Exhibit 10.9

EXECUTION VERSION

US$2,000,000,000 FACILITY AGREEMENT

dated 20 November 2018

for

SANDS CHINA LTD.

as the Company

arranged by

THE ENTITIES LISTED IN PART 1 OF SCHEDULE 1

as Global Coordinators and/or Joint Lead Arrangers

with

BANK OF CHINA LIMITED, MACAU BRANCH

acting as Agent

CONTENTS

| CLAUSE | PAGE | |||||

| SECTION 1 INTERPRETATION | 1 | |||||

1. | Definitions and Interpretation | 1 | ||||

| SECTION 2 THE FACILITY | 32 | |||||

2. | The Facility | 32 | ||||

3. | Purpose | 32 | ||||

4. | Conditions of Utilisation | 33 | ||||

| SECTION 3 UTILISATION | 34 | |||||

5. | Utilisation | 34 | ||||

| SECTION 4 REPAYMENT, PREPAYMENT, CANCELLATION AND EXTENSION | 37 | |||||

6. | Repayment | 37 | ||||

7. | Prepayment and Cancellation | 41 | ||||

8. | Extension | 45 | ||||

| SECTION 5 COSTS OF UTILISATION | 48 | |||||

9. | Interest | 48 | ||||

10. | Interest Periods | 49 | ||||

11. | Changes to the Calculation of Interest | 49 | ||||

12. | Fees | 51 | ||||

| SECTION 6 ADDITIONAL PAYMENT OBLIGATIONS | 53 | |||||

13. | TaxGross-up and Indemnities | 53 | ||||

14. | Increased Costs | 57 | ||||

15. | Mitigation by the Lenders | 59 | ||||

16. | Other Indemnities | 60 | ||||

17. | Costs and Expenses | 62 | ||||

| SECTION 7 REPRESENTATIONS, UNDERTAKINGS AND EVENTS OF DEFAULT | 64 | |||||

18. | Representations | 64 | ||||

19. | Information Undertakings | 68 | ||||

20. | Financial Covenants | 72 | ||||

21. | General Undertakings | 79 | ||||

22. | Events of Default | 82 | ||||

| SECTION 8 CHANGES TO PARTIES | 87 | |||||

23. | Changes to the Lenders | 87 | ||||

24. | Assignments and transfers by the Company | 94 | ||||

| SECTION 9 THE FINANCE PARTIES | 95 | |||||

25. | Role of the Administrative Parties and Others | 95 | ||||

26. | Sharing among the Finance Parties | 105 | ||||

| SECTION 10 ADMINISTRATION | 108 | |||||

27. | Payment Mechanics | 108 | ||||

28. | Set-off | 113 | ||||

29. | Notices | 113 | ||||

30. | Calculations and Certificates | 115 | ||||

31. | Partial Invalidity | 116 | ||||

32. | Remedies and Waivers | 116 | ||||

33. | Amendments and Waivers | 117 | ||||

34. | Confidential Information | 123 | ||||

35. | Confidentiality of Funding Rates | 127 | ||||

36. | Counterparts | 129 | ||||

| SECTION 11 GOVERNING LAW AND ENFORCEMENT | 130 | |||||

37. | Governing Law | 130 | ||||

38. | Enforcement | 130 | ||||

| Schedule 1 The Original Parties | 131 | |||||

| Schedule 2 Conditions Precedent | 133 | |||||

| Schedule 3 Requests | 135 | |||||

| Schedule 4 Form of Transfer Certificate | 136 | |||||

| Schedule 5 Form of Assignment Agreement | 138 | |||||

| Schedule 6 Form of Compliance Certificate | 141 | |||||

| Schedule 7 Timetables | 142 | |||||

| Schedule 8 Subsidiaries | 143 | |||||

| Schedule 9 Additional Covenants | 145 | |||||

| Schedule 10 Form of Quarterly Financial Statements | 151 | |||||

| Schedule 11 Cotai Plan | 157 | |||||

| Schedule 12 List of financial institutions | 159 | |||||

THIS AGREEMENT is dated 20 November 2018 and made between:

| (1) | SANDS CHINA LTD., an exempted company incorporated in the Cayman Islands with limited liability with registration number 228336 and its registered address at Intertrust Corporate Services (Cayman) Limited, 190 Elgin Avenue, George Town, Grand CaymanKY1-9005 as borrower (the “Company”); |

| (2) | THE ENTITIESlisted in Part I of Schedule 1 (The Original Parties) as global coordinators and joint lead arrangers andTHE ENTITIESlisted in Part I of Schedule 1 (The Original Parties) as joint lead arrangers (each an “Arranger” and together, the “Arrangers”); |

| (3) | THE FINANCIAL INSTITUTIONS listed in Part II of Schedule 1 (The Original Parties) as lenders (the “Original Lenders”); and |

| (4) | BANK OF CHINA LIMITED, MACAU BRANCHas agent of the Finance Parties (other than itself) (the “Agent”). |

IT IS AGREED as follows:

SECTION 1

INTERPRETATION

1.DEFINITIONS AND INTERPRETATION

| 1.1 | Definitions |

In this Agreement:

“Acceptable Bank” means a bank or financial institution which has a rating for its long-term unsecured and non credit-enhanced debt obligations of BBB or higher by S&P or Fitch or Baa2 or higher by Moody’s or a comparable rating from an internationally recognised credit rating agency.

“Additional Commitment Lender” has the meaning assigned to such term in Clause 8.2 (Election to Extend).

“Administrative Party” means each of the Agent and each Arranger.

“Affiliate” means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company.

“Agent’s Spot Rate of Exchange” means:

| (a) | the Agent’s spot rate of exchange; or |

| (b) | (if the Agent does not have an available spot rate of exchange) any publicly available spot rate of exchange selected by the Agent (acting reasonably), |

for the purchase of the relevant currency with the Base Currency in the Hong Kong foreign exchange market at or about 11 a.m. on a particular day.

“Anti-Money Laundering Laws” has the meaning given to that term in Clause 18.18 (Anti-Money Laundering Laws and Sanctions).

“APLMA” means the Asia Pacific Loan Market Association Limited.

“Assignment Agreement” means an agreement substantially in the form set out in Schedule 5 (Form of Assignment Agreement) or any other form agreed between the relevant assignor, assignee and the Agent.

“Authorisation” means an authorisation, consent, approval, resolution, licence, exemption, filing, notarisation, lodgement or registration.

“Availability Period” means the period from and including the date of this Agreement to and including the Termination Date.

“Available Commitment” means, in respect of a Lender, that Lender’s Available HKD Commitment and/or Available USD Commitment.

“Available Facility” means the aggregate amount for the time being of:

| (a) | the Available USD Facility; and |

| (b) | the Base Currency Amount of the Available HKD Facility. |

“Available HKD Commitment” means, in respect of a Lender, that Lender’s HKD Commitment minus:

| (a) | the amount of its participation in any outstanding HIBOR Loans and HKD Swing Line Loans; and |

| (b) | in relation to any proposed HIBOR Loan or HKD Swing Line Loan, the amount of its participation in any other HIBOR Loans and HKD Swing Line Loans that are due to be made on or before the proposed Utilisation Date, |

but adding back that Lender’s participation in any HIBOR Loans and HKD Swing Line Loans that are due to be repaid or prepaid on or before the proposed Utilisation Date.

“Available HKD Facility” means the aggregate for the time being of each Lender’s Available HKD Commitment.

“Available Swing Line Facility” means the Base Currency Amount of the Swing Line Lender’s Available Commitment.

“Available USD Commitment” means, in respect of a Lender, that Lender’s USD Commitment minus:

| (a) | the amount of its participation in any outstanding LIBOR Loans and USD Swing Line Loans; and |

2

| (b) | in relation to any proposed LIBOR Loan or USD Swing Line Loan, the amount of its participation in any other LIBOR Loans and USD Swing Line Loans that are due to be made on or before the proposed Utilisation Date, |

but adding back that Lender’s participation in any LIBOR Loans and USD Swing Line Loans that are due to be repaid or prepaid on or before the proposed Utilisation Date.

“Available USD Facility” means the aggregate for the time being of each Lender’s Available USD Commitment.

“Bail-In Action” means the exercise of any Write-down and Conversion Powers.

