Exhibit 99.1

MANITEX INTERNATIONAL, INC.

(NASD A Q : M N T X )

Corporate Presentation December 2015

FO RWARD-LOOKIN G S TAT E M E N T

& N O N—G A A P M E A S U R E S

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company’s filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Non-GAAP Measures: Manitex International from time to time refers to various non-GAAP (generally accepted accounting principles) financial measures in this presentation. Manitex believes that this information is useful to understanding its operating results without the impact of special items. See Manitex’s Q3 2015 earnings release on the Investor Relations section of our website www.manitexinternational.com for a description and/or reconciliation of these measures.

NASDAQ : MNTX

C O M PA N Y S N A P S H OT

Manitex International Inc.

Global provider of highly specialized cranes; straight-mast and knucklebooms

Materials and container handling equipment

Miscellaneous specialized equipment

ASV compact track-loaders and skid-steers

Equipment distribution segment

Niches Served

Construction-residential and non-residential

Military

Power line construction Railroads Ports Government/agency

Energy exploration and field development

Company Origin

Launched as a private company in 2003

Publicly traded since 2006 NASDAQ: MNTX

Industry consolidator: consistently adding branded product lines through M&A since 2006

NASDAQ : MNTX

COMPA N Y T I M E L I N E

MARCH 2002

Manitowoc (NYSE:MTW) acquires Grove

JANUARY 2003

Manitowoc divests Manitex

NASDAQ : MNTX

O U R L A R G E S T P R O D U CT G R O U P S

Engineered lifting equipment Manitex boom trucks SkyCrane aerial platforms Sign cranes

Compact track loaders and skid-steer loaders Commercial and Residential Markets Generally ideal for pick & carry and digging applications, site clearance

Leading Italian manufacturer of truck-mounted hydraulic knuckle boom cranes Diverse product lines ranging up to 108 metric tons in lifting capacity; sales in 50 countries

Rough Terrain (RT) forklifts Special mission-oriented vehicles Carriers Heavy material handling Transporters & steel mill equipment

NASDAQ : MNTX

C O M P E T I T I V E P O S I T I O N I N G

Core Competency

Strong brand history

Acknowledged product development record International dealers enable us to follow demand

Focused on specialized equipment and niche end-markets

Products

Niche markets Broad end-user base

Highly customized/specialized; will configure-to-order Parts and service an important part of business model

Superior ROI

Lower capital commitment for a boom truck vs. competitors’ custom cranes of similar lifting capacity Usually less or no special permitting vs. competitors’ custom cranes of similar lifting capacity

