BlueLinx Q3 2022 Results November 2, 2022

Q3 2022 RESULTS | 2 SAFE HARBOR STATEMENT This presentation contains forward-looking statements. Forward-looking statements include, without limitation, any statement that predicts, forecasts, indicates or implies future results, performance, liquidity levels or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” “will be,” “will likely continue,” “will likely result” or words or phrases of similar meaning. The forward-looking statements in this presentation include statements about our confidence in the Company’s long-term growth strategy; our ability to capitalize amid supply chain constraints and wood-based commodity price volatility; our ability to capitalize on supplier-led price increases and our value-added services; our areas of focus and management initiatives; the demand outlook for construction materials and expectations regarding new home construction, repair and remodel activity and continued investment in existing and new homes; our positioning for long-term value creation; our efforts and ability to generate profitable growth; our ability to increase net sales in specialty product categories; our ability to generate profits and cash from sales of specialty products; our multi-year capital allocation plans; our ability to manage volatility in wood-based commodities; our improvement in execution and productivity; our efforts and ability to maintain a disciplined capital structure and capital allocation strategy; our ability to maintain a strong balance sheet; our ability to focus on operating improvement initiatives and commercial excellence; constraints, volatility or disruptions in the capital markets or other factors affecting the amount and timing of share repurchases; whether or not the Company will continue, and the timing of, any open market repurchases. Forward-looking statements in this presentation are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties that may cause our business, strategy, or actual results to differ materially from the forward-looking statements. These risks and uncertainties include those discussed in greater detail in our filings with the Securities and Exchange Commission. We operate in a changing environment in which new risks can emerge from time to time. It is not possible for management to predict all of these risks, nor can it assess the extent to which any factor, or a combination of factors, may cause our business, strategy, or actual results to differ materially from those contained in forward-looking statements. Factors that may cause these differences include, among other things: pricing and product cost variability; volumes of product sold; competition; changes in the supply and/or demand for products that we distribute; the cyclical nature of the industry in which we operate; housing market conditions; consolidation among competitors, suppliers, and customers; disintermediation risk; loss of products or key suppliers and manufacturers; our dependence on international suppliers and manufacturers for certain products; potential acquisitions and the integration and completion of such acquisitions; business disruptions; effective inventory management relative to our sales volume or the prices of the products we produce; information technology security risks and business interruption risks; the ability to attract, train, and retain highly qualified associates and other key personnel while controlling related labor costs; exposure to product liability and other claims and legal proceedings related to our business and the products we distribute; natural disasters, catastrophes, fire, wars, or other unexpected events; successful implementation of our strategy; wage increases or work stoppages by our union employees; costs imposed by federal, state, local, and other regulations; compliance costs associated with federal, state, and local environmental protection laws; the COVID-19 pandemic and other contagious illness outbreaks and their potential effects on our industry; fluctuations in our operating results; our level of indebtedness and our ability to incur additional debt to fund future needs; the covenants of the instruments governing our indebtedness limiting the discretion of our management in operating the business; variable interest rate risk under certain indebtedness; the fact that we have consummated certain sale leaseback transactions with resulting long-term non-cancelable leases, many of which are or will be finance leases; the fact that we lease many of our distribution centers, and we would still be obligated under these leases even if we close a leased distribution center; inability to raise funds necessary to finance a required repurchase of our senior secured notes; a lowering or withdrawal of debt ratings; changes in our product mix; increases in petroleum prices; shareholder activism; changes in insurance-related deductible/retention reserves based on actual loss experience; the possibility that the value of our deferred tax assets could become impaired; changes in our expected annual effective tax rate could be volatile; changes in actuarial assumptions for our pension plan; the costs and liabilities related to our participation in multi-employer pension plans could increase; the risk that our cash flows and capital resources may be insufficient to service our existing or future indebtedness; the possibility that we could be the subject of securities class action litigation due to stock price volatility; activities of activist shareholders; indebtedness terms that limit our ability to pay dividends on common stock; and changes in, or interpretation of, accounting principles. Given these risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures. BlueLinx reports its financial results in accordance with GAAP. The Company also believes that presentation of certain non-GAAP measures may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Any non-GAAP measures used herein are reconciled to their most directly comparable GAAP measures herein or in the financial tables accompanying this news release. The Company cautions that non-GAAP measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Immaterial Rounding Differences. Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations. This presentation and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together.

Q3 2022 RESULTS | 3 Opening Remarks Dwight Gibson, President & CEO

Q3 2022 RESULTS | 4 A WHOLE NEW BLUE / executive summary Note: see appendix for reconciliations to all non-GAAP measures ▪ Net sales of $3.6b / up 9% year-over-year ▪ Adjusted EBITDA of $415m / up 18% year-over-year ▪ Adjusted EBITDA of $100m ▪ Generated operating cash of $143m – an all-time high ▪ Specialty product sales grew 13% y-o-y in Q3 2022 and comprised 68% of sales and 80% of gross profit ▪ Acquired Vandermeer on October 3, 2022 for $67m ▪ Repurchased 9% of outstanding shares for $66m ▪ Invested $19m in capital expenditures thru September ▪ 0.7x net leverage at the end of Q3 2022 ▪ $576m of liquidity – an all-time high ▪ $229m of cash on hand + $346m of revolver capacity ✓ Delivered strong year-to-to date results ✓ Solid Q3 results highlighted by record cash generation ✓ Remain focused on specialty product growth ✓ Executed strategic capital allocation actions ✓ Further strengthened our financial position

