As filed with the Securities and Exchange Commission on September 2, 2004

No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Language Line Holdings, Inc.

(Exact name of registrant as specified in their organizational documents)

| | | | |

| Delaware | | 4899 | | 20-0997806 |

| (State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

One Lower Ragsdale Drive

Building 2

Monterey, California 93940

(877) 886-3885

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Matthew T. Gibbs II

Chief Financial Officer

One Lower Ragsdale Drive

Building 2

Monterey, California 93940

(877) 886-3885

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Joshua N. Korff, Esq.

Kirkland & Ellis LLP

Citigroup Center

153 East 53rd Street

New York, New York 10022-4675

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to registered additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | |

Title of Each Class of Securities to be Registered | | Amount to be Registered | | Proposed Maximum

Aggregate Offering

Price Per Note | | | Proposed Maximum

Aggregate

Offering Price (1) | | Amount of

Registration Fee |

14 1/8% Senior Discount Notes due 2013 | | $ | 108,993,000 | | 100 | % | | $ | 108,993,000 | | $ | 13,810 |

| (1) | | Estimated solely for the purpose of calculating the registration fee. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and this is not an offer to buy these securities in any state where the offer and sale is not permitted.

Subject to completion, dated September 2, 2004

PROSPECTUS

Language Line Holdings, Inc.

Offer for all outstanding 14 1/8% Senior Discount Notes due 2013 (which we refer to as the “Old Notes”) in aggregate principal amount at maturity of $108,993,000 in exchange for up to $108,993,000 aggregate principal amount at maturity of 14 1/8% Senior Discount Exchange Notes due 2013 (which we refer to as the “New Notes”) have been registered under the Securities Act of 1933, as amended.

| | | | | | |

| Terms of the Exchange Offer | | Terms of the New Notes |

| | | |

| • | | Expires 5:00 p.m., New York City time, , 2004, unless extended. | | • | | The terms of the New Notes are identical to our outstanding 14 1/8% Senior Secured Notes due 2013 except for transfer restrictions and registration rights. |

| • | | Not subject to any condition other than that the exchange offer not violate applicable law or any interpretation of the staff of the Securities and Exchange Commission. | | | |

| | | |

| • | | We can amend or terminate the exchange offer. | | | | |

| | | |

| • | | We will exchange all Old Notes that are validly tendered and not validly withdrawn. | | | | |

For a discussion of specific risks that you should consider before tendering your outstanding 14 1/8% Senior Discount Notes due 2013 in the exchange offer, see “Risk Factors” beginning on page 11.

There is no public market for our outstanding 14 1/8% Senior Discount Notes due 2013 or the New Notes. Our outstanding 14 1/8% Senior Discount Notes due 2013 trade in the Private Offerings Resale and Trading through Automatic Linkages, or PORTAL™, market.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the New Notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2004

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The selling noteholders are offering to sell, and seeking offers to buy, 141/8% Senior Discount Notes due 2013 only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our 141/8% Senior Discount Notes due 2013.

Each broker-dealer that receives new securities for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of these new securities. By so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new securities received in exchange for securities where those securities were acquired by this broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the expiration date and ending on the close of business 180 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

TABLE OF CONTENTS

As used in this prospectus and unless the context indicated otherwise, “Notes” refers, collectively, to our “Old Notes,” and our “New Notes.”

i

MARKET AND INDUSTRY DATA

The data included in this prospectus regarding markets and ranking, including the size of certain markets and our position and the position of our competitors within these markets, are based on third-party market studies, other publicly available information and our own estimates. Our estimates are based on information obtained from our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate and our management’s knowledge and experience. We believe these estimates to be accurate as of the date of this prospectus. However, this information may prove to be inaccurate because of the methods by which we obtained some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in a survey of market size. In addition, although we believe that the independent industry publications and other publicly available information are reliable, we have not independently verified and do not guarantee the accuracy or completeness of this information. Unless the context otherwise requires, market and industry data is for 2003.

ISSUER’S SUBSIDIARY’S PREDECESSOR; NAME CHANGES

References to “Predecessor” in this prospectus refer to Language Line Holdings, Inc., (the “Company”) which was the predecessor of the Issuer’s subsidiary, Language Line, Inc. and was under different ownership than we are. Predecessor merged with Language Line, Inc. (the “Merger”) and the merged company was named “Language Line, Inc.” Predecessor is not the issuer of the Notes.

References in this prospectus to the “Issuer” refer only to Language Line Acquisition, Inc., which was renamed “Language Line Holdings, Inc.” (the “Company”), immediately after the effectiveness of the merger described in this prospectus, and not to any of its subsidiaries. References in this prospectus to “we,” “us” and “our” refer to Predecessor when the context of the reference is prior to this merger and to the Issuer and its subsidiaries when the context of the reference is subsequent to the merger. Issuer is a wholly owned subsidiary of Language Line Holdings II, Inc., a wholly owned subsidiary of Language Line Holdings, LLC, which entities are referred to as our “parent” and “ultimate parent”, respectively.

ii

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the U.S. federal securities laws. These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those included in the forward-looking statements. The words “believe,” “expect,” “plan,” “intend,” “estimate” or “anticipate” and similar expressions, as well as future or conditional verbs such as “will,” “should,” “would,” and “could,” often identify forward-looking statements. Actual results could differ materially from those projected or suggested in any forward-looking statements as a result of a variety of factors and conditions which include, but are not limited to:

| | Ÿ | | the ability of our subsidiaries to make distributions to us in amounts sufficient to make required interest and principal payments on the Notes; |

| | Ÿ | | the effect of our substantial leverage on our financial condition; |

| | Ÿ | | our ability to service our debt and generate sufficient cash; |

| | Ÿ | | our ability to successfully implement our business strategy; |

| | Ÿ | | continued demand from the primary industries we serve and the continued need for our services; |

| | Ÿ | | our ability to compete effectively in a highly competitive and changing environment; |

| | Ÿ | | our ability to finance future operations or capital needs or to engage in other business activities; |

| | Ÿ | | the effects of governmental regulation on our business; |

| | Ÿ | | general business and economic conditions; and |

| | Ÿ | | our ability to attract and retain qualified personnel and management. |

The information contained in this prospectus, including the information provided under the heading “Risk Factors,” identifies additional factors that could affect our operating results and performance. We urge you to carefully consider those factors.

Our forward-looking statements are expressly qualified in their entirety by this cautionary statement. Our forward-looking statements are only made as of the date of this prospectus and we undertake no obligation to update these forward-looking statements to reflect new information, subsequent events or otherwise.

iii

PROSPECTUS SUMMARY

The following summary contains basic information about us and highlights selected information from the prospectus. It likely does not contain all the information that is important to you. Because it is a summary, it does not contain all the information that you should consider before tendering your Old Notes. We encourage you to read this entire document and the documents we have referred you to. Unless indicated otherwise, as used herein, “Language Line,” the “Company,” “we,” “us,” and “our” refer to Predecessor when the context of the reference is prior to the merger and to Language Line Acquisition, Inc., (as renamed to Language Line Holdings, Inc.) and its subsidiaries. The Notes are the exclusive obligations of the Issuer and not of Language Line, Inc. or any of its other subsidiaries when the context of the reference is subsequent to the merger. The Issuer is a holding company with no income from operations or material assets. The Issuer operates its business through, and receives all its income from, Language Line, Inc. and its other subsidiaries.

