Washington, D.C. 20549

Intrepid Capital Fund

Semi-Annual Report

March 31, 2005

Intrepid Capital Fund

May 5, 2005

Dear Fellow Shareholders:

Welcome to the Intrepid Capital Fund! The fund is a result of what I jokingly refer to as “the ten year overnight success” of Intrepid Capital in managing money for customers in separate accounts. This fund now makes our services available to customers with smaller account balances.

The fund commenced operations on January 3, 2005, at which point I forgot the admonishment of the great Florida cowboy Lum Townsend, who said, “We are in a hurry, so let’s take it easy,” and overlooked all that I learned at his knee as a thirteen year old. I rushed to commit the capital that was in the fund at the time—less than $500,000 into 3 equity securities—anticipating additional capital that was slow to arrive. This caused a 4% plus decline in net asset value in the first several weeks of operations.

After this wobbly start, the fund recovered nicely with positive results in February and March, despite generally negative results in the broad stock and bond markets. The net result of this is the fund was down 2.7% for the quarter with an ending N.A.V. of 9.73. The good news for many of you, I suspect, is that your price at quarter end is little different than what you paid initially.

As lead portfolio manager of the fund, I am endeavoring to find two types of investments. First, I’m seeking equity securities (or as I like to think of them, partial business interests) that trade at a discount to what rational buyers and sellers would pay if the company were private. With the help of the Intrepid Capital analytical team, this daily search can lead us to some businesses you may know well and maybe even more you won’t know at all. These businesses will tend to exhibit similar traits, since at first blush, they may appear rather mundane. However, they often generate significant operational “free” cash flows. This allows them to support their financing needs internally, as well as possess a strong balance sheet.

The way things work on Wall St. if you need financing is, in order to sell stock (equity) or a bond (debt), you will need an investment banker. The investment banker will get an analyst from his firm to start coverage to help promote this offering in their firm and to outsiders as well.

This situation is reversed when your business doesn’t need financing due to strong operational cash flows. No investment banker frequently means no analyst coverage and a security that can become mispriced because too few people are watching closely.

Intrepid Capital Fund

On the fixed income side of the portfolio, I am focused on shorter-term, frequently callable high yield debt, where I hope to earn 3-4% higher returns versus the risk free rate over a full market cycle. I am trying to position the fund to weather the continuation of increases in the short-term rate, engineered by the Federal Reserve.

In the industry, the fund will generally be considered “focused,” in that our number of holdings, both equity and debt, will be about half of our typical peer (i.e. Intrepid Capital Fund: 60 holdings, Peer group: 120+ holdings). At March 31, 2005, the fund held 30 positions of which 54.5% was in stock, 25.5% was in bonds and the remaining 20%+ was in short-term treasury bills and cash.

Again, welcome to the fund. The 17 employees of Intrepid Capital are here to assist you along with our service providers in this venture, U.S. Bancorp Fund Services in Milwaukee at 1-866-996-FUND.

We are continually evaluating potential services to offer through our new website, www.intrepidcapitalfunds.com, and through other ways we hope you will find beneficial. Thank you for entrusting your hard earned money to the Intrepid Capital Fund.

Best regards,

/s/ Mark F. Travis

Mark F. Travis President/C.E.O.

The Fund is subject to special risks including volatility due to investments in small- and mid-cap stocks, high yield securities and is considered non-diversified as a result of limiting its holdings to a relatively small number of positions.

Must be preceded or accompanied by a current prospectus.

Quasar Distributors, LLC. Distributor (5/05)

Intrepid Capital Fund

EXPENSE EXAMPLE

March 31, 2005 (Unaudited)

As a shareholder of the Intrepid Capital Fund (“the Fund”), you incur ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held of the entire period (January 3, 2005 - March 31, 2005).

