| As filed with the Securities and Exchange Commission on January 21, 2005 | Registration No. 333- 120722 | |

|---|---|---|

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-1/A

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AMERICAN GOLDRUSH CORPORATION

(Exact name of Registrant as specified in its charter)

| Canada | 1040 | Not Applicable |

|---|---|---|

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code) | (I.R.S. Employer Identification No.) |

1155 West Pender, Suite 708

Vancouver, British Columbia V6E 2P4

Tel: (604) 974-1175

(Address and telephone number of Registrant’s principal executive offices)

David Lubin & Associates

92 Washington Avenue

Cedarhurst, NY 11516

Tel: (516) 569-9629

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all Correspondence to:

David Lubin, Esq.

David Lubin & Associates

92 Washington Avenue

Cedarhurst, NY 11516

Tel: (516) 569-9629

Facsimile No.: (516) 569-5053

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: [x]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box: [ ]

| Calculation of Registration Fee | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Title of Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Aggregate Price Per Share | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||

| Common Stock, no par | 9,557,350 | $ | 0.001 (1) | $ | 9,557.35 | $ | 1.21 | |||||||

| value (2) | ||||||||||||||

| Common Stock, no par | 28,500,000 | $ | 0.84166667 (4) | $ | 23,987,500.00 | $ | 3,046.42 | |||||||

| value (3) | ||||||||||||||

| Total | 38,057,350 | $ | 23,997,057.35 | $ | 3,047.63 | |||||||||

| (1) | There is no current market for the securities and the price at which the shares held by the selling security holders will be sold is unknown. The registrant’s common stock has no par value. The Company believes that the calculations offered pursuant to Rule 457(f)(2) are not applicable and, as such, the registrant has valued the registration fee based on $.001 per share. |

| (2) | Represents Common shares currently outstanding to be sold by the selling security holders. |

| (3) | Represents Common shares that are issuable upon the exercise of our Class A, Class B and Class C warrants to purchase an aggregate of 28,500,000 Common shares , with Class A, Class B and Class C warrants each exercisable to purchase 9,500,000 Common shares at an exercise price $0.082 (CDN $0.10) per share, $1.197 (CDN $1.46) per share and $1.246 (CDN $1.52) per share, respectively. In the event of a stock split, stock dividend or similar transaction involving our Common shares, the number of shares registered shall automatically be increased to cover the additional Common shares issuable pursuant to Rule 416 under the Securities Act of 1933, as amended. |

| (4) | Pursuant to Rule 457(g), calculated based upon the weighted-average exercise price of the Class A, B and C warrants. These warrants are exercisable for (a) in the case of the Class A warrants, 9,500,000 shares at an exercise price of $0.082, (b) in the case of the Class B warrants, 9,500,000 shares at an exercise price of $1.197 and (c) in the case of the Class C warrants, 9,500,000 shares at an exercise price of $1.246. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS, SUBJECT TO COMPLETION, DATED ______, 2005

AMERICAN GOLDRUSH CORPORATION

38,057,350 COMMON SHARES

This prospectus relates to the sale of up to 38,057,350 Common shares without par value by persons who are shareholders of American Goldrush Corporation. The shares registered in this prospectus include:

| o | 9,557,350 Common shares currently outstanding; and |

| o | 9,500,000 Common shares issuable upon the exercise of Class A warrants with an exercise price of CDN $0.10 per share; and |

| o | 9,500,000 Common shares issuable upon the exercise of Class B warrants with an exercise price of CDN $1.46 per share; and |

| o | 9,500,000 Common shares issuable upon the exercise of Class C warrants with an exercise price of CDN $1.52 per share. |

We will not receive any of the proceeds from the sale of the shares by the selling securityholders; however, we may receive up to CDN $29,260,000 from the exercise of warrants for up to 28,500,000 Common shares if all of such warrants are exercised in full. All costs associated with this registration will be borne by us.

Each of the selling stockholders may be deemed to be an “underwriter,” as such term is defined in the Securities Act of 1933. The selling stockholders may sell the shares from time to time at the prevailing market price or in negotiated transactions.

There has been no market for our securities and a public market may not develop, or, if any market does develop, it may not be sustained. As of January 14, 2005, we have 39,557,350 Common shares issued and outstanding.

Investing in our securities involves signficant risks. See “Risk Factors” beginning on page 4.

Each of the United States Securities and Exchange Commission, the British Columbia Securities Commission and state securities regulators has not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the Securities and Exchange Commission. The selling securityholders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is January _____, 2005.

TABLE OF CONTENTS

| Page | |

|---|---|

| Prospectus Summary | 1 |

| The Offering | 1 |

| Selected Financial Information | 3 |

| Note Regarding Forward Looking Statements | 4 |

| Risk Factors | 4 |

| Risk Factors Relating to Our Company | 4 |

| Risk Factors Relating to Our Common Shares | 11 |

| Capitalization | 14 |

| Description of Business | 14 |

| Foreign Currency Exchange: United States Dollars and Canadian Dollars | 21 |

| Operating and Financial Review and Prospects | 22 |

| Management | 26 |

| Security Ownership of Certain Beneficial Owners and Management | 28 |

| Certain Relationships and Related Transactions | 29 |

| Selling Security holders | 31 |

| Plan of Distribution | 34 |

| Use of Proceeds | 37 |

| Dividend Policy | 37 |

| Material Income Tax Considerations | 37 |

| Exchange Controls | 38 |

| Share Capital | 39 |

| Legal Matters | 41 |

| Experts | 41 |

| Interest of Named Experts and Counsel | 41 |

| Enforceability of Certain Civil Liabilities and Agent for Service of Process in the | 41 |

| United States | |

| Indemnification for Securities Act Liabilities | 41 |

| Where You Can Find More Information | 42 |

| Glossary | 42 |

| Financial Statements | F-1 |

PROSPECTUS SUMMARY

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements and the notes to the financial statements.

Our Company

We were formed as a corporation under the Federal laws of Canada pursuant to the Canada Business Corporations Act on August 8, 2003. We are a natural resource exploration stage company and anticipate acquiring, exploring, and if warranted and feasible, developing natural resource properties. We have an option to acquire a 100% interest in a property in the Province of British Columbia known as the Polischuk Property. We may exercise the option by making cash payments totaling (Canadian) $70,000 to Randy Polischuk and incurring net expenditures on the property of at least (Canadian) $525,000. To date, we have paid in full (Canadian) $10,000 under the agreement.

