UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

| |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x | Definitive Proxy Statement |

| |

¨ | Definitive Additional Materials |

| |

¨ | Soliciting Material under § 240.14a-12 |

DEMANDWARE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | |

x | No fee required. |

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| |

o | Fee paid previously with preliminary materials. |

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

DEMANDWARE, INC.

5 Wall Street

Burlington, Massachusetts 01803 USA

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 18, 2016

The 2016 Annual Meeting of Stockholders of Demandware, Inc. will be held on Wednesday, May 18, 2016 at 10:00 a.m., eastern time, at the offices of Demandware, Inc., 5 Wall Street, Burlington, Massachusetts 01803 USA. At the Annual Meeting, stockholders will consider and act upon the following matters:

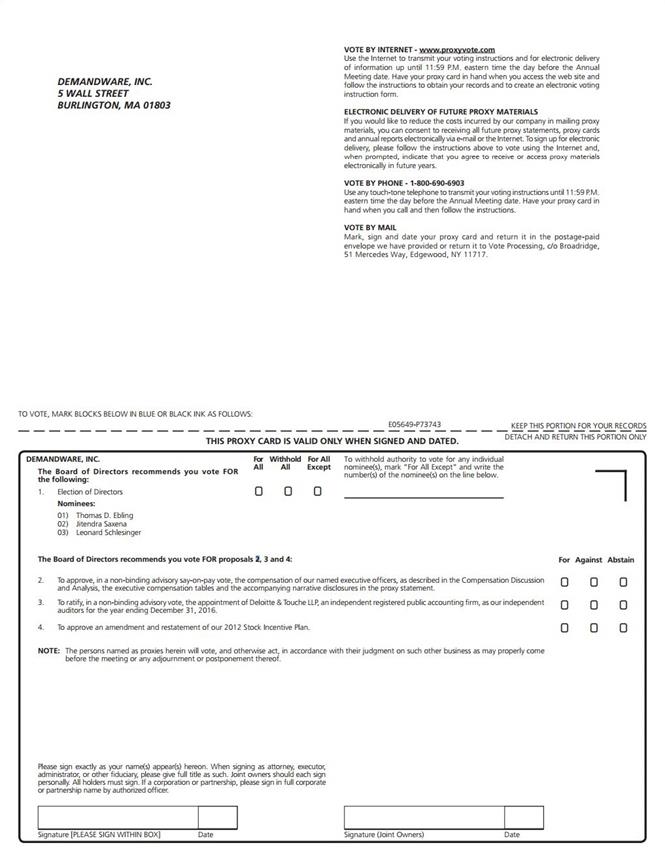

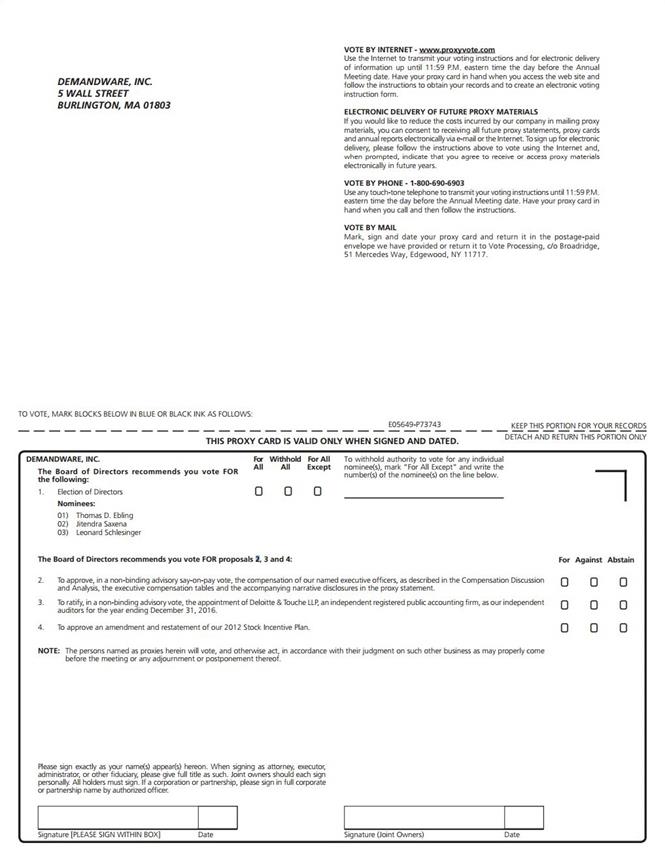

1. To elect three Class I directors nominated by our Board of Directors, each to serve for a term ending in 2019, or until his successor has been duly elected and qualified;

2. To approve, in a non-binding advisory “say-on-pay” vote, the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” the executive compensation tables and the accompanying narrative disclosures in this proxy statement;

3. To ratify, in a non-binding advisory vote, the appointment of Deloitte & Touche LLP, an independent registered public accounting firm, as our independent auditors for the year ending December 31, 2016;

4. To approve an amendment and restatement of our 2012 Stock Incentive Plan; and

5. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Stockholders of record on our books at the close of business on March 21, 2016, the record date for the Annual Meeting, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. If you are a stockholder of record, please vote in one of these three ways:

| · | Vote over the Internet, by going to the website of our tabulator, Broadridge Financial Solutions, Inc., at www.proxyvote.com, and following the instructions for internet voting shown on the enclosed proxy card; |

| · | Vote by Telephone, by calling +1 (800) 690-6903 and following the recorded instructions; or |

| · | Vote by Mail, by completing and signing the enclosed proxy card and mailing it in the enclosed postage prepaid envelope. If you vote over the internet or by telephone, please do not mail your proxy card. |

If your shares are held in “street name,” that is, held for your account by a broker or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

You may obtain directions to the location of the Annual Meeting by contacting our Vice President of Investor Relations at

+1 (781) 425-7675. Whether or not you plan to attend the Annual Meeting in person, we urge you to take the time to vote your shares.

By Order of the Board of Directors,

KATHLEEN B. PATTON

Secretary

April 1, 2016

TABLE OF CONTENTS

i

DEMANDWARE, INC.