“Bail-In Legislation” means:

| (a) | in relation to an EEA Member Country which has implemented, or which at any time implements, Article 55 of Directive 2014/59/EU establishing a framework for the recovery and resolution of credit institutions and investment firms, the relevant implementing law or regulation as described in the EUBail-In Legislation Schedule from time to time; and |

| (b) | in relation to any other state, any analogous law or regulation from time to time which requires contractual recognition of any Write-down and Conversion Powers contained in that law or regulation. |

“Bank Levy” means any amount payable by any Finance Party or any of their respective Affiliates on the basis of or in relation to its balance sheet or capital base or any part of it or its liabilities or minimum regulatory capital or any combination thereof including, without limitation, the United Kingdom bank levy as set out in the Finance Act 2011.

“Base Currency” means US dollars.

“Base Currency Amount” means:

| (a) | with respect to any amount denominated in the Base Currency, such amount; and |

| (b) | with respect to any amount denominated in Hong Kong dollars, the amount in the Base Currency determined using the HKD / USD Exchange Rate. |

“Beneficial Owner” has the meaning assigned to such term in Rule13d-3 and Rule13d-5 under the Exchange Act and the terms “Beneficially Owns” and “Beneficially Owned” have a corresponding meaning.

“Break Costs” means the amount (if any) by which:

| (a) | the interest (excluding any Margin) which a Lender should have received for the period from the date of receipt of all or any part of its participation in a LIBOR Loan, HIBOR Loan or Unpaid Sum to the last day of the current Interest Period in respect of that Loan or Unpaid Sum, had the principal amount of that Loan or Unpaid Sum received been paid on the last day of that Interest Period; exceeds: |

3

| (b) | the amount which that Lender would be able to obtain by placing an amount equal to the principal amount of that Loan or Unpaid Sum received by it on deposit with a leading bank for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period. |

“Business Day” means a day (other than a Saturday or Sunday) on which banks are open for general business in Hong Kong, New York, Macau, Singapore and, with respect to all notices, determinations, Interest Periods, fundings and payments in connection with any LIBOR Loan, HIBOR Loan or USD Swing Line Loan, London.

“Change of Control” means the occurrence of any of the following:

| (a) | the direct or indirect sale, transfer, conveyance or other disposition (other than by way of merger or consolidation), in one or a series of related transactions, of all or substantially all of the properties or assets of the Group, taken as a whole, to any “person” (as that term is used in Section 13(d)(3) of the Exchange Act), other than to Las Vegas Sands, either of the Principals and/or any of his or her Related Parties; |

| (b) | the adoption of a plan relating to the liquidation or dissolution of the Company or any successor thereto; or |

| (c) | the consummation of any transaction (including, without limitation, any merger or consolidation) the result of which is that any “person” (as defined in paragraph (a) above), other than Las Vegas Sands, either of the Principals and/or any of his or her Related Parties, becomes the Beneficial Owner, directly or indirectly, of more than 50% of the outstanding Voting Stock of the Company, measured by voting power rather than number of shares. |

Notwithstanding the foregoing, a Change of Control shall not be deemed to have occurred if (i) the Company becomes a direct or indirect wholly-owned Subsidiary of a holding company and (ii)(A) the direct or indirect holders of the Voting Stock of such holding company immediately following that transaction are substantially the same as the holders of the Voting Stock of the Company immediately prior to that transaction or (B) immediately following that transaction no “person” (as defined in paragraph (a) above), other than a holding company satisfying the requirements of this sentence and/or Las Vegas Sands, either of the Principals and/or any of his or her Related Parties, is the Beneficial Owner, directly or indirectly, of more than 50% of the Voting Stock of such holding company (measured by voting power rather than number of shares).

Notwithstanding the foregoing or any provision of the Exchange Act, a “person” (as defined in paragraph (a) above) shall not be deemed to beneficially own Voting Stock subject to a stock or asset purchase agreement, merger agreement, option agreement, warrant agreement or similar agreement (or voting, support, option or similar agreement related thereto) until the consummation of the acquisition of the Voting Stock in connection with the transactions contemplated by such agreement.

4

“Code” means the US Internal Revenue Code of 1986.

“Commitment” means, in relation to a Lender, its HKD Commitment and/or its USD Commitment.

“Compliance Certificate” means a certificate substantially in the form set out in Schedule 6 (Form of Compliance Certificate) or in such other form satisfactory to the Agent (acting reasonably).

“Confidential Information” means all information relating to the Company, the Group, the Principals, the Related Parties, Las Vegas Sands, the Finance Documents or the Facility (including any Utilisation and any quarterly financial statements provided by the Company pursuant to the terms of this Agreement) of which a Finance Party becomes aware in its capacity as, or for the purpose of becoming, a Finance Party or which is received by a Finance Party in relation to, or for the purpose of becoming a Finance Party under, the Finance Documents or the Facility from either:

| (a) | any member of the Group, the Principals, the Related Parties, Las Vegas Sands, or any of their respective advisers; or |

| (b) | another Finance Party, if the information was obtained by that Finance Party directly or indirectly from any member of the Group, the Principals, the Related Parties, Las Vegas Sands, or any of their respective advisers, |

in whatever form, and includes information given orally and any document, electronic file or any other way of representing or recording information which contains or is derived or copied from such information but excludes:

| (i) | information that: |

| (A) | is or becomes public information other than as a direct or indirect result of any breach by that Finance Party of Clause 34 (Confidential Information); |

| (B) | is identified in writing at the time of delivery asnon-confidential by any member of the Group or any of its advisers; or |

| (C) | is known by that Finance Party before the date the information is disclosed to it in accordance with paragraph (a) or (b) above or is lawfully obtained by that Finance Party after that date, from a source which is, as far as that Finance Party is aware, unconnected with the Group, the Principals, the Related Parties and Las Vegas Sands, and which, in either case, as far as that Finance Party is aware, has not been obtained in breach of, and is not otherwise subject to, any obligation of confidentiality; and |

| (ii) | any Funding Rate. |

5

“Confidentiality Undertaking” means a confidentiality undertaking substantially in a recommended form of the APLMA or in any other form agreed between the Company and the Agent.

“Cotai” means the area of reclaimed land between the islands of Taipa and Coloane in Macau SAR.

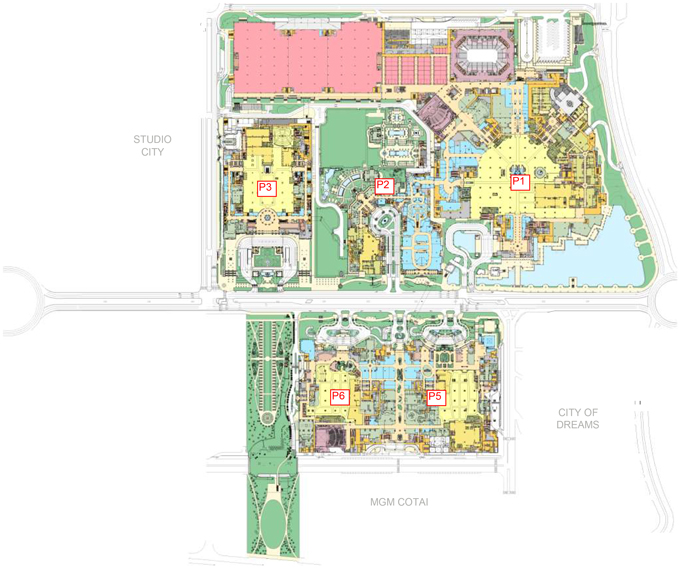

“Cotai Plan” means the plan for the development of the Cotai Strip submitted to Macau SAR, the form of which as at the date of this Agreement is set forth in the diagram set out in Schedule 11 (Cotai Plan) showing the approximate placement of the land parcels along the Cotai Strip as designated by Macau SAR, as such plan may be modified in anon-material manner from time to time upon notice of any such modification to the Agent.

“Cotai Strip” means the land located at Cotai in Macau SAR.

“Cotai Subsidiary” means Venetian Cotai Limited.

“Default” means an Event of Default or any event or circumstance specified in Clause 22 (Events of Default) which would (with the expiry of a grace period, the giving of notice or any combination of any of the foregoing) be an Event of Default.

