Exhibit 99.1

Exhibit 99.1

MANITEX INTERNATIONAL, INC.

(N ASD AQ: M N TX )

Corporate Presentation May 2017

F O R WA RD -LOOKI NG S TATE M E N T

& N O N—G A A P M E A S U R E S

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; financial statements and concerning operational projections, results and predictions, future economic expectations, performance; estimates and or statements forecasts as of to management’s our business, goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and a number similar of expressions. known and Such unknown statements risks, uncertainties are based on and current other plans, factors estimates that could and cause expectations the Company’s and involve future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company’s filings with the Securities and Exchange Commission and statements that these statements in this presentation are based should upon reasonable be evaluated assumptions, in light of these we cannot important guarantee factors. future Although results. we believe Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Non-GAAP Measures: Manitex International from time to time refers to variousnon-GAAP (generally accepted accounting principles) financial measures in this presentation. Manitex believes that this information is useful to understanding its operating results without the impact of special items. See www. Manitex’s manitexinternational. Q1 2017 earnings com release for a on description the Investor and/or Relations reconciliation section of of our these website measures.

NASDAQ : MNTX

2

PR OD U C T O V E R V I E W Manitex International Inc. Global provider of highly specialized straight- mast and knuckle booms cranes Miscellaneous specialized industrial equipment ASV compact track- loaders and skid- steers Equipment distribution segment Niches Served Construction- residential and non- residential Power line construction Railroads Energy exploration and field development Warehouses and distribution Company Origin Launched as a private company in 2003 as divested from Manitowoc Publicly traded since 2006 NASDAQ: MNTX Industry consolidator: consistently adding branded product lines through M&A since 2006 3

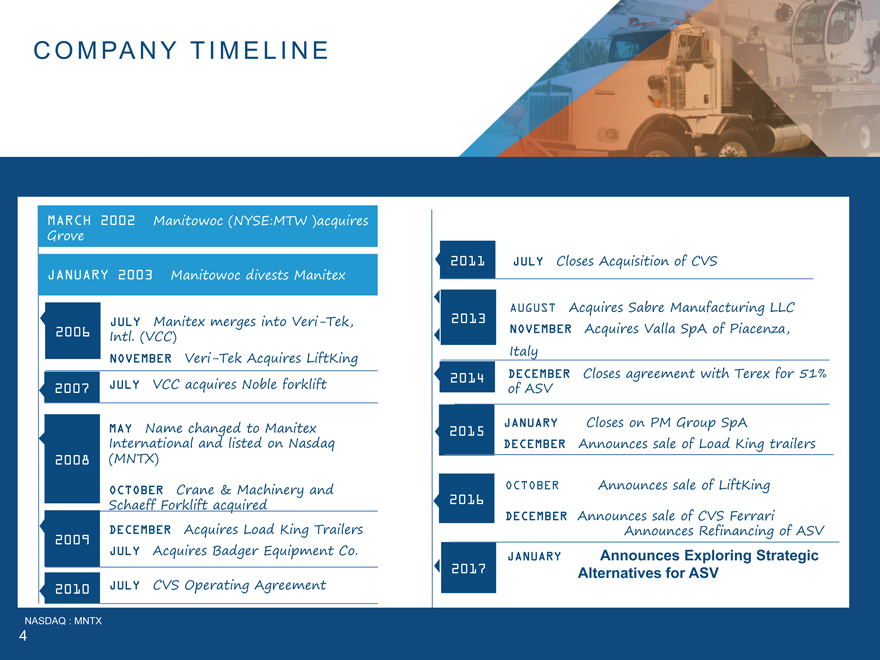

CO MPA NY TI M E L I N E

MARCH 2002 Manitowoc (NYSE:MTW )acquires

Grove

JANUARY 2003 Manitowoc divests Manitex

Her my thoughts:

JULY Manitex merges intoVeri-Tek,

2006 Intl. (VCC)

Sidoti is topNOVEMBER10 amongVeri-Teka limitedAcquires LiftKingnumber

in 2007 onalJULYsponsorship.VCC acquires NobleThereforkliftwill be November and all others that we’ve MAY Name changed to Manitex bo byInternationaltheir teamand withlisted onqualifiedNasdaq

an 2008 ice(MNTX) providers that will pop up OCTOBER Crane & Machinery and

Schaeff Forklift acquired DECEMBER Acquires Load King Trailers 2009 JULY Acquires Badger Equipment Co. 2010 JULY CVS Operating Agreement 2011 JULY Closes Acquisition of CVS AUGUST Acquires Sabre Manufacturing LLC

2013 NOVEMBER Acquires Valla SpA of Piacenza, Italy options for companies that have limited or no

2014 DECEMBER Closes agreement with Terex for 51% , butof ASVlike Craig Hallum’s conference in anJANUARY expect onlyCloses aon few PM Group 1/1s SpA to be 2015 , DECEMBERand thereAnnounceswill besalenumerousof Load Kingbankerstrailers OCTOBER Announces sale of LiftKing 2016 DECEMBER Announces sale of CVS Ferrari Announces Refinancing of ASV JANUARY Announces Exploring Strategic 2017 Alternatives for ASV NASDAQ : MNTX 4

Updat e—M arch 2 0 1 7

E m e r g i n g f r o m m u l t i—y e a r i n d u s t r i a l d o w n t u r n

First Quarter 2017 Highlights:

• Finished quarter with book to bill of over 1.3, highest level in three years ($90M

orders taken)

• Achieved gross margin of 21 percent, highest in three years

• Announced 60 percent growth in the backlog over 12/31/16

• First quarter since 2007 IPO with no materials handling businesses in the

portfolio; peak revenue for remaining businesses is over $350 million; normalized

