STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

National Instrument 43-101 Technical Report:

Updated Mineral Resource and Reserve Estimates for the

San Martin Mine, Querétaro State, México

Effective Date: April 30, 2022

Report Date: July 18, 2022

Prepared for:

STARCORE INTERNATIONAL MINES LTD

Suite 750 - 580 Hornby Street Box 113

Vancouver, BC

Canada, V6C 3B6

Prepared by:

Erme Enriquez C.P.G., BSc, MSc

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

IMPORTANT NOTICE

This report was prepared as a National Instrument 43-101 Technical Report for Starcore International Mines Ltd. (SIM) by Erme Enriquez, CPG (QP). The quality of information, conclusions, and estimates contained herein is consistent with the scope of Mr. Enriquez services based on: 1) information available at the time of preparation, 2) data supplied by outside sources, and 3) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by SIM subject to the terms and conditions of its contract with Mr. Enriquez, who permits SIM to file this report with Canadian Securities Regulatory Authorities pursuant to National Instrument 43-101, Standards of Disclosure for Mineral Projects. Except for the purposes legislated under provincial securities law, any other use of this report by any third party is at that party’s sole risk.

Erme Enriquez, CPGJuly 18, 2022i

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

CERTIFICATE OF QUALIFIED PERSSON

I, Erme Enriquez, CPG, do hereby certify that:

1. | I am independent of the issuer applying all the tests in section 1.5 of NI 43-101. |

2. | I am a graduate of the Universidad de Sonora having obtained the degree of BSc in 1983 and from Colorado School of Mines obtained the degree of MSc in 1996, both in Geological Engineering. |

3. | I am a registered member of the Association of Professional Geologists, CPG 11214. I am also a Fellow of the Society of Economic Geologists (SEG) and a member of the Asociación de Ingenieros de Minas Metalurgistas y Geólogos de México (AIMMGM). |

4. | I have been employed in the mining industry continuously since 1983. Since 1985 I have performed resource and reserve estimating in several commodities, including extensive experience in gold and silver and base metals deposits. |

• | Underground production geologist to Exploration Manager for Luismin-Wheaton River from 1983 to 2003. |

• | Exploration Manager Mexico, Capstone Mining………...……….……….2003-2004 |

• | Director Exploration and Development Canasil Resources…....…….2004-2022 |

• | Consulting Geologist……………………………………………………….……………2004-present |

5. | I have read the definition of “Qualified Person” set out in National Instrument 43-101(NI 43-101) and certify that by reason of my education, affiliation of my professional association and past relevant work experience, I fulfil the requirements to be a “Qualified Person” for the purposes of NI 43-101. |

6. | I personally inspected the San Martin Mine June 7 through June 10, 2022. I have been a reviewer of previous reserve reports on the San Martin Mine from 1998 to 2002 for Minas Luismin, SA de CV (former owner of the mine). |

7. | I have had prior involvement with the property that is the subject of this Technical Report as a QP author of a previous (2018 and 2019) NI 43-101 Technical Report. |

8. | I have read the instrument and Form 43-101F. The Technical Report titled “National Instrument 43-101 Technical Report: Updated Mineral Resource and Reserve Estimates for the San Martin Mine, Queretaro State, Mexico, as of April 30, 2022”, which was prepared from information available as of April 30, 2022, and has been prepared in compliance with the instrument and form. I am responsible for this report. |

9. | As of the date of this certificate and as of the effective date of the Technical Report, to the best of my knowledge, information and belief, the Technical Report contains all scientific and technical information required to be disclosed to make the report not misleading. |

10. | I have read National Instrument 43-101 and Form 43-101F1, and the Technical Report has been prepared in compliance with that instrument and form. |

