UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2013

Commission File No. 001-34297

ON4 COMMUNICATIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 98-0540536 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

Suite 1707-1188 West Pender Street,

Vancouver, British Columbia, Canada V6E 0A2

(Address of principal executive offices, zip code)

(604) 620-6879

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☐ No☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes☐ No☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes☑ No☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes☑ No☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting Company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ☐ | Accelerated Filer ☐ |

| Non-Accelerated Filer ☐ | Smaller Reporting Company ☑ |

Indicate by check mark whether the registrant is a shell Company (as defined in Rule 12b-2 of the Exchange Act). Yes☐ No☑

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant is $1,450,544.11 based upon the price of $0.6757 at which the common stock was last sold as of the last business day of the most recently completed second fiscal quarter, multiplied by the approximate number of shares of common stock held by persons other than executive officers, directors and five percent stockholders of the registrant without conceding that any such person is an “affiliate” of the registrant for purposes of the federal securities laws. Our common stock is traded in the over-the-counter market and quoted on the Over-The-Counter Bulletin Board under the symbol (“ONCI”).

As of March 13, 2014, there were 2,146,728 issued and outstanding shares of the Company’s common stock, $0.0001 par value.

ON4 COMMUNICATIONS, INC.

TABLE OF CONTENTS

| | | | Page No. |

| | | | |

| | | PART I | |

| | | | |

| Item 1. | | Business | 2 |

| Item 1A. | | Risk Factors | 6 |

| Item 1B. | | Unresolved Staff Comments | 6 |

| Item 2. | | Properties | 7 |

| Item 3. | | Legal Proceedings | 7 |

| Item 4. | | Mine Safety Disclosures | 7 |

| | | | |

| | | PART II | |

| | | | |

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 7 |

| Item 6. | | Selected Financial Data | 9 |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 9 |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | 12 |

| Item 8. | | Financial Statements and Supplementary Data | 13 |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 33 |

| Item 9A. | | Controls and Procedures | 33 |

| Item 9B. | | Other Information | 34 |

| | | | |

| | | PART III | |

| | | | |

| Item 10. | | Directors, Executive Officers and Corporate Governance | 34 |

| Item 11. | | Executive Compensation | 37 |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 39 |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence | 40 |

| Item 14. | �� | Principal Accounting Fees and Services | 40 |

| | | | |

| | | PART IV | |

| | | | |

| Item 15. | | Exhibits and Financial Statement Schedules | 42 |

| | | Signatures | |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| · | The availability and adequacy of our cash flow to meet our requirements; |

| · | Economic, competitive, demographic, business and other conditions in our local and regional markets; |

| · | Changes or developments in laws, regulations or taxes in our industry; |

| · | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; |

| · | Competition in our industry; |

| · | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; |

| · | Changes in our business strategy, capital improvements or development plans; |

| · | The availability of additional capital to support capital improvements and development; and |

| · | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Term

Except as otherwise indicated by the context, references in this report to the “Company”,“ONCI”, “we”, “us” and “our” are references toOn4 Communications, Inc. All references to “USD” or United States Dollars refer to the legal currency of the United States of America.

PART I

General Overview

We were incorporated as a Delaware Company on June 4, 2001 under the name Sound Revolution Inc. On July 2, 2009 we changed our name to On4 Communications, Inc. Our address is 1704-1188 West Pender Street, Vancouver, British Columbia, Canada V6E 0A2. Our telephone number is (604) 620-6879. We have not entered into any bankruptcy, receivership or similar proceeding.

Our common stock is quoted on the Pink Sheets Quotation system under the symbol “ONCI.PK” and on the Berlin Stock Exchange under the symbol O4C:GR.

On June 10, 2008, our company effected a 1 for 42 reverse stock split of the outstanding shares of common stock our company and also increased the number of authorized share capital of our company from 100,000,000 to 110,000,000 shares. 100,000,000 shares out the total authorized capital shall be common stock and 10,000,000 shall be preferred stock. On June 26, 2008, the reverse stock split and the increase in our company’s authorized capital came into effect. As a result of the reverse split, the number of the outstanding shares of common stock of our company was decreased from 10,854,629 shares to 258,444 shares of common stock.

On March 13, 2012, we received written consent from the board of directors and the holders of 52.40% of our company’s voting securities to amend the Articles of Incorporation to increase our authorized capital.

On April 19, 2012, the Delaware Secretary of State accepted for filing of a Certificate of Amendment, wherein, we amended our Articles of Incorporation to increase the authorized number of shares of our common stock from 100,000,000 to 200,000,000 shares of common stock, par value of $0.0001 per share, effective April 20, 2012. Our preferred stock remained unchanged.

On November 1, 2012, our company received written consent from the board of directors and the holders of 78.72% of our company’s voting securities to amend the Articles of Incorporation to increase our authorized capital.

On November 30, 2012, the Delaware Secretary of State accepted for filing of a Certificate of Amendment, wherein, our company amended its Articles of Incorporation to increase the authorized number of shares of our common stock from 210,000,000 to 630,000,000 shares, with a par value of $0.0001, which consists of 600,000,000 shares of common stock and 30,000,000 shares of preferred stock.

On October 11, 2013, the Financial Industry Regulatory Authority (“FINRA”) approved a reverse stock split (the “Reverse Split”) of the common shares of the Company, whereby every four hundred and fifty (450) old shares of the Company’s common stock shall be exchanged for one (1) new share of the Company’s common stock. As a result, the issued and outstanding shares of common stock of the Company decreased from five hundred ninety nine million, six hundred fifty seven thousand, three hundred and forty six (599,657,346) shares prior to the Reverse Split to one million, three hundred thirty two thousand, five hundred seventy two (1,332,572) shares following the Reverse Split. The Reverse Split became effective on October 15, 2013.

Our common stock is quoted on Over-the-Counter Bulletin Board under the symbol “ONCI”.

Corporate History

On March 12, 2009, we entered into a merger agreement with On4 Communications, Inc., a private Arizona company incorporated on June 5, 2006 (“On4”). We subsequently amended this agreement on April 7, 2009, and on May 1, 2009 we completed the merger with On4, with us as the surviving entity. Upon the completion of the merger, we had three wholly-owned subsidiaries: (i) Charity Tunes Inc., a Delaware company incorporated on June 27, 2005 for the purpose of operating a website for the distribution of music online; (ii) Sound Revolution Recordings Inc., a British Columbia, Canada company incorporated on June 20, 2001 for the purpose of carrying on music marketing services in British Columbia; and (iii) PetsMobility Inc., a Delaware company incorporated on March 23, 2006 for the purpose of operating the website www.petsmo.com and related business.

On April 29, 2010, we sold our interest in PetsMobility, excluding certain specific assets, to On4 Communications Inc., a private Canadian company and our shareholder (“On4 Canada”) pursuant to an asset purchase agreement in exchange for On4 Canada returning 2,000,000 shares of our common stock to our treasury for cancellation. On October 29, 2010 we amended the asset purchase agreement to clarify certain terms of the purchase and sale.

On March 16, 2011, we sold our interest in Charity Tunes and Sound Revolution to Empire Success, LLC, a private Nevada limited liability company, in exchange for $15,000 and 6,300 shares of Empire’s common stock. As a result, we currently have no subsidiaries.