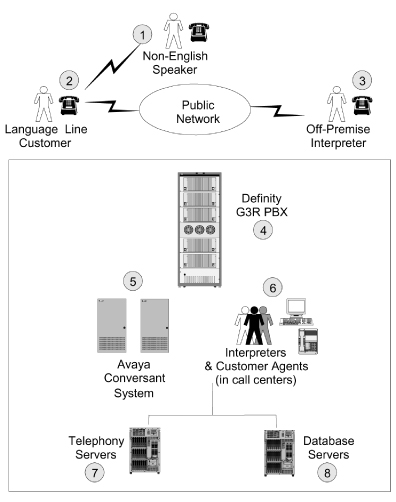

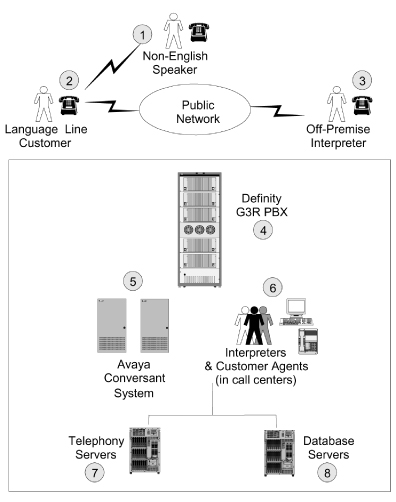

Our Company

We are the leading global provider of over-the-phone interpretation (“OPI”) services from English into more than 150 different languages, 24 hours a day, seven days a week. Our specially-trained, proprietary base of interpreters perform value-added OPI services which facilitate critical business transactions and delivery of emergency and government services between our customers and limited English proficiency (“LEP”) speakers throughout the world. In 2003, we helped more than 18 million people communicate across linguistic and cultural barriers, providing over 80 million billed minutes of OPI services to our customers. We offer our customers a high-quality, cost-effective alternative to staffing in-house multilingual employees or using face-to-face interpretation. Through our OPI services, we improve our customers’ revenue potential, customer service and competitiveness by enhancing their ability to effectively serve the growing population of current and prospective LEP speakers.

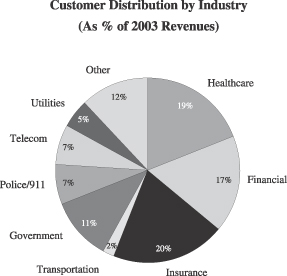

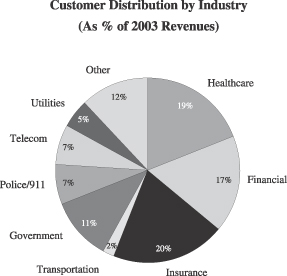

We have over 10,000 customers throughout the United States, the United Kingdom and Canada serving industry sectors such as insurance, financial services, telecommunications, healthcare, transportation and utilities, as well as federal, state and local governments. Our customer base is highly diversified with no single customer accounting for more than 4% and no single industry representing more than 20% of our revenues in 2003. We have enjoyed stable, long-term relationships with our customers, as reflected by average annual customer retention of approximately 95% of our largest 250 customers over the last ten years. Approximately 87% of our largest 250 customers have been customers for over three years and between January 1, 2000 and December 31, 2003, our average annual customer churn, as measured by billed minutes, was approximately 2.4%.

As of December 31, 2003, we managed 1,924 interpreters, approximately 80% of whom were engaged on a dedicated full-time or agency basis. Our interpreters assist customers in a broad variety of applications, including insurance claim processing, emergency room and 911/critical care assistance, resolving credit card problems, enhancing customer service centers and multicultural marketing services. We employ a rigorous qualification and testing program for our interpreters, with only one out of every twelve applicants being qualified and hired. In addition, we conduct industry-specific training programs for our employee and agency interpreters, including initial and ongoing specialized training in medical, insurance and finance terminology, as well as police, emergency and 911 procedures. Our interpreters deliver our services throughout the United States, the United Kingdom and Canada from a distributed work-at-home interpreter force and six domestic and global interpretation centers located in Monterey, California; Chicago, Illinois; Costa Rica, the Dominican Republic and two locations in Panama. We have also recently executed a lease for a second interpretation center in Costa Rica. Approximately 44% of our OPI billed minutes provided in the first quarter of 2004 were interpreted from our off-shore global interpretation centers.

1

Based on our estimates of industry-wide revenues, we believe we represent an approximate 75% market share of the outsourced OPI market, which we estimate is roughly ten times larger than our next largest competitor. We estimate that the total global market opportunity for OPI services is approximately $1.0 billion, representing approximately 620 million billed minutes. Currently, we estimate that over 95% of the total OPI market opportunity is concentrated in the U.S. market, with the United Kingdom and Canada principally contributing the remainder. We believe that the market for outsourced OPI service is growing and remains significantly under-penetrated with current outsourced OPI market penetration of both the total global OPI market and the U.S. OPI market estimated to be less than 20%. Since 1998, we have successfully increased our penetration of the global OPI market, increasing our total billed minutes from approximately 31 million minutes to approximately 81 million minutes in 2003, an average annual increase of 21%.

We have experienced stable revenue growth in each of the past five years as a result of the growing population of LEP speakers and our ability to increase billed minutes from both our existing and new customers. Over the same period, we have also achieved significant increases in profitability by decreasing the cost per minute of delivering our OPI services. Since 1998, we have demonstrated average annual revenue and EBITDA growth of approximately 15% and 21%, respectively. For the six months ended June 30, 2004, we generated total revenues of approximately $72 million. Additionally, our business has not historically required substantial capital expenditure investment.

Our senior management team is highly experienced and remained in place following the merger. Senior management intends to continue to implement its existing operating strategies and remains strongly committed to our future financial success. Following the merger described below, our senior management obtained approximately 4% of the fully-diluted shares of the ultimate parent by direct investment and collectively owns up to approximately 18% of the fully-diluted shares of the ultimate parent, with up to 14% subject to repurchase under certain circumstances related to their continued employment. For a description of the merger, see “Transaction Summary.”

Our Sponsor

ABRY Partners, LLC. ABRY is one of the largest private equity firms in the United States focused on media, communications, information and business services investments, with approximately $2.0 billion under management. ABRY maintains a disciplined investment approach seeking to invest in businesses with high barriers to entry, recurring revenues, a high degree of operating leverage and the ability to support reasonable financial leverage. ABRY has widespread experience with leveraged companies and has an excellent record of generating high returns to its investors, while seeking safety of principal. ABRY believes that we reflect many of the attributes and opportunities that it typically seeks in its equity investments.

Transaction Summary

On June 11, 2004, in accordance with a merger agreement entered into on April 14, 2004, the Issuer merged its subsidiary, Language Line, Inc., with and into Predecessor (with Predecessor as the surviving corporation of the merger) for a purchase price of approximately $715.6 million (subject to customary closing and post-closing adjustment of the merger consideration to reflect working capital adjustments and similar items). The merger agreement contains customary representations and warranties and covenants. At closing, $30 million of the merger consideration was deposited into an escrow account on behalf of the stockholders and optionholders of Predecessor to secure their potential indemnity obligations and payment of any post-closing adjustment to the merger consideration.

2

Concurrently with the merger, we consummated certain related financing transactions, including the issuance of approximately $109.0 million aggregate principal amount at maturity (approximately $55.0 million in gross proceeds) of the Old Notes; the issuance by the Issuer’s subsidiary, Language Line, Inc., of $165.0 million aggregate principal amount at maturity of 111/8% senior subordinated notes dues 2012; and the entering into of senior credit facilities in the amount of $325.0 million by the Issuer’s subsidiary, Language Line, Inc.

