Intrepid Capital Fund

Intrepid Small Cap Fund

Intrepid Income Fund

Semi-Annual Report

April 1, 2023

| |

|  |

| Mark F. Travis, President/C.E.O. |

PERFORMANCE

| | Total Return as of March 31, 2023 |

| | Inception |

| | Date | Qtr. | YTD | 1 Year |

Intrepid Capital Fund – Inv. | 01/03/05 | 3.82% | 3.82% | -5.17% |

Intrepid Capital Fund – Inst. | 04/30/10 | 3.84% | 3.84% | -5.00% |

BBC Combined 1-5Yr |

| 5.22% | 5.22% | -4.38% |

S&P 500 Index |

| 7.50% | 7.50% | -7.73% |

| | |

| | Average Annualized Total Returns |

| | as of March 31, 2023 |

| | | | | Since |

| | 3 Year | 5 Year | 10 Year | Inception |

Intrepid Capital Fund – Inv. | 11.89% | 1.37% | 3.18% | 5.08% |

Intrepid Capital Fund – Inst. | 12.16% | 1.61% | 3.43% | 4.60% |

BBC Combined 1-5Yr | 10.86% | 7.55% | 7.94% | 6.68%^ |

S&P 500 Index | 18.60% | 11.19% | 12.24% | 9.14%^ |

| ^ | Since Inception returns are as of the Fund’s Investor Class inception date. Since the inception date of the Institutional Class, the annualized return of the BBC Combined 1-5Yr Index is 8.16% and S&P 500 Index is 10.87%. |

Performance data quoted represents past performance and does not guarantee future results.

Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Fund imposes a 2% redemption fee on shares held for 30 days or less. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

Per the Prospectus dated January 31, 2023, the annual operating expense (gross) for the Intrepid Capital Fund-Investor Share Class is 1.92% and for the Intrepid Capital Fund-Institutional Share Class is 1.67%. The Fund’s Advisor has contractually agreed to reduce its fees and/or reimburse expenses until January 31, 2024, such that the total operating expense for the Capital Fund-Investor Share Class is 1.40% and for the Capital Fund-Institutional Share Class is 1.15%. The Capital Fund may have

Net Expense higher than these expense caps as a result of any sales, distribution and other fees incurred under a plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), acquired fund fees and expenses or other expenses (such as taxes, interest, brokerage commissions and extraordinary items) that are excluded from the calculation. As a result of the calculations, the Net Expense for the Capital Fund-Investor Share Class is 1.40%. The Net Expense for the Capital Fund-Institutional Share Class is 1.15%. The Net Expense Ratio represents the percentage paid by investors. Otherwise, performance shown would have been lower.

April 1, 2023

“Blessings we enjoy daily; and for the most of them, because they be

so common, most men forget to pay their praise.”

—Izaak Walton

Dear Fellow Shareholders

The author of the quote above, from the book “The Complete Angler,” wasn’t thinking about his blessings in the financial markets. Instead, he wrote those words about fishing. I too have reacquainted myself with a love of fishing from my youth. I find the distraction and focus required to be successful fishing useful after a day staring into the flashing red and green symbols on my Bloomberg screen!

The Intrepid Capital Fund successfully completed the first six month’s of the funds fiscal year ending March 31, 2023. For the first quarter of this calendar year, the Fund appreciated 3.82% which, when compounded on the 4.96% return in the fourth quarter of 2022, resulted in a non-annualized 8.97% total return over the six months since September 30, 2022. Included in these results was a dividend paid on March 31, 2023, of 22.59 cents per share.

We are now living through the experiment from several years ago that some describe as “modern monetary theory” which brought us, at one point, 18 trillion (with a T!) of negative yielding debt. Only a room full of PhD’s could come up with something like that. I mean really – am I going to deposit my monies in a bank account and “earn” negative interest rates so I will be worse off when I come back for my funds!? At one point, retailers in Germany couldn’t keep safes in stock as locals preferred a safe over their local bank! The Federal Reserve, staffed with 400 PhD’s, has now realized the error of their ways and raised the Fed Funds rate from close to zero in March of 2022 to roughly 5% now. That has now acquainted the public with a term I have used frequently in the past: duration (as a measure of interest rate risk). As well as the term “uninsured” depositors.

March of 2023 brought us the largest bank failure since the Great Financial Crisis of 2008 when depositors at Silicon Valley Bank requested $147 billion be paid back to them in two days. Regulators quickly moved to close the bank. While the bank had the highest credit quality assets in US Treasury bonds, they had significant unhedged duration risk coupled with close to 80% of deposits over the $250,000 FDIC limits.

To give you a specific example applicable to Silicon Valley Bank, if you bought a 10 years to maturity Treasury bond at a 2% yield at par (100) and due to inflationary pressures and Federal Reserve activity the current rate was now 4%, the bond you bought at par when rates were 2% is now worth 83 cents on the dollar. I am amazed that bank regulators didn’t insist that management hedge that duration risk. Well, the rest is history.

The Intrepid Capital Fund hasn’t been a bank investor since inception for the simple reason it is very hard to understand the various assets a bank holds. We know the liabilities are the deposits, which as we have seen in the example above can quickly flee. There isn’t a bank out there that could survive a “run” on their deposits. A good example of a bank run is from one of my favorite movies “It’s a Wonderful Life” where Jimmy Stewart pleads with his neighbors to keep their money in his savings and loan – arguing that Joe’s deposits are in Carl’s house, etc.

My preference is for less exciting investments in the equity markets. I am attracted to founder/managers that often have a significant ownership interest. I have observed that this type of owner/operator often runs a company void of liabilities on the balance sheet and to quote the famous race car driver Mario Andretti “to finish first, you must first finish”. These balances sheets are built to finish.

| Top Ten Holdings | | (% of Net Assets) |

| | | | |

| Verano Holdings, 10/30/2026, 14.25% | | | 4.6 | % |

| Becle SAB de CV | | | 4.5 | % |

| Civitas Resources, Inc. | | | 4.2 | % |

| FRP Holdings Inc. | | | 4.0 | % |

| Alphabet Inc – Class A | | | 3.7 | % |

| Berkshire Hathaway – Class B | | | 3.4 | % |

| The TJX Companies, Inc. | | | 3.2 | % |

| Copart, Inc. (CPRT) | | | 3.1 | % |

| Jefferies Financial Group, Inc. (JEF) | | | 3.1 | % |

| WNS Holdings Ltd. | | | 3.1 | % |

Top ten holdings are as of March 31, 2023. Fund holdings are subject to change and are not recommendations to buy or sell any security.

Two recent acquisitions fit this bill to a “T”. Garmin (GRMN) dominates the marine/avionic/fitness categories for navigation. The families that founded the firm have a combined equity stake of roughly 20%, and the company has a billion (with a B!) in cash on the balance sheet. Watsco (WSO) is run by the father/son team of Albert and AJ Nahmad. This company is the leading HVAC distributor in the country with a large portion of their revenues coming from replacement equipment. Anyone close to the beach in Florida knows that the replacement cycle can be short!

I believe we are closer to the end than the beginning of the Federal Reserves rate hikes, but that doesn’t mean we won’t have price volatility around announcements of Consumer Price Index (CPI) statistics or future Fed policy. I will continue to seek investments like the two mentioned above when volatility spikes.

Thank you for your continued support. If there is anything we can do to serve you better, please don’t hesitate to call.

All the best,

Mark F. Travis

Intrepid Capital Fund Portfolio Manager

All investments involve risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.

The S&P 500 Index is a broad-based, unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Bloomberg US Gov/Credit 1-5Y TR Index measures the performance of U.S. dollar-denominated U.S. Treasury bonds, government-related bonds, and investment-grade U.S. corporate bonds that have a remaining maturity of greater than or equal to one year and less than five years. The Bloomberg (BBC) Combined Index consists of an unmanaged portfolio of 60% common stocks represented by the S&P 500 Index and 40% bonds represented by the Bloomberg US Government/Credit 1-5 Yr Index. You cannot invest directly in an index.

The Consumer Price Index (CPI) measures the monthly change in prices paid by U.S. consumers.

Duration is an approximate measure of the price sensitivity of a fixed-income investment to a change in interest rates, expressed as a number of years.

Basis point is a standard financial measure for interest rates. One basis point equals 1/100th of 1%.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

April 1, 2023

| | | | |

|  | | |

| | Matt Parker, CFA, CPA | | Joe Van Cavage, CFA |

| Small Cap Fund | | Small Cap Fund |

| Co-Portfolio Manager | | Co-Portfolio Manager |

PERFORMANCE

| | Total Return as of March 31, 2023 |

| | Inception | | | |

| | Date | Qtr. | YTD | 1 Year |

Intrepid Small Cap Fund – Inv. | 10/03/05 | 3.94% | 3.94% | -6.94% |

Intrepid Small Cap Fund – Inst. | 11/03/09 | 4.02% | 4.02% | -6.78% |

Morningstar Small Cap Index |

| 4.90% | 4.90% | -8.84% |

| | |

| | Average Annualized Total Returns |

| | as of March 31, 2023 |

| | | | | Since |

| | 3 Year | 5 Year | 10 Year | Inception |

Intrepid Small Cap Fund – Inv. | 10.74% | 1.87% | 1.93% | 6.03% |

Intrepid Small Cap Fund – Inst. | 10.94% | 2.09% | 2.16% | 4.56% |

Morningstar Small Cap Index | 19.17% | 5.42% | 8.18% | 7.85%^ |

| ^ | Since Inception returns are as of the Fund’s Investor Class inception date. Since the inception date of the Institutional Class, the annualized return of the Morningstar Small Cap Index is 10.87%. |

Performance data quoted represents past performance and does not guarantee future results.

Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Fund imposes a 2% redemption fee on shares held for 30 days or less. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

Per the Prospectus dated January 31, 2023, the annual operating expense (gross) for the Intrepid Small Cap Fund-Investor Share Class is 1.77% and for the Intrepid Small Cap Fund-Institutional Share Class is 1.51%. The Fund’s Advisor has contractually agreed to reduce its fees and/or reimburse expenses until January 31, 2024, such that the total operating expense for the Small Cap Fund-Investor Share Class is 1.30% and the Small Cap Fund-Institutional Share Class is 1.15%. The Small Cap Fund may have Net Expense higher than these expense caps as a result of

any sales, distribution and other fees incurred under a plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), acquired fund fees and expenses or other expenses (such as taxes, interest, brokerage commissions and extraordinary items) that are excluded from the calculation. As a result of the calculations, the Net Expense for the Small Cap Fund-Investor Share Class is 1.30%. The Net Expense for the Small Cap Fund-Institutional Share Class is 1.15%. The Net Expense Ratio represents the percentage paid by investors. Otherwise, performance shown would have been lower. As of June 6, 2022, the Intrepid Endurance Fund’s name changed to the Intrepid Small Cap Fund.

April 1, 2023

Dear Fellow Shareholders,

Similar to last quarter, small cap stocks again showed how volatile they can be during calendar Q1 2023 (the 2nd quarter of fiscal 2023).

Small caps rallied hard to start the period, rising over double digits by early February. However, the well-publicized banking crisis that emerged in early March pushed them all the way back into negative territory. From there, small caps rallied in the last few weeks to end the quarter with lightly positive returns.

The concerns about the banking system came out of left field during the quarter. We certainly did not expect it.

However, the Fund was positioned reasonably well for it, with only one traditional bank stock in the portfolio and at a very small weight. For the quarter, the Intrepid Small Cap Fund (“the Fund”) returned 3.94% versus 4.90% for the benchmark Morningstar Small Cap Index.

As a general rule, we do not invest much in the bank sector, despite it being a rather large part of the small cap market. Banks are very difficult to analyze or value with confidence and – as seen in the last few weeks – have black swan risks on both the asset and liability side of their business. In addition, it’s a competitive industry with very few companies that possess the type of durable competitive advantages we look for. That is not to say that we would never invest in them; however, under normal circumstances we would anticipate having little banking exposure.

Besides the banks stocks themselves, another difficult thing to analyze is what the economic impact from the crisis will be. Now that things have calmed down and some confidence has been restored, will the economy go right back to normal? Or will the financial system pull back on credit growth in order to keep cash available for future deposit runs, stifling the economy in the second half of the year?

These questions lead to more questions, and there are a lot of investors guessing about what happens next. If the economy does slow, will the Fed stubbornly continue to tighten? Or will they relent and lower rates? When will they decide? And at what pace will they raise or lower rates? Is quantitative easing back on the table to improve liquidity in the system?

As usual, we believe trying to answer these questions is counter-productive to our task of trying to source high quality small cap companies at attractive valuations. Instead, we often use periods of high uncertainty that drive questions like the above and thus higher volatility to source new positions that meet our investment criteria.

For instance, we added three new positions to the Fund in calendar Q1 (compared to zero new positions in calendar Q4):

| | • | Chicago Atlantic Real Estate Finance (REFI) is real-estate investment trust that focuses on providing short-term secured loans to the legal US cannabis industry. After some unsuccessful attempts to benefit from the capital-constrained cannabis industry in the past, we have decided to move up in the capital structure to take advantage of the attractive and well-covered loans that scaled lenders to the space are able to make. In addition, for a REIT the company has little leverage and a very attractive dividend (over 10%). |

| | | |

| | • | Armstrong World Industries (AWI) is the leading manufacturer of ceiling systems in the United States. Assuming that you are in an office building reading this letter – if you look at the ceiling tile above your head, there is a greater-than-50% chance that Armstrong manufactured it. As a dominant market share leader in a low growth industry that supplies a very small component of the cost of new build and remodel projects, Armstrong has demonstrated very robust pricing power even before the recent bout of high inflation. |

| | | |

| | • | Vector Group Ltd (VGR) is the fourth-largest manufacturer of cigarettes in the US, specializing in the discount and deep discount categories. From a decades-old legal settlement that awarded them favorable tax treatment, the company has a structural cost advantage versus its peers that management exploits by launching new brands that undercut competition in order to gain market share. After establishing distribution and customer loyalty with the new brand, Vector implements the typical tobacco playbook by raising prices which sheds some market share but drives significant incremental profitability that more than compensates for the lost share. We believe the company is entering one of its profit harvesting periods today, which is an especially attractive time given that many consumers are trading down to the discount cigarette category. |

The three largest contributors to the Fund’s performance for the quarter were Civitas Resources (CIVI), Becle Sab de CV (CUERVO MM) and WNS Holdings (WNS). The three largest detractors to performance were Franklin Covey (FC), Silicom (SILC) and Conduent (CNDT). We believe the selloff in each of these stocks was mostly due to temporary challenges and investor frustration surrounding earnings, but have not changed our favorable view of their long-term fundamentals.

Despite the three new holdings, positioning remains largely the same today as when we began the quarter. The top positions in the Fund continue to possess what we believe is the best combination of business quality and valuation. In addition, we continue to emphasize financial strength – only one of the top seven holdings has net debt. While the banking crisis has caused longer-term interest rates to fall dramatically over the last month, we still value balance sheet strength and liquidity as an important risk mitigator in the volatile small cap market.

| Top Ten Holdings | | (% of Net Assets) |

| | | | |

| Civitas Resources, Inc. | | | 5.7 | % |

| WNS Holdings Ltd | | | 5.3 | % |

| Becle SAB de CV | | | 5.3 | % |

| Silicom Ltd. | | | 5.1 | % |

| FRP Holdings, Inc. | | | 5.1 | % |

| Skechers USA Inc. – Class A | | | 4.9 | % |

| Fabrinet | | | 4.7 | % |

| Valvoline Inc. | | | 4.3 | % |

| Franklin Covey Co. | | | 4.3 | % |

| Chicago Atlantic Real Estate Finance | | | 4.2 | % |

Top ten holdings are as of March 31, 2023. Fund holdings are subject to change and are not recommendations to buy or sell any security.

With that said, two of the three new names described above (Armstrong World Industries and Vector Group) do have some debt. It’s an important point to mention – we are not afraid of debt, we just want to make sure that our holdings that have debt:

| | • | Have stable, consistent operations to support the debt |

| | | |

| | • | Have ample liquidity and no near-term debt maturities |

| | | |

| | • | Are priced adequately for the higher risk |

While we are not going full-throttle into highly levered small cap opportunities, it is not terribly surprising that – given the elevated volatility in the credit markets – we have found more opportunities in companies with debt recently. For instance Armstrong World trades at the lowest valuation it ever has since the spin-off of its flooring business in 2016. And at approximately 10x earnings, we believe Vector Group’s potential for attractive near-term earnings growth (and high dividend) are being ignored. We believe both of these opportunities exist partially because of the companies’ not-quite-pristine balance sheets.

We will continue to remain flexible and try to take advantage of what the market offers, with the goal of generating attractive risk-adjusted returns in what is often a volatile small cap market.

Thank you for your investment.

|  |

| | |

| Matt Parker, CFA, CPA | Joe Van Cavage, CFA |

| Intrepid Small Cap Fund | Intrepid Small Cap Fund |

| Co-Portfolio Manager | Co-Portfolio Manager |

Past performance is not a guarantee of future results.

Mutual Fund investing involves risk. Principal loss is possible. The Fund is subject to special risks including volatility due to investments in smaller companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The risks of owning ETFs generally reflect the risks of owning the underlying securities they are designed to track. ETFs also have management fees that increase their costs versus the costs of owning the underlying securities directly.