“Defaulting Lender” means any Lender:

| (a) | which has failed to make its participation in a Loan available or has notified the Agent or the Company (which has notified the Agent) that it will not make its participation in a Loan available by the Utilisation Date of that Loan in accordance with Clause 5.5 (Loan amount andLenders’ participation); |

| (b) | which has otherwise rescinded or repudiated a Finance Document; |

| (c) | with respect to which an Insolvency Event has occurred and is continuing; or |

| (d) | whose Commitments are subject to anyBail-in Action, |

unless, in the case of paragraph (a) above:

| (i) | its failure to pay is caused by: |

| (A) | administrative or technical error(s); or |

| (B) | one or more Disruption Events; and |

| payment | is made within three Business Days of its due date; or |

| (ii) | the Lender is disputing in good faith whether it is contractually obliged to make the payment in question. |

6

“Deposit Account” means a demand, time, savings, passbook or like account with a bank, savings and loan association, credit union or like organisation, other than an account evidenced by a negotiable certificate of deposit.

“Disruption Event” means either or both of:

| (a) | a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with the Facility (or otherwise in order for the transactions contemplated by the Finance Documents to be carried out) which disruption is not caused by, and is beyond the control of, any of the Parties; and |

| (b) | the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of a Party preventing that, or any other Party: |

| (i) | from performing its payment obligations under the Finance Documents; or |

| (ii) | from communicating with other Parties in accordance with the terms of the Finance Documents, |

and which (in either such case) is not caused by, and is beyond the control of, the Party whose operations are disrupted.

“Disqualified Financial Institution” means any of the following:

| (a) | banks, financial institutions or other institutional lenders or entities separately identified in writing by the Company to the Agent prior to the date of this Agreement; |

| (b) | at any time when an Event of Default is continuing, any person that owns or operates a casino or other gaming operation located in Singapore, Macau SAR, the United Kingdom or the states of Nevada, New Jersey, Pennsylvania or Michigan in the United States or any other jurisdiction in which the Company or any of its Subsidiaries has obtained or applied for a gaming licence (provided that, for the purposes of this paragraph (b), the holding of a passive investment constituting less than 10 per cent. of the common stock of any such casino or other gaming operation shall not constitute ownership thereof); |

| (c) | at any time when an Event of Default is continuing, any person that owns or operates a trade show, convention, exhibition or conference centre in Singapore, Macau SAR, the United Kingdom, or Las Vegas or Clark County in the state of Nevada in the United States, or the states of New Jersey, Pennsylvania or Michigan in the United States, or any other jurisdiction in which the Company or any of its Subsidiaries owns, operates or is developing a convention, trade show, conference centre or exhibition facility (provided that, for the purposes of this paragraph (c), the holding of a passive investment instrument constituting less than 10 per cent. of the common stock of any such casino or trade show, convention, exhibition and conference centre facility shall not constitute ownership thereof); |

7

| (d) | at any time when an Event of Default is continuing, any union pension fund (provided that, for the purposes of this paragraph (d), any intermingled fund or managed account which has, as part of its assets under management, the assets of a union pension fund shall not be a Disqualified Financial Institution so long as the manager of such fund is not controlled by a union pension fund or a union pension fund does not own 10 per cent. or more of the assets of such fund); |

| (e) | notwithstanding paragraphs (a) to (d) above, any competitors of any member of the Group to the extent identified to the Agent in writing from time to time; and |

| (f) | any Affiliates of the persons referred to in paragraphs (a) to (e) above to the extent identified by the Company to the Agent in writing from time to time or clearly identifiable by name, |

in each case, determined at the time of the relevant assignment, transfer, novation orsub-participation.

“EEA Member Country” means any member state of the European Union, Iceland, Liechtenstein and Norway.

“Employee Benefit Plan” means any “employee benefit plan” as defined in Section 3(3) of ERISA which is maintained or contributed to by the Company or any of its Subsidiaries or any of their respective ERISA Affiliates.

“Environmental Claim” means any claim, proceeding or investigation by any person in respect of any Environmental Law.

“Environmental Law” means any applicable law in any jurisdiction in which any member of the Group conducts business which relates to the pollution or protection of the environment or harm to or the protection of human health or the health of animals or plants.

“Environmental Permits” means any Authorisation and the filing of any notification, report or assessment required under any Environmental Law for the operation of the business of any member of the Group conducted on or from the properties owned or used by the relevant member of the Group.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time, and any successor thereto.

“ERISA Affiliate” means, as applied to any person:

| (a) | any corporation which is a member of a controlled group of corporations within the meaning of Section 414(b) of the Code of which that person is a member; |

8

| (b) | any trade or business (whether or not incorporated) which is a member of a group of trades or businesses under common control within the meaning of Section 414(c) of the Code of which that person is a member; and |

| (c) | any member of an affiliated service group within the meaning of Section 414(m) or (o) of the Code of which that person, any corporation described in clause (a) above or any trade or business described in paragraph (b) above is a member. |

Any former ERISA Affiliate of the Company or any of its Subsidiaries shall continue to be considered an ERISA Affiliate of the Company or such Subsidiary within the meaning of this definition with respect to the period such entity was an ERISA Affiliate of the Company or such Subsidiary and with respect to liabilities arising after such period for which Company or such Subsidiary could be liable under the Code or ERISA.

“ERISA Event” means:

| (a) | a “reportable event” within the meaning of Section 4043 of ERISA and the regulations issued thereunder with respect to any Pension Plan (excluding those for which the provision for30-day notice to the PBGC has been waived by regulation); |

| (b) | the failure to meet the minimum funding standard of Section 412 of the Code with respect to any Pension Plan (whether or not waived in accordance with Section 412(c) of the Code) or the failure to make by its due date a required instalment under Section 430(j) of the Code with respect to any Pension Plan or the failure to make any required contribution to a Multiemployer Plan; |

| (c) | the provision by the administrator of any Pension Plan pursuant to Section 4041(a)(2) of ERISA of a notice of intent to terminate such plan in a distress termination described in Section 4041(c) of ERISA; |

| (d) | the withdrawal by the Company or any of its Subsidiaries or any of their respective ERISA Affiliates from any Pension Plan with two or more contributing sponsors or the termination of any such Pension Plan resulting in liability pursuant to Section 4063 or 4064 of ERISA; |

| (e) | the institution by the PBGC of proceedings to terminate any Pension Plan, or the occurrence of any event or condition which might constitute grounds under ERISA for the termination of, or the appointment of a trustee to administer, any Pension Plan; |

| (f) | the imposition of liability on the Company or any of its Subsidiaries or any of their respective ERISA Affiliates pursuant to Section 4062(e) or 4069 of ERISA or by reason of the application of Section 4212(c) of ERISA; |

9

| (g) | the withdrawal of the Company or any of its Subsidiaries or any of their respective ERISA Affiliates in a complete or partial withdrawal (within the meaning of Sections 4203 and 4205 of ERISA) from any Multiemployer Plan if there is any potential liability therefor, or the receipt by the Company or any of its Subsidiaries or any of their respective ERISA Affiliates of notice from any Multiemployer Plan that it is in reorganization or insolvency pursuant to Section 4241 or 4245 of ERISA, or that it intends to terminate or has terminated under Section 4041A or 4042 of ERISA; |

| (h) | the occurrence of an act or omission which could give rise to the imposition on the Company or any of its Subsidiaries or any of their respective ERISA Affiliates of fines, penalties, taxes or related charges under Chapter 43 of the Code or under Section 409, Section 502(c), (i) or (l), or Section 4071 of ERISA in respect of any Employee Benefit Plan; |

| (i) | the assertion of a material claim (other than routine claims for benefits) against any Employee Benefit Plan other than a Multiemployer Plan or the assets thereof, or against the Company or any of its Subsidiaries or any of their respective ERISA Affiliates in connection with any Employee Benefit Plan; |

| (j) | receipt from the PBGC of notice of the failure of any Pension Plan (or any other Employee Benefit Plan intended to be qualified under Section 401(a) of the Code) to qualify under Section 401(a) of the Code, or the failure of any trust forming part of any Pension Plan to qualify for exemption from taxation under Section 501(a) of the Code; or |

| (k) | the conditions for imposition of a Lien (as defined in Schedule 9 (Additional covenants)) pursuant to Section 430(k) of the Code or Section 303(k) of ERISA with respect to any Pension Plan. |

“EUBail-In Legislation Schedule” means the document described as such and published by the Loan Market Association (or any successor person) from time to time.

“Event of Default” means any event or circumstance specified as such in Clause 22 (Events of Default).

“Exchange Act” means the U.S. Securities Exchange Act of 1934.