* * *

Our company is incorporated under the laws of the State of Delaware. Our principal executive offices are located at 1 Lower Ragsdale Drive, Building 2, Monterey, California 93940. Our telephone number is (877) 886-3885. We maintain the following website: www.languageline.com. Information contained on this website, however, is not incorporated into this prospectus.

3

SUMMARY DESCRIPTION OF THE EXCHANGE OFFER AND NEW NOTES

The Exchange Offer

| | |

Securities Offered | | Up to $108,993,000 aggregate principal amount at maturity ($54,997,868 in gross proceeds) of 14 1/8% Senior Discount Notes due 2013. The terms of the New Notes and the Old Notes are identical in all material respects, except for certain transfer restrictions and registration rights relating to the Old Notes. |

The Exchange Offer | | We are offering to exchange the Old Notes for a like principal amount at maturity of New Notes. Old Notes may be exchanged only in multiples of $1,000. |

Expiration Date; Withdrawal of Tender | | Our exchange offer will expire 5:00 p.m. New York City time, on , 2004, or a later time if we choose to extend this exchange offer. You may withdraw your tender of Old Notes at any time prior to the expiration date. All outstanding Old Notes that are validly tendered and not validly withdrawn will be exchanged. Any Old Notes not accepted by us for exchange for any reason will be returned to you at our expense as promptly as possible after the expiration or termination of the exchange offer. |

Resales | | We believe that you can offer for resale, resell and otherwise transfer the New Notes without complying with the registration and prospectus delivery requirements of the Securities Act if: Ÿyou acquire the New Notes in the ordinary course of business; Ÿyou are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the New Notes; and Ÿyou are not an “affiliate” of ours, as defined in Rule 405 of the Securities Act. If any of these conditions is not satisfied and you transfer any New Notes without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We do not assume or indemnify you against this liability. Each broker-dealer acquiring New Notes issued for its own account in exchange for Old Notes, which it acquired through market-making activities or other trading activities, must acknowledge that it will deliver a proper prospectus when any New Notes issued in the exchange offer are transferred. A broker-dealer may use this prospectus for an offer to resell, a resale or other retransfer of the New Notes issued in the exchange offer. |

4

| | |

Conditions to the Exchange Offer | | Our obligation to accept for exchange, or to issue the New Notes in exchange for, any Old Notes is subject to certain conditions as set forth under “The Exchange Offer—Conditions to the Exchange Offer.” |

| |

Procedures for Tendering Old Notes | | The Old Notes were issued as global securities and were deposited upon issuance with The Bank of New York. The Bank of New York issued certificate-less depository interests in those outstanding Old Notes, which represent a 100% interest in those Old Notes, to The Depository Trust Company. |

| |

| | | Beneficial interests in the outstanding Old Notes, which are held by direct or indirect participants in The Depository Trust Company, are shown on, and transfers of the Old Notes can only be made through, records maintained in book-entry form by The Depository Trust Company. |

| |

| | | You may tender your outstanding Old Notes by instructing your broker or bank where you keep the Old Notes to tender them for you by submitting the BLUE-colored “Letter of Transmittal” that accompanies this prospectus. By tendering your Old Notes you will have to acknowledge and agree to be bound by the terms set forth under “The Exchange Offer.” |

| |

| | | A timely confirmation of book-entry transfer of your outstanding Old Notes into the exchange agent’s account at The Depository Trust Company, under the procedure described in this prospectus under the heading “The Exchange Offer” must be received by the exchange agent on or before 5:00 p.m. on the expiration date. |

| |

United States Federal Income Tax Considerations | | The exchange offer will not result in any income, gain or loss to the holders of Old Notes or to us for United States Federal Income Tax Purposes. See “Certain Material United States Federal Income Tax Considerations.” |

| |

Use of Proceeds | | We will not receive any proceeds from the issuance of the New Notes in the exchange offer. The proceeds from the offering of the Old Notes were used to: Ÿconsummate the merger; and Ÿpay related fees and expenses. |

| |

Exchange Agent | | The Bank of New York is serving as the exchange agent for the exchange offer. |

| |

Shelf Registration Statement | | In limited circumstances, holders of Old Notes may require us to register their Old Notes under a shelf registration statement. |

5

The New Notes

The form and terms of the New Notes are the same as the form and terms of the Old Notes, except that the New Notes will be registered under the Securities Act. As a result, the New Notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the Old Notes. The New Notes represent the same debt as the Old Notes. The Old Notes and the New Notes are governed by the same indenture and are together considered a “series” of securities under that indenture. Any reference to Notes in the following summary is a reference to the New Notes offered pursuant to this prospectus.

Issuer | Language Line Acquisition, Inc. (renamed Language Line Holdings, Inc.) |

Notes Offered | $108,993,000 aggregate principal amount at maturity of 14 1/8% Senior Discount Exchange Notes due 2013. |

Accretion; Interest | No cash interest will accrue on the Notes prior to June 15, 2009. Thereafter, cash interest on the Notes will accrue at a rate of 14 1/8% per annum and be payable semi-annually in arrears on June 15 and December 15 of each year, beginning on December 15, 2009. The Notes will have an initial accreted value of $504.60 per $1,000 principal amount at maturity of Notes. The accreted value of each Note will increase from the date of issuance through June 15, 2009 at a rate of 14 1/8% per annum compounded semi-annually such that the accreted value will equal the principal amount at maturity of each Note on that date. |

Ranking | The Notes will be unsecured senior obligations, will rank equally with all of the Issuer’s future senior indebtedness and will rank senior to all of the Issuer’s subordinated indebtedness. The Notes will not be guaranteed by any of the Issuer’s subsidiaries and will be structurally subordinated to all of the Issuer’s subsidiaries’ existing and future obligations. |

| | As of June 30, 2004, the Issuer’s and its subsidiaries had approximately $509.8 million of debt outstanding. |

Optional Redemption | The Issuer may redeem some or all of the Notes at any time on or after June 15, 2008 at the redemption prices set forth herein, plus accrued and unpaid interest, if any. See “Description of Notes—Optional Redemption.” |

Equity Offering Optional Redemption | The Issuer may redeem up to 35% of the Notes on or prior to June 15, 2007 from the proceeds of one or more equity offerings at 114.125% of the accreted value thereof, plus accrued and unpaid interest, if any, to the date of redemption, so long as at least 65% of the aggregate principal amount at maturity of the Notes issued under the indenture remains outstanding. |

6

Change of Control Offer | Upon the occurrence of a change of control, holders of the Notes may require the Issuer to repurchase some or all of the Notes at 101% of their accreted value, plus accrued and unpaid interest, if any, to the repurchase date. See “Description of Notes—Repurchase at the Option of the Holders—Change of Control.” |

Covenants | The indenture governing the Notes contains covenants limiting, among other things, the Issuer’s ability and the ability of its restricted subsidiaries to: |

| | Ÿ | | incur additional indebtedness; |

| | Ÿ | | make restricted payments; |

| | Ÿ | | restrict payments by the Issuer’s subsidiaries to it; |

| | Ÿ | | guarantee indebtedness; |

| | Ÿ | | enter into transactions with affiliates; and |

| | Ÿ | | merge or consolidate or transfer and sell assets. |

These covenants are subject to important exceptions and qualifications described under “Description of Notes.”

Risk Factors | See “Risk Factors” for a discussion of factors you should carefully consider before exchanging your Old Notes for New Notes. |

Delivery requirements | Each broker-dealer that receives new securities for its own account in exchange for securities, where those securities were acquired by this broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of those new securities. See “Plan of Distribution.” |

7

Summary Historical Consolidated Financial and Other Data

The Issuer is offering the Notes. The financial statements of Predecessor and the Company are presented in this prospectus.

