MANITEX INTERNATIONAL, INC. NASDAQ: MNTX First Quarter 2022 Earnings Conference Call May 4, 2022 Exhibit 99.2

Forward-Looking Statement and Non-GAAP Measures Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains statements that are forward-looking in nature which express the beliefs and expectations of management including statements regarding the Company’s expected results of operations or liquidity; statements concerning projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results and future economic performance; and statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “estimate,” “plan,” “project,” “continuing,” “ongoing,” “expect,” “we believe,” “we intend,” “may,” “will,” “should,” “could,” and similar expressions. Such statements are based on current plans, estimates and expectations and involve a number of known and unknown risks, uncertainties and other factors that could cause the Company's future results, performance or achievements to differ significantly from the results, performance or achievements expressed or implied by such forward-looking statements. These factors and additional information are discussed in the Company's filings with the Securities and Exchange Commission and statements in this presentation should be evaluated in light of these important factors. Although we believe that these statements are based upon reasonable assumptions, we cannot guarantee future results. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. NASDAQ : MNTX

Changes at Manitex Announced April 11, 2022: Michael Coffey Named CEO, Acquisition of Rabern Rentals NASDAQ : MNTX Michael Coffey 25 years of industry experience spanning operations management, strategic integrations, manufacturing, M&A as Director, General Manager, Chief Executive Officer, and Chief Operating Officer Experience includes heavy equipment manufacturing and service providers such as H-E International, (sold to Hitachi Construction Machinery in 2016) a private equity backed enterprise, serving mining, oil & gas, and power generation markets, Old Castle Materials, a subsidiary of CRH International, and AMECO, a subsidiary of Fluor Worked with Manitex International management to identify, negotiate, and close Rabern Rentals transaction Rabern Rentals Annual revenues in 2021 of $21 million and $8 million Adjusted EBITDA Three locations, currently adding fourth, all in Texas Fleet/Rentals include 1,700 machines Gross Margins and Adjusted EBITDA margins are multiples of Manitex currently

