MANITEX INTERNATIONAL, INC. (NASDAQ: MNTX) First Quarter Earnings Conference Call May 6, 2019 Exhibit 99.2

FORWARD-LOOKING STATEMENT & NON-GAAP MEASURES NASDAQ : MNTX Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

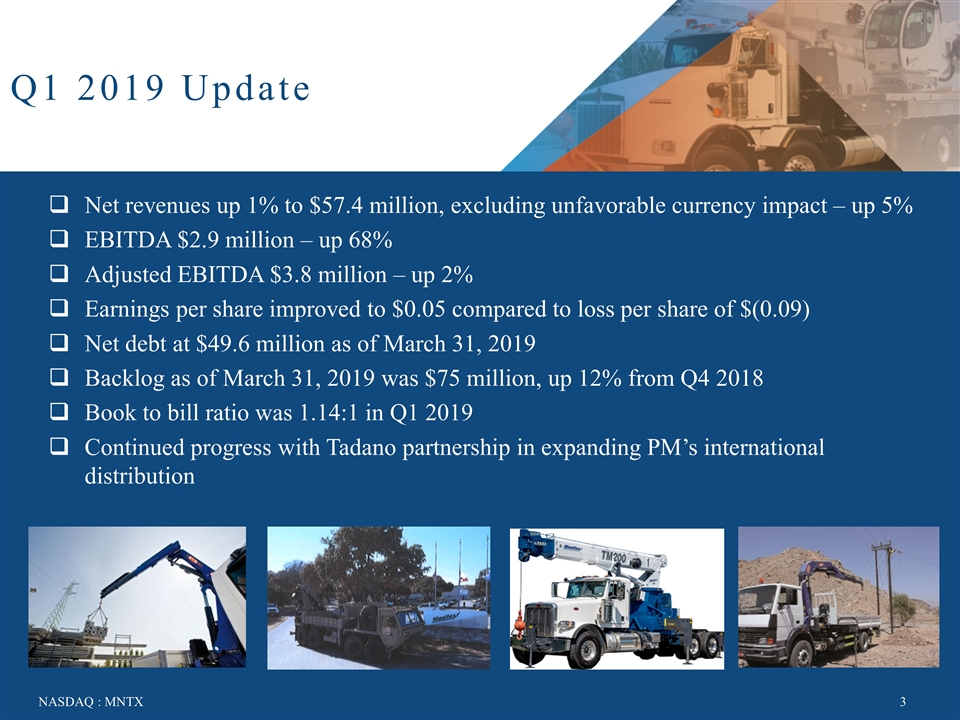

Q1 2019 Update NASDAQ : MNTX3 Net revenues up 1% to $57.4 million, excluding unfavorable currency impact – up 5% EBITDA $2.9 million – up 68% Adjusted EBITDA $3.8 million – up 2% Earnings per share improved to $0.05 compared to loss per share of $(0.09) Net debt at $49.6 million as of March 31, 2019 Backlog as of March 31, 2019 was $75 million, up 12% from Q4 2018 Book to bill ratio was 1.14:1 in Q1 2019 Continued progress with Tadano partnership in expanding PM’s international distribution

