1 Alpha Natural Resources European Investor Presentation February 25, 2013 Alpha Natural Resources J.P. Morgan Global High Yield & Leveraged Finance Conference

2 Forward-Looking Statements Statements in this presentation which are not statements of historical fact are “forward-looking statements” within the Safe Harbor provision of the Private Securities Litigation Reform Act of 1995. Such statements are not guarantees of future performance. Many factors could cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward looking-statements. These factors are discussed in detail in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in our other filings with the SEC. We make forward-looking statements based on currently available information, and we assume no obligation to update the statements made today or contained in our Annual Report or other filings due to changes in underlying factors, new information, future developments, or otherwise, except as required by law. Third Party Information This presentation, including certain forward-looking statements herein, include information obtained from third party sources that we believe to be reliable. However, we have not independently verified this third party information and cannot assure you of its accuracy or completeness. While we are not aware of any misstatements regarding any third party data contained in this presentation, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed in detail in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in our other filings with the SEC. We assume no obligation to revise or update this third party information to reflect future events or circumstances.

3 • Leading US supplier and exporter of metallurgical coal with expertise in blending and optimization Globally # 3 in metallurgical coal by shipment volume Exports $2.9 billion or 42% of total revenues in 2012 • One of the most regionally diversified producers in the US • More export terminal capacity than any other US producer: 25-30 million tons • Approximately $2.1 billion in total liquidity as of December 31, 2012 • Focus on operational optimization, cost control, consistent execution and positive free cash-flow generation Leading U.S. Producer with Global Reach Alpha Natural Resources Highlights

4 Alpha Natural Resources European Investor Presentation Alpha Natural Resources Overview Strategy to Create an Industry Leader

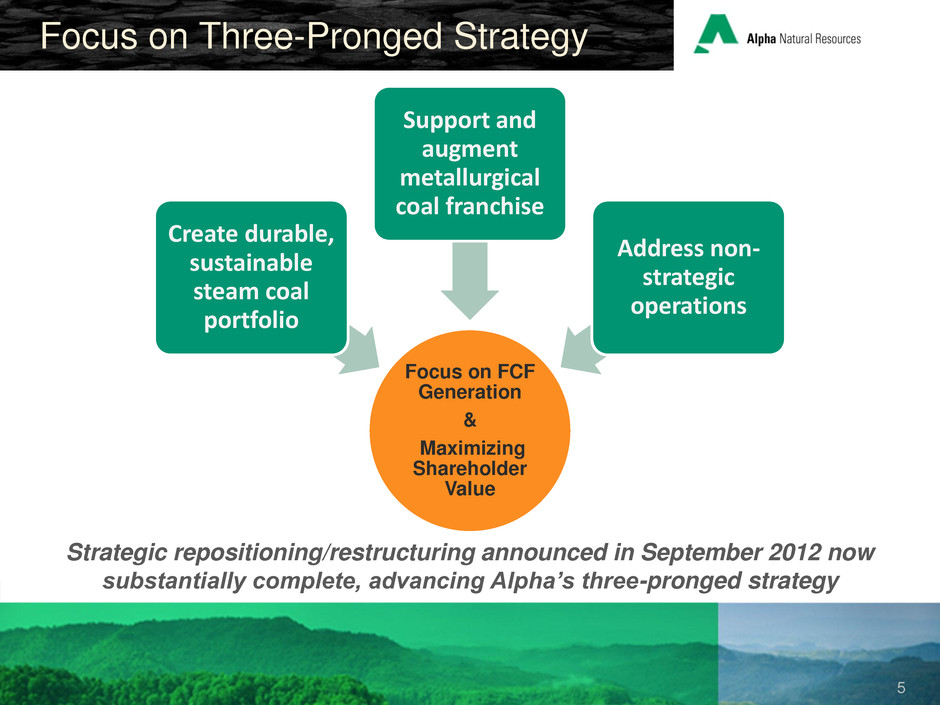

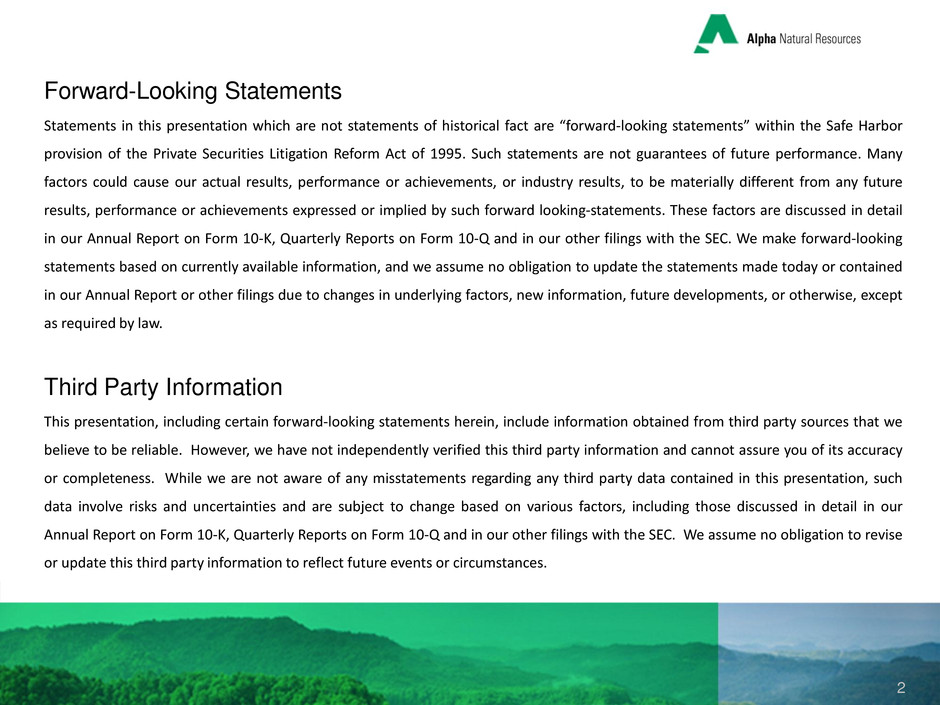

5 Focus on Three-Pronged Strategy Focus on FCF Generation & Maximizing Shareholder Value Create durable, sustainable steam coal portfolio Support and augment metallurgical coal franchise Address non- strategic operations Strategic repositioning/restructuring announced in September 2012 now substantially complete, advancing Alpha’s three-pronged strategy

6 Strategic Repositioning: Decisive Action Adjusted production and shipments in response to current market & pricing environment Expecting 2013 shipment volumes of approximately 81-92mm tons* Implemented cost containment initiatives throughout company Reducing overhead expenses ~ $150+mm annually by streamlining field operations & corporate functions Expected savings of at least $100mm in cost of coal sales & $50mm in SG&A Reduced capital expenditures to enhance cash flows 2013 capex guidance (capex + LBA expense) of $300mm - $350mm* compared with $498mm in 2012 * Based on February 14, 2012 guidance.

