UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PokerTek, Inc. |

(Name of Registrant as Specified In Its Charter) |

| |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

__________________________________________________________________

| (2) | Aggregate number of securities to which transaction applies: |

__________________________________________________________________

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

__________________________________________________________________

| (4) | Proposed maximum aggregate value of transaction: |

__________________________________________________________________

__________________________________________________________________

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

__________________________________________________________________

| (2) | Form, Schedule or Registration Statement No.: |

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

POKERTEK, INC.

1150 CREWS ROAD, SUITE F

MATTHEWS, NORTH CAROLINA 28105

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 25, 2008

Notice of Annual Meeting of Shareholders:

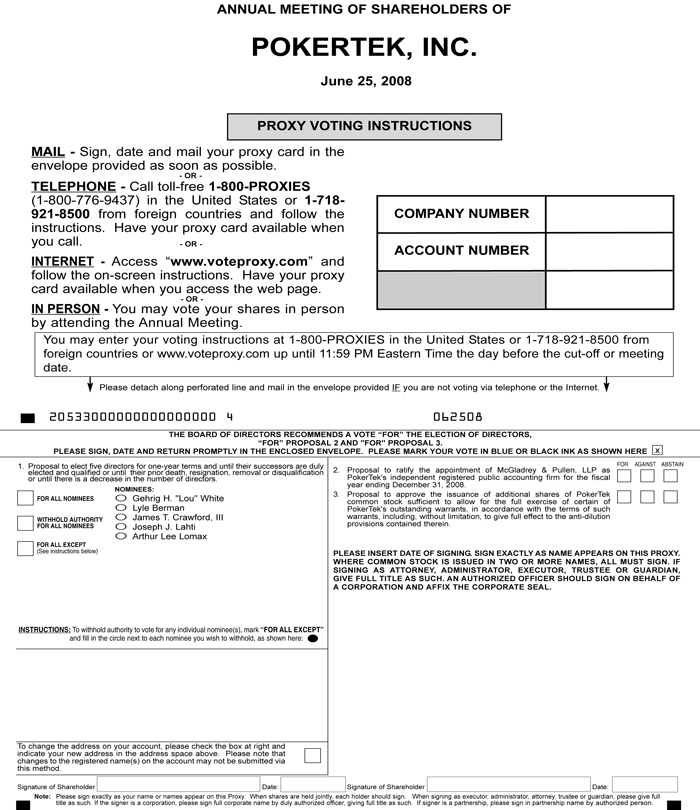

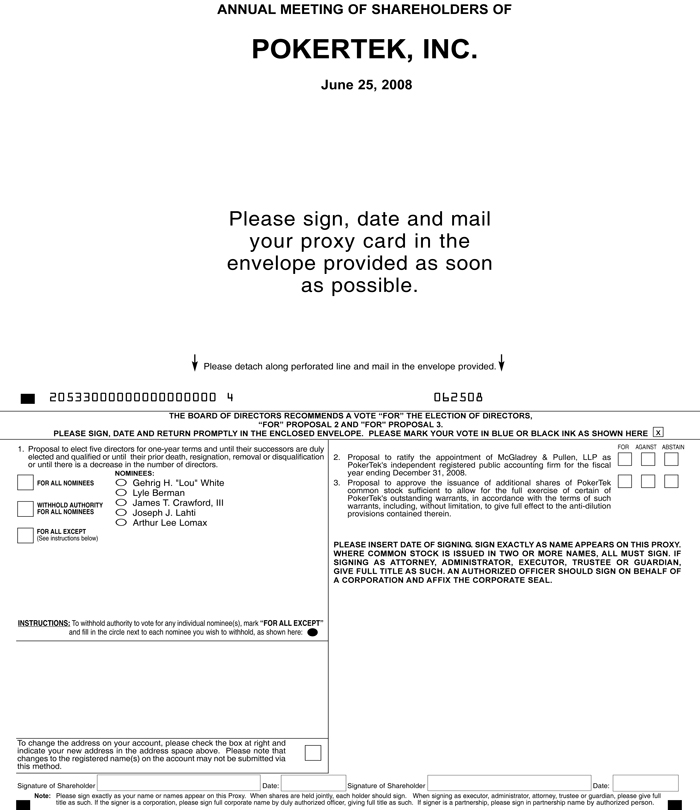

We hereby give notice that the Annual Meeting of Shareholders of PokerTek, Inc. will be held on June 25, 2008, at 2:00 p.m. local time, at PokerTek’s headquarters, 1150 Crews Road, Suite F, Matthews, North Carolina, for the following purposes:

| (1) | To elect five directors for one-year terms and until their successors are duly elected and qualified or until their prior death, resignation, removal or disqualification or until there is a decrease in the number of directors. |

| (2) | To ratify the appointment of McGladrey & Pullen, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2008. |

| (3) | To approve the issuance of additional shares of our common stock sufficient to allow for the full exercise of certain of our outstanding warrants, in accordance with the terms of such warrants, including, without limitation, to give full effect to the anti-dilution provisions contained therein. |

| (4) | To transact such other business as may properly come before the meeting. |

Under North Carolina law, only shareholders of record at the close of business on the record date, which is May 15, 2008, are entitled to notice of and to vote at the annual meeting or any adjournment. It is important that your shares of common stock be represented at this meeting so that the presence of a quorum is assured.

This proxy statement and the accompanying proxy card are being mailed to our shareholders on or about May 23, 2008. A copy of our 2007 Annual Report on Form 10-K containing our financial statements for the fiscal year ended December 31, 2007 (the “Annual Report”) is enclosed.

| By Order of the Board of Directors |

| |

|

| James T. Crawford, III |

| President and Secretary |

May 23, 2008

Your vote is important. Even if you plan to attend the meeting in person, please date and execute the enclosed proxy and return it promptly in the enclosed postage-paid envelope or vote by using the telephone or Internet as soon as possible. Additional information regarding these voting methods is provided in the proxy statement and in the enclosed proxy. If you attend the meeting, you may revoke your proxy and vote your shares in person.

POKERTEK, INC.

1150 CREWS ROAD, SUITE F

MATTHEWS, NORTH CAROLINA 28105

PROXY STATEMENT

GENERAL INFORMATION

Solicitation of Proxies

The enclosed proxy, for use at the Annual Meeting of Shareholders to be held on June 25, 2008, at 2:00 p.m. local time at PokerTek’s headquarters, 1150 Crews Road, Suite F, Matthews, North Carolina, and any adjournment thereof, is solicited on behalf of the Board of Directors of PokerTek, Inc. The approximate date that we are first sending these proxy materials to shareholders is May 23, 2008. This solicitation is being made by mail and may also be made in person or by fax, telephone or Internet by our officers or employees. We will pay all expenses incurred in this solicitation. We will ask banks, brokerage houses and other institutions, nominees and fiduciaries to forward the soliciting material to beneficial owners and to obtain authorization for the execution of proxies. We will, upon request, reimburse these parties for their reasonable expenses in forwarding proxy materials to beneficial owners.

The accompanying proxy is for use at the meeting if a shareholder either will be unable to attend in person or will attend but wishes to vote by proxy. Shares may be voted by either completing the enclosed proxy card and mailing it in the postage-paid envelope provided, voting over the Internet or using a toll-free telephone number. “Registered holders,” who have shares registered in the owner’s name through our transfer agent, may vote by returning a completed proxy card in the enclosed postage-paid envelope. For shares held in “street name,” that is, shares held in the name of a brokerage firm, bank or other nominee, a voting instruction form should be received from that institution by mail in lieu of a proxy card. The voting instruction form should indicate whether the institution has a process for beneficial holders to vote over the Internet or by telephone. A large number of banks and brokerage firms are participating in the Broadridge Financial Solutions online program. This program provides eligible shareholders who receive a paper copy of the proxy statement the opportunity to vote over the Internet or by telephone. The Internet and telephone voting facilities will close at 11:59 p.m. Eastern Daylight Time on June 24, 2008. The Internet and telephone voting procedures are designed to authenticate the shareholder’s identity and to allow shareholders to vote their shares and confirm that their instructions have been properly recorded. If the voting instruction form or form of proxy does not reference Internet or telephone information, or if the shareholder prefers to vote by mail, please complete and return the paper voting instruction form or form of proxy in the self-addressed, postage-paid envelope provided.

