- MNTX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Manitex International (MNTX) CORRESPCorrespondence with SEC

Filed: 29 Jul 10, 12:00am

Confidential treatment of this Response Letter has been requested pursuant to 17 CFR 200.83. This Response Letter omits certain confidential information included in the unredacted version of the letter that was delivered to the SEC, Division of Corporation Finance. Asterisks denote such omissions.

Mr. Martin James

Senior Assistant Chief Accountant

Securities and Exchange Commission

Division of Corporation Finance

100 F Street NE

Washington, D.C. 20549

Re: | Manitex International, Inc. Form 10-K for fiscal year ended December 31, 2009 Filed on March 30, 2010 Form 10-Q for the quarterly period ended March 31, 2010 Amendment No. 1 to Form 8-K dated December 31, 2009 File No. 001-32401 |

Dear Mr. James: |

The following are our responses to the Staff’s comment letter of July 13, 2010 containing the Staff’s comments regarding the Company’s 10-K for the year ended December 31, 2009, the Company’s 10-Q for the quarter ended March 31, 2010 and Amendment No. 1 to Form 8-K dated December 31, 2009. For your convenience, the full text of each of the Staff’s comments is set forth below, and the Company’s response to each follows.

Form 10-K for the Fiscal Year Ended December 31, 2009

Note 3. Summary of Significant Accounting Policies, page 61

| 1. | We note that you disclose a revenue recognition policy for bill and hold arrangements. Please tell us the amount of revenues recorded related to bill and hold arrangements for each period presented. |

| Response | |

| SeeAnnex I. |

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

| 2. | In addition, please tell us how you evaluated those arrangements to determine when to recognize revenue including how you considered each factors in SAB Topic 13.A3.(a). |

| Response | |

| General Background - The bill and hold arrangements are related to the sale of our cranes (boom trucks and skycranes). With very limited exceptions, our cranes are built to our customers’ specifications. The customers will specify the make and model of the chassis, boom length, and whether there are features such as an enclosed cab or air conditioning, etc. Often the customer will supply a customer-owned chassis on which we will mount a crane. Customers’ orders are not accepted without a firm written purchase order being received, which includes a delivery date. | |

| The Company has past experience and a pattern of entering into bill and hold transactions with its dealers. Dealers are expected to make payments according to our normal terms. The Company actively pursues the collection of receivables based on its standard terms, and regularly receives payments when a crane is still in our possession. The customers have issued a firm purchase orders at specified prices and, therefore, have the risk of loss in the event of decline in market value of the goods. Finally, the Company’s custodial risk is insurable and the Company has purchased insurance which provides this coverage. | |

| SAB Topic 13.A3.(a). lists 7 factors that are to be considered in evaluating bill and hold arrangements. Attached as Exhibit I, is a sample of the bill and hold agreement that is executed by the customer. Reference to this document will be made as we address how we considered each of the 7 points below: | |

| 1. “The risk of ownership must have passed to the buyer.” |

SeeExhibit I. It specifically states the customer acknowledges and assumes risk of ownership. It also requires the customer to notify their insurance carrier.

2. “The customer must have made a fixed commitment to purchase the goods, preferably in written documentation.”

As stated above, customers’ orders are not accepted without a firm written purchase order being received, which includes a delivery date.

3. “The buyer, not the seller must request that the transaction be on a bill and hold basis. The buyer must have a substantial business purpose for ordering goods on a bill and hold basis. Such request should be set forth in writing by the buyer.”

The customer may ask to initiate a bill and hold arrangement following notification from the Company that manufacturing is completed and that a unit is ready for shipment. There are several reasons for the customer to request the completed unit be held at our location. For example, first, if the dealer has multiple locations and is not yet in a position to determine which location requires the unit, such dealer does not/may not want to incur the expense of shipping the unit twice. Second, if the dealer does not have sufficient yard space at the time to store the unit. Third, the dealer may

2

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

want to ship the unit directly to the end user to avoid the double expense of shipping the unit to the dealer and then to the end customer.

Our dealers are very sensitive to freight costs. Our dealers’ margins are significantly eroded when a dealer incurs double freight.

As noted on our bill and hold customer authorization, the customer requesting the bill and hold arrangement must indicate in writing the reasons for their request.

4. “There must be a fixed schedule for delivery of the goods. The date for delivery must be reasonable and must be consistent with the buyer’s business purpose.”

The bill and hold authorization asks the customer to specify an expected pick up or delivery date.

5. “The seller must not have retained any specific performance obligations such that the earning process is not complete.”

The Company only enters into a bill and hold arrangement when the unit is completed and ready to be shipped.

6. “The ordered goods must have been segregated from the seller’s inventory and not be subject to being used to fill other orders.”

Any unit invoiced under a bill and hold arrangement are physically segregated from the Company’s inventory. Since the cranes are customers’ property, they of course cannot be used to fill another customer order.

7. “The equipment must be complete and ready for shipment.”

See the responses to Comments 3 & 5 above.

Note 9. Goodwill and Other Intangible Assets, page 73

| 3. | Please describe to us in more detail the methods and assumptions used to determine your estimated fair value as of October 1, 2009 for the purposes of your goodwill impairment analysis. |

| Response | |

| The Company engaged a valuation expert to provide guidance and assistance to management which was considered and in part relied upon in completing goodwill impairment testing. Taking into account the expert’s valuation analysis, the Company used the following methods and assumptions: | |

| Methods |

3

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

For the estimation of the fair value of Manitex International, Inc.’s (“MNTX”) Lifting Equipment and Equipment Distribution reporting units, an Income Approach, Market Approach, and an Asset Approach were considered. Ultimately, the Income Approach (i.e., the Discounted Cash Flow (“DCF”) Method) and the Market Approach (i.e., the Guideline Public Company (“GPC”) Method) were employed in the estimation of the fair values of the reporting units. The Merger and Acquisition Method (a form of the Market Approach) was not applied given a lack of recent relevant merger and acquisition activity. Additionally, the Asset Approach was not utilized given the intangible value inherent in the reporting units.