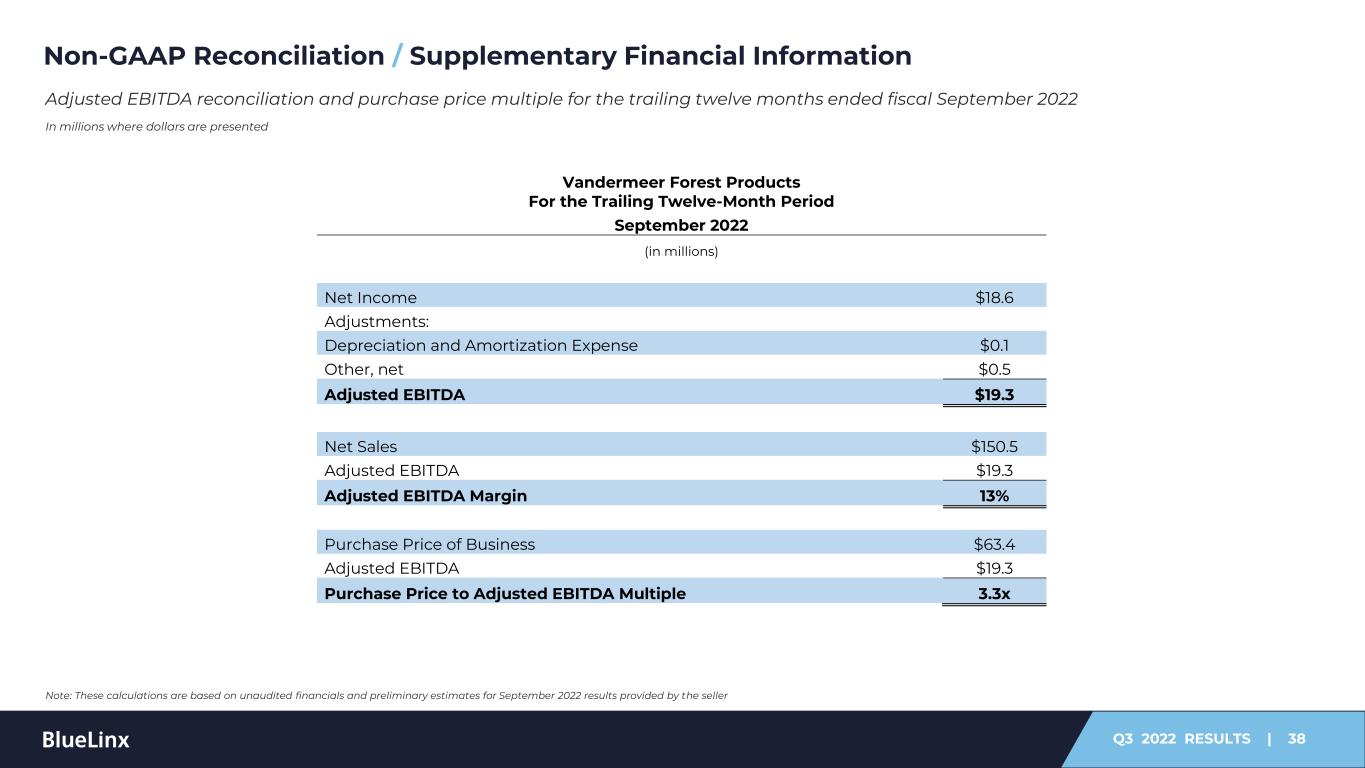

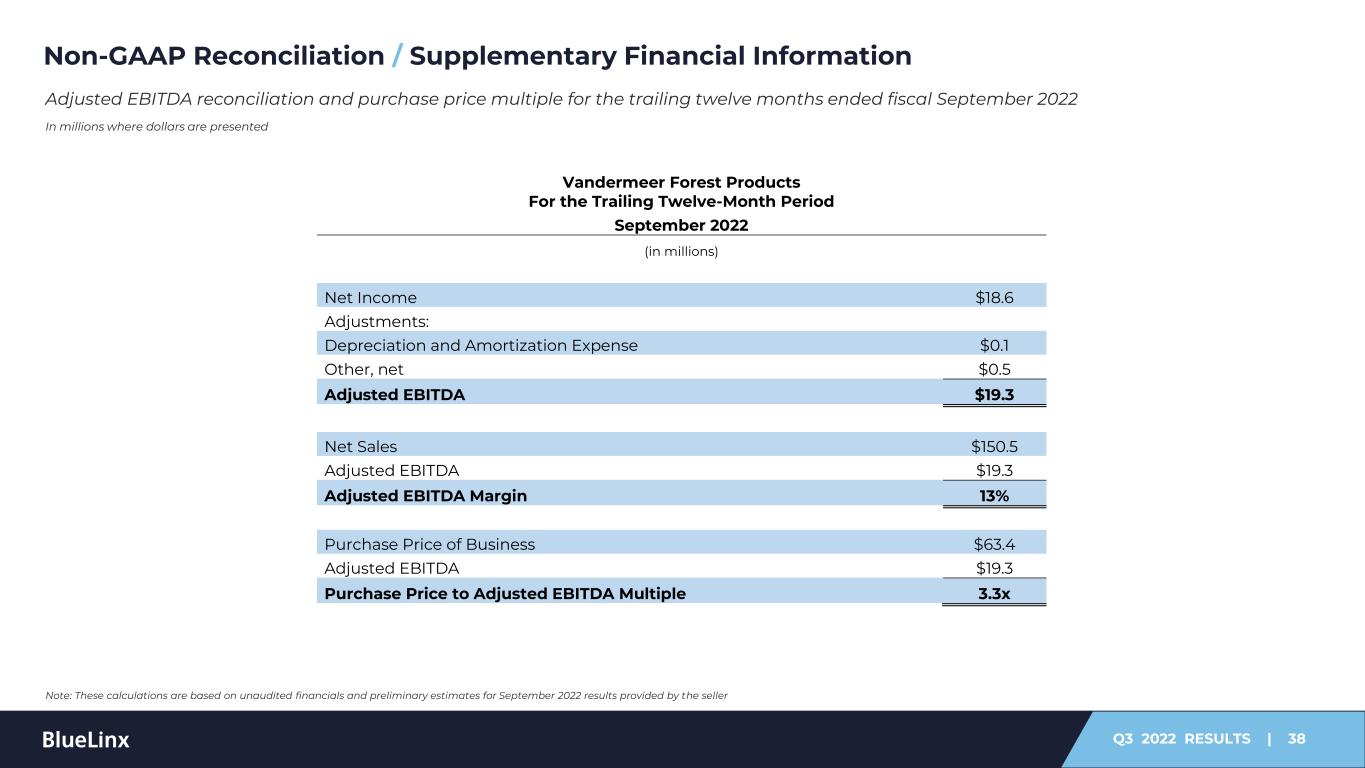

Q3 2022 RESULTS | 5 ▪ Acquired privately-owned Vandermeer, a premier wholesale distributor of building products with trailing twelve-month sales of ~$150 million that serves over 250 customers across the Pacific Northwest, Alaska, Hawaii, British Columbia and Alberta ▪ Signed and closed October 3, 2022 ▪ Total purchase price: $67.0m ❑ $63.4m to acquire the business which reflects an estimated multiple of ~3.3x on trailing twelve-month adjusted EBITDA ❑ $3.6m to acquire distribution facility and real estate in Spokane, WA ▪ Immediately accretive to diluted EPS beginning in Q4 2022 (pre-synergies) ▪ Funded with cash on hand ▪ After the acquisition, as of the end of October, net leverage remained below 1.0x, cash on hand was over $220 million and available liquidity was over $560 million VANDERMEER ACQUISITION / transaction overview Note: See appendix for reconciliations for all non-GAAP figures

Q3 2022 RESULTS | 6 ▪ Aligns to specialty products strategy ▪ Establishes meaningful growth platform in the Pacific Northwest: ❑ Adds three distribution branches in Washington state ❑ Provides direct access to Seattle and Portland (two of the top 15 MSAs in the United States) ❑ BlueLinx now has coast-to-coast reach and serves all 50 states ▪ Increases market penetration in key specialty product categories: ❑ Siding ❑ Engineered Wood ▪ Strengthens strategic supplier relationships ▪ Enhances ability to accelerate growth with National Accounts VANDERMEER ACQUISITION / strategic rationale Note: Highest growth MSAs as forecasted by John Burns Real Estate Consulting

Q3 2022 RESULTS | 7 Q3 2022 RESULTS / specialty products growth and record cash generation ▪ Net sales of $1.1b, up 9% year-over-year: ❑ Specialty product sales increased 13% to $724m ❑ Structural product sales increased 2% to $336m as a result of wood-based commodity price inflation ▪ Gross profit of $189m, up 24% year-over-year: ❑ 17.9% of net sales ❑ 80% of gross profit from specialty products ▪ Diluted EPS of $6.38, up 35% year-over-year ❑ $0.43 per share benefit from share repurchases ▪ Adjusted EBITDA of $100m, or 9.4% of sales ▪ Generated operating cash of $143m, up 37% year-over-year: ❑ Free Cash Flow of $130m, or 130% of adjusted EBITDA Specialty Products 80% Structural Products 20% Gross Profit by Product Category Note: see appendix for reconciliations to all non-GAAP measures

Q3 2022 RESULTS | 8 $1,308 $971 $973 $1,302 $1,239 $1,061 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Sales 12.7% 8.1% 11.5% 15.5% 9.1% 9.4% Adj. EBITDA % QUARTERLY RESULTS / continued operational improvement and growth in specialty products BlueLinx productivity improvements: ▪ Rigorous structural inventory management: ❑ Wood-based inventory reduced by ~65% since Q1 2020 ▪ Disciplined pricing and purchasing ▪ Lower repair and maintenance expense due to capex investments 87% 11% 12% 27% (5%) 9% sales growth vs. prior year period Note: reduction in wood-based inventory of ~65% is based on footage and occurred from Q1 2020 to Q3 2022 Note: see appendix for reconciliations to all non-GAAP measures Six consecutive quarters of strong execution: ▪ Average yoy sales growth of 24% per quarter ▪ Average adjusted EBITDA margin of 11.1% per quarter ▪ Reduced net leverage from 1.5x to 0.7x ~70% (Q3 2021) and >50% (Q2 2022) decline in wood-based commodity prices

