| ALLIANZ VARIABLE INSURANCE PRODUCTS |

| FUND OF FUNDS TRUST |

| (THE “TRUST”) |

AZL FusionSM Balanced Fund

AZL FusionSM Moderate Fund

Prospectus Dated April 30, 2012, as supplemented

Allianz Investment Management LLC (the “Manager”)

Shares of each Fund are sold exclusively to certain insurance companies in connection with particular variable annuity contracts (each, a “Contract,” and collectively, the “Contracts”) they issue. The insurance companies invest in shares of the Funds in accordance with instructions received from owners of the applicable Contracts.

This prospectus must be accompanied or preceded by a current prospectus for the Contracts that invest in the Funds.

Questions?

Call toll free 1-877-833-7113

or your investment representative.

The Securities and Exchange Commission has not approved or disapproved the shares described in this prospectus or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may contain information on Funds not available under your Contract. Please refer to your Contract prospectus for information regarding the investment options available to you.

AZL® is a registered service mark of Allianz SE. Allianz SE is the ultimate owner of the Manager.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

| TABLE OF CONTENTS |

AZL FusionSM Balanced Fund | 3 |

AZL FusionSM Moderate Fund | 7 |

| Tax Information | 11 |

| Financial Intermediary Compensation | 11 |

| More about the Funds | 12 |

| Overview | 12 |

The AZL FusionSM Funds | 13 |

| Investment Risks | 17 |

| Management | 39 |

| The Manager | 39 |

| Duties of the Manager | 39 |

| Management Fees | 40 |

| The Administrator | 41 |

| The Distributor | 41 |

| Payments to Affiliated Insurance Companies | 41 |

| Transfer Supported Features of Certain Annuity Contracts | 41 |

| Legal Proceedings | 42 |

| The Commodity Exchange Act | 42 |

| Shareholder Information | 43 |

| Pricing of Fund Shares | 43 |

| Purchase and Redemption of Shares | 43 |

| Market Timing | 44 |

| Dividends, Distributions, and Taxes | 44 |

| Portfolio Securities | 45 |

| Financial Highlights | 46 |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

2

Fund Summaries AZL FusionSM Balanced Fund

AZL FusionSM Balanced Fund

Investment Objective

The Fund seeks long-term capital appreciation with preservation of capital as an important consideration.

Fees and Expenses

Fees and Expenses of the Fund

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. The Fund is offered only as an investment option for certain Contracts. The table below reflects only Fund expenses and does not reflect Contract fees and expenses. Please refer to your Contract prospectus for a description of those fees and expenses.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Management Fee | 0.20% |

| Distribution (12b-1) Fees | 0.00% |

| Other Expenses | 0.03% |

Acquired Fund Fees and Expenses(1) | 0.86% |

| Total Annual Fund Operating Expenses | 1.09% |

| (1) | Because Acquired Fund Fees and Expenses are not included in the Fund’s Financial Highlights, the Fund’s total annual fund operating expenses do not correlate to the ratios of expenses to average net assets shown in the Financial Highlights table. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year, that the Fund’s operating expenses remain the same, and that you reinvest all dividends and distributions. It does not reflect any Contract fees. If Contract fees were included, the costs shown would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years |

| $111 | $347 | $601 | $1,329 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 20% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund is a fund of funds that invests primarily in the shares of other mutual funds managed by affiliates of the Manager that represent different asset classes in the Fund’s asset allocation. The Fund also may invest in unaffiliated mutual funds and in other securities, including affiliated and unaffiliated unregistered investment pools. The affiliated and unaffiliated mutual funds and investment pools are referred to as the Fusion Permitted Underlying Investments. The Fund may also invest directly in equity and debt securities.

Under normal market conditions, the Manager will allocate approximately 40% – 60% of the Fund’s assets to equity funds and approximately 40% – 60% of the Fund’s assets to fixed income funds. These allocations do not include assets that may be invested in affiliated or unaffiliated unregistered investment pools.

The Fund is designed to provide diversification across several major asset classes, and the Fund is not restricted in its investments in any particular asset class. The Fund’s portfolio management team monitors the Fund’s holdings and cash flow and periodically adjusts the Fund’s asset allocation. The Manager utilizes a strategic asset allocation model to help determine appropriate asset allocations for the Fund among the Fusion Permitted Underlying Investments.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

3

Fund Summaries AZL FusionSM Balanced Fund

Effective on or about April 29, 2013, the Fund may allocate up to 20% of its assets to the MVP (Managed Volatility Portfolio) risk management process to seek to adjust the risk of the portfolio based on quantitative indicators of market risk, such as the current level of the fund, underlying fund and market volatility. Under normal market conditions, up to 20% of the Fund’s assets may be allocated to the Funds’ MVP risk management process, which is intended to manage the risk of the Fund and its allocation to equities and to other, relatively more volatile asset classes, such as high yield bonds. This process could cause the equity exposure of the Fund to fluctuate but equity exposure generally will not be lower than 10%. Generally, the MVP risk management process would not reduce equity exposure during periods of moderate and low market volatility.

The Manager will implement the Funds’ MVP risk management process primarily using futures, but may also use other derivative securities, such as options. The Fund normally will gain exposure to derivatives by investing directly in derivatives, but may also gain exposure to derivatives indirectly through Fusion Permitted Underlying Investments.

Derivative securities provide the Manager an effective method to reduce volatility of the Fund and limit the need to decrease or increase allocations to underlying funds. The process is intended to limit market exposure during periods of high volatility, although the process may not always be successful. In some market conditions exhibiting high volatility, the process may result in the Fund underperforming the market during rising markets, and outperforming the market during declining markets. The Manager seeks to maintain an annualized volatility level for the Fund at or below 10% over a typical business cycle (i.e., over a period of a year or more). The actual or realized volatility for short-term or long-term periods of time will be dependent on the market environment and may be significantly higher in the event that the strategy is unsuccessful.

The Fund’s allocation to the MVP risk management process may include (a) derivatives such as index futures, other futures contracts, options, and other similar securities and (b) cash, money market equivalents, short-term debt instruments, money market funds, and short-term debt funds to satisfy all applicable margin requirements and to provide additional portfolio liquidity to satisfy large redemptions and any margin calls. Due to the leverage provided by derivatives, the notional value of the Fund’s derivative positions could exceed 20% of the Fund’s value. The Fund may also use futures to gain equity exposure and may hold cash as a buffer in the event of market shocks.

Principal Risks of Investing in the Fund

The price per share of the Fund will fluctuate with changes in value of the investments held by the Fund. You may lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. There is no guarantee that the Fund will achieve its objective.

As a fund of funds, the Fund is subject to allocation risk, which is the risk associated with the Manager’s decision regarding how the Fund’s assets should be allocated among the various underlying investment options. The Manager’s decisions about the allocation of the Fund’s assets could cause the Fund to underperform other funds with similar investment objectives. There also can be no guarantee that investment decisions made by the Manager will produce the desired results.

The Fund invests in a variety of Fusion Permitted Underlying Investments and is therefore also subject to the risks associated with those investments. With a target allocation of approximately 40%-60% of its assets in fixed income strategies, the Fund is proportionately subject to bond risks, including: interest rate risk, which is the risk that the debt securities held by the underlying fund may decline in value due to rising interest rates; credit risk, which is the chance that the failure of the issuer of a debt security to pay interest or repay principal in a timely manner may have an adverse impact on the underlying fund’s earnings; income risk, which is the chance that falling interest rates may cause the underlying fund’s income to decline; call risk or prepayment risk, which is the risk that if interest rates fall, issuers of callable debt securities are more likely to prepay prior to the maturity date, and the underlying fund may not be able to reinvest the proceeds from the prepayment in investments that will generate the same level of income; and extension risk, which is the risk that, if interest rates rise, debt securities may be paid in full more slowly than anticipated.