EBITDA > 10% for crane businesses (run rate stated to be roughly $200 million,

ex-ASV)

• Strategic alternatives are being considered for ASV joint venture with Terex

• Production is expected to steadily increase along with revenues, margins, and

EBITDA throughout the year and into next

NASDAQ : MNTX 5

Sales i n c r e a s e s , D e b t r e d u c t i o n s a n d M a r g i n E x p a n s i o n i n 2 0 1 6—1 7

Crane backlog growth should add gradually to sales throughout 2017 Peak sales level for remaining businesses was > $350M; we are now at a run rate of just over $200M

Margin Profile Improves heading to 2017:

Approximate sales reduction fromnon-crane divestitures $90M EBITDA reduction fromnon-crane divestitures $4M

Debt Reduction in 2015-2017:

Total peak net debt—at 2015 $225M Net approximate debt—at 3/31/17 $140M Total debt reduction 2016 $90M From business divestitures $40M

Fromops-Adj. EBITDA + Working Cap $50M

NASDAQ : MNTX 6

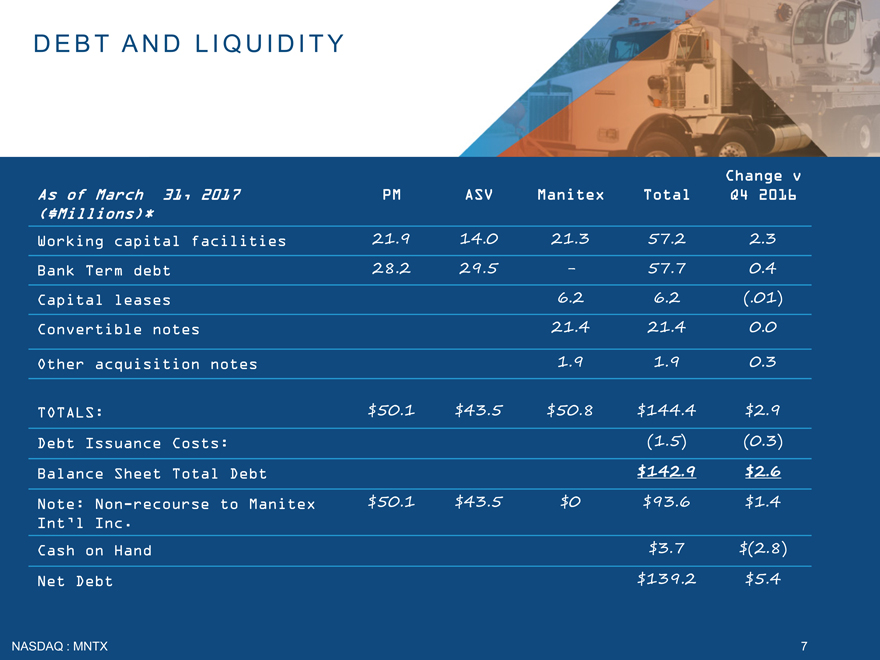

DE B T A N D L I Q U I D I TY

Change v

As of March 31, 2017 PM ASVManitexTotalQ4 2016

($Millions)*

Working capital facilities 21.9 14.021.357.22.3

Bank Term debt 28.2 29.5-57.70.4

Capital leases 6.26.2(.01)

Convertible notes 21.421.40.0

Other acquisition notes 1.91.90.3

TOTALS: $50.1 $43.5$50.8$144.4$2.9 Debt Issuance Costs: (1.5)(0.3)

Balance Sheet Total Debt $142.9$2.6

Note:Non-recourse to Manitex $50.1 $43.5$0$93.6$1.4 Int’l Inc. Cash on Hand $3.7$(2.8)

Net Debt $139.2$5.4 NASDAQ : MNTX 7

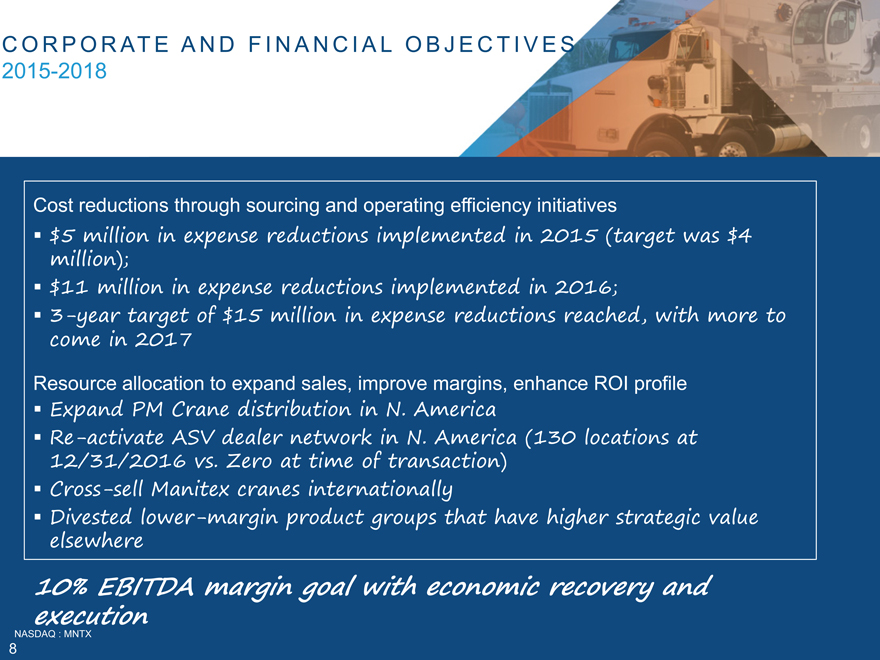

CO RP O RAT E A N D F I N A N C I A L O B J E C T I V E S 2015-2018

Cost reductions through sourcing and operating efficiency initiatives

$5 million in expense reductions implemented in 2015 (target was $4

million);