In applying the DCF Method, management-prepared prospective financial information (“PFI”) and a market-derived weighted average cost of capital (“WACC”) were employed. The PFI includes the fiscal years ending December 31, 2009 through 2014 and contemplates prospective revenue, cost of sales, depreciation, selling, general, and administrative expenses, income taxes, capital expenditures, and changes in net working capital requirements.

The GPC Method is a valuation technique whereby the value of a company is estimated by comparing it to similar public companies. Criteria for comparability in the selection of publicly traded companies include operational characteristics, growth patterns, relative size, earnings trends, markets served, and risk characteristics. Each should be within a reasonable range of the subject reporting unit’s characteristics to make comparability relevant.

Once the 14 guideline public companies were selected, pricing multiples were developed by dividing the enterprise value (“EV”) (i.e., equity plus net interest-bearing debt) by earnings before interest, taxes, depreciation, and amortization (“EBITDA”). After analyzing the risk and return characteristics of the guideline companies relative to the subject reporting units, pricing multiples were applied to the EBITDA of the subject reporting units to estimate EV.

FASB ASC 820 prescribes that the measurement of the fair value of an asset or liability should be based on assumptions that market participants would use in pricing the asset or liability. Accordingly, the fair value measurements utilized in our analysis were determined based on the price that would be received to sell the reporting units, assuming a hypothetical transaction, at the measurement date (i.e., an exit price). In developing market-participant assumptions, FASB 820 provides that specific market participants need not be identified. Rather, characteristics that distinguish market participants generally should be identified, considering factors specific to (i) the asset or liability, (ii) the principal (or most advantageous) market for the asset or liability, and (iii) market participants whom the reporting entity would transact within that market.

In determining the highest and best use of an asset measured at fair value, considerations should include the use of the asset that is physically possible, legally permissible, and financially feasible as of the measurement date. Given the fact that the reporting units are producing a return in excess of that required on their tangible and intangible assets (i.e.,

4

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

there exists positive goodwill value), we determined the appropriate premise of value to be “in use” (i.e., through the use in combination with other assets as a group (as installed or as otherwise configured)) and that the highest and best use of the reporting units’ tangible and intangible assets is as operated and employed by the reporting units as of the measurement date.

The principal market is the market in which the reporting entity would sell the asset or transfer the liability with the greatest volume or level of activity for the asset or liability. Given that this analysis and report is premised on the price that would be received to sell the reporting units in a controlling transaction, the principal market for the reporting units is deemed to be the merger and acquisition (“M&A”) market. In our attempt to identify characteristics that distinguish market participants in the reporting units’ principal market, we selected a group of 14 publicly traded companies that operate in the construction, mining, and materials handling industries as well as the equipment rentals and leasing industries that we deemed comparable to the reporting units. The characteristics of these companies were relied on in our determination of rates of return to apply in the DCF Method, as well as the multiples applied under the GPC Method.

Next, we compared certain operating and financial metrics between the reporting units and the comparable, publicly traded companies in order to ensure that the valuation assumptions reflect assumptions that would be employed by a market participant.

Finally, we employed valuation methodologies that are consistent with approaches that would be employed by market participants in evaluating the reporting units. For example, the estimated WACC used in the DCF Method is based on market participant assumptions for the cost of equity, cost of debt, and capital structure as of the measurement date.

The inputs to valuation techniques employed in the measurement of fair value of the reporting units included Level 1, Level 2, and Level 3 inputs. However, because inputs classified within Level 3 (such as management-prepared financial projections) were significant in the fair value measurement, the fair value measurements for the reporting units were determined to fall within Level 3 of the fair value hierarchy.

Assumptions

SeeAnnex II.

| 4. | Further, we noted your disclosure that during the fourth quarter and as of December 31, 2009, your market capitalization was below book value. It also appears that this continues to be true throughout the first quarter of 2010. Please describe to us in more detail your consideration of your market capitalization in your evaluation of fair value as part of your goodwill analysis. |

| Response |

5

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

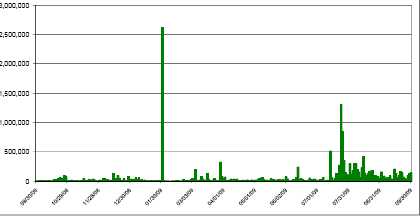

As of the goodwill impairment measurement date (i.e., October 1, 2009), Manitex’s stock was trading at a price of $2.35 per share, implying a total equity market capitalization of approximately $26.2 million and an EV of $56.5 million. However, Manitex’s publicly traded value is not believed to be indicative of fair value for several reasons. Manitex’s stock is thinly traded. Over the past year, Manitex’s average and median daily trading volume was approximately 66,000 and 18,000 shares, respectively, as shown in the graph below.