Shareholders who vote over the Internet or by telephone need not return a proxy card or voting instruction form by mail, but may incur costs, such as usage charges, from telephone companies or Internet service providers, for which the shareholder is responsible. Registered holders may also vote their shares in person at the annual meeting. In order to vote shares held in street name in person at the meeting, a proxy issued in the owner’s name must be obtained from the record holder and presented at the annual meeting.

The proxy may be revoked by the shareholder at any time before it is exercised by filing with our corporate secretary an instrument revoking it, filing a duly executed proxy bearing a later date (including a proxy given over the Internet or by telephone) or by attending the meeting and electing to vote in person. All shares of our common stock represented by valid proxies received pursuant to this solicitation, and not revoked before they are exercised, will be voted in the manner specified. If no specification is made, properly executed and returned proxies will be voted in favor of the proposals. Management is not aware of any matters, other than those specified above, that will be presented for action at the annual meeting. If other matters are properly presented at the annual meeting for consideration, the agents named on the proxy card will have the discretion to vote on those matters for you.

The presence in person or by proxy of a majority of the shares of common stock outstanding on the record date constitutes a quorum for purposes of voting on a particular matter and conducting business at the meeting. Once a share is represented for any purpose at a meeting, it is deemed present for quorum purposes for the remainder of the meeting.

Brokers that are members of the New York Stock Exchange, Inc. (the “NYSE”) and that hold shares of our common stock in street name for clients have authority to vote on certain items when they have not received instructions from beneficial owners. Under the rules of the NYSE, the proposals to elect directors and ratify the appointment of the independent registered public accounting firm are considered “discretionary” items. This means that brokers may vote in their discretion on these matters on behalf of beneficial owners who have not furnished voting instructions. In contrast, certain items are considered “non-discretionary,” and a “broker non-vote” occurs when brokers do not receive voting instructions from beneficial owners with respect to such items. The proposal to approve the issuance of additional shares of our common stock is a “non-discretionary” item, which means that brokers that have not received voting instructions from beneficial owners with respect to this matter may not vote on the proposal.

Assuming the existence of a quorum, the persons receiving a plurality of the votes cast by the shares entitled to vote will be elected as directors. The proposals to ratify the appointment of McGladrey & Pullen, LLP as our independent registered public accounting firm and to approve the issuance of additional shares of our common stock, respectively, will be approved if the votes cast in favor of each respective proposal exceed the votes against it. Abstentions, shares that are withheld as to voting with respect to nominees for director and broker non-votes will be counted for determining the existence of a quorum, but will not be counted as a vote in favor of or against the proposals and, therefore, will have no effect on the outcome of the vote for any of the proposals presented at the meeting.

Voting Securities Outstanding

In accordance with North Carolina law, May 15, 2008 has been fixed as the record date for determining holders of common stock entitled to notice of and to vote at the annual meeting. Each share of our common stock issued and outstanding on May 15, 2008 is entitled to one vote on each proposal presented at the annual meeting. Holders of shares of common stock vote together as a voting group on all proposals. At the close of business on May 15, 2008, there were 10,934,464 shares of our common stock outstanding and entitled to vote.

BOARD OF DIRECTORS AND MANAGEMENT

PROPOSAL 1 - ELECTION OF DIRECTORS

Under our amended and restated bylaws, the Board of Directors consists of five to nine members, as determined by the Board or the shareholders from time to time. The Board has determined that the number of directors within the range shall be five. Directors are elected annually to serve for one-year terms and until their successors are duly elected and qualified or until their prior death, resignation, removal or disqualification or until there is a decrease in the number of directors. The five nominees named below have been recommended by our Nominating and Governance Committee and approved by the Board to be presented as nominees to serve on the Board. All nominees presently serve as a director and each director is standing for re-election. There are no family relationships among any of our directors or officers. We intend that the agents named in the accompanying proxy card will vote properly returned proxies to elect the five nominees listed below as directors, unless the authority to vote is withheld. Although we expect that each of the nominees will be available for election, if any vacancy in the slate of nominees occurs, we expect that shares of common stock represented by proxies will be voted for the election of a substitute nominee or nominees recommended by the Nominating and Governance Committee and approved by the Board of Directors or for the election of the remaining nominees recommended by the Nominating and Governance Committee and approved by the Board of Directors.

The names of the nominees for election to the Board, their principal occupations and certain other information follow:

Lyle Berman has served as the Chairman of our Board of Directors since January 2005. Mr. Berman also currently serves as Chairman and Chief Executive Officer of Lakes Entertainment, Inc., a publicly-held company that develops and manages Native American-owned casinos, a position he has held since January 1999. He also currently serves as Executive Chairman of WPT Enterprises, Inc., a publicly-held media and entertainment company, a position he has held since April 2005. Prior to serving as WPT’s Executive Chairman, he served as WPT’s Chairman of the Board from WPT’s inception in March 2002 until April 2005 and also served as Chief Executive Officer of WPT from February 2004 until April 2005. Previously, Mr. Berman served as Chief Executive Officer of Rainforest Cafe, Inc. from February 1993 until December 2000. Mr. Berman received a B.S. degree in Business Administration from the University of Minnesota.

| Gehrig H. “Lou” White | Age 45 |

Gehrig “Lou” White served as our Chief Executive Officer from our inception in August 2003 until September 2007 when he became Vice-Chairman of the Board of Directors. In July 2002, Mr. White retired from Network Appliance, Inc., a provider of enterprise network storage and data management solutions, with the intention of identifying a business that he may acquire or establish. From July 2001 to July 2002, Mr. White served as an account executive for Network Appliance, Inc. Previously, from 1994 to 2001, Mr. White was a National Account Executive at Dell Inc. Mr. White received a B.S. degree in Computer Science from North Carolina State University and a Masters in Business Administration from Queens College.

| James T. Crawford, III | Age 47 |

James Crawford has served in an executive officer capacity and as a member of our Board of Directors since our inception in August 2003 and currently serves as our President and Secretary. Previously, from 1998 to 2004, Mr. Crawford owned and managed FastSigns franchises in Charlotte, North Carolina.

Joseph Lahti has served as a member of our Board of Directors since February 2006. Mr. Lahti served as president, chief executive officer and chairman of the board of Shuffle Master, Inc., a gaming supply company for the casino industry, from 1993 to 2002. He currently is active as both a shareholder and member of the boards and executive committees of several privately held companies in industries ranging from software, manufacturing, asset management (equities) and real estate development. He also served on the board of Zomax Incorporated, a publicly traded outsourcing service company, from May 2004 through May 2006. Mr. Lahti received a B.S. degree from Harvard University, with an emphasis in economics.

Lee Lomax has served as a member of our Board of Directors since our inception in August 2003. From our inception until July 2005, Mr. Lomax also served as our Treasurer. Previously, in 2002, he founded Carolina Classical School in Tryon, North Carolina where he served as Headmaster since its founding through August 2007. From 1994 to 2002, Mr. Lomax worked at Dell Computer Corporation and concluded his career there as Area Vice President of Sales within Dell’s Enterprise Customer Group. Mr. Lomax received a B.S. in Business Administration from University of North Carolina at Chapel Hill.

Lyle Berman, Gehrig H. (“Lou”) White, James T. Crawford, III, Joseph J. Lahti and Arthur Lee Lomax have been recommended by our Nominating and Governance Committee and approved by the Board to be presented as nominees to serve on the Board. All nominees presently serve as a director and each director is standing for re-election.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED ABOVE.