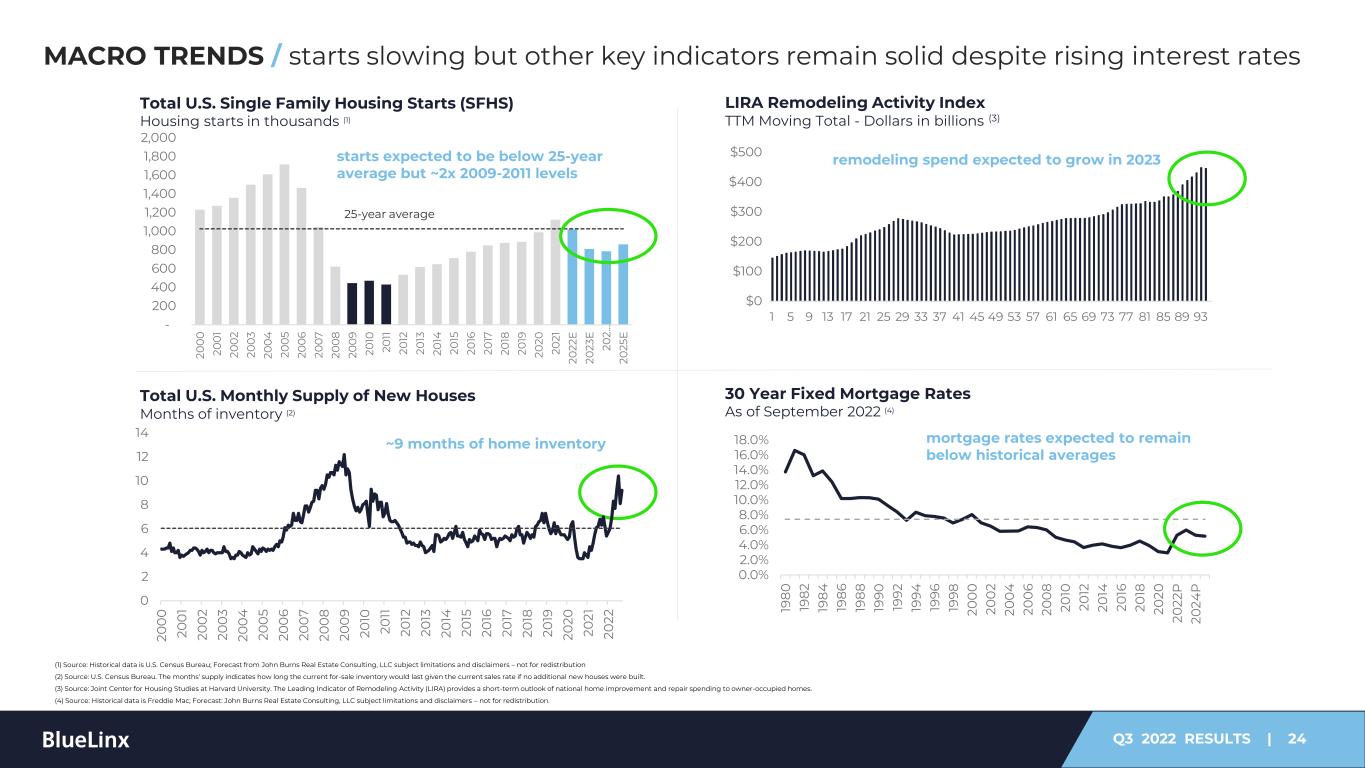

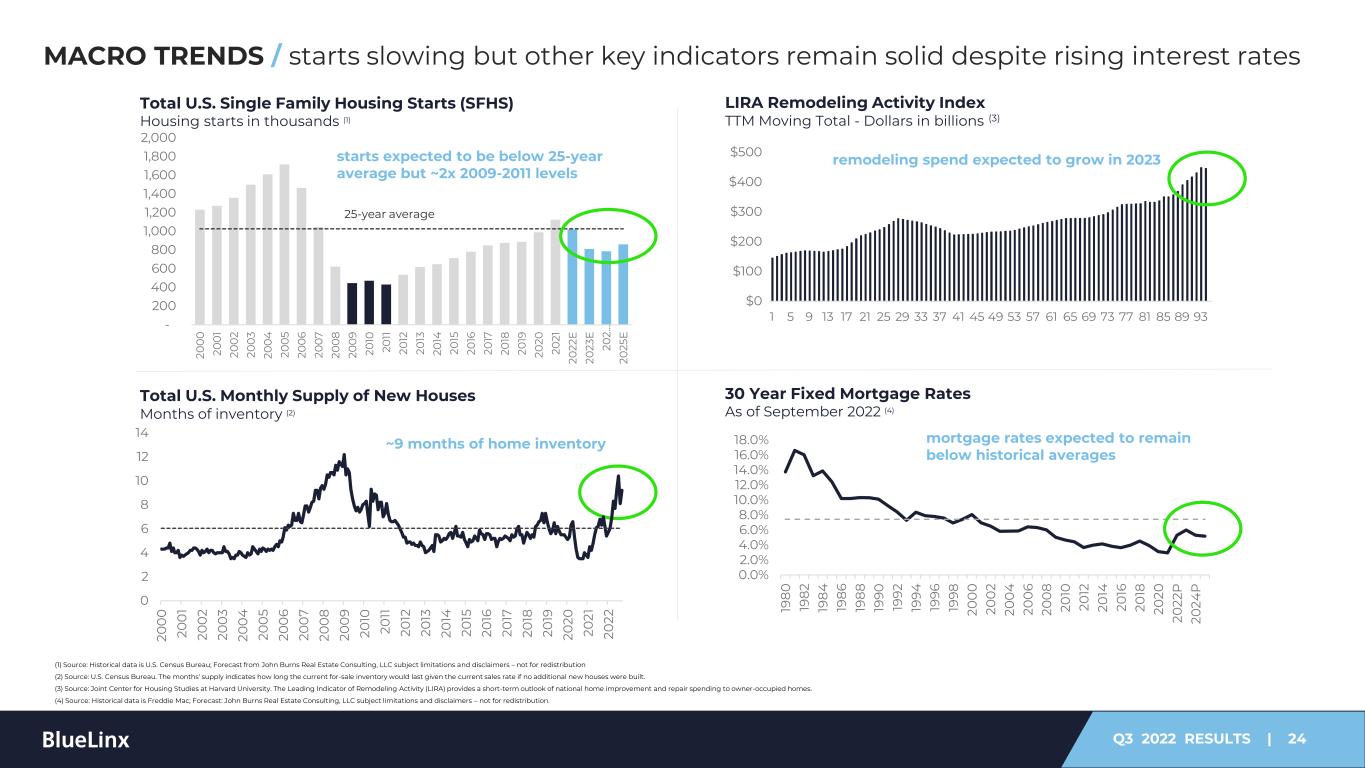

Q3 2022 RESULTS | 9 ▪ Repair and remodel rate of growth expected to slow during 2023, per LIRA Index(1): ❑ Home price appreciation and record home equity levels ❑ Remote work flexibility ❑ Average age of existing homes ~40 years old(2) ▪ Home affordability has come under pressure: ❑ Mortgage rates have more than doubled this year ❑ Home price appreciation ❑ Broad-based inflation ▪ New home starts expected to slow: ❑ U.S. new home supply now at ~9 months(3) ❑ Builders’ confidence down to 38, below the 20-year average(4) ❑ Single-family housing starts predicted to decline ~20% in 2023(5) U.S. HOUSING INDUSTRY / U.S. housing fundamentals slowing BLUELINX SALES BY END MARKET 45% 40% 15% New Home ConstructionRepair & Remodel Commercial Note: management’s estimate of 2019 sales by end market for two-step distribution of building materials (1) Source: Joint Center for Housing Studies at Harvard University. The Leading Indicator of Remodeling Activity (LIRA) provides a short-term outlook of national home improvement and repair spending to owner-occupied homes. (2) Source: American Community Survey completed in 2019.. (3) Source: U.S. Census Bureau. The months' supply indicates how long the current for-sale inventory would last given the current sales rate if no additional new houses were built (4) Source: NAHB Housing Market Index (HMI) is based on a monthly survey of NAHB members designed to take the pulse of the single-family housing market. The survey asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes (5) Source: . Forecast: John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution

Q3 2022 RESULTS | 10 *As of October 28, 2022 Supply/Cost Environment ▪ Average lumber and panel prices declined 26% and 23%, respectively, from Q2 to Q3, and have declined 16% and 14% respectively from Q3 through October ▪ Tight labor market for drivers persists ▪ Higher input costs due to widespread inflation ▪ Access to supply easing across most of our key specialty product categories Average quarterly prices for framing lumber ($/MBF) and structural panels ($/MSF) (per RISI(1)): U.S. HOUSING INDUSTRY / wood-based commodity prices remained volatile (1) Source: Random Lengths, company analysis; Oct-22 data thru 10/28/22 $987 $1,243 $466 $702 $1,244 $797 $587 $492 $1,003 $1,566 $766 $715 $1,232 $874 $671 $577 $300 $500 $700 $900 $1,100 $1,300 $1,500 $1,700 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22* Quarterly Average Price of Framing Lumber Quarterly Average Price for Structural Panels

Q3 2022 RESULTS | 11 Financial Review Kelly Janzen, Chief Financial Officer

Q3 2022 RESULTS | 12 ▪ Net sales increased 9% to $1.1b: ❑ Specialty product sales grew 13% ❑ Structural product sales grew 2% ▪ Gross Margin of 17.9%, up 210 bps: ❑ Driven by improved structural product margin ▪ Diluted EPS of $6.38, up 35%: ❑ Includes $0.43 per share benefit from lower share count related to share repurchases ▪ Adjusted EBITDA of $100m, up 27%: ❑ Adjusted EBITDA margin of 9.4% ▪ Free Cash Flow of $130m, up 28%: ❑ +$29m vs prior year period ❑ Net working capital reduced $72m sequentially Note: All comparisons versus the prior-year period unless otherwise noted; see Appendix for reconciliations for all non-GAAP figures $ millions, except per share data Q3 2021 Q3 2022 Variance Net sales $971 $1,061 +9% Gross Profit $153 $189 +24% Gross Margin % 15.8% 17.9% +210 bps Diluted Earnings Per Share $4.74 $6.38 +35% Adjusted EBITDA $79 $100 +27% Adjusted EBITDA % 8.1% 9.4% +130 bps Free Cash Flow $102 $130 +28% Net Leverage 1.3x 0.7x (0.6x) THIRD QUARTER 2022 RESULTS / key metrics

Q3 2022 RESULTS | 13 Days Sales of Inventory (DSI) Number of Days Operating Working Capital Management(1) Dollars in millions Cash Cycle Days Number of Days(2) ▪ Significant return on working capital, 57% for TTM Q3 2022 ▪ $52m sequential increase in operating working capital due primarily to higher cash on hand ▪ Inventory increase year over year due to increase in higher value specialty products ▪ Cash cycle days increased by 5 days over 2Q22 due to specialty inventory mix Note: See Appendix for reconciliations for all non-GAAP figures (1) Operating working capital includes accounts receivable, inventory, accounts payable and cash on hand (2) Cash Cycle Days = Days Sales Outstanding plus Days Sales of Inventory less Days Payable Outstanding WORKING CAPITAL / 57% return on working capital for TTM Q3 2022 48 54 50 45 60 63 58 63 68 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 40 43 39 35 48 54 47 50 58 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 $446 $471 $576 $636 $571 $733 $904 $866 $918 0% 10% 20% 30% 40% 50% 60% 70% 80% $200 $300 $400 $500 $600 $700 $800 $900 $1,000 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 Total Operating Working Capital Return on Working Capital

Q3 2022 RESULTS | 14 $496 $499 $563 $675 $641 $641 $768 $788 $724 17.4% 17.4% 19.3% 24.4% 23.0% 21.9% 24.0% 22.9% 20.9% 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 ($ millions) GM Rate Net sales ▪ Net sales grew 13%, or $83m: ▪ Sales growth driven by strategic pricing actions ▪ Volume relatively flat ▪ Gross Profit of $151m, up 3%: ▪ Disciplined, value-based pricing ▪ Gross margin of 20.9%, down 210 bps: ▪ Due to the easing of supply constraints, primarily millwork Q3 year-over-year analysis SPECIALTY PRODUCTS Q3 2022 RESULTS / sales grew 13% with gross profit up 3%

Q3 2022 RESULTS | 15 ($ millions) $375 $367 $462 $633 $330 $331 $534 $452 $336 19.6% 10.2% 15.5% 13.6% 1.7% 16.1% 20.0% 4.7% 11.3% 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 GM Rate Net sales ▪ Net sales increased 2%, or $7m: ▪ Reflects year-over-year higher average pricing for commodity framing lumber: ❑ 26% increase in average price of lumber ▪ Volume up modestly ▪ Gross Profit of $38m, up 574%: ▪ Continued improvement in managing structural inventory and optimizing profitability ▪ Gross margin of 11.3%, up 960 bps: ▪ Reflects continued improvement in inventory management and higher prices for commodity framing lumber Q3 year-over-year analysis STRUCTURAL PRODUCTS Q3 2022 RESULTS / sales grew $7m and profit increased $32m

Q3 2022 RESULTS | 16 BALANCE SHEET / strong financial position to support value creation Note: see appendix for reconciliations to all non-GAAP measures ▪ At the end of Q3 2022: ▪ Net leverage at 0.7x ▪ Net debt at $343m ▪ Cash on hand of $229m ▪ Total available liquidity of $576m ▪ Targeting +$30m of capex in 2022 ($19m completed YTD 2022) ▪ No material debt maturities until 2029 $273 $277 $273 $263 $223 $58 $300 3Q20 3Q21 3Q22 Finance Leases Revolver Term Loan Senior Notes $594 ($ millions) $500 $573 Gross Debt Structure $350 $300 2022 2023 2024 2025 2026 2027 2028 2029 ABL @ ~2% $300m Senior Notes @ 6% undrawn revolver Debt Maturity Schedule Note: debt maturity schedule does not include finance lease obligations 9.2x 3.5x 1.3x 0.9x 0.7x 2019 2020 3Q21 2Q22 3Q22 Net Leverage

Q3 2022 RESULTS | 17 INVEST IN THE BUSINESS STRATEGIC ACQUISITIONS SHARE REPURCHASES OPERATING CASH FLOW GUIDING PRINCIPLES ▪ Maintain strong balance sheet and financial stability ▪ Long-term net leverage could increase to at or around 3.0x when considering growth ▪ Invest in business through economic cycles ▪ Acquisitions aligned to strategy ▪ Opportunistic share repurchases FREE CASH FLOW RETURN TO SHAREHOLDERSGROWTH AND MARGIN EXPANSION CAPITAL ALLOCATION FRAMEWORK / disciplined approach to drive value creation

Q3 2022 RESULTS | 18 Executive Summary Dwight Gibson, President and CEO

Q3 2022 RESULTS | 19 BlueLinx: A Whole New Blue Delighting Customers, Elite Execution, Performance Driven 1 2 3Attractive market BlueLinx is well positioned to grow Leveraging growth ▪ >$40b addressable market ▪ 5%+ long-term growth rate ▪ Fragmented competition ▪ Optimizing productivity ▪ Infusing capabilities ▪ Driving performance Source: Estimated 2021 and market growth CAGR based on Principia Consulting, LLC ▪ ~10% market share ▪ Growing with best customers ▪ Strong financial position A WHOLE NEW BLUE / a compelling investment