Manitex International, Inc. - Historical Volume

| These average and median daily trading volumes approximate one-half of 1% of Manitex’s total shares outstanding. Further, the Company does not provide guidance and had limited analyst coverage prior to the measurement date, with two analysts maintaining coverage. Institutional investors are less willing to purchase stock that does not have thorough analyst coverage. For these reasons, while Manitex’s market capitalization was considered, it was ultimately determined not to be representative of fair value of the reporting units. | |

| Our stock price has been very volatile. Our stock price was as low as $0.39 during the first quarter of 2009 and $0.52 during the third quarter of 2009 and as high as $2.99 in the fourth quarter of 2009. Our stock price has increased or decreased significantly (30% to 100%) over a short period of time. If fact, there has been at least one day where the difference between the high and low trading price varied by as much of 50%. The changes in our stock price cannot be explained by announcements by the Company or fundamental changes in the market. This supports our belief that our stock price is not a reliable indicator of the value of the company. | |

| 5. | Please tell us the amount of goodwill by reportable segment and how you considered the disclosure requirements of FASB ASC 805-30-50-1(e). |

| Response |

6

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

As of September 30, 2009, the Lifting Equipment and Equipment Distribution reporting units carried goodwill balances of $14,177,463 and $274,537, respectively. In our future filings, the amount of goodwill applicable to each reporting segment will disclosed separately as required by FASB ASC 805-30-50-1(e).

Note 18. Acquisitions in our 10-K dated December 31, 2009, also discloses the goodwill associated with each of the acquisitions and specifies to which segment the acquired assets or business belongs.

Note 18. Acquisitions, page 84

| 6. | Please provide us with your significance calculations under Instruction 4 to Item 2.01 of Form 8-K and Rule 8-04(b) of Regulation S-X for your acquisition of Badger Equipment Company on July 10, 2009. |

| Response | |

| Detailed calculations for the three significance tests for the July 10, 2009 acquisition of Badger Equipment Company are shown onExhibit II. | |

| 7. | You disclosed that the fair value of the stock consideration was established using the guideline public company method to establish an enterprise value for the company at the transaction date. As a result, you valued the 300,000 shares issued at $3.25 per share, or an aggregate value of $976,000. We note that the NASDAQ closing price of your stock on the date of acquisition, July 10, 2009, was $0.74. You note that you considered this value but believe it was not a reliable indicator of the value of the company because your trading volume on your stock is very limited, the company does not provide guidance nor is there is any significant analyst coverage. Describe to us the method and significant assumptions used in your valuation and explain how you considered FASB ASC 805-30- 30-07 in determining the fair value of the common shares issued in the acquisition. |

| Response | |

| FASB ASC 805-30-30-07 prescribes that “the consideration transferred in a business combination shall be measured atfair value(emphasis added), which shall be calculated as the sum of the acquisition-date fair values of the assets transferred by the acquirer, the liabilities incurred by the acquirer to former owners of the acquiree, and the equity interests issued by the acquirer.” | |

| The estimation of Manitex’s fair value (on a per-share basis) of $3.25 was determined in accordancewith the fair value standard as prescribed in FASB ASC Topic 820. | |

| Specifically, the Guideline Public Company Method was used in order to determine the enterprisevalue (“EV”) of Manitex as of July 10, 2009. The application of the GPC | |

| in this case is exactly consistent with the application of the GPC Method used in theannual goodwill impairment testing analysis, which was discussed in our response | |

| to Comment# 3 above. | |

7

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

The concluded EV as indicated by the GPC Method was adjusted to derive the fair value of equity per share for the following: (i) a deduction for interest-bearing debt, (ii) an addition for cash and cash equivalents, (iii) an addition for the present value of net operating loss carryforwards, and (iv) an addition for the present value of the tax benefit of amortization. This analysis yields the fair value of Manitex on a fully-diluted, per-share basis of $3.25.

The rationale (i.e., limited analyst coverage and low trading volume) for not using Manitex’s closing stock price of $0.74 per share on July 10, 2009 as an indication of fair value in the determination of transaction consideration is the same rationale as discussed in our response to Comment # 4 above.

| 8. | Please explain to us the purpose and rationale for the pro forma adjustment to move the gain on bargain purchase of $3,815,000 from 2009 to 2008 and similar adjustment in Note 5 of your March 31, 2010 Form 10-Q to move the gain on bargain purchase of $3,715,000 and a tax benefit of $1,893,000 to the first quarter from the third and fourth quarters. Tell us why you made these adjustments and how you considered the guidance in Article 11-02(b)(5) of Regulation S-X. Refer to our comments below on your pro forma financial information included in your Form 8-K. |

| Response | |

| The Company acquired Badger Equipment Company on July 10, 2009 and the assets of Load King on December 31, 2009. Under ASC 805, a bargain purchase gain is recorded on the date of acquisition when the value of assets acquired exceeds consideration paid. It was determined that the assets acquired exceeded the consideration paid for Badger and Load King by $900,000 and $2,915,000, respectively. | |

| Additionally, as part of the purchase price allocation, a deferred tax liability was established. As a result, the Company decreased its valuation allowance by $1,893,000 and recognized a tax benefit in that amount. | |

| Article 11-02(a) states that “financial information should provide investors with information about continuing impact of a particular transaction by showing how it might have affected historical financial statements if the transaction had been consummated at an earlier time. Such statements should assist investors analyzing the future prospect of the registrants because they illustrate the possible scope of the change in the registrant’s historical financial position and results of operations caused by the transaction.” | |

| Additionally, Article 11-02(b)(6) states “Pro forma adjustments related to the pro forma condensedincome statement shall be computed assuming the transaction was | |

| consummated at the beginning of the fiscal year presented and shall include adjustments whichgive effect to events that are (i) directly attributable to the transaction; (ii) expect | |

| have a continuing impact on the registrant; (iii) are factually supportable.” | |

| Article 11-02(b)(5) states “The pro forma condensed income statement shall disclose (loss) from continuing operations before nonrecurring charges or credits directly |

8

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

attributable to the transaction”. We believe the bargain purchase gain is not a nonrecurring item as it has a continuing impact on our future financial statements for the reasons noted below.