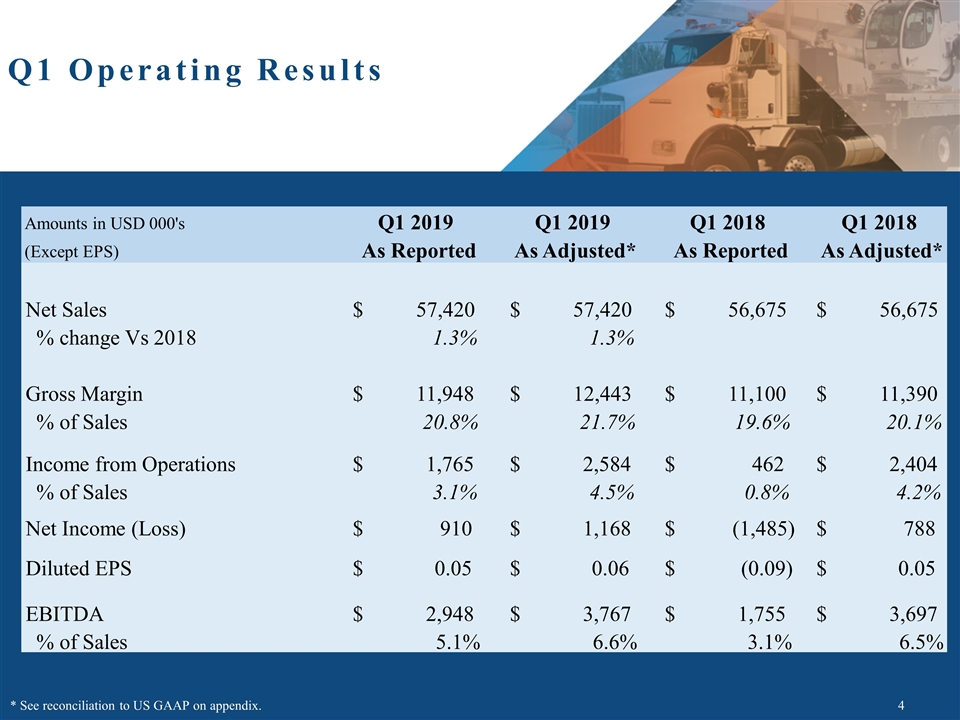

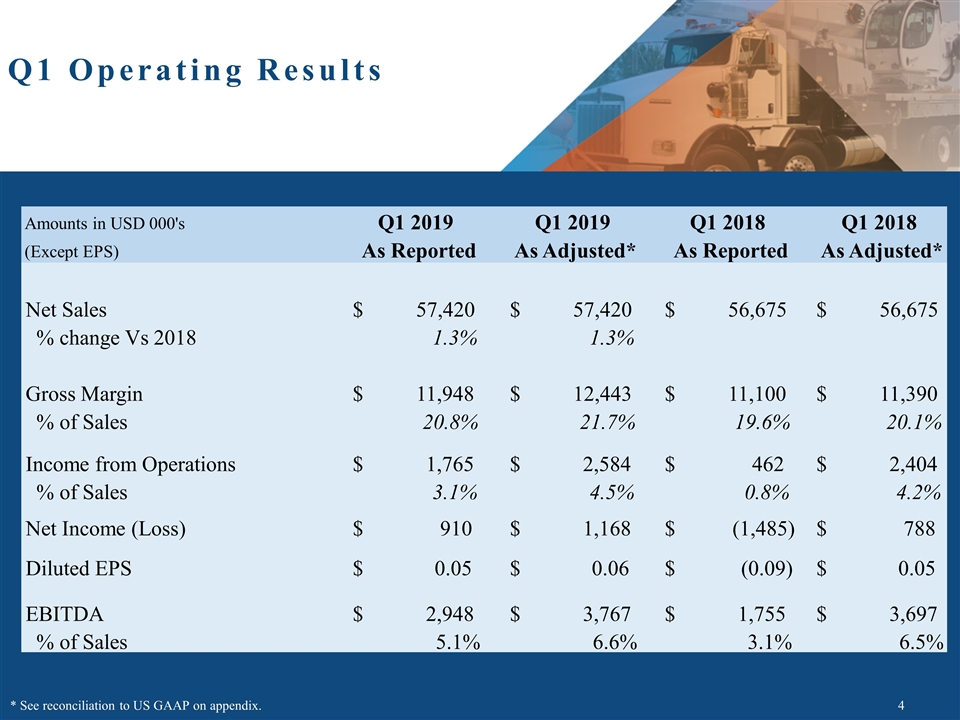

Q1 Operating Results * See reconciliation to US GAAP on appendix. 4 Amounts in USD 000's Q1 2019 Q1 2019 Q1 2018 Q1 2018 (Except EPS) As Reported As Adjusted* As Reported As Adjusted* Net Sales 57,420 $ 57,420 $ 56,675 $ 56,675 $ % change Vs 2018 1.3% 1.3% Gross Margin 11,948 $ 12,443 $ 11,100 $ 11,390 $ % of Sales 20.8% 21.7% 19.6% 20.1% Income from Operations 1,765 $ 2,584 $ 462 $ 2,404 $ % of Sales 3.1% 4.5% 0.8% 4.2% Net Income (Loss) 910 $ 1,168 $ (1,485) $ 788 $ Diluted EPS 0.05 $ 0.06 $ (0.09) $ 0.05 $ EBITDA 2,948 $ 3,767 $ 1,755 $ 3,697 $ % of Sales 5.1% 6.6% 3.1% 6.5%