On November 3, 2011, we entered into a binding letter of intent (“LOI”) to acquire 100% of the issued and outstanding shares of NetCents Systems Ltd. (“NetCents”), a private Alberta corporation engaged in the development and implementation of a unique and secure electronic payment system for online merchants and consumers. The LOI provides for a period of due diligence which will lead to a formal agreement whereby we will acquire 100% of the issued and outstanding capital of NetCents. Clayton Moore, an officer and director of our Company, and Ryan Madson, an officer of our Company, are shareholders of NetCents and Mr. Moore is the president and director of Net Cents.

On November 4, 2011, Clayton Moore was appointed as a director, president and chief executive officer of our Company, Steven Allmen was appointed a director, Ryan Madson was appointed chief operating officer, Tom Locke was appointed as a director, chief financial officer, secretary and treasurer, and John Kaczmarowski was appointed chief technical officer. Effective July 23, 2012, Tom Locke resigned as chief financial officer, secretary, treasurer and as a director of our Company. His resignation was not the result of any disagreements with our Company regarding its operations, policies, practices or otherwise.

On December 15, 2011, we entered into a share exchange agreement with NetCents and the selling shareholders of NetCents (“Share Exchange Agreement”). Pursuant to the terms of the Share Exchange Agreement, our Company and NetCents agreed to engage in a share exchange which, if completed, would result in NetCents becoming a wholly owned subsidiary of our Company. The share exchange has not been completed as of the date of this Annual Report and is subject to completion of due diligence by the parties, and to the following material terms and conditions:

| | 1. | We will issue 2 shares of our common stock from treasury for every 1 share of NetCents stock issued and outstanding on the date of closing; |

| | 2. | NetCents will have no more than 16,245,421 shares of its common stock issued and outstanding on the closing date of the Share Exchange Agreement. Additional issuances must be authorized by our company; |

| | 3. | NetCents will have delivered to our company audited financial statements for its last two fiscal years and any applicable interim period ended no more than 35 days before the closing of the share exchange agreement, prepared in accordance with United States GAAP and audited by an independent auditor registered with the Public Company Accounting Oversight Board in the United States; and |

| | 4. | NetCents will file all required documentation with the Province of Alberta to effect the share exchange. |

Also on December 15, 2011, NetCents received the approval for the share exchange agreement and the share exchange transaction from holders of approximately 76% of its voting securities through written resolution in lieu of holding a meeting. However, as reported above, as of the date of this annnual report, the share exchange has yet to be completed.

Our Current Business

We are a development stage company, and currently focus on providing wireless communications services to telecommunication companies, consumers and businesses. Our platform comprises global positioning system (“GPS”) device management, location-based services (“LBS”) capabilities, and the broadcasting of proprietary and non-proprietary content. LBS is a term used to describe the delivery of information and entertainment content to consumers with mobile devices based on the geographical position of the mobile device. We intend to deliver LBS via two-way communication tracking devices with applications that are able to track people, pets, assets and inventory. Our solution platform integrates various location-aware devises, such as GPS receivers, and transmits data to a range of devices, including Web browsers, instant messengers, short message service/mail, and mobile phones. However, we anticipate that our business focus will change upon completion of the share exchange with NetCents contemplated by the Share Exchange Agreement.

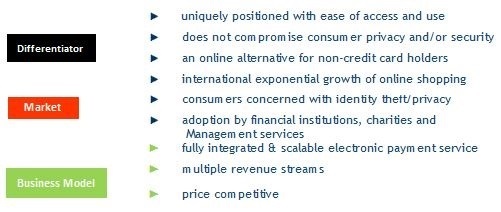

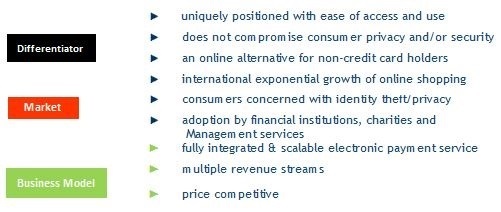

Our Business Upon Consummation of the Share Exchange

Upon the consummation of the acquisition of NetCents contemplated by the Share Exchange Agreement, we anticipate that our business will be that of an enhanced electronic Payment Service Provider (or “PSP”) that offers new, unique features to benefit both merchants and consumers for a better way to buy and sell online. It is anticipated that the Company will be able to provide a seamless, transparent enabling technology adopted by financial institutions to allow their clientele the option of conducting financial transactions on the web in a secure fashion without the use of credit card information. Triggered by a valid email address, the Company will be able to deliver a 100% secure, self-administered and anonymous payment system for the purpose of making safe online purchases and transferring of funds. The Company will be able to enable a simple yet innovative, swift, two-way flow of funds when paying for goods and services over the Internet. The Company will be able to provide the merchant with the means to connect with all consumers whether or not they hold direct access to a credit card. It also allows new entrants under the age of 18 to shop online. This payment option for the consumers and merchants will provide peace-of-mind with no fear of identity theft or credit card fraud.

The Company intends to brand and grow its services quickly by developing the NetCents payment system, which will:

| · | Provide peace-of-mind with no fear of identity theft and/or credit card fraud |

| · | Cater to those who wish to protect personal information |

| · | Offer a way to buy/sell without a credit card due to poor credit ratings and with no risk to the merchant |

| · | Offer new entrants under the age of 18 a way to shop online even without access to credit cards |

| · | Open access to online shopping without attached privacy and security concerns |

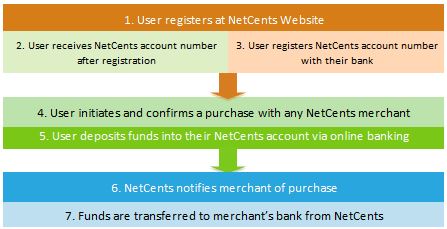

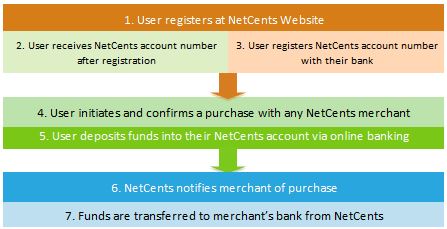

How the NetCents System Works

Note: Once the registration in Steps 1 through 3 is complete, the NetCents User will begin at Step 4 or 5 for all future transactions.

The Market

In 2009, there were over 1.7 billion online Internet users worldwide. The growth of the Internet has far exceeded the growth of any other communications medium in the 20th century. In just under 4 years, the Internet reached penetration rates that took television 13 years to reach and radio over 30 years to reach. For the five-year period from 2009 to 2014, it is estimated that revenues generated by the US online payment market will increase to approximately $248.7 billion, representing a compound annual growth rate of approximately 15%.

The global payment service market has experienced exponential growth. The development of the global online payment market to date has been led by companies in the United States with the global market estimate for generated revenue at approximately $670 billion for 2009. NetCents is well positioned to capture a portion of this global market via its “Secure Payment Service.”

Marketing

The Company’s objectives will be:

| · | To initiate an advertising and promotion strategy to garner awareness and trust of consumers and merchants |

| · | To develop an advertising and promotion strategy consistent with the Company’s vision of being a world leader in providing merchants and consumers a better and secure way to buy and sell online |

| · | To develop marketing materials to be used by the Company in its corporate and public endeavors |

Associations

NetCents has completed integration with the The Royal Bank of Canada. NetCents is currently integrating software with contracted merchants including Swimco, The Alberta Diamond Exchange, Global Storm IT Corporation and the Western Arctic Conservative Association and is also under contract and integrating with the following major charities: the Princess Margaret Hospital Foundation, The Canadian Cancer Society, Mental Health, Canadian National Institute for the Blind, the Sick Kids Foundation, the Heart & Stoke Foundation, Southern Alberta Brain Injuries, The Mustard Seed, Habitat for Humanity and Special Olympics Calgary. Together they account for hundreds of thousands of active customers and donors that would be integrated with the NetCents Payment System for payment and donations.