Recording the gain on the bargain purchase and recognizing the tax benefit have a continued income statement effect. Amortization of intangibles for the periods presented and future periods is based on the allocated purchase price. As a result of recognizing the gain on the bargain purchase, the amount allocated to trade names and trademarks, patented and unpatented technology, customer relationships and customer backlog is increased significantly. Accordingly, amortization expense for periods presented and future periods is also significantly higher. If the tax benefit was not recognized, tax expenses in future years would lower as there would be net operating losses for which no benefit was recognized available to offset future income.

Our position is further supported by the fact Article 11-02(b)(8)2 states “pro forma adjustment for the income statement shall include amortization of goodwill, depreciation and other adjustments based on the allocated purchase price of net assets acquired.” The gain on the bargain purchase is recorded based on the allocated purchase price of net assets acquired.

The pro forma disclosures in the 10-K for the year ended December 31, 2009 and the 10-Q for the quarterly period ended March 31, 2009 assume that the transactions were consummated on January 1, 2008 and January 1, 2009. As such, the bargain purchase gains and the tax benefit would have been recorded on assumed date of acquisitions, i.e., January 1, 2008 or January 1, 2009. The above pro forma entries were made to reflect the gain on bargain purchase and the tax benefit as of the assumed acquisition dates, i.e., January 1, 2008 or January 1, 2009. If the bargain purchase gains were excluded the objective as outlined Article 11-02 (a) to show how historic financial statements would have been affected if the transactions had been consummated at an earlier time is not achieved.

In our opinion, it would have been misleading to reflect the higher amortization expense and not to reflect the gain on the bargain purchase which caused the increase in future amortization expense. We believe that it would also be misleading not to show a tax benefit that would have the impact of increasing future years’ tax expense.

| 9. | We note the various disclosures in this section with respect to your use of independent appraisals. Please describe to us and revise future filings to clarify the nature and extent of the third party appraiser’s involvement and management’s reliance on the work of the independent appraisers. Please refer Question 141.02 of the Compliance and Disclosure Interpretations on the Security Act Sections, which can be found athttp://www.sec.gov/divisions/corpfin/guidance/sasinterp.htmand which would be applicable to the extent your Form 10-K is incorporated by reference into any registration statement. |

| Response |

9

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

The answer to question 141.02 states that “the registrant has no requirement to make reference to a third party expert simply because the registrant used or relied on the third party expert report or valuation opinion in connection with the preparation of Securities Act registration statement.”

After reviewing the above guidance, our future filings will not make reference to “utilizing” independent appraisals. Accordingly, the following sentence will be replaced in future filings: “Our assessment and valuation of the acquisition utilized professional independent valuation advisors and tax advisors.” The deleted sentence will be replaced with the following sentence. “The Company engaged a valuation expert and a tax advisor to provide guidance and assistance to management which was considered and in part relied upon in completing its purchase price allocation.”

Attached asAnnex III, is draft of the revised disclosure for your review.

Controls and Procedures, page 110

10. We note your disclosure regarding your officers’ conclusion about the effectiveness of the company’s disclosure controls and procedures. While you are not required to include the definition of disclosure controls and procedures in your conclusion, when you do so in future filings, please revise that definition to be consistent with the language that appears in the definition of “disclosure controls and procedures” set forth in Rule 13a-15(e) of the Exchange Act. Alternatively, in future filings you may remove the definition.

Response

In future filings, the definition of disclosure controls will be either modified to make the definition consistent with the language that appears in the definition of “disclosure controls and procedures” set forth in Rule 13a-15(e) of the Exchange Act or it will be removed from the officers’ conclusion about the effectiveness of the company’s disclosure controls and procedure.

Form 10-Q for the Quarterly Period Ended March 31, 2010

Note 16. Transactions between the Company and Related Parties, page 25.

11. Please tell us the significant terms of the transaction whereby, in January 2009. Mr. Langevin assigned his ownership interest in GT to Bob Litchev, a Senior Vice President of Manitex International, Inc. Tell us the amount of and the type of consideration paid by Mr. Litchev to Mr. Langevin for the ownership interest in GT.

Response

As stated in our filings, Mr. Langevin assigned his 38.80% ownership interest in GT to Mr. Litchev in January 2009. The assignment transaction was made without an exchange of consideration between Mr. Litchev and Mr. Langevin.

Amendment No. 1 to Form 8-K dated December 31, 2009

10

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

Exhibit 99.3 Unaudited Pro Forma Condensed Consolidating Financial Statements:

12. In your unaudited pro forma condensed consolidating statement of income for the year ended December 31, 2008, you included an adjustment to eliminate the historic goodwill impairment of Terex Load King of $7,992,000. Please tell us how you considered the guidance in Article 11-02(b)(6) of Regulation S-X. In this regard, discuss the basis for eliminating the historical goodwill impairment charge recorded by Terex.

Response

In our rational to eliminate the historical goodwill impairment charge, we considered article 11-02(b)(6) as well as other sections we deemed relevant contained in article 11-02 of Regulation S-X and concluded the following:

Article 11-02(a) states that “financial information should provide investors with information about continuing impact of a particular transaction by showing how it might have affected historical financial statements if the transaction had been consummated at an earlier time. Such statements should assist investors analyzing the future prospect of the registrant because they illustrate the possible scope of the change in the registrant’s historical financial position and results of operations caused by the transaction.”

