Divider slide 29 September, 2020 Fourth Quarter & Full-Year 2020 Results Conference Call March 4, 2021

1 Safe Harbor Statement -1- Note to Our Investors This presentation contains forward-looking statements. Forward-looking statements include, without limitation, any statement that predicts, forecasts, indicates or implies future results, performance, liquidity levels or achievements, and may contain the words “ believe,”“ anticipate,”“ expect,”“ estimate,”“ intend,”“ project,” “plan,” “will be, ”be, ”will likely continue, ”continue,” “will likely result” or words or phrases of similar meaning. The forward-looking statements in this presentation include statements about single-family residential housing demand and the drivers of demand; general economic conditions, including unemployment and mortgage rates; management priorities and areas of focus; future trends in wood-based commodity prices; trends in deurbanization, housing inventory and prices; trends in residential repair and remodel activity; the influence of wood-based commodity price inflation on specialty product sales; trends in working capital performance; our estimated annual cash commitments; and the ability of our balance sheet to support operating initiatives and growth strategy. Forward-looking statements are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties that may cause our business, strategy, or actual results to differ materially from the forward-looking statements. These risks and uncertainties include those discussed in greater detail in our filings with the Securities and Exchange Commission. . We operate in a changing environment in which new risks can emerge from time to time It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy, or actual results to differ materially from those contained in forward-looking statements. Factors that may cause these differences include, among other things: fluctuations in commodity prices; inventory management; changes in the prices, supply and/or demand for products that we distribute; adverse housing market conditions; levels of new residential housing starts and residential repair and remodeling activity; the COVID-19 pandemic and other contagious illness outbreaks and their potential effects on our industry, suppliers and supply chain, and customers, and our business, results of operations, cash flows, financial condition, and future prospects; our ability to integrate and realize anticipated synergies from acquisitions; loss of material customers, suppliers, or product lines in connection with acquisitions; operational disruption in connection with the integration of acquisitions; our indebtedness and its related limitations; sufficiency of cash flows and capital resources; our ability to monetize real estate assets; disintermediation by customers and suppliers; competitive industry pressures; industry consolidation; product shortages; loss of and dependence on key suppliers and manufacturers; import taxes and costs, including new or increased tariffs, anti-dumping duties, countervailing duties, or similar duties; our ability to successfully implement our strategic initiatives; fluctuations in operating results; sale-leaseback transactions and their effects; real estate leases; changes in interest rates; exposure to product liability claims; our ability to complete offerings under our shelf registration statement on favorable terms, or at all; changes in our product mix; petroleum prices; information technology security and business interruption risks; litigation and legal proceedings; natural disasters and unexpected events; activities of activist stockholders; labor and union matters; limits on net operating loss carryovers; pension plan assumptions and liabilities; risks related to our internal controls; retention of associates and key personnel; federal, state, local and other regulations, including environmental laws and regulations; and changes in accounting principles. Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures. BlueLinx reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). We also believe that presentation of certain non-GAAP measures, such as Adjusted EBITDA, the ratio of our total net debt to Adjusted EBITDA, and free cash flow, may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Explanations of these non-GAAP measures are included in the accompanying Appendix to this presentation, and any non-GAAP measures used herein are reconciled herein or in the financial tables in the Appendix to their most directly comparable GAAP measures. We caution that non-GAAP measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Immaterial Rounding Differences. Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations. This presentation and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together.