Q3 2022 RESULTS | 20 A WHOLE NEW BLUE / North America’s Preeminent Building Products Distributor Accelerating Growth Accelerating growth with our best customers and our best specialty products Optimizing Productivity Optimizing productivity thru distribution center optimization and procurement excellence Driving Performance Building an extraordinary team, creating a performance-based culture Creating Value Creating value thru profitable growth and disciplined capital allocation North America’s Preeminent Building Products Distributor

Q3 2022 RESULTS | 21 ▪ Thru the first nine months of 2022 we delivered strong results: ✓ Net sales of $3.6b, up 9% year-over-year ✓ Adjusted EBITDA of $415m, up 18% year-over-year ✓ Operating cash of $246m, up ~2x year-over-year ▪ Closely monitoring the US housing industry and broader economic environment; prepared to successfully navigate a slower demand environment ▪ Focused on accelerating growth in specialty products, optimizing productivity and driving world-class performance A WHOLE NEW BLUE / executive summary Note: see appendix for reconciliations to all non-GAAP measures

Q3 2022 RESULTS | 22 Appendix

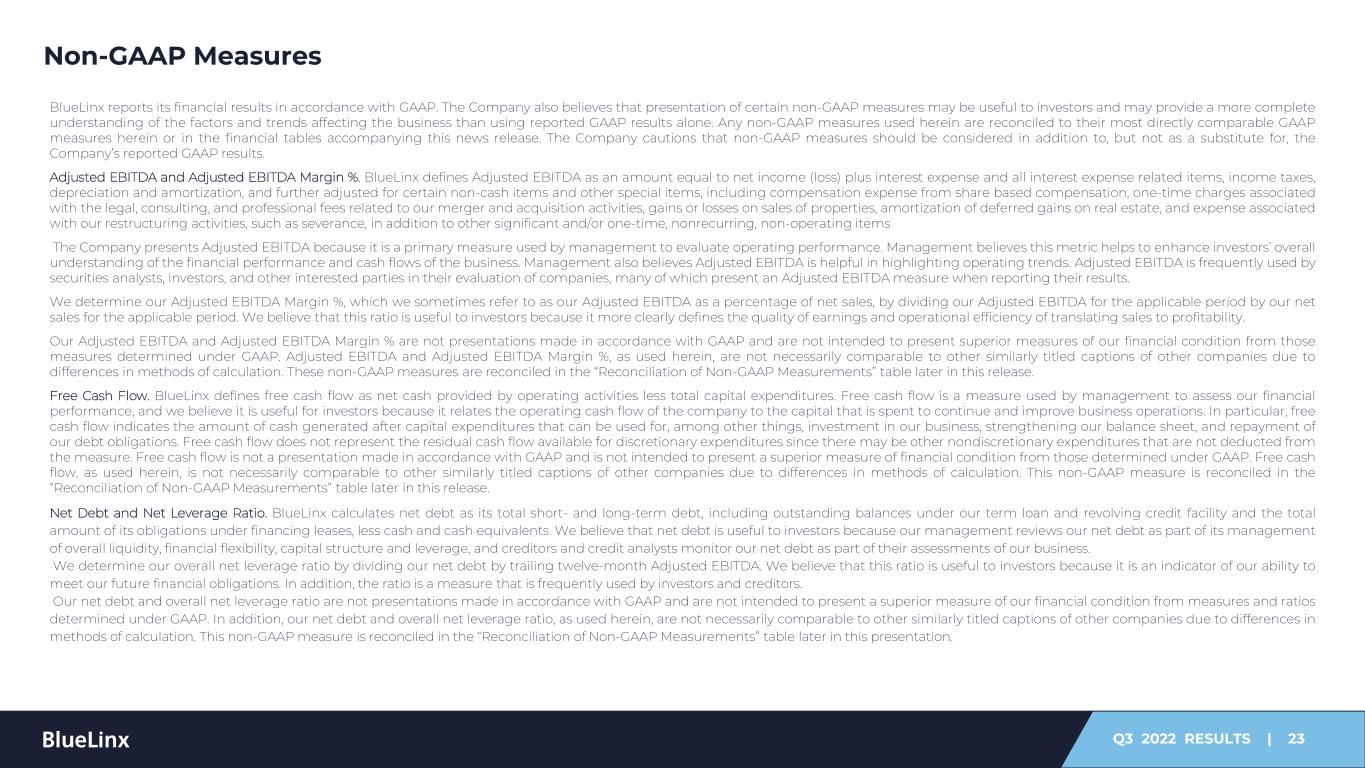

Q3 2022 RESULTS | 23 BlueLinx reports its financial results in accordance with GAAP. The Company also believes that presentation of certain non-GAAP measures may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Any non-GAAP measures used herein are reconciled to their most directly comparable GAAP measures herein or in the financial tables accompanying this news release. The Company cautions that non-GAAP measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. Adjusted EBITDA and Adjusted EBITDA Margin %. BlueLinx defines Adjusted EBITDA as an amount equal to net income (loss) plus interest expense and all interest expense related items, income taxes, depreciation and amortization, and further adjusted for certain non-cash items and other special items, including compensation expense from share based compensation, one-time charges associated with the legal, consulting, and professional fees related to our merger and acquisition activities, gains or losses on sales of properties, amortization of deferred gains on real estate, and expense associated with our restructuring activities, such as severance, in addition to other significant and/or one-time, nonrecurring, non-operating items The Company presents Adjusted EBITDA because it is a primary measure used by management to evaluate operating performance. Management believes this metric helps to enhance investors’ overall understanding of the financial performance and cash flows of the business. Management also believes Adjusted EBITDA is helpful in highlighting operating trends. Adjusted EBITDA is frequently used by securities analysts, investors, and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results. We determine our Adjusted EBITDA Margin %, which we sometimes refer to as our Adjusted EBITDA as a percentage of net sales, by dividing our Adjusted EBITDA for the applicable period by our net sales for the applicable period. We believe that this ratio is useful to investors because it more clearly defines the quality of earnings and operational efficiency of translating sales to profitability. Our Adjusted EBITDA and Adjusted EBITDA Margin % are not presentations made in accordance with GAAP and are not intended to present superior measures of our financial condition from those measures determined under GAAP. Adjusted EBITDA and Adjusted EBITDA Margin %, as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. These non-GAAP measures are reconciled in the “Reconciliation of Non-GAAPMeasurements” table later in this release. Free Cash Flow. BlueLinx defines free cash flow as net cash provided by operating activities less total capital expenditures. Free cash flow is a measure used by management to assess our financial performance, and we believe it is useful for investors because it relates the operating cash flow of the company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures that can be used for, among other things, investment in our business, strengthening our balance sheet, and repayment of our debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures since there may be other nondiscretionary expenditures that are not deducted from the measure. Free cash flow is not a presentation made in accordance with GAAP and is not intended to present a superior measure of financial condition from those determined under GAAP. Free cash flow, as used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. This non-GAAP measure is reconciled in the “Reconciliation of Non-GAAPMeasurements” table later in this release. Net Debt and Net Leverage Ratio. BlueLinx calculates net debt as its total short- and long-term debt, including outstanding balances under our term loan and revolving credit facility and the total amount of its obligations under financing leases, less cash and cash equivalents. We believe that net debt is useful to investors because our management reviews our net debt as part of its management of overall liquidity, financial flexibility, capital structure and leverage, and creditors and credit analysts monitor our net debt as part of their assessments of our business. We determine our overall net leverage ratio by dividing our net debt by trailing twelve-month Adjusted EBITDA. We believe that this ratio is useful to investors because it is an indicator of our ability to meet our future financial obligations. In addition, the ratio is a measure that is frequently used by investors and creditors. Our net debt and overall net leverage ratio are not presentations made in accordance with GAAP and are not intended to present a superior measure of our financial condition from measures and ratios determined under GAAP. In addition, our net debt and overall net leverage ratio, as used herein, are not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. This non-GAAP measure is reconciled in the “Reconciliation of Non-GAAPMeasurements” table later in this presentation. Non-GAAP Measures

Q3 2022 RESULTS | 24 MACRO TRENDS / starts slowing but other key indicators remain solid despite rising interest rates Total U.S. Single Family Housing Starts (SFHS) Housing starts in thousands (1) 25-year average $0 $100 $200 $300 $400 $500 1 5 9 13 17 21 25 29 33 37 41 45 49 53 57 61 65 69 73 77 81 85 89 93 LIRA Remodeling Activity Index TTM Moving Total - Dollars in billions (3) Total U.S. Monthly Supply of New Houses Months of inventory (2) 30 Year Fixed Mortgage Rates As of September 2022 (4) 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 19 8 0 19 8 2 19 8 4 19 8 6 19 8 8 19 90 19 92 19 94 19 96 19 98 20 0 0 20 0 2 20 0 4 20 0 6 20 0 8 20 10 20 12 20 14 20 16 20 18 20 20 20 22 P 20 24 P (1) Source: Historical data is U.S. Census Bureau; Forecast from John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution (2) Source: U.S. Census Bureau. The months' supply indicates how long the current for-sale inventory would last given the current sales rate if no additional new houses were built. (3) Source: Joint Center for Housing Studies at Harvard University. The Leading Indicator of Remodeling Activity (LIRA) provides a short-term outlook of national home improvement and repair spending to owner-occupied homes. (4) Source: Historical data is Freddie Mac; Forecast: John Burns Real Estate Consulting, LLC subject limitations and disclaimers – not for redistribution. remodeling spend expected to grow in 2023 mortgage rates expected to remain below historical averages 0 2 4 6 8 10 12 14 20 0 0 20 0 1 20 0 2 20 0 3 20 0 4 20 0 5 20 0 6 20 0 7 20 0 8 20 0 9 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 ~9 months of home inventory - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 20 0 0 20 0 1 20 0 2 20 0 3 20 0 4 20 0 5 20 0 6 20 0 7 20 0 8 20 0 9 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 E 20 23 E 20 2… 20 25 E starts expected to be below 25-year average but ~2x 2009-2011 levels