Dated this 18th day of July 2022

Dated this 18th day of July 2022

_________________________________

Erme Enriquez, CPG BSc, MSc

Erme Enriquez, CPGJuly 18, 2022ii

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

TABLE OF CONTENTS

IMPORTANT NOTICEi

CERTIFICATE OF QUALIFIED PERSSONii

ACRONYMS AND ABBREVIATIONSix

1.0SUMMARY1

1.1Introduction1

1.2Property Description and Ownership1

1.3History1

1.4Geology and Mineralization2

1.5Mineral Resource Estimate2

1.6Mineral Reserve Estimate4

1.7Conclusions and Recommendations5

2.0INTRODUCTION7

2.1Issuer and Terms of Reference7

2.2Sources of Information7

2.3Qualified Person8

2.4Units and Currency8

3.0RELIANCE OF OTHER EXPERTS9

4.0PROPERTY DESCRIPTION AND LOCATION10

4.1Property Description10

4.2Property Location10

4.3Mineral Concessions and Agreements12

4.4Permits and Environmental Liabilities14

5.0ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY14

5.1Access14

5.2Climate14

5.3Local Resources and Infrastructure15

5.4Physiography15

6.0HISTORY16

7.0GEOLOGICAL SETTING AND MINERALIZATION19

7.1Regional Geology19

7.2Property Geology and Mineralization22

6.2.1Las Trancas Formation22

Erme Enriquez, CPGJuly 18, 2022iii

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

6.2.2El Doctor Formation22

6.2.3Soyatal–Mezcala Formation22

6.2.4Igneous Rocks22

6.2.5Andesite/Dacite22

8.0DEPOSIT TYPE24

9.0EXPLORATION27

9.1Channel Samples28

10.0DRILLING28

10.1Collar and Downhole Surveys29

10.2Drill Core Sampling30

10.3Core Logging30

10.4Important Drilling Results31

11.0SAMPLE PREPARATION, ANALYSES AND SECURITY33

11.1Sample preparation and Analysis34

11.1.1Underground Channel Samples34

11.1.2Diamond Drill Core Samples34

11.2Security, Storage, and Transport34

11.3 Quality Control (QA/QC)35

11.3.1Standards35

11.3.2Blanks35

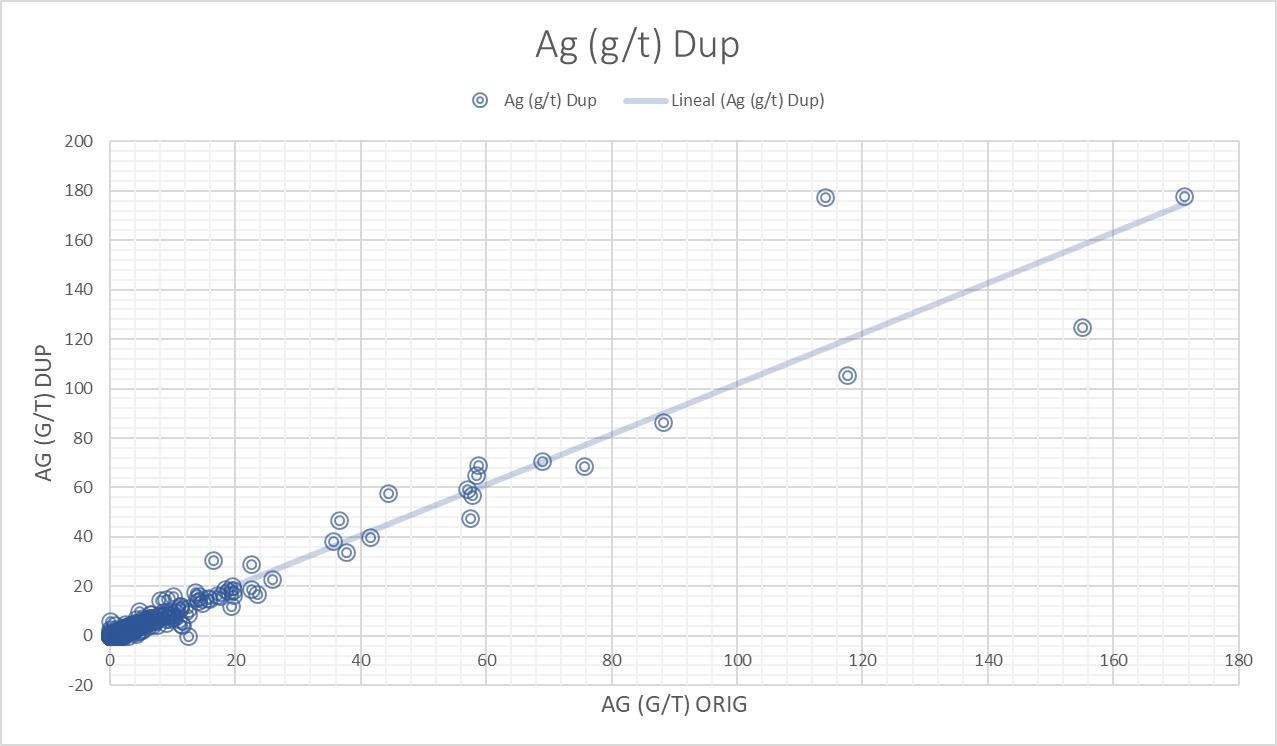

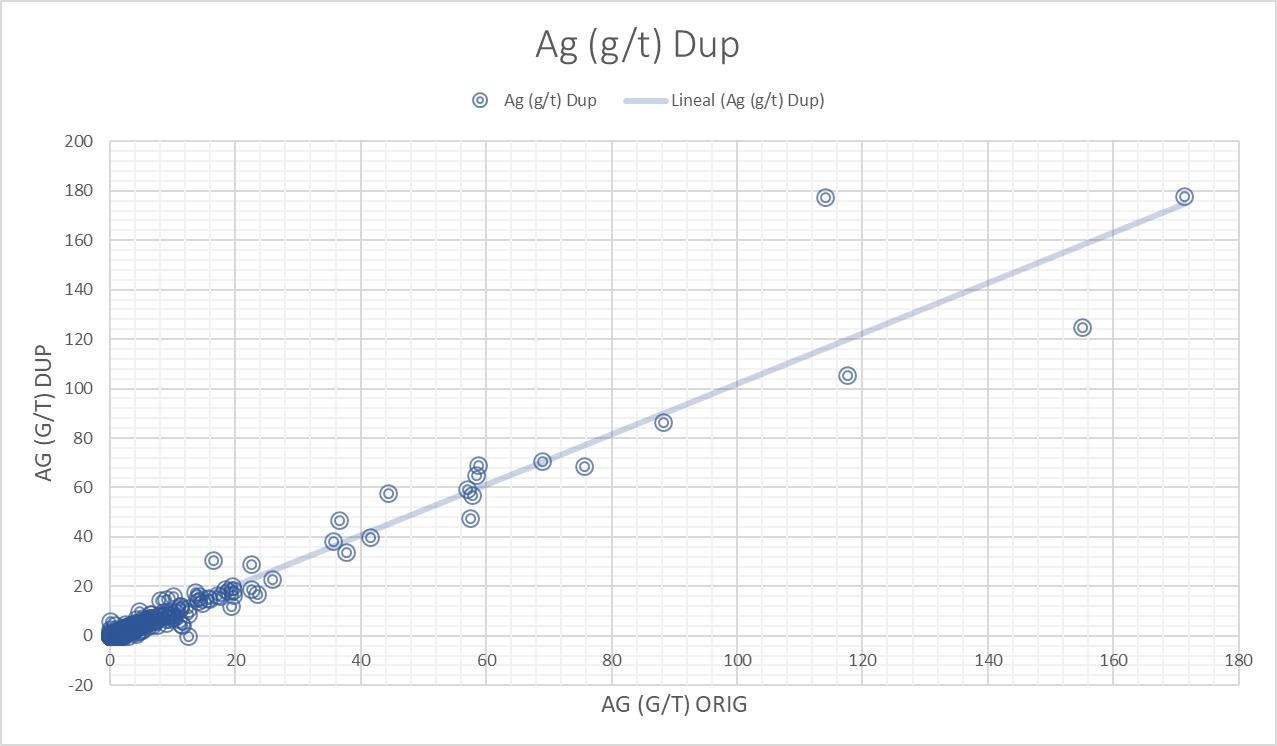

11.3.3Duplicates35

11.4:QP Opinion37

12.0DATA VERIFICATION37

12.2Comment on Data Verification38

13.0MINERAL PROCESSING AND METALLURGICAL TESTING38

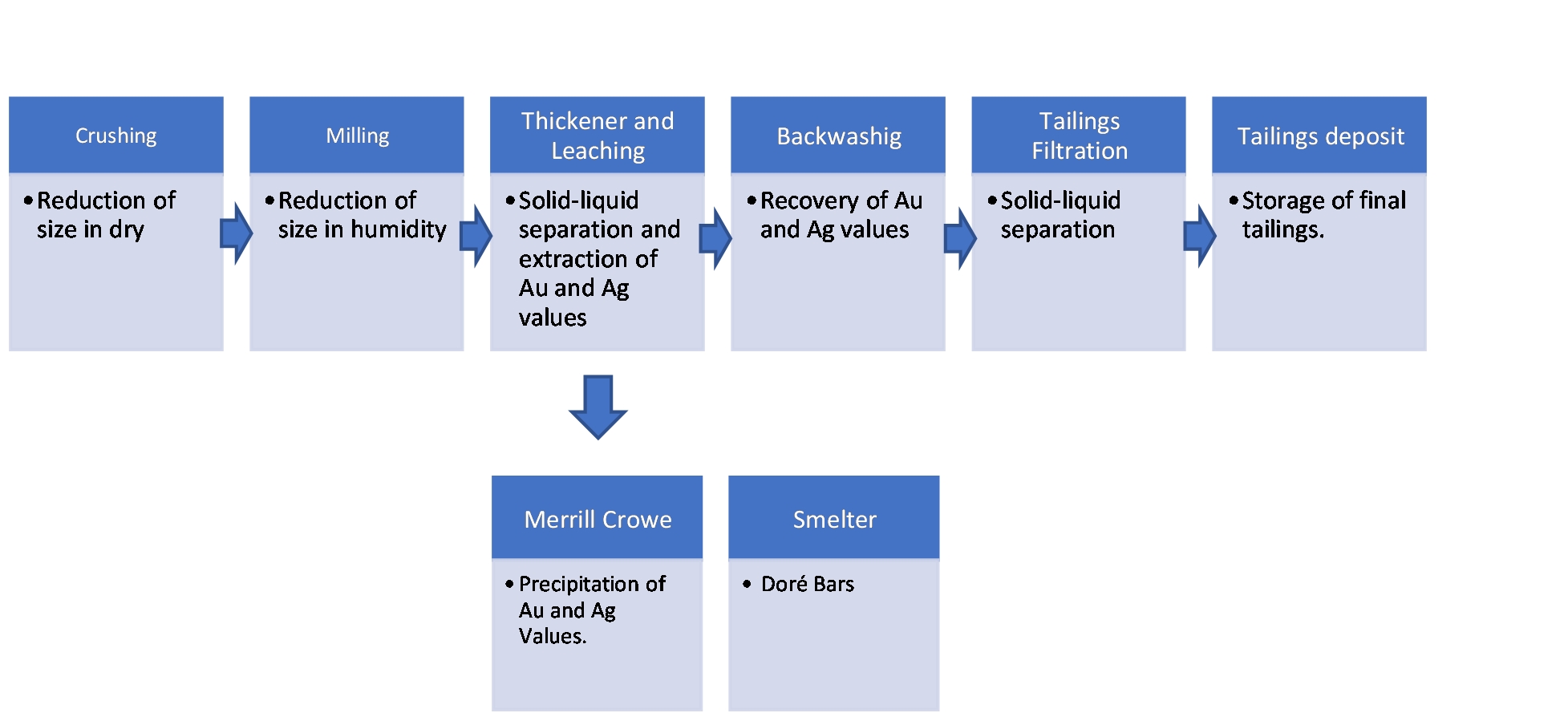

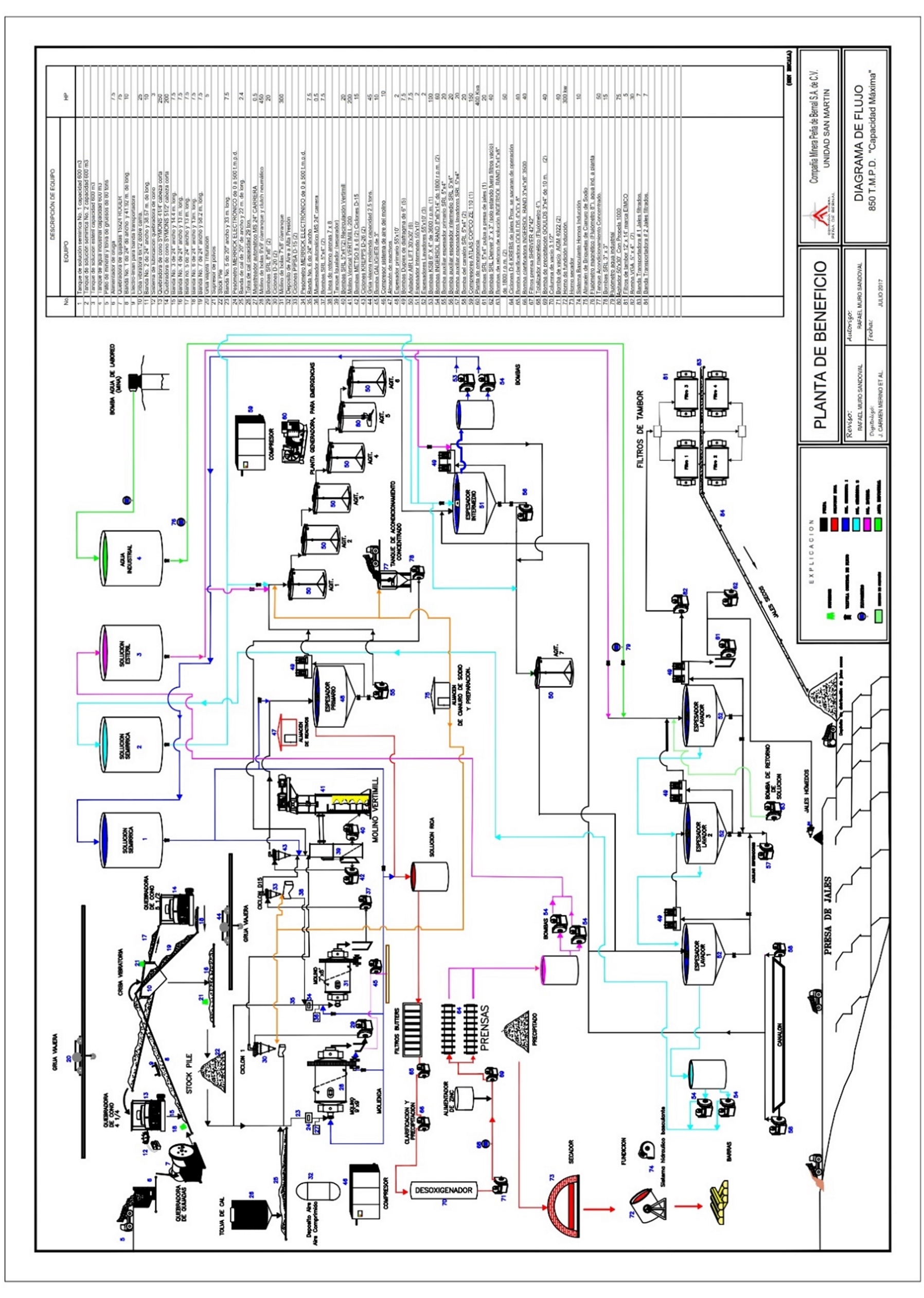

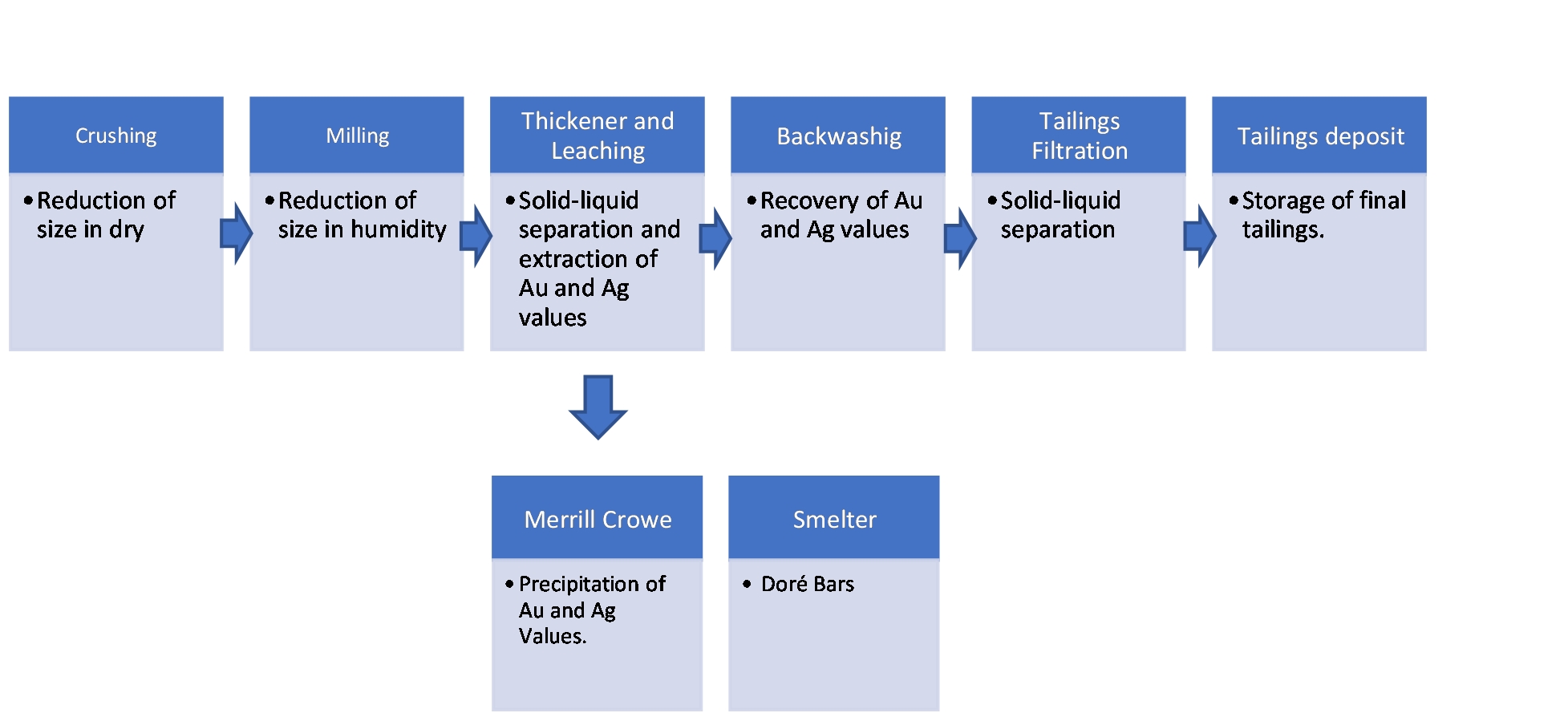

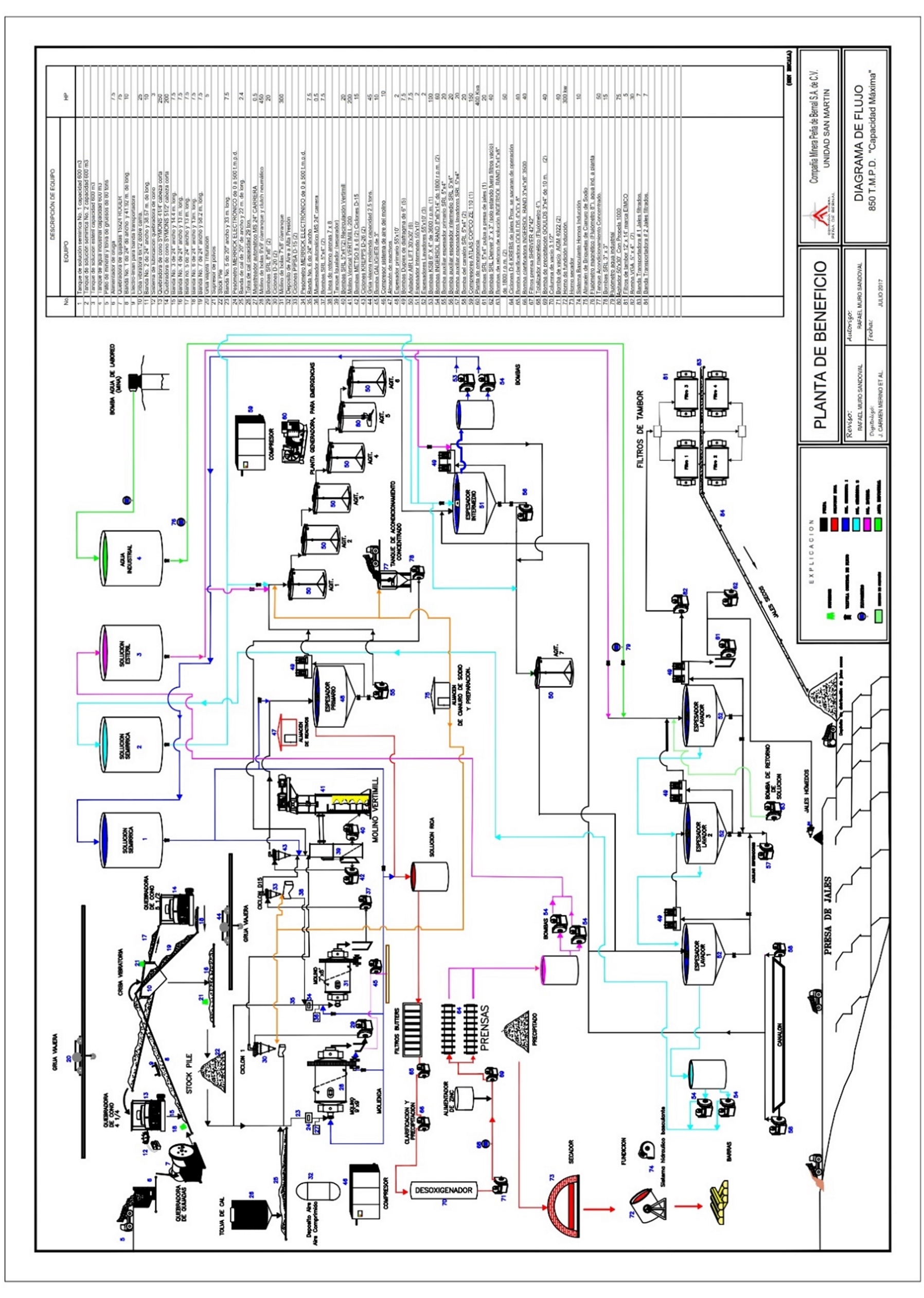

13.1Process of the Benefit Plant39

13.1.1Crushing Area40

13.1.2Grinding Area40

13.1.3Chemical Treatment Area40

13.1.4Tailings Filtration Area40

13.1.5Merrill-Cowe Area41

13.1.6Smelting Area41

13.2Comment on Mineral Processing and Metallurgical Testing and Recoveries41

13.3Data Adequacy41

Erme Enriquez, CPGJuly 18, 2022iv

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

13.1Metallurgical Testing and Recovery41

13.2Data Adequacy42

14.0MINERAL RESOURCE ESTIMATES45

14.1Introduction and Qualified Person45

14.2Density45

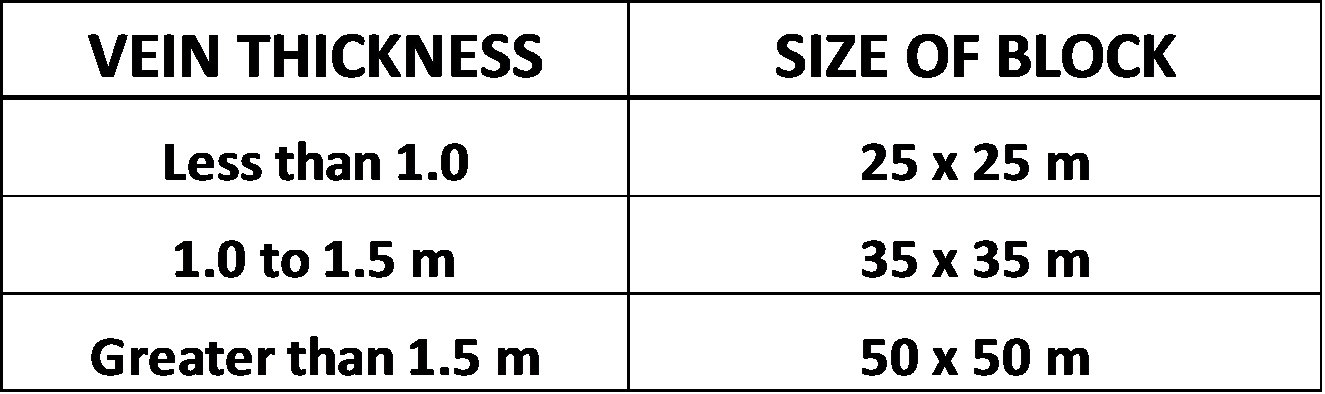

14.3Methodology45

14.4Definition Mineral Resource46

15.0MINERAL RESERVE ESTIMATE49

15.1Introduction49

15.2Methodology50

15.3Reconciliation of Mineral Reserves to Production51

15.4Mineral Reserve Statement52

15.5Current Reserve Estimate Parameters54

15.5Factors that may Affect the Reserve Calculation54

16.0MINING METHODS57

16.1Mining Operations57

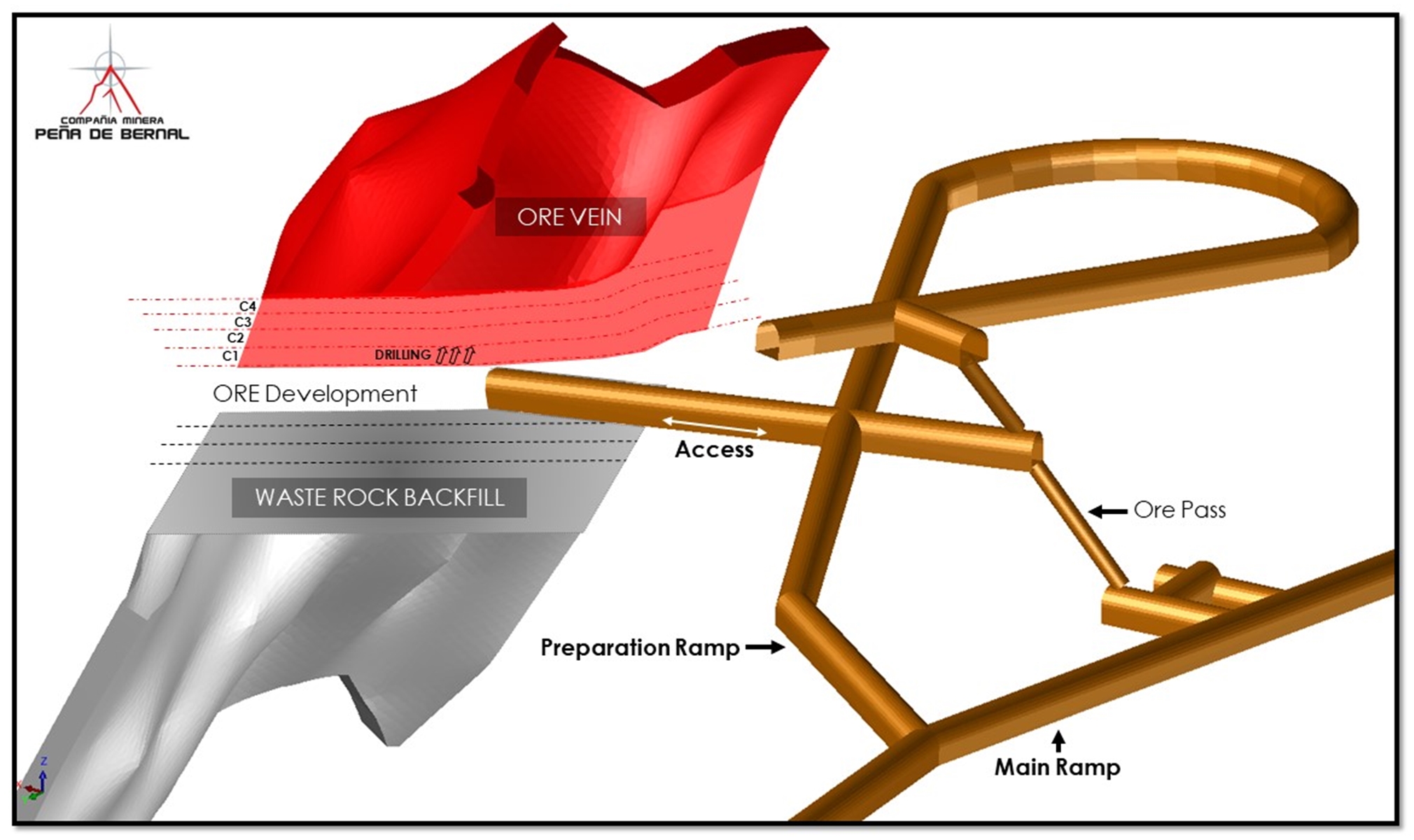

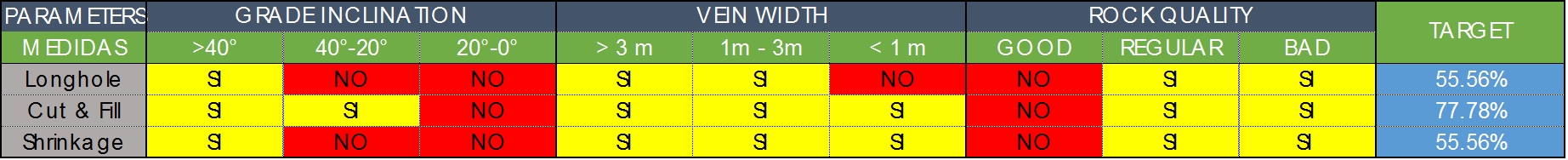

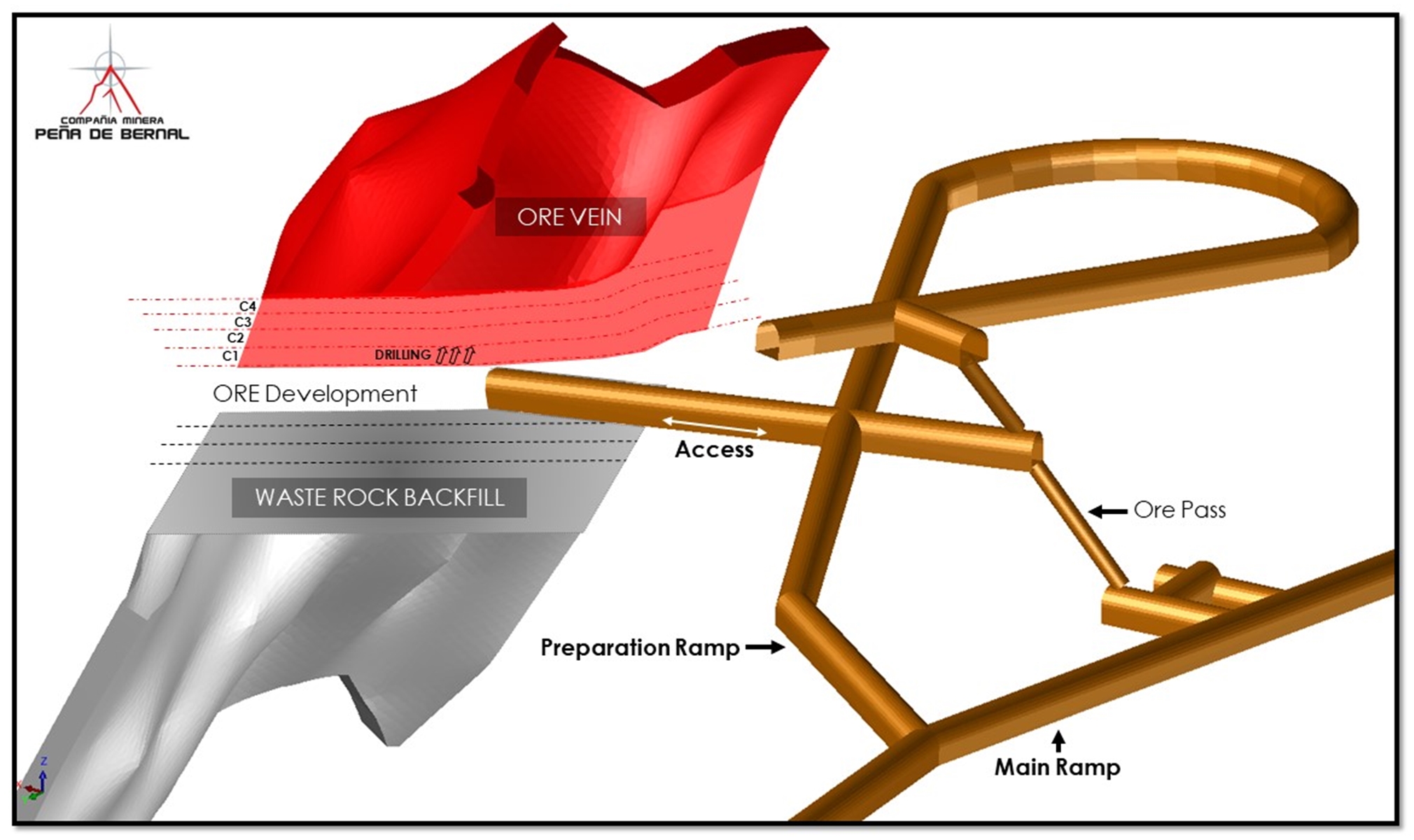

16.2Mining Method57

16.3Mining Method Description58

16.4Drilling59

16.5 Blasting59

16.6 Mucking59

16.7Haulage of Ore60

16.8Geotechnical Review60

16.9Ventilation60

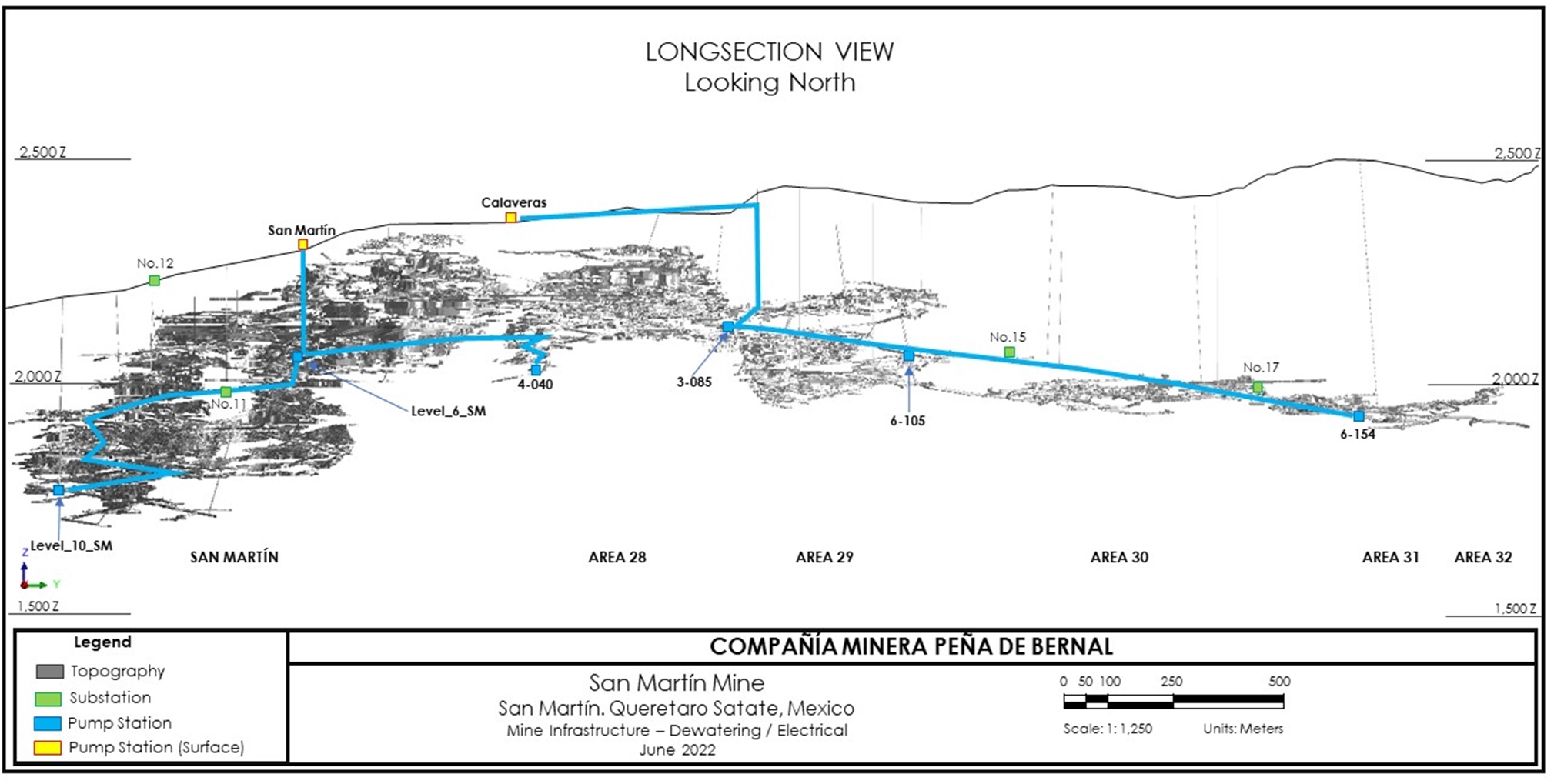

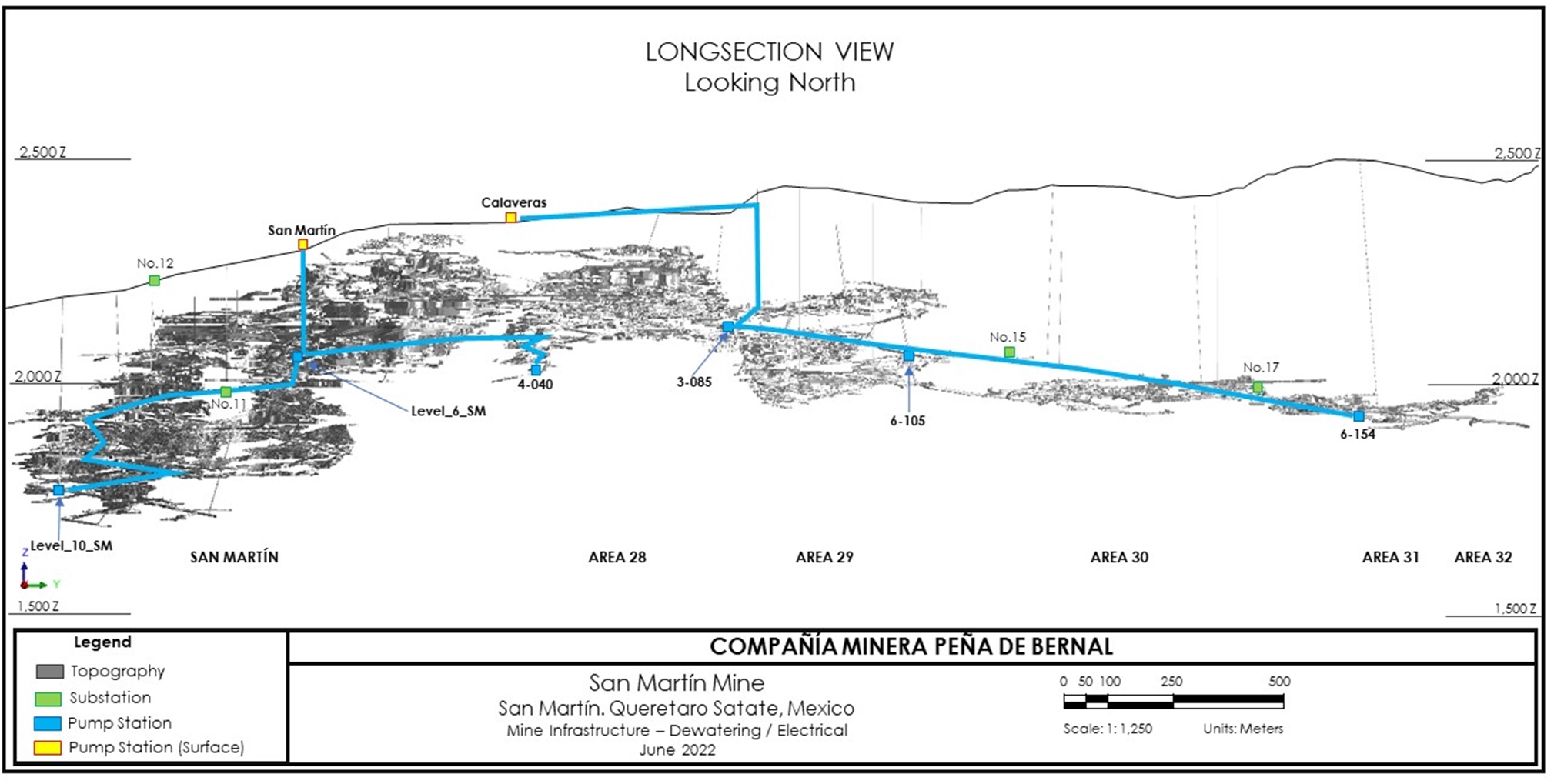

16.10Dewatering60

16.11Mining Equipment62

16.12Comments on the Mine Operations62

17.0RECOVERY METHODS64

18.0PROJECT INFRASTRUCTURE64

18.1Buildings65

18.2Processing Plant65

18.3Waste Rock65

18.4Tailings65

18.5Power and Electrical65

18.6Water Usage66

Erme Enriquez, CPGJuly 18, 2022v

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

18.7Logistics, supplies and Administration66

19.0MARKET STUDIES AND CONTRACTS69

20.0ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT71

20.1 General71

20.2Permitting72

20.3Permitting Requirements and Status72

20.4Surface Water Management Plan73

20.5Tailings Dam and Reforestation74

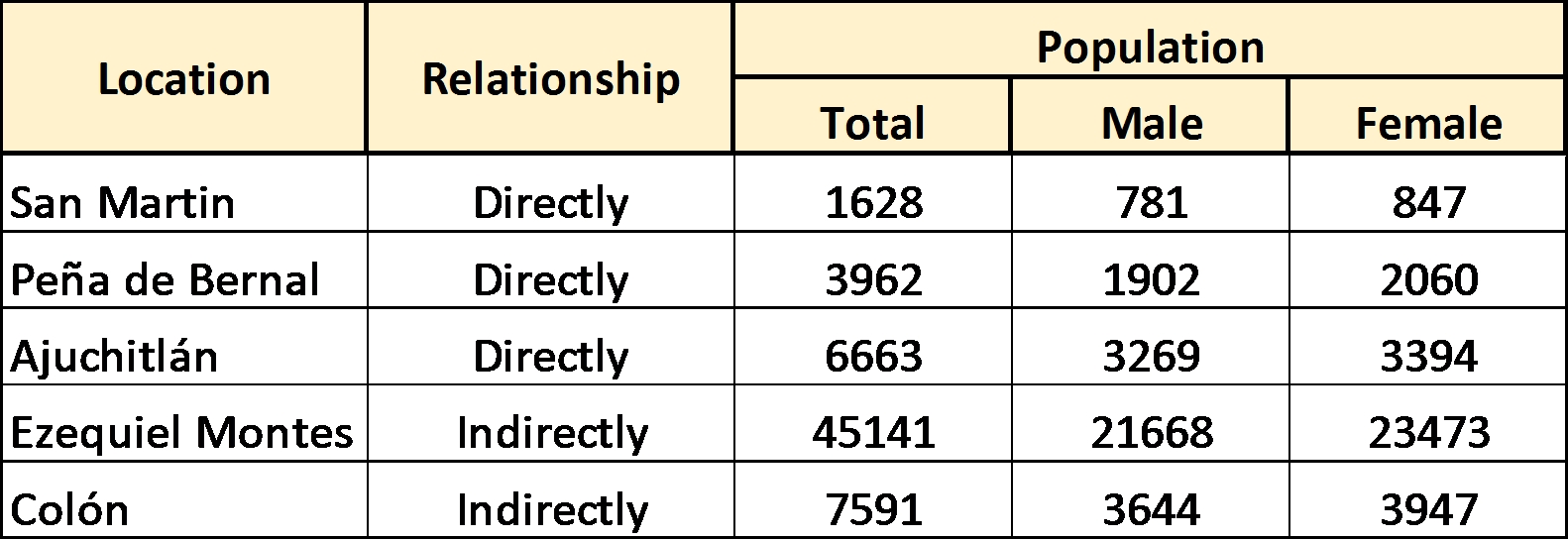

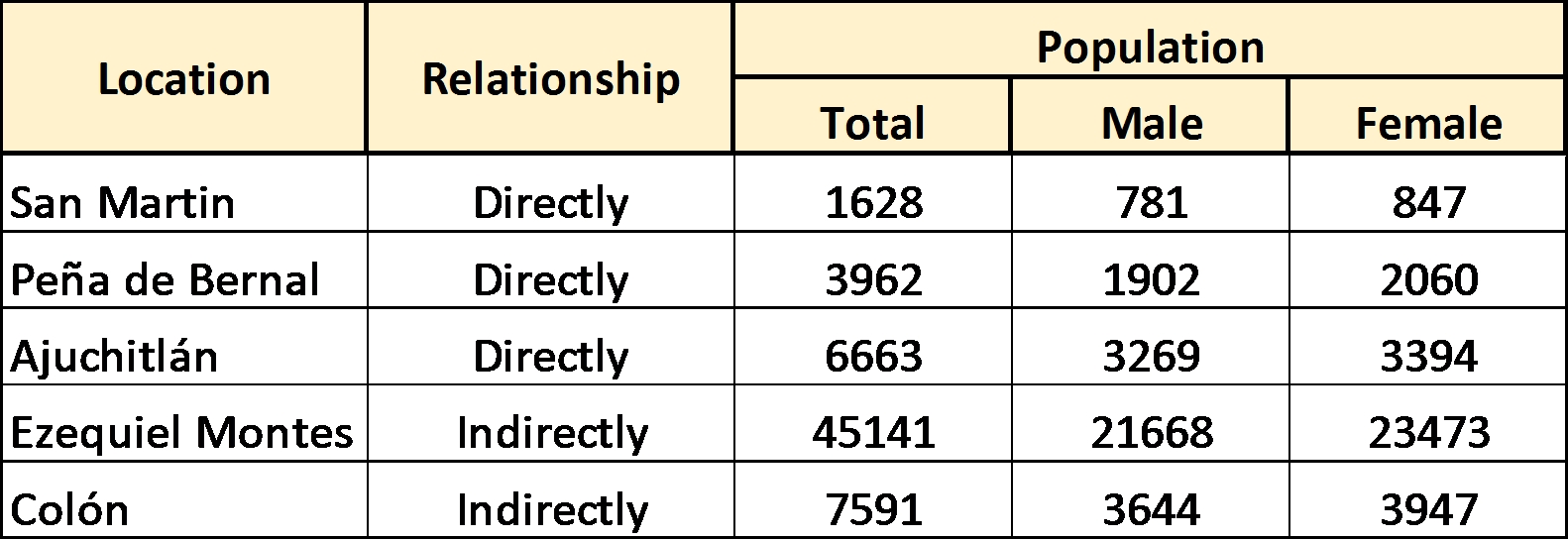

20.6Social Community Impact74

20.6Comment on Environmental Compliance, Permitting, and Local Engagement76

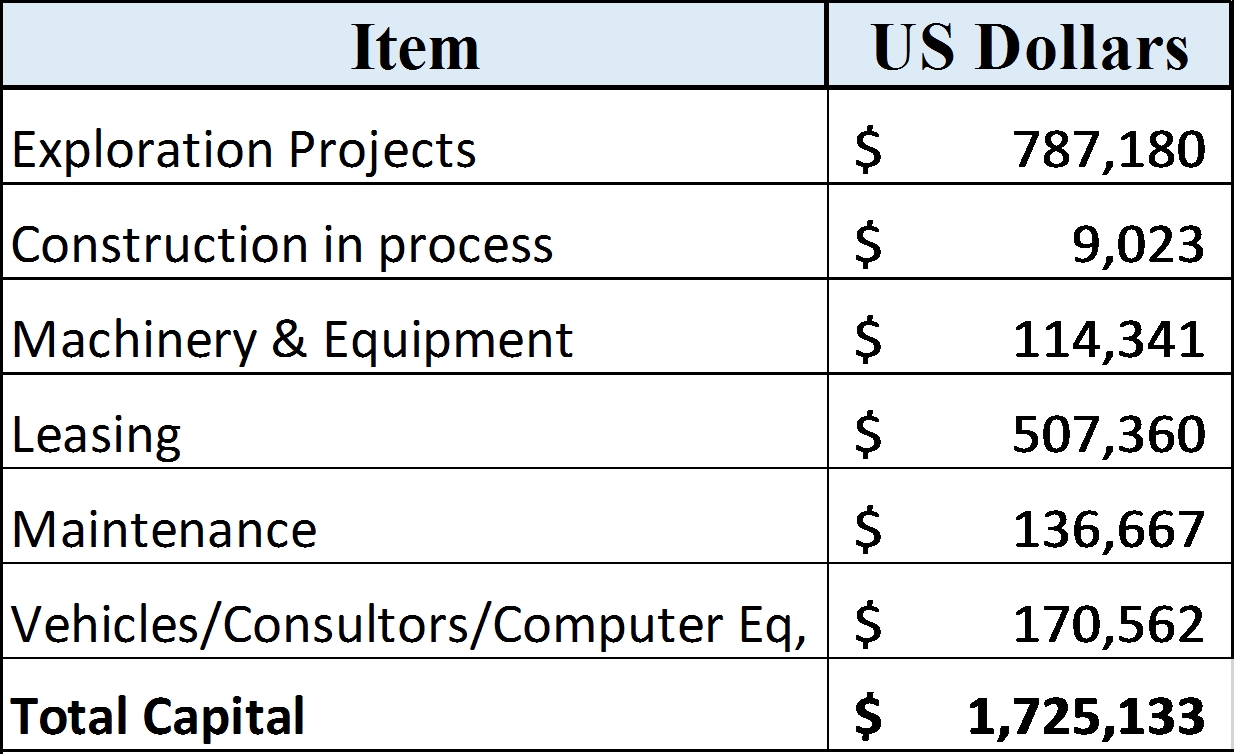

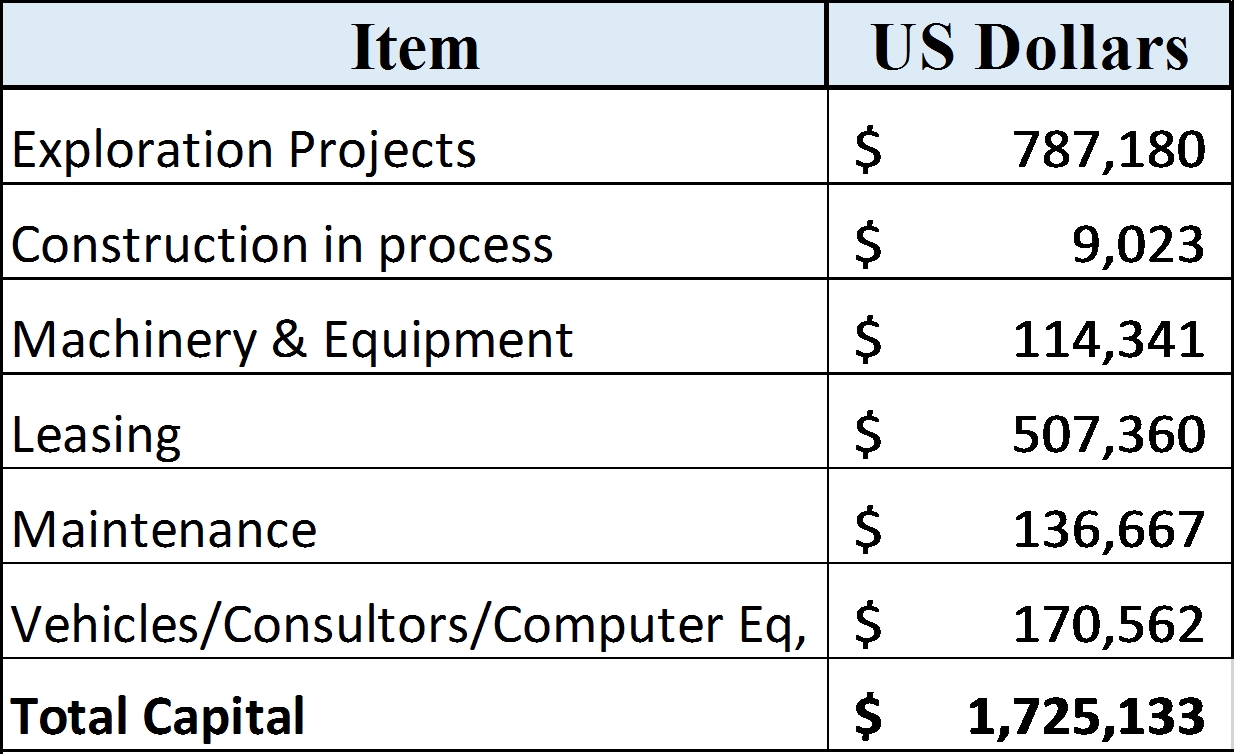

21.0CAPITAL AND OPERATING COSTS77

21.1Capital Costs77

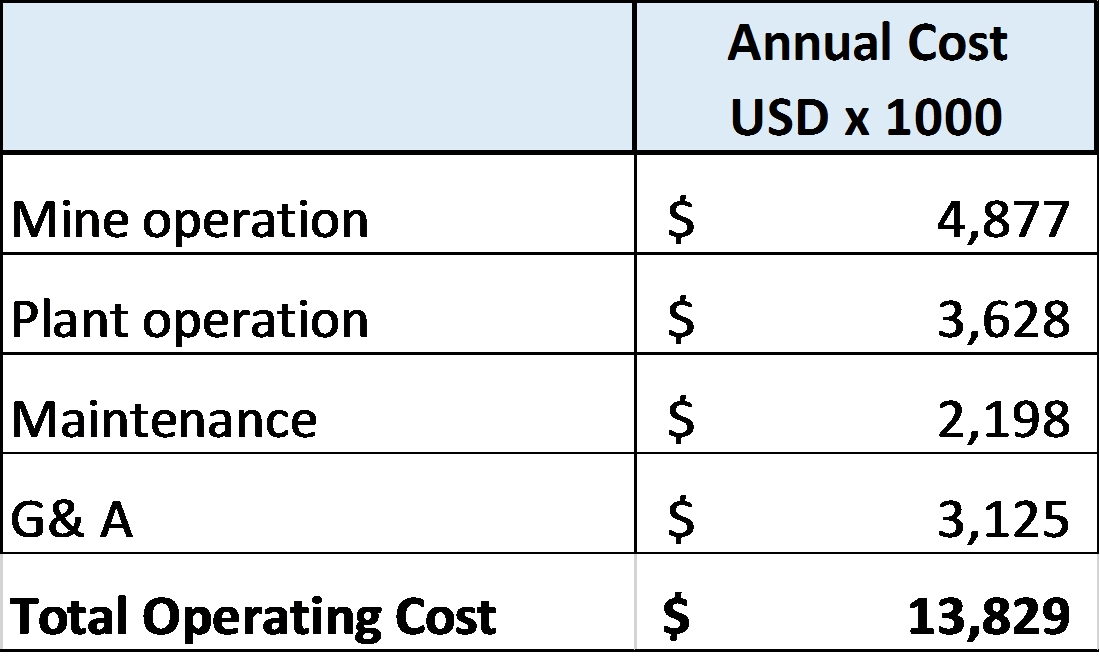

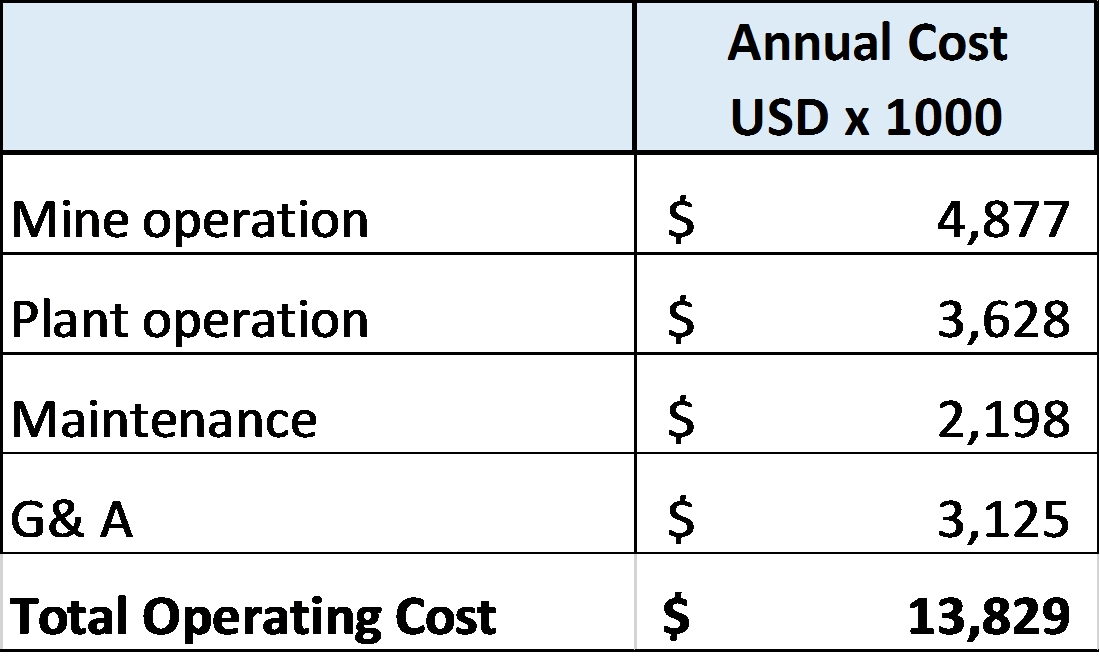

20.2Operating Costs77

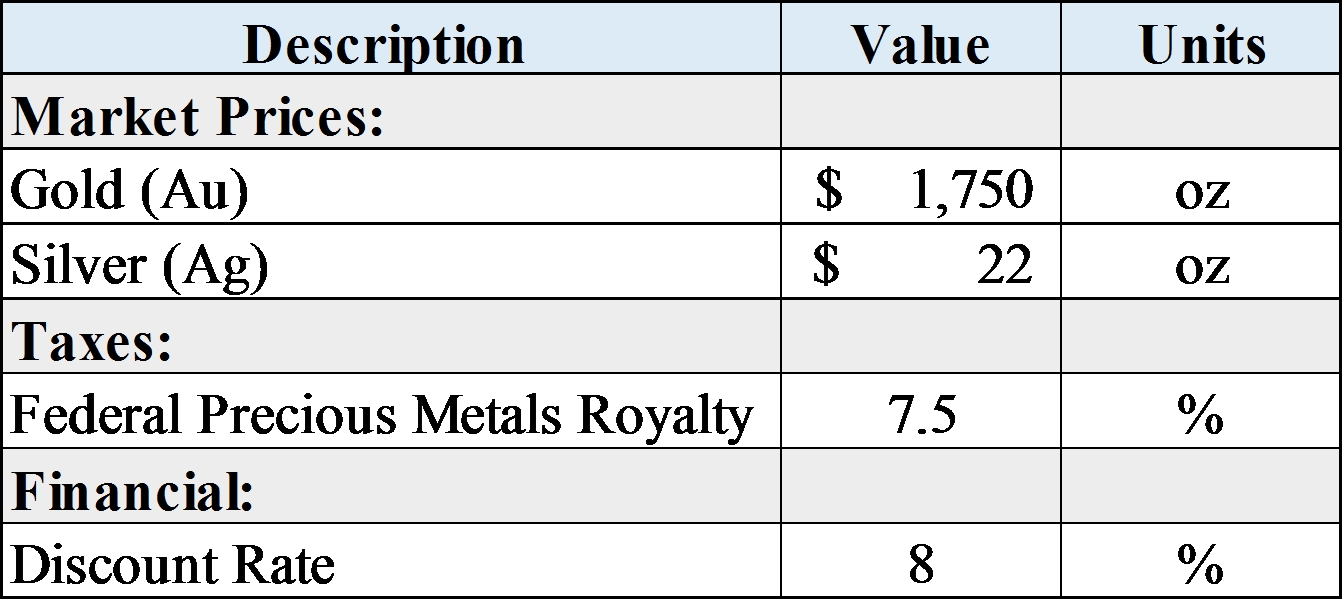

22.0ECONOMIC ANALYSIS78

23.0ADJACENT PROPERTIES80

24.0OTHER RELEVANT DATA AND INFORMATION80

25.0INTERPRETATION AND CONCLUSIONS80

25.1Geology and Resources80

25.1.1Data Verification80

25.1.2Mineral Reserve Estimates81

25.1.3Exploration81

25.2Conclusions81

26.0RECOMMENDATIONS82

26.1Geology82

26.1.1Database82

26.1.2Underground Sampling82

26.1.3QA/QC Sampling82

26.1.4Umpire Sampling83

26.1.5Resource Estimation83

26.1.6Exploration83

26.2Mining83

26.3Process83

26.4Environmental83

27.0REFERENCES84

Erme Enriquez, CPGJuly 18, 2022vi

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

LIST OF TABLES

Table 1-1:Mineral Resources Inferred and Indicated, San Martín Mine4

Table 1-2:Proven and Probable Mineral Reserves, Effective Date April 30, 20225

Table 4-1:San Martin Mines Concessions Controlled by CMPB12

Table 6-1:Summary of production for the San Martín Mine (from 1993 to April 30, 2022)18