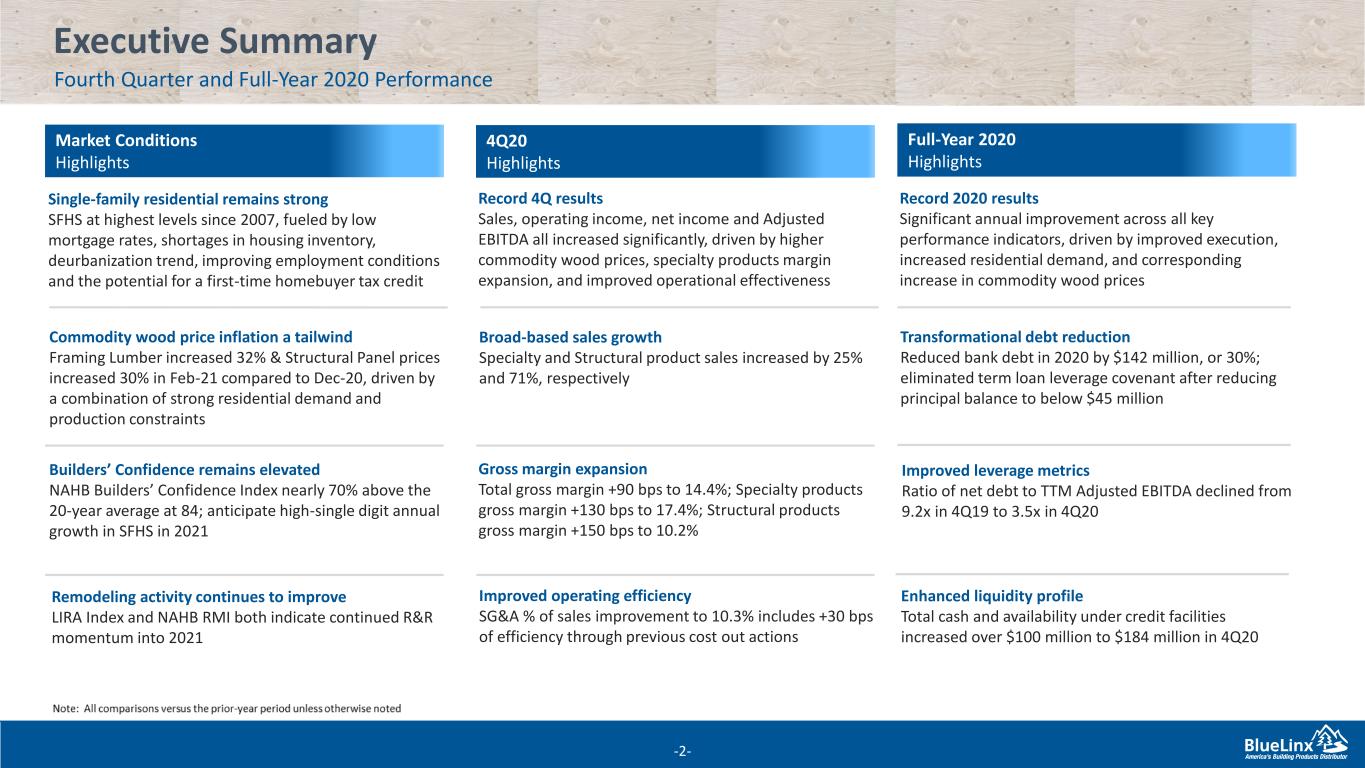

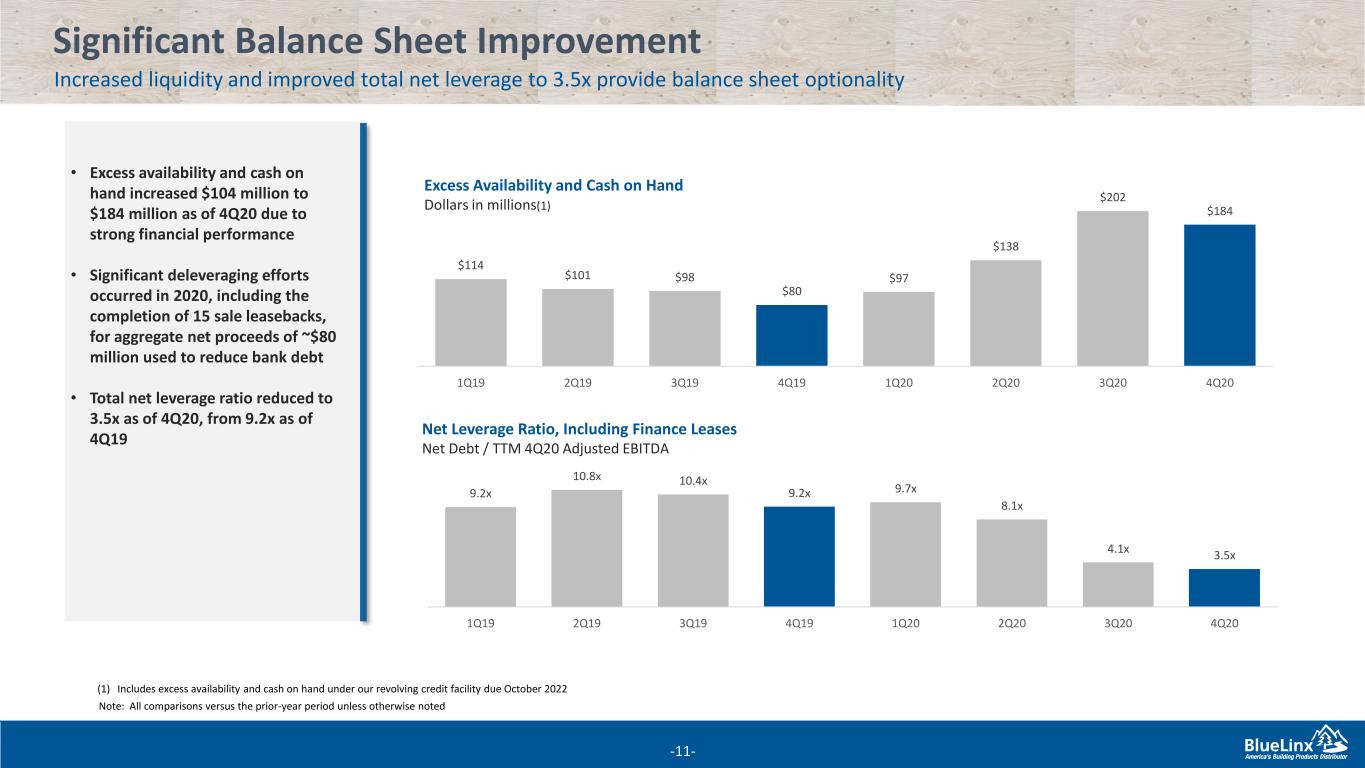

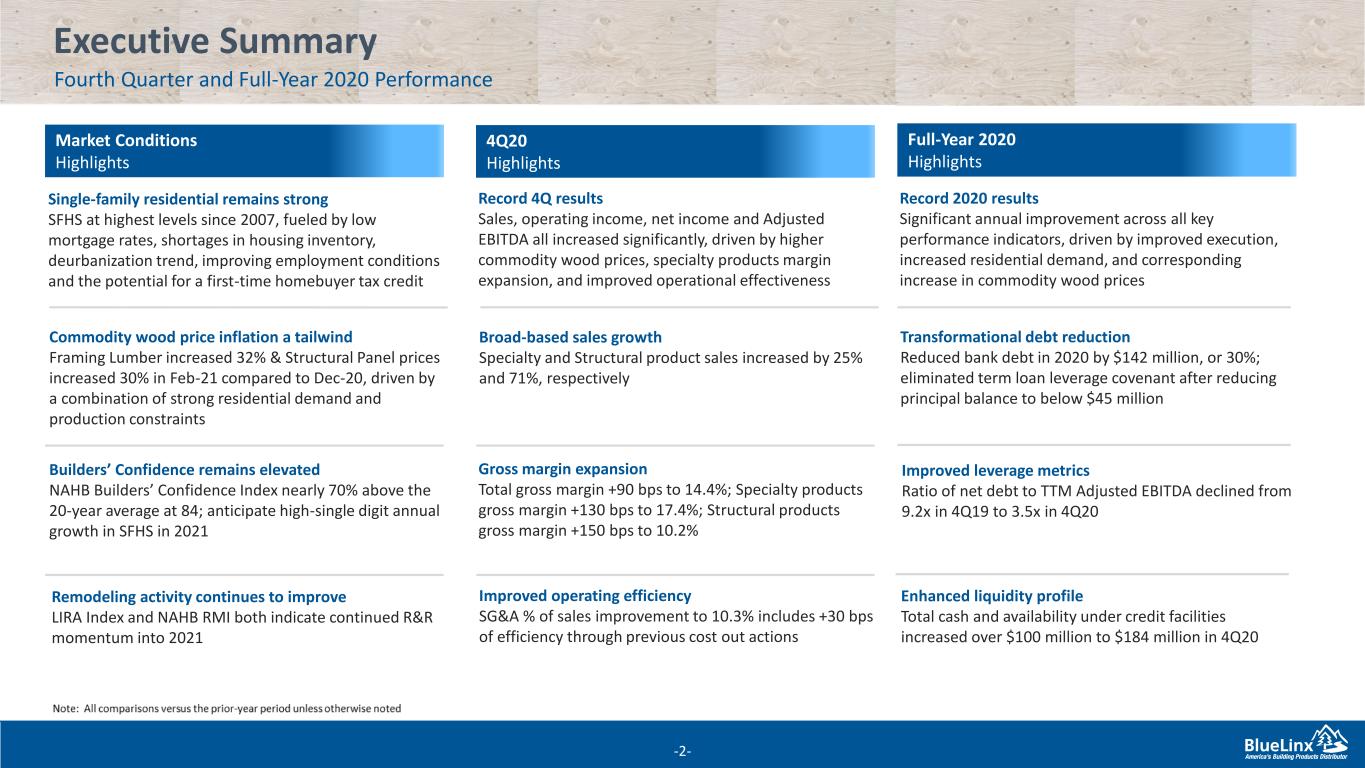

2 -2- Executive Summary Fourth Quarter and Full-Year 2020 Performance Market Conditions Highlights 4Q20 Highlights Full-Year 2020 Highlights Single-family residential remains strong SFHS at highest levels since 2007, fueled by low mortgage rates, shortages in housing inventory, deurbanization trend, improving employment conditions and the potential for a first-time homebuyer tax credit Commodity wood price inflation a tailwind Framing Lumber increased 32% & Structural Panel prices increased 30% in Feb-21 compared to Dec-20, driven by a combination of strong residential demand and production constraints Builders’ Confidence remains elevated NAHB Builders’ Confidence Index nearly 70% above the 20-year average at 84; anticipate high-single digit annual growth in SFHS in 2021 Remodeling activity continues to improve LIRA Index and NAHB RMI both indicate continued R&R momentum into 2021 Record 4Q results Sales, operating income, net income and Adjusted EBITDA all increased significantly, driven by higher commodity wood prices, specialty products margin expansion, and improved operational effectiveness Broad-based sales growth Specialty and Structural product sales increased by 25% and 71%, respectively Gross margin expansion Total gross margin +90 bps to 14.4%; Specialty products gross margin +130 bps to 17.4%; Structural products gross margin +150 bps to 10.2% Improved operating efficiency SG&A % of sales improvement to 10.3% includes +30 bps of efficiency through previous cost out actions Record 2020 results Significant annual improvement across all key performance indicators, driven by improved execution, increased residential demand, and corresponding increase in commodity wood prices Transformational debt reduction Reduced bank debt in 2020 by $142 million, or 30%; eliminated term loan leverage covenant after reducing principal balance to below $45 million Improved leverage metrics Ratio of net debt to TTM Adjusted EBITDA declined from 9.2x in 4Q19 to 3.5x in 4Q20 Enhanced liquidity profile Total cash and availability under credit facilities increased over $100 million to $184 million in 4Q20

3 Key Areas of Management Focus Roadmap to sustained, profitable growth -3- • National account growth, utilizing extensive product assortment and excellent supply chain capabilities • Product category emphasis; drive growth with strategic supplier partners and marquee brands • Local market strategic share gains • Service expansion across broad, national platform • Focus on specialized, higher- value products and services • Disciplined pricing strategy and effective price management • Mitigating wood-based commodity price variability risk, including centralized purchasing and consignment • Realize economies of scale associated with large national network • Local sales execution strategies along with disciplined product purchasing • Focus on ensuring efficient cost of delivery • Increasing investment in facility optimization and technology • Continuously improving working capital management • Generate cash flow to support sustained, profitable sales growth • Maintain adequate liquidity to support business initiatives • Continue to reduce net leverage • Provide financial optionality for inorganic opportunities Organic Sales Growth 1 Margin Expansion 2 Organizational Efficiencies 3 Disciplined Capital Allocation 4