We derived the summary historical consolidated income statement data for the years ended December 31, 2001, December 31, 2002 and December 31, 2003 from Predecessor’s audited historical consolidated financial statements appearing elsewhere in this prospectus. The summary historical consolidated income statement data for the six months ended June 30, 2003 and for the period from January 1, 2004 through June 11, 2004 were derived from Predecessor’s unaudited historical consolidated financial statements appearing elsewhere in this prospectus. The summary historical consolidated income statement data for the period from June 12, 2004 to June 30, 2004 and the consolidated balance sheet data as of June 30, 2004 were derived from the Company’s unaudited historical consolidated financial statements appearing elsewhere in this prospectus. Historical operating results in the following table are not necessarily indicative of the results of operations to be expected in the future.

The summary historical financial and other data should be read in conjunction with: “Transaction Summary,” “Capitalization,” “Selected Historical Consolidated Financial Data,” “Unaudited Pro Forma Consolidated Financial Data” and the notes thereto, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our historical audited and unaudited consolidated financial statements and the notes thereto included elsewhere in this prospectus.

The table on the following page presents Predecessor’s summary historical consolidated financial and other data.

8

Summary Historical Consolidated Financial and Other Data

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Predecessor

| | | | |

| | | Years Ended December 31,

| | | Six

Months

Ended

June 30,

2003

| | | January 1

to

June 11,

2004

| | | June 12 to

June 30,

2004

| |

| | | 2001

| | | 2002

| | | 2003

| | | | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 125,614 | | | $ | 133,318 | | | $ | 140,641 | | | $ | 70,000 | | | $ | 64,692 | | | $ | 7,388 | |

Costs of services: | | | | | | | | | | | | | | | | | | | | | | | | |

Interpreters | | | 40,519 | | | | 40,911 | | | | 40,740 | | | | 21,004 | | | | 18,374 | | | | 1,870 | |

Answer points | | | 2,938 | | | | 1,135 | | | | 542 | | | | 279 | | | | 256 | | | | 26 | |

Telecommunications | | | 5,864 | | | | 7,087 | | | | 6,646 | | | | 3,738 | | | | 2,882 | | | | 256 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total costs of services | | | 49,321 | | | | 49,133 | | | | 47,928 | | | | 25,021 | | | | 21,512 | | | | 2,152 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross margin | | | 76,293 | | | | 84,185 | | | | 92,713 | | | | 44,979 | | | | 43,180 | | | | 5,236 | |

| | | | | | |

Other expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Selling, general and administrative | | | 24,780 | | | | 20,896 | | | | 24,221 | | | | 11,499 | | | | 10,423 | | | | 1,201 | |

Interest, net | | | 18,752 | | | | 20,168 | | | | 12,025 | | | | 6,121 | | | | 5,982 | | | | 2,591 | |

Merger related expenses | | | — | | | | — | | | | — | | | | — | | | | 9,848 | | | | — | |

Depreciation and amortization | | | 11,986 | | | | 2,787 | | | | 3,612 | | | | 1,771 | | | | 1,735 | | | | 2,004 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total other expenses | | | 55,518 | | | | 43,851 | | | | 39,858 | | | | 19,391 | | | | 27,988 | | | | 5,796 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) before taxes on income and accounting change | | | 20,775 | | | | 40,334 | | | | 52,855 | | | | 25,588 | | | | 15,192 | | | | (560 | ) |

Taxes on income | | | 8,397 | | | | 15,415 | | | | 20,467 | | | | 9,900 | | | | 5,968 | | | | (218 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) before accounting change | | | 12,378 | | | | 24,919 | | | | 32,388 | | | | 15,688 | | | | 9,224 | | | | (342 | ) |

Cumulative effect of accounting change, net of tax effect | | | (187 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | | 12,191 | | | | 24,919 | | | | 32,388 | | | | 15,688 | | | | 9,224 | | | | (342 | ) |

Accretion of preferred stock redemption value | | | (10,900 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) allocable to common stockholders | | $ | 1,291 | | | $ | 24,919 | | | $ | 32,388 | | | $ | 15,688 | | | $ | 9,224 | | | $ | (342 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Other Financial and Operating Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Billed minutes (in thousands) | | | 59,350 | | | | 70,065 | | | | 80,715 | | | | 39,552 | | | | 39,235 | | | | 4,513 | |

Cash flows provided by (used in): | | | | | | | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | 34,176 | | | $ | 39,035 | | | $ | 31,864 | | | $ | 15,581 | | | $ | 20,024 | | | $ | 1,525 | |

Investing activities | | | (4,135 | ) | | | (20,942 | )(1) | | | (2,574 | ) | | | (1,579 | ) | | | (860 | ) | | | (713,691 | ) |

Financing activities | | | (30,600 | ) | | | (15,771 | ) | | | (29,649 | ) | | | (15,386 | ) | | | (12,260 | ) | | | 718,046 | |

| | | | | | |

EBITDA(2) | | $ | 51,326 | | | $ | 63,289 | | | $ | 68,492 | | | $ | 33,480 | | | $ | 22,909 | | | $ | 4,035 | |

| | | | | | |

Ratio of earnings to fixed charges(3)(4) | | | 2.10 | x | | | 2.97 | x | | | 5.30 | x | | | 5.09 | x | | | 1.97 | x | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | As of June

30, 2004

| |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | | $ | 5,880 | |

Total assets | | | | 931,841 | |

Total debt | | | | 509,840 | |

Stockholders’ equity | | | | 225,947 | |

(footnotes on following page)

9

Notes to Summary Historical Consolidated Financial and Other Data

| (1) | | Includes $18.5 million in investing activities related to the May 2002 acquisition of OnLine Interpreters, Inc. |

| (2) | | EBITDA represents net income, plus depreciation and amortization, plus net interest expense, plus taxes on income. While we do not intend for EBITDA to represent cash flow from operations as defined by Accounting Principles Generally Accepted in the United States of America (“U.S. GAAP”) and while we do not suggest that you consider it as an indicator of operating performance or an alternative to operating cash flow or operating income (as measured by U.S. GAAP), we include it to provide additional information with respect to our ability to meet our future debt service, capital expenditures and working capital requirements. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” We believe EBITDA provides investors and analysts useful information with which to analyze and compare our operating performance to other companies. However, since EBITDA is not defined by U.S. GAAP, it may not be calculated on the same basis as other similarly titled measures of other companies within our industry. |

The following table provides an unaudited reconciliation from net income to EBITDA (in thousands):

| | | | | | | | | | | | | | | | | | | |

| | | Years Ended December 31,

| | Six

Months Ended

June 30,

2003

| | January 1

to

June 11,

2004

| | June 12

to

June 30,

2004

| |

| | | 2001

| | 2002

| | 2003

| | | |

Net income (loss) | | $ | 12,191 | | $ | 24,919 | | $ | 32,388 | | $ | 15,688 | | $ | 9,224 | | $ | (342 | ) |

Depreciation and amortization | | | 11,986 | | | 2,787 | | | 3,612 | | | 1,771 | | | 1,735 | | | 2,004 | |

Interest, net | | | 18,752 | | | 20,168 | | | 12,025 | | | 6,121 | | | 5,982 | | | 2,591 | |

Taxes (benefit) on income (loss) | | | 8,397 | | | 15,415 | | | 20,467 | | | 9,900 | | | 5,968 | | | (218 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

EBITDA | | $ | 51,326 | | $ | 63,289 | | $ | 68,492 | | $ | 33,480 | | $ | 22,909 | | $ | 4,035 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

| (3) | | For purposes of calculating the ratio of earnings to fixed charges, earnings represent income (loss) before income taxes (benefit) plus fixed charges. Fixed charges consist of interest expense, deferred financing costs written off (included in merger related expenses) and one-third of operating rental expense which management believes is representative of the interest component of rent expense. |

| (4) | | For the period from June 12, 2004 to June 30, 2004 the ratio of earnings to fixed charges was less than 1.0x because the fixed charges exceed the earnings. |

10

RISK FACTORS

You should consider carefully all of the information in this prospectus, including the following risk factors and warnings, before deciding whether to exchange your Old Notes for the New Notes to be issued in this exchange offer. Except for the first three risk factors described below, these risk factors apply to both the Old Notes and the New Notes.