Executive Officers

Our current executive officers are as follows:

Name | | Age | | Title |

| | | | | |

| Christopher J.C. Halligan | | 41 | | Chief Executive Officer (principal executive officer, "PEO”) |

| | | | | |

| Mark D. Roberson | | 43 | | Chief Financial Officer (principal financial officer, “PFO”) |

| | | | | |

| James T. Crawford, III | | 47 | | President and Secretary |

| | | | | |

| Hal J. Shinn, III | | 43 | | Chief Technology Officer |

Certain information with respect to our executive officers is provided below. Officers are appointed to serve at the discretion of the Board. Information regarding Mr. Crawford is included in the director profiles set forth above.

Christopher J.C. Halligan has served as our Chief Executive Officer since September 2007. Prior to his appointment as CEO, Mr. Halligan served as our Vice President - Sales and Planning from October 2006 to September 2007. In January 2006, he co-founded Kieden Corporation, an on-demand software business located in San Francisco, California, where he served as a director until Kieden was purchased by Salesforce.com, Inc. in August 2006. Since April 2005, Mr. Halligan has been a significant shareholder and served as a member of the board of directors of Chantilly, Virginia-based Mascot Books, Inc., which publishes children’s books featuring popular sports teams and well-known entertainment personalities. From April 2001 to December 2004, Mr. Halligan was a self-employed consultant in the software and marketing industry. Prior to 2001, he served in several managerial positions with webMethods, Inc., which is now part of Software AG, and Dell Computer Corporation. Mr. Halligan acquired a Bachelor of Arts degree in English Literature, with a Minor in Physics/Calculus, from the University of Arizona.

Mark D. Roberson has served as our Chief Financial Officer since October 2007. Prior to his appointment as CFO, from November 2006 to October 2007, Mr. Roberson served as Vice President and Controller of Baker & Taylor, Inc., a leading distributor of books and entertainment products with fiscal year 2007 revenues of approximately $1.7 billion. At Baker & Taylor, Mr. Roberson was responsible for all financial reporting and accounting functions. Prior to his employment at Baker & Taylor, Mr. Roberson was Director of Financial Reporting for Curtiss-Wright Controls from January 2005 to November 2006 and Director of Finance for the Manufacturing & Distribution operations of Krispy Kreme Doughnuts, Inc. from October 2002 to January 2005. From July 1996 to October 2002, Mr. Roberson served in various financial management roles with LifeStyle Furnishings International, Ltd., concluding with the sale of the company. Mr. Roberson, a Certified Public Accountant, received his MBA from Wake Forest University in 2001 and undergraduate degrees in Economics and Accounting from Southern Methodist University and UNC-Greensboro.

Hal J. Shinn, III has served as our Chief Technology Officer since August 2004. Before joining us, from January 1999 through August 2004, Mr. Shinn served as Chief Information Officer of V3 Systems, Inc. Mr. Shinn is a graduate of the Georgia Institute of Technology, where he earned a B.S. degree in Aerospace Engineering and an M.S. degree in Technology and Science Policy.

CORPORATE GOVERNANCE MATTERS

Independent Directors

In accordance with the listing standards of The NASDAQ Stock Market LLC, our Board of Directors must consist of a majority of independent directors. The Board has determined that Messrs. Berman, Lahti and Lomax are independent under these NASDAQ listing standards. The Board performed a review to determine the independence of its members and made a subjective determination as to each of these independent directors that no transactions, relationships or arrangements exist that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director of PokerTek, Inc. In making these determinations, the Board reviewed information provided by the directors and us with regard to each director’s business and personal activities as they may relate to us and our management. Each of the members of the Board’s Audit Committee, Compensation Committee and Nominating and Governance Committee also has been determined by the Board to be independent under applicable NASDAQ listing standards and, in the case of the Audit Committee, under the independence requirements established by the Securities and Exchange Commission.

Code of Business Conduct and Ethics

We maintain a Code of Business Conduct and Ethics to provide guidance on sustaining our commitment to high ethical standards. The code applies to employees, officers, directors, agents, representatives, consultants, advisors and independent contractors of PokerTek.

A copy of this code is available in the “Investor Relations” section of our website under the heading “Corporate Governance” at http://www.pokertek.com/corporategovernance.html or may be obtained by contacting our Investor Relations Department at the address set forth above or at investor_relations@pokertek.com. We will disclose any waivers of the code applicable to our directors or executive officers, and the reasons therefor, on a Form 8-K as required by NASDAQ listing standards or applicable law. Any waivers of the code for executive officers or directors may be made only by the Board or by a Board committee.

Committees and Meetings

The Board maintains three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. Each committee operates under a written charter and reports regularly to the Board. A copy of each of these committee charters is available in the “Investor Relations” section of our website under the heading “Corporate Governance” at http://www.pokertek.com/corporategovernance.html and may also be obtained by contacting our Investor Relations Department at the address set forth above or at investor_relations@pokertek.com.

Each of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee must be comprised of no fewer than three members, at least a majority of whom must satisfy membership requirements imposed by NASDAQ listing standards and the applicable committee charter. A brief description of the responsibilities of each of these committees, and their current membership, follows.

Compensation Committee

The Compensation Committee operates under a written charter and is appointed by the Board to discharge the Board’s responsibilities relating to compensation of our directors and officers and to approve and evaluate the director and officer compensation plans, policies and programs of PokerTek. In fulfilling its duties, the Compensation Committee has the authority to, among other things: (i) annually review and approve corporate goals and objectives relevant to CEO compensation; (ii) review and approve salary and incentives, employment agreements, severance agreements, change in control agreements and any special supplemental benefits, as appropriate, for the CEO and senior executives of PokerTek; (iii) make recommendations to the Board with respect to incentive compensation plans and equity-based plans; and (iv) adopt, administer, approve and ratify awards made under incentive compensation and stock plans. Please refer to the “Report of Compensation Committee” and the compensation philosophy and actions taken in 2007 described in the “Compensation Discussion and Analysis” section of this proxy statement for further discussion, including the role of executive officers in determining or recommending the amount or form of executive and director compensation. The Compensation Committee also reviews and evaluates the fees paid to members of our Board of Directors. The Compensation Committee may condition its approval of any compensation on ratification by the Board if Board action is required by applicable law or otherwise deemed appropriate. The Compensation Committee has the authority to obtain advice and assistance from both internal and external advisors, including compensation consultants, although the Compensation Committee did not retain a compensation consultant to assist with determining executive compensation during 2007. In addition, although the Compensation Committee may delegate authority to subcommittees to fulfill its responsibilities when appropriate, no such authority was delegated during 2007. The current members of the Compensation Committee are Messrs. Berman, Lomax and Lahti. Mr. Berman serves as chairman of the Compensation Committee. None of Messrs. Berman, Lomax and Lahti is an employee of PokerTek and each is independent under existing NASDAQ listing standards.

Audit Committee

The Audit Committee is a separately-designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934. The Audit Committee operates under a written charter and is appointed by the Board to (i) assist the Board in monitoring and ensuring: (a) the integrity of our financial statements; (b) our compliance with legal and regulatory requirements; (c) the qualifications, compensation and independence of our independent registered public accounting firm; and (d) the performance of our internal audit function and our independent registered public accounting firm; (ii) prepare the report required to be prepared by the Audit Committee under SEC rules; and (iii) oversee our accounting and financial reporting processes and the audits of the financial statements of PokerTek. The current members of the Audit Committee are Messrs. Berman, Lahti and Lomax. Mr. Lahti serves as chairman of the Audit Committee. None of Messrs. Berman, Lahti and Lomax is an employee of PokerTek and each has been determined to be independent under applicable listing standards of The NASDAQ Stock Market, LLC and applicable SEC rules. In addition, the Board has examined the SEC’s definition of “audit committee financial expert” and determined that Mr. Lahti satisfies this definition. See “Report of the Audit Committee,” below.