With a target allocation of approximately 40%-60% of its assets in equity strategies, the Fund is proportionately subject to market risk, which is the risk that the market value of portfolio securities may go up or down, sometimes rapidly and unpredictably.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

4

Fund Summaries AZL FusionSM Balanced Fund

The Fund is also subject to issuer risk, which is the risk that the value of a security may decline for a number of reasons directly related to the issuer of the security.

Because the Fund may allocate up to 20% of its assets to derivative securities pursuant to its MVP risk management process, the Fund is proportionately subject to derivatives risk, including risks related to futures and options. Investing in derivative instruments involves risks that may be different from or greater than the risks associated with investing directly in securities or other traditional investments. The value of options and futures contracts depend primarily upon the price of the securities, indexes, commodities, currencies or other instruments underlying them. Price movements are also influenced by, among other things, interest rates, changing supply and demand relationships, trade, fiscal, monetary, and exchange control programs and policies of governments, and national and international political and economic events and policies. The cost of options is related, in part, to the degree of volatility of the underlying indices, securities, currencies, or other assets. Accordingly, options on highly volatile indices, securities, currency, or other assets may be more expensive than options on other investments. Changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index, and the Fund could lose more than the principal amount invested.

Performance Information

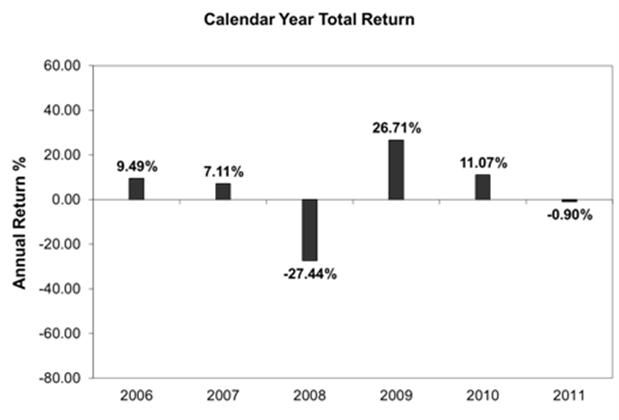

The following bar chart and table provide an indication of the risks of an investment in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns for one year, five years, and since its inception compare with those of a broad measure of market performance, the S&P 500® Index. The Fund’s performance also is compared to the Barclays Capital U.S. Aggregate Bond Index, which shows how the Fund’s performance compares with the returns of a broad index of investment-grade fixed-rate debt issues, and to a Balanced Composite Index, which shows how the Fund’s performance compares with a composite index composed of the S&P 500® Index (50%) and the Barclays Capital U.S. Aggregate Bond Index (50%) in proportions similar to the equity to fixed income allocation of the Fund.

Both the bar chart and the table assume reinvestment of dividends and distributions.

The performance of the Fund will vary from year to year. The Fund’s performance does not reflect the cost of insurance and separate account charges which are imposed under your Contract. If they were included, performance would be reduced. Past performance does not indicate how the Fund will perform in the future.

Performance Bar Chart and Table

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

5

Fund Summaries AZL FusionSM Balanced Fund

Highest and Lowest Quarter Returns (for periods shown in the bar chart)

| Highest (Q2, 2009) | 12.93% |

| Lowest (Q4, 2008) | -14.80% |

Average Annual Total Returns

| One Year Ended December 31, 2011 | Five Years Ended December 31, 2011 | Since Inception (4/29/2005) | |

AZL FusionSM Balanced Fund | -0.90% | 1.63% | 3.69% |

S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 2.11% | -0.25% | 3.40% |

Barclays Capital U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 7.84% | 6.50% | 5.75% |

Balanced Composite Index (reflects no deduction for fees, expenses, or taxes) | 5.57% | 3.73% | 5.08% |

Management

Allianz Investment Management LLC (the “Manager”) serves as the investment adviser to the Fund.

Since November 12, 2010, Brian Muench has been the Fund’s portfolio manager. Mr. Muench has been employed by the Manager since 2005, and is the president of the Manager.

For important information about tax information and financial intermediary compensation, please turn to the sections “Tax Information” and “Financial Intermediary Compensation” at page 11 in this prospectus.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

6

Fund Summaries AZL FusionSM Moderate Fund

AZL FusionSM Moderate Fund

Investment Objective

The Fund seeks long-term capital appreciation.

Fees and Expenses

Fees and Expenses of the Fund

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. The Fund is offered only as an investment option for certain Contracts. The table below reflects only Fund expenses and does not reflect Contract fees and expenses. Please refer to your Contract prospectus for a description of those fees and expenses.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Management Fee | 0.20% |

| Distribution (12b-1) Fees | 0.00% |

| Other Expenses | 0.02% |

Acquired Fund Fees and Expenses(1) | 0.92% |

| Total Annual Fund Operating Expenses | 1.14% |

| (1) | Because Acquired Fund Fees and Expenses are not included in the Fund’s Financial Highlights, the Fund’s total annual fund operating expenses do not correlate to the ratios of expenses to average net assets shown in the Financial Highlights table. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated. The example also assumes that your investment has a 5% return each year, that the Fund’s operating expenses remain the same, and that you reinvest all dividends and distributions. It does not reflect any Contract fees. If Contract fees were included, the costs shown would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years |

| $116 | $362 | $628 | $1,386 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 19% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies of the Fund

The Fund is a fund of funds that invests primarily in the shares of other mutual funds managed by affiliates of the Manager that represent different asset classes in the Fund’s asset allocation. The Fund also may invest in unaffiliated mutual funds and in other securities, including affiliated and unaffiliated unregistered investment pools. The affiliated and unaffiliated mutual funds and investment pools are referred to as the Fusion Permitted Underlying Investments. The Fund may also invest directly in equity and debt securities.

Under normal market conditions, the Manager will allocate approximately 55% – 75% of the Fund’s assets to equity funds and approximately 25% – 45% of the Fund’s assets to fixed income funds. These allocations do not include assets that may be invested in affiliated or unaffiliated unregistered investment pools.

The Fund is designed to provide diversification across several major asset classes, and the Fund is not restricted in its investments in any particular asset class. The Fund’s portfolio management team monitors the Fund’s holdings and cash flow and periodically adjusts the Fund’s asset allocation. The Manager utilizes a strategic asset allocation model to help determine appropriate asset allocations for the Fund among the Fusion Permitted Underlying Investments.

Effective on or about April 29, 2013, the Fund may allocate up to 20% of its assets to the MVP (Managed Volatility Portfolio) risk management process to seek to adjust the risk of the portfolio based on quantitative indicators of market

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

7

Fund Summaries AZL FusionSM Moderate Fund

risk, such as the current level of the fund, underlying fund and market volatility. Under normal market conditions, up to 20% of the Fund’s assets may be allocated to the Funds’ MVP risk management process, which is intended to manage the risk of the Fund and its allocation to equities and to other, relatively more volatile asset classes, such as high yield bonds. This process could cause the equity exposure of the Fund to fluctuate but equity exposure generally will not be lower than 10%. Generally, the MVP risk management process would not reduce equity exposure during periods of moderate and low market volatility.

The Manager will implement the Funds’ MVP risk management process primarily using futures, but may also use other derivative securities, such as options. The Fund normally will gain exposure to derivatives by investing directly in derivatives, but may also gain exposure to derivatives indirectly through Fusion Permitted Underlying Investments.

