QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on September 2, 2004

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BLUELINX HOLDINGS INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 5031 | 77-0627356 | ||

| (State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

4300 Wildwood Parkway

Atlanta, Georgia 30339

(770) 953-7000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Barbara V. Tinsley, Esq.

General Counsel and Secretary

4300 Wildwood Parkway

Atlanta, Georgia 30339

(770) 953-7000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Michael R. Littenberg, Esq. Schulte Roth & Zabel LLP 919 Third Avenue New York, NY 10022 Ph: (212) 756-2000 Fax: (212) 593-5955 | Robert E. Buckholz, Jr., Esq. Sullivan & Cromwell LLP 125 Broad Street New York, NY 10004 Ph: (212) 558-4000 Fax: (212) 558-3588 |

Approximate date of commencement of the proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| Title Of Each Class Of Securities To Be Registered | Amount To Be Registered(1) | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price(2) | Amount Of Registration Fee | ||||

|---|---|---|---|---|---|---|---|---|

| Common Stock, $.01 par value | — | — | $150,000,000 | $19,005 | ||||

- (1)

- Includes shares of common stock issuable upon exercise of an over-allotment option granted to the underwriters.

- (2)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Subject to Completion. Dated September 2, 2004.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Shares

BlueLinx Holdings Inc.

Common Stock

This is an initial public offering of shares of common stock of BlueLinx Holdings Inc. All of the shares of common stock are being sold by the company.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . BlueLinx intends to apply for listing the common stock on the New York Stock Exchange under the symbol "BXC".

See "Risk Factors" on page 11 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

| Initial public offering price | $ | $ | |||||

| Underwriting discount | $ | $ | |||||

| Proceeds, before expenses, to BlueLinx | $ | $ | |||||

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from BlueLinx at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2004.

| Goldman, Sachs & Co. | Morgan Stanley | |

| Credit Suisse First Boston | Lehman Brothers |

Prospectus dated , 2004.

(Artwork to be filed by amendment).

MARKET SHARE, RANKING AND OTHER DATA

In this prospectus, we refer to information regarding market data obtained from internal sources, publicly available information and industry publications. Although we believe the information is reliable, we cannot guarantee its accuracy or completeness and have not independently verified it. Unless otherwise noted, market data is based on internal management estimates for 2003 and is an approximation.

We measure our market share based on the data published annually by Home Channel News, or HCN. We define our market share as our sales as a percentage of the reported sales of the 123 firms from HCN's list whom we consider to be our competitors.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus includes "forward-looking statements." Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words "believe," "anticipate," "expect," "estimate," "intend," "project," "plan," "will be," "will likely continue," "will likely result" or words or phrases of similar meaning. All of these forward-looking statements are based on estimates and assumptions made by our management that, although we believe to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. These risks and uncertainties may include those discussed under the heading "Risk Factors" and other factors, some of which may not be known to us. We operate in a changing environment in which new risks can emerge from time to time. It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy or actual results to differ materially from those contained in forward-looking statements. Factors you should consider that could cause these differences include, among other things:

- •

- changes in the supply and/or demand for products which we distribute;

- •

- the activities of competitors;

- •

- changes in significant operating expenses;

- •

- changes in the availability of capital;

- •

- our ability to identify acquisition opportunities and effectively and cost-efficiently integrate acquisitions;

- •

- general economic and business conditions in the United States;

- •

- acts of war or terrorist activities;

- •

- variations in the performance of the financial markets; and

- •

- the other factors described herein under "Risk Factors."

Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

None of Georgia-Pacific or any of its employees, affiliates or control persons is responsible for, or is making, any representations concerning our future performance or the accuracy or completeness of this prospectus.

1

This prospectus includes trade names and trademarks of other companies. Our use or display of other parties' trade names, trademarks or products is not intended to and does not imply a relationship with, or endorsement or sponsorship of us by, the trade name or trademark owners.

2

The following summary highlights selected information from this prospectus. It does not contain all the information that you should consider in making an investment decision and should be read together with the more detailed information appearing elsewhere in this prospectus, including "Risk Factors" and the financial statements and related notes. Except as otherwise indicated herein, or as the context may otherwise require, the words "we," "our," "us" and "the company" refer to BlueLinx Holdings Inc., or BlueLinx, and its consolidated subsidiaries. References to the "division" refer to the building products distribution division of Georgia-Pacific Corporation, or Georgia-Pacific, that we acquired on May 7, 2004; prior to the acquisition, we did not have any ownership interest in the division and it was wholly-owned by Georgia-Pacific. We refer to our wholly-owned operating company, BlueLinx Corporation, as our "operating company."

References to (1) fiscal 2003 refer to the 53-week period ended January 3, 2004, (2) fiscal 2002 refer to the 52-week period ended December 28, 2002 and (3) fiscal 2001 refer to the 52-week period ended December 29, 2001.

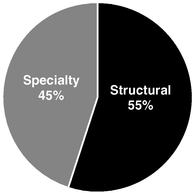

We are the largest distributor of building products in the United States. We operate in all of the major metropolitan areas in the United States and distribute over 10,000 products to more than 11,700 customers through our network of 63 warehouses and third-party operated warehouses. We distribute products in two principal categories: structural products and specialty products. Structural products, which represented approximately 55% of our fiscal 2003 net sales, include plywood, oriented strand board, or OSB, lumber and other wood products primarily used for structural support, walls and flooring in residential construction projects. Specialty products, which represented approximately 45% of our fiscal 2003 net sales, include roofing, insulation, moulding, engineered wood products, vinyl products (used primarily in siding) and metal products. During the 12-month period ended July 3, 2004, our net sales were $5.2 billion, our pro forma EBITDA was $200 million and our pro forma net income was $95 million. During this period, we grew our net revenue by 39% and unit volume by 8.5%.

Our customers include building material dealers, industrial users of building products, manufactured housing builders and home improvement centers. We purchase our products from over 750 vendors and serve as a national distributor for a number of our suppliers. We distribute products through our owned fleet of 900 trucks and over 1,200 trailers, as well as by common carrier.

The division commenced operations in 1954 with 13 warehouses primarily used as an outlet for Georgia-Pacific's plywood. On May 7, 2004, Georgia-Pacific sold the division to a new company formed by Cerberus Capital Management, L.P., or Cerberus, and members of our management team.

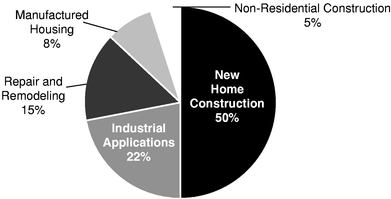

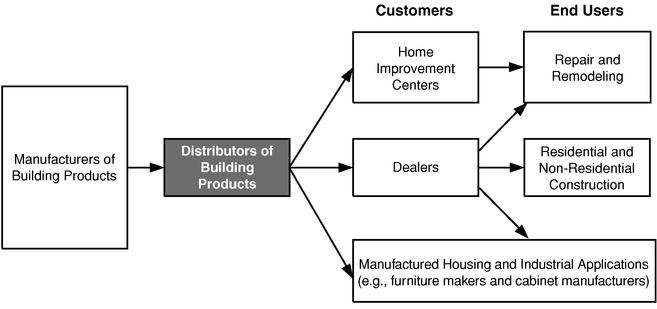

We participate primarily in the U.S. building products' two-step distribution market. Within this market, distributors, such as ourselves, generally buy building products from manufacturers and sell these products to industrial users or to building materials dealers and retailers, who in turn sell the products directly to the ultimate end user of the product. End users of building products generally operate in five principal markets: (1) new home construction; (2) repair and remodeling; (3) manufactured housing; (4) non-residential construction; and (5) industrial users.