The Load King acquisition was an asset purchase in which the Company purchased specific tangible and specific intangible assets, including trade names, technology, etc. The Company did not purchase the prior owner’s historic goodwill. In an acquisition assets (including intangible assets) and liabilities are valued at their fair market value at date of acquisition. Goodwill is recognized when the consideration paid exceeds the net value of all other assets acquired. Under ASC 805, if the value of assets acquired exceeds consideration paid, then a gain on a bargain purchase is recorded on the date of acquisition. Under no circumstance is an impairment of goodwill recognized on date of acquisition.

Regardless of date of acquisition, the Company’s historic financial statements would never reflect the $7,992,000 impairment charge that Terex recorded in income for the year ended December 31, 2008. We believe that to include this charge would be misleading to investors as “scope of the change in the registrant’s historical financials and results of operations caused by the transaction” would never have resulted in this charge being recorded in the Company’s financial statements.

Our position is further supported by the fact Article 11-02(b)(8)2 states “pro forma adjustment for the income statement shall include amortization of goodwill, depreciation and other adjustments based on the allocated purchase price of net assets acquired.” The pro forma adjustment was made to remove the impairment charge (an “other adjustment”) as it is not “based on the allocated purchase price of net assets acquired”.

13. Further, you also included an adjustment to include a gain on the bargain purchase of Terex Load King of $2,832,000. Please tell us how you considered the guidance in

11

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

Article 11-02(b)(5) of Regulation S-X. In this regard, discuss why you believe it was appropriate to include the gain on the bargain purchase since it appears that this adjustment is a nonrecurring credit that is directly attributed to the transaction.

Response

Article 11-02(b)(5) states “The pro forma condensed income statement shall disclose income (loss) from continuing operations before nonrecurring charges or credits directly attributable to the transaction”. We believe the bargain purchase gain is not a nonrecurring item as it has a continuing impact on our future financial statements for the reasons noted in our response to Comment # 8 above and for the reasons further detailed below.

Article 11-02(b)(8)2 states “pro forma adjustment for the income statement shall include amortization of goodwill, depreciation and other adjustments based on the allocated purchase price of net assets acquired.” The gain on the bargain purchase is an adjustment that is “based on the allocated purchase price of net assets acquired,” as a gain is recognized on the date of acquisition under ASC 805, when the value of assets acquired exceeds consideration paid.

Pro forma adjustments are entries which arenotrecorded in the Company’s actual financial statements. For example, a pro forma adjustment is made to record interest expense on acquisition debt from the assumed 8-K acquisition date. The Company’s actual financial statements of course do not include any interest expense for the period before the actual acquisition date.

Under ASC 805, a bargain purchase gain is recorded in the Company actual financial statements on the date of acquisition when the value of assets acquired exceeds consideration paid. If the bargain purchase gain were excluded the objective as outlined Article 11-02 (a) to show how historic financial statements would have been affected if the transaction had been consummated at an earlier time is not achieved.

Finally, recording the gain on the bargain purchase has a continued income statement effect. Amortization of intangibles for the periods presented and future periods is based on the allocated purchase price. As a result of recognizing the gain on the bargain purchase, the amount allocated to trade names and trademarks, patented and unpatented technology, customer relationships and customer backlog is increased significantly. Accordingly, amortization expense for periods presented and future periods is also significantly higher. In our opinion, it is misleading to reflect the higher amortization expense and not to reflect the gain on the bargain purchase which caused the increase in future amortization expense.

The Company acknowledges that

12

Manitex International, Inc. requests confidential treatment of this letter pursuant to 17 CFR 200.83.

***************************************************************************** Please do not hesitate to contact the undersigned at (708) 237-2078 if you have any questions or comments regarding the foregoing responses.

Very truly yours,

/s/ David H. Gransee

David H. Gransee

Vice President and Chief Financial Officer

| cc: | Kate Tillan, Assistant Chief Accountant |

13

Confidential treatment of this Response Letter has been requested pursuant to 17 CFR 200.83. This Response Letter omits certain confidential information included in the unredacted version of the letter that was delivered to the SEC, Division of Corporation Finance. Asterisks denote such omissions.

Annex I

[*]

Confidential treatment of this Response Letter has been requested pursuant to 17 CFR 200.83. This Response Letter omits certain confidential information included in the unredacted version of the letter that was delivered to the SEC, Division of Corporation Finance. Asterisks denote such omissions.

Annex II

[*]

Confidential treatment of this Response Letter has been requested by Manitex International, Inc. pursuant to 17 CFR 200.83.

Annex III

5. Acquisitions

Badger Equipment Company

On July 10, 2009, Manitex International, Inc. completed the acquisition of 100% of the capital stock of Badger Equipment Company, a Minnesota corporation, (“Badger”) pursuant to a Stock Purchase Agreement (the “Purchase Agreement”) with Avis Industrial Corporation, an Indiana corporation (“Avis”). Badger produces specialized rough terrain cranes and material handling products, including a newly introduced 30-ton model, the first in new line of specialized high quality rough terrain cranes. Badger primarily serves the needs of the construction, municipality, and railroad industries. The Company acquired Badger primarily to obtain the recently developed new 30 ton Rough Terrain crane together with Badger’s long standing crane legacy and niche customer relationships. These provide significant additional markets for the Company and are also strategically aligned with its existing lifti ng equipment segment.