ACTUAL EXPENSES

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Fund’s transfer agent. To the extent that the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying fund are expected to vary among the various underlying funds. These expenses are not included in the example below. The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Intrepid Capital Fund

EXPENSE EXAMPLE (Continued)

March 31, 2005 (Unaudited)

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charge (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | Expenses Paid |

| | Beginning | | Ending | | During Period* |

| | Account Value | | Account Value | | January 3, 2005 - |

| | January 3, 2005 | | March 31, 2005 | | March 31, 2005 |

| Actual | $1,000.00 | | $ 973.00 | | $4.64 |

| | | | | | |

| Hypothetical (5% return | | | | | |

| before expenses) | 1,000.00 | | 1,007.35 | | 4.72 |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 1.95%, multiplied by the average account value over the period, multiplied by 88/365 to reflect the period. |

Intrepid Capital Fund

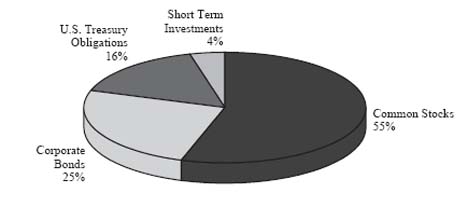

ALLOCATION OF PORTFOLIO HOLDINGS

March 31, 2005 (Unaudited)

COMPONENTS OF PORTFOLIO HOLDINGS

| Common Stocks | $4,841,807 | 55% |

| Corporate Bonds | 2,223,844 | 25% |

| U.S. Treasury Obligations | 1,393,917 | 16% |

| Short Term Investments | 384,667 | 4% |

| Total | $8,844,235 | 100% |

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS

March 31, 2005 (Unaudited)

| | Number of | | Market |

| | Shares | | Value |

COMMON STOCKS - 54.5% | | | |

Beverages - 6.5% | | | |

| Grolsch NV (a) (b) | 10,210 | $ | 312,117 |

| The Coca-Cola Co | 6,395 | | 266,480 |

| | | | 578,597 |

Capital Markets - 2.4% | | | |

| SEI Investments Co. | 6,000 | | 216,960 |

Chemicals - 1.8% | | | |

| Stepan Co | 6,775 | | 159,280 |

Commercial Services & Supplies - 5.0% | | | |

| H&R Block, Inc | 4,270 | | 215,977 |

| The ServiceMaster Co | 16,885 | | 227,947 |

| | | | 443,924 |

Communications Equipment - 2.1% | | | |

| Tellabs, Inc. (a) | 26,145 | | 190,859 |

Energy Equipment & Services - 2.1% | | | |

| Tidewater, Inc | 4,720 | | 183,419 |

Gas Utilities - 2.4% | | | |

| Cascade Natural Gas Corp | 10,690 | | 213,372 |

Health Care Providers & Services - 2.8% | | | |

| Health Management Associates, Inc. | 9,370 | | 245,307 |

Household Products - 1.9% | | | |

| Oil-Dri Corporation of America | 9,075 | | 167,887 |

Insurance - 10.9% | | | |

| Berkshire Hathaway, Inc. (a) | 80 | | 228,480 |

| Horace Mann Educators Corp | 15,120 | | 268,229 |

| The St. Paul Travelers Companies Inc | 6,800 | | 249,764 |

| XL Capital Ltd. (b) | 3,040 | | 220,005 |

| | | | 966,478 |

IT Services - 2.1% | | | |

| Automatic Data Processing, Inc. | 4,120 | | 185,194 |

See notes to financial statements.

Intrepid Capital Fund

SCHEDULE OF INVESTMENTS (continued) March 31, 2005 (Unaudited)