We are a mineral exploration company in the exploration stage, and cannot give assurance that commercially viable minerals exist on the property. Extensive geological analysis of the property will be required before we can make an evaluation as to the economic feasibility of developing or finding valuable resources on these grounds. We have not, as yet, identified any mineral resources on the property.

No commercially viable mineral deposit may exist on our mineral claims. Our plan of operations is to carry out geological analysis of these claims in order to ascertain whether they possess deposits of gold or silver. We can provide no assurance to investors that our mineral claims contain a commercially viable mineral deposit until appropriate exploratory work is done and an evaluation based on that work concludes further work programs are justified. At this time, we definitely have no known reserves on our mineral claims.

For the period from August 8, 2003 (inception) to June 30, 2004, we did not generate any revenue.

Our principal offices are located at 1155 West Pender, Suite 708, Vancouver, British Columbia V6E 2P4; our telephone number is (604) 974-1175. We do not yet maintain an Internet address.

1

THE OFFERING

| Securities offered Shares to be outstanding after the offering if none of the warrants are exercised Shares to be outstanding after the offering if all of the warrants are exercised Use of Proceeds Plan of Distribution Risk Factors Symbol | 38,057,350 Common shares. (1) 39,557,350 Common shares. (2) 68,057,350 (3) We will not receive any proceeds from the sale of the Common Shares by the selling stockholders; however, we may receive up to CDN $29,260,000 from the exercise of warrants for up to 28,500,000 Common shares of our common stock if all of such warrants are exercise in full. See "Use of Proceeds." The offering of our Common shares is being made by certain of our stockholders who wish to sell their shares. Sales of our common stock may be made by the selling stockholders in the open market or in privately negotiated transactions and at fixed or negotiated prices. There are substantial risk factors involved in investing in our company. For a discussion of certain factors you should consider before buying our Common shares , see the section entitled "Risk Factors". Not listed |

| (1) | Includes (a) 9,557,350 Common shares currently outstanding, and (b) up to 28,500,000 Common shares issuable upon exercise of Class A warrants at an exercise price of CDN$0.10 per share, Class B warrants at an exercise price of CDN$ 1.46 per share and Class C warrants at an exercise price of CDN$1.52 per share. The warrants become exercisable on October 30, 2006 unless we accelerate the exercise date. The Class A warrants expire at the close of business on October 30, 2008, the Class B warrants expire at the close of business on October 30, 2009 and the Class C warrants expire at the close of business on October 30, 2010. |

| (2) | Such figure does not include 28,500,000 Common shares issuable upon exercise of the Class A, Class B and Class C warrants. This amount represents the number of shares issued and outstanding as of October 15, 2004. |

| (3) | Such figure includes the 28,500,000 Common shares issuable upon exercise of the Class A, Class B and Class C warrants. |

2

Description of Financing Transactions

On October 30, 2003, we closed a private placement with six investors for the sale of 9,500,000 units of our securities at a price of $0.01 per unit for gross proceeds of CDN$95,000. Each unit included:

| o | one Common share; and |

| o | one Class A Warrant exercisable for two years commencing on October 30, 2006 to purchase one Common share at CDN $0.10 per share; and |

| o | one Class B Warrant exercisable for three years commencing on October 30, 2006 to purchase one Common share at CDN $1.46 per share; and |

| o | one Class C Warrant exercisable for four years commencing on October 30, 2006 to purchase one Common share at CDN $1.52 per share. |

The exercise prices of our Class A, B and C warrants (the “Warrants”) are subject to adjustment if there are certain capital adjustments or similar transactions, such as a stock split or merger. The Warrants are non-transferable and provide for a cashless exercise option. We have the right, in our sole and absolute discretion, to (i) accelerate the exercise date of the Warrants to a date that is prior to October 30, 2006 and/or (ii) reduce the exercise price. We believe that the private placement was exempt from the registration requirements of the Securities Act of 1933, as amended, by virtue of Regulation S promulgated thereunder since the units were offered and sold outside the United States to non-U.S. citizens.

We received total proceeds of CDN $95,000 from the sale of the units.

On January 28, 2004, we closed a private placement with thirty-eight Canadian investors for the sale of 57,350 Common shares at a price of CDN $0.10 per share, for total gross proceeds of CDN $5,735. We believe this offering was exempt from the registration requirements of the Securities Act of 1933, as amended, by virtue of Regulation S promulgated thereunder, since all the shares were offered and sold outside the United States to non-U.S. citizens.

The proceeds from the sale of the units and from the January 2004 private placement are intended to be used for exploration and general working capital purposes. See “Use of Proceeds” section below for a discussion of the use of the proceeds by us from any exercise of the warrants.

Although we have no contractual obligation to do so, we are registering for the selling shareholders: (i) the Common shares which were included in the units which were sold in the October 2003 private placement and the Common shares we sold in the January 2004 private placement, and (ii) all of the Common shares issuable upon exercise of the Warrants which were sold in the October 2003 private placement, on a registration statement of which this prospectus forms a part. We will bear all costs associated with this registration statement and prospectus.

Trading Market

There is currently no trading market for our securities. We intend to apply initially for our securities to be traded on the Over the Counter Bulletin Board market sponsored by the National Association of Securities Dealers, Inc. The Over the Counter Bulletin Board is maintained by the NASDAQ Stock Market, but does not have any of the quantitative or qualitative standards such as those required for companies listed on the NASDAQ Small Cap Market or National Markets System. We may not now or ever qualify for listing of our securities on the OTC Bulletin Board.

3

SELECTED FINANCIAL INFORMATION

The following table sets forth and summarizes certain of the Company’s financial information for the periods from January 1, 2004 to June 30, 2004, August 8, 2003 (date of inception) to December 31, 2003, and August 8, 2003 (date of inception) to June 30, 2004 prepared in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). Canadian GAAP, as applied to the Company, does not materially differ from United States generally accepted accounting principles (“U.S. GAAP”), as set forth in Note 6 to the Financial Statements of the Company. This financial information is derived from, and should be read in conjunction with and is qualified in its entirety by reference to the Company’s financial statements, including the notes thereto, and Management’s Discussion and Analysis of Results of Operations and Financial Condition. The Company’s Financial Statements for the periods ended June 30, 2004 and December 31, 2003 have been audited by BDO Dunwoody LLP.