During the assessment of the Badger acquisition it became apparent that the transaction may result in a bargain purchase. Our initial view was that a favorable price had been negotiated due to there being no open market sale process due to the long standing relationship with Avis since 2000. In addition, Avis did not use any outside advisors for the transaction and needed to focus on its core (mainly automotive) businesses that were under significant pressure in the current economy. The Company engaged a valuation expert and a tax advisor to provide guidance and assistance to management which was considered and in part relied upon in completing its purchase price allocation. A physical count of the inventory and fixed assets was conducted. As required by accounting standard, FASB ASC 805-30-30, a reassessment was conducted to ensure that assets and liabilities were completely identified and fairly valued which inclu ded a decision to a further review of the fair value of the real estate and the consideration given including the stock in Manitex International Inc and the interest bearing promissory note.

| The fair value of the purchase consideration was $5,112 as follows: | |||

| Fair Value | |||

| Cash | $ | 40 | |

| 300,000 shares of Manitex International Inc stock | 976 | ||

| Interest-bearing promissory note | 2,440 | ||

| Capital lease obligation | 1,656 | ||

| Total purchase consideration | 5,112 | ||

| Less: none cash items and cash received; | |||

| Manitex International, Inc. common stock | (976 | ) | |

| Promissory note | (2,440 | ) | |

| Capital lease | (1,656 | ) | |

| Cash received in the acquisition | (1 | ) | |

| Net cash consideration paid | $ | 39 | |

| Purchase Price allocation | |||

| Cash | $ | 1 | |

| Inventory | 2,301 | ||

| Machinery & equipment | 698 | ||

| Land & buildings | 1,700 | ||

| Accounts receivable | 604 | ||

Confidential treatment of this Response Letter has been requested by Manitex International, Inc. pursuant to 17 CFR 200.83.

| Fair Value | |||

| Deferred taxes | 345 | ||

| Prepaid expenses | 10 | ||

| Trade names & trademarks | 600 | ||

| Unpatented technology | 810 | ||

| In-process research and development | 100 | ||

| Dealer relationships | 440 | ||

| Accounts payable | (560 | ) | |

| Accrued expenses | (354 | ) | |

| Deferred tax liability | (683 | ) | |

| Gain on bargain purchase | (900 | ) | |

| Net assets acquired | $ | 5,112 |

Manitex International Inc. stock- The fair value of the stock consideration was established using the guideline public company method to establish an enterprise value for the Company at the transaction date, which resulted in a per share value of $3.25 or an aggregate value of $976 for the three hundred thousand shares. While the NASDAQ closing price was considered in our valuation of fair value, the market price of our stock is only one indicator. It has been our opinion that it is simply not a reliable indicator of the value for the Company, either now or in the past. Our conclusion is based on the fact that trading volume on our stock is very limited, the Company does not provide guidance nor is there is any significant analyst coverage. Furthermore, very modest sized trades can impact the stock price significantly because our trading volume is so low.

Interest-bearing Promissory Note -Under the terms of the Purchase Agreement, the Company promises to pay Avis the principal sum of $2,750 at an interest rate of 6.0% per annum from the date of the Transaction through July 10, 2014. The Promissory Note requires the Company to make interest only payments commencing on October 1, 2009 and continuing on the first day of each subsequent quarter thereafter. Furthermore principal payments will be paid annually, in the amount of $550 commencing on July 10, 2010 and continuing on each subsequent July 10th for the following four years. The Agreement also states that the Promissory Note is secured by all of the outstanding shares of capital stock of Badger. The fair value of the promissory note was calculated to be equal to the present value of the future debt payments discounted at a marke t rate of return commensurate with similar debt instruments with comparable levels of risk and marketability. A rate of interest of 11% was determined to be the appropriate rate following an assessment of the risk inherent in the debt issue and the market rate for debt of this nature using corporate credit ratings criteria adjusted for the lack of public markets for this Note. The calculated fair value was $2,440.

Confidential treatment of this Response Letter has been requested by Manitex International, Inc. pursuant to 17 CFR 200.83.

Capital Lease obligation -The Company entered into a five year lease for the Badger premises which expires in April 2018 that provides for annual rent of $0.3 million payable in twelve equal monthly installments. The lease has been classified as a capital lease under the provisions of ASC 840-10. The Company has an option to purchase the facility for $500 at the end of the lease by giving notice to Landlord of its intent to purchase the Facility. The fair value of this obligation was calculated by discounting the payments required under the lease by a discount factor of 6.125%, a rate that is considered to be the market rate for similar mortgage type transactions. The calculated fair value was $1,656.

Under the acquisition method of accounting, the total acquisition consideration is allocated to the assets acquired and liabilities assumed based on their fair values as of the date of the acquisition as shown below.

Cash and other tangible assets and liabilities:The tangible assets and liabilities were valued at their respective carrying values by Badger, except for certain adjustments necessary to state such amounts at their estimated fair values at the acquisition date.

Intangible assets: There are three fundamental methods applied to value intangible assets outlined in FASB ASC 820. These methods include the Cost Approach, the Market Approach, and the Income Approach. Each of these valuation approaches was considered in our estimation of value.

Trade names and trademarks and Unpatented Technology:Valued using the Relief from Royalty method, a form of both the Market Approach and the Income Approach. Because the Company has established trade names and trademarks and has developed unpatented technology, we estimated the benefit of ownership as the relief from the royalty expense that would need to be incurred in absence of ownership.

In-process research and technology and dealer relationships:Because there is a specific earnings stream that can be associated exclusively with the in-process research and development and with the dealer relationships, we determined the discounted cash flow method was the most appropriate methodology for valuation.