Risks Related To The Offering

Since outstanding Old Notes will continue to have restrictions on transfer and cannot be sold without registration under securities laws or exemptions from registration, you may have difficulty selling the Old Notes which you do not exchange.

If a large number of outstanding Old Notes are exchanged for New Notes issued in the exchange offer, it may be difficult for holders of outstanding Old Notes that are not exchanged in the exchange offer to sell their Old Notes, since those Old Notes may not be offered or sold unless they are registered or there are exemptions from registration requirements under the Securities Act of 1933, hereinafter referred to as the Securities Act, or state laws that apply to them. In addition, if there are only a small number of Old Notes outstanding, there may not be a very liquid market in those Old Notes. There may be few investors that will purchase unregistered securities in which there is not a liquid market. See “The Exchange Offer — You May Suffer Adverse Consequences if You Fail to Exchange Outstanding Notes.”

In addition, if you do not tender your outstanding Old Notes or if we do not accept some outstanding Old Notes, those Old Notes will continue to be subject to the transfer and exchange provisions of the indenture and the existing transfer restrictions of the Old Notes that are described in the legend on the Old Notes and in the prospectus relating to the Old Notes.

Due to resale restrictions, if you exchange your Old Notes, you may not be able to resell the New Notes you receive in the exchange offer without registering them and delivering a prospectus.

You may not be able to resell New Notes that you receive in the exchange offer without registering those New Notes or delivering a prospectus. Based on interpretations by the Securities and Exchange Commission, hereinafter referred to as the Commission, in no-action letters, we believe, with respect to New Notes issued in the exchange offer, that:

| | Ÿ | | holders who are not “affiliates” of ours within the meaning of Rule 405 of the Securities Act; |

| | Ÿ | | holders who acquire their New Notes in the ordinary course of business; and |

| | Ÿ | | holders who do not engage in, intend to engage in, or have arrangements to participate in a distribution (within the meaning of the Securities Act) of the New Notes |

do not have to comply with the registration and prospectus delivery requirements of the Securities Act.

Holders described in the preceding sentence must tell us in writing at our request that they meet these criteria. Holders that do not meet these criteria could not rely on interpretations of the Commission in no-action letters and would have to register the New Notes that they receive in the exchange offer and deliver a prospectus if they sold the New Notes. In addition, holders that are broker-dealers may be deemed “underwriters” within the meaning of the Securities Act in connection with any resale of New Notes acquired in the exchange offer. Holders that are broker-dealers must acknowledge that they acquired their outstanding New Notes in market-making activities or other trading activities and must deliver a prospectus when they resell the New Notes they acquire in the exchange offer in order not to be deemed an underwriter.

11

You should review the more detailed discussion in “The Exchange Offer — Procedures for Tendering Old Notes and Consequences of Exchanging Outstanding Old Notes.”

Servicing our debt will require a significant amount of cash, and our ability to generate sufficient cash depends upon many factors, some of which are beyond our control.

Our ability to make payments on and refinance our debt and to fund planned capital expenditures depends on our ability to generate cash flow in the future. To some extent, this is subject to general economic, financial, competitive, legislative and regulatory factors and other factors that are beyond our control. We may be unable to continue to generate cash flow from operations at current levels. If we are unable to generate sufficient cash flow from operations in the future to service our debt, we may have to refinance all or a portion of our existing debt or obtain additional financing. Any refinancing of this kind may not be possible, and we may be unable to obtain any additional financing. The inability to obtain additional financing could have a material adverse effect on our financial condition and on our ability to meet our obligations to you under the Notes.

Risks Related to the Notes

Our substantial leverage may impair our financial condition and we may incur significant additional debt, which could increase the risks facing the holders of the Notes.

We have a substantial amount of debt. As of June 30, 2004, our total consolidated debt was $509.8 million. See “Capitalization” for additional information.

Our substantial debt could have important consequences to you, including:

| | Ÿ | | making it more difficult for us to satisfy our obligations with respect to the Notes; |

| | Ÿ | | increasing our vulnerability to general adverse economic and industry conditions; |

| | Ÿ | | limiting our ability to obtain additional financing to fund future working capital requirements, capital expenditures, and other general corporate requirements; |

| | Ÿ | | requiring a substantial portion of our cash flow from operations for the payment of interest on our debt, thus reducing our ability to use our cash flow to fund working capital, capital expenditures, acquisitions and general corporate requirements; |

| | Ÿ | | limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and |

| | Ÿ | | placing us at a competitive disadvantage compared to other less-leveraged competitors. |

Subject to specified limitations, the indenture governing the Notes, the indenture governing Language Line, Inc.’s senior subordinated notes and Language Line, Inc.’s senior secured credit facilities permit us and our subsidiaries to incur substantial additional debt. Language Line, Inc. is able to borrow up to an additional $35.8 million (less any standby letter of credit issuances) under its senior secured credit facilities. If new debt is added to our and our subsidiaries’ current debt levels, the related risks that we and they now face could intensify. See “Description of Other Indebtedness” for additional information.

The Notes are structurally subordinated to the debt and liabilities of our subsidiaries, including Language Line, Inc., and are effectively subordinated to any of the Issuer’s future secured debt.

The Issuer has no operations of its own and derives all of its revenue and cash flow from its subsidiaries. The Issuer’s subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay amounts due under the notes or to make any funds available to pay those amounts, whether by dividend, distribution, loan or other payments.

12

The Notes are structurally subordinated to all debt and liabilities, including trade payables, of the Issuer’s subsidiaries, including Language Line, Inc. You are only entitled to participate with all other holders of the Issuer’s indebtedness and liabilities in the assets of the Issuer’s subsidiaries remaining after the Issuer’s subsidiaries have paid all of their debt and liabilities. The Issuer’s subsidiaries may not have sufficient funds or assets to permit payments to the Issuer in amounts sufficient to permit the Issuer to pay all or any portion of its indebtedness and other obligations, including the Issuer’s obligations on the Notes. As of June 30, 2004, the total consolidated debt of the Issuer’s subsidiaries was approximately $454.4 million and the aggregate amount of trade payables, accrued liabilities, deferred tax liabilities and other balance sheet liabilities (other than debt) of the Issuer’s subsidiaries was approximately $190.0 million. In addition, Language Line, Inc. has approximately $33.3 million of additional borrowings available under its senior secured credit facilities (less any standby letter of credit issuances).