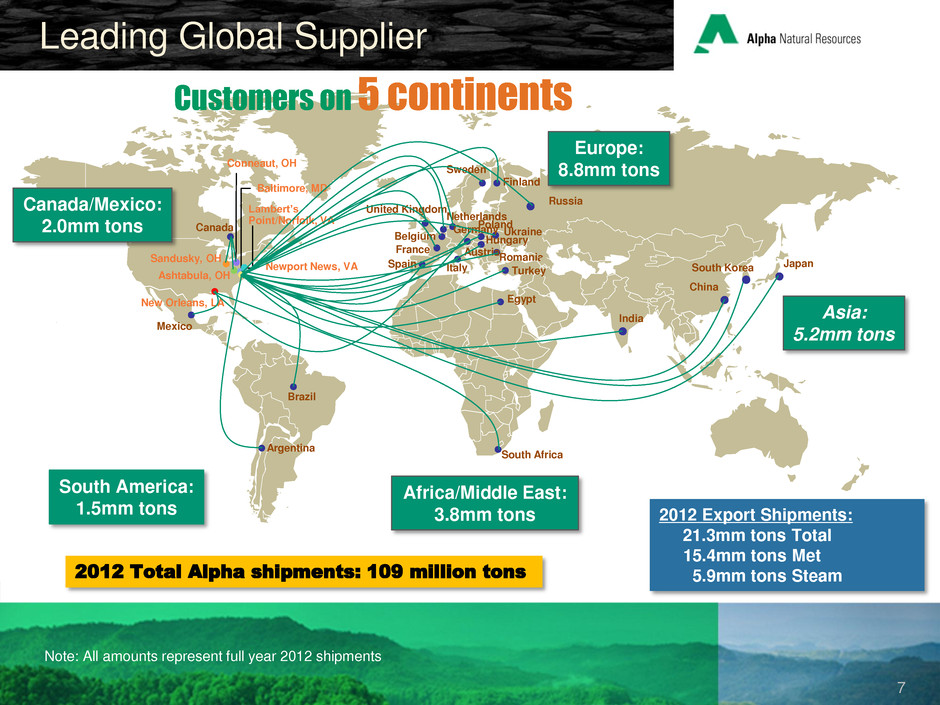

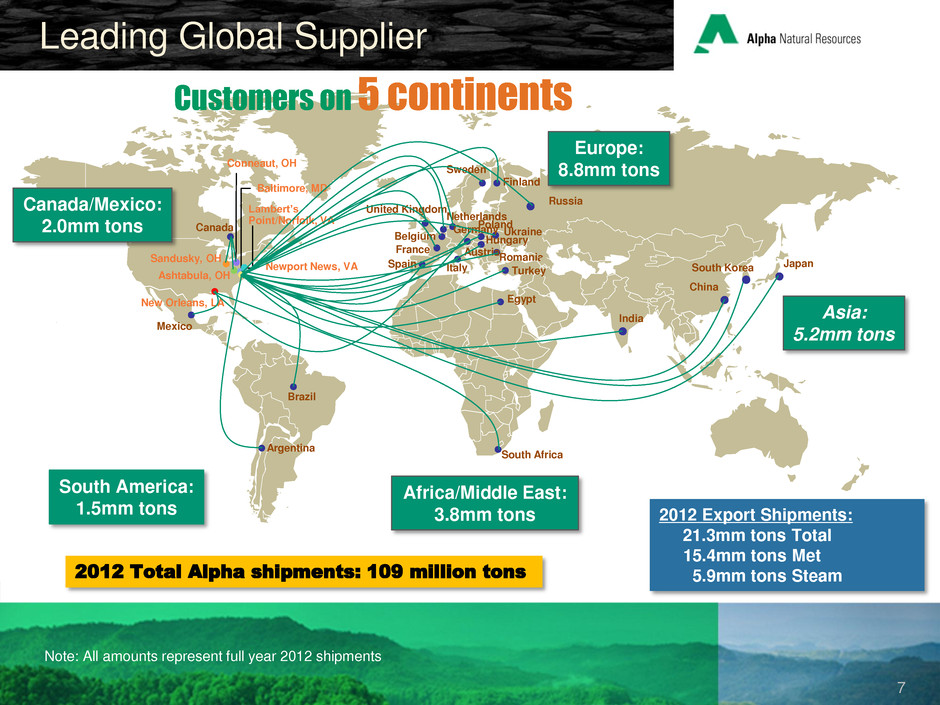

7 Leading Global Supplier Belgium Brazil Romania Canada France Egypt Sweden Netherlands Ukraine Spain Turkey United Kingdom Sandusky, OH Conneaut, OH Newport News, VA Lambert’s Point/Norfolk, VA Baltimore, MD Ashtabula, OH Russia New Orleans, LA Argentina Mexico Finland India Japan South Africa China Austria Italy Poland Hungary Germany Europe: 8.8mm tons South America: 1.5mm tons Asia: 5.2mm tons Africa/Middle East: 3.8mm tons South Korea 2012 Total Alpha shipments: 109 million tons 2012 Export Shipments: 21.3mm tons Total 15.4mm tons Met 5.9mm tons Steam Customers on 5 continents Canada/Mexico: 2.0mm tons Note: All amounts represent full year 2012 shipments

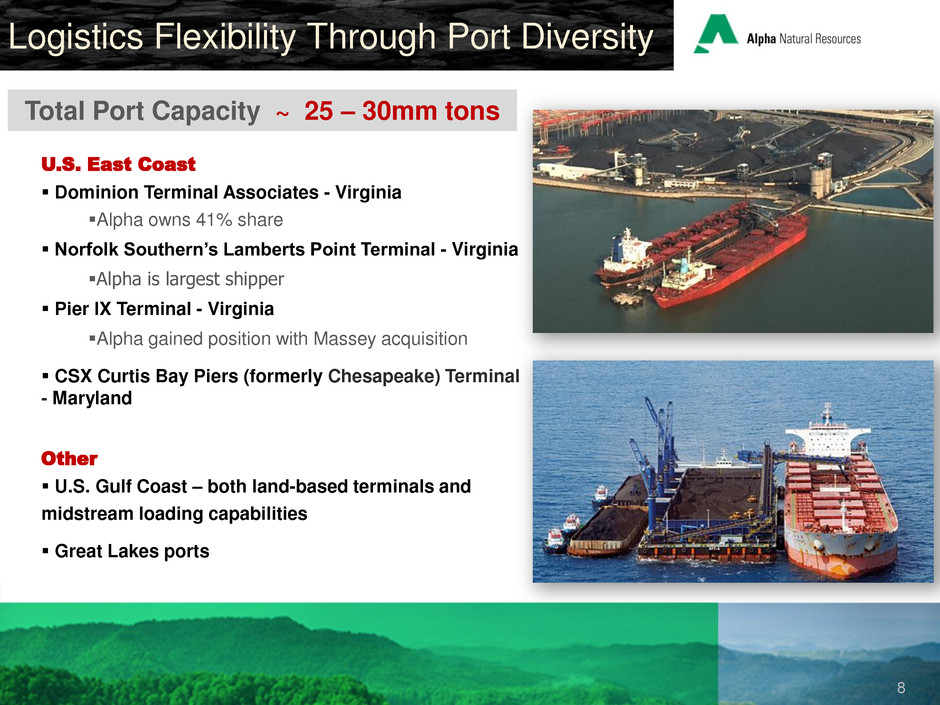

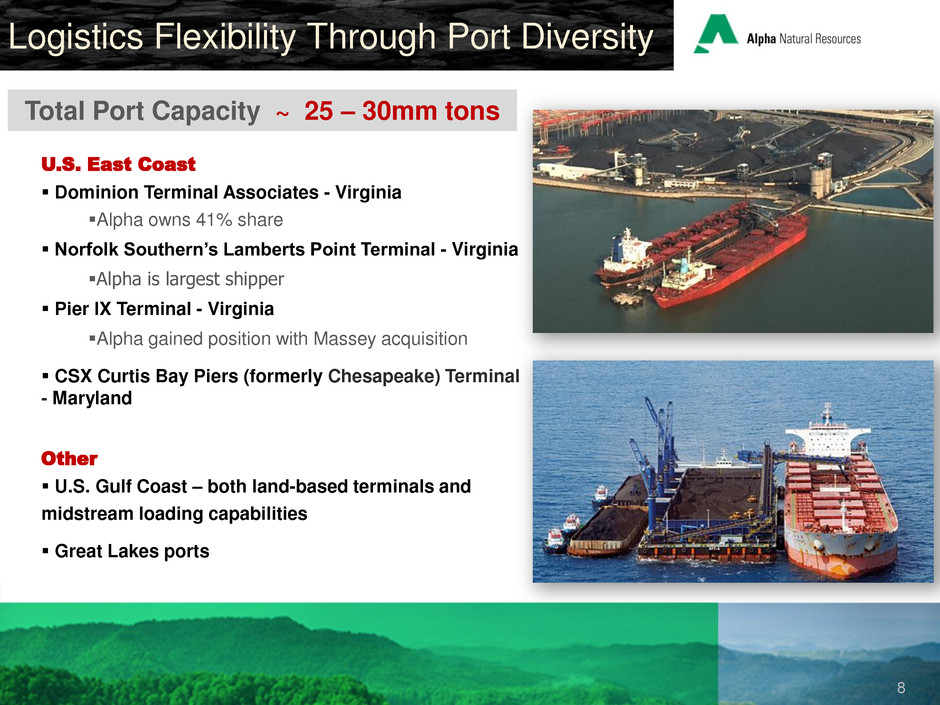

8 Logistics Flexibility Through Port Diversity Total Port Capacity ~ 25 – 30mm tons U.S. East Coast Dominion Terminal Associates - Virginia Alpha owns 41% share Norfolk Southern’s Lamberts Point Terminal - Virginia Alpha is largest shipper Pier IX Terminal - Virginia Alpha gained position with Massey acquisition CSX Curtis Bay Piers (formerly Chesapeake) Terminal - Maryland Other U.S. Gulf Coast – both land-based terminals and midstream loading capabilities Great Lakes ports