Gain on bargain purchase:In accordance with ASC 805, any excess of fair value of acquired net assets over the acquisition consideration results in a bargain purchase. Prior to recording a gain, the acquiring entity must reassess whether all acquired assets and assumed liabilities have been identified and recognized and perform remeasurements to verify that the consideration paid, assets acquired and liabilities assumed have been properly valued. The Company, together with its advisors, underwent such a reassessment, and as a result, has recorded a gain on bargain purchase of $900. In accordance with acquisition method of accounting, any resulting gain on bargain purchase was recognized in earnings on the acquisition date. The Company believes that the gain on bargain purchase resulted from the negotiation of a favorable price for Badger due to there being no open market sale process due to the long standing relationship with Avis since 2000, Avis not using any outside advisors for the transaction and the fact that Avis needed to focus on its core (mainly automotive) businesses that were under significant pressure in the current economy.

Acquisition transaction costs:The majority of acquisition transaction costs were the responsibility of the seller, Avis Industrial Corp, who paid for legal costs. Due diligence and other legal activities were performed by internal Company employees. Costs for valuation and tax services amounted to $17 and are recorded in selling, general and administration expense for the quarter ended September 30, 2009.

The results of the acquired Badger operations have been included in our consolidated statement of operations since July 10, 2009, the acquisition date. The results of Badger also form part of the segment disclosures for the Lifting Equipment segment.

Terex Load King Acquisition

On December 31, 2009, Manitex International, Inc. completed the purchase of the assets and certain liabilities of Terex Load King Trailers, (“Load King”) an Elk Point, South Dakota-based manufacturer of specialized custom trailers and hauling systems typically used for transporting heavy equipment, pursuant to an Asset Purchase Agreement with Genie Industries, Inc., a subsidiary of Terex Corporation. Load King primarily serves the commercial construction, railroad, oilfield service, military and equipment rental industries. The Company acquired Load King primarily because of its long standing legacy niche products and customer relationships. These attributes

Confidential treatment of this Response Letter has been requested by Manitex International, Inc. pursuant to 17 CFR 200.83.

provide significant additional markets for the Company combined with its synergy with existing material handling products within the Company’s lifting equipment segment.

During the assessment of the processing of the Load King acquisition it became apparent that the transaction may result in a bargain purchase. This supported an initial view that a favorable price had been negotiated due to the transaction being completed with a motivated seller as Terex Corporation (Terex.) desired to restructure its operations and focus on core competencies. Additionally, although Terex employed an investment banker to solicit potential buyers, Manitex was the only bidder identified willing to consummate a transaction with terms attractive to Terex (i.e. the only bidder who was willing to purchase substantially all the assets of Load King).

The Company engaged a valuation expert and a tax advisor to provide guidance and assistance to management which was considered and in part relied upon in completing its purchase price allocation. Physical assets had been reviewed and visited. As required by accounting standard, FASB ASC 805-30-30, a reassessment was conducted to ensure that assets and liabilities were completely identified and fairly valued which included a further review of the fair value of consideration.

The fair value of the purchase consideration was $2,960 as follows:

| Fair Value | |||

| Cash | $ | 100 | |

| 130,890 shares of Manitex International Inc stock | 250 | ||

| Interest-bearing promissory note | 2,580 | ||

| Contingent consideration | 30 | ||

| Total purchase consideration | 2,960 | ||

| Less: none cash items and cash received; | |||

| Manitex International, Inc. common stock | (250 | ) | |

| Promissory note | (2,580 | ) | |

| Contingent consideration | (30 | ) | |

| Net cash consideration paid | $ | 100 |

Manitex International Inc. stock. The fair value of the stock consideration was determined to be $250, as the Asset Purchase Agreement contained a methodology to determine the number of shares equal to $250.

Interest-bearing Promissory Note.Per the terms of the Agreement, Manitex promised to pay Genie Industries, Inc. the principal sum of $2,750 at an interest rate of 6.0% per annum from the date of the Transaction through December 31, 2016. The Promissory Note requires Manitex to make interest payments commencing on December 31, 2009 and continuing on the last day of each subsequent quarter through and including December 31, 2016. Furthermore, principal payments equal to one-sixth of the principal sum (i.e., approximately $458) will be paid annually, commencing on December 31, 2011 and continuing on each subsequent December 31 for the following five years. The Promissory Note is secured by certain real property and machinery and equipment of Load King, located in South Dakota.

The note was recorded at its fair value on date of issuance at $2,580. The fair value of the promissory note was calculated to be equal to the present value of the future debt payments discounted at a market rate of return commensurate with similar debt instruments with comparable levels of risk and marketability. A rate of interest of 8% was determined to be the appropriate rate following an assessment of the risk inherent in the debt issue and the market rate for debt of this nature using corporate credit ratings criteria adjusted for the lack of public markets for this Note. The difference between face amount of the note and its fair value is being amortized over the life of the note, and is being charged to interest expenseContingent Consideration.In ac cordance with ASC 805, the acquirer is to recognize the acquisition date fair value of contingent consideration. The agreement has a contingent consideration provision which provides for a onetime payment of $750 if net revenues are equal to or greater than $30,000 in any of the next three years, i.e., 2010, 2011 or 2012. Given the disparity between the revenue threshold and the Company’s projected financial results, it was determined that a Monte Carlo simulation analysis was appropriate to determine the fair value of contingent

Confidential treatment of this Response Letter has been requested by Manitex International, Inc. pursuant to 17 CFR 200.83.

consideration. It was determined that the probability weighted average earn out payment is $30. Based thereon, we determined the fair value of the contingent consideration to be $30.