We estimate the size of the U.S. two-step building products distribution industry at $39 billion in 2003. This industry is highly fragmented, with the top four industry participants comprising 31% of

3

the market in 2003 and more than 100 other competitors comprising the remaining 69%. Our market share of 10.9% in 2003 was the largest in the industry.

We believe the following industry conditions and trends will benefit our business:

- •

- increased market share opportunity for national distributors;

- •

- fragmented industry with consolidation opportunities;

- •

- end user focus on reducing inventories and improving supply-chain efficiency;

- •

- secular growth of new housing market;

- •

- relative stability of repair and remodeling market;

- •

- recovery in industrial, manufactured housing and nonresidential markets; and

- •

- increase in imports of building products.

We believe that the following competitive strengths are the keys to our success:

Largest building products distributor in the United States. We believe that the benefits of our industry-leading position include superior market information, geographic diversity and a better ability to serve multi-regional customers and vendors. Unlike our two largest competitors who are owned by manufacturers, our independence allows us to have independent control of our inventory management, as well as our product and vendor selection.

Centralized business structure with a meaningful local presence. We believe that our centralized business model allows strategic oversight and captures economies of scale while allowing us to maintain a meaningful local sales and operating presence. Centralizing sales, procurement, technology systems and accounting and strategic oversight allows the branch sales and operations teams to focus on local market requirements. We maintain a meaningful local sales and operating presence at each of our 63 branches, which allows us to monitor local trends and expand relationships with our local customers. In addition, we believe that our centralized business structure will enhance our ability to absorb acquisitions into our existing infrastructure.

Diversified customer base. We have over 11,700 customers, including building material dealers, industrial customers, manufactured housing builders and home improvement centers. Our 10 largest customers accounted for approximately 18% of our fiscal 2003 net sales, and no single customer accounted for more than 4% of our fiscal 2003 net sales.

Extensive product and services offerings. We distribute over 10,000 building products and do not rely on any single product type. In addition, we provide comprehensive services to our customers and vendors, including marketing, packaging and transportation services, inventory management and end-user assistance.

Strong relationships with vendors. We have long-term relationships with many of our 750 suppliers, including relationships of more than 20 years with each of our top 10 vendors. We have primary or exclusive distribution agreements with many of our suppliers, including Georgia-Pacific, our largest supplier. Other than Georgia-Pacific, which accounted for 32% of our total purchases in fiscal 2003, no other supplier accounted for more than 5% of our fiscal 2003 purchases.

Experienced management team whose interests are aligned with shareholders. Our six senior operating managers average approximately 25 years of industry experience and 16 years of employment with us and the division. Over 250 of our employees participate in a bonus program. Our six senior operating managers have purchased 9.5% of our common stock in connection with the acquisition transactions and may earn bonuses of up to 80 to 100% of their respective base salaries.

4

Our mission is to create cost-effective, value-added supply-chain solutions for our customers and vendors. We believe this approach enhances our industry-leading position and maximizes shareholder value. We seek to achieve this objective by implementing the following strategies:

Continue to organically grow our unit volumes and revenues. We intend to continue to organically grow our unit volumes and revenues by further penetrating our customer base, capturing new customer opportunities and broadening our product and service offerings through our existing distribution channels. Our year-over-year unit volume growth over the 12 months ended in June 2004 is estimated to be 8.5% and has significantly outpaced overall market growth.

Selectively pursue strategic acquisitions. We plan to be a leader in the consolidation of the highly fragmented building products distribution industry. Our acquisition strategy will be to selectively pursue acquisitions that would further expand our product offering and customer base. We intend to focus on acquisitions of small and medium-sized regional operators at prices that generate attractive returns on invested capital.

Expand our product portfolio and service offerings. We plan to extend our product and service offerings to generate increased revenue. As a newly independent distributor, we have started to build relationships with new vendors who did not do business with us while we were owned by Georgia-Pacific.

Leverage our operating platform. We believe that we have the capacity to support unit volume growth without incurring a proportional increase in our fixed costs and capital expenditure requirements. We estimate that our operating margin on incremental volume growth is more than double the level of our ongoing operating margins.

Further enhance operating margins and inventory management. We intend to continue to improve our operating margins by implementing several productivity and efficiency initiatives. These include a new pricing software initiative that is expected to improve our sales force productivity and gross margins, as well as several other initiatives designed to improve our inventory management, vehicle routing and the efficiencies of other centralized processes.

Our Acquisition of the Division's Assets From Georgia-Pacific

On March 12, 2004, we and our operating company entered into two separate definitive agreements to acquire the real estate and operating assets, respectively, of the division. The transactions were consummated on May 7, 2004. At the closing, we paid an aggregate purchase consideration of approximately $773 million. Based on our calculation, we are obligated to make a final working capital settlement payment of $41.0 million to Georgia-Pacific, plus 4% interest per annum from the closing date of the acquisition. The acquisition was funded with net proceeds of $476.0 million from drawings under our revolving credit facility, net proceeds of $97.0 million from our term loan, proceeds of $100.0 million from a mortgage payable to ABPMC LLC, or ABPMC, an affiliate of Cerberus, proceeds of $95.0 million from the issuance of preferred stock and proceeds of $5.0 million from the issuance of common stock. In addition, we paid debt issue costs of $12.0 million and $3.0 million for our revolving credit facility and our term loan facility, respectively.

Cerberus Capital Management, L.P., or Cerberus, is a New York-based global private investment firm which, together with its affiliates, manages in excess of $14 billion of capital.

We are a Delaware corporation. Our principal executive offices are located at 4300 Wildwood Parkway, Atlanta, Georgia 30339 and our telephone number at those offices is (770) 953-7000.