| | | | Number of | | Market |

| | | | Shares | | Value |

COMMON STOCKS - 54.5% (continued) | | | |

Pharmaceuticals - 5.5% | | | |

| Merck & Co., Inc. | 6,895 | $ | 223,191 |

| Mylan Laboratories | 15,000 | | 265,800 |

| | | | | | 488,991 |

Specialty Retail - 7.0% | | | | | |

| Limited Brands | 13,070 | | 317,601 |

| Payless Shoesource, Inc. (a) | | 19,305 | | 304,826 |

| | | | | | 622,427 |

Wireless Telecommunication Services - 2.0% | | | |

| Telephone & Data Systems, Inc. | | | 2,195 | | 179,112 |

| TOTAL COMMON STOCKS | | | | 4,841,807 |

| (Cost $4,783,539) | | | | |

| | | Principal | |

| | | Amount | |

CORPORATE BONDS - 25.0% | | | |

Books: Publishing, Or Publishing And Printing - 3.4% | | | |

| Houghton Mifflin Co., 0.000%, 10/15/2013 | $ | 425,000 | 297,500 |

Commercial Services & Supplies - 3.5% | | | |

| Williams Scotsman, Inc., 9.875%, 06/01/2007 | | 307,000 | 307,000 |

Communications Services - 2.3% | | | |

| Xm Satellite Radio, Inc., 0.000%, 12/31/2009 | | 200,000 | 205,000 |

Food & Staples Retailing - 0.3% | | | |

| Great Atlantic & Pac Tea, Inc., | | | |

| 7.750%, 04/15/2007 | | 25,000 | 25,250 |

Hotels Restaurants & Leisure - 6.2% | | | |

| Bally Total Fitness Holding Corp. | | | |

| 10.500%, 07/15/2011 | | 275,000 | 272,250 |

| Six Flags, Inc., 9.750%, 04/15/2013 | | 300,000 | 281,250 |

| | | | 553,500 |

See notes to financial statements.

Intrepid Capital Fund

| | | | Amount | | Value |

CORPORATE BONDS - 25.0% (continued) | | | | | |

Multi-Utilities & Unregulated Power - 3.0% | | | | | |

| Calpine Corp., 7.625%, 04/15/2006 | $ | 275,000 | $ | 268,125 |

Short-term Business Credit | | | | | |

Institutions, Except Agricultural - 3.1% | | | | | |

| Qwest Capital Funding, Inc., 7.750%, 08/15/2006 | | | 275,000 | | 279,469 |

Wireless Telecommunication Services - 3.2% | | | | | |

| Rural Cellular Corp., 9.625%, 05/15/2008 | | 300,000 | | 288,000 |

| TOTAL CORPORATE BONDS | | | | | |

| (Cost $2,256,230) | | | | | 2,223,844 |

| | | | | | |

U.S. TREASURY OBLIGATIONS - 15.7% | | | | | |

| U.S. Treasury Bill, 2.250%, 05/12/2005 | | 400,000 | | 398,922 |

| U.S. Treasury Bill, 2.380%, 06/09/2005 | 1,000,000 | | 994,995 |

| | | | | | 1,393,917 |

| TOTAL U.S. TREASURY OBLIGATIONS | | | | | |

| (Cost $1,393,917) | | | | | 1,393,917 |

| | | Number of | |

| | | Shares | |

SHORT-TERM INVESTMENTS - 4.3% | | | |

| SEI Daily Income Trust Treasury Fund (c) | | | |

| 1.970% | 384,667 | 384,667 |

| TOTAL SHORT-TERM INVESTMENTS | | | |

| (Cost $384,667) | | 384,667 |

Total Investments - 99.5% | | | |

| (Cost $8,818,353) | | 8,844,235 |

Other Assets in Excess of Liabilities - 0.5% | . | | 48,864 |

TOTAL NET ASSETS - 100.0% | | $8,893,099 |

(a) Non Income Producing. (b) Foreign Issued Security.

(c) Variable Rate Security. The rate shown is the rate in effect on March 31, 2005.

See notes to financial statements.