Competition

Seventy-four percent of online shoppers who have seen or heard of alternative online payment services report having used methods such as:

PayPal laid the groundwork by familiarizing many online consumers, primarily eBay buyers and sellers, with alternative payment methods. Other payment providers soon followed.

NetCents, by providing an alternative that does not involve credit cards, appeals to both consumers and merchants who are concerned with online identity theft. NetCents is also attractive to new customers who are non-credit cardholders.

Competitive Advantages

Key Competitive Advantages of the NetCents System include:

| o | Payment solutions that do not require disclosure of any personal or financial information |

| o | Fast, efficient and viable method of completing online transactions |

| o | Access to a new market segment of online shoppers |

| o | Guaranteed payments to merchants |

| o | Merchant transaction fees structured to be less than those of traditional credit cards |

The following chart provides details describing some of the features of NetCents in comparison to its primary competitor.

| Feature | Description | | PayPal |

| Anonymity | Account set-up without disclosure of financial or personal information. | Yes | No |

| Online Bill Pay | Transfer funds to your account within the secure framework of your chosen financial institution. | Yes | No |

| Availability | Service available to persons of all ages. | Yes | No |

| Guaranteed Payment | Funds transfer to merchant without threat of charge back. | Yes | No |

| Credit Protocol | Service available to consumers without direct access to credit cards. | Yes | No |

| Rewards Program | Initiative to promote customer loyalty. | Yes | No |

| Transaction Fee | Fee charged to merchants per online transaction. | 1.99% | 2.4% - 3.4% |

| Integration | Time required facilitating integration with merchant account. | 1 Hour | 1 Day |

| New Accounts Process | Time required for consumer to open new account. | 60 Seconds | Up to 3 Days |

| Direct Access | PSP has access to consumer credit and bank accounts. | No | Yes |

| Buy Now Buttons | Enable ecommerce on your merchant websites. | Yes | Yes |

| Money-Back Guarantee | Money-Back Guarantee to ensure delivery and protect your purchase. | Yes | Yes |

| Mobile | Transactions over web- enabled mobile phones. | Yes | Yes |

Alternative payment methods are becoming a preferred choice by many consumers shopping online and will continue to grow over the next five years, steadily increasing to one-third of the online retail transaction volume. Upon consummation of the Share Exchange, the Company will be well positioned to play an integral role in the transitioning that is taking place worldwide.

Intellectual Property

The Company does not currently own any intellectual property. All intellectual property associated with the NetCents System is the property of NetCents Systems, Ltd. and shall be owned by the Company upon completion of the Share Exchange.

Subsidiaries

As at the year ended October 31, 2013, we do not have any subsidiaries. However, upon consummation of the Share Exchange Agreement, as anticipated, NetCents Systems, Inc. shall be a wholly owned subsidiary of the Company.

Research and Development Expenditures

We have incurred $Nil in research and development expenditures over the last two fiscal years.

Employees

As of October 31, 2013, our only employees are our directors and officers. We plan to hire additional employees when circumstances warrant.

WHERE YOU CAN GET ADDITIONAL INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy our reports or other filings made with the SEC at the SEC’s Public Reference Room, located at 100 F Street, N.E., Washington, DC 20549. You can obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also access these reports and other filings electronically on the SEC’s web site,www.sec.gov.

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, the Company is not required to provide the information called for by this Item.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

Our principal offices are located at Suite 1704 – 1188 West Pender Street, Vancouver, British Columbia, Canada V6E 0A2. Our office space at this location consists of approximately 600 square feet at the cost of $1,100 per month, which is paid by NetCents. We believe that our office space and facilities are sufficient to meet our present needs and do not anticipate any difficulty securing alternative or additional space, as needed, on terms acceptable to us.

There are no current proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not Applicable.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

Market Information

In the United States, our common shares are quoted on the Over-the-Counter Bulletin Board under the symbol “ONCI.” The following quotations, obtained from OTC Markets, reflect the high and low bids for our common shares based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

| OTC Bulletin Board(1) |

| Quarter Ended | High | Low |

| October 31, 2013 | $0.4955 | $0.0100 |

| July 31, 2013 | $0.9009 | $0.2703 |

| April 30, 2013 | $1.4414 | $0.4505 |

| January 31, 2013 | $5.1802 | $0.6757 |

| October 31, 2012 | $20.2703 | $1.8018 |

| July 31, 2012 | $33.3333 | $4.4595 |

| April 30, 2012 | $36.0360 | $4.9550 |

| January 31, 2012 | $33.7838 | $1.8018 |

(1) Over-the-counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission, and may not represent actual transactions.

Our shares are issued in registered form. Holladay Stock Transfer, Inc., 2939 N 67th Place, Scottsdale, AZ 85251, is the registrar and agent for our common and preferred shares.

Warrants, Options and Other Rights to Acquire Shares

Other than as disclosed below, there are no outstanding warrants or options to purchase our securities.

Record Holders

As of March 13, 2014, we had a total of 82 active registered shareholders and 2,146,728 shares of common stock issued and outstanding. There are no shares of preferred stock issued and outstanding.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

During the year ended October 31, 2013, we issued an aggregate of 1,196,779 shares of our common stock related to the conversion of $251,967 of convertible promissory notes plus accrued interest. These securities were issued pursuant to an exemption from registration requirements relying on Regulation Rule 506 of Regulation D of the Securities Act of 1933.

Subsequent Issuances:

Subsequent to October 31, 2013, the Company issued 681,162 common shares upon the conversion of $3,468 of principal relating to convertible notes payable. These securities were issued pursuant to an exemption from registration requirements relying on Regulation Rule 506 of Regulation D of the Securities Act of 1933.

All securities issued to Asher Enterprises, Inc. were issued in reliance on the exemption from registration contained in Rule 506 of Regulation D of the Securities Act of 1933

We did not sell any other equity securities which were not registered under the Securities Act during the year ended October 31, 2013 that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended October 31, 2013.

Dividends

We have not paid any cash dividends on our common stock since inception and presently anticipate that all earnings, if any, will be retained for development of our business and that no dividends on our common stock will be declared in the foreseeable future. Any future dividends will be subject to the discretion of our Board of Directors and will depend upon, among other things, future earnings, operating and financial condition, capital requirements, general business conditions and other pertinent facts. Therefore, there can be no assurance that any dividends on our common stock will be paid in the future.

Securities Authorized for Issuance Under Equity Compensation Plans

We have no long-term incentive plans, other than the 2006 Non-Qualified Stock Option Plan described below.