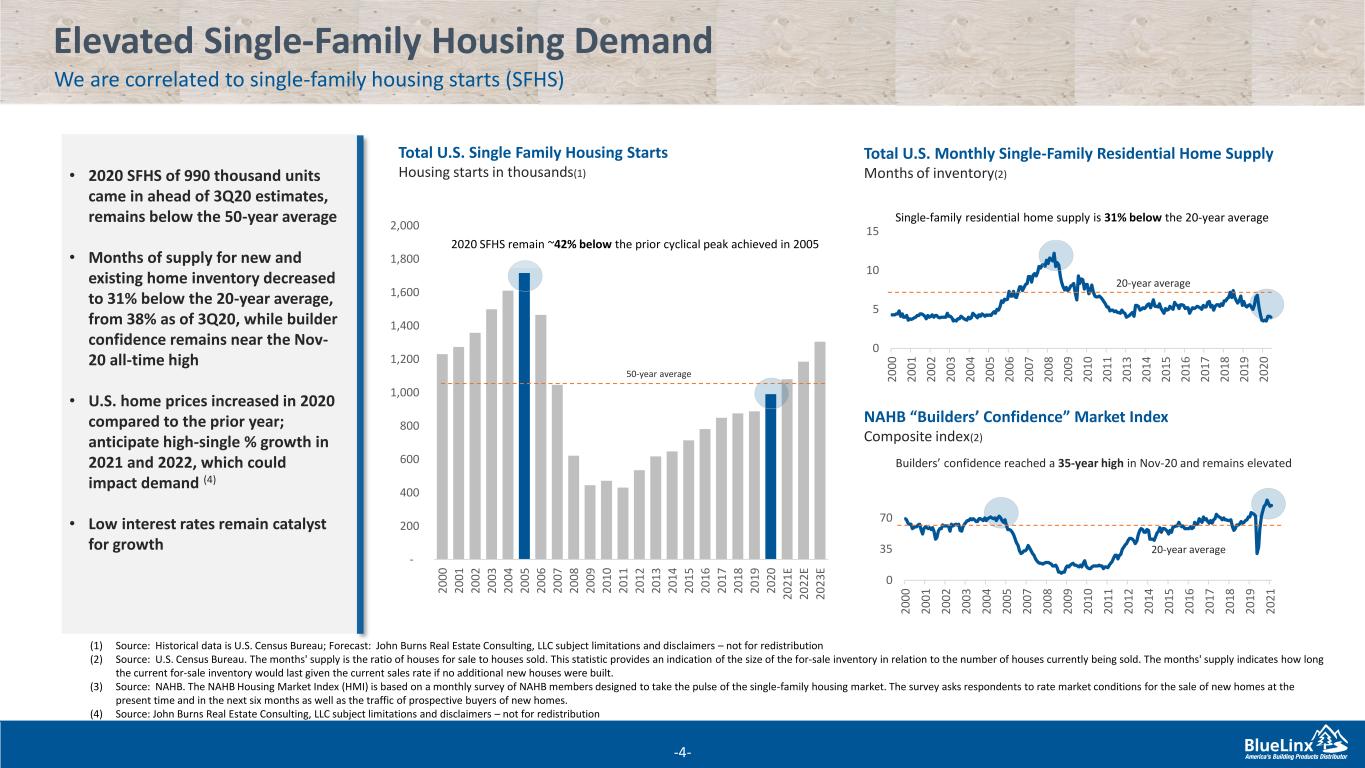

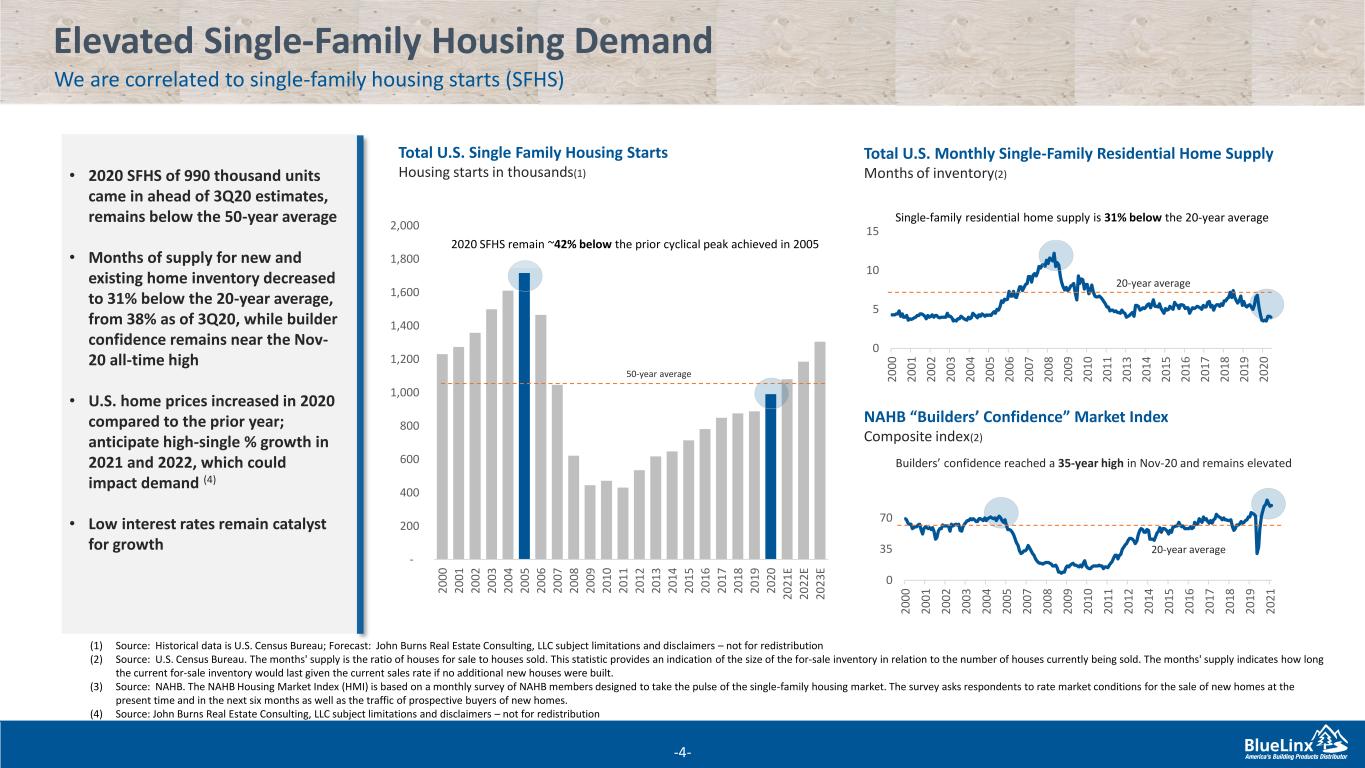

4 - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 E 2 0 2 2 E 2 0 2 3 E 0 5 10 15 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 (1) Source: Historical data is U.S. Census Bureau; Forecast: John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution (2) Source: U.S. Census Bureau. The months' supply is the ratio of houses for sale to houses sold. This statistic provides an indication of the size of the for-sale inventory in relation to the number of houses currently being sold. The months' supply indicates how long the current for-sale inventory would last given the current sales rate if no additional new houses were built. (3) Source: NAHB. The NAHB Housing Market Index (HMI) is based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes. (4) Source: John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution Elevated Single-Family Housing Demand We are correlated to single-family housing starts (SFHS) -4- Total U.S. Single Family Housing Starts Housing starts in thousands(1) Total U.S. Monthly Single-Family Residential Home Supply Months of inventory(2) NAHB “Builders’ Confidence” Market Index Composite index(2) Builders’ confidence reached a 35-year high in Nov-20 and remains elevated 50-year average 2020 SFHS remain ~42% below the prior cyclical peak achieved in 2005 Single-family residential home supply is 31% below the 20-year average 20-year average 0 35 70 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 1 20-year average • 2020 SFHS of 990 thousand units came in ahead of 3Q20 estimates, remains below the 50-year average • Months of supply for new and existing home inventory decreased to 31% below the 20-year average, from 38% as of 3Q20, while builder confidence remains near the Nov- 20 all-time high • U.S. home prices increased in 2020 compared to the prior year; anticipate high-single % growth in 2021 and 2022, which could impact demand (4) • Low interest rates remain catalyst for growth

5 (1) Source: HIRL Research (2) Source: Historical data is from the U.S. Census Bureau; The Value of Construction Put in Place Survey (VIP) provides monthly estimates of the total dollar value of construction work done in the U.S. The survey covers construction work done each month on new structures or improvements to existing structures for private and public sectors. (3) Source: Joint Center for Housing Studies at Harvard University. The Leading Indicator of Remodeling Activity (LIRA) provides a short-term outlook of national home improvement and repair spending to owner-occupied homes. The indicator, measured as an annual rate-of-change of its components, is designed to project the annual rate of change in spending for the current quarter and subsequent four quarters, and is intended to help identify future turning points in the business cycle of the home improvement and repair industry. Residential Repair & Remodel Activity Remains Healthy U.S. Installed base of more than 124 million homes -5- U.S. Private Residential Construction Put-In-Place (CPP) Dollars in millions(2) LIRA Remodeling Activity Index TTM Moving Total - Dollars in Billions(3) Total Installed Base of U.S. Homes, Including Renter and Owner-Occupied Homes Homes in millions(1) $0 $200 $400 $600 $800 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 $0 $100 $200 $300 $400 1 Q 0 0 1 Q 0 1 1 Q 0 2 1 Q 0 3 1 Q 0 4 1 Q 0 5 1 Q 0 6 1 Q 0 7 1 Q 0 8 1 Q 0 9 1 Q 1 0 1 Q 1 1 1 Q 1 2 1 Q 1 3 1 Q 1 4 1 Q 1 5 1 Q 1 6 1 Q 1 7 1 Q 1 8 1 Q 1 9 1 Q 2 0 1 Q 2 1 ( P ) • Most recent HIRL data for total installed base of U.S. homes as of 2020 is 4% above 3Q20 estimates • CPP and remodeling data indicate continued elevating R&R activity, with the LIRA index at record levels • Work from home trends continue, generating ongoing demand in home remodeling and upgrades • Commodity price inflation may have the potential to impact future R&R activity 116 117 117 118 118 119 120 121 122 123 124 125 126 127 128 129

6 (1) Source: Random Lengths, company analysis; Feb-21 data thru 2/26/21 (2) Source: Random Lengths; company analysis; Feb-21 data thru 2/26/21 Commodity Price Environment a Key Growth Driver Strong residential demand driving lumber and panel prices toward multi-year highs -6- Framing Lumber Composite Index As of February 2021(1) Structural Panel Composite Index As of February 2021(2) 200 400 600 800 1000 1200 Ja n -1 5 M a r- 1 5 M a y -1 5 Ju l- 1 5 S e p -1 5 N o v -1 5 Ja n -1 6 M a r- 1 6 M a y -1 6 Ju l- 1 6 S e p -1 6 N o v -1 6 Ja n -1 7 M a r- 1 7 M a y -1 7 Ju l- 1 7 S e p -1 7 N o v -1 7 Ja n -1 8 M a r- 1 8 M a y -1 8 Ju l- 1 8 S e p -1 8 N o v -1 8 Ja n -1 9 M a r- 1 9 M a y -1 9 Ju l- 1 9 S e p -1 9 N o v -1 9 Ja n -2 0 M a r- 2 0 M a y -2 0 Ju l- 2 0 S e p -2 0 N o v -2 0 Ja n -2 1 Index Price TTM Avg. Index Price 200 400 600 800 1000 1200 Ja n -1 5 M a r- 1 5 M a y -1 5 Ju l- 1 5 S e p -1 5 N o v -1 5 Ja n -1 6 M a r- 1 6 M a y -1 6 Ju l- 1 6 S e p -1 6 N o v -1 6 Ja n -1 7 M a r- 1 7 M a y -1 7 Ju l- 1 7 S e p -1 7 N o v -1 7 Ja n -1 8 M a r- 1 8 M a y -1 8 Ju l- 1 8 S e p -1 8 N o v -1 8 Ja n -1 9 M a r- 1 9 M a y -1 9 Ju l- 1 9 S e p -1 9 N o v -1 9 Ja n -2 0 M a r- 2 0 M a y -2 0 Ju l- 2 0 S e p -2 0 N o v -2 0 Ja n -2 1 Index Price TTM Avg. Index Price Feb-21 structural panel prices were 126% above the 5-year average and 51% above the TTM rolling average • Framing Lumber and Structural Panel demand continues to outpace supply; production capacity constrained • Framing Lumber and Structural Panels prices reached all-time high in Feb-21 • Commodity price uncertainty expected in the near term as supply-demand imbalances continue • Further strengthening in single- family construction, together with an acceleration in the R&R market, provide a strong demand backdrop into 2021 Feb-21 framing lumber prices were 138% above the 5-year average and 49% above the TTM rolling average