$11 million in expense reductions implemented in 2016;

3-year target of $15 million in expense reductions reached, with more to

come in 2017 Resource allocation to expand sales, improve margins, enhance ROI profile

Expand PM Crane distribution in N. AmericaRe-activate ASV dealer network in N. America (130 locations at 12/31/2016 vs. Zero at time of transaction) Cross-sell Manitex cranes internationally

Divested lower-margin product groups that have higher strategic value elsewhere 10% EBITDA margin goal with economic recovery and execution NASDAQ : MNTX

8

C OM PETI TI V E P O S I TI O N I N G

Core Competency

Strong brand history

Acknowledged product development record

International dealers enable us to follow demand Focused on specialized equipment and nicheend-m

Products

Niche markets Broadend-user base

Highly customized/specialized; willconfigure-to-order

Parts and service an important part of business model

Superior ROI Lower capital commitment for a boom truck vs. competitors’

custom cranes of similar lifting capacity Usually less or no special permitting vs. competitors’ custom

cranes of similar lifting capacity NASDAQ : MNTX

9

|

|

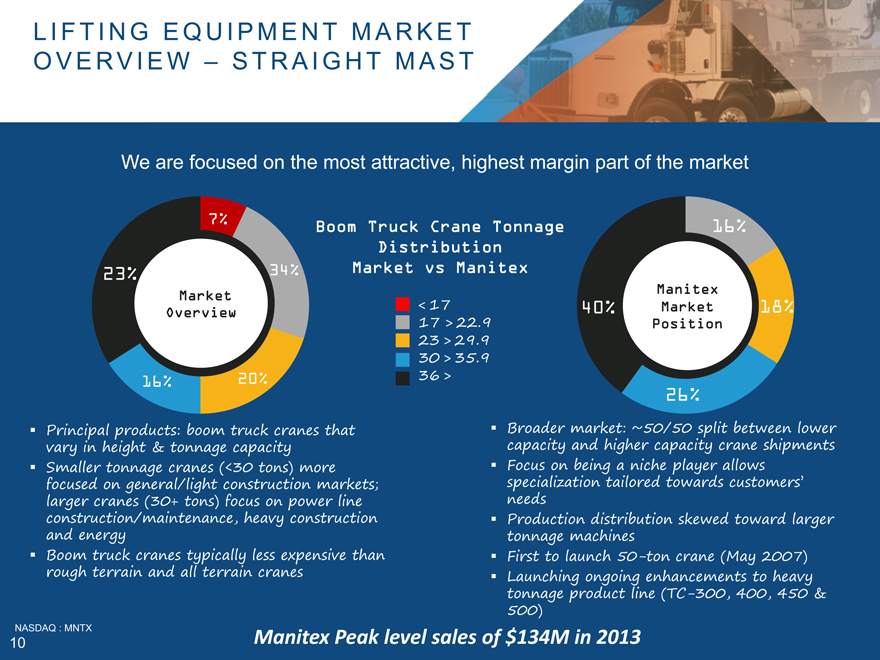

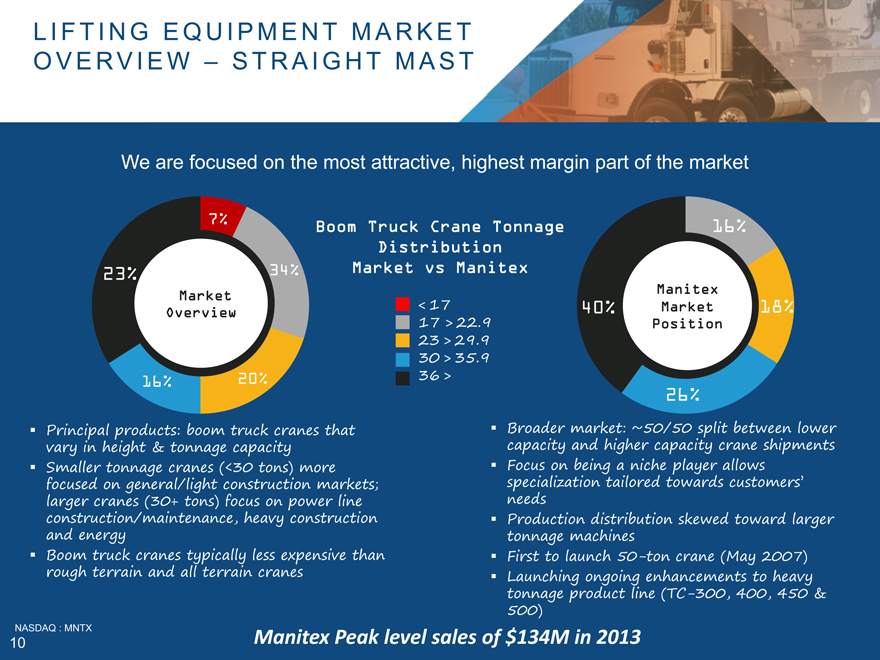

L I FTI NG E Q U I P M E N T M A R K E T O V E R V I E W- S TR A I G H T M A S T We are focused on the most attractive, highest margin part of the market 7% 16% Boom Truck Crane Tonnage Distribution 23% 34% Market vs Manitex Manitex Market < 17 40% Market 18% Overview 17 23 > 29.9 22.9 Position > 30 > 35.9 16% 20% 36 > 26% Principal products: boom truck cranes that vary in height & tonnage capacity Smaller tonnage cranes (<30 tons) more focused on general/light construction markets; larger cranes (30+ tons) focus on power line construction/maintenance, heavy construction and energy Boom truck cranes typically less expensive than rough terrain and all terrain cranes capacity and higher capacity crane shipments Focus on being a niche player allows specialization tailored towards customers’ needs Production distribution skewed toward larger tonnage machines First to launch 50-ton crane (May 2007) Launching ongoing enhancements to heavy tonnage product line (TC-300, 400, 450 & 500) NASDAQ : MNTX Manitex Peak level sales of $134M in 2013 10

