Exhibit 99.2 MANITEX INTERNATIONAL, INC. ( N A S D A Q : M N T X ) Third Quarter Earnings Conference Call November 1, 2018Exhibit 99.2 MANITEX INTERNATIONAL, INC. ( N A S D A Q : M N T X ) Third Quarter Earnings Conference Call November 1, 2018

F O R WA R D - L O O K I N G S TAT E M E N T & N O N - G A A P M E A S U R E S Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. 2 NASDAQ : MNTX F O R WA R D - L O O K I N G S TAT E M E N T & N O N - G A A P M E A S U R E S Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. 2 NASDAQ : MNTX

Q3 2 018 Update q Net revenue of $60.9 million is up 7.9% compared to the same quarter prior year q Adjusted EBITDA increased 21% to $5.0 million, from $4.2 million in the same quarter prior year q Record low net debt level at $49.4 million as of September 30, 2018 q Backlog as of September 30, 2018 was $60.5 million, up 20% from Q3 2017 q Book to bill ratio was 0.75:1 in Q3 2018 q Backlog as of October 31, 2018 was $79.2 million q Continued progress with Tadano partnership in expanding PM’s international distribution Adjusted EBITDA over $5.0 million for the second consecutive quarter NASDAQ : MNTX 3Q3 2 018 Update q Net revenue of $60.9 million is up 7.9% compared to the same quarter prior year q Adjusted EBITDA increased 21% to $5.0 million, from $4.2 million in the same quarter prior year q Record low net debt level at $49.4 million as of September 30, 2018 q Backlog as of September 30, 2018 was $60.5 million, up 20% from Q3 2017 q Book to bill ratio was 0.75:1 in Q3 2018 q Backlog as of October 31, 2018 was $79.2 million q Continued progress with Tadano partnership in expanding PM’s international distribution Adjusted EBITDA over $5.0 million for the second consecutive quarter NASDAQ : MNTX 3

Q 3 O p e ra t i n g R e s u l t s $63,904 -4.6% 12,441 19.5% Adjusted Net Income* 2,119 1,174 1,892 Adjusted Earnings per share* $0.11 $0.07 $0.11 Adjusted EBITDA* 5,026 4,153 5,161 8.2% 7.4% 8.1% Adjusted EBITDA % of Sales Working capital 67,779 38,840 65,632 Backlog 60,477 50,281 75,601 20.3% (20.0)% % change in 2018 to prior period *As adjusted. See reconciliation to US GAAP on appendix. 4Q 3 O p e ra t i n g R e s u l t s $63,904 -4.6% 12,441 19.5% Adjusted Net Income* 2,119 1,174 1,892 Adjusted Earnings per share* $0.11 $0.07 $0.11 Adjusted EBITDA* 5,026 4,153 5,161 8.2% 7.4% 8.1% Adjusted EBITDA % of Sales Working capital 67,779 38,840 65,632 Backlog 60,477 50,281 75,601 20.3% (20.0)% % change in 2018 to prior period *As adjusted. See reconciliation to US GAAP on appendix. 4