5 Wall Street

Burlington, Massachusetts 01803 USA

PROXY STATEMENT

For the Annual Meeting of Stockholders on May 18, 2016

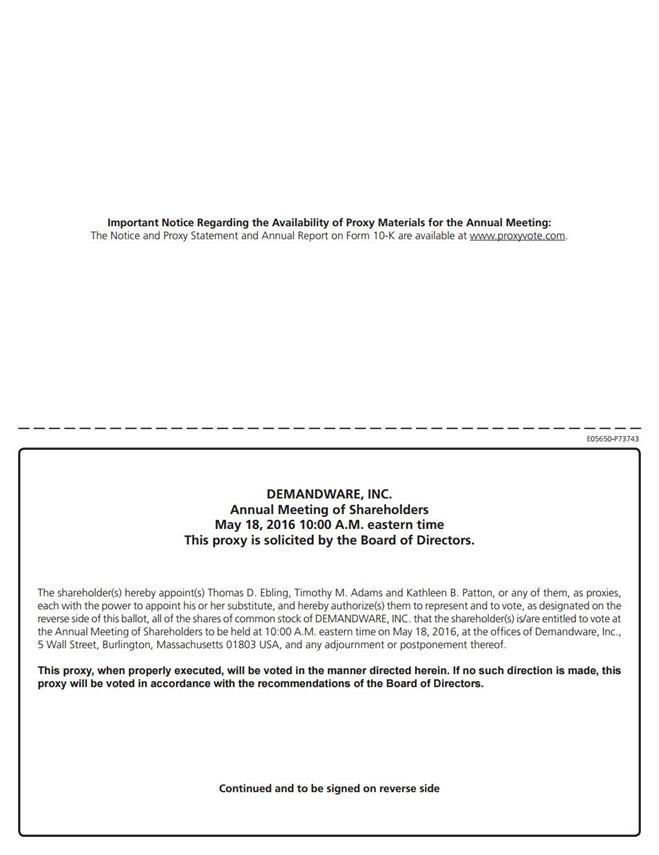

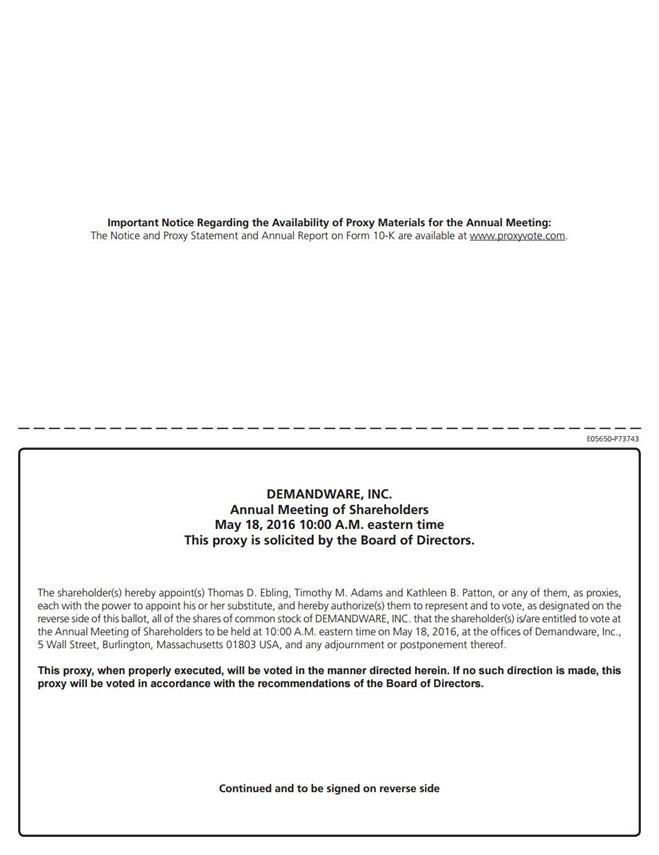

This proxy statement and the enclosed proxy card are being furnished in connection with the solicitation of proxies by our Board of Directors for use at the 2016 Annual Meeting of Stockholders, to be held on Wednesday, May 18, 2016 at 10:00 a.m., eastern time, at the offices of Demandware, Inc., 5 Wall Street, Burlington, Massachusetts 01803 USA, and at any adjournment or postponement thereof.

All proxies will be voted in accordance with the instructions contained in those proxies. If no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Annual Meeting of Stockholders.

We are first mailing this proxy statement and the accompanying proxy card to stockholders on or about April 1, 2016 in conjunction with the mailing of our 2015 Annual Report to Stockholders.

| |

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS |

|

For the 2016 Annual Meeting of Stockholders on May 18, 2016 |

|

This proxy statement and the 2015 Annual Report to Stockholders are available for viewing, printing and downloading at www.proxyvote.com. |

|

A copy of our Annual Report on Form 10-K (including financial statements and schedules) for the year ended December 31, 2015, as filed with the Securities and Exchange Commission, or SEC, except for exhibits, will be furnished without charge to any stockholder after written or oral request to: |

|

| Demandware, Inc. |

| Attn: Vice President of Investor Relations |

| 5 Wall Street |

| Burlington, Massachusetts 01803 USA |

| Telephone: +1 (781) 425-7675 |

|

This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2015 are also available on the SEC’s website, www.sec.gov. |

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

| | |

Q. Why did I receive these proxy materials? | | A. We are providing these proxy materials to you in connection with the solicitation by our Board of Directors, or Board, of proxies to be voted at our 2016 Annual Meeting of Stockholders, or Annual Meeting, to be held at the offices of Demandware, Inc., 5 Wall Street, Burlington, Massachusetts 01803 USA on Wednesday, May 18, 2016 at 10:00 a.m., eastern time. |

| | |

Q. Who can vote at the Annual Meeting? | | A. Our Board has fixed March 21, 2016 as the record date for the Annual Meeting. If you were a stockholder of record on the record date, you are entitled to vote (in person or by proxy) all of the shares that you held on that date at the Annual Meeting and at any postponement or adjournment thereof. On the record date, we had 37,802,035 shares of common stock outstanding (each of which entitles its holder to one vote per share). |

| | |

Q. How do I vote? | | A. If your shares are registered directly in your name, you may vote: |

| | |

| | (1) Over the Internet: Go to the website of our tabulator, Broadridge Financial Solutions, Inc., or Broadridge, at www.proxyvote.com. Use the vote control number printed on your enclosed proxy card to access your account and vote your shares. You must specify how you want your shares voted or your internet vote cannot be completed and you will receive an error message. Your shares will be voted according to your instructions. You must submit your internet proxy before 11:59 p.m., eastern time, on May 17, 2016, the day before the Annual Meeting, for your proxy to be valid and your vote to count. |

| | |

| | (2) By Telephone: Call +1 (800) 690-6903, toll free from the United States, Canada and Puerto Rico, and follow the recorded instructions. You must specify how you want your shares voted and confirm your vote at the end of the call or your telephone vote cannot be completed. Your shares will be voted according to your instructions. You must submit your telephonic proxy before 11:59 p.m., eastern time, on May 17, 2016, the day before the Annual Meeting, for your proxy to be valid and your vote to count. |

| | |

| | (3) By Mail: Complete and sign your enclosed proxy card and mail it in the enclosed postage prepaid envelope to Broadridge. Broadridge must receive the proxy card not later than May 17, 2016, the day before the Annual Meeting, for your proxy to be valid and your vote to count. Your shares will be voted according to your instructions. If you do not specify how you want your shares voted, they will be voted as recommended by our Board. |

| | |

| | (4) In Person at the Annual Meeting: If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which we will provide to you at the Annual Meeting. |

| | |

| | If your shares are held in “street name,” meaning they are held for your account by a broker or other nominee, you may vote: |

| | |

| | (1) Over the Internet or by Telephone: You will receive instructions from your broker or other nominee if they permit internet or telephonic voting. You should follow those instructions. |

| | |

| | (2) By Mail: You will receive instructions from your broker or other nominee explaining how you can vote your shares by mail. You should follow those instructions. |

| | |

2

| | (3) In Person at the Annual Meeting: You may contact your broker or other nominee who holds your shares to obtain a broker’s proxy and bring it with you to the Annual Meeting. A broker’s proxy is not the form of proxy enclosed with this proxy statement. You will not be able to vote shares you hold in street name in person at the Annual Meeting unless you have a proxy from your broker or other nominee issued in your name giving you the right to vote your shares. |

| | |

Q. Can I change my vote? | | A. If your shares are registered directly in your name, you may revoke your proxy and change your vote before or at the Annual Meeting. To do so, you must do one of the following: |

| | |

| | (1) Vote over the internet or by telephone as instructed above. Only your latest internet or telephone vote is counted. You may not change your vote over the internet or by telephone after 11:59 p.m., eastern time, on May 17, 2016. |

| | |

| | (2) Sign a new proxy and submit it by mail as instructed above. Only your latest dated proxy that was received by Broadridge by May 17, 2016 will be counted. |

| | |

| | (3) Attend the Annual Meeting, request that your proxy be revoked and vote in person as instructed above. Attending the Annual Meeting will not revoke your internet vote, telephone vote or proxy, as the case may be, unless you specifically request it. |

| | |

| | If your shares are held in street name, you may submit new voting instructions by contacting your broker or other nominee. You may also vote in person at the Annual Meeting if you obtain a broker’s proxy as described in the answer above. |

| | |

Q. Will my shares be voted if I do not return my proxy? | | A. If your shares are registered directly in your name, your shares will not be voted if you do not vote over the internet, by telephone, by returning your proxy or by ballot at the Annual Meeting. |

| | |

| | If your shares are held in street name, your broker or other nominee may, under certain circumstances, vote your shares if you do not timely return your proxy. Brokers and other nominees can vote their customers’ unvoted shares on discretionary matters but cannot vote such shares on non-discretionary matters. If you do not timely return a proxy to your broker or other nominee to vote your shares, your broker or other nominee may, on discretionary matters, either vote your shares or leave your shares unvoted. The election of directors (Proposal 1), the advisory “say-on-pay” vote (Proposal 2) and amendment and restatement of our 2012 Stock Incentive Plan (Proposal 4) are non-discretionary matters. The ratification of the appointment of our independent auditors (Proposal 3) is a discretionary matter. |

