Divider slide 29 September, 2020 Fourth Quarter and Full Year 2021 Results Conference Call February 23, 2022

1 Safe Harbor Statement -1- This presentation contains forward-looking statements. Forward-looking statements include, without limitation, any statement that predicts, forecasts, indicates or implies future results, performance, liquidity levels or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” “will be,” “will likely continue,” “will likely result” or words or phrases of similar meaning. The forward-looking statements in this press release include statements about our ability to capitalize on strong demand amid supply chain constraints and wood-based commodity price volatility; our ability to capitalize on supplier-led price increases and our value-added services; our areas of focus and management initiatives; our ability to manage structural product inventory and leverage our centralized purchasing and pricing teams successfully; the demand outlook for construction materials and expectations regarding new home construction and renovation activity; our positioning for long-term value creation; our efforts and ability to foster a performance-driven culture and generate profitable growth; our efforts and ability to migrate our revenue mix toward higher-margin specialty product categories, and the benefits thereof; our efforts and ability to maintain a disciplined capital structure and pursue high-return investments and the benefits thereof; our ability to maintain a strong balance sheet; our ability to focus on operating improvement initiatives and commercial excellence; our ability to attract, retain and motivate strong leadership talent; our expectations for fleet and facility investment and the benefits thereof; and our evaluation of potential acquisition targets . Forward-looking statements in this press release are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties that may cause our business, strategy, or actual results to differ materially from the forward-looking statements. These risks and uncertainties include those discussed in greater detail in our filings with the Securities and Exchange Commission. We operate in a changing environment in which new risks can emerge from time to time. It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy, or actual results to differ materially from those contained in forward-looking statements. Factors that may cause these differences include, among other things: pricing and product cost variability; volumes of product sold; competition; changes in the supply and/or demand for products that we distribute; the cyclical nature of the industry in which we operate; housing market conditions; consolidation among competitors, suppliers, and customers; disintermediation risk; loss of products or key suppliers and manufacturers; our dependence on international suppliers and manufacturers for certain products; potential acquisitions and the integration and completion of such acquisitions; business disruptions; effective inventory management relative to our sales volume or the prices of the products we produce; information technology security risks and business interruption risks; the ability to attract, train, and retain highly qualified associates and other key personnel while controlling related labor costs; exposure to product liability and other claims and legal proceedings related to our business and the products we distribute; natural disasters, catastrophes, fire, or other unexpected events; successful implementation of our strategy; wage increases or work stoppages by our union employees; costs imposed by federal, state, local, and other regulations; compliance costs associated with federal, state, and local environmental protection laws; the COVID-19 pandemic and other contagious illness outbreaks and their potential effects on our industry; regulations concerning mandatory COVID-19 vaccines; fluctuations in our operating results; our level of indebtedness and our ability to incur additional debt to fund future needs; the covenants of the instruments governing our indebtedness limiting the discretion of our management in operating the business; variable interest rate risk under certain indebtedness; the fact that we have consummated certain sale leaseback transactions with resulting long-term non-cancelable leases, many of which are or will be finance leases; the fact that we lease many of our distribution centers, and we would still be obligated under these leases even if we close a leased distribution center; inability to raise funds necessary to finance a required repurchase of our senior secured notes; a lowering or withdrawal of debt ratings; changes in our product mix; increases in petroleum prices; shareholder activism; changes in insurance-related deductible/retention reserves based on actual loss experience; the possibility that the value of our deferred tax assets could become impaired; changes in our expected annual effective tax rate could be volatile; changes in actuarial assumptions for our pension plan; the costs and liabilities related to our participation in multi-employer pension plans could increase; the risk that our cash flows and capital resources may be insufficient to service our existing or future indebtedness; the possibility that we could be the subject of securities class action litigation due to stock price volatility; activities of activist shareholders; indebtedness terms that limit our ability to pay dividends on common stock; and changes in, or interpretation of, accounting principles. Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures. BlueLinx reports its financial results in accordance with GAAP. The Company also believes that presentation of certain non-GAAP measures may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Any non-GAAP measures used herein are reconciled to their most directly comparable GAAP measures herein or in the financial tables accompanying this news release. The Company cautions that non-GAAP measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Immaterial Rounding Differences. Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations. This presentation and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together.

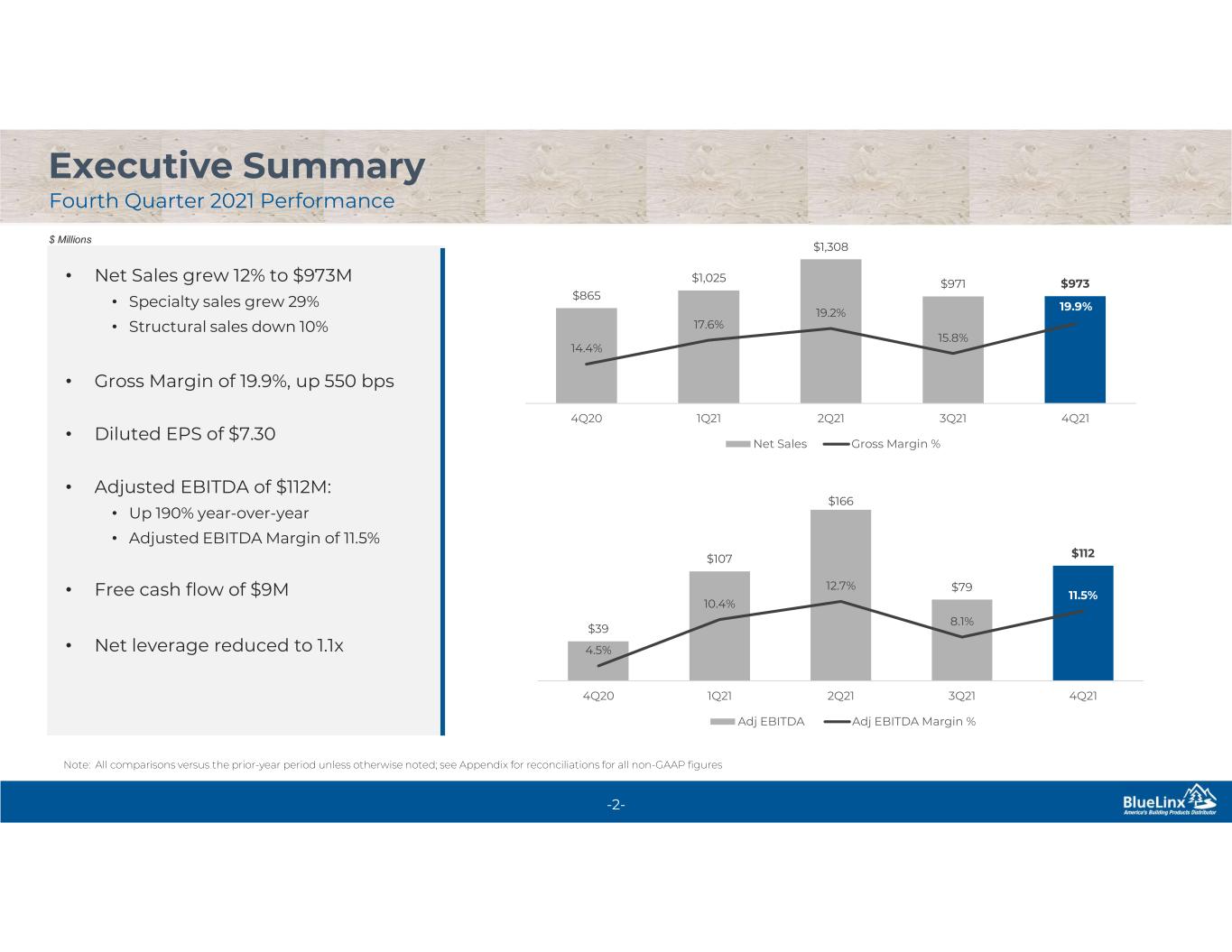

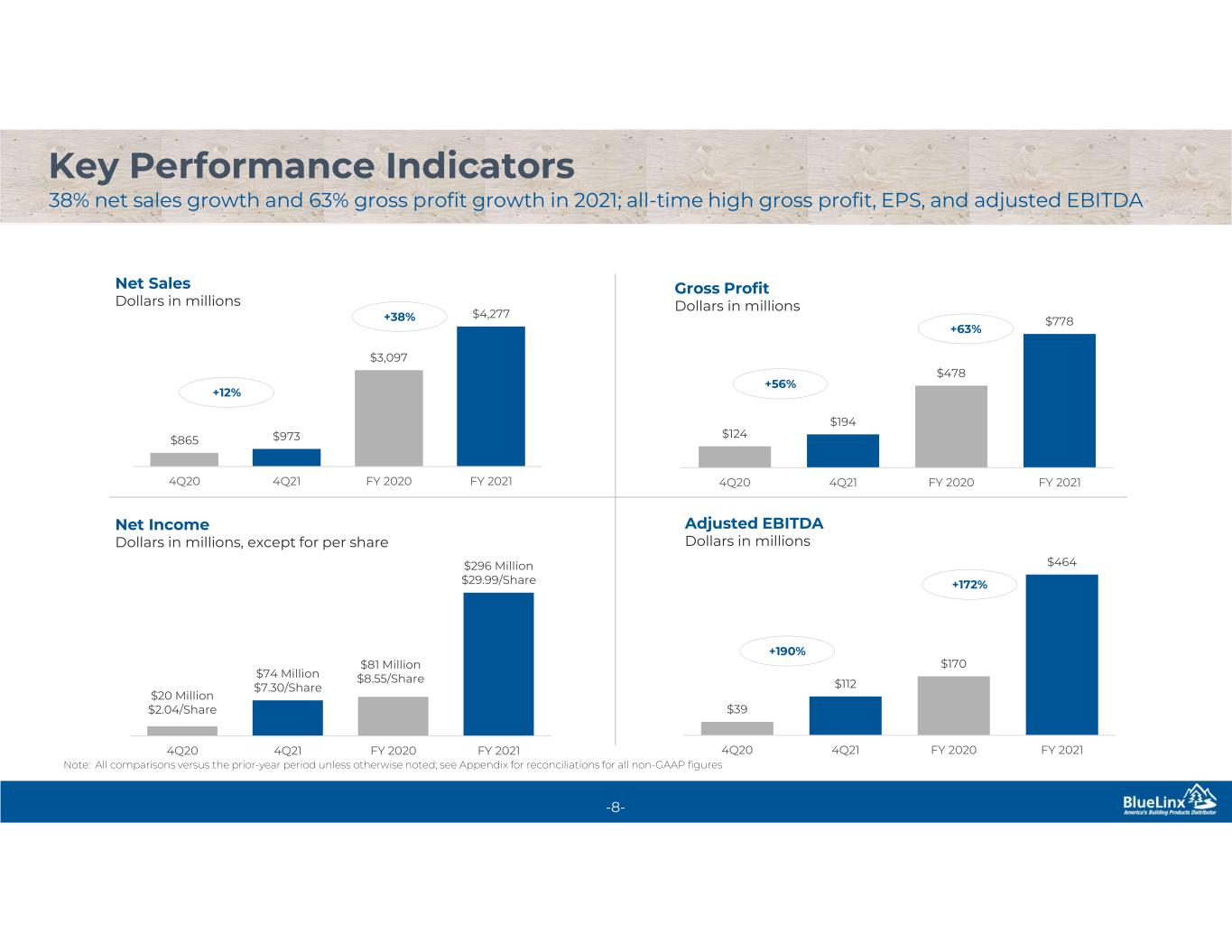

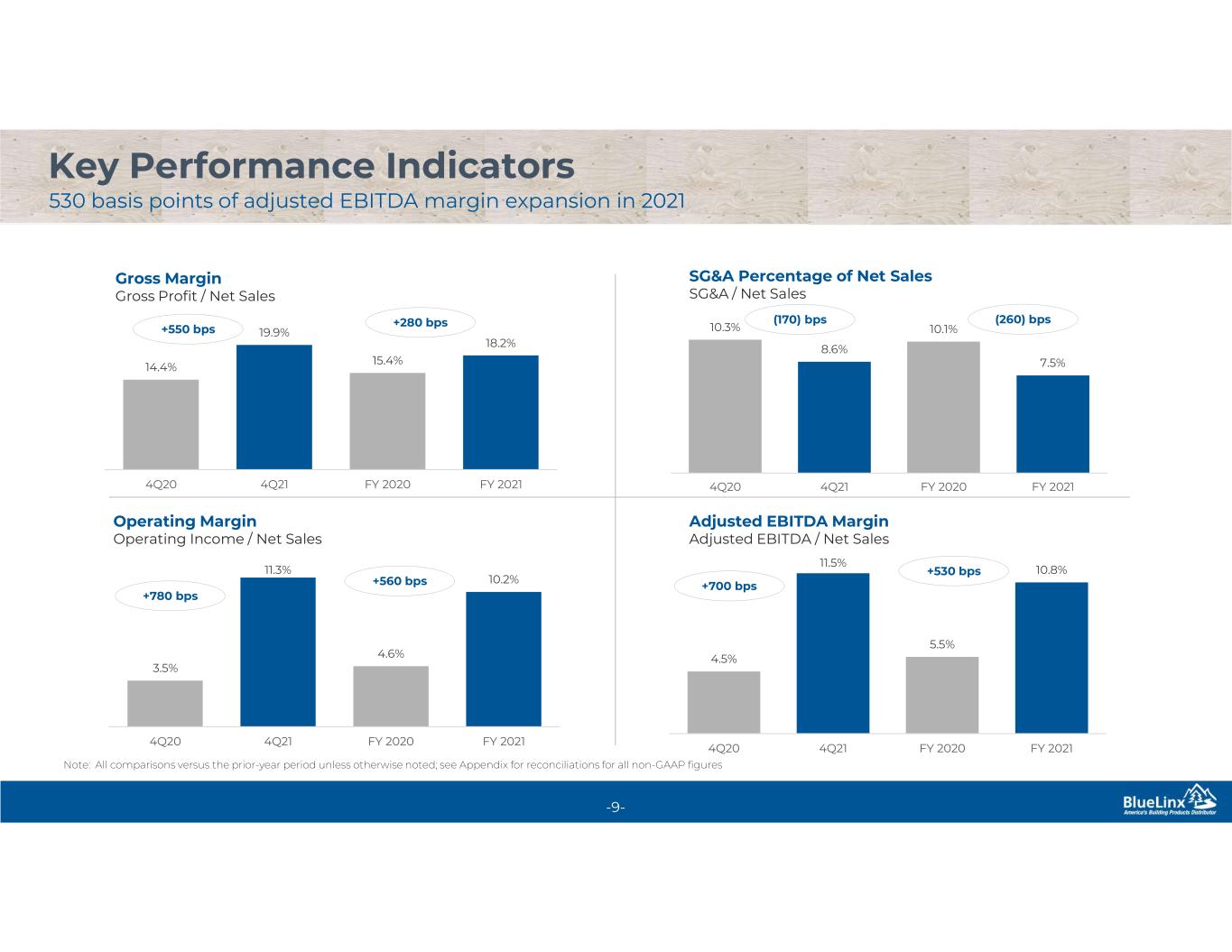

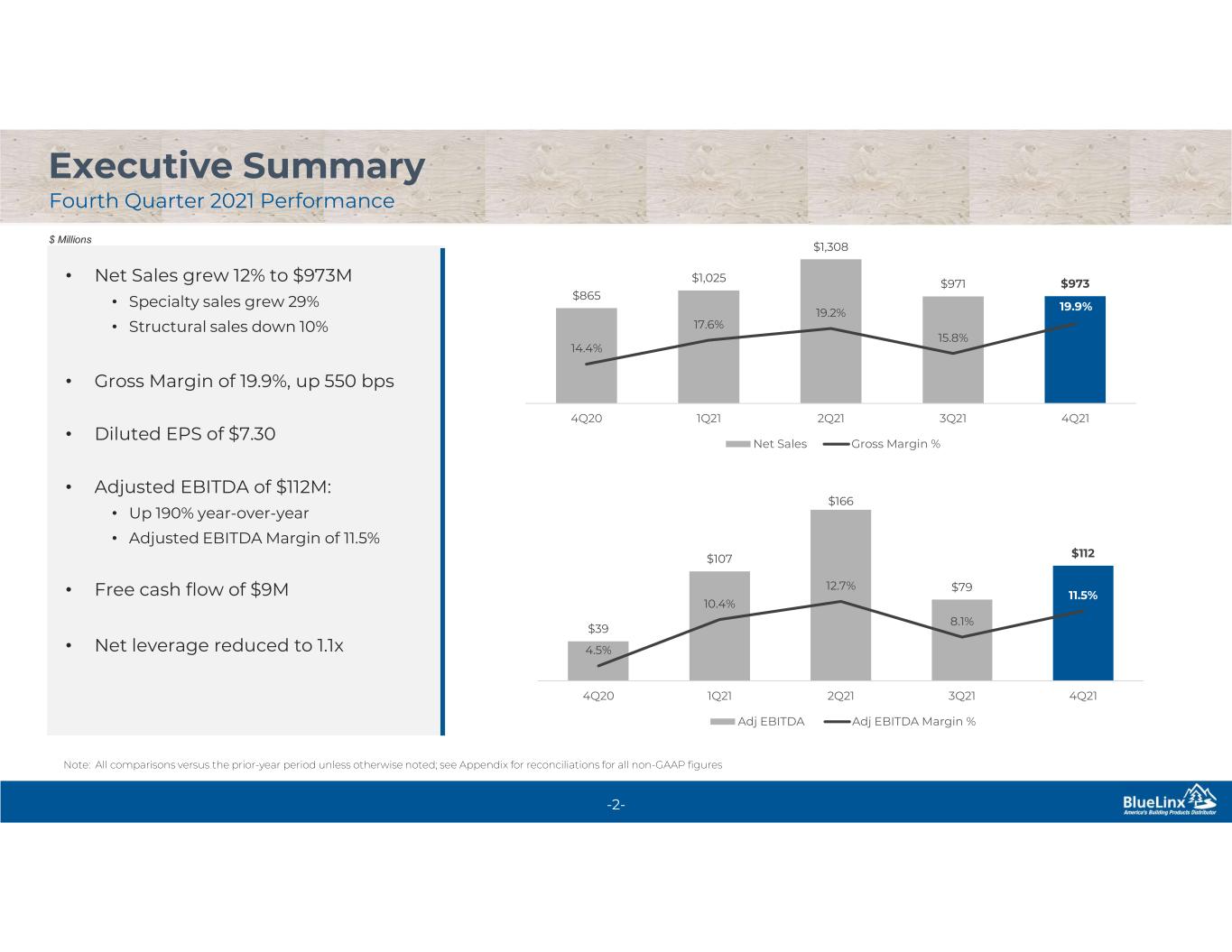

2 Executive Summary Fourth Quarter 2021 Performance -2- $ Millions • Net Sales grew 12% to $973M • Specialty sales grew 29% • Structural sales down 10% • Gross Margin of 19.9%, up 550 bps • Diluted EPS of $7.30 • Adjusted EBITDA of $112M: • Up 190% year-over-year • Adjusted EBITDA Margin of 11.5% • Free cash flow of $9M • Net leverage reduced to 1.1x $865 $1,025 $1,308 $971 $973 14.4% 17.6% 19.2% 15.8% 19.9% 4Q20 1Q21 2Q21 3Q21 4Q21 Net Sales Gross Margin % $39 $107 $166 $79 $112 4.5% 10.4% 12.7% 8.1% 11.5% 4Q20 1Q21 2Q21 3Q21 4Q21 Adj EBITDA Adj EBITDA Margin % Note: All comparisons versus the prior-year period unless otherwise noted; see Appendix for reconciliations for all non-GAAP figures