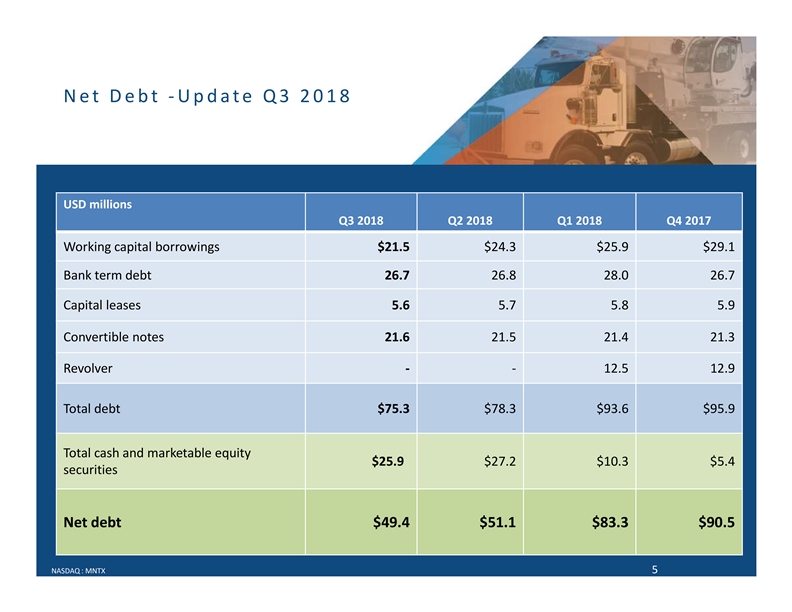

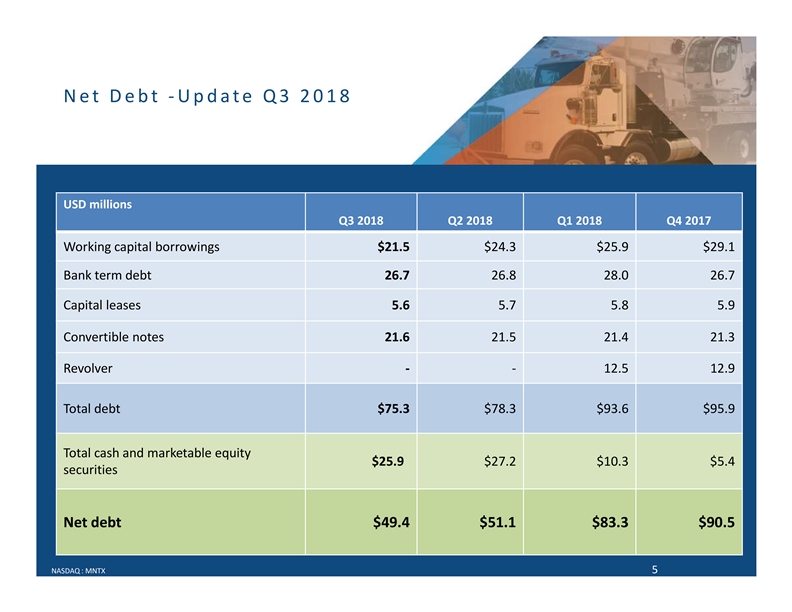

N e t D e b t - U p d a t e Q 3 2 0 1 8 USD millions Q3 2018 Q2 2018 Q1 2018 Q4 2017 Working capital borrowings $21.5 $24.3 $25.9 $29.1 Bank term debt 26.7 26.8 28.0 26.7 Capital leases 5.6 5.7 5.8 5.9 Convertible notes 21.6 21.5 21.4 21.3 Revolver - - 12.5 12.9 Total debt $75.3 $78.3 $93.6 $95.9 Total cash and marketable equity $25.9 $27.2 $10.3 $5.4 securities Net debt $49.4 $51.1 $83.3 $90.5 NASDAQ : MNTX 5N e t D e b t - U p d a t e Q 3 2 0 1 8 USD millions Q3 2018 Q2 2018 Q1 2018 Q4 2017 Working capital borrowings $21.5 $24.3 $25.9 $29.1 Bank term debt 26.7 26.8 28.0 26.7 Capital leases 5.6 5.7 5.8 5.9 Convertible notes 21.6 21.5 21.4 21.3 Revolver - - 12.5 12.9 Total debt $75.3 $78.3 $93.6 $95.9 Total cash and marketable equity $25.9 $27.2 $10.3 $5.4 securities Net debt $49.4 $51.1 $83.3 $90.5 NASDAQ : MNTX 5

