Washington, D.C. 20549

POKERTEK, INC.

1150 CREWS ROAD, SUITE F

MATTHEWS, NORTH CAROLINA 28105

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 2, 2011

We hereby give notice that the Annual Meeting of Shareholders of PokerTek, Inc. will be held on June 2, 2011, at 2:00 p.m. local time, at PokerTek’s headquarters, 1150 Crews Road, Suite F, Matthews, North Carolina, for the following purposes:

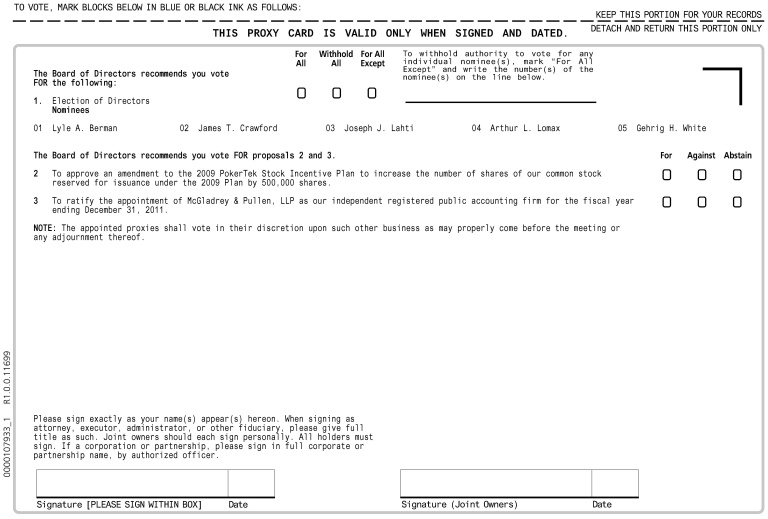

| (1) | To elect five directors; |

| (2) | To approve an amendment to the 2009 PokerTek Stock Incentive Plan to increase the number of shares of our common stock reserved for issuance under the 2009 Plan by 500,000 shares; |

| (3) | To ratify the appointment of McGladrey & Pullen, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011; and |

| (4) | To transact other business that may properly come before the meeting. |

Under North Carolina law, only shareholders of record at the close of business on the record date, which is March 31, 2011, are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

Shareholders are cordially invited to attend the meeting in person. WHETHER OR NOT YOU NOW PLAN TO ATTEND THE MEETING, YOU ARE ASKED TO COMPLETE, DATE, SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY CARD FOR WHICH A POSTAGE PAID RETURN ENVELOPE IS PROVIDED. If you decide to attend the meeting, you may revoke your proxy and vote your shares in person. It is important that your shares be voted.

| | | By Order of the Board of Directors, | |

| | | | |

| | |

| |

| | | | |

| April 29, 2011 | | James T. Crawford | |

| | | President and Secretary | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held June 2, 2011. The Proxy Statement and Annual Report are available at www.proxyvote.com |

POKERTEK, INC.

1150 CREWS ROAD, SUITE F

MATTHEWS, NORTH CAROLINA 28105

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

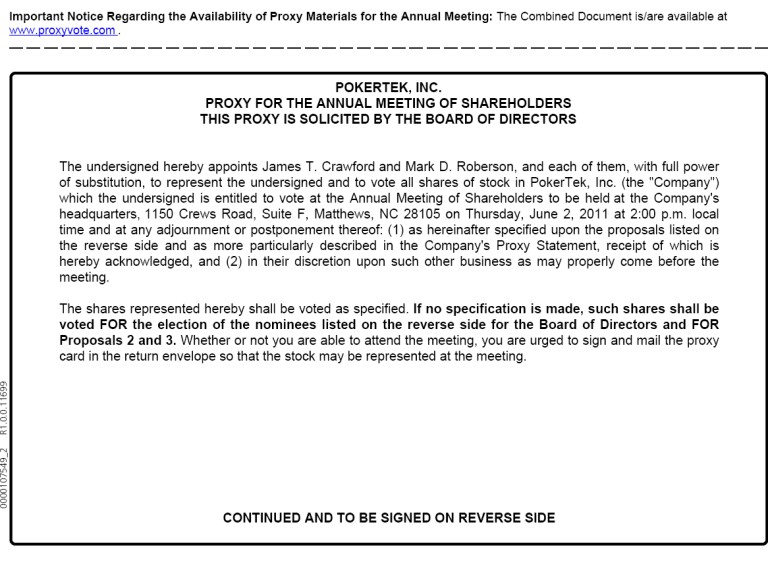

Our Board of Directors (the “Board”) is soliciting proxies for our 2011 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on June 2, 2011 at 2:00 p.m. local time at our headquarters, located at 1150 Crews Road, Suite F, Matthews, NC 28105.

The proxy materials, including this proxy statement, proxy card, and our 2010 Annual Report, are being distributed and made available on or about May 5, 2011. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

We will bear the expense of soliciting proxies. In addition to these proxy materials, our directors and employees (who will receive no compensation in addition to their regular salaries) may solicit proxies in person, by telephone, or email. We will reimburse banks, brokers and other custodians, nominees, and fiduciaries for reasonable charges and expenses incurred in forwarding soliciting materials to their clients.

