- MNTX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Manitex International (MNTX) DEF 14ADefinitive proxy

Filed: 1 May 06, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

VERI-TEK INTERNATIONAL, CORP.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No: |

| 3) | Filing Party: |

| 4) | Date Filed: |

May 11, 2006

Dear Veri-Tek Stockholder:

You are cordially invited to attend the 2006 annual meeting of stockholders of Veri-Tek International, Corp. which will be held on Tuesday, May 30, 2006 at 10:00 a.m. (Eastern Standard Time) in the Board Room, located at 33 Bloomfield Hills Parkway, Bloomfield Hills, Michigan 48304 and thereafter as it may be adjourned from time to time.

At this year’s annual meeting, you will be asked to elect three (3) directors; ratify the selection of Freedman & Goldberg, PLLC as our independent auditors for fiscal 2006; and transact such other business as may properly come before the meeting or any adjournments thereof.

Details of the matters to be considered at the meeting are contained in the attached notice of annual meeting and proxy statement, which we urge you to consider carefully.

As a stockholder, your vote is important. Whether or not you plan to attend the meeting, please complete, date, sign and return your proxy card promptly in the enclosed envelope which requires no postage if mailed in the United States. Alternatively, you may vote through the Internet atwww.voteproxy.com or by telephone at 1-800-PROXIES. If you attend the meeting, you may vote in person if you wish, even if you have previously returned your proxy card.

Thank you for your cooperation, continued support and interest in VERI-TEK INTERNATIONAL, CORP.

| Sincerely, |

Michael C. Azar |

Secretary |

VERI-TEK INTERNATIONAL, CORP.

50120 Pontiac Trail

Wixom, MI 48393

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 30, 2006

10:00 a.m.(Eastern Standard Time)

Notice is hereby given that the Annual Meeting of Stockholders of Veri-Tek International, Corp. will be held in the Board Room, located at 33 Bloomfield Hills Parkway, Bloomfield Hills, Michigan 48304 on Tuesday, May 30, 2006 at 10:00 a.m. (Eastern Standard Time) to consider and vote upon:

| 1. | The election of three (3) Directors to serve for a one year term expiring at the Annual Meeting of Stockholders to be held in 2007 or until their successors have been duly elected and qualified. The Proxy Statement which accompanies this notice includes the names of the nominees to be presented by the Board of Directors for election; |

| 2. | Ratification of Freedman & Goldberg, PLLC as independent public accountants of the Company; and |

| 3. | The transaction of such other business as may properly come before the Annual Meeting and any adjournment(s) thereof. |

The Board of Directors has fixed the close of business on May 5, 2006 as the record date for determination of Stockholders entitled to notice of, and to vote at, the Annual Meeting.To assure that your shares will be represented at the Annual Meeting, please either (1) mark, sign, date and promptly return the accompanying Proxy in the enclosed envelope, (2) vote utilizing the automated telephone feature described in the Proxy, or (3) vote over the Internet pursuant to the instructions set forth on the Proxy. You may revoke your Proxy at any time before it is voted.

Stockholders are cordially invited to attend the meeting in person. Please indicate on the enclosed Proxy whether you plan to attend the meeting. Stockholders may vote in person if they attend the meeting even though they have executed and returned a Proxy.

| By Order of the Board of Directors, |

/s/ MICHAEL C. AZAR |

Michael C. Azar Secretary |

Dated: May 11, 2006

VERI-TEK INTERNATIONAL, CORP.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

INTRODUCTION

This Proxy Statement is furnished by the Board of Directors of Veri-Tek International, Corp., a Michigan corporation, (the “Company”) in connection with the solicitation of proxies for use at the Annual Meeting of Stockholders to be held on May 30, 2006 and at any adjournments thereof. The Annual Meeting has been called to consider and vote upon (1) the election of three (3) Directors, (2) the ratification of Freedman & Goldberg, PLLC as the Company’s independent public accountants, and (3) such other business as may properly come before the Annual Meeting or any adjournment(s) thereof. This Proxy Statement and the accompanying Proxy are being sent to Stockholders on or about May 11, 2006.

Persons Making the Solicitation

The Proxy is solicited on behalf of the Board of Directors of the Company. The original solicitation will be by mail. Following the original solicitation, the Board of Directors expects that certain individual Stockholders will be further solicited through telephone or other oral communications from the Board of Directors. The Board of Directors does not intend to use specially engaged employees or paid solicitors. The Board of Directors intends to solicit Proxies for shares which are held of record by brokers, dealers, banks or voting trustees, or their nominees, and may pay the reasonable expenses of such record holders for completing the mailing of solicitation materials to persons for whom they hold shares. All solicitation expenses will be borne by the Company.

Terms of the Proxy

The enclosed Proxy indicates the matters to be acted upon at the Annual Meeting and provides boxes to be marked to indicate the manner in which the Stockholder’s shares are to be voted with respect to such matters. By appropriately marking the boxes, a Stockholder may specify whether the proxyholder shall vote for or against or shall be without authority to vote the shares represented by the Proxy. The Proxy also confers upon the proxyholder discretionary voting authority with respect to such other business as may properly come before the Annual Meeting.

If the Proxy is executed properly and is received by the proxy holder prior to the Annual Meeting, the shares represented by the Proxy will be voted. An abstention and a broker non-vote would be included in determining whether a quorum is present at the meeting, but would otherwise not affect the outcome of any vote. Where a Stockholder specifies a choice with respect to the matter to be acted upon, the shares will be voted in accordance with such specification. Any Proxy which is executed in such a manner as not to withhold authority to vote for the election of the specified nominees as Directors (see “Matters To Be Acted Upon—Item 1: Election of Directors”) shall be deemed to confer such authority. A Proxy may be revoked at any time prior to its exercise by giving written notice of the revocation thereof to Michael C. Azar, Secretary, Veri-Tek International, Corp., 50120 Pontiac Trail, Wixom, Michigan 48393, by attending the meeting and electing to vote in person, or by a duly executed Proxy bearing a later date.