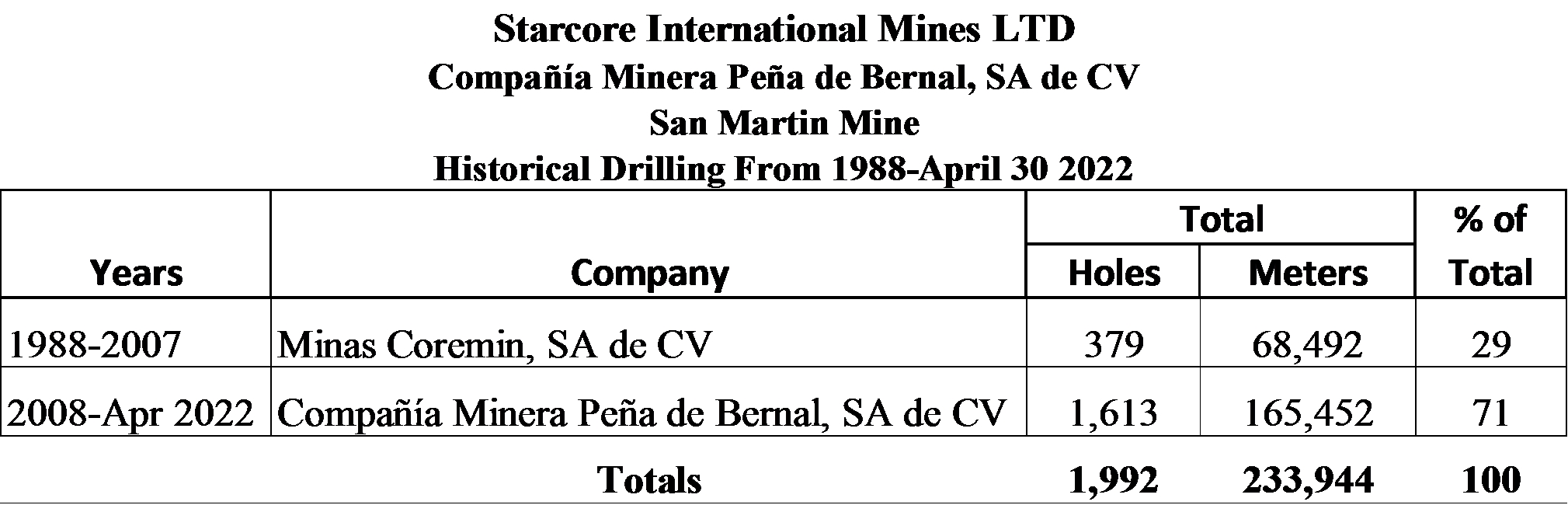

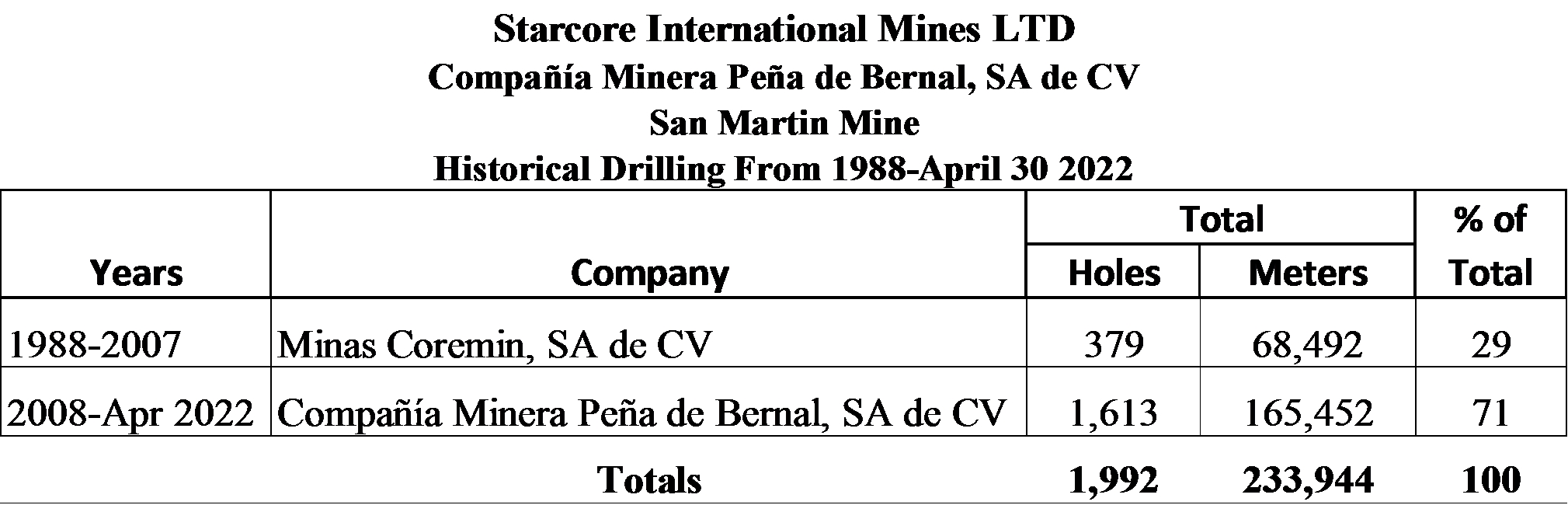

Table 10-1:Summary of drill hole programs performed by MICO and CMPB29

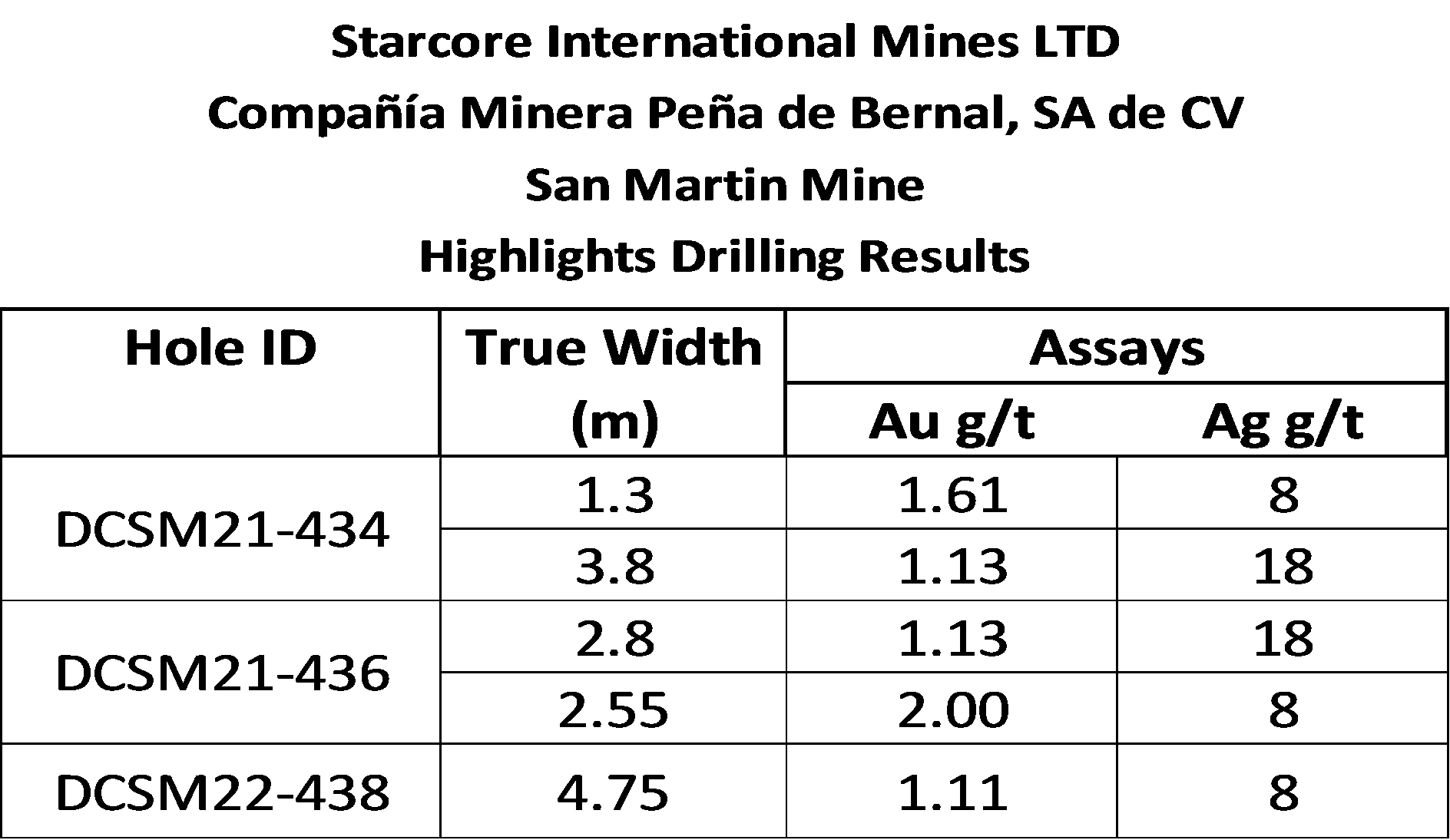

Table 10-2:Drill Results of the San Martin Body Extension31

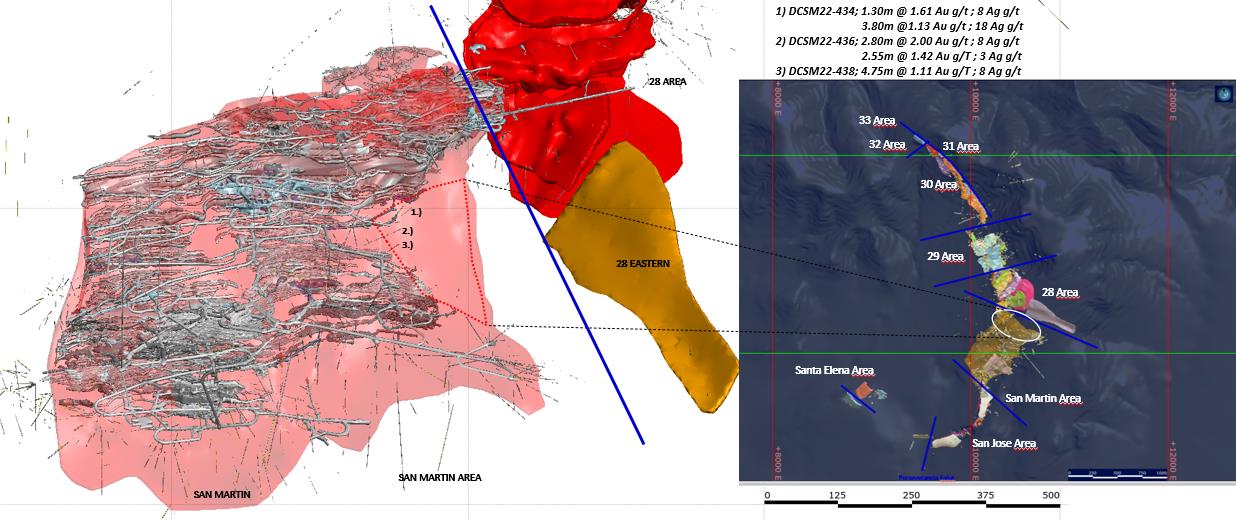

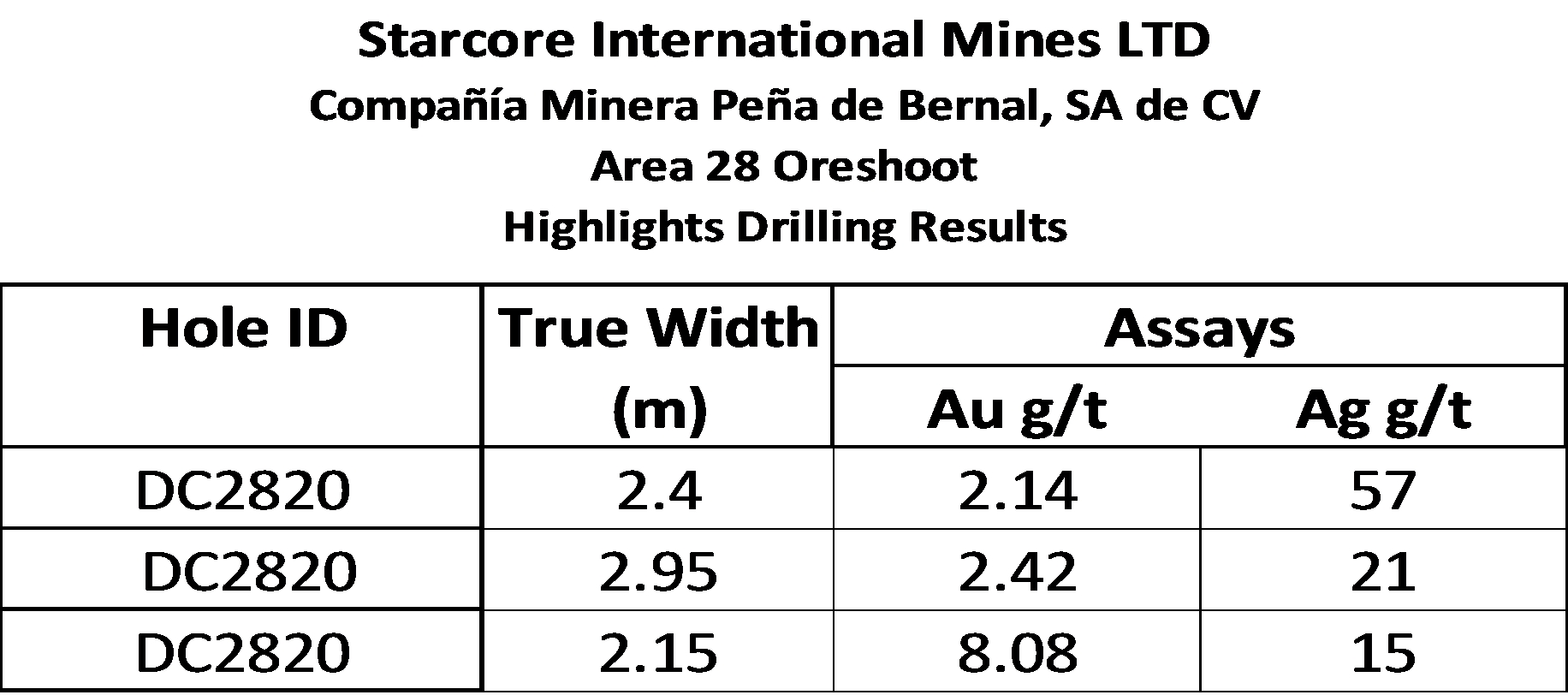

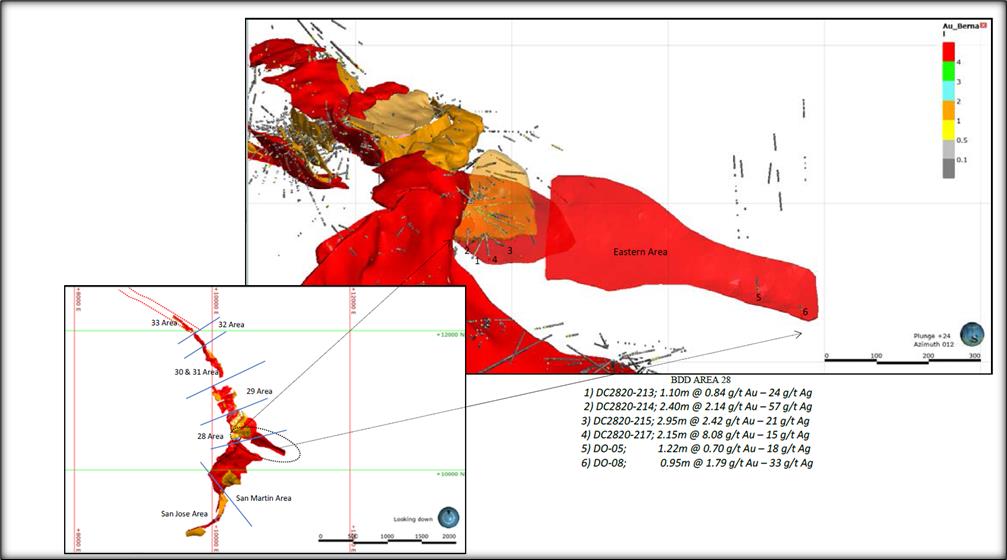

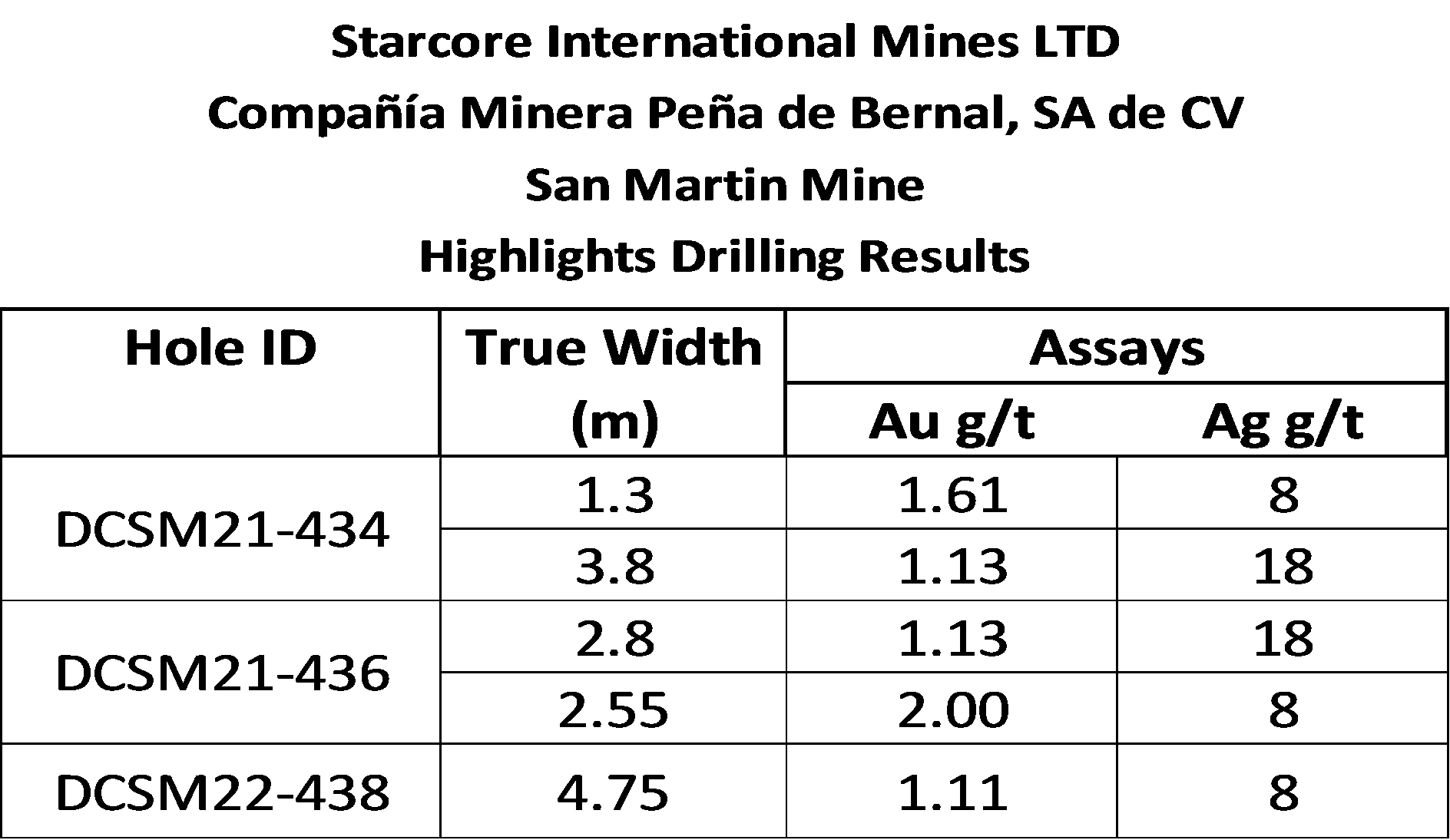

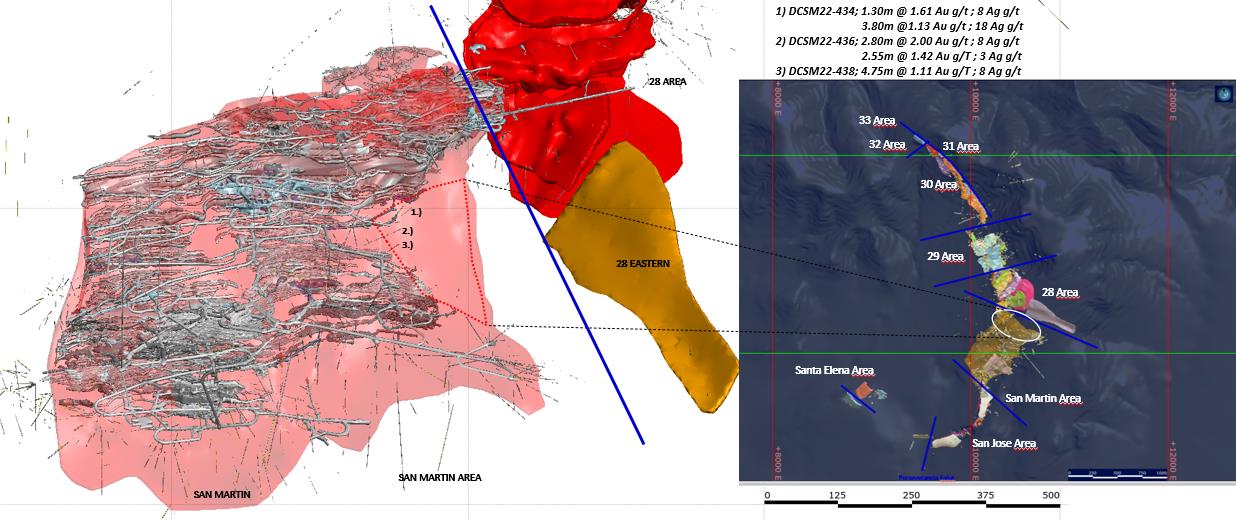

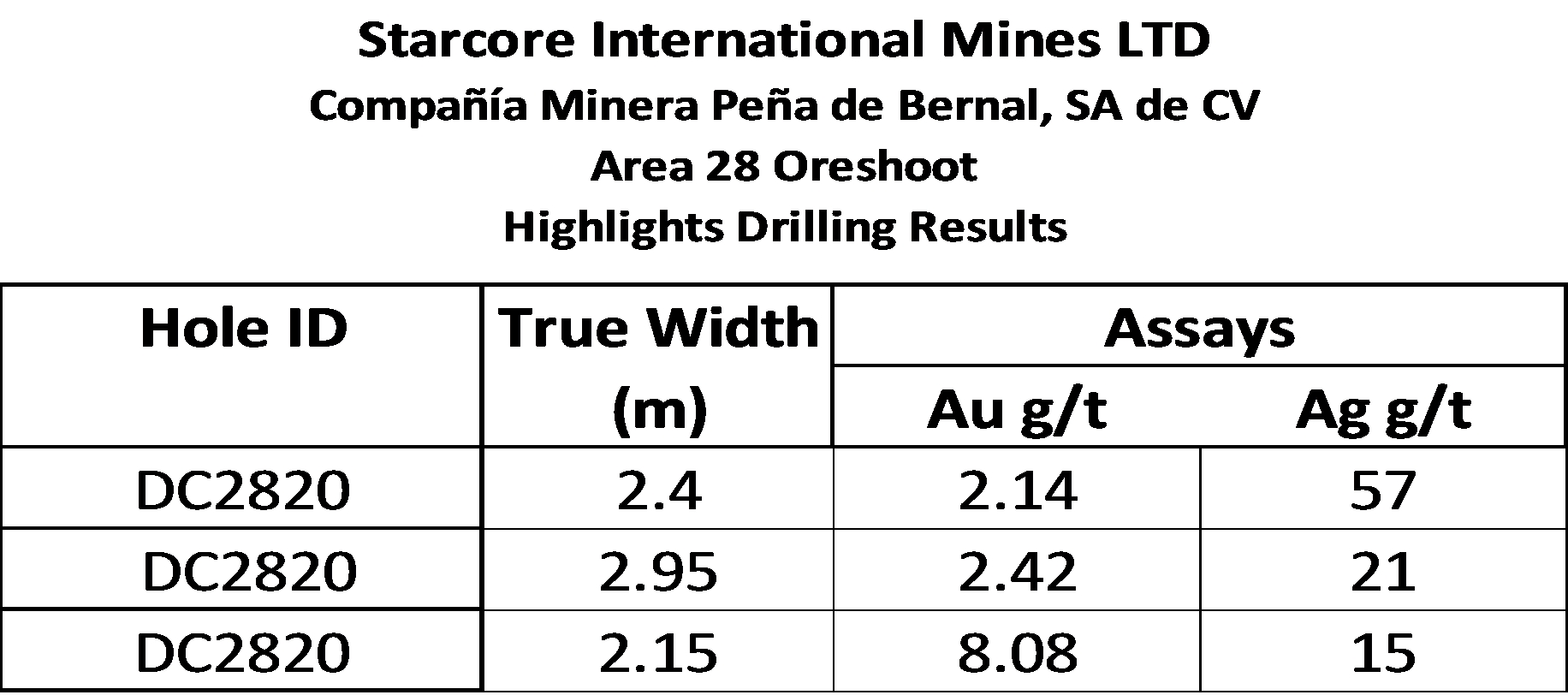

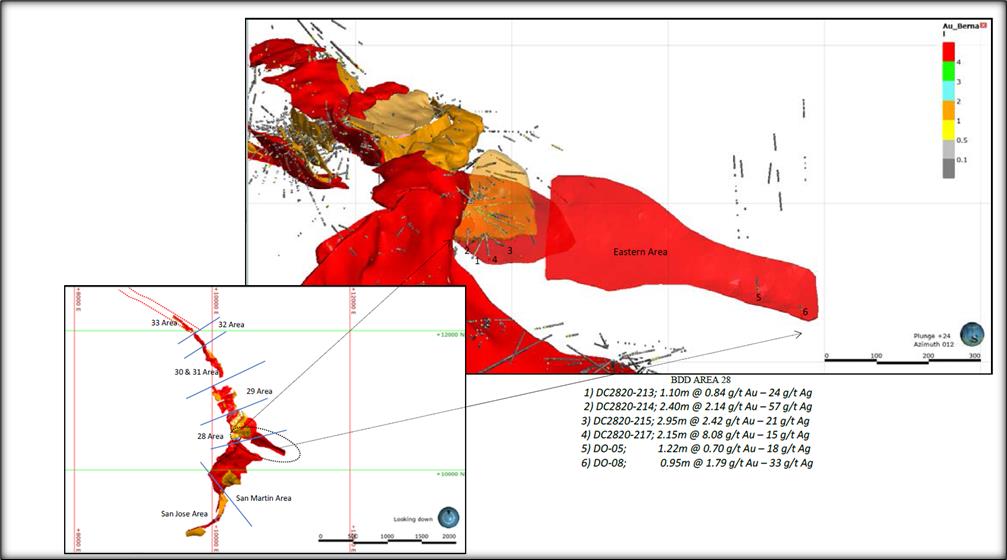

Table 10-3:Highlights of Drill Results at Area 28 Oreshoot32

Table 14-1:Inferred and Indicated Mineral Resources at the San Martín Mine49

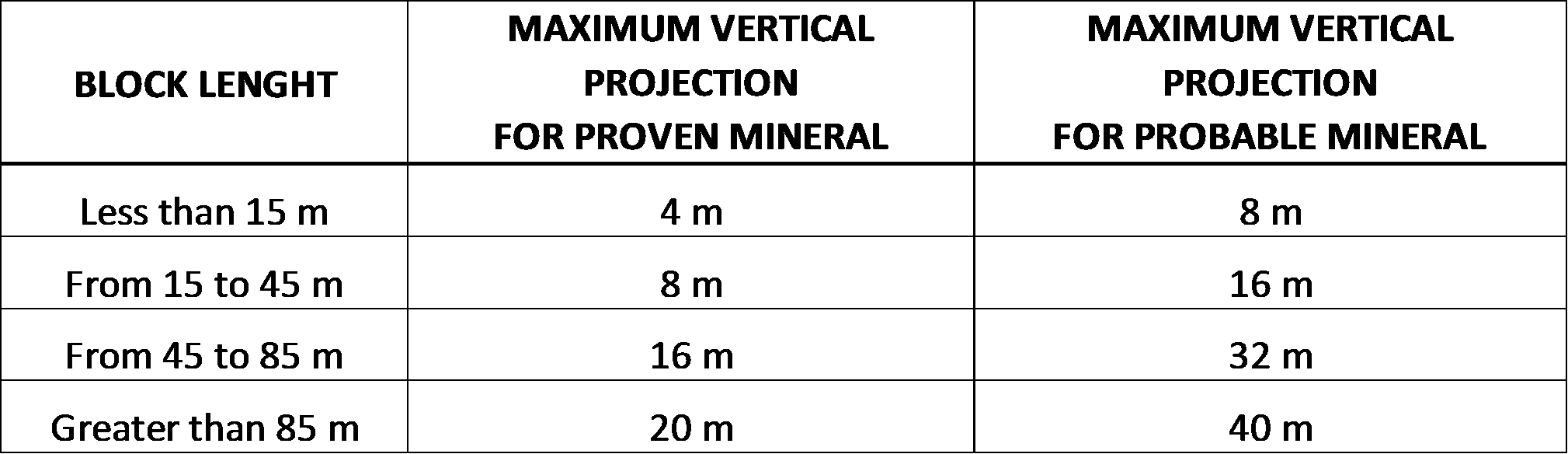

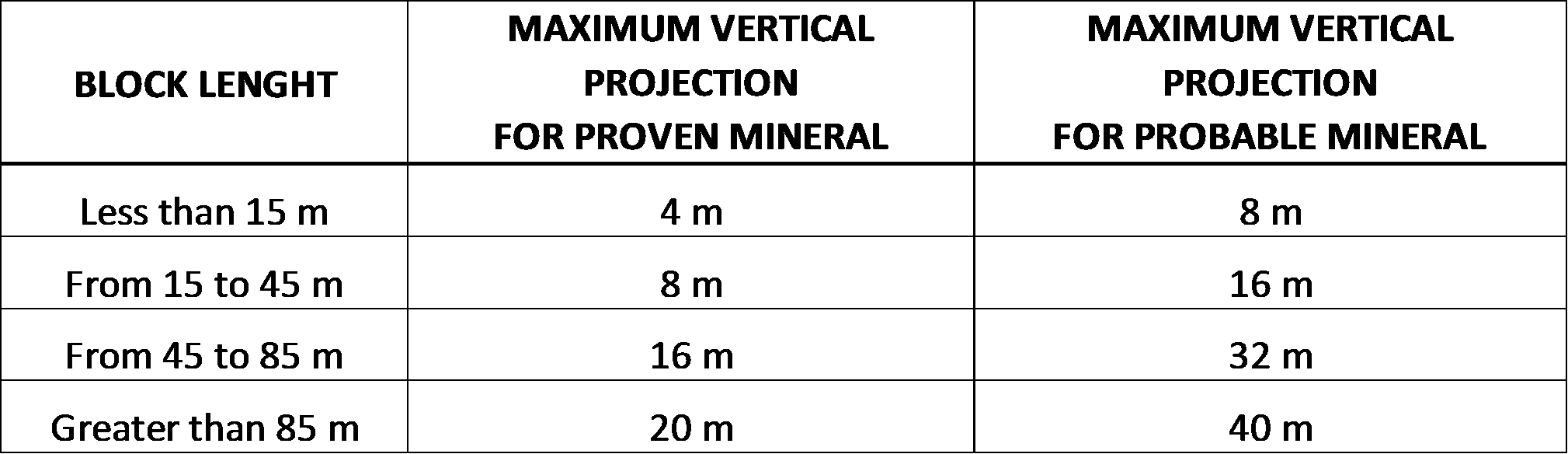

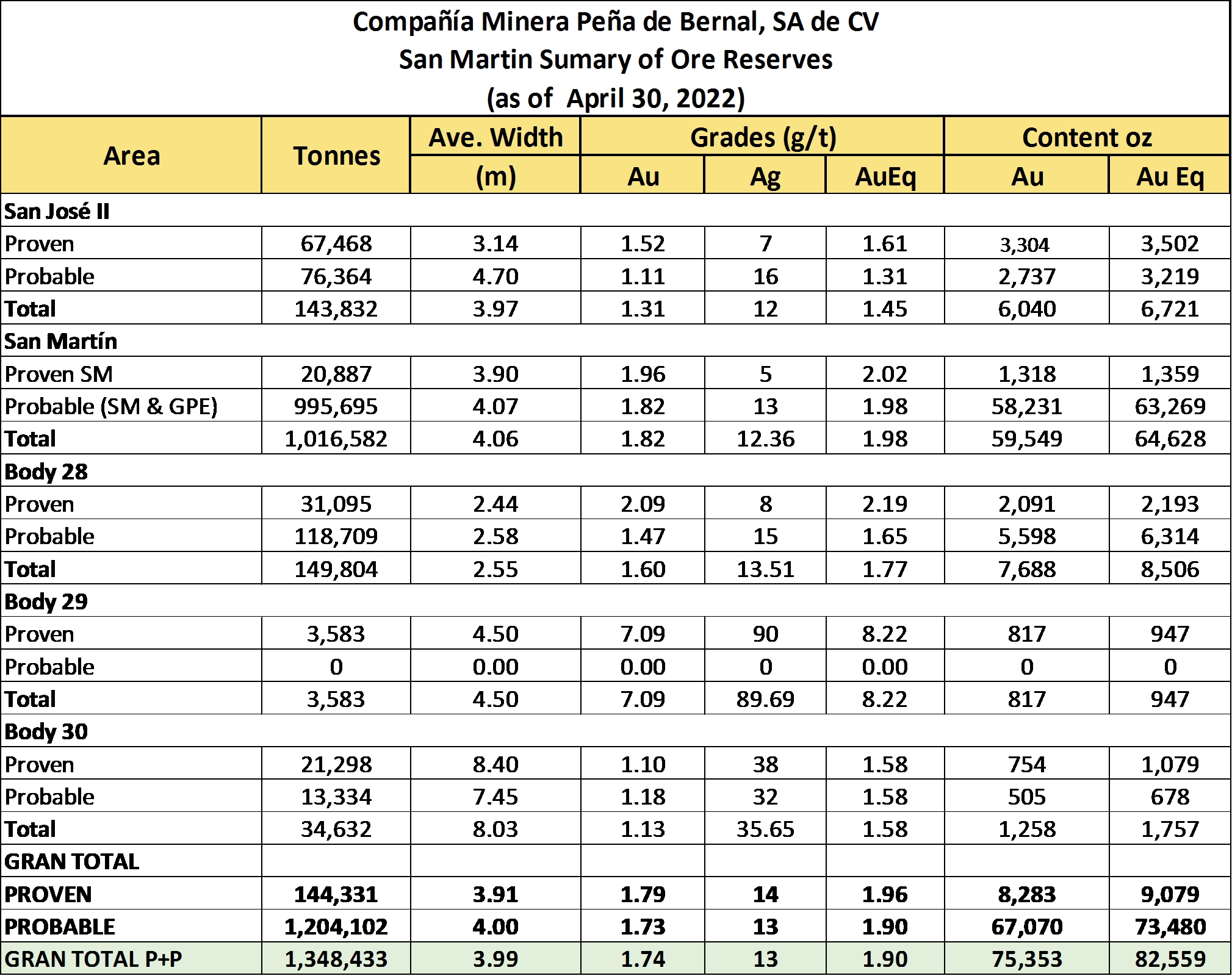

Table 15-1:Resources Transformed into Reserves from April 2017 to April 202252

Table 15-1:Proven and Probable Mineral Reserves, Effective Date April 30, 202253

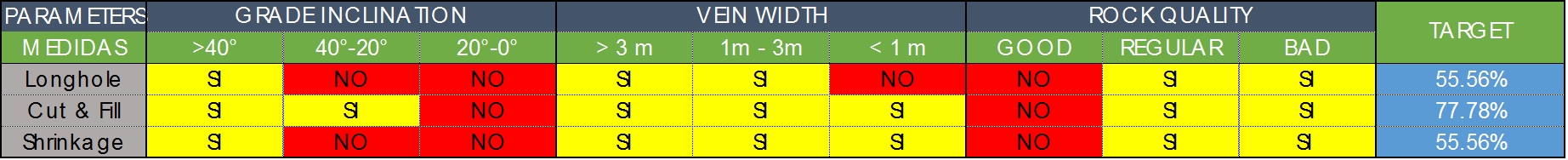

Table 16-1:Table for choosing the mining method59

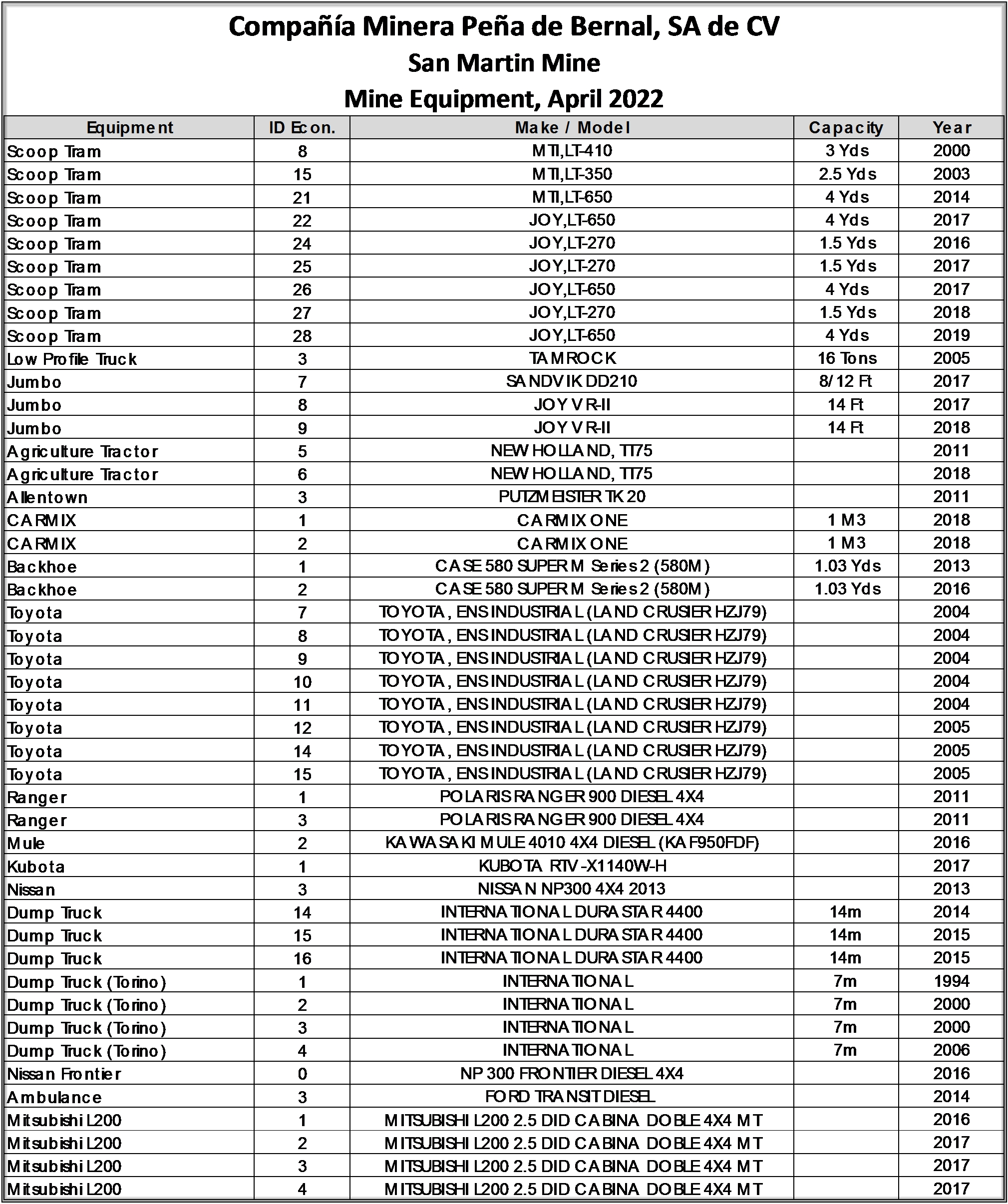

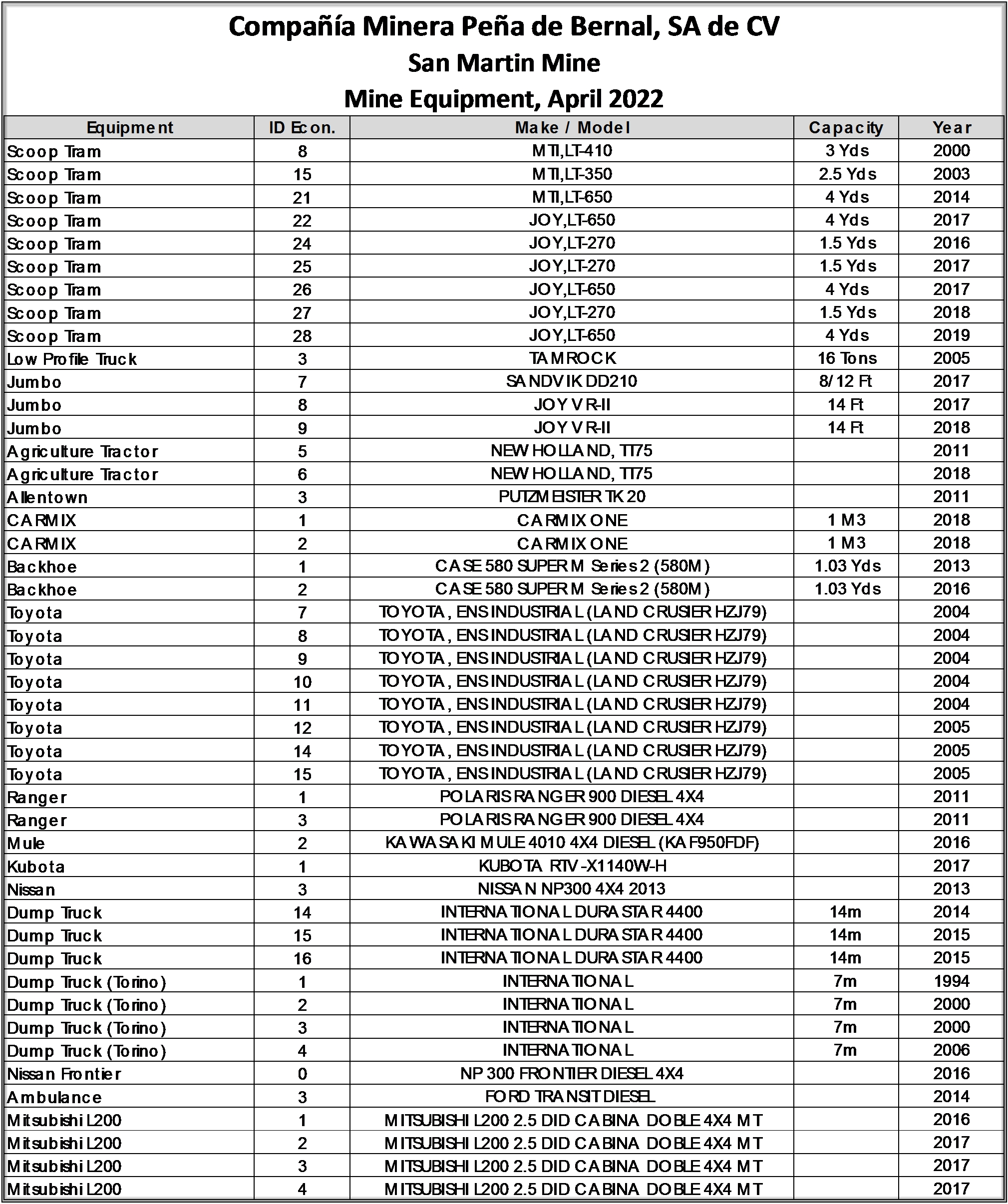

Table 16-2:List of Mining Equipment used at the San Martin Mine63

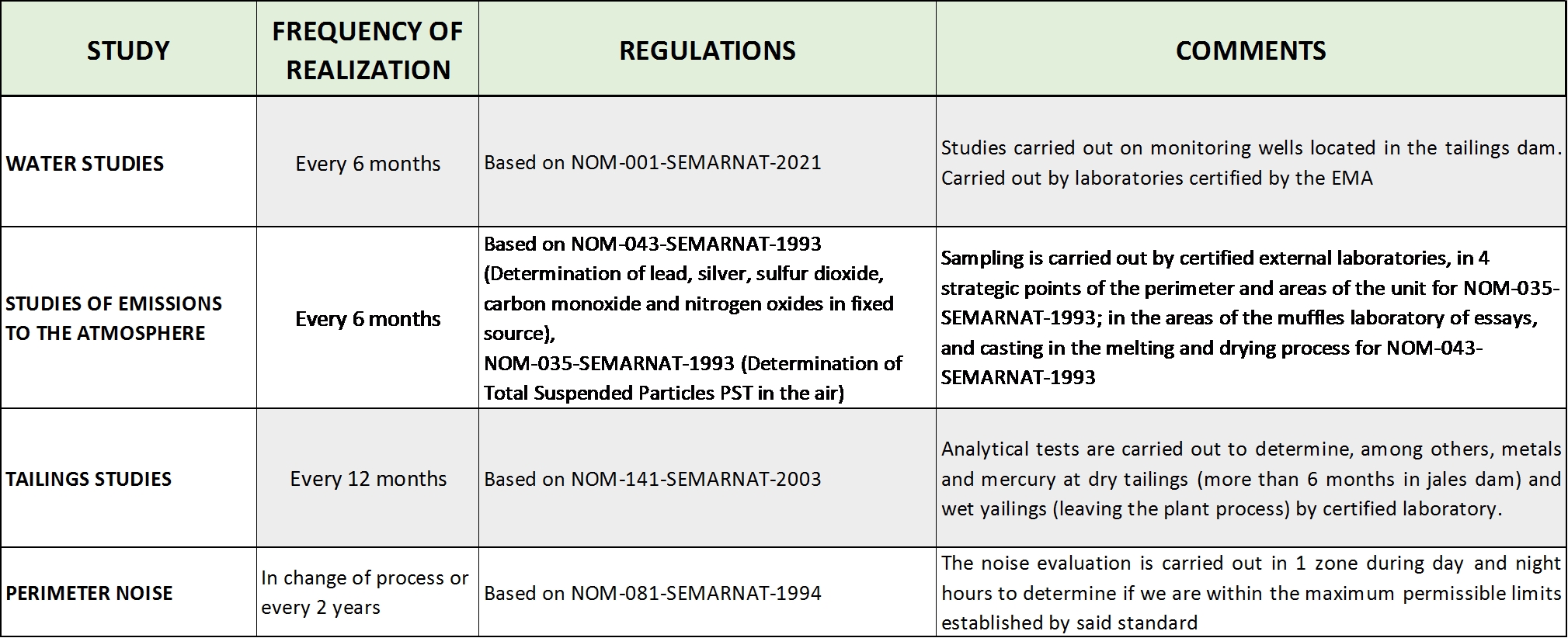

Table 20-1:San Martin Mine Recent Environmental Studies (Environmental Department)72

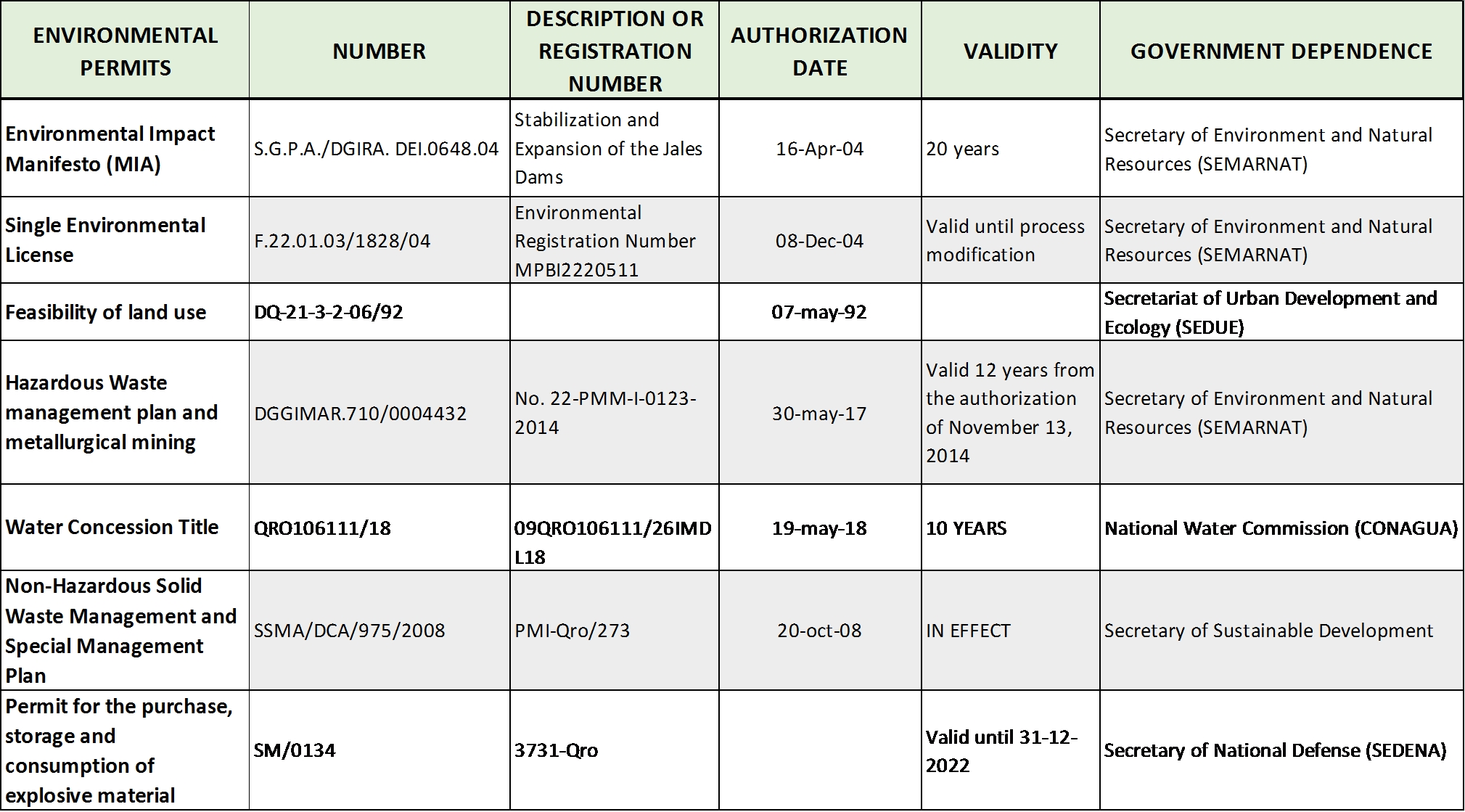

Table 20-2:List of Permits and Status (Environmental Department)73

Table 20-3:Neighboring community population at San Martin mine75

