MANITEX INTERNATIONAL, INC. (NASDAQ: MNTX) Second Quarter Earnings Conference Call August 8, 2019 Exhibit 99.2

FORWARD-LOOKING STATEMENT & NON-GAAP MEASURES NASDAQ : MNTX Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise.

Q2 2019 Update NASDAQ : MNTX3 Introduced new 60-Ton Series TC600, with deliveries beginning in the second half of 2019 Added four new dealers for Manitex and PM including MADISA Group and Wyoming Machinery Company Renewal of supply agreement with a leading Italian-based utility company for Aerial work platforms Shipped first PM units to Tadano dealers in Asia with PM/Tadano branding Secured an order for PM cranes from a military customer in Asia valued at $1.0 million

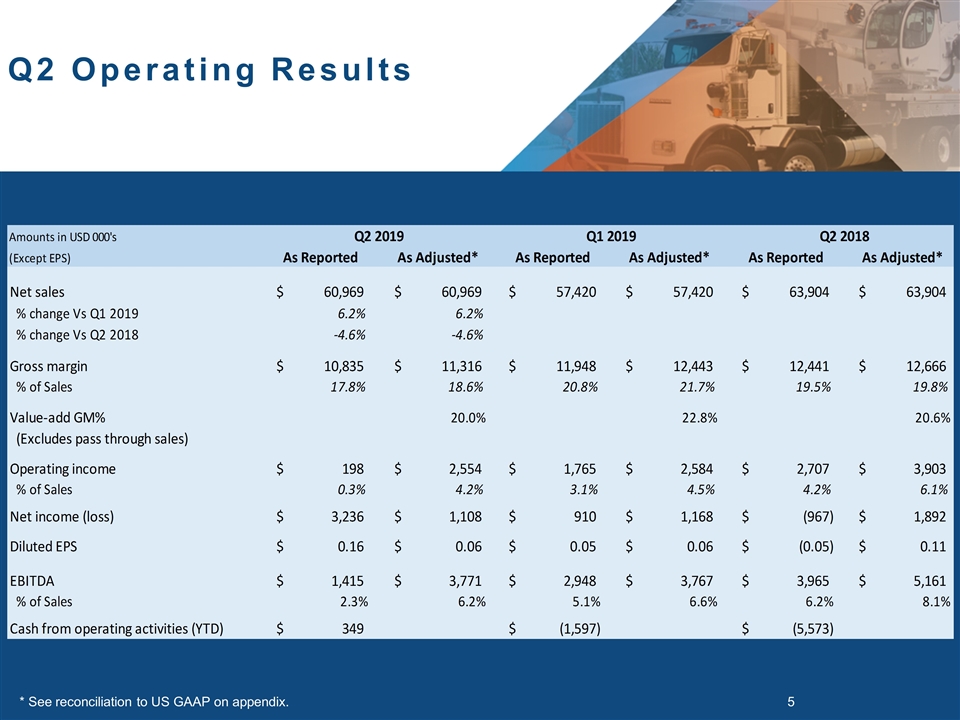

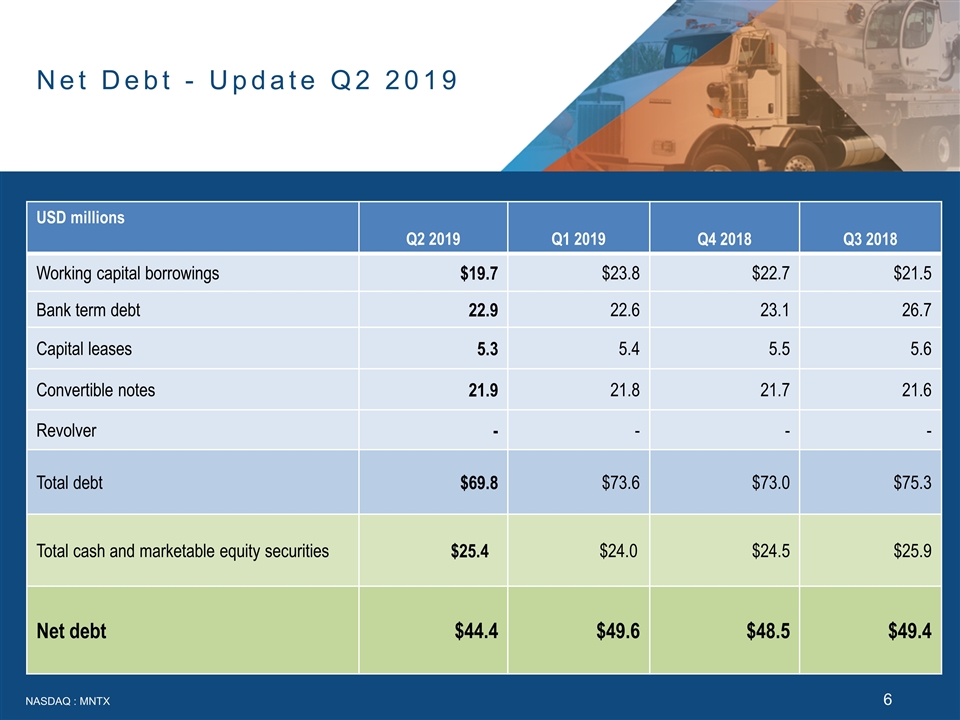

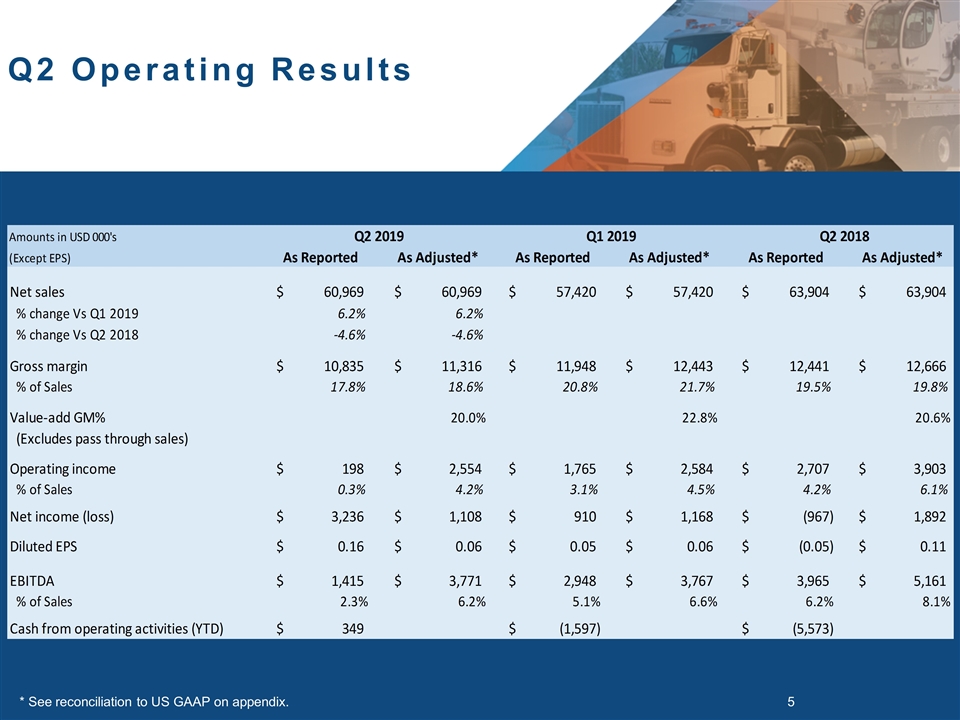

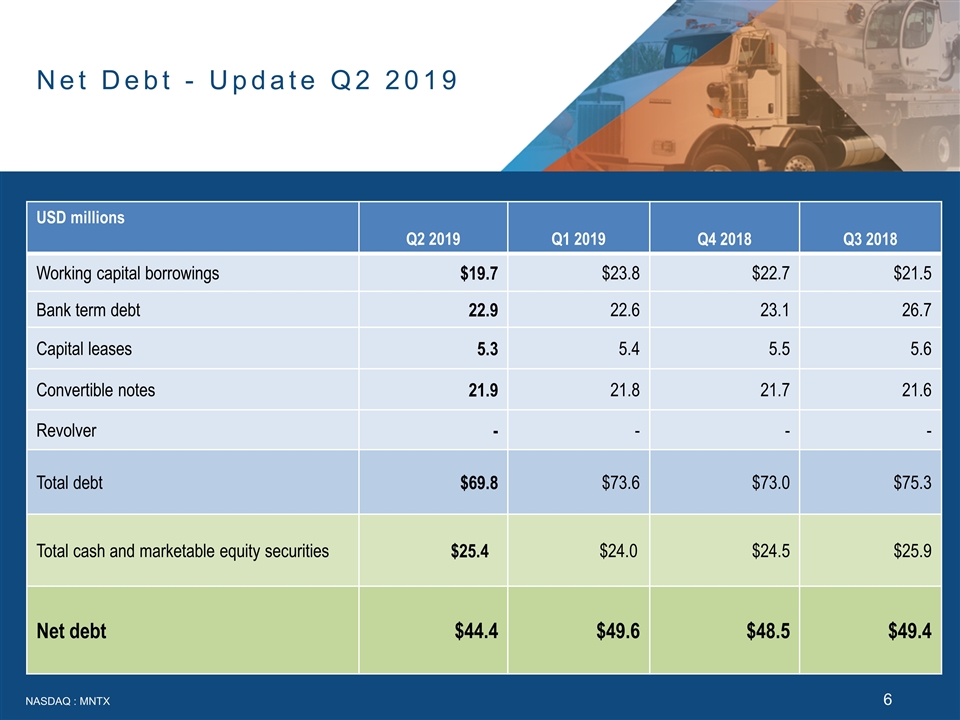

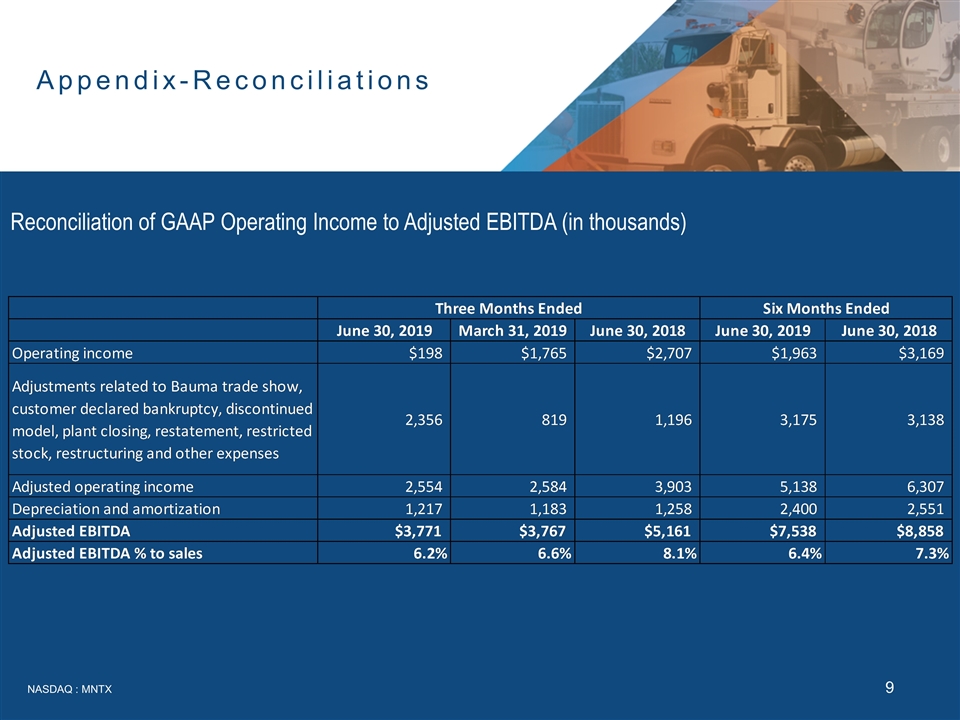

Q2 2019 Update NASDAQ : MNTX4 Net revenues of $61.0 million, up 6% from Q1 2019, down 5% vs. prior year or 2% excluding unfavorable currency impact Adjusted EBITDA $3.8 million or 6.2 % of sales Earnings per share improved to $0.16 per share compared to $0.05 from Q1 2019 Net debt reduction of $5.2 million in Q2 Backlog as of July 31, 2019 was $63 million Book to bill ratio was 0.71:1 in Q2 2019 Increase in value of our holdings in ASV after the announcement of the pending sale of ASV to Yanmar resulted a $4.4 million gain in Q2