VOTING RIGHTS AND REQUIREMENTS

Voting Securities

The securities entitled to vote at the Annual Meeting consist of all of the outstanding shares of the Company’s common stock, no par value per share (“Common Stock”). The close of business on May 5, 2006 has been fixed by the Board of Directors of the Company as the record date. Only Stockholders of record as of the record date may vote at the Annual Meeting. As of April 1, 2006 there were approximately 4,800,000 outstanding shares of the Company’s Common Stock entitled to vote at the Annual Meeting.

Quorum

The presence at the Annual Meeting of the holders of record of a number of shares of the Company’s Common Stock and Proxies representing the right to vote shares of the Company’s Common Stock in excess of one-half of the number of shares of the Company’s Common Stock outstanding as of the record date will constitute a quorum for transacting business.

2

PRINCIPAL STOCKHOLDERS

The following table sets forth information, as of April 1, 2006, with respect to the beneficial ownership of the Company’s Common Stock by: (i) each person known by the Company to own more than 5% of the Company’s Common Stock; (ii) each director and nominee for director; (iii) each officer of the Company named in the Summary Compensation Table; and (iv) all executive officers and directors of the Company as a group. Except as otherwise indicated, each Stockholder listed below has sole voting and investment power with respect to the shares beneficially owned by such person.

Name and Address of Beneficial Owner1 | Number of Shares Beneficially Owned2 | Percentage of Common Stock Beneficially Owned2 | |||

Robert J. Skandalaris3 | 581,284 | 12.1 | % | ||

David J. Langevin3 | 581,284 | 12.1 | % | ||

Jack Silver4 | 292,600 | 6.1 | % | ||

Michael C. Azar3 | 290,642 | 6.1 | % | ||

James Juranitch | 246,591 | 5.0 | % | ||

Todd C. Antenucci | 13,403 | * | |||

David V. Harper | 8,041 | * | |||

Robert S. Gigliotti | 0 | * | |||

Joseph B. Davies | 0 | * | |||

Diana E. Roggenbauer | 0 | * | |||

All Directors and Officers as a Group (4 persons) | 290,642 | 6.1 | % |

| * | Less than 1% |

| 1 | The address of each named person, with the exception of Jack Silver, is 50120 Pontiac Trail, Wixom, Michigan 48393. |

| 2 | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting and investment power with respect to the securities. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, each share of common stock subject to options held by that person that will become exercisable within sixty (60) days of the date hereof is deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| 3 | The reporting person held an ownership interest in Quantum Value Partners, LP. On or about October 7, 2005, Quantum Value Partners, LP distributed the common stock of Issuer it held to the individual partners. The shares of common stock reflected in this report are the shares that they received as a liquidating distribution from Quantum Value Partners, LP, representing their pro-rata interest in Quantum Value Partners. |

| 4 | Information is based exclusively on Schedule 13G filed by Jack Silver, with the Securities Exchange Commission on December 31, 2005. The Schedule 13G states that Jack Silver beneficially owns 292,600 shares of our common stock. |

3

MATTERS TO BE ACTED UPON

| ITEM 1: | ELECTION OF DIRECTORS |

Directors

The nominees for the Board of Directors are set forth below. The Company’s Bylaws provide for the annual election of Directors and to provide the Board the power to set the number of Directors at no less than five (5) and no more than nine (9). The size of the Company’s Board is currently set at three (3) and each will be filled by election at the Annual Meeting to be held on May 30, 2006.

Three (3) persons have been nominated by the Board of Directors to serve as Directors until the 2007 Annual Meeting of Stockholders. The Board of Directors recommends that each nominee, Joseph B. Davies, Robert S. Gigliotti, and Diana E. Roggenbauer, be elected to serve until the 2007 Annual Meeting of Stockholders. Information on the background and qualification of the nominees is set forth on the following page.

The Board knows of no reason why any nominee for Director would be unable to serve as a Director. In the event that any of them should become unavailable prior to the Annual Meeting, the Proxies will be voted for a substitute nominee or nominees designated by the Board of Directors, or the number of Directors may be reduced accordingly. In no event will the Proxies be voted for more than three (3) persons.

Vote Required

The favorable vote of a plurality of the shares of Common Stock of the Company present in person or by proxy at the Annual Meeting is required for the election of each nominee for Class III Director.THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

NOMINEES FOR DIRECTORS

Nominees to Serve Until the 2007 Annual Meeting

Name | Age | Director Since | Positions Held | |||

Joseph B. Davies | 45 | 2004 | Director | |||

Robert S. Gigliotti | 57 | 2004 | Director | |||

Diana E. Roggenbauer | 40 | 2004 | Director |

Joseph B. Davies, Age 45, joined the Company’s Board of Directors in 2004. Mr. Davies currently serves as President of JBD Acquisition Corporation, (“JBD”) a position that he has held since 1996. JBD is a fully integrated company active in all facets of the development process including land acquisition, financing, coordinating architectural and engineering design, competitive bidding, leasing and property management. Mr. Davies holds a Certified Public Accountant’s license from the State of Michigan. Mr. Davies is also a member of the Urban Land Institute, International Council of Shopping Centers and licensed real estate broker. Mr. Davies is involved with numerous other community organizations. Mr. Davies graduated with a Bachelor of Arts Degree in Accounting and Finance from Michigan State University.

Robert S. Gigliotti, Age 57,joined the Company’s Board of Directors in 2004. Mr. Gigliotti is the tax and business development partner with the Rehmann Group. Prior to merging with the Rehmann Group, Mr. Gigliotti was Managing Partner for the firm of Perrin Fordree & Company, P.C. in Troy, Michigan. Mr. Gigliotti was granted his Certified Public Accountant’s license in 1972 and joined the firm of Perrin, Fordree & Company, P.C. in 1976 after six years in the tax department of the Detroit office of Arthur Andersen & Company. His

4

specialties include estate and financial planning, franchising and corporate taxation. Mr. Gigliotti has a Bachelor Degree in Business from Alma College. He has been a Visiting Professor in Taxation at Alma College and was on the Board of Trustees of that Institution for thirteen years. He is a member of the American institute of Certified Public Accountants and the Michigan Association of Certified Public Accountants.