2006 Non-Qualified Stock Option Plan

On September 18, 2006, our directors approved the adoption of our 2006 Non-Qualified Stock Option Plan (amended October 10, 2006) which permits our company to grant up to 1,500,000 options to acquire shares of common stock, to directors, officers, employees and consultants of our company.

| Equity Compensation Plan Information |

| Plan category | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights | Weighted-average

exercise price of

outstanding options,

warrants and rights | Number of securities

remaining available for

future issuance under equity

compensation plans

(excluding securities

reflected in column (a)) |

| Equity compensation plans approved by security holders | Nil | Nil | Nil |

| Equity compensation plans not approved by security holders | 1,500,000 | Nil | 1,500,000 |

| Total | 1,500,000 | Nil | 1,500,000 |

| ITEM 6. | SELECTED FINANCIAL DATA |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. You should read this report completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Results of Operations

Years Ended October 31, 2013 and 2012, and the Period from June 5, 2006 (Date of Inception) to October 31, 2013.

Our results of operations are presented below:

| | |

| | | | | | | | | | | Accumulated from | |

| | | | | | | | | | | June 5, 2006 | |

| | | | | Year | | | Year | | | (Date of | |

| | | | | Ended | | | Ended | | | Inception) to | |

| | | | | October 31, | | | October 31, | | | October 31, | |

| | | | | 2013 | | | 2012 | | | 2013 | |

| | | | | ($) | | | ($) | | | ($) | |

| Revenue | | | | | Nil | | | | Nil | | | | Nil | |

| Total Operating Expenses | | | | | 165,886 | | | | 190,531 | | | | 11,732,723 | |

| Total Other Income (Expenses) | | | | | (745,277) | | | | (716,870) | | | | (2,285,933) | |

| Net Loss from continuing operations | | | | | (911,163) | | | | (907,401) | | | | (14,018,656) | |

From our inception on June 5, 2006 to October 31, 2013, we did not generate any revenue.

Expenses

| | |

| | | | | | | | | | | Accumulated from | |

| | | | | | | | | | | June 5, 2006 | |

| | | | | Year | | | Year | | | (Date of | |

| | | | | Ended | | | Ended | | | Inception) to | |

| | | | | October 31, | | | October 31, | | | October 31, | |

| | | | | 2013 | | | 2012 | | | 2013 | |

| | | | | ($) | | | ($) | | | ($) | |

| Advertising and Marketing | | | | | 62,000 | | | | Nil | | | | 244,182 | |

| Amortization of intangible assets | | | | | Nil | | | | Nil | | | | 18,138 | |

| Amortization of property and equipment | | | | | Nil | | | | 241 | | | | 32,677 | |

| Consulting fees | | | | | 5,232 | | | | 52,440 | | | | 2,173,938 | |

| Foreign exchange (gain) loss | | | | | (4,840) | | | | 295 | | | | 249,962 | |

| General and administrative | | | | | 13,661 | | | | 23,676 | | | | 1,127,665 | |

| Impairment of goodwill | | | | | Nil | | | | Nil | | | | 3,274,109 | |

| Impairment of assets | | | | | Nil | | | | 885 | | | | 2,220,609 | |

| Management fees | | | | | 19,638 | | | | 44,175 | | | | 1,226,409 | |

| Payroll | | | | | Nil | | | | Nil | | | | 29,516 | |

| Professional fees | | | | | 70,195 | | | | 68,819 | | | | 817,158 | |

| Research and development | | | | | Nil | | | | Nil | | | | 318,360 | |

Our total operating expenses during the year ended October 31, 2013 were $165,886 which consisted of $62,000 in advertising and marketing, $4,840 in foreign exchange gain, $13,661 in general and administrative expenses, $5,232 in consulting fees, $19,638 in management fees and $70,195 in professional fees. During this period, we also incurred $263,786 in accretion of discounts on convertible notes payable, $9,599 in amortization of deferred financing costs, $173,399 in interest expenses and $298,493 in loss on change in fair value of derivative liabilities.

Our total operating expenses during the year ended October 31, 2012 were $190,531 which consisted of $241 in amortization of property and equipment, $52,440 in consulting fees, $295 in foreign exchange gain, $23,676 in general and administrative expenses, $885 in impairment of assets, $44,175 in management fees and $68,819 in professional fees. During this period, we also incurred $145,176 in the form of interest expense, $163,115 of accretion of discounts on convertible notes payable, $10,123 of amortization of deferred financing costs, and $398,456 of loss due to the change in fair value of derivative liabilities.

Our total operating expenses from our inception on June 5, 2006 to October 31, 2013 were $11,732,723 which consisted of $244,182 in advertising and marketing expenses, $18,138 in amortization of intangible assets, $32,677 in amortization of property and equipment, $2,173,938 in consulting fees, $249,962 in foreign exchange loss, $1,127,665 in general and administrative expenses, $3,274,109 in impairment of goodwill, $2,220,609 in impairment of assets, $1,226,409 in management fees, $29,516 in payroll expenses, $817,158 in professional fees and $318,360 in research and development expenses.

Our general and administrative expenses consisted of travel, meals and entertainment, office maintenance, communication expenses (cellular, internet, fax and telephone), office supplies and courier and postage costs. Our professional fees consisted of legal, accounting and auditing fees.

The decrease in our operating expenses during the year ended October 31, 2013 compared to the same period in 2012 was primarily due to decreases in general and administrative expenses, Consulting fees, management fees, and impairment of assets during the most recent period.

During the year ended October 31, 2013, we incurred a $165,886 operating loss, and a net loss of $911,163. During the year ended October 31, 2012 we incurred an operating loss of $190,531 and a net loss of $907,401. We experienced a net loss per share of $1.27 during the year ended October 31, 2013 and $5.64 per share during the year ended October 31, 2012. From our inception on June 5, 2006 to October 31, 2013 we incurred a total of $11,732,723 in operating loss, incurred a $1,205,782 loss from discontinued operations, and incurred a net loss $15,224,438.

Liquidity and Capital Resources

Working Capital

| | | | | | | | | |

| | | | At | | | | At | |

| | | | October 31, | | | | October, 31 | |

| | | | 2013 | | | | 2012 | |

| | | | ($) | | | | ($) | |

| Total Current Assets | | | 121,090 | | | | 78,572 | |

| Total Current Liabilities | | | 1,977,748 | | | | 1,817,242 | |

| Working Capital/(Deficit) | | | (1,856,658) | | | | (1,738,670 | ) |

| | | | | | | | | | | |

Cash Flows

| | | | | | | | | Period from | |

| | | Year | | | Year | | | Inception | |

| | | Ended | | | Ended | | | (June 5, 2006) | |

| | | October 31, | | | October 31, | | | to October 31, | |

| | | 2013 | | | 2012 | | | 2013 | |

| | | ($) | | | ($) | | | ($) | |

| Net Cash used in Operating Activities | | | (103,454 | ) | | | (119,790 | ) | | | (2,899,578 | ) |

| Net Cash used in Investing Activities | | | (42,888 | ) | | | (78,202 | ) | | | (1,434,289 | ) |

| Net Cash provided by Financing Activities | | | 147,022 | | | | 198,500 | | | | 4,281,716 | |

| Net Increase (Decrease) in Cash During Period | | | (370 | ) | | | 370 | | | | Nil | |

As of October 31, 2013, we had $Nil in cash, $121,868 in total assets, $1,977,748 in total liabilities and a working capital deficit of $1,856,658. As of October 31, 2012, we had working capital deficit of $1,738,670.

During the year ended October 31, 2013, we spent $103,454 on operating activities, compared to spending of $119,790 on operating activities during the same period in fiscal 2012. The decrease in our expenditures on operating activities during the year ended October 31, 2013 was largely due to decreases in stock based compensation and amounts due to related parties. From our inception on June 5, 2006 to October 31, 2013, we spent $2,899,578 on operating activities.