Nominating and Governance Committee

The Nominating and Governance Committee operates under a written charter and is appointed by the Board to: (i) assist the Board in identifying individuals qualified to become Board members; (ii) recommend to the Board the director nominees for the next annual meeting of shareholders; and (iii) develop and recommend to the Board a set of Corporate Governance Guidelines applicable to us. The Nominating and Governance Committee also oversees evaluations of executive management and is responsible for reviewing and making recommendations to the Board regarding our responses to any shareholder proposals. The current members of the Nominating and Governance Committee are Messrs. Berman, Lomax and Lahti. Mr. Berman serves as chairman of the Nominating and Governance Committee. None of Messrs. Berman, Lomax and Lahti is an employee of PokerTek and each is independent under existing NASDAQ listing standards. The Nominating and Governance Committee will consider written nominations of candidates for election to the Board properly submitted by shareholders. For information regarding shareholder nominations to the Board, see “Procedures for Director Nominations” and “Proposals for 2009 Annual Meeting,” below.

Meeting Attendance

All directors are expected to make every effort to attend meetings of the Board, assigned committees and annual meetings of shareholders.

All directors attended all of the Board meetings and assigned committee meetings during the fiscal year ended December 31, 2007. During fiscal 2007, the Board held four meetings, the Compensation Committee held two meetings, the Audit Committee held eight meetings, and the Nominating and Governance Committee held one meeting. All of our directors in office at the time of the 2007 annual meeting of shareholders, except for Messrs. Berman and Lahti, attended the annual meeting.

Executive Sessions

Independent directors are expected to meet in executive session at all regularly scheduled meetings of the Board with no members of management present. The Chairman of the Nominating and Governance Committee or the Chairman of the Board will preside at each executive session, unless the independent directors determine otherwise. During fiscal 2007, Mr. Berman, as Chairman of the Board, presided at each of the executive sessions.

Procedures for Director Nominations

Members of the Board are expected to collectively possess a broad range of skills, industry and other knowledge and expertise, and business and other experience useful for the effective oversight of our business. The Nominating and Governance Committee is responsible for identifying, screening and recommending to the Board qualified candidates for membership. All candidates must meet the minimum qualifications and other criteria established from time to time by the Board. In considering possible candidates for election as director, the Nominating and Governance Committee is guided by the following standards:

| · | Each director should be an individual of the highest character and integrity; |

| · | Each director should have substantial experience that is of particular relevance to PokerTek; |

| · | Each director should have sufficient time available to devote to the affairs of PokerTek; and |

| · | Each director should represent the best interests of the shareholders as a whole rather than special interest groups. |

We also consider the following criteria, among others, in our selection of directors:

| · | Economic, technical, scientific, academic, financial and other expertise, skills, knowledge and achievements useful to the oversight of our business; |

| · | Diversity of viewpoints, backgrounds, experiences and other demographics; and |

| · | The extent to which the interplay of the candidate’s expertise, skills, knowledge and experience with that of other Board members will build a Board that is effective, collegial and responsive to the needs of PokerTek. |

The Nominating and Governance Committee evaluates suggestions concerning possible candidates for election to the Board submitted to us, including those submitted by Board members (including self-nominations), shareholders and third parties. All candidates, including those submitted by shareholders, will be similarly evaluated by the Nominating and Governance Committee using the Board membership criteria described above and in accordance with applicable procedures. Once candidates have been identified, the Nominating and Governance Committee will determine whether such candidates meet the minimum qualifications for director nominees established in the charter and under applicable laws, rules or regulations and make a recommendation to the Board. The Board, taking into consideration the recommendations of the Nominating and Governance Committee, is responsible for selecting the nominees for director and for appointing directors to fill vacancies.

The Nominating and Governance Committee has authority to retain and approve the compensation of search firms to be used to identify director candidates.

As noted above, the Nominating and Governance Committee will consider qualified director nominees recommended by shareholders when such recommendations are submitted in accordance with applicable SEC requirements, our bylaws and any other applicable law, rule or regulation regarding director nominations. When submitting a nomination to us for consideration, a shareholder must provide certain information that would be required under applicable SEC rules, including the following minimum information for each director nominee: full name and address; age; principal occupation during the past five years; current directorships on publicly held companies and registered investment companies; and number of shares of our common stock owned, if any. In addition, under our bylaws, a shareholder’s written notice regarding a proposed nominee must include (in addition to any information required by applicable law or the Board): (i) the name and address of the shareholder who intends to present the proposal and the beneficial owner, if any, on whose behalf the proposal is made; (ii) the number of shares of each class of capital stock owned by the shareholder and such beneficial owner; (iii) a description of the business proposed to be introduced to the shareholders; (iv) any material interest, direct or indirect, which the shareholder or beneficial owner may have in the business described in the notice; (v) a representation that the shareholder is a holder of record of shares of PokerTek entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to present the proposal; and (vi) a consent signed by each nominee to serve as a director if elected. Certain specific notice deadlines also apply with respect to submitting director nominees. See “Proposals for 2009 Annual Meeting,” below.

No candidates for director nominations were submitted to the Nominating and Governance Committee by any shareholder in connection with the annual meeting. Any shareholder desiring to present a nomination for consideration by the Nominating and Governance Committee prior to the 2009 annual meeting must do so in accordance with our bylaws and policies. See “Proposals for 2009 Annual Meeting,” below.

Shareholder Communications with Directors

Any shareholder desiring to contact the Board, or any specific director(s), may send written communications to: Board of Directors (Attention: (Name(s) of director(s), as applicable)), c/o Corporate Secretary, 1150 Crews Road, Suite F, Matthews, North Carolina 28105. Any communication so received will be processed by the Secretary and conveyed to the Board or, as appropriate, to the member(s) of the Board named in the communication.

Procedures for Reporting Complaints about Accounting and Auditing Matters

The Audit Committee has adopted procedures for receiving and handling complaints from employees and third parties regarding accounting, internal accounting controls or auditing matters, including procedures for confidential, anonymous submissions by employees of complaints or concerns regarding questionable accounting, auditing or other matters. Employees or third parties may report their concerns by calling the PokerTek, Inc. Values Line, an anonymous third-party hotline service operated by Global Compliance Services, at 888-475-8376.

Upon receipt of a complaint relating to the matters set forth above, Global Compliance will promptly notify the Chief Financial Officer, General Counsel and the Audit Committee. If the matter involves either the Chief Financial Officer or the General Counsel, they would not be notified of the complaint. The Audit Committee will oversee the review of any such complaint and will maintain the confidentiality of an employee or third-party complaint to the fullest extent possible, consistent with the need to conduct an adequate review. Prompt and appropriate corrective action will be taken when and as warranted in the judgment of the Audit Committee. We will maintain a log of all complaints received, tracking their receipt, investigation and resolution, and will prepare a periodic report summarizing the complaints for submission by the Audit Committee to the Board. We will maintain copies of complaints and the complaint log for a reasonable time or for any period prescribed by our document retention policy but in no event for less than five years.

These Procedures for Reporting Complaints about Accounting and Auditing Matters are available in the “Investor Relations” section of our website under the heading “Corporate Governance” at http://www.pokertek.com/corporategovernance.html or may be obtained by contacting our Investor Relations Department at our address set forth above.

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee are Messrs. Berman (Chairman), Lomax and Lahti, each of whom also served as a member of the Compensation Committee during 2007. None of the current members of the Compensation Committee has ever served as an officer or employee of PokerTek. No interlocking relationships exist between PokerTek’s current Board of Directors or Compensation Committee and the board of directors or compensation committee of any other company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our common stock as of March 31, 2008 by (a) each person known by us to own beneficially more than five percent of the outstanding shares of our common stock, (b) each director and nominee for director, (c) the Named Executives (as defined in “Summary Compensation Table,” below), and (d) all current directors and executive officers as a group. Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options or warrants held by that person that are currently exercisable or that are or may become exercisable within 60 days of March 31, 2008 are deemed outstanding. These shares, however, are not deemed outstanding for purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and under applicable community property laws, each shareholder named in the table has sole voting and dispositive power with respect to the shares set forth opposite the shareholder’s name. Unless otherwise noted, the address of all listed shareholders is c/o PokerTek, Inc., 1150 Crews Road, Suite F, Matthews, North Carolina 28105.