Diana E. Roggenbauer, Age 40, joined the Company’s Board of Directors in 2004. Ms. Roggenbauer is group controller for GT Technologies, the automotive division of Gen Tek, Inc., a provider of products and services to the automotive, appliance and electronics industries and a manufacturer of specialty chemicals. Ms. Roggenbauer has been employed by Gen Tek, Inc. since 1993. Ms. Roggenbauer holds a Masters in Business Administration from the University of Michigan.

Executive Officers of the Company who are not also Directors are as follows:

Donald Brown, Age 50, President and Chief Operating Officerjoined the Company in April, 2006. Prior to joining the Company, Mr. Brown worked at Mercury Products and Services, LLC, a company he founded to provide strategic and operational support. Mr. Brown served as Vice President of the Automotive Division and President of the Latin American Operations for Fanuc Robotics North America. Mr. Brown holds a Bachelor in Business Administration from Western Michigan University.

Michael C. Azar, Age 42, Vice President and Secretary, joined the Company in November 2003. Mr. Azar is also Vice President, General Counsel and Secretary of Noble, having served as General Counsel of Noble since 1997. Mr. Azar is also a Principal and Managing Director of Quantum Value Partners, LP. Mr. Azar also currently serves as President and Member of the Board of Directors of Oakmont Acquisition Corp., a special purpose acquisition company. Mr. Azar holds a B.A. from Kalamazoo College and a J.D. from the University of Detroit.

Board of Directors Meetings and Committees

The Board of Directors manages or directs the management of the business of the Company. During the fiscal year ended December 31, 2005, there were five (5) meetings of the Board of Directors. All members attended at least seventy-five percent of the meetings of the directors and the committees on which they serve.

The Board has established three (3) standing committees the principal functions of which are briefly described below. The charters of the Compensation, Audit, and Directors and Board Governance committees are posted on our website,www.Veri-Tek.com, in the investor information section and paper copies will be provide upon request to the office of the Secretary, VERI-TEK INTERNATIONAL, CORP., 50120 Pontiac Trail, Wixom, MI 48393.

Stockholder Communication with the Board of Directors

Stockholders desiring to communicate with a director or the entire Board of Directors may address such communication to the attention of the Secretary of the Company at the Company’s executive offices and such communication will be forwarded to the intended recipient or recipients.

Compensation Committee

Joseph B. Davies, Robert S. Gigliotti and Diana E. Roggenbauer, all of whom are outside directors, served on the Company’s Compensation Committee. Mr. Davies served as Chairman of the Compensation Committee. The Compensation Committee reviews and makes recommendations regarding the compensation of the Company’s Executive Officers and certain other management staff. The members of the Compensation Committee are independent as defined by Rule 4200(1)(15) of the National Association of Securities Dealers’ listing standards. The Compensation Committee met four (4) times during the year ended December 31, 2005.

5

Audit Committee

Joseph B. Davies, Robert S. Gigliotti and Diana E. Roggenbauer, all of whom are outside directors, served on the Company’s Audit Committee. Mr. Davies served as Chairman of the Audit Committee. The Audit Committee assists the Board in monitoring (1) the integrity of the financial statements of the Company, (2) the independent auditor’s qualifications and independence, (3) the performance of the Company’s internal control function and independent auditors and (4) the compliance by the Company with legal and regulatory requirements. The Audit Committee met five (5) times during the year ended December 31, 2005. The members of the Audit Committee are independent as defined by Rule 4200(1)(15) of the National Association of Securities Dealers’ listing standards. The Board of Directors has determined that Joseph B. Davies is an “audit committee financial expert,” as defined by Item 401(h) of Regulation S-K.

Committee on Directors and Board Governance

Joseph B. Davies, Robert S. Gigliotti and Diana E. Roggenbauer served on the Committee on Directors and Board Governance. Mr. Gigliotti serves as the Chairman of the Committee on Directors and Board Governance. The Committee on Directors and Board Governance annually reviews the performance of the Company’s Directors, makes recommendations for new directors, and evaluates and makes recommendations regarding the Company’s governance practices. The Committee on Directors and Board Governance will consider nominees recommended by Stockholders provided such recommendations are made in accordance with the procedures described in this Proxy Statement under “Stockholders Proposals.” The Committee on Directors and Board Governance met three (3) times during the year ended December 31, 2005.

Director Compensation

Directors who are employees of the Company receive no compensation, as such, for their service as members of the Board. In calendar year 2005, pursuant to the Non-Employee Director Plan, Directors who were not employees of the Company will receive $2,500 for each meeting of the Board of Directors and its Committees. All Directors are reimbursed for expenses incurred in connection with attendance at meetings. In addition, Directors are eligible to participate in the Company’s 2004 Equity Incentive Plan.

6

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Compensation

The following table sets forth the total compensation earned by the former and current Chief Executive Officer and each of the other four most highly compensated executive officers whose salary plus bonus exceeded $100,000 per annum during any of the Company’s last three fiscal years.