QUESTIONS AND ANSWERS

| Q: | Who may vote at the Annual Meeting? |

| | |

| A: | Our Board set March 31, 2011 as the record date (the “Record Date”) for the Annual Meeting. If you owned our common stock at the close of business on the Record Date, you may attend and vote at the Annual Meeting. Each shareholder is entitled to one vote for each share of our common stock held on all matters to be voted on. As of the Record Date, there were 6,284,117 shares of our common stock outstanding and entitled to vote at the Annual Meeting. |

| | |

| Q: | What is the quorum requirement for the Annual Meeting? |

| | |

| A: | A majority of our outstanding shares as of the Record Date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. This is called a quorum. Your shares will be counted as present at the Annual Meeting if you are present and entitled to vote in person at the Annual Meeting or have properly submitted a proxy card or voted by telephone or over the Internet. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum. |

| | |

| Q: | What proposals will be voted on at the Annual Meeting? |

| | |

| A: | There are four proposals scheduled to be voted on at the Annual Meeting. We will also consider any other business that properly comes before the Annual Meeting. As of the Record Date, we are not aware of any other matters to be submitted for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named in the enclosed proxy card will vote the shares they represent using their best judgment. |

| | |

| Q: | How can I get electronic access to the proxy materials? |

| | |

| A: | You can view the proxy materials on the Internet at www.proxyvote.com. Please have your 12 digit control number available. Your 12 digit control number can be found on your proxy card. |

| | |

| Q: | How may I vote my shares in person at the Annual Meeting? |

| | |

| A: | If your shares are registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., you are considered, with respect to those shares, the shareholder of record. As the shareholder of record, you have the right to vote in person at the Annual Meeting. If your shares are held in a brokerage account or by another nominee or trustee, you are considered the beneficial owner of shares held in street name. As the beneficial owner, you are also invited to attend the Annual Meeting. Since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from your broker, nominee, or trustee that holds your shares, giving you the right to vote the shares at the Annual Meeting. |

| | |

| Q: | How can I vote my shares without attending the Annual Meeting? |

| | |

| A: | Whether you hold shares directly as a registered shareholder of record or beneficially in street name, you may vote without attending the Annual Meeting. Shareholders of record must sign and return their proxy cards by mail for their votes to be counted. Beneficial owners may submit voting instructions to their stockbroker, trustee or nominee by returning their voting instruction cards by mail, or they may vote their shares on the Internet or by telephone. |

| | |

| Q: | How can I revoke my proxy and change my vote after I return my proxy card? |

| | |

| A: | You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. If you are a shareholder of record, you may do this by signing and submitting a new proxy card with a later date which must be completed by 11:59 p.m. Eastern Time on June 1, 2011 or by attending the Annual Meeting and voting in person. Attending the Annual Meeting alone will not revoke your proxy unless you specifically request your proxy to be revoked. If you hold shares through a bank or brokerage firm, you must contact that bank or firm directly to revoke any prior voting instructions. |

| | |

| Q: | What happens if I do not give specific voting instructions? |

| | |

| A: | Shareholders of Record. If you return your signed proxy card but do not specify how you want to vote your shares, the proxies will vote your shares in the manner recommended by the Board on all matters in this proxy statement and as they proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of the New York Stock Exchange, the organization that holds your shares may generally vote at its discretion on routine matters but cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Thus, broker non-votes will not affect the outcome of any matter being voted on at the Annual Meeting, assuming that a quorum is obtained. The election of directors (Proposal 1) and the amendment to the 2009 PokerTek Stock Incentive Plan (Proposal 2) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters; consequently, there may be broker non-votes on these proposals. The ratification of the appointment of McGladrey & Pullen, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011 (Proposal 3) is considered routine under applicable rules. A broker or other nominee may generally vote on routine matters; consequently, no broker non-votes are expected on Proposal 3. |

| | |

| Q: | How many votes will be needed to approve each proposal? |

| | |

| A: | With respect to the election of directors (Proposal 1), assuming a quorum is present, the affirmative vote of a plurality of the votes cast by the holders of our common stock present in person or represented by proxy at the Annual Meeting is required to elect each nominee. Election by a plurality means that the director nominee with the most votes for a particular Board seat is elected for that seat. With respect to the proposals to approve the amendment of the 2009 PokerTek Stock Incentive Plan (Proposal 2) and the ratification of the appointment of McGladrey & Pullen, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011 (Proposal 3), assuming a quorum is present, the affirmative vote of a majority of the votes cast by the holders of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the matter is required to approve each proposal. As discussed above, for purposes of the vote on any such proposal, abstentions and “broker non-votes” will not be counted and therefore will have no impact on the outcome. |

| | |

| Q: | Do I have dissenters’ rights? |

| | |

| A: | No. Under the North Carolina Business Corporation Act, shareholders are not entitled to dissenters’ rights with respect to the matters to be voted on at the Annual Meeting. |

| | |

| Q: | Where can I find the voting results of the Annual Meeting? |

| | |

| A: | The preliminary voting results will be announced at the Annual Meeting. The final voting results will be reported in a current report on Form 8-K, which will be filed with the Securities and Exchange Commission (the “SEC”) within four business days after the Annual Meeting. If our final voting results are not available within four business days after the Annual Meeting, we will file a current report on Form 8-K reporting the preliminary voting results and subsequently file the final voting results in an amendment to the current report on Form 8-K within four business days after the final voting results are known to us. |

| | |

PROPOSAL 1

ELECTION OF DIRECTORS

Under our amended and restated bylaws, the Board consists of five to nine members, as determined by the Board or the shareholders from time to time. As of the date hereof, the Board consists of five members. Directors are elected annually to serve for one-year terms and until their successors are duly elected and qualified or until their prior death, resignation, removal or disqualification or until there is a decrease in the number of directors. The five nominees named below have been recommended by our Nominating and Governance Committee and approved by the Board to be presented as nominees to serve on the Board. All nominees presently serve as a director, and each is standing for re-election. There are no family relationships among any of our directors or executive officers.