The indenture governing the Notes, the indenture governing Language Line, Inc.’s senior subordinated notes and Language Line, Inc.’s senior secured credit facilities permit the Issuer and/or its subsidiaries to incur additional indebtedness, including secured indebtedness, under certain circumstances. See “Description of Other Indebtedness.” If the Issuer incurs any secured debt in the future, holders of such secured debt will have claims that are prior to your claims as holders of the Notes to the extent of the value of the assets securing that other debt. In the event of a bankruptcy, liquidation or reorganization or similar proceeding relating to us, holders of secured debt will have a prior claim to the assets that constitute their collateral.

We may not have access to the cash flow and other assets of our subsidiaries that may be needed to make payments on the Notes.

Our operations are conducted through our subsidiaries and our ability to make payment on the Notes is dependent on the earnings and the distribution of funds from our subsidiaries. However, none of our subsidiaries is obligated to make funds available to us for payment on the Notes. In addition, the terms of the indenture governing Language Line, Inc.’s senior subordinated notes and the senior secured credit facilities significantly restrict Language Line, Inc. and its subsidiaries from paying dividends and otherwise transferring assets to us. Furthermore, our subsidiaries are permitted under the terms of the senior secured credit facilities and other indebtedness (including under the indenture) to incur additional indebtedness that may severely restrict or prohibit the making of distributions, the payment of dividends or the making of loans by such subsidiaries to us.

The agreements governing the current and future indebtedness of our subsidiaries may not permit our subsidiaries to provide us with sufficient dividends, distributions or loans to fund scheduled interest and principal payments on the Notes when due. See “Description of Other Indebtedness.”

Covenant restrictions under our indebtedness may limit our ability to operate our business.

The indenture governing the Notes, Language Line, Inc.’s senior secured credit facilities, the indenture governing Language Line, Inc.’s senior subordinated notes and certain of our other agreements relating to our indebtedness contain, among other things, covenants that may restrict our and our subsidiaries’ ability to finance future operations or capital needs or to engage in other business activities. Our and our subsidiaries’ debt instruments restrict, among other things, our ability and the ability of our subsidiaries to:

| | Ÿ | | incur additional indebtedness; |

| | Ÿ | | make restricted payments; |

| | Ÿ | | restrict payments by our subsidiaries to us and restrict payments by Language Line, Inc.’s subsidiaries to it; |

| | Ÿ | | enter into transactions with affiliates; and |

| | Ÿ | | merge or consolidate or transfer and sell assets. |

13

In addition, Language Line, Inc.’s senior secured credit facilities require Language Line, Inc. to maintain specified financial ratios and satisfy certain financial condition tests that may require action to reduce Language Line, Inc.’s debt or to act in a manner contrary to our business objectives. Events beyond our control, including changes in general economic and business conditions, may affect Language Line, Inc.’s ability to meet those financial ratios and financial condition tests. We may be unable to meet those tests, and the senior secured lenders may not waive any failure to meet those tests. See “Description of Other Indebtedness” for additional information.

A default under the indenture governing the Notes, Language Line, Inc.’s senior secured credit facilities or the indenture governing the notes issued by Language Line, Inc. could result in an acceleration of our indebtedness, which would have a material adverse effect on our business, financial condition and results of operations.

The indenture governing the Notes, the credit agreement governing Language Line, Inc.’s senior secured credit facilities and the indenture governing the notes issued by Language Line, Inc. contain numerous financial and operating covenants. The breach of any of these covenants will result in a default under the applicable indenture or credit agreement which could result in the indebtedness under the applicable indenture or credit agreement becoming immediately due and payable. If this were to occur, we may be unable to adequately finance our operations. In addition, a default under one of such debt instruments could result in a default or acceleration of our other indebtedness subject to cross-default provisions. If this occurs, we may not be able to pay our debts or borrow sufficient funds to refinance them. Even if new financing is available, it may not be on terms that are acceptable to us.

We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture.

Upon a change of control, subject to certain conditions, we are required to offer to repurchase all outstanding Notes at 101% of the accreted value thereof, plus accrued and unpaid cash interest, if any, to the date of repurchase.

The occurrence of certain of the events that would constitute a change of control would constitute a default under Language Line, Inc.’s senior secured credit facilities. Future indebtedness of us and our subsidiaries may also contain prohibitions of certain events that would constitute a change of control or require such indebtedness to be repurchased upon a change of control. Moreover, the exercise by the holders of Notes of their right to require us to repurchase the notes could cause a default under such indebtedness, even if the change of control itself does not, including a default due to the financial effect of such repurchase on us. Finally, our ability to pay cash to the holders upon a repurchase may be limited by our then existing financial resources. There can be no assurance that sufficient funds will be available when necessary to make any required repurchases. Even if sufficient funds were otherwise available, the terms of Language Line, Inc.’s senior secured credit facilities and senior subordinated notes restrict the restricted subsidiaries thereunder from paying dividends or distributions to us for purchasing the Notes in the event of a change of control. There can be no assurance that in the event of a change of control we will be able to obtain the necessary consents from the lenders under the senior secured credit facilities or holders of Language Line, Inc.’s senior subordinated notes to consummate a change of control offer. Consequently, if we are not able to prepay the indebtedness under the senior secured credit facilities and any other indebtedness containing similar restrictions or obtain requisite consents, we will be unable to fulfill our repurchase obligations if holders of Notes exercise their repurchase rights following a change of control. See “Description of Notes—Repurchase at the Option of the Holders—Change of Control” and “Description of Other Indebtedness” for additional information.

The interests of our principal equityholder may not be aligned with the interests of the holders of the Notes.

Entities associated with ABRY Partners beneficially own securities representing more than 85% of the voting equity interests of our ultimate parent, Language Line Holdings, LLC and therefore indirectly control our

14

affairs and policies. Circumstances may occur in which the interests of our principal equityholder could be in conflict with the interests of the holders of the Notes. In addition, our principal equityholder may have an interest in pursuing acquisitions, divestitures, capital expenditures or other transactions that, in their judgment, could enhance their equity investment, even though these transactions might involve risks to the holders of the Notes. See “Management,” “Security Ownership of Certain Beneficial Owners and Management” and “Certain Relationships and Related Transactions.”

Risks Related to Our Business

If we are unable to successfully implement our business strategy, our business, financial condition and results of operations could be adversely affected.

The implementation of our business strategy will place significant demands on our senior management and operational, financial and marketing resources. The successful implementation of our business strategy involves the following principal risks which could materially adversely affect our business, financial condition and results of operations:

| | Ÿ | | the merger may result in significant unexpected operating difficulties, liabilities or contingencies; |

| | Ÿ | | the operation of our business may place significant or unachievable demands on our management team; |

| | Ÿ | | we may be unable to increase our penetration of the OPI market at average rates per billed minute of service which are acceptable to us; |

| | Ÿ | | we may be unable to continue to achieve cost reductions on a per billed minute basis consistent with our low-cost provider strategy; and |

| | Ÿ | | we may be unable to recruit a sufficient number of qualified interpreters. |

Our continued success depends on continued demand from the primary industries we serve.

Our success depends upon continued demand for our services from our customers within the industries we serve. A significant downturn in the insurance, healthcare, financial services or telecommunications industries, which together accounted for a majority of our net revenues in 2003, or a trend in any of these industries to reduce or eliminate their use of OPI services may negatively impact our results of operations.

Our continued success depends on our customers’ trend toward outsourcing OPI services.

Our business depends on the continued need for outsourced OPI services as driven by general economic and public policy factors. These trends may not continue, as businesses and organizations may either elect to perform OPI services in-house or discontinue OPI services, both of which would have a negative effect on our revenues. Additionally, Spanish-English interpretation services accounted for the majority of our total OPI billed minutes in 2003. A decision by our customers to conduct an increasing amount of OPI services in-house, especially for the rapidly growing Spanish-speaking community, could have an adverse effect on our business, financial condition and results of operations.

