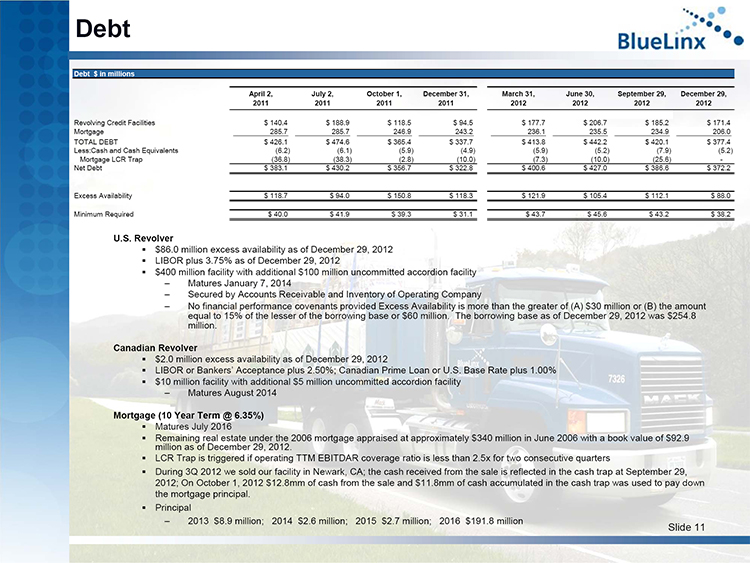

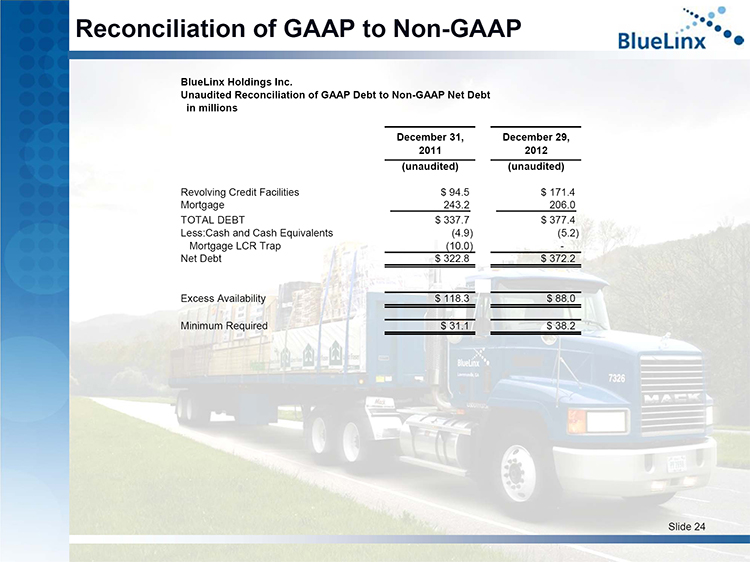

Debt

Debt $ in millions

April 2, July 2, October 1, December 31, March 31, June 30, September 29, December 29, 2011 2011 2011 2011 2012 2012 2012 2012

Revolving Credit Facilities $ 140.4 $ 188.9 $ 118.5 $ 94.5 $ 177.7 $ 206.7 $ 185.2 $ 171.4 Mortgage 285.7 285.7 246.9 243.2 236.1 235.5 234.9 206.0 TOTAL DEBT $ 426.1 $ 474.6 $ 365.4 $ 337.7 $ 413.8 $ 442.2 $ 420.1 $ 377.4 Less:Cash and Cash Equivalents (6.2) (6.1) (5.9) (4.9) (5.9) (5.2) (7.9) (5.2) Mortgage LCR Trap (36.8) (38.3) (2.8) (10.0) (7.3) (10.0) (25.6) -Net Debt $ 383.1 $ 430.2 $ 356.7 $ 322.8 $ 400.6 $ 427.0 $ 386.6 $ 372.2

Excess Availability $ 118.7 $ 94.0 $ 150.8 $ 118.3 $ 121.9 $ 105.4 $ 112.1 $ 88.0

Minimum Required $ 40.0 $ 41.9 $ 39.3 $ 31.1 $ 43.7 $ 45.6 $ 43.2 $ 38.2

U.S. Revolver

$86.0 million excess availability as of December 29, 2012LIBOR plus 3.75% as of December 29, 2012

$400 million facility with additional $100 million uncommitted accordion facility

– Matures January 7, 2014

– Secured by Accounts Receivable and Inventory of Operating Company

– No financial performance covenants provided Excess Availability is more than the greater of (A) $30 million or (B) the amount equal to 15% of the lesser of the borrowing base or $60 million. The borrowing base as of December 29, 2012 was $254.8 million.

Canadian Revolver

$2.0 million excess availability as of December 29, 2012

LIBOR or Bankers’ Acceptance plus 2.50%; Canadian Prime Loan or U.S. Base Rate plus 1.00%$10 million facility with additional $5 million uncommitted accordion facility

– Matures August 2014

Mortgage (10 Year Term @ 6.35%)

Matures July 2016

Remaining real estate under the 2006 mortgage appraised at approximately $340 million in June 2006 with a book value of $92.9 million as of December 29, 2012.

LCR Trap is triggered if operating TTM EBITDAR coverage ratio is less than 2.5x for two consecutive quarters

During 3Q 2012 we sold our facility in Newark, CA; the cash received from the sale is reflected in the cash trap at September 29, 2012; On October 1, 2012 $12.8mm of cash from the sale and $11.8mm of cash accumulated in the cash trap was used to pay down the mortgage principal.

Principal

– 2013 $8.9 million; 2014 $2.6 million; 2015 $2.7 million; 2016 $191.8 million

Slide 11