Selected Financial Information

| Selected Financial Information | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| All in Canadian $ except Common Shares issued | For the Period January 1, 2004 to June 30, 2004 | For the Period August 8, 2003 to December 31, 2003 | For the Period August 8, 2003 to June 30, 2004 | ||||||||

| Operating Revenues | -- | -- | -- | ||||||||

| Interest Income | -- | -- | -- | ||||||||

| Loss from Operations | $ | (26,304 | ) | $ | (14,261 | ) | $ | (40,565 | ) | ||

| Net Loss | $ | (26,304 | ) | $ | (14,261 | ) | $ | (40,565 | ) | ||

| Loss per Share - Basic and Diluted | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||

| As at June 30, 2004 | As at December 31, 2003 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Assets | $ | 71,151 | $ | 93,455 | |||||||

| Net Assets | $ | 60,170 | $ | 80,739 | |||||||

| Total Liabilities | $ | 10,981 | $ | 12,716 | |||||||

| Working Capital | $ | 60,170 | $ | 80,739 | |||||||

| Share Capital | $ | 100,735 | $ | 95,000 | |||||||

| Common Shares Issued | 39,557,3 | 50 | 39,500,0 | 00 | |||||||

| Dividends Declared | -- | -- | -- | ||||||||

4

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this prospectus and the documents incorporated by reference into this prospectus include forward-looking statements (as defined in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act), which mean that they relate to events or transactions that have not yet occurred, our expectations or estimates for our future operations, our growth strategies or business plans or other facts that have not yet occurred. Such statements can be identified by the use of forward-looking terminology such as “might,” “may,” “will,” “could,” “expect,” “anticipate,” “estimate,” “likely,” “believe,” or “continue” or the negative thereof or other variations thereon or comparable terminology. The above risk factors contain discussions of important factors that should be considered by prospective investors for their potential impact on forward-looking statements included in this prospectus . These important factors, among others, may cause actual results to differ materially and adversely from the results expressed or implied by the forward-looking statements. Notwithstanding the foregoing statements, the safe harbor provisions of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, for forward-looking statements do not, and will not apply to us, so long as our Common shares qualify as a “penny stock.”

RISK FACTORS

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

RISKS RELATING TO OUR COMPANY:

| 1. | As only two of our directors, Messrs. Blomkamp and Cann, have technical training or experience in exploring for, starting, and operating a mine, we will have to hire qualified consultants. If we cannot locate qualified consultants, we may have to suspend or cease operations which will result in the loss of your investment. |

Only two of our directors, Messrs. Blomkamp and Cann have experience with exploring for, starting, and operating a mine. Except for our President, none of our executive officers have any technical training or experience in exploring for, starting, and operation a mine. As such, we will have to hire qualified consultants to perform surveying and exploration of the Polischuk Property. The other executive officers and director have no direct training or experience in these areas and as a result may not be fully aware of many of the specific requirements related to working within the industry. Their decisions and choices may not take into account standard engineering or managerial approaches, mineral exploration companies commonly use. Consequently our operations, earnings and ultimate financial success could suffer irreparable harm due to management’s lack of experience in this industry. As a result we may have to suspend or cease operations which will result in the loss of your investment.

| 2. | As the property has not been examined by a professional geologist or mining engineer we have no known mineral reserves. Without mineral reserves we cannot generate income, and if we cannot generate income we will have to cease operations. |

The Polischuk Property has not been examined by a professional geologist or mining engineer. As such, we have no known mineral reserves. Without mineral reserves, we have nothing to economically remove. If we have nothing to economically remove from the Polischuk Property, we cannot generate income and in such a situation, we will have to cease operations which will result in the loss of your investment.

5

| 3. | Weather interruptions in the Province of British Columbia may delay our proposed exploration operations. Such delay will extend the time when we may be able to generate revenues. |

Our proposed exploration work can only be performed approximately five to six months out of the year. This is because rain and snow cause travel to our claims to be difficult during six to seven months of the year. During the winter, we are unable to conduct exploration operations on the Polischuk Property. This will delay exploration and subsequent removal of any mineralized material, should any be discovered. As a result of the delay in removing mineralized material, no revenue will be generated by us, which will result in the loss of your investment.

| 4. | Since Messrs. Blomkamp, Prail and Cann, directors of the Company, have other outside business activities and will only be devoting 20% of their time to our operations, our operations may be sporadic. This may result in periodic interruptions or suspensions of exploration which may result in the loss of your investment. |

Since our directors and executive officers have other outside business activities and will only be devoting 20% of their time to our operations, our operations may be sporadic and only occur at times which are convenient to Messrs. Blomkamp, Praill and Cann. As a result, exploration of our properties may be periodically interrupted or suspended.

| 5. | We have had losses and such losses may continue, which may negatively impact our ability to achieve our business objectives. |

We had a net loss for the periods ended December 31, 2003 and June 30, 2004. Our operations are subject to the risks and competition inherent in the establishment of a business enterprise. Revenues and profits, if any, will depend upon various factors, including whether we will be able to develop the land interests that we have an option to purchase and whether we will be able to meet our obligations under our option to purchase. We may not achieve our business objectives and the failure to achieve such goals may result in the loss of your investment.

| 6. | Our auditors’ opinion on our June 30, 2004 and December 31, 2003 financial statements includes an explanatory paragraph in respect of there being substantial doubt about our ability to continue as a going concern. |

We have incurred net losses of $40,565 for the period from August 8, 2003 (inception) to June 30, 2004. We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern as described in the Comments for US Readers on Canada – US Reporting Differences by our auditors with respect to the financial statements for the period from August 8, 2003 to June 30, 2004. Our plans to deal with this uncertainty include raising additional capital or entering into a strategic arrangement with a third party. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in our company.

| 7. | If we are unable to obtain additional funding, our business operations will be harmed. Even if we do obtain additional financing our then existing shareholders may suffer substantial dilution. |

We will require additional funds to acquire development interests in properties that we want to explore for natural mineral resources. We anticipate that we will require up to approximately CDN $126,700 to fund our continued operations for the next twelve months. Additional capital will be required to effectively support the operations and to otherwise implement our overall business strategy. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will likely be required to curtail our development plans which could cause the company to become dormant. Any additional equity financing may involve substantial dilution to our then existing shareholders.