5

Common stock offered by BlueLinx | shares | |

Common stock to be outstanding immediately after this offering | shares | |

Common stock to be held by Cerberus immediately after this offering | shares | |

Use of proceeds | We will receive net proceeds from the offering of approximately $ million. We intend to use the net proceeds from the offering (i) to repay our operating company's $100 million term loan plus accrued and unpaid interest thereon, (ii) to redeem up to $35 million of our series A preferred stock and pay all accrued and unpaid dividends on the portion redeemed and (iii) for general corporate purposes. | |

Concurrently, with this offering, we intend to obtain from a third party a new $162 million mortgage secured by our 61 wholly-owned warehouses. See "Description of Certain Indebtedness—Real Property Mortgage." | ||

Proceeds from the new mortgage will be used to (i) repay our existing $100 million of mortgage debt plus accrued and unpaid interest thereon and (ii) redeem the remaining series A preferred stock and pay all accrued and unpaid dividends on the portion redeemed. | ||

As described under "Use of Proceeds," Cerberus will receive a significant portion of the proceeds of this offering. | ||

Dividend policy | We intend to pay dividends on our common stock at the quarterly rate of $ per share. Future dividends will be subject to certain considerations discussed under "Risk Factors — Risks Related to the Offering — We intend to pay dividends on our common stock but may change our dividend policy; the instruments governing our indebtedness contain various covenants that may limit our ability to pay dividends," and "Dividend Policy." | |

Proposed New York Stock Exchange symbol | "BXC" | |

Risk factors | For a discussion of risks relating to our company, our business and an investment in our common stock, see "Risk Factors" and all other information set forth in this prospectus before investing in our common stock. |

6

The number of shares of common stock to be outstanding after this offering is based on shares outstanding as of , 2004 and excludes:

- •

- shares subject to options unvested as of , 2004 and having a weighted average exercise price of $ per share; and

- •

- additional shares reserved as of , 2004 for future issuance under our stock-based compensation plans.

Except where we state otherwise, the information we present in this prospectus assumes no exercise by the underwriters of the option granted by us to purchase additional shares in this offering, and has been adjusted to reflect:

- •

- a -for- split of the common stock to occur prior to the closing of this offering; and

- •

- the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated by-laws prior to the closing of this offering.

7

Summary Consolidated Historical and Pro Forma Financial Data

The following table provides a summary of our consolidated historical financial, pro forma and other financial data. On May 7, 2004, our operating company acquired the operating assets of the division and we acquired its real estate assets. We refer to these transactions, together with the issuance of equity and the related financings, as the "acquisition transactions." The financial statements prior to May 7, 2004 are referred to as "pre-acquisition period" statements.

The summary consolidated historical financial data for fiscal 2003, 2002 and 2001 have been derived from the audited consolidated financial statements of the division included elsewhere in this prospectus. We have derived the summary historical consolidated financial data at July 3, 2004 and for the period from May 8, 2004 to July 3, 2004 from our unaudited consolidated financial statements included elsewhere in this prospectus, which include all adjustments, consisting only of normal recurring adjustments, that, in our opinion, are necessary for a fair presentation of our results for such period. We have derived the summary historical consolidated financial data for the period from January 4, 2004 to May 7, 2004 and for the six months ended June 28, 2003 from the division's unaudited consolidated financial statements included elsewhere in this prospectus, which include all adjustments, consisting only of normal recurring adjustments, that, in our opinion, are necessary for a fair presentation of the division's results for such periods. The results of operations for the interim periods are not necessarily indicative of results for the full year or any future period.

The unaudited condensed consolidated pro forma statements of operations for the year ended January 3, 2004 and for the six months ended July 3, 2004 give pro forma effect, in each case as if they occurred on December 29, 2002, to:

- •

- the acquisition transactions,

- •

- a -for- split of our common stock to occur prior to the consummation of this offering,

- •

- the following transactions, which we refer to collectively as the "offering transactions":

- •

- the sale by us of shares of common stock in this offering at the assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus,

- •

- the refinancing of our current mortgage with our new mortgage, and

- •

- the application of the net proceeds of this offering and of our new mortgage as described under "Use of Proceeds."

The unaudited pro forma as adjusted consolidated balance sheet at July 3, 2004 gives effect to the offering transactions, in each case as if they had occurred on July 3, 2004.

The unaudited pro forma as adjusted condensed data do not necessarily reflect what our results of operations or financial position would have been had these transactions taken place on the dates indicated and are not intended to project our results of operations or financial position for any future period or date.

The acquisition of the assets of the division was accounted for using the purchase method of accounting, and the assets acquired and liabilities assumed were accounted for at their fair market values at the date of consummation based on preliminary estimates. The final allocation of the purchase price may differ from the amounts reflected herein, and those differences could be significant.

The following table should be read in conjunction with "Capitalization," "Selected Consolidated Historical Financial Data," "Unaudited Pro Forma Consolidated Financial Statements," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and all of the consolidated historical financial statements and accompanying notes thereto included elsewhere in this prospectus.

8

| | BlueLinx | Pre-acquisition Period | Pro Forma As Adjusted(1) | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Period from May 8, 2004 to July 3, 2004 | Period from January 4, 2004 to May 7, 2004 | Six Months Ended June 28, 2003 | Year Ended January 3, 2004 | Year Ended December 28, 2002 | Year Ended December 29, 2001 | Six Months Ended July 3, 2004 | Year Ended January 3, 2004 | ||||||||||||||||||

| | (unaudited) | (unaudited) | (unaudited) | | | | (unaudited) | |||||||||||||||||||

| | (Dollars in thousands, except per share data) | |||||||||||||||||||||||||

| Statement of Operations Data: | ||||||||||||||||||||||||||

| Net sales | $ | 955,612 | $ | 1,885,334 | $ | 1,910,907 | $ | 4,271,842 | $ | 3,734,029 | $ | 3,768,700 | $ | 2,840,946 | $ | 4,271,842 | ||||||||||

| Cost of sales | 866,203 | 1,658,123 | 1,722,398 | 3,814,375 | 3,370,995 | 3,395,184 | 2,520,288 | 3,818,687 | ||||||||||||||||||

| Gross profit | 89,409 | 227,211 | 188,509 | 457,467 | 363,034 | 373,516 | 320,658 | 453,155 | ||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

| Selling, general and administrative | 62,292 | 138,393 | 159,284 | 346,585 | 295,492 | 298,576 | 197,371 | 359,149 | ||||||||||||||||||

| Depreciation and amortization | 2,317 | 6,175 | 9,948 | 19,476 | 21,757 | 26,747 | 7,357 | 14,996 | ||||||||||||||||||

| Total operating expenses | 64,609 | 144,568 | 169,232 | 366,061 | 317,249 | 325,323 | 204,728 | 374,146 | ||||||||||||||||||

| Operating income (loss) | 24,800 | 82,643 | 19,277 | 91,406 | 45,785 | 48,193 | 115,930 | 79,009 | ||||||||||||||||||

| Non-operating expenses (income): | ||||||||||||||||||||||||||

| Interest expense | 6,620 | — | — | — | — | — | 14,952 | 28,230 | ||||||||||||||||||

| Other expense (income), net | (174 | ) | 614 | (5 | ) | 376 | 348 | 448 | 440 | 376 | ||||||||||||||||

| Income before provision (benefit) for income taxes | 18,354 | 82,029 | 19,282 | 91,030 | 45,437 | 47,745 | 100,538 | 50,403 | ||||||||||||||||||

| Provision for income taxes | 7,158 | 31,089 | 7,404 | 34,877 | 17,597 | 18,470 | 39,210 | 19,657 | ||||||||||||||||||

| Net income | 11,196 | $ | 50,940 | $ | 11,878 | $ | 56,153 | $ | 27,840 | $ | 29,275 | $ | 61,328 | $ | 30,747 | |||||||||||

| Less: Preferred stock dividends | 1,484 | |||||||||||||||||||||||||

| Net income applicable to common stockholders | $ | 9,712 | $ | 61,328 | $ | 30,747 | ||||||||||||||||||||