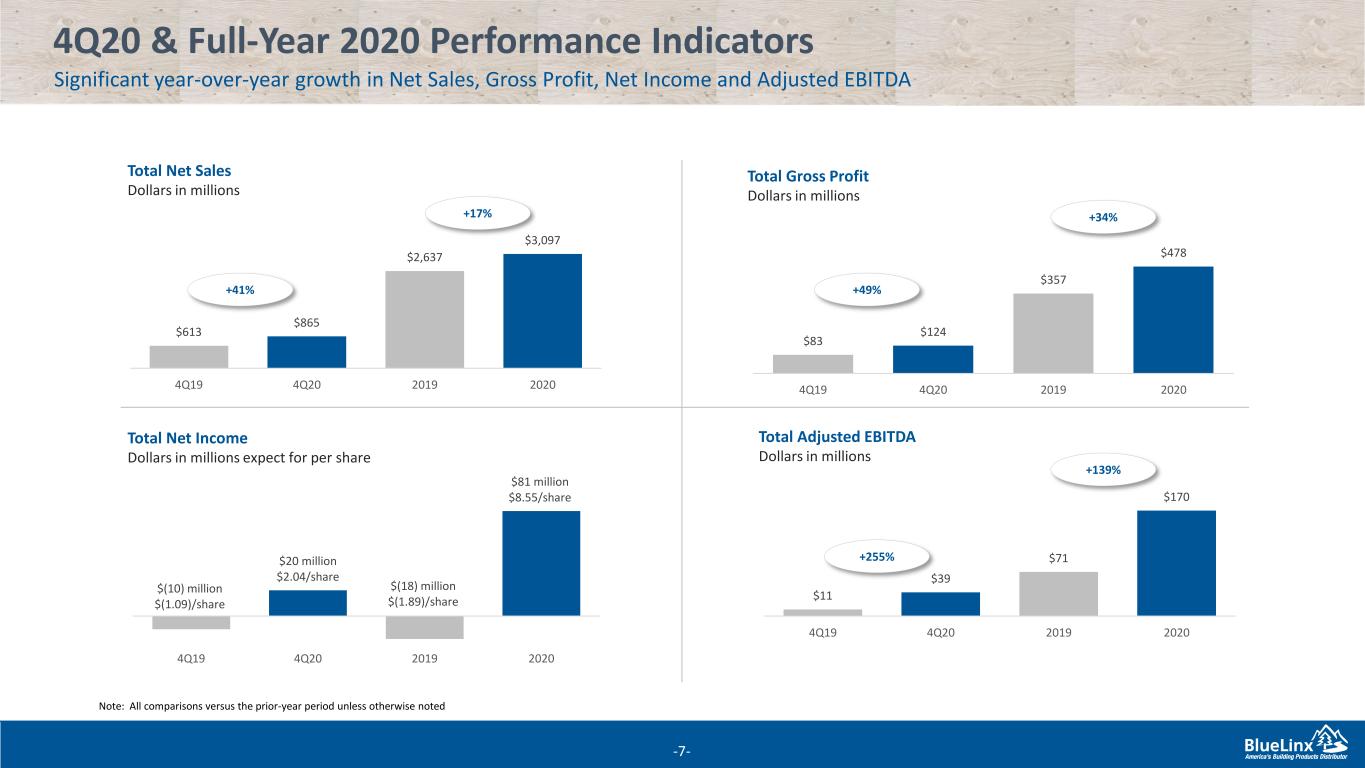

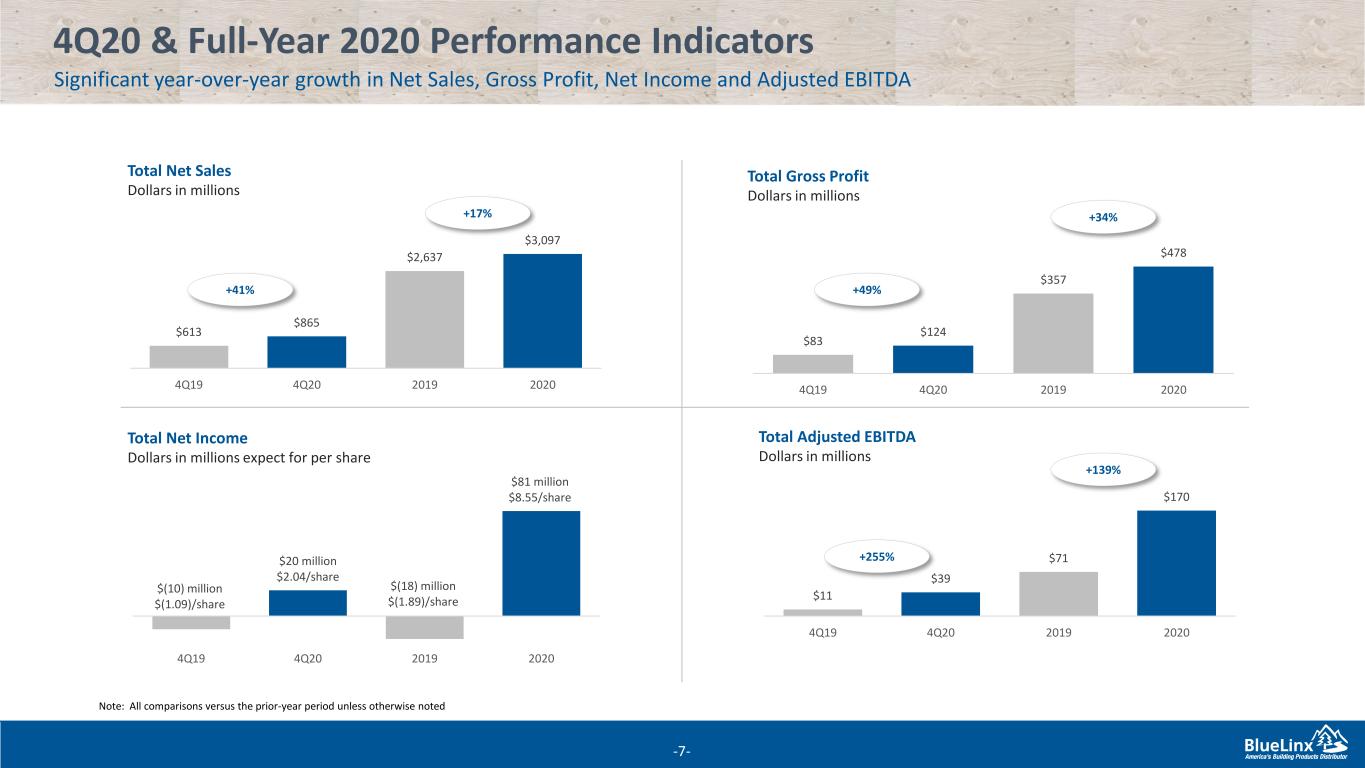

7 4Q20 & Full-Year 2020 Performance Indicators Significant year-over-year growth in Net Sales, Gross Profit, Net Income and Adjusted EBITDA -7- Total Net Sales Dollars in millions Total Gross Profit Dollars in millions Total Adjusted EBITDA Dollars in millions Total Net Income Dollars in millions expect for per share $613 $865 $2,637 $3,097 4Q19 4Q20 2019 2020 +41% +17% $83 $124 $357 $478 4Q19 4Q20 2019 2020 +49% +34% $11 $39 $71 $170 4Q19 4Q20 2019 2020 +255% +139% $(10) million $(1.09)/share $20 million $2.04/share $(18) million $(1.89)/share $81 million $8.55/share 4Q19 4Q20 2019 2020 Note: All comparisons versus the prior-year period unless otherwise noted

8 -8- 4Q20 & Full-Year 2020 Performance Indicators Margin expansion driven by improved operating leverage and cost reductions Gross Margin Gross Profit / Net Sales Adjusted EBITDA Margin Adjusted EBITDA / Net Sales Operating Margin Operating Income / Net Sales SG&A Margin SG&A / Net Sales 13.5% 14.4% 13.5% 15.4% 4Q19 4Q20 2019 2020 +90 bps +190 bps 11.9% 10.3% 11.1% 10.1% 4Q19 4Q20 2019 2020 -160 bps -100 bps 0.4% 3.5% 1.3% 4.6% 4Q19 4Q20 2019 2020 +310 bps +330 bps 1.8% 4.5% 2.7% 5.5% 4Q19 4Q20 2019 2020 +270 bps +280 bps Note: All comparisons versus the prior-year period unless otherwise noted