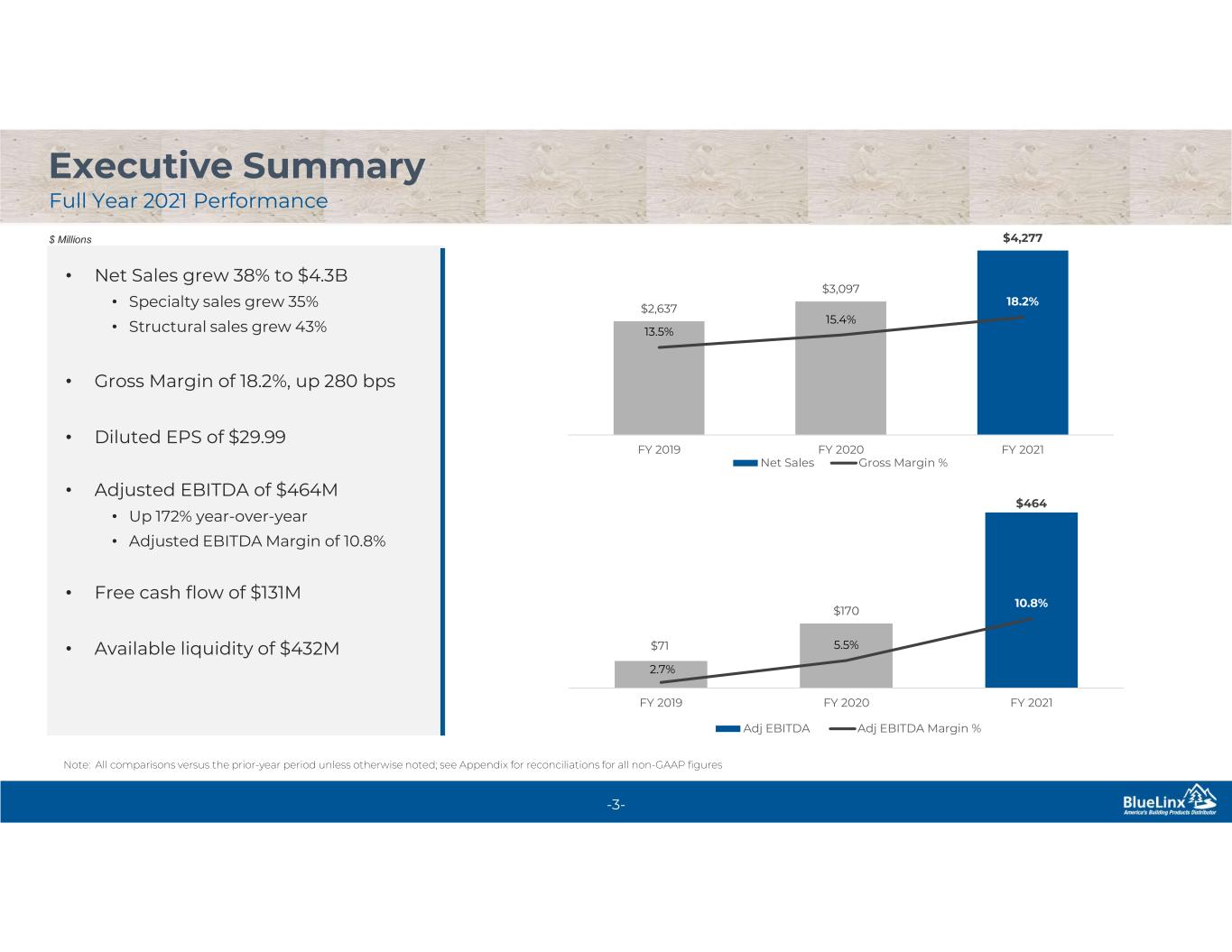

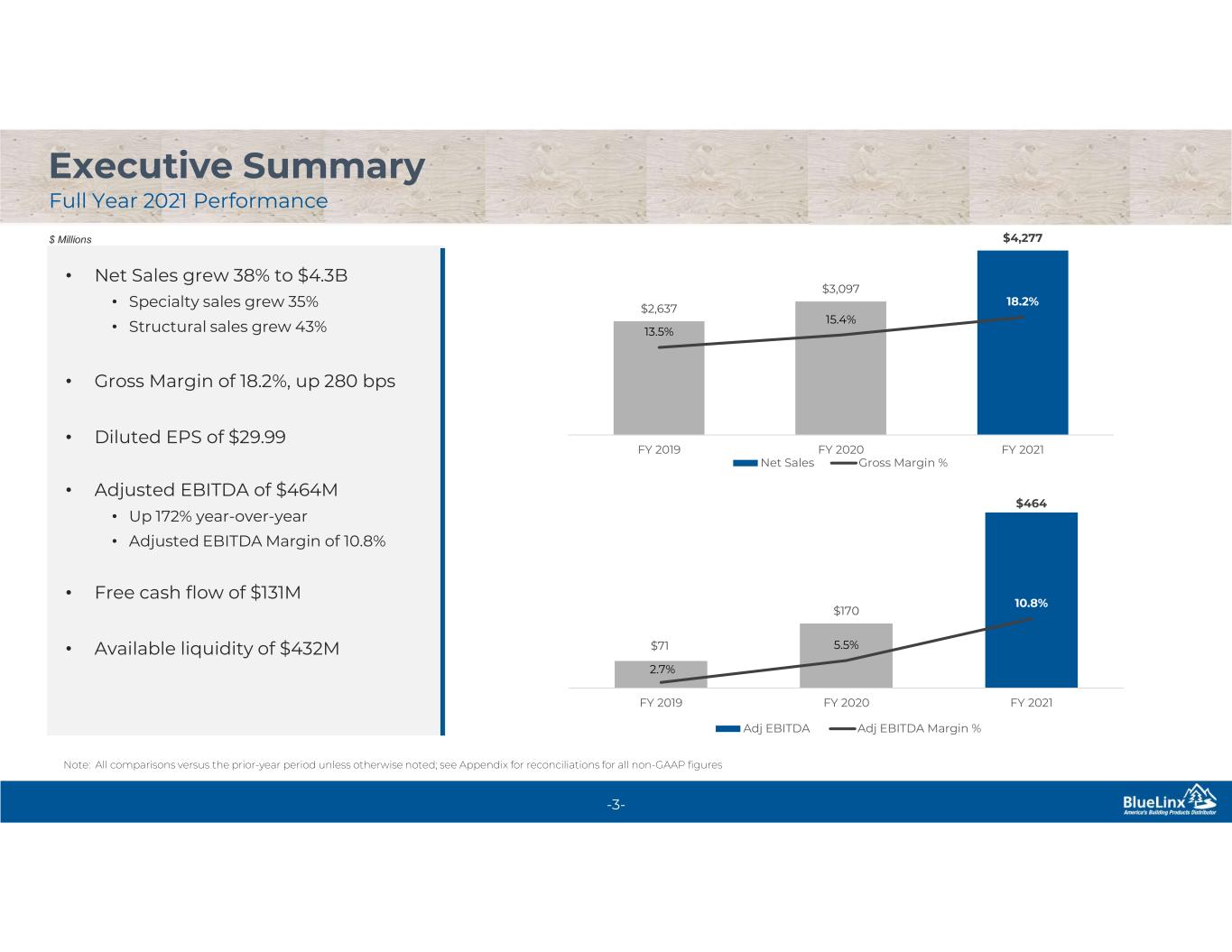

3 Executive Summary Full Year 2021 Performance -3- $ Millions • Net Sales grew 38% to $4.3B • Specialty sales grew 35% • Structural sales grew 43% • Gross Margin of 18.2%, up 280 bps • Diluted EPS of $29.99 • Adjusted EBITDA of $464M • Up 172% year-over-year • Adjusted EBITDA Margin of 10.8% • Free cash flow of $131M • Available liquidity of $432M $2,637 $3,097 $4,277 13.5% 15.4% 18.2% FY 2019 FY 2020 FY 2021 Net Sales Gross Margin % $71 $170 $464 2.7% 5.5% 10.8% FY 2019 FY 2020 FY 2021 Adj EBITDA Adj EBITDA Margin % Note: All comparisons versus the prior-year period unless otherwise noted; see Appendix for reconciliations for all non-GAAP figures

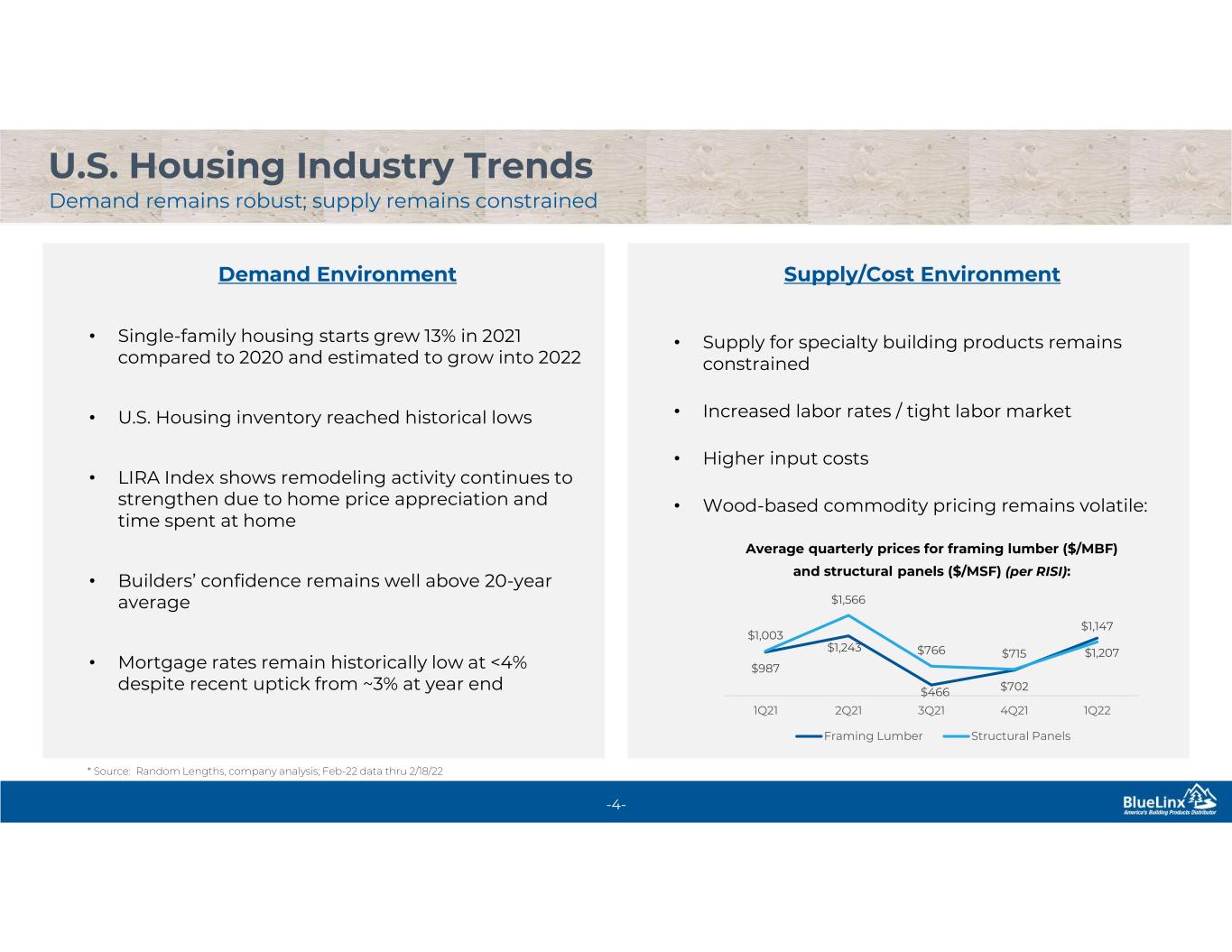

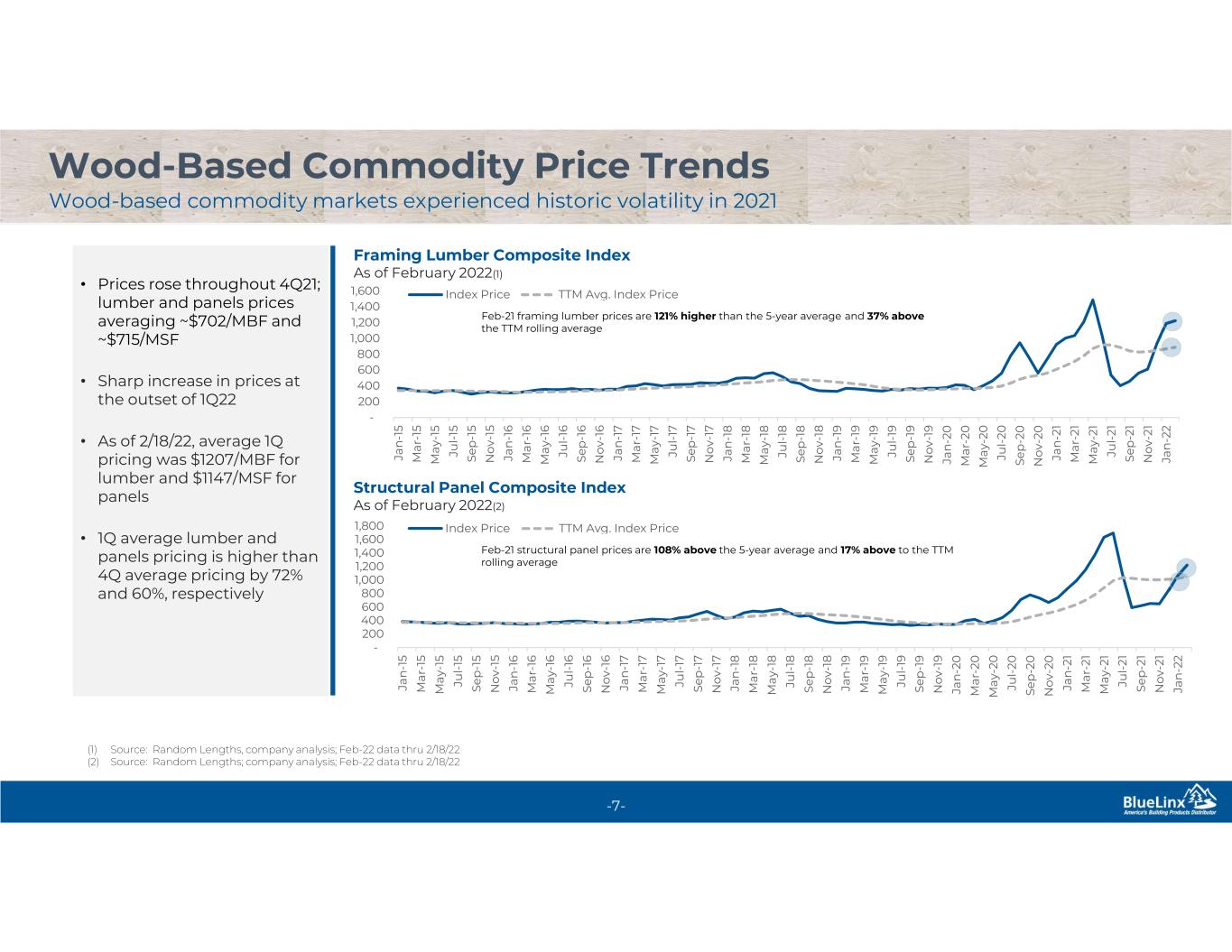

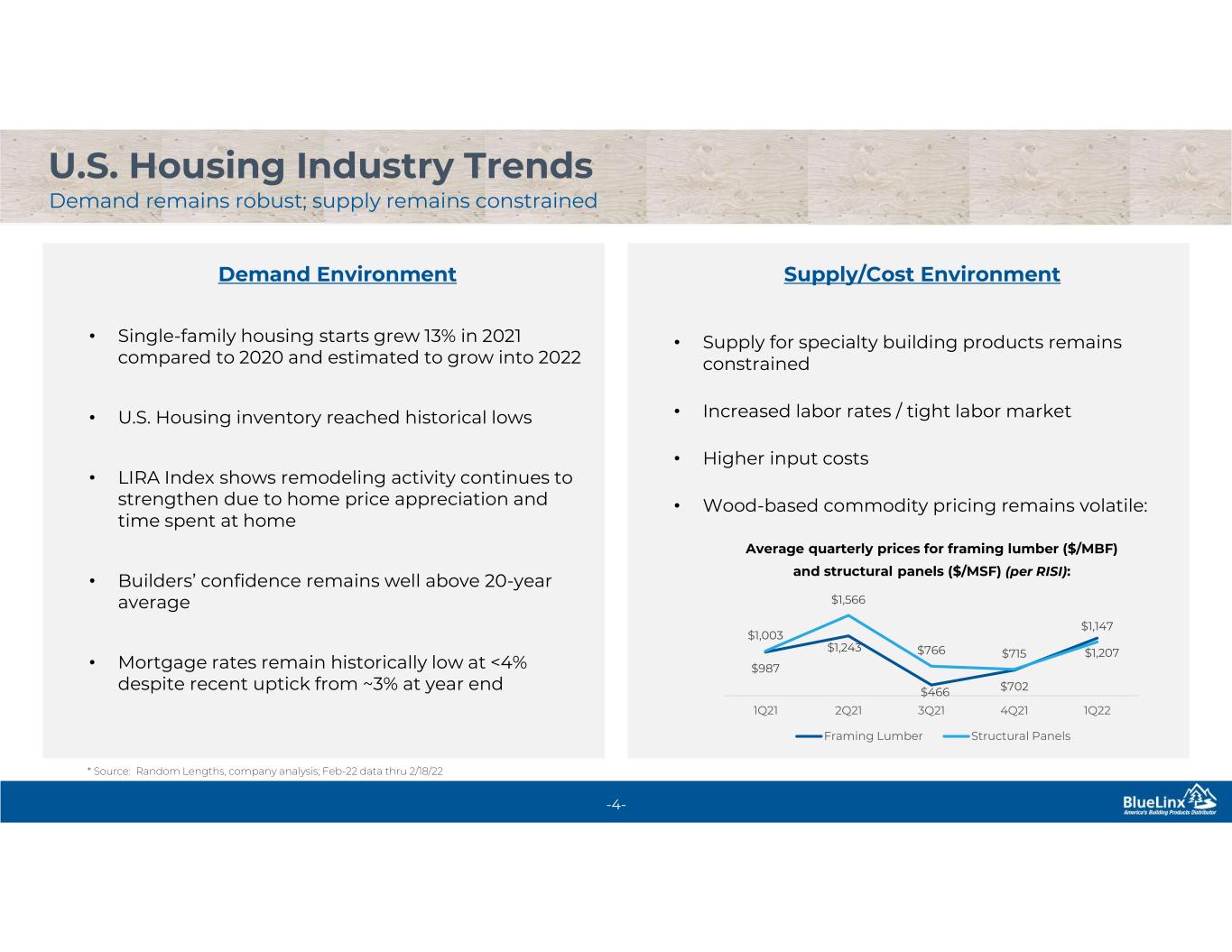

4 U.S. Housing Industry Trends Demand remains robust; supply remains constrained -4- Demand Environment • Single-family housing starts grew 13% in 2021 compared to 2020 and estimated to grow into 2022 • U.S. Housing inventory reached historical lows • LIRA Index shows remodeling activity continues to strengthen due to home price appreciation and time spent at home • Builders’ confidence remains well above 20-year average • Mortgage rates remain historically low at <4% despite recent uptick from ~3% at year end Supply/Cost Environment • Supply for specialty building products remains constrained • Increased labor rates / tight labor market • Higher input costs • Wood-based commodity pricing remains volatile: * Source: Random Lengths, company analysis; Feb-22 data thru 2/18/22 $987 $1,243 $466 $702 $1,207 $1,003 $1,566 $766 $715 $1,147 1Q21 2Q21 3Q21 4Q21 1Q22 Framing Lumber Structural Panels Average quarterly prices for framing lumber ($/MBF) and structural panels ($/MSF) (per RISI):