| Basic weighted average number of common shares outstanding | 20,000 | |||||||||||||||||||||||||

| Basic net income (loss) per share applicable to common stock | $ | 0.49 | $ | $ | ||||||||||||||||||||||

| Diluted weighted average number of common shares outstanding | 20,000 | |||||||||||||||||||||||||

| Diluted net income (loss) per share applicable to common stock | $ | 0.49 | $ | $ | ||||||||||||||||||||||

| Other Financial Data: | ||||||||||||||||||||||||||

| Capital expenditures | $ | 141 | $ | 1,378 | $ | 2,035 | $ | 5,404 | $ | 3,596 | $ | 817 | $ | $ | ||||||||||||

| EBITDA(2) | $ | 27,291 | $ | 88,204 | $ | 29,230 | $ | 110,506 | $ | 67,194 | $ | 74,492 | $ | 122,847 | $ | 93,630 | ||||||||||

| | At July 3, 2004 | |||||

|---|---|---|---|---|---|---|

| | Actual | Pro Forma As Adjusted(1) | ||||

| | (Dollars in thousands) | |||||

| Balance Sheet Data: | ||||||

| Cash and cash equivalents | $ | 32,902 | $ | 32,902 | ||

| Working capital(3) | 607,154 | 607,154 | ||||

| Total assets | 1,292,445 | 1,292,445 | ||||

| Total debt(4) | 692,802 | 654,802 | ||||

| Shareholders' equity | 111,591 | 149,591 | ||||

9

- (1)

- Reflects the acquisition transactions and the offering transactions.

- (2)

- EBITDA is an amount equal to net income (loss) plus interest expense, income taxes, depreciation and amortization. EBITDA is presented herein because we believe it is a useful supplement to net income (loss) and cash flow from operations in understanding operating results and cash flows generated from operations that are available for debt service (interest and principal payments) and further investment in acquisitions. We believe EBITDA provides meaningful additional information that enables management to monitor and evaluate our ongoing operating results and trends and provides investors an understanding of operating performance over comparative periods. However, EBITDA is not a presentation made in accordance with generally accepted principles in the United States, or GAAP, and is not intended to present a superior measure of financial condition or profitability from those determined under GAAP. Although our management uses the measure of EBITDA, it is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation.

- A reconciliation of net earnings (loss), the most directly comparable U.S. GAAP measure, to EBITDA for each of the respective periods indicated is as follows:

| | BlueLinx | Pre-acquisition Period | Pro Forma As Adjusted | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Period from May 8, 2004 to July 3, 2004 | Period from January 4, 2004 to May 7, 2004 | Six Months Ended June 28, 2003 | Year Ended January 3, 2004 | Year Ended December 28, 2002 | Year Ended December 29, 2001 | Six Months Ended July 3, 2004 | Year Ended January 3, 2004 | ||||||||||||||||

| | (Unaudited) | (Unaudited) | (Unaudited) | | | | (Unaudited) | (Unaudited) | ||||||||||||||||

| | (Dollars in thousands) | |||||||||||||||||||||||

| Net income (loss) | $ | 11,196 | $ | 50,940 | $ | 11,878 | $ | 56,153 | $ | 27,840 | $ | 29,275 | $ | 61,328 | $ | 30,746 | ||||||||

| Interest expense | 6,620 | — | — | — | — | — | 14,952 | 28,231 | ||||||||||||||||

| Provision (benefit) for income taxes | 7,158 | 31,089 | 7,404 | 34,877 | 17,597 | 18,470 | 39,210 | 19,657 | ||||||||||||||||

| Depreciation and amortization | 2,317 | 6,175 | 9,948 | 19,476 | 21,757 | 26,747 | 7,357 | 14,996 | ||||||||||||||||

| EBITDA | $ | 27,291 | $ | 88,204 | $ | 29,230 | $ | 110,506 | $ | 67,194 | $ | 74,492 | $ | 122,847 | $ | 93,630 | ||||||||

Our pro forma EBITDA for the 12-month period ended July 3, 2004 was $200 million. We derive this number by adding back $29 million of interest expense, $61 million of provision for income taxes and $15 million for depreciation and amortization for the corresponding period to our net income of $95 million for the 12-month period ended July 3, 2004.

- (3)

- Working capital is defined as total current assets minus total current liabilities excluding current maturities of long-term debt. Working capital as defined herein is not a presentation made in accordance with GAAP and is not intended to present a superior measure of financial condition or liquidity from those determined under GAAP. Although our management uses this measure, it is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation.

- (4)

- Total debt represents long-term debt, including current maturities and our current estimate of amounts payable to Georgia-Pacific pursuant to the working capital adjustment relating to the acquisition. See "Unaudited Pro Foma Consolidated Financial Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operation—Overview."

10

An investment in our common stock involves a high degree of risk. You should carefully consider the following information, together with other information in this prospectus, before buying shares of our common stock. If any of the following risks or uncertainties occurs, our business, financial condition and operating results could be materially and adversely affected. The trading price of our common stock could decline and you may lose all or a part of the money you paid to buy our common stock. The risks described below are not the only ones facing our company. Additional risks not currently known to us or that we currently deem immaterial also may impair our business, financial condition and operating results and the trading price of our common stock.

Risks Related to Our Indebtedness and Our Business

Our industry is highly cyclical, and prolonged periods of weak demand or excess supply may have a material adverse effect on our business, financial condition and operating results.

The building products distribution industry is subject to cyclical market pressures. Prices of building products are determined by overall supply and demand in the market for building products. Market prices of building products historically have been volatile and cyclical and we have limited ability to control the timing and amount of pricing changes for building products. Demand for building products is driven mainly by factors outside of our control, such as general economic and political conditions, interest rates, the construction, repair and remodeling and industrial markets, weather and population growth. The supply of building products fluctuates based on available manufacturing capacity, and excess capacity in the industry can result in significant declines in market prices for those products.

We believe that building products prices and volumes may be at or near a cyclical peak. If these prices and volumes decline, our revenues and profits would likely decline as well. Our results in some periods have been similarly affected by swings in the market cycles. This cyclicality also makes it more difficult to forecast our operating results. Weak demand or excess supply could seriously reduce our margins and harm our business, financial condition and operating results, including due to a decline in the resale price of our inventory.

Our substantial indebtedness and future indebtedness could adversely affect our financial health, limit our cash flow available to invest in the ongoing needs of our business and adversely affect the price of our common stock.

We have a substantial amount of debt. As of July 3, 2004, after giving effect to the consummation of the offering transactions, we would have had approximately $654.8 million of debt, which includes $451.8 million outstanding under the revolving credit facility, $162 million outstanding under the new mortgage, and our current $41 million estimate of amounts payable to Georgia-Pacific in connection with the acquisition in respect of working capital. As of July 3, 2004 we had $229.2 million of additional borrowing capacity under the revolving credit facility.