NASDAQ : MNTX

F I N A N C I A L S U M M A R Y S N A P S H OT

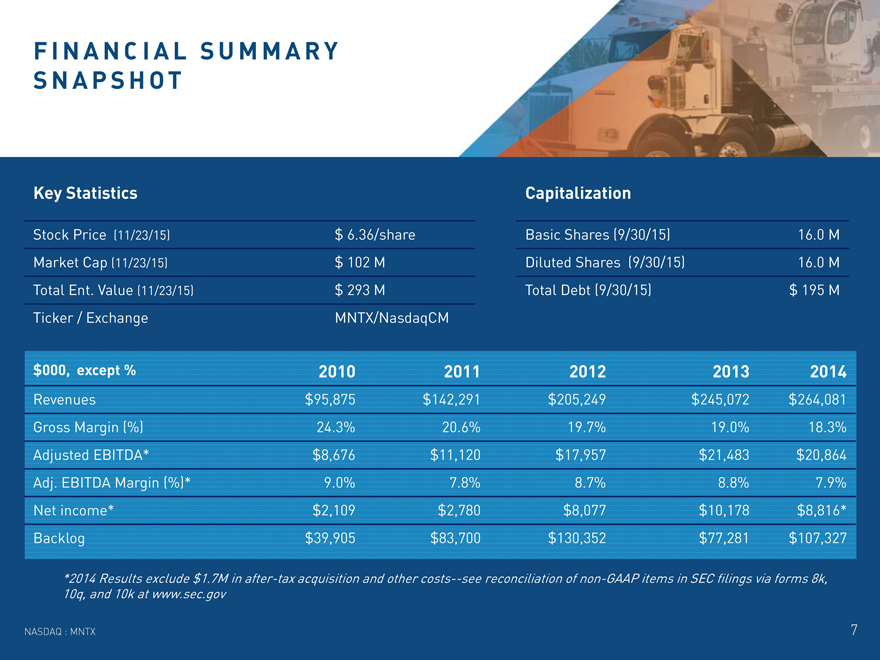

Key Statistics Capitalization

Stock Price (11/23/15) $ 6.36/share Basic Shares (9/30/15) 16.0 M Market Cap (11/23/15) $ 102 M Diluted Shares (9/30/15) 16.0 M Total Ent. Value (11/23/15) $ 293 M Total Debt (9/30/15) $ 195 M Ticker / Exchange MNTX/NasdaqCM

$000, except % 2010 2011 2012 2013 2014

Revenues $95,875 $142,291 $205,249 $245,072 $264,081 Gross Margin (%) 24.3% 20.6% 19.7% 19.0% 18.3% Adjusted EBITDA* $8,676 $11,120 $17,957 $21,483 $20,864 Adj. EBITDA Margin (%)* 9.0% 7.8% 8.7% 8.8% 7.9% Net income* $2,109 $2,780 $8,077 $10,178 $8,816* Backlog $39,905 $83,700 $130,352 $77,281 $107,327

*2014 Results exclude $1.7M in after-tax acquisition and other costs—see reconciliation of non-GAAP items in SEC filings via forms 8k, 10q, and 10k at www.sec.gov

NASDAQ : MNTX

K E Y 2 0 1 4 / 2 0 1 5 T R A N S A CT I O N S ASV and PM-Group

ASV ASV (closed 12/2014) Agreement with Terex Corporation that brings a broad product line of rubber-track compact and skid-steer loaders and accessories to the product group.

ASV, Inc. had trailing twelve month revenues of approximately $130 million.

Manitex contributes $25M, with $20M in common shares and debt securities being issued to Terex, as well as $5M in cash; ASV had $44M in non-recourse debt.

PM- PM-Group S.p.A (closed 1/2015) is a leading Italian manufacturer of truck Group mounted hydraulic knuckle boom cranes with a product range spanning more than 50 models.

S.p.A

PM-Group had trailing twelve month revenues of approximately $100 million.

Consideration was $30.4 million, consisting of $20.3 million in cash, $10.1 million in equity, and the assumption of $62.2 million in non-recourse PM-Group debt and liabilities.