“Facility” means the revolving loan facility made available under this Agreement as described in Clause 2 (The Facility).

“Facility Office” means the office (or branch) or offices (or branches) notified by a Lender to the Agent in writing on or before the date it becomes a Lender (or, following that date, by not less than five Business Days’ written notice) as the office (or branch) or offices (or branches) through which it will perform its obligations under this Agreement.

“FATCA” means:

| (a) | sections 1471 to 1474 of the Code or any associated regulations; |

| (b) | any treaty, law or regulation of any other jurisdiction, or relating to an intergovernmental agreement between the US and any other jurisdiction, which (in either case) facilitates the implementation of any law or regulation referred to in paragraph (a) above; or |

10

| (c) | any agreement pursuant to the implementation of any treaty, law or regulation referred to in paragraph (a) or (b) above with the US Internal Revenue Service, the US government or any governmental or taxation authority in any other jurisdiction. |

“FATCA Application Date” means:

| (a) | in relation to a “withholdable payment” described in section 1473(1)(A)(i) of the Code (which relates to payments of interest and certain other payments from sources within the US), 1 July 2014; |

| (b) | in relation to a “withholdable payment” described in section 1473(1)(A)(ii) of the Code (which relates to “gross proceeds” from the disposition of property of a type that can produce interest from sources within the US), 1 January 2019; or |

| (c) | in relation to a “passthru payment” described in section 1471(d)(7) of the Code not falling within paragraph (a) or (b) above, 1 January 2019, |

or, in each case, such other date from which such payment may become subject to a deduction or withholding required by FATCA as a result of any change in FATCA after the date of this Agreement.

“FATCA Deduction” means a deduction or withholding from a payment under a Finance Document required by FATCA.

“FATCA Exempt Party” means a Party that is entitled to receive payments free from any FATCA Deduction.

“Federal Funds Effective Rate” means, for any period, a fluctuating interest rate equal for each day during such period to the weighted average of the rates on overnight Federal funds transactions with members of the Federal Reserve System arranged by Federal funds brokers, as published for such day (or, if such day is not a Business Day, for the next preceding Business Day) by the Federal Reserve Bank of New York, or, if such rate is not so published for any day which is a Business Day, the average of the quotations for such day on such transactions received by the Agent from three Federal funds brokers of recognized standing selected by the Agent.

“Fee Letter” means any letter or letters referring to this Agreement or the Facility between one or more Finance Parties and the Company setting out any of the fees referred to in Clause 12 (Fees).

“Finance Document” means this Agreement, any Fee Letter, any Utilisation Request and any other document designated as such by the Agent and the Company.

“Finance Party” means the Agent, each Arranger or a Lender.

11

“Financial Indebtedness” means, without double counting, any indebtedness for or in respect of:

| (a) | moneys borrowed; |

| (b) | any amount raised by acceptance under any acceptance credit facility or dematerialised equivalent; |

| (c) | any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; |

| (d) | the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with IFRS, be treated as a balance sheet liability (other than any liability in respect of a lease or hire purchase contract which would, in accordance with IFRS in force as at the date of this Agreement, have been treated as an operating lease); |

| (e) | receivables sold or discounted (but only to the extent of any recourse); |

| (f) | any amount raised under any other transaction (including any forward sale or purchase agreement) of a type not referred to in any other paragraph of this definition having the commercial effect of a borrowing; |

| (g) | any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value (or, if any actual amount is due as a result of the termination orclose-out of that derivative transaction, that amount) shall be taken into account); |

| (h) | any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution, but only to the extent such counter-indemnity obligation is called and is outstanding; and |

| (i) | the amount of any liability in respect of any guarantee or indemnity supporting Financial Indebtedness of a third party of a type described in paragraphs (a) to (h) above. |

“Financial Quarter” means the period commencing on the day after one Quarter Date and ending on the next Quarter Date.

“Fitch” means Fitch, Inc., or any successor thereto, and if such person shall for any reason no longer perform the function of a securities rating agency, Fitch shall be deemed to refer to any other rating agency designated by the Company with the written consent of the Agent (such consent not to be unreasonably withheld or delayed).

“Four Seasons Macau Casino” means the operation and maintenance by VML of gaming areas located within the Four Seasons Macau Resort Project and the purchase of associated gaming machines, utensils and equipment.

12

“Four Seasons Macau Mall” means the ownership, operation and maintenance by the Cotai Subsidiary of a retail complex as part of the Four Seasons Macau Resort Project.

“Four Seasons Macau Overall Project” means the Four Seasons Macau Casino, the Four Seasons Macau Resort Project, and the Four Seasons Macau Mall; other than any such component that has been sold.

“Four Seasons Macau Resort Project” means the ownership, operation and maintenance by the Cotai Subsidiary (other than any gaming areas therein which shall be operated by VML) of a luxury hotel complex operated and maintained by Four Seasons Hotels and Resorts, Inc. or an Affiliate thereof (or another comparable hotel management company reasonably satisfactory to the Agent) located on Site 2, which Site 2 is leased to the Cotai Subsidiary (except, to the extent the lease of Unit D (as defined in the Venetian Macau Land Concession Contract) has not been transferred back to the Cotai Subsidiary or another member of the Group, for Unit D (as defined in the Venetian Macau Land Concession Contract)) pursuant to the Venetian Macau Land Concession Contract.

“Funding Rate” means any individual rate notified by a Lender to the Agent pursuant to paragraph (a)(ii) of Clause 11.4 (Cost of funds).

“Gaming Authority” means any agency, authority, board, bureau, commission, department, office or instrumentality of any nature whatsoever of any national or foreign government, any state, province or city or other political subdivision or otherwise, including the government of Macau SAR and any other applicable gaming regulatory authority or agency, in each case, with authority to regulate the sale or distribution of liquor or any gaming operation (or proposed gaming operation) owned, managed or operated by the Company or any of its Affiliates.

“GamingLaw” means the gaming laws, rules, regulations or ordinances of any jurisdiction or jurisdictions to which Las Vegas Sands, the Company or any of their respective Affiliates is, or may be, at any time subject.

“Governmental Agency” means any government or any governmental agency, semi-governmental or judicial entity or authority (including any stock exchange or any self-regulatory organisation established under statute).

“Group” means the Company and its Subsidiaries from time to time.

“Hedging Agreements” means (a) currency exchange or interest rate swap agreements, currency exchange or interest rate cap agreements and currency exchange or interest rate collar agreements, (b) other agreements or arrangements designed to protect against fluctuations in currency exchange or interest rates and (c) any agreement or arrangements designed to protect against fluctuations in the price of fuel (including fuel consumed by ferries and other watercraft).

“HIBOR” means, in relation to any Loan denominated in Hong Kong dollars:

| (a) | the applicable Screen Rate as of the Specified Time for Hong Kong dollars and for a period equal in length to the Interest Period of that Loan (or, for the purposes of calculating the HKD Swing Line Rate, an Interest Period of three months); or |

13

| (b) | as otherwise determined pursuant to Clause 11.1 (Unavailability of Screen Rate), |

and if, in either case, that rate is less than zero, HIBOR shall be deemed to be zero.

“HIBOR Loan” means a Loan (other than a HKD Swing Line Loan) denominated in Hong Kong dollars.

“HKD Commitment” means:

| (a) | in relation to an Original Lender, the amount set opposite its name under the heading “HKD Commitment” in Part II of Schedule 1 (The Original Parties) and the amount of any other HKD Commitment transferred to it under this Agreement; and |

| (b) | in relation to any other Lender, the amount of any HKD Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

“HKD Prime Rate” means the rate that the Agent announces from its Macau office (or, following consultation with the Company, such other office of the Agent) from time to time as its Hong Kong dollars prime lending rate.

“HKD Swing Line Rate” means, at any time, the highest of:

| (a) | the HKD Prime Rate; and |

| (b) | the aggregate of 3 Month HIBOR and 1.00%, |

and if, in either case, that rate is less than zero, the HKD Swing Line Rate shall be deemed to be zero.

“HKD / USD Exchange Rate” means an exchange rate of HK$1.00 to US$ (1 / 7.8312).

“HKD Swing Line Loan” means a Swing Line Loan denominated in Hong Kong dollars.

“Holding Company” means, in relation to a person, any other person in respect of which it is a Subsidiary.

“Hong Kong” means the Hong Kong Special Administrative Region of the People’s Republic of China.