Table 21-1:San Martin Capital Costs77

Table 20-2:Mine Operating Cost Summary78

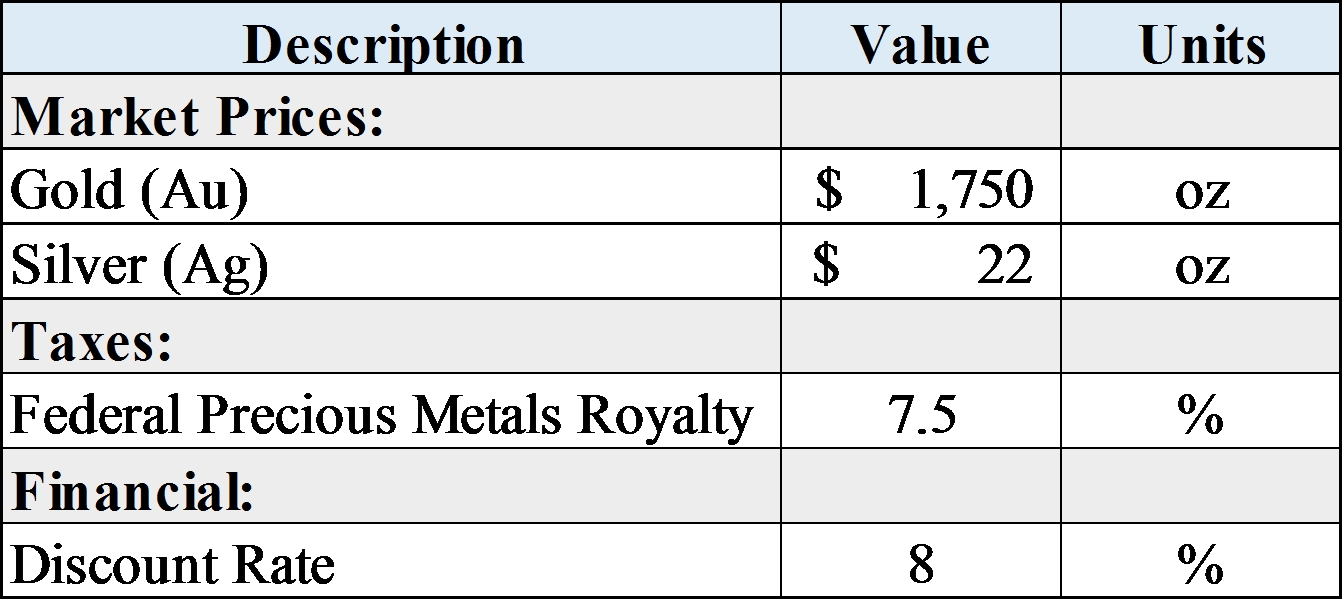

Table 22-1:Economic Model Input Parameters79

Table 22-2:LOM Plan Summary79

LIST OF FIGURES

Figure 4-1:San Martin Mine Location Map11

Figure 4-2:San Martin Mine and Surrounding Area Property Map13

Figure 5-1:Physiographic map of Mexico showing the location of the San Martin Mine between the Volcanic Axis, Sierra Madre Oriental, and the Central Plateau (after Raisz, 1964)16

Figure 7-1:Regional geological map of the surrounding San Martin Mine. Taken from Nuñez-Miranda, 200720

Figure 7-2:Generalized Stratigraphic Column of the San Martin Region21

Figure 7-3:Geologic Map of the San Martín Mine Project (After Labarthe, et. al, 2004)23

Figure 8-1:Generalized sketch of kinematic evolution and structural styles of fold-and-thrust faults in the San Martin Mine26

Erme Enriquez, CPGJuly 18, 2022vii

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

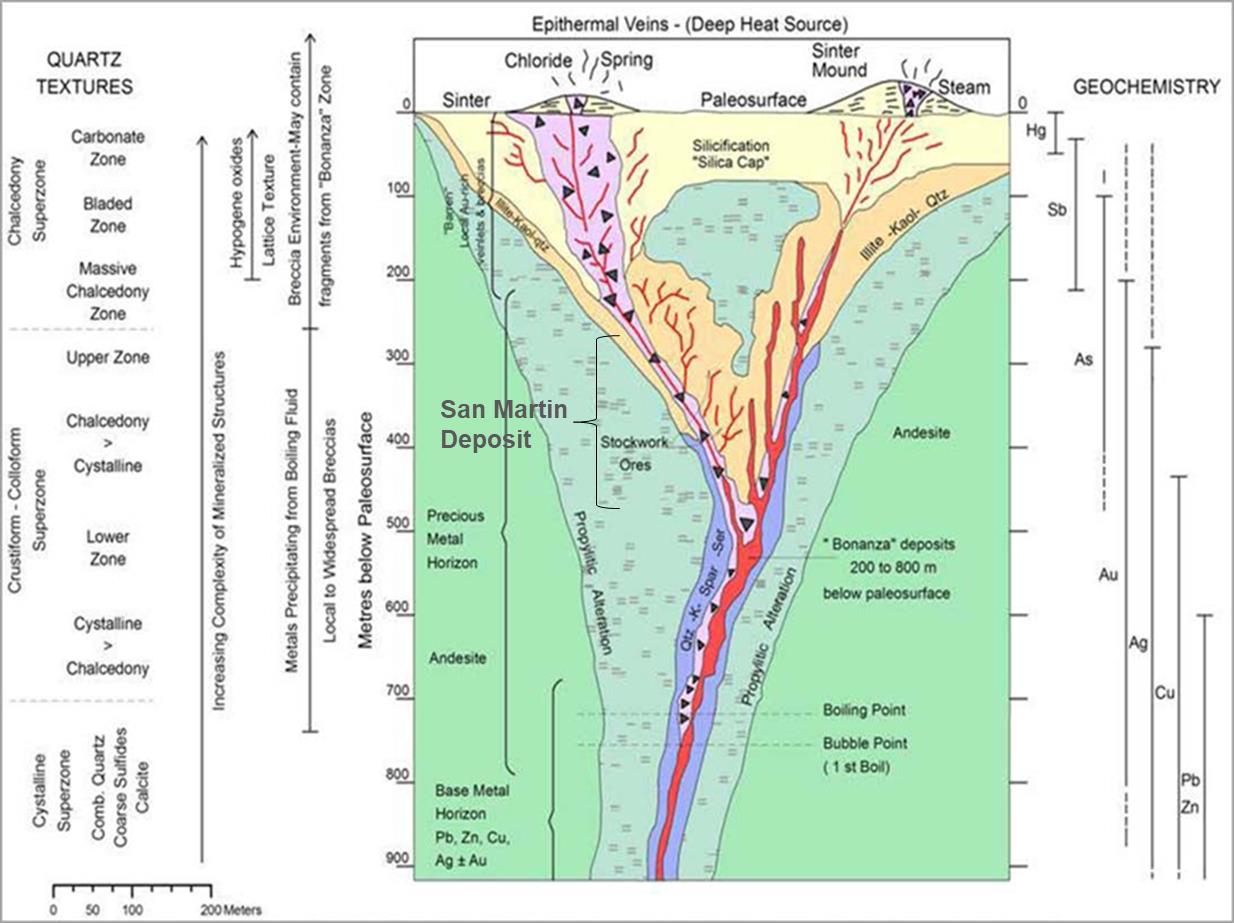

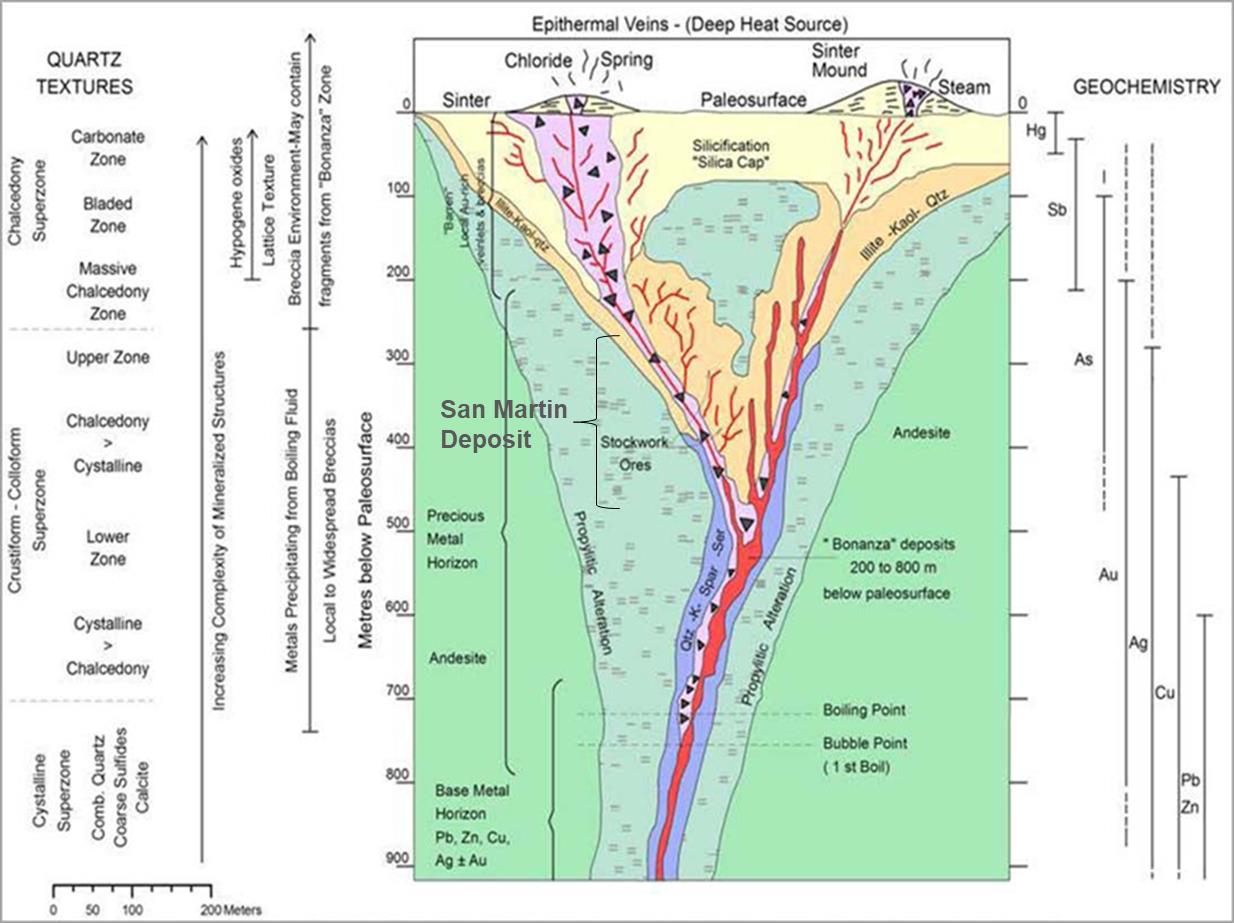

Figure 8-2:Schematic cross section showing the key geologic elements of the main epithermal systems and their crustal depths. Modified after Buchanan, 1982, Berger and Eimon, 1983, Hollister, 1985, Corbett and Leach, 1996, dated December 2013.27

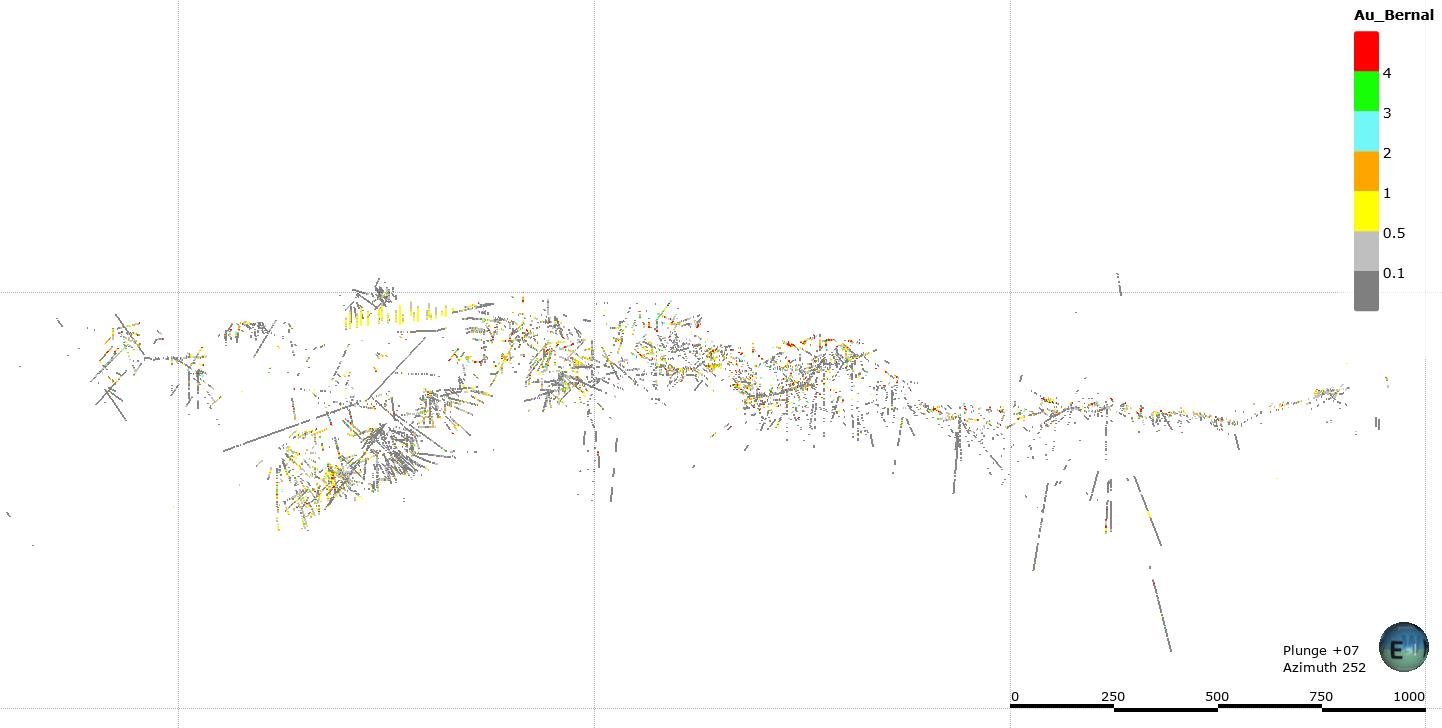

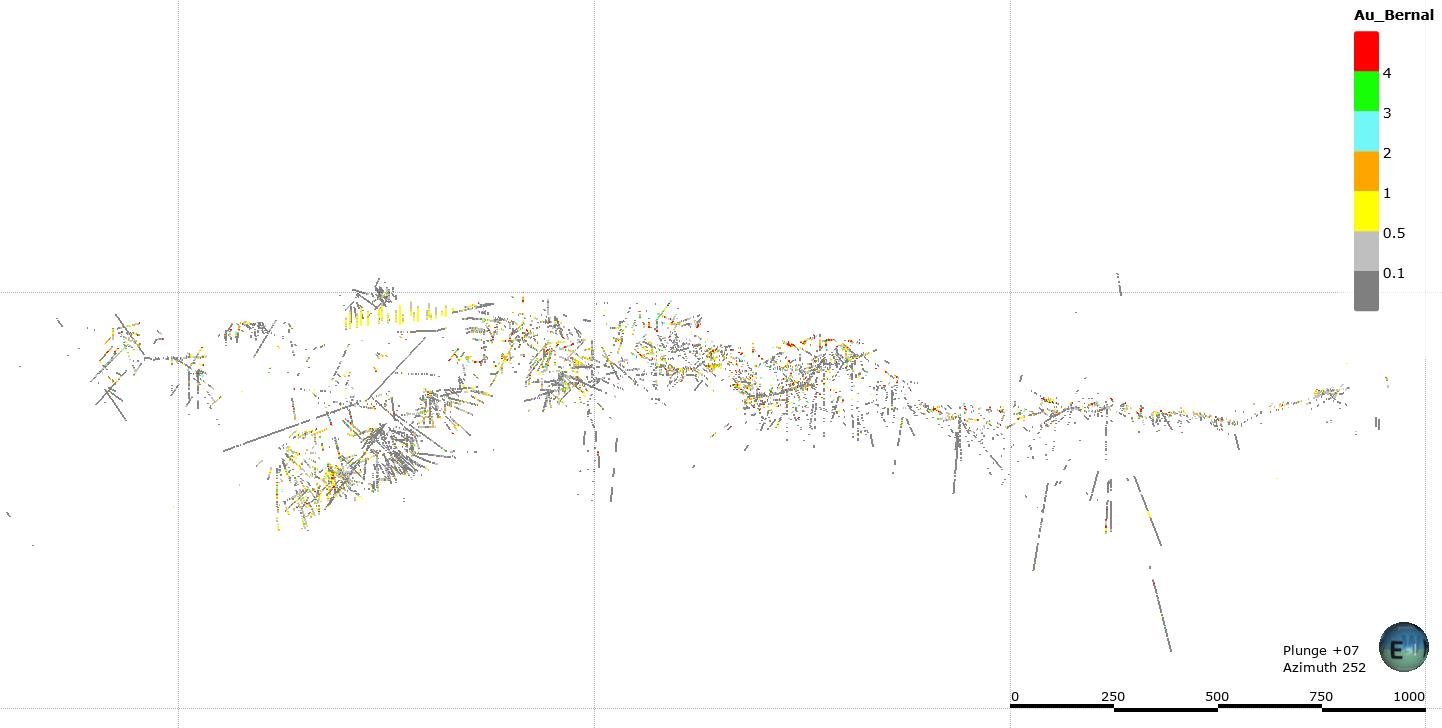

Figure 10-1:Map showing the swarm of drill holes done at the entire San Martin mine30