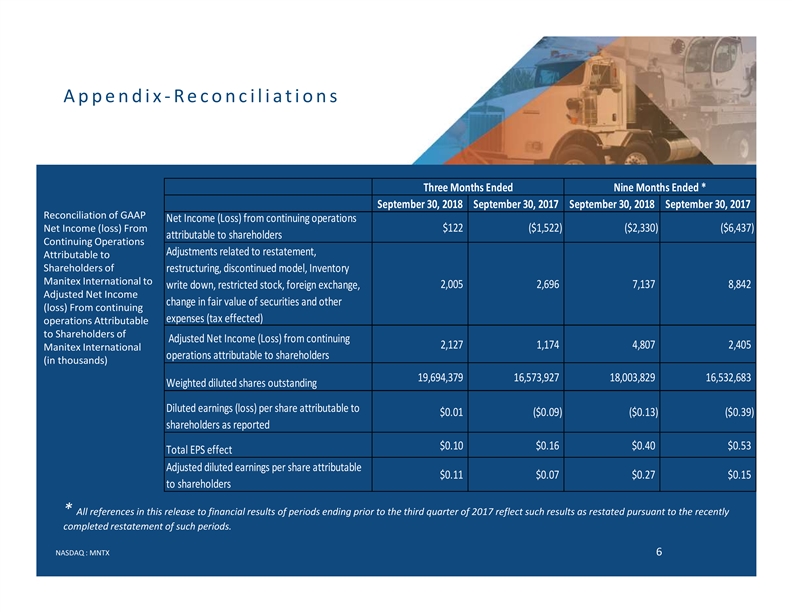

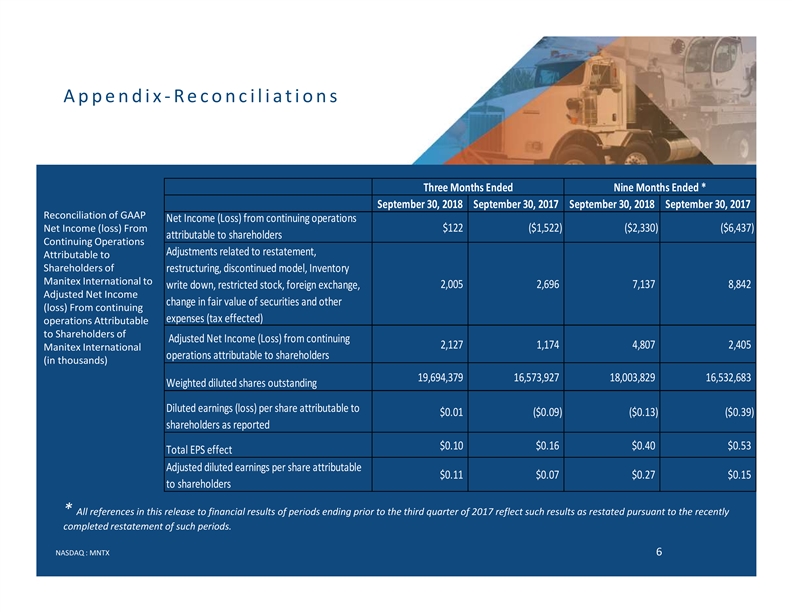

A p p e n d i x - R e c o n c i l i a t i o n s Three Months Ended Nine Months Ended * September 30, 2018 September 30, 2017 September 30, 2018 September 30, 2017 Reconciliation of GAAP Net Income (Loss) from continuing operations Net Income (loss) From $122 ($1,522) ($2,330) ($6,437) attributable to shareholders Continuing Operations Adjustments related to restatement, Attributable to Shareholders of restructuring, discontinued model, Inventory Manitex International to 2,005 2 ,696 7,137 8 ,842 write down, restricted stock, foreign exchange, Adjusted Net Income change in fair value of securities and other (loss) From continuing expenses (tax effected) operations Attributable to Shareholders of Adjusted Net Income (Loss) from continuing 2,127 1 ,174 4,807 2 ,405 Manitex International operations attributable to shareholders (in thousands) 19,694,379 1 6,573,927 18,003,829 1 6,532,683 Weighted diluted shares outstanding Diluted earnings (loss) per share attributable to $0.01 ($0.09) ($0.13) ($0.39) shareholders as reported $0.10 $0.16 $0.40 $0.53 Total EPS effect Adjusted diluted earnings per share attributable $0.11 $0.07 $0.27 $0.15 to shareholders * All references in this release to financial results of periods ending prior to the third quarter of 2017 reflect such results as restated pursuant to the recently completed restatement of such periods. 6 NASDAQ : MNTX A p p e n d i x - R e c o n c i l i a t i o n s Three Months Ended Nine Months Ended * September 30, 2018 September 30, 2017 September 30, 2018 September 30, 2017 Reconciliation of GAAP Net Income (Loss) from continuing operations Net Income (loss) From $122 ($1,522) ($2,330) ($6,437) attributable to shareholders Continuing Operations Adjustments related to restatement, Attributable to Shareholders of restructuring, discontinued model, Inventory Manitex International to 2,005 2 ,696 7,137 8 ,842 write down, restricted stock, foreign exchange, Adjusted Net Income change in fair value of securities and other (loss) From continuing expenses (tax effected) operations Attributable to Shareholders of Adjusted Net Income (Loss) from continuing 2,127 1 ,174 4,807 2 ,405 Manitex International operations attributable to shareholders (in thousands) 19,694,379 1 6,573,927 18,003,829 1 6,532,683 Weighted diluted shares outstanding Diluted earnings (loss) per share attributable to $0.01 ($0.09) ($0.13) ($0.39) shareholders as reported $0.10 $0.16 $0.40 $0.53 Total EPS effect Adjusted diluted earnings per share attributable $0.11 $0.07 $0.27 $0.15 to shareholders * All references in this release to financial results of periods ending prior to the third quarter of 2017 reflect such results as restated pursuant to the recently completed restatement of such periods. 6 NASDAQ : MNTX