9 Specialty Products and Structural Products Performance Net sales growth and margin expansion across both specialty and structural products in 2020 -9- Specialty Products Sales and Gross Margin Dollars in Millions, Margin in Percent Structural Products Sales and Gross Margin Dollars in Millions, Margin in Percent $442 $482 $453 $398 $421 $449 $496 $498 15.2% 15.9% 16.2% 16.1% 16.4% 17.3% 17.4% 17.4% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% 22.0% 24.0% 200.0 250.0 300.0 350.0 400.0 450.0 500.0 550.0 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Full-Year 2019 Sales: $1.8 billion Gross Margin: 15.9% Full-Year 2020 Sales: $1.9 billion Gross Margin: 17.1% Full-Year 2019 Sales: 862 million Gross Margin: 8.7% Full-Year 2020 Sales: $1.2 billion Gross Margin: 12.8% • Specialty products net sales of $498 million, 58% of total 4Q20 net sales • Specialty products gross margin 17.4% in 4Q20, increased 130 basis points • Improvement in specialty net sales and gross margin attributable to disciplined pricing strategy and product expansion • Structural products net sales of $367 million, 42% of total 4Q20 net sales • Structural products gross margin 10.2% in 4Q20, increased 150 basis points • Impact of wood-based commodity inflation on net sales estimated to be between $210 to $230 million for the full year Note: All comparisons versus the prior-year period unless otherwise noted $197 $225 $226 $215 $241 $250 $375 $367 9.6% 7.8% 9.0% 8.7% 10.0% 9.3% 19.6% 10.2% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% - 50.0 100.0 150.0 200.0 250.0 300.0 350.0 400.0 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 GM Rate GM Rate

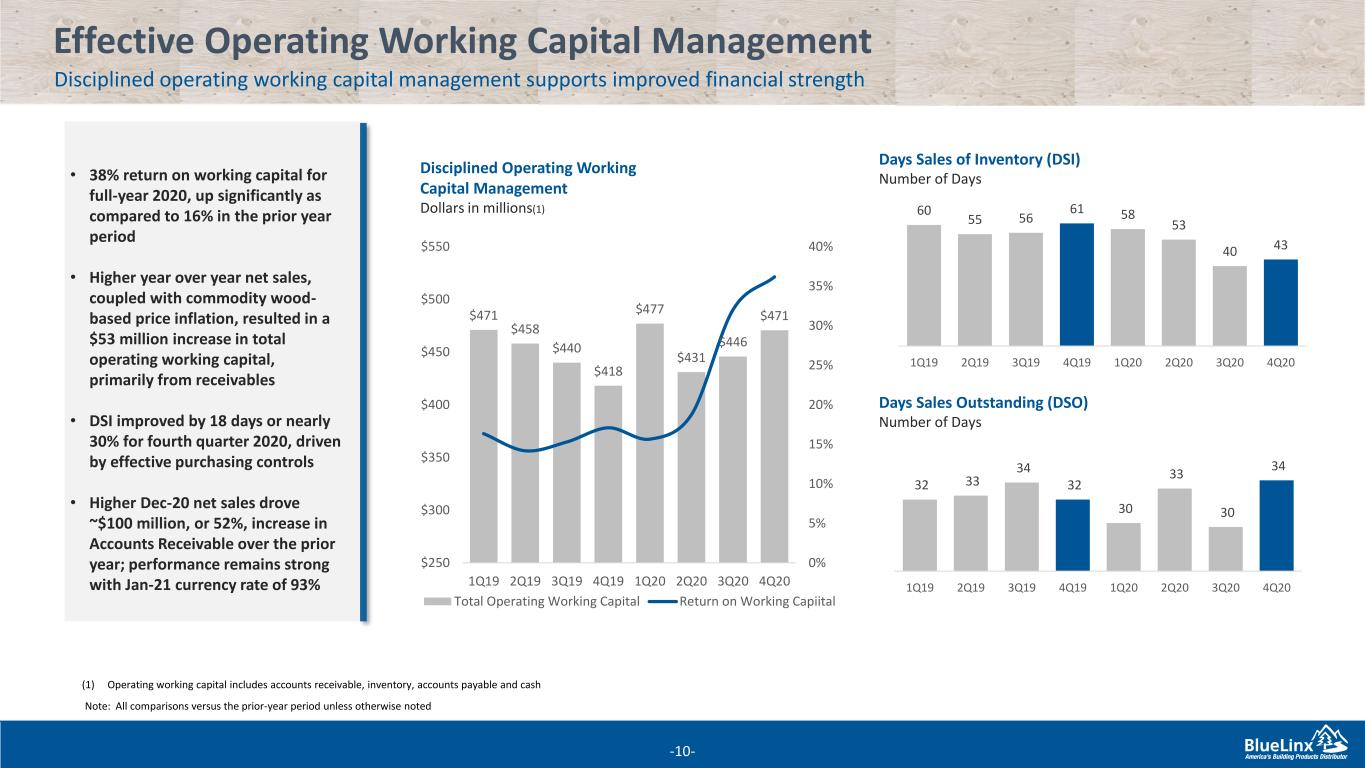

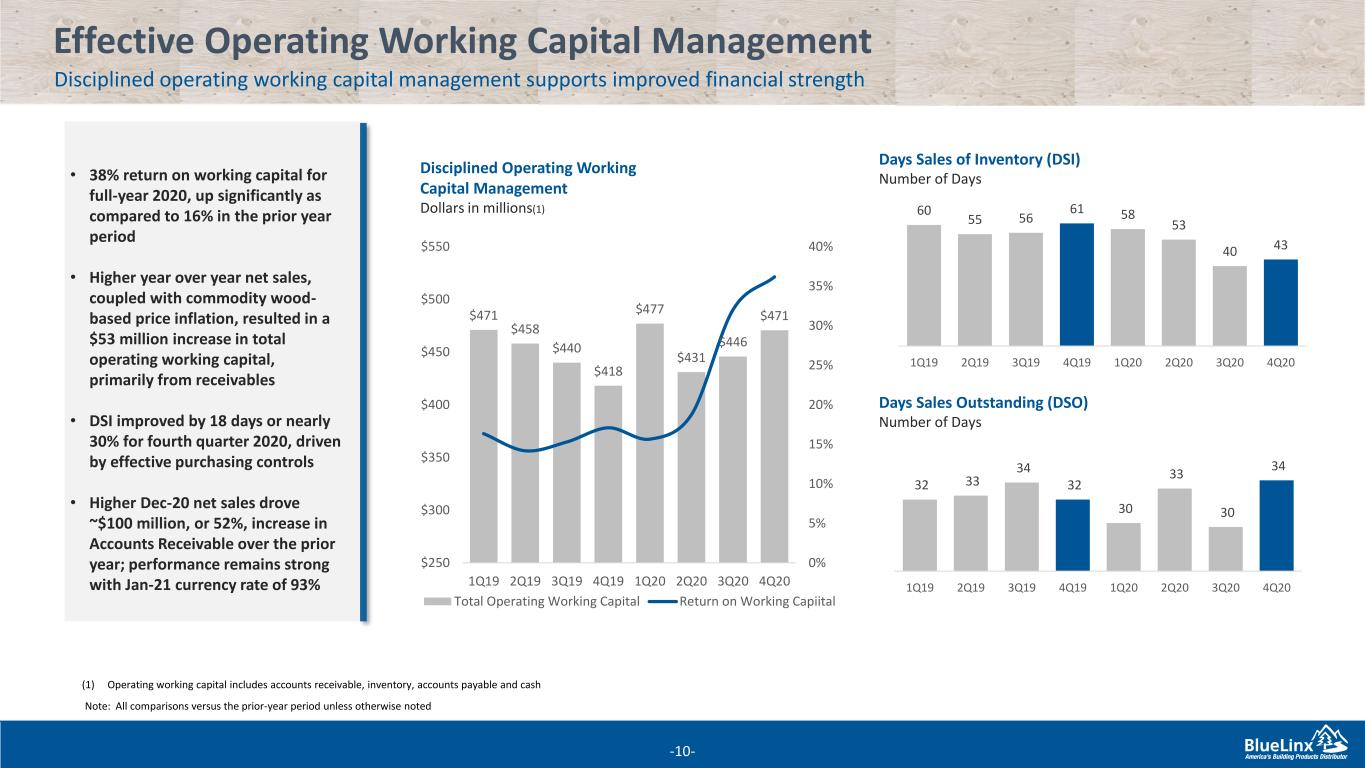

10 Effective Operating Working Capital Management Disciplined operating working capital management supports improved financial strength -10- Days Sales of Inventory (DSI) Number of Days Days Sales Outstanding (DSO) Number of Days (1) Operating working capital includes accounts receivable, inventory, accounts payable and cash • 38% return on working capital for full-year 2020, up significantly as compared to 16% in the prior year period • Higher year over year net sales, coupled with commodity wood- based price inflation, resulted in a $53 million increase in total operating working capital, primarily from receivables • DSI improved by 18 days or nearly 30% for fourth quarter 2020, driven by effective purchasing controls • Higher Dec-20 net sales drove ~$100 million, or 52%, increase in Accounts Receivable over the prior year; performance remains strong with Jan-21 currency rate of 93% 60 55 56 61 58 53 40 43 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 32 33 34 32 30 33 30 34 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Note: All comparisons versus the prior-year period unless otherwise noted $471 $458 $440 $418 $477 $431 $446 $471 0% 5% 10% 15% 20% 25% 30% 35% 40% $250 $300 $350 $400 $450 $500 $550 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Total Operating Working Capital Return on Working Capiital Disciplined Operating Working Capital Management Dollars in millions(1)