Figure 10-2:San Martin Orebody detected with Diamond Drill Holes31

Figure 10-3:Eastern extension of the 28 Orebody detected with diamond drilling32

Figure 13-1:Plant flow chart (from Processing Department)39

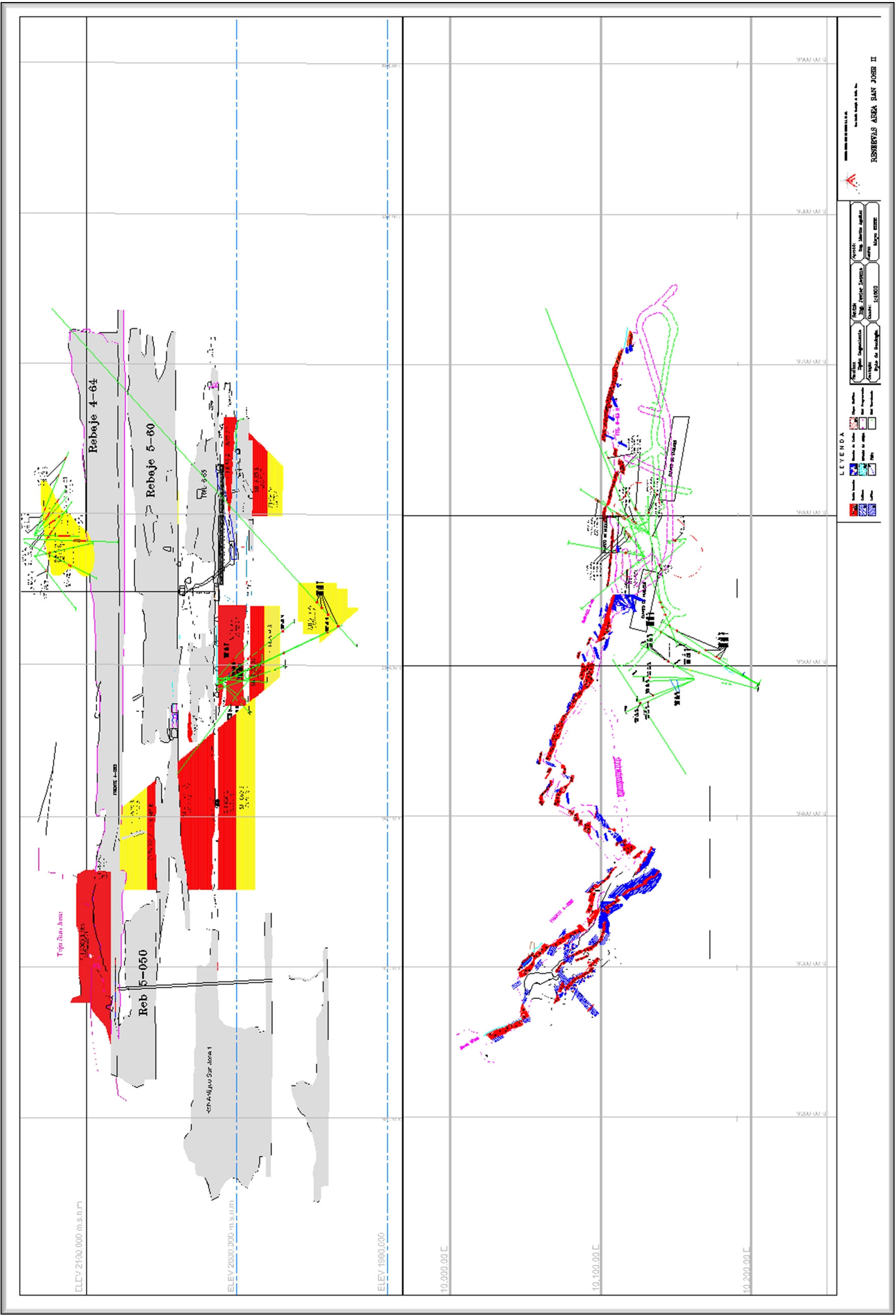

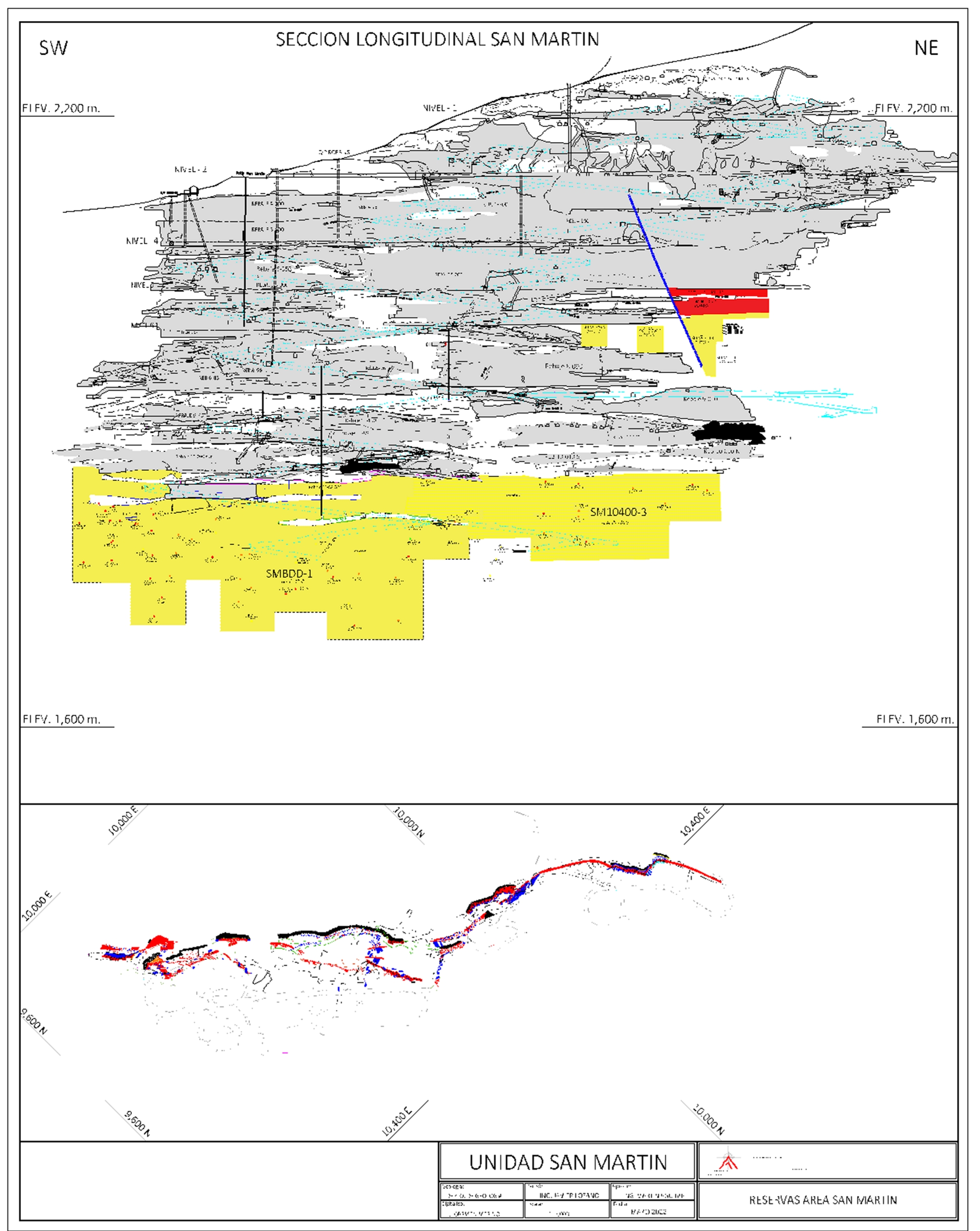

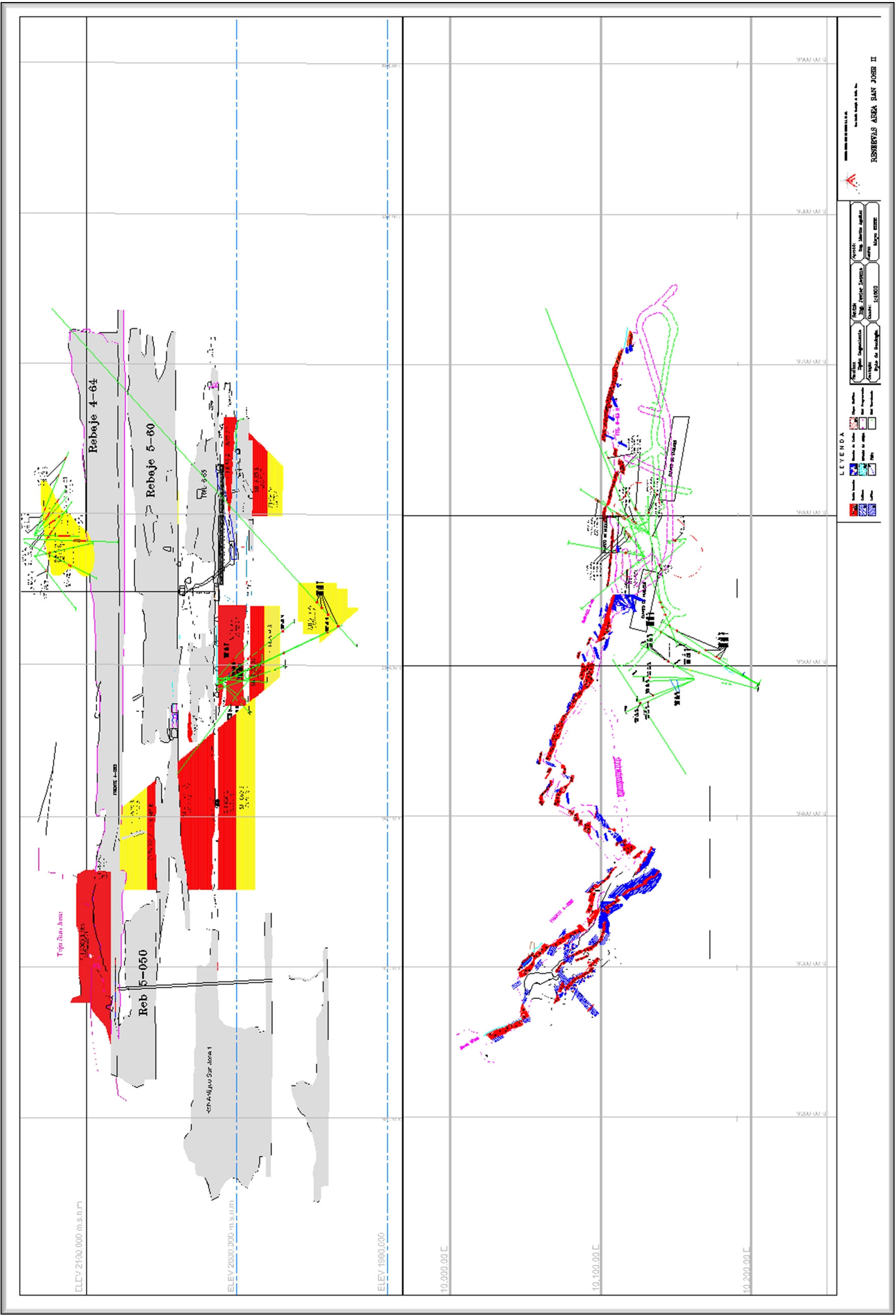

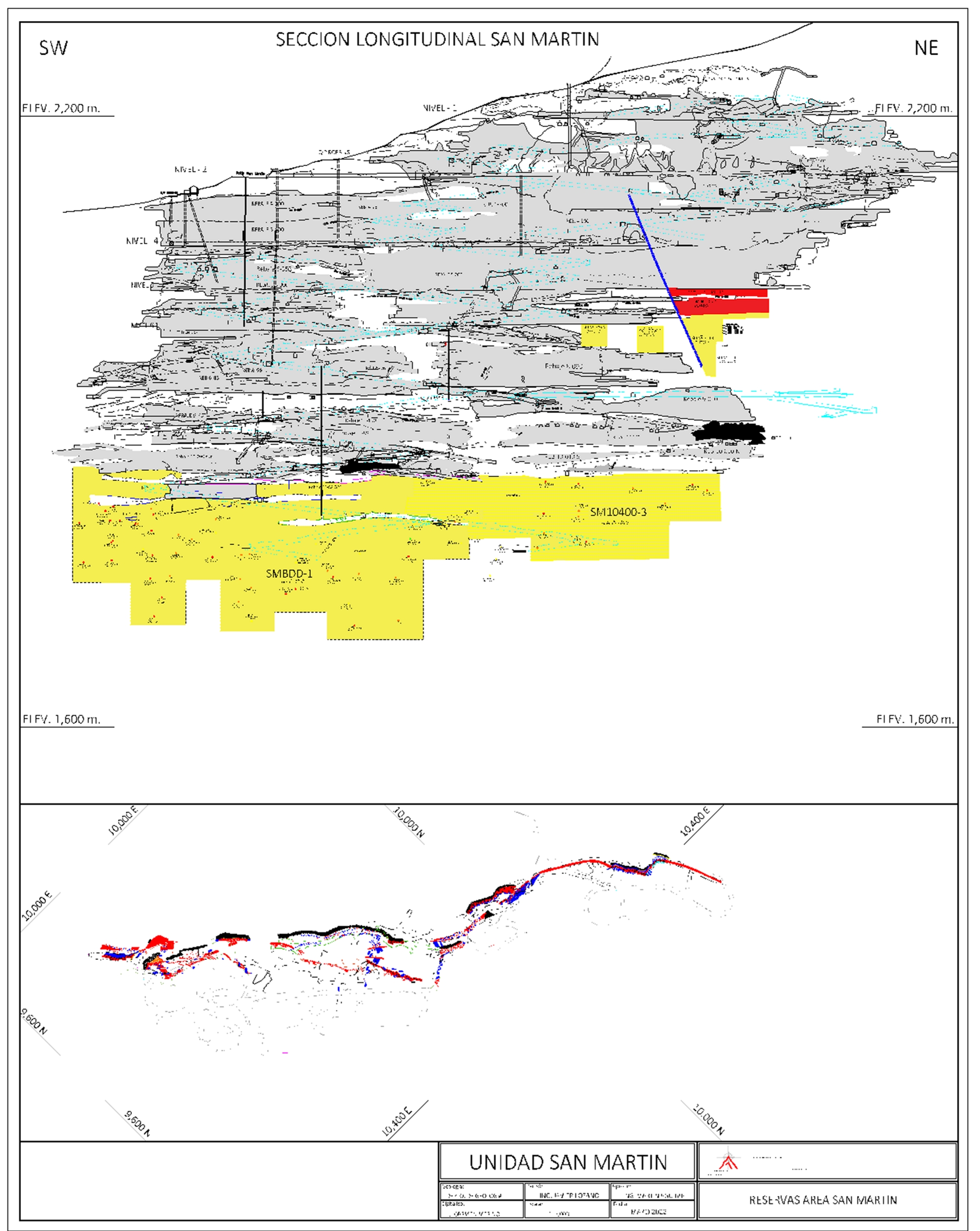

Figure 15-1:Typical vertical longitudinal section (VLP) showing the blocks of proven (red) and probable (yellow) ore in the San José II orebody55

Figure 15-2:Generalized vertical longitudinal section of the San Martin oreshoot showing the proven and probable reserve blocks56

Figure 16-1:Schematic of the overhead cut-and-fill mining method (from Mine Engineering, Survey & Planning, 2022)58

Figure 13-2:Ventilation circuit, at the San Martin Mine, by using Robbins raises ventilation intake and for exhausting (from Mine Engineering, Survey & Planning)61

Figure 16-3:Pumping systems in the entire San Martin Mine. Water is sent to surface for usage in the plant process ( from Mine Engineering, Survey & Planning)61

Figure 18-1:San Martin Infrastructure Map (from Planning Department)67

Figure 18-2:Portal of the incline for access to the San Martin mine68

Figure 18-3:General view of the processing plant at San Martin68

Figure 18-4:San Martin Tailings Dam, reforested69

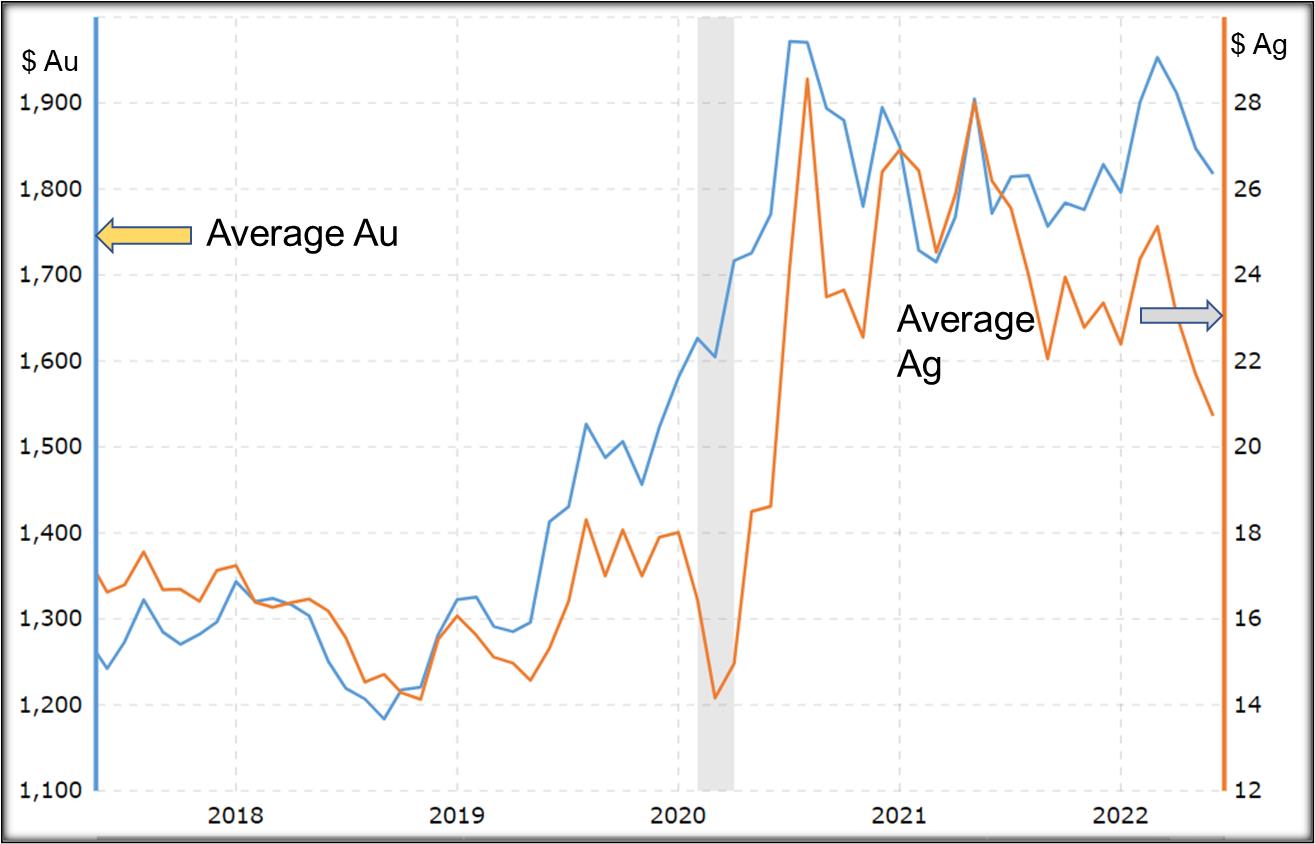

Figure 19-1:Chart showing the prices (in US Dollars) from May 2017 to April 202270

Figure 20-1:Part of the nursery with endemic species of plants ready to be planted76

Figure 20-2:Reforested of the NE side of the main Tailings Pond76

Erme Enriquez, CPGJuly 18, 2022viii

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

ACRONYMS AND ABBREVIATIONS

AbbreviationDescription Unit

Au Gold

AuEqGold equivalent

AgSilver

CFEComision Federal de Electricidad (Owned by the Federal Government)

CIMCanadian Institute of Mining

cmCentimetre

CMPBCompañía Minera Peña de Bernal

CPGCertified Professional Geologist

CRFCemented Rock Fill

COOChief Operating Officer

EEast

epepidote

Feiron

FAFire Assay

FSEFrankfurt Stock Exchange

ggram

g/tgrams per tonne

gptgrams per tonne

hahectare

HQdrill core size (63.5 mm)

ICPInductively Coupled Plasma

INEGIInstituto Nacional de Estadística y Geografía

IPinduced polarization

K-sparPotassium feldspar

kgkilogram

kmkilometre

kVAKilo-Volt Ampere

kWKilowatt

llitre

LOMLife of Mine

mmetre

m.a.s.l.metres above sea level

mmmillimetre

m2square metre

m3cubic metre

Mmillion

MaMillion years

MX$Mexican peso

NNorth

NENortheast

NI 43-101 National Instrument 43-101 Standards of Disclosure for Mineral Projects

NQdrill core size (47.6 mm)

NSRNet Smelter Return

Erme Enriquez, CPGJuly 18, 2022ix

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

NWNorthwest

Oxoxide

oztroy ounce

oz/tounce per tonne

PENBER Peña de Bernal Lab

P.EngProfessional Engineer

P.GeoProfessional Geologist

ppbparts per billion

ppmparts per million

QA/QCQuality Assurance/Quality Control

QtzQuartz

QPQualified Person

S.A. de C.V. Sociedad Anónima de Capital Variable

SE Southeast

SEMARNATSecretaría del Medio Ambiente y Recursos Naturales

Sersericite

SGspecific gravity

SRMstandard reference material

SIMStarcore International Mines LTD

SWSouthwest

tontonne

TSXToronto Stock Exchange

US$United States dollar

UTMUniversal Transverse Mercator

WWest

WGMWatts, Griffis & McQuat, Ltd

WGSWorld Geodetic System

%Percent

°Cdegree Celsius

Gold equivalent

AuEq(g/t)= Au(g/t)+( Ag(g/t)/79.5)

Contained ounces

oz Au=[(Au g/t X tonnes)/1000]X 32.1507

Erme Enriquez, CPGJuly 18, 2022x

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

1.0SUMMARY

1.1Introduction

Erme Enriquez (QP) was retained by STARCORE International Mines Ltd. (SIM) to complete an independent technical audit and to update the mineral resource and reserve estimates for the San Martin Mine (SM) located in Queretaro State, Mexico. The Mineral Reserve update has been performed by the San Martin´s mine personnel, all employees of SIM. SIM also provided the sections on geology, mining methods, project infrastructure, market studies and contracts, capital and operating costs, and economic analysis and a part of the conclusions and recommendations

Erme Enriquez is a Qualified Person under NI 43-101 and have no affiliation with SIM except that of independent consultant/client relationships. Mr. Enriquez has been an employee of Luismin-Wheaton River, first owner of San Martín, for more than 21 years and he participated in the supervision of the exploration and exploitation of San Martin from 1993 to 2003. Mr. Enriquez is responsible for assembling all items of the technical report and for preparing the Mineral Resource Estimate.

This report presents the results of QP efforts and is intended to fulfill the Standards of Disclosure for Mineral Projects according to Canadian National Instrument 43-101 (“NI 43-101”). This report was prepared in accordance with the requirements and guidelines set forth in Companion Policy 43-101CP and Form 43-101F1 (June 2011), and the mineral resources and reserves presented herein are classified according to Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards - For Mineral Resources and Mineral Reserves, prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council on May 10, 2014. The mineral resource and mineral reserve estimates reported here are based on all available technical data and information as of April 30th, 2022.

1.2Property Description and Ownership

The San Martin mine is located 47 kilometres, in straight line, northeast of the Queretaro City, Queretaro State, on local road No.100 and about 250 kilometres NW of Mexico City, near the towns of Bernal, Tequisquiapan and Ezequiel Montes. The San Martin mine underground mine has been in continuous operation since 1993.

The San Martin mine complex consists of 8 mining claims that cover 12,991.7805 hectares. The total annual land-holding costs are estimated to be US$105,190 dollars. All mineral titles and permits are held by Compañía Minera Peña de Bernal, S. A. de C. V. (CMPB), a direct, wholly owned subsidiary of SIM. A 3.0% net smelter returns royalty (“NSR”) is payable to Servicio Geológico Mexicano (“SGM”- Mexican Geological Survey) on the claims San Martin Fracc. A, Title 215262, San Martin Fracc. B, Title 215263, and San Martin Fracc. C, Title 215264.

1.3History

The deposit was discovered in the 18th century and high-grade mineralization reportedly was exploited by the Spaniards for approximately 40 years; however, no production records exist. The first records show the Ajuchitlán Mining and Milling Company produced an estimated 250,000 tonnes at a grade of 15 g Au/t and 100 g Ag/t from1900 to 1924.

Erme Enriquez, CPGJuly 18, 20221

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

In 1982, the Mexican government, through the Council of Mineral Resources (CRM) staked a mining claim of 6,300 hectares which covered the area of the mine in its central part. In 1986 Minas Luismin negotiated with the CRM an option in the mining claims of his property for a payment of US $ 250,000 dollars and a royalty of 5%, which latter was reduced to 3% in 1996. Luismin was purchased by Wheaton River in 2003 and operated the mine until 2008, when SMI acquired the 100% of the rights to the property.

1.4Geology and Mineralization

The San Martín gold-silver district hosts classic, medium-grade gold-silver, epithermal vein deposits characterized by low sulphidation mineralization and adularia-sericite alteration. The San Martin veins are typical of most other epithermal silver-gold vein deposits in Mexico in that they are primarily hosted in the Upper Cretaceous black limestone and calcareous shales of the Soyatal-Mezcala Formation. Tertiary Lower Volcanic series of rhyolite flows, pyroclastics and epiclastics, overlain the sediments.

Mineralization at San Martín occurs in association with an epithermal low sulphidation, quartz-carbonate, fracture-filling vein hosted by a structure trending approximately N40°-60°E, dipping to the 50° to 90° to the southeast.

The San Martin structure has been known in distinct stages of exploration and has adopted several names, San José, San José II, San Martín, Cuerpo 28, Cuerpo 29, Cuerpo 30, Cuerpo 31, Cuerpo 32 and Cuerpo 33. The structure itself is offset by a series of faults of northeast trending that divides the oreshoots. The structure behaves vertical at the San José and San Martin areas (Tronco) and becomes flatter from Cuerpo 28 to 31 (Mantos), and mineralization follows the planes of the folded rocks.

The San Martin vein itself has been known underground traced for 2 km along trend, with widths between 1.5 to 30 metres and averages approximately 4.0 m. A secondary mineralized vein is located, both in the footwall and hangingwall, of the San Martin vein, on the western limb of the local fold that contains the mineralization. This structure is the Santa Elena and represents a good target for exploration to the NE and SE of San Martin.

1.5Mineral Resource Estimate

The mineral resource estimation for the San Martin Mine was completed following the requirements of Subpart 1300 of Regulation S-K (“Subpart 1300”) and align with Canada’s National Instrument 43-101 (“NI 43-101”) for which original estimates were prepared. The modeling and estimation of the mineral resources were completed on June 10, 2022, under the supervision of Erme Enriquez, qualified person with respect to mineral resource estimations under S-K 1300. The effective date of the resource estimate is April30, 2022.

The San Martin resources are classified in order of increasing geological and quantitative confidence in Proven and Probable, Inferred and Indicated categories in accordance with the “CIM Definition Standards for Mineral Resources and Mineral Reserves” (2014) and therefore NI 43-101, as is the Inferred Resources category.

In the years prior to mining by CMPB reserve and resource estimates were based on the assumptions and subject to rules defined by Luismin many years ago. In recent years, with the involvement of

Erme Enriquez, CPGJuly 18, 20222

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

various professionals, it was recognized that mining methodology was changing due to factors such as:

| • | A greater percentage of production coming from narrow to wide steeply dipping vein structures. |

| • | Sub-horizontal Mantos mineralized structures that were somewhat narrower than historical Mantos. |

| • | Reopening and scavenging of the footwall mineralization in old stopes, where lower grade mineralization was not mined during times of lower gold prices. |

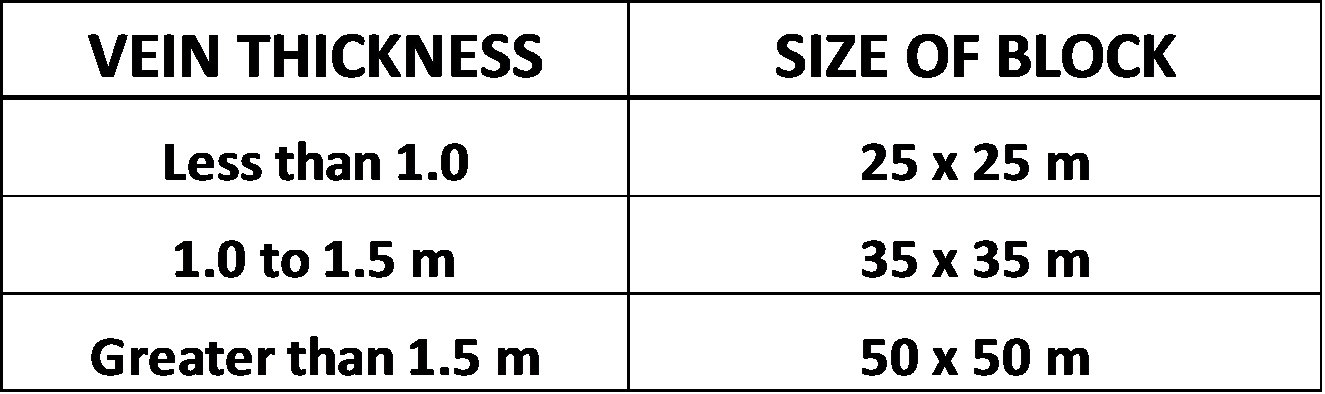

Based on the above mining changes and incorporating mining experience over the last eight years some of the original Luismin assumptions have been modified to improve tonnage and grade estimation for reserves. The assumptions used in this estimate are:

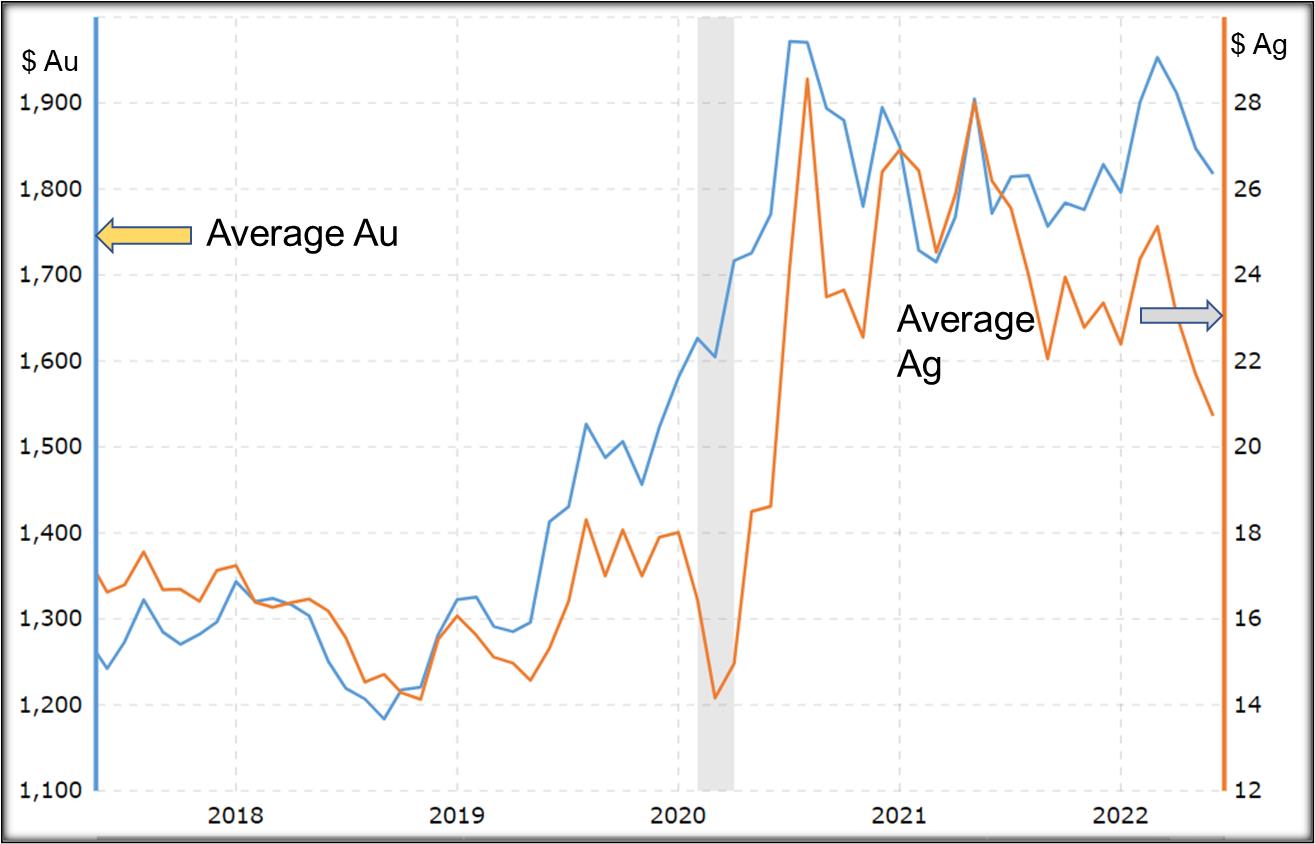

| • | A gold price of $1750 per ounce. |

| • | A silver price of $22.00 per ounce. |

| • | First quarters of 2022 operating costs of US$69.30 per metric dry tonne. |

| • | Average metallurgical recoveries of 86% for gold and 55% for silver. |

| • | Using the above price and cost assumptions the resultant calculated cutoff grade is approximately 1.41 g/t Au equivalent. |

| • | Specific gravity of 2.6 g/cm3 has been applied to all calculated mineralized volumes. |

| • | Mining dilution is applied to in situ mineralized zones, and recovery factors are applied to these diluted blocks using the following factors: |

Mining dilution of 20% of zero grade in horizontal mineralized zones (Mantos) mined by room and pillar.

| a) | Mining dilution of 20% of zero grade in steeply dipping mineralized zones mined by cut and fill. This dilution factor is modified by first applying a minimum 2-meter mining width to narrow zones. |

| b) | Remnant pillars left in room and pillar stopes are typically 20% of the total tonnage, i.e., 80% extraction. This recovery factor has been applied to sub horizontal mineralized zones. |

In addition to these factors reserve grades are lowered to reflect mined grades in ore blocks that have sufficient historical production to establish that mined grades are similar than estimated from exploration data. The reserves and resources estimated in this report are based on data available up until April 30, 2022.

The mineral resources reported here are classified as Measured, Indicated and Inferred according to CIM Definition Standards.