Intrepid Capital Fund

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2005 (Unaudited)

ASSETS: | | |

| Investments in securities, at market value (cost: $8,818,353). | $ | 8,844,235 |

| Cash | | 473,369 |

| Dividends and interest receivable | | 58,912 |

| Receivable from Advisor | | 23,655 |

| Other assets | | 23,894 |

| Total assets | | 9,424,065 |

| | | |

LIABILITIES: | | |

| Payable for securities purchased | | 487,948 |

| Accrued expenses | | 43,018 |

| Total liabilities | | 530,966 |

| Total net assets | $ | 8,893,099 |

| | | |

| | | |

NET ASSETS CONSIST OF: | | |

| Capital stock | $ | 8,853,479 |

| Accumulated undistributed net investment income | | 14,500 |

| Accumulated undistributed net realized loss on investments | | (762) |

| Unrealized appreciation on investments | | 25,882 |

| Total net assets | $ | 8,893,099 |

| | | |

| | | |

| Shares outstanding (unlimited shares of no par value authorized) | | 913,808 |

| | | |

| Net asset value, offering and redemption price per share | $ | 9.73 |

| | | |

See notes to financial statements.

Intrepid Capital Fund

STATEMENT OF OPERATIONS | | |

For the period January 3, 2005(1) through March 31, 2005 (Unaudited) | | |

| | | |

INVESTMENT INCOME: | | |

| Dividend income | $ | 11,492 |

| Interest income | | 22,954 |

| Total investment income | | 34,446 |

| | | |

EXPENSES: | | |

| Professional fees | | 12,603 |

| Advisory fees | | 10,229 |

| Administration fees | | 9,574 |

| Shareholder servicing fees and expenses | | 8,937 |

| Fund accounting fees | | 8,828 |

| Insurance | | 4,683 |

| Trustees fees and expenses | | 3,219 |

| Distribution (12b-1) fees | | 2,557 |

| Federal and state registration | | 2,257 |

| Reports to shareholders | | 1,770 |

| Custody fees | | 1,637 |

| Miscellaneous | | 263 |

| Total expenses before Advisor reimbursement | | 66,557 |

| Less fees and expenses reimbursed and waived by Advisor | | (46,611) |

| Net expenses | | 19,946 |

| Net investment income | | 14,500 |

NET REALIZED AND UNREALIZED | | | |

GAIN/(LOSS) ON INVESTMENTS: | | | |

| Net realized loss on investments | | (762) |

| Net change in unrealized appreciation on investments | | 25,882 |

| Net realized and unrealized gain on investments | | 25,120 |

| Net increase in net assets resulting from operations | $ | 39,620 |

(1) Commencement of Operations.

See notes to financial statements.

Intrepid Capital Fund

STATEMENT OF CHANGES IN NET ASSETS | | | | |

| | | | | |

| | | | January 3, 2005(1) |

| | | | Through |

| | | | March 31, 2005 |

| | | | (Unaudited) |

OPERATIONS: | | | | |

| Net investment income | $ | 14,500 |

| Net realized loss on investments | | (762) |

| Net change in unrealized appreciation on investments | | | 25,882 |

| Net increase in assets resulting from operations | | | 39,620 |

| | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | |

| Proceeds from shares sold | | 8,791,698 |

| Cost of shares redeemed | | (38,219) |

| Net increase in net assets from capital share transactions | | | 8,753,479 |

| | | | | |

TOTAL INCREASE IN NET ASSETS | | 8,793,099 |

| | | | | |

NET ASSETS: | | | | |

| Beginning of period | | 100,000 |

| End of period | | | $ | 8,893,099 |

(1) Commencement of Operations.

See notes to financial statements.

Intrepid Capital Fund

Per share data for a share of capital stock outstanding for the entire period and selected information for the period are as follows:

| | | | | January 3, 2005(1) Through March 31, 2005 | |

| | | | | (Unaudited) | |

NET ASSET VALUE: | | | | | |

| Beginning of period | | | | | $ | 10.00 | |

| | | | | | | | |

OPERATIONS: | | | | | | | |

Net investment gain(2) | | | | | | 0.02 | |

| Net realized and unrealized loss on investment securities | | | | | | (0.29 | ) |