| | |

| | We encourage you to provide voting instructions to your broker or other nominee by giving your proxy to them. This ensures that your shares will be voted at the Annual Meeting according to your instructions. |

| | |

Q. How many shares must be present to hold the Annual Meeting? | | A. A majority of our shares of common stock issued and outstanding and entitled to vote must be present to hold the Annual Meeting and conduct business. This is called a quorum. For purposes of determining whether a quorum exists, we count as present any shares that are voted over the internet, by telephone or by completion and submission of a proxy or that are represented in person at the Annual Meeting. Further, for purposes of establishing a quorum, we will count as present shares that a stockholder holds even if the stockholder votes to withhold or abstain or votes on only one of the proposals. In addition, we will count as present shares held in street name by brokers or other nominees that indicate on their proxies that they do not have authority to vote those shares on Proposals 1, 2 and 4. If a quorum is not present, we expect to adjourn the Annual Meeting until we obtain a quorum. |

| | |

3

Q. What vote is required to approve each proposal and how are votes counted? | | A. Proposal 1 — Election of Three Class I Directors The three nominees for Class I director receiving the highest number of votes FOR election will be elected as directors. This is called a plurality. Proposal 1 is a non-discretionary matter. Therefore, if your shares are held in street name and you do not vote your shares, your broker or other nominee cannot vote your shares on Proposal 1. Shares held in street name by brokers or nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 1 will not be counted as votes FOR or WITHHELD from any nominee and will be treated as “broker non-votes.” Broker non-votes will have no effect on the voting on Proposal 1. With respect to Proposal 1, you may: |

| | |

| | · vote FOR all three nominees; |

| | · vote FOR two nominees and WITHHOLD your vote from the third nominee; |

| | |

| | · vote FOR one nominee and WITHHOLD your vote from the other two nominees; or |

| | |

| | · WITHHOLD your vote from all three nominees. |

| | |

| | Votes that are withheld will not be included in the vote tally for the election of directors and will not affect the results of the vote. |

| | |

| | Proposal 2 — Non-binding “Say-on-Pay” Vote on the Compensation of Our Named Executive Officers To approve Proposal 2, stockholders holding a majority of the votes cast on the matter must vote FOR the approval of the compensation of our named executive officers, as described in the “Compensation Discussion and Analysis,” executive compensation tables and accompanying narrative disclosures in this proxy statement. Proposal 2 is a non-discretionary matter. Therefore, if your shares are held in street name and you do not vote your shares, your broker or other nominee cannot vote your shares on Proposal 2. Shares held in street name by brokers or other nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 2 will not be counted as votes FOR or AGAINST Proposal 2 and will be treated as broker non-votes. Broker non-votes will have no effect on the voting on Proposal 2. If you vote to ABSTAIN on Proposal 2, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. Voting to ABSTAIN will have no effect on the voting on Proposal 2. With respect to Proposal 2, you may: |

| | |

| | · vote FOR the non-binding resolution; |

| | |

| | · vote AGAINST the non-binding resolution; or |

| | |

| | · ABSTAIN from voting on the non-binding resolution. |

| | |

| | As an advisory vote, this proposal is not binding. The outcome of this advisory vote will not overrule any decision by us or our Board (or any committee thereof). However, our Compensation Committee and our Board value the opinions expressed by our stockholders in their votes on this proposal and will consider the outcome of the vote when making future compensation decisions for our named executive officers. |

| | |

4

| | Proposal 3 — Ratification of Appointment of Independent Auditors |

| | |

| | To approve Proposal 3, stockholders holding a majority of the votes cast on the matter must vote FOR the proposal. Proposal 3 is a discretionary matter. Therefore, if your shares are held in street name and you do not vote your shares, your broker or other nominee may vote your unvoted shares on Proposal 3. If your broker or other nominee does not exercise its discretionary authority, your shares will not be voted and will be treated as broker non-votes. Broker non-votes will have no effect on the voting on Proposal 3. If you vote to ABSTAIN on Proposal 3, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. Voting to ABSTAIN will have no effect on the voting on Proposal 3. |

| | |

| | Although stockholder approval of our Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2016 is not required, we believe that it is advisable to give stockholders an opportunity to ratify this appointment. As an advisory vote, this proposal is not binding. The outcome of this advisory vote will not overrule any decision by us or our Board (or any committee thereof). However, if this proposal is not approved at the Annual Meeting, our Audit Committee may reconsider its appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2016. |

| | |

| | Proposal 4 — Amendment and Restatement of 2012 Stock Incentive Plan |

| | |

| | To approve Proposal 4, stockholders holding a majority of the votes cast on the matter must vote FOR the proposal. Proposal 4 is a non-discretionary matter. Therefore, if your shares are held in street name and you do not vote your shares, your broker or other nominee cannot vote your shares on Proposal 4. Shares held in street name by brokers or other nominees who indicate on their proxies that they do not have authority to vote the shares on Proposal 4 will not be counted as votes FOR or AGAINST Proposal 4 and will be treated as broker non-votes. Broker non-votes will have no effect on the voting on Proposal 4. If you vote to ABSTAIN on this Proposal 4, your shares will not be voted FOR or AGAINST the proposal and will also not be counted as votes cast or shares voting on the proposal. Voting to ABSTAIN will have no effect on the voting on Proposal 4. |

| | |

Q. Are there other matters to be voted on at the Annual Meeting? | | A. We do not know of any matters that may come before the Annual Meeting other than the election of three Class I directors, the advisory “say-on-pay” vote, the ratification of the appointment of our independent registered public accounting firm and the amendment and restatement of the 2012 Stock Incentive Plan. If any other matters are properly presented at the Annual Meeting, the persons named in the accompanying proxy will vote, and otherwise act, in accordance with their judgment on the matter. |

| | |

Q. Where can I find the voting results? | | A. We will report the voting results in a Current Report on Form 8-K within four business days following the adjournment of the Annual Meeting. |

| | |

Q. What are the costs of soliciting these proxies? | | A. We will bear the cost of soliciting proxies. In addition to these proxy materials, our directors, officers and employees may solicit proxies without additional compensation. We have retained Innisfree M&A Incorporated to assist with the solicitation of proxies, in person, by telephone, or by other means of communication, for a base fee of $15,000, plus reimbursable expenses. We may reimburse brokers or other nominees holding stock in their names, or in the names of their nominees, for their expenses in sending proxies and proxy materials to beneficial owners. |

5

BOARD OF DIRECTORS AND MANAGEMENT

Information Regarding Directors and Director Nominees

Our certificate of incorporation provides for the classification of our Board into three classes, each having as nearly an equal number of directors as possible. The terms of service of the three classes are staggered so that the term of one class expires each year.

Our Board currently consists of seven directors. Class I consists of Thomas D. Ebling, Jitendra Saxena and Leonard Schlesinger, each with a term ending in 2016. Class II consists of Jeffrey G. Barnett and Charles F. Kane, each with a term ending in 2017. Class III consists of Linda M. Crawford and Jill Granoff, each with a term ending in 2018.

At each annual meeting of stockholders, directors are elected for a full term of three years to continue or succeed those directors whose terms are expiring. Upon the recommendation of our Nominating and Corporate Governance Committee, our Board has nominated Messrs. Ebling and Saxena and Dr. Schlesinger for election at the Annual Meeting as Class I directors, each to serve until 2019.

Director Qualifications

The following table and biographical descriptions provide information as of March 31, 2016 relating to each director and director nominee, including his or her age and period of service as a director of our company; his or her Board committee memberships; his or her business experience during the past five years, including directorships at other public companies; his or her community activities; and the other experience, qualifications, attributes or skills that led our Board to conclude he or she should serve as a director of our company.