6

| 8. | Because we are organized under the Canada Business Corporations Act, enforcement of civil liabilities against us or our officers or directors may be difficult or impossible from outside the jurisdiction of Canada. |

We are a corporation organized under the Canada Business Corporations Act. Our directors and officers reside in Canada. Because all or a substantial portion of our assets and the assets of these persons are located outside the United States, it may be difficult for an investor to sue, for any reason, us or any of our officers or directors outside the United States. If an investor was able to obtain a judgment against us or any of our officers or directors in a United States court based on United States securities laws or other reasons, it may be difficult, if not impossible, to enforce such judgment in Canada.

| 9. | If we do not continue to make payments under our Property Option Agreement for the Polischuck Property, we will lose our interest in the property as well as losing all monies incurred in connection with the property. |

We have secured, under the Property Option Agreement with Randy Polischuck, the right to acquire a 100% interest in the Polischuk Property. Pursuant to the Option Agreement (as amended November 29, 2004), we may continue to exercise the option by making a series of annual cash payments to Randy Polischuk. Payments in the aggregate of CDN $70,000 (of which CDN $10,000 has been paid) must be provided to Randy Polischuk by the Company before November 29, 2009. On or before November 29th of each year commencing November 2005, we must pay him CDN $10,000, and on or before November 29th in 2008 and 2009, we must pay $15,000. In addition, under the Option Agreement we will be required to incur net expenditures on the Polischuk Property of at least (Canadian) $525,000 by November 2009. See the “Property Option Agreement for the Polischuk Property” description of the prospectus on page_16for a more detailed description of the Option Agreement. If we do not make payments to Mr. Polischuk or incur the required expenditures in accordance with the Option Agreement we will lose our option to purchase the Polischuk Property and may not be able to continue to execute our business objectives if we are unable to find an alternate exploration interest.

| 10. | Because our business involves numerous operating hazards, we may be subject to claims of a significant size which would cost a significant amount of funds and resources to rectify. This could force us to cease our operations, which will cause you a loss of your investment. |

Our operations are subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure, and craterings. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs and force us to cease our operations, which will cause you a loss of your investment.

| 11. | Damage to the environment could also result from our operations. If our business is involved in one or more of these hazards, we may be subject to claims of a significant size which could force us to cease our operations. |

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, provincial, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry since the rules and regulations frequently are amended or interpreted. We cannot predict the future cost or impact of complying with these laws.

7

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulation could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the cost of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and properties are subject to extensive federal, state, provincial and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences, (ii) restrict the types, quantities and concentration of various substances that can be released into the environment in connection with exploration activities, (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas, (iv) require remedial measures to mitigate pollution from former operations and (v) impose substantial liabilities for pollution resulting from our proposed operations.

The exploration of mineral reserves are subject to all of the usual hazards and risks associated with mineral exploration, which could result in damage to life or property, environmental damage, and possible legal liability for any or all damages. The exploration activities may be subject to prolonged disruptions due to the weather conditions surrounding the location of the Polischuk Property. Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. Even though we are at liberty to obtain insurance against certain risks in such amounts we deem adequate, the nature of those risks is such that liabilities could over exceed policy limits or be excluded from coverage. We do not currently carry insurance to protect against these risks and we may not obtain such insurance in the future. There are also risks against which we cannot, or may not elect to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, thereby hurting our financial position, future earnings, and/or competitive positions. We may not have enough capital to continue operations and you will lose your investment.

| 12. | Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail. |

The search for valuable natural resources on the Polischuk Property is extremely risky as the exploration for natural resources is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing mines. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. Because the probability of an individual prospect ever having reserves is extremely remote, in all probability our properties do not contain any reserves, and any funds we spent on exploration will probably be lost. In such a case, we would be unable to complete our business plan.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. The risks associated with mineral exploration include:

| o | the identification of potential mineralization based on superficial analysis; |

| o | the quality of our management and our geological and technical expertise; and |

| o | the capital available for exploration and development. |

8

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to develop our business.

| 13. | We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in developing mineral reserves. |

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

| 14. | If we lose the services of any of our management team we may not be able to continue to operate our business and may be required to cease operations. |

We are presently dependent to a great extent upon the experience, abilities and continued services of Ronald Blomkamp, our Chief Executive Officer. Mr. Blomkamp, who currently spends approximately 1 day per week working on the Company’s business, has an extensive background in the natural resource exploration industry and the loss of his services would negatively impact our operations. If we lost the services of this individual we would be forced to find other qualified management to assist us in location and exploration of a property. This would be costly to us in terms of both time and expenses. We do not maintain an employment agreement with Mr. Blomkamp nor do we have key-man life insurance on him. Therefore, if we were unable to replace the services and experience of Mr. Blomkamp, we may be forced to discontinue our operations.

| 15. | The Prices of Metals are Highly Volatile And A Decrease In Metals Prices Could Result in us Incurring Losses. |

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals markets from the time development of a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a mineral property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metals prices have decreased. Adverse fluctuations of metals market price may force us to curtail or cease our business operations.

| 16. | Our principal stockholders, officers and directors own a controlling interest in our voting stock and investors will not have any voice in our management, which could result in decisions adverse to our general shareholders. |

Our officers and directors, in the aggregate, beneficially own approximately or have the right to vote 75.8% of our outstanding common stock. As a result, these stockholders, acting together, will have the ability to control substantially all matters submitted to our stockholders for approval including:

| o | election of our board of directors; |

| o | removal of any of our directors; |

| o | amendment of our Articles of Incorporation or bylaws; and |

| o | adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us. |

9

As a result of their ownership and positions, our directors and executive officers collectively are able to influence all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. In addition, sales of significant amounts of shares held by our directors and executive officers, or the prospect of these sales, could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in the Company may decrease. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

| 17. | We are an exploration stage company and the probability that commercially viable deposits or “reserves” exists in the property is extremely remote. |

We are an exploration stage company with no known commercially viable deposits, or “reserves” on our property. Therefore, determination of the existence of a reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic, and environmental factors. If we fail to to find a commercially viable deposit on our property our financial condition and results of operations will suffer. If we cannot generate income from the property we will have to cease operation which will result in the loss of your investment.

| 18. | We expect losses to continue in the future because we have no reserves and, consequently, no revenue to offset losses. |

Based upon current plans and the fact that we currently do not have any reserves, we expect to incur operating losses in future periods. This will happen because there are expenses associated with the acquisition of, and exploration of natural resource properties which do not have any income-producing reserves. We cannot guarantee that we will be successful in generating revenues in the future. Failure to generate revenues may cause us to go out of business. We will require additional funds to achieve our current business strategy and our inability to obtain additional financing will interfere with our ability to expand our current business operations.