The Morningstar Small Cap Index tracks the performance of U.S. small-cap stocks that fall between 90th and 97th percentile in market capitalization of the investable universe. You cannot invest directly in an index.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

April 1, 2023

| | | | |

|  | | |

| | Mark F. Travis, President/C.E.O. | | Hunter Hayes, CFA |

| Income Fund Co-Portfolio Manager | | Income Fund Co-Portfolio Manager |

PERFORMANCE

| | Total Return as of March 31, 2023 |

| | Inception | | | |

| | Date | Qtr. | YTD | 1 Year |

Intrepid Income Fund – Inst.^ | 08/16/10 | 1.70% | 1.70% | -1.67% |

Bloomberg USGov/Cred 1-5Y | | 1.82% | 1.82% | -0.33% |

Bloomberg US Agg Bond Index | | 2.96% | 2.96% | -4.78% |

ICE BofAML US Corporate Index | | 3.45% | 3.45% | -5.19% |

ICE BofAML High Yield Index | | 3.72% | 3.72% | -3.56% |

| | |

| | Average Annualized Total Returns |

| | as of March 31, 2023 |

| | | | | Since |

| | 3 Year | 5 Year | 10 Year | Inception |

Intrepid Income Fund – Inst.^ | 8.08% | 4.46% | 3.40% | 3.86% |

Bloomberg USGov/Cred 1-5Y | -0.79% | 1.32% | 1.13% | 1.33% |

Bloomberg US Agg Bond Index | -2.77% | 0.91% | 1.36% | 1.94% |

ICE BofAML US Corporate Index | -0.28% | 1.67% | 2.35% | 3.20% |

ICE BofAML High Yield Index | 5.84% | 3.05% | 4.03% | 5.46% |

| ^ | Institutional Class shares of the Intrepid Income Fund commenced operations on August 16, 2010. Performance shown prior to August 16, 2010 (Since Inception) reflects the performance of Investor Class shares, which commenced operations on July 2, 2007, and includes expenses that are not applicable to and are higher than those of Institutional Class shares. |

Effective January 31, 2014, the Investor Class shares of the Fund were closed, and any outstanding Investor Class shares were converted into Institutional Class shares.

Performance data quoted represents past performance and does not guarantee future results.

Investment returns and principal value will fluctuate, and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher than the performance quoted and can be obtained by calling 866-996-FUND. The Fund imposes a 2% redemption fee on shares held for 30 days or less. Performance data does not reflect the redemption fee. If it had, returns would be reduced.

Per the Prospectus dated January 31, 2023, the annual operating expense (gross) for the Intrepid Income Fund-Institutional Share Class is 0.98%. The Fund’s Advisor has contractually agreed to reduce its fees and/or reimburse expenses until January 31, 2024 such that total operating expense for the Income Fund-Institutional Share Class is 0.90%. The Income Fund may have Net Expense higher than the expense cap as a result of any sales, distribution and other fees incurred under a plan adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), acquired fund fees and expenses or other expenses (such as taxes, interest, brokerage commissions and extraordinary items) that are excluded from the calculation. As a result of the calculations, the Net Expense for the Income Fund-Institutional Class is 0.91%. The Net Expense Ratio represents the percentage paid by investors. Otherwise, performance shown would have been lower.

30-Day Subsidized SEC Yield: 11.31%; 30-Day Unsubsidized SEC Yield: 11.24%

April 1, 2023

Dear Fellow Shareholders,

Despite the steady drumbeat of higher rates and fears of a recession, the first three months of 2023 shined favorably upon credit markets. We continue to be reluctantly optimistic about certain pockets of high yield credit, especially on the front-end of the curve, but we are also taking advantage of “three-foot putts” that continue to pop up, specifically in short-dated, investment grade credit.

| Top Ten Holdings | | (% of Net Assets) |

| | | | |

| Trulieve Cannabis Corp., 10/06/2026, 8.00% | | | 4.2 | % |

| Turning Point Brands, Inc., 02/15/2026, 5.625% | | | 3.5 | % |

| American Tower Corp., 06/15/2023, 3.00% | | | 3.3 | % |

| Abercrombie & Fitch Management Co., | | | | |

| 07/15/2025, 8.75% | | | 3.0 | % |

| Fiserv, Inc., 10/01/2023, 3.80% | | | 3.0 | % |

| Shryne Group, Inc., 05/26/2026, 16.00% | | | 3.0 | % |

| VCP23, LLC., 04/30/2024, 7.00% | | | 2.8 | % |

| Starwood Property Trust, Inc., | | | | |

| 04/01/2023, 4.375% | | | 2.7 | % |

| Verano Holdings Corp., 10/30/2026, 14.25% | | | 2.6 | % |

| AFC Gamma, Inc., 05/01/2027, 5.75% | | | 2.5 | % |

Top ten holdings are as of March 31, 2023. Fund holdings are subject to change and are not recommendations to buy or sell any security.

During March, for instance, when markets became dislocated on the back of a slew of bank failures, many investors unloaded higher-quality positions to prepare for potential redemptions and/or runs on capital. Why unload higher quality positions? Because these positions are often more liquid and usually incur a lower mark-down to liquidate in times of distress. Regardless of the reasons, we were keen to purchase high quality securities at double-digit money market yields as the drama unfolded, and the Intrepid Income Fund (the “Fund”) ended the first calendar quarter of 2023 with 22.1% of the portfolio in investment grade bonds.

We view this short-dated, investment grade sleeve as a ballast for the portfolio that will allow us to continue redeploying capital into a choppy, but attractive, high yield bond environment. We continue to look for robust, core credit positions issued by companies that we believe have the liquidity and cash flow profile to weather a recession and/or absorb the impact of higher rates.

It is interesting to compare this fixed income environment, which we view as attractive on a risk-adjusted basis, to the environment of 18 months ago, which we viewed as extremely unattractive. There is an old saying in credit that there are “no bad bonds, just bad prices” that we think rings true against this backdrop. Although we expect default rates to tick up, and for there to be more carnage as the higher cost of capital permeates its way through the system, we also believe that there are plenty of opportunities out there that compensate one for those risks. In other words, we are fine with the choppier economic environment given the significantly enhanced yield we can receive.

Another encouraging sign for lenders is the pick-up of new issue supply that priced in the first quarter. Despite considerable volatility, $45 billion and $404 billion of new issues were brought to market in the high yield and investment grade markets, respectively, according to CreditSights. These new issues carry significantly better rates and terms for lenders than we have seen in quite some time, and we participated in several deals. Although there continues to be gamesmanship by companies around tapping credit markets, many have recognized that we are in a new paradigm, and taken advantage of the credit window being open. We expect the new issue window to be a source of ideas for us now that things have shifted to more of a lender-friendly market, and we are taking an active role in refinancing discussions with many of our borrowers.

As the chart shows, we have taken advantage of the market dislocations to enhance our yield profile, but we have also kept our duration low relative to indices. We admit that we have no superior insight into the path of interest rates from here, but we do feel good about the credits we are underwriting. We expect our performance to be more volatile than it has been historically given our higher yield profile, and we will continue to deploy capital into this higher yielding environment for as long as the market gives us attractive risk-adjusted opportunities.

Shifting to performance, the Fund returned 1.70% in the first calendar quarter. The High Yield Index increased 3.72% over the same period. The Bloomberg Barclays U.S. Gov/Credit 1-5Y TR Index gained 1.82% and the Bloomberg Barclays US Aggregate Bond Index gained 2.96% during the quarter.

The Fund’s top contributors for the quarter were Cimpress 7.0% Unsecured Notes due 6/15/2026, Abercrombie & Fitch 8.75% Secured Notes due 7/15/2025, and Vista Outdoor Inc. 4.5% Unsecured Notes due 3/15/2029.

The Fund’s top detractors during the quarter were Atento 8.0% Secured Notes due 2/10/2026, QVCN 4.85% Secured Notes due 4/01/2024, and Trulieve 8.0% Secured Notes due 10/06/2026.

As always, we encourage investors to reach out for additional commentary on our positioning and strategy.

We remain sanguine about the prospects for short duration high yield despite the turbulence that may lie ahead for risk markets. Careful credit analysis will be the differentiator. The yield-to-worst for the Fund at the end of the first calendar quarter was 13.68% with a modified duration of 1.97 years.

Thank you for your investment.

Sincerely,

|  |

| | |

| Hunter Hayes | Mark F. Travis, President |

| Intrepid Income Fund | Intrepid Income Fund |

| Co-Portfolio Manager | Co-Portfolio Manager |

Mutual Fund investing involves risk.

All investments involve risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is generally greater for longer term debt securities. Investments by the Fund in lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The ICE BofAML US High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have

a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million. Bloomberg Barclays Capital U.S. Aggregate Bond Index is an index representing about 8,200 fixed income securities. To be included in the index, bonds must be rated investment grade by Moody’s and S&P. ICE BofAML U.S. Corporate Index is an unmanaged index of U.S. dollar denominated investment grade corporate debt securities publicly issued in the U.S. domestic market with at least one-year remaining term to final maturity. The Bloomberg Barclays US Gov/Credit 1-5Y TR Index measures the performance of U.S. dollar-denominated U.S. Treasury bonds, government-related bonds, and investment-grade U.S. corporate bonds that have a remaining maturity of greater than or equal to one year and less than five years.

Bond ratings are grades given to bonds that indicate their credit quality as determined by private independent rating services such as Standard & Poor’s, Moody’s and Fitch. These firms evaluate a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as nonrated.

A high-yield bond is a high paying bond with lower credit rating than investment-grade corporate bonds, Treasury bonds and municipal bonds. Bonds in high yield indices tend to be less liquid and more volatile than U.S. Treasuries. Corporate bonds come with significant credit risks and, although sometimes secured by collateral, do not have any guarantee of principal repayment. U.S. Treasury Bonds are long-term government debt securities with a maturity of more than 10 years. They are guaranteed as to the timely payment of principal and interest and are backed by the full faith and credit of the U.S. Government. Investment Grade (IG) is a bond with credit rating of BBB or higher by Standard & Poor’s or Baa3 or higher by Moody’s.