Nominees

Lyle A. Berman, age 69, is Chairman of the Board and Chief Executive Officer of Lakes Entertainment, Inc., a position he has held since June 1998. Lakes Entertainment is a publicly-held company that develops and manages Native-American-owned casinos. Mr. Berman has served as Executive Chairman of the Board of Voyager Oil & Gas, Inc. (formerly Ante4, Inc. and WPT Enterprises, Inc.) from its inception in February 2002, and he served as its Chief Executive Officer from February 25, 2005 until April 1, 2005. Mr. Berman also served as Chief Executive Officer of Rainforest Cafe, Inc. from February 1993 until December 2000. Mr. Berman has served as the Chairman of our Board since January 2005. Mr. Berman received a B.S. degree in Business Administration from the University of Minnesota.

Mr. Berman has extensive experience in casino operations and with a wide variety of publically-traded and privately-held companies in gaming and other diverse industries. Mr. Berman brings executive decision-making skills; operating, management, and business development experience; and general business acumen to the Board as a result of his professional experiences. These experiences provide the Board with industry expertise and general business experience important to the oversight of our business.

James T. Crawford, age 49, has served as an executive officer and member of our Board since our inception in August 2003; he currently serves as our President and Secretary. Mr. Crawford is a co-founder of the Company. From 1998 to 2004, Mr. Crawford owned and managed FastSigns franchises in Charlotte, North Carolina.

Mr. Crawford brings operating and sales experience to the Company as a result of his professional experiences. These experiences and Mr. Crawford’s ongoing interaction with our customers and suppliers provides the Board with industry expertise important to our business, as well as a detailed understanding of our business and operations and the economic environment in which it operates.

Joseph J. Lahti, age 50, held the positions of Chief Operating Officer, President, Chief Executive Officer, and Chairman at Shuffle Master, Inc., a gaming-supply company to the casino industry, between 1993 and 2002. He served on the board of Zomax, Inc. from October 2004 to June 2007. In April 2010, Mr. Lahti joined the board of Voyager Oil & Gas, Inc., which operates for the purposes of acquiring acreage in prospective natural resource plays across the continental United States. Mr. Lahti is also President of JL Holdings, through which he provides funding and management leadership to early-stage companies. Mr. Lahti received a B.A. degree in economics from Harvard University.

Mr. Lahti has served on our Board since March 2006 and currently serves as the Audit Committee financial expert. Mr. Lahti brings executive decision-making skills, operating and management experience, expertise in finance, business development and direct gaming industry business acumen to the Board as a result of his professional experiences. These experiences provide the Board with financial and strategic planning expertise and direct industry expertise important to the oversight of our financial reporting and business strategy implementation.

Arthur L. Lomax, age 54, worked at Dell Computer Corporation from 1994 to 2002 and concluded his career there as Area Vice President of Sales within Dell’s Enterprise Customer Group. In 2002, he founded Carolina Classical School in Tryon, North Carolina and served as Headmaster until the school merged with another in 2007. Mr. Lomax has served as a director since our inception in August 2003. He also served as our Treasurer from August 2003 until July 2005. Mr. Lomax received a B.S. in Business Administration from University of North Carolina at Chapel Hill.

Mr. Lomax brings executive decision-making skills, sales, business development and general business acumen to our Board as a result of his professional experiences. These experiences provide the Board with general business experience important to the oversight of our business.

Gehrig H. White, age 48, is a co-founder of PokerTek, Inc. and has served as a member of our Board since our inception in August 2003. He also served as Chief Executive Officer from August 2003 until September 2007 when he became Vice-Chairman of the Board. Mr. White worked for Dell Computer Corporation from 1994 to 2001 where he served in a variety of sales functions focused primarily on the acquisition of large enterprise accounts. After spending a year as an account executive with Network Appliance, Inc., a provider of enterprise network storage and data management solutions, Mr. White left the computer industry with the intention of identifying a business to acquire or establish. Mr. White received a B.S. degree in Computer Science from North Carolina State University and a Masters in Business Administration from Queens College.

Mr. White brings executive decision-making skills, sales, business development and general business acumen to our Board as a result of his professional experiences. These experiences provide the Board with general business experience and important to the oversight of our business.

OUR BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED ABOVE.

Information Regarding Executive Officers

Executive officers are appointed to serve at the discretion of the Board. As of March 31, 2011 our executive officers included the following individuals:

Mark D. Roberson, age 45, has been serving as our Chief Executive Officer since February 22, 2010 and has served as our Chief Financial Officer and Treasurer since October 2007. He was our Acting Chief Executive Officer from May 29, 2009 through February 22, 2010. He started his career in public accounting and was part of the team that opened the current PricewaterhouseCoopers office in Greensboro, North Carolina. Mr. Roberson also served in various financial leadership roles with LifeStyle Furnishings International, a manufacturer and distributor of home furnishings with annual revenues of $2 billion. He was a member of the management team that led the purchase of LifeStyle from Masco Corporation as well as the successful sale of the company six years later. He also obtained extensive corporate finance and operations experience with Baker & Taylor, Krispy Kreme Manufacturing & Distribution, and Curtiss-Wright Controls. Mr. Roberson is a Certified Public Accountant in the state of North Carolina.

James T. Crawford, age 49, currently serves as President and Treasurer. Information regarding Mr. Crawford is included in the director nominee profiles above.

Hal J. Shinn, age 46, has served as our Chief Technology Officer since August 2004.

Procedures for Director Nominations

Members of the Board are expected to collectively possess a broad range of skills, industry and other knowledge and expertise, and business and other experience useful for the effective oversight of our business. The Nominating and Governance Committee is responsible for identifying, screening and recommending to the Board qualified candidates for membership. The Nominating and Governance Committee has authority to retain and approve the compensation of search firms to be used to identify director candidates. All candidates must meet the minimum qualifications and other criteria established from time to time by the Board.