SUMMARY COMPENSATION TABLE

| Annual Compensation1 | Long Term Compensation | |||||||||||||

Name/Principal Position | Year | Salary ($) | Bonus ($) | Restricted Stock Awards | Securities Underlying | All Other Compensation ($) | ||||||||

Donald F. Brown, President & Chief Operating Officer2 | 2005 2004 2003 | $ | 106,154 — — | | — — — | — — — | — — — | — — — | ||||||

Todd C. Antenucci, Former President3 | 2005 2004 2003 | $ $ | 193,615 60,577 — | $ | 59,385 — — | — — — | — — — | — — — | ||||||

James Juranitch, Former Chief Technology Officer | 2005 2004 2003 | $ $ $ | 150,615 200,000 146,924 | | — — — | — — — | — — — | — — — | ||||||

David V. Harper, Former Vice President & Chief Financial Officer4 | 2005 2004 2003 | $ $ | 175,000 127,885 — | $ | 44,538 — — | — — — | — — — | — — — | ||||||

Phil Davies, Vice President | 2005 2004 2003 | $ $ $ | 125,000 100,000 100,000 | | $39,180 $28,600 | — — — | — — — | — — — | ||||||

Randy Murphy, Vice President | 2005 2004 2003 | $ $ $ | 112,804 79,700 79,700 | $ | 80,000 — — | — — — | — — — | 197,500 70,000 — | ||||||

| 1 | Does not include any value that might be attributable to job-related personal benefits, the annual value of which has not exceeded the lesser of 10% of annual salary plus bonus or $50,000 for each executive officer. Except as otherwise noted, bonus figures for 2005 represent bonuses earned for fiscal year 2005 but paid in 2006. |

| 2 | Mr. Brown became President and Chief Operating Officer in March 2006. From April 2005 until March 2006 Mr. Brown served as Vice President of Business Development of the Company. |

| 3 | Mr. Antenucci served as President of the Company from July 2004 until March 2006. |

| 4 | Mr. Harper served as Vice President and Chief Financial Officer of the Company from April 2004 until November 2005. |

OPTION/SAR GRANTS IN 2005

None were granted.

7

2004 Equity Incentive Plan

In 2004, the Company adopted the 2004 Equity Incentive Plan, to enable us to attract, retain and motivate our employees and non-employee directors through equity-based compensatory awards including stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares and performance units.

The maximum number of shares of common stock reserved for issuance under the plan is 350,000 shares. The total number of shares reserved for issuance may, however, be adjusted to reflect certain corporate transactions or changes in our capital structure. No shares will be granted to an employee prior to January 1, 2006. During any calendar year, participants are limited in the number of grants they may receive under the plan. No participant may receive options for more than 15,000 shares, stock appreciate rights with respect to more than 20,000 shares, more than 20,000 shares of restricted stock and/or an award for more than 10,000 performance shares or restricted stock units or performance units. The plan may be administered by a committee of our board comprised of members who are outside directors within the meaning of Section 162(m) of the Internal Revenue Code of 1986 and “non-employee directors” within the meaning of Rule 16b-3 promulgated under Section 16 of the Securities Exchange Act of 1934. The committee may delegate administration of the plan to an executive officer who is not subject to Section 16 of the Exchange Act. The plan provides that the committee has the authority to, among other things, select plan participants, determine the type and amount of awards, determine award terms, fix all other conditions of any awards, interpret the plan and any plan awards. Our employees and members of our board of directors who are not our employees or employees of our affiliates are eligible to participate in the plan. All references in this summary to “directors” refer to our non-employee directors.

Employees may be granted stock options under the plan that are intended to qualify as incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986, or stock options that are not intended t so qualify, called non-qualified stock options. Directors may be granted non-qualified stock options. The committee shall determine the type of option, the price and the term and vesting schedule of each stock option, but no incentive stock option will vest less than one year after the date of the grant or be exercisable more than ten years after the date of grant. The exercise price of each incentive stock option must not be less than 100.0% of the fair market value of our common stock on the grant date. The exercise price of each stock option granted under the plan will be paid in the form(s) specified by the committee, and may be made in a single payment, in installments, or on a deferred basis, as prescribed by the committee. Stock options are not transferable except by will or the laws of descent and distribution.

Employees may be granted stock appreciation rights under the plan. Directors are not eligible to receive stock appreciation rights. Stock appreciation rights entitle employees to receive upon exercise an amount equal to the number of shares of common stock subject to the award multiplied by the excess of the fair market value of a share of common stock at the time of exercise over the grant price per share. A stock appreciation right may be granted by the committee at any time, will become exercisable as determined by the committee and must have an exercise price of at least 100.0% of the fair market value of a share of common stock on the grant date. Stock appreciation rights may be settled in cash, shares of stock, other securities, other awards, other property, or any combination of the foregoing, as determined by the committee. The plan also provides for awards of restricted stock and restricted stock units to both employees and to our directors, entitling the recipients to acquire or receive shares of our common stock that are subject to such vesting, transferability, forfeiture, repurchase and other conditions as the committee may determine. Restricted shares and restricted stock units are subject to restrictions as determined by the committee including, with respect to restricted shares, limitation on voting rights and the right to receive dividends, and other restrictions that lapse upon the achievement of goals such as completion of service or performance goals. If vesting of restricted stock and restricted stock units is subject only to completion of specified period of employment or board service, the minimum period of service must be at least three years. The restricted shares or restricted stock units will be evidenced as determined by the committee. Any stock certificates issued with respect to restricted shares will contain legends describing the restrictions on the stock. At the end of the restriction period, stock certificates without restrictive legends will be delivered or, if stock certificates with legends were previously issued with respect to restricted shares, the legends on these

8

certificates will be removed. If any employee’s employment or a director’s service terminates for any reason during the restriction period, all shares of restricted stock or restricted stock units still subject to restriction will be forfeited, unless the committee determines that it is in our best interest to waive the restrictions.

The plan provides that performance shares and performance units may be granted to our employees. Directors are not eligible to receive these awards. Performance shares entitle our employees to acquire shares of our common stock upon the attainment of specified performance goals as described in the plan. Performance units entitle our employees to receive cash, shares of stock or restricted stock or restricted stock units upon the attainment of specific performance goals as described in the plan. The committee may determine in its discretion the specific performance goals applicable under each performance share or unit award, the periods during which performance shares is to be measured and all other limitations and conditions applicable to the award. The committee may alter performance goals, subject to shareholder approval, to qualify the performance shares for the performance-based exception contained in Section 162(m) of the Internal Revenue Code. The committee may also grant performance shares that do not meet this performance-based exception. Following the end of the performance period, if the performance goals have been met, payment of the earned performance shares or performance units will be made. The form of payment will be designated by the committee and can include cash shares, restricted shares, restricted stock units, or a combination of the foregoing.