|

|

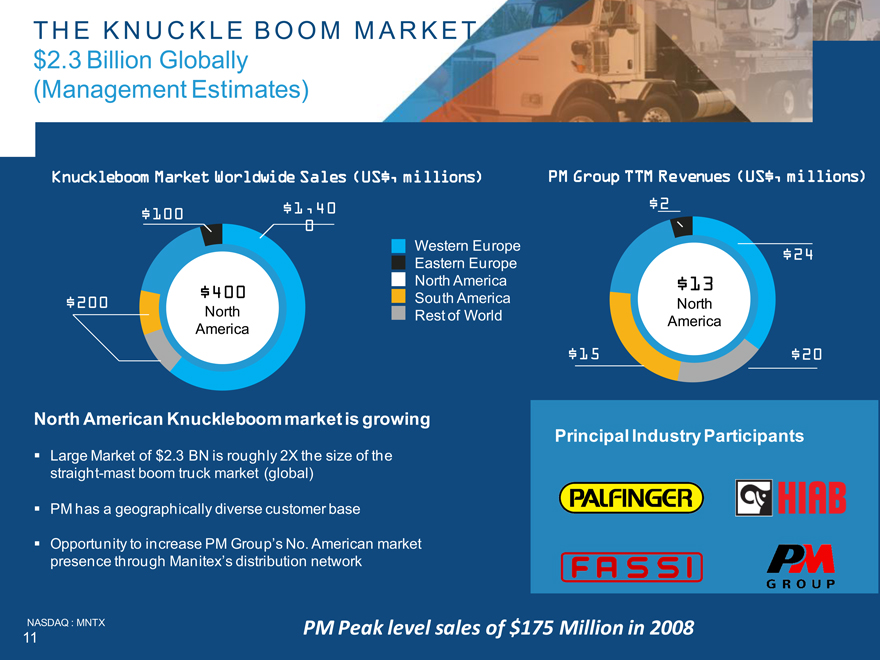

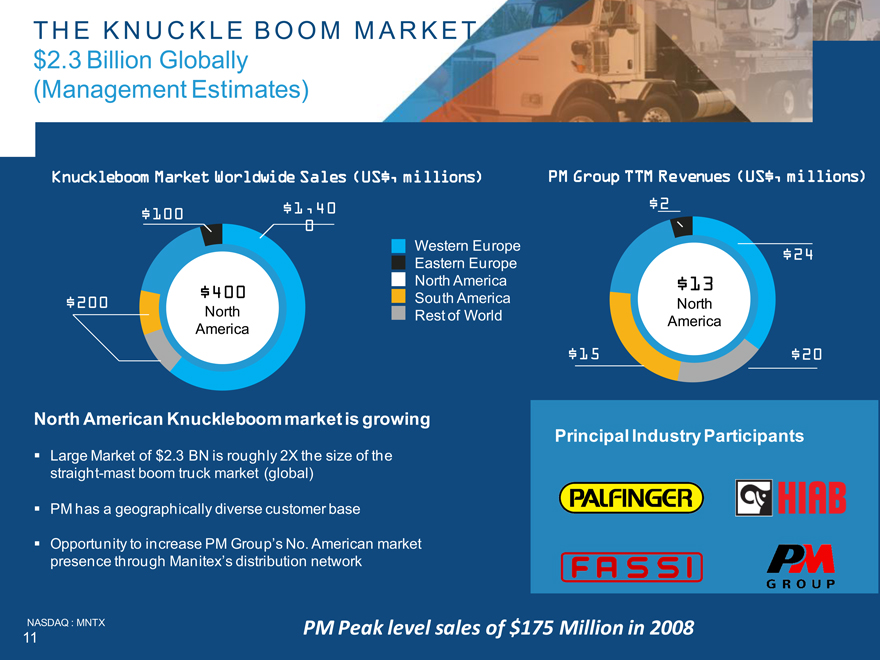

TH E K N U C K L E B O O M M A R K E T $2.3 Billion Globally (Management Estimates) Knuckleboom Market Worldwide Sales (US$, millions) PM Group TTM Revenues (US$, m $100 $1,40 0 $400 $200 Americ North a Western Europe Eastern Europe North America South America Rest of World $2 $24 $13 North Americ a $15 $20 North American Knuckleboom market is growing Large Market of $2.3 BN is roughly 2X the size of the straight-mast boom truck market (global) PM has a geographically diverse customer base Opportunity to increase PM Group’s No. American market presence through Manitex’s distribution network Principal Industry Participants NASDAQ : MNTX PM Peak level sales of $175 Million in 2008 11 TH E K N U C K L E B O O M M A R K E T $2.3 Billion Globally (Management Estimates) Knuckleboom Market Worldwide Sales (US$, millions) PM Group TTM Revenues (US$, m $100 $1,40 0 $400 $200 Americ North a Western Europe Eastern Europe North America South America Rest of World $2 $24 $13 North Americ a $15 $20 North American Knuckleboom market is growing Large Market of $2.3 BN is roughly 2X the

size of the straight-mast boom truck market (global) PM has a geographically diverse customer base Opportunity to increase PM Group’s No. American market presence through Manitex’s distribution network Principal Industry Participants NASDAQ : MNTX PM Peak level sales of $175 Million in 2008 11