Name of Beneficial Owner | | Number of Shares Beneficially Owned | | Percent of Class | |

| | | | | | |

Directors and Executive Officers: | | | | | |

| Gehrig H. White | | | 2,129,900 | (1) | | 19.48 | % |

| Lyle Berman | | | 479,438 | (2) | | 4.38 | % |

| James T. Crawford, III | | | 1,224,900 | (3) | | 11.20 | % |

| Joseph J. Lahti | | | 20,000 | (4) | | * | |

| Arthur Lee Lomax | | | 360,100 | (5) | | 3.29 | % |

| Christopher J. C. Halligan | | | 80,298 | (6) | | * | |

| Hal J. Shinn, III | | | 163,125 | (4) | | 1.49 | % |

| Mark D. Roberson | | | 1,000 | (7) | | * | |

| All directors and executive officers as a group (8 persons) | | | 4,458,761 | | | 40.78 | % |

| | | | | | | | |

5% Shareholders: | | | | | | | |

| GHW Enterprises, LLC | | | 1,829,900 | (8) | | 16.74 | % |

| Crawford Ventures, LLC | | | 1,373,900 | (9) | | 12.56 | % |

| Aristocrat International Pty. Limited | | | 1,807,545 | (10) | | 16.53 | % |

* Indicates less than one percent

| (1) | Consists of 300,000 shares of common stock owned by Mr. White and 1,829,900 shares of common stock owned by GHW Enterprises, LLC, which is controlled by Mr. White. Mr. White has sole voting and dispositive power with respect to all of the shares of common stock. |

| (2) | Includes 329,438 shares of common stock and 150,000 presently exercisable options to purchase our common stock owned by the Lyle A. Berman Revocable Trust, for which Mr. Berman serves as trustee and with respect to which Mr. Berman has sole voting and dispositive power. |

| (3) | Consists of shares of common stock owned by Crawford Ventures, LLC, which is controlled by Mr. Crawford. Mr. Crawford has sole voting and dispositive power with respect to all of the shares of common stock. |

| (4) | Consists of presently exercisable options to purchase our common stock. |

| (5) | Consists of 296,700 shares of common stock owned by Mr. Lomax, with respect to which he has sole voting and dispositive power and 63,400 shares of common stock owned by Charitable Remainder Unitrust, for which Mr. Lomax shares dispositive power with Larry Swartz. |

| (6) | Consists of 8,423 shares of common stock owned by Mr. Halligan and 71,875 presently exercisable options to purchase our common stock. |

| (7) | Consists of 1,000 shares of common stock owned by Mr. Roberson. |

| (8) | The address of GHW Enterprises, LLC is 6207 Glynmoor Lakes Drive, Charlotte, North Carolina 28277. Gehrig H. White, as manager, controls GHW Enterprises, LLC and has sole voting and dispositive power with respect to the shares of common stock held by GHW Enterprises, LLC. |

| (9) | The address of Crawford Ventures, LLC is 5237 Lancelot Drive, Charlotte, North Carolina 28270. James T. Crawford, III, as manager, controls Crawford Ventures, LLC and has sole voting and dispositive power with respect to the shares of common stock held by Crawford Ventures, LLC. |

| (10) | Consists of shares of common stock for which voting and dispositive power is shared by Aristocrat International Pty. Limited and Aristocrat Leisure Limited. The address of each of Aristocrat International Pty. Limited and Aristocrat Leisure Limited is 71 Longueville Road, Lane Cove, NSW 2066, Australia. Information reported is based on information provided by Aristocrat International Pty. Limited on February 12, 2008. |

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

2007 Executive Officer Compensation Program

Our objectives with respect to compensation of our executive officers are to: (1) link executive compensation to our business strategy execution and performance; (2) offer compensation designed to attract, retain and reward key executive officers; and (3) offer salary, cash bonus and incentive compensation pay opportunities that are competitive in the marketplace, recognize achievement of our business strategy objectives, and align the long-term interests of executive officers with those of our shareholders. The primary objectives that we consider are market penetration of product, revenue growth, and analysis of our financial performance as compared to our internal budget and projected forecasts.

We currently have four named executive officers: Mr. Christopher J.C. Halligan, our Chief Executive Officer; Mr. James T. Crawford, III, our President; Mr. Mark D. Roberson, our Chief Financial Officer; and Mr. Hal J. Shinn, III, our Chief Technology Officer. During 2007, we also employed two additional named executive officers: Mr. Christopher Daniels, who served as our Chief Financial Officer until June 2007, and Mr. Gehrig H. “Lou” White, who served as our Chief Executive Officer until he resigned to assume the vice chairman position in September 2007. Our executive compensation program is comprised of two components: annual cash compensation, paid in the form of annual salary and discretionary bonuses; and long-term compensation, paid historically in the form of options to purchase our common stock. Mr. Crawford was paid only an annual base salary during 2007. Mr. Halligan, Mr. Roberson, and Mr. Shinn received a base salary and Mr. Halligan and Mr. Roberson received long-term compensation in the form of options to purchase our common stock. The Compensation Committee retains the right to offer our named executive officers restricted shares of our common stock and other forms of equity compensation in lieu of, or in conjunction with, stock options.

Messrs. Halligan, Roberson, and Shinn have employment agreements with certain severance provisions and accelerated vesting of options upon termination of employment, as discussed in more detail under “Executive Officer Compensation – Employment Agreements,” below.

Prior to our initial public offering, we granted a relatively large stock option package to Mr. Shinn. Mr. Crawford was a founder of the Company and holds a significant percentage of our common stock. As such, the Compensation Committee has not deemed it necessary to incentivize him with an employment agreement, a severance agreement or any retirement plans other than a 401(k) plan that is available to all employees. The Compensation Committee also considers whether prior awards and current stock ownership are sufficient in deciding the amount of equity-based compensation to award in a particular year. On that basis, Messrs. Crawford and Shinn were not awarded equity-based compensation during 2007. Currently, our executive compensation philosophy is focused on current cash payment in the form of annual base salary and performance-based discretionary bonuses based upon certain objective criteria, including market penetration of product, revenue growth, and analysis of our financial performance as compared to our internal budget and projected forecasts. In establishing the equity component of our executive compensation program, we considered the effects of Statement of Financial Accounting Standards No. 123R (“FAS 123R”), “Share-Based Compensation,” which requires us to currently expense an estimated fair value of equity compensation. The Compensation Committee believes that the combination of cash compensation and equity compensation is important to align the interests of our executive officers with those of our shareholders and provides an effective motivational tool at this stage of the Company’s growth.

The Compensation Committee typically reviews and adjusts base salaries and awards of cash bonuses and equity-based compensation at least once per fiscal year. During 2007, our CEO presented the Compensation Committee and the Board of Directors with a forecast of our performance for the current year and made recommendations regarding annual base salaries and discretionary bonus payments for our executive officers. Mr. Crawford does not make any recommendation or participate in any decisions regarding his own compensation. The Compensation Committee considered the recommendations of the CEO in determining executive officer compensation for 2007. In order to qualify as an incentive stock option, equity-based compensation awards have historically been priced based upon the closing market price of our common stock on the last day of the fiscal quarter, which also is the date of grant.