NASDAQ : MNTX

C O N S I S T E N T F I N A N C I A L G R O W T H

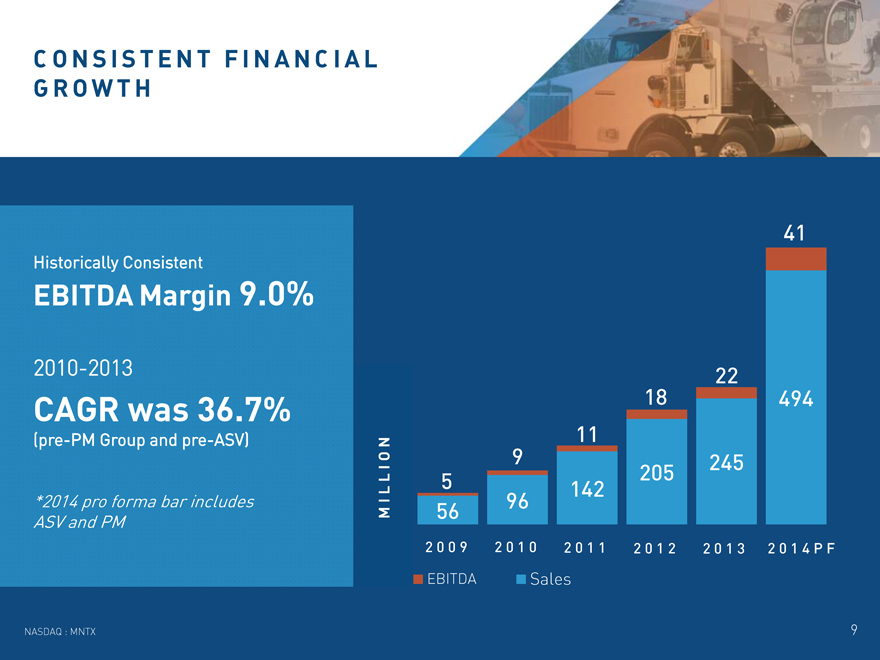

Historically Consistent

EBITDA Margin 9.0%

2010-2013

CAGR was 36.7%

(pre-PM Group and pre-ASV)

*2014 pro forma bar includes ASV and PM

41

22

18 494 11

9 205 245

MILLION 96

56

2009 2010 2011 2012 2013 2014P F

EBITDA Sales

NASDAQ : MNTX

9

M A R G I N E X PA N S I O N O P P O R T U N I T I E S 2015-2017

Cost reductions through sourcing and operating efficiency initiatives

$4 million in expense reductions identified for 2015; $3 million realized through 9/30/15 $15 million in additional expense reductions to be implemented through 2018

Continued integration of ASV and PM Group

Optimize our capital allocation

Invest in and grow our higher margin businesses-PM, ASV, Manitex are our portfolio’s “top producers” with respect to margins and addressable markets Consider “addition by subtraction” for lower margin units that could have synergies elsewhere

Balance sheet improvement

Return our debt and capital ratios to historic range Reduce debt servicing costs

NASDAQ : MNTX

10

L I F T I N G E Q U I P M E N T M A R K E T O V E R V I E W – S T R A I G H T M A S T

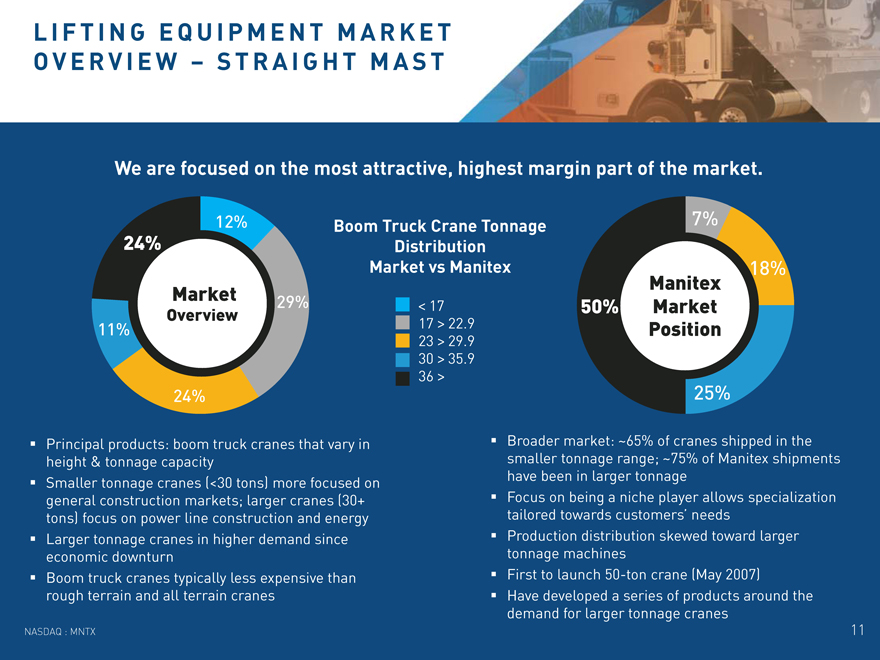

We are focused on the most attractive, highest margin part of the market.