In considering possible candidates for election as a director, the Committee is guided by the following principles: (a) each director should be an individual of the highest character and integrity; (b) each director should have substantial experience which is of particular relevance to the Company; (c) each director should have sufficient time available to devote to the affairs of the Company; and (d) each director should represent the best interests of the shareholders as a whole rather than special interest groups.

We also consider a candidate’s (a) economic, technical, scientific, academic, financial and other expertise, skills, knowledge and achievements useful to the oversight of our business; (b) diversity of viewpoints, background, and experience; and (c) ability to join with the other Board members in building a Board that is effective, collegial, and responsive to our needs as well as those of our shareholders.

The Nominating and Governance Committee will consider shareholder recommendations from Board members, shareholders, and third parties for candidates for the Board using the same criteria described above. Once candidates have been identified, the Nominating and Governance Committee will determine whether such candidates meet the minimum qualifications for director nominees established in the charter and under applicable laws, rules or regulations and make a recommendation to the Board. The Board, taking into consideration the recommendations of the Nominating and Governance Committee, is responsible for selecting the nominees for director and for appointing directors to fill vacancies.

When submitting a nomination to us for consideration, a shareholder must provide certain information that would be required under applicable SEC rules, including the following minimum information for each director nominee: full name and address; age; principal occupation during the past five years; current directorships on publicly held companies and registered investment companies; and number of shares of our common stock owned, if any. In addition, under our bylaws, a shareholder’s written notice regarding a proposed nominee must include (in addition to any information required by applicable law or the Board): (i) the name and address of the shareholder who intends to present the proposal and the beneficial owner, if any, on whose behalf the proposal is made; (ii) the number of shares of each class of capital stock owned by the shareholder and such beneficial owner; (iii) a description of the business proposed to be introduced to the shareholders; (iv) any material interest, direct or indirect, which the shareholder or beneficial owner may have in the business described in the notice; (v) a representation that the shareholder is a holder of record of shares of PokerTek entitled to vote at the Annual Meeting and intends to appear in person or by proxy at the Annual Meeting to present the proposal; and (vi) a consent signed by each nominee to serve as a director if elected. Certain specific notice deadlines also apply with respect to submitting director nominees. See “Proposals for 2012 Annual Meeting.”

No candidates for director nominations were submitted to the Nominating and Governance Committee by any shareholder in connection with the Annual Meeting.

MEETINGS AND MEETING ATTENDANCE

All directors attended all of the Board meetings and assigned committee meetings during the fiscal year ended December 31, 2010. During fiscal 2010, the Board held 6 meetings, the Compensation Committee held 5 meetings, the Audit Committee held 5 meetings, and the Executive Leadership Committee held 10 meetings. The Nominating and Governance Committee and the Compliance Committee conducted business during Executive Leadership Committee and Board meetings. All Board members attended the 2010 Annual Meeting.

CORPORATE GOVERNANCE MATTERS

Director Independence

In accordance with the listing standards of The NASDAQ Stock Market LLC, the Board must consist of a majority of independent directors. The Board has determined that Messrs. Berman, Lahti and Lomax are independent under these NASDAQ listing standards. The Board performed a review to determine the independence of its members and made a subjective determination as to each of these independent directors that no transactions, relationships, or arrangements exist that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed information provided by the directors and us with regard to each director’s business and personal activities as they may relate to us and our management. Each of the members of the Board’s Audit Committee, Compensation Committee and Nominating and Governance Committee also has been determined by the Board to be independent under applicable NASDAQ listing standards and, in the case of the Audit Committee, under the independence requirements established by the SEC. The independent directors meet in executive session at least quarterly.

Chief Executive Officer and Chairman of the Board

We separate the roles of Chief Executive Officer and Chairman of the Board in recognition of the differences between the two roles. The CEO is responsible for setting the strategic direction for us, provides day-to-day leadership and sets performance standards for our employees while the Chairman of the Board is responsible for leading the Board in the execution of its fiduciary duties. We believe that this separation of responsibilities provides a balanced approach to managing the Board and overseeing our operations in their entirety.

Board Committees

Only independent directors are members of the Audit, Compensation, and Nominating and Governance Committees.

Risk Oversight

It is management’s responsibility to manage risk and bring to the Board’s attention the most material risks that we face. The Board has oversight responsibility of the processes established to report and monitor systems for material risks that apply to us and oversees the appropriate allocation of responsibility for risk oversight among the committees of the Board. The Audit Committee periodically reviews enterprise-wide risk management, which focuses primarily on financial and accounting, legal and compliance, and other risk management functions. The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The Compliance Committee reviews risks associated with gaming control and regulation. The full Board considers strategic risks and opportunities and regularly receives reports from the committees regarding risk oversight in their areas of responsibility.

Board Committees

Audit Committee

The Audit Committee is a separately-designated standing Audit Committee established in accordance with section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee operates under a written charter and is appointed by the Board to (i) assist the Board in monitoring and ensuring: (a) the integrity of our financial statements; (b) our compliance with legal and regulatory requirements; (c) the qualifications, compensation and independence of our independent registered public accounting firm; and (d) the performance of our internal audit function and our independent registered public accounting firm; (ii) prepare the report required to be prepared by the Audit Committee under SEC rules; and (iii) oversee our accounting and financial reporting processes and the audits of our financial statements. The current members of the Audit Committee are Messrs. Berman, Lahti and Lomax. Mr. Lahti serves as chairman of the Audit Committee. The Board has examined the SEC’s definition of “audit committee financial expert” and determined that Mr. Lahti satisfies this definition. A copy of this Committee’s charter is available at www.pokertek.com.