| Total from operations | | | | | | (0.27 | ) |

| | | | | | | | |

NET ASSET VALUE: | | | | | | | |

| End of period | | | | | $ | 9.73 | |

| | | | | | | | |

| | | | | | | | |

| Total return | | -2.70%(3) |

| | | | | | | | |

| Net assets at end of period (000s omitted) | | $8,893 |

| | | | | | | | |

RATIO OF EXPENSES TO AVERAGE NET ASSETS: | | | | | | | |

| Before expense reimbursement | | 6.43%(4) |

| After expense reimbursement | | 1.93%(4) |

| | | | | | | | |

RATIO OF NET INVESTMENT | | | | | | | |

LOSS TO AVERAGE NET ASSETS: | | | | | | | |

| Before expense reimbursement | | -3.10%(4) |

| After expense reimbursement | | 1.40%(4) |

| | | | | | | | |

| Portfolio turnover rate | | | | | | 0 | % |

(1) Commencement of Operations.

(2) Net investment income per share is calculated using the ending balances prior to consideration or adjustment for permanent book-to-tax differences.

(3) Not annualized. (4) Annualized.

See notes to financial statements.

Intrepid Capital Fund

NOTES TO FINANCIAL STATEMENTS

March 31, 2005 (Unaudited)

Intrepid Capital Management Funds Trust (the “Trust”), was organized as a Delaware Statutory Trust on August 27, 2004 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company issuing its shares in series, each series representing a distinct portfolio with its own investment objectives and policies. The series presently authorized is the Intrepid Capital Fund (the “Fund”). The Fund commenced operations on January 3, 2005.

| | 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles (“GAAP”).

Valuation of Securities

The Fund’s securities that are listed on national securities exchanges are valued at the last sales price on the securities exchange on which such securities are primarily traded. Securities that are traded on the Nasdaq National Market or the Nasdaq Smallcap Market (collectively “Nasdaq traded securities”) are valued at the Nasdaq Official Closing Price (“NOCP”). Exchange-traded securities for which there were no transactions and Nasdaq traded securities for which there is no NOCP are valued at the most recent bid price. Other securities will be valued by an independent pricing service at the most recent bid price, if market quotations are readily available. Short-term investments are stated at amortized cost, which approximates fair value. The valuation of certain debt securities for which market quotations are not readily available may be based upon current market prices of securities which are comparable in coupon, rating and maturity quality, general market conditions or an appropriate matrix utilizing similar factors. Any securities for which there are no readily available market quotations and other assets will be valued at their value as determined in good faith by the Board of Trustees.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Intrepid Capital Fund

NOTES TO FINANCIAL STATEMENTS (continued)

March 31, 2005 (Unaudited)

Securities Transactions and Investment Income

The Fund records security transactions based on trade date. Dividend income is recognized on the ex-dividend date, and interest income is recognized on an accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Distribution to Shareholder Policy

Dividends from net investment income, if any, are declared and paid quarterly. Distributions of net realized capital gains, if any, are declared and paid at least annually.

Organization and Offering Costs

Organization costs consist of costs incurred to establish the Trust and enable it legally to do business. The Fund expenses organization costs as incurred. Offering costs include registration fees and legal fees regarding the preparation of the initial registration statement. Offering costs are accounted for as a deferred charge and are amortized to expense over twelve months on a straight-line basis.

Federal Income Taxes

The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code necessary to qualify as a regulated investment company and to make the requisite distributions of income and capital gains to its shareholders sufficient to relieve it from Federal income taxes.

The Trust has an Investment Advisory Agreement (the “Agreement”) with the Adviser, with whom certain officers and Trustees of the Trust are affiliated, to furnish investment advisory services to the Fund. Under the terms of the Agreement, the Trust, on behalf of the Fund, compensates the Adviser for its management services at the annual rate of 1.00% on the first $500 million of average daily net assets and 0.80% on the Fund’s average daily net assets in excess of $500 million.