12% 7%

Boom Truck Crane Tonnage 24% Distribution

Market vs Manitex 18%

Manitex Market 29% < 17 50% Market

Overview

17 > 22.9

11% Position

23 > 29.9

30 > 35.9

36 >

24% 25%

Principal products: boom truck cranes that vary in height & tonnage capacity Smaller tonnage cranes (<30 tons) more focused on general construction markets; larger cranes (30+ tons) focus on power line construction and energy Larger tonnage cranes in higher demand since economic downturn Boom truck cranes typically less expensive than rough terrain and all terrain cranes

Broader market: ~65% of cranes shipped in the smaller tonnage range; ~75% of Manitex shipments have been in larger tonnage Focus on being a niche player allows specialization tailored towards customers’ needs Production distribution skewed toward larger tonnage machines First to launch 50-ton crane (May 2007) Have developed a series of products around the demand for larger tonnage cranes

NASDAQ : MNTX

11

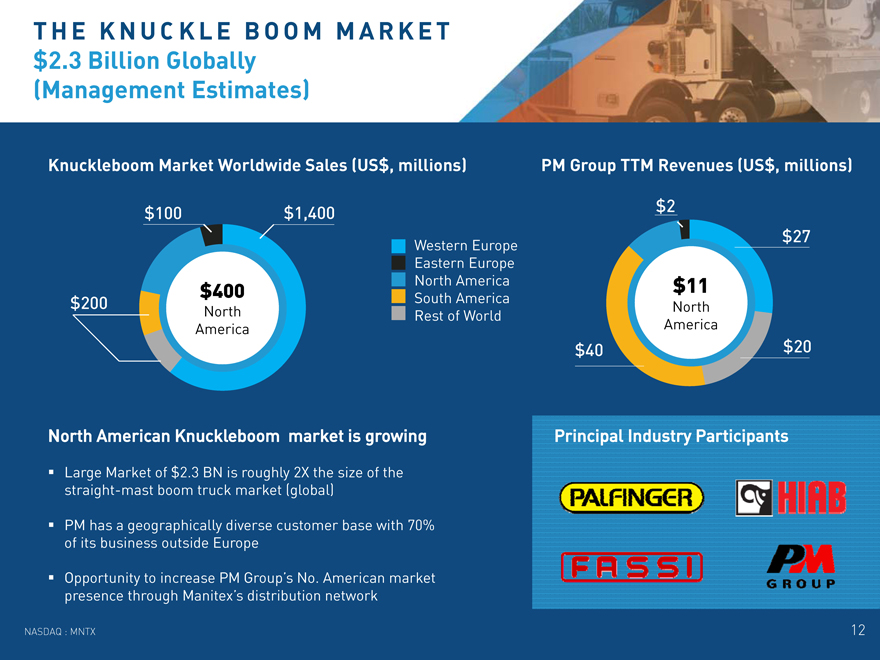

T H E K N U C K L E B O O M M A R K E T $2.3 Billion Globally (Management Estimates)

Knuckleboom Market Worldwide Sales (US$, millions) PM Group TTM Revenues (US$, millions)

$2 $100 $1,400

Western Europe $27 Eastern Europe North America $11 $400 South America $200 North North Rest of World America America

$40 $20

North American Knuckleboom market is growing

Large Market of $2.3 BN is roughly 2X the size of the straight-mast boom truck market (global)

PM has a geographically diverse customer base with 70% of its business outside Europe

Opportunity to increase PM Group’s No. American market presence through Manitex’s distribution network

NASDAQ : MNTX

Principal Industry Participants

12

REPLA C E M E N T S PA R T S & S E R V I C E

Consistent recurring revenue stream throughout the cycle

Typically generates 10%-20% of net sales in a quarter/year (ASV is approx. 25%) Typically carry 2x gross margin of core equipment business

Spares relate to swing drives, rotating components, & booms among others, many of which are proprietary

Serve additional brands

Service team for crane equipment

Automated proprietary system implemented in principal operations

NASDAQ : MNTX

13

I N V E S T M E N T H I G H L I G H T S

Growth in End Markets

Niche markets with solid demand drivers for products Steadying of construction environment and energy markets driving demand Diverse end markets result in risk mitigation

Flexible Operating Model

Customer focused design strategy Diversified product offering Quickly adaptable to changes in demand* Commitment to innovation, research, & product development

Growth in Key Financial Metrics

Revenue and earnings growth have consistently outpaced market and industrial peers since 2009 Backlog at $89m as of 9/30/2015