Derivative securities provide the Manager an effective method to reduce volatility of the Fund and limit the need to decrease or increase allocations to underlying funds. The process is intended to limit market exposure during periods of high volatility, although the process may not always be successful. In some market conditions exhibiting high volatility, the process may result in the Fund underperforming the market during rising markets, and outperforming the market during declining markets. The Manager seeks to maintain an annualized volatility level for the Fund at or below 12% over a typical business cycle (i.e., over a period of a year or more). The actual or realized volatility for short-term or long-term periods of time will be dependent on the market environment and may be significantly higher in the event that the strategy is unsuccessful.

The Fund’s allocation to the MVP risk management process may include (a) derivatives such as index futures, other futures contracts, options, and other similar securities and (b) cash, money market equivalents, short-term debt instruments, money market funds, and short-term debt funds to satisfy all applicable margin requirements and to provide additional portfolio liquidity to satisfy large redemptions and any margin calls. Due to the leverage provided by derivatives, the notional value of the Fund’s derivative positions could exceed 20% of the Fund’s value. The Fund may also use futures to gain equity exposure and may hold cash as a buffer in the event of market shocks.

Principal Risks of Investing in the Fund

The price per share of the Fund will fluctuate with changes in value of the investments held by the Fund. You may lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. There is no guarantee that the Fund will achieve its objective.

As a fund of funds, the Fund is subject to allocation risk, which is the risk associated with the Manager’s decision regarding how the Fund’s assets should be allocated among the various underlying investment options. The Manager’s decisions about the allocation of the Fund’s assets could cause the Fund to underperform other funds with similar investment objectives. There also can be no guarantee that investment decisions made by the Manager will produce the desired results.

The Fund invests in a variety of Fusion Permitted Underlying Investments and is therefore also subject to the risks associated with those investments. With a target allocation of approximately 55%-75% of its assets in equity strategies, the Fund is proportionately subject to market risk, which is the risk that the market value of portfolio securities may go up or down, sometimes rapidly and unpredictably.

With a target allocation of approximately 25%-45% of its assets in fixed income strategies, the Fund is proportionately subject to bond risks, including: interest rate risk, which is the risk that the debt securities held by the underlying fund may decline in value due to rising interest rates; credit risk, which is the chance that the failure of the issuer of a debt security to pay interest or repay principal in a timely manner may have an adverse impact on the underlying fund’s earnings; income risk, which is the chance that falling interest rates may cause the underlying fund’s income to decline; call risk or prepayment risk, which is the risk that if interest rates fall, issuers of callable debt securities are more likely to prepay prior to the maturity date, and the underlying fund may not be able to reinvest the proceeds from the prepayment in investments that will generate the same level of income; and extension risk, which is the risk that, if interest rates rise, debt securities may be paid in full more slowly than anticipated.

The Fund is also subject to issuer risk, which is the risk that the value of a security may decline for a number of reasons directly related to the issuer of the security.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

8

Fund Summaries AZL FusionSM Moderate Fund

Because the Fund may allocate up to 20% of its assets to derivative securities pursuant to its MVP risk management process, the Fund is proportionately subject to derivatives risk, including risks related to futures and options. Investing in derivative instruments involves risks that may be different from or greater than the risks associated with investing directly in securities or other traditional investments. The value of options and futures contracts depend primarily upon the price of the securities, indexes, commodities, currencies or other instruments underlying them. Price movements are also influenced by, among other things, interest rates, changing supply and demand relationships, trade, fiscal, monetary, and exchange control programs and policies of governments, and national and international political and economic events and policies. The cost of options is related, in part, to the degree of volatility of the underlying indices, securities, currencies, or other assets. Accordingly, options on highly volatile indices, securities, currency, or other assets may be more expensive than options on other investments. Changes in the value of the derivative may not correlate perfectly with the underlying asset, rate or index, and the Fund could lose more than the principal amount invested.

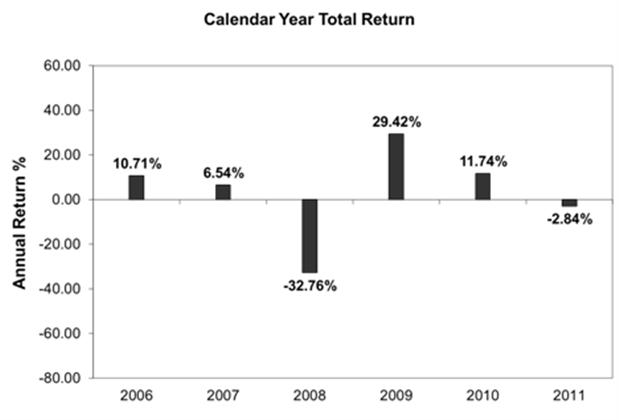

Performance Information

The following bar chart and table provide an indication of the risks of an investment in the Fund by showing changes in its performance from year to year and by showing how the Fund’s average annual returns for one year, five years, and since its inception compare with those of a broad measure of market performance, the S&P 500® Index. The Fund’s performance also is compared to the Barclays Capital U.S. Aggregate Bond Index, which shows how the Fund’s performance compares with the returns of a broad index of investment-grade fixed-rate debt issues, and to a Moderate Composite Index, which shows how the Fund’s performance compares with a composite index composed of the S&P 500® Index (65%) and the Barclays Capital U.S. Aggregate Bond Index (35%) in proportions similar to the equity to fixed income allocation of the Fund.

Both the bar chart and the table assume reinvestment of dividends and distributions.

The performance of the Fund will vary from year to year. The Fund’s performance does not reflect the cost of insurance and separate account charges which are imposed under your Contract. If they were included, performance would be reduced. Past performance does not indicate how the Fund will perform in the future.

Performance Bar Chart and Table

Highest and Lowest Quarter Returns (for periods shown in the bar chart)

| Highest (Q2, 2009) | 14.82% |

| Lowest (Q4, 2008) | -18.42% |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

9

Fund Summaries AZL FusionSM Moderate Fund

Average Annual Total Returns

| One Year Ended December 31, 2011 | Five Years Ended December 31, 2011 | Since Inception (4/29/2005) | |

AZL FusionSM Moderate Fund | -2.84% | 0.13% | 2.97% |

S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 2.11% | -0.25% | 3.40% |

Barclays Capital U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 7.84% | 6.50% | 5.75% |

Moderate Composite Index (reflects no deduction for fees, expenses, or taxes) | 4.66% | 2.66% | 4.69% |

Management

Allianz Investment Management LLC (the “Manager”) serves as the investment adviser to the Fund.

Since November 12, 2010, Brian Muench has been the Fund’s portfolio manager. Mr. Muench has been employed by the Manager since 2005, and is the president of the Manager.