At any time, the board may amend the plan, subject to shareholder approval for certain amendments, including increasing the shares that may be awarded under the plan and expanding the persons who may participate in the plan. The committee may amend any outstanding award in accordance with the plan. The board may suspend or terminate the plan at any time; however, termination will not affect the participants’ rights with respect to awards previously granted to them, and unexpired awards will continue in full force until they lapse by their own terms.

AGGREGATED OPTION EXERCISES IN 2005

AND FISCAL YEAR-END OPTION VALUES

None were exercised

Employment Agreement

The Company and Don Brown have agreed in principal to the terms of his employment as President and Chief Operating Officer, and the Company expects to enter into a definitive employment agreement (the “Employment Agreement”) with Mr. Brown in April 2006. The Employment Agreement will provide for an initial term commencing on March 1, 2006 and expiring December 31, 2006, with an unlimited number of successive one-year renewals subject to the election by either party not to renew the Employment Agreement. Mr. Brown will also be entitled to an incentive bonus for each fiscal year in an amount to be determined by the Compensation Committee of the Board, as well as to participate in any executive bonus or other incentive compensation program adopted by the Company. In the event Mr. Brown’s employment were terminated by the Company without cause, or by reason of his death or disability, or in the event the Employment Agreement were not renewed, the Company will be obligated to pay to Mr. Brown, as severance and/or liquidated damages, an amount equal to one-half times his annual base salary at the time of termination.

On March 10, 2006 the Company entered into a Severance and Release Agreement with Todd Antenucci, its former President. The Severance and Release Agreement provides for Mr. Antenucci to receive severance payments equal to his base salary through May 31, 2006, payable in accordance with the Company’s payroll practices. The Severance and Release Agreement provides Mr. Antenucci will not receive any other benefits during the severance period.

9

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s officers, directors and persons who beneficially own more than 10% of a registered class of the Company’s equity securities to file reports of securities ownership and changes in such ownership with the Securities and Exchange Commission (the “SEC”). Officers, directors and greater than 10% beneficial owners are also required by rules promulgated by the SEC to furnish the Company with copies of all Section 16(a) forms they file.

Based solely upon a review of the copies of such forms furnished to the Company, or written representations that no Form 5 filings were required, the Company believes that during the period from January 1, 2005 through December 31, 2005, all Section 16(a) filing requirements applicable to its officers, directors and greater than 10% beneficial owners were complied with except the following: i) On or about October 7, 2005, Quantum Value Partners, LP distributed the common stock of Issuer it held to the individual partners, including Mr. Skandalaris and Mr. Langevin. The Form 3s for this transaction were not filed until April, 2006.

Code of Ethics

The Company has adopted a code of ethics that applies to all of our employees, executive officers and directors including our principal executive officer, principal financial officer, general counsel and principal accounting officer. The code of ethics includes provisions covering compliance with laws and regulations, insider trading practices, conflicts of interest, confidentiality, protection and proper use of our assets, accounting and record keeping, fair competition and fair dealing, business gifts and entertainment, payments to government personnel and reporting of illegal or unethical behavior. The code of ethics is posted on our website atwww.Veri-Tek.com. Any waiver of any provision of the code of ethics granted to an executive officer or director may only be made by the board of directors and will be promptly disclosed on our website.

10

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such acts.

Compensation Philosophy

The Company’s executive compensation program is designed to link executive compensation to corporate performance. To this end, the Company has developed an overall compensation strategy and specific compensation plans that tie executive compensation to the Company’s success in meeting specified performance goals. The overall objectives of this strategy are to attract and retain the best possible executive talent, to motivate these executives to achieve goals that support the Company’s business strategy, to establish a link between executive and stockholder interests, and to provide a compensation package that is based on individual performance and initiative, as well as overall business results, both long and short term.

The Compensation Committee reviews the Company’s executive compensation program annually. The review includes a comparison of current total compensation levels (including base salary, annual bonus and long-term incentives) to those provided in similarly situated companies, with data being collected from several executive compensation surveys. In addition to the compensation surveys, the Compensation Committee also considers the compensation reported for executives by the companies included in a group of automotive companies.

The Compensation Committee determines the compensation of the CEO and the officers of the corporation, reviews the policies and philosophy set for the next level of key executives (approximately 5), and evaluates and recommends to the Board of Directors all long-term incentive plans. This process is designed to ensure congruity throughout the executive compensation program.

The key elements of the Company’s executive compensation program are base salary, annual bonus and long-term incentives that consist of cash compensation, Company stock, and stock options.

Base Salaries

Base salaries for management employees are based primarily on the responsibilities of the position and the experience of the individual, with reference to the competitive marketplace for management talent, measured in terms of executive compensation offered by comparable companies in related businesses. Increases in base salaries are based upon the performance of the executive officers as compared to pre-established goals.

Cash Bonuses

Cash bonuses are awarded, at the discretion of the Compensation Committee, to executive officers based in part on the overall financial performance of the Company and in part on the performance of the executive officer. The financial performance of the Company is measured by revenue and operating income growth and actual performance against budgeted performance. Although annual bonuses depend primarily on the achievement of performance objectives as described above, the Compensation Committee may adjust bonus measures and awards based on other financial or non-financial actions that the Compensation Committee believes will benefit long-term stockholder value. For fiscal year 2005, cash bonuses were paid to Todd Antenucci, David Harper, Phil Davies and Randy Murphy in connection with the performance of the Company.

Stock Options

The Company grants stock options under the 2004 Equity Incentive Plan as part of its strategy to attract and retain qualified persons as executive officers and to motivate such persons by providing them with an equity participation in the Company. During 2005, no options were granted to executive officers.

11

Stock Grants

The Company grants stock pursuant to the 2004 Equity Incentive Plan as part of its strategy to attract and retain qualified persons as executive officers and to motivate such persons by providing them with an opportunity to obtain equity in the Company. During 2005, no stock grants were made.