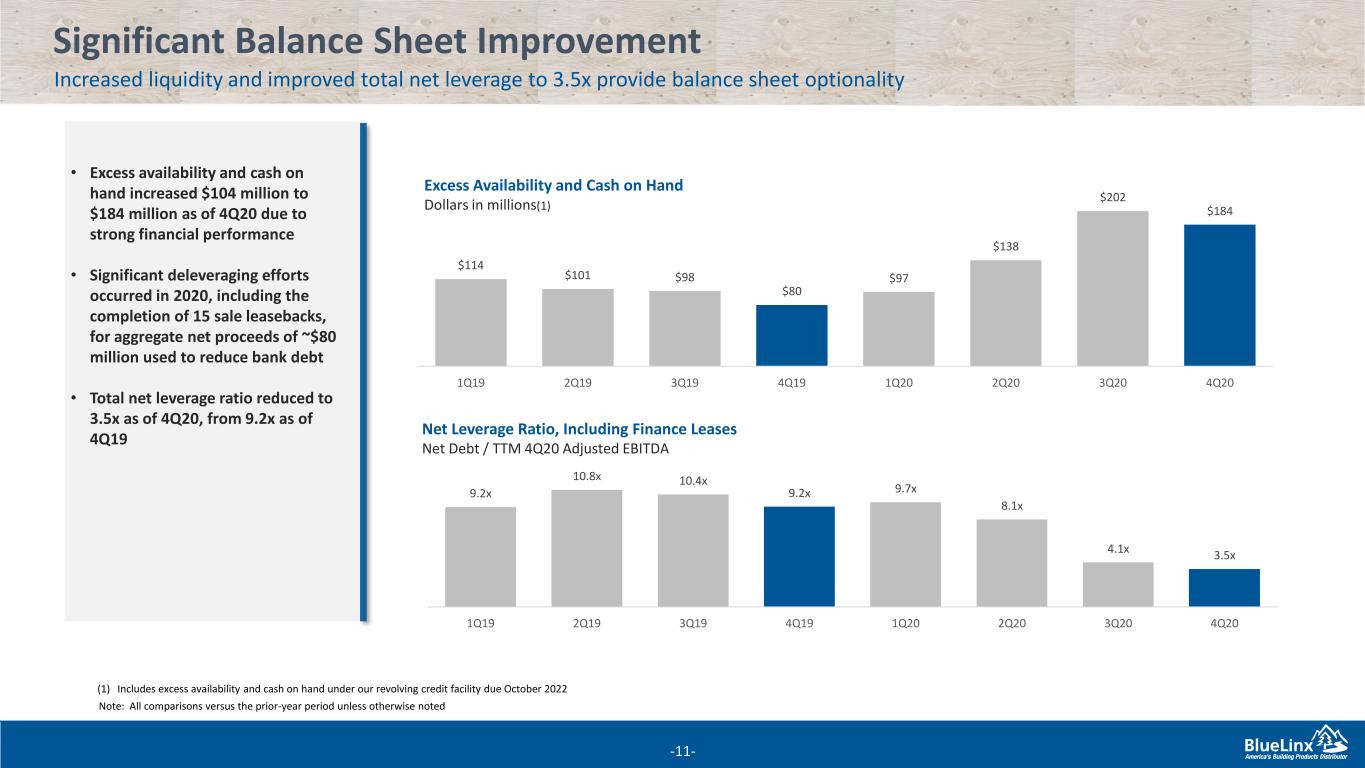

11 $114 $101 $98 $80 $97 $138 $202 $184 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Significant Balance Sheet Improvement Increased liquidity and improved total net leverage to 3.5x provide balance sheet optionality -11- Excess Availability and Cash on Hand Dollars in millions(1) (1) Includes excess availability and cash on hand under our revolving credit facility due October 2022 Net Leverage Ratio, Including Finance Leases Net Debt / TTM 4Q20 Adjusted EBITDA Note: All comparisons versus the prior-year period unless otherwise noted • Excess availability and cash on hand increased $104 million to $184 million as of 4Q20 due to strong financial performance • Significant deleveraging efforts occurred in 2020, including the completion of 15 sale leasebacks, for aggregate net proceeds of ~$80 million used to reduce bank debt • Total net leverage ratio reduced to 3.5x as of 4Q20, from 9.2x as of 4Q19 9.2x 10.8x 10.4x 9.2x 9.7x 8.1x 4.1x 3.5x 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20

12 Significant Reduction In Bank Debt Outstanding Reduced bank debt outstanding by $142 million in 2020, supported by strong free cash flow generation -12- Free Cash Flow Generation Dollars in millions(2) Bank Debt Reduction Dollars in millions(1) 14 asset sales Estimated Annual Cash Commitments, excluding Taxes Dollars in millions(3) (1) Denotes a $43 million 8.2% term loan due October 2023; and a $288 million 3.3% revolving credit facility due October 2022 (2) Free cash flow in a non-GAAP metric defined as total operating cash flow less total capital expenditures (3) Provided solely to illustrate potential future annual uses of cash; excludes principal payments under Term Loan, ABL and Finance Leases Note: All comparisons versus the prior-year period unless otherwise noted • In fiscal 2020, reduced bank debt outstanding by $142 million or 30%; down by almost half since 2Q18 • Total net interest expense, including interest on bank debt and financing obligations, decreased by ~$7 million for 2020 • TTM 4Q20 FCF increased by more than $65 million vs. TTM 4Q19, supporting deleveraging cycle • Fourth quarter inventory investments and inflation impacting TTM 4Q20 FCF $450 $415 $333 $394 $369 $355 $326 $382 $322 $263 $288 $180 $179 $179 $178 $147 $147 $147 $77 $69 $58 $43 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 ABL Debt Outstanding Term Loan Debt Outstanding $630 $594 $512 $572 $516 $502 $459$473 $391 $321 $331 ($15) ($16) $51 $98 $51 TTM 4Q19 TTM 1Q20 TTM 2Q20 TTM 3Q20 TTM 4Q20 Finance Lease Interest $24 ABL Interest $6 Term Loan Interest $3 Capital Expenditures $6 Pension $1 Annual Cash Commitments before Taxes ~$40

Divider slide 29 September, 2020App ndix

14 Non-GAAP Measures -14- BlueLinx reports its financial results in accordance with GAAP, but we also believe that presentation of certain non-GAAP measures may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. We caution that non-GAAP measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Adjusted EBITDA. We define Adjusted EBITDA as and amount equal to net income plus interest expense and all interest expense related items, income taxes, depreciation and amortization, and further adjusted for certain non-cash items and other special items, including compensation expense from share based compensation, one-time charges associated with the legal, consulting, and professional fees related to the Cedar Creek acquisition, and gains on sales of properties including amortization of deferred gains. We present Adjusted EBITDA because it is the primary measure used by management to evaluate operating performance and, we believe, helps to enhance investors’ overall understanding of the financial performance and cash flows of our business. We believe Adjusted EBITDA is helpful in highlighting operating trends. We also believe that Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results. However, Adjusted EBITDA is not a presentation made in accordance with GAAP, and is not intended to present a superior measure of financial condition from those determined under GAAP. Adjusted EBITDA, as used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. Free Cash Flow. We define free cash flow as net cash provided by operating activities less total capital expenditures. Free cash flow is a measure used by management to assess our financial performance, and we believe it is useful for investors because it relates the operating cash flow of the company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures that can be used for, among other things, investment in our business, strengthening our balance sheet, and repayment of our debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Free cash flow is not a presentation made in accordance with GAAP, and is not intended to present a superior measure of financial condition from those determined under GAAP. Free cash flow, as used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. Net Debt and Overall Net Leverage Ratio. We determine our net debt based on our total short- and long-term debt, including our outstanding balances under our term loan and revolving credit facility and the total amount of our obligations under our financing leases, less cash and cash equivalents. We believe that net debt is useful to investors because our management reviews our net debt as part of its management of overall liquidity, financial flexibility, capital structure and leverage, and creditors and credit analysts monitor our net debt as part of their assessments of our business. We determine our overall net leverage ratio by dividing our net debt by trailing twelve-month Adjusted EBITDA. We believe that this ratio is useful to investors because it is an indicator of our ability to meet our future financial obligations. In addition, the ratio is a measure that is frequently used by investors and creditors. Our net debt and overall net leverage ratio are not presentations made in accordance with GAAP, and are not intended to present a superior measure of our financial condition from measures and ratios determined under GAAP. In addition, our net debt and overall net leverage ratio, as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation.