For important information about tax information and financial intermediary compensation, please turn to the sections “Tax Information” and “Financial Intermediary Compensation” at page11 in this prospectus.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

10

Fund Summaries Tax Information and Financial Intermediary Compensation

| TAX INFORMATION |

Shares of the Funds are sold exclusively to the separate accounts of certain insurance companies in connection with particular variable annuity and variable life insurance contracts (the “Contracts”). Provided that a Fund and a separate account investing in the Fund satisfy applicable tax requirements, any distributions from the Fund to the separate account will be exempt from current federal income taxation to the extent that such distributions accumulate in the Contract. You should refer to your Contract prospectus for further information regarding the tax treatment of the Contract and the separate accounts in which the Contract is invested.

| FINANCIAL INTERMEDIARY COMPENSATION |

Shares of the Funds are sold exclusively to certain insurance companies in connection with particular Contracts. The Trust and its related companies may pay such insurance companies (or their related companies) for the sale of shares of the Funds and related services. Such insurance companies (or their related companies) may pay broker-dealers or other financial intermediaries (such as banks) that sell the Contracts for the sale of shares of the Funds and related services. When received by an insurance company, such payments may be a factor that the insurance companies consider in including a Fund as an investment option in the Contracts. The prospectus or other disclosures relating to a Contract may contain additional information about these payments. When received by a broker-dealer or other intermediary, such payments may create a conflict of interest by influencing the broker-dealer or other intermediary and salespersons to recommend the Fund over other mutual funds available as investment options in the Contracts. Ask the salesperson or visit the financial intermediary's website for more information.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

11

More About the Funds Overview

| MORE ABOUT THE FUNDS |

Overview

This prospectus provides information about two mutual funds (the “Funds”) that are series of the Allianz Variable Insurance Products Fund of Funds Trust (the “Trust”). The prospectus summarizes key information about the Funds, including information regarding the investment objectives, strategies and risks and performance and fees for all the Funds. Each Fund’s investment objective can be changed without shareholder approval. Use this information to compare the Funds with other mutual funds. Although the Fund’s direct shareholders are the insurance company separate accounts that invest assets on behalf of their contract holders, “you” and “your” refer to the contract holders who invest in the Funds indirectly through their variable annuity contracts (the “Contracts”).

Each Fund is a diversified open-end fund and a series of the Trust. Each Fund is a “fund of funds” and diversifies its assets by investing primarily in the shares of other affiliated underlying mutual funds. The Funds may also invest in unaffiliated mutual funds and in other securities, including interests in both affiliated and unaffiliated unregistered investment pools. Each Fund currently offers one share class.

The Funds have the flexibility to make portfolio investments and engage in investment techniques that differ from the strategies discussed in this prospectus. The Manager may recommend additional or different underlying funds for investment by any of the Funds, without seeking the approval of shareholders. The Manager may allocate a Fund’s assets outside of the target ranges specified in this Prospectus when the Manager believes that doing so would better enable the Fund to pursue its investment objective or is necessary for temporary defensive purposes.

Unless otherwise indicated, any percentage limitation on a Fund’s holdings set forth in the prospectus is applied only when that particular type of security is purchased.

In addition to the information about the Funds in the summaries, investors should consider the following information about the Funds.

This prospectus is designed to help you make informed decisions about one of the investments available under your Contract. You will find details about how your Contract works in your Contract prospectus.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

12

More About the Funds The AZL FusionSM Funds

The AZL FusionSM Funds

· AZL FusionSM Balanced Fund

· AZL FusionSM Moderate Fund

General

“Fusion” is a branding term that refers to the “fusion” of the Manager’s investment process with research in the form of statistical and factual information coupled with broadly diversified asset classes and investment managers to build a comprehensive portfolio. The Manager determines what securities should be purchased or sold by the Funds and regularly advises the Funds with regard to investing in, purchasing, or selling securities. The Manager makes investment decisions based on many factors, one of which is research provided by Wilshire Associates Incorporated (“Wilshire”). Wilshire serves as a consultant to the Manager with respect to selecting the Fusion Permitted Underlying Investments and the Funds’ asset allocations among the Fusion Underlying Funds by providing portfolio modeling and statistical analysis. Wilshire does not have advisory authority with regard to the Funds and does not effect any portfolio transactions. The Funds’ portfolios are managed by and investment decisions are made by the Manager.

The AZL Fusion Funds are distinguished primarily on the basis of relative allocations among equity, fixed income and derivative securities. The terms “Balanced,” and “Moderate,” are commonly used terms describing the risk profile and equity allocation of each Fund. The Fusion Balanced Fund allocates approximately 40%-60% of assets to equity funds and approximately 40%-60% to fixed income funds. The Fusion Moderate Fund allocates approximately 55%-75% of assets to equity funds and approximately 25%-45% to fixed income funds.

In selecting a Fund, investors should consider their personal objectives, investment time horizons, risk tolerances and financial circumstances.

Investment Strategies

The Manager’s principal investment strategies for the AZL Fusion Funds may also include:

| (1) | Utilizing a strategic asset allocation model, developed from information provided by Wilshire, to help determine appropriate asset allocations among the Fusion Permitted Underlying Investments according to each Fund’s investment objective. |

| (2) | Utilizing other quantitative and qualitative measures to periodically review and adjust each Fund’s asset allocation consistent with each Fund’s investment objective. |

| (3) | Investing in futures and options, and other similar securities, and in cash and cash equivalents to reduce the potential volatility of each Fund’s investment performance, either directly or through unregistered investment pools. |

| (4) | Investing in unregistered investment pools that utilize a tactical asset allocation overlay strategy to enhance the risk/return profile over the long term. |

The asset allocation in each Fund’s investment strategy should approximate the target allocation mix over longer investment periods. However, asset allocations for each Fund do not restrict the Manager from allocating Fund assets outside its target range when the Manager believes that doing so would better enable the Fund to pursue its investment objective or is necessary for temporary defensive purposes. The Fund intends to be fully invested at all times. However, the Fund, like other mutual funds, may maintain liquidity reserves for cash awaiting investment or held to meet redemptions.

The currently available Fusion Underlying Funds are advised or subadvised by the Manager or an affiliate of the Manager and include all of the investment portfolios offered by the Allianz Variable Insurance Products Trust. Please see the section entitled “Management – The Manager” below for further information regarding the Manager’s affiliation with certain Fusion Underlying Funds.

In addition to investing in the Fusion Underlying Funds, the Manager may also use a tactical asset allocation overlay strategy in managing the Funds. Most of the Fusion Underlying Funds use conventional security selection techniques to implement their various investment strategies. By contrast, the tactical asset allocation overlay strategy makes investments in broad market segments based on the views of an investment manager concerning macroeconomic trends in the domestic and foreign securities markets. The tactical asset allocation overlay strategy is intended to enhance the

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

13

More About the Funds The AZL FusionSM Funds

risk/return profile. The overall strategy uses derivative instruments, including, but not limited to, equity futures, fixed income futures, and forward currency contracts. Through the tactical asset allocation overlay strategy, the Funds seek to profit from short- and medium-term market moves by shifting their investment weightings among domestic and foreign equity, bond, and currency markets. The Funds pursue this strategy by investing in unregistered investment pools that are not Fusion Underlying Funds and that are managed by either the Manager or unaffiliated investment managers. Investing in these investment pools creates within each of the Funds exposure to equity, bond, and currency positions intended to generate positive returns for the Funds. However, there can be no guarantee that such results will be achieved. If the tactical asset allocation overlay strategy is utilized, generally up to 5% of the net assets of each of the Funds will be allocated to the strategy. Depending upon market conditions, cash flows, and other considerations, the amount of net assets allocated to the tactical asset allocation overlay strategy may be higher or lower.

The AZL Fusion Balanced Fund and AZL Fusion Moderate Fund may also allocate up to 5% of their respective net assets to (a) index futures, other futures contracts, options, and other similar securities and (b) cash, money market equivalents, short-term debt instruments, money market funds, and short-term debt funds to satisfy all applicable margin requirements and to provide additional portfolio liquidity to satisfy large redemptions and any margin calls. The AZL Fusion Funds may also invest in exchange-traded funds (ETFs) for additional exposure to relevant markets. This strategy is intended to reduce the potential volatility of the Funds’ investment performance and may limit the Funds’ ability to benefit from rising markets while protecting the Funds in declining markets. The Funds may pursue this strategy by investing directly or indirectly through unregistered investment pools that are not Fusion Underlying Funds and that are managed by either the Manager, affiliates of the Manager, or unaffiliated investment managers.