Annual Cash Compensation

Annual cash compensation for our executive officers consists of a base salary and a discretionary bonus based upon certain objective criteria (including market penetration of product, revenue growth, and analysis of our financial performance as compared to our internal budget and projected forecasts). The 2007 annual cash compensation was also targeted to be competitive in relation to other similar companies. However, because of our short operating history, the total compensation of our executive officers is currently below average when compared with other publicly traded companies. The Compensation Committee did not utilize the services of an independent compensation consulting firm to determine the cash compensation paid to executive officers in 2007. The Compensation Committee determined that the annual cash compensation that was paid to our executive officers was an adequate reward for the executive officer’s performance and discretionary bonuses were not awarded during 2007.

Annual Base Salary

The annual base salaries of our executive officers and adjustments to executive officers’ base salaries are generally based upon a subjective evaluation of the individual executive officer’s performance by the Compensation Committee. The Compensation Committee’s evaluation is based upon non-quantitative factors such as the current responsibilities of each executive officer, the compensation of similarly situated executive officers at comparable companies, the performance of each executive officer during the prior calendar year, our performance during the prior calendar year, and the recommendations submitted to the Compensation Committee by our Chief Executive Officer. For 2007, Messrs. Crawford, Halligan and Roberson had base salaries of $160,000. Mr. Shinn’s annual base salary was $145,000 from January 1, 2007 through June 30, 2007 and such amount was increased to $152,250 from July 1, 2007 through December 31, 2007. These base salaries remain unchanged as of March 31, 2008.

Long-Term Equity Compensation

We believe that an appropriate level of equity-based compensation is part of a balanced and effective compensation program designed to align the interests of executive officers with those of our shareholders. We believe that the level of equity-based compensation awarded to our executive officers is adequate to align those officers’ interests with the interests of our shareholders. Our long-term compensation program has historically been based principally upon awards of options to purchase our common stock under the PokerTek, Inc. 2004 Stock Option Plan and the PokerTek, Inc. 2005 and 2007 Stock Incentive Plans. Awards of equity-based compensation are based upon a subjective evaluation of the executive officer’s performance by the Compensation Committee and recommendations submitted to the Compensation Committee by our Chief Executive Officer. The Compensation Committee’s evaluation considers a number of non-quantitative factors, including the responsibilities of the individual officers for, and contribution to, our operating results and their expected future contributions. The Compensation Committee also considers whether prior awards of equity-based compensation were sufficient in deciding the amount of equity-based compensation to award in a particular year. Messrs. Crawford and Shinn were not awarded equity-based compensation during 2007 because the Compensation Committee concluded that additional equity-based compensation would not further the goals of our executive compensation policies in light of Mr. Crawford’s large equity stake in PokerTek and Mr. Shinn’s previous stock option awards.

Compliance With Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended, limits the corporate tax deduction to $1 million for compensation paid to certain executives of public companies. However, performance-based compensation that has been approved by shareholders is excluded from the $1 million limit if, among other requirements, the compensation is payable only upon attainment of pre-established, objective performance goals and the board committee that establishes the goals consists only of “outside directors.” Additionally, stock options will qualify for the performance-based exception where, among other requirements, the exercise price of the stock option is not less than the fair market value of the stock on the date of grant, and the plan includes a per-executive limitation on the number of shares for which stock options may be granted during a specified period. All members of the Compensation Committee qualify as outside directors within the meaning and as defined by Section 162(m) and the regulations thereunder. Historically, the combined salary and bonus of each of our executive officers has been below this $1 million limit. The Compensation Committee’s present intention is to grant future compensation that does not exceed the limitations of Code Section 162(m).

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis that accompanies this report with our management. Based on its review and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2007.

Except for the Annual Report on Form 10-K described above, this Compensation Committee report is not incorporated by reference into any of our previous or future filings with the SEC, unless any such filing explicitly incorporates the report.

Lyle Berman (Chairman)

Joseph J. Lahti

Arthur Lee Lomax

Executive Officer Compensation

The following table sets forth the compensation paid by or on behalf of PokerTek to each person who served as Chief Executive Officer, each person who served as Chief Financial Officer and our other named executive officers for services rendered during the fiscal years ended December 31, 2007 and 2006.

SUMMARY COMPENSATION TABLE

Name and Principal Position | | Year | | Salary | | Bonus | | Option

Awards (1) | | All Other Compensation (2) | | Total | |

| | | | | | | | | | | | | | |

Christopher J.C. Halligan (3) | | | 2007 | | $ | 160,000 | | $ | - | | $ | 182,461 | | $ | - | | $ | 342,461 | |

| Chief Executive Officer | | | 2006 | (7) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Mark D. Roberson (4) | | | 2007 | | $ | 32,804 | | $ | - | | $ | - | | | - | | $ | 32,804 | |

| Chief Financial Officer | | | 2006 | (7) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| James T. Crawford, III | | | 2007 | | $ | 160,000 | | $ | - | | $ | - | | $ | 4,133 | | $ | 164,133 | |

| President and Secretary | | | 2006 | | | 151,250 | | | - | | | - | | | 6,050 | | | 157,300 | |

| | | | | | | | | | | | | | | | | | | | |

| Hal J. Shinn, III | | | 2007 | | $ | 148,021 | | $ | - | | $ | 19,403 | | $ | 5,921 | | $ | 173,345 | |

| Chief Technology Officer | | | 2006 | | | 139,167 | | | - | | | 27,288 | | | 5,567 | | | 172,022 | |

| | | | | | | | | | | | | | | | | | | | |

| | | 2007 | | $ | 160,000 | | $ | - | | $ | - | | $ | - | | $ | 160,000 | |

| Vice Chairman of the Board and former Chief Executive Officer | | | 2006 | | | 151,250 | | | - | | | - | | | - | | | 151,250 | |

| | | | | | | | | | | | | | | | | | | | |

Christopher Daniels (6) | | | 2007 | | $ | 100,304 | | $ | - | | $ | - | | $ | 4,485 | | $ | 104,789 | |

| Former Chief Financial Officer | | | 2006 | | | 126,250 | | | 20,326 | | | 27,288 | | | 5,863 | | | 179,727 | |

| (1) | The amounts in the Option Awards column reflect the dollar amount recognized by the Company for financial reporting purposes for the years ended December 31, 2007 and 2006 in accordance with FAS 123R and may include options granted in and prior to 2007 and 2006. A discussion of the assumptions used in calculating these values may be found in Note 9 to our 2007 audited financial statements on page F-14 to our Annual Report. |

| (2) | The amounts in the All Other Compensation column consist of Company matching contributions to our 401(k) plan. |

| (3) | Salary for Mr. Halligan includes earnings during his employment with the Company during 2007, including periods prior to his appointment as Chief Executive Officer. |

| (4) | Salary for Mr. Roberson represents earnings from his date of hire, October 18, 2007, through December 31, 2007. |

| (5) | Salary for Mr.White includes earnings during 2006 and 2007, including his earnings subsequent to his resignation as Chief Executive Officer, effective September 24, 2007. Mr. White continues as an employee of the Company and also serves as Vice Chairman of the Board, but does not receive compensation for his position on the Board. |

| (6) | Mr. Daniels' employment as our Chief Financial Officer ceased as of September 14, 2007. The amount shown as Bonus was a discretionary cash bonus awarded during 2006. The amount shown in the All Other Compensation column includes health care benefits received by Mr. Daniels through September 30, 2007 as part of his severance. |

| (7) | Messrs. Halligan and Roberson became named executive officers in 2007. |

The following table sets forth information regarding all individual grants of plan-based awards granted to named executive officers for the fiscal year ending December 31, 2007.