During the year ended October 31, 2013, we spent $42,888 on investing activities, whereas we spent $78,202 on investing activities during the same period in fiscal 2012. From our inception on June 5, 2006 to October 31, 2013, we spent $1,434,289 on investing activities, the bulk of which was in the form of advances for notes receivable of $1,114,182, loan receivables of $121,090 and the acquisition of intangible assets of $182,687.

During the year ended October 31, 2013, we received $147,022 from financing activities, of which $152,500 was in the form of proceeds from notes payable offset by $6,500 in payment of deferred financing costs, whereas we received $198,500 from financing activities during the same period in fiscal 2012 related primarily to proceeds from the issuance of convertible notes payable. From our inception on June 5, 2006 to October 31, 2013, we received $4,281,716 from financing activities, primarily in the form of proceeds from the issuance of our common stock and preferred stock and proceeds from notes payable and convertible notes payable.

For the next 12 months (beginning October 2013), we estimate our planned expenses to be approximately $1,400,000, as summarized in the table below:

| Description | | Potential | | | Estimated | |

| | | Completion | | | Expenses | |

| | | Date | | | ($) | |

| General and administrative expenses | | | 12 months | | | | 250,000 | |

| Professional fees | | | 12 months | | | | 150,000 | |

| Unallocated working capital | | | 12 months | | | | 100,000 | |

| Debt repayment | | | 12 months | | | | 900,000 | |

| Total | | | | | | | 1,400,000 | |

Based on our planned expenditures, we require additional funds of approximately $1,400,000 to proceed with our business plan over the next 12 months (beginning October 2013). If we are not able to obtain additional financing on a timely basis, we will be unable to conduct our operations as planned, and we will not be able to meet our obligations as they become due. In such event, we will be forced to scale down or perhaps even cease our operations.

Future Financings

We have not generated significant revenues since inception and are unlikely to generate significant revenues or earnings in the immediate or foreseeable future. We rely upon the sale of our securities and proceeds from related parties to fund our operations. We anticipate that we will incur substantial losses for the foreseeable future, and we are dependent upon obtaining outside financing to carry out our operations.

We will require approximately $1,400,000 over the next 12 months (beginning October 2013) to enable us to proceed with our plan of operations, including paying our ongoing expenses. These cash requirements are in excess of our current cash and working capital resources. Accordingly, we intend to raise funds from private placements, loans or possibly a registered public offering (either self-underwritten or through a broker-dealer). At this time we do not have a commitment from any broker-dealer to provide us with financing, and there is no guarantee that any financing will be available to us or if available, on terms that will be acceptable to us.

If we are unable to obtain the necessary additional financing, then we plan to reduce the amounts that we spend on our operations, our professional fees and our general and administrative expenses so as not to exceed the amount of capital resources that are available to us. If we do not secure additional financing our current cash reserves and working capital will be not be sufficient to enable us to sustain our operations for the next 12 months, even if we do decide to scale them down.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive activities. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Contractual Obligations

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Inflation

The amounts presented in our financial statements do not provide for the effect of inflation on our operations or financial position. The net operating losses shown would be greater than reported if the effects of inflation were reflected either by charging operations with amounts that represent replacement costs or by using other inflation adjustments.

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete summary of these policies is included in Note 2 of the notes to our financial statements for the three and twelve months ended October 31, 2013. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

Comprehensive Loss

ASC 220, “Comprehensive Income” establishes standards for the reporting and display of comprehensive income and its components in the financial statements. As at October 31, 2013 and 2012, our company had no items that represent comprehensive income or loss.

Recently Issued Accounting Pronouncements

Our company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY |

Financial Statements

Years Ended October 31, 2013 and 2012

(Expressed in US dollars)

| | |

| |

| | |

| | Index |

| Report of Independent Registered Public Accounting Firm | 19 |

| Balance Sheets | 20 |

| Statements Of Operations | 21 |

| Statement Of Stockholders' Equity (Deficit) | 22 |

| Statements Of Cash Flow | 25 |

| Notes to the Financial Statements | 26 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

On4 Communications Inc.

(A Development Stage Company)

We have audited the accompanying balance sheets of On4 Communications Inc. (A Development Stage Company) (the “Company”) as of October 31, 2013 and 2012, and the related statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended and accumulated from June 5, 2006 (date of inception) to October 31, 2013. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. An audit includes consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the Company as of October 31, 2013 and 2012, and the results of its operations and its cash flows for the years then ended and accumulated from June 5, 2006 (date of inception) to October 31, 2013, in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has not generated significant revenue, has a working capital deficit, and has incurred operating losses since inception. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 1 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ SATURNA GROUP CHARTERED ACCOUNTANTS LLP

Vancouver, Canada

March 17, 2014

ON4 COMMUNICATIONS, INC.

(A Development Stage Company)

Balance Sheets

(Expressed in US Dollars)

| | October 31, | October 31, |

| | 2013 | 2012 |

| | $ | $ |

| | | |

| ASSETS | | |

| | | |

| Current Assets | | |

| | | |

| Cash | – | 370 |

| Loan receivable (Note 3) | 121,090 | 78,202 |

| | | |

| Total Current Assets | 121,090 | 78,572 |

| | | |

| Deferred financing costs | 778 | 3,877 |

| | | |

| Total Assets | 121,868 | 82,449 |

| | | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | | |

| | | |

| Current Liabilities | | |

| | | |

| Bank indebtedness | 1,022 | – |

| Accounts payable and accrued liabilities (Note 5) | 1,378,983 | 1,214,181 |

| Due to related parties (Note 4) | 4,858 | 2,329 |

| Notes payable (Note 6) | 390,320 | 431,370 |

| Convertible notes payable, net of unamortized discount of $38,099 and $44,385, respectively (Note 7) | 80,933 | 65,615 |

| Derivative liabilities (Note 8) | 121,632 | 103,747 |

| | | |

| Total Liabilities | 1,977,748 | 1,817,242 |

| | | |

| Nature of Operations and Continuance of Business (Note 1) | | |

| Commitments (Note 13) | | |

| Subsequent Event (Note 15) | | |

| | | |

| Stockholders’ Deficit | | |

| | | |

Preferred stock: 30,000,000 shares authorized, non-voting, no par value; No shares issued and outstanding | – | – |

| | | |

Common stock: 600,000,000 shares authorized, $0.0001 par value; 1,465,566 shares issued and outstanding (2012 – 268,755) | 147 | 27 |

| | | |

| Additional paid-in capital | 13,381,883 | 12,591,927 |

| | | |

| Common stock issuable | 70,000 | 70,000 |

| | | |

| Deficit accumulated during the development stage | (15,307,910) | (14,396,747) |

| | | |

| Total Stockholders’ Deficit | (1,855,880) | (1,734,793) |

| | | |

| Total Liabilities and Stockholders’ Deficit | 121,868 | 82,449 |

| | | |

(The accompanying notes are an integral part of these financial statements) |

ON4 COMMUNICATIONS INC.