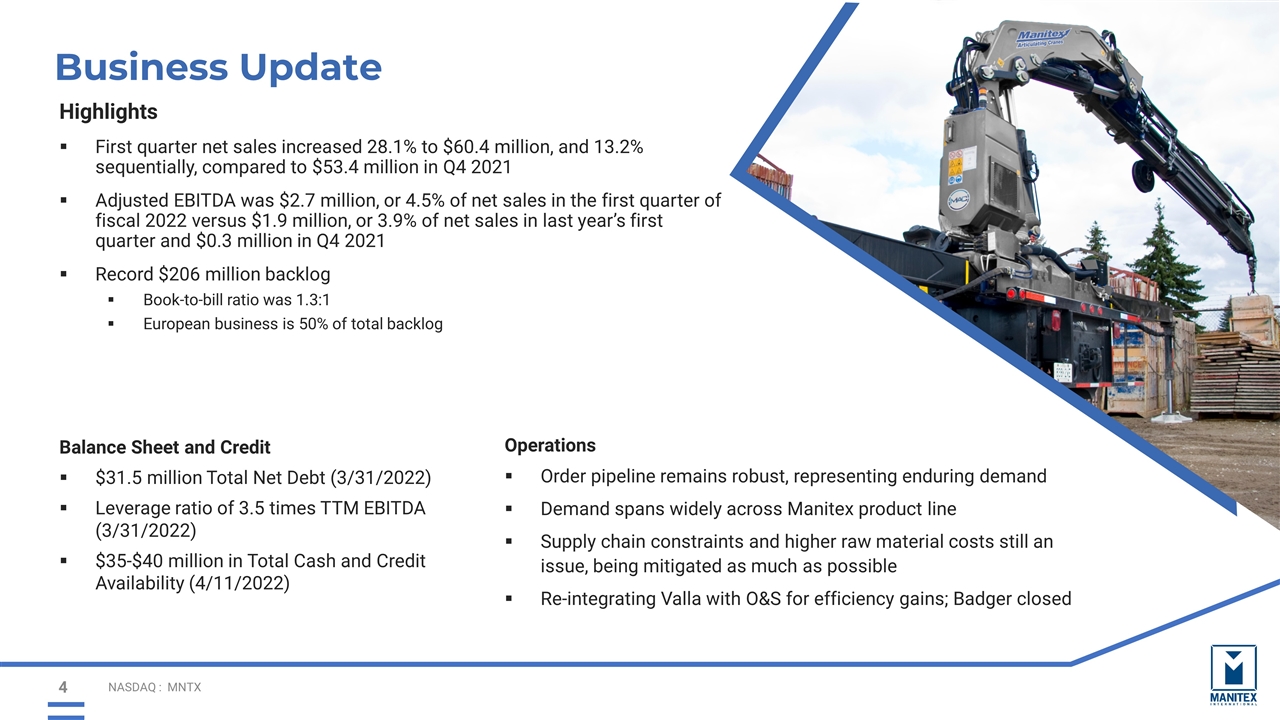

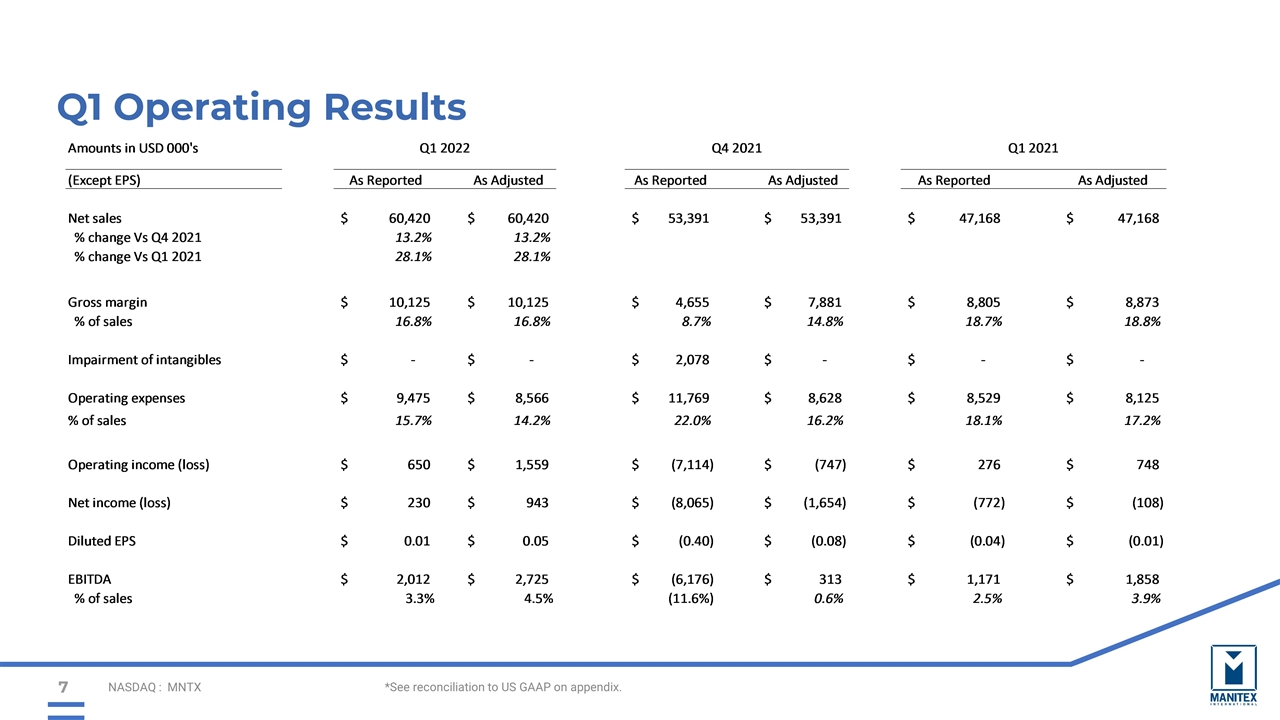

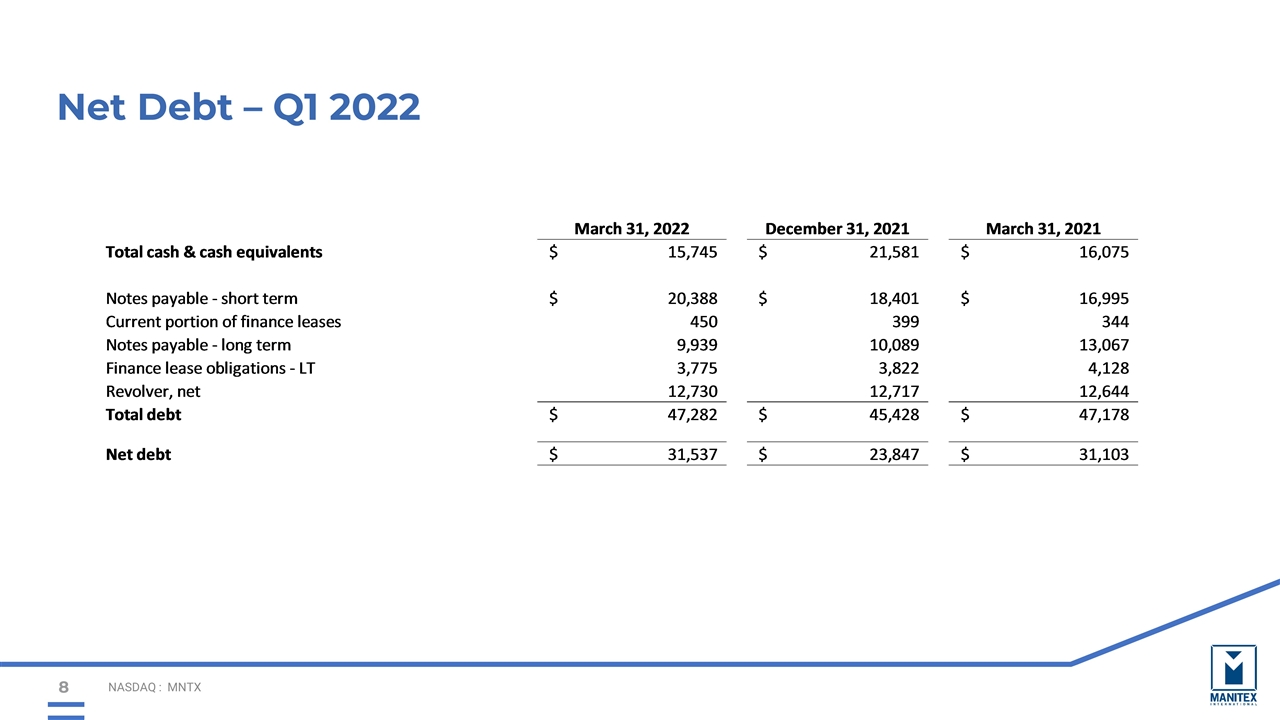

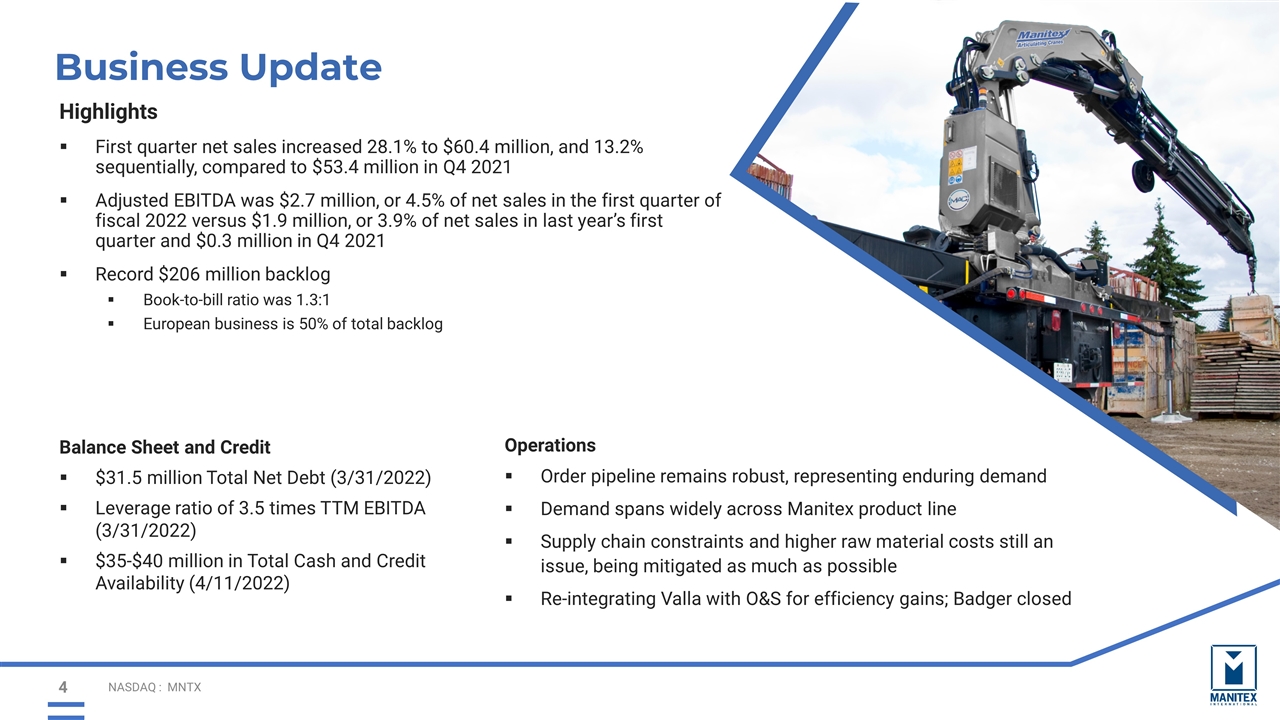

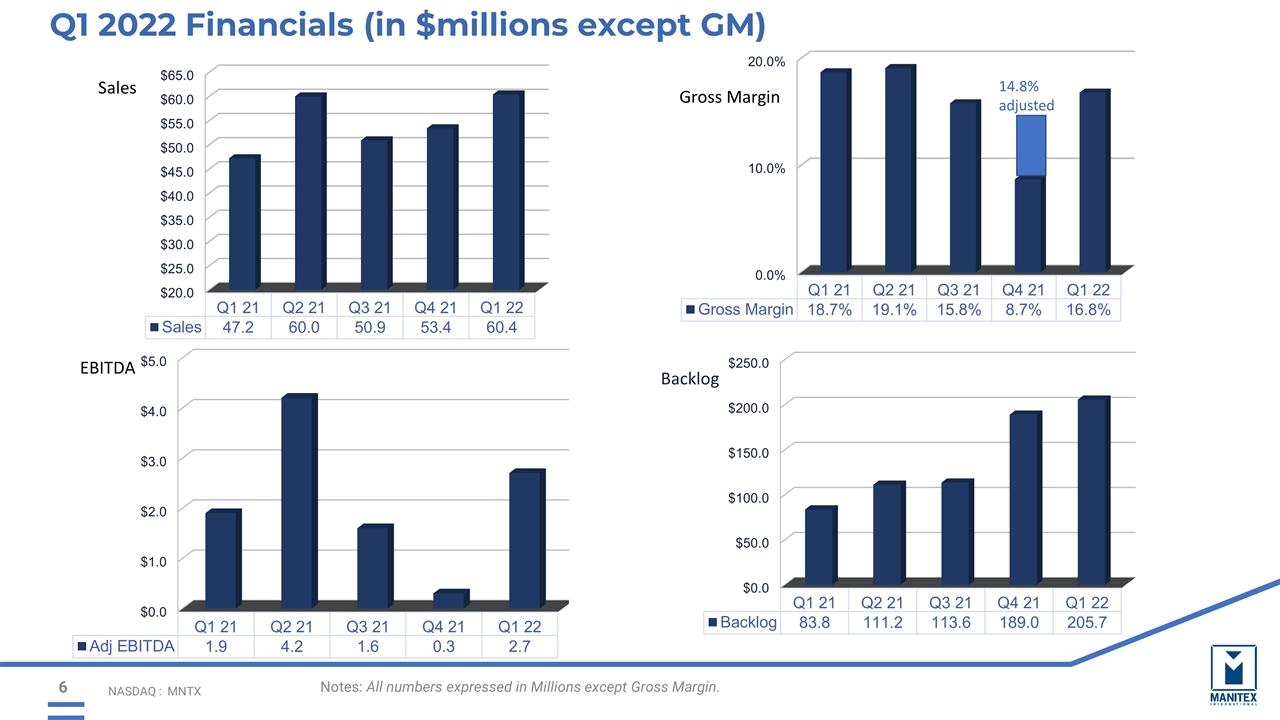

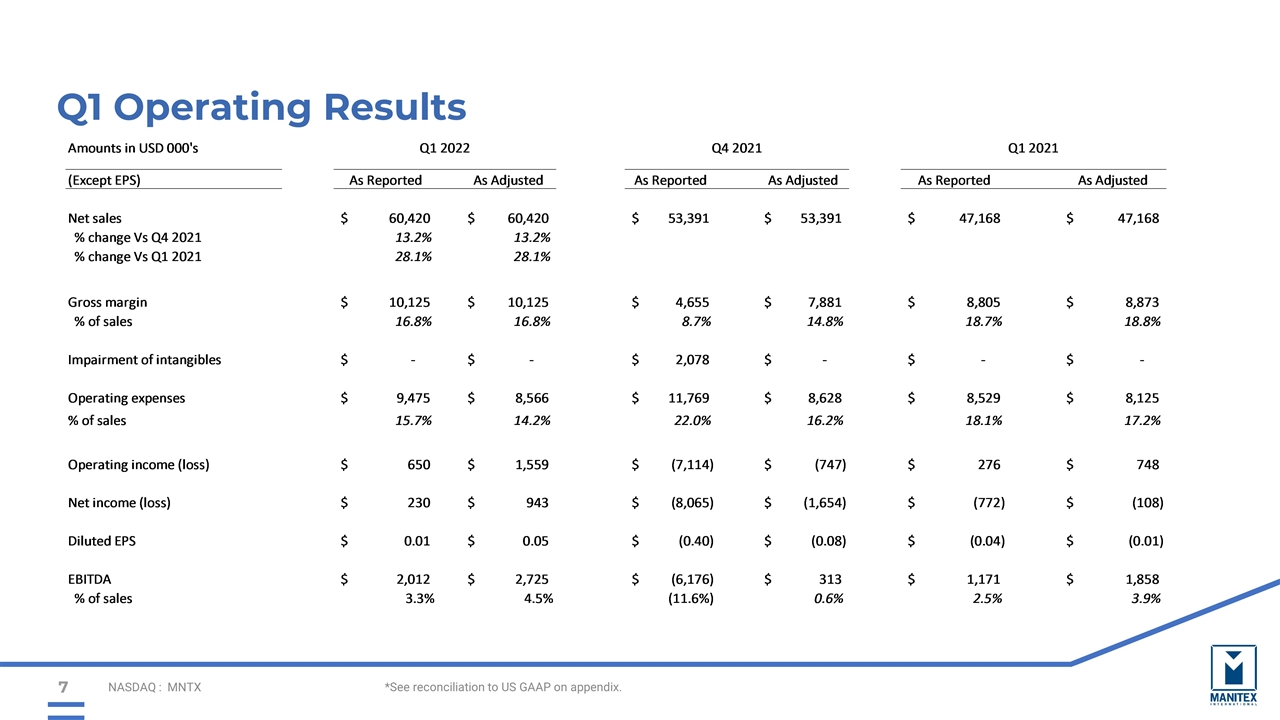

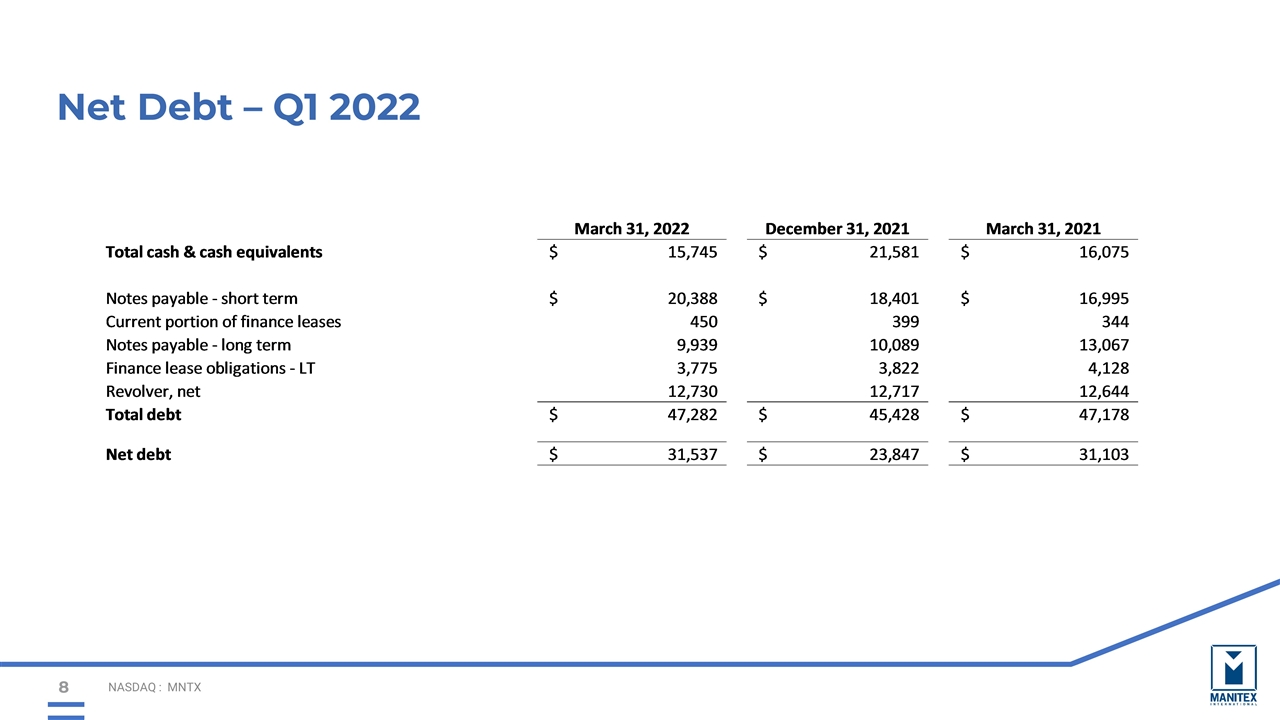

Business Update NASDAQ : MNTX Highlights First quarter net sales increased 28.1% to $60.4 million, and 13.2% sequentially, compared to $53.4 million in Q4 2021 Adjusted EBITDA was $2.7 million, or 4.5% of net sales in the first quarter of fiscal 2022 versus $1.9 million, or 3.9% of net sales in last year’s first quarter and $0.3 million in Q4 2021 Record $206 million backlog Book-to-bill ratio was 1.3:1 European business is 50% of total backlog Balance Sheet and Credit $31.5 million Total Net Debt (3/31/2022) Leverage ratio of 3.5 times TTM EBITDA (3/31/2022) $35-$40 million in Total Cash and Credit Availability (4/11/2022) Operations Order pipeline remains robust, representing enduring demand Demand spans widely across Manitex product line Supply chain constraints and higher raw material costs still an issue, being mitigated as much as possible Re-integrating Valla with O&S for efficiency gains; Badger closed