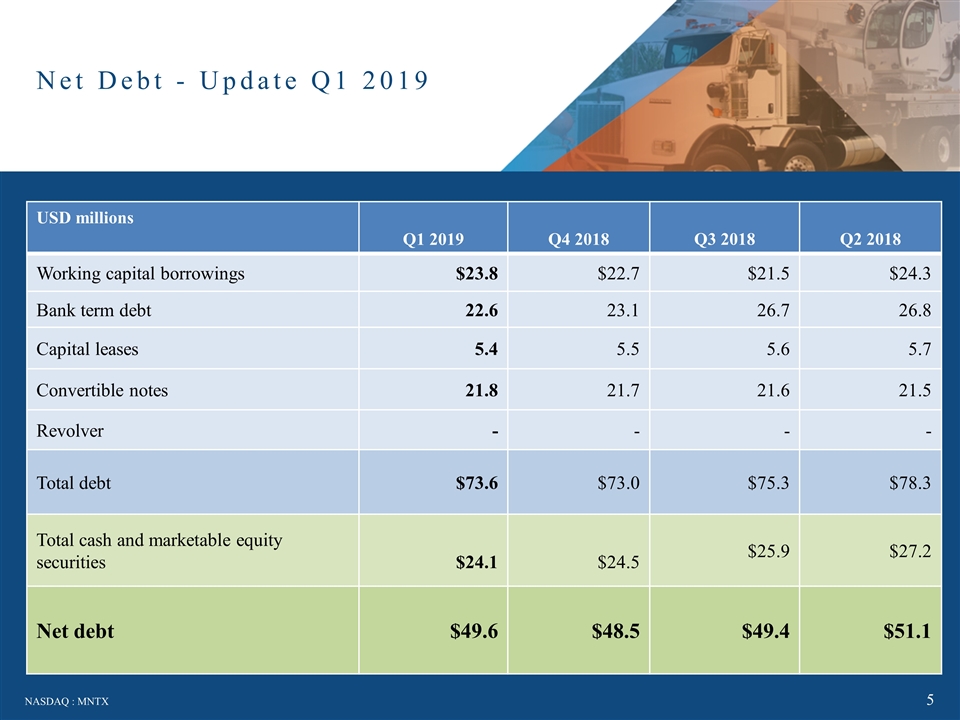

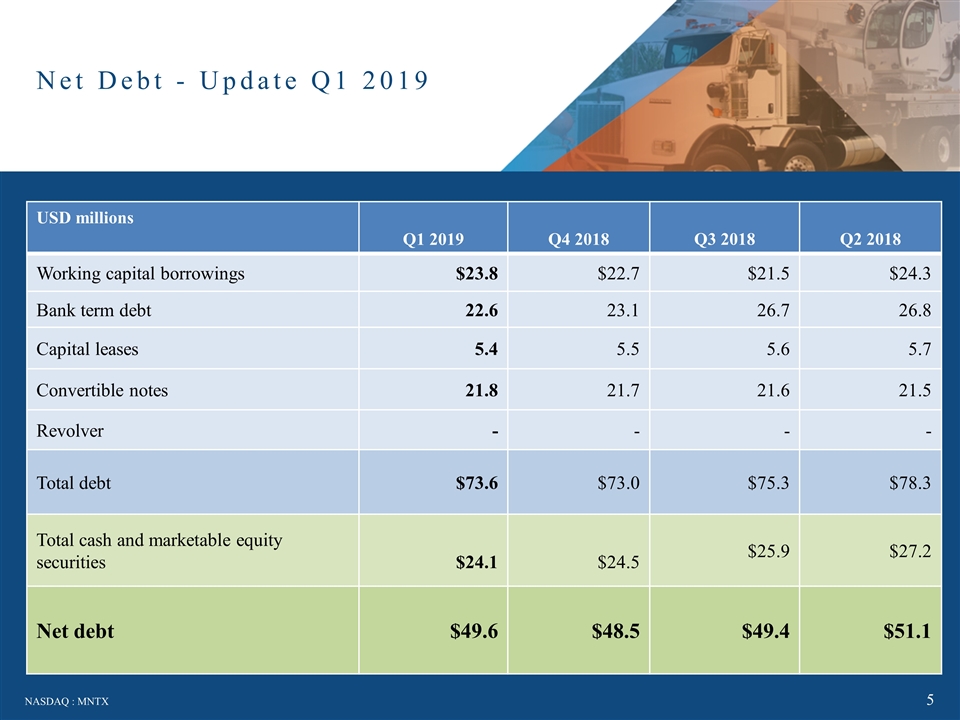

Net Debt - Update Q1 2019 NASDAQ : MNTX USD millions Q1 2019 Q4 2018 Q3 2018 Q2 2018 Working capital borrowings $23.8 $22.7 $21.5 $24.3 Bank term debt 22.6 23.1 26.7 26.8 Capital leases 5.4 5.5 5.6 5.7 Convertible notes 21.8 21.7 21.6 21.5 Revolver - - - - Total debt $73.6 $73.0 $75.3 $78.3 Total cash and marketable equity securities $24.1 $24.5 $25.9 $27.2 Net debt $49.6 $48.5 $49.4 $51.1