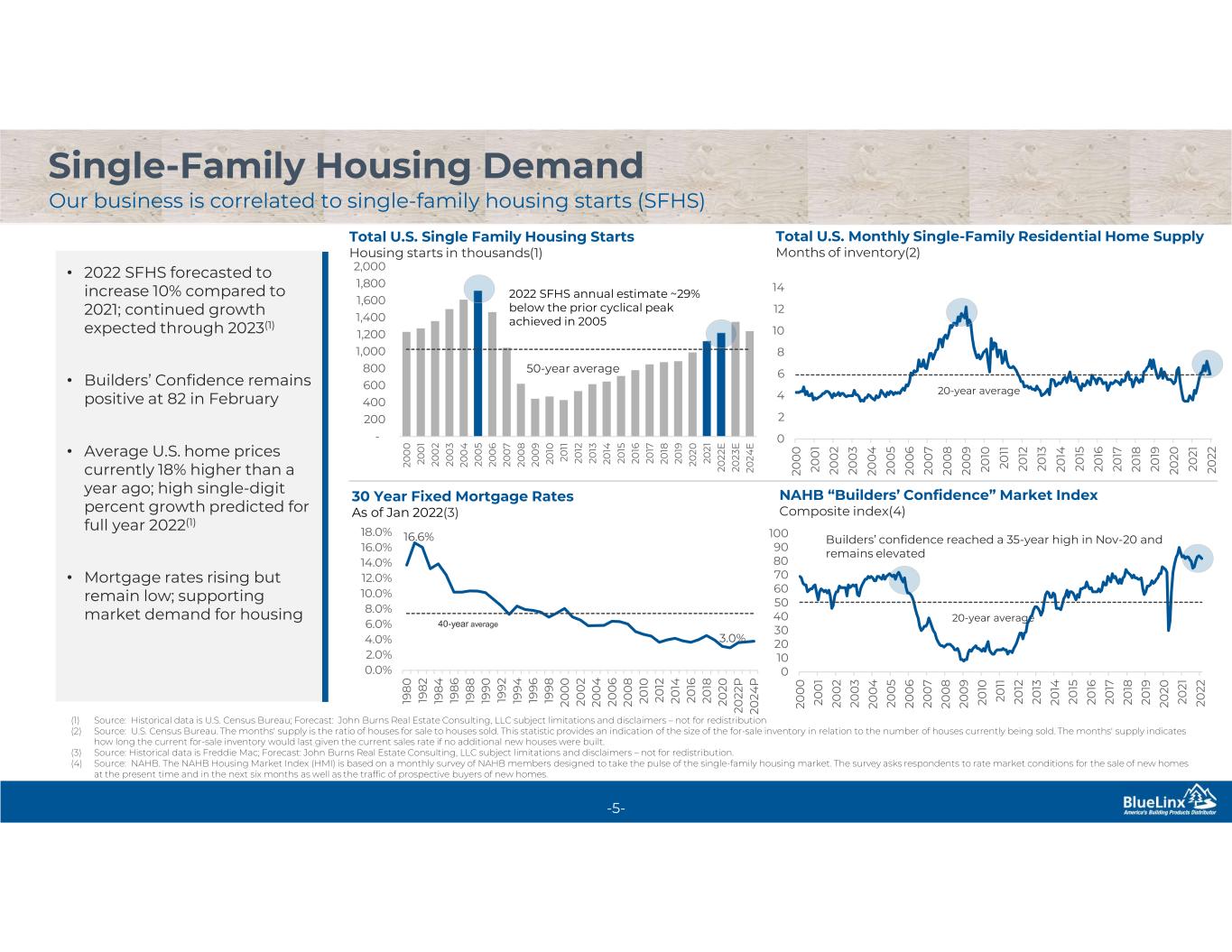

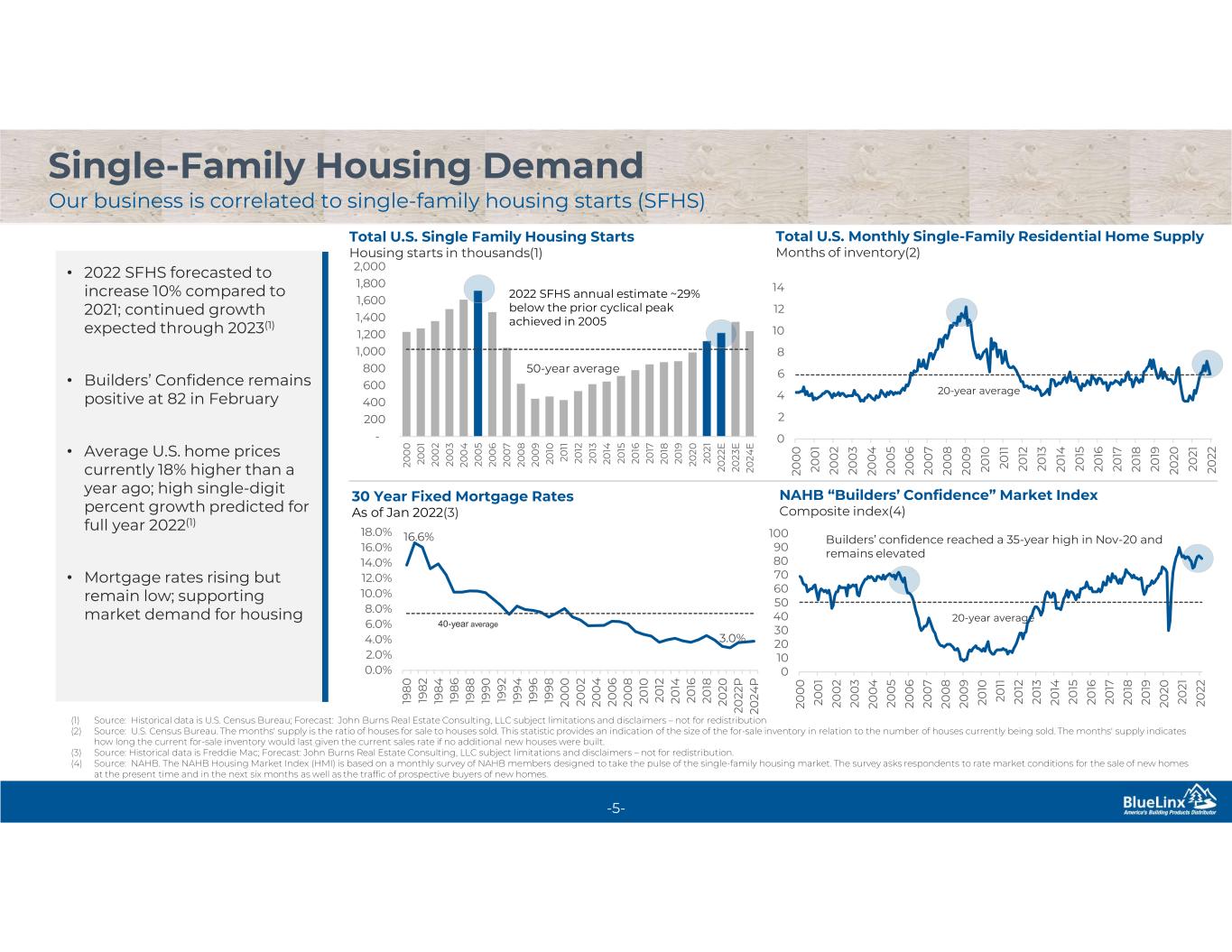

5 Single-Family Housing Demand Our business is correlated to single-family housing starts (SFHS) -5- Total U.S. Monthly Single-Family Residential Home Supply Months of inventory(2) NAHB “Builders’ Confidence” Market Index Composite index(4) Builders’ confidence reached a 35-year high in Nov-20 and remains elevated 50-year average 20-year average 20-year average 30 Year Fixed Mortgage Rates As of Jan 2022(3) - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 20 0 0 20 0 1 20 0 2 20 0 3 20 0 4 20 0 5 20 0 6 20 0 7 20 0 8 20 0 9 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 E 20 23 E 20 24 E Total U.S. Single Family Housing Starts Housing starts in thousands(1) 0 2 4 6 8 10 12 14 20 0 0 20 0 1 20 0 2 20 0 3 20 0 4 20 0 5 20 0 6 20 0 7 20 0 8 20 0 9 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 0 10 20 30 40 50 60 70 80 90 100 20 0 0 20 0 1 20 0 2 20 0 3 20 0 4 20 0 5 20 0 6 20 0 7 20 0 8 20 0 9 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 16.6% 3.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 19 8 0 19 8 2 19 8 4 19 8 6 19 8 8 19 9 0 19 9 2 19 9 4 19 9 6 19 9 8 20 0 0 20 0 2 20 0 4 20 0 6 20 0 8 20 10 20 12 20 14 20 16 20 18 20 20 20 22 P 20 24 P 40-year average • 2022 SFHS forecasted to increase 10% compared to 2021; continued growth expected through 2023(1) • Builders’ Confidence remains positive at 82 in February • Average U.S. home prices currently 18% higher than a year ago; high single-digit percent growth predicted for full year 2022(1) • Mortgage rates rising but remain low; supporting market demand for housing (1) Source: Historical data is U.S. Census Bureau; Forecast: John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution (2) Source: U.S. Census Bureau. The months' supply is the ratio of houses for sale to houses sold. This statistic provides an indication of the size of the for-sale inventory in relation to the number of houses currently being sold. The months' supply indicates how long the current for-sale inventory would last given the current sales rate if no additional new houses were built. (3) Source: Historical data is Freddie Mac; Forecast: John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution. (4) Source: NAHB. The NAHB Housing Market Index (HMI) is based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes. 2022 SFHS annual estimate ~29% below the prior cyclical peak achieved in 2005

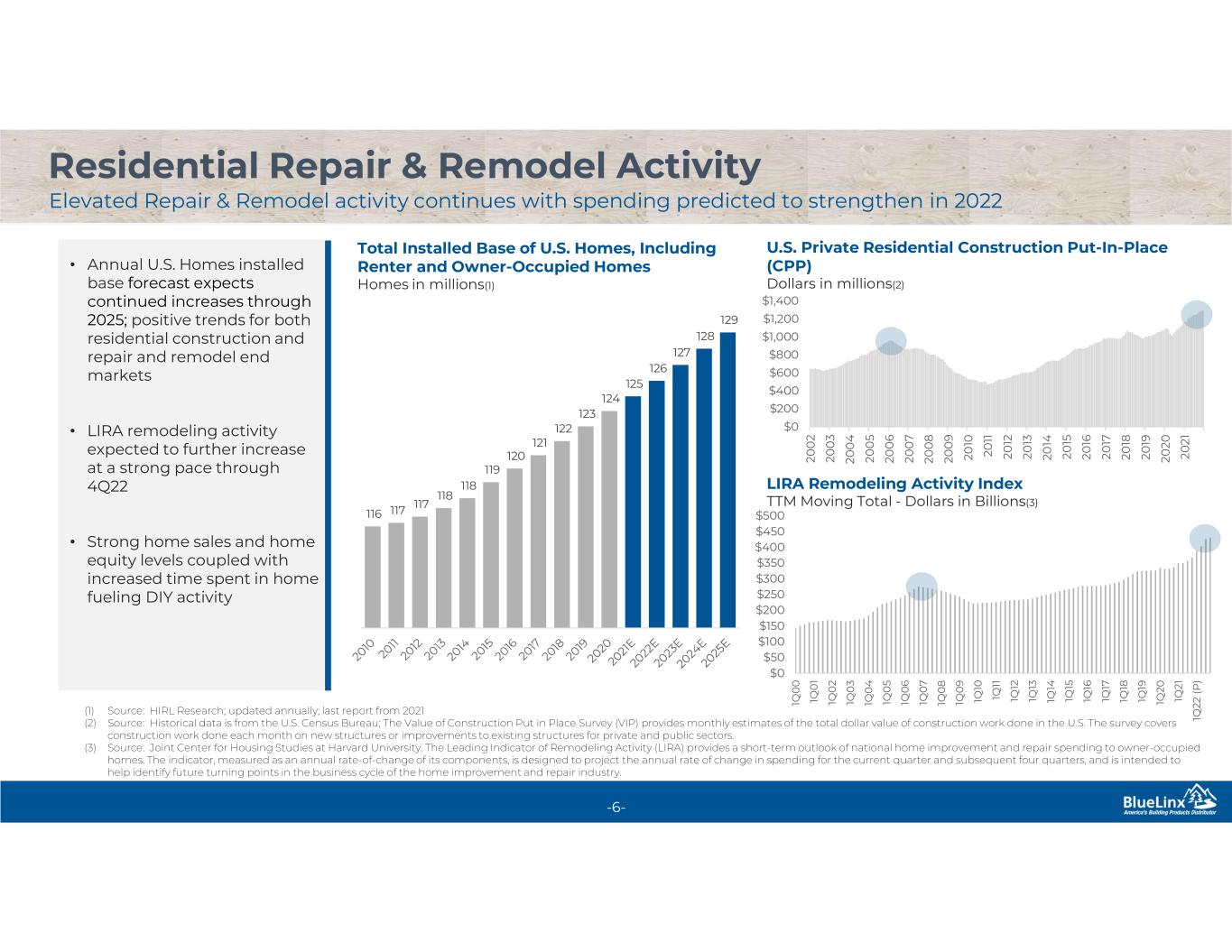

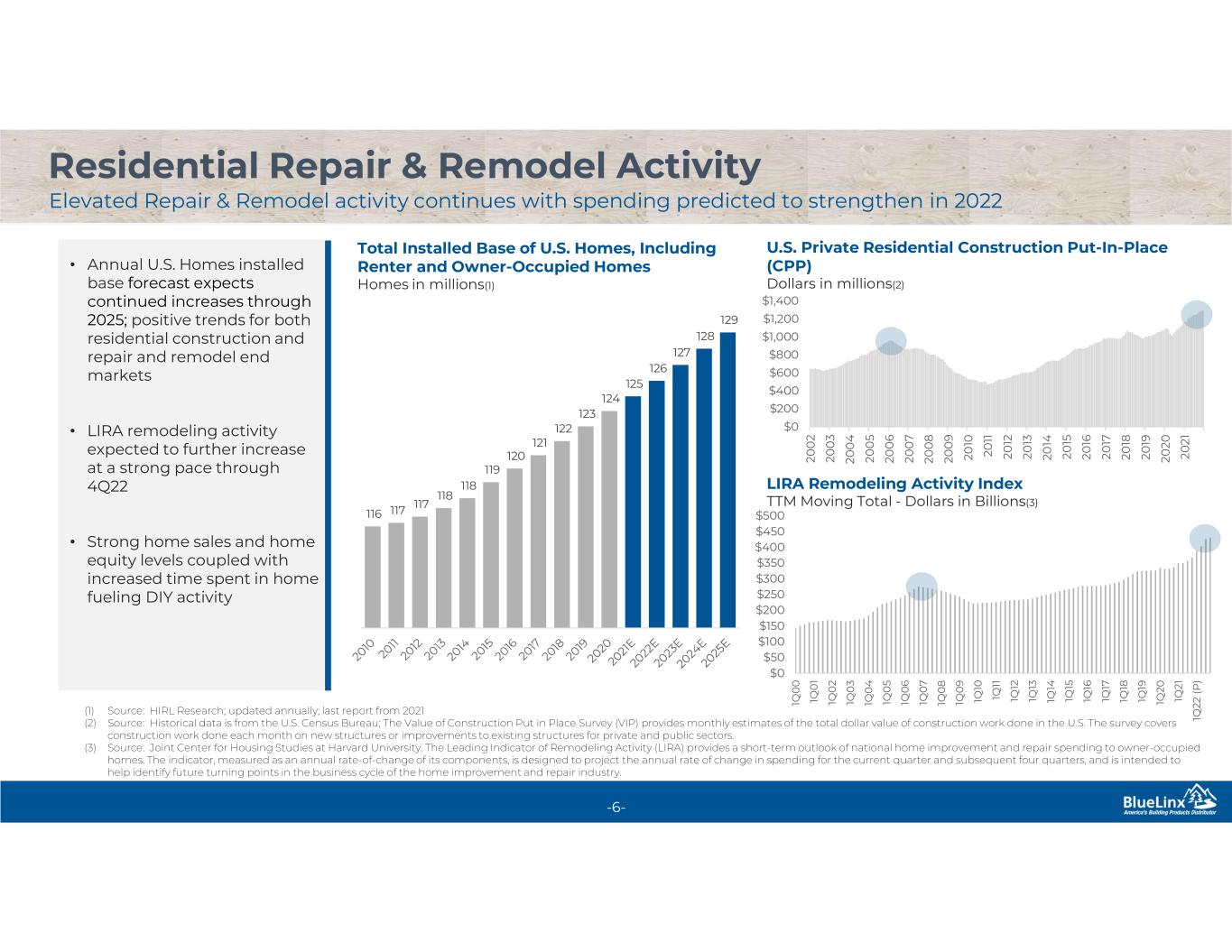

6 Residential Repair & Remodel Activity Elevated Repair & Remodel activity continues with spending predicted to strengthen in 2022 -6- U.S. Private Residential Construction Put-In-Place (CPP) Dollars in millions(2) LIRA Remodeling Activity Index TTM Moving Total - Dollars in Billions(3) Total Installed Base of U.S. Homes, Including Renter and Owner-Occupied Homes Homes in millions(1) $0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 1Q 0 0 1Q 0 1 1Q 0 2 1Q 0 3 1Q 0 4 1Q 0 5 1Q 0 6 1Q 0 7 1Q 0 8 1Q 0 9 1Q 10 1Q 11 1Q 12 1Q 13 1Q 14 1Q 15 1Q 16 1Q 17 1Q 18 1Q 19 1Q 20 1Q 21 1Q 22 (P ) • Annual U.S. Homes installed base forecast expects continued increases through 2025; positive trends for both residential construction and repair and remodel end markets • LIRA remodeling activity expected to further increase at a strong pace through 4Q22 • Strong home sales and home equity levels coupled with increased time spent in home fueling DIY activity (1) Source: HIRL Research; updated annually; last report from 2021 (2) Source: Historical data is from the U.S. Census Bureau; The Value of Construction Put in Place Survey (VIP) provides monthly estimates of the total dollar value of construction work done in the U.S. The survey covers construction work done each month on new structures or improvements to existing structures for private and public sectors. (3) Source: Joint Center for Housing Studies at Harvard University. The Leading Indicator of Remodeling Activity (LIRA) provides a short-term outlook of national home improvement and repair spending to owner-occupied homes. The indicator, measured as an annual rate-of-change of its components, is designed to project the annual rate of change in spending for the current quarter and subsequent four quarters, and is intended to help identify future turning points in the business cycle of the home improvement and repair industry. 116 117 117 118 118 119 120 121 122 123 124 125 126 127 128 129 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 20 0 2 20 0 3 20 0 4 20 0 5 20 0 6 20 0 7 20 0 8 20 0 9 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21

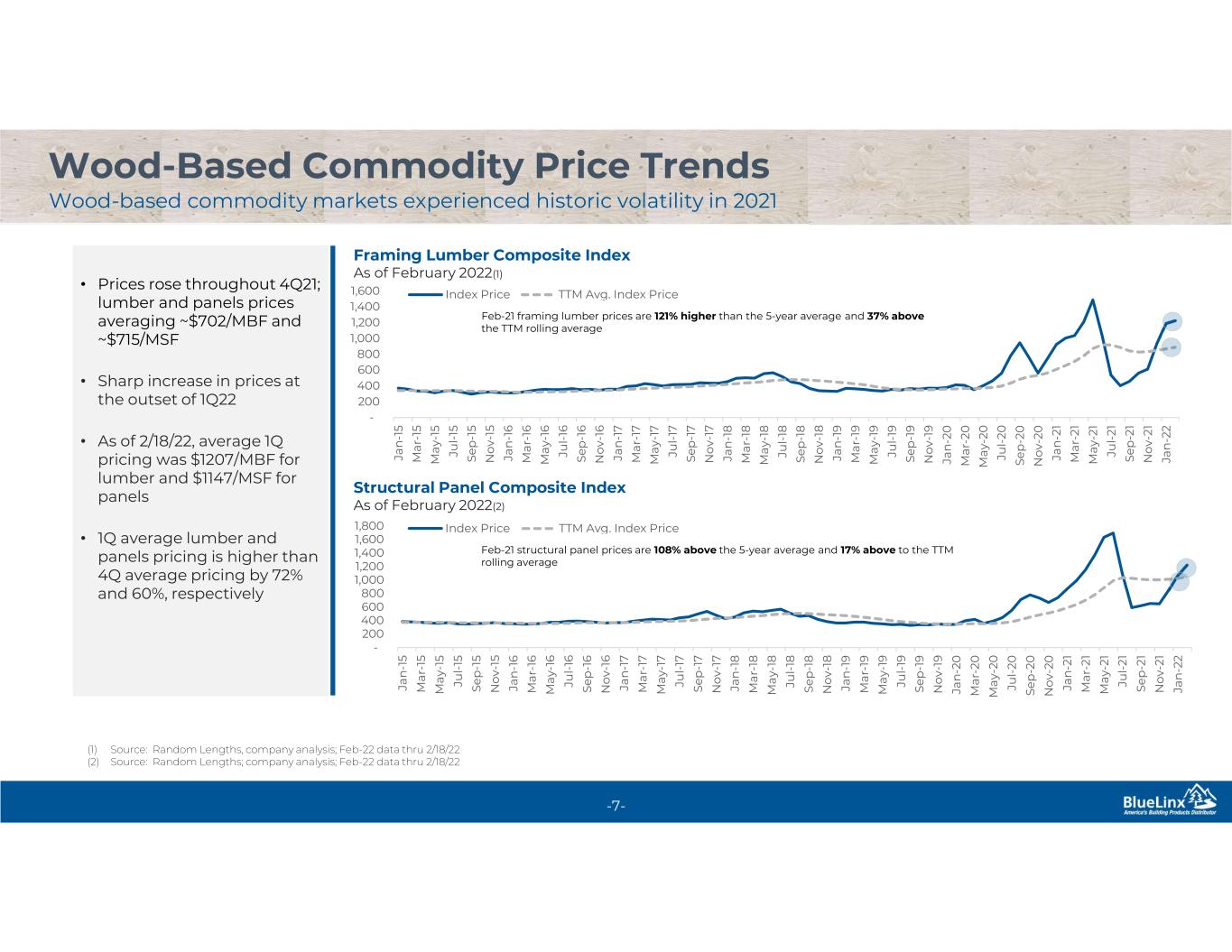

7 (1) Source: Random Lengths, company analysis; Feb-22 data thru 2/18/22 (2) Source: Random Lengths; company analysis; Feb-22 data thru 2/18/22 Wood-Based Commodity Price Trends Wood-based commodity markets experienced historic volatility in 2021 -7- Framing Lumber Composite Index As of February 2022(1) Structural Panel Composite Index As of February 2022(2) • Prices rose throughout 4Q21; lumber and panels prices averaging ~$702/MBF and ~$715/MSF • Sharp increase in prices at the outset of 1Q22 • As of 2/18/22, average 1Q pricing was $1207/MBF for lumber and $1147/MSF for panels • 1Q average lumber and panels pricing is higher than 4Q average pricing by 72% and 60%, respectively - 200 400 600 800 1,000 1,200 1,400 1,600 Ja n -1 5 M ar -1 5 M ay -1 5 Ju l- 15 S ep -1 5 N o v- 15 Ja n -1 6 M ar -1 6 M ay -1 6 Ju l- 16 S ep -1 6 N o v- 16 Ja n -1 7 M ar -1 7 M ay -1 7 Ju l- 17 S ep -1 7 N o v- 17 Ja n -1 8 M ar -1 8 M ay -1 8 Ju l- 18 S ep -1 8 N o v- 18 Ja n -1 9 M ar -1 9 M ay -1 9 Ju l- 19 S ep -1 9 N o v- 19 Ja n -2 0 M ar -2 0 M ay -2 0 Ju l- 20 S ep -2 0 N o v- 20 Ja n -2 1 M ar -2 1 M ay -2 1 Ju l- 21 S ep -2 1 N o v- 21 Ja n -2 2 Index Price TTM Avg. Index Price - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 Ja n -1 5 M ar -1 5 M ay -1 5 Ju l- 15 S ep -1 5 N o v- 15 Ja n -1 6 M ar -1 6 M ay -1 6 Ju l- 16 S ep -1 6 N o v- 16 Ja n -1 7 M ar -1 7 M ay -1 7 Ju l- 17 S ep -1 7 N o v- 17 Ja n -1 8 M ar -1 8 M ay -1 8 Ju l- 18 S ep -1 8 N o v- 18 Ja n -1 9 M ar -1 9 M ay -1 9 Ju l- 19 S ep -1 9 N o v- 19 Ja n -2 0 M ar -2 0 M ay -2 0 Ju l- 20 S ep -2 0 N o v- 20 Ja n -2 1 M ar -2 1 M ay -2 1 Ju l- 21 S ep -2 1 N o v- 21 Ja n -2 2 Index Price TTM Avg. Index Price Feb-21 framing lumber prices are 121% higher than the 5-year average and 37% above the TTM rolling average Feb-21 structural panel prices are 108% above the 5-year average and 17% above to the TTM rolling average