The Adviser has agreed to waive, through September 30, 2007, its management fee and/or reimburse the Fund’s other expenses, including organization expenses, to the extent necessary to ensure that the Fund’s operating expenses do not exceed 1.95% of the Fund’s average daily net assets. Any such waiver or reimbursement is subject to later adjustment to allow the Adviser to recoup amounts waived or reimbursed to the extent actual fees and expenses for a fiscal year are less than the respective expense cap limitations, provided, however, that the Adviser shall only be entitled to recoup such amounts for a period of three years from the date such amount was waived or reimbursed. At March 31, 2005, $46,611 was available for potential recoupment.

Intrepid Capital Fund

NOTES TO FINANCIAL STATEMENTS (continued)

March 31, 2005 (Unaudited)

The Trust, on behalf of the Fund, has adopted a distribution plan pursuant to Rule 12b-1 under the 1940 Act (the “12b-1 Plan”), which provides that the Fund may reimburse the Fund’s distributor or others at an annual rate of up to 0.25% of the average daily net assets attributable to its shares.

| | 5. | INVESTMENT TRANSACTIONS |

The aggregate purchases and sales of securities (excluding short-term securities), by the Fund for the period ended March 31, 2005 are as follows:

| | Purchases | | Sales |

| Non-U.S. Government | $ | 7,037,620 | | $ | — |

| U.S. Government | $ | 3,282,967 | | $ | 1,894,412 |

| 6. | CAPITAL SHARE TRANSACTIONS |

| | Period Ended March 31, 2005 |

| Shares sold | 907,753 |

| Shares redeemed | (3,945) |

| Net increase in shares | 903,808 |

| | |

| Shares outstanding: | |

| Beginning of period | 10,000 |

| End of year | |

| | 913,808 |

| | 7. | FEDERAL INCOME TAX INFORMATION |

As of March 31, 2005, the components of the tax basis cost of investments and net unrealized appreciation were as follows:

| | Federal tax cost of investments | $ | 8,818,353 |

| | | | |

| | Unrealized appreciation | $ | 117,582 |

| | Unrealized depreciation | | (91,700) |

| | Net unrealized | $ | 25,882 |

| | | | |

Intrepid Capital Fund

ADDITIONAL INFORMATION

March 31, 2005 (Unaudited)

1. Disclosure Regarding Fund Trustees and Officers | | |

| | | | | # of | |

| | | Term of | | Portfolios | |

| | | Office and | | in Fund | Other |

| | Position(s) | Length | | Complex | Director/ |

| | Held with | of Time | Principal Occupation | Overseen | Trustee |

Name, Age and Address | the Trust | Served | During Past Five Years | by Trustee | Positions |

Independent Trustees | | | | | |

| | | | | | |

| John J. Broaddus, 55 | Trustee | Indefinite | Vice President of | 1 | None |

| c/o Intrepid Capital | | Term | Development, Sunnyside | | |

| Management Funds Trust | | since | Communities (a retirement | | |

| 3652 South Third Street, | | November | community) (1999-present); | | |

| Suite 200 | | 2004 | Principal, Peak Consulting | | |

| Jacksonville Beach, FL 32250 | | | (a management consulting | | |

| | | | firm) (1998-1999); President | |

| | | | and Chief Executive Officer, | |

| | | | Casseo Ice & Cold Storage | | |

| | | | (a national third party | | |

| | | | logistics, warehousing, ice | | |

| | | | manufacturing and food | | |

| | | | distribution company) | | |

| | | | (1990-1998). | | |

| | | | | | |

| Roy F. Clarke, 65 | Trustee | Indefinite | Owns and operates a | 1 | None |

| c/o Intrepid Capital | | Term | dentistry office (1974- | | |

| Management Funds Trust | | since | present). | | |

| 3652 South Third Street, | | November | | | |

| Suite 200 | | 2004 | | | |

| Jacksonville Beach, FL 32250 | | | | | |

| | | | | | |

| Peter R. Osterman, 56 | Trustee | Indefinite | Chief Executive Officer, | 1 | None |