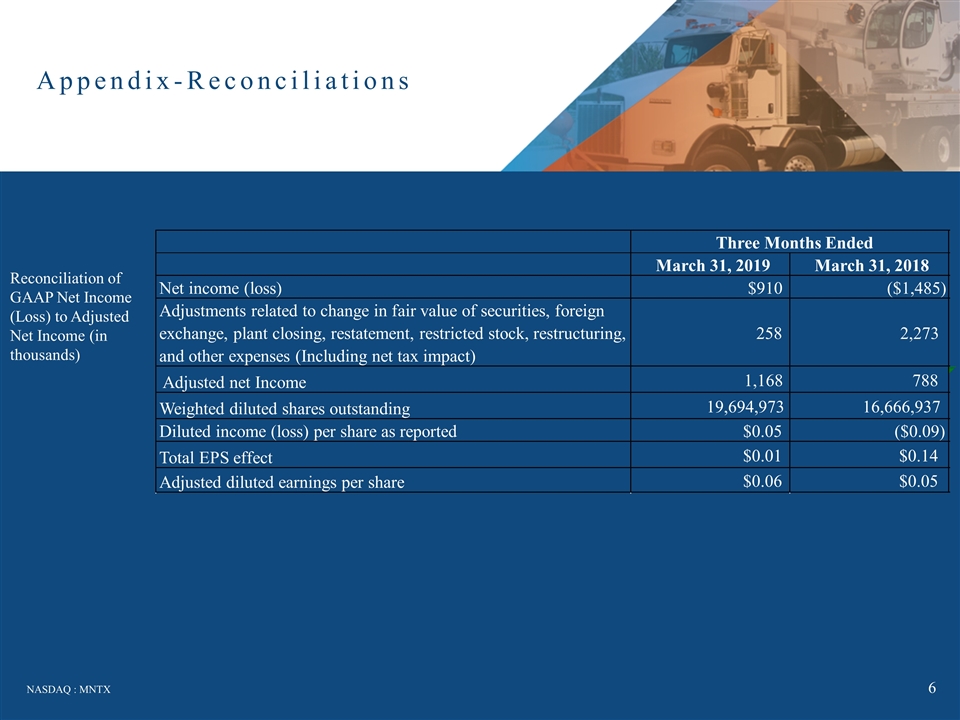

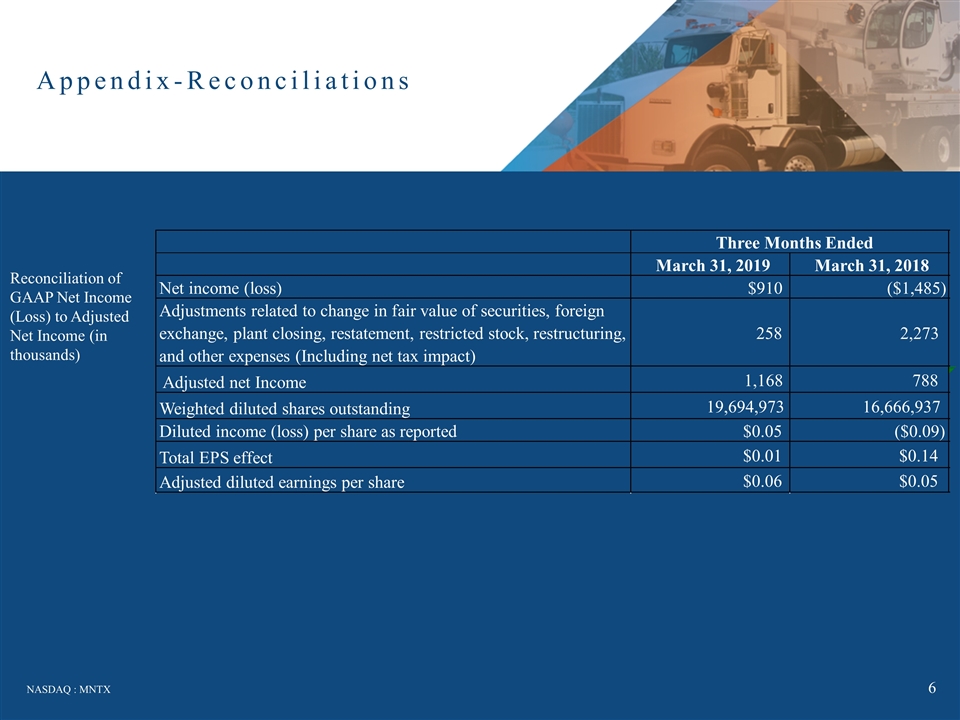

Appendix-Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (in thousands) March 31, 2019 March 31, 2018 Net income (loss) $910 ($1,485) Adjustments related to change in fair value of securities, foreign exchange, plant closing, restatement, restricted stock, restructuring, and other expenses (Including net tax impact) 258 2,273 Adjusted net Income 1,168 788 Weighted diluted shares outstanding 19,694,973 16,666,937 Diluted income (loss) per share as reported $0.05 ($0.09) Total EPS effect $0.01 $0.14 Adjusted diluted earnings per share $0.06 $0.05 Three Months Ended