Under the acquisition method of accounting, in accordance ASC 805, Business Combinations, the assets acquired and liabilities assumed are valued based on their estimated fair values as of the date of the acquisition as shown below.

| Purchase Price allocation: | |||

| Inventory | $ | 1,841 | |

| Machinery & equipment | 1,716 | ||

| Land & buildings | 2,610 | ||

| Accounts receivable | 464 | ||

| Prepaid expenses | 5 | ||

| Trade names & trademarks | 420 | ||

| Unpatented technology | 670 | ||

| Accounts payable | (144 | ) | |

| Accrued expenses | (150 | ) | |

| Deferred tax liability | (1,557 | ) | |

| Gain on bargain purchase | (2,915 | ) | |

| Net assets acquired | $ | 2,960 |

Tangible assets and liabilities:The tangible assets and liabilities were valued at their respective carrying values by Load King, except for certain adjustments necessary to state such amounts at their estimated fair values at the acquisition date. A significant fair market adjustment to land and building was made. Fair market adjustments, which were not significant, were also made to adjust machinery and equipment and inventory.

Intangible assets:There are three fundamental methods applied to value intangible assets outlined in FASB ASC 820. These methods include the Cost Approach, the Market Approach, and the Income Approach. Each of these valuation approaches was considered in our estimation of value.

Trade names and trademarks and Unpatented Technology:Valued using the Relief from Royalty method, a form of both the Market Approach and the Income Approach. Because the Company has established trade names and trademarks and has developed unpatented technology, we estimated the benefit of ownership as the relief from the royalty expense that would need to be incurred in absence of ownership.

Gain on bargain purchase:In accordance with ASC 805, any excess of fair value of acquired net assets over the acquisition consideration results in a bargain purchase. Prior to recording a gain, the acquiring entity must reassess whether all acquired assets and assumed liabilities have been identified and recognized and perform remeasurements to verify that the consideration paid, assets acquired and liabilities assumed have been properly valued. The Company, together with its advisors, underwent such a reassessment, and as a result, has recorded a gain on bargain purchase of $2,915. In accordance with acquisition method of accounting, any resulting gain on bargain purchase must be recognized in earnings on the acquisition date. The gain on bargain purchase is disclosed on a separate line in the Company consolidated statement of o perations for year ended December 31 2009. The Company believes that the gain on bargain purchase resulted from the negotiation of a favorable price for Load King due to the transaction being completed with a motivated seller who desired to restructure its operations and focus on core competencies. Additionally, although the Seller employed an investment banker to solicit potential buyers, Manitex was the only bidder identified willing to consummate a transaction with terms attractive to Terex (i.e. the only bidder who was willing to purchase substantially all the assets of Load King).

Acquisition transaction costs:The Company incurred $54 in legal fees in connection with the Load King acquisition. Due diligence and other activities were performed by internal Company employees. Internal cost and legal fees are recorded in recorded in selling, general and administration expense in 2009. Costs for prior years audits, valuation and tax services preformed after December 31, 2009 are approximately $86 and have been recorded in the first quarter of 2010.

Confidential treatment of this Response Letter has been requested by Manitex International, Inc. pursuant to 17 CFR 200.83.

The results of the acquired Load King operations have been included in our consolidated statement of operations since December 31, 2009, the acquisition date. The results of Load King also form part of the segment disclosures for the Lifting Equipment segment.

Pro Forma Results

The following unaudited pro forma information assumes the acquisition of Badger Equipment Company and Terex Load King occurred on January 1, 2009. The unaudited pro forma results have been prepared for informational purposes only and do not purport to represent the results of operations that would have been had the acquisition occurred as of the date indicated, nor of future results of operations. The unaudited pro forma results for the three months ended March 31, 2009 are as follows (in thousands, except per share data)

| Three Months Ended | ||

| March 31, | ||

| 2009 | ||

| Net revenues | $ | 17,611 |

| Net income | $ | 4,158 |

| Income per share | ||

| Basic | $ | 0.37 |

| Diluted | $ | 0.37 |

Pro Forma Adjustment Note

A Pro Forma adjustment was made to give effect to the amortization of the intangibles recorded as a result of the acquisition, which would have resulted in $54 of additional amortization expense. Pro Forma adjustments to interest expense was made to reflect interest on the promissory notes issued in connection with the acquisitions, the capital lease executed in the Badger acquisition and to eliminate interest expense for Badger debt not assumed in the transaction. The net effect was to increase interest expense by $137. Pro Forma adjustments were made to account for the changes in depreciation expense based on the value of fixed as determined in the purchase price allocation. The effect was to decrease depreciation expense by $7. A pro forma adjustment was made to move the gain on bargain purchases of $3,715 and a tax benefit of $1,893 to the first quarter from the third quarter and fourth quarters.

Basic and diluted shares outstanding were increased by 430,890 shares.

Confidential treatment of this Response Letter has been requested pursuant to 17 CFR 200.83. This Response Letter omits certain confidential information included in the unredacted version of the letter that was delivered to the SEC, Division of Corporation Finance. Asterisks denote such omissions.

Exhibit I

[*]

Confidential treatment of this Response Letter has been requested pursuant to 17 CFR 200.83. This Response Letter omits certain confidential information included in the unredacted version of the letter that was delivered to the SEC, Division of Corporation Finance. Asterisks denote such omissions.

Manitex International, Inc.

Exhibit II

[*]