Duration is an approximate measure of the price sensitivity of a fixed-income investment to a change in interest rates, expressed as a number of years. Call is an option contract that gives the holder the right to buy a certain quantity of an underlying security from the writer of the option, at a specified price up to a specified date.

Yield-to-worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. It is a type of yield that is referenced when a bond has provisions that would allow the issuer to close it out before it matures.

Free cash flow, or cash flow, represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice or recommendations to buy or sell any security.

The Intrepid Capital Funds are distributed by Quasar Distributors, LLC.

| EXPENSE EXAMPLE |

| March 31, 2023 (Unaudited) |

As a shareholder of the Intrepid Capital Management Funds Trust (the “Funds”), you incur ongoing costs, including management fees; distribution and/or service fees; and other expenses incurred by the Funds. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period of October 1, 2022 through March 31, 2023.

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks or stop payment orders at prevailing rates charged by U.S. Bank Global Fund Services, the Funds’ transfer agent. If you request a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. To the extent that a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the following example. The example includes, but is not limited to, management fees, shareholder servicing fees, distribution fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, interest expense and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| EXPENSE EXAMPLE (continued) |

| March 31, 2023 (Unaudited) |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

INTREPID CAPITAL FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2022 - |

| | October 1, 2022 | March 31, 2023 | March 31, 2023 |

| Actual | $1,000.00 | $1,089.70 | $6.77 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.45 | 6.54 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.30%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID CAPITAL FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2022 - |

| | October 1, 2022 | March 31, 2023 | March 31, 2023 |

| Actual | $1,000.00 | $1,090.70 | $5.99 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.20 | 5.79 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID SMALL CAP FUND – INVESTOR CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2022 - |

| | October 1, 2022 | March 31, 2023 | March 31, 2023 |

| Actual | $1,000.00 | $1,125.10 | $6.89 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,018.45 | 6.54 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.30%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

| EXPENSE EXAMPLE (continued) |

| March 31, 2023 (Unaudited) |

INTREPID SMALL CAP FUND – INSTITUTIONAL CLASS

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2022 - |

| | October 1, 2022 | March 31, 2023 | March 31, 2023 |

| Actual | $1,000.00 | $1,126.10 | $6.10 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,019.20 | 5.79 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.15%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

INTREPID INCOME FUND

| | | | Expenses Paid |

| | Beginning | Ending | During Period* |

| | Account Value | Account Value | October 1, 2022 - |

| | October 1, 2022 | March 31, 2023 | March 31, 2023 |

| Actual | $1,000.00 | $1,034.10 | $4.56 |

| Hypothetical (5% return | | | |

| before expenses) | 1,000.00 | 1,020.44 | 4.53 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.90%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the period. |

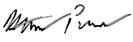

| ALLOCATION OF PORTFOLIO HOLDINGS (as a % of total net assets) |

| March 31, 2023 (Unaudited) |

INTREPID CAPITAL FUND

| | Components of Portfolio Holdings | | | |

| | Common Stocks | | $ | 24,453,552 | |

| | Corporate Bonds | | | 9,517,026 | |

| | Bank Loans | | | 4,856,106 | |

| | Short-Term Investment | | | 2,896,634 | |

| | Convertible Bonds | | | 1,544,194 | |

| | Warrants | | | 71,760 | |

| | | | $ | 42,814,317 | |

| * | Cash, cash equivalents and other assets less liabilities are equal to (1%). |

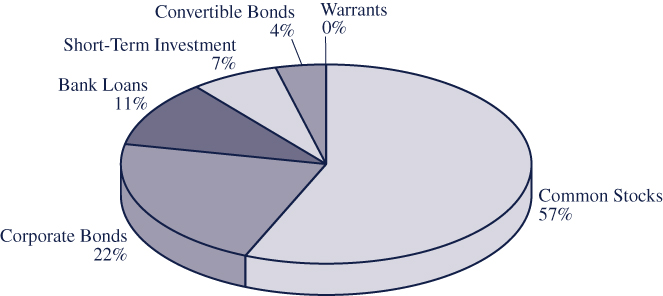

| ALLOCATION OF PORTFOLIO HOLDINGS (as a % of total net assets) |

| March 31, 2023 (Unaudited) |

INTREPID SMALL CAP FUND

| | Components of Portfolio Holdings | | | |

| | Industrials | | $ | 11,406,765 | |

| | Information Technology | | | 7,282,362 | |

| | Financials | | | 7,060,828 | |

| | Consumer Discretionary | | | 5,805,718 | |

| | Consumer Staples | | | 3,314,897 | |

| | Energy | | | 3,021,106 | |

| | Real Estate | | | 2,696,108 | |

| | Materials | | | 2,277,354 | |

| | Mutual Fund ETF | | | 2,061,254 | |

| | Communication Services | | | 1,673,233 | |

| | Cash* | | | 6,392,867 | |

| | | | $ | 52,992,492 | |

* | Cash, cash equivalents and other assets less liabilities. |

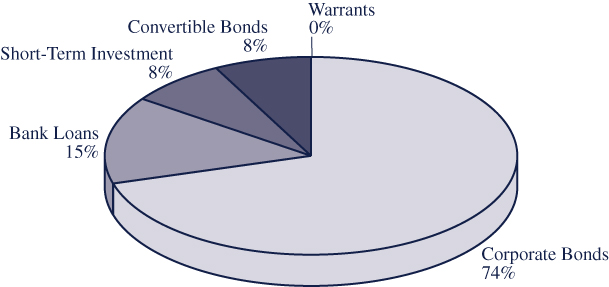

| ALLOCATION OF PORTFOLIO HOLDINGS (as a % of total net assets) |

| March 31, 2023 (Unaudited) |

INTREPID INCOME FUND

| | Components of Portfolio Holdings | | | |

| | Corporate Bonds | | $ | 221,791,224 | |

| | Bank Loans | | | 44,987,518 | |

| | Short-Term Investment | | | 25,207,359 | |

| | Convertible Bonds | | | 24,909,246 | |

| | Warrants | | | 17,185 | |

| | | | $ | 300,328,600 | |

| * | Cash, cash equivalents and other assets less liabilities are equal to (5%). |

| SCHEDULE OF INVESTMENTS |

| March 31, 2023 (Unaudited) |

| BANK LOANS - 11.34% | | Principal Amount | | | Value | |

| Health Care - 11.34% | | | | | | |

| Gage Growth Corp. 13.750%, 11/01/2024 (a) | | $ | 1,003,838 | | | $ | 995,506 | |

| Shryne Group, Inc. 7.500%, 05/26/2026 (a)(b) | | | 1,000,000 | | | | 984,200 | |

| VCP23 LLC 7.000%, 04/30/2024 (a)(b) | | | 1,000,000 | | | | 930,000 | |

| Verano Holdings Corp. 12.750%, 10/30/2026 (a) | | | 2,000,000 | | | | 1,946,400 | |

| TOTAL BANK LOANS (Cost $4,922,868) | | | | | | | 4,856,106 | |

| | | | | | | | | |

| COMMON STOCKS - 57.12% | | Shares | | | | | |

| Capital Goods - 5.53% | | | | | | | | |

| Acuity Brands, Inc. | | | 6,816 | | | | 1,245,488 | |

| Watsco, Inc. | | | 3,521 | | | | 1,120,241 | |

| | | | | | | | 2,365,729 | |

| | | | | | | | | |

| Commercial & Professional Services - 3.06% | | | | | | | | |

| Copart, Inc. (c) | | | 17,426 | | | | 1,310,609 | |

| | | | | | | | | |

| Consumer Durables & Apparel - 8.06% | | | | | | | | |

| Carter’s, Inc. | | | 16,717 | | | | 1,202,287 | |

| Garmin Ltd. (d) | | | 10,898 | | | | 1,099,826 | |

| Levi Strauss & Co. - Class A | | | 63,000 | | | | 1,148,490 | |

| | | | | | | | 3,450,603 | |

| | | | | | | | | |

| Diversified Financials - 6.39% | | | | | | | | |

| Berkshire Hathaway, Inc. - Class B (c) | | | 4,615 | | | | 1,424,974 | |

| Jefferies Financial Group, Inc. | | | 41,253 | | | | 1,309,370 | |

| | | | | | | | 2,734,344 | |

| | | | | | | | | |

| Energy - 4.11% | | | | | | | | |

| Civitas Resources, Inc. | | | 25,761 | | | | 1,760,507 | |

| | | | | | | | | |

| Food, Beverage & Tobacco - 4.44% | | | | | | | | |

| Becle SAB de CV (d) | | | 730,215 | | | | 1,900,099 | |

| | | | | | | | | |

| Health Care Equipment & Services - 2.02% | | | | | | | | |

| CVS Health Corp. | | | 11,673 | | | | 867,421 | |

| | | | | | | | | |

| Media & Entertainment - 6.37% | | | | | | | | |

| Alphabet, Inc. - Class A (c) | | | 14,928 | | | | 1,548,481 | |

| Take-Two Interactive Software, Inc. (c) | | | 9,872 | | | | 1,177,730 | |

| | | | | | | | 2,726,211 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| COMMON STOCKS - 57.12% (continued) | | Shares | | | Value | |