REPLACEMENTS PARTS&SERVICE

Consistent recurring revenue stream throughout the cycle

Typically generates10%-20% of net sales in a quarter/year (ASV is approx. 30%)

Typically carry 2x gross margin of core equipment business Spares relate to swing drives, rotating components, & booms among others, many of which are proprietary

Serve additional brands

Service team for crane equipment

Automated proprietary system implemented in principal operations

NASDAQ : MNTX 12

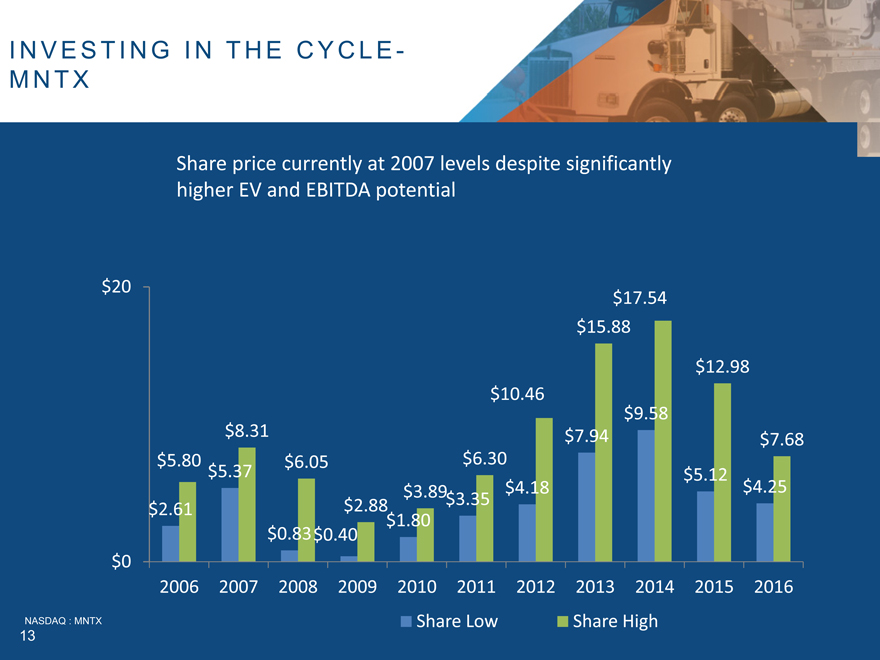

INVESTING IN THE CYCLE- MNTX NASDAQ : MNTX 13 $2.61 $5.37 $0.83 $0.40 $1.80 $3.35 $4.18 $7.94 $9.58 $5.12 $4.25 $5.80 $8.31 $6.05 $2.88 $3.89 $6.30 $10.46 $15.88 $17.54 $12.98 $7.68 $0 $20 2006 2007 2008 2009 2010 2011 2012

2013 2015 2016 Share Low Share High

Share price currently at 2007 levels despite significantly higher EV and EBITDA potential

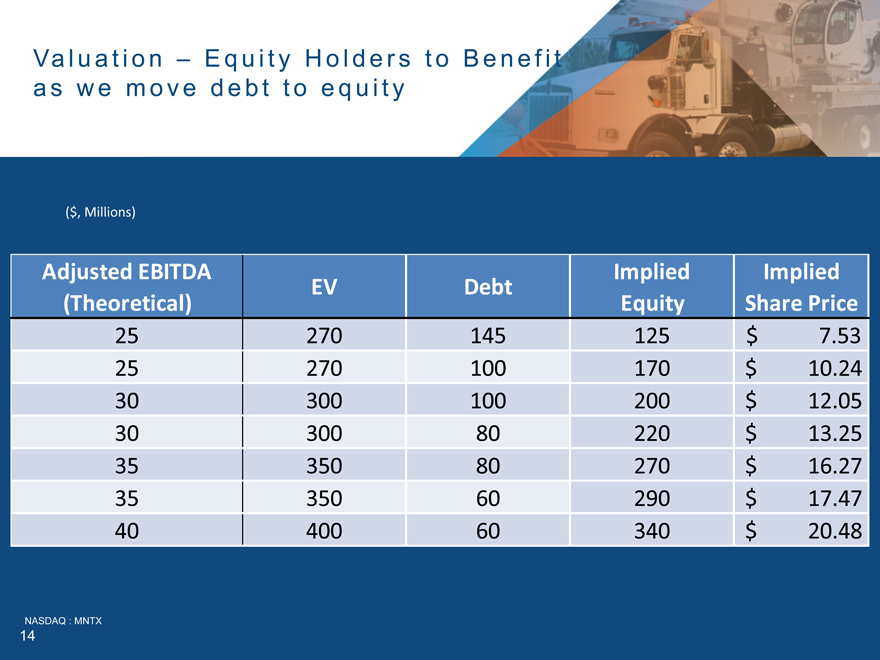

Valuation – Equity Holders to Benefit as we move debt to equity

NASDAQ : MNTX

14

($, Millions)

ImpliedEquity25270145125 $ 7.53 25270100170 $ 10.24 30300100200 $ 12.05 3030080220 $ 13.25 3535080270 $ 16.27 3535060290 $ 17.47 4040060340 $ 20.48 Adjusted EBITDA (Theoretical)DebtImplied Share PriceEV

MANITEX INTERNATIONAL, INC.

FINANCIAL OVERVIEW

May 2017

*Results may contain adjustments, please see reconciliation to GAAP on Slide 19 and other Manitex source disclosure and SEC filings.

