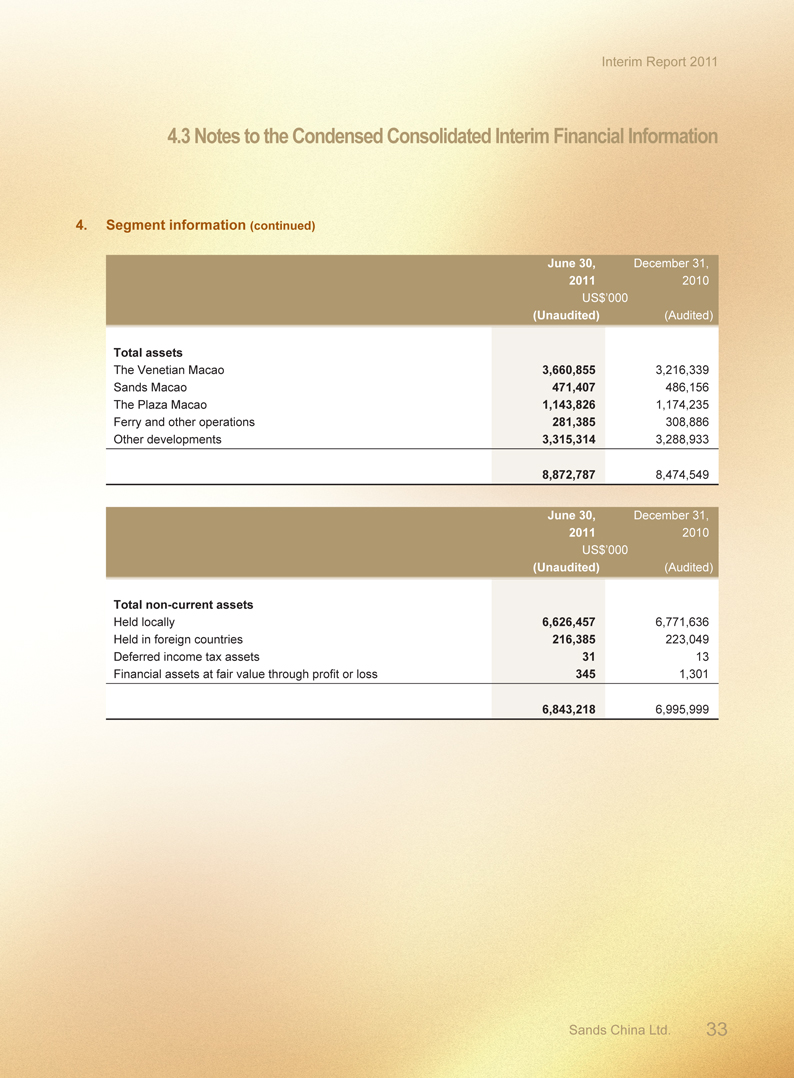

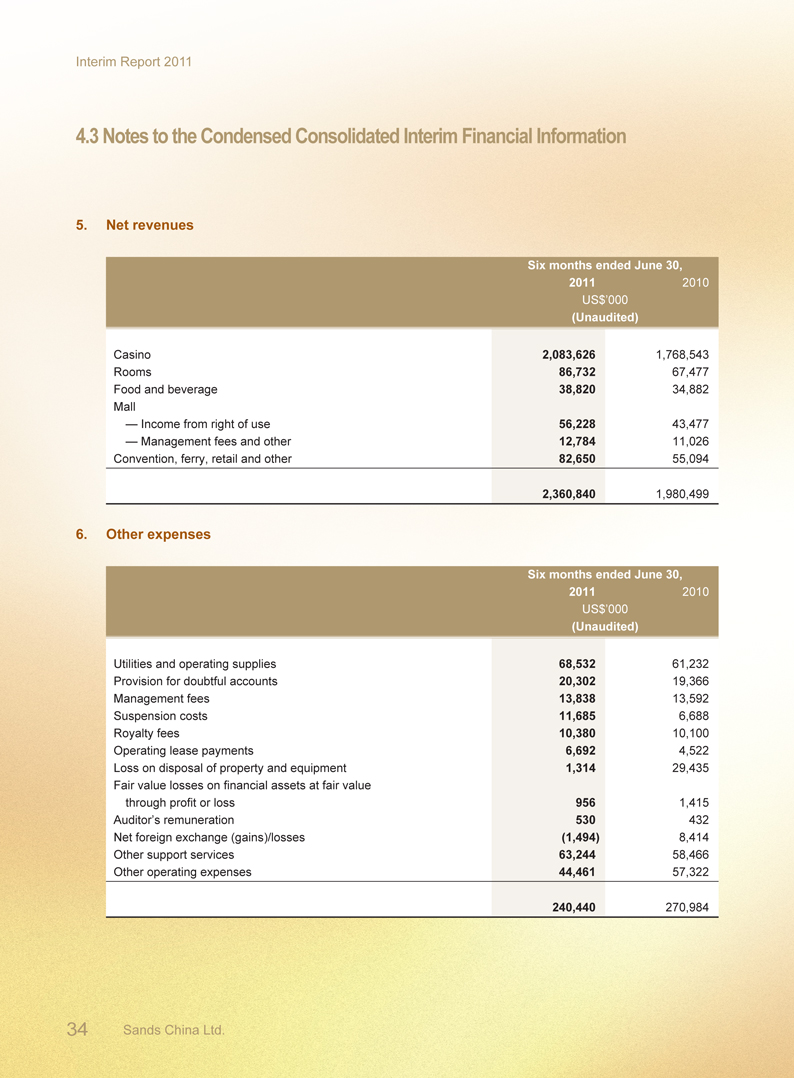

Amortization of show production costs 2,164 2,105