Name | | Age | | Board Tenure, Principal Occupation, Other Business Experience During the Past Five Years and Other Directorships |

| | | | |

Class I Director Nominees to be elected at the 2016 Annual Meeting (terms expiring in 2019) | | | | |

| | | | |

Thomas D. Ebling President, Chief Executive Officer and Chairman of the Board | | 60 | | Mr. Ebling has served as our President and Chief Executive Officer and a member of our Board since December 2009 and as Chairman of our Board since July 2014. Mr. Ebling previously served on our Board from May 2006 until December 2007. From October 2007 until August 2009, Mr. Ebling served as Chief Executive Officer of Lattice Engines, Inc., a provider of sales and software solutions. Prior to joining Lattice Engines, Mr. Ebling served as Chief Executive Officer and Chairman of the Board of Directors of ProfitLogic, Inc., an optimization solutions company, from 2002 until it was acquired by Oracle Corporation in 2005. Earlier in his career, Mr. Ebling served as Chief Executive Officer of Torrent Systems, Inc., a data warehousing and analytics software provider, and he held various leadership positions at Marcam Solutions, Inc., a software applications company. Mr. Ebling currently serves on the board of directors of Tracelink, a private life sciences cloud company. Mr. Ebling holds a B.A. in mathematics from Williams College. Mr. Ebling’s extensive executive leadership experience and comprehensive knowledge of our company and the software solutions industry qualify him to serve on our Board and make him a critical asset to our Board. |

6

Name | | Age | | Board Tenure, Principal Occupation, Other Business Experience During the Past Five Years and Other Directorships |

| | | | |

Jitendra Saxena Audit Committee Compensation Committee | | 70 | | Mr. Saxena has served as a member of our Board since July 2010. Mr. Saxena founded Netezza Corporation, a leading data warehouse appliance provider, in September 2000 and served as Chief Executive Officer and a member of the board of directors of Netezza from its inception until January 2009. Mr. Saxena served as Chairman of Netezza’s Board of Directors from February 2009 until it was acquired by IBM in November 2010. Prior to founding Netezza, Mr. Saxena served as Chairman and Chief Executive Officer of Applix, Inc., a provider of performance management applications, from 1983 until 2000. Mr. Saxena currently serves on the board of directors of several private companies. Mr. Saxena holds a B.S. in electrical engineering from IIT Mumbai, an M.S. in electrical engineering from Michigan State University and an M.B.A. from Boston University. Mr. Saxena’s qualifications to serve on our Board include his decades of experience in the software industry and his leadership experience as a chief executive officer of a publicly-traded company. |

| | | | |

Leonard Schlesinger Compensation Committee Nominating and Corporate

Governance Committee | | 63 | | Dr. Leonard Schlesinger has served as a member of our Board since September 2013 and as Lead Independent Director since July 2014. Dr. Schlesinger has served as the Baker Foundation Professor of Business Administration at Harvard Business School since July 2013. Dr. Schlesinger served as the President of Babson College from July 2008 until July 2013. From 1999 to 2007, Dr. Schlesinger held various executive positions at Limited Brands, including Vice Chairman of the Board of Directors and Chief Operating Officer. While at Limited Brands, he was responsible for the operational and financial functions across the enterprise including Express, Limited Stores, Victoria’s Secret Beauty, Bath and Body Works, C.O. Bigelow, Henri Bendel and the White Barn Candle Company. Dr. Schlesinger has also served as Executive Vice President and Chief Operating Officer at Au Bon Pain and as a director of numerous public and private retail, consumer products and technology companies. Dr. Schlesinger currently serves on the board of directors of Restoration Hardware Holdings, Inc., a public home furnishings retail company. Dr. Schlesinger has also held leadership roles at leading MBA and executive education programs and other academic institutions, including twenty years at Harvard Business School. Dr. Schlesinger holds a Doctor of Business Administration from Harvard Business School, an MBA from Columbia University and a B.A. in American Civilization from Brown University. Dr. Schlesinger’s more than 30 years of leadership and operational experience in retail, technology and academia qualify him to serve on our Board. |

| | | | |

7

Name | | Age | | Board Tenure, Principal Occupation, Other Business Experience During the Past Five Years and Other Directorships |

Class II Directors (terms expiring in 2017) | | | | |

| | | | |

Jeffrey G. Barnett Executive Vice President

and Chief Operating Officer | | 53 | | Mr. Barnett has served as our Executive Vice President and Chief Operating Officer since January 2013 and as a member of our Board since July 2014. He previously served as our Executive Vice President of Field Operations from November 2005 until December 2012. Prior to joining us, Mr. Barnett served as Vice President of Sales for Europe, Middle East and Africa of Siebel Systems, Inc., a software company. Prior to joining Siebel, Mr. Barnett served as Managing Director, International Operations and as Vice President, International Sales and Marketing of edocs, Inc., an online billing and customer service software company. Before joining edocs, Mr. Barnett held leadership positions at Kenan Systems Corporation, a billing and customer care software company, and at TRW, Inc., a global manufacturing and service company. Since September 2012, Mr. Barnett has served on the board of directors of Apperian, Inc., a private mobile application platform provider. Mr. Barnett holds a B.S. in computer information systems from Colorado State University and an M.B.A. from the Massachusetts Institute of Technology Sloan School of Management. Mr. Barnett’s extensive sales, operations and industry experience qualifies him to serve on our Board. |

| | | | |

Charles F. Kane Audit Committee | | 58 | | Mr. Kane has served as a member of our Board since April 2010. Mr. Kane is an adjunct professor of international finance at the Massachusetts Institute of Technology Sloan School of Management. He served as Executive Vice President and Chief Administrative Officer of Global BPO Services Corp., a special purpose acquisition corporation, from July 2007 until March 2008, and as Chief Financial Officer of Global BPO from August 2007 until March 2008. Prior to joining Global BPO, he served as Chief Financial Officer of RSA Security Inc., a provider of e-security solutions, from May 2006 until RSA was acquired by EMC Corporation in October 2006. From 2003 until 2006, he served as Chief Financial Officer of Aspen Technology, Inc., a provider of management software and professional services. Mr. Kane serves on the board of directors of One Laptop Per Child, a non-profit organization that provides computing and internet access for students in the developing world, for which he served as President and Chief Operating Officer from 2008 until 2009. Mr. Kane has served as a member of the board of directors of Progress Software Corporation, a publicly traded provider of infrastructure software, since November 2006, Carbonite, a publicly traded data storage and restoration company, since July 2011 and RealPage, Inc., a publicly traded company providing on demand software solutions for the rental housing industry, since August 2012. Mr. Kane is a CPA and holds a B.B.A. in accounting from the University of Notre Dame and an M.B.A. in international finance from Babson College. |

| | | | |

| | | | Mr. Kane’s experience as a chief financial officer and senior executive officer of several public companies and his experience serving on the boards of directors of other public and private companies qualify him to serve on our Board. |

| | | | |

| | | | |

8

Name | | Age | | Board Tenure, Principal Occupation, Other Business Experience During the Past Five Years and Other Directorships |

Class III Directors (terms expiring in 2018) | | | | |

| | | | |

Linda M. Crawford Compensation Committee Nominating and Corporate

Governance Committee | | 52 | | Ms. Crawford has served as a member of our Board since January 2016. She has served as the Chief Customer Officer at Optimizely, a private company that provides website and mobile A/B testing and personalization, since January 2016. She previously served in several executive positions at salesforce.com, inc. from November 2006 to June 2015, most recently serving as the Executive Vice President and General Manager of the Salesforce Sales Cloud from February 2012 to June 2015 and as the Senior Vice President of Sales Strategy and Productivity from December 2008 to February 2012. Prior to joining salesforce, Ms. Crawford served as the Vice President of Sales at Rivermine, Inc., a telecom expense management software platform, from November 2004 to November 2006 and held several executive positions at Siebel Systems, Inc. Ms. Crawford is an advisor of several private companies and holds a B.B.A in computer information systems and an M.B.A. from James Madison University. |

| | | | |

| | | | Ms. Crawford’s extensive enterprise sales and product leadership experience qualifies her to serve as a member of our Board. |

| | | | |

Jill Granoff Audit Committee Nominating and Corporate

Governance Committee | | 53 | | Ms. Granoff has served as a member of our Board since July 2011. She served as Chief Executive Officer and a director of Vince Holding Corp., a publicly-traded leading contemporary fashion brand, from May 2012 until September 2015. From May 2012 until November 2013, Ms. Granoff also served as Chief Executive Officer and a director of Kellwood Company, an affiliate of Sun Capital Partners. Prior to Kellwood, Ms. Granoff served as Chief Executive Officer and a director of Kenneth Cole Productions, Inc. from May 2008 until February 2011. She previously served as Executive Vice President of Direct Brands at Liz Claiborne Inc., where she had global responsibility for Juicy Couture, Lucky Brand and Kate Spade from August 2006 until April 2008. Prior to joining Liz Claiborne, Ms. Granoff served as President and Chief Operating Officer of Victoria’s Secret Beauty, a division of Limited Brands. Before Victoria’s Secret, Ms. Granoff held various executive positions at The Estee Lauder Companies, last serving as Senior Vice President, Strategic Planning, Finance and Information Systems for Estee Lauder, Inc. Ms. Granoff holds a B.A. from Duke University and an M.B.A. from Columbia University. She is also a board member of the Fashion Institute of Technology Foundation. |

| | | | |

| | | | Ms. Granoff’s extensive business and executive leadership experience in the fashion and retail industries provides a depth of relevant management, operational and financial qualifications to serve as a member of our Board. |