“IFRS” means international accounting standards within the meaning of the IAS Regulation 1606/2002 to the extent applicable to the relevant financial statements.

14

“Indemnified Person” means any Finance Party, any Affiliate of a Finance Party and any of their respective directors, officers, employees, trustees or agents.

“Indenture” means the indenture dated as of 9 August 2018 between the Company as issuer and U.S. Bank National Association as trustee in connection with US$1,800,000,000 aggregate principal amount of 4.600% senior notes due 2023, US$1,800,000,000 aggregate principal amount of 5.125% senior notes due 2025 and US$1,900,000,000 aggregate principal amount of 5.400% senior notes due 2028.

“Impaired Agent” means the Agent at any time when:

| (a) | it has failed to make (or has notified a Party that it will not make) a payment required to be made by it under the Finance Documents by the due date for payment; |

| (b) | the Agent otherwise rescinds or repudiates a Finance Document; |

| (c) | (if the Agent is also a Lender) it is a Defaulting Lender; or |

| (d) | an Insolvency Event has occurred and is continuing with respect to the Agent; |

unless, in the case of paragraph (a) above:

| (i) | its failure to pay is caused by: |

| (A) | administrative or technical error; or |

| (B) | a Disruption Event; and |

| payment | is made within three Business Days of its due date; or |

| (ii) | the Agent is disputing in good faith whether it is contractually obliged to make the payment in question. |

“Indirect Tax” means any goods and services tax, consumption tax, value added tax or any tax of a similar nature.

“Insolvency Event” in relation to an entity means that the entity:

| (a) | is dissolved (other than pursuant to a consolidation, amalgamation or merger); |

| (b) | becomes insolvent or is unable to pay its debts or fails or admits in writing its inability generally to pay its debts as they become due; |

| (c) | makes a general assignment, arrangement or composition with or for the benefit of its creditors; |

| (d) | institutes or has instituted against it, by a regulator, supervisor or any similar official with primary insolvency, rehabilitative or regulatory jurisdiction over it in the jurisdiction of its incorporation or organisation or the jurisdiction of its head or home office, a proceeding seeking a judgment of insolvency or bankruptcy or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or a petition is presented for itswinding-up or liquidation by it or such regulator, supervisor or similar official; |

15

| (e) | has instituted against it a proceeding seeking a judgment of insolvency or bankruptcy or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or a petition is presented for itswinding-up or liquidation, and, in the case of any such proceeding or petition instituted or presented against it, such proceeding or petition is instituted or presented by a person or entity not described in paragraph (d) above and: |

| (i) | results in a judgment of insolvency or bankruptcy or the entry of an order for relief or the making of an order for itswinding-up or liquidation; or |

| (ii) | is not dismissed, discharged, stayed or restrained in each case within 30 days of the institution or presentation thereof; |

| (f) | has a resolution passed for itswinding-up, official management or liquidation (other than pursuant to a consolidation, amalgamation or merger); |

| (g) | seeks or becomes subject to the appointment of an administrator, provisional liquidator, conservator, receiver, trustee, custodian or other similar official for it or for all or substantially all its assets (other than, for so long as it is required by law or regulation not to be publicly disclosed, any such appointment which is to be made, or is made, by a person or entity described in paragraph (d) above); |

| (h) | has a secured party take possession of all or substantially all its assets or has a distress, execution, attachment, sequestration or other legal process levied, enforced or sued on or against all or substantially all its assets and such secured party maintains possession, or any such process is not dismissed, discharged, stayed or restrained, in each case within 30 days thereafter; |

| (i) | causes or is subject to any event with respect to it which, under the applicable laws of any jurisdiction, has an analogous effect to any of the events specified in paragraphs (a) to (h) above; or |

| (j) | takes any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any of the foregoing acts. |

“Interest Period” means, in relation to a Loan, each period determined in accordance with Clause 10 (Interest Periods) and, in relation to an Unpaid Sum, each period determined in accordance with Clause 9.3 (Default interest).

“Interpolated Screen Rate” means, in relation to any Loan, the rate (rounded to the same number of decimal places as the two relevant Screen Rates) which results from interpolating on a linear basis between:

| (a) | the applicable Screen Rate for the longest period (for which that Screen Rate is available) which is less than the Interest Period of that Loan; and |

16

| (b) | the applicable Screen Rate for the shortest period (for which that Screen Rate is available) which exceeds the Interest Period of that Loan. |

“Land Concession Contract” means the Sands Macau Land Concession Contract, the Venetian Macau Land Concession Contract and the VOL Land Concession Contract.

“Las Vegas Sands” means Las Vegas Sands Corp., a Nevada corporation, or any successor thereto.

“Legal Reservations” means:

| (a) | the principle that equitable remedies may be granted or refused at the discretion of a court and the limitation of enforcement by laws relating to insolvency, reorganisation and other laws generally affecting the rights of creditors; |

| (b) | the time barring of claims under the Limitation Ordinance (Cap 347), the possibility that an undertaking to assume liability for or indemnify a person againstnon-payment of stamp duty may be void and defences ofset-off or counterclaim; |

| (c) | similar principles, rights and defences under the laws of any relevant jurisdiction; and |

| (d) | any other matters which are set out as qualifications or reservations as to matters of law of general application in any legal opinion delivered to the Lenders in relation to the Finance Documents. |

“Lender” means:

| (a) | any Original Lender; and |

| (b) | any bank, financial institution, trust, fund or other entity which has become a Party as a “Lender” in accordance with Clause 23 (Changes to the Lenders), |

which in each case has not ceased to be a Party as such in accordance with the terms of this Agreement.

“LIBOR” means, in relation to any Loan denominated in US dollars:

| (a) | the applicable Screen Rate as of the Specified Time for US dollars and for a period equal in length to the Interest Period of that Loan (or, for the purposes of calculating the USD Swing Line Rate, an Interest Period of three months); or |

| (b) | as otherwise determined pursuant to Clause 11.1 (Unavailability of Screen Rate), |

and if, in either case, that rate is less than zero, LIBOR shall be deemed to be zero.

17

“LIBOR Loan” means a Loan (other than a USD Swing Line Loan) denominated in US dollars that bears interest at a rate that is calculated by reference to LIBOR.

“LMA” means the Loan Market Association.

“Loan” means a loan made or to be made under the Facility or the principal amount outstanding for the time being of that loan.

“London Business Day” means a day (other than a Saturday or Sunday) on which banks are open for general business in London.

“Macau SAR” means the Macau Special Administrative Region of the People’s Republic of China.

“Majority Lenders” means a Lender or Lenders whose USD Commitments and HKD Commitments (converted into the Base Currency at the HKD / USD Exchange Rate) aggregate more than 50% of the Total Commitments (or, if the Total Commitments have been reduced to zero, aggregated more than 50% of the Total Commitments immediately prior to the reduction).

“Margin” means:

(a) prior to receipt by the Agent of the first Compliance Certificate:

| (i) | with respect to LIBOR Loans, 2% per annum; |

| (ii) | with respect to HIBOR Loans, 2% per annum; and |

| (iii) | with respect to Swing Line Loans, 1% per annum; and |

(b) following receipt by the Agent of the first Compliance Certificate, the rate determined by reference to the table below based on the Consolidated Leverage Ratio specified in the most recent Compliance Certificate received by the Agent:

Consolidated Leverage Ratio | Margin (% per annum) for Swing Line Loans | Margin (% per annum) for LIBOR Loans | Margin (% per annum) for HIBOR Loans | |||||||||

Greater than or equal to 2.75x | 1.500 | % | 2.500 | % | 2.500 | % | ||||||

Greater than or equal to 2.50x but less than 2.75x | 1.375 | % | 2.375 | % | 2.375 | % | ||||||

Greater than or equal to 2.25x but less than 2.50x | 1.250 | % | 2.250 | % | 2.250 | % | ||||||

Greater than or equal to 2.00x but less than 2.25x | 1.125 | % | 2.125 | % | 2.125 | % | ||||||

Greater than or equal to 1.75x but less than 2.00x | 1.000 | % | 2.000 | % | 2.000 | % | ||||||

Greater than or equal to 1.50x but less than 1.75x | 0.875 | % | 1.875 | % | 1.875 | % | ||||||

Greater than or equal to 1.25x but less than 1.50x | 0.750 | % | 1.750 | % | 1.750 | % | ||||||

Greater than or equal to 1.00x but less than 1.25x | 0.625 | % | 1.625 | % | 1.625 | % | ||||||

Less than 1.00x | 0.500 | % | 1.500 | % | 1.500 | % | ||||||

18

Any Margin adjustment required for a Loan shall take effect on the first Business Day falling after the day on which the Agent has received the relevant Compliance Certificate.