Broad Industry & Geographic Distribution

Manitex dealer network provides footprint for on-going North American expansion PM Group has little penetration in US and has excellent non-US and non-Europe customer base No Customer represents over 10% of annual revenues

Experienced Management

Seasoned senior management over 70 years of collective industry experience Successfully integrated multiple acquisitions Significant management ownership

*In 2009 “Great Recession” only ONE quarter without positive EBITDA

A consolidator in the lifting and hauling industry, Manitex International serves addressable markets with an estimated $4 BN in annual sales

NASDAQ : MNTX

14

MANITEX INTERNATIONAL, INC.

F I N A N C I A L O V E R V I E W

December 2015

*Results may contain adjustments, please see reconciliation to GAAP on Slide 20 and other Manitex source disclosure and CSS filings.

15

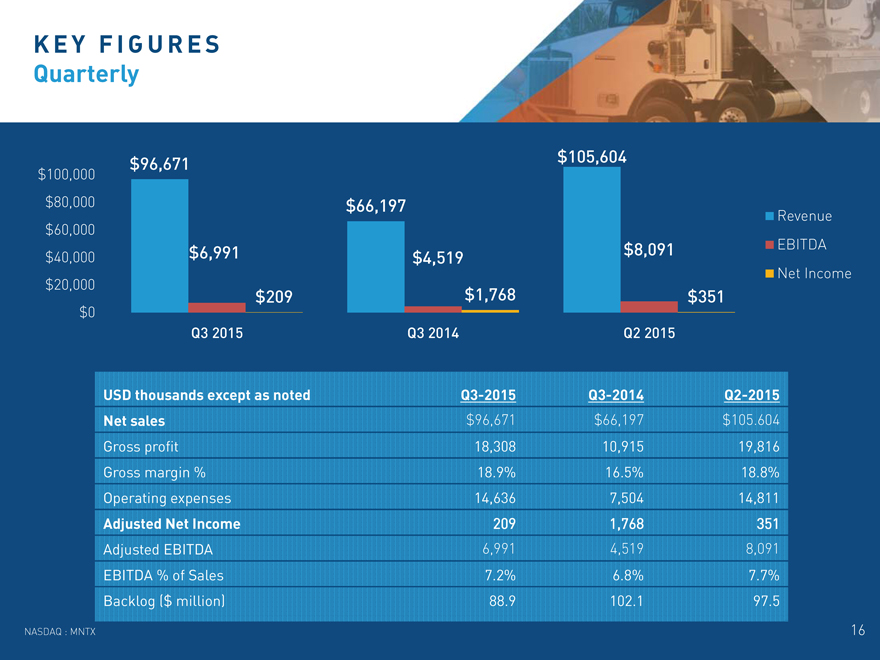

K E Y F I G U R E S Quarterly

$105,604 $96,671 $100,000

$80,000 $66,197

Revenue $60,000 $8,091 EBITDA $40,000 $6,991 $4,519

Net Income $20,000 $209 $1,768 $351 $0

Q3 2015 Q3 2014 Q2 2015

USD thousands except as noted Q3-2015 Q3-2014 Q2-2015

Net sales $96,671 $66,197 $105.604

Gross profit 18,308 10,915 19,816 Gross margin % 18.9% 16.5% 18.8% Operating expenses 14,636 7,504 14,811

Adjusted Net Income 209 1,768 351 Adjusted EBITDA 6,991 4,519 8,091 EBITDA % of Sales 7.2% 6.8% 7.7% Backlog ($ million) 88.9 102.1 97.5