Q3 2022 RESULTS | 25 MACRO TRENDS / shift to hybrid work and record levels of home equity support home investment $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 19 8 0 -… 19 8 1- … 19 8 3- … 19 8 4 -… 19 8 6- … 19 8 7- … 19 8 9- … 19 90 -… 19 92 -… 19 93 -… 19 95 -… 19 96 -… 19 98 -… 19 99 -… 20 0 1- … 20 0 2- … 20 0 4 -… 20 0 5- … 20 0 7- … 20 0 8 -… 20 10 -… 20 11 -… 20 13 -… 20 14 -… 20 16 -… 20 17 -… 20 19 -… 20 20 -… 20 22 -… Household Owners’ Equity Levels in Real Estate Dollars in billions (1) (1) Source: Historical data is Board of Governors of the Federal Reserve System (US), Households; Owners' Equity in Real Estate, Level [OEHRENWBSHNO], retrieved from FRED, Federal Reserve Bank of St. Louis Hybrid/work from home Fully on-site record levels of home equity

Q3 2022 RESULTS | 26 Framing Lumber Composite Index As of October 2022(1) Structural Panel Composite Index As of October 2022(2) ▪ Prices declined throughout 3Q22 ▪ Lumber and panels prices averaged ~$587/MBF and ~$671/MSF in 3Q22 ▪ As of 10/28/22, average Oct- 22 pricing was $492/MBF for lumber and $577/MSF for panels ▪ Oct-22 average lumber and panels pricing was lower than 3Q22 average pricing by 16% and 14%, respectively - 200 400 600 800 1,000 1,200 1,400 1,600 Ja n -1 5 A p r- 15 Ju l- 15 O ct -1 5 Ja n -1 6 A p r- 16 Ju l- 16 O ct -1 6 Ja n -1 7 A p r- 17 Ju l- 17 O ct -1 7 Ja n -1 8 A p r- 18 Ju l- 18 O ct -1 8 Ja n -1 9 A p r- 19 Ju l- 19 O ct -1 9 Ja n -2 0 A p r- 20 Ju l- 20 O ct -2 0 Ja n -2 1 A p r- 21 Ju l- 21 O ct -2 1 Ja n -2 2 A p r- 22 Ju l- 22 O ct -2 2 Index Price TTM Avg. Index Price - 200 400 600 800 1,000 1,200 1,400 1,600 1,800 Ja n -1 5 A p r- 15 Ju l- 15 O ct -1 5 Ja n -1 6 A p r- 16 Ju l- 16 O ct -1 6 Ja n -1 7 A p r- 17 Ju l- 17 O ct -1 7 Ja n -1 8 A p r- 18 Ju l- 18 O ct -1 8 Ja n -1 9 A p r- 19 Ju l- 19 O ct -1 9 Ja n -2 0 A p r- 20 Ju l- 20 O ct -2 0 Ja n -2 1 A p r- 21 Ju l- 21 O ct -2 1 Ja n -2 2 A p r- 22 Ju l- 22 O ct -2 2 Index Price TTM Avg. Index Price Oct-22 framing lumber prices are 18% lower than the 5-year average and 40% below the TTM rolling average Oct-22 structural panel prices are 10% lower the 5-year average and 33% below to the TTM rolling average (1) Source: Random Lengths, company analysis; Oct-22 data thru 10/28/22 (2) Source: Random Lengths; company analysis; Oct-22 data thru 10/28/22 WOOD-BASED COMMODITY PRICE TRENDS / wood-based commodity markets remain volatile

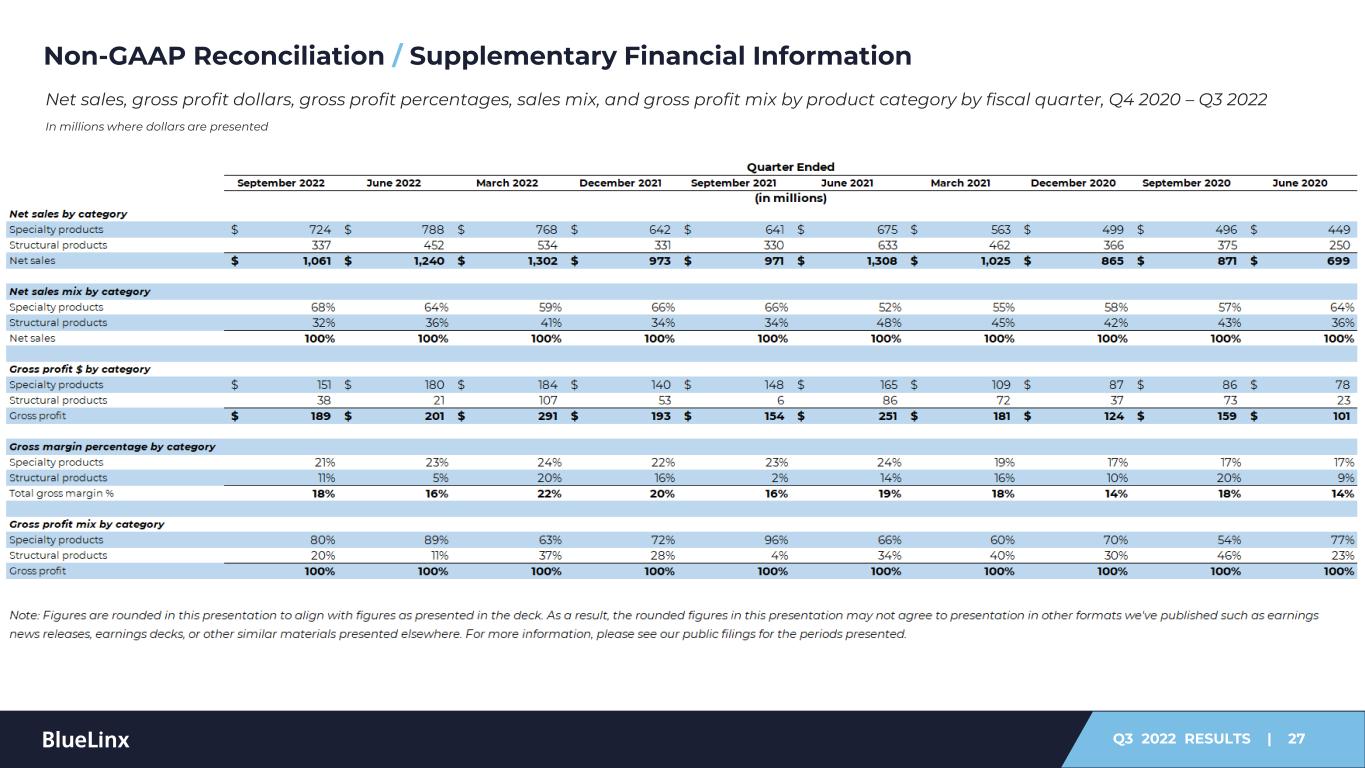

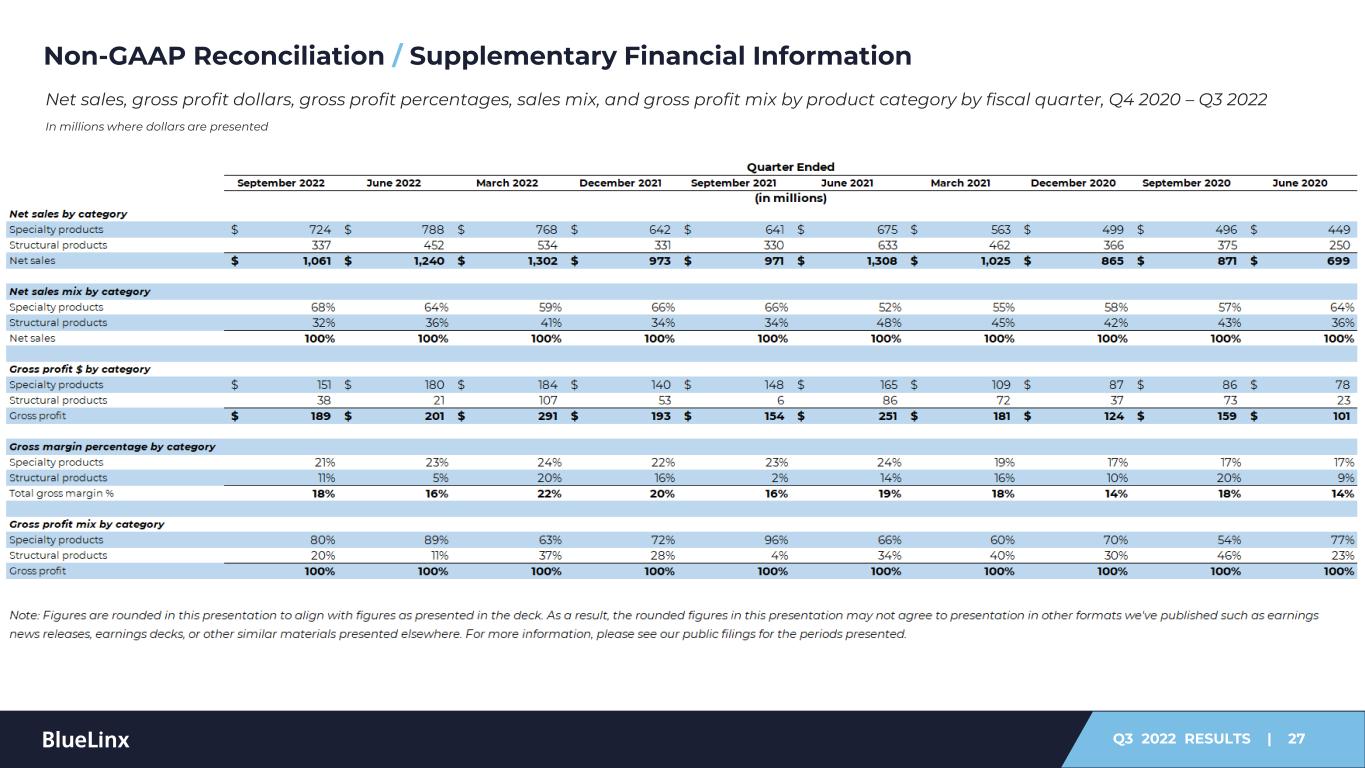

Q3 2022 RESULTS | 27 Non-GAAP Reconciliation / Supplementary Financial Information Net sales, gross profit dollars, gross profit percentages, sales mix, and gross profit mix by product category by fiscal quarter, Q4 2020 – Q3 2022 In millions where dollars are presented