A p p e n d i x - R e c o n c i l i a t i o n s Three Months Ended Nine Months Ended * September 30, 2018 September 30, 2017 September 30, 2018 September 30, 2017 Reconciliation of GAAP Operating Income From $3,003 $972 $6,172 ($1,030) Operating income (loss) Continuing Operations to Adjustments related to restatement, Adjusted EBITDA (in thousands) restructuring, discontinued model, restricted 785 1,956 3,923 7 ,763 stock, and other expenses 3,788 2 ,928 10,095 6,733 Adjusted operating income (loss) 1,238 1 ,225 3,789 3 ,908 Depreciation and amortization $5,026 $4,153 $13,884 $10,641 Adjusted EBITDA 8.2% 7.4% 7.6% 7.2% Adjusted EBITDA % to sales * All references in this release to financial results of periods ending prior to the third quarter of 2017 reflect such results as restated pursuant to the recently completed restatement of such periods. 7 NASDAQ : MNTX A p p e n d i x - R e c o n c i l i a t i o n s Three Months Ended Nine Months Ended * September 30, 2018 September 30, 2017 September 30, 2018 September 30, 2017 Reconciliation of GAAP Operating Income From $3,003 $972 $6,172 ($1,030) Operating income (loss) Continuing Operations to Adjustments related to restatement, Adjusted EBITDA (in thousands) restructuring, discontinued model, restricted 785 1,956 3,923 7 ,763 stock, and other expenses 3,788 2 ,928 10,095 6,733 Adjusted operating income (loss) 1,238 1 ,225 3,789 3 ,908 Depreciation and amortization $5,026 $4,153 $13,884 $10,641 Adjusted EBITDA 8.2% 7.4% 7.6% 7.2% Adjusted EBITDA % to sales * All references in this release to financial results of periods ending prior to the third quarter of 2017 reflect such results as restated pursuant to the recently completed restatement of such periods. 7 NASDAQ : MNTX