For temporary defensive purposes, any of the Funds may invest up to 100% of its assets in short-term U.S. Government securities, bank certificates of deposit, prime commercial paper, money market funds, and other high quality short-term fixed-income securities and repurchase agreements with respect to those securities. If a Fund invests substantially in such instruments, it may not be pursuing its principal investment strategies and may not achieve its investment objective. The Manager also may allocate a Fund’s assets outside of the target ranges specified in this Prospectus when the Manager believes that doing so would better enable the Fund to pursue its investment objective or is necessary for temporary defensive purposes.

Information About the Fusion Permitted Underlying Investments

The Fusion Permitted Underlying Investments include the Fusion Underlying Funds, mutual funds that are managed by affiliates of the Manager, and other types of investments, including unaffiliated mutual funds, and affiliated and unaffiliated unregistered investment pools. Each of the Fusion Underlying Funds is categorized into one of the following asset classes according to its investment objective and investment strategies: Small Cap, Mid Cap, Large Growth, Large Blend, Large Value, International Equity, Specialty, High-Yield Bonds (also known as “junk bonds”), Intermediate-Term Bonds, and Cash Equivalent. Each Fund may, but is not limited to, investing in Fusion Underlying Funds in any of these asset classes. Under applicable regulations, the Funds are also permitted to invest directly in equity and debt securities and derivatives. In accordance with their investment objectives and principal investment strategies, the Fusion Underlying Funds invest in equity securities, bonds, and other investments that are consistent with their asset class category. The following lists identify the Fusion Underlying Funds and other Fusion Permitted Underlying Investments by asset class. Each Fund may invest in these Fusion Underlying Funds as provided in its asset allocation mix. In the future, the Funds may invest in Fusion Permitted Underlying Investments that are not listed below, at the discretion of the Manager, in order to further diversify each Fund. The Fusion Permitted Underlying Investments in which the Funds invest may be changed at any time based on the portfolio management team’s judgment.

Asset Classes | Fusion Underlying Funds |

Small Cap (Equity) Seeks maximum capital appreciation, primarily by investing in small capitalization companies, generally less than $3 billion market value. Investments in these types of companies include considerable risk and volatility. | AZL Columbia Small Cap Value Fund AZL Federated Clover Small Value Fund AZL Oppenheimer Discovery Fund AZL Small Cap Stock Index Fund |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

14

More About the Funds The AZL FusionSM Funds

Mid Cap (Equity) Seeks growth by investing in mid-capitalization companies, generally between $1.5 billion and $10 billion in market value. Investments in these types of companies include a considerable amount of risk. | AZL Columbia Mid Cap Value Fund AZL Mid Cap Index Fund AZL Morgan Stanley Mid Cap Growth Fund |

Large Growth (Equity) Seeks growth by investing in large capitalization companies, generally in excess of $10 billion in market value. Growth investing generally seeks companies that are growing earnings and sales more quickly than their peers. | AZL BlackRock Capital Appreciation Fund AZL Dreyfus Research Growth Fund AZL Russell 1000 Growth Index Fund |

Large Blend (Equity) Seeks to invest in established companies with solid earnings prospects and market liquidity. These investments generally invest in growth and value stocks or stocks with growth and value characteristics, offering diversification across market sectors) | AZL JPMorgan U.S. Equity Fund AZL MFS Investors Trust Fund AZL S&P 500 Index Fund |

Large Value (Equity) Seeks growth through large capitalization stocks with lower than average price, as measured by either price-to-book or price-to-earnings ratios. Value investing generally seeks companies that are considered to be undervalued and have the potential for capital appreciation. | AZL Davis New York Venture Fund AZL Eaton Vance Large Cap Value Fund AZL Invesco Growth and Income Fund AZL Russell 1000 Value Index Fund |

International Equity (Equity) Invests in assets of companies around the world, including emerging markets. Because of fluctuations in value of various currencies and the political and economic uncertainties of foreign countries, international investments involve greater levels of risk and volatility. | AZL Invesco International Equity Fund AZL International Index Fund AZL JPMorgan International Opportunities Fund AZL NFJ International Value Fund |

Specialty (Equity and Fixed Income) Focus on specific market sectors. Sector investing can pay potentially significant returns, but involves significant risks as well. | AZL BlackRock Global Allocation Fund AZL Franklin Templeton Founding Strategy Plus Fund AZL Gateway Fund AZL Invesco Equity and Income Fund AZL Morgan Stanley Global Real Estate Fund AZL Schroder Emerging Markets Equity Fund PIMCO VIT CommodityRealReturn™ Strategy Portfolio PIMCO VIT Unconstrained Bond Portfolio |

High-Yield Bonds (Fixed Income) Seek total return by investing in bonds with low credit ratings. Because of the risky nature of high-yield bonds, high-yield investments have greater volatility than the average bond investment. | PIMCO VIT High Yield Portfolio |

Intermediate-Term Bonds (Fixed Income) Typically invest at least 70% of their assets in a mixture of corporate and government bonds with primary focus on intermediate-term bonds. These bonds have an average duration from 3.5 to 6 years or an average effective maturity from 4 to 10 years. | AZL Enhanced Bond Index Fund PIMCO VIT Real Return Portfolio PIMCO VIT Total Return Portfolio PIMCO VIT Global Advantage Strategy Bond Portfolio PIMCO VIT Global Bond Portfolio (Unhedged) PIMCO VIT Emerging Markets Bond Portfolio |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

15

More About the Funds The AZL FusionSM Funds

Asset Classes | Other Fusion Permitted Underlying Investments |

Tactical Overlay (Alternative Investments and Derivatives) | Affiliated and unaffiliated unregistered investment pools |

Other Mutual Funds (Equity and/or Fixed Income) | Unaffiliated mutual funds |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

16

More About the Funds Investment Risks

Investment Risks

All of the Funds are funds of funds and are subject to the general risk associated with the allocation of their assets to particular underlying investments. In addition, separate from possible investments in derivatives by the Funds’ various underlying funds, all of the Funds are permitted to invest in derivatives or in investment pools that invest in derivatives. The risks listed below are generally applicable to all the Funds.

| Allocation Risk | |

| •All of the Funds | The risk that the Manager allocates assets in a manner which results in the Fund underperforming other funds with similar investment objectives. For those Funds where the Manager has limited discretion to allocate Fund assets among various underlying investments, the Fund’s allocation structure may cause the Fund to underperform other funds of funds with similar investment objectives. For those Funds where the Manager has discretion to allocate Fund assets among various underlying investments which represent different asset classes, each underlying investment is subject to different levels and combinations of risk, depending on the Fund’s exact asset allocation. |

| Derivatives Risk | |

| •All of the Funds | The Funds may invest directly or through affiliated or unaffiliated mutual funds or unregistered investment pools in derivative instruments such as futures, options, and options on futures. A derivative is a financial contract whose value depends on, or is derived from, the value of an underlying asset, reference rate, or risk. Funds typically use derivatives as a substitute for taking a position in the underlying asset and/or as part of a strategy designed to reduce exposure to other risks, such as interest rate or currency risk. Funds may also use derivatives for leverage, in which case their use would involve leveraging risk. Use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of other risks, such as liquidity risk, interest rate risk, market risk, credit risk, and selection risk. Derivatives also involve the risk of mispricing or improper valuation and the risk that changes in the value may not correlate perfectly with the underlying asset, rate, or index. Using derivatives may result in losses, possibly in excess of the principal amount invested. Also, suitable derivative transactions may not be available in all circumstances. The other party to a derivatives contract could default. |

The various underlying funds in which the Funds may invest present varying degrees of investment risk based upon their own investment objectives and strategies. A Fund will be impacted by these risks depending on the extent to which it invests in a particular underlying fund.