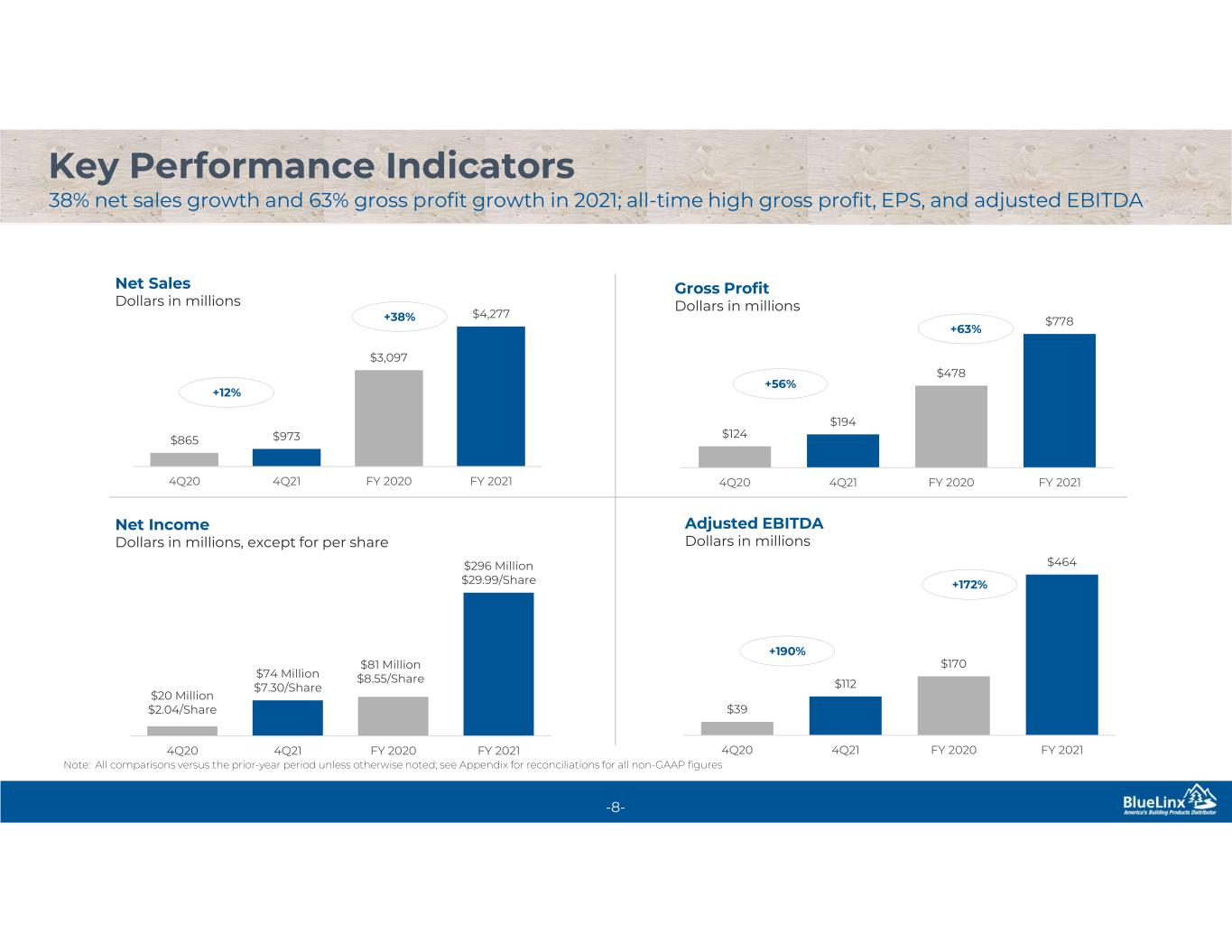

8 Key Performance Indicators 38% net sales growth and 63% gross profit growth in 2021; all-time high gross profit, EPS, and adjusted EBITDA -8- Net Sales Dollars in millions Gross Profit Dollars in millions Adjusted EBITDA Dollars in millions Net Income Dollars in millions, except for per share $865 $973 $3,097 $4,277 4Q20 4Q21 FY 2020 FY 2021 $124 $194 $478 $778 4Q20 4Q21 FY 2020 FY 2021 $39 $112 $170 $464 4Q20 4Q21 FY 2020 FY 2021 $20 Million $2.04/Share $74 Million $7.30/Share $81 Million $8.55/Share $296 Million $29.99/Share 4Q20 4Q21 FY 2020 FY 2021 +12% +38% +56% +63% +190% +172% Note: All comparisons versus the prior-year period unless otherwise noted; see Appendix for reconciliations for all non-GAAP figures

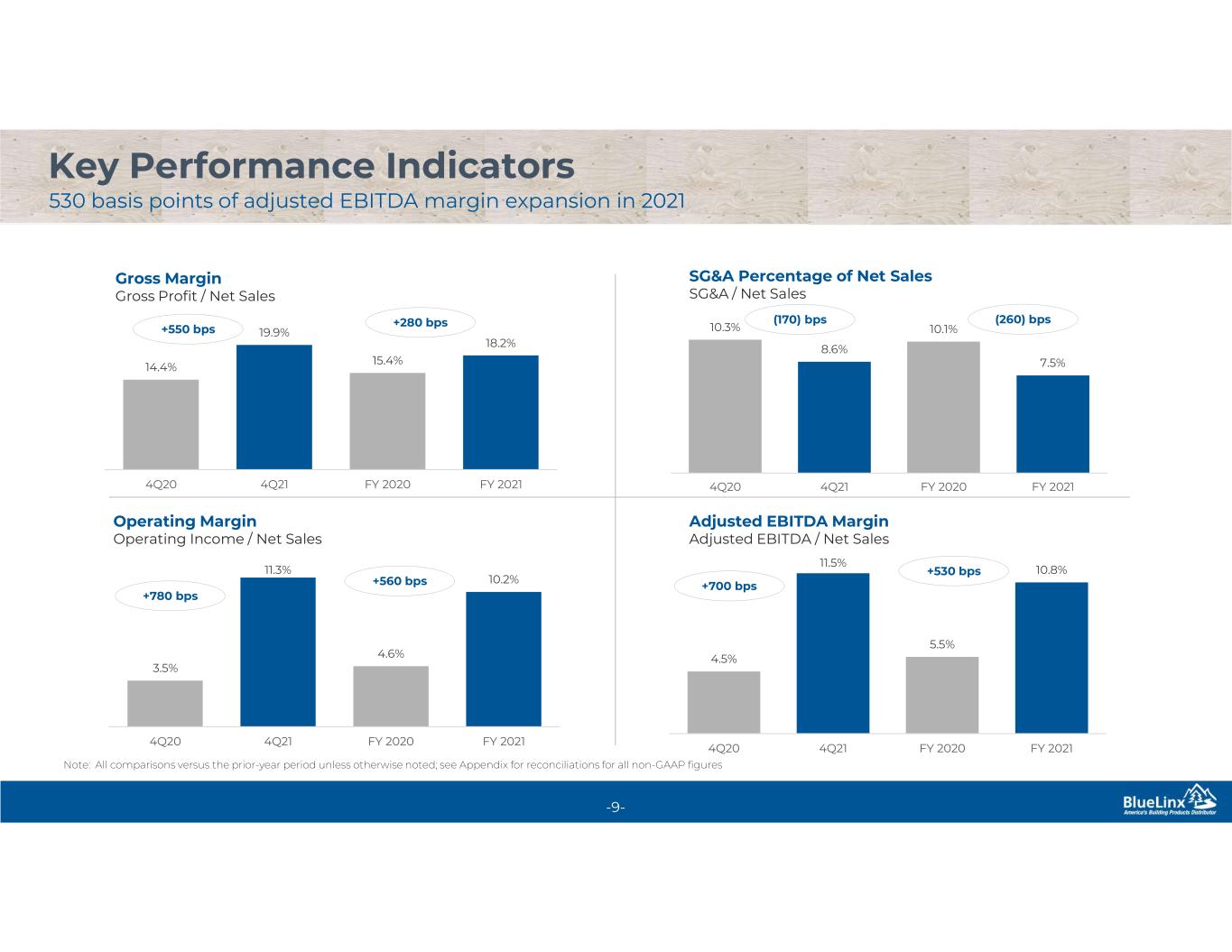

9 -9- Key Performance Indicators 530 basis points of adjusted EBITDA margin expansion in 2021 Gross Margin Gross Profit / Net Sales Adjusted EBITDA Margin Adjusted EBITDA / Net Sales Operating Margin Operating Income / Net Sales SG&A Percentage of Net Sales SG&A / Net Sales 14.4% 19.9% 15.4% 18.2% 4Q20 4Q21 FY 2020 FY 2021 10.3% 8.6% 10.1% 7.5% 4Q20 4Q21 FY 2020 FY 2021 3.5% 11.3% 4.6% 10.2% 4Q20 4Q21 FY 2020 FY 2021 4.5% 11.5% 5.5% 10.8% 4Q20 4Q21 FY 2020 FY 2021 +550 bps +280 bps (170) bps (260) bps +780 bps +560 bps +700 bps +530 bps Note: All comparisons versus the prior-year period unless otherwise noted; see Appendix for reconciliations for all non-GAAP figures

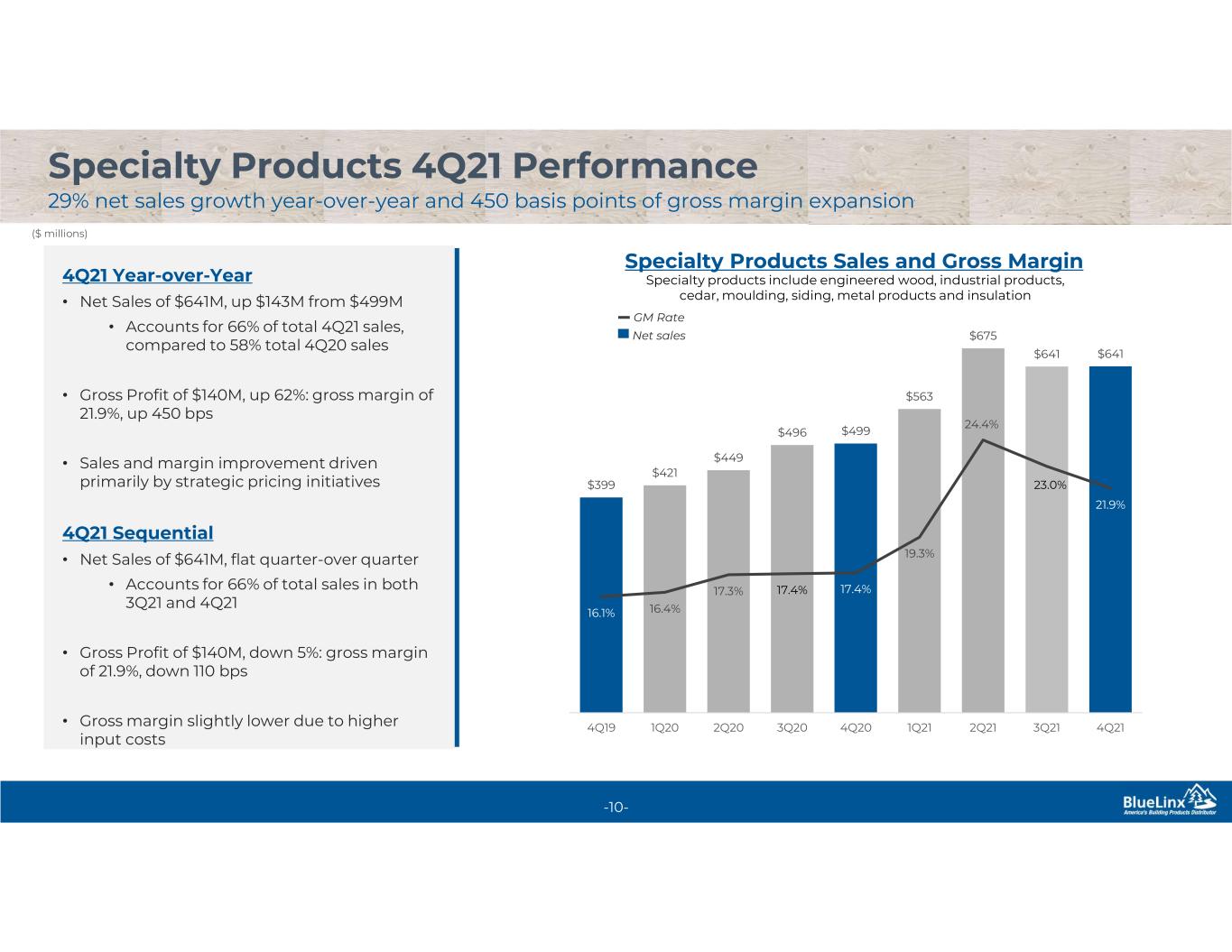

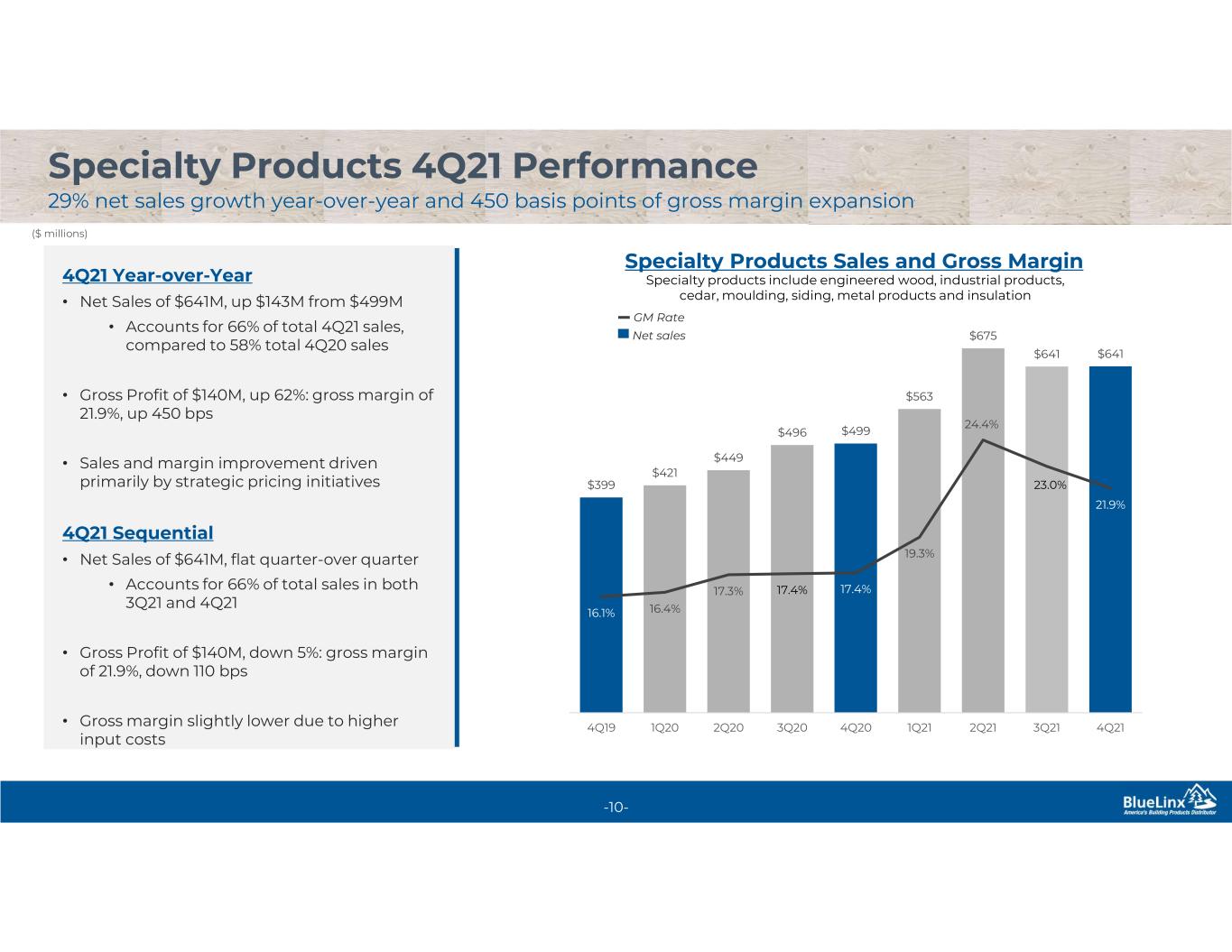

10 Specialty Products 4Q21 Performance 29% net sales growth year-over-year and 450 basis points of gross margin expansion -10- Specialty Products Sales and Gross Margin $399 $421 $449 $496 $499 $563 $675 $641 $641 16.1% 16.4% 17.3% 17.4% 17.4% 19.3% 24.4% 23.0% 21.9% 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Specialty products include engineered wood, industrial products, cedar, moulding, siding, metal products and insulation ($ millions) 4Q21 Year-over-Year • Net Sales of $641M, up $143M from $499M • Accounts for 66% of total 4Q21 sales, compared to 58% total 4Q20 sales • Gross Profit of $140M, up 62%: gross margin of 21.9%, up 450 bps • Sales and margin improvement driven primarily by strategic pricing initiatives 4Q21 Sequential • Net Sales of $641M, flat quarter-over quarter • Accounts for 66% of total sales in both 3Q21 and 4Q21 • Gross Profit of $140M, down 5%: gross margin of 21.9%, down 110 bps • Gross margin slightly lower due to higher input costs GM Rate Net sales