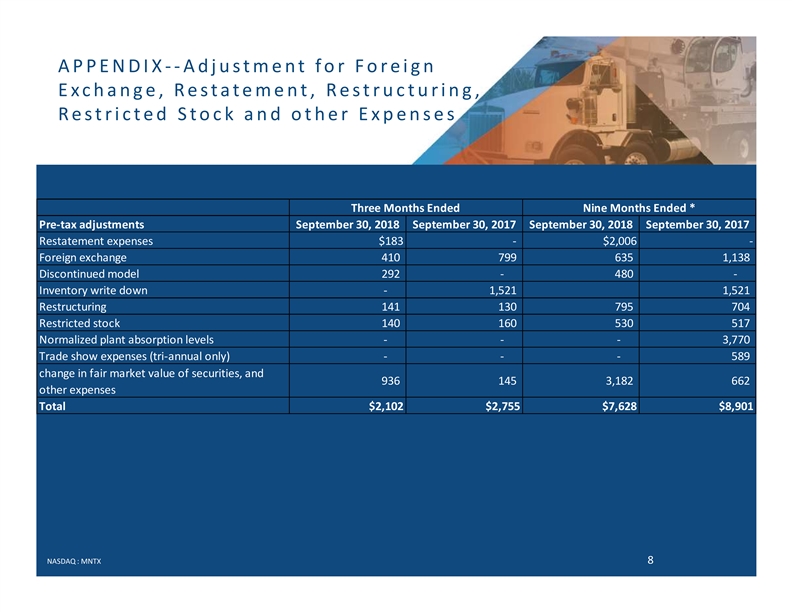

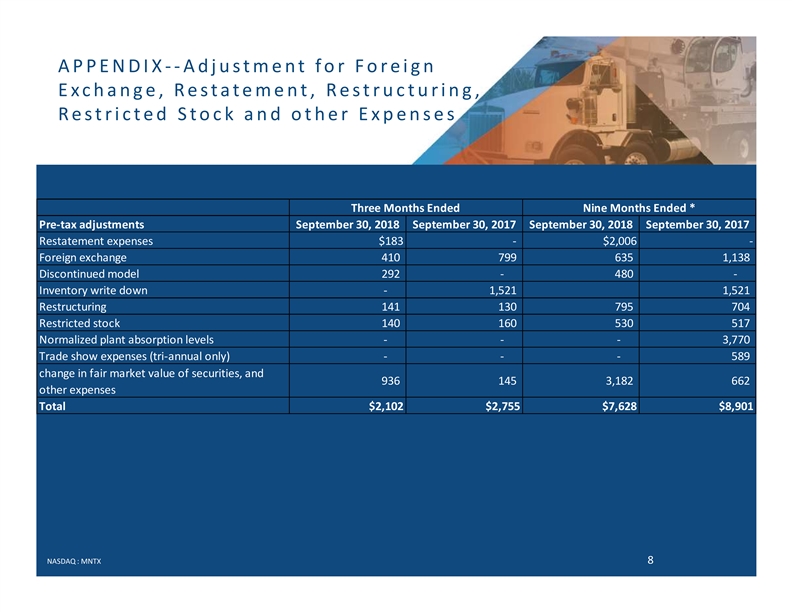

A P P E N D I X - - A d j u s t m e n t f o r F o r e i g n E x c h a n g e , R e s t a t e m e n t , R e s t r u c t u r i n g , R e s t r i c t e d S t o c k a n d o t h e r E x p e n s e s Three Months Ended Nine Months Ended * Pre-tax adjustments September 30, 2018 September 30, 2017 September 30, 2018 September 30, 2017 Restatement expenses $183 - $2,006 - Foreign exchange 4 10 799 635 1 ,138 Discontinued model 2 92 - 4 80 - Inventory write down - 1,521 1,521 Restructuring 1 41 130 795 704 Restricted stock 1 40 160 530 517 Normalized plant absorption levels - - - 3,770 Trade show expenses (tri-annual only) - - - 5 89 change in fair market value of securities, and 9 36 145 3 ,182 6 62 other expenses Total $2,102 $2,755 $7,628 $8,901 NASDAQ : MNTX 8A P P E N D I X - - A d j u s t m e n t f o r F o r e i g n E x c h a n g e , R e s t a t e m e n t , R e s t r u c t u r i n g , R e s t r i c t e d S t o c k a n d o t h e r E x p e n s e s Three Months Ended Nine Months Ended * Pre-tax adjustments September 30, 2018 September 30, 2017 September 30, 2018 September 30, 2017 Restatement expenses $183 - $2,006 - Foreign exchange 4 10 799 635 1 ,138 Discontinued model 2 92 - 4 80 - Inventory write down - 1,521 1,521 Restructuring 1 41 130 795 704 Restricted stock 1 40 160 530 517 Normalized plant absorption levels - - - 3,770 Trade show expenses (tri-annual only) - - - 5 89 change in fair market value of securities, and 9 36 145 3 ,182 6 62 other expenses Total $2,102 $2,755 $7,628 $8,901 NASDAQ : MNTX 8

MANITEX INTERNATIONAL, INC. ( N A S D A Q : M N T X ) Third Quarter Earnings Conference Call November 1, 2018MANITEX INTERNATIONAL, INC. ( N A S D A Q : M N T X ) Third Quarter Earnings Conference Call November 1, 2018