| c/o Intrepid Capital | | Term | W&O Supply, Inc. (a | | |

| Management Funds Trust | | since | distribution company) | | |

| 3652 South Third Street, | | November | (2001-present); Owned | | |

| Suite 200 | | 2004 | L.K. Erectors, Inc. (a | | |

| Jacksonville Beach, FL 32250 | | | construction company) | | |

| | | | (2000-2001); Controller, | | |

| | | | Encompass Management | | |

| | | | Co. (1999-2000); Controller, | |

| | | | Media One (1998-1999). | | |

Intrepid Capital Fund

ADDITIONAL INFORMATION (continued)March 31, 2005 (Unaudited)

| | | |

| | | | | |

| | | | | | |

| | | | | # of | |

| | | Term of | | Portfolios | |

| | | Office and | | in Fund | Other |

| | Position(s) | Length | | Complex | Director/ |

| | Held with | of Time | Principal Occupation | Overseen | Trustee |

Name, Age and Address | the Trust | Served | During Past Five Years | by Trustee | Positions |

| | | | | | |

| Ed Vandergriff, 55 | Trustee | Indefinite | President, Development | 1 | None |

| c/o Intrepid Capital | | Term | Catalysts (a real estate | | |

| Management Funds Trust | | since | finance and development | | |

| 3652 South Third Street, | | November | company) (2000-present); | | |

| Suite 200 | | 2004 | Executive Vice President | | |

| Jacksonville Beach, FL 32250 | | | and Chief Financial Officer, | |

| | | | Haskell Company (a design | |

| | | | construction and development | |

| | | | company for commercial | | |

| | | | structures) (1981-2000). | | |

| | | | | | |

Interested Trustees | | | | | |

| Mark F. Travis, 43 | Trustee, | Indefinite | President, Intrepid Capital | 1 | None |

| c/o Intrepid Capital | President | Term | Management Inc. (1995- | | |

| Management Funds Trust | and | since | present); Chief Executive | | |

| 3652 South Third Street, | Treasurer | November | Officer, Intrepid Capital | | |

| Suite 200 | | 2004 | Management Inc. (2003- | | |

| Jacksonville Beach, FL 32250 | | | present). | | |

| | | | | | |

Officers | | | | | |

| Donald White, 44 | Secretary | Indefinite | Chief Financial Officer, | N/A | N/A |

| c/o Intrepid Capital | | Term | Intrepid Capital | | |

| Management Funds Trust | | since | Management Inc. (2003- | | |

| 3652 South Third Street, | | November | present); Independent | | |

| Suite 200 | | 2004 | Business Consultant (2002- | | |

| Jacksonville Beach, FL 32250 | | | 2003); Vice President of | | |

| | | | Finance & Operations, | | |

| | | | MunicipalTrade.com | | |

| | | | (2000-2002); Vice President | |

| | | | in Global Professional | | |

| | | | Services, Computer | | |

| | | | Associates (1999-2000). | | |

The Statement of Additional information includes additional information about the Fund’s Trustees and is available free of charge upon request by calling the Fund toll free at 1.866.996.3863.

Intrepid Capital Fund

ADDITIONAL INFORMATION (continued) March 31, 2005 (Unaudited)

2. Investment Advisory Agreement Disclosure

On November 16, 2004, the Board of Trustees of Intrepid Capital Management Funds Trust approved the investment advisory agreement with Intrepid Capital Management Inc. Prior to approving the agreement, the Board considered:

the nature, extent and quality of the services to be provided by Intrepid Capital Management Inc.

the investment strategies and performance history of Intrepid Capital Management Inc.

the cost of the services to be provided and profits to be realized by Intrepid Capital Management Inc. from its relationship with the Fund

the extent to which economies of scale would be realized as the Fund grew and whether fee levels reflect any such economies of scale

the expense ratio of the Fund

the manner in which portfolio transactions for the Fund would be conducted, including the use of soft dollars

In considering the nature, extent and quality of the services provided by Intrepid Capital Management Inc., the Board of Trustees considered the Adviser’s expertise in managing accounts with similar strategies, the entrepreneurial risk by the Adviser in starting the Fund, the financial connection of the Adviser and the Adviser’s ability to manage the Fund in the future from a fiscal standpoint, the Adviser’s willingness to enter into a contractual expense limitation agreement and the Adviser’s ability to attract investors for the Fund.