Q2 Operating Results * See reconciliation to US GAAP on appendix.5

Net Debt - Update Q2 2019 NASDAQ : MNTX USD millions Q2 2019 Q1 2019 Q4 2018 Q3 2018 Working capital borrowings $19.7 $23.8 $22.7 $21.5 Bank term debt 22.9 22.6 23.1 26.7 Capital leases 5.3 5.4 5.5 5.6 Convertible notes 21.9 21.8 21.7 21.6 Revolver - - - - Total debt $69.8 $73.6 $73.0 $75.3 Total cash and marketable equity securities $25.4 $24.0 $24.5 $25.9 Net debt $44.4 $49.6 $48.5 $49.4

Appendix-Net sales and gross margin% NASDAQ : MNTX

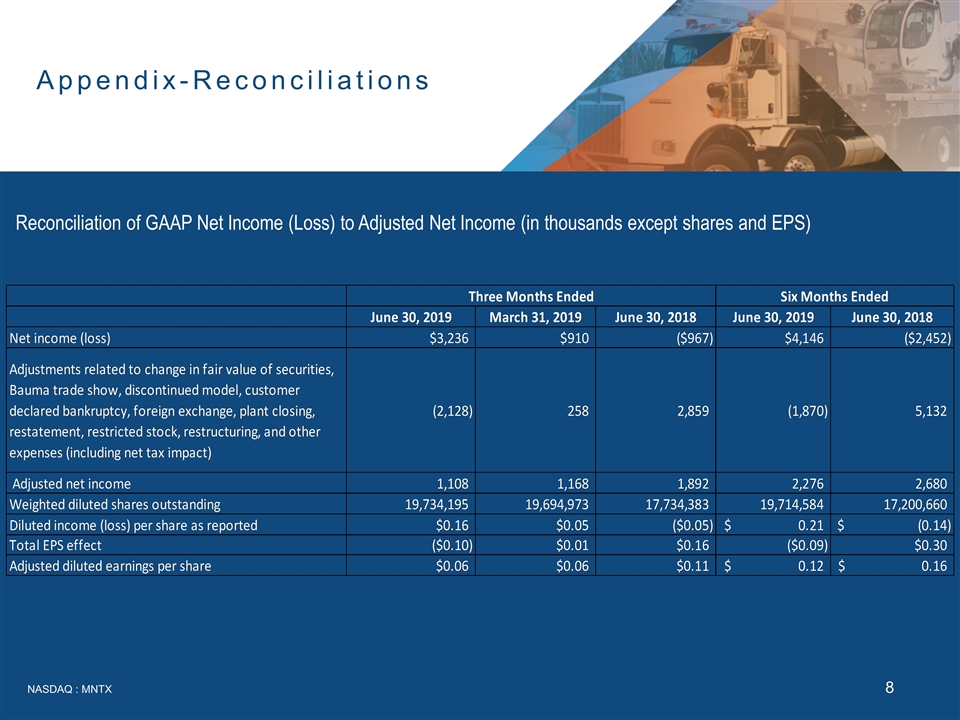

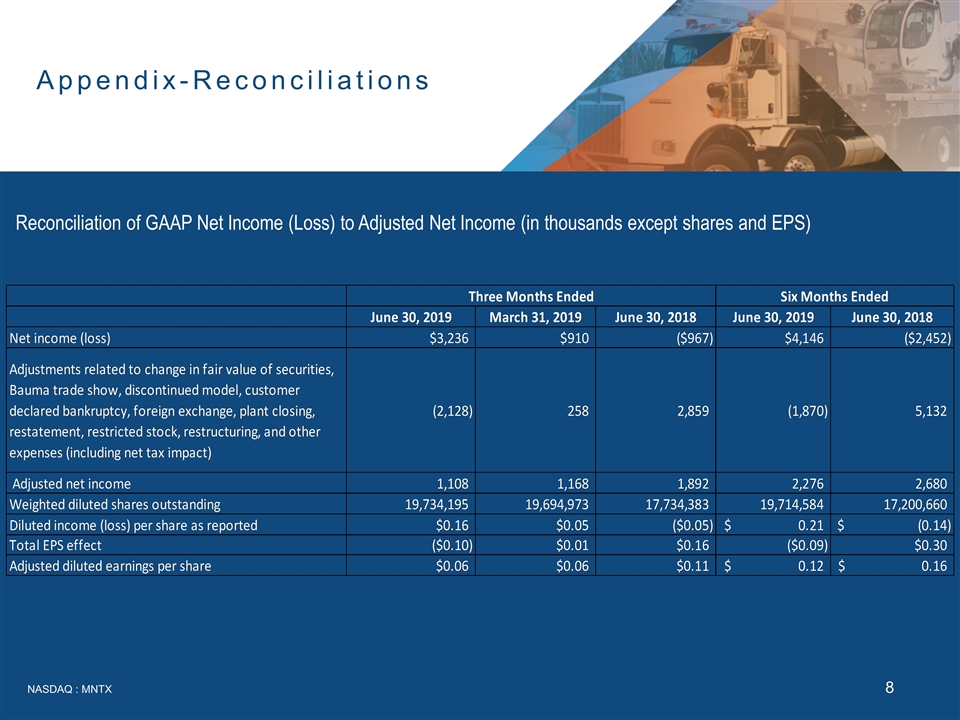

Appendix-Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (in thousands except shares and EPS)

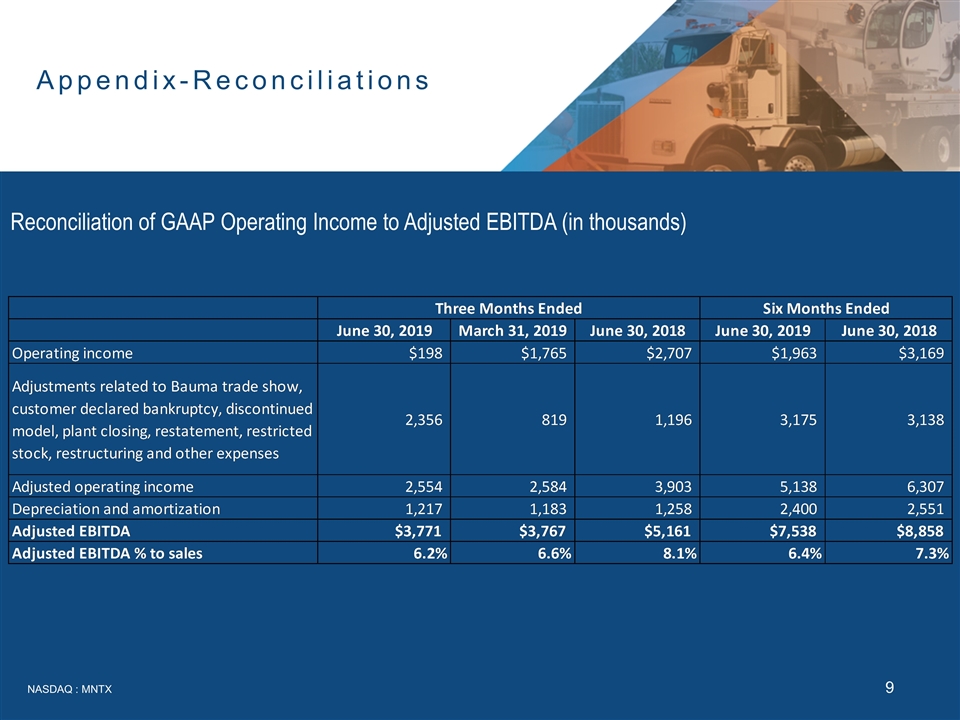

Appendix-Reconciliations NASDAQ : MNTX Reconciliation of GAAP Operating Income to Adjusted EBITDA (in thousands)