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

17

More About the Funds Investment Risks

The risks listed below are generally applicable to the underlying funds identified under the heading for each risk. Risks which are principal risks of a fund of the FOF Trust also are identified. However, any of the underlying funds may be exposed to any of the risks listed below if they invest in securities or other assets that entail a risk or multiple risks associated with that asset class.

| Call Risk (also known as Prepayment Risk) | |

A principal risk of the AZL Fusion Funds. A principal risk of the following underlying funds: •AZL Enhanced Bond Index Fund •AZL Franklin Templeton Founding Strategy Plus Fund • AZL Invesco Equity and Income Fund • AZL Money Market Fund | If interest rates fall, it is possible that issuers of callable securities held by the underlying fund will call or prepay their securities before their maturity dates. In this event, the proceeds from the called securities would most likely be reinvested by the underlying fund in securities bearing the new, lower interest rates, resulting in a possible decline in the underlying fund’s income and distributions to shareholders and termination of any conversion option on convertible securities. |

| Capitalization Risk | |

A principal risk of the following underlying funds: •AZL BlackRock Capital Appreciation Fund •AZL BlackRock Global Allocation Fund •AZL Columbia Mid Cap Value Fund •AZL Columbia Small Cap Value Fund •AZL Federated Clover Small Value Fund •AZL Franklin Templeton Founding Strategy Plus Fund •AZL Invesco Growth and Income Fund •AZL JPMorgan International Opportunities Fund •AZL JPMorgan U.S. Equity Fund •AZL Mid Cap Index Fund •AZL Morgan Stanley Mid Cap Growth Fund •AZL NFJ International Value Fund •AZL Oppenheimer Discovery Fund •AZL Schroder Emerging Markets Equity Fund •AZL Small Cap Stock Index Fund | To the extent the underlying fund invests significantly in small or mid-capitalization companies, it may have capitalization risk. These companies may present additional risk because they have less predictable earnings or no earnings, more volatile share prices and less liquid securities than large capitalization companies. These securities may fluctuate in value more than those of larger, more established companies and, as a group, may suffer more severe price declines during periods of generally declining stock prices. The shares of smaller companies tend to trade less frequently than those of larger, more established companies, which can adversely affect the price of smaller companies’ securities and the underlying fund’s ability to sell them when the portfolio manager deems it appropriate. These companies may have limited product lines, markets, or financial resources, or may depend on a limited management group. The value of some of the underlying fund’s investments will rise and fall based on investor perception rather than economic factors. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

18

More About the Funds Investment Risks

| Commodity Risk | |

A principal risk of the following underlying funds: •AZL BlackRock Global Allocation Fund •PIMCO VIT CommodityRealReturn™ Strategy Portfolio | The portfolio’s investments in commodity-linked derivative instruments may subject the portfolio to greater volatility than investments in traditional securities. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, changes in interest rates, or factors affecting a particular industry of commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political, and regulatory developments. The portfolio, and the wholly-owned subsidiary in which it invests, may concentrate their assets in a particular sector of the commodities market, such as, oil, metal, or agricultural products. As a result, the portfolio may be more susceptible to risks associated with those sectors. The U.S. Commodities Futures Trading Commission has proposed changes to certain of its rules governing investment in commodities by mutual funds. In the event these changes are adopted, or if there are changes in the tax treatment of a Fund’s direct and indirect investments in commodities, the Fund may be unable to obtain exposure to commodity markets, or may be limited in the extent to which or manner in which it can obtain such exposure. |

| Convertible Securities Risk | |

A principal risk of the following underlying funds: •AZL BlackRock Capital Appreciation Fund •AZL BlackRock Global Allocation Fund •AZL Eaton Vance Large Cap Value Fund •AZL Franklin Templeton Founding Strategy Plus Fund •AZL Invesco Equity and Income Fund •AZL Invesco International Equity Fund •AZL JPMorgan International Opportunties Fund •AZL Morgan Stanley Global Real Estate Fund •AZL Morgan Stanley Mid Cap Growth Fund •AZL Schroder Emerging Markets Equity Fund | The values of the convertible securities in which the underlying fund may invest also will be affected by market interest rates, the risk that the issuer may default on interest or principal payments and the value of the underlying common stock into which these securities may be converted. Specifically, since these types of convertible securities pay fixed interest and dividends, their values may fall if market interest rates rise, and rise if market interest rates fall. Additionally, an issuer may have the right to buy back certain of the convertible securities at a time and at a price that is unfavorable to the underlying fund. |

| Correlation Risk | |

A principal risk of the following underlying fund: •AZL Gateway Fund | The effectiveness of the Fund’s index option-based risk management strategy may be reduced if the Fund’s equity portfolio does not correlate to the index underlying its option positions. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

19

More About the Funds Investment Risks

| Country/ Regional Risk | |

A principal risk of the following underlying funds: •AZL JPMorgan International Opportunities Fund •AZL Schroder Emerging Markets Equity Fund | Local events, such as political upheaval, financial troubles, or natural disasters, may weaken a country’s or a region’s securities markets. Because the underlying fund may invest a large portion of its assets in securities of companies located in any one country or region, its performance may be hurt disproportionately by the poor performance of its investments in that area. Country/regional risk is especially high in emerging markets. |

| Credit Risk | |

A principal risk of the AZL Fusion Funds. A principal risk of the following underlying funds: •AZL BlackRock Capital Appreciation Fund •AZL BlackRock Global Allocation Fund •AZL Eaton Vance Large Cap Value Fund •AZL Enhanced Bond Index Fund •AZL Federated Clover Small Value Fund •AZL Franklin Templeton Founding Strategy Plus Fund •AZL Invesco Equity and Income Fund •AZL Invesco Growth and Income Fund •AZL Invesco International Equity Fund •AZL JPMorgan International Opportunities Fund •AZL NFJ International Value Fund | Credit risk is the chance that the issuer of a debt security will fail to repay interest and principal in a timely manner, reducing the fund’s return. Also, an issuer may suffer adverse changes in financial condition that could lower the credit quality and liquidity of a security, leading to greater volatility in the price of the security and of the fund’s shares. |

A principal risk of the following underlying funds: •PIMCO VIT CommodityRealReturn™ Strategy Portfolio •PIMCO VIT Global Advantage Strategy Bond Portfolio •PIMCO VIT Total Return Portfolio •PIMCO VIT Unconstrained Bond Portfolio | The underlying fund could lose money if the issuer or the guarantor of a fixed income security, or the counterparty to a derivatives contract, repurchase agreement, or a loan of portfolio securities, is unwilling or unable to make payments of principal and/or interest in a timely manner, or to otherwise honor its obligations. Securities are subject to varying degrees of credit risk, which are often reflected in their credit ratings. Those underlying funds that are permitted to invest in municipal bonds are subject to the risk that litigation, legislation, or other political events, local business or economic conditions, or the bankruptcy of the issuer could have a significant effect on an issuer’s ability to make payments of principal and/or interest. |

A principal risk of the following underlying fund: •AZL Money Market Fund | Although credit risk is low because the underlying fund invests only in high quality obligations, if an issuer fails to pay interest or repay principal, the value of the underlying fund’s assets could decline. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