| 19. | We may not have the funds to purchase all of the supplies, manpower and materials we need to begin exploration which could cause us to delay or suspend operations. |

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, manpower and certain equipment such as bulldozers and excavators that we might need to conduct exploration. If there is a shortage or scarcity, we cannot compete with larger companies in the exploration industry for supplies, manpower and equipment. In the event that the prices for such resources rise above our affordability levels, we may have to delay or suspend operations. In the event we are forced to limit our exploration activities, we may not find any minerals, even though our properties may contain mineralized material. Without any minerals we cannot generate revenues and you may lose your investment.

| 20. | Because of the early stage of development and the nature of our business, our securities are considered highly speculative. |

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted and feasible, developing natural resource properties. Our current property is in the exploration stage only and is without known reserves of natural resources. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of natural resources, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

10

| 21. | It is possible that there may be native or aboriginal claims to our property, which could result in us incurring additional expenses to explore the Polischuk Property. |

Although we believe that we have the right to explore the Polischuk Property, we cannot substantiate that there are no native or aboriginal claims to the property. Native groups have made extensive land claims to large areas of land within British Columbia. The status of such claims is uncertain, and has not been resolved despite lengthy and expensive court proceedings. If a native or aboriginal claim is made to this property, it would negatively affect our ability to explore this property as we would have to incur significant legal fees protecting our right to explore the property. We may also have to pay third parties to settle such claims. If it is determined that there is a legitimate claim to this property then we may be forced to return this property without adequate consideration. Even if there is no legal basis for such claim, the costs involved in resolving such matter may force us to delay or curtail our exploration completely. When we make the application to commence our exploration activities, representatives of Native groups will have the right to participate in, or may be consulted in, review by regulatory authorities of our proposed mining operations. If this occurs, we may have to incur additional resources and it may take longer to obtain the required permits.

RISKS RELATING TO OUR COMMON SHARES:

| 1. | We may, in the future, issue additional Common shares, which would reduce investors’ percent of ownership and may dilute our share value. |

Our Articles of Incorporation authorize the issuance of an unlimited number of Common shares without par value and an unlimited number of Preferred shares without par value. The future issuance of our unlimited authorized Common shares may result in substantial dilution in the percentage of our Common shares held by our then existing shareholders. We may value any Common shares issued in the future on an arbitrary basis. The issuance of Common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our Common shares.

| 2. | Our Common shares are subject to the “Penny Stock” Rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock. |

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

| o | that a broker or dealer approve a person's account for transactions in penny stocks; and |

| o | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| o | obtain financial information and investment experience objectives of the person; and |

| o | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

11

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

| o | sets forth the basis on which the broker or dealer made the suitability determination; and |

| o | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our Common shares and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

| 3. | We are registering 28,500,000 Common shares underlying our warrants that may be available for future sale. The sale of these shares may depress the market price of our Common shares and shareholders could suffer a loss on their investment. |

As of November 15, 2004, we had 39,557,350 Common shares issued and outstanding and warrants outstanding to purchase an aggregate of 28,500,000 Common shares . We are registering 9,557,350 Common shares and 28,500,000 Common shares underlying warrants, for a total of 38,057,350 Common shares . All of these shares and warrants will be freely traded under U.S. law upon the effective date of this prospectus and may be sold without restriction. If such warrants are exercised in full and converted to Common shares, our shareholders may experience a decline in the price of our Common shares as such Common shares are sold into the open market. If such decline in the price of our Common shares were to materialize, shareholders could suffer a loss on their investment.

| 4. | There is no current trading market for our securities and if a trading market does not develop, purchasers of our securities may have difficulty selling their shares. |

There is currently no established public trading market for our securities and an active trading market in our securities may not develop or, if developed, may not be sustained. We intend to apply for admission to quotation of our securities on the OTC Bulletin Board. If for any reason our Common shares are not listed on the OTC Bulletin Board or a public trading market does not otherwise develop, purchasers of the shares may have difficulty selling their Common shares should they desire to do so. No market makers have committed to becoming market makers for our Common shares and none may do so.

| 5. | State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus. |

Secondary trading in common stock sold in this offering will not be possible in any state until the Common shares are qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the Common shares in any particular state, the Common shares could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our Common shares, the liquidity for the Common shares could be significantly impacted thus causing you to realize a loss on your investment.

12

| 6. | We are a “foreign private issuer”, and you may not have access to the information you could obtain about us if we were not a “foreign private issuer”. |

We are considered a “foreign private issuer” under the Securities Act of 1933, as amended. As an issuer incorporated in Canada, we will be required to prepare our annual and interim financial statements in accordance with Canadian generally accepted accounting principles. For purpose of our annual disclosure obligations in the United States, we will annually file in the United States consolidated financial statements prepared in accordance with Canadian GAAP together with a reconciliation to US GAAP. In addition, as a foreign private issuer we will not have to file quarterly reports with the SEC nor will our directors, officers and 10% stockholders be subject to Section 16(b) of the Exchange Act. As a foreign private issuer we will not be subject to the proxy rules of Section 14 of the Exchange Act. Furthermore, Regulation FD does not apply to non-U.S. companies and will not apply to us. Accordingly, you may not be able to obtain information about us as you could obtain if we were not a “foreign private issuer”.

| 7. | Because we do not intend to pay any cash dividends on our Common shares, our stockholders will not be able to receive a return on their shares unless they sell them. |

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our Common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

| 8. | We may become a passive foreign investment company, or PFIC, which could result in adverse U.S. tax consequences to U.S. investors. |

If we are a “passive foreign investment company” or “PFIC” as defined in Section 1297 of the Code, U.S. Holders will be subject to U.S. federal income taxation under one of two alternative tax regimes at the election of each such U.S. Holder. Section 1297 of the Code defines a PFIC as a corporation that is not formed in the United States and either (i) 75% or more of its gross income for the taxable year is “passive income”, which generally includes interest, dividends and certain rents and royalties or (ii) the average percentage, by fair market value (or, if we elect, adjusted tax basis), of its assets that produce or are held for the production of “passive income” is 50% or more. Whether we are a PFIC in any year and the tax consequences relating to PFIC status will depend on the composition of our income and assets, including cash. U.S. Holders should be aware, however, that if we become a PFIC, it may not be able or willing to satisfy record-keeping requirements that would enable U.S. Holders to make an election to treat us as a “qualified electing fund” for purposes of one of the two alternative tax regimes applicable to a PFIC. U.S. Holders or potential shareholders should consult their own tax advisor concerning the impact of these rules on their investment in us.