NASDAQ : MNTX

16

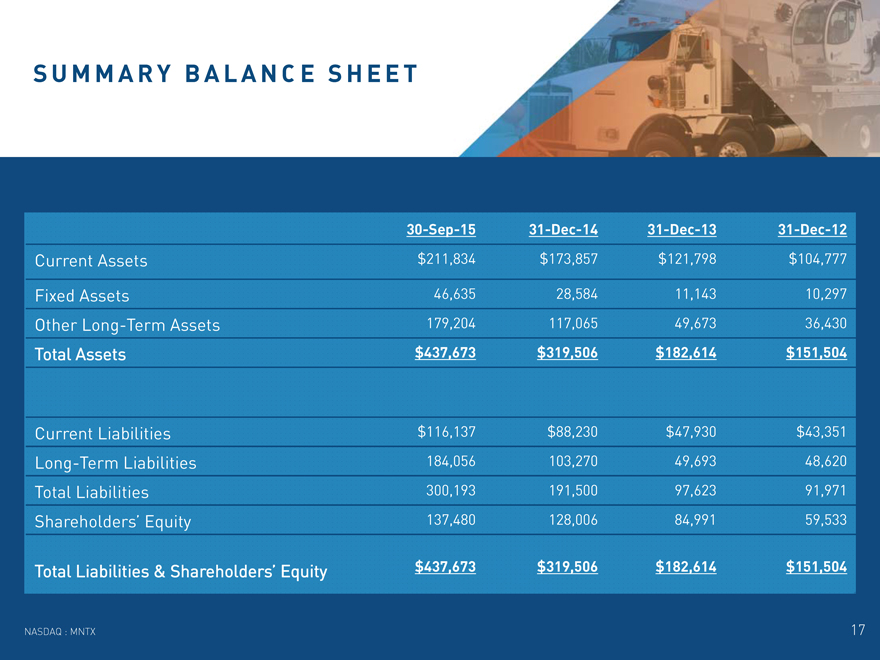

S U M M A R Y B A L A N C E S H E E T

30-Sep-15 31-Dec-14 31-Dec-13 31-Dec-12

Current Assets $211,834 $173,857 $121,798 $104,777 Fixed Assets 46,635 28,584 11,143 10,297 Other Long-Term Assets 179,204 117,065 49,673 36,430

Total Assets $437,673 $319,506 $182,614 $151,504

Current Liabilities $116,137 $88,230 $47,930 $43,351 Long-Term Liabilities 184,056 103,270 49,693 48,620 Total Liabilities 300,193 191,500 97,623 91,971 Shareholders’ Equity 137,480 128,006 84,991 59,533

Total Liabilities & Shareholders’ Equity $437,673 $319,506 $182,614 $151,504

NASDAQ : MNTX

17

W O R K I N G C A P I TA L

Operating working capital increase of $22.4m

($19.6m is from PM acquisition)

Working capital ratios now reflect higher proportion of international activity

Current ratio would be 2.2 at Sep 30, 2015 adjusting for PM working capital facilities of $18.7m that are transactional and therefore current, (compared to N. American term lines of credit that are long term)

Sep 30, Dec 31, 2015 2014

Working Capital $95,697 $85,627

Days sales outstanding

(DSO) 69 83 Days payable outstanding (DPO) 61 60 Inventory turns 2.5 2.2 Current ratio 1.8 2.0