Our substantial debt could have important consequences to you. For example, it could:

- •

- make it difficult for us to satisfy our debt obligations;

- •

- make us more vulnerable to general adverse economic and industry conditions;

- •

- limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions and other general corporate requirements;

- •

- expose us to interest rate fluctuations because the interest rate on the debt under our revolving credit facility is variable;

11

- •

- require us to dedicate a substantial portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow for operations and other purposes;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and

- •

- place us at a competitive disadvantage compared to competitors that may have proportionately less debt.

In addition, our ability to make scheduled payments or refinance our obligations depends on our successful financial and operating performance, cash flow and capital resources, which in turn depend upon prevailing economic conditions and certain financial, business and other factors, many of which are beyond our control. These factors include, among others:

- •

- economic and demand factors affecting the building products distribution industry;

- •

- pricing pressures;

- •

- increased operating costs;

- •

- competitive conditions; and

- •

- other operating difficulties.

If our financial and operating performance, cash flow and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell material assets or operations, obtain additional capital or restructure our debt. In the event that we are required to dispose of material assets or operations or restructure our debt to meet our debt service and other obligations, this may have an adverse effect on our business, financial condition and operating results. The obligations of our operating company under the revolving credit facility are secured by a first priority security interest in all of our operating company's inventories, receivables and proceeds from those items. In addition, our new mortgage will be secured by our real property. The foregoing encumbrances may limit our ability to dispose of material assets or operations.

We may incur substantial additional indebtedness in the future, including under the revolving credit facility. Our incurrence of additional indebtedness would intensify the risks described above. The material terms of our debt instruments are discussed under "Description of Certain Indebtedness."

The instruments governing our indebtedness and preferred stock contain various covenants limiting the discretion of our management in operating our business.

The revolving credit facility and our new mortgage contain various restrictive covenants that limit our management's discretion in operating our business. In particular, these instruments limit our ability to, among other things:

- •

- incur additional debt;

- •

- grant liens on assets;

- •

- make investments, including capital expenditures;

- •

- sell or acquire assets outside the ordinary course of business;

- •

- engage in transactions with affiliates; and

- •

- make fundamental business changes.

12

If our operating company fails to maintain minimum excess availability of $40,000,000 under the revolving credit facility, the revolving credit facility requires our operating company to (i) maintain certain financial ratios and (ii) limit its capital expenditures. If our operating company fails to comply with the restrictions in the revolving credit facility or any other current or future financing agreements, a default may allow the creditors under the relevant instruments to accelerate the related debt and to exercise their remedies under these agreements, which will typically include the right to declare the principal amount of that debt, together with accrued and unpaid interest and other related amounts, immediately due and payable, to exercise any remedies our operating company's creditors may have to foreclose on any of its assets that are subject to liens securing that debt and to terminate any commitments they had made to supply our operating company with further funds. This may have an adverse effect on our business, financial condition and operating results.

As described under "We intend to pay dividends on our common stock but may change our dividend policy; the instruments governing our indebtedness contain various covenants that may limit our ability to pay dividends," the revolving credit facility also contains various covenants that limit the amount of dividends we may pay.

We have a limited operating history as a separate company upon which you can evaluate our performance. The division's historical financial information may not be representative of our results as a separate company.

On May 7, 2004, we and our operating company acquired the real estate and operating assets of the division, respectively. Therefore, our operating history as a separate company is limited. We cannot assure you that our business strategy as a independent entity will be successful on a long-term basis. We may not be able to grow our business as planned and may not remain a profitable business. The historical financial information included in this prospectus may not necessarily reflect what our results of operations, financial condition and cash flows would have been had we been a separate, independent entity pursuing our own strategies during the periods presented. In "Management's Discussion and Analysis of Financial Condition and Results of Operations," we discuss certain factors that may cause the division's historical financial information to not be representative of our results as a separate company.

Our limited operating history as a separate entity makes evaluating our business and our future financial prospects difficult. Our potential for future business success and operating profitability must be considered in light of the risks, uncertainties, expenses and difficulties typically encountered by recently sold companies that were part of a larger entity. If we fail to address these risks, uncertainties and difficulties or to manage these expenses adequately, our business, financial condition and operating results may be materially adversely affected and may differ materially from your expectations based on the historical and pro forma financial information provided in this prospectus.

We depend upon a single supplier, Georgia-Pacific, for a significant percentage of our products and have significant purchase commitments under our supply agreement with them.

Georgia-Pacific is our largest supplier, accounting for approximately 32% of the division's purchases during fiscal 2003. In fiscal 2003, the division purchased 8% of its lumber, 59% of its structural panels and 24% of its specialty products from Georgia-Pacific. Concurrently with the acquisitions, we entered into a Master Purchase, Supply & Distribution Agreement with Georgia-Pacific, which we refer to as the supply agreement. The supply agreement has a five-year initial term followed by an "evergreen" provision and requires two years' notice, exercisable after year four, to terminate. It may be terminated, including before year five, by Georgia-Pacific upon a material breach of the agreement by us. If Georgia-Pacific does not renew the supply agreement or if it discontinues sales of a product, we would experience a product shortage unless and until we

13

obtain a replacement supplier. We cannot assure you that we would be able to obtain replacement products on favorable economic terms, if at all. An inability to replace products on favorable economic terms could have a material adverse effect on our business, financial condition and operating results.

We believe that the economic terms of the supply agreement are beneficial to us. While we also believe these terms benefit Georgia-Pacific, Georgia-Pacific could, if it chose, terminate the supply agreement as early as May 7, 2010. If it did so and we could not obtain comparable terms from Georgia-Pacific or another vendor thereafter, our results of operations could be adversely affected.

Under the supply agreement, we have substantial minimum purchase volume commitments with respect to a number of products supplied to us. These products account for a majority of our purchases from Georgia-Pacific. If we fail or refuse to purchase any products that we are obligated to purchase pursuant to the supply agreement, Georgia-Pacific has the right to sell products to third parties and for certain products terminate our exclusivity, which could have a material adverse effect on our business, financial condition and operating results.

If we cannot successfully compete in the marketplace, our business, financial condition and operating results may be materially adversely affected.

The building products distribution industry is highly fragmented and competitive and the barriers to entry for local competitors are relatively low. Some of our competitors are part of larger companies and therefore have access to greater financial and other resources than we do. In addition, certain product manufacturers sell and distribute their products directly to customers. Additional manufacturers of products distributed by us may elect to sell and distribute directly to end users in the future or enter into exclusive supply arrangements with other distributors. In addition, we may not be able to maintain our costs at a level sufficiently low for us to compete effectively.

We depend on our information technology systems to conduct our business.

Our ability to effectively monitor and control our operations and conduct our business depends to a large extent on the proper functioning of our information technology systems. Any disruption in our information technology systems or the failure of these systems to operate as expected could, depending on the magnitude and duration of the problem, adversely affect our business, financial condition and operating results.

Our strategy of supplementing our growth through selective acquisitions presents risks.