Compensation Committee

The Compensation Committee is responsible for evaluating our compensation policies and programs and approving director and officer compensation plans. In fulfilling its duties, the Compensation Committee has the authority to, among other things: (i) review and approve corporate goals and objectives relevant to executive compensation; (ii) review and approve salary and incentives, employment agreements, severance agreements, change in control agreements and any special supplemental benefits, as appropriate, for the Chief Executive Officer and our other senior executives; (iii) make recommendations to the Board with respect to incentive compensation plans and equity-based plans; and (iv) adopt, administer, approve and ratify awards made under incentive compensation and stock plans. The Compensation Committee also reviews and evaluates the fees paid to members of our Board.

The Compensation Committee has the authority to obtain advice and assistance from both internal and external advisors, including compensation consultants, although the Compensation Committee did not elect to retain a compensation consultant to assist with determining executive compensation during 2010. In addition, although the Compensation Committee may delegate authority to subcommittees to fulfill its responsibilities when appropriate, no such authority was delegated during 2010. The current members of the Compensation Committee are Messrs. Berman, Lomax, and Lahti. Mr. Berman serves as chairman of the Compensation Committee. A copy of this Committee’s charter is available at www.pokertek.com.

Nominating and Governance Committee

The Nominating and Governance Committee operates under a written charter and is appointed by the Board to: (i) assist the Board in identifying individuals qualified to become Board members; (ii) recommend to the Board the director nominees for the next annual meeting of shareholders; and (iii) develop and recommend to the Board a set of Corporate Governance Guidelines applicable to us. The Nominating and Governance Committee also oversees evaluations of executive management and is responsible for reviewing and making recommendations to the Board regarding our responses to any shareholder proposals. The current members of the Nominating and Governance Committee are Messrs. Berman, Lomax, and Lahti. Mr. Berman serves as chairman of the Nominating and Governance Committee. A copy of this Committee’s charter is available at www.pokertek.com.

Compliance Committee

The Compliance Committee is responsible for identifying and evaluating situations in which we are involved that could result in a violation of laws, rules and regulations relating to the gaming industry. The Compliance Committee has at least three members appointed by our Board, and at least one member must be knowledgeable regarding Nevada gaming laws and regulations. The Compliance Committee must include our Compliance Officer and at least one independent director. The Compliance Committee reports to the Board and advises the Board if any activities, after investigation, are inappropriate. The Compliance Committee is responsible for determining that all transactions involving gaming devices and gaming equipment are with licensed customers, where required, and for reporting to the Board regarding material litigation, material loans or extensions of credit, transactions meeting certain thresholds, and material loans made by PokerTek and its affiliates other than for PokerTek’s or the affiliate’s benefit. Further, the Committee requires that appropriate background checks be conducted on persons with whom the Company transacts business. The Committee annually reviews the list of our shareholders. The members of the Compliance Committee are Mark Roberson, Chairman of the Committee; James Crawford, Compliance Officer; and Lyle Berman.

Executive Leadership Committee

The Executive Leadership Committee was established in 2009 to provide Board-level guidance to our executives, particularly our Chief Executive Officer. The Committee meets periodically with Mark Roberson, our Chief Executive Officer and our Chief Financial Officer, and James Crawford, our President, to review our performance and address areas of concern. The members of the Executive Leadership Committee are Mr. Lahti, Chairman, and Messrs. Berman, Lomax, and White.

DIRECTOR COMPENSATION

Effective July 1, 2009, we entered into Board Member Agreements with Lyle Berman, Joseph Lahti, Arthur Lomax, and Gehrig White. Pursuant to these agreements, for their service on the Board, each receives annual compensation of $48,000, payable in quarterly installments of $12,000. In addition, Mr. Lahti receives annual compensation of $60,000 for serving as Chairman of the Executive Leadership Committee, payable in quarterly installments of $15,000; however, this annual compensation was discontinued after the second quarter of 2010. At each director’s election, the fees are payable either in cash or in shares of our common stock. In the event that such fees are paid in the form of shares of our common stock, the number of shares issued will be determined by dividing the dollar amount of such fees by the average closing price of a share of our common stock for the 10 business days preceding the end of the quarterly period as reported on the NASDAQ Capital Market; provided, however, that if such average price per share calculation is less than the closing bid price on the effective date of the agreement, then such closing bid price is used.

See “Related Person Transactions” for information regarding the Indemnification Agreements we entered into in 2009 with Messrs. Berman, Lahti, Lomax, and White.

DIRECTOR COMPENSATION TABLE

| Name | | Fees Earned or

Paid in Cash | (1) | | Option Awards | (2) | | All Other Compensation | | | Total | |

| | | | | | | | | | | | | |

| Joseph J. Lahti | | $ | - | | | $ | 25,045 | | | $ | 78,500 | (3) | | $ | 103,545 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Arthur L. Lomax | | $ | - | | | $ | - | | | $ | 33,000 | (4) | | $ | 33,000 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Lyle A. Berman | | $ | - | | | $ | 44,025 | | | $ | 36,000 | (5) | | $ | 80,025 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Gehrig H. White | | $ | 36,000 | | | $ | - | | | $ | - | | | $ | 36,000 | |

| | | | | | | | | | | | | | | | | |

| (1) | Mr. White received this amount as a retainer for his service on the Board for Q4-09, Q1-10 and Q2-10 pursuant to his July 1, 2009 Board Agreement. |

| | | | | | | | | | | |

| (2) | The amounts in the Option Awards column reflect the dollar amount of awards recognized for financial reporting purposes for the year ended December 31, 2010 in accordance with ASC 718, disregarding the estimate of forfeitures related to service-based vesting conditions. A discussion of the assumptions used in calculating these values may be found in Note 11 to our audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2010. |