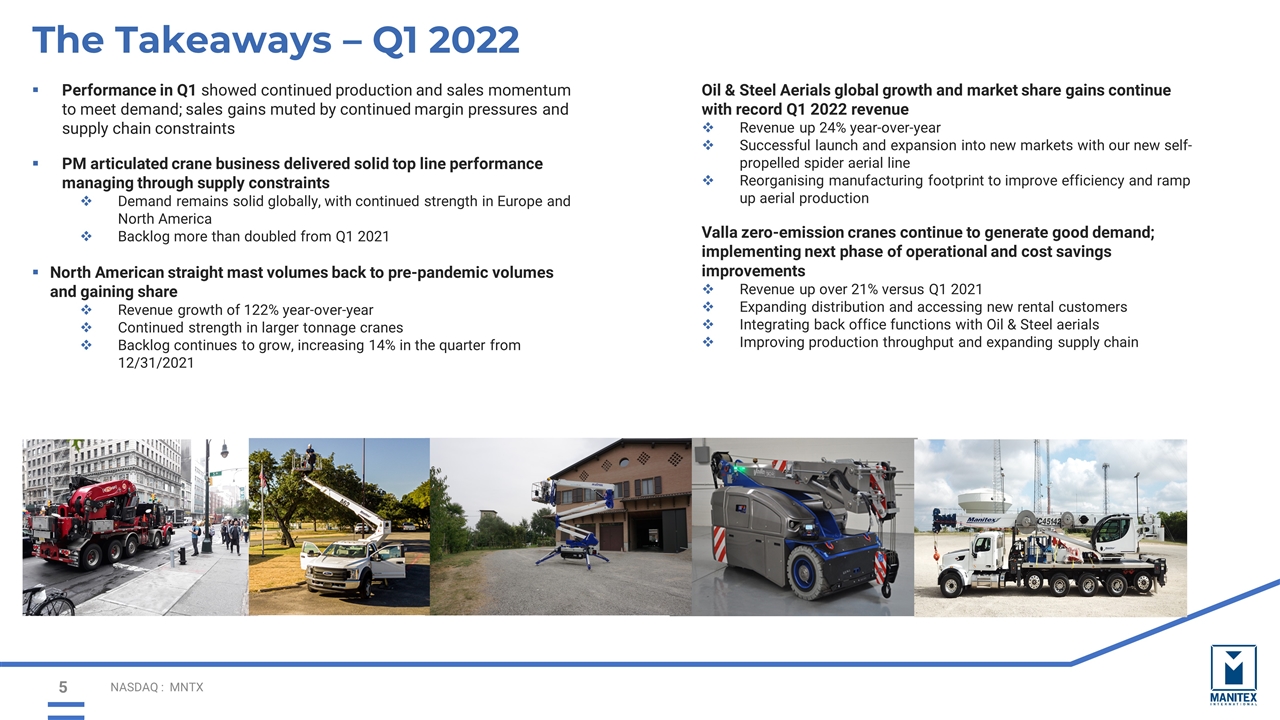

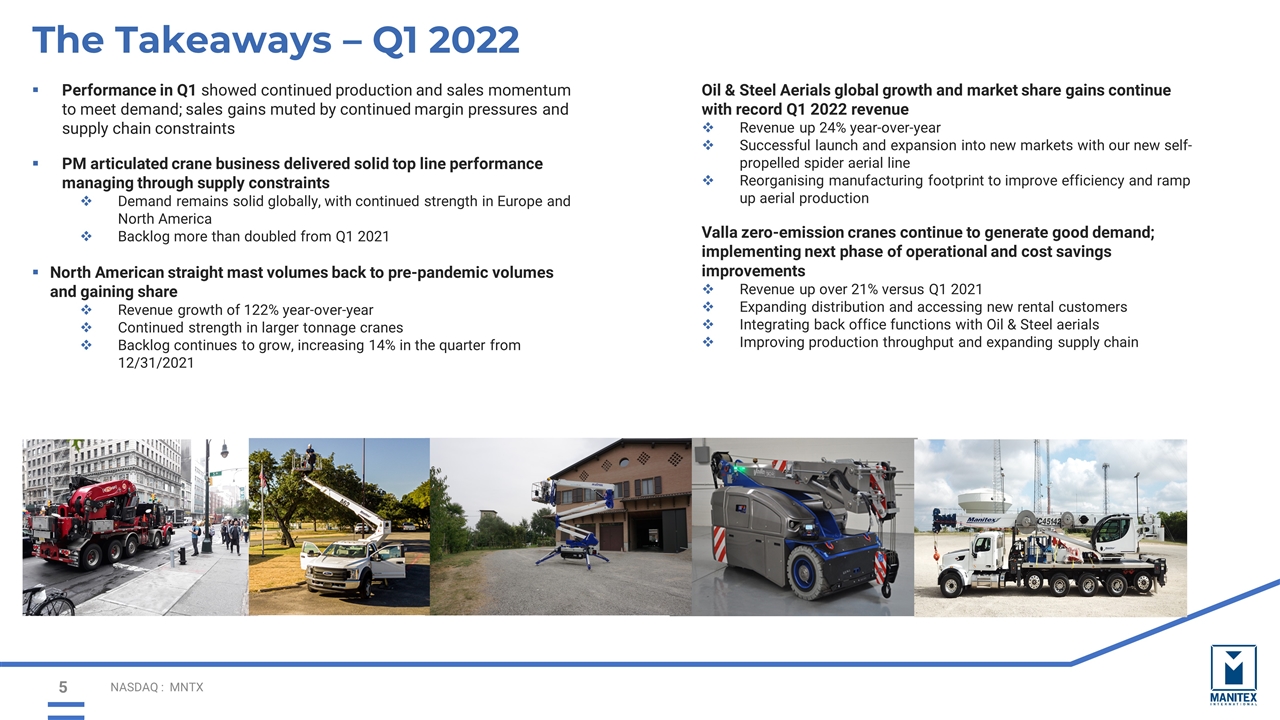

NASDAQ : MNTX The Takeaways – Q1 2022 Performance in Q1 showed continued production and sales momentum to meet demand; sales gains muted by continued margin pressures and supply chain constraints PM articulated crane business delivered solid top line performance managing through supply constraints Demand remains solid globally, with continued strength in Europe and North America Backlog more than doubled from Q1 2021 North American straight mast volumes back to pre-pandemic volumes and gaining share Revenue growth of 122% year-over-year Continued strength in larger tonnage cranes Backlog continues to grow, increasing 14% in the quarter from 12/31/2021 Oil & Steel Aerials global growth and market share gains continue with record Q1 2022 revenue Revenue up 24% year-over-year Successful launch and expansion into new markets with our new self-propelled spider aerial line Reorganising manufacturing footprint to improve efficiency and ramp up aerial production Valla zero-emission cranes continue to generate good demand; implementing next phase of