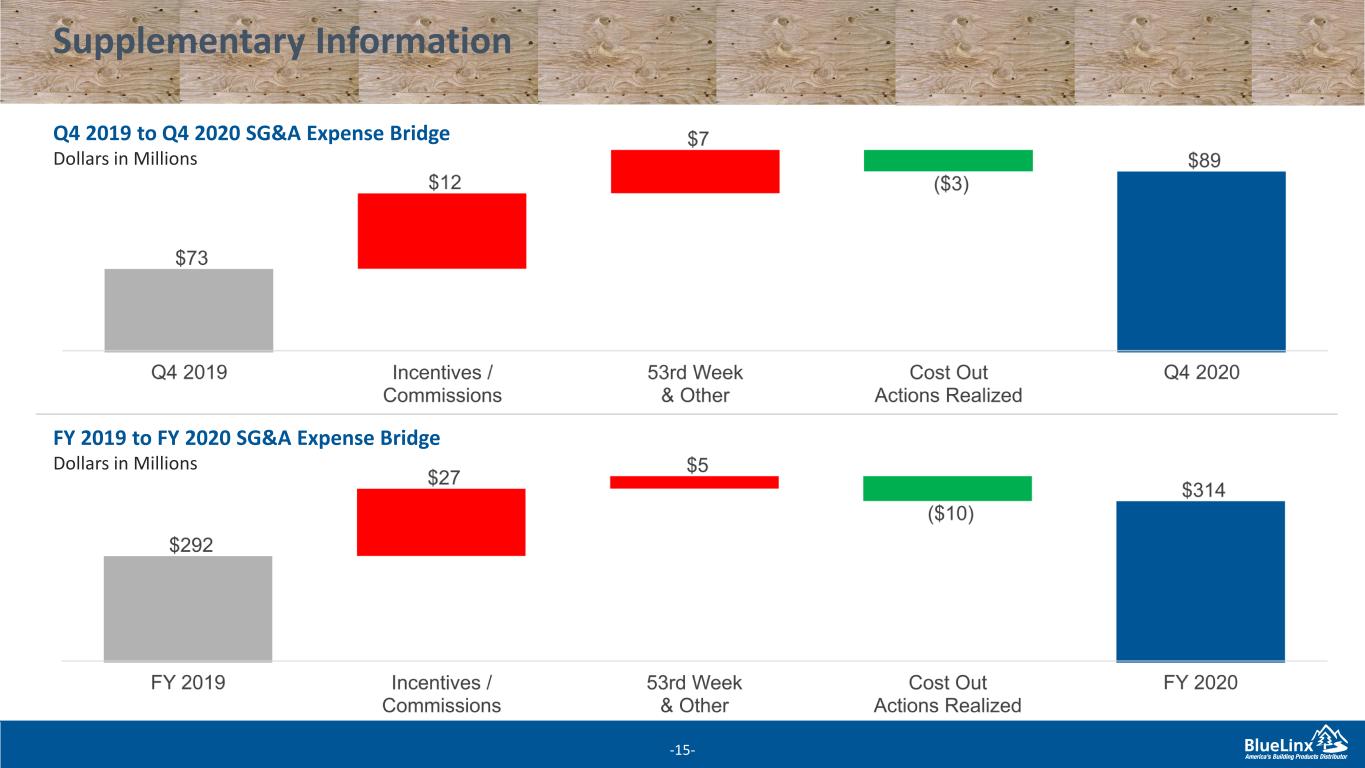

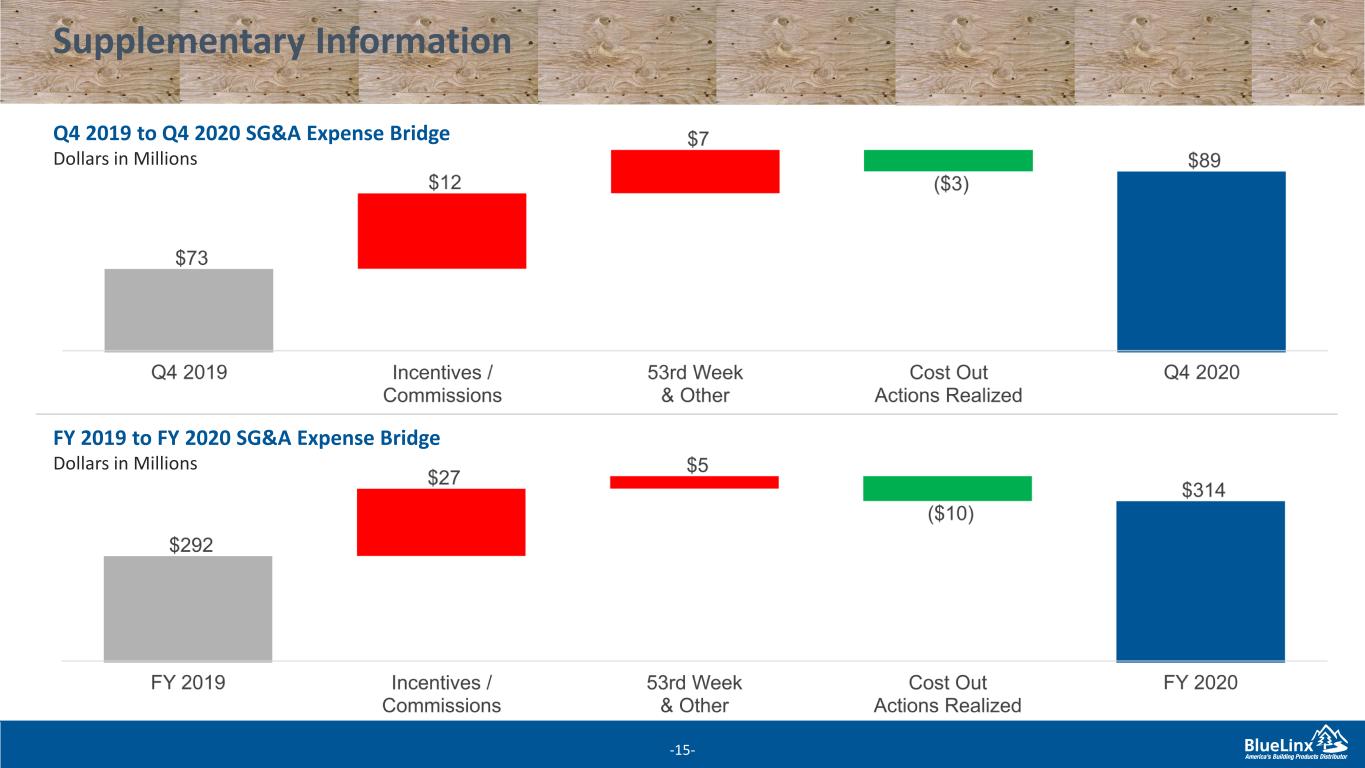

15 Q4 2019 to Q4 2020 SG&A Expense Bridge Dollars in Millions -15- Supplementary Information FY 2019 to FY 2020 SG&A Expense Bridge Dollars in Millions