CEO Compensation

The factors considered by the Compensation Committee in determining the compensation of the Chief Executive Officer, include the Company’s operating and financial performance, as well as his leadership and establishment and implementation of the strategic direction for the Company.

Mr. Brown is the President of the Company and is currently the senior executive officer. His base compensation for fiscal 2006 is $180,000 in accordance with the terms of his proposed Employment Agreement. In the event Mr. Brown’s employment is terminated by the Company without cause, or in the event the Employment Agreement is not renewed, the Company is obligated to pay to Mr. Brown, as severance, an amount equal to six (6) months of his annual base salary at the time of termination.

Compensation Limitations

Under section 162(m) of the Internal Revenue Code, adopted in August 1993, and regulations adopted thereunder by the Internal Revenue Service, publicly-held companies may be precluded from deducting certain compensation paid to an executive officer in excess of $1.0 million in a year. The regulations exclude from this limit performance-based compensation and stock options provided certain requirements such as Stockholder approval, are satisfied. The Company plans to take actions, as necessary, to insure that its stock option plans and executive compensation plans qualify for exclusion.

Summary

The Compensation Committee believes that the compensation plans are consistent with the Company’s strategic objectives and are properly aligned with the stockholder’s best interest. The programs enable the Company to attract, retain and incent highly qualified individuals and provide appropriate incentives to reward them for achieving and surpassing corporate and personal goals. The Committee periodically reviews these programs to assure that they emphasize performance and reward enhancement of stockholder value, and modifies the programs as deemed necessary and appropriate to achieve stated objectives, as well as to take into account systemic changes in leading compensation practices. The Committee also reviews these programs and changes them in recognition of the market in which the Company competes.

Sincerely,

Joseph B. Davies

Robert S. Gigliotti

Diana E. Roggenbauer

COMPENSATION COMMITTEE

12

THE COMMITTEE ON DIRECTORS AND BOARD GOVERNANCE

The Committee on Directors and Board Governance is currently composed of three directors, Joseph B. Davies, Robert S. Gigliotti and Diana E. Roggenbauer. Messrs. Davies and Gigliotti, and Ms. Roggenbauer, meet the criteria for independence specified in the listing standards of the NASDAQ. The principal functions of the Committee on Directors and Board Governance is to:

| • | consider and recommend to the Board qualified candidates for election as directors of the Company; |

| • | periodically prepare and submit to the Board for adoption the Committee’s selection criteria for directors nominees; |

| • | recommend to the Board and management a process for new Board member orientation; |

| • | consider matters of corporate governance and Board practices and recommend improvements to the Board; |

| • | review periodically the Company’s charter and bylaws in light of statutory changes and current best practices; |

| • | review periodically the charter, responsibilities, membership and chairmanship of each committee of the Board and recommend appropriate changes; |

| • | review Director independence, conflicts of interest, qualifications and conduct and recommend to the Board removal of a Director when appropriate; and |

| • | annually assess the Committee’s performance. |

The Committee on Directors and Board Governance held three (3) meetings in fiscal year 2005. See “Nominating Procedures” below for further information on the nominating process.

Nominating Procedures

As described above, the Company has a standing Committee on Directors and Board Governance. The Committee on Directors and Board Governance’s charter is posted on our website, www.Veri-Tek.com in the investor relations section.

The Board has adopted membership guidelines that outline the desired composition of the Board and the criteria to be used in selecting directors. These guidelines provide that the Board should be composed of directors with a variety of experience and backgrounds who have high-level managerial experience in a complex organization and who represent the balanced interests of shareowners as a whole rather than those of special interest groups. Other important factors in Board composition include diversity, age, international background and experience and specialized expertise. A significant majority of the Board should be directors who are not past or present employees of the Company or a significant stockholder, customer or supplier.

In considering candidates for the Board, the Committee on Directors and Board Governance considers the entirety of each candidate’s credentials and does not have any specific, minimum qualifications that must be met by a Board nominee. The Committee is guided by the composition guidelines set forth above and by the following basic selection criteria: highest character and integrity; experience and character.

Corporate Governance

The Board of Directors has determined that all three of the Company’s directors are independent under the rules of the NASDAQ. The independent directors are: Joseph B. Davies, Robert S. Gigliotti and Diana E. Roggenbauer. Each of the directors serving on the Audit Committee, the Compensation Committee and the Corporate Governance Committee are independent under the standards of the NASDAQ.

13

Meetings of Non-Employee Directors

The non-employee directors of the Board typically meet in executive session without management present either prior to or immediately following each scheduled Board Meeting, and as otherwise needed. When the non-employee directors of the Board or respective committees meet in executive session without management, a temporary chair is selected from among the directors to preside at the executive session.

Charters

The Company has adopted Charters for its Audit, Compensation, Executive and Corporate Governance Committees. The charters of the Compensation, Audit, and Directors and Board Governance committees are posted on our website:www.Veri-Tek.com. The Company will provide without charge a copy of the Charters to any stockholder upon written request to the Corporate Secretary.

Communication with the Board of Directors

Correspondence for any member of Veri-Tek’s Board of Directors may be sent to his attention: c/o Corporate Secretary, VERI-TEK INTERNATIONAL, CORP., 50120 Pontiac Trail, Wixom, Michigan 48393. Any written communication will be forwarded to the Board for its consideration.

Director Attendance at Annual Meetings

The Company does not expect it directors to attend the Annual Meeting of Stockholders.

14

AUDIT COMMITTEE

The Board of Directors has adopted a written charter for the Audit Committee. The four members of the Audit Committee are “independent” as that term is defined in Rule 4200(a)(15) of the National Association of Securities Dealer’s listing standards.