(A Development Stage Company)

Statements of Operations

(Expressed in US Dollars)

| | Year Ended | Year Ended | Accumulated From June 5, 2006 (Date of Inception) |

| | October 31, | October 31, | to October 31, |

| | 2013 | 2012 | 2013 |

| | $ | $ | $ |

| Revenue | – | – | – |

| | | | |

| Operating Expenses | | | |

| | | | |

| Advertising and marketing | 62,000 | – | 244,182 |

| Amortization of intangible assets | – | – | 18,138 |

| Amortization of property and equipment | – | 241 | 32,677 |

| Consulting fees | 5,232 | 52,440 | 2,173,938 |

| Foreign exchange loss (gain) | (4,840) | 295 | 249,962 |

| General and administrative | 13,661 | 23,676 | 1,127,665 |

| Impairment of goodwill | – | – | 3,274,109 |

| Impairment of assets | – | 885 | 2,220,609 |

| Management fees (Note 4) | 19,638 | 44,175 | 1,226,409 |

| Payroll | – | – | 29,516 |

| Professional fees | 70,195 | 68,819 | 817,158 |

| Research and development | – | – | 318,360 |

| | | | |

| Total Operating Expenses | 165,886 | 190,531 | 11,732,723 |

| | | | |

| Operating Loss | (165,886) | (190,531) | (11,732,723) |

| | | | |

| Other Income (Expense) | | | |

| | | | |

| Accretion of discounts on convertible notes payable (Note 7) | (263,786) | (163,115) | (501,901) |

| Amortization of deferred financing costs | (9,599) | (10,123) | (19,722) |

| Gain on settlement of debt | – | – | 807,352 |

| Interest and other income | – | – | 181,682 |

| Interest expense | (173,399) | (145,176) | (942,213) |

| Loss on change in fair value of derivative liabilities (Note 8) | (298,493) | (398,456) | (696,949) |

| Write-off of note receivable | – | – | (1,114,182) |

| | | | |

| Total Other Income (Expense) | (745,277) | (716,870) | (2,285,933) |

| | | | |

| Loss from Continuing Operations | (911,163) | (907,401) | (14,018,656) |

| | | | |

| Discontinued Operations | | | |

| | | | |

| Loss from discontinued operations | – | – | (1,282,616) |

| Gain on disposal of discontinued operations | – | – | 76,834 |

| | | | |

| Loss from Discontinued Operations | – | – | (1,205,782) |

| | | | |

| Net Loss | (911,163) | (907,401) | (15,224,438) |

| | | | |

| Net Loss Per Share – Basic and Diluted | (1.27) | (5.64) | |

| | | | |

| Weighted Average Shares Outstanding | 717,000 | 161,000 | |

| | | | |

| (The accompanying notes are an integral part of these financial statements) |

ON4 COMMUNICATIONS INC.

(A Development Stage Company)

Statements of Stockholders’ Equity (Deficit)

For the Period from June 5, 2006 (Date of Inception) to October 31, 2013

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | Preferred Stock | | Common Stock | Additional Paid-in | Share Subscriptions | Deficit Accumulated During the Development | |

| | Shares | Amount | | Shares | Amount | Capital | Receivable | Stage | Total |

| | # | $ | | # | $ | $ | $ | $ | $ |

| | | | | | | | | | |

| Balance, June 5, 2006 (Date of Inception) | – | – | | – | – | – | – | – | – |

| | | | | | | | | | |

| Issuance of common stock for cash at $0.0001 per share | – | – | | 22,222 | 2 | 998 | (1,000) | – | – |

| | | | | | | | | | |

| Issuance of common stock for cash at $0.07 per share | – | – | | 22,222 | 1,556 | 698,444 | (25,000) | – | 675,000 |

| | | | | | | | | | |

| Net loss for the period | | | | – | – | – | – | (282,206) | (282,206) |

| | | | | | | | | | |

| Balance, October 31, 2006 | – | – | | 44,444 | 1,558 | 699,442 | (26,000) | (282,206) | 392,794 |

| | | | | | | | | | |

| Issuance of 4,444 Series A Preferred Shares at $0.50 per share | 4,444 | 2,222 | | – | – | 997,778 | – | – | 1,000,000 |

| | | | | | | | | | |

| Stock subscriptions received | – | – | | – | – | – | 25,120 | – | 25,120 |

| | | | | | | | | | |

| Issuance of common stock at $0.50 per share | – | – | | 1,111 | 555 | 249,445 | – | – | 250,000 |

| | | | | | | | | | |

| Issuance of common stock to subsidiary | – | – | | 1 | – | – | – | – | – |

| | | | | | | | | | |

| Fair value of share purchase warrants issued | – | – | | – | – | 497,980 | – | – | 497,980 |

| | | | | | | | | | |

| Fair value of stock options granted | – | – | | – | – | 108,710 | – | – | 108,710 |

| | | | | | | | | | |

| Cumulative preferred dividends | – | – | | – | – | – | – | (48,472) | (48,472) |

| | | | | | | | | | |

| Net loss for the year | | | | – | – | – | – | (2,183,150) | (2,183,150) |

| | | | | | | | | | |

| Balance, October 31, 2007 | 4,444 | 2,222 | | 45,556 | 2,113 | 2,553,355 | (880) | (2,513,828) | 42,982 |

| | | | | | | | | | |

| Issuance of common stock at $0.50 per share | – | – | | 6,713 | 3,369 | 1,512,631 | – | – | 1,516,000 |

| | | | | | | | | | |

| Stock subscriptions received | – | – | | – | – | – | 880 | – | 880 |

| | | | | | | | | | |

| Share issuance costs | – | – | | – | (173) | (77,842) | – | – | (78,015) |

| | | | | | | | | | |

| Fair value of share purchase warrants issued | – | – | | – | – | 29,350 | – | – | 29,350 |

| | | | | | | | | | |

| Fair value of stock options granted | – | – | | – | – | 102,960 | – | – | 102,960 |

| | | | | | | | | | |

| Cumulative preferred dividends | – | – | | – | – | – | – | (35,000) | (35,000) |

| | | | | | | | | | |

| Net loss for the year | – | – | | – | – | – | – | (3,115,418) | (3,115,418) |

| | | | | | | | | | |

| Balance, October 31, 2008 | 4,444 | 2,222 | | 52,269 | 5,309 | 4,120,454 | – | (5,664,246) | (1,536,261) |

| | | | | | | | | | |

| (The accompanying notes are an integral part of these financial statements) |

ON4 COMMUNICATIONS INC.

(A Development Stage Company)

Statements of Stockholders’ Equity (Deficit) Continued

For the Period from June 5, 2006 (Date of Inception) to October 31, 2013

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | Preferred Stock | | Common Stock | Additional Paid-in | Common Stock | Deficit Accumulated During the Development | |

| | Shares | Amount | | Shares | Amount | Capital | Issuable | Stage | Total |

| | # | $ | | # | $ | $ | $ | $ | $ |

| | | | | | | | | | |

| Balance, October 31, 2008 | 4,444 | 2,222 | | 52,269 | 5,309 | 4,120,454 | – | (5,664,246) | (1,536,261) |

| | | | | | | | | | |

| Issuance of common stock for services at $0.50 per share | – | – | | 222 | 111 | 49,889 | – | – | 50,000 |

| | | | | | | | | | |

| Stock-based compensation | – | – | | – | – | 94,539 | – | – | 94,539 |

| | | | | | | | | | |

| Common shares issued upon conversion of preferred stock | (4,444) | (2,222) | | 8,889 | 2,222 | – | – | – | – |