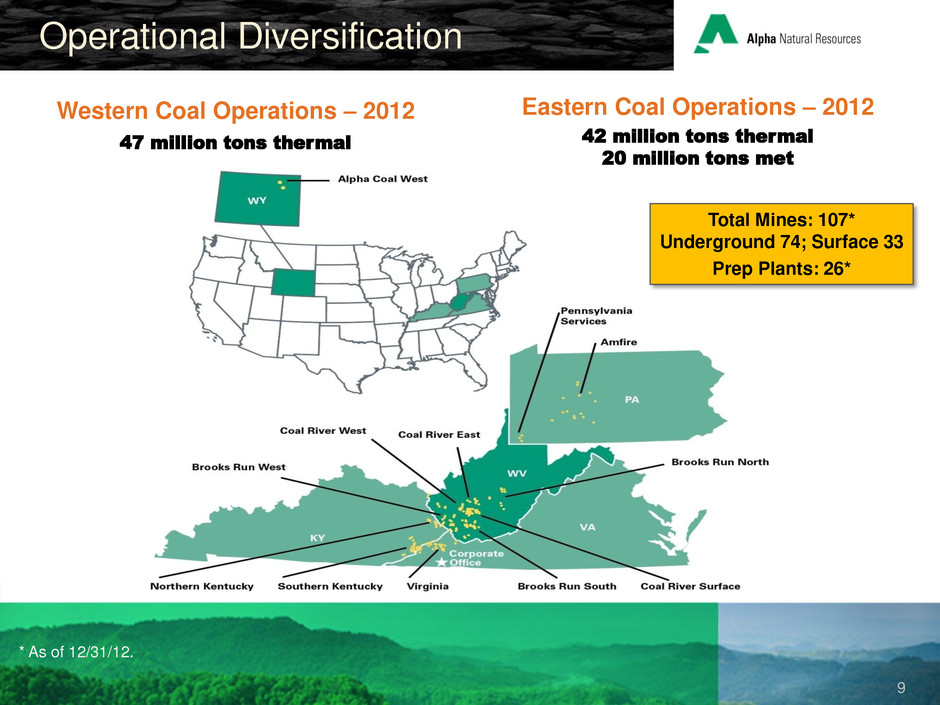

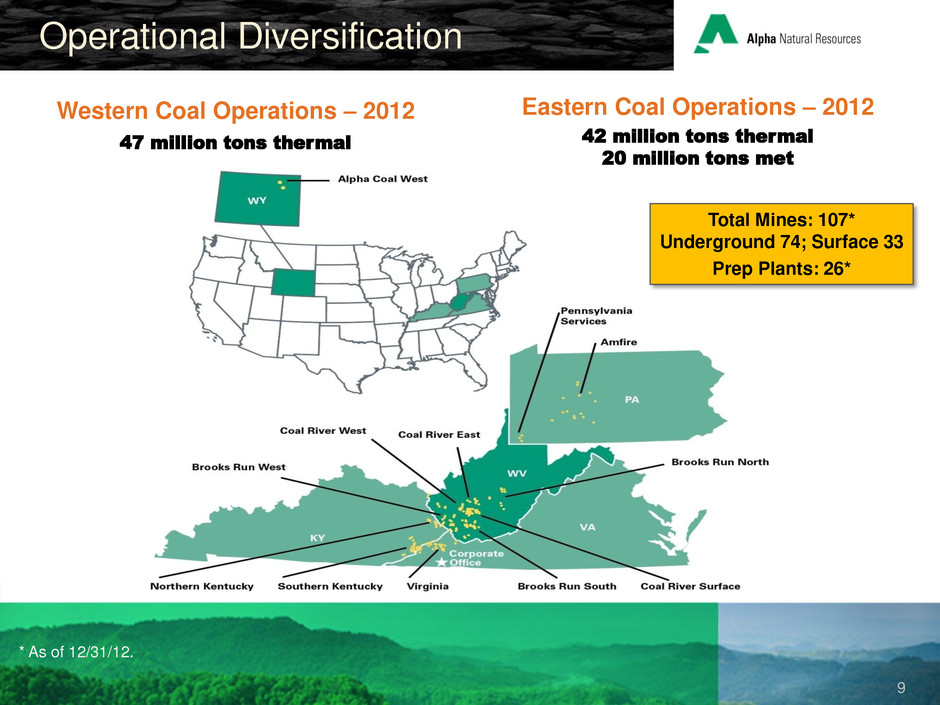

9 Operational Diversification Western Coal Operations – 2012 47 million tons thermal Eastern Coal Operations – 2012 42 million tons thermal 20 million tons met Total Mines: 107* Underground 74; Surface 33 Prep Plants: 26* * As of 12/31/12.

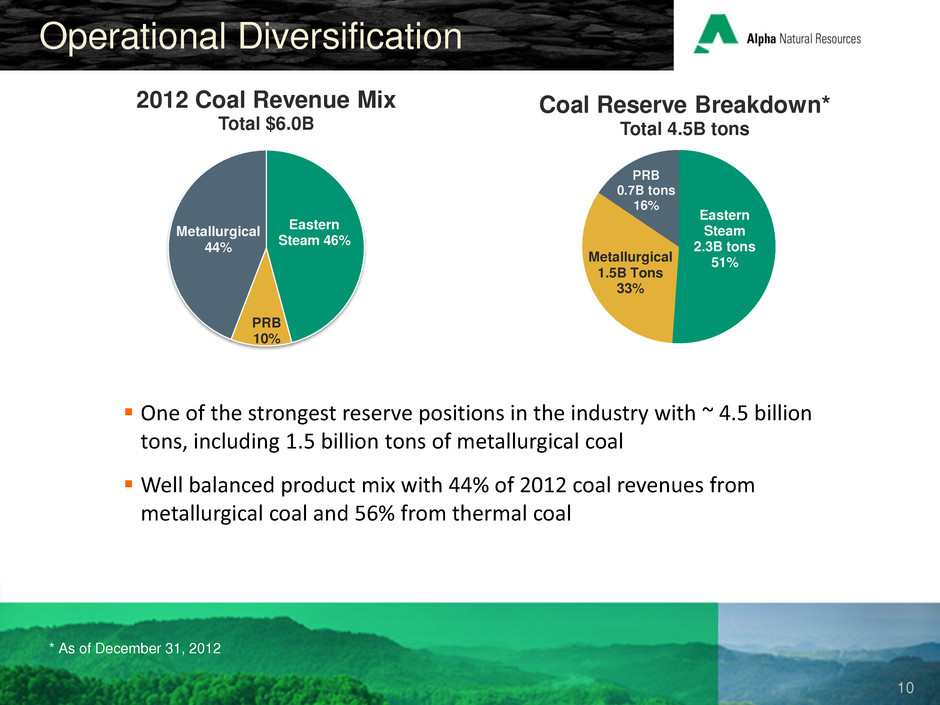

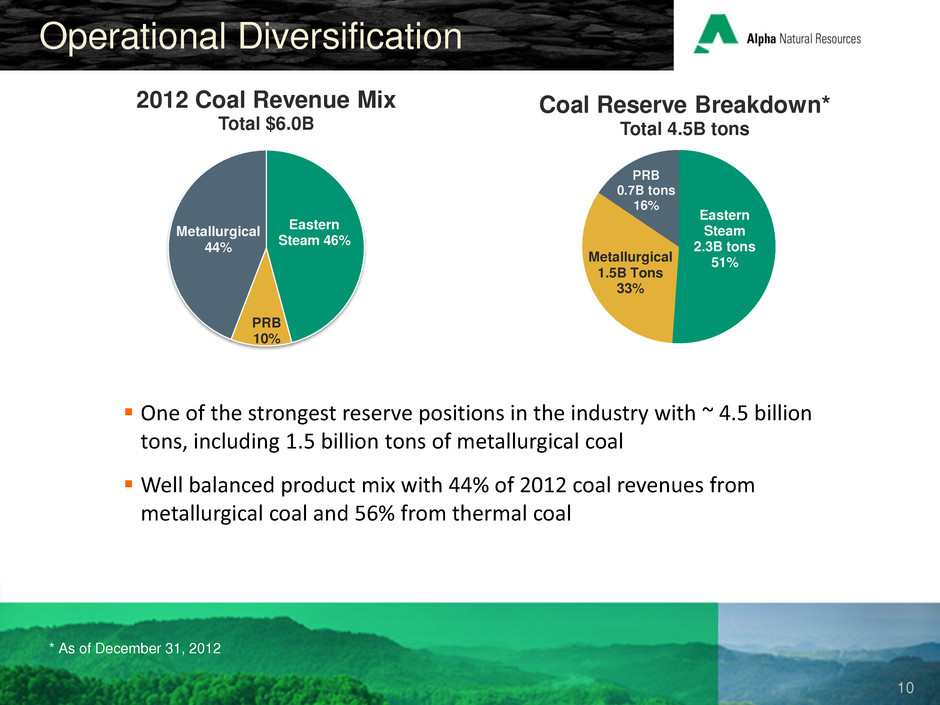

10 Operational Diversification * As of December 31, 2012 Eastern Steam 46% PRB 10% Metallurgical 44% 2012 Coal Revenue Mix Total $6.0B Eastern Steam 2.3B tons 51% Metallurgical 1.5B Tons 33% PRB 0.7B tons 16% Coal Reserve Breakdown* Total 4.5B tons One of the strongest reserve positions in the industry with ~ 4.5 billion tons, including 1.5 billion tons of metallurgical coal Well balanced product mix with 44% of 2012 coal revenues from metallurgical coal and 56% from thermal coal

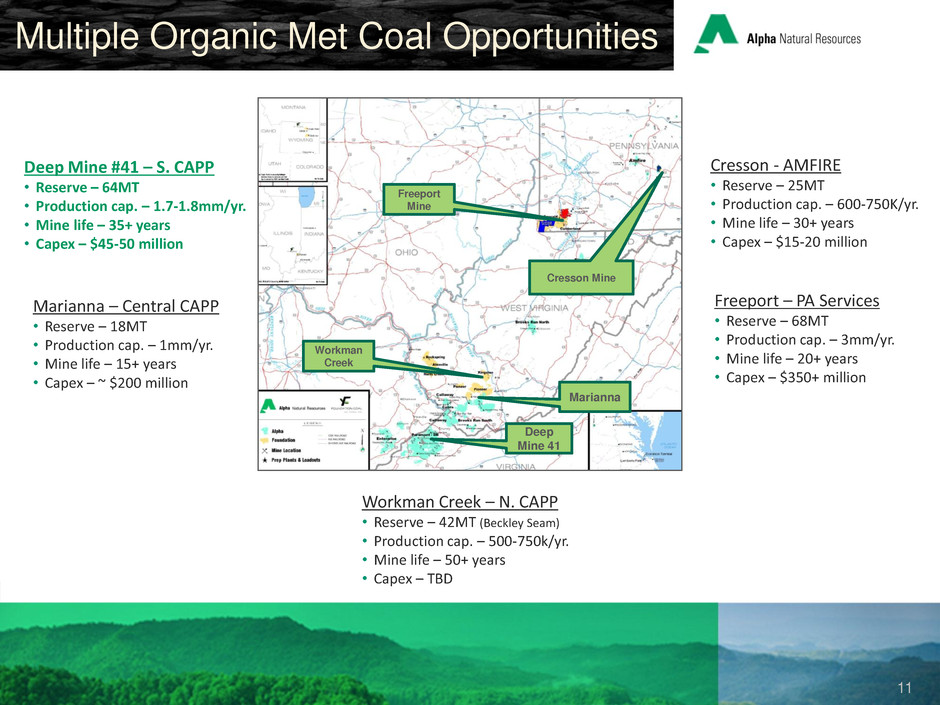

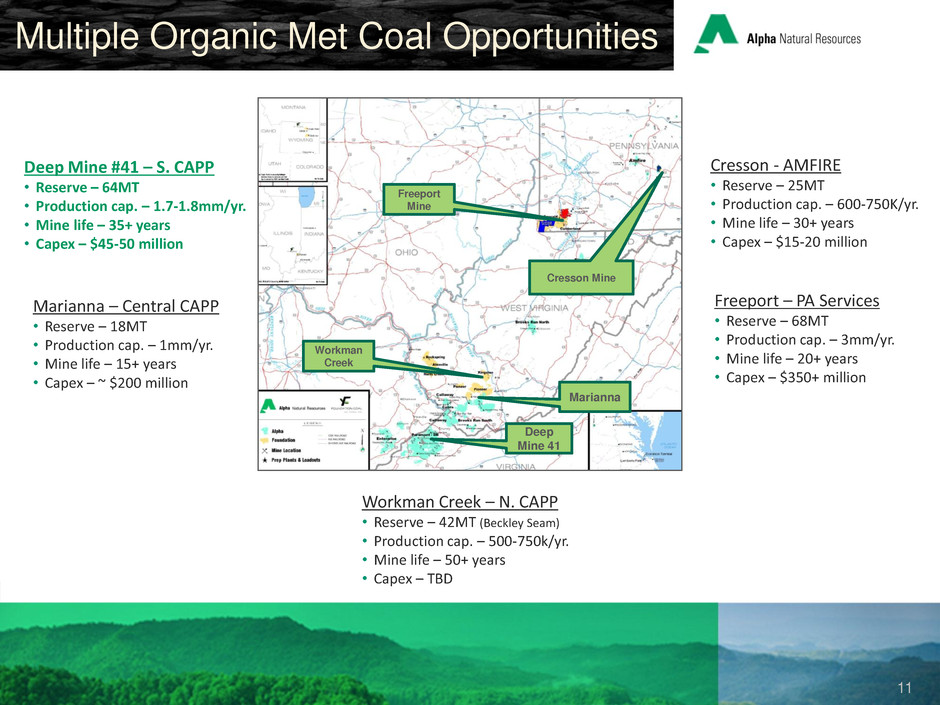

11 Multiple Organic Met Coal Opportunities Freeport – PA Services • Reserve – 68MT • Production cap. – 3mm/yr. • Mine life – 20+ years • Capex – $350+ million Cresson - AMFIRE • Reserve – 25MT • Production cap. – 600-750K/yr. • Mine life – 30+ years • Capex – $15-20 million Workman Creek – N. CAPP • Reserve – 42MT (Beckley Seam) • Production cap. – 500-750k/yr. • Mine life – 50+ years • Capex – TBD Deep Mine #41 – S. CAPP • Reserve – 64MT • Production cap. – 1.7-1.8mm/yr. • Mine life – 35+ years • Capex – $45-50 million Marianna – Central CAPP • Reserve – 18MT • Production cap. – 1mm/yr. • Mine life – 15+ years • Capex – ~ $200 million Cresson Mine Freeport Mine Deep Mine 41 Marianna Workman Creek

12 Alpha Natural Resources European Investor Presentation Market Overview BRICS Drive Global Growth

13 Asia Drives Thermal Demand Sources: IEA World Energy Outlook 2011, New Policies Scenario; IEA Coal Information 2011; Internal Analysis 2009 2015 2020 India 6.2% CAGR 5.2% CAGR 2009 2015 2020 China 4.4% CAGR 6.2% CAGR 0 5,000 10,000 15,000 20,000 25,000 30,000 2009 2015 2020 El ec tri c Ge n er at io n ( T W h ) World 3.0% CAGR (2009-2020) 2.7% CAGR (2009-2020) 5.4B 6.7B 7.2B Thermal Coal (tons) 2.9% CAGR 2.4% CAGR 2009 2015 2020 Other Asia

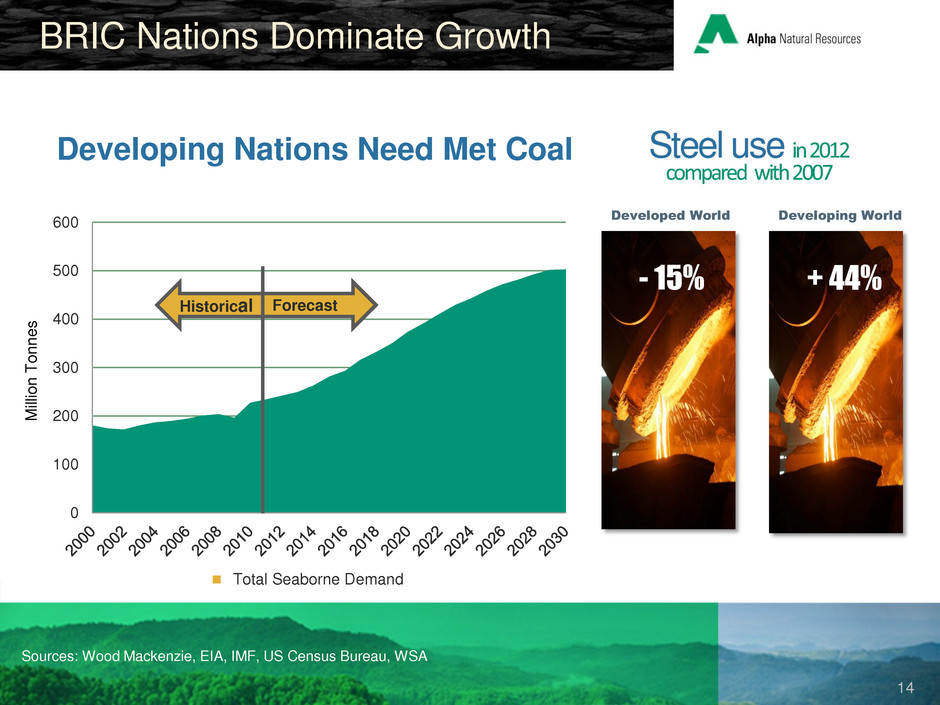

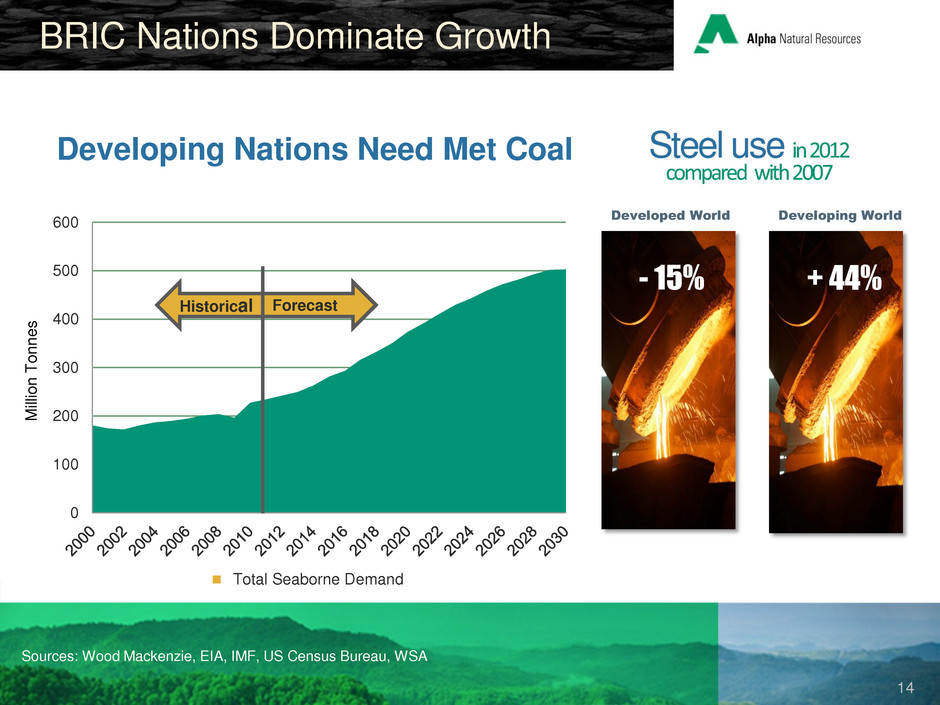

14 0 100 200 300 400 500 600 Total Seaborne Demand M ill io n T o n n e s - 15% Developed World Developing World + 44% BRIC Nations Dominate Growth Steel use in 2012 compared with 2007 Sources: Wood Mackenzie, EIA, IMF, US Census Bureau, WSA Developing Nations Need Met Coal Forecast Historical

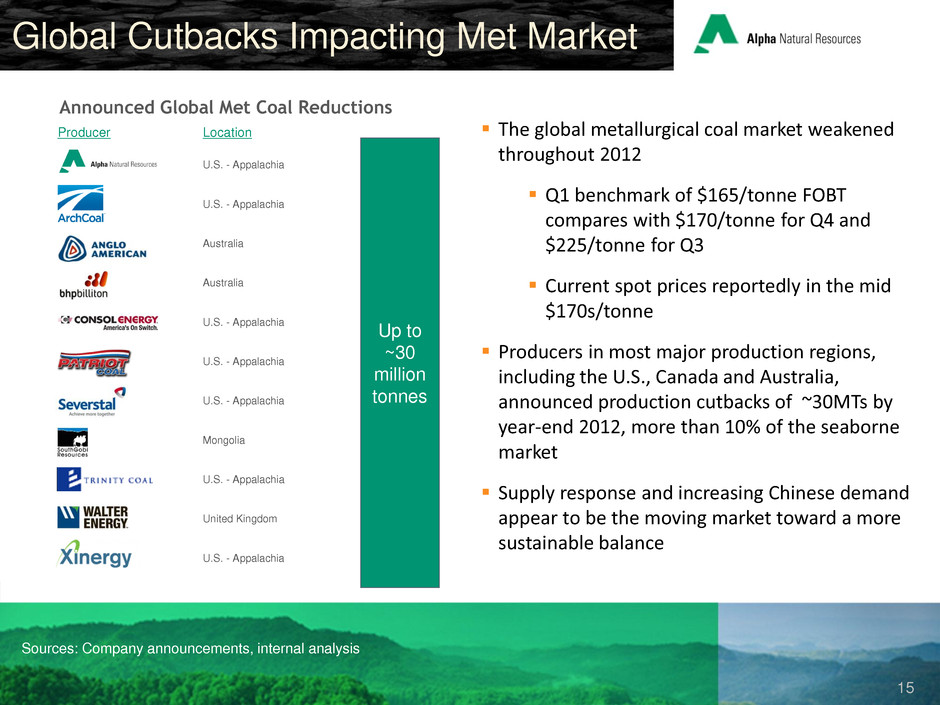

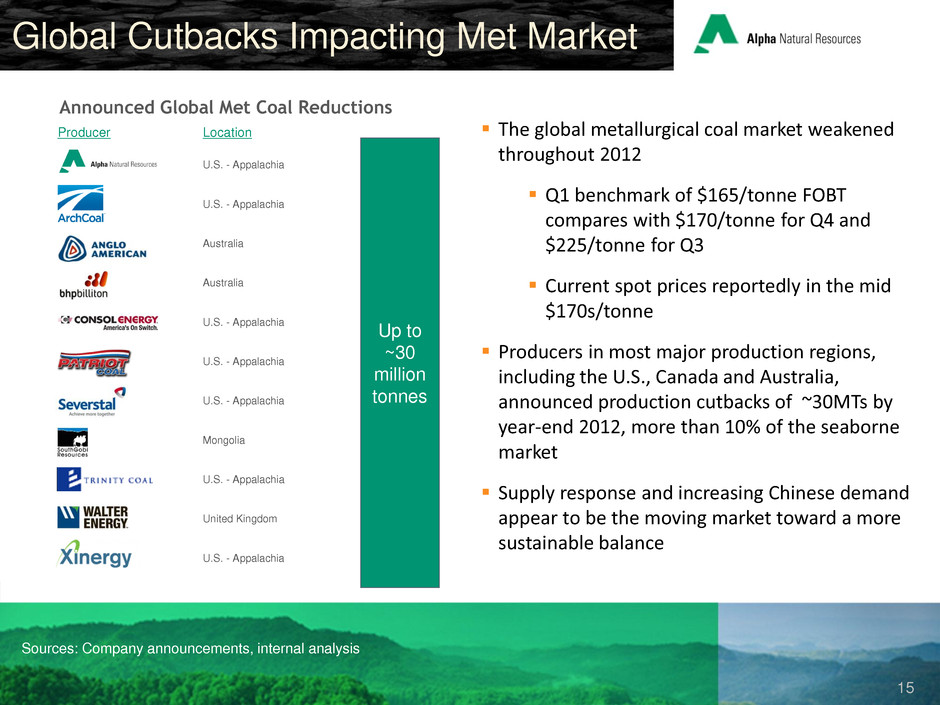

15 Global Cutbacks Impacting Met Market Sources: Company announcements, internal analysis Announced Global Met Coal Reductions Up to ~30 million tonnes U.S. - Appalachia U.S. - Appalachia Australia Australia U.S. - Appalachia U.S. - Appalachia U.S. - Appalachia Mongolia U.S. - Appalachia United Kingdom U.S. - Appalachia Producer Location The global metallurgical coal market weakened throughout 2012 Q1 benchmark of $165/tonne FOBT compares with $170/tonne for Q4 and $225/tonne for Q3 Current spot prices reportedly in the mid $170s/tonne Producers in most major production regions, including the U.S., Canada and Australia, announced production cutbacks of ~30MTs by year-end 2012, more than 10% of the seaborne market Supply response and increasing Chinese demand appear to be the moving market toward a more sustainable balance

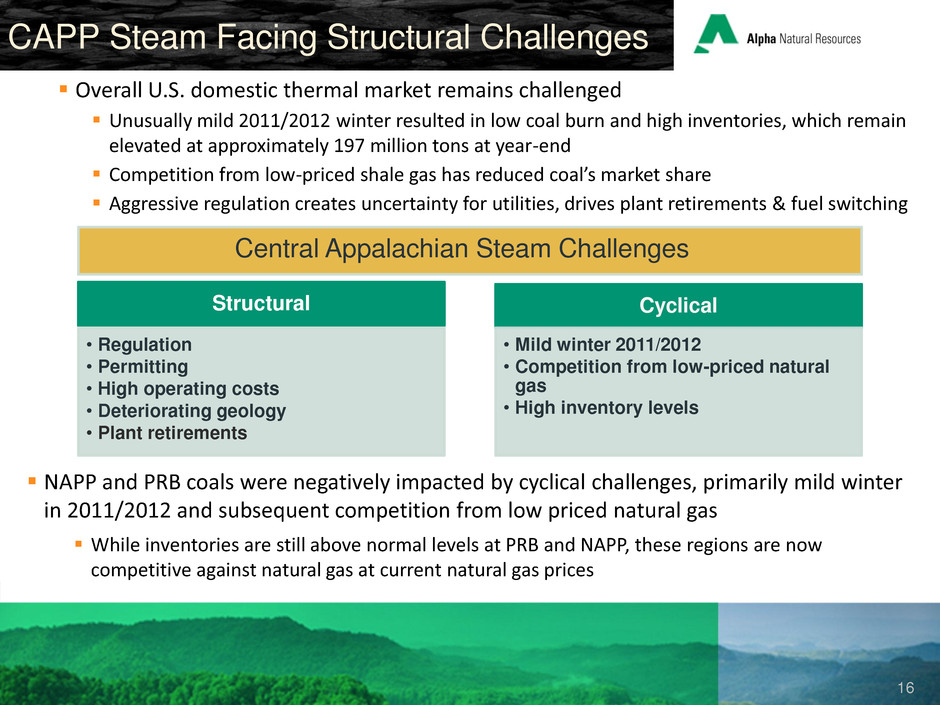

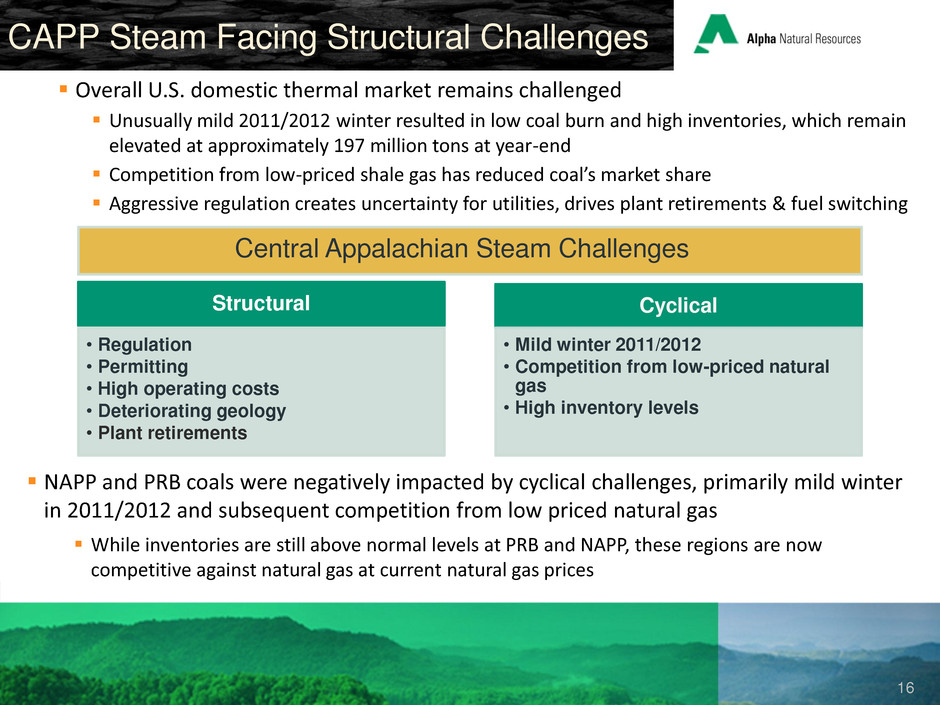

16 Overall U.S. domestic thermal market remains challenged Unusually mild 2011/2012 winter resulted in low coal burn and high inventories, which remain elevated at approximately 197 million tons at year-end Competition from low-priced shale gas has reduced coal’s market share Aggressive regulation creates uncertainty for utilities, drives plant retirements & fuel switching CAPP Steam Facing Structural Challenges Structural • Regulation • Permitting • High operating costs • Deteriorating geology • Plant retirements Cyclical • Mild winter 2011/2012 • Competition from low-priced natural gas • High inventory levels NAPP and PRB coals were negatively impacted by cyclical challenges, primarily mild winter in 2011/2012 and subsequent competition from low priced natural gas While inventories are still above normal levels at PRB and NAPP, these regions are now competitive against natural gas at current natural gas prices Central Appalachian Steam Challenges

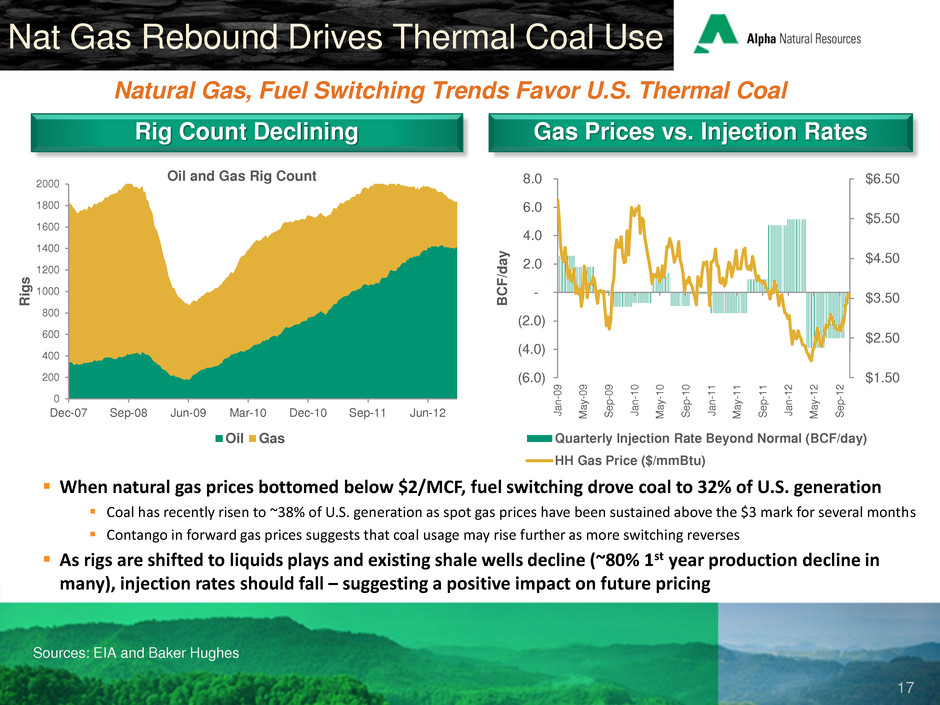

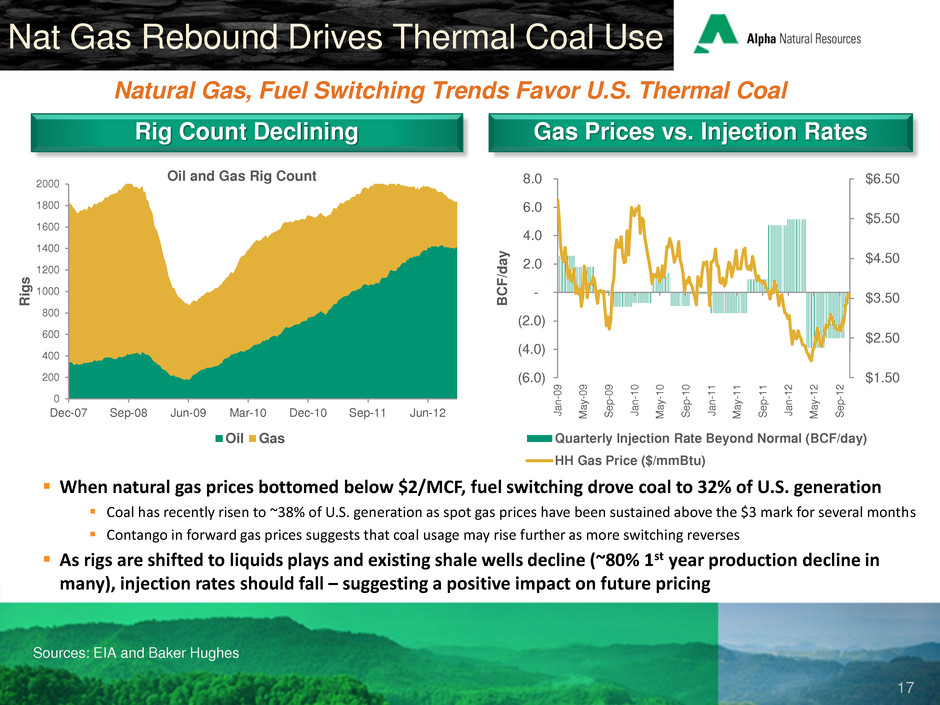

17 When natural gas prices bottomed below $2/MCF, fuel switching drove coal to 32% of U.S. generation Coal has recently risen to ~38% of U.S. generation as spot gas prices have been sustained above the $3 mark for several months Contango in forward gas prices suggests that coal usage may rise further as more switching reverses As rigs are shifted to liquids plays and existing shale wells decline (~80% 1st year production decline in many), injection rates should fall – suggesting a positive impact on future pricing Nat Gas Rebound Drives Thermal Coal Use Natural Gas, Fuel Switching Trends Favor U.S. Thermal Coal Rig Count Declining Gas Prices vs. Injection Rates 0 200 400 600 800 1000 1200 1400 1600 1800 2000 Dec-07 Sep-08 Jun-09 Mar-10 Dec-10 Sep-11 Jun-12 R ig s Oil and Gas Rig Count Oil Gas Sources: EIA and Baker Hughes $1.50 $2.50 $3.50 $4.50 $5.50 $6.50 (6.0) (4.0) (2.0) - 2.0 4.0 6.0 8.0 J a n -0 9 Ma y -0 9 S e p -0 9 J a n -1 0 Ma y -1 0 S e p -1 0 J a n -1 1 Ma y -1 1 S e p -1 1 J a n -1 2 Ma y -1 2 S e p -1 2 B C F/da y Quarterly Injection Rate Beyond Normal (BCF/day) HH Gas Price ($/mmBtu)

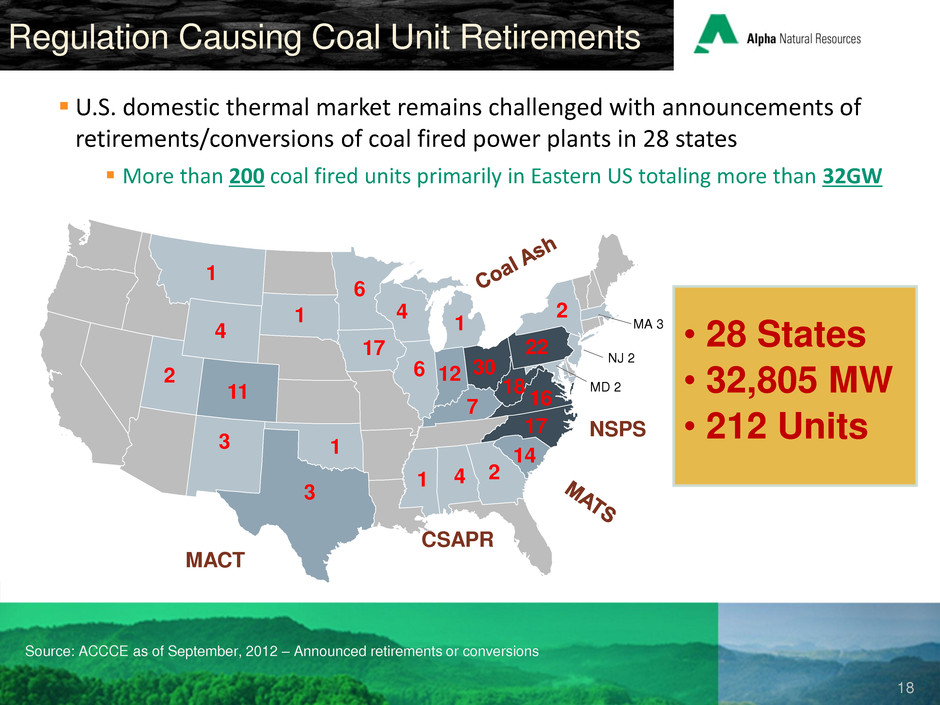

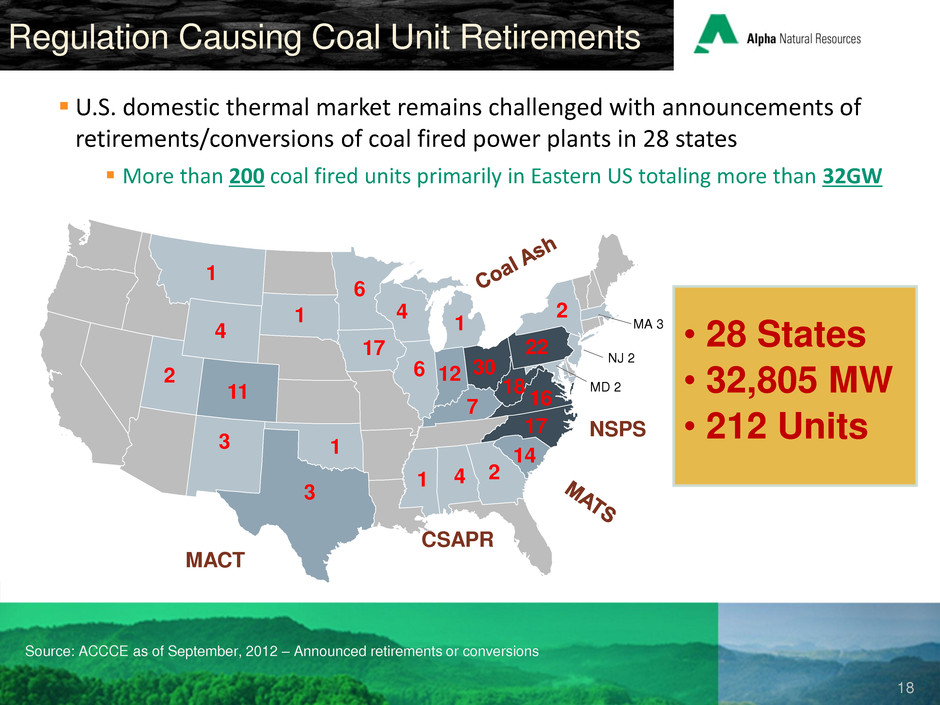

18 MA 3 MD 2 NJ 2 22 14 16 17 18 30 17 6 1 3 4 2 3 2 4 1 6 4 12 7 11 1 U.S. domestic thermal market remains challenged with announcements of retirements/conversions of coal fired power plants in 28 states More than 200 coal fired units primarily in Eastern US totaling more than 32GW Regulation Causing Coal Unit Retirements • 28 States • 32,805 MW • 212 Units Source: ACCCE as of September, 2012 – Announced retirements or conversions MACT NSPS CSAPR 1 2 1

19 Alpha Natural Resources European Investor Presentation Financial Overview Resources to Enhance Shareholder Value

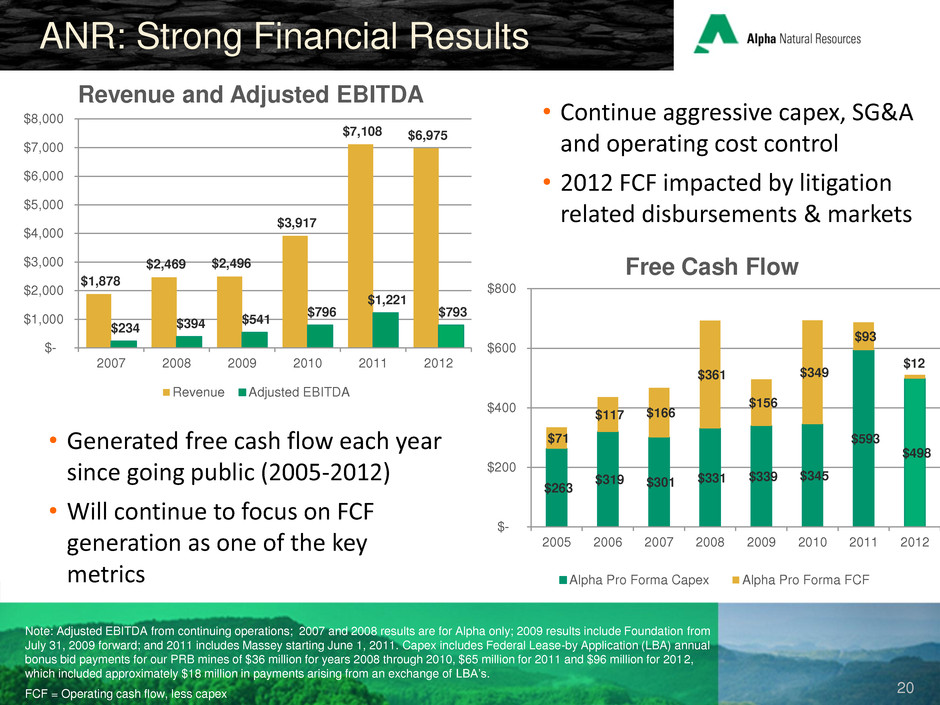

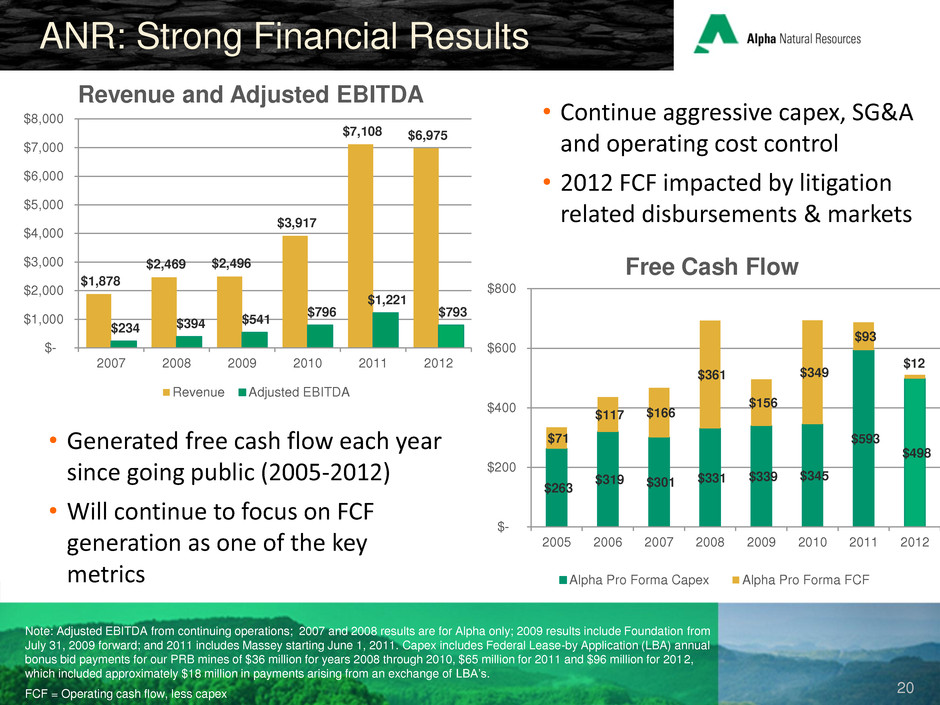

20 Note: Adjusted EBITDA from continuing operations; 2007 and 2008 results are for Alpha only; 2009 results include Foundation from July 31, 2009 forward; and 2011 includes Massey starting June 1, 2011. Capex includes Federal Lease-by Application (LBA) annual bonus bid payments for our PRB mines of $36 million for years 2008 through 2010, $65 million for 2011 and $96 million for 2012, which included approximately $18 million in payments arising from an exchange of LBA’s. FCF = Operating cash flow, less capex ANR: Strong Financial Results • Continue aggressive capex, SG&A and operating cost control • 2012 FCF impacted by litigation related disbursements & markets • Generated free cash flow each year since going public (2005-2012) • Will continue to focus on FCF generation as one of the key metrics $263 $319 $301 $331 $339 $345 $593 $498 $71 $117 $166 $361 $156 $349 $93 $12 $- $200 $400 $600 $800 2005 2006 2007 2008 2009 2010 2011 2012 Free Cash Flow Alpha Pro Forma Capex Alpha Pro Forma FCF $1,878 $2,469 $2,496 $3,917 $7,108 $6,975 $234 $394 $541 $796 $1,221 $793 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 2007 2008 2009 2010 2011 2012 Revenue and Adjusted EBITDA Revenue Adjusted EBITDA

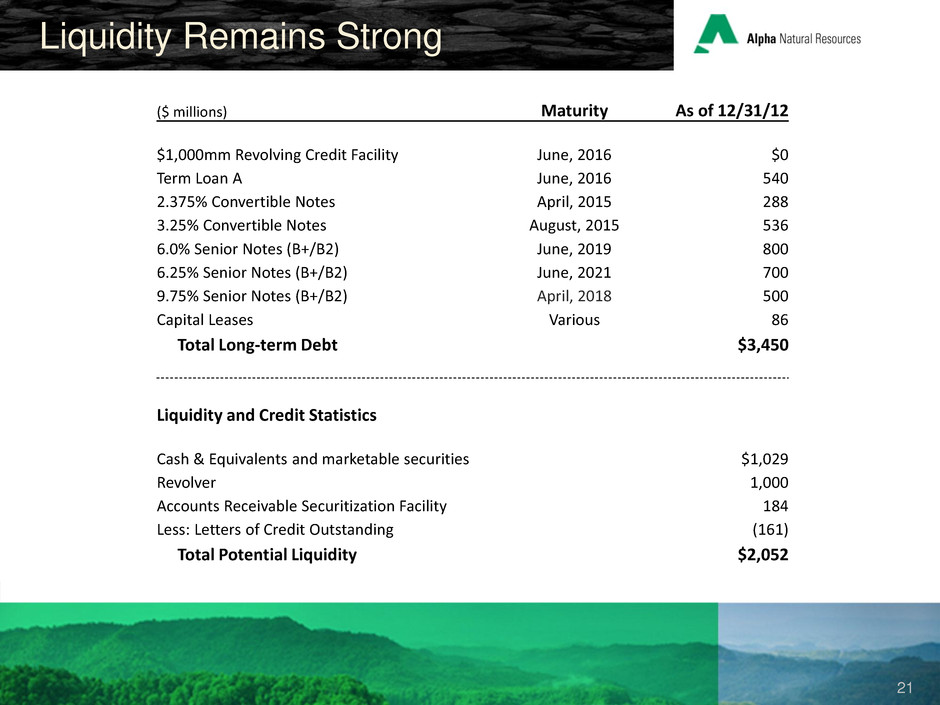

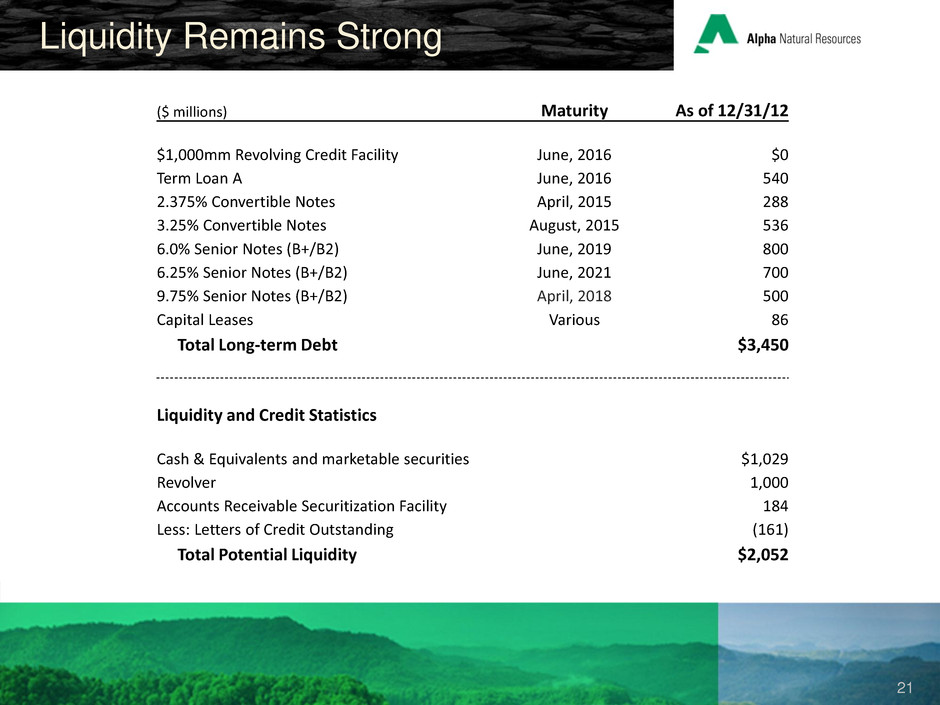

21 Liquidity Remains Strong ($ millions) Maturity As of 12/31/12 $1,000mm Revolving Credit Facility June, 2016 $0 Term Loan A June, 2016 540 2.375% Convertible Notes April, 2015 288 3.25% Convertible Notes August, 2015 536 6.0% Senior Notes (B+/B2) June, 2019 800 6.25% Senior Notes (B+/B2) June, 2021 700 9.75% Senior Notes (B+/B2) April, 2018 500 Capital Leases Various 86 Total Long-term Debt $3,450 Liquidity and Credit Statistics Cash & Equivalents and marketable securities $1,029 Revolver 1,000 Accounts Receivable Securitization Facility 184 Less: Letters of Credit Outstanding (161) Total Potential Liquidity $2,052

22 Leading global met producer with consistent performance enhanced by product and regional diversification o #3 globally in metallurgical coal More export capacity than any other US producer allows Alpha to take advantage of growing seaborne demand Prudent capital expenditure management with focus on free cash flow generation Focus on operational optimization, cost control, consistent execution and positive free cash flow generation to enhance shareholder value Well positioned to take advantage of improving markets for metallurgical and thermal coals Well-Positioned for Future Growth

23 www.alphanr.com Appendices

24 2013 Guidance Issued Feb. 14, 2013 NOTES: 1. Based on committed and priced coal shipments as of January 25, 2013. 2. Actual average per ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per ton realizations. 3. Eastern shipments in 2013 include an estimated 0.5 to 1.0 million tons of brokered coal. 4. As of January 25, 2013, compared with the midpoint of shipment guidance range. 5. In 2013, committed and unpriced Eastern tons include approximately 6.7 million tons of metallurgical coal subject to market pricing, approximately 0.3 million tons of steam coal tons subject to market pricing, approximately 0.2 million tons of steam coal subject to collared pricing with an average pricing range of approximately $83 to $103 per ton, and approximately 0.2 million tons of steam coal subject to average indexed pricing estimated at approximately $74 per ton. 6. Excludes merger-related expenses and UBB charges. Alpha has not reconciled the adjusted Eastern cost of coal sales per ton to Eastern cost of coal sales per ton because merger-related expenses and UBB charges, necessary reconciling items, cannot be reasonably predicted, and Alpha is unable to provide guidance for such expenses. 7. Alpha has not reconciled the adjusted selling, general & administrative expense to selling, general & administrative expense because merger-related expenses, a necessary reconciling item, cannot be reasonably predicted, and Alpha is unable to provide guidance for such expenses. 8. Includes the annual bonus bid payment on the Federal Lease by Application for the Belle Ayr mine of $42 million. Guidance (in millions, except per-ton and percentage amounts) 2013 Average per Ton Sales Realization on Committed and Priced Coal Shipments1,2 West $12.84 Eastern Steam $62.71 Eastern Metallurgical $113.25 Coal Shipments (tons)3 81 – 92 West 37 – 40 Eastern Steam 25 – 30 Eastern Metallurgical 19 – 22 Committed and Priced (%)4 85% West 97% Eastern Steam 94% Eastern Metallurgical 47% Committed and Unpriced (%)4,5 9% West 0% Eastern Steam 2% Eastern Metallurgical 33% West – Cost of Coal Sales per Ton $10.00 – $11.00 East – Cost of Coal Sales per Ton6 $71.00 – $75.00 Selling, General & Administrative Expense7 (excluding merger-related expenses) $140 – $160 Depletion, Depreciation & Amortization $875 – $975 Interest Expense $230 – $240 Capital Expenditures8 $300 – $350

25 Reconciliation Use of Non-GAAP Measures In addition to the results prepared in accordance with generally accepted accounting principles in the United States (GAAP) provided throughout this press release, Alpha has presented the following non-GAAP financial measures, which management uses to gauge operating performance: EBITDA, adjusted EBITDA, adjusted net income (loss), adjusted diluted earnings (loss) per common share, adjusted cost of coal sales per ton, adjusted coal margin per ton and adjusted weighted average coal margin per ton. These non-GAAP financial measures exclude various items detailed in the attached “Reconciliation of EBITDA and Adjusted EBITDA to Net Income (Loss)” and “Reconciliation of Adjusted Net Income (Loss) to Net Income (Loss).” The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends. These measures are not intended to replace financial performance measures determined in accordance with GAAP. Rather, they are presented as supplemental measures of the Company’s performance that management believes are useful to securities analysts, investors and others in assessing the Company’s performance over time. Moreover, these measures are not calculated identically by all companies and therefore may not be comparable to similarly titled measures used by other companies. A reconciliation of each of these measures to its most directly comparable GAAP measure is provided in the tables below.

26 Reconciliation of Adjusted EBITDA Alpha Natural Resources, Inc. and Subsidiaries Reconciliation of EBITDA and Adjusted EBITDA to Net Loss (In Thousands) (Unaudited) December 31, 2012 September 30, 2012 December 31, 2011 2012 2011 Net loss $ (127,578) $ (46,146) $ (792,926) $ (2,437,148) $ (730,542) Interest expense 58,834 47,345 47,188 198,147 141,914 Interest income 376 (1,328) (991) (3,373) (3,978) Income tax expense (benefit) 26,769 (83,182) (38,150) (549,996) (35,906) Depreciation, depletion and amortization 240,059 238,894 285,767 1,037,575 770,769 Amortization of acquired intangibles, net (5,858) (11,682) (50,859) (70,338) (114,422) EBITDA 192,602 143,901 (549,971) (1,825,133) 27,835 Goodwill impairment 188,194 - 802,337 1,713,526 802,337 Asset impairment and restructuring 40,296 13,676 - 1,068,906 - UBB expenses 5,810 (1,539) 24,503 31,508 40,920 Change in fair value and settlement of derivative instruments 7,110 28,581 (53,617) (8,275) (107,573) Merger related expense (benefit) (12,747) (6,101) 29,912 13,741 402,099 (Gain) loss on early extinguishment of debt (773) - 258 (773) 10,026 Changes in future costs of asset retirement obligations (154,377) - - (154,377) 37,137 Mineral lease terminations - - 7,955 - 7,955 Impact of benefits-related accrual reversal (45,865) - - (45,865) - Impacts on accrual for legal matters (3,067) - - (3,067) - Impact of write-off of weather-related property damage - - - 2,300 - Adjusted EBITDA $ 217,183 $ 178,518 $ 261,377 $ 792,491 $ 1,220,736 This information is intended to be reviewed in conjunction with the company's filings with the U.S. Securities and Exchange Commission. Three Months Ended Twelve Months Ended December 31,

27 Reconciliation of Adjusted Income December 31, 2012 September 30, 2012 December 31, 2011 2012 2011 Net loss $ (127,578) $ (46,146) $ (792,926) $ (2,437,148) $ (730,542) Goodwill impairment 188,194 - 802,337 1,713,526 802,337 Asset impairment and restructuring 40,296 13,676 - 1,068,906 - UBB expenses 5,810 (1,539) 24,503 31,508 40,920 Change in fair value and settlement of derivative instruments 7,110 28,581 (53,617) (8,275) (107,573) Merger related expense (benefit) (12,747) (6,101) 29,912 13,741 402,099 (Gain) loss on early extinguishment of debt (773) - 258 (773) 10,026 Changes in future costs of asset retirement obligations (154,377) - - (154,377) 37,137 Mineral lease terminations - - 7,955 - 7,955 Impact of benefits-related accrual reversal (45,865) - - (45,865) - Impacts on accrual for legal matters (3,067) - - (3,067) - Impact of write-off of weather-related property damage - - - 2,300 - Amortization of acquired intangibles, net (5,858) (11,682) (50,859) (70,338) (114,422) Estimated income tax effect of above adjustments 67,850 (10,401) 12,345 (330,668) (66,274) Discrete tax charge from valuation allowance adjustment 20,051 (2,048) - 40,757 - Discrete tax charge from state statutory tax rate and apportionment change, net of federal tax impact (20,437) - - (26,834) - Discrete tax charge from non-deductible transaction costs - - 2,268 - 8,230 Reversal of certain tax reserves - - (1,057) - (1,057) Adju ted net income (loss) $ (41,391) $ (35,660) $ (18,881) $ (206,607) $ 288,836 Weighted average shares--diluted 220,542,577 220,417,448 219,280,297 220,261,555 182,012,022 Adjusted diluted earnings (loss) per common share $ (0.19) $ (0.16) $ (0.09) $ (0.94) $ 1.59 This information is intended to be reviewed in conjunction with the company's filings with the U.S. Securities and Exchange Commission. Three Months Ended Twelve Months Ended December 31, Alpha Natural Resources, Inc. and Subsidiaries Reconciliation of Adjusted Net Income (Loss) to Net Loss (In Thousands Except Shares and Per Share Data) (Unaudited)