9

Corporate Governance Matters

Our Board believes that good corporate governance is important to ensure that our company is managed for the long-term benefit of our stockholders. This section describes key corporate governance guidelines and practices that we have adopted. Complete copies of the charters of our Audit Committee, our Compensation Committee and our Nominating and Corporate Governance Committee, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics are available on the Investor Relations section of our website, www.demandware.com. Alternatively, you can request a copy of any of these documents by writing us at: Demandware, Inc., Attn: Vice President of Investor Relations, 5 Wall Street, Burlington, Massachusetts 01803 USA.

Corporate Governance Guidelines

Our Board has adopted Corporate Governance Guidelines to assist it in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. These principles, which set forth a framework for the conduct of our Board’s business, provide that:

| · | the principal responsibility of the directors is to oversee our management and to hold our management accountable for the pursuit of our corporate objectives; |

| · | a majority of the members of our Board must be independent directors; |

| · | the independent directors meet regularly in executive session; |

| · | directors have full and free access to management and, as necessary and appropriate, independent advisors; |

| · | new directors participate in an orientation program and all directors are encouraged to attend director education programs; and |

| · | at least annually, our Board and its committees conduct self evaluations to determine whether they are functioning effectively. |

Policies and Procedures for Related Person Transactions

Our Board has adopted a written policy for the review of any transaction, arrangement or relationship in which we are a participant, the amount involved exceeds $120,000, and one of our executive officers, directors, director nominees or 5% stockholders (or their immediate family members), each of whom we refer to as a “related person,” has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which we refer to as a “related person transaction,” the related person must report the proposed related person transaction to our General Counsel. The policy calls for the proposed related person transaction to be reviewed and, if deemed appropriate, approved by the Audit Committee. Whenever practicable, the reporting, review and approval will occur prior to entry into the transaction. If advance review and approval is not practicable, the Audit Committee will review, and, in its discretion, may ratify the related person transaction. The policy also permits the Chair of the Audit Committee to review and, if deemed appropriate, approve proposed related person transactions that arise between committee meetings, subject to ratification by the Audit Committee at its next meeting. Any related person transactions that are ongoing in nature will be reviewed annually.

A related person transaction reviewed under the policy will be considered approved or ratified if it is authorized by the Audit Committee after full disclosure of the related person’s interest in the transaction. As appropriate for the circumstances, the Audit Committee will review and consider:

| · | the related person’s interest in the related person transaction; |

| · | the approximate dollar value of the amount involved in the related person transaction; |

| · | the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss; |

| · | whether the transaction is undertaken in the ordinary course of our business; |

| · | whether the terms of the transaction are no less favorable to us than terms that could have been reached with an unrelated third party; |

| · | the purpose, and the potential benefits to us, of the transaction; and |

| · | any other information regarding the related person transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

10

Our Audit Committee may approve or ratify the transaction if it determines that, under all of the circumstances, the transaction is in or is not inconsistent with our best interests. The Audit Committee may impose any conditions on the related person transaction that it deems appropriate.

In addition to the transactions that are excluded by the instructions to the SEC’s related person transaction disclosure rule, our Board has determined that the following transactions, among others, do not create a material direct or indirect interest on behalf of related persons and, therefore, are not related person transactions for purposes of this policy:

| · | interests arising solely from the related person’s position as an executive officer of another entity (whether or not the person is also a director of such entity), that is a participant in the transaction, where (a) the related person and all other related persons own in the aggregate less than a 10% equity interest in such entity, (b) the related person and his or her immediate family members are not involved in the negotiation of the terms of the transaction and do not receive any special benefits as a result of the transaction, (c) the amount involved in the transaction equals less than the greater of $1.0 million or 2% of the annual consolidated gross revenue of the other entity that is a party to the transaction, and (d) the amount involved in the transaction equals less than 2% of our annual consolidated gross revenues; and |

| · | a transaction that is specifically contemplated by provisions of our certificate of incorporation and by-laws. |

The policy provides that transactions involving compensation of executive officers shall be reviewed and approved by the Compensation Committee in the manner specified in its charter.

Related Person Transactions

Ms. Granoff, one of our directors, was the Chairman and Chief Executive Officer and a director of Vince Holding Corp., the parent of Vince, LLC. Since January 1, 2015, Vince, LLC purchased approximately $174,000 in services from us. We believe that this transaction was carried out on terms that were in the aggregate no less favorable to us than those that would have been obtained by an unrelated third party in a transaction of similar size.

The son of Timothy M. Adams, our Executive Vice President, Chief Financial Officer and Treasurer, is an employee at Avison Young. Since January 1, 2015, we paid approximately $126,000 to Avison Young for commercial real estate services and Avison Young received approximately $125,000 in commissions related to certain of our lease transactions entered into in 2015. Mr. Adams’ son participated in a portion of the lease transactions but did not receive any portion of the fees or commissions. We believe that this transaction was carried out on terms that were in the aggregate no less favorable to us than those that would have been obtained by an unrelated third party in a transaction of similar size.

The daughter of Mr. Saxena, one of our directors, is a Demandware employee. Since January 1, 2015, we paid Mr. Saxena’s daughter salary and bonus payments of approximately $136,000; however, her total compensation in 2015 was less than $120,000.

Board Determination of Independence

In accordance with the New York Stock Exchange, or NYSE, corporate governance listing standards, a director will qualify as “independent” if (1) our Board affirmatively determines that he or she has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us and (2) he or she is independent as determined under Section 303A.02(b) of the NYSE Listed Company Manual. Ownership of a significant amount of our stock, by itself, does not constitute a material relationship.

Pursuant to the corporate governance listing standards of the NYSE, a director employed by us cannot be deemed to be an “independent director,” and consequently, Messrs. Ebling and Barnett are not independent directors.

In January 2016, our Board reviewed the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board determined that each of Messrs. Kane and Saxena, Dr. Schlesinger and Mses. Crawford and Granoff is “independent” in accordance with Section 303A.02 of the NYSE Listed Company Manual. Our Board reached a similar determination in 2015 with respect to Michael Skok, Stephan Schambach and Lawrence Bohn, each of whom served as a director in 2015. In making its determinations, our Board considered the following transactions, relationships or arrangements in addition to the transactions disclosed under “Related Person Transactions” above:

| · | board positions or other relationships held by a director at our partners or vendors, and |

| · | employment of a director or family member of a director by our partners or vendors. |

11

Our Board determined that all of the members of our Board’s three standing committees described below are independent, as defined under applicable NYSE rules and, in the case of all members of the Audit Committee, the independence requirements contemplated by Rule 10A-3 under the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act, and, in the case of all members of the Compensation Committee, the independence requirements contemplated by Rule 10C-1 under the Exchange Act.

Director Nomination Process

The process followed by the Nominating and Corporate Governance Committee to identify and evaluate director candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates, and interviews of selected candidates by members of the Nominating and Corporate Governance Committee and the Board. In 2015, the Board also engaged Heidrick & Struggles, an executive search firm, to assist with a search for director candidates. This search culminated in the appointment of Ms. Crawford to the Board.