operational and cost savings improvements Revenue up over 21% versus Q1 2021 Expanding distribution and accessing new rental customers Integrating back office functions with Oil & Steel aerials Improving production throughput and expanding supply chain

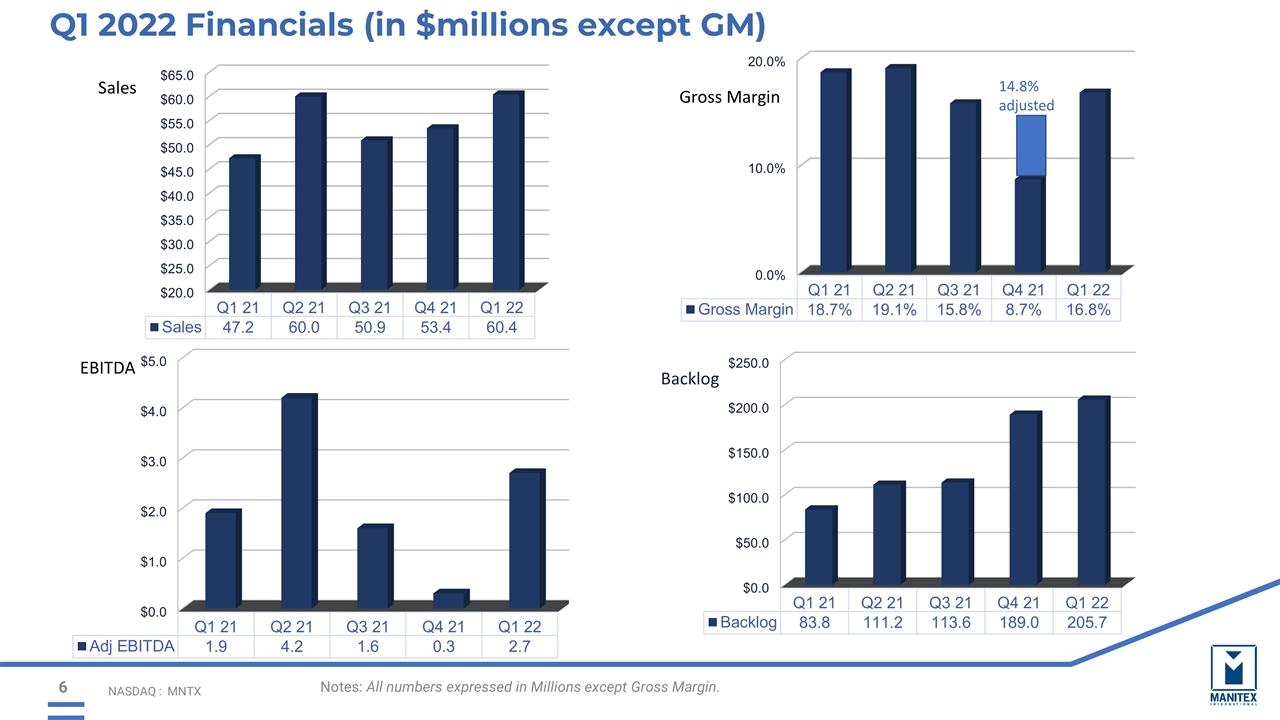

NASDAQ : MNTX Notes: All numbers expressed in Millions except Gross Margin. Q1 2022 Financials (in $millions except GM) Sales 14.8% adjusted

Q1 Operating Results *See reconciliation to US GAAP on appendix. NASDAQ : MNTX

Net Debt – Q1 2022 NASDAQ : MNTX

Closing Comments: NASDAQ : MNTX Customer value best represented in record level backlog, providing good visibility to higher revenue in 2022 Supply chain and inflation remain as headwinds Managed price and surcharge pass throughs Working capital management Efficiency initiatives at production level Cost reduction and supplier rationalization initiatives continue Rabern Rentals expected to provide enhanced financial performance to consolidated results Demand for rental products remains strong Integration activities underway Contribution to sales, margins, and cash flows begins in Q2 2022