| Real Estate - 3.98% | | | | | | |

| FRP Holdings, Inc. (c) | | | 29,429 | | | $ | 1,703,351 | |

| | | | | | | | | |

| Retailing - 5.35% | | | | | | | | |

| Dollar General Corp. | | | 4,448 | | | | 936,126 | |

| The TJX Companies, Inc. | | | 17,307 | | | | 1,356,176 | |

| | | | | | | | 2,292,302 | |

| | | | | | | | | |

| Software & Services - 7.81% | | | | | | | | |

| Accenture PLC - Class A (d) | | | 3,453 | | | | 986,902 | |

| Dropbox, Inc. - Class A (c) | | | 49,233 | | | | 1,064,417 | |

| WNS Holdings Ltd. - ADR (c)(d) | | | 13,857 | | | | 1,291,057 | |

| | | | | | | | 3,342,376 | |

| TOTAL COMMON STOCKS (Cost $17,960,591 | | | | | | | 24,453,552 | |

| | | | | | | | | |

| CONVERTIBLE BONDS - 3.61% | | Principal Amount | | | | | |

| Diversified Financials - 1.16% | | | | | | | | |

| WisdomTree, Inc. | | | | | | | | |

| 5.750%, 08/15/2028 (e) | | $ | 500,000 | | | | 497,250 | |

| | | | | | | | | |

| Financial Services - 2.45% | | | | | | | | |

| EZCORP, Inc. | | | | | | | | |

| 2.875%, 07/01/2024 | | | 56,000 | | | | 59,783 | |

| 3.750%, 12/15/2029 (e) | | | 1,000,000 | | | | 987,161 | |

| | | | | | | | 1,046,944 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | |

| (Cost $1,560,148) | | | | | | | 1,544,194 | |

| | | | | | | | | |

| CORPORATE BONDS - 22.23% | | | | | | | | |

| Broadcasting (except Internet) - 2.08% | | | | | | | | |

| DISH DBS Corp. | | | | | | | | |

| 5.875%, 11/15/2024 | | | 1,000,000 | | | | 891,140 | |

| | | | | | | | | |

| Consumer Durables & Apparel - 2.64% | | | | | | | | |

| Vista Outdoor, Inc. | | | | | | | | |

| 4.500%, 03/15/2029 (e) | | | 1,400,000 | | | | 1,131,718 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| CORPORATE BONDS - 22.23% (continued) | | Principal Amount | | | Value | |

| Consumer Services - 1.97% | | | | | | |

| Nathan’s Famous, Inc. | | | | | | |

| 6.625%, 11/01/2025 (e) | | $ | 845,000 | | | $ | 842,811 | |

| | | | | | | | | |

| Financial Services - 0.15% | | | | | | | | |

| Oppenheimer Holdings, Inc. | | | | | | | | |

| 5.500%, 10/01/2025 | | | 66,000 | | | | 63,332 | |

| | | | | | | | | |

| Food, Beverage & Tobacco - 2.25% | | | | | | | | |

| Turning Point Brands, Inc. | | | | | | | | |

| 5.625%, 02/15/2026 (e) | | | 1,064,000 | | | | 964,807 | |

| | | | | | | | | |

| Materials - 2.23% | | | | | | | | |

| Vedanta Resources Finance II PLC | | | | | | | | |

| 8.000%, 04/23/2023 (d)(e) | | | 1,000,000 | | | | 953,500 | |

| | | | | | | | | |

| Nonstore Retailers - 1.87% | | | | | | | | |

| QVC, Inc. | | | | | | | | |

| 4.850%, 04/01/2024 | | | 1,000,000 | | | | 801,270 | |

| | | | | | | | | |

| Pharmaceuticals, Biotechnology & Life Sciences - 3.69% | | | | | | | | |

| Celgene Corp. | | | | | | | | |

| 3.900%, 02/20/2028 | | | 23,000 | | | | 21,957 | |

| Trulieve Cannabis Corp. | | | | | | | | |

| 9.750%, 06/18/2024 (d) | | | 1,005,000 | | | | 956,140 | |

| 8.000%, 10/06/2026 (d) | | | 750,000 | | | | 602,201 | |

| | | | | | | | 1,580,298 | |

| | | | | | | | | |

| Securities, Commodity Contracts, and Other | | | | | | | | |

| Financial Investments and Related Activities - 3.12% | | | | | | | | |

| Atento Luxco 1 SA | | | | | | | | |

| 8.000%, 02/10/2026 (d)(e) | | | 2,325,000 | | | | 732,375 | |

| 20.000%, 03/10/2025 (d)(e) | | | 642,000 | | | | 601,875 | |

| | | | | | | | 1,334,250 | |

| | | | | | | | | |

| Utilities - 2.23% | | | | | | | | |

| IEA Energy Services LLC | | | | | | | | |

| 6.625%, 08/15/2029 (e) | | | 1,000,000 | | | | 953,900 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $10,801,338) | | | | | | | 9,517,026 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| WARRANTS - 0.17% | | Shares | | | Value | |

| Health Care - 0.16% | | | | | | |

| Cansortium Warrants | | | | | | |

| Expiration: 04/29/2025, | | | | | | |

| Exercise Price $1.20 (b)(c) | | | 250,000 | | | $ | 37,500 | |

| Green Thumb Industries, Inc. | | | | | | | | |

| Expiration: 10/15/2026, | | | | | | | | |

| Exercise Price $30.00 (b)(c) | | | 7,328 | | | | 32,976 | |

| | | | | | | | 70,476 | |

| Securities, Commodity Contracts, and Other | | | | | | | | |

| Financial Investments and Related Activities - 0.01% | | | | | | | | |

| Atento Warrants 2025 | | | | | | | | |

| Expiration: 02/13/2026, | | | | | | | | |

| Exercise Price $3.78 (b)(c) | | | 128,400 | | | | 1,284 | |

| TOTAL WARRANTS (Cost $0) | | | | | | | 71,760 | |

| | | | | | | | | |

| SHORT-TERM INVESTMENT - 6.76% | | | | | | | | |

| Money Market Fund - 6.76% | | | | | | | | |

| STIT - Treasury Portfolio - | | | | | | | | |

| Institutional Class, 4.72% (f) | | | 2,896,634 | | | | 2,896,634 | |

| TOTAL SHORT-TERM INVESTMENT | | | | | | | | |

| (Cost $2,896,634) | | | | | | | 2,896,634 | |

| Total Investments (Cost $38,141,580) - 101.23% | | | | | | | 43,339,272 | |

| Liabilities in Excess of Other Assets - (1.23%) | | | | | | | (524,955 | ) |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 42,814,317 | |

ADR - American Depository Receipt

Percentages are stated as a percent of net assets.

| (a) | The rate listed is a fixed rate. |

| (b) | Security is fair valued using fair value methodologies established by the Fund’s investment adviser, and is deemed a Level 3 security. See Footnote 2. The aggregate value of fair valued securities as of March 31, 2023 was $1,985,960, which represented 4.64% of net assets. |

| (c) | Non-income producing security. |

| (d) | Foreign Issued Security. |

| (e) | Securities purchases pursuant to Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of March 31, 2023, the value of these investments was $7,665,397, or 17.90% of total net assets. |

| (f) | Rate listed is the 7-day effective yield. |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| March 31, 2023 (Unaudited) |

| COMMON STOCKS - 79.84% | | Shares | | | Value | |

| Banks - 1.21% | | | | | | |

| Hilltop Holdings, Inc. | | | 21,633 | | | $ | 641,851 | |

| | | | | | | | | |

| Capital Goods - 9.36% | | | | | | | | |

| Acuity Brands, Inc. | | | 8,097 | | | | 1,479,565 | |

| Armstrong World Industries, Inc. | | | 19,078 | | | | 1,359,117 | |

| Park Aerospace Corp. | | | 157,694 | | | | 2,120,984 | |

| | | | | | | | 4,959,666 | |

| | | | | | | | | |

| Commercial & Professional Services - 6.82% | | | | | | | | |

| Conduent, Inc. (a) | | | 391,528 | | | | 1,342,941 | |

| Franklin Covey Co. (a) | | | 59,102 | | | | 2,273,654 | |

| | | | | | | | 3,616,595 | |

| | | | | | | | | |

| Consumer Durables & Apparel - 10.96% | | | | | | | | |

| Carter’s, Inc. | | | 23,820 | | | | 1,713,134 | |

| LGI Homes, Inc. (a) | | | 13,206 | | | | 1,505,880 | |

| Skechers USA, Inc. - Class A (a) | | | 54,434 | | | | 2,586,704 | |

| | | | | | | | 5,805,718 | |

| | | | | | | | | |

| Diversified Financials - 5.91% | | | | | | | | |

| Cboe Global Markets, Inc. | | | 11,649 | | | | 1,563,762 | |

| Jefferies Financial Group, Inc. | | | 49,435 | | | | 1,569,067 | |

| | | | | | | | 3,132,829 | |

| | | | | | | | | |

| Energy - 5.70% | | | | | | | | |

| Civitas Resources, Inc. | | | 44,207 | | | | 3,021,107 | |

| | | | | | | | | |

| Financial Services - 2.00% | | | | | | | | |

| Pagseguro Digital Ltd. - Class A (a)(b) | | | 123,482 | | | | 1,058,241 | |

| | | | | | | | | |

| Food, Beverage & Tobacco - 6.25% | | | | | | | | |

| Becle SAB de CV (b) | | | 1,071,395 | | | | 2,787,886 | |

| Vector Group Ltd. | | | 43,881 | | | | 527,011 | |

| | | | | | | | 3,314,897 | |

| | | | | | | | | |

| Materials - 4.30% | | | | | | | | |

| Valvoline, Inc. | | | 65,179 | | | | 2,277,354 | |

| | | | | | | | | |

| Media & Entertainment - 3.16% | | | | | | | | |

| IAC, Inc. (a) | | | 32,427 | | | | 1,673,233 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| COMMON STOCKS - 79.84% (continued) | | Shares | | | Value | |