At the Annual Meeting, stockholders will be asked to consider the election of Dr. Schlesinger, who has been nominated for election as a director for the first time. Dr. Schlesinger was appointed to the Board of Directors in September 2013. Dr. Schlesinger was initially recommended by Thomas D. Ebling, our Chairman of the Board, Chief Executive Officer and President, and Lawrence Bohn, a former director. The Board determined to include Dr. Schlesinger among its nominees.

Criteria and Diversity

In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Nominating and Corporate Governance Committee applies the criteria specified in our Corporate Governance Guidelines. These criteria include the candidate’s integrity, business acumen, knowledge of our business and industry, experience, diligence, conflicts of interest and ability to act in the interests of our stockholders. The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for any prospective nominee.

Our Board does not have a formal policy with respect to diversity, but our Corporate Governance Guidelines provide that an objective of Board composition is to bring to our company a variety of perspectives and skills derived from high quality business and professional experience. Our Board recognizes its responsibility to ensure that nominees for our Board possess appropriate qualifications and reflect a reasonable diversity of personal and professional experience, skills, backgrounds and perspectives. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow our Board to promote our strategic objectives and to fulfill its responsibilities to our stockholders.

The director biographies on pages 6 to 9 indicate each director’s experience, qualifications, attributes and skills that led the Board to conclude that each should continue to serve as a member of our Board. Our Board believes that each of the directors has had substantial achievement in his or her professional and personal pursuits and possesses the background, talents and experience that our Board desires and that will contribute to the best interests of our company and to long-term stockholder value.

Stockholder Nominations

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting the candidates’ names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of our common stock for at least a year as of the date such recommendation is made, to the Nominating and Corporate Governance Committee, c/o Secretary, Demandware, Inc., 5 Wall Street, Burlington, Massachusetts 01803 USA. The information required for such recommendations to be considered is specified in our by-laws. Assuming that appropriate biographical and background material has been provided on a timely basis, the Nominating and Corporate Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Stockholders also have the right under our by-laws to directly nominate director candidates, without any action or recommendation on the part of the Nominating and Corporate Governance Committee or the Board, by following the procedures set forth under “Stockholder Proposals for 2017 Annual Meeting.” If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election, then his or her name will be included in our proxy statement and proxy card for the next annual meeting. Otherwise, candidates nominated by stockholders in accordance with the procedures set forth in our by-laws will not be included in our proxy statement and proxy card for the next annual meeting.

12

Board Meetings and Attendance

Our Board met 12 times during 2015, either in person or by teleconference, and acted by written consent on four occasions. During 2015, each of our directors attended at least 75% of the aggregate number of the meetings of the Board and the committees on which he or she served.

Our Corporate Governance Guidelines provide that our directors are expected to attend our annual meeting of stockholders. Mr. Ebling attended our 2015 Annual Meeting of Stockholders.

Board Leadership Structure

Our Corporate Governance Guidelines provide that the Nominating and Corporate Governance Committee shall periodically assess the Board’s leadership structure, including whether the offices of Chairman of the Board and Chief Executive Officer should be separate. Our guidelines provide the Board with flexibility to determine whether the two roles should be combined or separated based upon our needs and the Board’s assessment of its leadership from time to time. In July 2014, our Board, upon the recommendation of our Nominating and Corporate Governance Committee, determined to combine the role of Chief Executive Officer and Chairman of the Board and appointed Mr. Ebling, our Chief Executive Officer, as our Chairman of the Board. Our Board, upon the recommendation of our Nominating and Corporate Governance Committee, has determined that, at this time, having the same individual hold both positions is in our best interests and the best interest of our stockholders and consistent with good corporate governance for the following reasons:

| · | Our Chief Executive Officer is the director most familiar with our business and strategy and is thus best positioned to focus our Board on the key issues facing our company and executing strategic priorities. |

| · | A single Chairman of the Board and Chief Executive Officer provides strong and consistent leadership for our company, without risking overlap or conflict of roles. |

| · | Oversight of our company is the responsibility of our Board as a whole, and this responsibility can be properly discharged without an independent Chairman of the Board. |

| · | The combined role of Chairman of the Board and Chief Executive Officer, together with a lead independent director having the duties described below, fosters clear accountability and effective decision-making while providing the appropriate balance between strategy development and independent oversight of management. |

| · | Our Lead Independent Director can provide similar benefits to those associated with an independent Chairman of the Board. |

Our Board, upon the recommendation of our Nominating and Corporate Governance Committee, has appointed Dr. Schlesinger as Lead Independent Director. Dr. Schlesinger is an independent director within the meaning of NYSE rules. His duties as Lead Independent Director include the following:

| · | chairing meetings of executive sessions of the Board; |

| · | consulting with our Chairman of the Board and Chief Executive Officer on preparation of the agenda for each meeting of the Board, determining the need for special meetings of the Board, matters relating to corporate strategy, governance and the performance of our Board; |

| · | discussing with any director who is not adequately performing his or her duties his or her obligation to fulfill such duties; |

| · | facilitating communications between other members of our Board and our Chairman of the Board and Chief Executive Officer; |

| · | monitoring, with assistance of our General Counsel, communications from stockholders and other interested parties; and |

| · | performing oversight responsibilities. |

In addition, our Board has three standing committees that are currently comprised of, and are chaired by, independent directors. Our Board delegates substantial responsibilities to the committees, which report their activities and actions back to the full Board. We believe that the independent committees of our Board and their Chairs promote effective independent governance. We believe this structure represents an appropriate allocation of roles and responsibilities for our company at this time because it strikes an effective balance in the participation of management and independent leadership in our Board proceedings.

13

Board Committees

Our Board has established three standing committees — the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee — each of which operates under a charter that has been approved by our Board. Current copies of each committee’s charter are posted on the Corporate Governance page of the Investor Relations section of our website, www.demandware.com.

Current committee memberships are set forth in the table below:

| | Audit Committee | | Compensation Committee | | Nominating and Corporate

Governance Committee |

Jeffrey G. Barnett* | | | | | | |

Linda M. Crawford | | | |

| |

|

Thomas D. Ebling** | | | | | | |

Jill Granoff | |

| | | |

|

Charles F. Kane | |

| | | | |

Jitendra Saxena | |

| |

| | |

Leonard Schlesinger*** | | | |

| |

|

| |

* | Executive Vice President and Chief Operating Officer |

** | President, Chief Executive Officer and Chairman of the Board |

*** | Lead Independent Director |

| Chair |

| Member |

Audit Committee

The responsibilities of our Audit Committee include:

| · | selecting, approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| · | overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of certain reports from such firm; |

| · | reviewing with management and our independent registered public accounting firm the effect of regulatory and accounting initiatives as well as off-balance sheet structures on our financial statements; |

| · | reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| · | monitoring our internal control over financial reporting and disclosure controls and procedures; |

| · | overseeing our internal audit function; |

| · | reviewing and discussing with management our risk management policies, including data privacy and security and business continuity risks; |

| · | considering the hiring of employees from our independent registered public accounting firm and establishing procedures for the receipt and retention of accounting related complaints and concerns; |

| · | meeting independently with our internal auditing staff, independent registered public accounting firm and management; |

| · | advising the Board with respect to our policies and procedures regarding compliance with applicable laws and regulations and with our Code of Business Conduct and Ethics; |

| · | reviewing and approving or ratifying any related person transactions; |

| · | discussing with our General Counsel any legal matters that may materially impact our financial statements, accounting policies, compliance with applicable laws and regulations and any material reports, notices or inquiries received from regulators or governmental agencies; |

| · | reviewing and approving the entry into swaps, including those that are subject to mandatory clearing, and the use of the end-user exception from clearing; and |

| · | preparing the Audit Committee report required by the rules of the SEC (which report is included on page 18 of this proxy statement). |

14

The members of our Audit Committee are Messrs. Kane (Chair) and Saxena and Ms. Granoff. Our Board has determined that Mr. Kane is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K. Mr. Kane serves on the audit committee of four public companies. Our Board has determined that such simultaneous service does not impair the ability of Mr. Kane to serve effectively on our Audit Committee. The Audit Committee met seven times during 2015, either in person or by teleconference.