| | | | | | | | | | | |

| (3) | The amount in the All Other Compensation column for Mr. Lahti consists of Q1-10, Q2-10 and Q3-10 Board Member and Executive Leadership Committee Chair fees, as well as Q2-09 Board Member fees. Mr. Lahti receives $12,000 per quarter for his service on the Board and $15,000 in Q1-10 and Q2-10 for his service as Chairman of the Executive Leadership Committee. As Mr. Lahti elected to have these fees paid in shares of PokerTek's common stock, Mr. Lahti received 13,846 shares as payment for Q1-10 fees, 13,689 shares as payment for Q2-10 fees, and 6,154 shares as payment for Q3-10 fees. Mr. Lahti also received $12,500 for his service on the Board in Q2-09. As Mr. Lahti elected to have these fees paid in shares of PokerTek's common stock, Mr. Lahti received 6,338 shares as payment for Q2-09 fees. |

| | | | | | | | | | | |

| (4) | The amount in the All Other Compensation column for Mr. Lomax consists of Q1-10 and Q2-10 Board Member fees, as well as Q2-09 Board Member fees. Mr. Lomax receives $12,000 per quarter for his service on the Board. As Mr. Lomax elected to have these fees paid in shares of PokerTek's common stock, Mr. Lomax received 6,154 shares as payment for Q1-10 fees and 6,084 shares as payment for Q2-10 fees. Mr. Lomax also received $9,000 for his service on the Board in Q2-09. As Mr. Lomax elected to have these fees paid in shares of PokerTek's common stock, Mr. Lomax received 4,563 shares as payment for Q2-09 fees. |

| | | | | | | | | | | |

| (5) | The amount in the All Other Compensation column for Mr. Berman consists of Q1-10, Q2-10, and Q3-10 Board Member fees. Mr. Berman receives $12,000 per quarter for his service on the Board. As Mr. Berman elected to have these fees paid in shares of PokerTek's common stock, Mr. Berman received 6,154 shares as payment for Q1-10 fees, 6,084 shares as payment for Q2-10 fees, and 6,154 shares as payment for Q3-10 fees. |

Shareholder Communications with Directors

Any shareholder desiring to contact the Board, or any specific director(s), may send written communications to: Board (Attention: (Name(s) of director(s), as applicable)), c/o Corporate Secretary, 1150 Crews Road, Suite F, Matthews, North Carolina 28105. Any communication so received will be processed by the Secretary and conveyed to the member(s) of the Board named in the communication or to the Board.

Procedures for Reporting Complaints about Accounting and Auditing Matters

The Audit Committee has adopted procedures for receiving and handling complaints from employees and third parties regarding accounting, internal accounting controls or auditing matters, including procedures for confidential, anonymous submissions by employees of complaints or concerns regarding questionable accounting, auditing, or other matters. Employees or third parties may report their concerns by calling the PokerTek, Inc. Values Line, an anonymous third-party hotline service operated by Global Compliance Services, at (888) 475-8376.

Upon receipt of a complaint relating to the matters set forth above, Global Compliance promptly notifies the Chief Financial Officer and the Audit Committee. If the matter involves the Chief Financial Officer, he is not notified of the complaint. The Audit Committee oversees the review of any such complaint and maintains the confidentiality of an employee or third-party complainant to the fullest extent possible. Prompt and appropriate corrective action is taken when and as warranted in the judgment of the Audit Committee. This procedure for reporting complaints about accounting and auditing matters is available at www.pokertek.com.

Code of Business Conduct and Ethics

We maintain a Code of Business Conduct and Ethics to provide guidance on sustaining our commitment to high ethical standards. The code applies to our employees, officers, directors, agents, representatives, consultants, advisors and independent contractors. We will disclose any waivers of the code applicable to our directors or executive officers on a Form 8-K as required by NASDAQ listing standards or applicable law. Any waivers of the code for executive officers or directors may be made only by the Board or by a Board committee. To date, no waivers have been requested or granted. A copy of this code is available at www.pokertek.com.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information with respect to the beneficial ownership of our common stock as of the Record Date by (a) each person known by us to own beneficially more than five percent of the outstanding shares of our common stock, (b) each director, (c) the Named Executive Officers (as defined below under “Summary Compensation Table”) and (d) all current directors and officers as a group. Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of our common stock subject to options or warrants held by that person that are currently exercisable or that are or may become exercisable within 60 days of the Record Date are deemed outstanding. These shares, however, are not deemed outstanding for purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to this table and under applicable community property laws, each shareholder named in the table has sole voting and dispositive power with respect to the shares set forth opposite the shareholder’s name. Unless otherwise noted, the address of all listed shareholders is c/o PokerTek, Inc., 1150 Crews Road, Suite F, Matthews, North Carolina 28105.

| Name of Beneficial Owner | | Number of Shares

Beneficially Owned | | | Percent of

Class | |

| | | | | | | | |

| Directors and Executive Officers: | | | | | | | |

| Gehrig H. White | | | 751,760 | (1) | | | 11.88 | % | |

| James T. Crawford | | | 747,949 | (2) | | | 11.82 | % | |

| Lyle A. Berman | | | 607,865 | (3) | | | 9.61 | % | |

| Arthur L. Lomax | | | 274,630 | (4) | | | 4.34 | % | |

| Joseph J. Lahti | | | 107,207 | (5) | | | 1.69 | % | |

| Mark D. Roberson | | | 87,778 | (6) | | | 1.39 | % | |

| Hal J. Shinn | | | 50,002 | (7) | | | 0.79 | % | |

| All directors and executive officers as a group (7 persons) | | | 2,577,189 | | | | 40.74 | % | |