FINANCIAL SUMMARY

SNAPSHOT

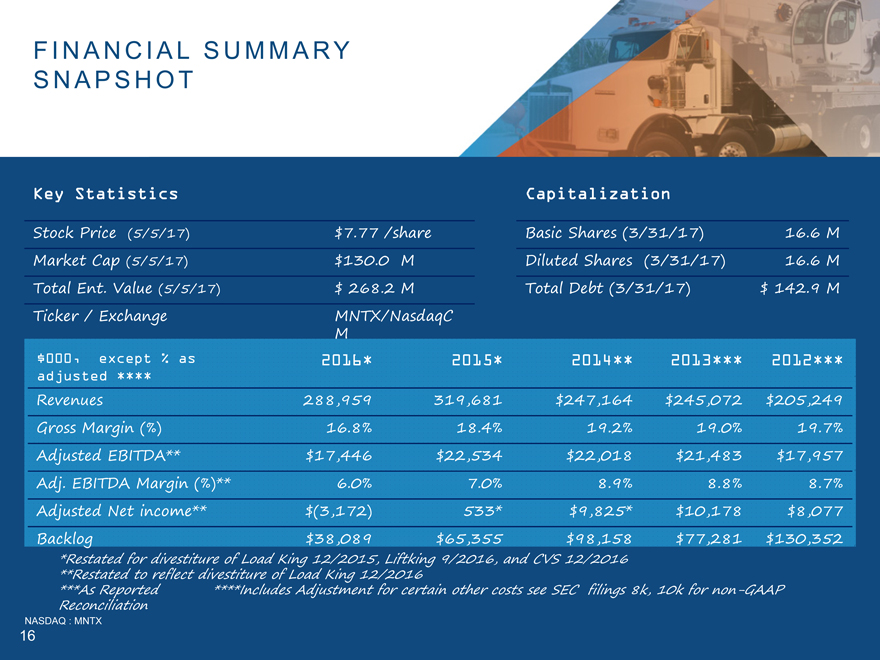

Key Statistics

$000, except % as adjusted ****

2016*

2015*

2014** 2013*** 2012*** Revenues 288,959 319,681 $247,164 $245,072 $205,249 Gross Margin (%) 16.8% 18.4% 19.2% 19.0% 19.7% Adjusted EBITDA** $17,446 $22,534 $22,018 $21,483 $17,957 Adj. EBITDA Margin (%)** 6.0% 7.0% 8.9% 8.8% 8.7% Adjusted Net income** $(3,172) 533* $9,825* $10,178 $8,077 Backlog $38,089 $65,355 $98,158 $77,281 $130,352 *Restated for divestiture of Load King 12/2015, Liftking 9/2016, and CVS 12/2016 **Restated to reflect divestiture of Load King 12/2016 ***As Reported ****Includes Adjustment for certain other costs see SEC filings 8k, 10k fornon-GAAP Reconciliation Stock Price (5/5/17) $7.77 /share Market Cap (5/5/17) $130.0 M Total Ent. Value (5/5/17) $ 268.2 M Ticker / Exchange MNTX/NasdaqCM Basic Shares (3/31/17) 16.6 M Diluted Shares (3/31/17) 16.6 M Total Debt (3/31/17) $ 142.9 M Capitalization NASDAQ : MNTX 16

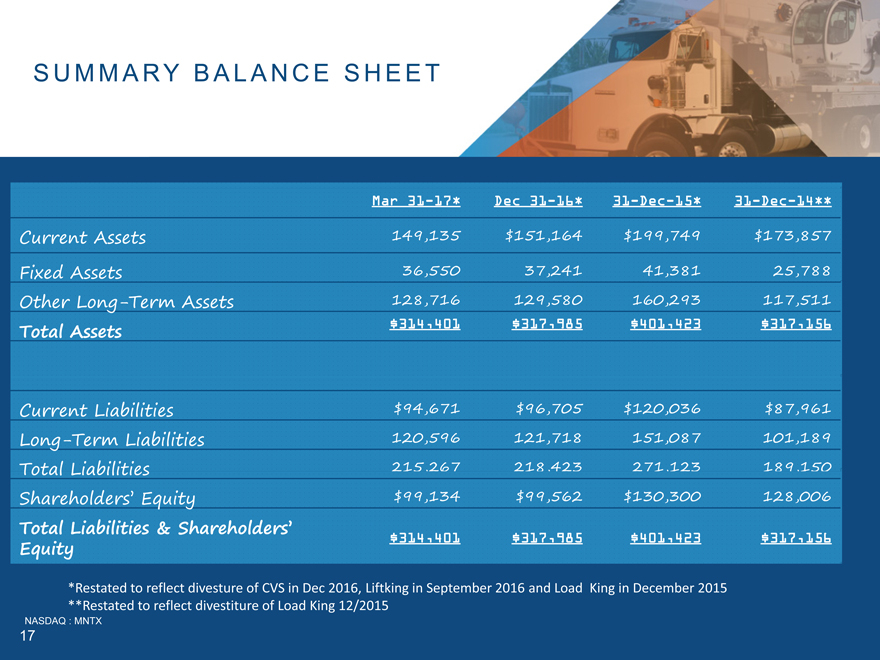

SUMMARY BALANCE SHEET

Mar31-17*

Dec31-16*

31-Dec-15*

31-Dec-14**

Current Assets

149,135 $151,164 $199,749 $173,857 Fixed Assets 36,550 37,241 41,381 25,788 Other Long-Term Assets 128,716 129,580 160,293 117,511 Total Assets $314,401 $317,985 $401,423 $317,156 Current Liabilities $94,671 $96,705 $120,036 $87,961 Long-Term Liabilities 120,596 121,718 151,087 101,189 Total Liabilities 215,267 218,423 271,123 189,150 Shareholders’ Equity $99,134 $99,562 $130,300 128,006 Total Liabilities & Shareholders’ Equity $314,401 $317,985 $401,423 $317,156 NASDAQ : MNTX 17 *Restated to reflect divesture of CVS in Dec 2016, Liftking in September 2016 and Load King in December 2015 **Restated to reflect divestiture of Load King 12/2015