| | | | | | | | | | |

| Common shares issued upon conversion of preferred dividend payable | – | – | | 742 | 185 | 83,287 | – | – | 83,472 |

| | | | | | | | | | |

| Balance, May 1, 2009 before recapitalization | – | – | | 62,122 | 7,827 | 4,348,169 | – | (5,664,246) | (1,308,250) |

| | | | | | | | | | |

| May 1, 2009 Recapitalization Transactions | | | | | | | | | |

| | | | | | | | | | |

| Shares acquired by legal parent | – | – | | (62,122) | – | – | – | – | – |

| | | | | | | | | | |

| Shares of Sound Revolution Inc. | – | – | | 151,685 | – | – | – | – | – |

| | | | | | | | | | |

| Shares issued to shareholders of On4 Communications Inc. | – | – | | 62,122 | 5 | 2,661,684 | – | – | 2,661,689 |

| | | | | | | | | | |

| To record par value adjustment | – | – | | – | (7,812) | 7,812 | – | – | – |

| | | | | | | | | | |

| Stock subscriptions received | – | – | | 1,470 | 1 | 132,281 | – | – | 132,282 |

| | | | | | | | | | |

| Share issuance costs | – | – | | – | – | (8,000) | – | – | (8,000) |

| | | | | | | | | | |

| Issuance of common stock for acquisition | – | – | | 6,667 | 1 | 2,129,999 | – | – | 2,130,000 |

| | | | | | | | | | |

| Common stock issuable for services | – | – | | – | – | – | 70,000 | – | 70,000 |

| | | | | | | | | | |

| Net loss for the year | – | – | | – | – | – | – | (5,420,719) | (5,420,719) |

| | | | | | | | | | |

| Balance, October 31, 2009 | – | – | | 221,944 | 22 | 9,271,945 | 70,000 | (11,084,965) | (1,742,998) |

| | | | | | | | | | |

| Beneficial conversion feature | – | – | | – | – | 75,000 | – | – | 75,000 |

| | | | | | | | | | |

| Shares issued upon conversion of notes | – | – | | 7,557 | 1 | 170,023 | – | – | 170,024 |

| | | | | | | | | | |

| Shares issued upon settlement of related party debt | – | – | | 33,224 | 3 | 1,645,159 | – | – | 1,645,162 |

| | | | | | | | | | |

| Cancellation of shares | – | – | | (120,497) | (12) | 12 | – | – | – |

| | | | | | | | | | |

| Shares issued for services | – | – | | 5,778 | 1 | 407,999 | – | – | 408,000 |

| | | | | | | | | | |

| Fair value of stock options granted | – | – | | – | – | 307,133 | – | – | 307,133 |

| | | | | | | | | | |

| Net loss for the year | – | – | | – | – | – | – | (2,408,836) | (2,408,836) |

| | | | | | | | | | |

| Balance, October 31, 2010 | – | – | | 148,006 | 15 | 11,877,271 | 70,000 | (13,493,801) | (1,546,515) |

| | | | | | | | | | |

| Stock-based compensation | – | – | | – | – | (3,691) | – | – | (3,691) |

| | | | | | | | | | |

| Net income for the year | – | – | | – | – | – | – | 4,455 | 4,455 |

| | | | | | | | | | |

| Balance, October 31, 2011 | – | – | | 148,006 | 15 | 11,873,580 | 70,000 | (13,489,346) | (1,545,751) |

| | | | | | | | | | | |

| (The accompanying notes are an integral part of these financial statements) |

ON4 COMMUNICATIONS INC.

(A Development Stage Company)

Statements of Stockholders’ Equity (Deficit) Continued

For the Period from June 5, 2006 (Date of Inception) to October 31, 2013

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | Preferred Stock | | Common Stock | Additional Paid-in | Common Stock | Deficit Accumulated During the Development | |

| | Shares | Amount | | Shares | Amount | Capital | Issuable | Stage | Total |

| | # | $ | | # | $ | $ | $ | $ | $ |

| | | | | | | | | | |

| Balance, October 31, 2011 | – | – | | 148,006 | 15 | 11,873,580 | 70,000 | (13,489,346) | (1,545,751) |

| | | | | | | | | | |

| Shares issued for services | – | – | | 3,333 | 1 | 48,749 | – | – | 48,750 |

| | | | | | | | | | |

| Shares issued upon conversion of notes payable | – | – | | 117,416 | 11 | 167,389 | – | – | 167,400 |

| | | | | | | | | | |

| Derivative liabilities relating to notes payable converted to shares | – | – | | – | – | 502,209 | – | – | 502,209 |

| | | | | | | | | | |

| Net loss for the year | – | – | | – | – | – | – | (907,401) | (907,401) |

| | | | | | | | | | |

| Balance, October 31, 2012 | – | – | | 268,755 | 27 | 12,591,927 | 70,000 | (14,396,747) | (1,734,793) |

| | | | | | | | | | |

| Shares issued upon conversion of notes payable | – | – | | 1,196,779 | 120 | 251,847 | – | – | 251,967 |

| | | | | | | | | | |

| Derivative liabilities relating to notes payable converted to shares | – | – | | – | – | 538,109 | – | – | 538,109 |

| | | | | | | | | | |

| Rounding for reverse stock split | – | – | | 32 | – | – | – | – | – |

| | | | | | | | | | |

| Net loss for the year | – | – | | – | – | – | – | (911,163) | (911,163) |

| | | | | | | | | | |

| Balance, October 31, 2013 | – | – | | 1,465,566 | 147 | 13,381,883 | 70,000 | (15,307,910) | (1,855,880) |

| | | | | | | | | | | |

| (The accompanying notes are an integral part of these financial statements) |

ON4 COMMUNICATIONS INC.

(A Development Stage Company)

Statements of Cash Flows

(Expressed in US Dollars)

| | | |

| Year Ended October 31, 2013 $ | Year Ended October 31, 2012 $ | Accumulated From June 5, 2006 (Date of inception) to October 31, 2013 $ |

| | | | |

| Operating Activities | | | |

| Net loss from continuing operations | (911,163) | (907,401) | (14,018,656) |

| | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Accretion of discounts on convertible notes payable | 263,786 | 163,115 | 501,901 |

| Amortization of property and equipment | – | 241 | 32,677 |

| Amortization of intangible assets | – | – | 18,138 |

| Amortization of deferred financing costs | 9,599 | 10,123 | 19,722 |

| Gain on settlement of debt | – | – | (807,352) |

| Impairment of goodwill | – | – | 3,274,109 |

| Impairment of assets | – | 885 | 2,220,609 |

| Issuance of notes payable for services and penalties | 62,000 | – | 152,402 |

| Issuance of shares for services | – | – | 576,750 |

| Loss on change in fair value of derivative liabilities | 298,493 | 48,750 | 696,949 |