| | | | | | | | | | |

| 5% Shareholders: | | | | | | | | | |

| GHW Enterprises, LLC | | | 731,960 | (8) | | | 11.57 | % | |

| Aristocrat International Pty. Limited | | | 723,018 | (9) | | | 11.43 | % | |

| Crawford Ventures, LLC | | | 678,628 | (10) | | | 10.73 | % | |

| | | | | | | | | | |

| (1) | Consists of 49,800 shares of common stock owned by Mr. White and 731,960 shares of common stock owned by GHW Enterprises, LLC, which is controlled by Mr. White. Mr. White has sole voting and dispositive power with respect to all of the shares of common stock. |

| | | | | |

| (2) | Consists of 39,313 shares of common stock and 37,508 presently exercisable options to purchase our common stock owned by Mr. Crawford and 671,128 shares of common stock owned by Crawford Ventures, LLC, which is controlled by Mr. Crawford. Mr. Crawford has sole voting and dispositive power with respect to all of the shares of common stock. |

| | | | | |

| (3) | Consists of 581,193 shares of common stock and 26,672 presently exercisable options to purchase our common stock owned by the Lyle A. Berman Revocable Trust and the Lyle A. Berman IRA, for which Mr. Berman serves as trustee and with respect to which Mr. Berman has sole voting and dispositive power. |

| | | | | |

| (4) | Consists of 26,648 shares of common stock owned by Mr. Lomax, with respect to which he has sole voting and dispositive power and 13,982 shares of common stock owned by Charitable Remainder Unitrust, for which Mr. Lomax shares voting power with Larry Swartz. |

| | | | | |

| (5) | Consists of 85,589 shares of common stock owned by Mr. Lahti and 6,668 presently exercisable options to purchase our common stock. |

| | | | | |

| (6) | Consists of 31,600 shares of common stock owned by Mr. Roberson and 56,178 presently exercisable options to purchase our common stock. |

| | | | | |

| (7) | Consists of presently exercisable options to purchase our common stock. | | |

| | | | | |

| (8) | The address of GHW Enterprises, LLC is 4620 Montibello Drive, Charlotte, North Carolina 28226. Gehrig H. White, as manager, controls GHW Enterprises, LLC and has sole voting and dispositive power with respect to the shares of common stock held by GHW Enterprises, LLC. |

| | | | | |

| (9) | Consists of shares of common stock for which voting and dispositive power is shared by Aristocrat International Pty. Limited and Aristocrat Leisure Limited. The address of each of Aristocrat International Pty. Limited and Aristocrat Leisure Limited is Building A, Pinnacle Office Park, 85 Epping Road, North Ryde, NSW 2113, Australia. Information reported is based on information provided by Aristocrat International Pty. Limited on April 5, 2010. |

| | | | | |

| (10) | The address of Crawford Ventures, LLC is 5237 Lancelot Drive, Charlotte, North Carolina 28270. James T. Crawford, as manager, controls Crawford Ventures, LLC and has sole voting and dispositive power with respect to the shares of common stock held by Crawford Ventures, LLC. |

| | | | | |

Summary Compensation Table

The following table sets forth the total compensation for the years ended December 31, 2010 and December 31, 2009 of our: (i) Chief Executive Officer and Chief Financial Officer and (ii) two other most highly compensated executive officers in 2010 whose total compensation exceeded $100,000, our President and Chief Technology Officer (our “Named Executive Officers”).

| Name and Principal Position | Year | | Salary | | | Bonus | | | Option Awards (1) | | | All Other

Compensation (2) | | | Total | |

| Mark D. Roberson | 2010 | | $ | 160,000 | | | $ | - | | | $ | 157,204 | | | $ | 2,133 | | | $ | 319,337 | |

Chief Executive Officer, Chief

Financial Officer and Treasurer | 2009 | | $ | 160,000 | | | $ | - | | | $ | 80,720 | | | $ | 4,267 | | | $ | 244,987 | |

| | | | | | | | | | | | | | | | | | | | | | |

| James T. Crawford | 2010 | | $ | 160,000 | | | $ | - | | | $ | 35,354 | | | $ | 2,133 | | | $ | 197,487 | |

| President and Secretary | 2009 | | $ | 160,000 | | | $ | - | | | $ | 6,990 | | | $ | 4,267 | | | $ | 171,257 | |

| | | | | | | | | | | | | | | | | | | | | | |

| Hal J. Shinn | 2010 | | $ | 152,250 | | | $ | - | | | $ | 23,886 | | | $ | 2,030 | | | $ | 178,166 | |

| Chief Technology Officer | 2009 | | $ | 152,250 | | | $ | - | | | $ | 17,848 | | | $ | 4,060 | | | $ | 174,158 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| (1) | The amounts in the Option Awards column reflects the dollar amount of awards recognized for financial statement reporting purposes for the years ended December 31, 2010 and 2009. A discussion of the assumptions used in calculating these values may be found in Note 11 to our audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2010. |

| | | | | | | | | |

| (2) | The amounts in the All Other Compensation column consist of Company matching contributions to our 401(k) plan. |

| | | | | | | | | |

| | | | | | | | | |

Outstanding Equity Awards at Fiscal-Year End

The following table details all outstanding equity awards held by Named Executive Officers at December 31, 2010.

| | | Option Awards |

| Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | Option Exercise Price | | Option Expiration Date |

| | | | | | | | | | | |

| Mark D. Roberson | | | 33,673 | | | | 67,327 | (1) | | $ | 2.03 | | September 11, 2019 |

| | | | 5,001 | | | | 69,999 | (1) | | $ | 1.20 | | March 31, 2020 |

| | | | 3,334 | | | | 16,666 | (1) | | $ | 2.75 | | May 12, 2020 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| James T. Crawford | | | 18,337 | | | | 36,663 | (1) | | $ | 2.03 | | September 11, 2019 |

| | | | 5,001 | | | | 69,999 | (1) | | $ | 1.20 | | March 31, 2020 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Hal J. Shinn | | | 30,000 | | | | - | (2) | | $ | 6.68 | | August 31, 2014 |

| | | | 8,000 | | | | - | (2) | | $ | 6.68 | | December 31, 2014 |

| | | | 12,002 | | | | 23,998 | (1) | | $ | 2.03 | | September 11, 2019 |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| (1) | 16.67% of the shares underlying this option vest every six months from the date of the option grant. |

| | |

| (2) | These options are fully vested and exercisable. |

Equity Compensation Plan Information

The following table summarizes information as of December 31, 2010 relating to our equity compensation plans, under which grants of stock options, restricted stock and other rights to acquire shares of our common stock may be granted from time to time.