20

More About the Funds Investment Risks

| Currency Risk | |

A principal risk of the following underlying funds: •AZL BlackRock Global Allocation Fund •AZL Davis New York Venture Fund •AZL Dreyfus Research Growth Fund •AZL Eaton Vance Large Cap Value Fund •AZL Franklin Templeton Founding Strategy Plus Fund •AZL International Index Fund •AZL Invesco Equity and Income Fund •AZL Invesco Growth and Income Fund •AZL Invesco International Equity Fund •AZL JPMorgan International Opportunities Fund •AZL MFS Investors Trust Fund •AZL Morgan Stanley Global Real Estate Fund • AZL Morgan Stanley Mid Cap Growth Fund •AZL NFJ International Value Fund •AZL Schroder Emerging Markets Equity Fund •PIMCO VIT CommodityRealReturn™ Strategy Portfolio •PIMCO VIT Global Advantage Strategy Bond Portfolio • PIMCO VIT Total Return Portfolio | Funds that invest in securities that trade in, and receive revenues in, foreign currencies are subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including changes in interest rates, intervention (or failure to intervene) by the U.S. or foreign governments, central banks, or supranational authorities, such as the International Monetary Fund, or by the imposition of currency controls or other political developments in the U.S. or abroad. As a result, the underlying fund’s investments with exposure to foreign currency fluctuations may decline in value (in terms of the U.S. dollar) and reduce the returns of the underlying fund. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

21

More About the Funds Investment Risks

| Derivatives Risk | |

A principal risk of the Fusion Funds A principal risk of the following underlying funds: •AZL BlackRock Capital Appreciation Fund •AZL BlackRock Global Allocation Fund •AZL Dreyfus Research Growth Fund •AZL Enhanced Bond Index Fund •AZL Federated Clover Small Value Fund •AZL Franklin Templeton Founding Strategy Plus Fund •AZL International Index Fund •AZL Invesco Equity and Income Fund •AZL Invesco Growth and Income Fund •AZL JPMorgan International Opportunities Fund •AZL JPMorgan U.S. Equity Fund •AZL Mid Cap Index Fund •AZL Morgan Stanley Mid Cap Growth Fund •AZL Russell 1000 Growth Index Fund •AZL Russell 1000 Value Index Fund •AZL S&P 500 Index Fund •AZL Schroder Emerging Markets Equity Fund •AZL Small Cap Stock Index Fund •PIMCO VIT CommodityRealReturn™ Strategy Portfolio •PIMCO VIT Global Advantage Strategy Bond Portfolio •PIMCO VIT Total Return Portfolio | A derivative is a financial contract whose value depends on, or is derived from, the value of an underlying asset, reference rate, or risk. Funds typically use derivatives as a substitute for taking a position in the underlying asset and/or as part of a strategy designed to reduce exposure to other risks, such as interest rate or currency risk. Funds may also use derivatives for leverage, in which case their use would involve leveraging risk. Use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. Derivatives are subject to a number of other risks, such as liquidity risk, interest rate risk, market risk, credit risk, and selection risk. Derivatives also involve the risk of mispricing or improper valuation and the risk that changes in the value may not correlate perfectly with the underlying asset, rate, or index. Using derivatives may result in losses, possibly in excess of the principal amount invested. Also, suitable derivative transactions may not be available in all circumstances. The counterparty to a derivatives contract could default. As required by applicable law, any fund that invests in derivatives segregates cash or liquid securities, or both, to the extent that its obligations under the instrument (for example, forward contracts and futures that are required to “cash settle”) are not covered through ownership of the underlying security, financial instrument, or currency. |

| Distressed Securities Risk | |

A principal risk of the following underlying fund: • AZL BlackRock Global Allocation Fund. | Distressed securities are speculative and involve substantial risks in addition to the risks of investing in junk bonds. The Fund will generally not receive interest payments on the distressed securities and may incur costs to protect its investment. In addition, distressed securities involve the substantial risk that principal will not be repaid. These securities may present a substantial risk of default or may be in default at the time of investment. The Fund may incur additional expenses to the extent it is required to seek recovery upon a default in the payment of principal of or interest on its portfolio holdings. In any reorganization or liquidation proceeding relating to a portfolio company, the Fund may lose its entire investment or may be required to accept cash or securities with a value less than its original investment. Distressed securities and any securities received in an exchange for such securities may be subject to restrictions on resale. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

22

More About the Funds Investment Risks

| Dividend Risk | |

A principal risk of the following underlying funds: •AZL Dreyfus Research Growth Fund •AZL Eaton Vance Large Cap Value Fund | There is no guarantee that the issuers of the stocks held by the underlying fund will declare dividends in the future or that if declared, they will either remain at current levels or increase over time. |

| Emerging Markets Risk | |

A principal risk of the following underlying funds: •AZL BlackRock Global Allocation Fund •AZL Davis New York Venture Fund •AZL Eaton Vance Large Cap Value Fund •AZL Federated Clover Small Value Fund •AZL Franklin Templeton Founding Strategy Plus Fund •AZL Invesco Equity and Income Fund •AZL Invesco Growth and Income Fund •AZL Invesco International Equity Fund •AZL JPMorgan International Oppurtunity Fund •AZL Morgan Stanley Global Real Estate Fund •AZL Morgan Stanley Mid Cap Growth Fund •AZL NFJ International Value Fund •PIMCO VIT Global Advantage Strategy Bond Portfolio •PIMCO VIT Total Return Portfolio | In addition to the risks described under “Foreign Risk,” issuers in emerging markets may present greater risk than investing in foreign issuers generally. Emerging markets may have less developed trading markets and exchanges which may make it more difficult to sell securities at an acceptable price and their prices may be more volatile than securities of companies in more developed markets. Settlements of trades may be subject to greater delays so that the underlying fund may not receive the proceeds of a sale of a security on a timely basis. Emerging countries may also have less developed legal and accounting systems and investments may be subject to greater risks of government restrictions, nationalization, or confiscation. |

A principal risk of the following underlying fund: •AZL Schroder Emerging Markets Equity Fund | Emerging markets may have less developed trading markets and exchanges. Emerging countries may have less developed legal and accounting systems and investments may be subject to greater risks of government restrictions of withdrawing the sales proceeds of securities from the country. Economies of developing countries may be more dependent on relatively few industries that may be highly vulnerable to local and global changes. Governments may be more unstable and present greater risks of nationalization or restrictions on foreign ownership of stocks of local companies. These investments may be substantially more volatile than stocks of issuers in the U.S. and other developed countries and may be very speculative. |

A principal risk of the following underlying funds: •PIMCO VIT CommodityRealReturn™ Strategy Portfolio •PIMCO VIT Total Return Portfolio | Foreign investment risk may be particularly high to the extent that the underlying fund invests in emerging market securities of issuers based in countries with developing economies. These securities may present market, credit, currency, liquidity, legal, political, and other risks different from, or greater than, the risks of investing in developed foreign countries. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