Compensation Committee

The responsibilities of our Compensation Committee include:

| · | annually reviewing and approving corporate goals and objectives relevant to compensation of our President and Chief Executive Officer; |

| · | reviewing and making recommendations to the Board with respect to the compensation of our President and Chief Executive Officer; |

| · | determining the compensation of our other executive officers; |

| · | reviewing and making recommendations to the Board with respect to director compensation; |

| · | overseeing and administering our cash and equity incentive plans; |

| · | the appointment, compensation and oversight of the work of any compensation consultant, legal counsel and other advisor retained by the Compensation Committee; and |

| · | preparing the Compensation Committee report required by the rules of the SEC (which report is included on page 28 of this proxy statement). |

The processes and procedures followed by our Compensation Committee in considering and determining executive and director compensation are described below under the heading “Executive and Director Compensation and Related Matters.”

The members of our Compensation Committee are Mr. Saxena (Chair), Dr. Schlesinger and Ms. Crawford. Mr. Skok was a member of our Compensation Committee until May 20, 2015, and Mr. Bohn was a member of our Compensation Committee throughout 2015 and until January 26, 2016. The Compensation Committee met five times during 2015 in person or by teleconference, and acted by written consent on five occasions in 2015.

Nominating and Corporate Governance Committee

The responsibilities of the Nominating and Corporate Governance Committee include:

| · | determining the skills and qualifications required of directors and developing criteria to be considered in selecting potential candidates for Board membership; |

| · | identifying individuals qualified to become Board members; |

| · | recommending to the Board the persons to be nominated for election as directors and to each of the Board’s committees; |

| · | recommending to the Board whether or not the Board should accept the resignation of a director; |

| · | reviewing and making recommendations to the Board with respect to our Corporate Governance Guidelines and board leadership structure; |

| · | reviewing and making recommendations to the Board with respect to management succession planning; and |

| · | overseeing an annual evaluation of the Board and its committees. |

The processes and procedures followed by the Nominating and Corporate Governance Committee in identifying and evaluating director candidates are described above under the heading “Director Nomination Process.”

The members of our Nominating and Corporate Governance Committee are Mses. Granoff (Chair) and Crawford and Dr. Schlesinger. The Nominating and Corporate Governance Committee met four times during 2015, either in person or by teleconference.

15

Risk Oversight

Our Board administers its risk oversight function directly and through its committees. The Audit Committee receives regular reports from members of senior management on areas of material risk to the company, including operational, financial, legal, regulatory, data privacy and security, strategic and reputational risks. As part of its charter, our Audit Committee regularly discusses with management our major risk exposures, their potential financial impact on our company and the steps we take to manage them. In addition, our Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management and risks arising from our compensation policies and programs. Our Nominating and Corporate Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, succession planning for our directors and executive officers and corporate governance.

Communicating with the Directors

Our Board will give appropriate attention to written communications that are submitted by stockholders and other interested parties, and will respond if and as appropriate. The Chair of the Nominating and Corporate Governance Committee, with the assistance of our General Counsel, is primarily responsible for monitoring communications from stockholders and other interested parties and for providing copies or summaries of such communications to the other directors as she considers appropriate.

Under procedures approved by a majority of the independent directors, communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our General Counsel considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters that are duplicative communications.

Stockholders and other interested parties who wish to send communications on any topic to the Board should address such communications to: Board of Directors, c/o Secretary, Demandware, Inc., 5 Wall Street, Burlington, Massachusetts 01803 USA.

Additionally, we have established a confidential process for reporting, investigating and resolving employee and other third party concerns related to accounting, auditing and similar matters under the Sarbanes-Oxley Act of 2002. Stockholders and other interested parties may confidentially provide information to one or more of our directors by contacting a representative at our Ethics Hotline who will forward the information to the appropriate director. The Ethics Hotline is operated by an independent, third party service. Within the United States and Canada, the Ethics Hotline can be reached by telephone, toll-free, at +1 (877) 275-7488 or worldwide via the internet at demandware.silentwhistle.com.

Code of Business Conduct and Ethics

We have adopted a written Code of Business Conduct and Ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. We have posted a current copy of the Code of Business Conduct and Ethics on the Corporate Governance page of the Investor Relations section of our website, www.demandware.com. In addition, we intend to post on our website all disclosures that are required by law or NYSE’s listing standards concerning amendments to, or waivers from, any provision of the Code of Business Conduct and Ethics.

Compensation Committee Interlocks and Insider Participation

The members of our Compensation Committee are Mr. Saxena (Chair), Dr. Schlesinger and Ms. Crawford. Mr. Saxena has been a member of the Compensation Committee since March 2012, Dr. Schlesinger has been a member of the Compensation Committee since May 2015 and Ms. Crawford became a member of the Compensation Committee in January 2016. Mr. Skok was a member of our Compensation Committee until May 20, 2015, and Mr. Bohn was a member of our Compensation Committee throughout 2015 and until January 26, 2016. None of the current members of the Compensation Committee, Mr. Skok or Mr. Bohn had interlocking or other relationships with other boards or with us during 2015 that require disclosure under the proxy rules and regulations promulgated by the SEC.

16

Executive Officers Who Are Not Directors

Certain information regarding our executive officers who are not also directors, as of March 31, 2016, is set forth below.

Name | | Age | | Positions(s) |

Timothy M. Adams | | 56 | | Executive Vice President, Chief Financial Officer and Treasurer |

Wayne R. Whitcomb | | 57 | | Chief Technology Officer |

Rohit Goyal | | 43 | | Senior Vice President of Engineering |

Kathleen B. Patton | | 49 | | Senior Vice President, General Counsel and Secretary |

Timothy M. Adams. Mr. Adams has served as our Executive Vice President, Chief Financial Officer and Treasurer since June 2014. Mr. Adams served as Senior Vice President and Chief Financial Officer of athenahealth, Inc., a leading provider of cloud-based services for electronic health records, practice management, and care coordination, from January 2010 to June 2014. Previously, Mr. Adams served as Chief Investment Officer of Constitution Medical Investors, Inc., a private investment firm focused on health-care-sector-related acquisitions and investments, as well as Senior Vice President of Corporate Strategy for Keystone Dental, Inc., a provider of dental health products and solutions. Earlier in his career, Mr. Adams was Chief Financial Officer at a number of other publicly traded companies. Mr. Adams began his career in public accounting at PricewaterhouseCoopers LLP, formerly Price Waterhouse, and is a Certified Public Accountant. Mr. Adams has served as a member of the board of directors of ABILITY Network, a private healthcare technology company, since November 2014. Mr. Adams obtained a B.S. from Murray State University and an M.B.A. from Boston University.

Wayne R. Whitcomb. Mr. Whitcomb has served as our Chief Technology Officer since helping to found Demandware in February 2004. Mr. Whitcomb also served as Vice President of Engineering and Technology from February 2004 until February 2012. Prior to joining Demandware, Mr. Whitcomb served as Vice President of Engineering and R&D of NaviSite, Inc., a provider of cloud-enabled hosting, managed applications and services, Vice President of Engineering of Mirror Image Internet, Inc., a provider of online content and transaction solutions, and Vice President of Engineering and Operations for CMGI-MyWay.com, a consumer content portal and search engine. Mr. Whitcomb holds a B.S. in Mechanical Engineering from University of Massachusetts, Lowell.

Rohit Goyal. Mr. Goyal has served as our Senior Vice President of Engineering since January 2013. Previously, he was co-founder and VP of Engineering at neoSaej Corp., which developed patented technology for personal finance and e-commerce verticals, from January 2007 to October 2012. Prior to neoSaej, Mr. Goyal was Director of Software at Enterasys Networks and held software engineering positions at Axiowave Networks, Lucent Technologies and Nexabit Networks. He holds a B.S. in Computer Science from Denison University, an M.S. and Ph.D. from The Ohio State University and an M.B.A. from Massachusetts Institute of Technology Sloan School of Management.