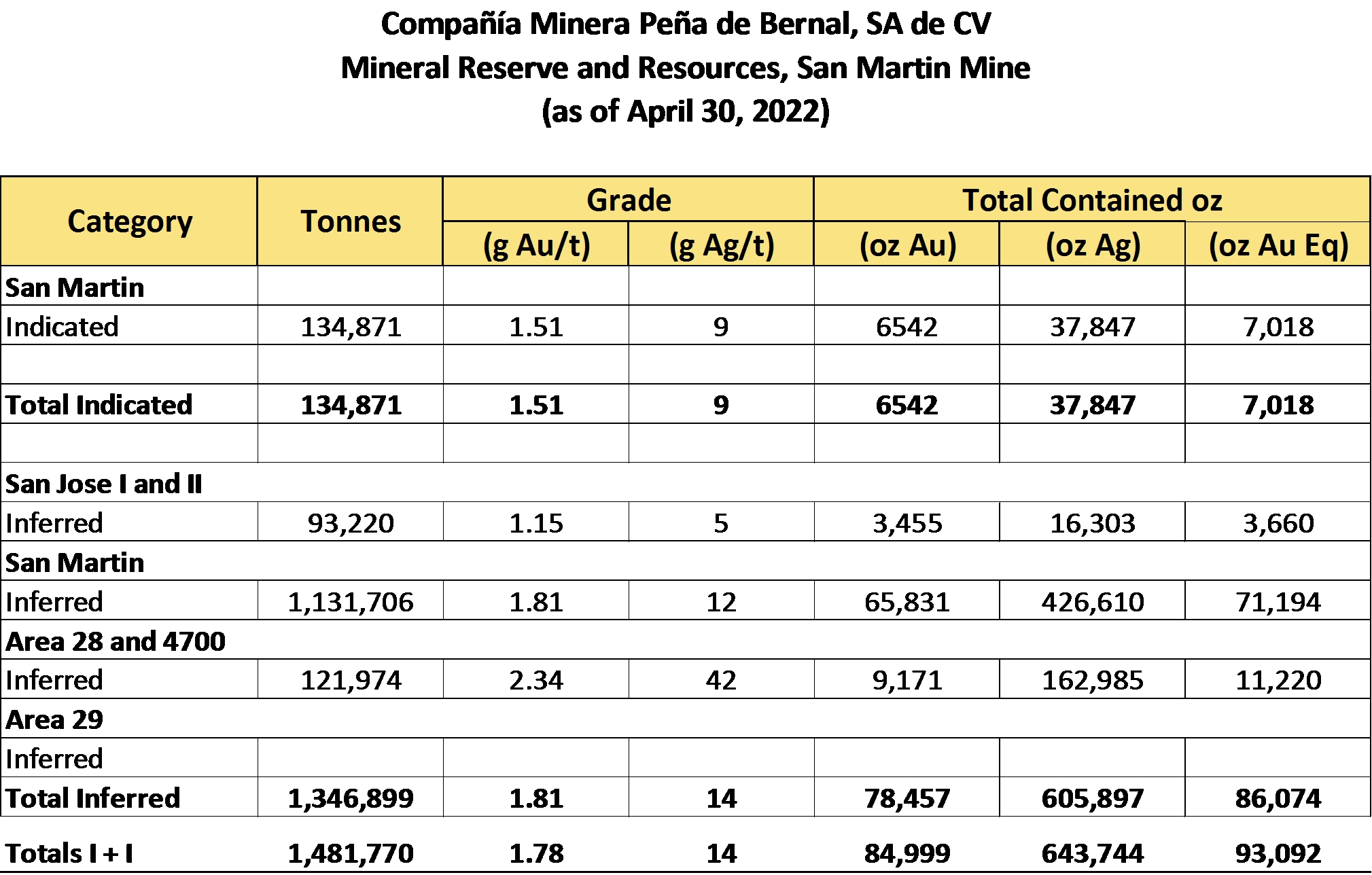

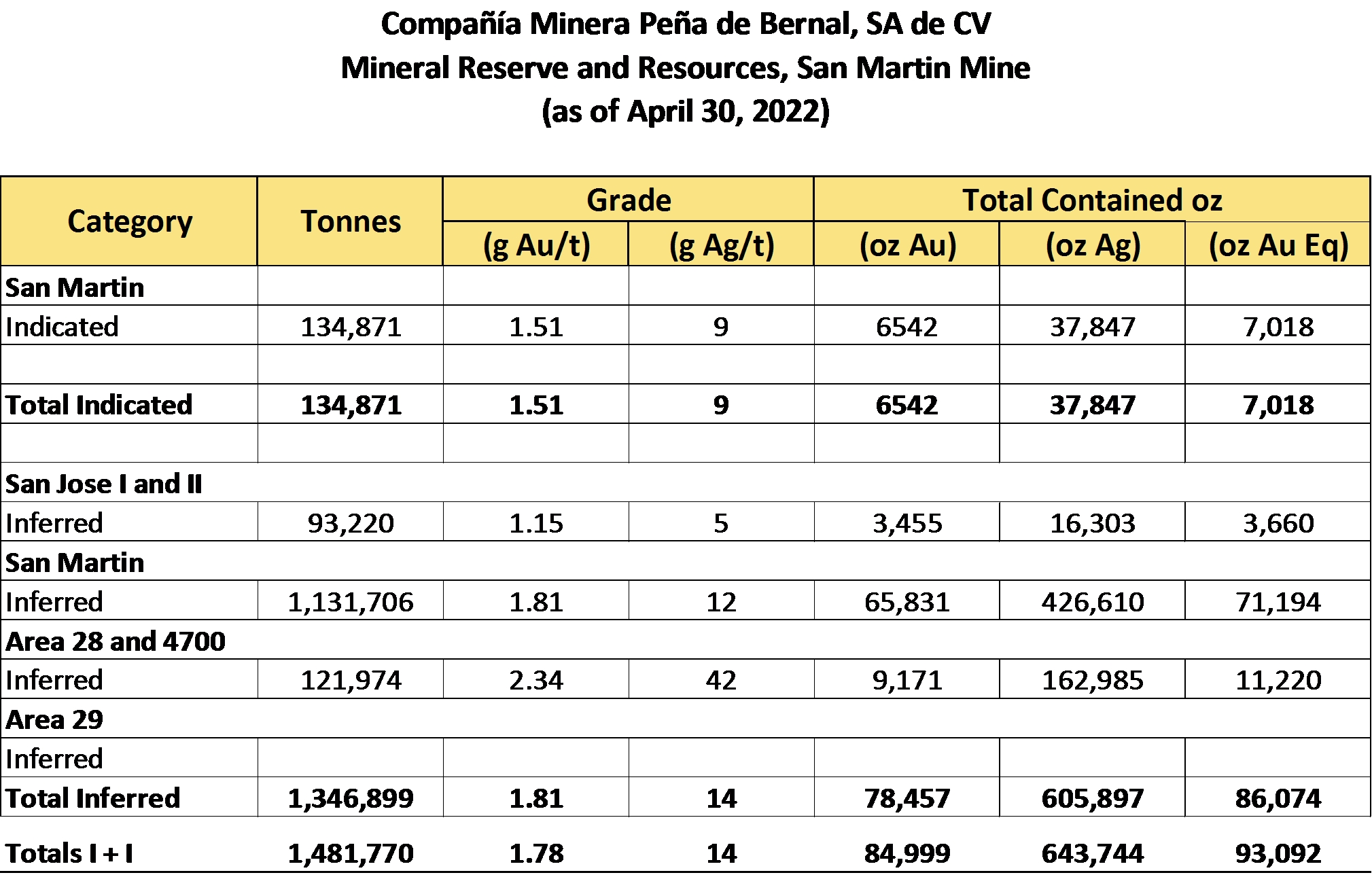

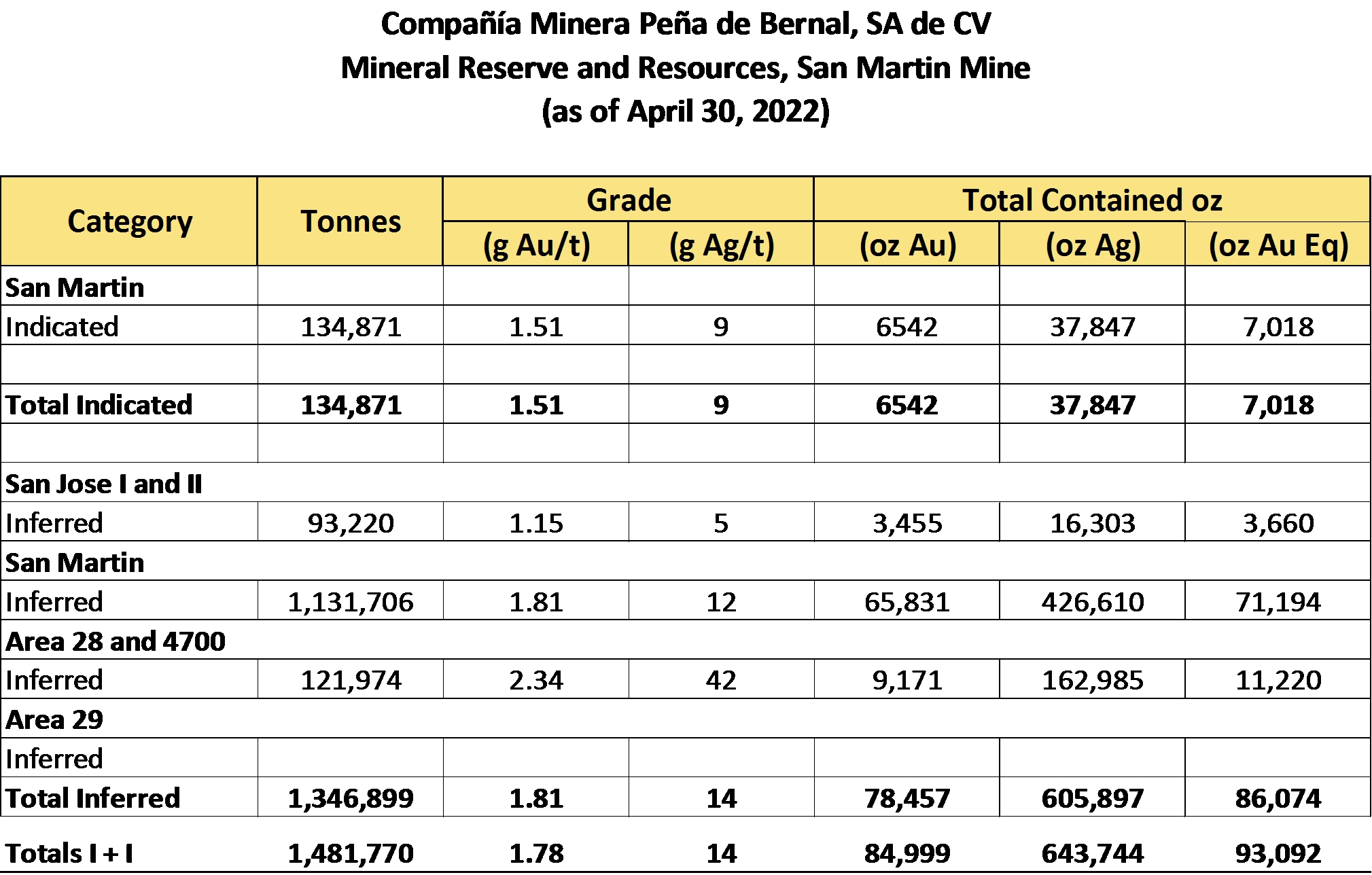

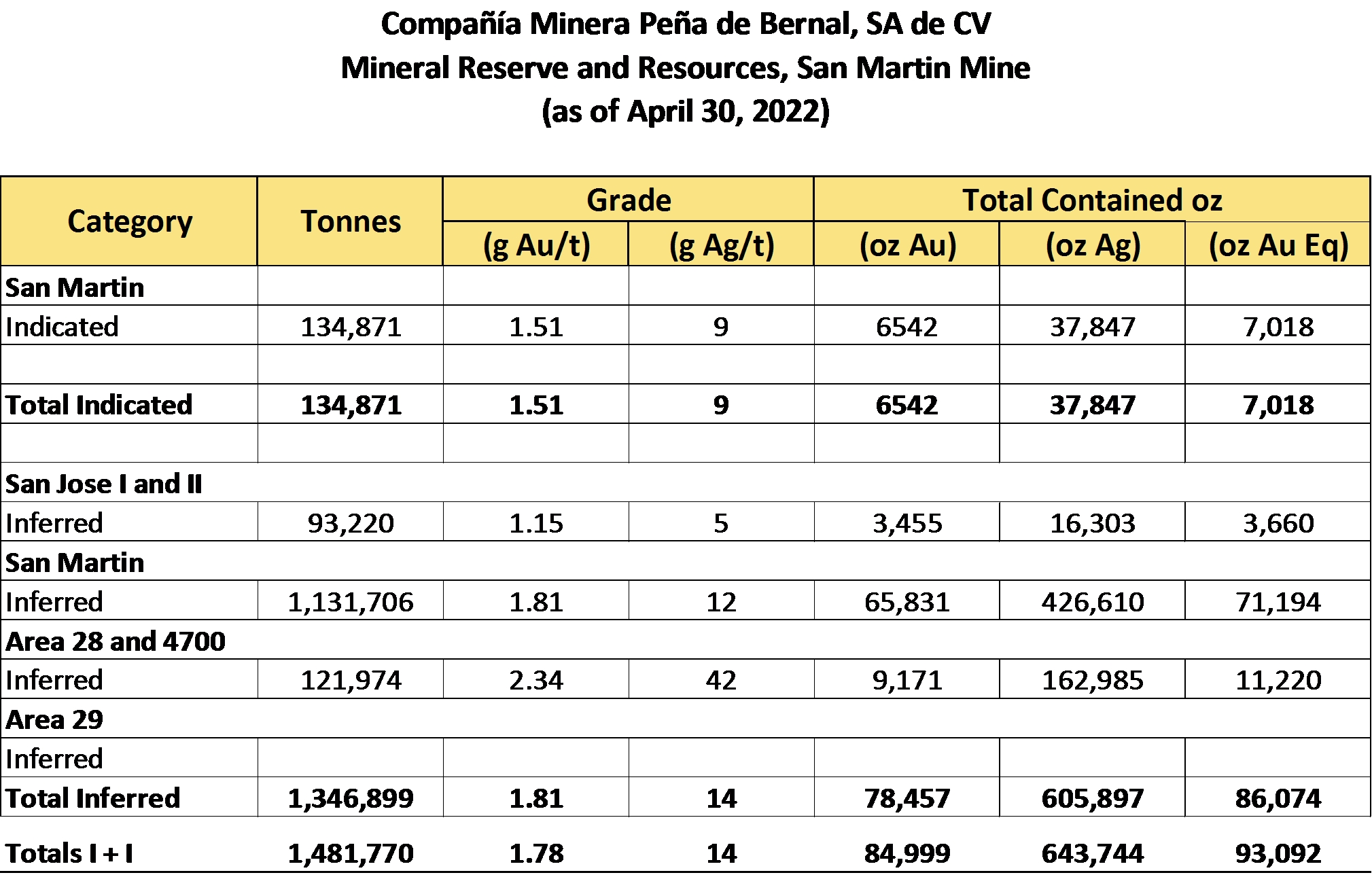

Total Indicated and Inferred Mineral Resources at the San Martin mine, estimated by SIM, are about 1,481,770 tonnes at a grade of 1.78 g Au/t and 14 g Ag/t. Inferred and Indicated Mineral Resources are not known to the same degree of certainty as Mineral Reserves and do not have demonstrated economic viability. A summary of resources is in Table 1-1.

Erme Enriquez, CPGJuly 18, 20223

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Table 1-1:Mineral Resources Inferred and Indicated, San Martín Mine

Table 1-1:Mineral Resources Inferred and Indicated, San Martín Mine

| • | Mineral resources have been classified into inferred and indicated in accordance with the |

| • | Tonnage is expressed in tonnes; metal content is expressed in ounces. Totals may not add up due to rounding. |

| • | Indicated and Inferred resource cut-off grades are based on a 1.41 g/t gold equivalent. |

| • | Metallurgical Recoveries were 86% gold and 55% silver. |

| • | Mining Recoveries of 90% were applied. |

| • | Minimum mining widths were 2.0 meters. |

| • | Dilution factors is 20%. Dilution factors are calculated based on internal stope dilution calculations. |

| • | Gold equivalents are based on a 1:79.5 gold:silver ratio. Au Eq= gAu/t + (gAg/t ÷ 79.5) |

| • | Price assumptions are $1750 per ounce for gold and $22 per ounce for silver. |

| • | Mineral resources are estimated exclusive of and in addition to mineral reserves. |

| • | Resources were estimated by SIM and reviewed by Erme Enriquez CPG. |

1.6Mineral Reserve Estimate

Mineral reserve estimates in this Report are reported following the requirements of Subpart 1300. Accordingly mineral resources in the Measured and Indicated categories have been converted to Proven and Probable mineral reserves respectively, by applying applicable modifying factors and are planned to be mined out under the LOM plan within the period of our existing rights to mine, or within the time of assured renewal periods of rights to mine.

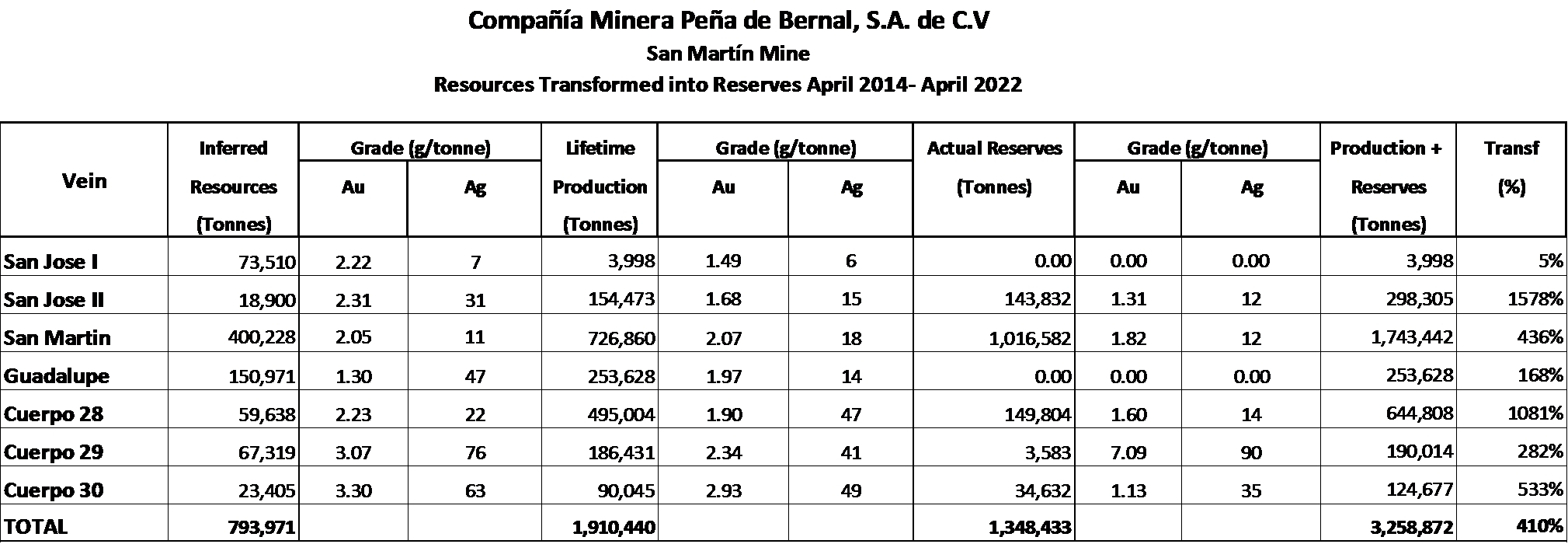

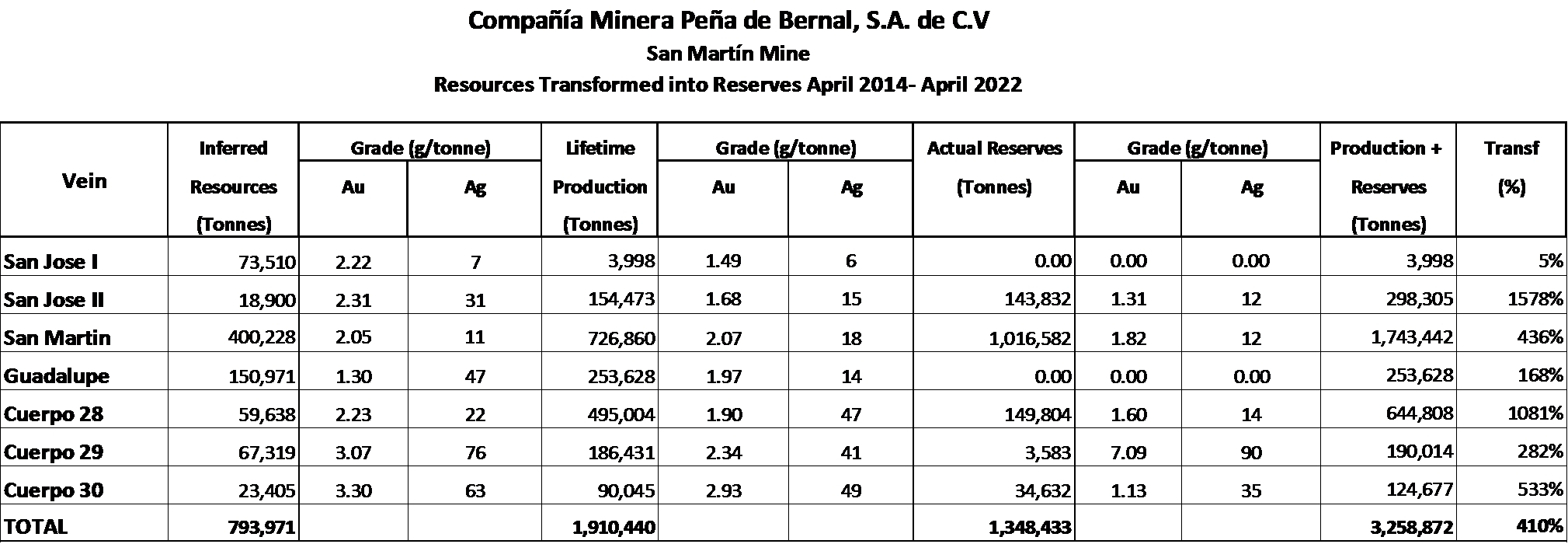

Total Proven and Probable Mineral Reserves at the San Martin mine as of April 30, 2022, estimated by Geology staff and reviewed by QP, are 1,348,433 tonnes at a grade of 1.74 g Au/t and 13 g Ag/t

Erme Enriquez, CPGJuly 18, 20224

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

(Table 1-2). This total includes Proven reserves of 144,331 tonnes grading 1.79 g/t Au and 14 g/t Ag along with Probable reserves of 1,204,102 tonnes grading 1.73 g/t Au and 13 g/t Ag.

Table 1-2:Proven and Probable Mineral Reserves, Effective Date April 30, 2022

| • | Reserve cut-off grades are based on a 1.41 g/t gold equivalent. |

| • | Metallurgical Recoveries were 86% gold and 55% silver. |

| • | Mining Recoveries of 90% were applied. |

| • | Minimum mining widths were 2.0 meters. |

| • | Dilution factors is 20%. Dilution factors are calculated based on internal stope dilution calculations. |

| • | Gold equivalents are based on a 1:79.5 gold - silver ratio. Au Eq= gAu/t + (gAg/t ÷ 79.5) |

| • | Price assumptions are $1750 per ounce for gold and $22 per ounce for silver. |

| • | Mineral resources are estimated exclusive of and in addition to mineral reserves. |

| • | Resources were estimated by SIM staff and reviewed by Erme Enriquez C.P.G. |

| • | Reserves are exclusive of the indicated and measured resources. |

| • | Tonnage is expressed in tonnes; metal content is expressed in ounces. Totals may not add up due to rounding. |

1.7Conclusions and Recommendations

The QP considers the San Martin resource and reserve estimates presented here to conform with the requirements and guidelines set forth in Companion Policy 43-101CP and Form 43-101F1 (June 2011), and the mineral resources and reserves presented herein are classified according to Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards - For Mineral Resources and Mineral Reserves, prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council on May 10, 2014. These resources and reserves form the basis for EDR’s ongoing mining operations at the San Martin Mine.

The QP is unaware of any significant technical, legal, environmental, or political considerations which would have an adverse effect on the extraction and processing of the resources and reserves located at the San Martin Mine. Mineral resources which have not been converted to mineral reserves, and do not demonstrate economic viability shall remain mineral resources. There is no certainty that all or any part of the mineral resources estimated will be converted into mineral reserves.

Erme Enriquez, CPGJuly 18, 20225

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

The QP considers that the mineral concessions in the San Martin mining district controlled by SIM continue to be highly prospective both along strike and down dip of the existing mineralization.

SIM’s San Martin Mine has an extensive mining history with well-known gold and silver bearing breccia-vein systems. Ongoing exploration has continued to demonstrate the potential for the discovery of additional resources at the project and within the mine and the surrounding district. Since SIM took control of the

San Martin mine, new mining areas have enabled SIM to increase production by providing additional sources of mill feed. SIM’s operation management teams continue to search for improvements in efficiency, lowering costs and researching and applying low-cost mining techniques.

Recommendations for further work:

| • | Continue the advance of the underground exploration at Body 32 and 33, the exploration of Body 28 with drifting at the centra zone and the exploration of San José FW and Santa Clara HW (both known as Sarah) at the south area. |

| • | Continue to collect specific gravity measurements and refine current estimation of specific gravity to have a more reliable measure. |

| • | Implement procedure of duplicate channel samples in stopes and drifts, to ensure the grade and thickness and to serve as duplicates of channel samples. |

| • | Implement procedure for standard and duplicate samples, in channel samples and drill core as well. The certified standards will give greater certainty to the QA/QC procedure for the evaluation and greater reliability in reserves and resources. |

| • | Perform detailed model reconciliation on stopes. A strict control in rebates will help to have a reliable number at the end of the year. |

| • | Complete a geochemical and structural model for future work to support the estimation domains. The QP notes that there is a large amount of multi-element data that could support a geochemical model to better understand the impact of elements such as antimony, arsenic, mercury, etc., on the gold distribution and recoveries |

Erme Enriquez, CPGJuly 18, 20226

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

2.0INTRODUCTION

2.1Issuer and Terms of Reference

Starcore International Mines LTD (“SIM”) is a Canadian based mining and exploration company actively engaged in the exploration, development, and production of mineral properties in Mexico. SIM is headquartered in Vancouver, British Columbia with management offices in Mexico City, Mexico, and is listed on the Toronto (TSX:SAM), Frankfurt (FK:V4JA) stock exchanges and OTCQB Markets (. The company has one currently active mining property in Mexico, the San Martín Property in northeast Queretaro State. SIM has retained Mr. Enriquez to complete an independent technical audit and update of the mineral resource and reserve estimates for the San Marín Mine Project (the “Project”) located within the Municipality of Colón. This report presents the results of Mr. Enriquez efforts and is intended to fulfill the Standards of Disclosure for Mineral Projects according to Canadian National Instrument 43-101 (“NI 43-101”).

This report was prepared in accordance with the requirements and guidelines set forth in NI 43-101 Companion Policy 43-101CP and Form 43-101F1 (June 2011), and the mineral resources and reserves presented herein are classified according to Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards - For Mineral Resources and Mineral Reserves, prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council on May 10, 2014. The mineral resource and mineral reserve estimates reported here are based on all available technical data and information as of April 30, 2022.

2.2Sources of Information

In preparation of this report, various historical engineering, geological and management reports compiled about the Mine or site were reviewed and supplemented by direct site examinations and investigations. All the data files reviewed for this study were provided by CMPB in the form of hard copy documents, electronic .pdf reports, .xls files, email correspondence, and personal communication with management and personnel from San Martin. Work completed by SM includes several decades of underground mining, drilling, and sampling, trenching, metallurgical testing, and geophysical surveying.

The main sources of information in preparing this report are:

A portion of the information and technical data for this study was obtained from the following previously filed NI 43-101 Technical Reports:

Spring, V., McFarlane, G.R., 2002, A Technical Review of the Tayoltita, Santa Rita, San Antonio, La Guitarra and San Martin Operating Silver and Gold Mines in Mexico. Watts, Griffis and McOuat NI 43-101 report prepared for Wheaton River Minerals Ltd.

Spring, V. (2005), An Audit of the Mineral Reserves/Resources Tayoltita, Santa Rita, San Antonio, and San Martin Mines as of December 31, 2004. For Wheaton River Minerals LTD.

Gunning, D. R. and Whiting, B., 2009, Reserves and Resources in the San Martín Mine, Mexico, as of July 31, 2009. For Starcore International Mines LTD.

Erme Enriquez, CPGJuly 18, 20227

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Gunning, D. R. and Campbell, J., 2011, Reserves and Resources in the San Martín Mine, Mexico, as of July 31, 2011. For Starcore International Mines LTD.

Campbell, J., 2012, Reserves and Resources in the San Martín Mine, Mexico, as of July 31, 2012. For Starcore International Mines LTD.

Gunning, D. R., 2013, Reserves and Resources in the San Martín Mine, Mexico, as of July 31, 2013. For Starcore International Mines LTD.

Gunning, D. R. and Campbell, J., 2014, Reserves and Resources in the San Martín Mine, Mexico, as of July 31, 2014. For Starcore International Mines LTD.

Enriquez, E., 2018, Reserves and Resources in the San Martin Mine, Queretaro State, Mexico, as of April 30, 2018. For Starcore International Mines LTD.

Enriquez, E., 2019, Reserves and Resources in the San Martin Mine, Queretaro State, Mexico, as of September 30, 2019. For Starcore International Mines LTD.

2.3Qualified Person

Erme Enriquez, CPG, has over 35 years of professional experience as geologist, both as an employee and a consulting geologist and has contributed to numerous mineral resource projects, including silver, gold, and polymetallic resources throughout Mexico past fifteen years. Mr. Enriquez is responsible for the full content of this report.

As Qualified Person, Mr. Enriquez conducted an on-site inspection of the San Martín property during June 07 to 10, 2022. While on site, Mr. Enriquez reviewed SIM’s current operating procedures and associated drilling, logging, sampling, quality assurance and quality control (QA/QC), grade control, and mine planning (short, medium, and long term) procedures, also inspected the laboratories at the San Martín facilities as well as the underground operations and plant.

Mr. Enriquez met with Mr. Martin Aguilar, who is the general mine manager and all personnel of the geology department to review the geologic understanding, sampling methods and types, modeling (resources, reserves, and grade control), prior to inspecting the procedures in the mine and office for collecting and handling the data. Once the geology department processes were reviewed, Mr. Enriquez discussed with the mine planning and survey department the process for short, medium, and long-term mine planning. Reconciliation was discussed with both departments and the plant supervisors. Mr. Enriquez also met with the staff of the Department of the Environment to obtain information regarding permits and environmental liabilities in the unit. The assay laboratory was toured, and the procedures were reviewed with the laboratory superintendent.

2.4Units and Currency

All units used in this report are in a metric system. Tonnages are shown as tonnes (1,000 kg), linear measurements as metres (“m”), or kilometres (“km”) and precious metal values as grams (“g”). Grades are grams of gold per tonne (“Au g/t”), and grams of silver per tonne (“Ag g/t”). All economic data is quoted in US dollars (“US$”). When peso amounts required conversion into US dollars, the

Erme Enriquez, CPGJuly 18, 20228

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

peso exchange rate used was 20.50 pesos equivalent to US$1.00 as this was the rate used in the April 2021 to April 2022 mine operating budget.

3.0RELIANCE OF OTHER EXPERTS

The author of this report is Qualified Person for those areas as identified in the Certificates of Qualified Person attached to this report. In preparing this report, the author relied heavily on various geological maps, reports and other technical information, mostly unpublished proprietary information collected on-site and provided to the author by SIM.

Much of the original information is in Spanish and English, with translations from Spanish to English of key and relevant technical documents provided by SIM. For this current report, most of the technical information was translated by geologist employed by SIM, although legends and annotations on many of the maps and sections are in Spanish or have been translated to English. I occasionally checked a few key parts of the translations and found them good.

From my experience on this report and the other previous reports I have done for other companies, I believe the translations provided to us are credible and generally reliable, but I cannot attest to their absolute accuracy.

Overall, the technical information I reviewed is very well-documented, comprehensive and of good technical quality. It clearly was gathered, prepared, and compiled by various competent technical persons, but not necessarily Qualified Persons as currently defined by NI 43-101. In recent years, the voluminous information collected by SIM has been carefully reviewed by Mr. David R. Gunning, P. Eng. and Joseph W. Campbell, P. Geo. whom are a Qualified Persons as defined by NI 43-101.

Because I am not expert in land, legal, environmental, and related matters, I have relied (and believe there is a reasonable basis for this reliance) on various other individuals who contributed the information regarding legal, land tenure, corporate structure, permitting, land tenure and environmental issues discussed in this report. Specifically, David Gunning and Joseph Campbell, both experienced independent Qualified Person as defined by NI 43-101.

This report summarizes the Mineral Resource and Reserve estimates for the San Martin mine, effective as of April 30, 2022, using the procedures which have been audited by both PAH and WGM in the past. These procedures have been verified by David R. Gunning, P. Eng. And Joseph W. Campbell, P. Geo, whom virtue of their education and experience is an independent Qualified Persons as defined by NI 43-101.

The information, conclusions, opinions, and estimates contained herein are based on:

| • | information available to the authors at the time the report was prepared |

| • | assumptions, conditions, and qualifications as outlined in this report |

| • | production and expenditure data, reports, and other information supplied by CMPB and other third-party sources. |

CMPB reported to the authors that, to the best of its knowledge, there is no known litigation that could potentially affect the mine operations.

Erme Enriquez, CPGJuly 18, 20229

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

4.0PROPERTY DESCRIPTION AND LOCATION

4.1Property Description

The San Martin mine is an underground gold-silver mining complex that has been in operation since 1993. It produces gold-silver by using the Merrill–Crowe Process technique for removing gold from the solution obtained by the cyanide leaching of gold and silver ores. The mine operates 365 days per year on a 24 hour per day schedule. Mining and ore processing operations are currently in production and the mine is considered a production stage property.

4.2Property Location

The San Martin Mine is located 47 km in a straight line to the NE of the city of Queretaro, 10 km NW of Ezequiel Montes, 4 km SW of the Peña de Bernal and 25 km to the NW of Tequisquiapan, in the State of Querétaro. Territorially, it is located within the municipality of Colón, at the UTM coordinates of 398,350E and 2292,700N and an average elevation of 2,130 m.a.s.l. (Figure 4-1)

Erme Enriquez, CPGJuly 18, 202210

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Figure 4-1:San Martin Mine Location Map

Erme Enriquez, CPGJuly 18, 202211

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

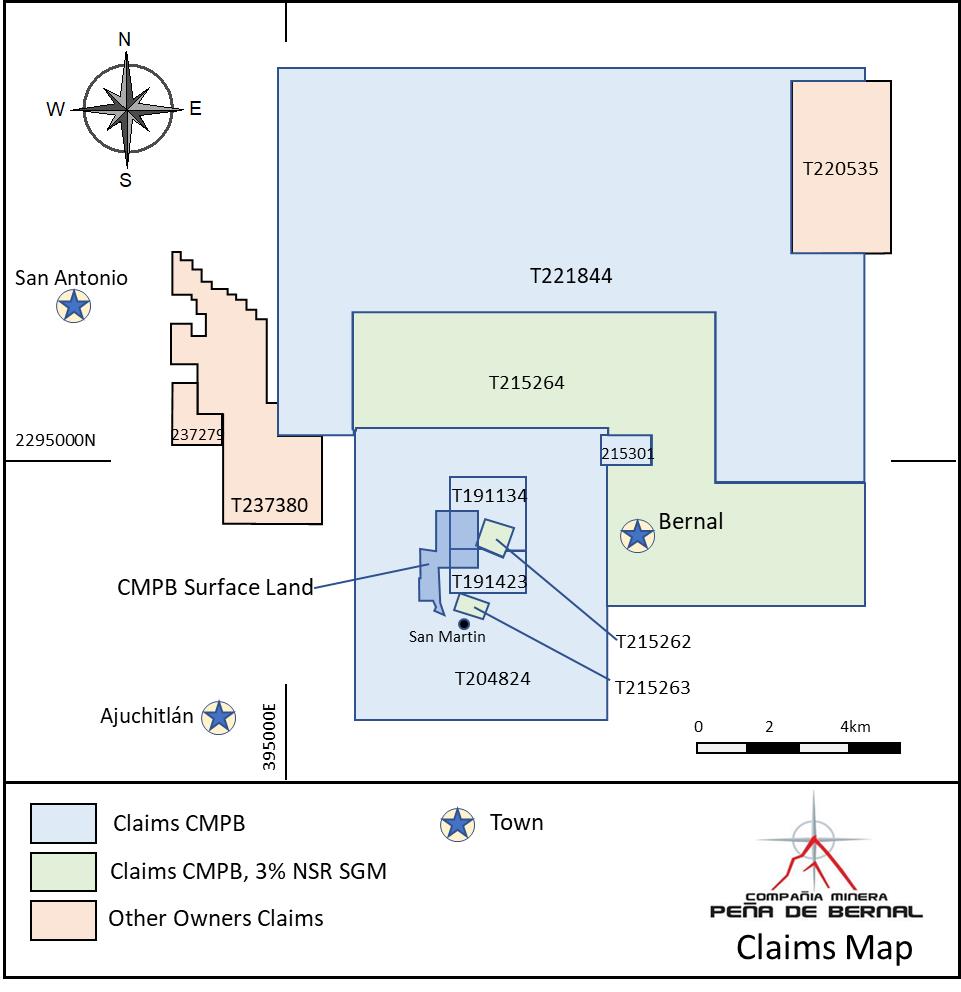

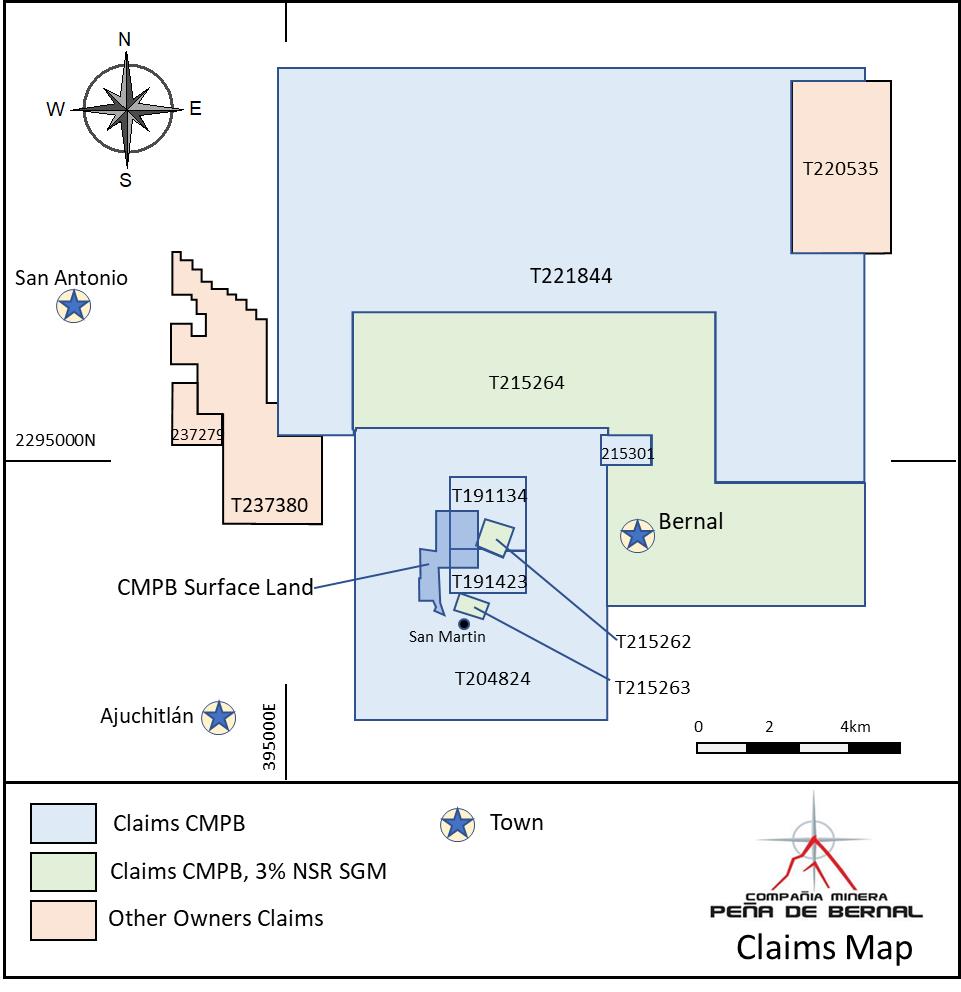

4.3Mineral Concessions and Agreements

Compañía Minera Peña de Bernal S.A. de C.V., a wholly owned SIM subsidiary, holds eight mining concessions covering 12,991.7805 hectares at the San Martin Mine in the State of Querétaro (Figure 4-2). Claims are indicated by its Title number. Right payments are done twice a year, every semester. The San Martin Mine presently consists of two underground mines, San José and San Martin. The San Martin mine is approximately 800 meters NNE of the San José mine. Minas Luismin, SA de CV (former owner of the mine) commenced mining in late 1993 on the San José deposit, with an open pit operation that was later abandoned and mining continued underground methods over the San José and the San Martin oreshoots.

Mining regulations in Mexico provides that all concessions are to be valid for a period of 50 years. Taxes are based on the surface area of each concession and the time of expedition of the title and are due in January and June of each year. All tax payments have been paid by SMI to date. Currently, annual claim-maintenance fees are the only federal payments related to mining claims, and these fees have been paid in full to January 31, 2022. The current annual holding costs for the San Martin mining claims are estimated at US$224,000 Dollars (Table 4-1).

Table 4-1:San Martin Mines Concessions Controlled by CMPB

Erme Enriquez, CPGJuly 18, 202212

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Figure 4-2:San Martin Mine and Surrounding Area Property Map

SMI acquired the San Martin Mine ("San Martin") from Goldcorp Inc. ("Goldcorp") in February 2008. Goldcorp is a Canadian mining company listed on both Canadian and United States Stock Exchanges. Goldcorp acquired the San Martin Project in February 2005 with the take-over of Wheaton River Minerals Ltd., who had acquired San Martin in the take-over in 2002 of the Mexican mining company Minas Luismin S.A. de C.V. ("Luismin"). SMI paid US$24 million in cash and issued 4,729,000 common shares to Luismin at a deemed value of CDN$0.50 per share in consideration for the shares of Bernal.

San Martin is owned and operated by Compañia Minera Peña de Bernal, S.A. de C.V., a wholly owned subsidiary of SMI.

The San Martin Mine is operated by Compañía Minera Peña de Bernal, S. A. de C. V. (CMPB), a direct, wholly owned subsidiary of SIM. A 3.0% net smelter returns royalty (“NSR”) is payable to Servicio

Erme Enriquez, CPGJuly 18, 202213

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Geológico Mexicano (“SGM”- Mexican Geological Survey) on the claims San Martin Fracc. A, Title 215262, San Martin Fracc. B, Title 215263 and San Martin Fracc. C, Title 215264.

SIM’s gold and silver is trading by ITALPREZIOSI, in Arezzo, Italy, Italpreziosi is one of the main operators in the production, refining and trading of precious metals, and the production and trading of investment gold. Contract with Italpreziosi has been signed June 2013 and in force to date.

All part of the logistics for the delivery of the product is contracted with the company IBI International Logistics Inc.