| 9. | Because all of our assets and our officers and directors are located outside the United States, it may be difficult for an investor to enforce within the United States any judgments obtained against us or any of our officers and directors. |

All of our assets are located outside of the United States and we do not currently maintain a permanent place of business within the United States. In addition, our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for an investor to effect service of process or enforce within the United States any judgments obtained against us or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, there is uncertainty as to whether the courts of Canada would recognize or enforce judgments of United States courts obtained against us or our directors and officers predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. There is even uncertainty as to whether the Canadian courts would have jurisdiction to hear original actions brought in Canada against us or our directors and officers predicated upon the securities laws of the United States or any state thereof.

13

CAPITALIZATION

The following table sets forth our capitalization as of June 30, 2004 and December 31, 2003. Our capitalization is presented on an actual basis (all amounts presented are in $CDN). You should read this table in conjunction with “Operating and Financial Review and Prospects” and our financial statements and the notes thereto, included elsewhere in this prospectus.

| December 31, 2003 | June 30, 2004 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number of Securities | Amount | Number of Securities | Amount | |||||||||||

| Shareholders' equity, no par value per | 39,500,000 | $ | 95,000 | 39,557,350 | $ | 100,735 | ||||||||

| share; Unlimited authorized; | ||||||||||||||

| Total shareholders' equity | $ | 80,739 | $ | 60,170 | ||||||||||

| Total capitalization | ||||||||||||||

| Total indebtedness | $ | 12,716 | $ | 10,981 | ||||||||||

As of June 30, 2004 and December 31, 2003, we had $10,981 and $12,716, respectively, in accounts payable and accrued liabilities, all of which is current and unsecured.

The information set forth in the foregoing table excludes approximately 28,500,000 Common shares issuable upon the Class A, Class B and Class C warrants at a weighted average exercise price of approximately CDN $0.75 per share.

DESCRIPTION OF BUSINESS

History and Overview of the Company

We are an exploration stage company incorporated under the Canada Business Corporations Act in British Columbia, Canada on August 8, 2003 under the name “American Goldrush Corporation.” Our registered office is located at 1000 — 840 Howe Street, Vancouver, B.C. and our head office and principal place of business located at 1155 West Pender, Suite 708, Vancouver, British Columbia V6E 2P4. Our telephone number is (604) 974-1175.

We are attempting to become a company engaged in the exploration and development of mineral properties. To accomplish our objective, our strategy is to acquire exploration prospects. We have an option to acquire a property in British Columbia that we believe fits within our property acquisition strategy. However, extensive geological analysis of this property will be required before we can make an evaluation as to the economic feasibility of developing or finding valuable resources on these grounds. We have not, as yet, identified any mineral resources on the property. In addition, there is no assurance that we will be able to continue to make payments required by the Property Option Agreement for the Polischuk Property. There is no assurance that the development of the property we have optioned will generate any revenue.

No commercially viable mineral deposit may exist on our mineral claims. Our plan of operations is to carry out exploration work on these claims in order to ascertain whether they possess deposits of gold or silver. We can provide no assurance to investors that our mineral claims contain a commercially viable mineral deposit until appropriate exploratory work is done and an evaluation based on that work concludes further work programs are justified. At this time, we definitely have no reserves on our mineral claims.

14

We have limited finances and require additional funding in order to accomplish our exploration, development and acquisition objectives. There is no assurance that we will have revenues in the future or that we will be able to secure other funding necessary for our future growth and expansion. There is also no assurance that our mineral exploration activities will produce commercially viable reserves. Our efforts to extract minerals may be unprofitable.

We may seek relationships with other mineral exploration and development companies that will allow us to exploit idle and/or undeveloped resources.

Regulation and Environmental Matters

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, provincial, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. We are in compliance with all laws and will continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect our business operations.

The prospecting of our claims on the property is provided under the laws of British Columbia. A Notice of Work which details proposed exploration activities must be submitted to and approved by the Ministry of Energy and Mines . We have not yet submitted a Notice of Work to commence exploration of the property.

The approval from the Ministry of Energy and Mines is the only authorization which we need to begin exploration. Idevelopment is warranted on the property and we decide to build a mining operation on the property, we will then have to file final plans of operation before we start any operations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulation could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the cost of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and properties are subject to extensive federal, state, provincial and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences, (ii) restrict the types, quantities and concentration of various substances that can be released into the environment in connection with exploration activities, (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas, (iv) require remedial measures to mitigate pollution from former operations and (v) impose substantial liabilities for pollution resulting from our proposed operations.

If we were to advance to the stage of commencing mining operations, we would require extensive environmental reviews. Prior to receiving a permit to operate a mine, we would need to undergo a provincial and federal environmental assessment which involves a detailed governmental review of our plans to protect the environment from damage due to mining. The review process requires public input as well as reviews by several levels of government and multiple ministries within each level of government. Final permitting also requires the submission of a closure plan and the posting of a reclamation bond.

There are no costs to us at the present time in connection with compliance with environmental laws. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint.

15

Property Option Agreement for the Polischuk Property

We have secured an option, through the Option Agreement, the right to acquire a 100% interest in the Polischuk Property. The Polischuk Option Agreement, which was executed on February 18, 2004 was subsequently amended November 29, 2004. We may exercise the option by making cash payments totaling CDN $70,000 to Randy Polischuk. To date, we have paid in full CDN $10,000 under the Option Agreement. The Amendment amended the payment schedule and requires that we pay an additional CDN $20,000 to Mr. Polischuk.