| Real Estate - 5.09% | | | | | | |

| FRP Holdings, Inc. (a) | | | 46,581 | | | $ | 2,696,108 | |

| | | | | | | | | |

| Software & Services - 9.35% | | | | | | | | |

| Dropbox, Inc. - Class A (a) | | | 98,255 | | | | 2,124,273 | |

| WNS Holdings Ltd. - ADR (a)(b) | | | 30,380 | | | | 2,830,505 | |

| | | | | | | | 4,954,778 | |

| | | | | | | | | |

| Technology Hardware & Equipment - 9.73% | | | | | | | | |

| Fabrinet (a)(b) | | | 20,670 | | | | 2,454,769 | |

| Silicom Ltd. (a)(b) | | | 72,127 | | | | 2,703,320 | |

| | | | | | | | 5,158,089 | |

| TOTAL COMMON STOCKS (Cost $34,169,933) | | | | | | | 42,310,466 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUND - 3.89% | | | | | | | | |

| Materials - 3.89% | | | | | | | | |

| IShares Gold Trust | | | 55,158 | | | | 2,061,254 | |

| TOTAL EXCHANGE-TRADED FUND | | | | | | | | |

| (Cost 1,411,681) | | | | | | | 2,061,254 | |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUST (REIT) - 4.21% | | | | | | | | |

| Real Estate - 4.21% | | | | | | | | |

| Chicago Atlantic Real Estate Finance, Inc. | | | 164,908 | | | | 2,227,907 | |

| TOTAL REIT (Cost 2,500,006) | | | | | | | 2,227,907 | |

| Total Investments (Cost 38,081,618) - 87.94% | | | | | | | 46,599,627 | |

| Other Assets in Excess of Liabilities - 12.06% | | | | | | | 6,392,865 | |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 52,992,492 | |

ADR - American Depository Receipt

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | Foreign Issued Security. |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS |

| March 31, 2023 (Unaudited) |

| BANK LOANS - 14.98% | | Principal Amount | | | Value | |

| Health Care - 13.25% | | | | | | |

| Devi Holdings, Inc. | | | | | | |

| 11.750%, 05/08/2024 (a)(b) | | $ | 7,312,089 | | | $ | 7,260,905 | |

| 8.000%, 04/08/2024 (a)(b) | | | 1,037,856 | | | | 1,037,856 | |

| Gage Growth Corp. 13.750%, 11/01/2024 (a) | | | 6,524,949 | | | | 6,470,792 | |

| Shryne Group, Inc. 7.500%, 05/26/2026 (a)(b) | | | 9,000,000 | | | | 8,857,800 | |

| Vcp23 LLC 7.000%, 04/30/2024 (a)(b) | | | 9,000,000 | | | | 8,370,000 | |

| Verano Holdings Corp. 12.750%, 10/30/2026 (a) | | | 8,000,000 | | | | 7,785,600 | |

| | | | | | | | 39,782,953 | |

| | | | | | | | | |

| Capital Goods - 1.73% | | | | | | | | |

| Tutor Perini Corp. 9.608% | | | | | | | | |

| (1 Month LIBOR USD + 0.9608%), | | | | | | | | |

| 05/31/2023 (c) | | | 5,568,226 | | | | 5,204,565 | |

| TOTAL BANK LOANS (Cost $45,592,269) | | | | | | | 44,987,518 | |

| | | | | | | | | |

| CONVERTIBLE BONDS - 8.29% | | | | | | | | |

| Capital Goods - 0.35% | | | | | | | | |

| Lightning eMotors, Inc. | | | | | | | | |

| 7.500%, 05/15/2024 (d) | | | 1,900,000 | | | | 1,054,500 | |

| | | | | | | | | |

| Diversified Financials - 4.00% | | | | | | | | |

| Starwood Property Trust, Inc. | | | | | | | | |

| 4.375%, 04/01/2023 | | | 8,000,000 | | | | 8,038,895 | |

| WisdomTree, Inc. | | | | | | | | |

| 5.750%, 08/15/2028 (d) | | | 4,000,000 | | | | 3,978,000 | |

| | | | | | | | 12,016,895 | |

| | | | | | | | | |

| Financial Services - 1.07% | | | | | | | | |

| EZCORP, Inc. | | | | | | | | |

| 3.750%, 12/15/2029 (d) | | | 3,250,000 | | | | 3,208,272 | |

| | | | | | | | | |

| Media & Entertainment - 1.65% | | | | | | | | |

| WildBrain Ltd. | | | | | | | | |

| 5.875%, 09/30/2024 (b)(e) | | | 7,000,000 | | | | 4,959,305 | |

| | | | | | | | | |

| Real Estate Management & Development - 1.22% | | | | | | | | |

| DigitalBridge Group, Inc. | | | | | | | | |

| 5.000%, 04/15/2023 | | | 3,652,000 | | | | 3,670,274 | |

| TOTAL CONVERTIBLE BONDS | | | | | | | | |

| (Cost $25,846,586) | | | | | | | 24,909,246 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| CORPORATE BONDS - 73.85% | | Principal Amount | | | Value | |

| Capital Goods - 2.44% | | | | | | |

| Carlisle Companies, Inc. | | | | | | |

| 0.550%, 09/01/2023 | | $ | 7,500,000 | | | $ | 7,337,572 | |

| | | | | | | | | |

| Clothing and Clothing Accessories Stores - 3.02% | | | | | | | | |

| Abercrombie & Fitch Management Co. | | | | | | | | |

| 8.750%, 07/15/2025 (d) | | | 9,000,000 | | | | 9,077,658 | |

| | | | | | | | | |

| Commercial & Professional Services - 2.94% | | | | | | | | |

| Cimpress PLC | | | | | | | | |

| 7.000%, 06/15/2026 (e) | | | 7,100,000 | | | | 5,808,262 | |

| ProSomnus, Inc. | | | | | | | | |

| 9.000%, 12/06/2025 (b) | | | 3,391,961 | | | | 3,025,629 | |

| | | | | | | | 8,833,891 | |

| | | | | | | | | |

| Consumer Durables & Apparel - 2.48% | | | | | | | | |

| LGI Homes, Inc. | | | | | | | | |

| 4.000%, 07/15/2029 (d) | | | 2,400,000 | | | | 1,952,376 | |

| Vista Outdoor, Inc. | | | | | | | | |

| 4.500%, 03/15/2029 (d) | | | 6,795,000 | | | | 5,492,874 | |

| | | | | | | | 7,445,250 | |

| | | | | | | | | |

| Consumer Discretionary - 0.95% | | | | | | | | |

| Evergreen Acqco 1 LP | | | | | | | | |

| 9.750%, 04/26/2028 (d) | | | 3,000,000 | | | | 2,853,075 | |

| | | | | | | | | |

| Consumer Services - 2.98% | | | | | | | | |

| Brinker International, Inc. | | | | | | | | |

| 5.000%, 10/01/2024 (d) | | | 7,000,000 | | | | 6,874,630 | |

| Nathan’s Famous, Inc. | | | | | | | | |

| 6.625%, 11/01/2025 (d) | | | 2,079,000 | | | | 2,073,616 | |

| | | | | | | | 8,948,246 | |

| | | | | | | | | |

| Data Processing, Hosting and Related Services - 1.84% | | | | | | | | |

| Conduent Business Services LLC | | | | | | | | |

| 6.000%, 11/01/2029 (d) | | | 7,000,000 | | | | 5,529,254 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| CORPORATE BONDS - 73.85% (continued) | | Principal Amount | | | Value | |