Q3 2022 RESULTS | 28 Non-GAAP Reconciliation / Supplementary Financial Information Adjusted EBITDA reconciliation by fiscal quarter, Q4 2020 – Q3 2022 In millions where dollars are presented

Q3 2022 RESULTS | 29 Non-GAAP Reconciliation / Supplementary Financial Information Adjusted EBITDA reconciliation for the nine-month periods, Q3 2022 – Q3 2021 In millions where dollars are presented

Q3 2022 RESULTS | 30 Non-GAAP Reconciliation / Supplementary Financial Information Free cash flow for the three and nine months ended, Q3 2022 and Q3 2021 In millions where dollars are presented September 2022 September 2021 September 2022 September 2021 (in millions) (in millions) (in millions) (in millions) Net cash provided by operating activities 143$ 104$ 246$ 127$ Less: Property and equipment investments (12) (2) (19) (6) Free cash flow 130$ 102$ 227$ 121$ Three Months Ended Nine Months Ended

Q3 2022 RESULTS | 31 Non-GAAP Reconciliation / Supplementary Financial Information Working capital by fiscal quarter, Q1 2020 – Q3 2022 In millions where dollars are presented Cash investments in property, plant, and equipment (CAPEX) for three months ended March 2022, June 2022, and September 2022 In millions where dollars are presented Three Months Ended Three Months Ended Three Months Ended Nine Months Ended March 2022 June 2022 September 2022 September 2022 Investments in PP&E (1) (3)$ (4)$ (12)$ (19)$ (in millions) (1) As disclosed within the "Property and equipment investments" line of our Consolidated Statements of Cash Flows for the three months ended April 2, 2022, July 2, 2022, and October 1, 2022, respectively.

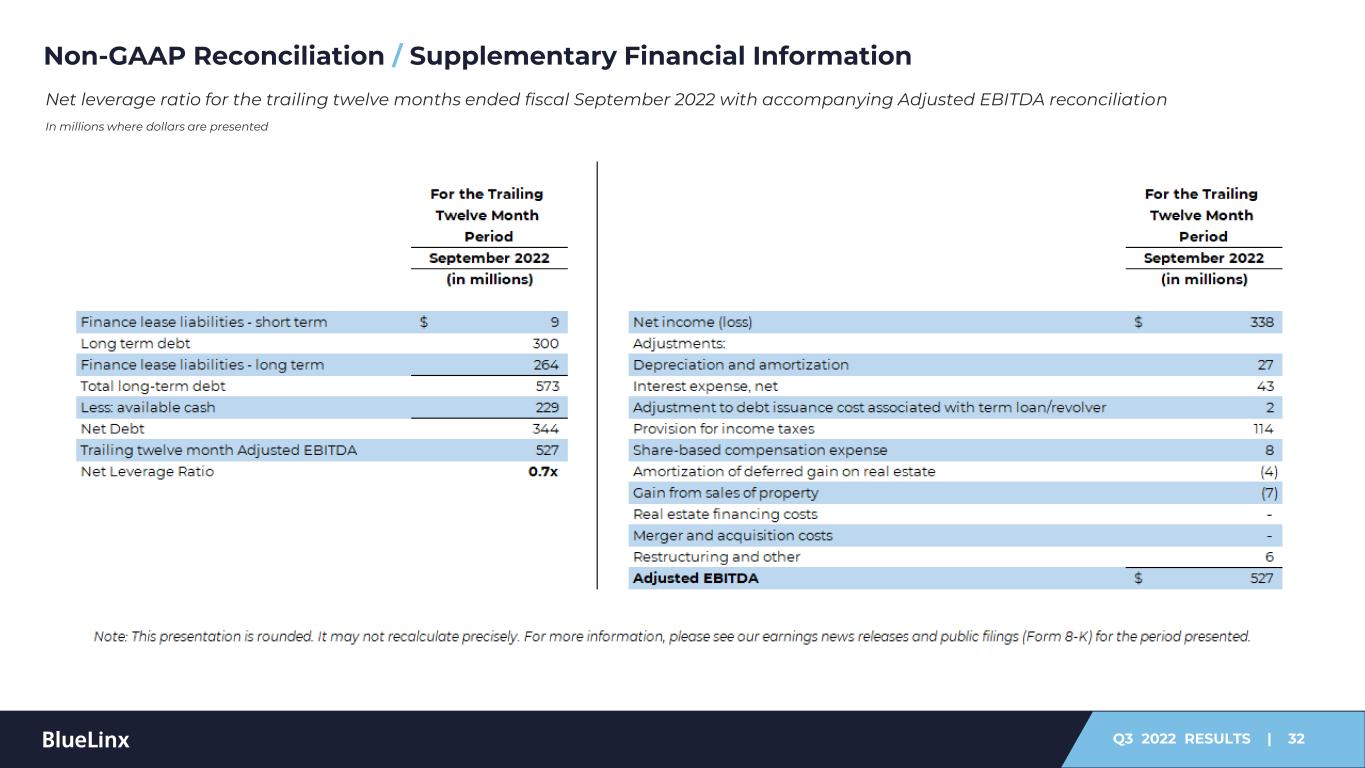

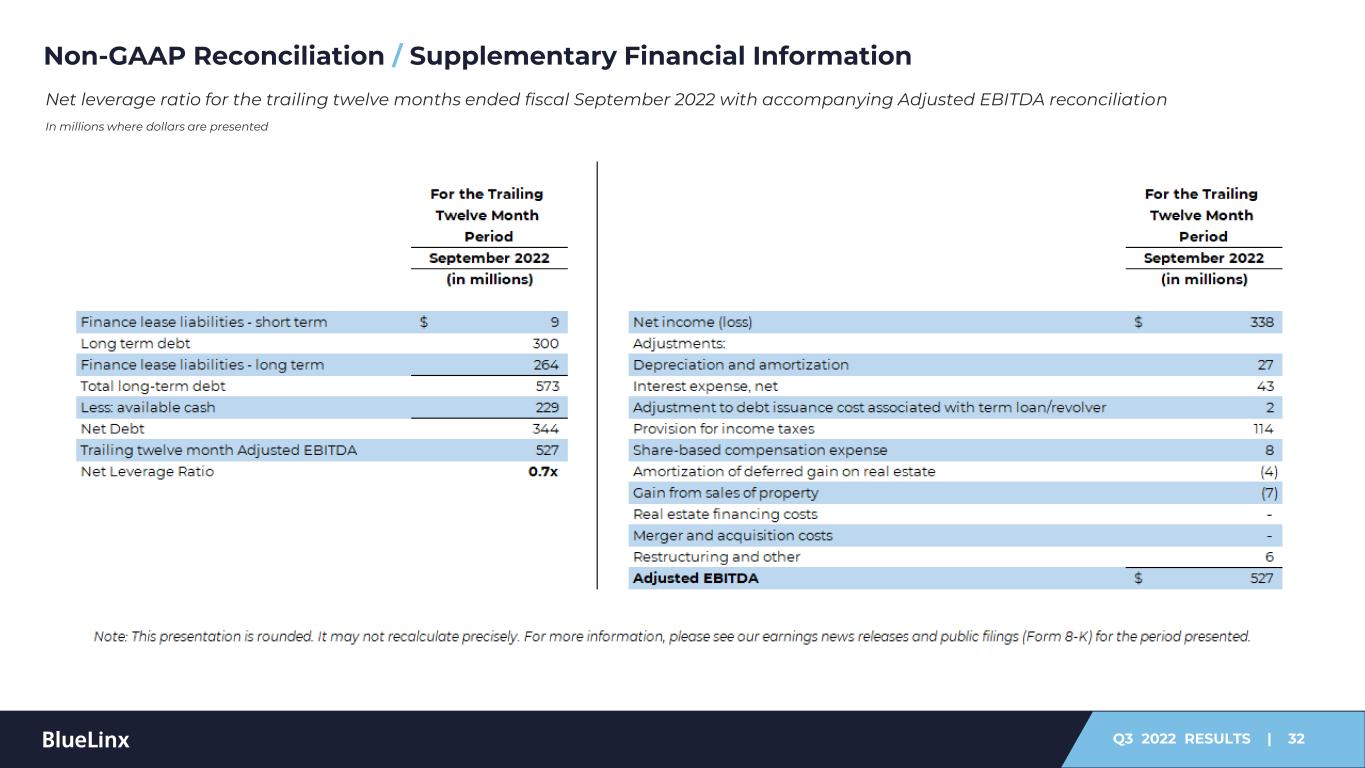

Q3 2022 RESULTS | 32 Non-GAAP Reconciliation / Supplementary Financial Information Net leverage ratio for the trailing twelve months ended fiscal September 2022 with accompanying Adjusted EBITDA reconciliation In millions where dollars are presented