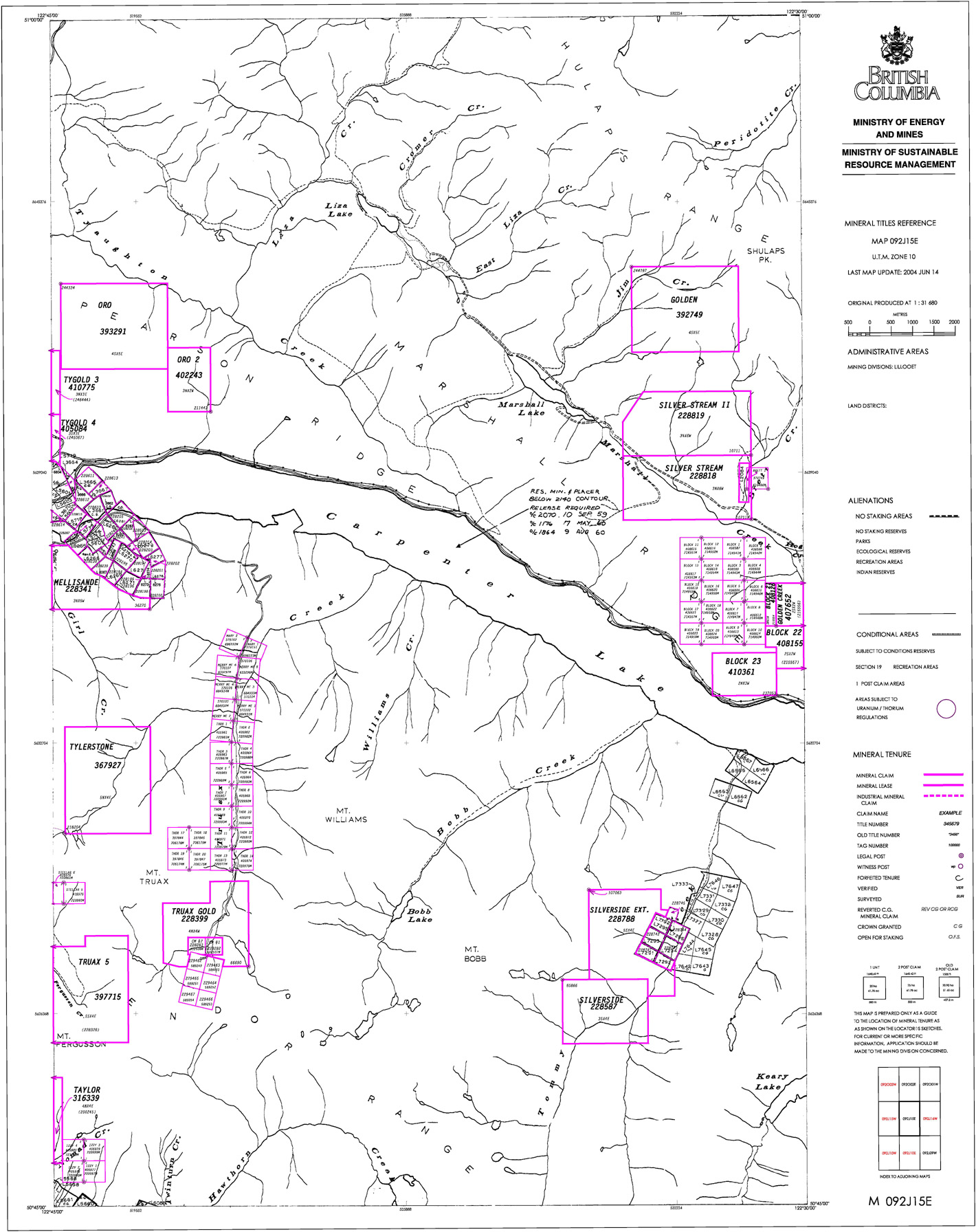

The Polischuk Property is legally known as the Taylor Claim and was formerly known as the Holland Claim. The claim is registered with the Province of British Columbia as Mineral Tenure Number 316339 and is located in the Bralorne area of the Lillooet Mining Division in British Columbia, Canada, primary map 092J15W-C. The claim area consists of 16 units (each unit is 500 meters by 500 meters) and is situated approximately one kilometer due east of the main soda granite mass that intrudes the productive augite diorite of the Bralorne camp. The property is located approximately 3.5 kilometers southeast of the town of Bralorne and 3.0 kilometers northeast of the Pioneer Mine. Access to the property is by means of 100 kilometers of gravel road from Lillooet, B.C., the closest town of any size.

The Bralorne area is primarily a gold centre with subordinate silver and scheelite (tungsten). Gold-bearing quartz veins in the Bralorne area occur in greenstone, dioritized greenstone and sediments. The veins consist of milky quartz and metallic minerals including pyrite, arsenopyrite, native gold, scheelite (tungsten), and stibnite (antimony). At Bralorne, a gold-scheelite(tungsten)-molybdenite(molybdenum) core is surrounded and over-lapped by a copper-silver-gold zone containing sphalerite (zinc) and galena (lead).

There is no drilled resource on our claims.

In the 1930‘s and 1940‘s extensive surface prospecting was done along with exploring the vein on what was then known as the Holland Claim. Adits were driven on the vein and some drilling was done during this time but the results did not warrant further exploration. No additional work was undertaken until the 1980‘s when Unicorn Resources Ltd. (Unicorn) optioned the property from Tarbo Resources Ltd. Work undertaken by Unicorn included field reconnaissance and sampling as well as a geochemical survey which delineated three anomalous areas. The conclusions of the geological reports prepared for Unicorn indicated that there were areas of interest on the property that warranted further exploration. In 1993 the Holland Claim became available and was filed by Randy Polischuk who renamed it the Taylor Claim.

We have agreed to make payments to Randy Polischuk based on the following payment schedule:

| Date | Amount of Payment | |||||||

|---|---|---|---|---|---|---|---|---|

| Upon signing the | CDN | $ | 5,000 | |||||

| original agreement | ||||||||

| Upon signing Amendment | CDN | $ | 5,000 | |||||

| No. 1 | ||||||||

| November 29, 2005 | CDN | $ | 10,000 | |||||

| Novmeber 29, 2006 | CDN | $ | 10,000 | |||||

| November 29, 2007 | CDN | $ | 10,000 | |||||

| November 29, 2008 | CDN | $ | 15,000 | |||||

| November 29, 2009 | CDN | $ | 15,000 | |||||

| Total | CDN | $ | 70,000 | |||||

16

In addition, we will be required to incur net expenditures on the Polischuk Property of at least CDN $525,000 by the fifth anniversary (November 2009) of the signing of Amendement No.1 to the Option Agreement. Meeting this payment schedule will provide us with a 100% interest in the Polischuk Property subject to Mr. Polischuk retaining a 1% Net Smelter Royalty which we have the right to buy from him at a fixed cost of CDN $1,000,000. The purchase option for this royalty is exercisable within 90 day period following receipt of a bankable feasibility study of the Polischuk Property.