Operating working capital 143,978 121,571

Operating working capital % of annualized LQS 37.2% 45.4%

NASDAQ : MNTX

18

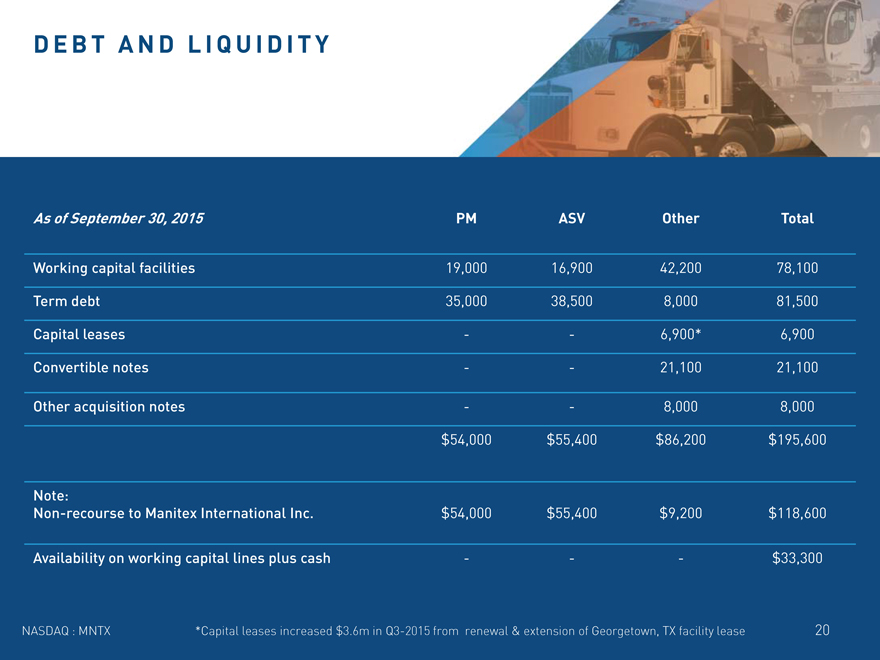

D E B T A N D L I Q U I D I T Y

Repayments of term debt of $2.0m in Q3-2015 and $10.0m year to date

Cash plus availability, based on collateral, under working capital lines equals $33m

Cash provided by operating activities in 3 months ended 9/30/2015 was $2.9m and is $22.0m YTD, adjusting for ASV conversion tax pmt.

Sep 30, Dec 31, 2015 2014

Total Cash $4,446 $4,370 Total Debt 195,580 112,294 Total Equity 137,481 128,006

Net capitalization 328,615 235,930 Net debt / capitalization 58.2% 45.7% Adjusted EBITDA (3 months) $6,991 $5,330

Adjusted EBITDA % of sales 5.9% 8.0%

NASDAQ : MNTX

19

D E B T A N D L I Q U I D I T Y

As of September 30, 2015 PM ASV Other Total

Working capital facilities 19,000 16,900 42,200 78,100

Term debt 35,000 38,500 8,000 81,500

Capital leases — 6,900* 6,900 Convertible notes — 21,100 21,100

Other acquisition notes — 8,000 8,000 $54,000 $55,400 $86,200 $195,600

Note:

Non-recourse to Manitex International Inc. $54,000 $55,400 $9,200 $118,600

Availability on working capital lines plus cash ——$33,300

NASDAQ : MNTX *Capital leases increased $3.6m in Q3-2015 from renewal & extension of Georgetown, TX facility lease

20

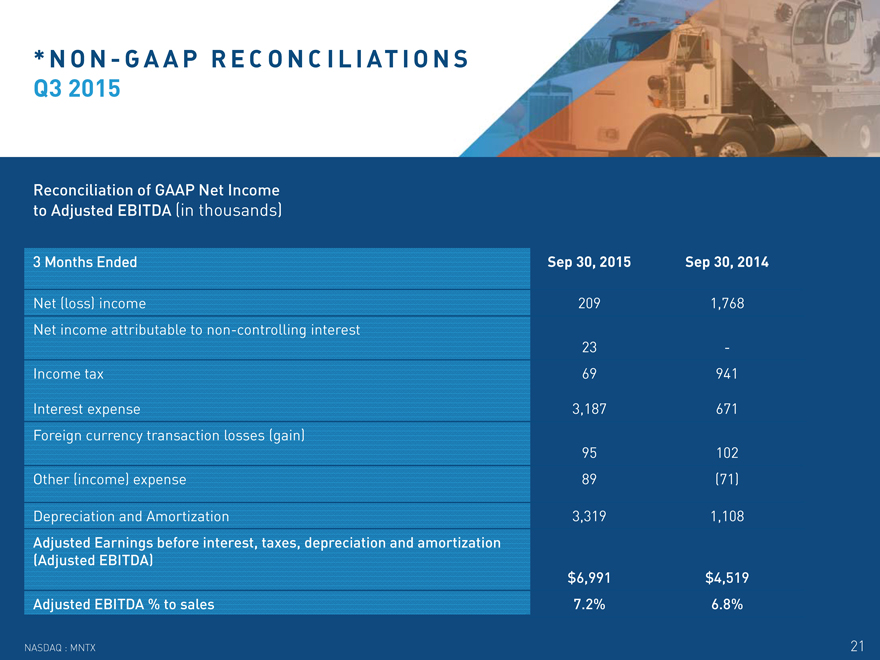

*NON-G A A P R E C O N C I L I AT I O N S Q3 2015

Reconciliation of GAAP Net Income to Adjusted EBITDA (in thousands)