“Material Adverse Effect”means a material adverse effect on:

| (a) | the financial condition, business, properties or results of operations of the Group taken as a whole; or |

| (b) | the ability of the Company to perform its payment obligations under the Finance Documents. |

“Month” means a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, except that:

| (a) | (subject to paragraph (c) below) if the numerically corresponding day is not a Business Day, that period shall end on the next Business Day in that calendar month in which that period is to end if there is one, or if there is not, on the immediately preceding Business Day; |

| (b) | if there is no numerically corresponding day in the calendar month in which that period is to end, that period shall end on the last Business Day in that calendar month; and |

| (c) | if an Interest Period begins on the last Business Day of a calendar month, that Interest Period shall end on the last Business Day in the calendar month in which that Interest Period is to end. |

The above rules will only apply to the last Month of any period.

19

“Moody’s” means Moody’s Investor Service, Inc., or any successor thereto, and if such person shall for any reason no longer perform the function of a securities rating agency, Moody’s shall be deemed to refer to any other rating agency designated by the Company with the written consent of the Agent (such consent not to be unreasonably withheld or delayed).

“Multiemployer Plan” means any Employee Benefit Plan which is a “multiemployer plan” as defined in Section 3(37) of ERISA.

“New Lender” has the meaning given to that term in Clause 23 (Changes to the Lenders).

“Official Bulletin” means the official bulletin of the government of Macau SAR.

“Original Financial Statements” means the audited consolidated financial statements of the Group for the financial year ended 31 December 2017.

“Parisian Casino” means the operation and maintenance by VML of the gaming areas located within the Parisian Macau Resort Project and the purchase of associated gaming machines, utensils and equipment.

“Parisian Macau Resort Project” means the Parisian Casino and the hotel resort, parking, entertainment, retail and restaurants areas developed on Site 3 owned, operated and maintained (other than any gaming areas therein which shall be operated by VML) by VML pursuant to the Venetian Macau Land Concession Contract.

“Party” means a party to this Agreement.

“Pension Plan” means any Employee Benefit Plan, other than a Multiemployer Plan, which is subject to Section 412 of the Code or Section 302 of ERISA.

“PBGC” means the Pension Benefit Guaranty Corporation or any successor thereto.

“Principals” means Sheldon G. Adelson and Dr. Miriam Adelson.

“Qualified Financial Institution” means:

| (a) | any Lender, Affiliate of a Lender or Related Fund of a Lender; and |

| (b) | any bank, financial institution, savings and loan association, institutional investor or mutual fund that regularly engages in making, purchasing or otherwise investing in commercial loans in the ordinary course of its business, |

other than any Disqualified Financial Institution, natural person and/or Defaulting Lender.

“Quarter Date” means each of March 31, June 30, September 30 and December 31.

20

“Quotation Day” means:

| (a) | in relation to any period for which an interest rate is to be determined in respect of a LIBOR Loan, two London Business Days before the first day of that period (unless market practice differs in the Relevant Market for that currency in which case the Quotation Day for that currency will be determined by the Agent in accordance with market practice in the Relevant Market (and if quotations would normally be given on more than one day, the Quotation Day will be the last of those days)); |

| (b) | in relation to any period for which an interest rate is to be determined in respect of USD Swing Line Loan, one London Business Day before the first day of that period unless market practice differs in the Relevant Market for that currency in which case the Quotation Day for that currency will be determined by the Agent in accordance with market practice in the Relevant Market (and if quotations would normally be given on more than one day, the Quotation Day will be the last of those days)); |

| (c) | in relation to any period for which an interest rate is to be determined in respect of a HIBOR Loan or an HKD Swing Line Loan, the first day of that period (unless market practice differs in the Relevant Market for that currency in which case the Quotation Day for that currency will be determined by the Agent in accordance with market practice in the Relevant Market (and if quotations would normally be given on more than one day, the Quotation Day will be the last of those days)); or |

| (d) | in relation to any Interest Period the duration of which is selected by the Agent pursuant to Clause 9.3 (Default interest), such date as may be determined by the Agent (acting reasonably). |

“Reference Bank Rate” means the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Agent at its request by the Reference Banks:

| (a) | in relation to LIBOR: |

| (i) | if: |

| (A) | the Reference Bank is a contributor to the applicable Screen Rate; and |

| (B) | it consists of a single figure, |

the rate (applied to the relevant Reference Bank and the relevant currency and period) which contributors to the applicable Screen Rate are asked to submit to the relevant administrator; or

| (ii) | in any other case, the rate at which the relevant Reference Bank could fund itself in the relevant currency for the relevant period with reference to the unsecured wholesale funding market; or |

21

| (b) | in relation to HIBOR: |

| (i) | (other than where paragraph (ii) below applies) the rate at which the relevant Reference Bank could borrow funds in the Hong Kong interbank market in Hong Kong dollars and for the relevant period, were it to do so by asking for and then accepting interbank offers for deposits in reasonable market size in that currency and for that period; or |

| (ii) | if different, the rate (if any and applied to the relevant Reference Bank and the relevant period) which contributors to the applicable Screen Rate are asked to submit to the relevant administrator. |

“Reference Banks” means, in relation to LIBOR, the principal London offices of Bank of China Limited and Industrial and Commercial Bank of China Limited and, in relation to HIBOR, the principal Hong Kong offices of Bank of China Limited and Industrial and Commercial Bank of China Limited or, in each case, such other entities as may be agreed between the Agent and the Company.

“Related Fund”, in relation to a fund (the “first fund”), means a fund which is managed or advised by the same investment manager or investment adviser as the first fund or, if it is managed by a different investment manager or investment adviser, a fund whose investment manager or investment adviser is an Affiliate of the investment manager or investment adviser of the first fund.

“Related Party” means:

| (a) | any immediate family member or former spouse (in the case of an individual) of either of the Principals; or |

| (b) | any trust, corporation, partnership, limited liability company or other entity, the beneficiaries, stockholders, partners, members, owners or persons beneficially holding a greater than 50% interest of which consist of either or both of the Principals and/or such other persons referred to in the immediately preceding paragraph (a) or this paragraph (b). |

“Relevant Market” means:

| (a) | in relation to Hong Kong dollars, the Hong Kong interbank market; |

| (b) | in relation to US dollars, the London interbank market. |

“Repeating Representations” means each of the representations set out in Clauses 18.1 (Status), 18.2 (Binding obligations), 18.3 (Non-conflict with other obligations), 18.4 (Power and authority), 18.5 (Authorisations), 18.7(b) (Subsidiaries), 18.9 (Good title to assets), 18.12 (No misleading information), 18.20 (Investment Company Act) and 18.21 (Margin Regulations).

“Representative” means any delegate, agent, manager, administrator, nominee, attorney, trustee or custodian.

“Resolution Authority” means any body which has authority to exercise any Write-down and Conversion Powers.

22

“Restricted Party” means a person that is:

| (a) | listed on, or owned or controlled by a person listed on, or acting on behalf of a person listed on, any Sanctions List; |

| (b) | located in, incorporated under the laws of, or owned or (directly or indirectly) controlled by, or acting on behalf of, a person located in or organized under the laws of a country or territory that is, or whose government is, the target of country-wide or territory-wide Sanctions, including, as of the date of this Agreement, Cuba, Iran, the Crimea, North Korea and Syria; |

| (c) | otherwise a target of Sanctions (“target of Sanctions” signifying a person with whom a US person or other national of a Sanctions Authority would be prohibited or restricted by law from engaging in trade, business or other activities). |

“Revolving Loan” means a HIBOR Loan and a LIBOR Loan advanced to the Company in accordance with Clause 5.5 (Loan amount and Lenders’ participation).

“Revolving Loan Amount” has the meaning given to it in Clause 5.3(b)(i) (Completion of a Utilisation Request).