The Board considered the presentation from the Adviser on the proposed investment strategies for the Fund including the Adviser’s theory in managing accounts with similar strategies. The Fund is newly organized and therefore had no performance history as of the date of the investment advisory agreement approval. The Adviser manages portfolios similar to the Fund (“Balanced Accounts”). The Balanced Accounts include all portfolios managed by the Adviser with objectives, strategies and policies substantially similar to those employed by the Fund. The Fund provided composite historical performance data for the Adviser’s Balanced Accounts. The Trustees concluded that the performance of the Balanced Accounts was satisfactory in comparison to performance of similar funds.

The Trustees concluded that the advisory fees payable by the Fund would be reasonable. The Trustees considered a report prepared by Intrepid Capital Management Inc. of the costs of services provided, and the profits realized, by Intrepid Capital Management Inc. from its relationship with the Fund and concluded that with respect to the Fund, the profits were reasonable and not excessive. The Trustees noted that the Adviser would be reimbursing expenses until the Fund gained more assets, and discussed the Adviser’s profitability.

Intrepid Capital Fund

ADDITIONAL INFORMATION (continued)

March 31, 2005 (Unaudited)

The Trustees reviewed a report showing the ranges of fees for comparable funds. The Trustees noted that the investment advisory fee paid by the Fund contained a breakdown when the Fund reached $500 million in assets.

The Trustees also reviewed reports prepared by U.S Bancorp Fund Services, LLC comparing the Fund’s expense ratio and the investment advisory fees paid by the Fund to those of other comparable mutual funds. After reviewing the reports, the Trustees concluded that the investment advisory fees paid the Fund were reasonable. They also concluded that the expense ratios were with in the range of comparable mutual funds.

The Board reviewed reports discussing the manner in which portfolio transactions for the Fund were conducted, including the use of soft dollars. Based on these reports, the Board concluded that the research obtained by Intrepid Capital Management Inc. was beneficial to the Fund and that Intrepid Capital Management Inc. would execute the Fund’s portfolio transactions in a manner designed to obtain best execution for the Fund.

3. Availability of Quarterly Portfolio Holdings Schedules

The Fund is required to file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Once filed, the Fund’s Form N-Q is available without charge, upon request on the SEC’s website (http://www.sec.gov) and may be available by calling 1.866.966.3863. You may also obtain copies at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1.800.SEC.0330.

4. Proxy Voting Policies and Procedures and Proxy Voting Record (Unaudited)

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, by calling 1.866.996.3863 and on the SEC’s website (http://www.sec.gov).

The Fund is required to file how they voted proxies related to portfolio securities during the most recent 12-month period ended June 30. Once filed, the information is available without charge, upon request, by calling 1.866.966.3863 and on the SEC’s website (http://www.sec.gov).

(This Page Intentionally Left Blank.)

Investment Adviser

Intrepid Capital Management Inc.

3652 South Third Street, Suite 200

Jacksonville Beach, FL 32250

Independent Registered Public Accounting Firm

Deloitte & Touche LLP

555 East Wells Street

Milwaukee, WI 53202

Legal Counsel

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, WI 53202

Custodian

U.S. Bank, N.A.

425 Walnut Street

Cincinnati, OH 45202

Distributor

Quasar Distributors, LLC

615 East Michigan Street

Milwaukee, WI 53202

Administrator, Transfer Agent and Dividend Disbursing Agent

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

Shareholder/Investor Information

1.866.966.3863

www.intrepidcapitalfunds.com

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable to open-end investment companies.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Not applicable to open-end investment companies.

Not applicable to open-end investment companies.

Not applicable to open-end investment companies.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Mark F. Travis, President

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Mark F. Travis, Treasurer