Part of our growth strategy includes pursuing acquisitions. Any integration process may be complex and time consuming, may be disruptive to the business and may cause an interruption of, or a distraction of management's attention from, the business as a result of a number of obstacles, including but not limited to:

- •

- the loss of key customers of the acquired company;

- •

- the incurrence of unexpected expenses and working capital requirements;

- •

- a failure of our due diligence process to identify significant issues or contingencies;

- •

- difficulties assimilating the operations and personnel of the acquired company;

- •

- difficulties effectively integrating the acquired technologies with our current technologies;

- •

- our inability to retain key personnel of acquired entities;

- •

- a failure to maintain the quality of customer service;

14

- •

- our inability to achieve the financial and strategic goals for the acquired and combined businesses; and

- •

- difficulty in maintaining internal controls, procedures and policies.

Any of the foregoing obstacles, or a combination of them, could have a material adverse effect on our business, financial position and operating results.

We have not completed any acquisitions to date. We cannot assure you that we will be able to consummate acquisitions in the future on terms acceptable to us, or at all. In addition, future acquisitions are accompanied by the risk that the obligations and liabilities of an acquired company may not be adequately reflected in the historical financial statements of that company and the risk that those historical financial statements may be based on assumptions which are incorrect or inconsistent with our assumptions or approach to accounting policies. Any of these material obligations, liabilities or incorrect or inconsistent assumptions could have a material adverse effect on our business, financial position and operating results.

Many of our employees are unionized, which may result in work stoppages and have an adverse effect on our operations.

As of August 31, 2004, approximately 1,200 of our employees were represented by various labor unions and 45 out of our 63 warehouse facilities were union sites. As of August 31, 2004, we had approximately 49 collective bargaining agreements, of which one is up for renewal before December 31, 2004 and five are up for renewal in 2005. We cannot give any assurance that we will not become subject to material cost increases, or additional work rules imposed by agreements with labor unions, or that work stoppages or other labor disturbances will not occur in the future, any of which could have a material adverse effect on our business, financial condition and operating results. Similarly, any failure to reach agreement on new labor agreements when required might result in a work stoppage that could have a material adverse effect on our business, financial condition and operating results.

Federal and state transportation regulations could have a material adverse effect on us.

We use our own fleet of over 900 trucks and over 1,200 trailers to service customers throughout the United States. The U.S. Department of Transportation, or DOT, regulates our operations in domestic interstate commerce. We are subject to safety requirements governing interstate operations prescribed by the DOT. Vehicle dimensions and driver hours of service also remain subject to both federal and state regulation. More restrictive limitations on vehicle weight and size, trailer length and configuration, or driver hours of service could have a material adverse effect on our business, financial condition and operating results.

Environmental laws impose risks and costs on us.

Our operations are subject to federal, state, provincial and local laws, rules and regulations governing the protection of the environment, including, but not limited to, those regulating discharges into the air and water, the use, handling and disposal of hazardous or toxic substances, the management of wastes, the cleanup of contamination and the control of noise and odors. We have made, and will continue to make, expenditures to comply with these requirements. While we believe, based upon current information, that we are in substantial compliance with all applicable environmental laws, rules and regulations, we cannot assure you of this, and we could be subject to potentially significant fines or penalties for any failure to comply. Moreover, under certain environmental laws, a current or previous owner or operator of real property, and parties that generate or transport hazardous substances that are disposed of at real property, may be held liable for the cost to investigate or clean up such real property and for related damages to natural

15

resources. We may be subject to liability, including liability for investigation and cleanup costs if contamination is discovered at one of our current or former warehouse facilities, or at a landfill or other location where we have disposed of, or arranged for the disposal of, wastes. Georgia-Pacific has agreed to indemnify us against any claim arising from environmental conditions that existed prior to May 7, 2004. We also carry environmental insurance. However, there can be no assurance that any remediation costs will be covered by indemnification or insurance. In addition, we could be subject to claims brought pursuant to applicable laws, rules or regulations for property damage or personal injury resulting from the environmental impacts of our operations. Increasingly stringent environmental requirements, more aggressive enforcement actions, the discovery of unknown conditions or the bringing of future claims may cause our expenditures for environmental matters to increase, and we may incur material costs associated with these matters.

Anti-terrorism measures may harm our business.

In the aftermath of recent terrorist attacks on the United States, federal, state and local authorities have implemented and are implementing various security measures, including checkpoints and travel restrictions on large trucks. Our customers typically need quick delivery and rely on our on-time delivery capabilities. If security measures disrupt or impede the timing of our deliveries, we may fail to meet the needs of our customers, or may incur increased expenses to do so. We cannot assure you that these measures will not have a material adverse effect on our business, financial condition or operating results.

Our management team is an important part of our business and the loss of key personnel could impair our success.

We benefit from the leadership and experience of our senior management team and we depend on their continued services in order to successfully implement our business strategy. The loss of any member of our senior management team could have an adverse effect on us until a replacement is found. Due to the competitive employment nature of our industry, there is a risk that we could lose one or more of our key employees, and that we might not be able to replace these key employees quickly or on market terms. We do not maintain key person life insurance policies on any of our senior management.

In addition, we believe that our future success will depend upon our ability to attract and train highly skilled technical, managerial, sales and marketing personnel. We maintain a "promote-from-within" practice and training program and if we do not effectively manage our employees, our business may suffer.

We may incur substantial costs relating to Georgia-Pacific's product liability related claims.

Georgia-Pacific and many other companies are defendants in suits brought in various courts around the nation by plaintiffs who allege that they have suffered personal injury as a result of exposure to products containing asbestos. In the case of Georgia-Pacific, these suits allege a variety of lung and other diseases based on alleged exposure to products previously manufactured by Georgia-Pacific. Georgia-Pacific's asbestos liabilities relate primarily to joint system products manufactured by Bestwall Gypsum Company and Georgia-Pacific's gypsum business. Georgia-Pacific discontinued using asbestos in the manufacture of these products in 1977. The assets sold to us by Georgia-Pacific do not include the joint systems products, Georgia-Pacific's gypsum business or any other products containing asbestos. In addition, the terms of the asset purchase agreement specifically provide that Georgia-Pacific retains and will indemnify, defend and hold us harmless against, all obligations and liabilities arising out of, relating to or otherwise in any way in respect of any product liability claims with respect to products purchased, sold, marketed, stored, delivered, distributed or transported by Georgia-Pacific and its affiliates, including the division, prior

16

to the acquisition, including, without limitation, claims, obligations or liabilities relating to the presence or alleged presence of asbestos-containing materials, formaldhyde-containing materials other hazardous materials or chromated copper arsenate and chromated copper arsenate-containing materials in any product or item purchased, sold, marketed, stored, delivered, distributed or transported by Georgia-Pacific and its affiliates prior to the acquisition. In the event that Georgia-Pacific or its affiliates fail to fulfill their indemnity obligations under the asset purchase agreement or Georgia-Pacific fails to defend product liability claims brought against us, we cannot assure you that we will not incur substantial costs in the defense and administration of such product liability related claims and/or judgments rendered against us, which could have a material adverse effect or our financial condition and operating results.

There is no existing market for our common stock, and we do not know if one will develop to provide you with adequate liquidity. If the stock price fluctuates after this offering, you could lose a significant part of your investment.

