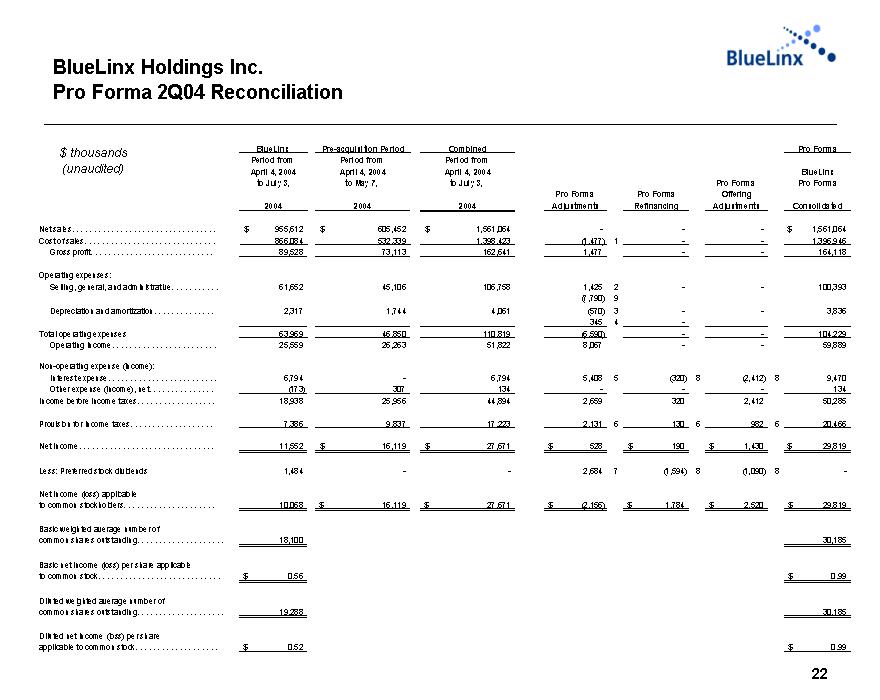

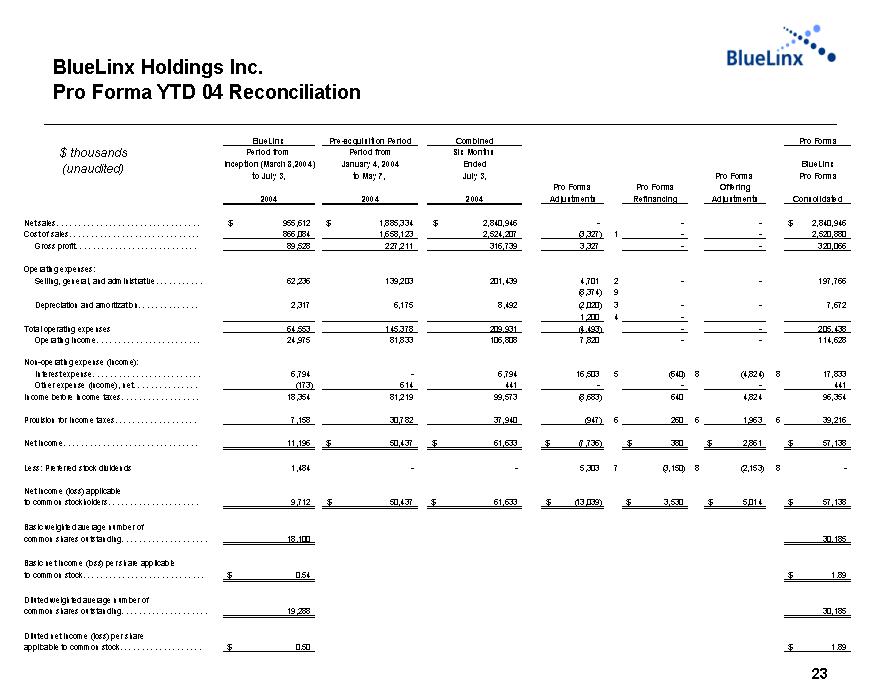

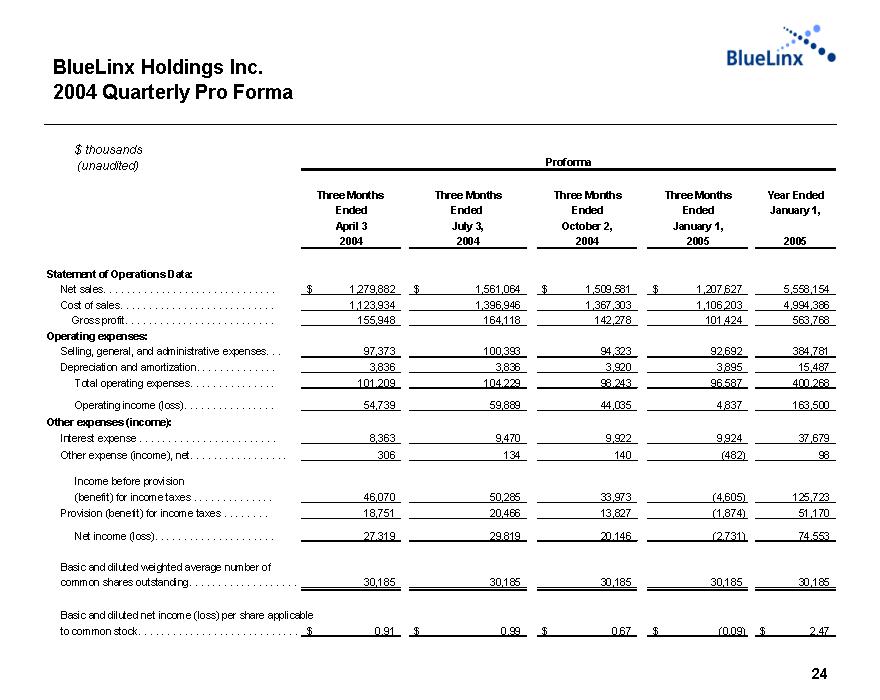

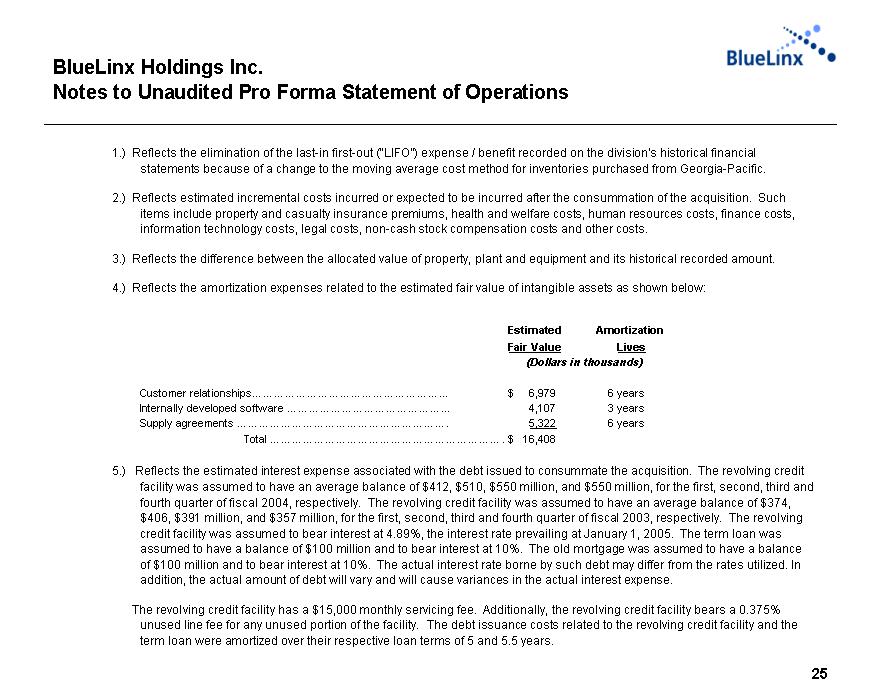

| BlueLinx Holdings Inc. Notes to Unaudited Pro Forma Statement of Operations 1.) Reflects the elimination of the last-in first-out ("LIFO") expense / benefit recorded on the division's historical financial statements because of a change to the moving average cost method for inventories purchased from Georgia-Pacific. 2.) Reflects estimated incremental costs incurred or expected to be incurred after the consummation of the acquisition. Such items include property and casualty insurance premiums, health and welfare costs, human resources costs, finance costs, information technology costs, legal costs, non-cash stock compensation costs and other costs. 3.) Reflects the difference between the allocated value of property, plant and equipment and its historical recorded amount. 4.) Reflects the amortization expenses related to the estimated fair value of intangible assets as shown below: Estimated Amortization Fair Value Lives (Dollars in thousands) Customer relationships...................................................... $ 6,979 6 years Internally developed software ............................................. 4,107 3 years Supply agreements .......................................................... 5,322 6 years Total ................................................................ $ 16,408 5.) Reflects the estimated interest expense associated with the debt issued to consummate the acquisition. The revolving credit facility was assumed to have an average balance of $412, $510, $550 million, and $550 million, for the first, second, third and fourth quarter of fiscal 2004, respectively. The revolving credit facility was assumed to have an average balance of $374, $406, $391 million, and $357 million, for the first, second, third and fourth quarter of fiscal 2003, respectively. The revolving credit facility was assumed to bear interest at 4.89%, the interest rate prevailing at January 1, 2005. The term loan was assumed to have a balance of $100 million and to bear interest at 10%. The old mortgage was assumed to have a balance of $100 million and to bear interest at 10%. The actual interest rate borne by such debt may differ from the rates utilized. In addition, the actual amount of debt will vary and will cause variances in the actual interest expense. The revolving credit facility has a $15,000 monthly servicing fee. Additionally, the revolving credit facility bears a 0.375% unused line fee for any unused portion of the facility. The debt issuance costs related to the revolving credit facility and the term loan were amortized over their respective loan terms of 5 and 5.5 years. |