Principal Accounting Firm Fees. The aggregate amount of fees billed by Freedman & Goldberg, PLLC for professional services rendered for the audit of the Company’s annual financial statements for the fiscal years ended December 31, 2005, December 31, 2004, are as follows:

| 2005 | 2004 | |||||

Audit Fees | $ | 71,059 | $ | 47,257 | ||

Audit Related Fees | $ | 0 | $ | 0 | ||

Total Audit and Audit-Related Fees | $ | 71,059 | $ | 47,257 | ||

Tax Fees | $ | 5,500 | $ | 6,765 | ||

All Other Fees | $ | 33,193 | $ | 58,331 | ||

Total Fees | $ | 109,752 | $ | 112,353 | ||

Audit Fees.These fees are for professional services rendered in connection with the audit of the Company’s annual financial statements for the fiscal year ended December 31, 2005 and December 31, 2004, and for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for that fiscal year.

Audit Related Fees.These fees are for professional services rendered in connection with the audit of the Company’s employee benefit plans and for Sarbanes-Oxley Act, Section 404 advisory and attestation audit services.

Financial Information System Design and Implementation Fees. There were no fees billed by Freedman & Goldberg, PLLC for professional services rendered to the Company for the fiscal year ended December 31, 2005, for the design and implementation of financial information systems.

Tax Fees.These fees relate to federal, state and foreign tax compliance services, including preparation, compliance, advice and planning.

All Other Fees. These fees are for professional services rendered in connection with the Company’s acquisitions, debt and equity offerings and other miscellaneous services.

The Audit Committee has adopted an Audit and Non-Audit Services Pre-Approval Policy which requires the Committee’s pre-approval of audit and non-audit services performed by the independent auditor to assure that the provisions of such services does not impair the auditor’s independence. For the fiscal year ended December 31, 2005, the Audit Committee approved all of the audit and non-audit services rendered by Deloitte and Touche listed above.

Leased Employees.Freedman & Goldberg, PLLC has informed the Company that none of the hours expended on its engagement to audit the Company’s financial statements for the fiscal year ended December 31, 2005, were attributable to work performed by persons other than full time, permanent employees.

The Audit Committee report set forth below shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such acts.

15

Audit Committee Report. Management is responsible for the Company’s internal controls, financial reporting process and compliance with laws and regulations and ethical business standards. The independent auditor is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes on behalf of the Board of Directors. In this context, the Audit Committee has reviewed and discussed with management and the independent auditors the audited financial statements. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has received from the independent auditors the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with them their independence from the Company and its management. Moreover, the Audit Committee has considered whether the independent auditor’s provision of other non-audit services to the Company is compatible with the auditor’s independence. In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005, for filing with the Securities and Exchange Commission. By recommending to the Board of Directors that the audited financial statements be so included, the Audit Committee is not opining on the accuracy, completeness or fairness of the audited financial statements.

Sincerely,

Joseph B. Davies

Robert S. Gigliotti

Diana E. Roggenbauer

AUDIT COMMITTEE

16

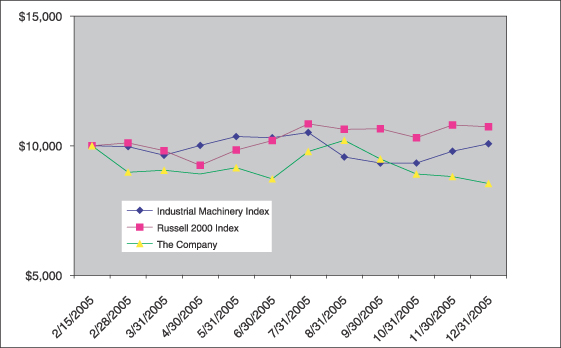

PERFORMANCE GRAPH

The following graph demonstrates the cumulative total return, on an indexed basis, to the holders of the Company’s Common Stock in comparison with the Russell 2000 Index and an industry index of nine publicly-traded companies operating primarily in Standard Industrial Classification 3559, with the exception of QualMark Corp. (3829) and FARO Technologies (3829) (the “Peer Group Index”). The Peer Group Index was selected by the Company because the companies included therein engaged in the manufacturing of either specialty industry machinery or measuring and controlling devices, with applications for the automotive industries and with market capitalizations similar to that of the Company. The Peer Group Index consists of Adept Technology, Amtech Systems, Inc., Perceptron, Inc., SmarTire Systems, Inc., FARO Technologies, QualMark Corp., Quipp, Inc., CVD Equipment, and Profile Technologies. The Peer Group Index closely approximates Veri-Tek’s peer group in range of products provided, target industries and market capitalization.

The graph assumes $10,000 invested on February 15, 2005, (the first day the Company began trading publicly) in the Common Stock of the Company, in the Russell 2000 Index, and in the Peer Group Index. The historical performance shown on the graph is not necessarily indicative of future price performance.

| 2/15/05 | 2/28/05 | 3/31/05 | 4/30/05 | 5/31/05 | 6/30/05 | 7/31/05 | 8/31/05 | 9/30/05 | 10/31/05 | 11/30/05 | 12/31/2005 | |||||||||||||||||||||||||

Industrial Machinery Index | $ | 10,000 | $ | 9,968 | $ | 9,638 | $ | 10,014 | $ | 10,359 | $ | 10,311 | $ | 10,515 | $ | 9,574 | $ | 9,336 | $ | 9,336 | $ | 9,792 | $ | 10,081 | ||||||||||||

Russell 2000 Index | $ | 10,000 | $ | 10,116 | $ | 9,813 | $ | 9,243 | $ | 9,839 | $ | 10,205 | $ | 10,845 | $ | 10,633 | $ | 10,654 | $ | 10,316 | $ | 10,805 | $ | 10,740 | ||||||||||||

The Company | $ | 10,000 | $ | 8,986 | $ | 9,058 | $ | 8,913 | $ | 9,159 | $ | 8,725 | $ | 9,783 | $ | 10,217 | $ | 9,493 | $ | 8,913 | $ | 8,812 | $ | 8,551 | ||||||||||||

17

| ITEM 2: | RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS |

The Board of Directors, upon recommendation of the Audit Committee, has appointed Freedman & Goldberg, PLLC as independent public accountants, to audit the consolidated financial statements of the Company for the year ending December 31, 2006, and to perform other appropriate services as directed by the Company’s management and Board of Directors.