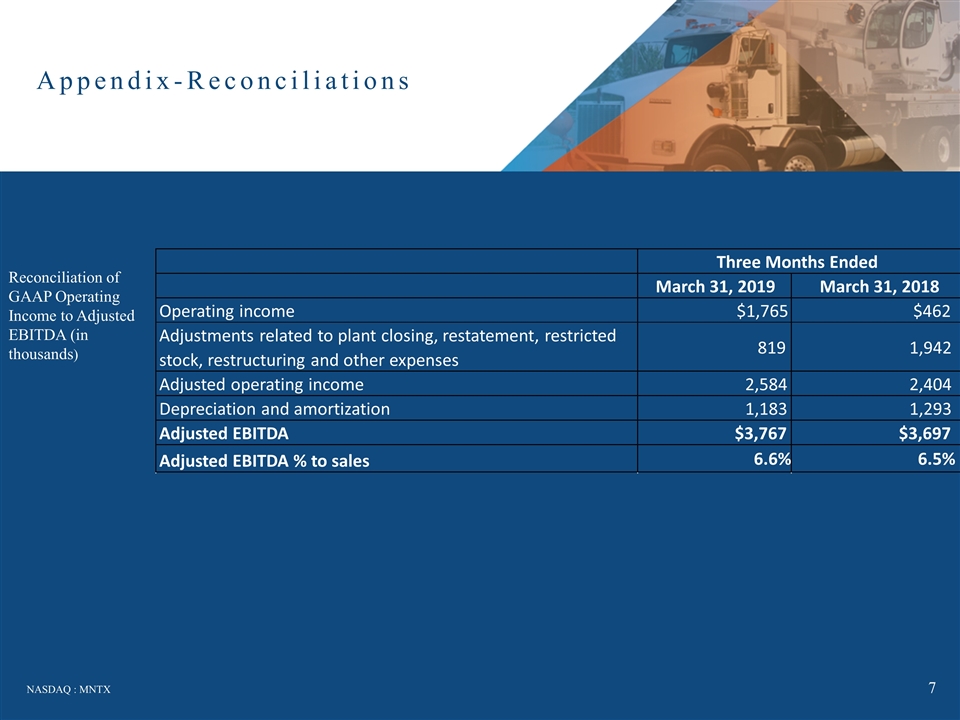

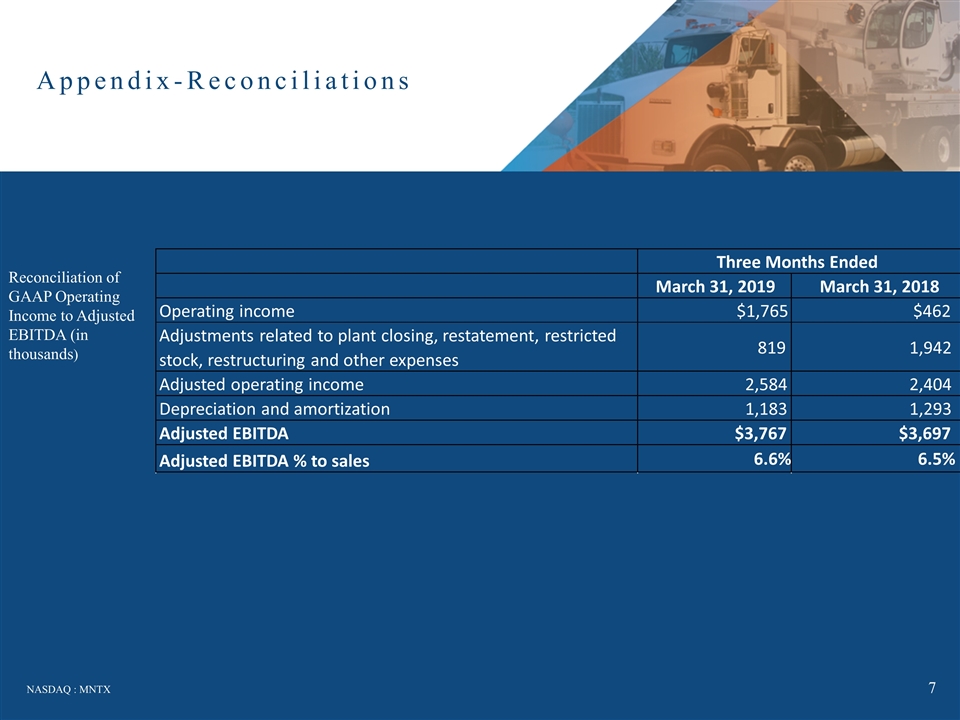

Appendix-Reconciliations NASDAQ : MNTX Reconciliation of GAAP Operating Income to Adjusted EBITDA (in thousands) March 31, 2019 March 31, 2018 Operating income $1,765 $462 Adjustments related to plant closing, restatement, restricted stock, restructuring and other expenses 819 1,942 Adjusted operating income 2,584 2,404 Depreciation and amortization 1,183 1,293 Adjusted EBITDA $3,767 $3,697 Adjusted EBITDA % to sales 6.6% 6.5% Three Months Ended