| Diversified Financials - 4.20% | | | | | | |

| AFC Gamma, Inc. | | | | | | |

| 5.750%, 05/01/2027 (d) | | $ | 10,000,000 | | | $ | 7,600,000 | |

| Enceladus Development Venture III LLC | | | | | | | | |

| 10.000%, 11/15/2023 (d) | | | 5,000,000 | | | | 5,012,500 | |

| | | | | | | | 12,612,500 | |

| | | | | | | | | |

| Energy - 9.50% | | | | | | | | |

| Bristow Group, Inc. | | | | | | | | |

| 6.875%, 03/01/2028 (d) | | | 7,550,000 | | | | 7,033,513 | |

| Citgo Holding, Inc. | | | | | | | | |

| 9.250%, 08/01/2024 (d) | | | 7,500,000 | | | | 7,521,150 | |

| Energy Transfer LP | | | | | | | | |

| 5.875%, 01/15/2024 | | | 269,000 | | | | 268,330 | |

| Kinder Morgan, Inc. | | | | | | | | |

| 5.625%, 11/15/2023 (d) | | | 7,345,000 | | | | 7,339,992 | |

| W&T Offshore, Inc. | | | | | | | | |

| 11.750%, 02/01/2026 (d) | | | 6,496,000 | | | | 6,371,674 | |

| | | | | | | | 28,534,659 | |

| | | | | | | | | |

| Financial Services - 4.62% | | | | | | | | |

| Fiserv, Inc. | | | | | | | | |

| 3.800%, 10/01/2023 | | | 9,000,000 | | | | 8,918,019 | |

| AIG Global Funding | | | | | | | | |

| 0.800%, 07/07/2023 (d) | | | 5,000,000 | | | | 4,940,737 | |

| | | | | | | | 13,858,756 | |

| | | | | | | | | |

| Food, Beverage & Tobacco - 5.21% | | | | | | | | |

| Turning Point Brands, Inc. | | | | | | | | |

| 5.625%, 02/15/2026 (d) | | | 11,610,000 | | | | 10,527,638 | |

| Vector Group Ltd. | | | | | | | | |

| 10.500%, 11/01/2026 (d) | | | 5,100,000 | | | | 5,130,473 | |

| | | | | | | | 15,658,111 | |

| | | | | | | | | |

| Materials - 3.40% | | | | | | | | |

| Warrior Met Coal, Inc. | | | | | | | | |

| 7.875%, 12/01/2028 (d) | | | 3,500,000 | | | | 3,523,206 | |

| Vedanta Resources Finance II PLC | | | | | | | | |

| 8.000%, 04/23/2023 (d)(e) | | | 7,000,000 | | | | 6,674,500 | |

| | | | | | | | 10,197,706 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| CORPORATE BONDS - 73.85% (continued) | | Principal Amount | | | Value | |

| Media & Entertainment - 1.43% | | | | | | |

| Rackspace Technology Global, Inc. | | | | | | |

| 5.375%, 12/01/2028 (d) | | $ | 11,316,000 | | | $ | 4,287,783 | |

| | | | | | | | | |

| Mining (except Oil and Gas) - 1.85% | | | | | | | | |

| Alliance Resource Operating Partners LP | | | | | | | | |

| 7.500%, 05/01/2025 (d) | | | 5,600,000 | | | | 5,569,944 | |

| | | | | | | | | |

| Nonstore Retailers - 2.18% | | | | | | | | |

| QVC, Inc. | | | | | | | | |

| 4.850%, 04/01/2024 | | | 8,155,000 | | | | 6,534,357 | |

| | | | | | | | | |

| Personal and Laundry Services - 2.03% | | | | | | | | |

| ANGI Group LLC | | | | | | | | |

| 3.875%, 08/15/2028 (d) | | | 8,000,000 | | | | 6,087,551 | |

| | | | | | | | | |

| Pharmaceuticals, Biotechnology & Life Sciences - 5.60% | | | | | | | | |

| Trulieve Cannabis Corp. | | | | | | | | |

| 9.750%, 06/18/2024 (e) | | | 4,798,000 | | | | 4,564,738 | |

| 8.000%, 10/06/2026 (e) | | | 15,250,000 | | | | 12,244,745 | |

| | | | | | | | 16,809,483 | |

| | | | | | | | | |

| Primary Metal Manufacturing - 0.77% | | | | | | | | |

| TMS International Corp. | | | | | | | | |

| 6.250%, 04/15/2029 (d) | | | 3,000,000 | | | | 2,316,394 | |

| | | | | | | | | |

| Real Estate - 3.26% | | | | | | | | |

| American Tower Corp. | | | | | | | | |

| 3.000%, 06/15/2023 | | | 9,829,000 | | | | 9,773,563 | |

| | | | | | | | | |

| Repair and Maintenance - 2.52% | | | | | | | | |

| WASH Multifamily Acquisition, Inc. | | | | | | | | |

| 5.750%, 04/15/2026 (d) | | | 8,000,000 | | | | 7,578,880 | |

| | | | | | | | | |

| Securities, Commodity Contracts, and Other | | | | | | | | |

| Financial Investments and Related Activities - 3.91% | | | | | | | | |

| Atento Luxco 1 SA | | | | | | | | |

| 8.000%, 02/10/2026 (d)(e) | | | 18,026,000 | | | | 5,678,190 | |

| 20.000%, 03/10/2025 (d)(e) | | | 6,481,000 | | | | 6,075,938 | |

| | | | | | | | 11,754,128 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| CORPORATE BONDS - 73.85% (continued) | | Principal Amount | | | Value | |

| Support Activities for Mining - 1.03% | | | | | | |

| Earthstone Energy Holdings LLC | | | | | | |

| 8.000%, 04/15/2027 (d) | | $ | 3,194,000 | | | $ | 3,102,373 | |

| | | | | | | | | |

| Telecommunication Services - 3.42% | | | | | | | | |

| Cincinnati Bell Telephone Co. LLC | | | | | | | | |

| 6.300%, 12/01/2028 | | | 3,253,000 | | | | 2,706,691 | |

| Linkem SpA | | | | | | | | |

| 8.452% (3 Month EURIBOR + 6.250%), | | | | | | | | |

| 08/09/2023 (c)(d)(e) | | | 7,000,000 | | | | 7,572,553 | |

| | | | | | | | 10,279,244 | |

| | | | | | | | | |

| Utilities - 2.27% | | | | | | | | |

| IEA Energy Services LLC | | | | | | | | |

| 6.625%, 08/15/2029 (d) | | | 7,140,000 | | | | 6,810,846 | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $239,497,402) | | | | | | | 221,791,224 | |

| | | | | | | | | |

| WARRANTS - 0.1% | | | | | | | | |

| Securities, Commodity Contracts, and Other | | | | | | | | |

| Financial Investments and Related Activities - 0.1% | | | | | | | | |

| Atento Luxco 1 SA | | | | | | | | |

| Expiration: 02/13/2026, | | | | | | | | |

| Exercise Price: $3.78 (b)(f) | | | 1,296,200 | | | | 12,962 | |

| | | | | | | | | |

| Health Care Equipment & Services - 0.00% | | | | | | | | |

| Prosomnus, Inc. | | | | | | | | |

| Expiration: 11/30/2027, Exercise Price: $11.50 (f) | | | 33,919 | | | | 4,223 | |

| TOTAL WARRANTS (Cost $0) | | | | | | | 17,185 | |

See notes to financial statements.

| SCHEDULE OF INVESTMENTS (continued) |

| March 31, 2023 (Unaudited) |

| SHORT-TERM INVESTMENT - 8.39% | | Shares | | | Value | |

| Money Market Fund - 8.39% | | | | | | |

| STIT - Treasury Portfolio - | | | | | | |

| Institutional Class, 4.72% (g) | | | 25,207,359 | | | $ | 25,207,359 | |

| TOTAL SHORT TERM INVESTMENT | | | | | | | | |

| (Cost $25,207,359) | | | | | | | 25,207,359 | |

| Total Investments (Cost $336,143,616) - 105.52% | | | | | | | 316,912,532 | |

| Liabilities in Excess of Other Assets - (5.52%) | | | | | | | (16,583,932 | ) |

| TOTAL NET ASSETS - 100.00% | | | | | | $ | 300,328,600 | |

Percentages are stated as a percent of net assets.

| (a) | The rate listed is a fixed rate. |

| (b) | Security is fair valued using fair value methodologies established by the Fund’s investment adviser, and is deemed a Level 3 security. See Footnote 2. The aggregate value of fair valued securities as of March 31, 2023 was $33,524,457 which represented 11.16% of net assets. |

| (c) | Rates for variable rate securities will typically have interest rates that redetermine periodically by reference to a base lending rate plus a spread. Variable rate securities that reference EURIBOR may be subject to a credit spread adjustment, particularly to legacy LIBOR bank loans or lines of credit that have transitioned to EURIBOR as the base lending rate. |

| (d) | Securities purchases pursuant to Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in that program or other “qualified institutional buyers.” As of March 31, 2023, the value of these investments was $168,850,090, or 56.22% of total net assets. |

| (e) | Foreign Issued Security. |

| (f) | Non-income producing security. |

| (g) | Rate listed is the 7-day effective yield. |

See notes to financial statements.

| SCHEDULE OF OPEN FORWARD CURRENCY CONTRACTS |

| March 31, 2023 (Unaudited) |

| | | | | Amount of | | | | Amount of | | | | |

| | | | | Currency to | | | | Currency to | | | | |

| | Forward

| Currency

| | be Received | | Currency

| | be Delivered | | | Unrealized

| |

| Counterparty | Settlement | to be | | in Local | | to be | | in Local | | | Appreciation | |

of Contracts | Date | Received | | Currency | | Delivered | | Currency | | | (Depreciation) | |

State Street Bank | 10/3/23 | USD | | | 5,344,071 | | CAD | | | 7,205,625 | | | $ | (3,461 | ) |

State Street Bank | 4/20/23 | USD | | | 7,637,140 | | EUR | | | 7,035,933 | | | | (1,840 | ) |

| | | | | | | | | | | | | | $ | (5,301 | ) |

See notes to financial statements.