The OPI services market in which we compete is highly competitive and our failure to compete effectively could erode our market share.

Our failure to compete effectively in the outsourced OPI services market that we serve could erode our market share and negatively impact our ability to service the notes. We expect that our existing competitors will strive to improve their outsourced OPI services and introduce new services with competitive price and customer service characteristics. From time to time we may lose customers as a result of competition. For example, in June 2004, we lost one of our larger customers, representing approximately 1.6% of our 2003 billed minutes, to a

15

competitor. Certain of our potential competitors may attempt to leverage their existing infrastructure to compete with us. For example, a large call center company may have the requisite scale to enter into the OPI services market. If this were to occur, the outsourced OPI industry may become more competitive and may force us to decrease our profit margins in order to maintain our market position.

Our average revenue per minute has been declining for the past five years.

Over the past five years, we have undertaken a strategy to manage pricing per billed minute as a strategic tool to encourage our customers to purchase more billed minutes and to optimize our market share. In furtherance of this strategy, we have decreased the per minute cost that we charge our customers, resulting in decreased average revenue per billed minute. If we are unable to attract sufficient volume to offset lower per minute charges or if average rates per billed minute decrease beyond our expectations, we may be unable to generate revenue growth or maintain current revenue levels in the future.

Our business could be adversely affected by a variety of factors related to doing business internationally.

We currently conduct operations internationally, and we anticipate that operations outside the United States may represent an increasing portion of our total operations in the future. Although our OPI services constitute generally accepted business practices in the United States, such practices may not be accepted in certain international markets. To the extent there is consumer, business or government resistance to the use of OPI services in international markets we target, our international growth prospects could be affected. In addition, our international operations are subject to numerous inherent challenges and risks, including the difficulties associated with operating in multilingual and multicultural environments, varying and potentially burdensome regulatory requirements, fluctuations in currency exchange rates, political and economic conditions in various jurisdictions, tariffs and other trade barriers, longer accounts receivable collection cycles, barriers to the repatriation of earnings and potentially adverse tax consequences. Moreover, expansion into new geographic regions will require considerable management and financial resources and, as a result, may negatively impact our results of operations.

Our continued success depends on our ability to attract and retain qualified personnel.

Our business is labor intensive and places significant importance on our ability to recruit and retain a qualified base of interpreters and technical and professional personnel. We continuously recruit and train replacement personnel as a result of our changing and expanding work force. A higher turnover rate among our personnel would increase our hiring and training costs and decrease operating efficiencies and productivity. We may not be successful in attracting and retaining the personnel that we require to conduct our operations successfully.

Our continued success depends on our ability to retain senior management.

Our success is largely dependent upon the efforts, direction, and guidance of our senior management. Although we have entered into or will enter into employment agreements with certain of our executive officers, our continued growth and success also depends in part on our ability to attract and retain qualified managers and on the ability of our executive officers and key employees to manage our operations successfully. The loss of Dennis Dracup, Chief Executive Officer, or Matthew Gibbs, Chief Financial Officer, or our inability to attract, retain or replace key management personnel in the future could have a material adverse effect on our business.

Our business is highly dependent on the availability of telephone service.

Our business is highly dependent upon telephone service provided by various local and long distance telephone companies. Any significant disruption in telephone service could adversely affect our business. Additionally, limitations on the ability of telephone companies to provide us with increased capacity in the future could adversely affect our growth prospects. Rate increases imposed by these telephone companies would have the

16

effect of increasing our operating expenses. In addition, our operation of global interpretation centers causes us to rely on the availability of telephone service outside the United States. Any significant disruption in telephone service in the countries where we operate global interpretation centers could adversely affect our business.

Our business could be adversely affected by an emergency interruption of our operations.

Our operations are dependent upon our ability to protect our OPI interpretation centers against damage that may be caused by fire, power failure, telecommunications failures, unauthorized intrusion, computer viruses and other emergencies. We have taken precautions to protect ourselves and our customers from events that could interrupt delivery of our services. These precautions include fire protection and physical security systems, rerouting of telephone calls to one or more of our other OPI interpretation centers in the event of an emergency, backup power generators and a disaster recovery plan. We also maintain business interruption insurance in amounts that we consider adequate. Notwithstanding such precautions, a fire, natural disaster, human error, equipment malfunction or inadequacy, or other event could result in a prolonged interruption in our ability to provide support services to our customers.

We cannot predict the outcome of various measures in Congress aimed at limiting the transfer of U.S. jobs overseas.

An increasing number of our interpreters are located in global interpretation centers outside of the United States. Although hourly wages for our off-shore interpreters are often above the average wage rate in their respective countries, these off-shore interpreters are paid less than comparable U.S.-based interpreters, and the global interpretation centers have an approximately 50% total cost per minute advantage over our domestic interpretation centers. Several measures have recently been introduced in Congress aimed at prohibiting, or at least limiting, the transfer of U.S. jobs to foreign countries. It is not clear whether these legislative proposals will eventually become law or what impact they may have on our business.

17

THE EXCHANGE OFFER

Terms of the Exchange Offer; Period for Tendering Outstanding New Notes

We issued the Old Notes on June 11, 2004 and entered into a registration rights agreement with the initial purchasers. The registration rights agreement requires that we register the Old Notes with the Commission and offer to exchange the registered New Notes for the outstanding Old Notes issued on June 11, 2004.

We will accept any validly tendered Old Notes that you do not withdraw before 5:00 p.m., New York City time, on the expiration date. We will issue $1,000 of principal amount at maturity of New Notes in exchange for each $1,000 principal amount at maturity of your outstanding Old Notes. You may tender some or all of your Old Notes in the exchange offer.

The form and terms of the New Notes are the same as the form and terms of the outstanding Old Notes except that:

| | (1) | | the New Notes being issued in the exchange offer will be registered under the Securities Act and will not have legends restricting their transfer; |

| | (2) | | the New Notes being issued in the exchange offer will not contain the registration rights and liquidated damages provisions contained in the outstanding Old Notes; and |

| | (3) | | interest on the New Notes will accrue from the last interest date on which interest was paid on your Old Notes. |

Outstanding Old Notes that we accept for exchange will not accrue interest after we complete the exchange offer.

The exchange offer will expire at 5:00 p.m., New York City time, on , 2004, unless we extend it. If we extend the exchange offer, we will issue a notice by press release or other public announcement before 9:00 a.m., New York City time, on the next business day after the previously scheduled expiration date.

We reserve the right, in our sole discretion:

| | (1) | | to extend the exchange offer; |

| | (2) | | to terminate the exchange offer and not accept any Old Notes for exchange if any of the conditions have not been satisfied; or |

| | (3) | | to amend the exchange offer in any manner; provided, however that if we amend the exchange offer to make a material change, including the waiver of a material condition, we will extend the exchange offer, if necessary, to keep the exchange offer open for at least five business days after such amendment or waiver. |

We will promptly give written notice of any extension, delay, non-acceptance, termination or amendment. We will also file a post-effective amendment with the Commission if we amend the terms of the exchange offer.

If we extend the exchange offer, Old Notes that you have previously tendered will still be subject to the exchange offer and we may accept them. We will promptly return your Old Notes if we do not accept them for exchange for any reason without expense to you after the exchange offer expires or terminates.