APPENDIX – SUPPLEMENTAL FINANCIALS

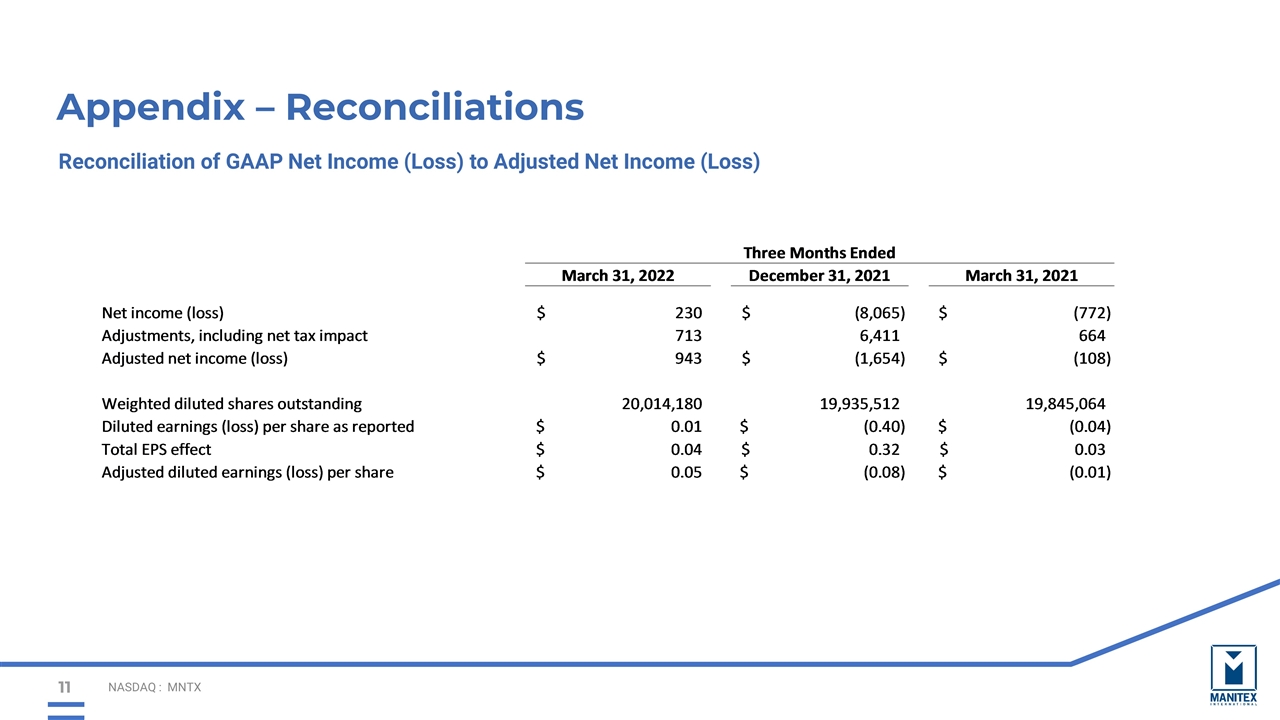

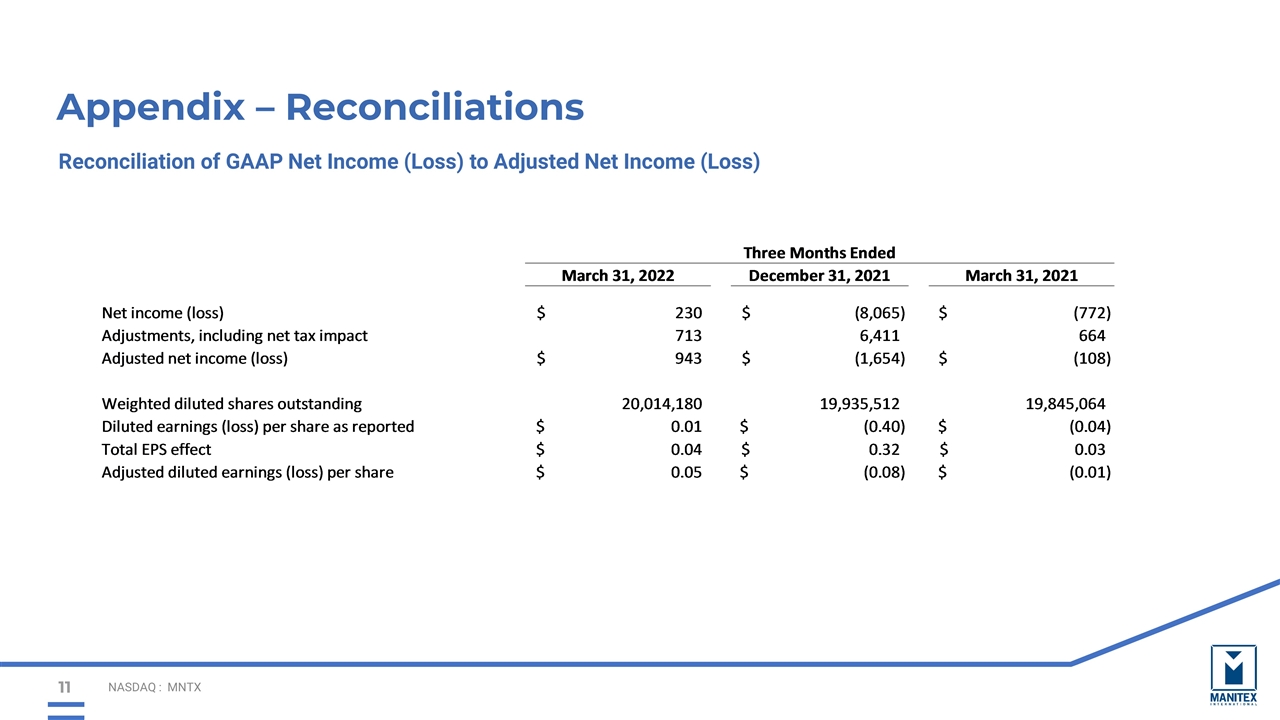

Appendix – Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted Net Income (Loss)