GRANTS OF PLAN-BASED AWARDS

| | | | | All Other Option | | | | Grant Date Fair | |

| | | | | Awards: Number of | | Exercise or Base | | Value of Stock and | |

| | | | | Securities Underlying | | | | Option Awards ($) | |

Name | | Grant Date | | Options (1) | | Awards ($/Sh) | | (2) | |

| Christopher J.C. Halligan | | September 28, 2007 | | | 125,000 | | $ | 9.62 | | $ | 542,500 | |

| Mark D. Roberson | | December 31, 2007 | | | 75,000 | | $ | 7.75 | | $ | 279,000 | |

| (1) | All options were granted pursuant to the 2007 Stock Incentive Plan. The exercise price was the closing market price of our common stock on the NASDAQ Global Market on the grant date. The options vest in equal installments every six months over a four-year period. |

| (2) | Grant date fair value was calculated in accordance with FAS 123R. See Note 9 to the Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2007 regarding our valuation assumptions with respect to stock option awards. |

Employment Agreements

We have not entered into an employment agreement with our President and Secretary, James T. Crawford, III. The salary of Mr. Crawford is determined by our Compensation Committee from time to time, as discussed in more detail under “Compensation Discussion and Analysis,” above. The Compensation Committee has currently set the annual salary of Mr. Crawford at $160,000.

Employment Agreement with Christopher J.C. Halligan

We have entered into an employment agreement, dated January 17, 2008, with Christopher J.C. Halligan, our Chief Executive Officer. The agreement has a term of two years.

Pursuant to this agreement, Mr. Halligan is entitled to receive a base salary of $160,000 per year, subject to our right to reduce Mr. Halligan’s salary in connection with a reduction of all of our employees’ salaries. Mr. Halligan’s salary, however, may not be reduced by more than 20% in any single reduction or a series of reductions, may not be reduced for a period greater than six months, and any severance payments payable to Mr. Halligan will be based on his original base salary before any such reduction.

In connection with Mr. Halligan’s promotion to Chief Executive Officer, Mr. Halligan previously received a grant of 125,000 stock options at fair market value determined by the closing price of our common stock on September 28, 2007, which vest 12.5% every six months (together with an earlier grant of 150,000 options). If Mr. Halligan’s employment is terminated by us for any reason except cause (as defined in the employment agreement), all stock options granted to him through the date of termination will vest immediately if he executes a general release with language acceptable to us on or before the effective date of termination. Mr. Halligan is also entitled to receive standard benefits generally available to other senior officers.

In the event we terminate Mr. Halligan’s employment without cause (as defined in the employment agreement) or if Mr. Halligan terminates his employment for good reason (as defined in the employment agreement, which includes relocation to a Company office more than 75 miles from Charlotte, North Carolina without his consent), and upon execution of a general release, Mr. Halligan is entitled to severance in the form of continuation of his base salary for three months. In addition, if Mr. Halligan terminates his employment for good reason, he will be entitled to additional severance in the form of reimbursement of any COBRA payments during the three-month period. If Mr. Halligan is terminated for cause or if he voluntarily terminates his employment with us for any reason other than good reason (as defined in the employment agreement), he would not receive severance pay or any such other compensation.

In the event we terminate Mr. Halligan’s employment following a change of control, he is entitled to severance in the form of continuation of his base salary and benefits for three months.

We have also entered into a proprietary information and inventions agreement with Mr. Halligan that, among other things, (i) provides that Mr. Halligan will not disclose our proprietary information to any third party during his employment with us and thereafter, and (ii) requires that Mr. Halligan assign to us his right, title and interest to any and all inventions made or conceived during his employment with us. For a period of six months after termination of his employment, Mr. Halligan also would be required to inform us of all inventions made or conceived by him and, for a period of one year after termination of his employment, he would be required to inform us of all patent applications filed by him or on his behalf. In addition, for a period of one year after the termination of his employment with us he will not:

| | • | provide services to any of our competitors within the continental United States similar to those provided to us during his employment with us; |

| | • | solicit or attempt to solicit any of our employees, independent contractors or consultants to terminate his or her relationship with us in order to become an employee, independent contractor or consultant of another entity; or |

| | • | solicit or attempt to solicit any of our customers with whom Mr. Halligan had contact as a result of his employment with us. |

Employment Agreement with Mark D. Roberson

We have entered into an employment agreement, dated January 17, 2008 with Mark D. Roberson, our Chief Financial Officer. The agreement has a term of two years.

Pursuant to this agreement, Mr. Roberson is entitled to receive a base salary of $160,000 per year, subject to our right to reduce Mr. Roberson’s salary in connection with a reduction of all of our employees’ salaries. Mr. Roberson’s salary, however, may not be reduced by more than 20% in any single reduction or a series of reductions, may not be reduced for a period greater than six months, and any severance payments payable to Mr. Roberson will be based on his original base salary before any such reduction.

In connection with Mr. Roberson’s appointment as Chief Financial Officer, Mr. Roberson previously received a grant of 75,000 stock options at fair market value determined by the closing price of our common stock on December 31, 2007, which vest 12.5% every six months. If Mr. Roberson’s employment is terminated by us for any reason except cause (as defined in the employment agreement), all stock options granted to him through the date of termination will vest immediately if he executes a general release with language acceptable to us on or before the effective date of termination. Mr. Roberson is also entitled to receive standard benefits generally available to other senior officers.

In the event we terminate Mr. Roberson’s employment without cause (as defined in the employment agreement) or if Mr. Roberson terminates his employment for good reason (as defined in the employment agreement, which includes relocation to a Company office more than 75 miles from Charlotte, North Carolina without his consent), and upon execution of a general release, Mr. Roberson is entitled to severance in the form of continuation of his base salary for six months. In addition, if Mr. Roberson terminates his employment for good reason, he will be entitled to additional severance in the form of reimbursement of any COBRA payments during the six-month period. If Mr. Roberson is terminated for cause or if he voluntarily terminates his employment with us for any reason other than good reason (as defined in the employment agreement), he would not receive severance pay or any such other compensation.

In the event we terminate Mr. Roberson’s employment following a change of control, he is entitled to severance in the form of continuation of his base salary and benefits for six months.

We have also entered into a proprietary information and inventions agreement with Mr. Roberson that, among other things, (i) provides that Mr. Roberson will not disclose our proprietary information to any third party during his employment with us and thereafter, and (ii) requires that Mr. Roberson assign to us his right, title and interest to any and all inventions made or conceived during his employment with us. For a period of six months after termination of his employment, Mr. Roberson also would be required to inform us of all inventions made or conceived by him and, for a period of one year after termination of his employment, he would be required to inform us of all patent applications filed by him or on his behalf. In addition, for a period of one year after the termination of his employment with us he will not:

| | • | provide services to any of our competitors within the continental United States similar to those provided to us during his employment with us; |

| | • | solicit or attempt to solicit any of our employees, independent contractors or consultants to terminate his or her relationship with us in order to become an employee, independent contractor or consultant of another entity; or |

| | • | solicit or attempt to solicit any of our customers with whom Mr. Roberson had contact as a result of his employment with us. |

Employment Agreement with Hal J. Shinn, III

We have entered into an employment agreement dated August 9, 2004, as amended effective July 1, 2005, with Hal J. Shinn, III, our Chief Technology Officer. The original agreement had a term of two years and on August 9, 2006 the agreement was extended for an additional two years through August 9, 2008.

Pursuant to this agreement, Mr. Shinn is entitled to receive a base salary of at least $126,000 per year, subject to our right to reduce Mr. Shinn’s salary in connection with a reduction of all of our employees’ salaries. Mr. Shinn’s salary, however, may not be reduced by more than 20% in any single reduction or a series of reductions, may not be reduced for a period greater than six months, and any severance payments payable to Mr. Shinn will be based on his original base salary before any such reduction. The Compensation Committee has authorized an increase in Mr. Shinn’s base salary each year since the employment agreement was executed, as discussed in more detail in the “Compensation Discussion and Analysis” section of this proxy statement.

Pursuant to the agreement, Mr. Shinn was granted an option to purchase 75,000 shares of our common stock, 7,500 shares of which vested on August 9, 2004 and 7,500 shares of which vest every quarter thereafter, and an additional option to purchase 75,000 shares of our common stock, 9,375 shares of which vested on February 28, 2005, and 9,375 shares of which vest every six months thereafter. The exercise price of the shares underlying both option grants is $2.67 per share. Mr. Shinn is also entitled to receive standard benefits generally available to other senior officers.