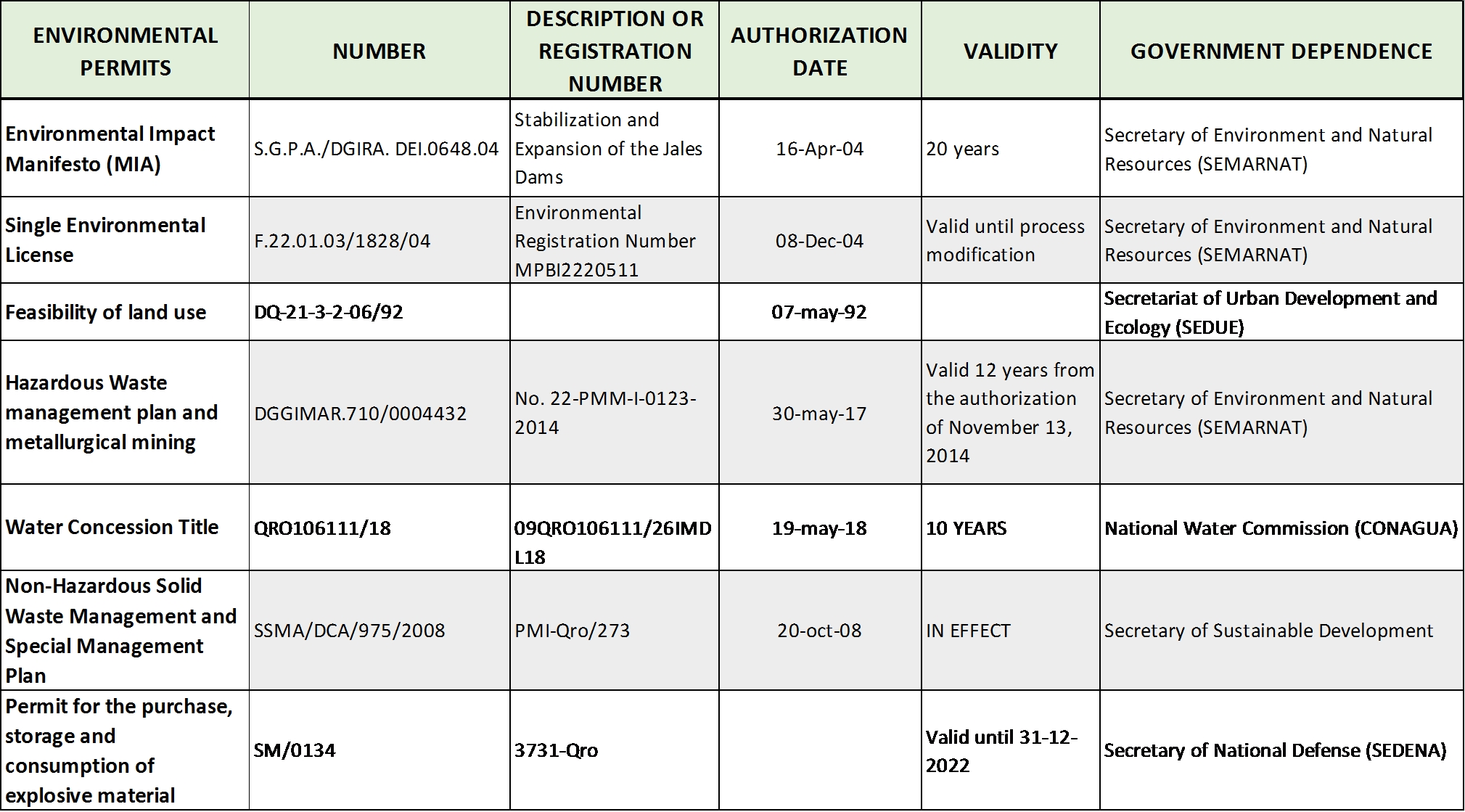

4.4Permits and Environmental Liabilities

SIM holds all environmental and mine permits required to conduct planned exploration and mining operations on the San Martin mine, and reports that it is following all environmental monitoring requirements and applicable safety, hygiene, and environmental standards. Environmental permitting and liabilities are discussed in greater detail in Section 20 of this report.

QP knows of no existing or anticipated significant factors which might affect access, title, or the right or ability to perform work on the San Martin mine.

5.0ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

5.1Access

The roads through which the San Martín mine is accessed are paved and they are in good condition all year long. It can be reached by highway No. 57 between the cities of Querétaro and San Luis Potosí. Access to the San Martin mine can be carried out also from Mexico City through highway 57D, for 160 kilometers, until reaching the City of San Juan del Río, Queretaro. From here, take the HW 120, for 19 km until Tequisquiapan, and continue for 16 km more until Ezequiel Montes. From here take the road to the junction with the # 100 highway, take this to the NE and 1.5 km more to enter the mine facilities.

From the City of Querétaro take Highway 45D for approximately 22 km to the SE and then take Highway No. 100 to the NW for 36 kilometers until reaching the junction with the entrance to the mine in the town of San Martin. This same road leads to the magical town of Peña de Bernal, which is the company's employee camp.

There are constant flights from the City of Querétaro to several destinations in the United States, particularly Chicago, Atlanta, Dallas, Houston and Detroit and other domestic destinations; although these change from season to season.

5.2Climate

The climate in the mine area is semi-dry, described by generally low rates of precipitation. During the year, the temperature generally varies from 5 ° C to 30 ° C and rarely drops below 2 °C or rises above 33 °C.

The warm season lasts for two to three months, from April to June, and the average daily maximum temperature is over 28 °C. The hottest month is May. The cool season lasts around three months, from December to February, and the average daily maximum temperature is less than 24 °C. The coldest days of the year is in January, with an average minimum temperature of 5 °C and an average maximum of 23 °C. The normal yearly temperature is 19°C.

Erme Enriquez, CPGJuly 18, 202214

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

The rainy season lasts six months, from June to November, with an average total accumulation of 509 millimeters. The dry season lasts from December to May.

5.3Local Resources and Infrastructure

The City of Querétaro is the closest major population center to the San Martín Mine Project, with a population of approximately 1.1 million inhabitants. Querétaro is an agricultural, commercial, tourist and mining center with all the associated municipal amenities, including an international airport with numerous regional flights to other major Mexican cities and the United States.

At each of the mine sites, the water required is supplied from the dewatering of the mines. Industrial water for the cyanide plant is recycled, and additional water (60,000 m3/y of fresh water) is obtained from a nearby wells.

The total capacity of the plant is a 1100 tpd facility capable of treating sulfides containing Au-Ag ores using a Merrill-Crowe processing circuit to produce doré bars.

Electrical power from the Federal Electricity Commission (34 kV) supplies both the plant and mine, and satisfies power demand, which averages about 1.1 megawatts. Two emergency generators, one of 500 kW and other of 200 kW, provide power to the mill in case or outages.

An upgrade to the tailings dam was completed in 2010, when dry stacking of the tailings began, and current capacity is sufficient for many years of production.

Apart from offices, dining room, warehouses, shop, and other facilities, CMPB also provides dormitories and limited housing facilities for employees working on a rotational schedule at the townships of Ezequiel Montes and Bernal. Much of the labor work force lives in the San Martin town and nearby communities. The area has a rich tradition of mining and there is an ample supply of skilled personnel sufficient to man both the underground mining operations and the surface facilities.

CMPB has negotiated access and the right to use surface lands sufficient for many years of operation. Sufficient area exists at the property for all needed surface infrastructure related to the LOM plan, including processing, maintenance, fuel storage, explosives storage and administrative offices. There exists enough capacity in existing tailing impoundments for tailings disposal.

5.4Physiography

The relief and landforms of Mexico have been greatly influenced by the interaction of tectonic plates. The resulting relief patterns are so complex that it is often claimed that early explorers, when asked to describe what the new-found lands were like, simply crumpled up a piece of parchment by way of response.

Figure (5-1) shows Mexico’s main physiographic regions. The core of Mexico (both centrally located, and where most of the population lives) is the Volcanic Axis (Region 10 on the map), a high plateau rimmed by mountain ranges to the west, south and east. Coastal plains lie between the mountains and the sea. The long Baja California Peninsula parallels the west coast. The low Isthmus of Tehuantepec separates the Chiapas Highlands and the low Yucatán Peninsula from the rest of Mexico.

The San Martin Mine falls in the convergence of the Central Plateau, Sierra Madre Oriental and Volcanic Axis or Trans-Mexican Volcanic Belt.

Erme Enriquez, CPGJuly 18, 202215

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Figure 5-1:Physiographic map of Mexico showing the location of the San Martin Mine between the Volcanic Axis, Sierra Madre Oriental, and the Central Plateau (after Raisz, 1964)

6.0HISTORY

Mining in the San Martín district extends back to at least 1770 when the mines were first worked by the Spanish, particularly by Don Pedro Romero de Terreros, Count of Regla. Spaniards worked in the district for 40 years, however, there is no production records available for that time. During those days, silver and gold production accounted for 80% of all exports from Nueva España (New Spain), although, by the late-eighteenth century silver production collapsed when mercury, necessary to the refining process, was diverted to the silver mines of Potosí in present day Bolivia.

Most of the production came prior to the 1910 Mexican Revolution with San Martin district being an important producer. The first records show the Ajuchitlán Mining and Milling Company produced an estimated 250,000 tonnes at a grade of 15 g Au/t and 100 g Ag/t during 1900 to 1924.

The first modern stake was with 1982, when the Mexican government declared a 6,300 ha National Reserve over the area surrounding the Peña de Bernal. Luismin entered into an agreement to explore in the claims of CRM in 1986 for a payment of US $ 250,000 dollars and a royalty of 5%, which later was reduced to 3% in 1996. In1988 geological reconnaissance and exploration program initiated.

Erme Enriquez, CPGJuly 18, 202216

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Geological works concluded in 1992 and by the end of 1993 the decision was made to start the open-pit mining in the San José area, at a rate of 300 tpd.

The operation of the San José pit only lasted a couple of years, when it was discovered that the deposit was not a "Carlin type", as had been thought, but that it was a tabular structure in form of vein that continued to deepen and laterally along its strike. Then it was decided to start the underground mining, on the same San Jose structure and on the oreshoot of San Martin, which ultimately turned out to be the one with the largest number of reserve and resources.

In the year 2000, the exploitation begins in the San Martín body, called "Tronco" due to its verticality. In 2001, at the same time, the exploration of high-grade gold bodies called "Mantos" began. The first of these oreshoots was the Body 28.

The mine is currently mined at 627 tpd and the capacity of the mill is 1100 tpd. The mining method is cut and filled with dry backfill. The exploitation in the Body 28 is currently room and pillars filled with a mixture of backfill and 5% cement.

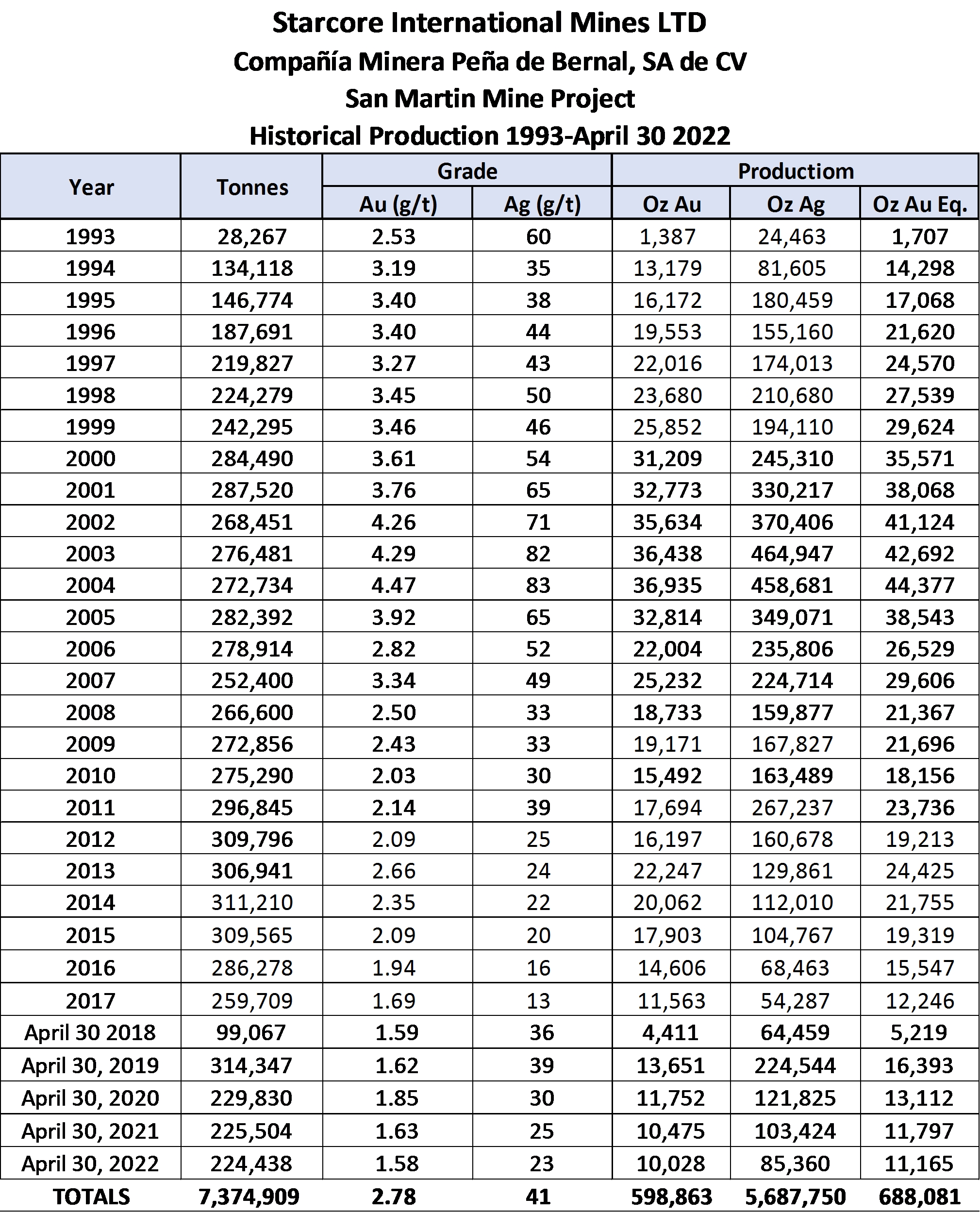

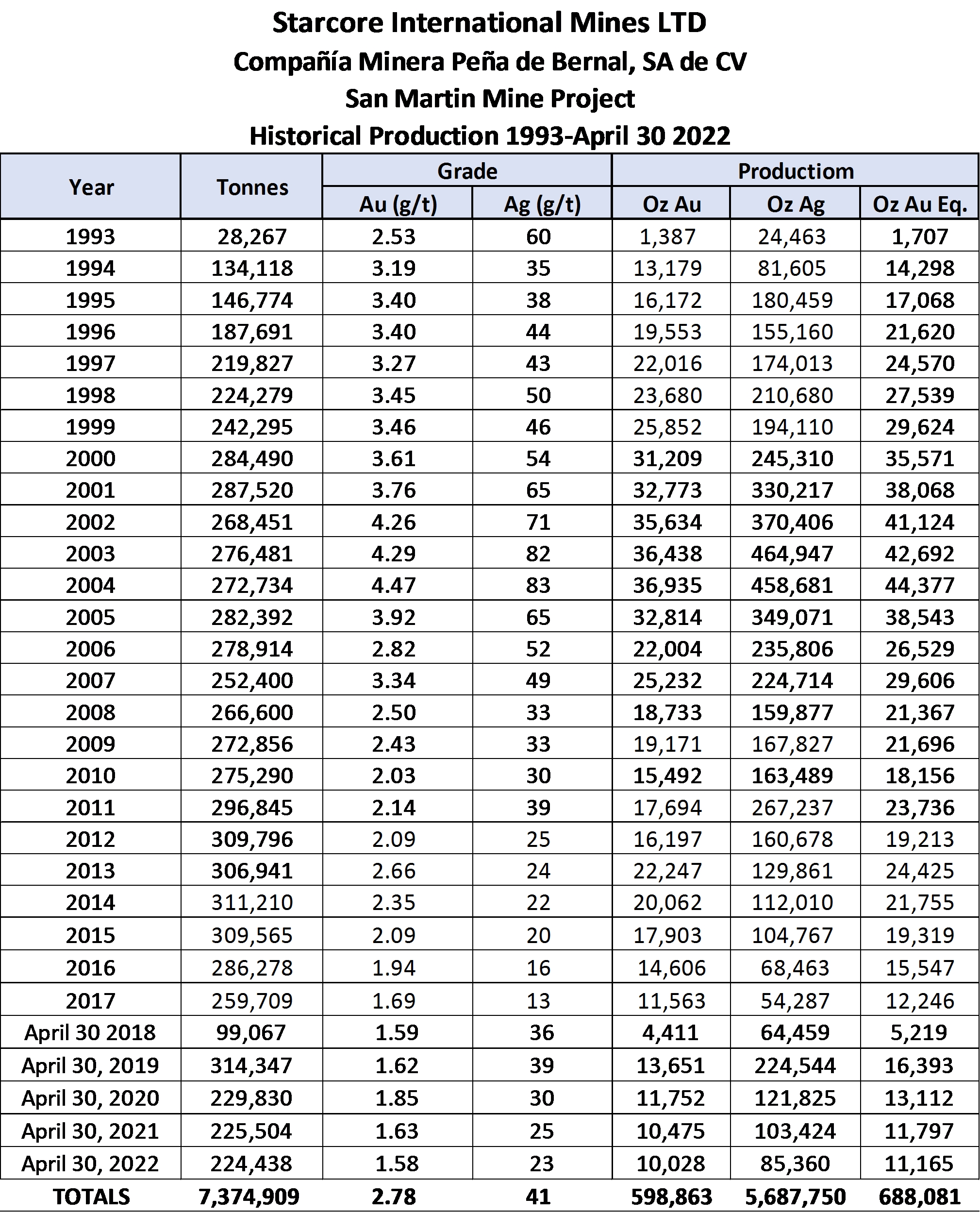

San Martin has produced over 7.3 million tonnes with average grades of 2.78 g/t Au and 41 g/t Ag, for a total of 688,081 oz of gold equivalent.

Historical production at the San Martín Mine for the years 1993 to April 30, 2022, is roughly estimated in Table 6-1.

Erme Enriquez, CPGJuly 18, 202217

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Table 6-1:Summary of production for the San Martín Mine (from 1993 to April 30, 2022)

Table 6-1:Summary of production for the San Martín Mine (from 1993 to April 30, 2022)

Erme Enriquez, CPGJuly 18, 202218

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

7.0GEOLOGICAL SETTING AND MINERALIZATION

7.1Regional Geology

The regional and local geology of the San Martín Mine Project is described in detail in several existing internal and previously published technical reports and other internal reports for SIM. The following descriptions of geology and mineralization are excerpted and/or modified from Labarthe, et. al (2006) and Rankin (2008). Mr. Enriquez has reviewed the available geologic data and information, and finds the information presented here in reasonably accurate and suitable for use in this report.

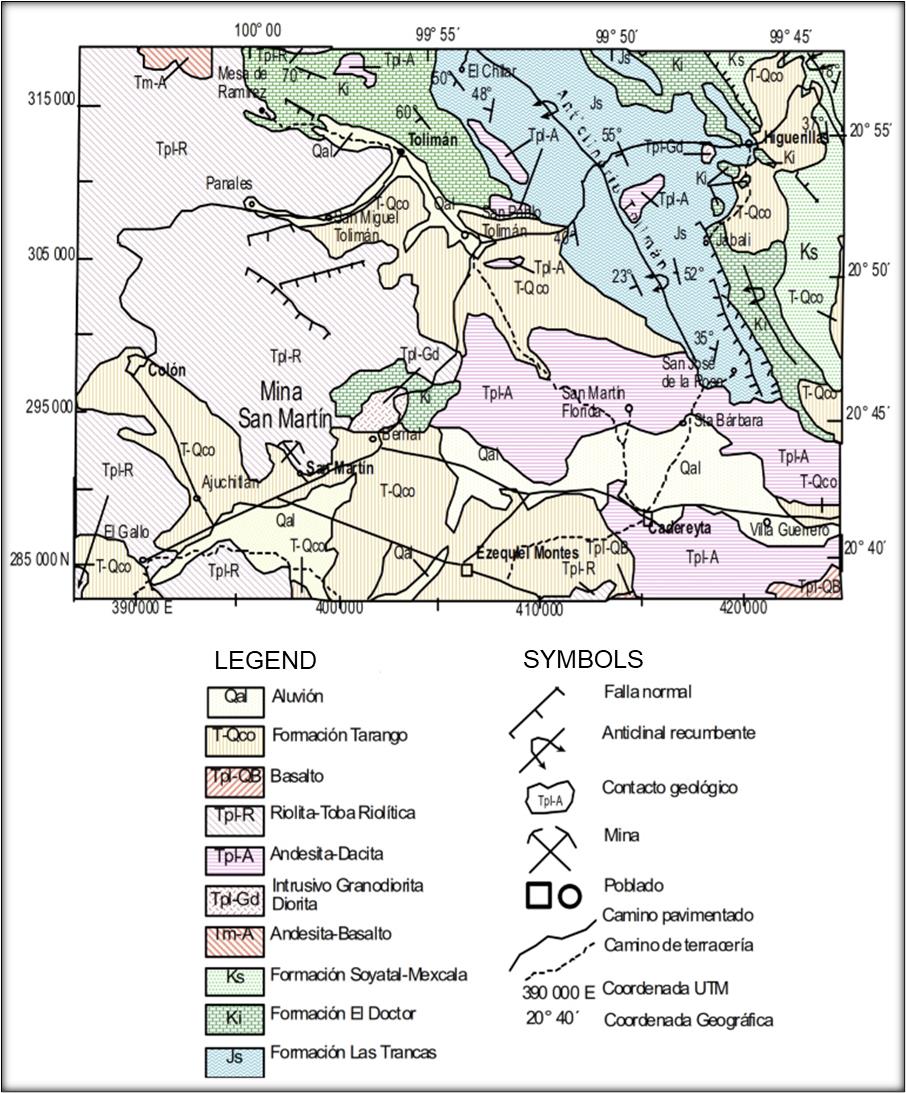

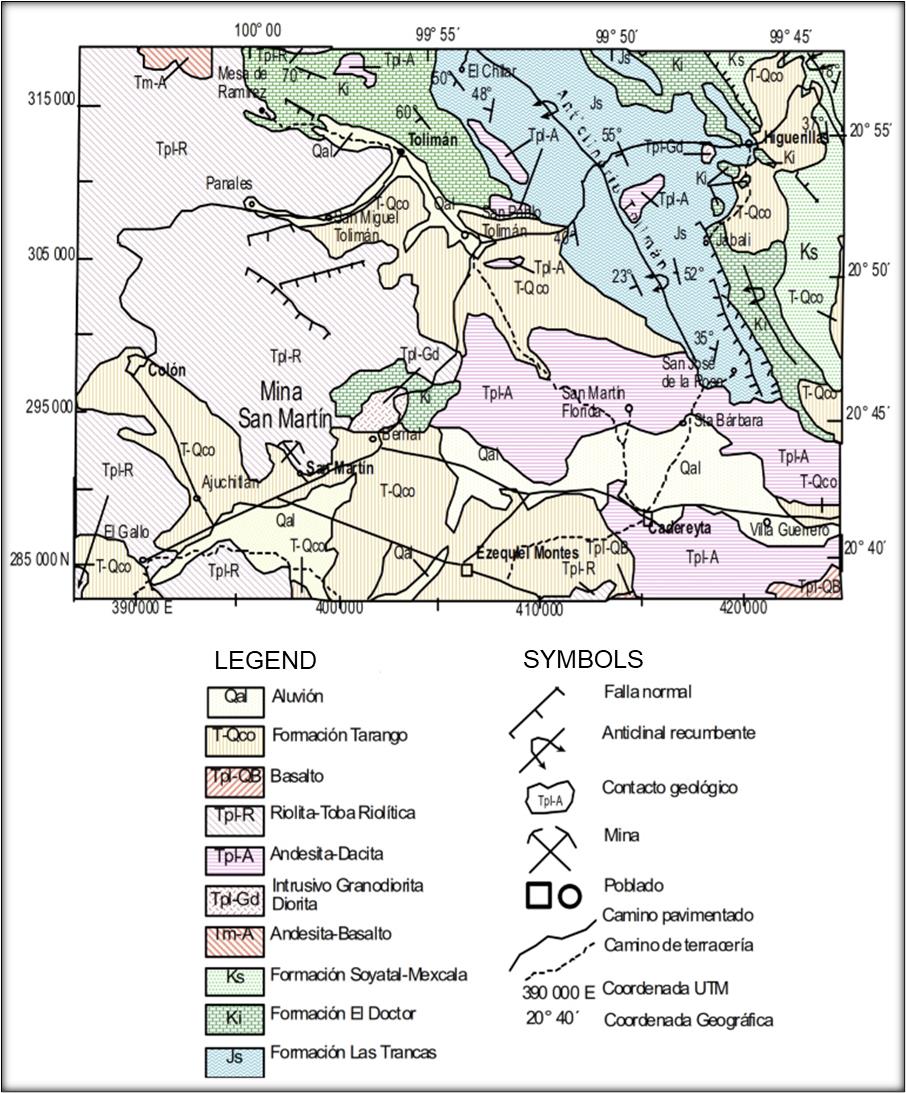

The San Martin area forms Mesozoic shallow-basin sediments (shales and limestones) unconformably overlain by Tertiary volcanics/epiclastic and volcaniclastic sediments. Localized subvolcanic micro-granodiorite also occurs (Figure 7-1)

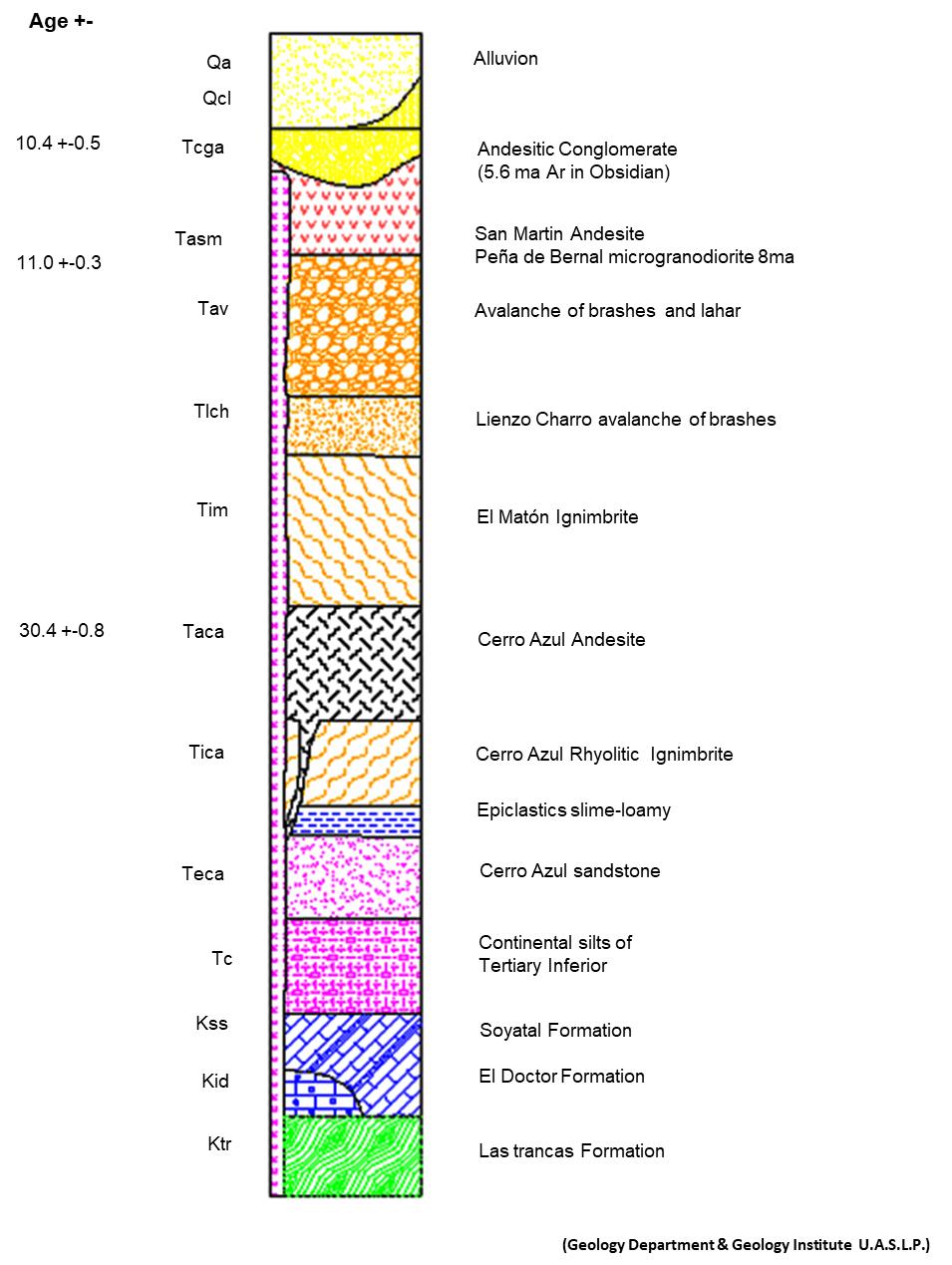

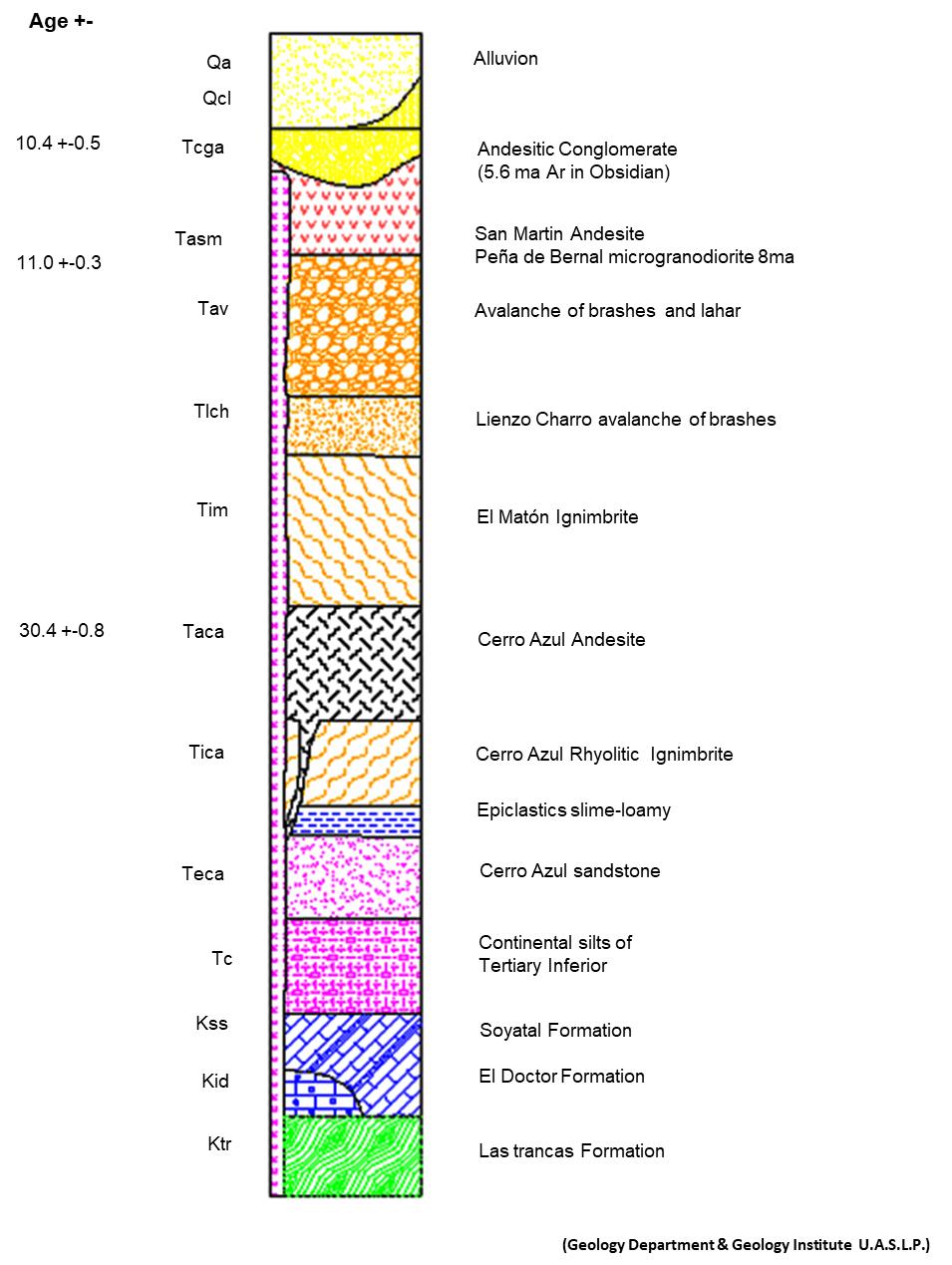

The primary formations are (from oldest to youngest): Jurassic: Las Trancas Formation(Jtr). This includes massive to well bedded and laminar limestones. Very thin (<10cm) shale intercalations occasionally occur. A dark carbonaceous limestone is known form the deeper SE sections of the San Martin mine.

Cretaceous: El Doctor and Soyatal-Mezcala Formations. These make up a lower pale buff to orange lithic shale, overlain by intercalated shale and limestone. Note that there may be some local problems in discrimination between the Cretaceous and Jurassic limestones in some outcrops and drill core; a zone of shallow-dipping limestones in the mine infrastructure area are shown in the geology map as Cretaceous Soyatal-Mezcala Formation.

Tertiary: Continental sediments, overlain by bimodal epiclastic, rhyolitic ignimbrite & andesite with a distribution around the mine site. The andesite has been dated at ~30 Ma. The volcanic breccias, lahar, epiclastic, ignimbrite and andesite are younger and have been dated at ~10–11Ma. The most conspicuous feature is the Peña de Bernal intrusive, which is a micro-granodiorite of an age of 35 Ma. See also Figure 7-2.