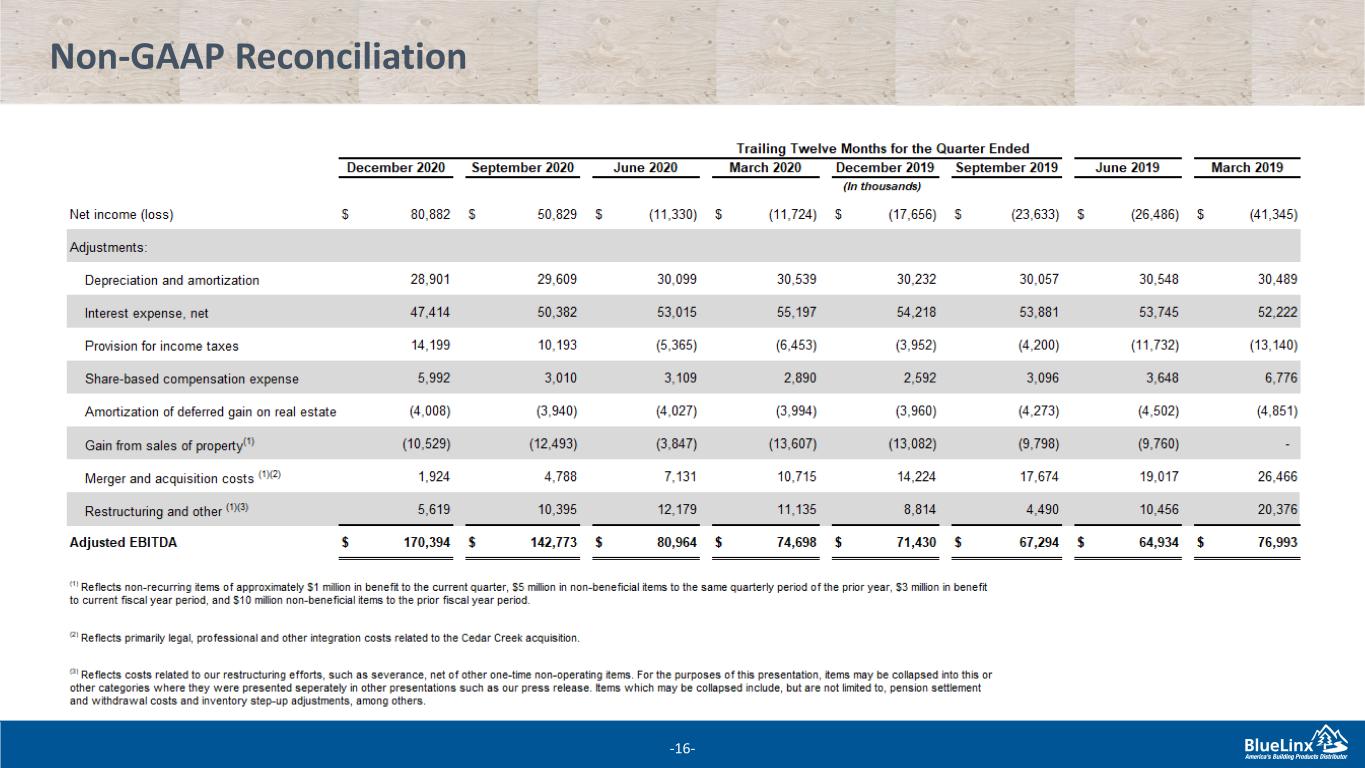

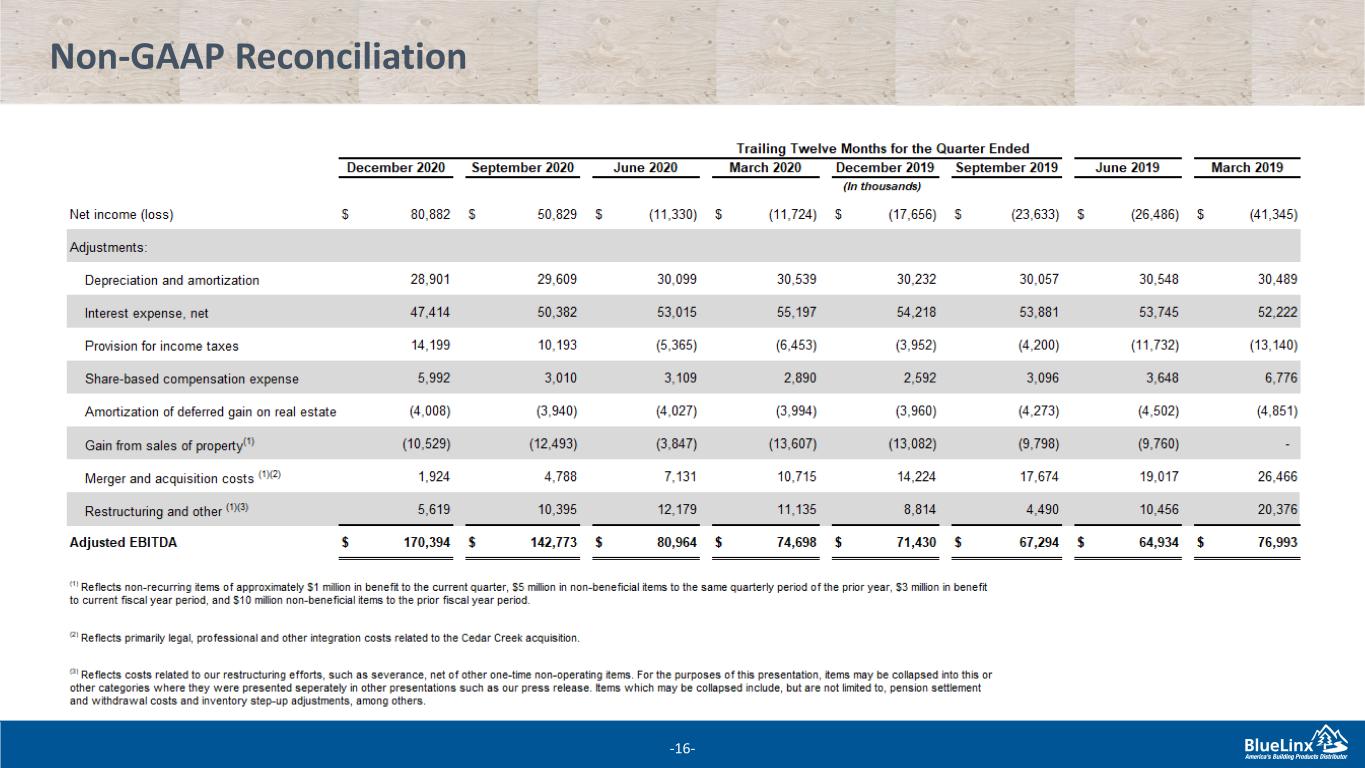

16 Non-GAAP Reconciliation -16-

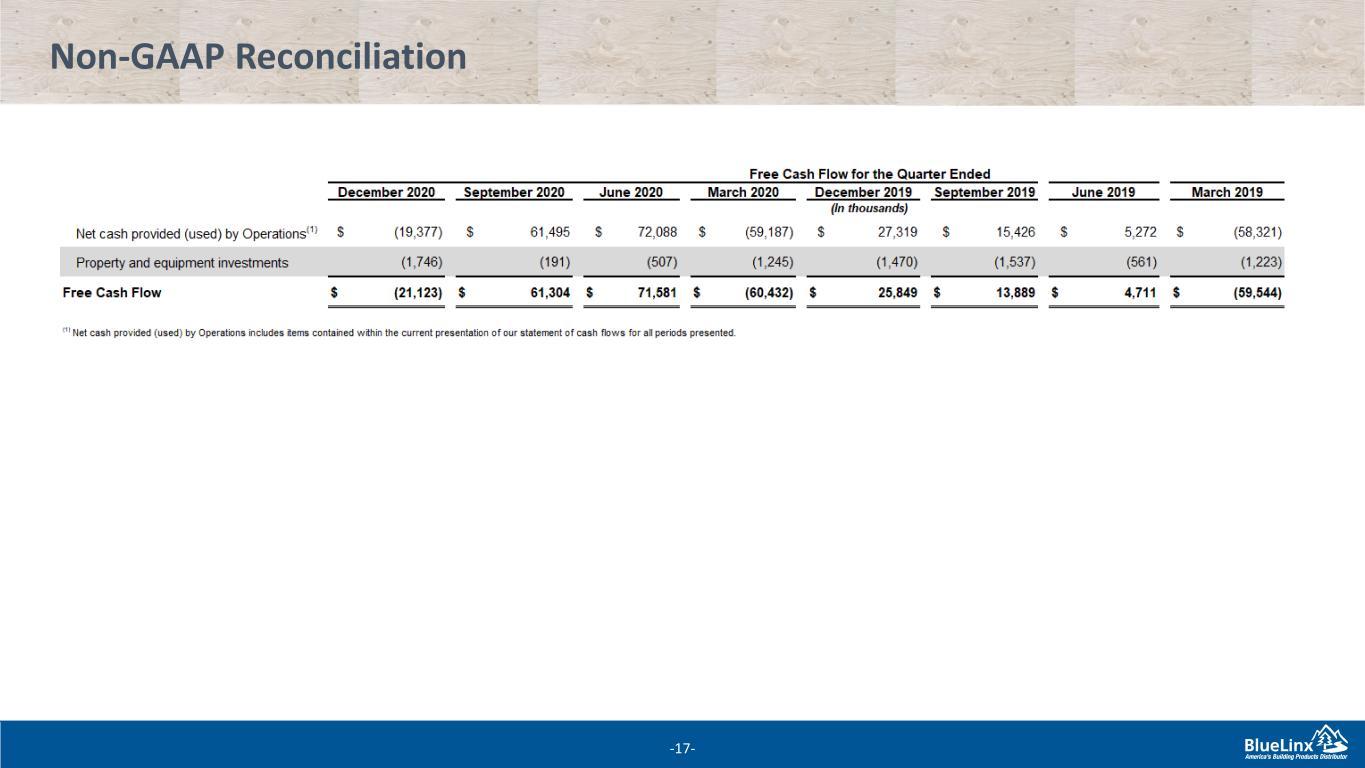

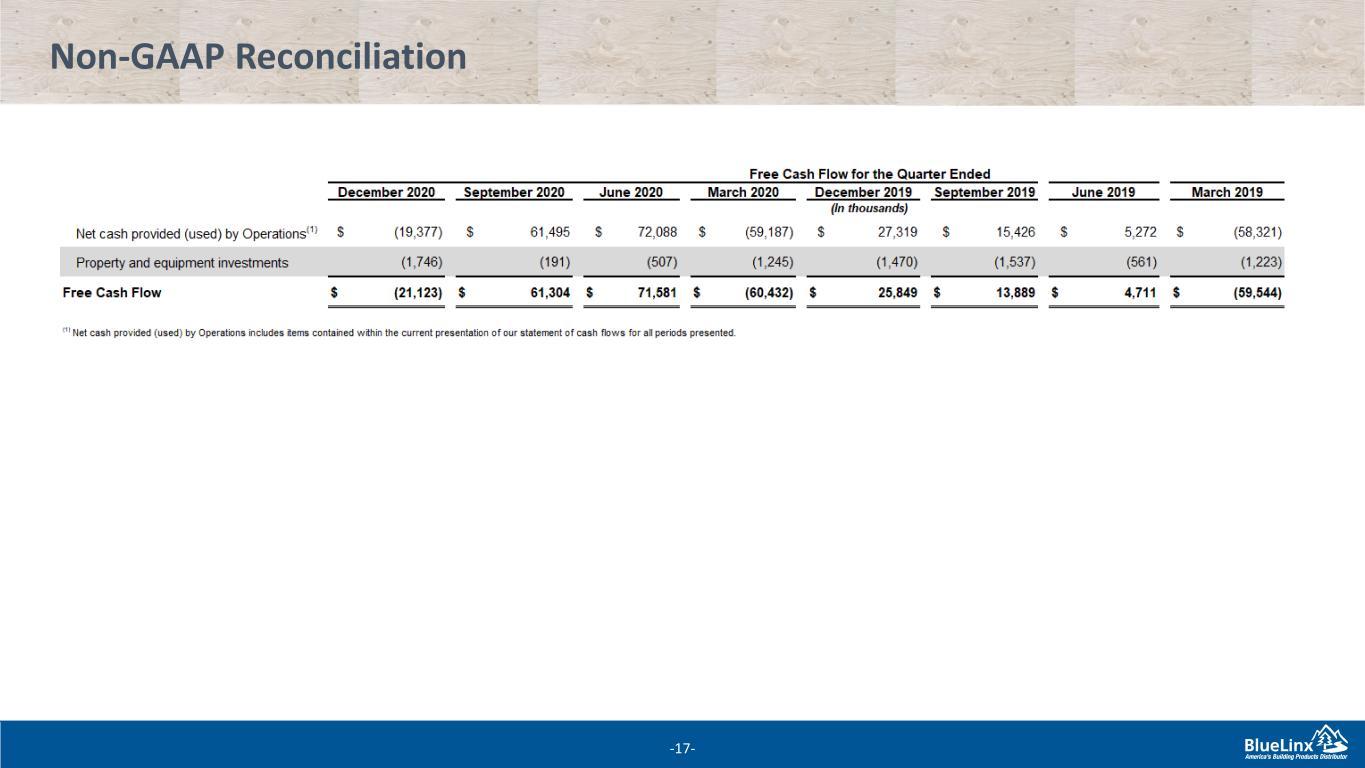

17 Non-GAAP Reconciliation -17-

18 Non-GAAP Reconciliation -18-