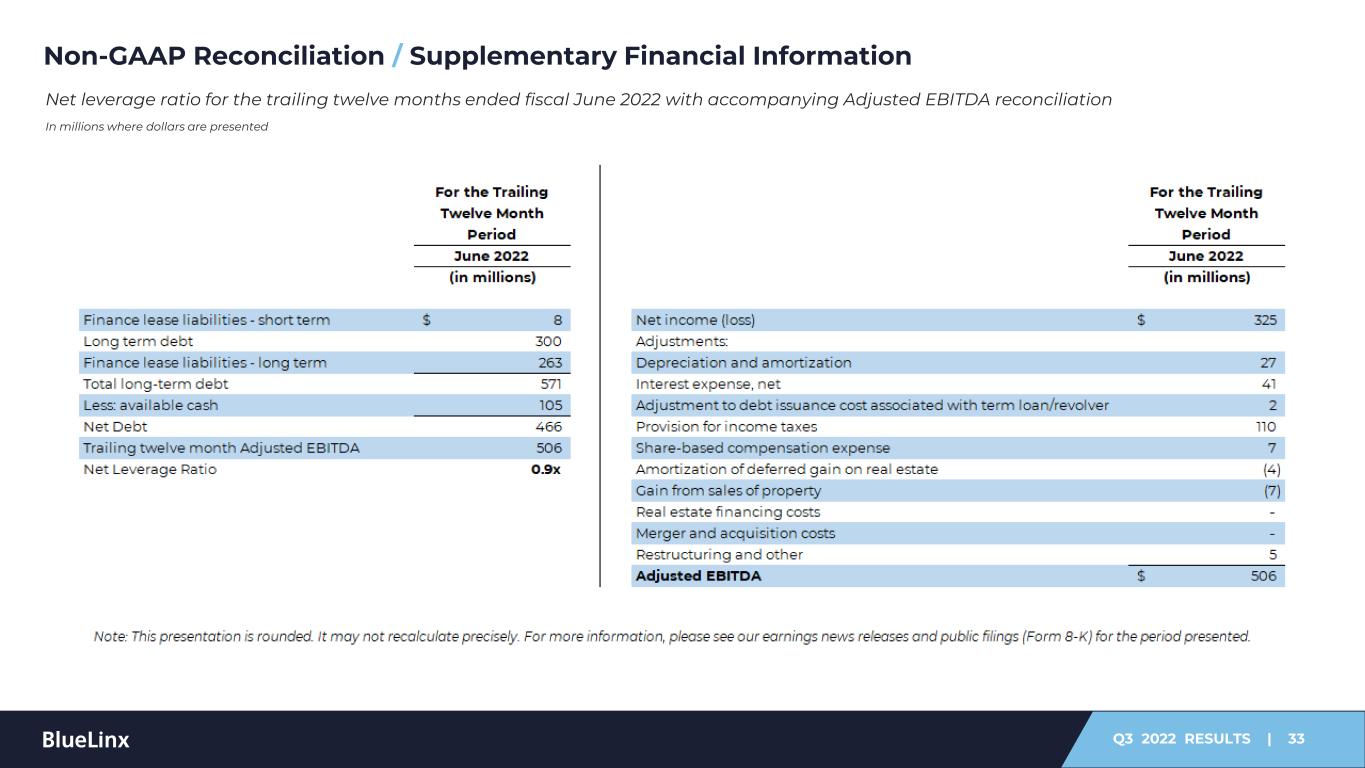

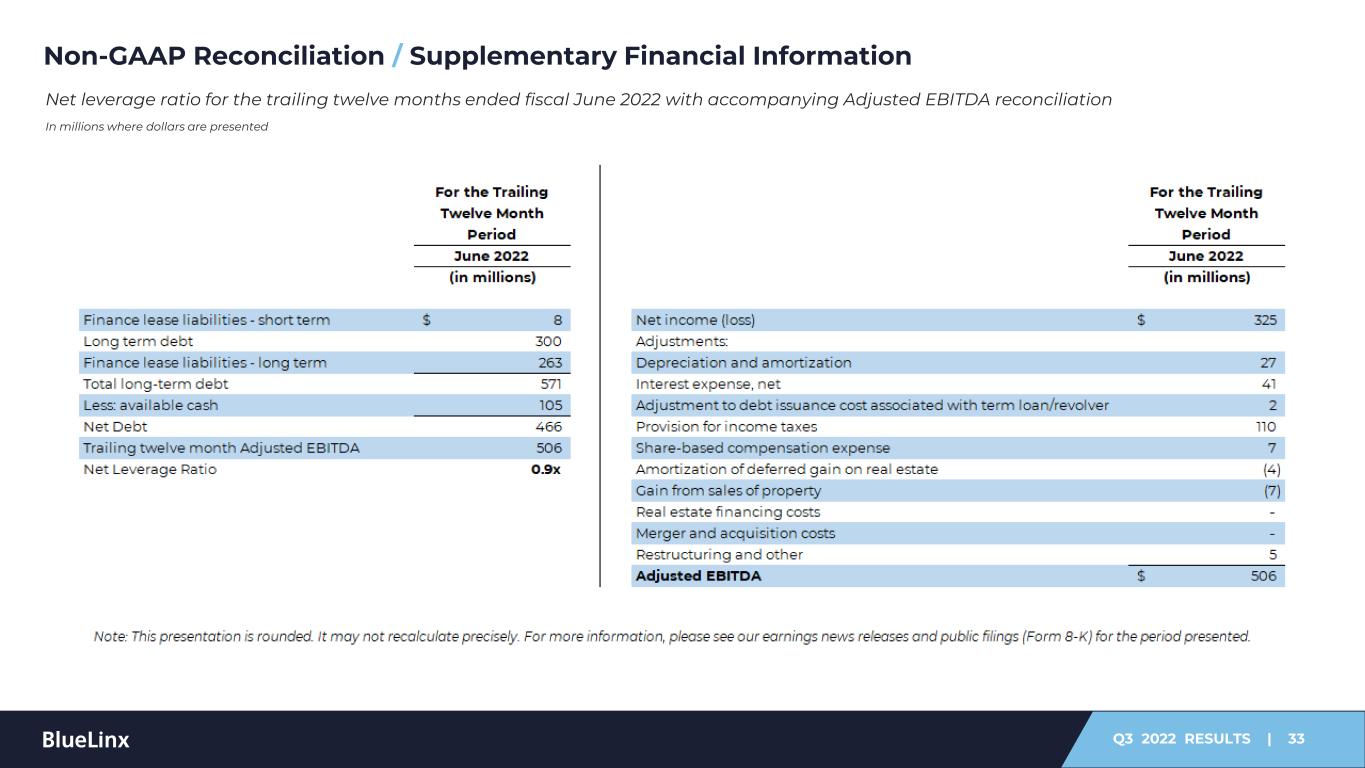

Q3 2022 RESULTS | 33 Non-GAAP Reconciliation / Supplementary Financial Information Net leverage ratio for the trailing twelve months ended fiscal June 2022 with accompanying Adjusted EBITDA reconciliation In millions where dollars are presented

Q3 2022 RESULTS | 34 Non-GAAP Reconciliation / Supplementary Financial Information Net leverage ratio for the trailing twelve months ended fiscal September 2021 with accompanying Adjusted EBITDA reconciliation In millions where dollars are presented

