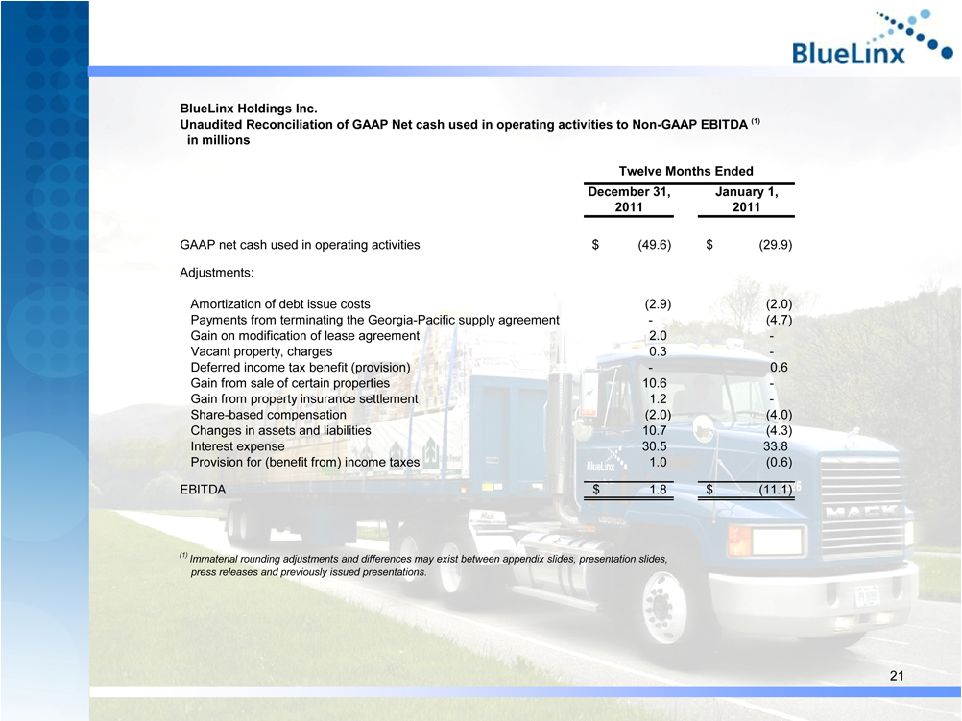

7 Cash Flows BXC generated $33.9 million in operating cash flow for the quarter Unaudited (in million’s) Q410 Q111 Q211 Q311 Q411 FY 2011 FY 2010 Cash flows from operating activities: Net loss (20.2) $ (12.3) $ (9.8) $ (6.2) $ (10.3) $ (38.6) $ (53.2) $ Adjustments to reconcile net loss to net cash provided by (used in) operations: Depreciation and amortization 3.1 2.9 2.6 2.6 2.4 10.6 13.4 Amortization of debt issuance costs 0.9 0.4 0.6 0.9 0.9 2.9 2.0 Payments from terminating the Georgia-Pacific supply agreement - - - - - - 4.7 (Gain) loss from sale of facilities - (7.2) - 0.3 (3.7) (10.6) - Gain from property insurance settlement - - - (1.2) - (1.2) - Changes associated with the ineffective interest rate swap (1.4) (1.8) - - 0.1 (1.7) (4.6) Write-off debt of issuance costs - - - - - - 0.2 Vacant property changes 0.1 - - - (0.3) (0.3) 0.1 Gain on modification of lease agreement - - - (2.0) - (2.0) - Deferred income tax (benefit) provision - (0.2) - (0.1) 0.3 - (0.6) Share-based compensation 1.1 0.8 0.3 0.4 0.4 2.0 3.9 Decrease in restricted cash related to the ineffective interest rate swap, insurance, and other 0.5 - 0.4 - 0.5 1.0 6.6 Changes in assets and liabilities: Receivables 47.4 (50.7) (35.8) 21.0 45.9 (19.7) - Inventories 7.3 (32.1) 7.7 8.9 18.2 2.7 (15.1) Accounts payable (17.9) 32.1 0.4 (5.9) (20.7) 6.0 (1.8) Changes in other working capital (5.8) 3.8 (5.0) 2.7 (1.7) (0.4) 15.5 Other 2.9 1.5 0.3 (3.9) 1.8 (0.3) (1.0) Net cash provided by (used in) operating activities 18.0 (62.8) (38.3) 17.5 33.9 (49.6) (29.9) Cash flows from investing activities: Property and equipment investments (1.4) (3.7) (1.8) (0.5) (1.2) (7.2) (4.1) Proceeds from disposition of assets - 8.8 0.2 - 9.4 18.3 0.7 Net cash (used in) provided by investing activities (1.4) 5.1 (1.6) (0.5) 8.2 11.1 (3.4) Cash flows from financing activities: Repurchase of common stock - - �� - - - - (0.7) Repayments on revolving credit facilities (136.3) (73.5) (98.2) (177.1) (129.8) (478.6) 41.2 Borrowings from revolving credit facilities 131.5 116.8 146.6 106.6 105.8 475.9 - Payment of principal on mortgage - - - (38.7) (3.7) (42.4) - Payments on capital lease obligations (0.1) (0.1) (0.1) (1.0) (0.2) (1.4) (0.6) (Decrease) increase in bank overdrafts (7.5) 12.6 (6.9) 1.5 (8.0) (0.8) (4.1) (Increase) decrease in restricted cash related to the mortgage (2.8) (6.2) (1.6) 35.5 (7.1) 20.6 (11.2) Debt financing costs - - - (2.6) (0.1) (2.7) (6.5) Proceeds from stock offering less expenses paid - - - 58.6 (0.1) 58.5 - Net cash (used in) provided by financing activities (15.2) 49.6 39.8 (17.2) (43.1) 29.1 18.1 Increase (decrease) in cash 1.4 (8.1) (0.1) (0.2) (1.0) (9.4) (15.2) Cash balance, beginning of period 12.9 14.3 6.2 6.1 5.9 14.3 29.5 Cash balance, end of period 14.3 $ 6.2 $ 6.1 $ 5.9 $ 4.9 $ 4.9 $ 14.3 $ |