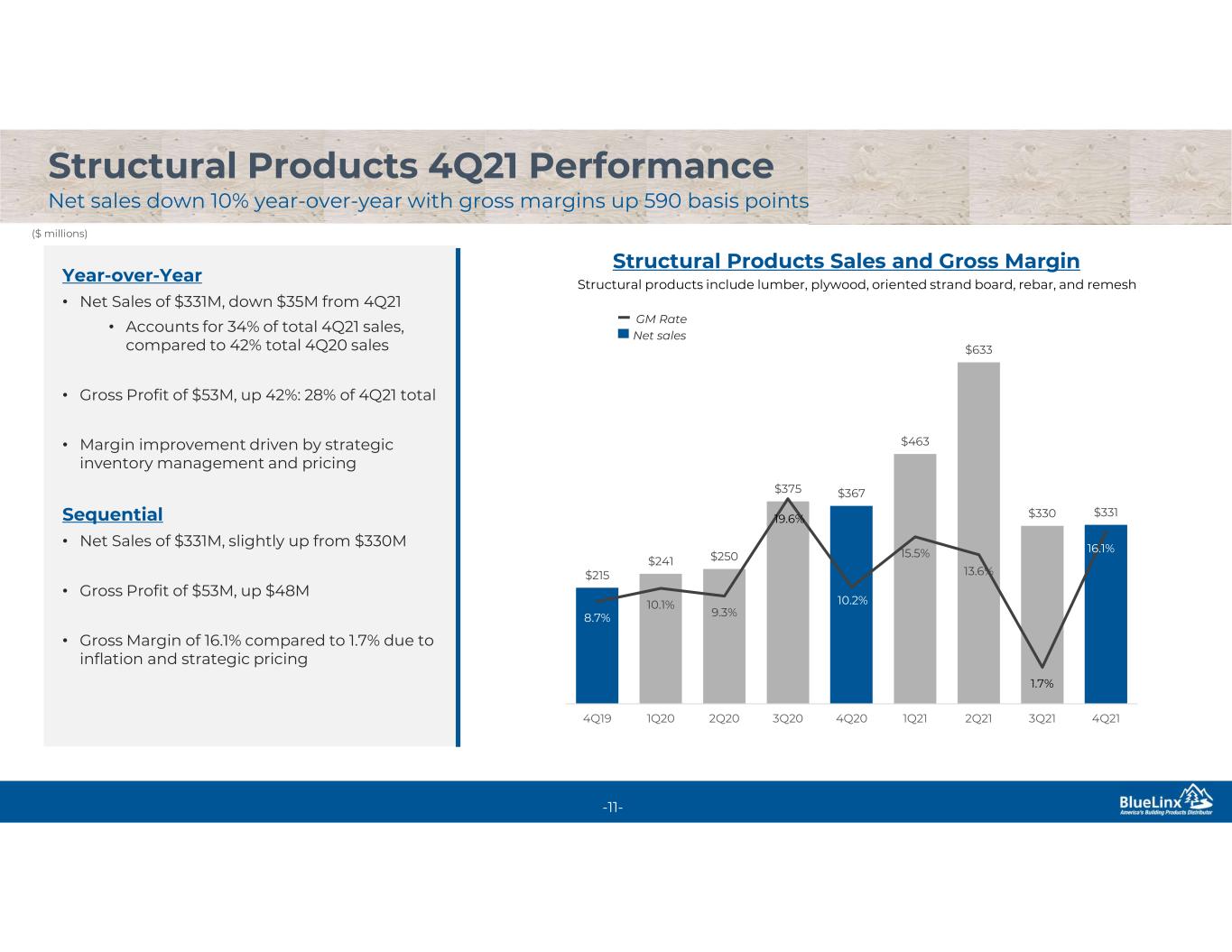

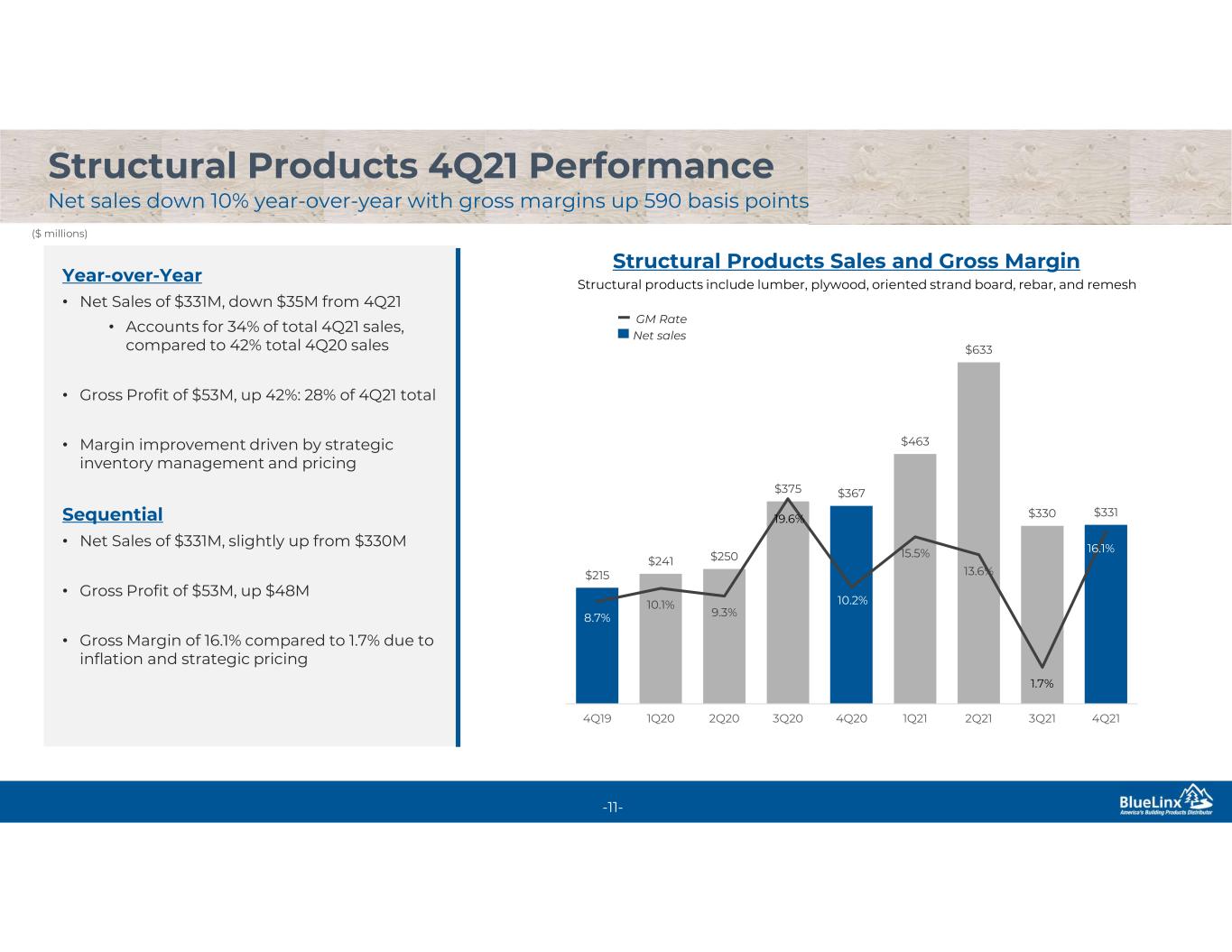

11 Structural Products 4Q21 Performance Net sales down 10% year-over-year with gross margins up 590 basis points -13- Structural Products Sales and Gross Margin ($ millions) Year-over-Year • Net Sales of $331M, down $35M from 4Q21 • Accounts for 34% of total 4Q21 sales, compared to 42% total 4Q20 sales • Gross Profit of $53M, up 42%: 28% of 4Q21 total • Margin improvement driven by strategic inventory management and pricing Sequential • Net Sales of $331M, slightly up from $330M • Gross Profit of $53M, up $48M • Gross Margin of 16.1% compared to 1.7% due to inflation and strategic pricing Structural products include lumber, plywood, oriented strand board, rebar, and remesh $215 $241 $250 $375 $367 $463 $633 $330 $331 8.7% 10.1% 9.3% 19.6% 10.2% 15.5% 13.6% 1.7% 16.1% 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 GM Rate -11- Net sales

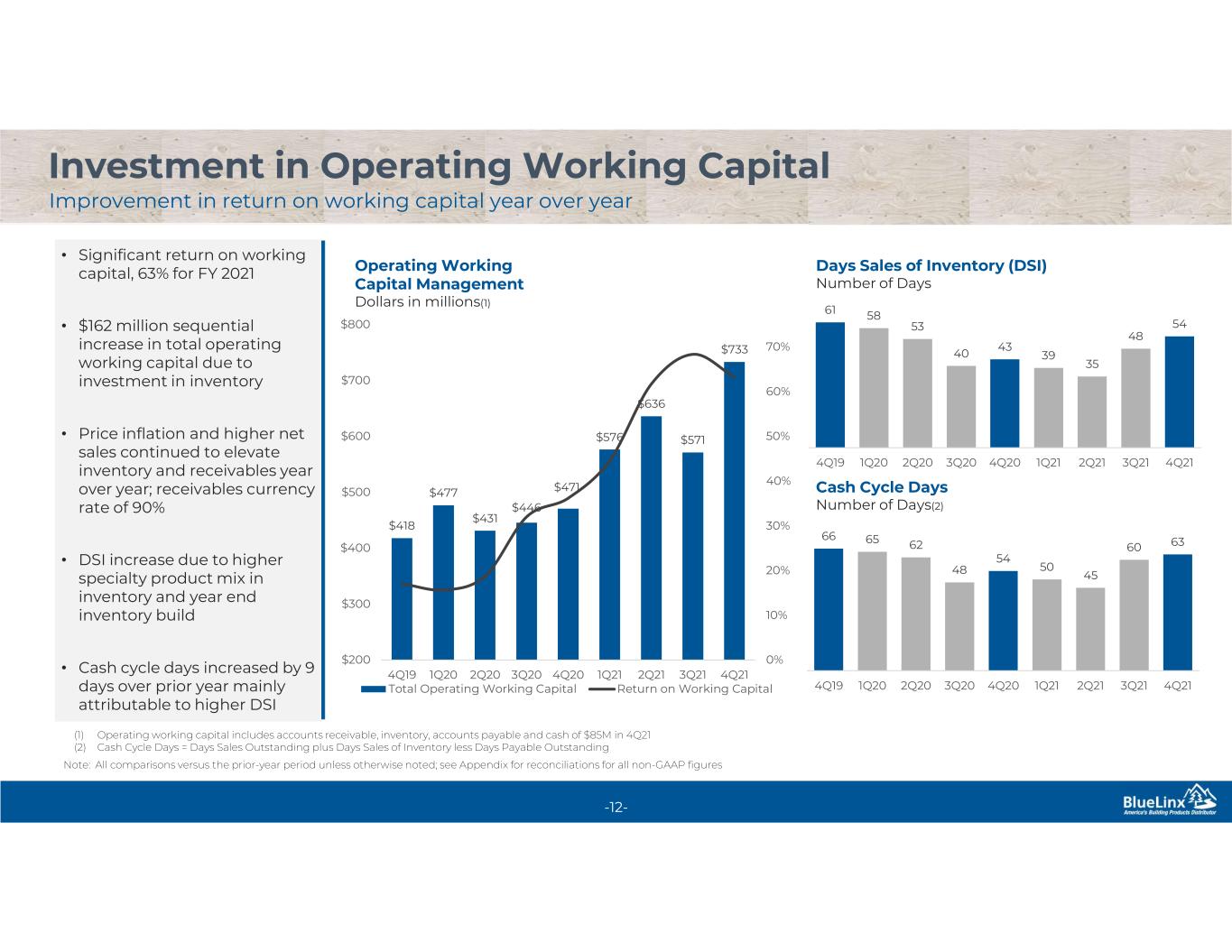

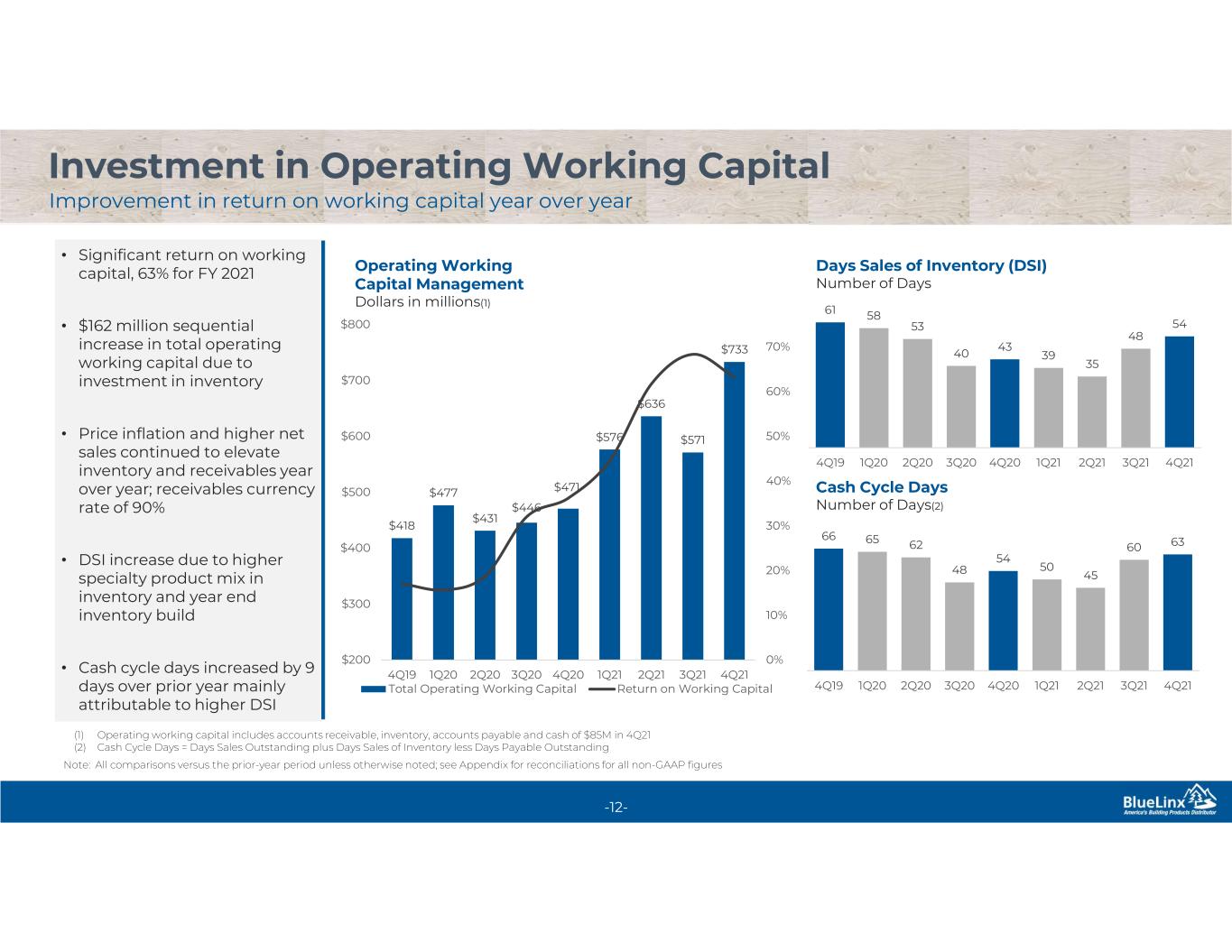

12 Investment in Operating Working Capital Improvement in return on working capital year over year -12- Days Sales of Inventory (DSI) Number of Days Operating Working Capital Management Dollars in millions(1) Cash Cycle Days Number of Days(2) • Significant return on working capital, 63% for FY 2021 • $162 million sequential increase in total operating working capital due to investment in inventory • Price inflation and higher net sales continued to elevate inventory and receivables year over year; receivables currency rate of 90% • DSI increase due to higher specialty product mix in inventory and year end inventory build • Cash cycle days increased by 9 days over prior year mainly attributable to higher DSI (1) Operating working capital includes accounts receivable, inventory, accounts payable and cash of $85M in 4Q21 (2) Cash Cycle Days = Days Sales Outstanding plus Days Sales of Inventory less Days Payable Outstanding 61 58 53 40 43 39 35 48 54 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 66 65 62 48 54 50 45 60 63 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 $418 $477 $431 $446 $471 $576 $636 $571 $733 0% 10% 20% 30% 40% 50% 60% 70% $200 $300 $400 $500 $600 $700 $800 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 Total Operating Working Capital Return on Working Capital Note: All comparisons versus the prior-year period unless otherwise noted; see Appendix for reconciliations for all non-GAAP figures

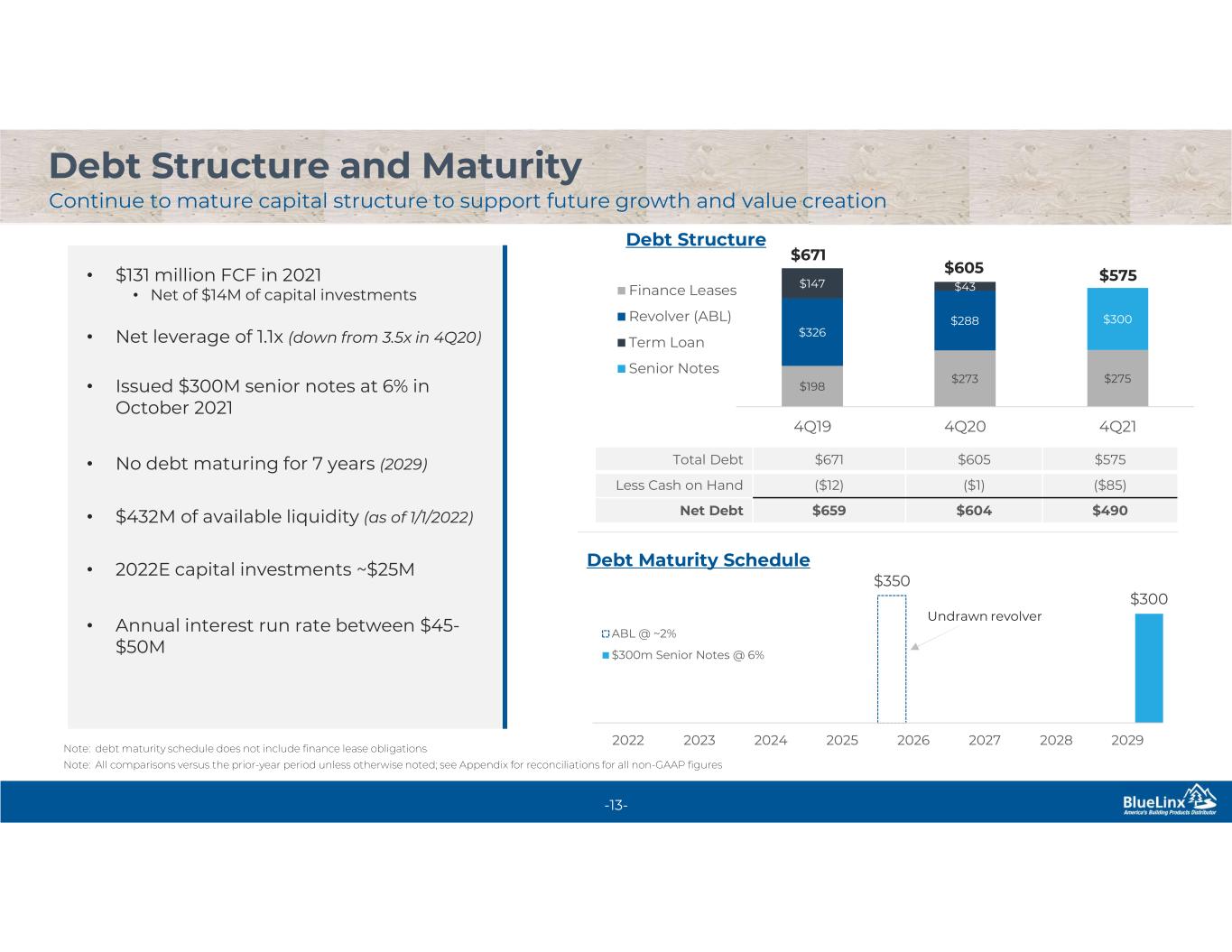

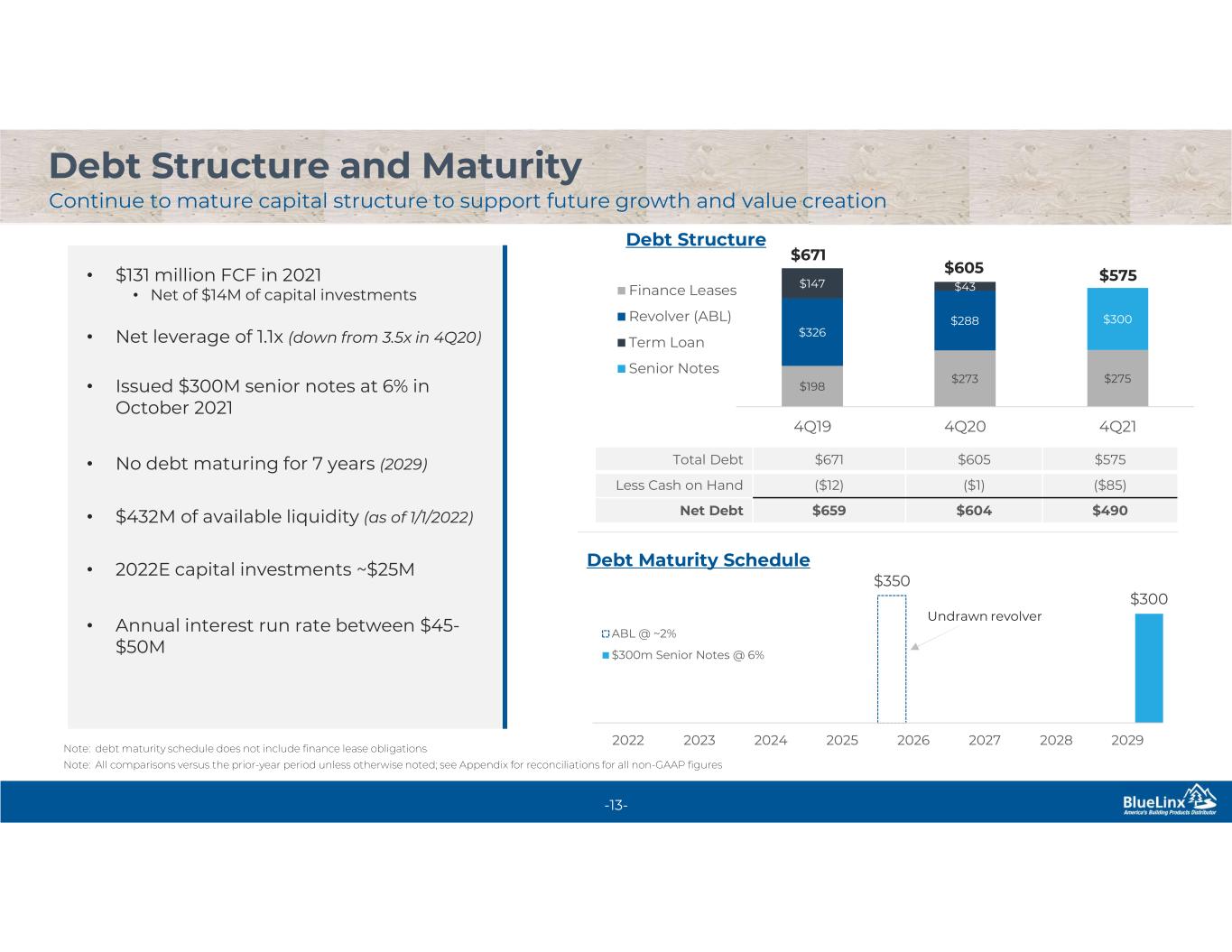

13 Debt Structure and Maturity Continue to mature capital structure to support future growth and value creation -13- • $131 million FCF in 2021 • Net of $14M of capital investments • Net leverage of 1.1x (down from 3.5x in 4Q20) • Issued $300M senior notes at 6% in October 2021 • No debt maturing for 7 years (2029) • $432M of available liquidity (as of 1/1/2022) • 2022E capital investments ~$25M • Annual interest run rate between $45- $50M $350 $300 2022 2023 2024 2025 2026 2027 2028 2029 Debt Maturity Schedule ABL @ ~2% $300m Senior Notes @ 6% Undrawn revolver Note: debt maturity schedule does not include finance lease obligations Total Debt $671 $605 $575 Less Cash on Hand ($12) ($1) ($85) Net Debt $659 $604 $490 $198 $273 $275 $326 $288 $147 $43 $300 4Q19 4Q20 4Q21 Debt Structure Finance Leases Revolver (ABL) Term Loan Senior Notes $671 $605 $575 Note: All comparisons versus the prior-year period unless otherwise noted; see Appendix for reconciliations for all non-GAAP figures