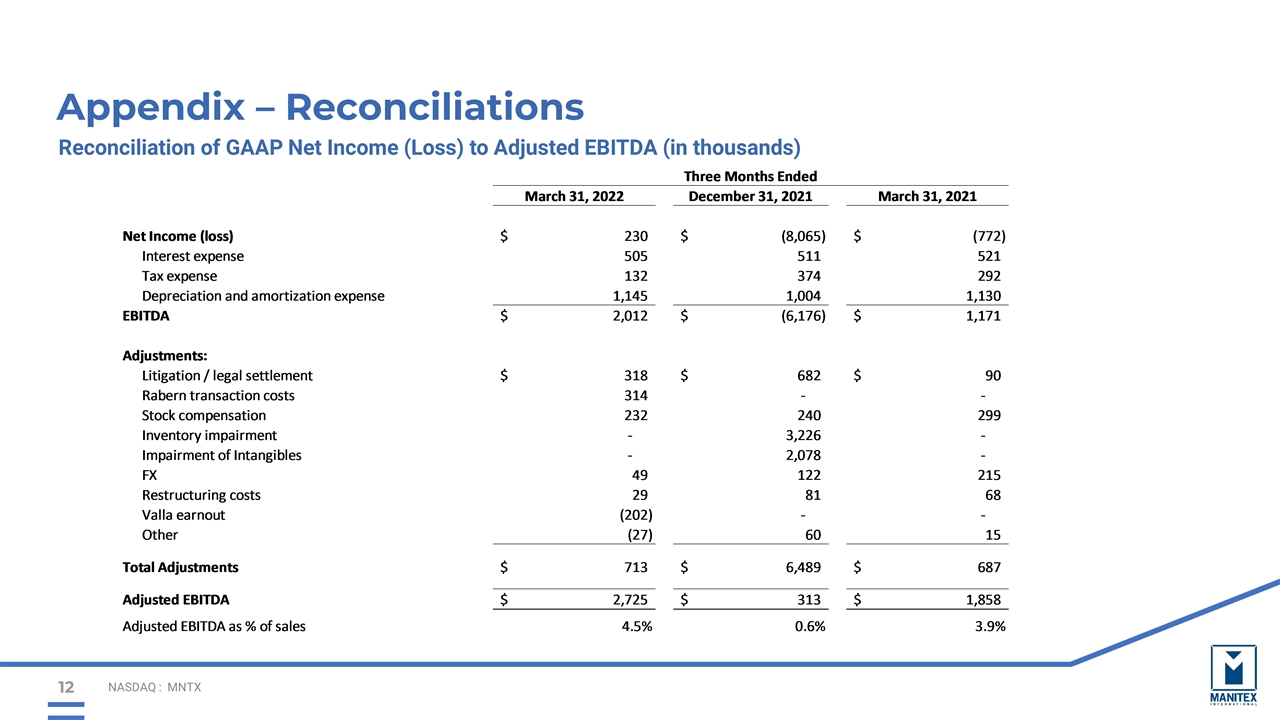

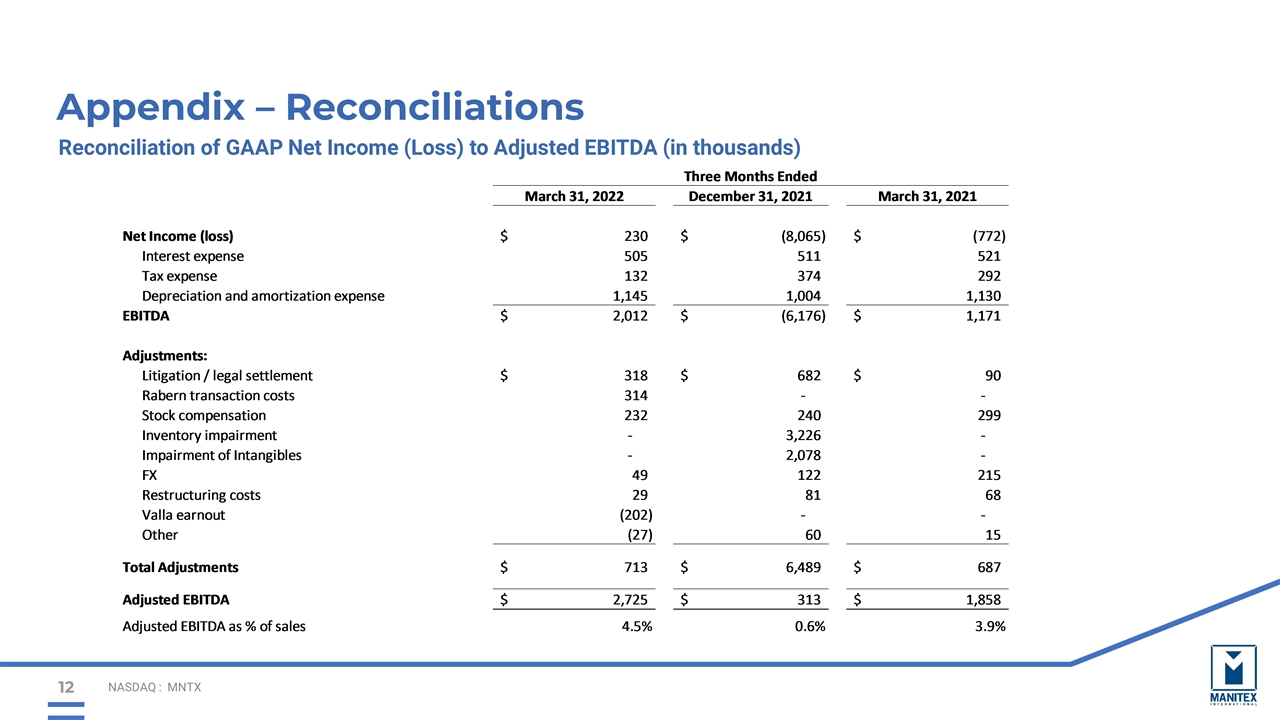

Appendix – Reconciliations NASDAQ : MNTX Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (in thousands)

MANITEX INTERNATIONAL, INC. NASDAQ: MNTX First Quarter 2022 Earnings Conference Call May 4, 2022