| STATEMENTS OF ASSETS AND LIABILITIES |

| March 31, 2023 (Unaudited) |

| | | Intrepid | | | Intrepid | | | Intrepid | |

| | | Capital Fund | | | Small Cap Fund | | | Income Fund | |

| ASSETS: | | | | | | | | | |

Investments, at value(1) | | $ | 43,339,272 | | | $ | 46,599,627 | | | $ | 316,912,532 | |

Foreign currency, at value(2) | | | — | | | | — | | | | 150,363 | |

| Receivable for investment securities purchased | | | — | | | | 518,431 | | | | 639,484 | |

| Income receivable | | | 376,304 | | | | 254,913 | | | | 5,369,896 | |

| Receivable for fund shares sold | | | 7,702 | | | | 372 | | | | 1,029,487 | |

| Cash | | | — | | | | 5,676,472 | | | | 807,870 | |

| Other assets | | | 35,355 | | | | 37,310 | | | | 93,796 | |

| Total assets | | | 43,758,633 | | | | 53,087,126 | | | | 325,003,428 | |

| LIABILITIES: | | | | | | | | | | | | |

| Payable for fund shares redeemed | | | 159,401 | | | | 13,033 | | | | 1,238,928 | |

| Payable for investment securities purchased | | | 664,688 | | | | — | | | | 22,980,115 | |

| Depreciation on forward currency contracts | | | — | | | | — | | | | 5,301 | |

| Payable for foreign currencies purchased | | | — | | | | — | | | | 332 | |

| Payable to Investment Adviser | | | 13,237 | | | | 19,406 | | | | 183,679 | |

| Payable to Custodian | | | — | | | | — | | | | 4,414 | |

| Distribution payable | | | 41,345 | | | | — | | | | 179,898 | |

| Accrued distribution fees | | | 6,602 | | | | 6,448 | | | | — | |

| Other expenses payable | | | 59,043 | | | | 55,747 | | | | 82,161 | |

| Total liabilities | | | 944,316 | | | | 94,634 | | | | 24,674,828 | |

| Total net assets | | $ | 42,814,317 | | | $ | 52,992,492 | | | $ | 300,328,600 | |

| NET ASSETS CONSIST OF: | | | | | | | | | | | | |

| Capital stock | | $ | 57,655,369 | | | $ | 49,363,153 | | | $ | 332,681,886 | |

| Total distributable earnings | | | (14,841,052 | ) | | | 3,629,337 | | | | (32,353,286 | ) |

| Total net assets | | $ | 42,814,317 | | | $ | 52,992,492 | | | $ | 300,328,600 | |

| Investor Class | | | | | | | | | | | | |

| Net assets | | $ | 13,387,446 | | | $ | 29,437,930 | | | $ | — | |

| Shares outstanding | | | 1,269,880 | | | | 1,959,992 | | | | — | |

| Institutional Class | | | | | | | | | | | | |

| Net assets | | | 29,426,871 | | | | 23,554,562 | | | | 300,328,600 | |

| Shares outstanding | | | 2,778,634 | | | | 1,516,160 | | | | 34,545,948 | |

| Total shares outstanding (unlimited | | | | | | | | | | | | |

| shares of no par value authorized) | | | 4,048,514 | | | | 3,476,152 | | | | 34,545,948 | |

| Investor Class Net asset value, offering | | | | | | | | | | | | |

and redemption price per share(3) | | $ | 10.54 | | | $ | 15.02 | | | $ | — | |

| Institutional Class Net asset value, offering | | | | | | | | | | | | |

and redemption price per share(3) | | $ | 10.59 | | | $ | 15.54 | | | $ | 8.69 | |

| (1) | Cost of Investments | | $ | 38,141,580 | | | $ | 38,081,618 | | | $ | 336,143,616 | |

| (2) | Cost of Foreign Securities | | | | | | | | | | $ | 150,262 | |

(3) | If applicable, redemption price per share may be reduced by a 2.00% redemption fee for shares redeemed within 30 days of purchase. |

See notes to financial statements.

| STATEMENTS OF OPERATIONS |

| For the Six Months Ended March 31, 2023 (Unaudited) |

| | | Intrepid | | | Intrepid | | | Intrepid | |

| | | Capital Fund | | | Small Cap Fund | | | Income Fund | |

| INVESTMENT INCOME: | | | | | | | | | |

| Dividend income | | $ | 240,434 | | | $ | 632,627 | | | $ | 3,723 | |

| Interest income | | | 938,463 | | | | — | | | | 15,087,468 | |

| Total investment income | | | 1,178,897 | | | | 632,627 | | | | 15,091,191 | |

| Advisory fees (See Note 3) | | | 221,206 | | | | 278,245 | | | | 1,120,381 | |

| Administration fees | | | 35,620 | | | | 37,700 | | | | 120,405 | |

| Fund accounting fees | | | 30,929 | | | | 30,561 | | | | 47,115 | |

| Shareholder servicing fees and expenses | | | 26,526 | | | | 30,561 | | | | 52,821 | |

| Audit fees | | | 22,108 | | | | 22,558 | | | | 22,288 | |

| Federal and state registration | | | 20,836 | | | | 18,106 | | | | 19,464 | |

| Legal fees | | | 11,080 | | | | 10,536 | | | | 9,904 | |

| Distribution (12b-1) fees - | | | | | | | | | | | | |

| Investor Class Only (See Note 4) | | | 10,564 | | | | 38,311 | | | | — | |

| Custody fees | | | 4,818 | | | | 3,935 | | | | 10,831 | |

| Trustees fees and expenses | | | 4,360 | | | | 5,722 | | | | 26,602 | |

| Miscellaneous | | | 3,640 | | | | 2,724 | | | | 6,856 | |

| Reports to shareholders | | | 3,192 | | | | 1,910 | | | | 3,850 | |

| Insurance | | | 1,272 | | | | 1,634 | | | | 7,536 | |

| Interest fees | | | 320 | | | | — | | | | 4,966 | |

| Total expenses before Adviser waiver | | | 396,471 | | | | 482,503 | | | | 1,453,019 | |

| Expenses waived by Adviser (See Note 3) | | | (131,200 | ) | | | (139,535 | ) | | | (103,596 | ) |

| Total net expenses | | | 265,271 | | | | 342,968 | | | | 1,349,423 | |

| Net investment income | | | 913,626 | | | | 289,659 | | | | 13,741,768 | |

| NET REALIZED AND UNREALIZED | | | | | | | | | | | | |

| GAIN (LOSS) ON INVESTMENTS: | | | | | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | | | | | |

| Investments and foreign currency translation | | | 197,242 | | | | 14,241 | | | | (4,063,158 | ) |

| Forward currency contracts | | | — | | | | — | | | | (399,400 | ) |

| Net change in unrealized | | | | | | | | | | | | |

| appreciation (depreciation) on: | | | | | | | | | | | | |

| Investments and foreign currency translation | | | 2,700,000 | | | | (17,248,718 | ) | | | 1,189,416 | |

| Forward currency contracts | | | — | | | | (124,502 | ) | | | (491,130 | ) |

| Net realized and unrealized gain (loss) | | | 2,897,242 | | | | (17,358,979 | ) | | | (3,764,267 | ) |

| Net increase in net assets | | | | | | | | | | | | |

| resulting from operations | | $ | 3,810,868 | | | $ | (17,069,320 | ) | | $ | 9,997,496 | |

See notes to financial statements.

| |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Period Ended | | | | |

| | | March 31, 2023 | | | Year Ended | |

| | | (Unaudited) | | | September 30, 2022 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 913,626 | | | $ | 1,179,544 | |

| Net realized gain on investments | | | | | | | | |

| and foreign currency translation | | | 197,242 | | | | 3,552,127 | |

| Net change in unrealized | | | | | | | | |

| appreciation (depreciation) | | | 2,700,000 | | | | (11,339,181 | ) |

| Net increase (decrease) in assets | | | | | | | | |

| resulting from operations | | | 3,810,868 | | | | (6,607,510 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Net dividends and distributions | | | | | | | | |

| to shareholders - Investor Class | | | | | | | | |

| Ordinary Income | | | (281,615 | ) | | | (360,288 | ) |

| Return of Capital | | | — | | | | (36,668 | ) |

| Net dividends and distributions | | | | | | | | |

| to shareholders - Institutional Class | | | | | | | | |

| Ordinary Income | | | (628,922 | ) | | | (708,787 | ) |

| Return of Capital | | | — | | | | (70,119 | ) |

| Total dividends and distributions | | | (910,537 | ) | | | (1,175,862 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Proceeds from shares sold - Investor Class | | | 70,260 | | | | 262,827 | |

| Proceeds from shares sold - Institutional Class | | | 1,554,544 | | | | 2,349,529 | |

| Proceeds from shares issued to holders in | | | | | | | | |

| reinvestment of dividends - Investor Class | | | 263,780 | | | | 372,130 | |

| Proceeds from shares issued to holders in | | | | | | | | |

| reinvestment of dividends - Institutional Class | | | 605,411 | | | | 739,073 | |

Cost of shares redeemed - Investor Class(1) | | | (2,145,825 | ) | | | (3,526,981 | ) |

Cost of shares redeemed - Institutional Class(2) | | | (3,761,092 | ) | | | (4,167,595 | ) |

| Net decrease in net assets | | | | | | | | |