18

Procedures for Tendering Old Notes Held Through Brokers and Banks

Since the Old Notes are represented by global book-entry notes, DTC, as depositary, or its nominee is treated as the registered holder of the notes and will be the only entity that can tender your Old Notes for New Notes. Therefore, to tender notes subject to this exchange offer and to obtain New Notes, you must instruct the institution where you keep your old notes to tender your notes on your behalf so that they are received on or prior to the expiration of this exchange offer.

The BLUE-colored “Letter of Transmittal” shall be used by you to give such instructions.YOU SHOULD CONSULT YOUR ACCOUNT REPRESENTATIVE AT THE BROKER OR BANK WHERE YOU KEEP YOUR NOTES TO DETERMINE THE PREFERRED PROCEDURE.

IF YOU WISH TO ACCEPT THIS EXCHANGE OFFER, PLEASE INSTRUCT YOUR BROKER OR ACCOUNT REPRESENTATIVE IN TIME FOR YOUR OLD NOTES TO BE TENDERED BEFORE THE 5:00 PM (NEW YORK CITY TIME) DEADLINE ON , 2004.

You may tender some or all of your Old Notes in this exchange offer. However, notes may be tendered only in integral multiples of $1,000.

When you tender your outstanding Old Notes and we accept them, the tender will be a binding agreement between you and us in accordance with the terms and conditions in this prospectus.

The method of delivery of outstanding Old Notes and all other required documents to the exchange agent is at your election and risk.

We will decide all questions about the validity, form, eligibility, acceptance and withdrawal of tendered Old Notes, and our determination will be final and binding on you. We reserve the absolute right to:

| | (1) | | reject any and all tenders of any particular note not properly tendered; |

| | (2) | | refuse to accept any Old Note if, in our judgment or the judgment of our counsel, the acceptance would be unlawful; and |

| | (3) | | waive any defects or irregularities or conditions of the exchange offer as to any particular Old Note before the expiration of the offer. |

Our interpretation of the terms and conditions of the exchange offer will be final and binding on all parties. You must cure any defects or irregularities in connection with tenders of Old Notes as we will determine. Neither we, the exchange agent nor any other person will incur any liability for failure to notify you of any defect or irregularity with respect to your tender of Old Notes. If we waive any terms and conditions pursuant to (3) above with respect to a noteholder, we will extend the same waiver to all noteholders with respect to that term or condition being waived.

Representations

To participate in the exchange offer, we require that you represent for our benefit that:

| | (1) | | you are acquiring them in the ordinary course of business; |

| | (2) | | you are not engaging in or intend to engage in a distribution of the New Notes issued in the exchange offer; |

| | (3) | | you do not have an arrangement or understanding with any person to participate in the distribution of New Notes issued in the exchange offer; |

19

| | (4) | | you are not our “affiliate” as defined under Rule 405 of the Securities Act; and |

| | (5) | | if you are a broker-dealer, you will receive New Notes for your own account, you acquired New Notes as a result of market-making activities or other trading activities, and you acknowledge that you will deliver a prospectus in connection with any resale of your New Notes. |

You must make such representations by executing the Blue-colored “Letter of Transmittal” and delivering to the institution through which you hold your Old Notes.

Broker-dealers who cannot make the representations in item (5) of the paragraph above cannot use this exchange offer prospectus in connection with resales of the New Notes issued in the exchange offer.

If you are our “affiliate,” as defined under Rule 405 of the Securities Act, you are a broker-dealer who acquired your outstanding Old Notes in the initial offering and not as a result of market-making or trading activities, or if you are engaged in or intend to engage in or have an arrangement or understanding with any person to participate in a distribution of New Notes acquired in the exchange offer, you or that person:

| | (1) | | may not rely on the applicable interpretations of the staff of the Commission and therefore may not participate in the exchange offer; and |

| | (2) | | must comply with the registration and prospectus delivery requirements of the Securities Act or an exemption therefrom when reselling the New Notes. |

Procedures for Brokers and Custodian Banks; DTC ATOP Account

In order to accept this exchange offer on behalf of a holder of Old Notes you must submit or cause your DTC participant to submit an Agent’s Message as described below.

The exchange agent, on our behalf, will seek to establish an Automated Tender Offer Program (“ATOP”) account with respect to the outstanding notes at DTC promptly after the delivery of this prospectus. Any financial institution that is a DTC participant, including your broker or bank, may make book-entry tender of outstanding Old Notes by causing the book-entry transfer of such notes into our ATOP account in accordance with DTC’s procedures for such transfers. Concurrently with the delivery of the Old Notes, an Agent’s Message in connection with such book-entry transfer must be transmitted by DTC to, and received by, the exchange agent on or prior to 5:00 p.m., New York City time on the expiration date. The confirmation of a book-entry transfer into the ATOP account as described above is referred to herein as a “Book-Entry Confirmation.”

The term “Agent’s Message” means a message transmitted by the DTC participants to DTC, and thereafter transmitted by DTC to the exchange agent, forming a part of the Book-Entry Confirmation which states that DTC has received an express acknowledgment from the participant in DTC described in such Agent’s Message stating that such participant and beneficial holder agree to be bound by the terms of this exchange offer.

Each Agent’s Message must include the following information:

| | (1) | | Name of the beneficial owner tendering such notes; |

| | (2) | | Account number of the beneficial owner tendering such notes; |

| | (3) | | Principal amount of notes tendered by such beneficial owner; and |

| | (4) | | A confirmation that the beneficial holder of the Old Notes tendered has made the representations set forth in the Letter of Transmittal. |

BY SENDING AN AGENT’S MESSAGE THE DTC PARTICIPANT IS DEEMED TO HAVE CERTIFIED THAT THE BENEFICIAL HOLDER FOR WHOM NOTES ARE BEING TENDERED HAS BEEN PROVIDED WITH A COPY OF THIS PROSPECTUS.

20

The delivery of notes through DTC, and any transmission of an Agent’s Message through ATOP, is at the election and risk of the person tendering notes. We will ask the exchange agent to instruct DTC to return those Old Notes, if any, that were tendered through ATOP but were not accepted by us, to the DTC participant that tendered such notes on behalf of holders of the notes. Neither we nor the exchange agent is responsible or liable for the return of such notes to the tendering DTC participants or to their owners, nor as to the time by which such return is completed.

Acceptance of Outstanding Old Notes for Exchange; Delivery of New Notes Issued in the Exchange Offer

We will accept validly tendered Old Notes when the conditions to the exchange offer have been satisfied or we have waived them. We will have accepted your validly tendered Old Notes when we have given oral or written notice to the exchange agent. The exchange agent will act as agent for the tendering holders for the purpose of receiving the New Notes from us. If we do not accept any tendered Old Notes for exchange because of an invalid tender or other valid reason, the exchange agent will return the certificates, without expense, to the tendering holder. If a holder has tendered Old Notes by book-entry transfer, we will credit the notes to an account maintained with The Depository Trust Company. We will return certificates or credit the account at The Depository Trust Company promptly after the exchange offer terminates or expires.

The agent’s message must be transmitted to exchange agent on or before 5:00 p.m., New York City time, on the expiration date.

Withdrawal Rights

You may withdraw your tender of outstanding notes at any time before 5:00 p.m., New York City time, on the expiration date.

For a withdrawal to be effective, you should contact your bank or broker where your Old Notes are held and have them send an ATOP notice of withdrawal so that it is received by the exchange agent before 5:00 p.m., New York City time, on the expiration date. Such notice of withdrawal must:

| | (1) | | specify the name of the person that tendered the Old Notes to be withdrawn; |

| | (2) | | identify the Old Notes to be withdrawn, including the CUSIP number and principal amount at maturity of the Old Notes; |