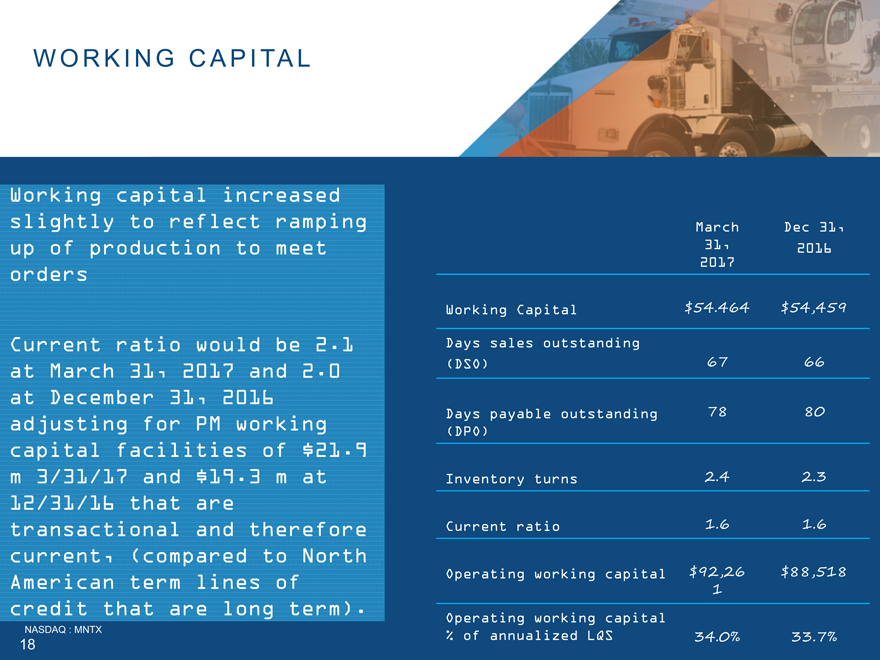

WORKING CAPITAL

Working capital increased slightly to reflect ramping up of production to meet orders Current ratio would be 2.1 at March 31, 2017 and 2.0 at December 31, 2016 adjusting for PM working capital facilities of $21.9 m 3/31/17 and $19.3 m at 12/31/16 that are transactional and therefore current, (compared to North American term lines of credit that are long term).

March 31, 2017

Dec 31,

2016

Working Capital $54.464 $54,459 Days sales outstanding (DSO) 67 66 Days payable outstanding (DPO) 78 80 Inventory turns 2.4 2.3 Current ratio 1.6 1.6 Operating working capital $92,261 $88,518 Operating working capital % of annualized LQS 34.0% 33.7% NASDAQ : MNTX 18

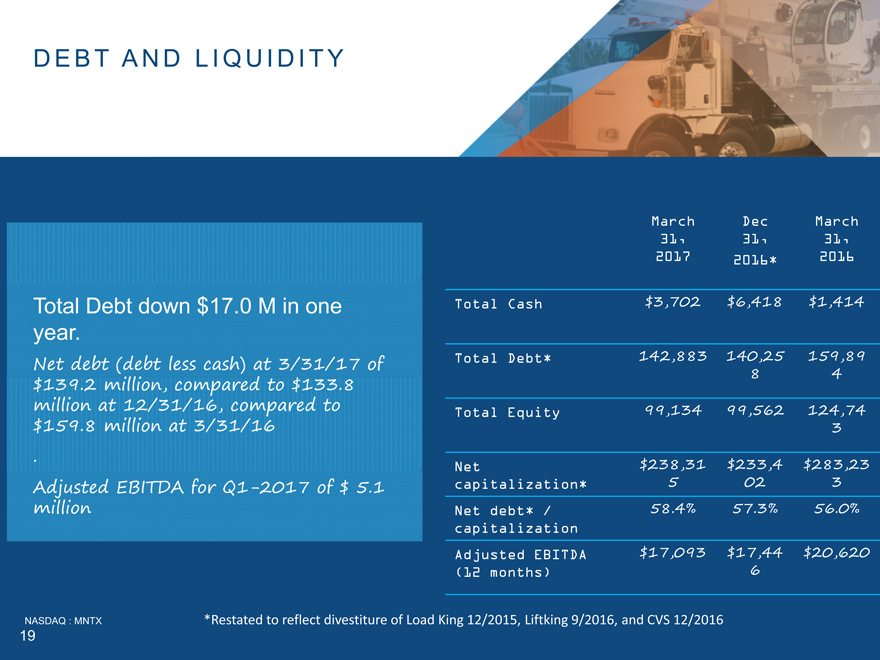

DEBT AND LIQUIDITY

Total Debt down $17.0 M in one year.

Net debt (debt less cash) at 3/31/17 of $139.2 million, compared to $133.8 million at 12/31/16, compared to $159.8 million at 3/31/16

.