We will lose our option if we fail to make any payment according to schedule or if we fail to incur the requisite expenditures prior to November 29th of any given year (“Anniversary Date”). If within 30 days of receipt of a written notice from Randy Polischuk that a payment was not made in a timely manner, we do not cure the default or give Mr. Polischuk notice that we deny that such default has occurred, the option will terminate. If we give notice and deny that a default has occurred, the option will not terminate until and unless a single arbitrator in arbitration under the rules of The Arbitration Act of British Columbia determines that we are in default. In addition, we have the right to terminate the Option Agreement at any time by giving notice of our election to terminate..

At present, we do not hold any interest in any exploration reserve property that is in production. Our viability and potential success is in our ability to successfully explore, exploit and eventually generate revenue from the Polischuk Property. However, we might never be able to generate any revenues from our operations. The exploration for minerals on the Polischuk Property generally involves a high risk over a long period of time, even with careful evaluations, experience and knowledge this long period may persist. It is almost impossible to ensure that exploration programs on the Polischuk Property will be profitable or successful. Our inability to locate any minerals on the Polischuk Property could result in a total loss of our business.

The exploration for minerals on the Property is subject to all of the usual hazards and risks associated with mineral exploration, which could result in damage to life or property, environmental damage, and possible legal liability for any or all damages. The exploration activities may be subject to prolonged disruptions due to the weather conditions surrounding the location of the Polischuk Property. Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. Even though we are at liberty to obtain insurance against certain risks in such amounts we deem adequate, the nature of those risks is such that liabilities could over exceed policy limits or be excluded from coverage. We do not currently carry insurance to protect against these risks and there is no assurance that we will obtain such insurance in the future. There are also risks against which we cannot, or may not elect to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, negatively affecting our financial position, future earnings, and/or competitive positions. If we cannot find capital, manpower, products and equipment we need to continue the exploration efforts we will have to suspend our exploration plans until we do find the capital, products and equipment we need. Suspension of operations will result in the inability to generate revenues.

Material Contracts

We are a party to the Option Agreement with Randy Polischuk which is described above.

We also have an agreement with Ron Blomkamp, our Chairman, President, Chief Executive and Operating Officer and Secretary, which allows us at any time to send a notice to Mr. Blomkamp that we are purchasing all or any portion of his 15,000,000 shares. The irrevocable option which he granted us is exercisable at any time at an exercise price of CDN $0.01 per share. We have the same option right with respect to the shares owned by Mr. Scott Praill, a director.Under these agreements, if we elect to exercise our option to purchase their shares, we shall pay the applicable purchase price thereof no later than 10 business days after the delivery of a notice.

Other than these contracts, we do not have any other material contracts.

17

Competition

The natural resource market is intensely competitive in all its phases, highly fragmented and subject to rapid change. We will encounter strong competition from many other natural resource companies, including many that possess substantial financial resources, in acquiring economically desirable producing properties and exploratory drilling prospects, and in obtaining equipment and labor to operate and maintain their properties. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

Employees

We have commenced only limited operations. We have no employees at this time . We utilize outside contractors where possible, and rely on the industry expertise of management and our Board of Directors. These contractors will be responsible for surveying, geology, engineering, exploration, and excavation. The geologists will evaluate the information derived from the exploration and excavation and the engineers will advise us on the economic feasibility of removing the mineralized material. No member of our management team is presently employed by us. We do not foresee any significant changes in the number of employees or consultants we will have over the next twelve months, unless the growth of our business demands it.

Properties

We currently lease our corporate headquarters at 1155 West Pender, Suite 708, Vancouver, British Columbia V6E 2P4, for CDN $235 per month. We believe that our rented properties are adequate for our current and immediately foreseeable operating needs. We do not have any policies regarding investments in real estate, securities or other forms of property.

Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have, individually or in the aggregate, a material adverse affect on our business, financial condition or operating results.

Plan of Operations

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, developing natural resource properties. Our primary focus in the natural resource sector is gold.

We have members on our board of directors who have extensive experience in the natural resource industry. However, exploration activities of properties without any proven reserves require a considerable amount of time and money, and the subsequent return on investment for our shareholders would be very long term indeed. Should the we make a finding of minerals on the Polischuk Property we would consider our alternatives to such finding, including the possibility of selling any findings to a major mining company. By selling its findings to another mining company, it would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves, and it would also provide future capital for the company to continue operations.

18

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the property we have optioned in British Columbia contains commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the purchase of small interests in producing properties, the purchase of property where feasibility studies already exist or by the optioning of natural resource exploration and development projects. To date we have one property under option, and are in the early stages of exploring these properties. There has been no indication as yet that any mineral deposits exist on these properties, and there is no assurance that a commercially viable mineral deposit exists on any of our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

Exploration Programs

Polischuk Property Project: The property is legally known as the Taylor Claim #316339 (Lillooet Mining Division), which was formerly known as the Holland Claim. The claim is located in the Bralorne area of the Lillooet Mining Division in British Columbia, Canada, primary map 092J15W-C. The claim area is situated approximately one kilometer due east of the main soda granite mass that intrudes the productive augite diorite of the Bralorne camp which is approximately 3.5 kilometers southeast of the town of Bralorne and 3.0 kilometers northeast of the Pioneer Mine. Access from Lillooet, the closest town of any size, is by 100 kilometers of gravel road.

The Bralorne area is primarily a gold centre with subordinate silver and scheelite (tungsten). Gold-bearing quartz veins in the Bralorne area occur in greenstone, dioritized greenstone and sediments. The veins consist of milky quartz and metallic minerals including pyrite, arsenopyrite, native gold, scheelite (tungsten), and stibnite (antimony). At Bralorne, a gold-scheelite(tungsten)-molybdenite(molybdenum) core is surrounded and over-lapped by a copper-silver-gold zone containing sphalerite (zinc) and galena (lead).

We have secured an option, through the Property Option Agreement (as amended on November 29, 2004), the right to acquire a 100% interest in a land package in the Province of British Columbia. We may exercise the option by making cash payments totaling CDN $70,000 to Randy Polischuk and incurring property expenditures of CDN $525,000 by the fifth anniversary (November, 2009) of the Property Option Agreement. To date, we have paid in full CDN $10,000 under the Property Option Agreement.