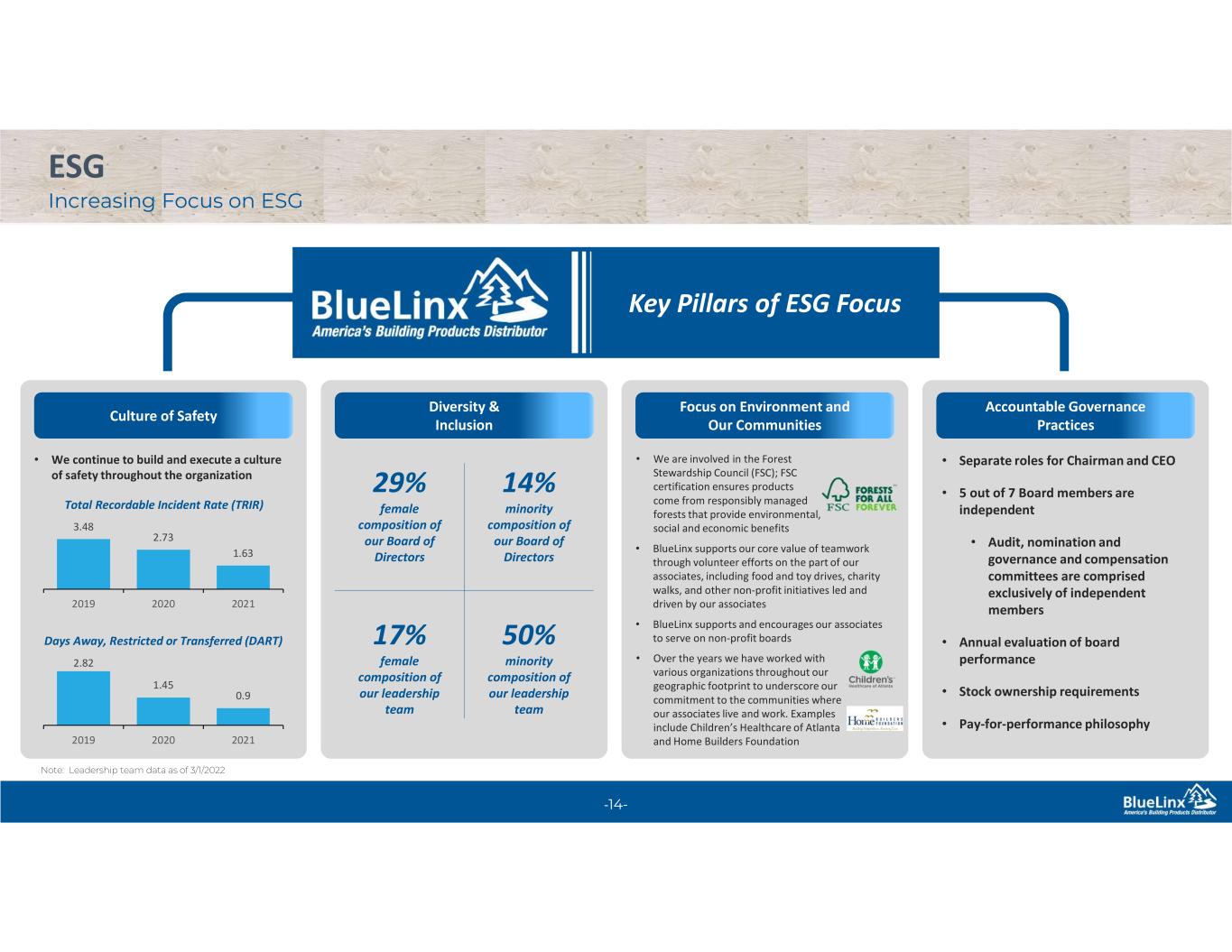

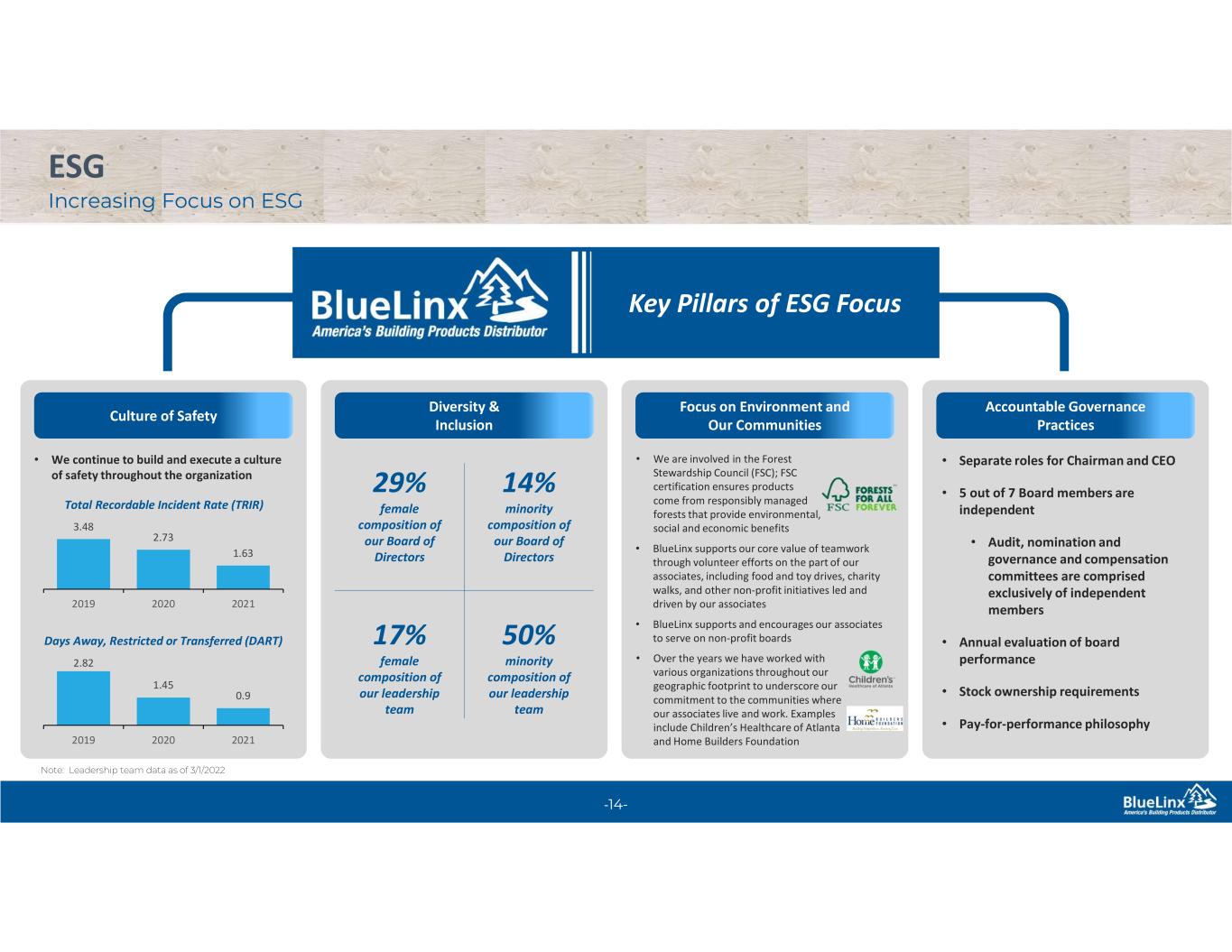

14 ESG Increasing Focus on ESG -14- Culture of Safety Diversity & Inclusion Key Pillars of ESG Focus • We continue to build and execute a culture of safety throughout the organization 29% female composition of our Board of Directors 17% female composition of our leadership team Accountable Governance Practices • Separate roles for Chairman and CEO • 5 out of 7 Board members are independent • Audit, nomination and governance and compensation committees are comprised exclusively of independent members • Annual evaluation of board performance • Stock ownership requirements • Pay-for-performance philosophy Focus on Environment and Our Communities • We are involved in the Forest Stewardship Council (FSC); FSC certification ensures products come from responsibly managed forests that provide environmental, social and economic benefits Total Recordable Incident Rate (TRIR) Days Away, Restricted or Transferred (DART) 3.48 2.73 1.63 2019 2020 2021 2.82 1.45 0.9 2019 2020 2021 14% minority composition of our Board of Directors 50% minority composition of our leadership team • BlueLinx supports our core value of teamwork through volunteer efforts on the part of our associates, including food and toy drives, charity walks, and other non-profit initiatives led and driven by our associates • BlueLinx supports and encourages our associates to serve on non-profit boards • Over the years we have worked with various organizations throughout our geographic footprint to underscore our commitment to the communities where our associates live and work. Examples include Children’s Healthcare of Atlanta and Home Builders Foundation Note: Leadership team data as of 3/1/2022

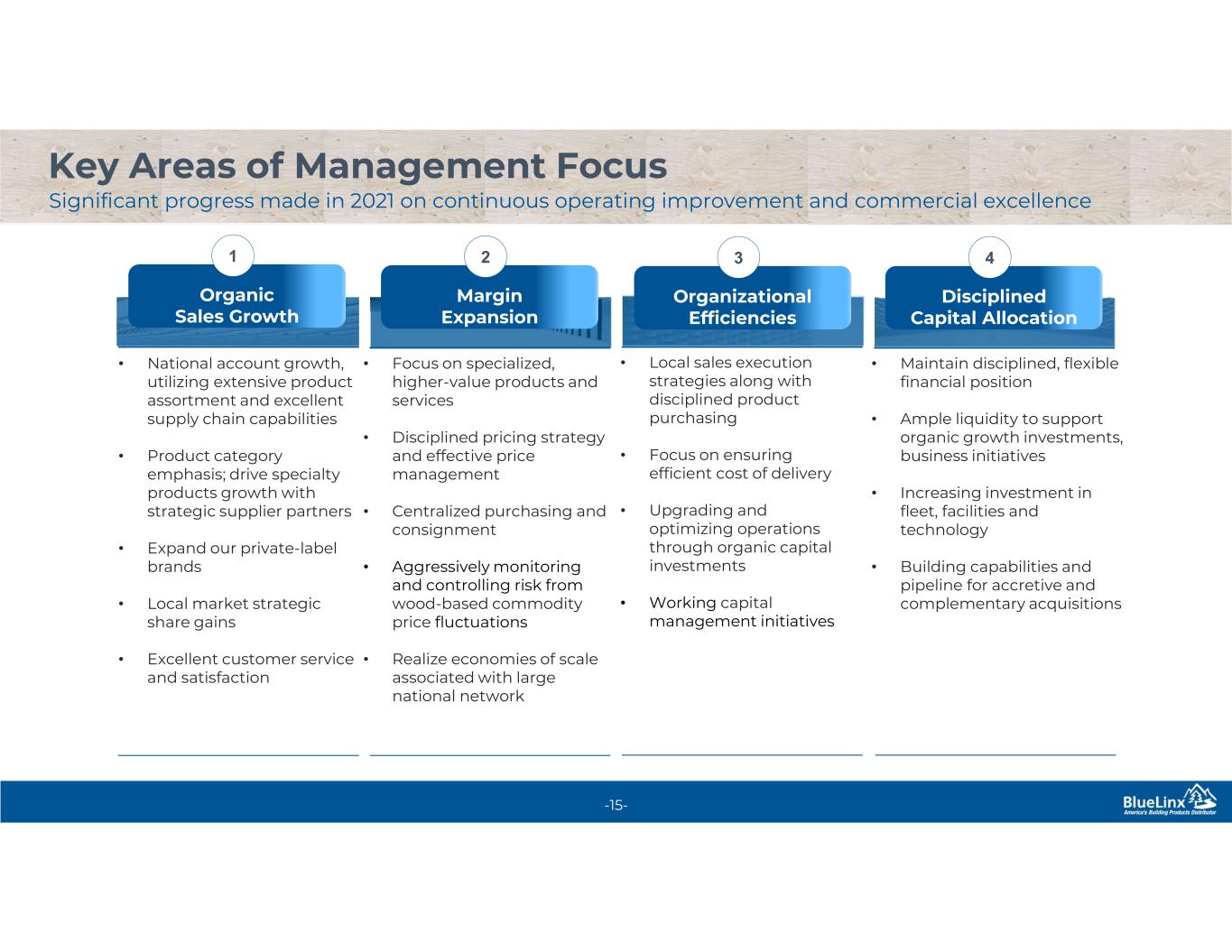

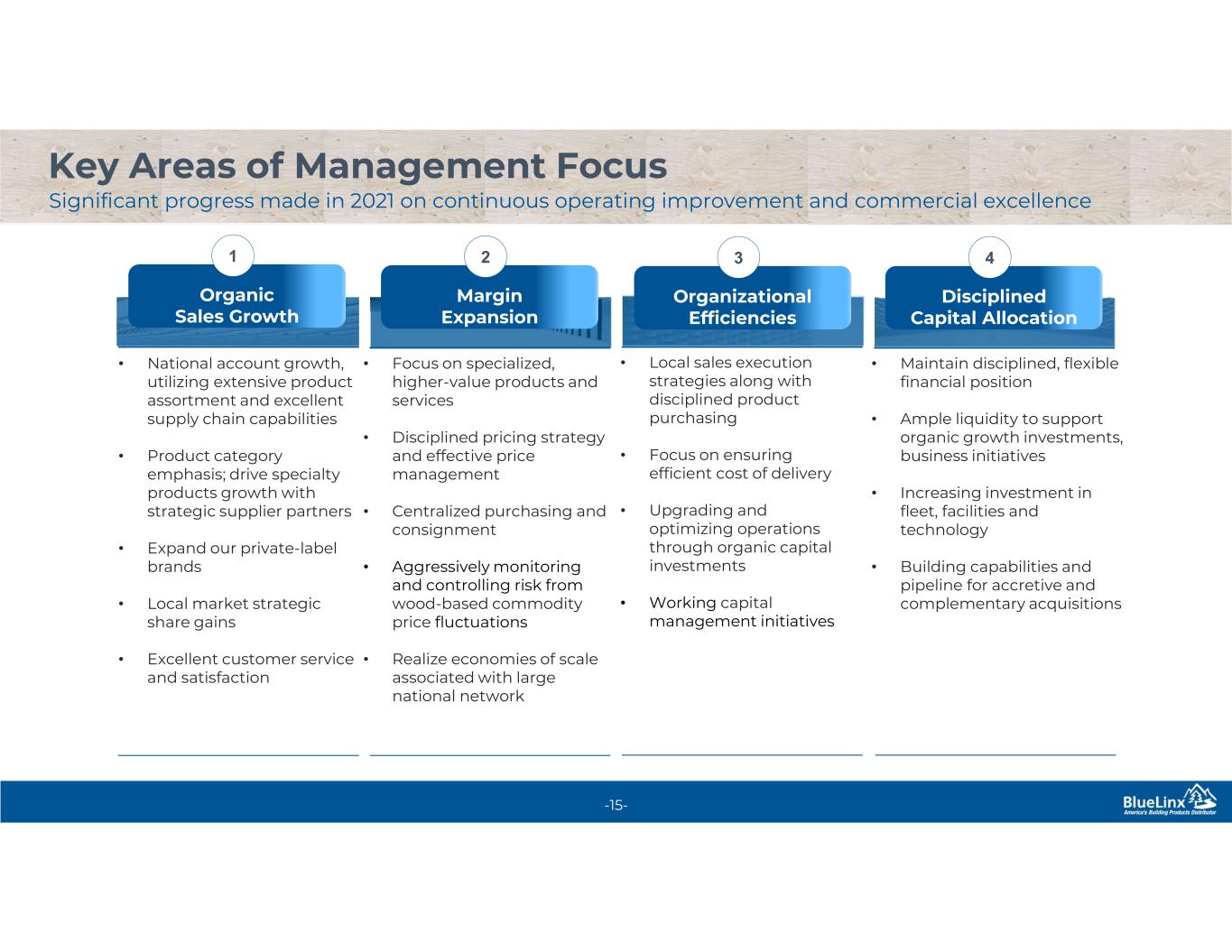

15 Key Areas of Management Focus Significant progress made in 2021 on continuous operating improvement and commercial excellence -15- • National account growth, utilizing extensive product assortment and excellent supply chain capabilities • Product category emphasis; drive specialty products growth with strategic supplier partners • Expand our private-label brands • Local market strategic share gains • Excellent customer service and satisfaction • Focus on specialized, higher-value products and services • Disciplined pricing strategy and effective price management • Centralized purchasing and consignment • Aggressively monitoring and controlling risk from wood-based commodity price fluctuations • Realize economies of scale associated with large national network • Local sales execution strategies along with disciplined product purchasing • Focus on ensuring efficient cost of delivery • Upgrading and optimizing operations through organic capital investments • Working capital management initiatives • Maintain disciplined, flexible financial position • Ample liquidity to support organic growth investments, business initiatives • Increasing investment in fleet, facilities and technology • Building capabilities and pipeline for accretive and complementary acquisitions Organic Sales Growth 1 Margin Expansion 2 Organizational Efficiencies 3 Disciplined Capital Allocation 4

Divider slide 29 September, 2020Appendix

17 Non-GAAP Measures -17- BlueLinx reports its financial results in accordance with GAAP. The Company also believes that presentation of certain non-GAAP measures may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Any non-GAAP measures used herein are reconciled to their most directly comparable GAAP measures herein or in the financial tables accompanying this news release. The Company cautions that non-GAAP measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Adjusted EBITDA. And Adjusted EBITDA Margin BlueLinx defines Adjusted EBITDA as an amount equal to net income plus interest expense and all interest expense related items, income taxes, depreciation and amortization, and further adjusted for certain non-cash items and other special items, including compensation expense from share-based compensation, one-time charges associated with the legal and professional fees and integration costs related to the Cedar Creek acquisition, and gains on sales of properties including amortization of deferred gains. The Company presents Adjusted EBITDA because it is a primary measure used by management to evaluate operating performance. Management believes this metric helps to enhance investors’ overall understanding of the financial performance and cash flows of the business. Management also believes Adjusted EBITDA is helpful in highlighting operating trends. Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results. We determine our Adjusted EBITDA Margin by dividing our Adjusted EBITDA for the applicable period by our net sales for the applicable period. We believe that this ratio is useful to investors because it more clearly defines the quality of earnings and operational efficiency of translating sales to profitability. Our Adjusted EBITDA and Adjusted EBITDA Margin are not presentations made in accordance with GAAP and are not intended to present superior measures of our financial condition from those measures determined under GAAP. Adjusted EBITDA and Adjusted EBITDA Margin, as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. These non-GAAP measures are reconciled in the “Reconciliation of Non-GAAP Measurements” table later in this presentation. Free Cash Flow. BlueLinx defines free cash flow as net cash provided by operating activities less total capital expenditures. Free cash flow is a measure used by management to assess our financial performance, and we believe it is useful for investors because it relates the operating cash flow of the company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures that can be used for, among other things, investment in our business, strengthening our balance sheet, and repayment of our debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Free cash flow is not a presentation made in accordance with GAAP and is not intended to present a superior measure of financial condition from those determined under GAAP. Free cash flow, as used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. This non-GAAP measure is reconciled in the “Reconciliation of Non-GAAP Measurements” table later in this release. Net Debt and Net Leverage Ratio. BlueLinx calculates net debt as its total short- and long-term debt, including outstanding balances under our term loan and revolving credit facility and the total amount of its obligations under financing leases, less cash and cash equivalents. We believe that net debt is useful to investors because our management reviews our net debt as part of its management of overall liquidity, financial flexibility, capital structure and leverage, and creditors and credit analysts monitor our net debt as part of their assessments of our business. We determine our overall net leverage ratio by dividing our net debt by trailing twelve-month Adjusted EBITDA. We believe that this ratio is useful to investors because it is an indicator of our ability to meet our future financial obligations. In addition, the ratio is a measure that is frequently used by investors and creditors. Our net debt and overall net leverage ratio are not presentations made in accordance with GAAP and are not intended to present a superior measure of our financial condition from measures and ratios determined under GAAP. In addition, our net debt and overall net leverage ratio, as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. This non-GAAP measure is reconciled in the “Reconciliation of Non-GAAP Measurements” table later in this release.