A proposal will be presented at the meeting to ratify the appointment of Freedman & Goldberg, PLLC as the Company’s independent public accountants. It is expected that a representative of Freedman & Goldberg, PLLC will be present at the Annual Meeting to respond to appropriate questions or to make a statement if he or she so desires. Stockholder ratification of the selection of Freedman & Goldberg, PLLC as the Company’s independent public accountants is not required by the Company’s Bylaws or other applicable legal requirement. However, the Board of Directors is submitting the selection of Freedman & Goldberg, PLLC to the Stockholders for ratification as a matter of good corporate practice. If the Stockholders fail to ratify this appointment other independent public accountants will be considered by the Board of Directors upon recommendation of the Audit Committee. Even if the appointment is ratified, the Board of Directors at its discretion may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its Stockholders.

Vote Required

The ratification of Freedman & Goldberg, PLLC as the Company’s independent public accountants will require the affirmative vote of the holders of at least a majority of the outstanding shares of the Company’s Common Stock present or represented at the meeting.THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF FREEDMAN & GOLDBERG, PLLC AS THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS.

| ITEM 3: | OTHER MATTERS |

Except for the matters referred to in the accompanying Notice of Annual Meeting, management does not intend to present any matter for action at the Annual Meeting and knows of no matter to be presented at the meeting that is a proper subject for action by the Stockholders. However, if any other matters should properly come before the meeting, it is intended that votes will be cast pursuant to the authority granted by the enclosed Proxy in accordance with the “recommendation of the Board of Directors.”

18

ANNUAL REPORT

The Annual Report to Stockholders covering the Company’s fiscal year ended December 31, 2005 is being mailed to Stockholders with this Proxy Statement.The Company’s annual report on Form 10-K under the Securities Exchange Act of 1934 for the year ended December 31, 2005, including the financial statements and schedules thereto, which the Company has filed with the Securities and Exchange Commission will be made available to beneficial owners of the Company’s securities without charge upon request by contacting Michael C. Azar, Secretary, 50120 Pontiac Trail, Wixom, Michigan 48393. The annual report does not form any part of the material for the solicitation of the Proxy.

STOCKHOLDER PROPOSALS

Stockholders who intend to have a proposal considered for inclusion in the Company’s proxy materials for presentation at the 2007 Annual Meeting of Stockholders must submit the written proposal to the Company no later than December 30, 2006. Stockholders who intend to present a proposal at the 2006 Annual Meeting of Stockholders without inclusion of such proposal in the Company’s proxy materials are required to provide notice of such proposal to the Company no later than March 3, 2006. The persons named in the Company’s proxies for its annual meeting of stockholders to be held in 2007, may exercise discretionary voting power with respect to any such proposal as to which the Company does not receive timely notice. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

REQUEST TO RETURN PROXIES PROMPTLY

A Proxy is enclosed for your use. Please mark, date, sign and return the Proxy at your earliest convenience or vote through the telephone or Internet procedures set forth on the proxy card. The Proxy requires no postage if mailed in the United States in the postage-paid envelope provided. A prompt return of your Proxy will be appreciated.

By Order of the Board of Directors, |

| /s/ MICHAEL C. AZAR |

Michael C. Azar, Secretary |

Wixom, Michigan

May 11, 2006

19

VERI-TEK INTERNATIONAL, CORP. PROXY - 2006 ANNUAL MEETING

Solicited on behalf of the Board of Directors for the Annual Meeting May 30, 2006

The undersigned, a Stockholder of VERI-TEK INTERNATIONAL, CORP., a Michigan corporation, appoints Michael C. Azar his, her or its true and lawful agent and proxy, with full power of substitution, to vote all the shares of stock that the undersigned would be entitled to vote if personally present at the Annual Meeting of Stockholders of VERI-TEK INTERNATIONAL, CORP. to be held in the Board Room, located at 33 Bloomfield Hills Parkway, Bloomfield Hills, Michigan 48304, on Friday, May 30, 2006 at 10:00 a.m., and any adjournment(s) thereof, with respect to the following matters which are more fully explained in the Proxy Statement of the Company dated May 11, 2006, receipt of which is acknowledged by the undersigned:

VERI-TEK INTERNATIONAL, CORP.

May , 2006

| Co. # | Acct. # |

| PROXY VOTING INSTRUCTIONS |

TO VOTE BY MAIL. Please date, sign and mail your proxy card in the envelope provided as soon as possible.

TO VOTE BY TELEPHONE (TOUCH-TONE ONLY). Please call toll-free 1-800-PROXIES and follow the instructions. Have your control number and the proxy card available when you call.

TO VOTE BY INTERNET. Please access the web page at “www.voteproxy.com” and follow the on-screen instructions. Have your control number available when you access the web page.

| YOUR CONTROL NUMBER IS ® |

ITEM 1: ELECTION OF DIRECTORS | ||||

| FOR all nominees | WITHHOLD AUTHORITY | |||

| (Except as listed below) | (As toall nominees.) | |||

Nominees: | Joseph B. Davies, Robert S. Gigliotti and Diana E. Roggenbauer. | |||

Instruction: | To withhold authority to vote for any individual nominee(s), write that nominee’s name in the space provided below. | |||

__________________________________________________

| ||||

ITEM 2: RATIFICATION OF FREEDMAN & GOLDBERG, PLLC AS THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS | ||||

FOR AGAINST

| ABSTAIN

| |||

ITEM 3: THE TRANSACTION OF SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE ANNUAL MEETINGS

|

This proxy will be voted in accordance with the instructions given. If no direction is made, the shares represented by this proxy will be voted FOR the election of the directors nominated by the Board of Directors, for the ratification of Deloitte Touche as the Company’s Independent Public Accountants and will be voted in accordance with the discretion of the proxies upon all other matters which may come before the Annual Meeting.

| DATED: , 2006 |

| Signature of Stockholder |

Signature of Stockholder |

PLEASE SIGN AS YOUR NAME APPEARS ON THE PROXY

Trustees, Guardians, Personal and other Representatives, please indicate full titles.