“Rollover Loan” means one or more Loans:

| (a) | made or to be made on the same day that a maturing Loan is due to be repaid; |

| (b) | the aggregate amount of which is equal to or less than the amount of the maturing Loan; |

| (c) | in the same currency as the maturing Loan; and |

| (d) | made or to be made for the purpose of refinancing that maturing Loan. |

“S&P” means S&P Global Ratings, a division of S&P Global Inc., or any successor thereto, and if such person shall for any reason no longer perform the function of a securities rating agency, S&P shall be deemed to refer to any other rating agency designated by the Company with the written consent of the Agent (such consent not to be unreasonably withheld or delayed).

“Sanctions” means the economic sanctions laws, regulations, embargoes or restrictive measures administered, enacted or enforced by a Sanctions Authority.

“Sanctions Authority” means each or any of:

| (a) | the United Nations; |

| (b) | the European Union; |

| (c) | the United States government, including the United States Treasury Department’s Office of Foreign Assets Control (“OFAC”) and the United States Department of State; |

23

| (d) | the Macau SAR government, including the Macau Monetary Authority, the Financial Intelligence Office and the Gaming Inspection and Coordination Bureau; |

| (e) | HM Treasury of the United Kingdom; |

| (f) | the Hong Kong Monetary Authority; |

| (g) | the Monetary Authority of Singapore; |

| (h) | the Ministry of Economy, Trade and Industry of Japan; |

| (i) | the Department of Foreign Affairs and Trade of Australia; |

| (j) | the Reserve Bank of Australia; and |

| (k) | the Department of Foreign Affairs, Trade and Development of Canada. |

“Sanctions List” means the “Specially Designated Nationals and Blocked Persons” list maintained by OFAC, or any other sanctions list maintained by, or public announcement of Sanctions designation made by, any Sanctions Authority.

“Sands Macau Casino” means the operation and maintenance by VML of the gaming areas located within the Sands Macau Project.

“Sands Macau Land Concession Contract” means the land concession contract, as published in the Official Bulletin on December 10, 2003, between Macau SAR and VML, and as amended as published in the Official Bulletin on April 23, 2008 (as amended, supplemented or otherwise modified) pursuant to which Macau SAR has leased certain land in Macau SAR to VML, and on which the Sands Macau Project is located.

“Sands Macau Project” means the ownership, operation and maintenance by VML of the Sands Macau Casino, and the hotel, parking, entertainment, retail and restaurant areas located on the Sands Macau Site, pursuant to the Sands Macau Land Concession Contract.

“Sands Macau Site” means the real property designated as such located on the land near the Macau Hong Kong Ferry Terminal on which the Sands Macau Project has been developed and which is leased to VML pursuant to the Sands Macau Land Concession Contract.

“Screen Rate” means:

| (a) | in relation to LIBOR, the London interbank offered rate administered by ICE Benchmark Administration Limited (or any other person which takes over the administration of that rate) for US dollars and the relevant period (equivalent to the relevant Interest Period) displayed (before any correction, recalculation or republication by the administrator) on page LIBOR01 or LIBOR02 of the Thomson Reuters screen (or any replacement Thomson Reuters page which displays that rate); and |

24

| (b) | in relation to HIBOR, the Hong Kong interbank offered rate administered by the Treasury Markets Association (or any other person which takes over the administration of that rate) for Hong Kong dollars for the relevant period (equivalent to the relevant Interest Period) displayed (before any correction, recalculation or republication by the administrator) on page HKABHIBOR of the Thomson Reuters screen (or any replacement Thomson Reuters page which displays that rate), |

or, in each case, on the appropriate page of such other information service which publishes that rate from time to time in place of Thomson Reuters. If such page or service ceases to be available, the Agent may specify another page or service displaying the relevant rate after consultation with the Company

“Securities” means any stock, shares, partnership interests, voting trust certificates, certificates of interest or participation in any profit-sharing agreement or arrangement, options, warrants, bonds, debentures, notes, or other evidences of indebtedness, secured or unsecured, convertible, subordinated or otherwise, or in general any instruments commonly known as “securities” or any certificates of interest, shares or participations in temporary or interim certificates for the purchase or acquisition of, or any right to subscribe to, purchase or acquire, any of the foregoing.

“Security” means a mortgage, charge, pledge, lien or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect.

“Separate Loan” has the meaning given to that term in Clause 6.1 (Repayment of Loans).

“Significant Subsidiaries” has the meaning given to that term in Section 1 of Schedule 9 (Additional covenants).

“Site” means any of Site 1, Site 2, Site 3, Site 5 & 6, or the Sands Macau Site, as any such Site may be modified in anon-material manner in accordance with the Cotai Plan.

“Site 1” means the real property designated as such on the Cotai Plan, on which the Venetian Macau Overall Project has been developed.

“Site 2” means the real property designated as such on the Cotai Plan, on which the Four Seasons Overall Project has been developed.

“Site 3” means the real property designated as such on the Cotai Plan, on which the Parisian Macau Resort Project has been and continues to be developed.

“Site 5 & 6” means the real property designated as such on the Cotai Plan, on which the VOL Casino Hotel Resort Project has been and continues to be developed.

“Specified Time” means a day or time determined in accordance with Schedule 7 (Timetables).

25

“Subsidiary” has the meaning given to that term in Section 1 of Schedule 9 (Additional covenants).

“Swing Line Lender” means Bank of China Limited, Macau Branch or such other Lender who has assumed the rights and obligations of the “Swing Line Lender” in accordance with Clause 23 (Changes to the Lenders).

“Swing Line Loan” means a Loan advanced to the Company by the Swing Line Lender (in its capacity as Swing Line Lender) in accordance with Clause 5.5(a)(ii) (Loan amount and Lenders’ participation).

“Swing Line Loan Amount” has the meaning given to it in Clause 5.3(b)(ii) (Completion of a Utilisation Request).

“Tax” means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same).

“Tax Deduction” has the meaning given to such term in Clause 13.1 (Tax definitions).

“Termination Date” means 31 July 2023, or as otherwise extended pursuant to Clause 8 (Extension).

“Total Commitments” means the aggregate of:

(a) the Base Currency Amount of the Total HKD Commitments; and

(b) the Total USD Commitments,

(being US$2,000,000,000 at the date of this Agreement).

“Total HKD Commitments” means the aggregate of the HKD Commitments.

“Total USD Commitments” means the aggregate of the USD Commitments.

“Transfer Certificate” means a certificate substantially in the form set out in Schedule 4 (Form of Transfer Certificate) or any other form agreed between the Agent and the Company.

“Transfer Date” means, in relation to an assignment or a transfer, the later of:

| (a) | the proposed Transfer Date specified in the relevant Assignment Agreement or Transfer Certificate; and |

| (b) | the date on which the Agent executes the relevant Assignment Agreement or Transfer Certificate. |

“Unpaid Sum” means any sum due and payable but unpaid by the Company under the Finance Documents.

“US” or “United States” means the United States of America.

26

“USA Foreign Corrupt Practices Act” means the United States Foreign Corrupt Practices Act of 1977.

“USA PATRIOT Act” means the USA Trading with the Enemy Act and each of the foreign assets control regulations of the United States Treasury Department (31 CFR Subtitle B, Chapter V) and any other enabling legislation or executive order relating thereto.

“USD Commitment” means:

| (a) | in relation to an Original Lender, the amount set opposite its name under the heading “USD Commitment” in Part II of Schedule 1 (The Original Parties) and the amount of any other USD Commitment transferred to it under this Agreement; and |

| (b) | in relation to any other Lender, the amount of any USD Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

“USD Prime Rate” means the rate that the Agent announces from its Macau office (or, following consultation with the Company, such other office of the Agent) from time to time as its US dollars prime lending rate.

“USD Swing Line Rate” means, at any time, the highest of:

| (a) | the USD Prime Rate; |

| (b) | the aggregate of the Federal Funds Effective Rate and 0.5%; and |

| (c) | the aggregate of 3 Month LIBOR and 1.00%, |

and if, the applicable rate is less than zero, the USD Swing Line Rate shall be deemed to be zero.

“USD / HKD Exchange Rate” means an exchange rate of US$1.00 to HK$7.8312.

“USD Swing Line Loan” means a Swing Line Loan denominated in US dollars.

“Utilisation” means a utilisation of the Facility.

“Utilisation Date” means the date of a Utilisation, being the date on which the relevant Loan is to be made.

“Utilisation Request” means a notice substantially in the form set out in Schedule 3 (Requests).

“Venetian Macau Casino” means the ownership of the casino and the operation and maintenance by VML of the casino and gaming areas, located within the Venetian Macau Resort Project, and the purchase of associated gaming machines, utensils and equipment.