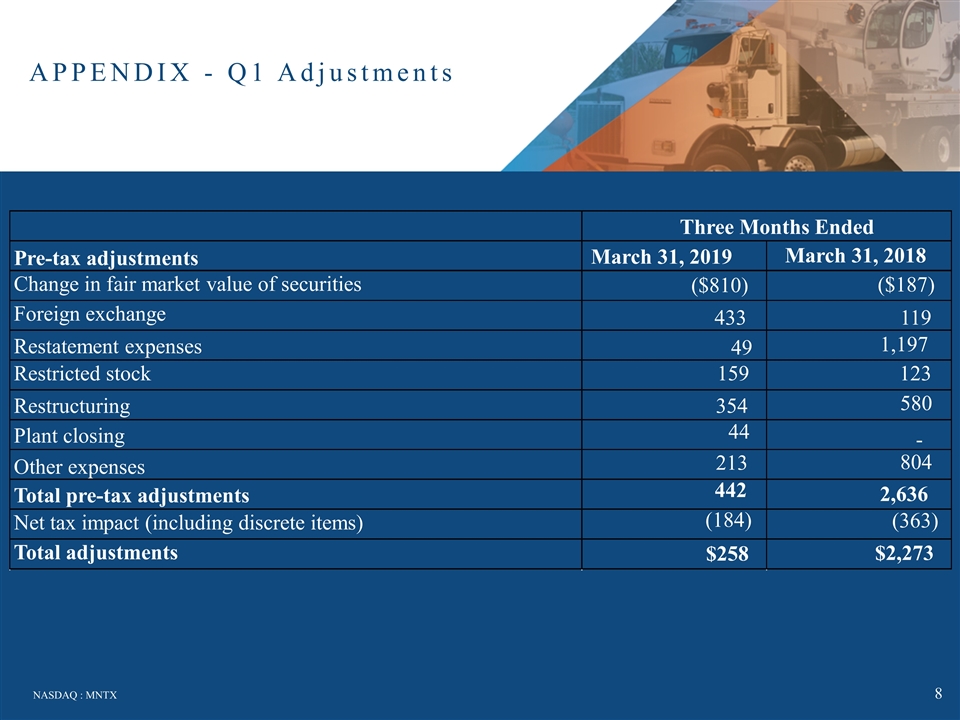

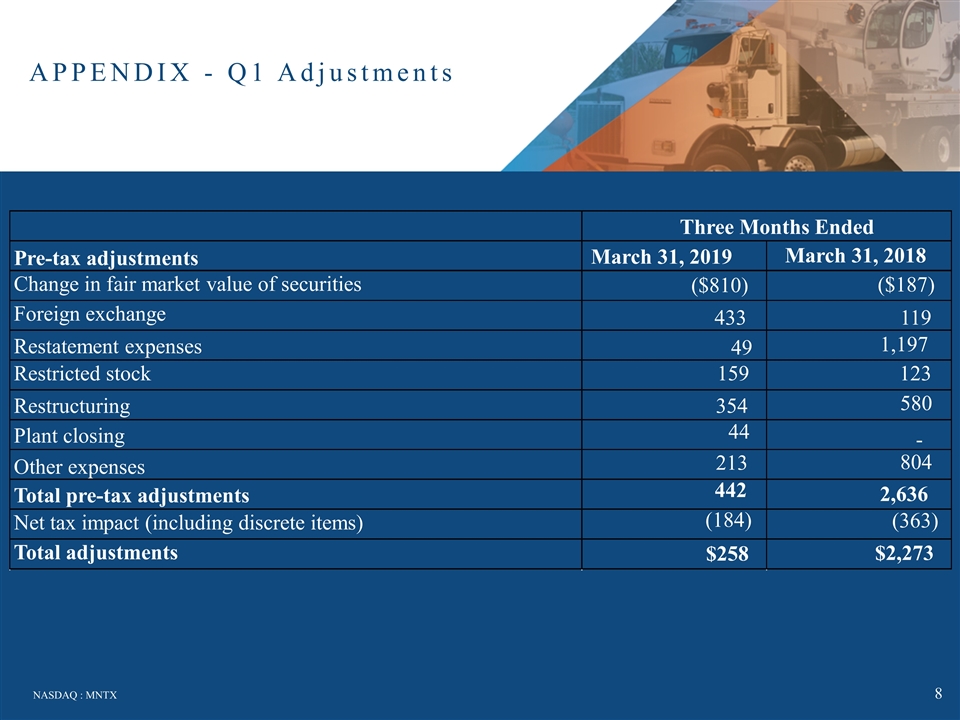

APPENDIX - Q1 Adjustments NASDAQ : MNTX Pre-tax adjustments Change in fair market value of securities Foreign exchange Restatement expenses Restricted stock Restructuring Plant closing Other expenses Total pre-tax adjustments Net tax impact (including discrete items) Total adjustments March 31, 2019 March 31, 2018 ($810) ($187) 433 119 49 1,197 159 123 354 580 44 - 213 804 442 2,636 (184) (363) $258 $2,273 Three Months Ended

MANITEX INTERNATIONAL, INC. (NASDAQ: MNTX) First Quarter Earnings Conference Call May 6, 2019