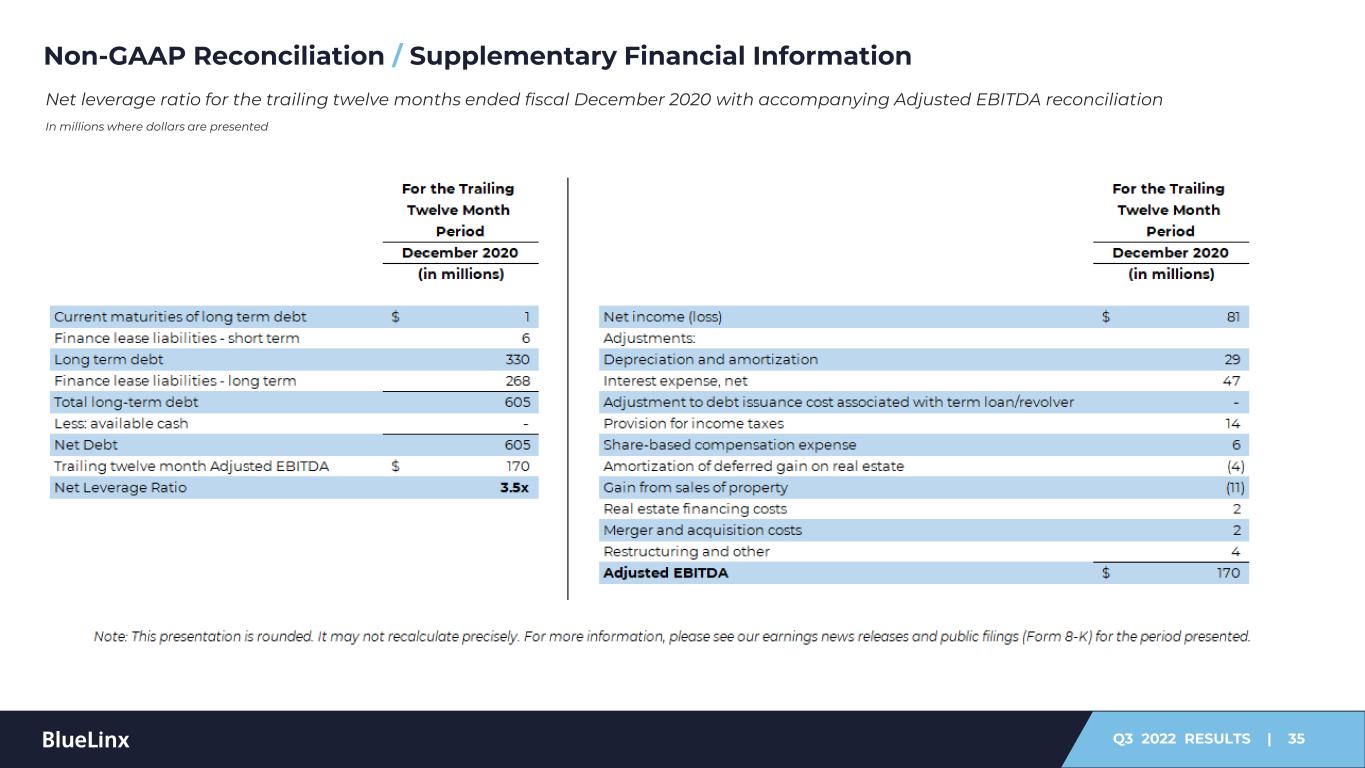

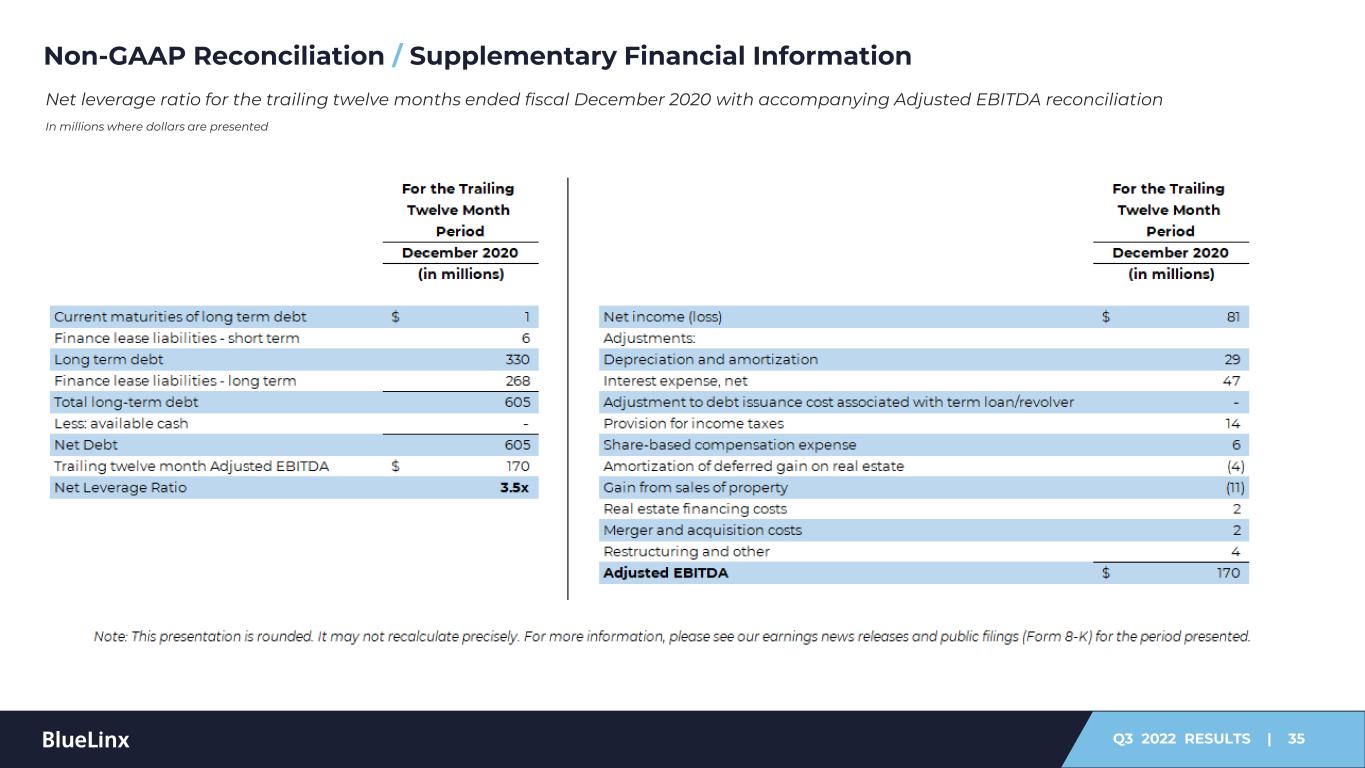

Q3 2022 RESULTS | 35 Non-GAAP Reconciliation / Supplementary Financial Information Net leverage ratio for the trailing twelve months ended fiscal December 2020 with accompanying Adjusted EBITDA reconciliation In millions where dollars are presented

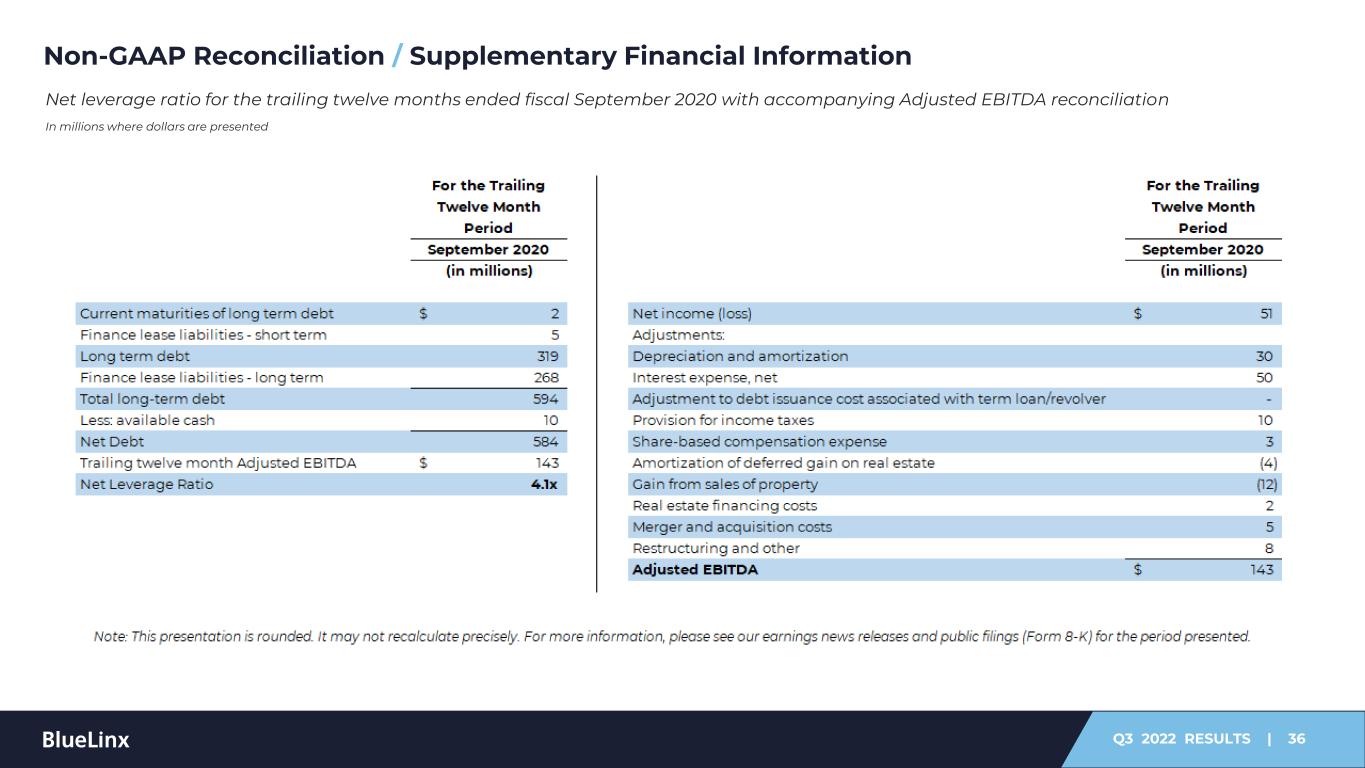

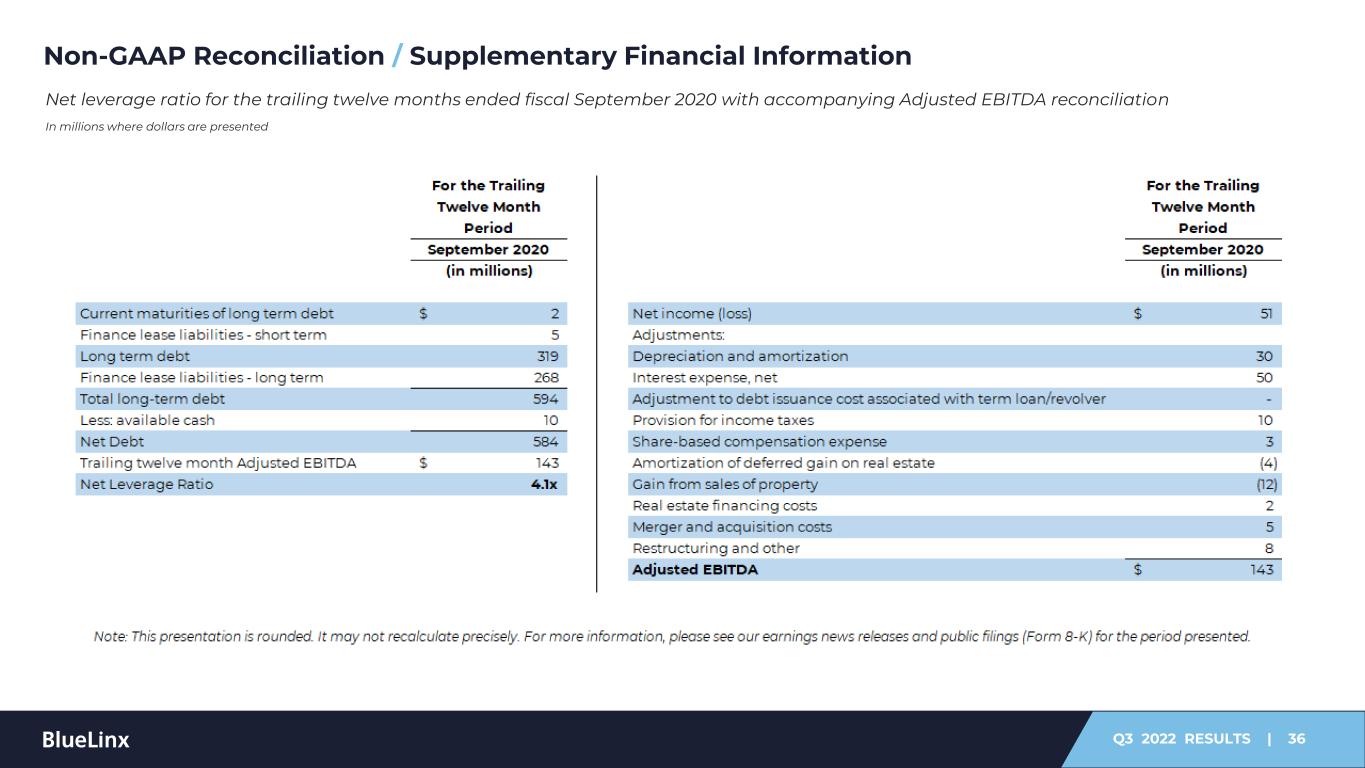

Q3 2022 RESULTS | 36 Non-GAAP Reconciliation / Supplementary Financial Information Net leverage ratio for the trailing twelve months ended fiscal September 2020 with accompanying Adjusted EBITDA reconciliation In millions where dollars are presented

Q3 2022 RESULTS | 37 Non-GAAP Reconciliation / Supplementary Financial Information Net leverage ratio for the trailing twelve months ended fiscal December 2019 with accompanying Adjusted EBITDA reconciliation In millions where dollars are presented

Q3 2022 RESULTS | 38 Non-GAAP Reconciliation / Supplementary Financial Information Note: These calculations are based on unaudited financials and preliminary estimates for September 2022 results provided by the seller Vandermeer Forest Products For the Trailing Twelve-Month Period September 2022 (in millions) Net Income $18.6 Adjustments: Depreciation and Amortization Expense $0.1 Other, net $0.5 Adjusted EBITDA $19.3 Net Sales $150.5 Adjusted EBITDA $19.3 Adjusted EBITDA Margin 13% Purchase Price of Business $63.4 Adjusted EBITDA $19.3 Purchase Price to Adjusted EBITDA Multiple 3.3x Adjusted EBITDA reconciliation and purchase price multiple for the trailing twelve months ended fiscal September 2022 In millions where dollars are presented