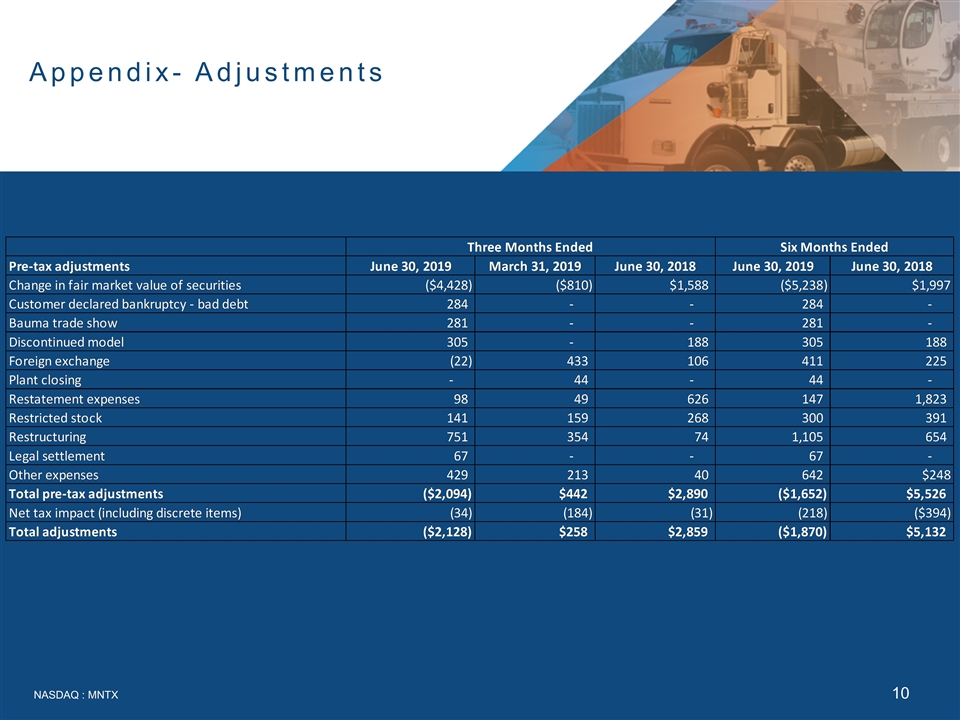

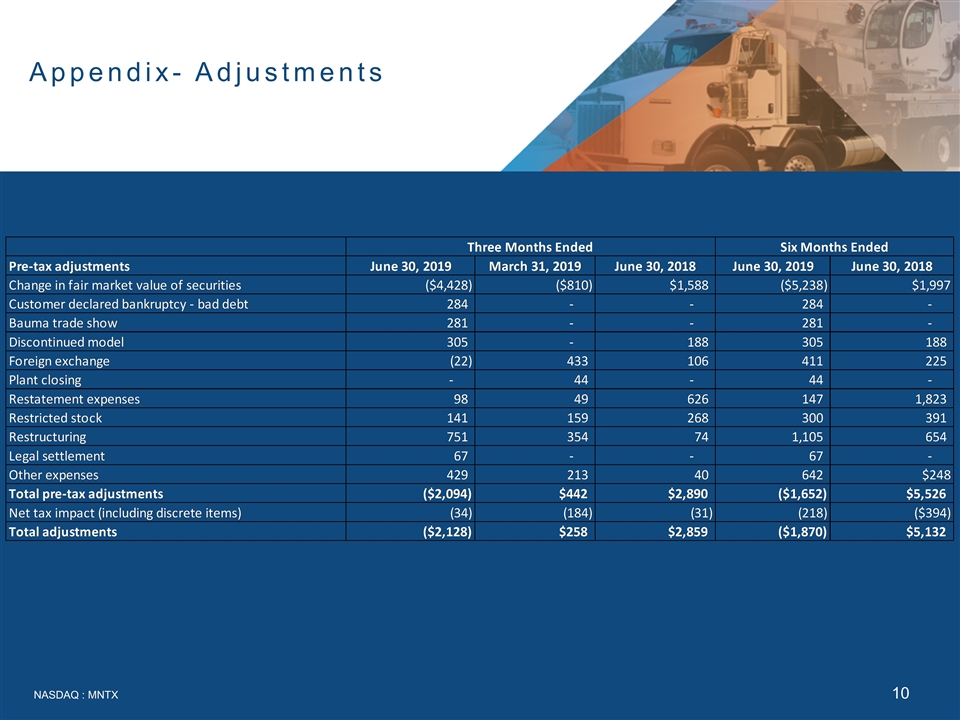

Appendix- Adjustments NASDAQ : MNTX

MANITEX INTERNATIONAL, INC. (NASDAQ: MNTX) Second Quarter Earnings Conference Call August 8, 2019