23

More About the Funds Investment Risks

| Equity Risk | |

A principal risk of the following underlying funds: •PIMCO VIT Global Advantage Strategy Bond Portfolio •PIMCO VIT Unconstrained Bond Portfolio | The risk that the value of equity securities, such as common stocks and preferred stocks, may decline due to general market conditions which are not specifically related to a particular company or to factors affecting a particular industry or industries. Equity securities generally have greater price volatility than fixed income securities. |

| ETF and Investment Company Risk | |

A principal risk of the following underlying funds: •AZL BlackRock Global Allocation Fund •AZL Federated Clover Small Value Fund •AZL JPMorgan U.S. Equity Fund •AZL Schroder Emerging Markets Equity Fund | The underlying fund may invest in shares of closed-end investment companies (including single country funds) and ETFs. Investing in another investment company exposes the underlying fund to all the risks of that investment company and, in general, subjects it to a pro rata portion of the other investment company’s fees and expenses. |

| Extension Risk | |

A principal risk of the AZL Fusion Funds. A principal risk of the following underlying funds: •AZL Enhanced Bond Index Fund •AZL Money Market Fund | When interest rates rise, certain bond obligations will be paid in full by the issuer more slowly than anticipated, causing the value of the securities to fall. |

| Focused Investment Risk | |

A principal risk of the following underlying fund: •AZL NFJ International Value Fund | Focusing investments in a small number of issuers, industries, or regions increases risk. Funds that invest in a relatively small number of issuers may have more risk because changes in the value of a single security or the impact of a single economic, political, or regulatory occurrence may have a greater impact on the fund’s net asset value. Some of those issuers also may present substantial credit or other risks. The fund may from time to time have greater risk if it invests a substantial portion of its assets in companies in related industries, such as technology or financial and business services, that may share common characteristics and are often subject to similar business risks and regulatory burdens. The securities of companies in similar industries may react similarly to economic, market, political, or other developments. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

24

More About the Funds Investment Risks

| Foreign Risk | |

A principal risk of the following underlying funds: •AZL BlackRock Global Allocation Fund •AZL Columbia Mid Cap Value Fund •AZL Columbia Small Cap Value Fund •AZL Davis New York Venture Fund •AZL Dreyfus Research Growth Fund •AZL Eaton Vance Large Cap Value Fund •AZL Enhanced Bond Index Fund •AZL Federated Clover Small Value Fund •AZL Franklin Templeton Founding Strategy Plus Fund •AZL Gateway Fund •AZL International Index Fund •AZL Invesco Equity and Income Fund •AZL Invesco Growth and Income Fund •AZL Invesco International Equity Fund •AZL JPMorgan International Opportunities Fund •AZL JPMorgan U.S. Equity Fund •AZL MFS Investors Trust Fund •AZL Morgan Stanley Global Real Estate Fund •AZL Morgan Stanley Mid Cap Growth Fund AZL NFJ International Value Fund •AZL Schroder Emerging Markets Equity Fund •PIMCO VIT CommodityRealReturn™ Strategy Portfolio •PIMCO VIT Total Return Portfolio •PIMCO VIT Global Advantage Strategy Bond Portfolio •PIMCO VIT Unconstrained Bond Portfolio | Because the fund invests in securities of foreign issuers, it may be subject to risks not usually associated with owning securities of U.S. issuers. These risks include, among others, adverse fluctuations in foreign currency values as well as adverse political, social and economic developments affecting a foreign country, including the risk of nationalization, expropriation or confiscatory taxation. In addition, foreign investing involves less publicly available information, and more volatile or less liquid securities markets. Investments in foreign countries could be affected by factors not present in the U.S., such as restrictions on receiving the investment proceeds from a foreign country, confiscatory foreign tax laws, and potential difficulties in enforcing contractual obligations. Transactions in foreign securities may be subject to less efficient settlement practices, including extended clearance and settlement periods. Foreign accounting may be less revealing than U.S. accounting practices. Foreign regulation may be inadequate or irregular. Owning foreign securities could cause the fund’s performance to fluctuate more than if it held only U.S. securities. |

A principal risk of the following underlying fund: •AZL Money Market Fund | The underlying fund may invest in obligations of foreign banks and other foreign issuers that involve certain risks in addition to those of domestic issuers, including higher transaction costs, less complete financial information, political and economic instability, less stringent regulatory requirements and less market liquidity. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

25

More About the Funds Investment Risks

| Growth Stocks Risk | |

A principal risk of the following underlying funds: •AZL BlackRock Capital Appreciation Fund •AZL Dreyfus Research Growth Fund •AZL Invesco International Equity Fund •AZL MFS Investors Trust Fund •AZL Morgan Stanley Mid Cap Growth Fund •AZL Oppenheimer Discovery Fund •AZL Russell 1000 Growth Index Fund | The returns on growth stocks may or may not move in tandem with the returns on other categories of stocks, or the stock market as a whole. Growth stocks may be particularly susceptible to rapid price swings during periods of economic uncertainty or in the event of earnings disappointments. Further, growth stocks typically have little or no dividend income to cushion the effect of adverse market conditions. To the extent a growth style of investing emphasizes certain sectors of the market, such investments will be more sensitive to market, political, regulatory and economic factors affecting those sectors. |

| Headline Risk | |

A principal risk of the following underlying fund: •AZL Davis New York Venture Fund | The subadviser seeks to acquire companies with expanding earnings at value prices. They may make such investments when a company becomes the center of controversy after receiving adverse media attention. The company may be involved in litigation, the company’s financial reports or corporate governance may be challenged, the company’s annual report may disclose a weakness in internal controls, investors may question the company’s published financial reports, greater government regulation may be contemplated, or other adverse events may threaten the company’s future. While the subadviser researches companies subject to such contingencies, it cannot be correct every time, and the company’s stock may never recover. |

| High Yield Risk | |

A principal risk of the following underlying funds: •PIMCO VIT Global Advantage Strategy Bond Portfolio •PIMCO VIT Unconstrained Bond Portfolio | The risk that high yield securities and unrated securities of similar credit quality (commonly known as “junk bonds”) are subject to greater levels of credit and liquidity risks. High yield securities are considered primarily speculative with respect to the issuer’s continuing ability to make principal and interest payments. |

| Income Risk | |

A principal risk of the AZL Fusion Funds. A principal risk of the following underlying funds: •AZL Franklin Templeton Founding Strategy Plus Fund •AZL Invesco Equity and Income Fund •AZL Money Market Fund | Income risk is the chance that falling interest rates will cause the underlying fund’s income to decline. Income risk is generally higher for short-term bonds. |

The Allianz Variable Insurance Products Fund of Funds Trust ¨ Prospectus ¨ April 30, 2012, as supplemented

26

More About the Funds Investment Risks

| Index Fund Risk | |

A principal risk of the following underlying funds: •AZL Enhanced Bond Index Fund •AZL International Index Fund •AZL Mid Cap Index Fund •AZL Russell 1000 Growth Index Fund •AZL Russell 1000 Value Index Fund •AZL S&P 500 Index Fund •AZL Small Cap Stock Index Fund | The underlying fund uses an indexing strategy. It does not attempt to manage market volatility, use defensive strategies, or reduce the effects of any long-term periods of poor stock performance. The correlation between the performance of the underlying fund and the performance of the index may be affected by the underlying fund’s expenses, changes in securities markets, changes in the composition of the index, and the timing of purchases and redemptions of underlying fund shares. |

| Industry Sector Risk | |

A principal risk of the following underlying funds: •AZL Davis New York Venture Fund •AZL Invesco Equity and Income Fund | At times, the underlying fund may invest a significant portion of its assets in the securities of companies involved in the financial services sector. By focusing on a particular sector from time to time, the underlying fund carries greater risk of adverse developments in a sector than a fund that always invests in a wide variety of sectors. Financial services companies are subject to extensive government regulation, which may affect their profitability in many ways, including by limiting the amount and types of loans and other commitments they can make, and the interest rates and fees they can charge. A financial services company’s profitability, and therefore its stock price is especially sensitive to interest rate changes throughout the world, as well as the ability of borrowers to repay their loans. Changing regulations, continuing consolidations, and development of new products and structures are all likely to have a significant impact on financial services companies. |