27

“Venetian Macau Convention Center” means the ownership, operation and maintenance by the Cotai Subsidiary of a convention centre located on land leased under the Venetian Macau Land Concession Contract and adjacent to the Venetian Macau Resort Project.

“Venetian Macau Land Concession Contract” means the land concession contract, as published in the Official Bulletin on April 18, 2007, as amended as published in the Official Bulletin on October 29, 2008, on June 5, 2013 and on October 22, 2014, entered into between Macau SAR, the Cotai Subsidiary, Cotai Strip Lot 2 Apart Hotel (Macau) Limited and the Company pursuant to which Macau SAR has leased Sites 1, 2 and 3 to the Cotai Subsidiary and the Cotai Subsidiary has transferred, by way of a deed, the Casino unit (as defined therein) to VML, and, to the extent not otherwise transferred back to the Cotai Subsidiary or other member of the Group, Unit D (as defined therein) to Cotai Strip Lot 2 Apart Hotel (Macau) Limited, and the total areas of Sites 1, 2 and 3 were changed and a certain area has reverted to the public domain of the Macau SAR, through Dispatches of the Secretary for Transport and Public Works, and on which the Venetian Macau Overall Project and the Four Seasons Macau Overall Project have been built and on which the Parisian Macau Resort Project has been and continues to be built.

“Venetian Macau Mall” means the ownership, operation and maintenance of a retail complex as part of the Venetian Macau Resort Project by the Cotai Subsidiary.

“Venetian Macau Overall Project” means the Venetian Macau Casino, the Venetian Macau Resort Project, the Venetian Macau Convention Center and the Venetian Macau Mall and related parts of the Venetian Macau complex, including the energy centre and the area generally referred to as the arena.

“Venetian Macau Resort Project” means the ownership, operation and maintenance by the Cotai Subsidiary of an approximately 3,000 suite luxury hotel resort located on Site 1, which is leased to the Cotai Subsidiary pursuant to the Venetian Macau Land Concession Contract.

“VML” means Venetian Macau Limited.

“VML Credit Facility” means the Second Amended and Restated Credit Agreement dated as of August 31, 2016, by and among VML US Finance LLC, as borrower, VML, as the company, the lenders listed therein, Bank of China, Macau Branch, as administrative agent for the lenders listed therein and the other arrangers, agents and parties listed therein.

“VOL” means Venetian Orient Limited.

“VOL Casino” means the ownership by VOL and the operation and maintenance by VML of the gaming areas located within the VOL Casino Hotel Resort Project, and the purchase of associated gaming machines, utensils and equipment.

“VOL Casino Hotel Resort Project” means the VOL Casino, hotel resorts, parking, entertainment and restaurants areas, and retail complexes developed on Site 5 & 6 owned, operated and maintained (other than any gaming areas therein which shall be operated by VML) by VOL pursuant to the VOL Land Concession Contract.

28

“VOL Land Concession Contract” means the land concession contract, as published in the Official Bulletin on May 12, 2010, entered into between Macau SAR, VOL and VML pursuant to which Macau SAR has leased Site 5 & 6 and Tropical Garden to VOL and VML has been commissioned with the operation of the VOL Casino.

“Voting Stock” of an entity as of any date means the corporate stock of such entity that is at the time entitled to vote in the election of the Board of Directors (as defined in Schedule 9 (Additional covenants)) of such entity.

“Write-down and Conversion Powers” means:

| (a) | in relation to anyBail-In Legislation described in the EUBail-In Legislation Schedule from time to time, the powers described as such in relation to thatBail-In Legislation in the EUBail-In Legislation Schedule; and |

| (b) | in relation to any other applicableBail-In Legislation: |

| (i) | any powers under thatBail-In Legislation to cancel, transfer or dilute shares issued by a person that is a bank or investment firm or other financial institution or affiliate of a bank, investment firm or other financial institution, to cancel, reduce, modify or change the form of a liability of such a person or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it or to suspend any obligation in respect of that liability or any of the powers under thatBail-In Legislation that are related to or ancillary to any of those powers; and |

| (ii) | any similar or analogous powers under thatBail-In Legislation. |

| 1.2 | Construction |

| (a) | Unless a contrary indication appears, any reference in this Agreement to: |

| (i) | any “Administrative Party”, the “Agent”, any “Arranger”, the “Company”, any “Finance Party”, any “Lender” or any “Party” shall be construed so as to include its successors in title, permitted assigns and permitted transferees to, or of, its rights and/or obligations under the Finance Documents; |

| (ii) | “assets” includes present and future properties, revenues and rights of every description; |

| (iii) | a “Finance Document” or any other agreement or instrument is a reference to that Finance Document or other agreement or instrument as amended, novated, supplemented, extended or restated; |

| (iv) | “including” shall be construed as “including without limitation” (and cognate expressions shall be construed similarly); |

| (v) | a “group of Lenders” includes all the Lenders; |

29

| (vi) | “indebtedness” includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent other than any obligation of the Company incurred in the ordinary course of business in respect of casino chips or similar instruments; |

| (vii) | a Lender’s “participation” in a Loan or Unpaid Sum includes an amount (in the currency of such Loan or Unpaid Sum) representing the fraction or portion (attributable to such Lender by virtue of the provisions of this Agreement) of the total amount of such Loan or Unpaid Sum and the Lender’s rights under this Agreement in respect thereof; |

| (viii) | a “person” includes any individual, firm, company, corporation, government, state or agency of a state or any association, trust, joint venture, consortium, partnership or other entity (whether or not having separate legal personality); |

| (ix) | a “regulation” includes any regulation, rule, official directive, request or guideline (whether or not having the force of law, but if not having the force of law being one with which it is the practice of the relevant person to comply) of any governmental, intergovernmental or supranational body, agency, department or of any regulatory, self-regulatory or other authority or organisation; |

| (x) | a provision of law is a reference to that provision as amended orre-enacted; and |

| (xi) | a time of day is a reference to Hong Kong time. |

| (b) | The determination of the extent to which a rate is “for a period equal in length” to an Interest Period shall disregard any inconsistency arising from the last day of that Interest Period being determined pursuant to the terms of this Agreement. |

| (c) | Section, Clause and Schedule headings are for ease of reference only. |

| (d) | Unless a contrary indication appears, a term used in any other Finance Document or in any notice given under or in connection with any Finance Document has the same meaning in that Finance Document or notice as in this Agreement. |

| (e) | A Default or an Event of Default is “continuing” if it has not been remedied or waived. |

| (f) | Where this Agreement specifies an amount in a given currency (the “specified currency”) “or its equivalent”, the “equivalent” is a reference to the amount of any other currency which, when converted into the specified currency utilising the Agent’s Spot Rate of Exchange for the purchase of the specified currency with that other currency at or about 11 a.m. on the relevant date, is equal to the relevant amount in the specified currency. |

30

| 1.3 | Currency symbols and definitions |

| (a) | “HK$” and “Hong Kong dollars” denote the lawful currency of Hong Kong. |

| (b) | “US$” and “US dollars” denote the lawful currency of the US. |

| (c) | “Patacas” denote the lawful currency of Macau SAR. |

| (d) | “Japanese Yen” denote the lawful currency of Japan. |

| (e) | “Singapore dollars” denote the lawful currency of Singapore. |

| 1.4 | Third party rights |

| (a) | A person who is not a Party (other than an Indemnified Person) has no right under the Contracts (Rights of Third Parties) Ordinance (Cap. 623) (the “Third Parties Ordinance”) to enforce or to enjoy the benefit of any term of this Agreement. |

| (b) | Subject to Clause 33.3 (Other exceptions) but otherwise notwithstanding any term of any Finance Document, the consent of any person who is not a Party is not required to rescind or vary this Agreement at any time. |

31

SECTION 2

THE FACILITY

| 2. | THE FACILITY |

| 2.1 | The Facility |

Subject to the terms of this Agreement, the Lenders make available to the Company a multicurrency revolving loan facility in an aggregate amount equal to the Total Commitments.

| 2.2 | Finance Parties’ rights and obligations |

| (a) | The obligations of each Finance Party under the Finance Documents are several. Failure by a Finance Party to perform its obligations under the Finance Documents does not affect the obligations of any other Party under the Finance Documents. No Finance Party is responsible for the obligations of any other Finance Party under the Finance Documents. |