Prior to this offering, there has not been a public market for our common stock. We cannot predict the extent to which investor interest in our company will lead to the development of an active trading market on the New York Stock Exchange or otherwise or how liquid that market might become. If an active trading market does not develop, you may have difficulty selling any of our common stock that you buy. The initial public offering price for the shares will be determined by negotiations between us and the underwriters and may not be indicative of prices that will prevail in the open market following this offering. The market price of our common stock may be influenced by many factors, some of which are beyond our control, including:

- •

- the failure of securities analysts to cover our common stock after this offering or changes in financial estimates by analysts;

- •

- changes in demand in the building products distribution industry;

- •

- the activities of competitors;

- •

- future sales of the common stock;

- •

- investor perceptions of us and the building products distribution industry;

- •

- our quarterly or annual earnings or those of other companies in our industry;

- •

- the public's reaction to our press releases, our other public announcements and our filings with the Securities and Exchange Commission, or SEC;

- •

- general economic conditions; and

- •

- the other factors described under "Risk Factors."

As a result of these factors, you may not be able to resell your shares at or above the initial offering price. In addition, the stock market in general has recently experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of a particular company. These broad market fluctuations and industry factors may materially reduce the market price of our common stock, regardless of our operating performance.

Affiliates of Cerberus control us and may have conflicts of interest with other stockholders in the future.

After the offering, funds and accounts managed by Cerberus or its affiliated management companies, which we will refer to collectively as our controlling stockholder, will indefinitely collectively own % of our common stock. As a result, our controlling stockholder will continue to

17

be able to control the election of our directors, determine our corporate and management policies and determine, without the consent of our other stockholders, the outcome of any corporate transaction or other matter submitted to our stockholders for approval, including potential mergers or acquisitions, asset sales and other significant corporate transactions. Our controlling stockholder will also have sufficient voting power to amend our organizational documents. We cannot assure you that the interests of our controlling stockholder will coincide with the interests of other holders of our common stock. Additionally, our controlling stockholder is in the business of making investments in companies and may, from time to time, acquire and hold interests in businesses that compete directly or indirectly with us. Our controlling stockholder may also pursue, for its own account, acquisition opportunities that may be complementary to our business, and as a result, those acquisition opportunities may not be available to us. So long as our controlling stockholder continues to own a significant amount of the outstanding shares of our common stock, it will continue to be able to strongly influence or effectively control our decisions, including potential mergers or acquisitions, asset sales and other significant corporate transactions. In addition, because we are a controlled company within the meaning of the New York Stock Exchange rules, we will be exempt from many corporate governance requirements.

Even if Cerberus no longer controls us in the future, certain provisions of our charter documents and agreements and Delaware law could discourage, delay or prevent a merger or acquisition at a premium price.

Our certificate of incorporation and bylaws contain provisions that:

- •

- permit us to issue, without any further vote or action by our stockholders, up to shares of preferred stock in one or more series and, with respect to each series, to fix the number of shares constituting the series and the designation of the series, the voting powers (if any) of the shares of such series, and the preferences and other special rights, if any, and any qualifications, limitations or restrictions, of the shares of the series; and

- •

- limit our stockholders' ability to call special meetings.

These provisions may discourage, delay or prevent a merger or acquisition at a premium price.

In addition, we are subject to Section 203 of the General Corporation Law of the State of Delaware, or the DGCL, which also imposes certain restrictions on mergers and other business combinations between us and any holder of 15% or more of the common stock. In addition, certain of our incentive plans provide for vesting of stock options and/or payments to be made to the employees in connection with a change of control, which could discourage, delay or prevent a merger or acquisition at a premium price.

If a substantial number of shares become available for sale and are sold in a short period of time, the market price of our common stock could decline.

If our existing stockholders or option holders sell substantial amounts of our common stock in the public market following this offering, the market price of our common stock could decrease significantly. The perception in the public market that our existing stockholders might sell shares of common stock could also depress our market price. Upon completion of this offering, we will have shares of common stock outstanding, assuming no exercise of the underwriters' over-allotment option, of which shares will be held by our current stockholders. Prior to this offering, we and our current stockholders will have agreed with the underwriters to a "lock-up" period, meaning that such parties may not, subject to certain other exceptions, sell any of their existing shares of our common stock without the prior written consent of Goldman, Sachs & Co. until approximately 180 days after the date of this prospectus. In addition, all of our current stockholders will be subject to the Rule 144 holding period requirement described in "Shares Eligible for Future Sales." When the lock-up agreements expire, these shares and the shares

18

underlying the options will become eligible for sale, in some cases subject to the requirements of Rule 144. In addition, our controlling stockholder has substantial demand and incidental registration rights, as described in "Certain Relationships and Related Transactions—Registration Rights Agreement." The market price for shares of our common stock may drop significantly when the restrictions on resale by our existing stockholders lapse. A decline in the price of shares of our common stock might impede our ability to raise capital through the issuance of additional shares of our common stock or other equity securities.

We intend to pay dividends on our common stock but may change our dividend policy; the instruments governing our indebtedness contain various covenants that may limit our ability to pay dividends.

We intend to pay dividends on our common stock. Our board of directors may, in its discretion, modify or repeal our dividend policy. Future dividends, if any, with respect to shares of our common stock will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions, provisions of applicable law and other factors that our board of directors may deem relevant. Accordingly, we cannot assure you that we will pay dividends in any given amount in the future or at all.

The revolving credit facility limits distributions by our operating company to us, which, in turn, may limit our ability to pay dividends to holders of our common stock. The revolving credit facility permits our operating company to pay dividends to us (i) in an amount equal to the sum of our federal, state and local income tax liability that is attributable to our operating company and its subsidiaries and (ii) for our general administrative expenses and/or operating expenses incurred by us on behalf of our operating company or its subsidiaries in an amount not to exceed $2.5 million in any fiscal year. In addition, our operating company's revolving credit facility permits our operating company, commencing at the conclusion of fiscal 2005, to pay dividends to us in an amount not to exceed, in the aggregate and together with any optional prepayments made with respect to indebtedness under the term loan permitted under the revolving credit facility, 50% of our operating company's cumulative net income earned since May 7, 2004, so long as: (i) no default or event of default exists thereunder; (ii) at all times during the 90-day period before the dividend payment date and the 90-day period following the dividend payment date, the amount of excess availability under the revolving credit facility is projected to be $100 million or more at all times; and (iii) the agents under the revolving credit facility shall have received our operating company's audited financial statements for the fiscal year then-ended.

In addition, under Delaware law, our board of directors may declare dividends only to the extent of our "surplus" (which is defined as total assets at fair market value minus total liabilities, minus statutory capital), or if there is no surplus, out of our net profits for the then current and/or immediately preceding fiscal years.

If you purchase shares of common stock sold in this offering, you will experience immediate and substantial dilution.

If you purchase shares of our common stock in this offering, you will experience immediate and substantial dilution of $ in pro forma net tangible book value per share, because the price that you pay will be substantially greater than the net tangible book value per share of the shares you acquire, based on the net tangible book value per share as of July 3, 2004. This dilution is due in large part to the fact that our earlier investors paid substantially less than the initial public offering price when they purchased their shares. You will experience additional dilution upon the exercise of stock options by employees or directors to purchase common stock under our equity incentive plan. On August 30 and 31, 2004, we granted stock options to purchase our common stock at an average exercise price of $ per share.