3 | | Months Ended Sep 30, 2015 Sep 30, 2014 |

Net (loss) income 209 1,768 Net income attributable to non-controlling interest

23 -Income tax 69 941

Interest expense 3,187 671 Foreign currency transaction losses (gain)

95 102 Other (income) expense 89 (71)

Depreciation and Amortization 3,319 1,108

Adjusted Earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) $6,991 $4,519

Adjusted EBITDA % to sales 7.2% 6.8%

NASDAQ : MNTX

21

E X P E R I E N C E D M A N A G E M E N T T E A M

David Langevin Chairman & CEO

20+ years principally with Terex

Andrew Rooke President & COO

20+ years principally with Rolls Royce, GKN Sinter Metals, Off-Highway & Auto Divisions

David Gransee CFO & Treasurer

Formerly with Arthur Andersen, 15+ years with Eon Labs (formerly listed)

Robert Litchev President – Manufacturing Operations

10+ years principally with Terex

Scott Rolston SVP Strategic Planning

13+ years principally with Manitowoc

Steve Kiefer, SVP Sales and Marketing

25+ years principally with Eaton Corp. and Hendrickson International

NASDAQ : MNTX

22

OPERAT I N G C O M PA N I E S Products, End Market, Drivers

Boom trucks and cranes Sign cranes Parts

Rough terrain cranes Specialized construction equipment Parts

Rough terrain forklifts Special mission-oriented vehicles Custom specialized carriers Parts

Custom trailers

Hauling systems for heavy equipment transport Parts

Reach stackers

Container handling forklifts Parts

Energy exploration Power transmission Industrial projects Infrastructure development

Railroad Construction Refineries Municipality

Military Utility Ship building Commercial

Energy Mining Railroad

Commercial construction

Global container market

Strong end market demand for specialized, competitively differentiated products for oil, gas, and energy sectors Product development

Equipment replacement cycle in small tonnage flexible cranes for refinery market More efficient product offering across end markets

Steady, profitable growth from both commercial and military application of products

U.S. energy exploration build-out Oil and gas exploration General infrastructure construction

International container market and global trade Re-establishing customer relationships and select product categories

NASDAQ : MNTX

23

OPERAT I N G C O M PA N I E S Products, End Market, Drivers

Specialized equipment for liquid storage & containment 8,000-21,000 gallon capacities

Precision pick & carry cranes

Knuckle boom cranes Truck-mounted Aerial Platforms

Compact track loaders Skid-steer loaders

Large client base in energy sector Petrochemical Waste management Oil & gas drilling

Automotive

Chemical / petrochemical Industrial projects Infrastructure development Aerospace Construction

Energy Construction Infrastructure Utilities

Construction Infrastructure

Reputation for quality & innovation Serves a market of over $1B annually At acquisition, TTM (3/31/13) revenues ~ $39.1M, adjusted EBITDA ~ $4.5M, EBIT ~ $4.2M

Strong end market demand for specialized, competitively differentiated products Environmental (electric) or hazardous (spark free) developments Product development

Growing acceptance of knucklebooms in North American markets Oil and gas exploration creating demand Product development

Improving fundamentals in general construction markets, residential and light commercial

NASDAQ : MNTX

24

MANITEX INTERNATIONAL, INC.

(NASD A Q : M N T X ) D e ce m b e r 2 0 1 5

D a v i d L a n g e v i n , C E O

7 | | 0 8—2 3 7—2 0 6 0 d j l a n g e v i n @ a o l . c o m |

P e t e r S e l t z b e r g , I R D a r r o w A s s o c i a t e s , I n c .

5 | | 1 6—5 1 0—8 7 6 8 p s e l t z b e r g @ d a r r o w i r. c o m |

25