Erme Enriquez, CPGJuly 18, 202219

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Figure 7-1:Regional geological map of the surrounding San Martin Mine. Taken from Nuñez-Miranda, 2007

Erme Enriquez, CPGJuly 18, 202220

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Figure 7-2:Generalized Stratigraphic Column of the San Martin Region

Erme Enriquez, CPGJuly 18, 202221

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

7.2Property Geology and Mineralization

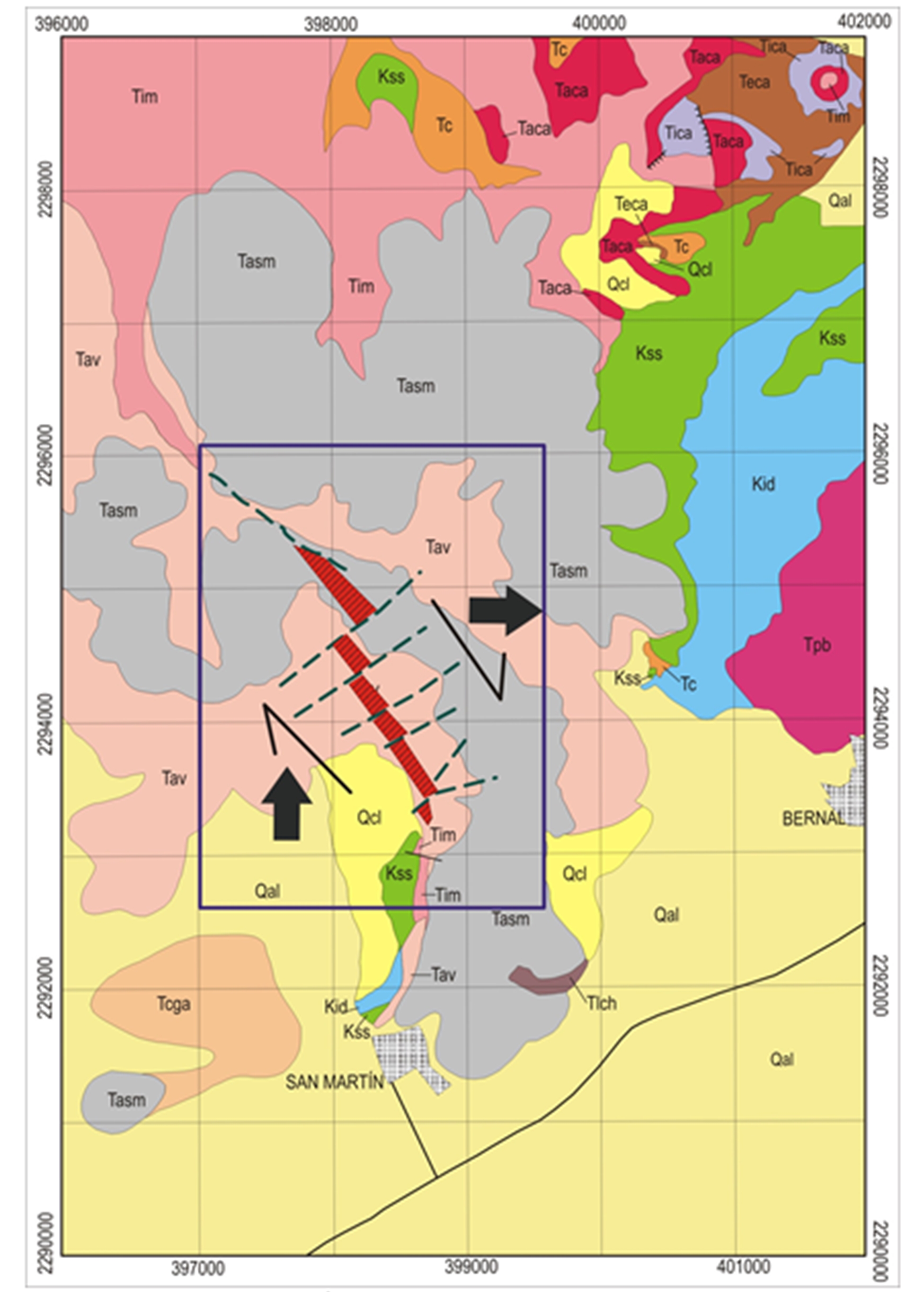

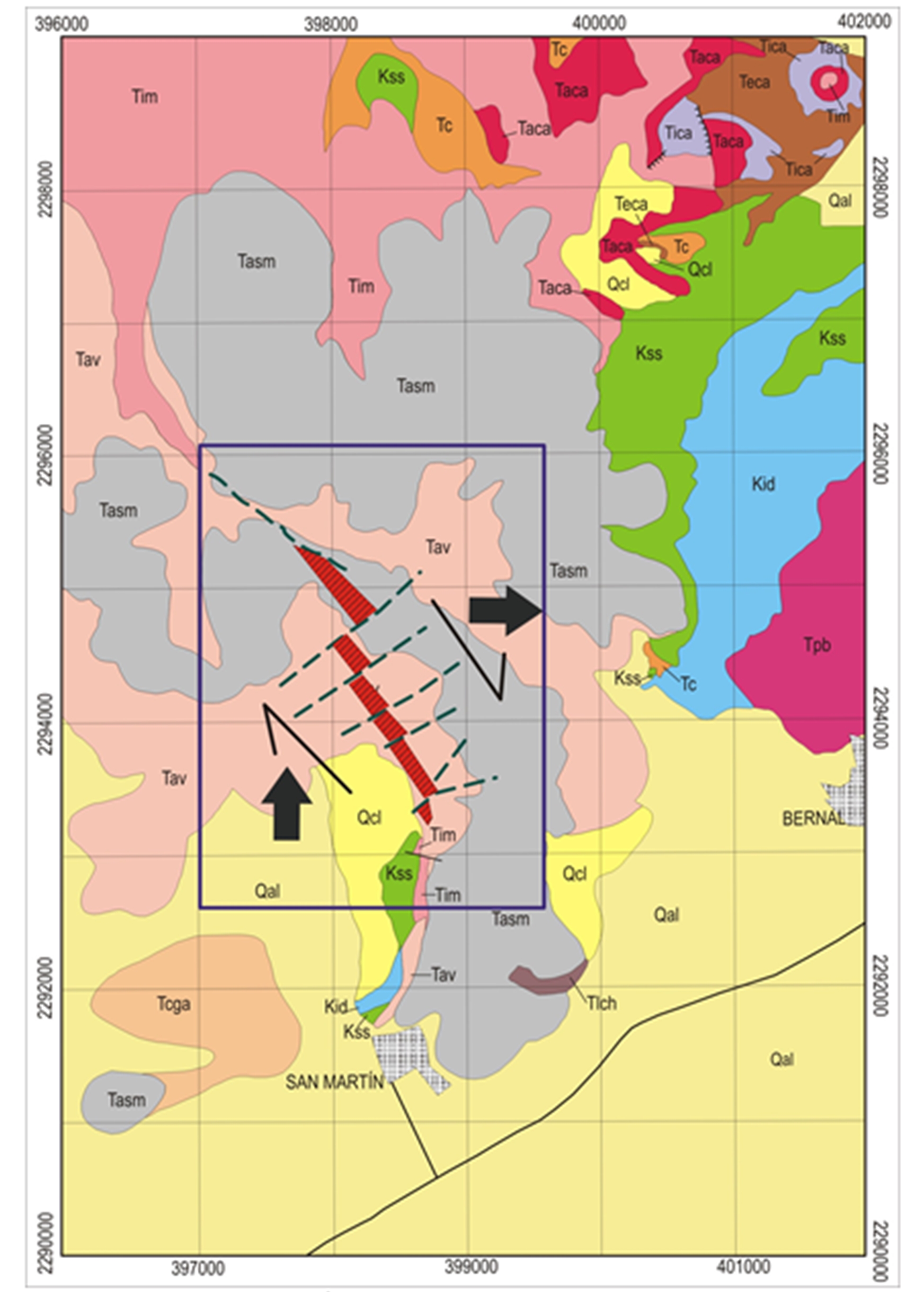

The local geology is represented by the Las Trancas Fm, Doctor Fm, Soyatal-Mezcala Fm, map presented in Figure 6-2. The map shows trace of the mineralized structure projected on the surface, to visualize the direction of the structure, even if there are only small outcrops at the pit of the San José I and II bodies, and part of San Martín (Figure 7-3)

6.2.1Las Trancas Formation

Burk (1993) describes this formation in the Arroyo Nacional, located in the area known

such as Chicarroma, distant 3 km to the NE of the central part of the San Martín mine. The package consists of well-foliated slates, red to gray-brown shales, interbedded with strata of a few centimeters of calcareous siltstones, fine-grained sandstones and, to a lesser extent, proportion, conglomerates.

6.2.2El Doctor Formation

This formation does not outcrop on the surface of the San Martín mine, and neither is it present in underground works as encasing rock. However, 3 km to the northeast been mapped by the geologists of the mining unit, in the areas known as Chicarroma and Capulín, located in the vicinity of the intrusive that makes up La Peña de Bernal.

6.2.3Soyatal–Mezcala Formation

In the underground mine workings of the San Martín mine, this formation is the main host rock throughout the entire mineralized structure. Regarding its behavior on surface, it is seen in the San José I and II and part of San Martín structure, Rock consists of micritic and calcarenite limestones thinly bedded, interbedded clayey with some chert lenses and horizons thin shale and marl, with strata between 10 to 20 centimeters of argillaceous limestone and calcareous shale. The upper part of the strata consists in thinner layers between 5 to 10 cm. Thickness of this Formation is around 150 meters.

6.2.4Igneous Rocks

Locally in the mine area two types of igneous rocks are recognized, clearly differentiated and after the Soyatal-Mezcala Formation:

| 1) | A unit of volcanic rocks of andesite/dacite composition that overlies unconformably to the Cretaceous sedimentary rock units, and which makes up the entire stratovolcano called Cerro San Martín. The geologists of the San Martín mine have subdivided this unit into the Andesitic/dacitic Breccia (Tdbx) and Andesite/dacite (Ta/d). |

| 2) | n intrusive known as a rhyolitic dike that fits between sedimentary rock units, the volcanic dacite-andesitic and the mineralized structure and that has only been observed in underground works. |

6.2.5Andesite/Dacite

Overlying the Soyatal-Mezcala Formation in erosional unconformity, they appear throughout the

region and in the surroundings of the mine a set of volcanic rocks, of andesitic composition, which are part of the stratovolcano that constitutes the San Martín hill. The structure at the base is brecciated with fragments from 10 to 30 centimeters in diameter. The dike outcrops underground between the andesite/dacite and limestone of the Soyatal-Mezcala Formation. In the underground

Erme Enriquez, CPGJuly 18, 202222

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

works of the mine, the intrusive body it is deeply silicified, megascopically it is milky white yellowish and with a general brecciated texture, that is, massive-brecciated quartz clasts and cemented by another stage of quartz that cements the entire rock.

Figure 7-3:Geologic Map of the San Martín Mine Project (After Labarthe, et. al, 2004)

Erme Enriquez, CPGJuly 18, 202223

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Mineralization occurs in Upper Cretaceous black limestone and calcareous shales of the Soyatal-Mezcala Formation as electrum, and silver selenide minerals principally associated with quartz and to a lesser degree with calcite. The deposit is an epithermal, low sulphidation precious metal (Au-Ag) type (metal ratio Ag:Au at 10:1).

Mineralization is generally made up of breccia that commonly is concordant with a limestone/shale contact (in the San Martin and San José areas) which forms the relatively steeply dipping “Tronco” and “Mantos” oreshoots, these breccia-veins contact the younger volcanic flows (dacite and ignimbrite) where they have formed the more horizontal portions of the deposit. The mineralized economic breccia grades from 30 g Ag/t to 250 g Ag/t.

Exploration has been concentrated along the NE trending breccia zone however evidence of a northerly trend in area 30 and 31 leads to suspect possible other structures together with 2.0 g Au/t to 30 g Au/t over widths that vary from 1.5 to 17.0 m but averaging 4.0 m.

The mineralized oreshoots show several stages of brecciation and cementation, with four major stages of hydrothermal breccias and supergene alteration that filled fractures and late cavities. The metallic mineralization is mainly formed by electrum, naumannite, tetrahedrite, pyrite and chalcopyrite as hypogene minerals, and free gold, partzite, chlorargyrite, malachite, hematite, goethite-limonite as supergene minerals. Gangue minerals are mainly quartz, chalcedony, and calcite, with minor amounts of adularia. Quartz and calcite occur in all the four stages cementing the breccia fragments of rock and older vein. Chalcedony, quartz, and calcite associated with the economic mineralization usually show saccharoidal, crustiform, colloform, cockade and comb textures. Stage one is totally barren of silver and gold. The main Ag-Au mineralization occurred in the second stage of brecciation, associated to colloform and chalcedony quartz. Stage three is carrying low grade and is abundant. The late stage of mineralization is characterized by native gold content, chlorargyrite and abundant partzite, because of the supergene alteration. Mineralization occurs as native gold, electrum, naumannite (AgSe) and argentojarosite (AgFe3(SO4)2(OH)6) associated principally with quartz and lesser calcite. The silver contained in argentojarosite is not recoverable with cyanidation.

8.0DEPOSIT TYPE

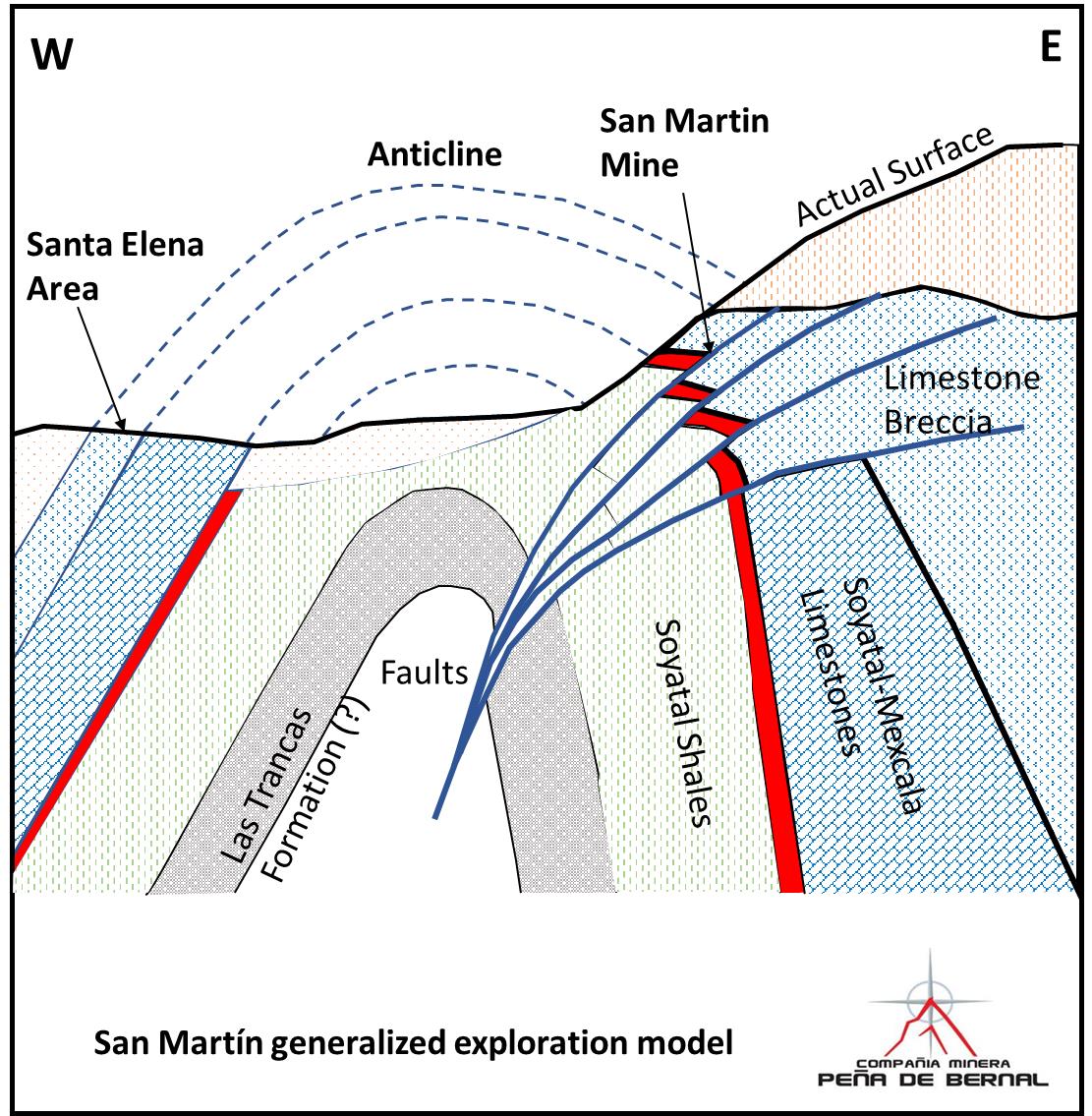

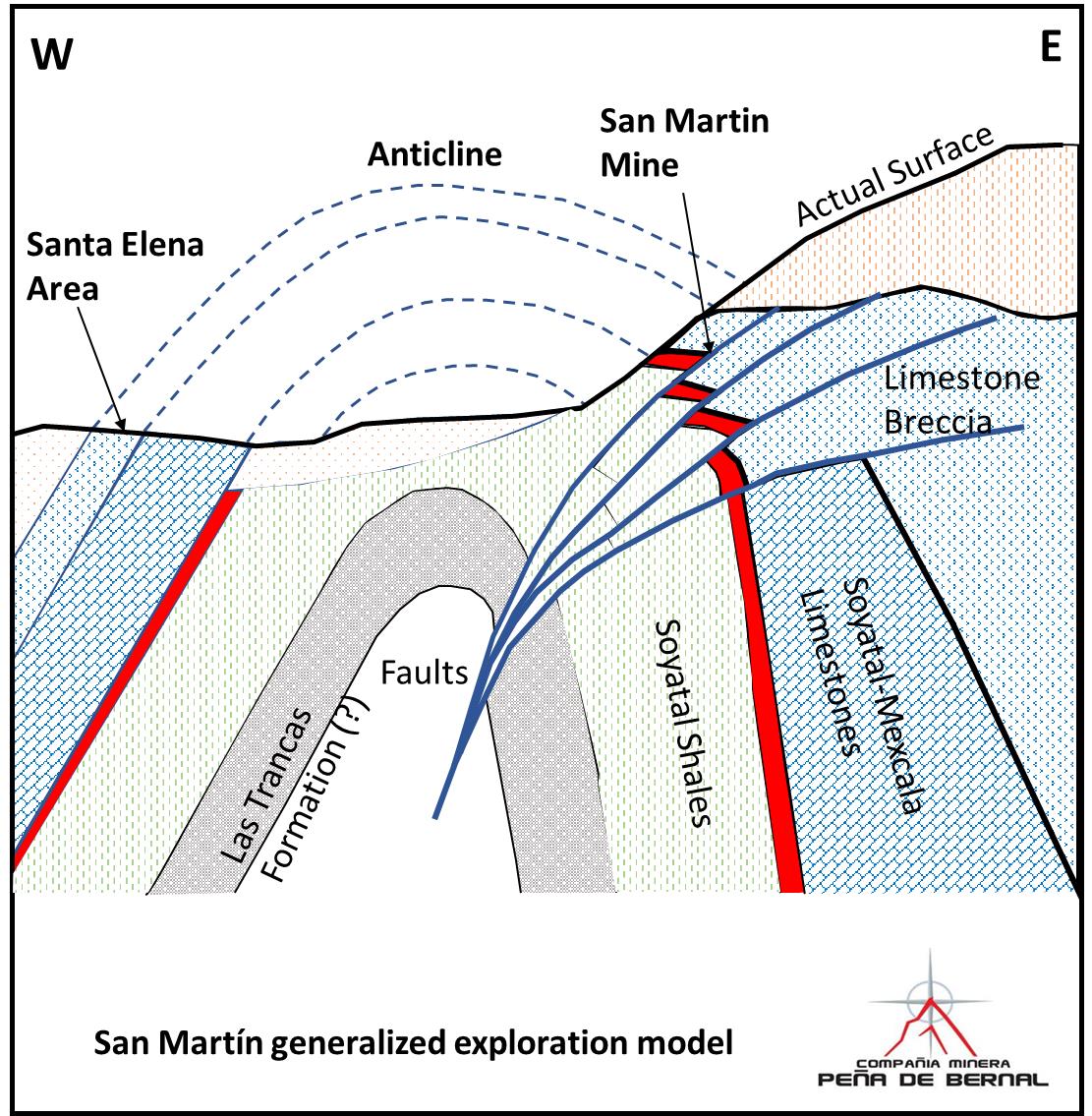

The San Martin deposit is composed by a tabular, vein-like subvertical mineralised structure that becomes to a sub-horizontal mineralised structure or “manto-like” close to surface. This mineralised structure is recognized for over 2 km along strike, with thicknesses between 1.5 and 17 metres and 400 m of vertical extent or “favorable zone”. In general, the mineralisation is hosted in the contact of limestone-shale of Soyatal-Mezcala Formation and associated to a silicified rhyolitic dike.

For many years it was thought that mineralisation was associated with a dome of rhyolitic composition, and that the structure was repeated towards the east portion of that dome. New observations have detected that mineralisation is associated with the stratification of the rocks of the Soyatal and Mezcala formations, which form an anticline fold of dimensions of up to one kilometer. The mineralisation hosted in the east Limb of the fold, with the hinge zone containing the mineralization of bodies 28 to 31 and eroded in its central part. That is why it is of the utmost importance to detect the stratigraphic position of the Soyatal-Mezcala Formations in the Santa Elena area as there may be a replica of the San Martin mineralisation in that zone (Figure (8-1).

Homogenization temperatures (Th) indicate that mineralization of the second stage occurred between 220 °C and 260 °C, with an average Th of 243 °C. Salinities range from 0.5 to 2.5 wt. % NaCl equiv., with an average of 1.9 wt. % NaCl equiv.

Erme Enriquez, CPGJuly 18, 202224

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Low sulphidation epithermal veins in Mexico typically have a well-defined, sub-horizontal ore horizon about 300 m to 500 m in vertical extent where the bonanza grade ore shoots have been deposited due to boiling of the hydrothermal fluids (Buchanan (1981), Enriquez (1995). Neither the top nor the bottom of the San Martin ore horizon has yet been found but, given that high gold-grade mineralization occurs over a 400-m vertical extent from the top of the San Martin oreshoot to below Level 10 in the general mine, it is likely that erosion has not removed a significant extent of the ore horizon due to a capping of rhyolites on top of the structure.

Low sulphidation deposits are formed by the circulation of hydrothermal solutions that are near neutral in pH, resulting in very little acidic alteration with the host rock units. The characteristic alteration assemblages include illite, sericite and adularia that are typically hosted by either the veins themselves or in the vein wall rocks. The hydrothermal fluid can travel either along discrete fractures where it may create vein deposits, or it can travel through permeable lithology such as a volcanic rocks, limestone, or shale, where it may deposit its load of precious metals in a vein deposit. In general terms, this style of mineralization is found within the San Martin district.

Figure 8-2 illustrates the spatial distribution of the alteration and veining found in a hypothetical low sulphidation hydrothermal system.

Erme Enriquez, CPGJuly 18, 202225

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Figure 8-1:Generalized sketch of kinematic evolution and structural styles of fold-and-thrust faults in the San Martin Mine

Erme Enriquez, CPGJuly 18, 202226

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Figure 8-2:Schematic cross section showing the key geologic elements of the main epithermal systems and their crustal depths. Modified after Buchanan, 1982, Berger and Eimon, 1983, Hollister, 1985, Corbett and Leach, 1996, dated December 2013.

9.0EXPLORATION

Exploration at San Martin is concentrated along the strike length of the breccia zone. In-house diamond drilling initially tests selected targets, which is followed by underground development that outlines Mineral Reserves. Target selection is assisted by structural, geochemical and geophysical surveying that has included magnetics, induced polarization and resistivity. The resistivity surveys have been particularly successful in outlining the quartz breccia and several promising resistivity anomalies, detected since 1998, to the northeast remain to be tested.

Exploration is being carried out in three areas: 1) North Area: over the extension of Bodies 32 and 33. 2) Central Area: exploration of the extension of Body 28 to the east; and 3) South Area: continues with the exploration of San José FW and Santa Clara HW, this zone is known as Area Sarah.

San Martin is a mature mining district with a long history of exploration. The data, methods, and historical activities presented in this section document actions that led to the first and continued development of the mine but are not intended to convey any discussion or disclosure of a new, material exploration target as defined by NI 43-101. Exploration outside of the current operation is

Erme Enriquez, CPGJuly 18, 202227

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

in conducted by geologists of the mining unit and incorporated into the geologic model that is still under construction. New drilling was included in the update of the geological resource model to support the mineral reserves and mineral resources. Drilling results added for the model update provide local refinement of the geologic interpretations and grade estimates, but do not materially alter these interpretations and estimates on a district-wide scale.

The mine has been extensively explored from surface using geologic mapping, vein mapping and vein sampling. Underground exploration consisted of diamond drilling, geologic level mapping, vein level mapping, vein sampling and drift and stope development. Historical underground development includes 69,102 meters of drift and raise, and 82,664 meters of preparation and accessing ramps. Channel samples are collected from drifts and stopes to conduct the exploration with drifting and grade control in stopes.

9.1Channel Samples

Channel samples are collected using the following guidelines:

| • | During level mapping, geologists paint sample locations on the back or development face to guide samplers. |

| • | Samples are collected by chiseling out the painted area, ideally cutting 10 cm wide sample. |

| • | The sample widths range from 0.2 m to 1.5 meters as maximum. |

| • | The sample’s weight is usually between 1.0 and 2.5 kg. The sample is broken into small pieces of around ¼ inch to 1.0 inch as maximum. |

| • | Sampling is carried out as perpendicular to the vein strike as possible and the true width is measured by sighting the vein dip and tilting the measuring tape accordingly. |

| • | Stope and face samples are collected at 2 m intervals across strike. Wall rock and vein material are sampled separately. When dictated by geological features, samples are taken at closer intervals |

| • | Sampling along cross cuts is conducted continuously. |

Sampling is subject to numerous sources of error, particularly to the differential hardness of material being sampled, and the tendency to include disproportionate volume of softer rock. Diligent of systematic collection of channel samples generates a large data set which in most cases is statistically representative, but never completely free of errors or potential bias. The collection of channel samples has been observed underground it was noted that the procedure follows accepted engineering practices for channel sampling established by the geology department. The author concludes channel samples procedures used in the mine result in samples which are reasonably representative of the mineralization and meet industry best practices guidelines for this type of sampling. The resulting data is sufficient to support the estimation of reserve and resources.

10.0DRILLING

Historic exploration drilling statistics for the period of 1988-2022 are summarized in Table 7-1. These results were proportionated by CMPB and summarized here, however; the data has not been independently verified by the author.

The drill hole database for the SM contains 1989 drill holes completed between 1988 and April 2022, representing 233,944 meters of drilling. This includes condemnation, district exploration, geotechnical. Minas Coremin, SA de CV (MICO), a subsidiary of Luismin-Wheaton River drilled the

Erme Enriquez, CPGJuly 18, 202228

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

property since 1988 to 2007. SMI acquired the mine in February 2008 and since then the performance of drilling has improved significantly.

These low-grade to barren holes are not in the immediate mining areas and are not used for resource estimation. Some of the drill holes used for geologic modeling are summarized in Table 10-1.

The goals of drilling by MICO, for the period of 1988-2007, was to trace the breccia structure from the San José open pit to the north-northwest, resulting in the discovery of the San Martin orebody and the San José II structure. The misconception of the type of deposit resulted in starting the exploitation of the San Martin with an open pit. The idea, at that time, was to mine out 180,000 tonnes of ore and shut down the mine at the third year. The San Martin giant breccia was discovered with the pit and then the concept of exploration was reviewed by Luismin.

Most of the drilling was done from underground. The author has no information about the holes done from surface but represent less than 2% of the total. Figure 10-1 shows the swarm of historical holes that have been performed in the entire mine.

Table 10-1:Summary of drill hole programs performed by MICO and CMPB

10.1Collar and Downhole Surveys

Upon completion of a drill hole, collar locations are surveyed using the surveyors for underground and Global Positioning System (GPS) units for surface holes . All coordinates are based on UTM mine grid system. Historically, downhole surveys were not systematically performed. For historical holes lacking surveys, the collar azimuth and dip are used for the entire length of the hole. Survey data are part of the district-wide database and are used in the modeling process to locate drill hole intercepts. Final reports for collar and downhole surveys are included in the drill hole log files. Original survey records are stored in a secure facility. Spatial locations of the drill holes are visually confirmed in the resource modeling software.

Erme Enriquez, CPGJuly 18, 202229

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

Figure 10-1:Map showing the swarm of drill holes done at the entire San Martin mine

10.2Drill Core Sampling

Diamond drill core samples are taken according to the following criteria:

| • | Drill core is split using a core saw |

| • | Samples are taken from the core sections with visible structure (breccia) or mineralization, and 1.5 meters of the surrounding wall rock |

| • | Will rock within the breccia structure is sampled independently |

| • | Information is recorded in the drill logs for each sample includes depth, width, core angle and ore/rock type |

10.3Core Logging

Core logging procedures used at the San Martin mine were developed under the ownership of MICO and recently by CMPB. Historical logging was done on paper and includes information regarding rock types, structure, mineralization, and alteration.

Currently, geological logging is done on laptop computers. Since 2008, all information is entered into a drill hole database. Information collected includes rock type, alteration type and intensity, mineralization, core recovery and rock quality designation (RQD). No high-resolution photographs are taken for each or set of boxes. Completed logs are validated, approved, and then printed out and stored on-site for each drill hole.

Erme Enriquez, CPGJuly 18, 202230

STARCORE International Mines Ltd.

San Martin Mine NI 43-101 Technical Report: Updated Mineral Resource and Reserve

10.4Important Drilling Results

A total of 7,360.50 meters were drilled in 2021 until the end of April 2022 which focused on two areas of the mine: the first focusing on the CENTRAL (San Martin Body and 28 Body) part of the operating mine, and the second searching for the extension of the orebodies of high-grade discovered during the 30 years of the mine’s life. The San Martin structure was cut after the normal fault the displaces right-lateral the breccia structure(Figure 10-2). Highlights of the best results are in Table 10-2.

Table 10-2:Drill Results of the San Martin Body Extension

Figure 10-2:San Martin Orebody detected with Diamond Drill Holes

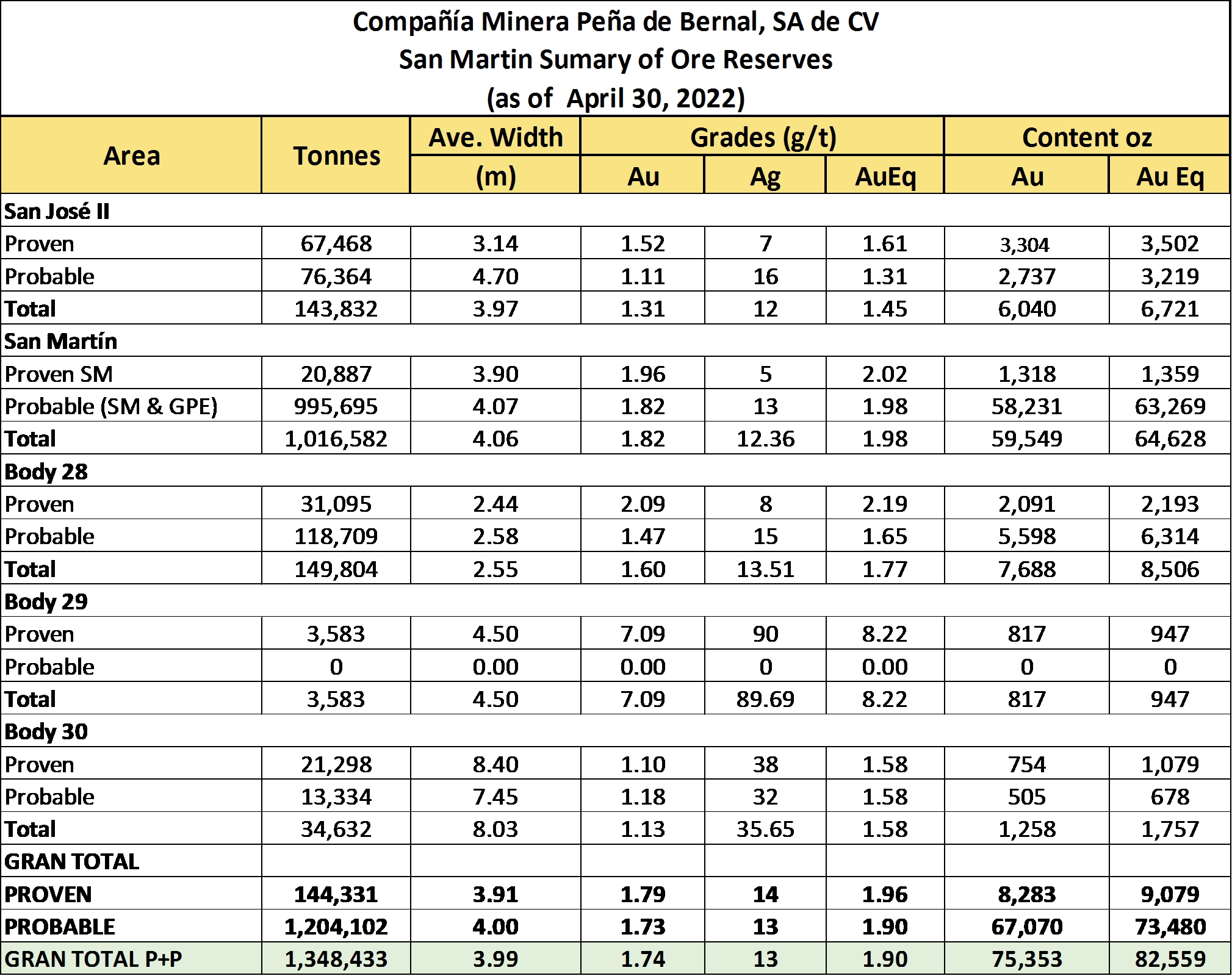

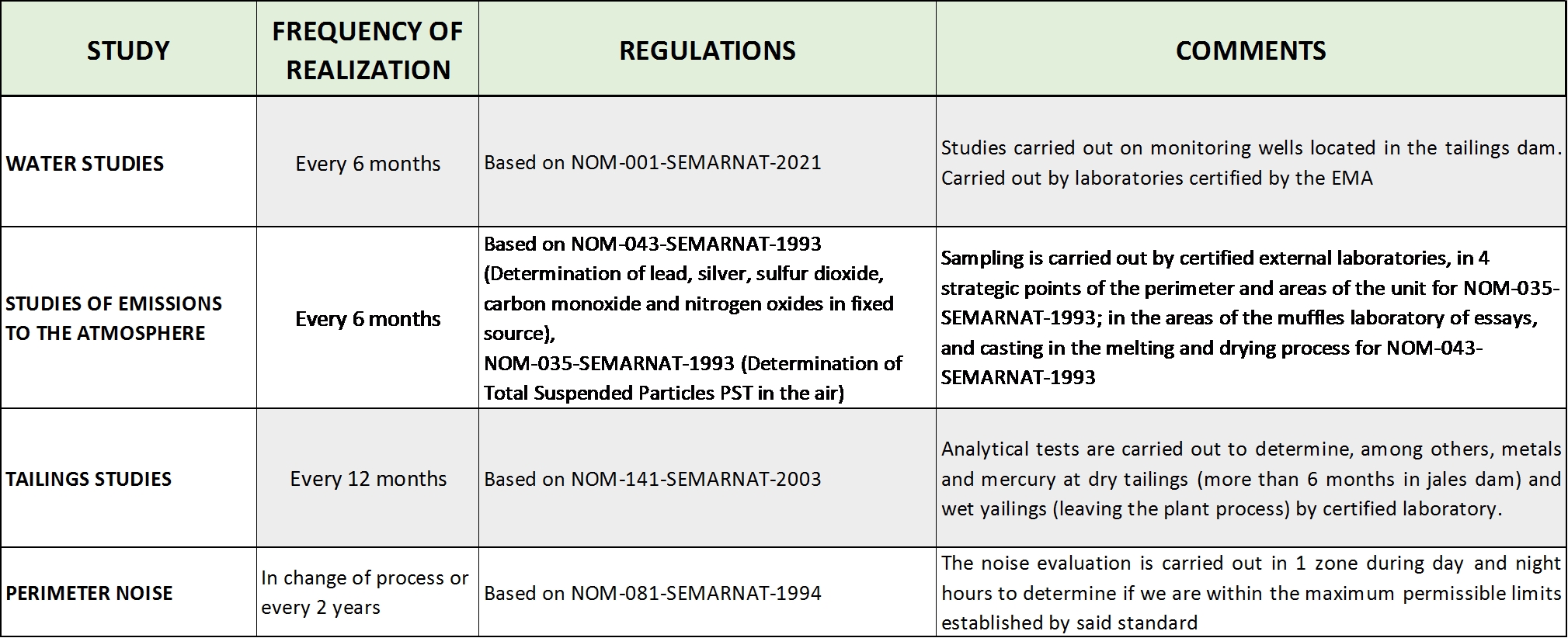

Erme Enriquez, CPGJuly 18, 202231