19

We will receive net proceeds from the offering of approximately $ million (approximately $ million if the underwriters exercise their over-allotment option in full), assuming that the common stock is offered at $ , the midpoint of the range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discount and our estimated expenses of the offering. We intend to use the net proceeds from the offering (i) to repay our operating company's $100 million term loan plus accrued and unpaid interest thereon, (ii) to redeem up to $35 million of our series A preferred stock and pay all accrued and unpaid dividends on the portion redeemed and (iii) for general corporate purposes.

Concurrently with this offering, we intend to obtain from a third party a new $162 million mortgage secured by our 61 wholly-owned warehouses. See "Description of Certain Indebtedness—Real Property Mortgage."

Proceeds from the new mortgage will be used to (i) repay our existing $100 million of mortgage debt plus accrued and unpaid interest thereon and (ii) redeem the remaining series A preferred stock and pay all accrued and unpaid dividends on the portion redeemed.

As further discussed under "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Financing Activities", proceeds from our operating company's term loan, our series A preferred stock and our mortgage were used to finance the acquisition transactions.

Cerberus will receive out of the proceeds of this offering and the new mortgage up to an aggregate of $ consisting of (i) million from the repayment of our term loan and accrued and unpaid interest thereon, (ii) up to $ million from the redemption of our series A preferred stock and the payment of accrued and unpaid dividends thereon and (iii) $ million from the repayment our existing mortgage debt and the payment of accrued and unpaid interest thereon.

At July 3, 2004, the interest rate under the term loan was 10%. The term loan matures on November 6, 2009. The interest rate on our existing mortgage is 10%. Our current mortgage does not amortize and there is a balloon payment due at maturity on December 15, 2010. Dividends accrue on our series A preferred stock at rate of 10% per annum, compounded quarterly and accrued daily. All of our series A preferred stock will be redeemed with the proceeds we expect to receive from this offering and our new mortgage.

20

We intend to pay dividends on our common stock at a quarterly rate of $ per share.

The revolving credit facility limits distributions by our operating company to us, which, in turn, may limit our ability to pay dividends to holders of common stock. The revolving credit facility permits our operating company to pay dividends to us (i) in an amount equal to the sum of our federal, state and local income tax liability that is attributable to our operating company and its subsidiaries and (ii) for our general administrative expenses and/or operating expenses incurred by us on behalf of our operating company or its subsidiaries in an amount not to exceed $2.5 million in any fiscal year. In addition, the revolving credit facility permits our operating company, commencing at the conclusion of fiscal 2005, to pay dividends to us in an amount not to exceed, in the aggregate and together with any optional prepayments made with respect to indebtedness under the term loan permitted under the revolving credit facility, 50% of our operating company's cumulative net income earned since May 7, 2004, so long as: (i) no default or event of default exists under the facility; (ii) at all times during the 90-day period before the dividend payment date and the 90-day period following the dividend payment date, the amount of excess availability under the revolving credit facility is projected to be $100 million or more at all times; and (iii) the agents under the revolving credit facility and term loan shall have received our operating company's audited financial statements for the fiscal year then ended.

We have not paid dividends in the past on our common stock.

For certain risks relating to the payment of dividends, see "Risk Factors—Risks Related to the Offering—We intend to pay dividends on our common stock but may change our dividend policy; the instruments governing our indebtedness contain various covenants that may limit our ability to pay dividends."

21

The following table sets forth our capitalization as of July 3, 2004:

- •

- on an actual basis; and

- •

- as adjusted to give effect to the offering transactions.

This table should be read in conjunction with our financial statements and the notes thereto, "Use of Proceeds," "Selected Consolidated Financial Data," "Unaudited Pro Forma Consolidated Financial Statements," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Description of Certain Indebtedness" and "Description of Capital Stock" included elsewhere in this prospectus.

| | At July 3, 2004 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| | Actual | Pro Forma As Adjusted | |||||||

| | (unaudited) (Dollars in thousands) | ||||||||

| Long-term obligations (including current maturities): | |||||||||

| Revolving credit facility | $ | 451,769 | $ | 451,769 | |||||

| Term loan | 100,000 | — | |||||||

| Payable to Georgia-Pacific for working capital settlement | 41,033 | 41,033 | |||||||

| Mortgage indebtedness | 100,000 | 162,000 | |||||||

| Total debt | 692,802 | 654,802 | |||||||

Shareholders' Equity | |||||||||

| Preferred stock; | |||||||||

| actual: 1,000,000 shares authorized; 95,000 shares of series A, $0.01 par value issued and outstanding; | 95,000 | — | |||||||

| pro forma as adjusted: shares authorized and shares issued and outstanding | |||||||||

| Common stock, $.01 par value; | |||||||||

| actual: 25,000,000 shares authorized; 19,999,900 shares issued and outstanding; | |||||||||

| pro forma as adjusted: shares authorized and shares issued and outstanding | 5,000 | 139,484 | |||||||

| Accumulated other comprehensive income | 395 | 395 | |||||||

| Retained earnings | 11,196 | 9,712 | |||||||

| Total shareholders' equity | 111,591 | 149,591 | |||||||

Total capitalization | $ | 804,393 | $ | 804,393 | |||||

22

Our net tangible book value as of July 3, 2004 was $ million, or $ per share of common stock. Net tangible book value per share represents the amount of our total tangible assets less total liabilities, divided by the total number of shares of common stock outstanding.

After giving effect to the sale of shares of common stock offered in this offering at an assumed initial public offering price of $ per share, the mid-point of the range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discount and estimated offering expenses payable by us, our net tangible book value, as adjusted, as of July 3, 2004 would have been $ million, or $ per share of common stock. This represents an immediate increase in net tangible book value of $ per share to existing stockholders and an immediate dilution of $ per share to new investors purchasing our common stock in this offering. The following table illustrates this per share dilution to the new investors:

| Assumed initial public offering price | $ | ||||||

| Net tangible book value per share as of , 2004 | $ | ||||||

| Increase in net tangible book value per share attributable to this offering | |||||||

| As adjusted net tangible book value per share after this offering | |||||||

| Dilution per share to new investors in this offering | $ | ||||||

If the underwriters exercise their option to purchase additional shares of our common stock in full in this offering, the as adjusted net tangible book value per share after this offering would be $ per share, the increase in net tangible book value per share to existing stockholders would be $ per share and the dilution to new investors purchasing shares in this offering would be $ per share.

The following table summarizes, on an as adjusted basis as of July 3, 2004, the differences between the number of shares of common stock purchased from us, the total consideration and the average price per share paid by existing stockholders and by the new investors, based on the assumed initial public offering price of $ per share, before deducting the estimated underwriting discount and estimated offering expenses payable by us:

| | Shares Purchased | Total Consideration | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Average Price Per Share | |||||||||||

| | Number | Percent | Amount | Percent | ||||||||

| Existing stockholders | % | $ | % | $ | ||||||||

| New investors | ||||||||||||

| Total | 100.0 | % | $ | 100.0 | % | |||||||