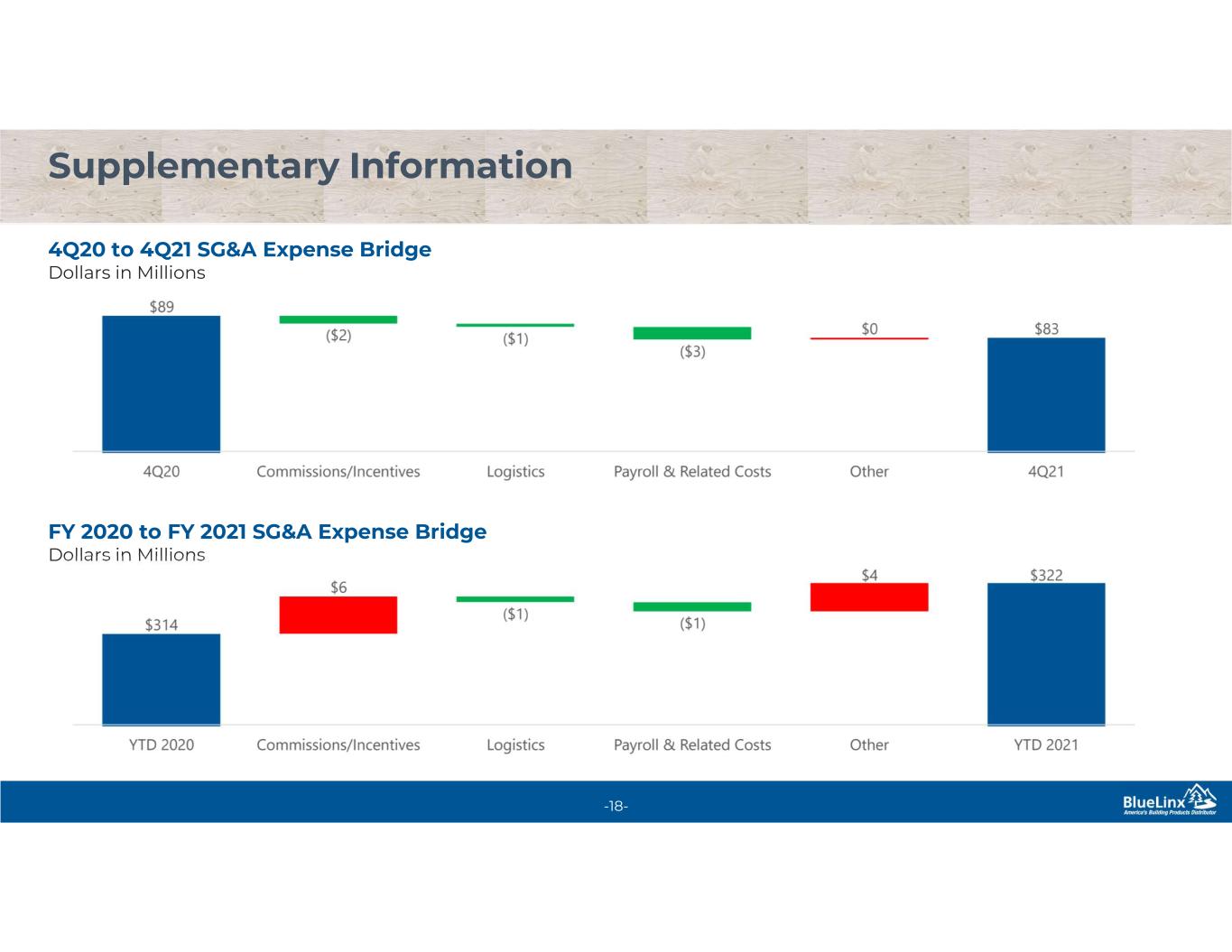

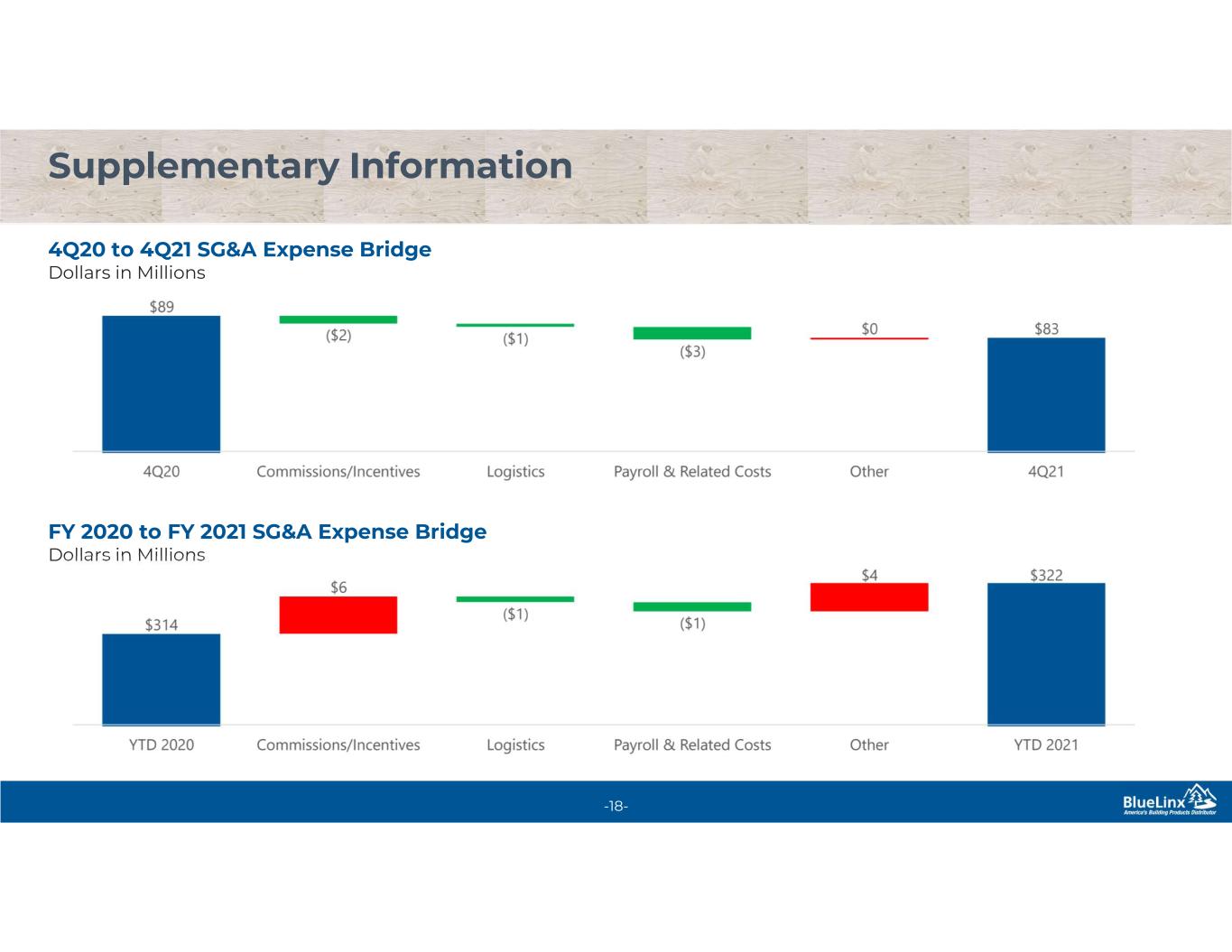

18 4Q20 to 4Q21 SG&A Expense Bridge Dollars in Millions -18- Supplementary Information FY 2020 to FY 2021 SG&A Expense Bridge Dollars in Millions

19 Non-GAAP Reconciliation -19- (1) Reflects non-recurring items of approximately $4.1 million of non-beneficial items to the current quarterly period and $1.2 million of non-beneficial items to the prior quarterly period. (2) Reflects costs related to our restructuring efforts, such as severance, net of other one-time non-operating items. For the purposes of this presentation, items may be collapsed into this or other categories where they were presented seperately in other presentations such as our press release. Items which may be collapsed include, but are not limited to, pension settlement and withdrawal costs and inventory step-up adjustments, among others. Net income (loss) $ 73,620 $ 19,858 Adjustments: Depreciation and amortization 6,763 7,116 Interest expense, net 10,213 10,723 Adjustment to debt issuance cost associated with term loan/revolver(1) 1,603 - Provision for income taxes 24,857 (15) Share-based compensation expense 1,580 3,077 Amortization of deferred gain on real estate (985) (1,057) Gain from sales of property(1) (7,140) (1,320) Real estate financing costs(1) - - Merger and acquisition costs (1)(2) - 106 Restructuring and other (1) 1,460 58 Adjusted EBITDA $ 111,971 $ 38,546 Quarter Ended December 2021 December 2020

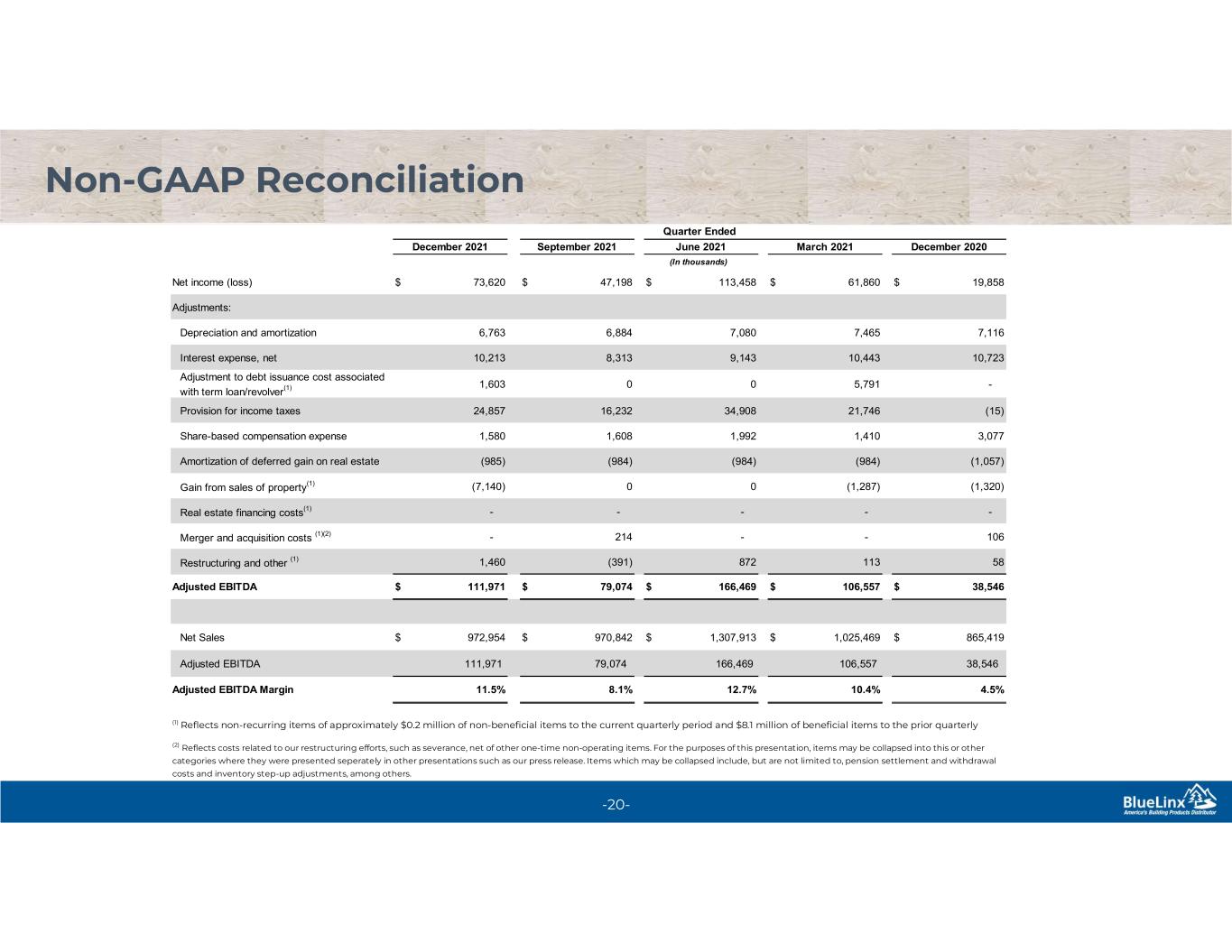

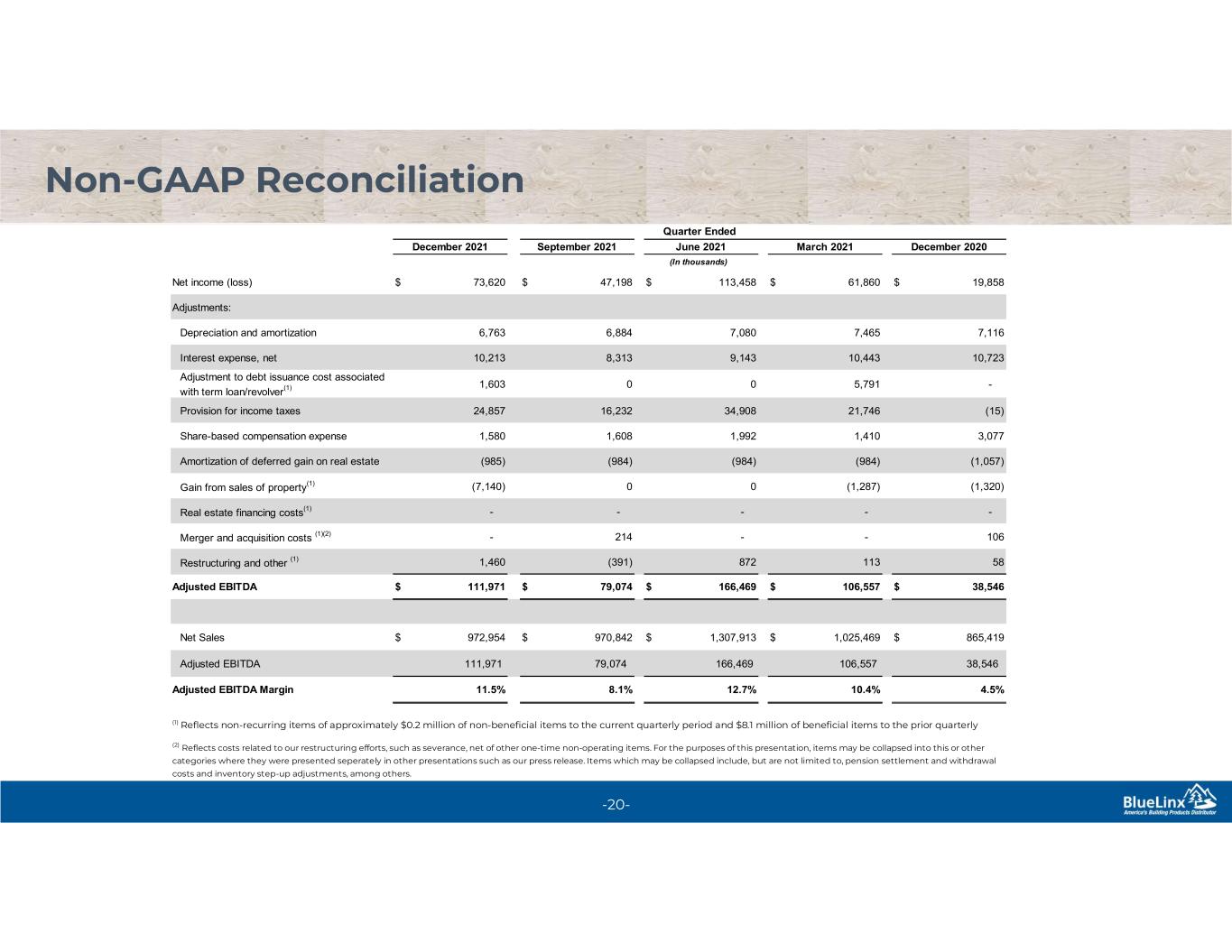

20 Non-GAAP Reconciliation -20- Net income (loss) $ 73,620 $ 47,198 $ 113,458 $ 61,860 $ 19,858 Adjustments: Depreciation and amortization 6,763 6,884 7,080 7,465 7,116 Interest expense, net 10,213 8,313 9,143 10,443 10,723 Adjustment to debt issuance cost associated with term loan/revolver(1) 1,603 0 0 5,791 - Provision for income taxes 24,857 16,232 34,908 21,746 (15) Share-based compensation expense 1,580 1,608 1,992 1,410 3,077 Amortization of deferred gain on real estate (985) (984) (984) (984) (1,057) Gain from sales of property(1) (7,140) 0 0 (1,287) (1,320) Real estate financing costs(1) - - - - - Merger and acquisition costs (1)(2) - 214 - - 106 Restructuring and other (1) 1,460 (391) 872 113 58 Adjusted EBITDA $ 111,971 $ 79,074 $ 166,469 $ 106,557 $ 38,546 Net Sales $ 972,954 $ 970,842 $ 1,307,913 $ 1,025,469 $ 865,419 Adjusted EBITDA 111,971 79,074 166,469 106,557 38,546 Adjusted EBITDA Margin 11.5% 8.1% 12.7% 10.4% 4.5% (In thousands) Quarter Ended (2) Reflects costs related to our restructuring efforts, such as severance, net of other one-time non-operating items. For the purposes of this presentation, items may be collapsed into this or other categories where they were presented seperately in other presentations such as our press release. Items which may be collapsed include, but are not limited to, pension settlement and withdrawal costs and inventory step-up adjustments, among others. (1) Reflects non-recurring items of approximately $0.2 million of non-beneficial items to the current quarterly period and $8.1 million of beneficial items to the prior quarterly period. December 2021 September 2021 June 2021 March 2021 December 2020