Kathleen B. Patton. Ms. Patton has served as our Senior Vice President, General Counsel and Secretary since June 2015. She previously served as our Associate General Counsel from April 2012 until June 2015. From June 2010 until March 2012, Ms. Patton was Associate General Counsel at Stream Global Services, a leading business process outsource service provider specializing in customer relationship management. Prior to Stream Global Services, Ms. Patton worked in law firms as the Director of Practice Development at Brown Rudnick, as the Practice Director at Day Pitney, as a corporate partner and associate at McDermott, Will & Emery and as an associate at Walter, Conston, Alexander & Green. She also served as Senior Counsel at BJ’s Wholesale Club. Ms. Patton earned an A.B. from Dartmouth College and a J.D. from Georgetown University Law Center.

Risk Considerations in Executive Compensation

Our Compensation Committee has discussed the concept of risk as it relates to our compensation programs, including our executive compensation program, and our Compensation Committee does not believe that our compensation programs encourage excessive or inappropriate risk taking. As described more fully below in the “Compensation Discussion and Analysis,” we structure our compensation to consist of both fixed and variable compensation. The fixed (or salary) portion of compensation is designed to provide a steady income regardless of our stock price performance so that executives do not feel pressured to focus exclusively on stock price performance to the detriment of other important business metrics. The variable (cash bonus and equity) portions of compensation are designed to reward both intermediate- and long-term corporate performance and generally are tied to the achievement of corporate and individual objectives. We believe that applying company-wide metrics encourages decision-making by our executives that is in the best long-term interest of our company and stockholders. Our equity awards feature vesting periods to foster retention and align our executives’ interests with those of our shareholders, In addition, our Stock Ownership Guidelines further align the interest of our executives with the interests of our stockholders. We cap potential payouts under both short- and long-term incentive plans to reduce the potential for any windfalls. Further, we believe that these variable elements of compensation constitute a sufficient percentage of overall compensation to motivate our executives to produce superior short-, intermediate- and long-term corporate results, while the fixed element is also sufficiently high that our executives are not encouraged to take unnecessary or excessive risks in doing so.

17

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed our audited financial statements for 2015 and has discussed these financial statements with our management and Deloitte & Touche LLP, our independent registered public accounting firm.

The Audit Committee has also received from, and discussed with, our independent registered public accounting firm various communications that our independent registered public accounting firm is required to provide to the Audit Committee, including the matters required to be discussed by Auditing Standard No. 16, Communication with Audit Committees, as adopted by the Public Company Accounting Oversight Board, or PCAOB.

Our independent registered public accounting firm also provided the Audit Committee with the written disclosures and the letter from the independent auditor required by PCAOB Rule 3526 (Communicating with Audit Committees Concerning Independence), as modified or supplemented. The Audit Committee has discussed with our independent registered public accounting firm the firm’s independence from us.

Based on its discussions with management and our independent registered public accounting firm, and its review of the representations and information provided by management and our independent registered public accounting firm, the Audit Committee recommended to our Board that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2015.

By the Audit Committee of the Board of Directors of Demandware, Inc.

Charles F. Kane (Chair)

Jill Granoff

Jitendra Saxena

18

EXECUTIVE AND DIRECTOR COMPENSATION AND RELATED MATTERS

Compensation Discussion and Analysis

This Compensation Discussion and Analysis is designed to provide our stockholders with an understanding of our compensation philosophy, objectives, programs and process, as well as the compensation paid to our named executive officers, or NEOs, in 2015. For 2015, our NEOs were:

| · | Thomas D. Ebling, our President and Chief Executive Officer; |

| · | Timothy M. Adams, our Executive Vice President and Chief Financial Officer; |

| · | Jeffrey G. Barnett, our Executive Vice President and Chief Operating Officer; |

| · | Wayne R. Whitcomb, our Chief Technology Officer; |

| · | Rohit Goyal, our Senior Vice President of Engineering; and |

| · | Sheila M. Flaherty, our former Chief Legal Officer. |

Our Compensation Committee is responsible for overseeing our executive compensation program. In this capacity, our Compensation Committee designs, implements, reviews and approves annually all compensation for our NEOs.

Executive Summary

Demandware’s philosophy regarding executive compensation is straightforward: attract, motivate and retain executives who have demonstrated superior talent and performance, and reward them for their contribution to the company’s short- and long-term performance by tying a significant portion of their total compensation to programs linked to our long-term success. The elements of our executives’ total compensation are base salary, short-term incentives, which are comprised of annual bonuses, and equity incentive compensation. A significant portion of executive compensation is performance-based, subject to increases when results exceed corporate targets, and reduction or elimination when results fall below target. The performance measures used in our compensation programs include non-GAAP adjusted EBITDA and renewal dollar percentage as well as performance relating to other operational efficiencies and strategic initiatives. Non-GAAP adjusted EBITDA is defined as GAAP operating loss plus depreciation expense, amortization expense, stock-based compensation expense and compensation expense related to contingent retention bonuses.

Business Environment. 2015 was a strong year for Demandware. Subscription revenue increased 38% and live customer websites increased 32% over 2014. This performance was driven by new customers and live customers growing their digital commerce business on our platform. Comparable customers who were live customers for all of 2015 and all of 2014 leveraged Demandware Commerce and our robust merchandising applications to grow their gross merchandise value, or GMV, 25% on a constant currency basis in 2015. Demandware stockholders experienced a decrease of 6.2% in their investment based on total shareholder return as measured from December 31, 2014 to December 31, 2015; however, Demandware stockholders have experienced an increase of 128.8% measured from our initial public offering on March 15, 2012 to December 31, 2015.

2015 Compensation Actions. The compensation paid to our NEOs reflects their contribution to Demandware’s success in 2015. In March 2015, our Compensation Committee approved increases for 2015 base salaries for our NEOs, except for Messrs. Ebling, Barnett and Adams, that averaged 8.6%. Following these increases, base salaries closely approximated the 60th percentile of market data provided by our consultant in December of 2014, with the exception of Mr. Ebling who more closely approximated the 25th percentile and Ms. Flaherty who more closely approximated the 75th percentile. Target total cash compensation (the sum of base salaries and target bonuses) for our NEOs in the aggregate approximated between the 50th and 75th percentile of market data provided by our consultant with Mr. Ebling more closely approximating the 25th percentile.

The 2015 short-term incentive plan considered financial results relative to goals including non-GAAP adjusted EBITDA and renewal dollar percentage, a more discretionary assessment of performance relating to a variety of operational efficiency, technological innovation and strategic initiatives, and an assessment of individual performance relative to role-specific performance goals. Although the company exceeded the performance objectives for non-GAAP adjusted EBITDA and renewal dollar percentage, the Compensation Committee determined, in light of the company’s overall performance in 2015, to apply its discretionary authority to cap the payouts attributable to these metrics at 100%. Combined achievement against performance goals resulted in short-term incentive plan payments that averaged 96% of target for our NEOs excluding Ms. Flaherty, who, in May 2015, determined to resign, effective as of June 26, 2015, as our Chief Legal Officer and did not receive a short-term incentive plan payment.

19

In 2015, in addition to the cash compensation earned by our NEOs, we made a grant of equity comprised of restricted stock awards and performance-based restricted stock. For each NEO other than Ms. Flaherty, who resigned in 2015, the restricted stock awards vested as to 25% of the award on March 1, 2016 and then vest quarterly over the following three years. The performance-based restricted stock is based on the company’s achievement of contract backlog, net of deferred services revenue on a constant currency basis. For each NEO other than Ms. Flaherty, the performance-based restricted stock vested as to 25% of the award on March 29, 2016, which was the later of March 1, 2016 or the date of certification of the performance condition, and then vest quarterly, on the first day of the last month of each quarter, over the following three years. In 2016, in connection with the annual review of our executive officers’ individual performance, our Compensation Committee approved additional equity incentive awards for our NEOs other than Ms. Flaherty, which begin vesting in 2017 and are comprised of both restricted stock awards and performance-based restricted stock, which will vest based on the company’s level of achievement against performance targets for contract backlog, net of deferred services revenue on a constant currency basis.