| Stock-based compensation | – | 398,456 | 1,136,981 |

| Write-off of notes receivable | – | – | 1,114,182 |

| | | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | – | – | (5,431) |

| Prepaid expenses and deposits | – | – | (10,678) |

| Accounts payable and accrued liabilities | 171,302 | 132,512 | 1,560,721 |

| Due to related parties | 2,529 | 33,529 | 637,398 |

| | | | |

| Net Cash Used In Operating Activities | (103,454) | (119,790) | (2,899,578) |

| | | | |

| Investing Activities | | | |

| Acquisition of intangible assets | – | – | (182,687) |

| Cash acquired in reverse merger | – | – | 1,523 |

| Cash from disposition of subsidiary | – | – | 15,709 |

| Loan receivable | (42,888) | (78,202) | (121,090) |

| Acquisition of property and equipment | – | – | (33,562) |

| Advances for note receivable | – | – | (1,114,182) |

| | | | |

| Net Cash Used In Investing Activities | (42,888) | (78,202) | (1,434,289) |

| | | | |

| Financing Activities | | | |

| Bank indebtedness | 1,022 | – | 1,022 |

| Proceeds from issuance of common stock | – | – | 1,821,267 |

| Proceeds from issuance of preferred stock | – | – | 1,000,000 |

| Proceeds from notes payable and convertible notes payable | 152,500 | 212,500 | 1,092,022 |

| Repayment of notes payable | – | – | (81,250) |

| Payment of deferred financing costs | (6,500) | (14,000) | (20,500) |

| Proceeds from related parties | – | – | 561,935 |

| Repayments to related parties | – | – | (84,780) |

| Share issuance costs | – | – | (8,000) |

| | | | |

| Net Cash Provided By Financing Activities | 147,022 | 198,500 | 4,281,716 |

| | | | |

| Effects of Exchange Rate Changes on Cash | (1,050) | (138) | 53,674 |

| | | | |

| Discontinued Operations: | | | |

| | | | |

| Operating activities | – | – | (119,701) |

| Investing activities | – | – | (661,509) |

| Financing activities | – | – | 779,687 |

| | | | |

| Net Cash Used in Discontinued Operations | – | – | (1,523) |

| | | | |

| Increase (Decrease) in Cash | (370) | 370 | – |

| | | | |

| Cash - Beginning of Period | 370 | – | – |

| | | | |

| Cash - End of Period | – | 370 | – |

| | | | |

| Supplemental Disclosures (Note 12) | | | |

| | | | |

| (The accompanying notes are an integral part of these financial statements) |

ON4 COMMUNICATIONS INC.

(A Development Stage Company)

Notes to the Financial Statements

October 31, 2013

(Expressed in US dollars)

| 1. | Nature of Operations and Continuance of Business |

Sound Revolution Inc. (the "Company"), was incorporated on June 4, 2001 under the laws of the State of Delaware and on October 2, 2009 changed its name to On4 Communications, Inc. On May 1, 2009, the Company merged with On4 Communications, Inc. (“On4”), an Arizona corporation incorporated on June 5, 2006. Pursuant to the terms of the merger agreement, the Company acquired all assets and liabilities of On4 by issuing new shares to all former shareholders of On4 on a 1-to-1 basis. The Company issued 62,122 common shares to the former shareholders of On4 and the merger was accounted for as a “reverse merger” using the purchase method of accounting, with the former shareholders of On4 controlling 68% of the issued and outstanding common shares of the Company after the closing of the transaction. Accordingly, On4 was deemed to be the acquirer for accounting purposes and the financial statements are presented as a continuation of On4 and include the results of operations of On4 since incorporation on June 5, 2006, and the results of operations of the Company since the date of acquisition on May 1, 2009. Refer to Note 13(b) for details of the share exchange agreement with NetCents Systems Ltd. (“NetCents”). On May 3, 2012, the Company’s shareholders approved a name change to NetCents Systems International Ltd., however, this has not been declared effective as of the date of issuance of these financial statements.

On4 is in the business of manufacturing two-way communication and location devices with applications that include tracking people, pets, assets, and inventory, among others.. The Company is a Development Stage Company, as defined byFinancial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 915,Development Stage Entities, and has not yet generated significant revenues from their intended business activities.

Going Concern

These financial statements have been prepared on a going concern basis, which implies that the Companywill continue to realize its assets and discharge its liabilities in the normal course of business. The Company has not generated significant revenues since inception and is unlikely to generate significant revenue or earnings in the immediate or foreseeable future. As at October 31, 2013, the Company has not generated any revenues since inception, has a working capital deficiency of $1,856,658, and has an accumulateddeficit of $15,307,910since inception.The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations,and the attainment of profitable operations.These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The Company will need additional working capital to continue or to be successful in any future business activities. Therefore, continuation of the Company as a going concern is dependent upon obtaining the additional working capital necessary to accomplish its objective. Management plans to seek debt or equity financing, or a combination of both, to raise the necessary working capital.

| 2. | Summary of Significant Accounting Principles |

Basis of Presentation

These financial statements are prepared in conformity with accounting principles generally accepted in the United States and are presented in US dollars, unless otherwise noted. The Company’s fiscal year end is October 31.

ON4 COMMUNICATIONS INC.

(A Development Stage Company)

Notes to the Financial Statements

October 31, 2013

(Expressed in US dollars)

| 1. | Summary of Significant Accounting Principles (continued) |

Use of Estimates

The preparation of financial statements in conformity with US generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the useful life and recoverability of long-lived assets, fair value of convertible notes payable, stock-based compensation, derivative liabilities, and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Cash and Cash Equivalents

The Company considers all highly liquid instruments with maturity dates of three months or less at the time of issuance to be cash equivalents.

Property and Equipment

Property and equipment consists of office equipment, is stated at cost and is amortized using the straight-line method over the estimated lives of the related assets of five years.

Impairment of Long-Lived Assets

In accordance with ASC 360,Property, Plant, and Equipment, the Company tests long-lived assets or asset groups for recoverability when events or changes in circumstances indicate that their carrying amount may not be recoverable. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life. Recoverability is assessed based on the carrying amount of the asset and its fair value which is generally determined based on the sum of the undiscounted cash flows expected to result from the use and the eventual disposal of the asset, as well as specific appraisal in certain instances. An impairment loss is recognized when the carrying amount is not recoverable and exceeds fair value.

Research and Development Expenses

Research and development costs are expensed as incurred.

Stock-based Compensation

The Company records stock-based compensation in accordance with ASC 718,Compensation – Stock Based Compensationand ASC 505-50 -Equity-Based Payments to Non-Employees. All transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

Reclassification

Certain financial statement items have been reclassified from the prior year in order to conform to presentation standards for the current year.

ON4 COMMUNICATIONS INC.

(A Development Stage Company)

Notes to the Financial Statements

October 31, 2013

(Expressed in US dollars)

| 2. | Summary of Significant Accounting Principles (continued) |

Loss Per Share

The Company computes net loss per share in accordance with ASC 260,Earnings per Share,which requires presentation of both basic and diluted earnings per share (EPS) on the face of the statements of operations. Basic EPS is computed by dividing net loss available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive.

Foreign Currency Translation

The Company’s functional currency and its reporting currency is the United States dollar and foreign currency transactions are primarily undertaken in Canadian dollars. Monetary balance sheet items expressed in foreign currencies are translated into US dollars at the exchange rates in effect at the balance sheet date. Non-monetary assets and liabilities are translated at historical rates. Revenues and expenses are translated at average rates for the period, except for amortization, which is translated on the same basis as the related asset. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income.

Comprehensive Income/Loss

ASC 220,Comprehensive Income, establishes standards for the reporting and display of comprehensive loss and its components in the financial statements. As at October 31, 2013 and 2012, the Company had no items representing comprehensive income or loss.

Income Taxes

The Company accounts for income taxes using the asset and liability method in accordance with ASC 740, Accounting for Income Taxes. The asset and liability method provides that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities, and for operating loss and tax credit carry-forwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized.