UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | | 811-21634 | |

| | (Exact name of registrant as specified in charter) |

| 7501 Wisconsin Avenue, Suite 1000 | Bethesda, MD | 20814 |

| (Address of principal executive offices) | (Zip code) |

| Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, OH 43219 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | (240) 497-6400 | |

| Date of fiscal year end: | December 31 | |

| Date of reporting period: | December 31, 2020 | |

Item 1. Reports to Stockholders.

Annual Report

DECEMBER 31, 2020

Access One Trust

Access VP High Yield Fund®

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website at ProFunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as banks & insurance companies).

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account that you invest in through your financial intermediary.

Table of Contents

| 1 | | Message from the Chairman |

| 3 | | Management Discussion of Fund Performance |

| 7 | | Expense Examples |

| 11 | | Financial Statements and Financial Highlights |

| 17 | | Notes to Financial Statements |

| 29 | | Report of Independent Registered Public Accounting Firm |

| | | Additional Tax Information |

| 30 | | Board Approval of Investment Advisory Agreements |

| 33 | | Trustees and Officers |

This Page Intentionally Left Blank

Message from the Chairman

Dear Shareholder:

As we continue to navigate these unprecedented times, we appreciate the opportunity to reaffirm our commitment to our customers, partners and associates. ProFunds continues to focus on ensuring the safety of our associates and managing our funds effectively. I am pleased to be able to provide you with the following annual report to shareholders of the Access VP High Yield Fund for the 12 months ended December 31, 2020.

High-Yield Bonds Decline in Early Days of the Pandemic and Then Recover

For the 12-month period, the U.S. high-yield bond market, as measured by the Markit iBoxx® $ Liquid High Yield Index, rose 4.66%. The early part of the period suggested a strong market for high-yield bonds as issuance of high-yield debt reached $50 billion, compared with $160 billion in issuance for all of 2019, according to Bank of America Global Research. However, confidence in high-yield investments began to erode in mid-January as coronavirus concerns became prominent. In February, global markets began to decline, at first in credit and emerging markets. Many investors reallocated capital into U.S. Treasurys as a result. High-yield bond prices then fell dramatically as pandemic fears escalated in February and March. As a result, the U.S. high-yield market experienced one of its worst quarters in history in the first quarter.

From their lows in March, U.S. equity markets began a steady recovery from the pandemic shutdowns — albeit unevenly with occasional pullbacks due to uncertainty from Washington. High-yield bonds were also able to claw back lost ground. The relatively swift market recovery was due in large part to the substantial pledge from the Federal Reserve (the Fed) in March to aggressively support markets by, among other things, providing liquidity support for the corporate bond market. The Fed also reduced the federal funds rate to zero during the period and committed to maintaining low interest rates for the foreseeable future.

Broader Bond Market Strong Amid Low Interest Rates

Strong demand for U.S. Treasurys during much of the first half of the reporting period propelled prices higher and yields, which move opposite to price, lower. Treasurys traded in a narrow range through the third calendar quarter, and the 10-year U.S. Treasury even briefly touched a record-low yield in August. Late in the period, the short end of the U.S. Treasury yield curve was unchanged as inflation remained low and the Fed maintained the zero-interest policy; yields on longer Treasury maturities rose slightly due to deficit concerns. At year-end, credit spreads in both high-yield and investment-grade corporate debt tightened or moved closer to interest rates for U.S. Treasurys. Over the 12-month period ended December 31, 2020, the Bloomberg Barclays US Aggregate Bond Index returned 7.51%, the Ryan Labs Returns Treasury Yield Curve 30 Year Index surged 18.99% and the Ryan Labs Returns Treasury Yield Curve 10 Year Index gained 10.75%.

Economic Improvement During the Third and Fourth Quarters

Stay-at-home orders and the shuttering of many businesses during the first wave of the pandemic dealt a significant blow to the U.S. economy during the first half of the period. By the third calendar quarter, the economy improved, regaining its losses and more, with GDP advancing 33.1%, according to the Department of Commerce Bureau of Economic Analysis. Employment also improved during the reporting period, though hiring slowed slightly in November. In December, the U.S. Congress passed an additional $900 billion stimulus package with aid to households, unemployed workers and small businesses that have been negatively impacted by the pandemic.

Access VP High Yield Fund

The Access VP High Yield Fund seeks investment results that correspond generally to the total return of the high yield market, consistent with maintaining reasonable liquidity. The fund provides investors with access to the relatively illiquid high yield credit market, with minimal spreads, in a mutual fund. The Access VP High Yield Fund lagged the overall high-yield market, as measured by the Markit iBoxx® $ Liquid High Yield Index, largely attributable to CDX series holdings in the fund during the period.

We appreciate the trust and confidence you have placed in us by choosing the Access VP High Yield Fund and look forward to continuing to serve your investing needs.

Sincerely,

Michael L. Sapir

Chairman of the Board of Trustees

Management Discussion of Fund Performance

This Page Intentionally Left Blank

Management Discussion of Fund Performance :: Access One Trust :: Access VP High Yield Fund :: 5

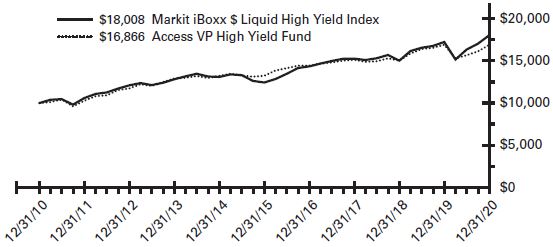

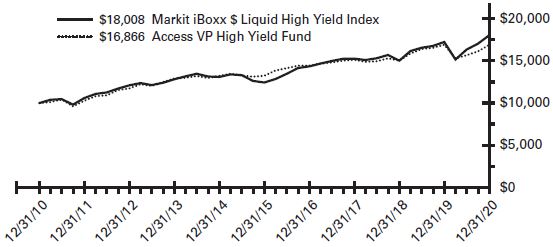

The Access VP High Yield Fund (the "Fund") seeks to provide investment results that correspond generally to the total return of the high yield market, consistent with maintaining reasonable liquidity. However, the Fund does not seek to match the daily returns of a specific benchmark. For the year ended December 31, 2020, the Fund had a total return of -0.06%. For the same period, the Markit iBoxx $ Liquid High Yield Index, a widely used measure of high yield market performance, had a total return of 4.66%1. The total return for the 5-year U.S. Treasury Note was 7.27%2.

The Fund is designed to maintain exposure to the high yield market, regardless of market conditions. This means the Fund does not adopt defensive positions in anticipation of an adverse market climate. The Fund seeks to achieve its high yield exposure primarily through credit default swaps (CDS) and 5-year treasury exposure but may also invest in high yield debt instruments (commonly referred to as junk bonds), other debt, money market instruments, total return swap agreements and futures contracts.

During the year ended December 31, 2020, the Fund invested in credit default swap agreements and futures contracts as a substitute for investing directly in high yield bonds. These derivatives generally tracked the performance of their underlying benchmark and were negatively impacted by financing costs associated with their use. The Fund entered into credit default swap agreements that were centrally cleared. In a centrally cleared swap agreement, the clearing organization takes on the credit risk of all parties involved in the trade, and in effect, guarantees each party's obligation under the contract. As a result, each party involved in a centrally cleared contract only faces the clearing organization. There can be no assurance, however, that the clearing organization, or its members, will satisfy its obligations to the Fund.

Value of a $10,000 Investment at Net Asset Value*

| * | The line graph represents the historical performance of a hypothetical investment of $10,000 in the Access VP High Yield Fund from December 31, 2010 to December 31, 2020, assuming the reinvestment of distributions. |

Average Annual Total Return as of 12/31/20

| Fund | | One Year | | | Five Year | | | Ten Year | |

| Access VP High Yield Fund | | | -0.06 | % | | | 4.99 | % | | | 5.37 | % |

| Markit iBoxx $ Liquid High Yield Index | | | 4.66 | % | | | 7.71 | % | | | 6.06 | % |

Expense Ratios**

| Fund | | Gross | | | Net | |

| Access VP High Yield Fund | | | 1.73 | % | | | 1.68 | % |

** Reflects the expense ratio as reported in the Prospectus dated May 1, 2020. Contractual fee waivers are in effect through April 30, 2021.

Allocation of Portfolio Holdings & Composition

Market Exposure

| Investment Type | | % of Net Assets | |

| U.S. Treasury Obligation | | | 45 | % |

| Futures Contracts | | | 18 | % |

| Credit Default Swap Agreements | | | 75 | % |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any instruments used for cash management.

Holdings

The Access VP High Yield Fund primarily invests in non-equity securities, which may include: credit default swap agreements, futures contracts, repurchase agreements, U.S. Government and money market securities.

Industry Exposure

| | | | % of Market

Exposure (CDS) | |

| Consumer, Cyclical | | | 32 | % |

| Consumer, Non-cyclical | | | 15 | % |

| Communications | | | 11 | % |

| Financial | | | 11 | % |

| Energy | | | 7 | % |

| Industrials | | | 7 | % |

| Basic Materials | | | 6 | % |

| Utilities | | | 6 | % |

| Technology | | | 5 | % |

Past performance does not guarantee future results. Return calculations assume the reinvestment of distributions and do not reflect taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and net asset value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. The performance above reflects any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would be lower. Performance numbers are net of all Fund fees and expenses but do not include any insurance, sales, or administrative charges of variable annuity or life insurance contracts. If these charges were included, the returns would be lower. To obtain performance current to the most recent month-end, please call toll-free 888-776-3637.

| 1 | The graph and table reflect the theoretical reinvestment of dividends on securities in the Index. The impact of transaction costs and the deduction of expenses associated with a mutual fund, such as investment management and accounting fees, are not reflected in the Index calculations. The Fund's performance reflects the reinvestment of dividends as well as the impact of transaction costs and the deduction of fees and expenses. It is not possible to invest directly in an index. |

| 2 | The 5-year U.S. Treasury Note reflects both price return and yield components. It does not reflect the impact of transaction and financing costs, nor the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. |

Investments in high yield bonds or in investments linked to the high yield market are subject to greater volatility and greater credit risks than investing in U.S. Treasuries. U.S. Treasury instruments are guaranteed by the U.S. government as to the timely payment of principal and interest, if held to maturity. Both the principal and yield of a mutual fund will fluctuate with changes in market conditions.

The above information is not covered by the Report of the Independent Registered Public Accounting Firm.

This Page Intentionally Left Blank

Expense Examples

This Page Intentionally Left Blank

Expense Examples (unaudited) :: Access One Trust :: 9

As a Fund shareholder, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees; distribution fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing cost of investing in other mutual funds. Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. If these transactional costs were included, your costs would have been higher. These examples also do not reflect fees associated with insurance company or insurance contracts. If these fees were reflected, expense would be higher. Therefore, these examples are useful in comparing ongoing costs only and will not help you determine the relative total cost of owning different funds.

Actual Expenses

The actual examples are based on an investment of $1,000 invested at the beginning of a six-month period and held throughout the period ended December 31, 2020.

The columns below under the heading entitled "Actual" provide information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled "Actual Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Expenses for Comparison Purposes

The hypothetical expense examples are based on an investment of $1,000 invested at the beginning of a six-month period and held throughout the period ended December 31, 2020.

The columns below under the heading entitled "Hypothetical" provide information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and as assumed rate of return of 5% per year before expenses, which is not each Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | Actual | | Hypothetical

(5% return before expenses) | |

| | | Annualized

Expense Ratio

During Period | | | Beginning

Account Value

7/1/20 | | Ending

Account Value

12/31/20 | | Expenses

Paid During

Period* | | Ending

Account Value

12/31/20 | | Expenses

Paid During

Period* | |

| Access VP High Yield Fund | | 1.68 | % | | $ | 1,000.00 | | $ | 1,078.00 | | $ | 8.78 | | $ | 1,016.69 | | $ | 8.52 | |

| * | Expenses are equal to the average account value over the period multiplied by the Fund's annualized expense ratio, multiplied by 184/366 (the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year). |

This Page Intentionally Left Blank

Financial Statements and Financial Highlights

12 :: Access One Trust :: Access VP High Yield Fund :: Schedule of Portfolio Investments :: December 31, 2020

U.S Treasury Obligation (44.5%)

| | | Principal

Amount | | | Value | |

| U.S. Treasury Notes, 0.375%, 11/30/25 | | $ | 8,850,000 | | | $ | 8,862,791 | |

TOTAL U.S TREASURY OBLIGATION

(Cost $8,826,863) | | | | | | | 8,862,791 | |

| Repurchase Agreements (47.6%) | | | | | | | | |

| Canadian Imperial Bank of Commerce, 0.01%, 1/4/21, dated 12/31/20, with a repurchase price of $477,001 (Collateralized by $487,600 U.S. Treasury Notes, 0.25%, 5/31/25, total value 486,591) | | | 477,000 | | | | 477,000 | |

| Credit Agricole CIB NY, 0.03%, 1/4/21, dated 12/31/20, with a repurchase price of $3,408,011 (Collateralized by $3,147,000 U.S. Treasury Notes, 2.625%, 3/31/25, total value $3,476,218) | | | 3,408,000 | | | | 3,408,000 | |

| HSBC Securities (USA), Inc., 0.005%, 1/4/21, dated 12/31/20, with a repurchase price of $1,677,001 (Collateralized by $1,572,800 U.S. Treasury Notes, 7.875%, 2/15/21, total value $1,710,586) | | | 1,677,000 | | | | 1,677,000 | |

| RBC Capital Markets, LLC, 0.01%, 1/4/21, dated 12/31/20, with a repurchase price of $783,001 (Collateralized by $733,100 U.S. Treasury Notes, 2.75%, 2/15/24, total value $798,757) | | | 783,000 | | | | 783,000 | |

| Societe' Generale, 0.02%, 1/4/21, dated 12/31/20, with a repurchase price of $2,726,006 (Collateralized by $2,626,100 U.S. Treasury Notes, 2.75%, 11/15/23, total value $2,780,525) | | | 2,726,000 | | | | 2,726,000 | |

| UMB Financial Corp., 0.01%, 1/4/21, dated 12/31/20, with a repurchase price of $414,000 (Collateralized by $391,000 Federal Farm Credit Banks, 2.61%, 2/27/24, total value $422,284) | | | 414,000 | | | | 414,000 | |

TOTAL REPURCHASE AGREEMENTS

(Cost $9,485,000) | | | | | | | 9,485,000 | |

TOTAL INVESTMENT SECURITIES

(Cost $18,311,863)—92.1% | | | | | | | 18,347,791 | |

| Net other assets (liabilities)—7.9% | | | | | | | 1,574,809 | |

| NET ASSETS—100.0% | | | | | | $ | 19,922,600 | |

Futures Contracts Purchased

| | | Number

of

Contracts | | | Expiration

Date | | Notional

Amount | | | Value and

Unrealized

Appreciation/

(Depreciation) | |

| 5-Year U.S. Treasury Note Futures Contracts | | | 29 | | | 4/1/21 | | $ | 3,658,305 | | | $ | 3,331 | |

| | | | | | | | | | | | | | | |

Centrally Cleared Swap Agreements

Credit Default Swap Agreements — Sell Protection(a)

| Underlying Instrument | | Payment

Frequency | | Fixed Deal

Receive

Rate | | | Maturity

Date | | Implied

Credit

Spread at

December 31,

2020(b) | | | Notional

Amount(c) | | Value | | | Premiums

Paid

(Received) | | | Unrealized

Appreciation/

(Depreciation) | | | Variation

Margin | |

| CDX North America High Yield Index Swap Agreement; Series 35 | | Daily | | | 5.00 | % | | 12/20/25 | | | 2.91 | % | | $ | 14,850,000 | | $ | 1,388,681 | | | $ | 697,895 | | | $ | 690,786 | | | $ | 21,539 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(a) When a credit event occurs as defined under the terms of the swap agreement, the Fund as a seller of credit protection will either (i) pay to the buyer of protection an amount equal to the par value of the defaulted reference entity and take delivery of the reference entity or (ii) pay a net amount equal to the par value of the defaulted reference entity less its recovery value.

(b) Implied credit spread, represented in absolute terms, utilized in determining the value of the credit default swap agreements as of period end will serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default or other credit event for the credit derivative. The implied credit spread of a referenced entity reflects the cost of buying/selling protection and may include payments required to be made to enter into the agreement. Generally, wider credit spreads represent a perceived deterioration of the referenced entity's credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the swap agreement.

(c) The notional amount represents the maximum potential amount the Fund could be required pay as a seller of credit protection if a credit event occurs, as defined under the terms of the swap agreement, for each security included in the CDX North America High Yield Index.

See accompanying notes to the financial statements.

Access One Trust :: Access VP High Yield Fund :: Financial Statements :: 13

Statement of Assets and Liabilities

December 31, 2020 |

| |

| ASSETS: |

| Total Investment Securities, at cost | | $ | 18,311,863 | |

| Securities, at value | | | 8,862,791 | |

| Repurchase agreements, at value | | | 9,485,000 | |

| Total Investment Securities, at value | | | 18,347,791 | |

| Cash | | | 22,339 | |

| Segregated cash balances for futures contracts with brokers | | | 18,343 | |

| Segregated cash balances for credit default swap agreements with brokers | | | 1,531,636 | |

| Interest receivable | | | 2,923 | |

| Receivable for capital shares issued | | | 27,365 | |

| Variation margin on credit default swap agreements | | | 21,539 | |

| Variation margin on futures contracts | | | 906 | |

| Prepaid expenses | | | 109 | |

| TOTAL ASSETS | | | 19,972,951 | |

| LIABILITIES: | | | | |

| Payable for capital shares redeemed | | | 722 | |

| Advisory fees payable | | | 11,303 | |

| Management services fees payable | | | 1,507 | |

| Administration fees payable | | | 1,315 | |

| Administrative services fees payable | | | 8,893 | |

| Distribution fees payable | | | 9,362 | |

| Transfer agency fees payable | | | 1,109 | |

| Fund accounting fees payable | | | 748 | |

| Compliance services fees payable | | | 108 | |

| Other accrued expenses | | | 15,284 | |

| TOTAL LIABILITIES | | | 50,351 | |

| NET ASSETS | | $ | 19,922,600 | |

| NET ASSETS CONSIST OF: | | | | |

| Capital | | $ | 21,916,740 | |

| Total distributable earnings (loss) | | | (1,994,140 | ) |

| NET ASSETS | | $ | 19,922,600 | |

| Shares of Beneficial Interest Outstanding (unlimited number of shares authorized, no par value) | | | 735,119 | |

| Net Asset Value (offering and redemption price per share): | | $ | 27.10 | |

Statement of Operations

For the Year Ended December 31, 2020

| INVESTMENT INCOME: | | | | |

| Interest | | $ | 102,799 | |

| EXPENSES: | | | | |

| Advisory fees | | | 149,023 | |

| Management services fees | | | 19,869 | |

| Administration fees | | | 18,598 | |

| Transfer agency fees | | | 14,528 | |

| Administrative services fees | | | 50,114 | |

| Distribution fees | | | 49,674 | |

| Custody fees | | | 6,906 | |

| Fund accounting fees | | | 10,037 | |

| Trustee fees | | | 446 | |

| Compliance services fees | | | 219 | |

| Audit fees | | | 21,442 | |

| Other fees | | | 30,545 | |

| Total Gross Expenses before reductions | | | 371,401 | |

| Expenses reduced and reimbursed by the Advisor | | | (33,521 | ) |

| Less fees paid indirectly | | | (4,070 | ) |

| TOTAL NET EXPENSES | | | 333,810 | |

| NET INVESTMENT INCOME (LOSS) | | | (231,011 | ) |

| REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS: | | | | |

| Net realized gains (losses) on investment securities | | | 849,035 | |

| Net realized gains (losses) on futures contracts | | | 61,631 | |

| Net realized gains (losses) on swap agreements | | | (1,102,195 | ) |

| Change in net unrealized appreciation/depreciation on investment securities | | | 29,287 | |

| Change in net unrealized appreciation/depreciation on futures contracts | | | 15,532 | |

| Change in net unrealized appreciation/depreciation on swap agreements | | | (91,568 | ) |

| NET REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | (238,278 | ) |

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (469,289 | ) |

See accompanying notes to the financial statements.

14 :: Access One Trust :: Access VP High Yield Fund :: Financial Statements

Statements of Changes in Net Assets

| | | Year Ended

December 31, 2020 | | | Year Ended

December 31, 2019 | |

| FROM INVESTMENT ACTIVITIES: |

| OPERATIONS: |

| Net investment income (loss) | | $ | (231,011 | ) | | $ | 71,899 | |

| Net realized gains (losses) on investments | | | (191,529 | ) | | | 1,423,021 | |

| Change in net unrealized appreciation/depreciation on investments | | | (46,749 | ) | | | 1,402,141 | |

| Change in net assets resulting from operations | | | (469,289 | ) | | | 2,897,061 | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Total distributions | | | (842,012 | ) | | | (1,712,917 | ) |

| Change in net assets from distributions | | | (842,012 | ) | | | (1,712,917 | ) |

| CAPITAL TRANSACTIONS: | | | | | | | | |

| Proceeds from shares issued | | | 62,693,306 | | | | 77,469,699 | |

| Distributions reinvested | | | 842,012 | | | | 1,712,917 | |

| Value of shares redeemed | | | (74,339,134 | ) | | | (64,383,444 | ) |

| Change in net assets resulting from capital transactions | | | (10,803,816 | ) | | | 14,799,172 | |

| Change in net assets | | | (12,115,117 | ) | | | 15,983,316 | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 32,037,717 | | | | 16,054,401 | |

| End of period | | $ | 19,922,600 | | | $ | 32,037,717 | |

| SHARE TRANSACTIONS: | | | | | | | | |

| Issued | | | 2,384,127 | | | | 2,758,429 | |

| Reinvested | | | 33,789 | | | | 61,497 | |

| Redeemed | | | (2,798,588 | ) | | | (2,304,629 | ) |

| Change in shares | | | (380,672 | ) | | | 515,297 | |

See accompanying notes to the financial statements.

Financial Highlights :: Access One Trust :: 15

Financial Highlights FOR THE PERIODS INDICATED

Selected data for a share of beneficial interest outstanding throughout the periods indicated.

| | | Year Ended

Dec. 31, 2020 | | | Year Ended

Dec. 31, 2019 | | | Year Ended

Dec. 31, 2018 | | | Year Ended

Dec. 31, 2017 | | | Year Ended

Dec. 31, 2016 | |

| Net Asset Value, Beginning of Period | | $ | 28.71 | | | $ | 26.74 | | | $ | 28.25 | | | $ | 29.12 | | | $ | 27.51 | |

| Investment Activities: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss)(a) | | | (0.31 | ) | | | 0.06 | | | | 0.16 | | | | (0.10 | ) | | | (0.24 | ) |

| Net realized and unrealized gains (losses) on investments | | | 0.16 | (b) | | | 3.21 | | | | (0.33 | ) | | | 1.47 | | | | 2.70 | |

| Total income (loss) from investment activities | | | (0.15 | ) | | | 3.27 | | | | (0.17 | ) | | | 1.37 | | | | 2.46 | |

| Distributions to Shareholders From: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.06 | ) | | | (0.16 | ) | | | — | | | | — | |

| In excess of net investment income | | | (1.46 | ) | | | (1.24 | ) | | | (0.37 | ) | | | (1.11 | ) | | | (0.85 | ) |

| Net realized gains on investments | | | — | | | | — | | | | (0.60 | ) | | | (1.13 | ) | | | — | |

| Return of capital | | | — | | | | — | | | | (0.21 | ) | | | — | | | | — | |

| Total distributions | | | (1.46 | ) | | | (1.30 | ) | | | (1.34 | ) | | | (2.24 | ) | | | (0.85 | ) |

| Net Asset Value, End of Period | | $ | 27.10 | | | $ | 28.71 | | | $ | 26.74 | | | $ | 28.25 | | | $ | 29.12 | |

| Total Return | | | (0.06 | )% | | | 12.43 | % | | | (0.61 | )%(c) | | | 4.79 | % | | | 9.00 | % |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Gross expenses | | | 1.87 | % | | | 1.73 | % | | | 1.72 | % | | | 1.71 | % | | | 1.68 | % |

| Net expenses | | | 1.68 | % | | | 1.70 | %(d) | | | 1.66 | %(c) | | | 1.68 | % | | | 1.68 | % |

| Net investment income (loss) | | | (1.16 | )% | | | 0.23 | % | | | 0.58 | %(c) | | | (0.34 | )% | | | (0.84 | )% |

| Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000's) | | $ | 19,923 | | | $ | 32,038 | | | $ | 16,054 | | | $ | 25,713 | | | $ | 61,327 | |

| Portfolio turnover rate(e) | | | 1,447 | % | | | 1,459 | % | | | 1,539 | % | | | 1,407 | % | | | 1,809 | % |

| (a) | Per share net investment income (loss) has been calculated using the average daily shares method. |

| (b) | The amount shown for a share outstanding throughout the period does not accord with the change in aggregate gains and losses in the portfolio of securities during the period because of the timing of sales and purchases of fund shares in relation to fluctuating market values during the period. |

| (c) | During 2018, the Fund received a non-recurring reimbursement from a third party relating to expenses that were incurred in a prior year. Had this reimbursement not occurred, the net expense ratio and net investment income (loss) ratio would have been 1.67% and 0.57%, respectively, and the total return would have been (0.62)%. |

| (d) | The expense ratio does not correlate to the applicable expense limits in place during the period given that the annual contractual expense limitation is applied for one year periods ended April 30th of each year, instead of coinciding with the December 31st year end. Details of the current expense limitation in effect can be found in Note 4 of the accompanying Notes to Financial Statements. |

| (e) | Portfolio turnover rate is calculated without regard to instruments having a maturity of less than one year from acquisition or derivative instruments (including swap agreements and futures contracts.) The portfolio turnover rate can be high and volatile due to the amount and timing of sales and purchases of fund shares during the period. |

See accompanying notes to the financial statements.

This Page Intentionally Left Blank

Notes to Financial Statements

This Page Intentionally Left Blank

December 31, 2020 :: Notes to Financial Statements :: Access One Trust :: 19

1. Organization

The Access One Trust (the "Trust") consists of three separate investment portfolios and is registered as an open-end management investment company under the Investment Company Act of 1940 (the "1940 Act") and thus follows accounting and reporting guidance for investment companies. The Trust is organized as a Delaware statutory trust and is authorized to issue an unlimited number of shares of beneficial interest of no par value which may be issued in more than one class or series. The accompanying financial statements relate to the Access VP High Yield Fund (the "Fund") which is classified as non-diversified under the 1940 Act. The Fund has one class of shares.

On December 10, 2020, the Trust's Board of Trustees approved an agreement and plan of reorganization and termination pursuant to which Access VP High Yield Fund will reorganize into a corresponding newly created series within ProFunds (an affiliated trust), named ProFund VP Access Flex High Yield. The transaction is expected to occur in the second calendar quarter of 2021.

Under the Trust's organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. In addition, in the normal course of business, the Trust enters into contracts with its vendors and others that provide for general indemnifications. The Trust and Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. generally accepted accounting principles ("GAAP"). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. The actual results could differ from those estimates.

Investment Valuation

The Fund records its investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used to determine fair value are further described in Note 3.

Repurchase Agreements

The Fund may enter into repurchase agreements with financial institutions in pursuit of its investment objective, as "cover" for the investment techniques it employs, or for liquidity purposes. Repurchase agreements are primarily used by the Fund as short-term investments for cash positions. Under a repurchase agreement, the Fund purchases a debt security and simultaneously agrees to sell the security back to the seller at a mutually agreed-upon future price and date, normally one business day. The resale price is greater than the purchase price, reflecting an agreed-upon market interest rate during the purchaser's holding period. While the maturities of the underlying securities in repurchase transactions may be more than one year, the term of each repurchase agreement will always be less than one year.

The Fund follows certain procedures designed to minimize the risks inherent in such agreements. These procedures include effecting repurchase transactions generally with major, global financial institutions whose creditworthiness is continuously monitored by ProFund Advisors LLC (the "Advisor"). In addition, the value of the collateral underlying the repurchase agreement is required to be at least equal to the repurchase price, including any accrued interest earned on the repurchase agreement. Funds within both the Trust and ProFunds (an affiliated trust) invest in repurchase agreements jointly. The Fund, therefore, holds a pro rata share of the collateral and interest income based upon the dollar amount of the repurchase agreements entered into by the Fund. The collateral underlying the repurchase agreement is held by the Fund's custodian. In the event of a default or bankruptcy by a selling financial institution, the Fund will seek to liquidate such collateral which could involve certain costs or delays and, to the extent that proceeds from any sale upon a default of the obligation to repurchase were less than the repurchase price, the Fund could suffer a loss. The Fund also may experience difficulties and incur certain costs in exercising its rights to the collateral and may lose the interest the Fund expected to receive under the repurchase agreement. Repurchase agreements usually are for short periods, such as one week or less, but may be longer. It is the current policy of the Fund not to invest in repurchase agreements that do not mature within seven days if any such investment, together with any other illiquid assets held by the Fund, amounts to more than 15% of the Fund's total net assets. The investments of the Fund in repurchase agreements at times may be substantial when, in view of the Advisor, liquidity, investment, regulatory, or other considerations so warrant. During periods of high demand for repurchase agreements, the Fund may be unable to invest available cash in these instruments to the extent desired by the Advisor.

Information concerning the counterparties, value of, collateralization and amounts due under repurchase agreement transactions may be found on the Fund's Schedule of Portfolio Investments.

Derivative Instruments

The Fund maintains exposure to the high yield market (i.e., U.S. corporate high yield debt market), regardless of market conditions. This means the Fund does not adopt defensive positions in cash or other instruments in anticipation of an adverse market climate. The Fund invests primarily in derivatives, money market instruments, and U.S. Treasury obligations that the Advisor believes, in combination, should provide investment results that correspond to the high yield market. During the year ended December 31, 2020, the Fund held credit default swap agreements for credit exposure to the high yield market and futures contracts and/or treasury notes for interest rate exposure to meet the Fund's investment objective.

All open derivative positions at year end are reflected on the Fund's Schedule of Portfolio Investments. The volume associated with derivative positions varies on a daily basis as the Fund transacts in derivative contracts in order to achieve the appropriate exposure, as expressed in notional amount, in comparison to net assets

20 :: Access One Trust :: Notes to Financial Statements :: December 31, 2020

consistent with the Fund's investment objective. The notional amount of open derivative positions relative to the Fund's net assets at year end is generally representative of the notional amount of open positions to net assets throughout the reporting period.

The Advisor is registered as a commodity pool operator (a "CPO") under the Commodity Exchange Act ("CEA"), in connection with its management of certain funds outside of the Trust. The Advisor also registered as a commodity trading advisor (a "CTA") under the CEA as a result of its role as subadvisor to funds outside the Trust. However, in connection with its management of the Fund, the Advisor has claimed an exclusion from the definition of CPO under the CEA, pursuant to Commodities Futures Trading Commission ("CFTC") Regulation 4.5 due to the Fund's limited trading in commodity interests. Accordingly, with respect to the Fund, the Advisor is not subject to registration or regulation as a CPO under the CEA. To remain eligible for the exclusion, the Fund will be limited in its ability to use certain financial instruments regulated under the CEA ("commodity interests"), including certain swap transactions (as well as futures). In the event that any of the Fund's investments in commodity interests are not within the thresholds set forth in the exemption, the Advisor will not be able to rely on the exclusion, and will be required to comply with the additional recordkeeping, reporting, and disclosure requirements with respect to the Fund. The Advisor's eligibility to claim the exclusion with respect to the Fund is based upon, among other things, the level and scope of the Fund's investment in commodity interests, the purpose of such investments and the manner in which the Fund holds out its use of commodity interests. The Fund's ability to invest in commodity interests (including, but not limited to swaps and futures on broad-based securities indexes and interest rates) is limited by the Advisor's intention to operate the Fund in a manner that would permit the Advisor to continue to claim the exclusion, which may affect the Fund's total return. In the event the Advisor becomes unable to rely on the exclusion and is required to register with the CFTC as a CPO with respect to the Fund, the Fund's expenses may increase, adversely affecting the Fund's return.

The following is a description of the derivative instruments utilized by the Fund, including certain risks related to each instrument type.

Swap Agreements

As of December 31, 2020, the Fund invested in centrally cleared credit default swaps as a substitute for investing directly in bonds in order to gain credit exposure to the high yield market.

In a credit default swap ("CDS"), the agreement will reference one or more debt securities or reference entities. The protection "buyer" in a credit default contract is generally obligated to pay the protection "seller" a periodic stream of payments over the term of the contract until a credit event, such as a default, on a reference entity has occurred. If a credit event occurs, the seller generally must pay the buyer: a) the full notional value of the swap; or b) the difference between the notional value of the defaulted reference entity and the recovery price/rate for the defaulted reference entity. CDS are designed to reflect changes in credit quality, including events of default. A CDS may require premium (discount) payments as well as daily payments (receipts) related to the interest leg of the swap or to the default or change in price of a reference entity.

The counterparty risk for cleared swap agreements is generally lower than for uncleared over-the-counter swap agreements because, generally, a clearing organization becomes substituted for each counterparty to a cleared swap agreement and, in effect, guarantees each party's performance under the contract as each party to a trade looks only to the clearing organization for performance of financial obligations. However, there can be no assurance that the clearing organization, or its members, will satisfy its obligations to the Fund.

If the Fund is a seller of a CDS contract (also referred to as a seller of protection or as a buyer of risk), the Fund would be required to pay the par (or other agreed upon) value of a referenced obligation to the counterparty in the event of a default or other credit event. In return, the Fund would receive from the counterparty a daily stream of payments over the term of the contract provided that no event of default has occurred. If no default occurs, the Fund would keep the stream of payments and would have no payment obligations. As the seller, the Fund would be subject to investment exposure on the notional amount of the swap.

If the Fund is a buyer of a CDS contract (also referred to as a buyer of protection or a seller of risk), the Fund would have the right to deliver a reference obligation and receive the par (or other agreed-upon) value of such obligation from the counterparty in the event of a default or other credit event (such as a credit downgrade). In return, the Fund would pay the counterparty a daily stream of payments over the term of the contract provided that no event of default has occurred. If no default occurs, the counterparty would keep the stream of payments and would have no further obligations to the Fund.

The Fund enters into a CDS with multiple reference entities, in which case payments and settlements in respect of any defaulting reference entity would typically be dealt with separately from the other reference entities.

Upon entering into a centrally cleared CDS, the Fund may be required to deposit with the broker an amount of cash or cash equivalents in the range of approximately 3% to 6% of the notional amount for CDS on high yield debt issuers (this amount is subject to change by the clearing organization that clears the trade). This amount, known as "initial margin," is in the nature of a performance bond or good faith deposit on the CDS and is returned to the Fund upon termination of the CDS, assuming all contractual obligations have been satisfied. Subsequent payments, known as "variation margin," to and from the broker will be made daily as the price of the CDS fluctuates, making the long and short positions in the CDS contract more or less valuable, a process known as "marking-to-market." The premium (discount) payments are built into the daily price of the CDS and thus are amortized through the variation margin. The variation margin payment also includes the daily portion of the periodic payment stream.

The use of swaps is a highly specialized activity which involves investment techniques and risks in addition to and in some cases different from those associated with ordinary portfolio securities transactions. The primary risks associated with the use of swap agreements are mispricing or improper valuation, imperfect correlation between movements in the notional amount and the price of the underlying investments, and the inability of the

December 31, 2020 :: Notes to Financial Statements :: Access One Trust :: 21

counterparties or clearing organization to perform. If a counterparty's creditworthiness for an over-the-counter swap declines, the value of the swap would likely decline. The Advisor, under the supervision of the Trust's Board of Trustees, is responsible for determining and monitoring the liquidity of the Fund's transactions in swap agreements.

Futures Contracts

The Fund may purchase or sell futures contracts as a substitute for a comparable market position in the underlying securities or to satisfy regulatory requirements. As of December 31, 2020, the Fund held cash-settled U.S. Treasury note futures contracts.

A cash-settled futures contract obligates the seller to deliver (and the purchaser to accept) an amount of cash equal to a specific dollar amount (the contract multiplier) multiplied by the difference between the final settlement price of a specific futures contract and the price at which the agreement is made. No physical delivery of the underlying asset is made.

The Fund generally engages in closing or offsetting transactions before final settlement of a futures contract, wherein a second identical futures contract is sold to offset a long position (or bought to offset a short position). In such cases, the obligation is to deliver (or take delivery of) cash equal to a specific dollar amount (the contract multiplier) multiplied by the difference between the price of the offsetting transaction and the price at which the original contract was entered into. If the original position entered into is a long position (futures contract purchased), there will be a gain (loss) if the offsetting sell transaction is carried out at a higher (lower) price, inclusive of commissions. If the original position entered into is a short position (futures contract sold), there will be a gain (loss) if the offsetting buy transaction is carried out at a lower (higher) price, inclusive of commissions.

Whether the Fund realizes a gain or loss from futures activities depends generally upon movements in the underlying currency, commodity, security or index. The extent of the Fund's loss from an unhedged short position in a futures contract is potentially unlimited and investors may lose the amount that they invest plus any profits recognized on that investment. The Fund will engage in transactions in futures contracts that are traded on a U.S. exchange or board of trade or that have been approved for sale in the U.S. by the CFTC.

Upon entering into a futures contract, the Fund will be required to deposit with the broker an amount of cash or cash equivalents in the range of approximately 1% to 3% of the contract amount for treasury futures (this amount is subject to change by the exchange on which the contract is traded). This amount, known as "initial margin," is in the nature of a performance bond or good faith deposit on the contract and is returned to the Fund upon termination of the futures contract, assuming all contractual obligations have been satisfied. Subsequent payments, known as "variation margin," to and from the broker will be made daily as the price of the asset underlying the futures contract fluctuates, making the long and short positions in the futures contract more or less valuable, a process known as "marking-to-market." At any time prior to expiration of a futures contract, the Fund may elect to close its position by taking an opposite position, which will operate to terminate the Fund's existing position in the contract.

The primary risks associated with the use of futures contracts are imperfect correlation between movements in the price of futures and the market value of the underlying assets, and the possibility of an illiquid market for a futures contract. Although the Fund intends to sell futures contracts only if there is an active market for such contracts, no assurance can be given that a liquid market will exist for any particular contract at any particular time. Many futures exchanges and boards of trade limit the amount of fluctuation permitted in futures contract prices during a single trading day. Once the daily limit has been reached in a particular contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the day. Futures contract prices could move to the limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of futures positions and potentially subjecting the Fund to substantial losses. If trading is not possible, or if the Fund determines not to close a futures position in anticipation of adverse price movements, the Fund will be required to make daily cash payments of variation margin. The risk that the Fund will be unable to close out a futures position will be minimized by entering into such transactions on a national exchange with an active and liquid secondary market. In addition, although the counterparty to a futures contract is often a clearing organization, backed by a group of financial institutions, there may be instances in which the counterparty could fail to perform its obligations, causing significant losses to the Fund.

Summary of Derivative Instruments

The following table summarizes the fair values of derivative instruments on the Fund's Statement of Assets and Liabilities, categorized by risk exposure, as of December 31, 2020.

| | | Assets | | Liabilities | |

| | | Variation

Margin

on Futures

Contracts* | | Variation

Margin on

Credit Default

Swap

Agreements* | | Variation

Margin

on Futures

Contracts* | | Variation

Margin on

Credit Default

Swap

Agreements* | |

| Credit Risk Exposure | | $ | — | | $ | 690,786 | | $ | — | | $ | — | |

| Interest Rate Risk Exposure | | | 3,331 | | | — | | | — | | | — | |

| * | Includes cumulative appreciation/depreciation for both futures contracts and credit default swap agreements as reported in the Schedule of Portfolio Investments. Only current day's variation margin for both futures contracts and credit default swap agreements are reported within the Statement of Assets and Liabilities. |

22 :: Access One Trust :: Notes to Financial Statements :: December 31, 2020

The following table presents the effect of derivative instruments on the Fund's Statement of Operations, categorized by risk exposure, for the year ended December 31, 2020.

| | | Realized Gain (Loss)

on Derivatives Recognized

as a Result from Operations | | | Change in Net Unrealized

Appreciation/Depreciation on Derivatives

Recognized as a Result from Operations | |

| | | | Net Realized

Gains (Losses)

on Futures

Contracts | | | | Net Realized

Gains (Losses)

on Swap

Agreements | | | | Change in

Net Unrealized

Appreciation/Depreciation

on Futures Contracts | | | | Change in

Net Unrealized

Appreciation/Depreciation

on Swap Agreements | |

| Credit Risk Exposure | | $ | — | | | $ | (1,102,195 | ) | | $ | — | | | $ | (91,568 | ) |

| Interest Rate Risk Exposure | | | 61,631 | | | | — | | | | 15,532 | | | | — | |

Investment Transactions and Related Income

Throughout the reporting period, investment transactions are accounted for no later than one business day following the trade date. For financial reporting purposes, investment transactions are accounted for on trade date on the last business day of the reporting period. Interest income is recognized on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount. Dividend income is recorded on the ex-dividend date. Pay-in-kind interest income and non-cash dividend income received in the form of securities in-lieu of cash, if any, are recorded at the fair value of the securities received. Gains or losses realized on sales of securities are determined using the specific identification method by comparing the identified cost of the security lot sold with the net sales proceeds.

Allocations

Expenses directly attributable to the Fund are charged to the Fund, while expenses which are attributable to more than one fund in the Trust, or jointly with an affiliate, are allocated among the respective funds in the Trust and/or affiliate based upon relative net assets or another reasonable basis.

Distributions to Shareholders

The Fund intends to declare and distribute net investment income at least quarterly, if any. Net realized capital gains, if any, will be distributed annually.

The amount of distributions from net investment income and net realized gains are determined in accordance with federal income tax regulations which may differ from GAAP. These "book/tax" differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature (e.g., differing treatment on certain swap agreements, net operating loss, distribution reclassification, and equalization), such amounts are reclassified within the composition of net assets based on their federal tax-basis treatment; temporary differences (e.g., wash sales and differing treatment on certain swap agreements) do not require a reclassification. The Fund may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized gains distributed to shareholders on redemption of shares, as a part of the dividends paid deduction for income tax purposes. Distributions which exceed net investment income and net realized capital gains for tax purposes are reported as distribution of capital.

Federal Income Taxes

The Fund intends to continue to qualify each year as a regulated investment company (a "RIC") under Subchapter M of the Internal Revenue Code of 1986, as amended. A RIC generally is not subject to federal income tax on income and gains distributed in a timely manner to its shareholders. The Fund intends to make timely distributions in order to avoid tax liability. Accordingly, no provision for federal income taxes is required in the financial statements. The Fund has a calendar tax year end.

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last four tax year ends and the interim tax period since then, as applicable). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken and the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Other

Expense offsets to custody fees that arise from credits on cash balances maintained on deposit are reflected on the Statement of Operations, as applicable, as "Fees paid indirectly."

Expense Reimbursement from a Third Party

During 2018, the Fund received a non-recurring reimbursement from a third party relating to expenses that were incurred in a prior year. The corresponding impacts to the Fund's Total Return and Ratios to Average Net Assets in the Financial Highlights are disclosed in a footnote to the Financial Highlights.

3. Investment Valuation Summary

The valuation techniques employed by the Fund, described below, maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These valuation techniques distinguish between market participant assumptions developed based on market data obtained from sources independent of the Fund (observable inputs) and the Fund's own

December 31, 2020 :: Notes to Financial Statements :: Access One Trust :: 23

assumptions about market participant assumptions developed based on the best information available under the circumstances (unobservable inputs). The inputs used for valuing the Fund's investments are summarized in the three broad levels listed below:

• Level 1 – quoted prices in active markets for identical assets

• Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayments speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments. For example, repurchase agreements are generally valued at amortized cost. Generally, amortized cost approximates the current fair value of a security, but since the valuation is not obtained from a quoted price in an active market, such securities are reflected as Level 2. Fair value measurements may also require additional disclosure when the volume and level of activity for the asset or liability have significantly decreased, as well as when circumstances indicate that a transaction is not orderly. Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy.

Derivatives are generally valued using independent pricing services and/or agreements with counterparties or other procedures approved by the Trust's Board of Trustees. Futures contracts are generally valued at their last sale price prior to the time at which the net asset value per share of the Fund is determined and are typically categorized as Level 1 in the fair value hierarchy. Swap agreements are generally valued according to prices as furnished by an independent pricing service, generally at the mean of the bid and ask quotes and are typically categorized as Level 2 in the fair value hierarchy. If there was no sale on that day, fair valuation procedures as described below may be applied.

Security prices are generally valued at their fair value using information provided by a third party pricing service or market quotations or other procedures approved by the Trust's Board of Trustees. The securities in the portfolio of the Fund, except as otherwise noted, that are listed or traded on a stock exchange or the Nasdaq National Market System ("Nasdaq/NMS"), are valued at the official closing price, if available, or the last sale price, on the exchange or system where the security is principally traded. If there have been no sales for that day on the exchange or system where the security is principally traded, then the value may be determined with reference to the last sale price, or the official closing price, if applicable, on any other exchange or system. In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy. If there have been no sales for that day on any exchange or system, the security will be valued using fair value procedures in accordance with procedures approved by the Trust's Board of Trustees as described below.

Securities regularly traded in the over-the-counter ("OTC") markets, including securities listed on an exchange, but that are primarily traded OTC other than those traded on the Nasdaq/NMS, are generally valued on the basis of the mean between the bid and asked quotes furnished by dealers actively trading those instruments. Fixed-income securities are generally valued according to prices as furnished by an independent pricing service, generally at the mean of the bid and asked quotes for those instruments. Short-term fixed-income securities maturing in sixty days or less, and of sufficient credit quality, may be valued at amortized cost, which approximates fair value. Under the amortized cost method, premium or discount, if any, is amortized or accreted, respectively, on a constant basis to the maturity of the security. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

When the Advisor determines that the market price of a security is not readily available or deemed unreliable (e.g., an approved pricing service does not provide a price, a furnished price is in error, certain stale prices, or an event occurs that materially affects the furnished price), it may be valued by other methods that the Board of Trustees believes accurately reflects fair value. The use of such a valuation method may be appropriate if, for example: (i) market quotations do not accurately reflect fair value; (ii) an investment's value has been materially affected by events occurring after the close of the exchange or market on which the investment is principally traded; (iii) a trading halt closes an exchange or market early; or (iv) other events result in an exchange or market delaying its normal close. Any such fair valuations will be conducted pursuant to Board-approved fair valuation procedures. Fair value pricing may require subjective determinations about the value of a security. While the Trust's policy is intended to result in a calculation of the Fund's NAV that fairly reflects security values as of the time of pricing, the Trust cannot ensure that fair values determined by the Advisor or persons acting at their direction would accurately reflect the price that the Fund could obtain for a security if it were to dispose of that security as of the time of pricing (for instance, in a forced or distressed sale). The prices used by the Fund may differ from the value that would be realized if the securities were sold and the differences could be material to the financial statements. Depending on the source and relative significance of valuation inputs, these instruments may be classified as Level 2 or Level 3 in the fair value hierarchy.

For the year ended December 31, 2020, there were no Level 3 investments for which significant unobservable inputs were used to determine fair value.

24 :: Access One Trust :: Notes to Financial Statements :: December 31, 2020

A summary of the valuations as of December 31, 2020, based upon the three levels defined above, is included in the table below:

| | | LEVEL 1 - Quoted Prices | | | LEVEL 2 - Other Significant

Observable Inputs | | | Total | |

| | | Investment

Securities | | | Other Financial

Instruments^ | | | Investment

Securities | | | Other Financial

Instruments^ | | | Investment

Securities | | | Other Financial

Instruments^ | |

| Access VP High Yield Fund | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S Treasury Obligations | | $ | — | | | $ | — | | | $ | 8,862,791 | | | $ | — | | | $ | 8,862,791 | | | $ | — | |

| Repurchase Agreements | | | — | | | | — | | | | 9,485,000 | | | | — | | | | 9,485,000 | | | | — | |

| Futures Contracts | | | — | | | | 3,331 | | | | — | | | | — | | | | — | | | | 3,331 | |

| Credit Default Swap Agreements | | | — | | | | — | | | | — | | | | 690,786 | | | | — | | | | 690,786 | |

| Total | | $ | — | | | $ | 3,331 | | | $ | 18,347,791 | | | $ | 690,786 | | | $ | 18,347,791 | | | $ | 694,117 | |

| ^ | Other financial instruments include any derivative instruments not reflected in the Schedule of Portfolio Investments as Investment Securities, such as futures contracts and credit default swap agreements. These investments are generally recorded in the financial statements at the unrealized appreciation/(depreciation) on the investment. |

4. Fees and Transactions with Affiliates and Other Parties

The Fund has entered into an Investment Advisory Agreement with the Advisor. Under this agreement, the Fund pays the Advisor a fee at an annualized rate of 0.75% of its average daily net assets.

In addition, subject to the condition that the aggregate daily net assets of the Trust and ProFunds be equal to or greater than $10 billion, the Advisor has agreed to the following fee reductions with respect to each individual Fund: 0.025% of the Fund's daily net assets in excess of $500 million to $1 billion, 0.05% of the Fund's daily net assets in excess of $1 billion to $2 billion, and 0.075% of the Fund's daily net assets in excess of $2 billion. During the year ended December 31, 2020, no Fund's annual investment advisory fee was subject to such reductions.

Citi Fund Services Ohio, Inc. ("Citi") acts as the Trust's administrator (the "Administrator"). For its services as Administrator, the Trust pays Citi an annual fee based on the Trust's and ProFunds' aggregate average net assets at a tier rate ranging from 0.00375% to 0.05%, and a base fee for certain filings. Administration fees also include additional fees paid to Citi by the Trust for additional services provided, including support of the Trust's compliance program.

Citi also acts as fund accounting agent for the Trust. For these services, the Trust pays Citi an annual fee based on the Trust's and ProFunds' aggregate average net assets at a tier rate ranging from 0.00375% to 0.03%, a base fee, and reimbursement of certain expenses.

FIS Investor Services LLC ("FIS") acts as transfer agent for the Trust. For these services, the Fund pays FIS a base fee, service charges fees based on the number of VP Funds, and reimbursement of certain expenses.

ProFunds Distributors, Inc. (the "Distributor"), a wholly owned subsidiary of the Advisor, serves as the Trust's distributor. Under a Distribution and Shareholder Services Plan, adopted by the Trust's Board of Trustees pursuant to Rule 12b-1 under the 1940 Act, the Fund may pay financial intermediaries such as broker-dealers, insurance companies and the Distributor up to 0.25%, on an annualized basis, of its average daily net assets as compensation for distribution-related activities and/or shareholder services.

The Advisor, pursuant to a separate Management Services Agreement, performs certain client support services and other administrative services on behalf of the Fund. For these services, the Fund pays the Advisor a fee at the annual rate of 0.10% of its average daily net assets.

The Trust, on behalf of the Fund, has entered into an administrative services agreement with certain insurance companies, pursuant to which the insurance companies will provide administrative services with respect to the Fund. For these services, the Fund may pay the insurance companies administrative services fees at an annual rate of up to 0.35% of its average daily net assets as reflected on the Statement of Operations as "Administrative services fees."

Certain Officers and a Trustee of the Trust are affiliated with the Advisor or the Administrator. Except as noted below with respect to the Trust's Chief Compliance Officer, such Officers and Trustee receive no compensation from the Fund for serving in their respective roles. The Trust, together with affiliated Trusts, pays each Independent Trustee compensation for his services at the annual rate of $185,000. Independent Trustees also receive $10,000 for attending each regular quarterly in-person meeting, $3,000 for attending each special in-person meeting and $3,000 for attending each telephonic meeting. During the year ended December 31, 2020, actual Trustee compensation was $684,000 in aggregate from the Trust and affiliated trusts. There are certain employees of the Advisor, such as the Trust's Chief Compliance Officer and staff who administer the Trust's compliance program, in which the Fund reimburses the Advisor for their related compensation and certain other expenses incurred as reflected on the Statement of Operations as "Compliance services fees."

The Advisor has contractually agreed to waive advisory and management services fees, and if necessary, reimburse certain other expenses of the Fund in order to limit the annual operating expenses (exclusive of brokerage costs, interest, taxes, dividends (including dividend expenses on securities sold short), litigation, indemnification, and extraordinary expenses) to an annualized rate of 1.68% of the average daily net assets of the Fund. This expense limitation remains in effect until at least April 30, 2021.

The Advisor may recoup the advisory and management services fees contractually waived or limited and other expenses reimbursed by it within three years from the expense limit period

December 31, 2020 :: Notes to Financial Statements :: Access One Trust :: 25

in which they were taken. Such repayments shall be made monthly, but only to the extent that such repayments would not cause annualized operating expenses of the Fund to exceed the expense limit in effect at the time of the waiver, and the expense limit in effect at the time of the recoupment. Any amounts recouped by the Advisor during the year are reflected on the Statement of Operations as "Recoupment of prior expenses reduced by the Advisor." As of December 31, 2020, the recoupments that may potentially be made by the Fund are as follows:

| | | Expires

4/30/23 | | | Expires

4/30/24 | | | Total | |

| Access VP High Yield Fund | | $ | 18,232 | | | $ | 23,629 | | | $ | 41,861 | |

| | | | | | | | | | | | | |

5. Securities Transactions

The cost of U.S. government security purchases and the proceeds from the sale of U.S. government securities (excluding securities maturing less than one year from acquisition) during the year ended December 31, 2020 were as follows:

| | | Purchases | | | Sales | |

| Access VP High Yield Fund | | $ | 161,657,158 | | | $ | 170,729,647 | |

| | | | | | | | | |

6. Investment Risks

The Fund may be subject to other risks in addition to these identified risks. This section discusses certain common principal risks encountered by the Fund. The risks are presented in an order intended to facilitate readability, and their order does not imply that the realization of one risk is likely to occur more frequently than another risk, nor does it imply that the realization of one risk is likely to have a greater adverse impact than another risk.

Risks Associated with the Use of Derivatives

The Fund may obtain investment exposure through derivatives. Investing in derivatives may be considered aggressive and may expose the Fund to greater risks and may result in larger losses or smaller gains than investing directly in the reference asset(s) underlying those derivatives. These risks include counterparty risk, liquidity risk and increased correlation risk. When the Fund uses derivatives, there may be imperfect correlation between the value of the reference asset(s) underlying the derivative (e.g., the securities in the high yield market) and the derivative, which may prevent the Fund from achieving its investment objective. Because derivatives often require only a limited initial investment, the use of derivatives also may expose the Fund to losses in excess of those amounts initially invested. Any costs associated with using derivatives will also have the effect of lowering the Fund's return.

Active Investor Risk

The Fund permits short-term trading of its securities. In addition, the Advisor expects a significant portion of the assets invested in the Fund to come from professional money managers and investors who use the Fund as part of active trading or tactical asset allocation strategies. These strategies often call for frequent trading to take advantage of anticipated changes in market conditions, which could increase portfolio turnover and may result in additional costs for the Fund. In addition, large movements of assets into and out of the Fund may have a negative impact on the Fund's ability to achieve its investment objective or maintain a consistent level of operating expenses. In certain circumstances, the Fund's expense ratio may vary from current estimates or the historical ratio disclosed in the Fund's prospectus.

Credit Default Swaps (CDS) Risk

While the Fund will normally be a net "seller" of CDS, at times the Fund may be a net "buyer" of CDS. When the Fund is a seller of credit protection, upon the occurrence of a credit event, the Fund will have an obligation to pay the full notional value of a defaulted reference entity less recovery value. When the Fund is a buyer of credit protection, upon the occurrence of a credit event, the counterparty to the Fund will have an obligation to pay the full notional value of a defaulted reference entity less recovery value. Recovery values for CDS are generally determined via an auction process to determine the final price for a given reference entity. Although the Fund intends, as practicable, to obtain exposure through centrally cleared CDS, an active market may not exist for any of the CDS in which the Fund invests or in the reference entities subject to the CDS. As a result, the Fund's ability to maximize returns or minimize losses on such CDS may be impaired. Other risks of CDS include difficulty in valuation due to the lack of pricing transparency and the risk that changes in the value of the CDS do not reflect changes in the credit quality of the underlying reference entities or may otherwise perform differently than expected given market conditions. Because the Fund may use a single counterparty or a small number of counterparties, certain CDS involve many reference entities and there are no limitations on the notional amount established for the CDS. As a result, counterparty risk may be amplified.

Counterparty Risk

The Fund will invest in financial instruments involving third parties (i.e., counterparties) and is subject to counterparty risk. The use of financial instruments, such as CDS or futures contracts, involves risks that are different from those associated with ordinary portfolio securities transactions. The Fund will be subject to credit risk (i.e., the risk that a counterparty is unwilling or unable to make timely payments to meet its contractual obligations) with respect to the amount it expects to receive from counterparties to financial instruments and repurchase agreements entered into by the Fund. The Fund generally structures the agreements such that, either party can terminate the contract without penalty prior to the termination date. The Fund may be negatively impacted if a counterparty becomes bankrupt or otherwise fails to perform its obligations, the value of an investment in the Fund may decline. The Fund may experience significant delays in obtaining any recovery in a bankruptcy or other reorganization proceeding and

26 :: Access One Trust :: Notes to Financial Statements :: December 31, 2020

the Fund may obtain only limited recovery or may obtain no recovery in such circumstances.

The Fund typically enters into transactions with counterparties whose credit rating, at the time of the transaction, is investment grade, as determined by a nationally recognized statistical rating organization, or, if unrated, judged by the Advisor to be of comparable quality. These are usually major, global financial institutions. Although the counterparty to a centrally cleared swap agreement and/or exchange-traded futures contract is often backed by a futures commission merchant ("FCM") or clearing organization that is further backed by a group of financial institutions, there may be instances in which the FCM or the clearing organization could fail to perform its obligations, causing significant losses to the Fund. For example, the Fund could lose margin payments it has deposited with a clearing organization as well as any gains owed but not paid to the Fund if the clearing organization becomes insolvent or otherwise fails to perform its obligations.

Under current CFTC regulations, a FCM maintains customers' assets in a bulk segregated account. If a FCM fails to do so, or is unable to satisfy a substantial deficit in a customer account, its other customers may be subject to risk of loss of their funds in the event of that FCM's bankruptcy. In that event, in the case of futures, the FCM's customers are entitled to recover, even in respect of property specifically traceable to them, only a proportional share of all property available for distribution to all of that FCM's customers. In the case of cleared swaps, customers of a FCM in bankruptcy are entitled to recover assets specifically attributable to them pursuant to new CFTC regulations, but may nevertheless risk loss of some or all of their assets due to accounting or operational issues or due to legal risk in connection with the application of bankruptcy law to cleared swaps.

Liquidity Risk

In certain circumstances, such as the disruption of the orderly markets for the securities or financial instruments in which the Fund invests, the Fund might not be able to acquire or dispose of certain holdings quickly or at prices that represent true fair value in the judgment of the Advisor. Markets for the securities or financial instruments in which the Fund invests may be disrupted by a number of events, including but not limited to economic crises, natural disasters, new legislation, or regulatory changes inside or outside of the U.S. For example, regulation limiting the ability of certain financial institutions to invest in certain securities would likely reduce the liquidity of those securities. These situations may prevent the Fund from limiting losses, realizing gains, or from achieving a high correlation with the total return of the high yield market.

Natural Disaster/Epidemic Risk