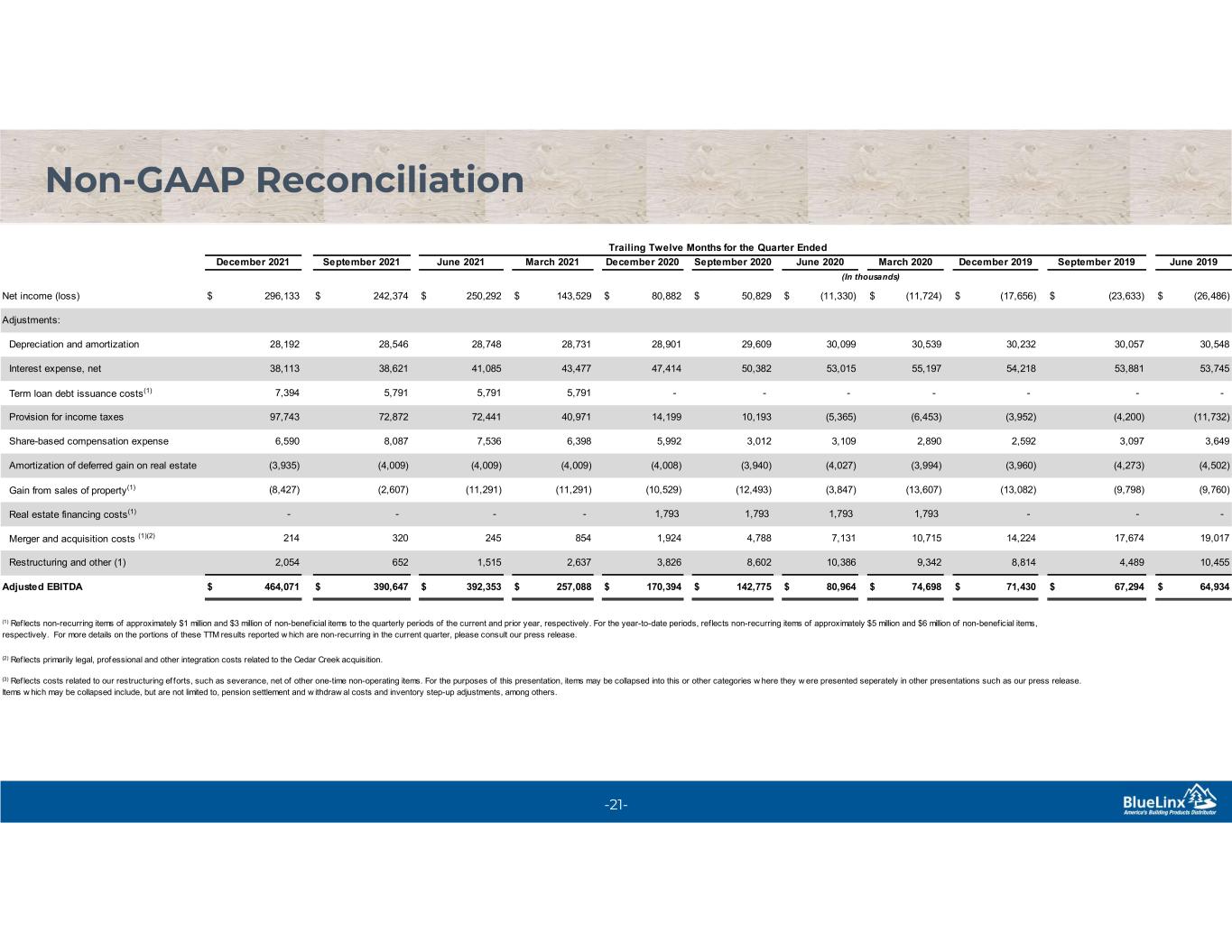

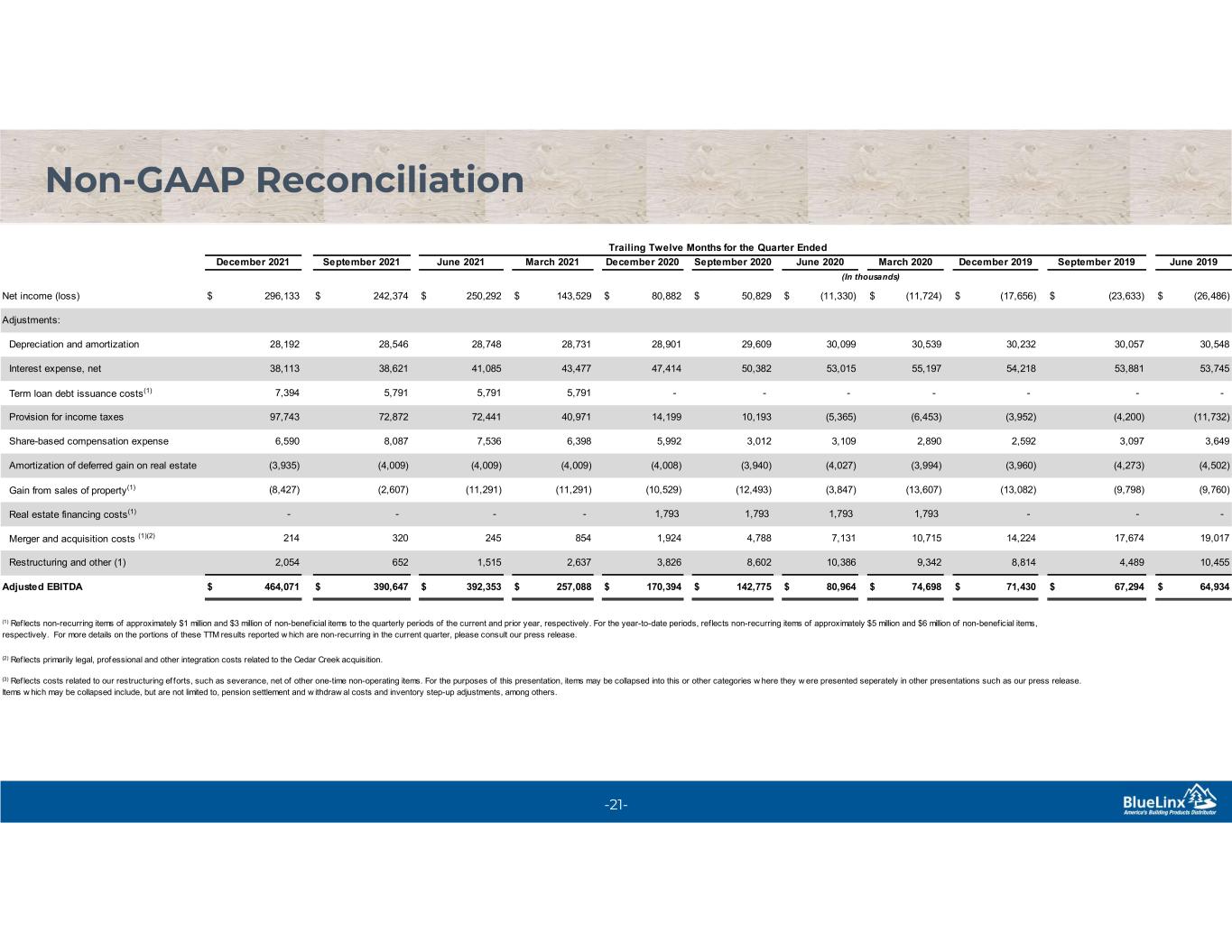

21 Non-GAAP Reconciliation -21- Net income (loss) $ 296,133 $ 242,374 $ 250,292 $ 143,529 $ 80,882 $ 50,829 $ (11,330) $ (11,724) $ (17,656) $ (23,633) $ (26,486) Adjustments: Depreciation and amortization 28,192 28,546 Interest expense, net 38,113 38,621 Term loan debt issuance costs(1) 7,394 5,791 Provision for income taxes 97,743 72,872 Share-based compensation expense 6,590 8,087 Amortization of deferred gain on real estate (3,935) (4,009) Gain from sales of property(1) (8,427) (2,607) Real estate financing costs(1) - - Merger and acquisition costs (1)(2) 214 320 Restructuring and other (1) 2,054 652 Adjusted EBITDA $ 464,071 $ 390,647 $ 392,353 $ 257,088 $ 170,394 $ 142,775 $ 80,964 $ 74,698 $ 71,430 $ 67,294 $ 64,934 Trailing Twelve Months for the Quarter Ended 854 2,637 (12,493) (3,847) 3,012 December 2021 1,793 3,097 - 5,791 June 2021 28,748 41,085 5,791 72,441 7,536 (4,009) - - - 10,193 (5,365) - 1,793 1,793 1,793 2,592 - (3,952) (4,200) (11,732) 2,890 3,109 - (9,760) 3,649 (6,453) (4,027) 30,548 50,382 53,015 10,455 4,788 7,131 10,715 14,224 17,674 19,017 - (1) Ref lects non-recurring items of approximately $1 million and $3 million of non-beneficial items to the quarterly periods of the current and prior year, respectively. For the year-to-date periods, reflects non-recurring items of approximately $5 million and $6 million of non-beneficial items, respectively. For more details on the portions of these TTM results reported w hich are non-recurring in the current quarter, please consult our press release. (3) Ref lects costs related to our restructuring ef forts, such as severance, net of other one-time non-operating items. For the purposes of this presentation, items may be collapsed into this or other categories w here they w ere presented seperately in other presentations such as our press release. Items w hich may be collapsed include, but are not limited to, pension settlement and w ithdraw al costs and inventory step-up adjustments, among others. 5,992 (4,008) (10,529) 1,924 3,826 (2) Ref lects primarily legal, professional and other integration costs related to the Cedar Creek acquisition. 8,602 10,386 9,342 8,814 4,489 6,398 (4,009) (13,607) (13,082) (9,798) - 1,515 245 (3,994) (3,960) (4,273) (11,291) 14,199 June 2019December 2020 28,901 47,414 55,197 54,218 53,881 (4,502) (In thousands) March 2021 September 2020 - - - (11,291) (3,940) September 2021 28,731 43,477 40,971 June 2020 December 2019 September 2019March 2020 53,745 29,609 30,099 30,539 30,232 30,057

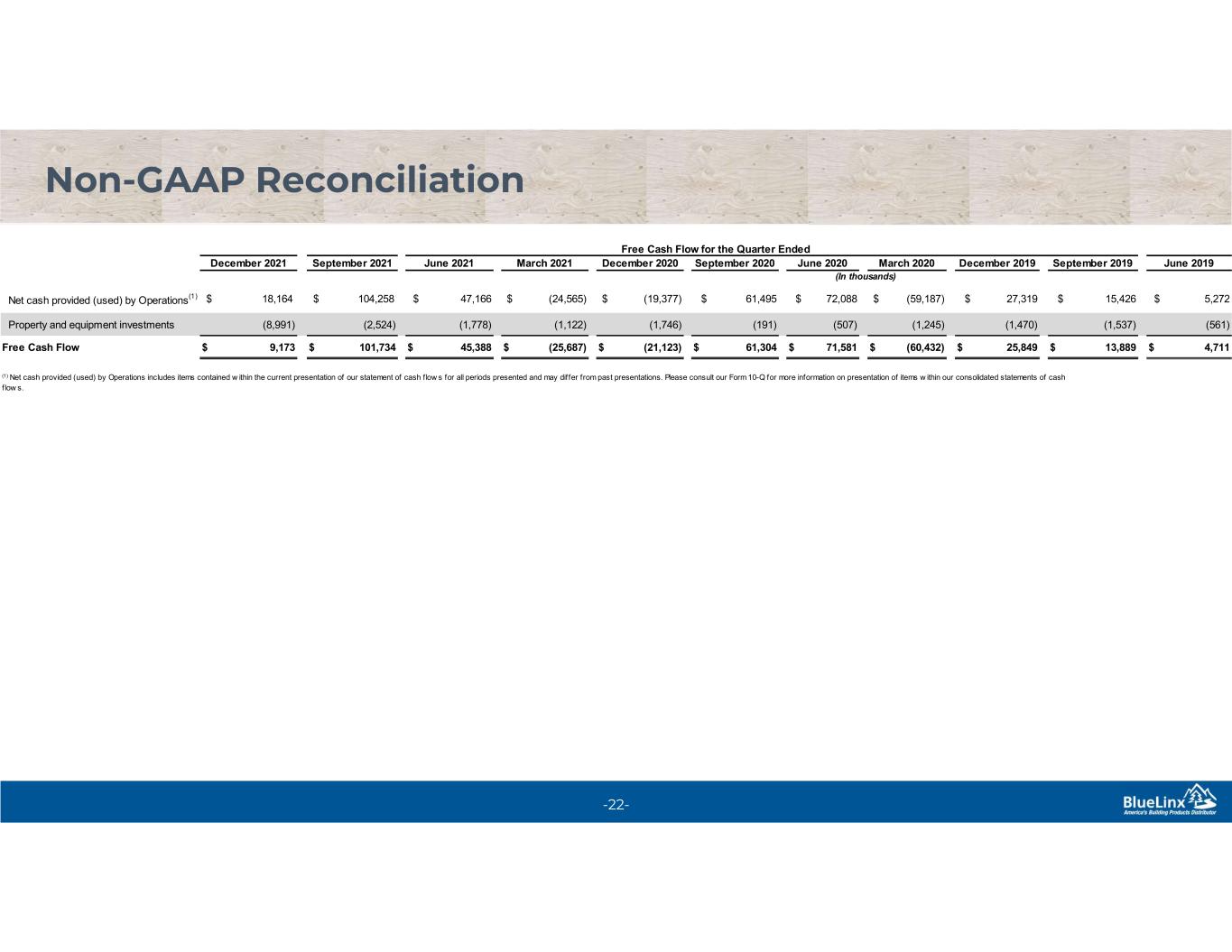

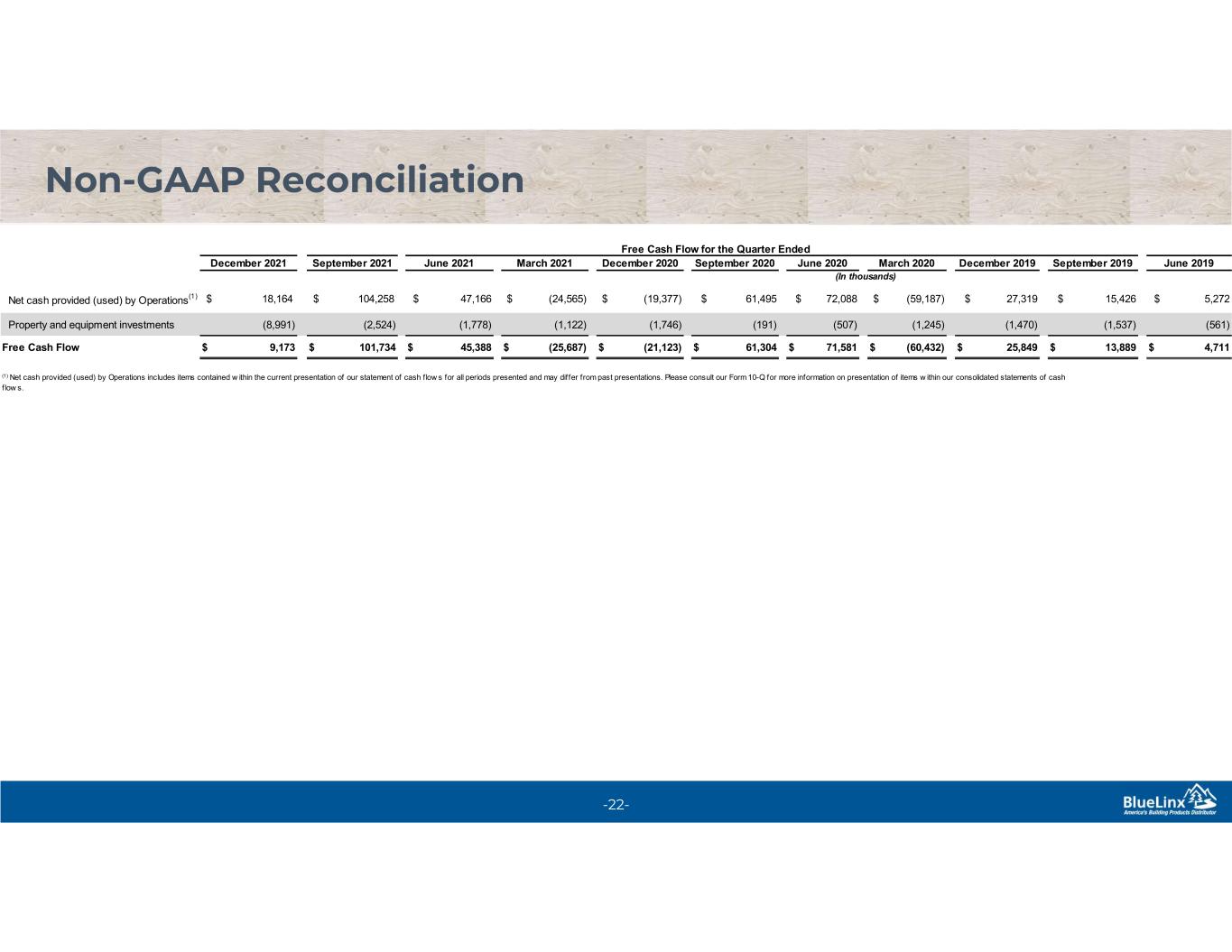

22 Non-GAAP Reconciliation -22- Net cash provided (used) by Operations(1) Property and equipment investments (8,991) (2,524) Free Cash Flow $ 9,173 $ 101,734 $ 45,388 $ (25,687) $ (21,123) $ 61,304 $ 71,581 $ (60,432) $ 25,849 $ 13,889 $ 4,711 Free Cash Flow for the Quarter Ended December 2021 $ 18,164 December 2019 September 2019 June 2019 $ 61,495 $ 72,088 $ (59,187) December 2020 $ (19,377) September 2020 June 2020 March 2020 (1,122) (In thousands) $ 15,426 $ 5,272 (561) September 2021 $ 104,258 $ 27,319 (1) Net cash provided (used) by Operations includes items contained w ithin the current presentation of our statement of cash flow s for all periods presented and may dif fer from past presentations. Please consult our Form 10-Q for more information on presentation of items w ithin our consolidated statements of cash flow s. (191) (507) (1,245) (1,470) (1,537)(1,746) June 2021 $ 47,166 (1,778) March 2021 $ (24,565)

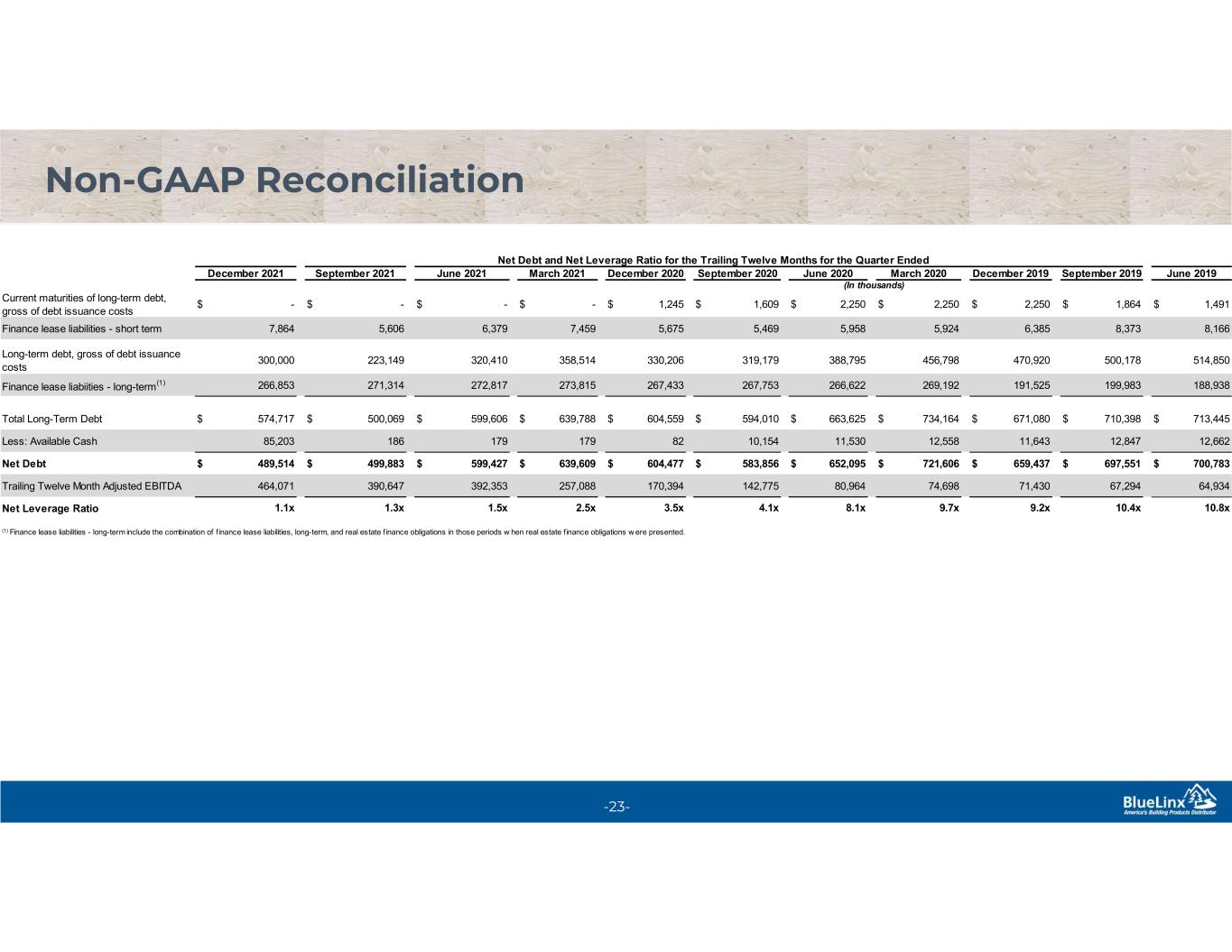

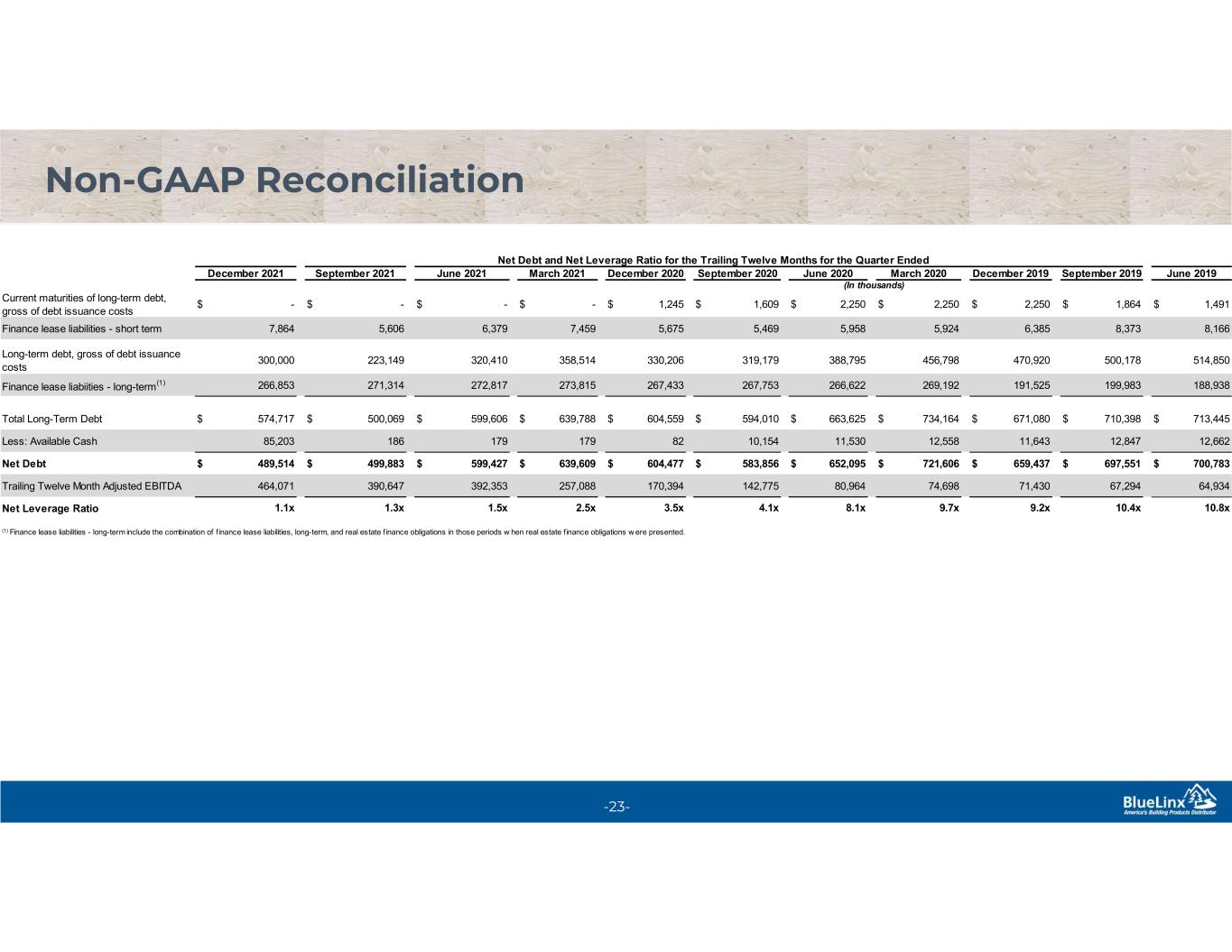

23 Non-GAAP Reconciliation -23- Current maturities of long-term debt, gross of debt issuance costs $ - $ - $ - $ - $ 1,245 $ 1,609 $ 2,250 $ 2,250 $ 2,250 $ 1,864 $ 1,491 Finance lease liabilities - short term Long-term debt, gross of debt issuance costs Finance lease liabiities - long-term(1) Total Long-Term Debt $ 574,717 $ 500,069 $ 599,606 $ 639,788 $ 604,559 $ 594,010 $ 663,625 $ 734,164 $ 671,080 $ 710,398 $ 713,445 Less: Available Cash Net Debt $ 489,514 $ 499,883 $ 599,427 $ 639,609 $ 604,477 $ 583,856 $ 652,095 $ 721,606 $ 659,437 $ 697,551 $ 700,783 Trailing Twelve Month Adjusted EBITDA Net Leverage Ratio Net Debt and Net Leverage Ratio for the Trailing Twelve Months for the Quarter Ended December 2021 7,864 300,000 266,853 85,203 464,071 1.1x 273,815 179 392,353 1.5x June 2021 6,379 320,410 272,817 (1) Finance lease liabilities - long-term include the combination of f inance lease liabilities, long-term, and real estate f inance obligations in those periods w hen real estate f inance obligations w ere presented. 4.1x 8.1x 9.7x 9.2x 10.4x 10.8x 179 257,088 2.5x 142,775 80,964 74,698 71,430 67,294 64,934 10,154 11,530 12,558 11,643 12,847 12,662 267,753 266,622 269,192 191,525 199,983 188,938 (In thousands) March 2021 7,459 358,514 5,675 330,206 267,433 8,166 September 2020 June 2020 March 2020 December 2019 September 2019 June 2019 5,469 5,958 5,924 6,385 8,373 514,850 319,179 388,795 456,798 470,920 500,178 186 390,647 1.3x September 2021 5,606 223,149 271,314 82 170,394 3.5x December 2020