In the event we terminate Mr. Shinn’s employment without cause (as defined in the employment agreement) or if Mr. Shinn terminates his employment for good reason (as defined in the employment agreement), and upon execution of a general release, Mr. Shinn is entitled to severance in the form of continuation of his base salary for two months. In addition, if Mr. Shinn terminates his employment for good reason, he will be entitled to additional severance in the form of reimbursement of any COBRA payments during the two-month period. Further, if Mr. Shinn’s employment is terminated by us for any reason except cause, all stock options granted will vest immediately if he executes a general release with language acceptable to us on or before the effective date of termination.

In the event we terminate Mr. Shinn’s employment following a change of control or we relocate Mr. Shinn to an office that is more than 75 miles from Charlotte, North Carolina without his consent, he is entitled to severance in the form of continuation of his base salary and benefits for two months.

We have also entered into a proprietary information and inventions agreement with Mr. Shinn that provides that Mr. Shinn will not disclose our proprietary information to any third party during his employment with us and thereafter, and for a period of one year after the termination of his employment with us he will not:

| | • | provide services to any of our competitors within the continental United States similar to those provided to us during his employment with us; |

| | • | solicit or attempt to solicit any of our employees, independent contractors or consultants to terminate his or her relationship with us in order to become an employee, independent contractor or consultant of another entity; or |

| | • | solicit or attempt to solicit any of our customers with whom Mr. Shinn had contact during his employment with us. |

Agreements with Christopher Daniels

We had entered into an employment agreement dated July 14, 2004, as amended July 1, 2005, with Christopher Daniels, who served as our Chief Financial Officer until September 14, 2007. Mr. Daniels’ employment agreement has since been replaced with the Severance Agreement and Full and Final Mutual Release (the “Separation Agreement”), pursuant to which Mr. Daniels’ employment with us ceased effective September 14, 2007.

The Separation Agreement was executed in connection with an independent investigation by the Audit Committee of the Board of Directors into use of our corporate credit cards. The Separation Agreement provided that the Company and Mr. Daniels mutually agreed to terminate his employment relationship with us. Mr. Daniels agreed to remain available to fully assist with the transition to our successor chief financial officer.

Under the terms of the Separation Agreement, Mr. Daniels was entitled to: (i) retain 14,000 of his existing and vested options to purchase our common stock, each with a strike price of $2.67 per share and (ii) continue to receive health care benefits provided by us through September 30, 2007. Mr. Daniels was not to receive any additional or continuing compensation or other benefits from us in connection with his departure and, pursuant to the Separation Agreement, the balance of Mr. Daniels’ stock options and his Key Employee Agreement, as amended, were terminated as of September 14, 2007.

In accordance with the Separation Agreement, Mr. Daniels agreed to: (i) reimburse us for $6,000 of charges made by Mr. Daniels to our corporate credit cards on or before September 30, 2007, and (ii) facilitate the transfer of approximately 244,000 frequent flyer miles to us, in each case without admission of liability by Mr. Daniels in connection therewith. The Separation Agreement also included mutual releases and a non-competition and non-solicitation covenant by Mr. Daniels.

Equity Plans

The discussion which follows describes the material terms of our principal equity plans.

PokerTek, Inc. 2004 Stock Incentive Plan

On July 15, 2004, we adopted the 2004 Plan, which was amended and restated on July 29, 2005. The 2004 Plan authorizes the issuance of up to 825,000 shares of common stock and is administered by the Compensation Committee of the Board of Directors. We have amended the 2004 Plan to provide that no further awards will be made thereunder. Both incentive and non-qualified stock options were granted under the 2004 Plan. Each award agreement under the 2004 Plan specifies the number and type of award, together with any other terms and conditions of such award.

Unless an award agreement or applicable law provides otherwise, if a change of control (as defined in the 2004 Plan) occurs, and if the agreements effectuating the change of control do not provide for the assumption or substitution of all options granted under the 2004 Plan, with respect to any non-assumed options the Compensation Committee may:

| | | accelerate the vesting and/or exercisability of such awards; |

| | | unilaterally cancel any such award that has not vested and/or which has not become exercisable as of the effective date of such change of control; |

| | | unilaterally cancel such award in exchange for: |

| | | whole and/or fractional shares of our common stock (or for cash in lieu of any fractional share) that, in the aggregate, are equal in value to the excess of the fair market value of the shares of common stock that could be purchased subject to such award, determined as of the effective date of the change of control, over the aggregate exercise price for such award; or |

| | | cash or other property equal in value to the excess of the fair market value of the shares of common stock that could be purchased subject to such award, determined as of the effective date of the change of control, over the aggregate exercise price for such shares; or |

| | unilaterally cancel such options after providing the holder of such options with: |

| | | an opportunity to exercise such options to the extent vested within a specified period before the date of the change of control; and |

| | | notice of such opportunity to exercise such options before the commencement of such specified period; or |

| | | unilaterally cancel such award and notify the holder of such award of such action, but only if the fair market value of the shares of common stock that could be purchased subject to such award determined as of the effective date of the change of control does not exceed the aggregate exercise price for such shares. |

The 2004 Plan will continue in effect until July 15, 2014, unless earlier terminated. The Compensation Committee generally may amend, alter or terminate the 2004 Plan at any time, provided that without shareholder approval, the 2004 Plan cannot be amended to increase the number of shares authorized, extend the term of the 2004 Plan, change the class of persons eligible to receive incentive stock options or effect any other change that would require shareholder approval under any applicable law or NASDAQ rule. Generally, any amendment, alteration or termination of the 2004 Plan or any award agreement may not adversely affect any outstanding award without the consent of the participant, except under certain circumstances as set forth in the 2004 Plan.

PokerTek, Inc. 2005 Stock Incentive Plan

On July 29, 2005, we adopted the 2005 Plan. The 2005 Plan authorizes the issuance of up to 800,000 shares of our common stock, plus up to 825,000 shares under the 2004 Plan that cease for any reason to be subject to such awards, up to a maximum of 1,625,000 shares of our common stock. Notwithstanding the maximum number of shares authorized for issuance under the 2005 Plan, the maximum number of shares of common stock that we may issue pursuant to incentive stock options is 800,000.

The authority to administer the 2005 Plan has been delegated by the Board of Directors to the Compensation Committee. The Compensation Committee has the power to make awards, to determine when and to whom awards will be granted, the form of each award, the amount of each award, and any other terms or conditions of each award consistent with the terms of the 2005 Plan. Awards may be made to our employees, directors and independent contractors.

The types of awards that may be granted under the 2005 Plan include incentive and non-qualified stock options, restricted awards, stock appreciation rights, performance awards, phantom stock awards, dividend equivalent awards and other stock-based awards. Each award agreement will specify the number and type of award, together with any other terms and conditions as determined by the Compensation Committee in its sole discretion.

Upon a change in control, as defined in the 2005 Plan, and unless an award agreement, employment agreement or other agreement between a participant and us provides otherwise or Internal Revenue Code Section 409A or related regulations or guidance requires otherwise, the 2005 Plan provides that:

| | | all options and stock appreciation rights outstanding as of the date of the change in control will become fully exercisable, whether or not then otherwise exercisable; and |

| | | any restrictions applicable to any restricted award, performance award or phantom stock award will be deemed to have been met, and such awards will become fully vested, earned and payable to the fullest extent of the original grant of the applicable award. |

However, under certain conditions, the 2005 Plan authorizes the Compensation Committee, in the event of a merger, share exchange, reorganization, sale of all or substantially all of our assets or other similar transaction or event affecting us or one of our affiliates or shareholders, to determine that any or all awards will not vest or become exercisable on an accelerated basis, if we or the surviving or acquiring corporation takes action, including but not limited to the assumption of awards or the grant of substitute awards, that, in the opinion of the Compensation Committee, is equitable or appropriate to protect the rights and interest of participants under the 2005 Plan.