Adjusted EBITDA forQ1-2017 of $ 5.1 million

March 31, 2017

Dec 31, 2016* March 31, 2016 Total Cash $3,702 $6,418 $1,414 Total Debt* 142,883 140,258 159,894 Total Equity 99,134 99,562 124,743 Net capitalization* $238,315 $233,402 $283,233 Net debt* / capitalization 58.4% 57.3% 56.0% Adjusted EBITDA (12 months) $17,093 $17,446 $20,620 NASDAQ : MNTX 19 *Restated to reflect divestiture of Load King 12/2015, Liftking 9/2016, and CVS 12/2016

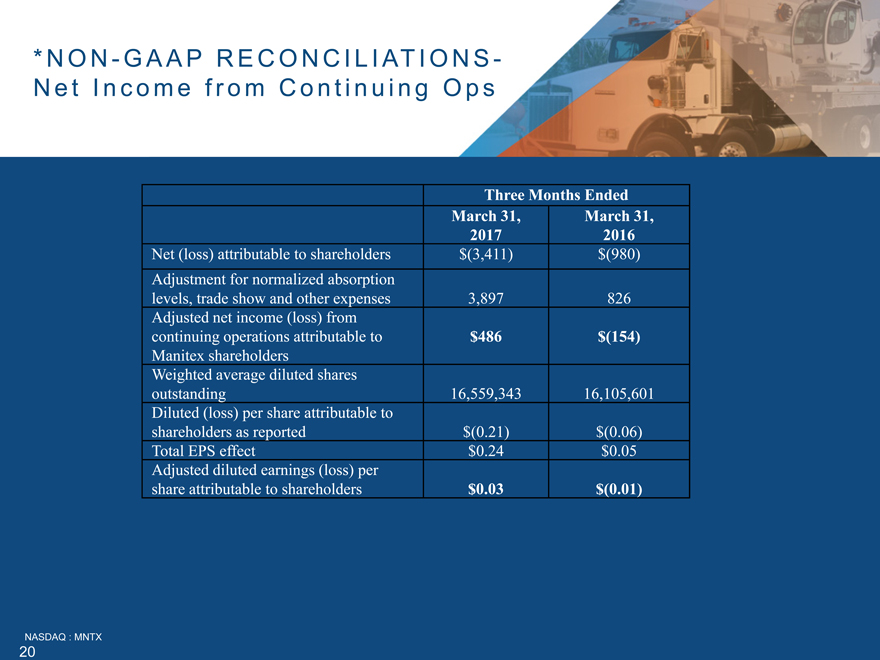

*NON-GAAP RECONCILIATIONS- Net Income from Continuing Ops

NASDAQ : MNTX

20

Three Months Ended

March 31,

2017

March 31, 2016 Net (loss) attributable to shareholders $(3,411) $(980) Adjustment for normalized absorption levels, trade showand other expenses 3,897 826 Adjusted net income (loss) from continuing operations attributable to Manitex shareholders $486 $(154) Weighted average diluted shares outstanding 16,559,343 16,105,601 Diluted (loss) per share attributable to shareholders as reported $(0.21) $(0.06) Total EPS effect $0.24 $0.05 Adjusted diluted earnings (loss) per share attributable to shareholders $0.03 $(0.01)

*NON-GAAP RECONCILIATIONS- Adjusted EBITDA NASDAQ : MNTX 21 Three Months Ended March 31, 2017 March 31, 2016 Operating (loss) income $(1,503) $2,129 Adjustment for normalized absorption levels, trade showand other expenses 3,901 310 Adjusted operating income $2,388 $2,439 Depreciation & amortization 2,639 2,941 Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) $5,027 $5,380 Adjusted EBITDA % to sales 7.4% 6.3%

|

|

OPERATING COMPANIES Products, End Market, Drivers Straight-mast boomtrucks and cranes Sign cranes Parts Power transmission Industrial projects Infrastructure development Strong end market demand for specialized, competitively differentiated products for oil, gas, and energy sectors Product development NASDAQ : MNTX 22 Knuckle boom cranes Truck-mounted Aerial Platforms Construction Infrastructure Utilities Growing acceptance of knucklebooms in North American markets Oil and gas exploration creating demand Product development Compact track loaders Skid-steer loaders Construction Infrastructure Improving fundamentals in general construction markets, residential and light commercial Precision pick & carry cranes Automotive Chemical / petrochemical Industrial projects Infrastructure development Aerospace Construction Strong end market demand for specialized, competitively differentiated products Environmental (electric) or hazardous (spark free) developments Product development

|

|

OPERATING COMPANIES Products, End Market, Drivers

Specialized equipment for liquid storage & containment

8,000-21,000 gallon capacities

Large client base in energy sector

Petrochemical

Waste management Oil & gas drilling Reputation for quality & innovation Serves a market of over $1B annually NASDAQ : MNTX 23 Rough terrain cranes Specialized construction equipment Parts Railroad Construction Refineries Municipality Equipment replacement cycle in small tonnage flexible cranes for refinery market More efficient product offering across end markets

EXPERIENCED MANAGEMENT TEAM

David Langevin, Chairman & CEO

20+ years principally with Terex

David Gransee, CFO & Treasurer

Formerly with Arthur Andersen, 15+ years with Eon Labs (formerly listed)

Michael Schneider, SVP – Financial Operations

Formerly with Ernst & Young, 20+ years in financial operations Scott Rolston, SVP Strategic Planning 13+ years principally with Manitowoc Steve Kiefer, SVP Sales and Marketing 25+ years principally with Eaton Corp. and Hendrickson International Jim Peterson, SVP Operations 35+ years in manufacturing operations Luigi Fucili, CEO PM Group 10+ years principally with PM Group NASDAQ : MNTX 24

MANITEX INTERNATIONAL, INC.

(NASDAQ: MNTX)

May 2017

David Langevin,CEO

708-237-2060

dlangevin@manitex.com

Peter Seltzberg, IR

Darrow Associates, Inc.

516-419-9915

pseltzberg@darrowir.com