| Plan Category | | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights | | | Weighted average

exercise price of

outstanding options,

warrants and rights (1) | | | Number of securities

remaining available for

future issuance under the

equity compensation plan

(excluding securities

reflected in column(a))

(2) | |

| | | (a) | | | (b) | | | (c) | |

| | | | | | | | | | |

Equity compensation plan

approved by security holders | | | 1,039,214 | | | $ | 5.35 | | | | 198,486 | |

| | | | | | | | | | | | | |

Equity compensation plan not

approved by security holders | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Total | | | 1,039,214 | | | $ | 5.35 | | | | 198,486 | |

| | | | | | | | | | | | | |

| (1) | The exercise prices for outstanding options granted to employees range from $1.20 to $29.90 per share. | |

| | | | | | | | |

| (2) | In addition to being available for future issuance upon exercise of stock options, our Stock Incentive Plans provide for the issuance of restricted stock awards and other stock-based awards. |

Policies and Procedures for Review and Approval of Related Person Transactions

The Audit Committee reviews statements of related parties required to be disclosed in the proxy statement. In evaluating related person transactions, the Audit Committee considers all factors it deems appropriate, including, without limitation, whether the related person transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances, the extent of the related person’s interest in the transaction, and whether products or services of a similar nature, quantity, or quality are readily available from alternative sources.

As required under the Audit Committee Charter, our Audit Committee is responsible for reviewing and approving all related party transactions for potential conflict of interest situations. A related party transaction refers to transactions required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the SEC.

Related Person Transactions

Transactions with Aristocrat

License fees from and equipment sales to Aristocrat of $229,000 and $5,000, respectively, were recorded in the year ended December 31, 2010, while $488,000 and $251,000, respectively, were recorded during the year ended December 31, 2009. As of December 31, 2010 and December 31, 2009, $40,000 and $150,000, respectively, were due from Aristocrat. As of December 31, 2010 and 2009, no amounts were due to Aristocrat.

We terminated our Distribution Agreement and entered into an Equipment Purchase Arrangement with Aristocrat effective January 15, 2010. The Equipment Purchase Arrangement provides that the purchase price for the purchased equipment will be paid from us to Aristocrat as the purchased equipment is deployed and revenues are received by us. As revenues are received by us, the payment to Aristocrat will be calculated as 20% of our gross revenue attributable to each table, up to a specified cap per table. We initially recorded a liability of $396,500 related to its purchase of inventory. During 2010, we paid $6,500 related to the Equipment Purchase Agreement. As of December 31, 2010, we have a liability of $390,000.

We agreed to assume responsibility for (and take title to) certain PokerPro tables currently installed at specified customer locations. In return for transfer of these tables to us, we agreed to relieve Aristocrat of all responsibility and related costs to service, support, maintain, replace and repair those tables.

As of December 31, 2010 and 2009, Aristocrat owned 11.7% and 12.9%, respectively, of our common stock.

Transactions with Board and Senior Management

On July 1, 2009, we entered into Indemnification Agreements with Joseph Lahti, Director, Arthur Lomax, Director, James Crawford, President and Director, Gehrig White, Director, and Mark Roberson, Chief Executive Officer and Chief Financial Officer, which provide for (i) indemnification against their personal liability to the fullest extent permitted by law and (ii) advancement of related expenses to them, including attorneys’ fees, judgments, fines and settlement amounts incurred by them in any action or proceeding. We entered into an Indemnification Agreement with Lyle Berman, Chairman of the Board, in January 2005.

On September 3, 2009, Mr. Berman participated in a private placement of our common stock. Mr. Berman invested $250,000 to purchase 131,579 shares at $1.90 per share, the consolidated closing bid price immediately preceding the transaction.

Between March 29, 2010 and April 7, 2010, Messrs. Berman, Crawford, Lahti and Roberson entered into Subscription Agreements providing for the issuance by us and the purchase by Messrs. Berman, Crawford, Lahti and Roberson of a total of 107,058 shares of our common stock for an aggregate purchase price of $130,000 in a transaction exempt from the registration requirements of the Act, as amended, pursuant to Section 4(6) and Regulation 506 under the Act.

Mr. White’s at-will employment with us terminated as of July 31, 2009, although he continues to serve as a member of our Board. In consideration of Mr. White’s services to us as a founder and employee, Mr. White received a severance payment of $100,000, which was paid in 12 equal monthly installments, and COBRA payment reimbursement in the monthly amount of $8,333 through August 1, 2010.

Office Lease

We currently lease our office and manufacturing facility from an entity owned and controlled by Mr. Crawford and Mr. White. The entity purchased the building while we were already a tenant. The lease terms were negotiated and are consistent with the rent paid by other tenants in the building. Rent expense recorded for the leased space for the years ended December 31, 2010 and 2009 were $166,000 and $189,000, respectively.

Founders’ Loan

We entered into a loan agreement with Messrs. Berman, Crawford, Lomax, and White on March 24, 2008, pursuant to which they loaned us an aggregate of $2.0 million. Messrs. Crawford, Lomax, and White are our founders. Each of the lenders is also a member of our Board, with Mr. Berman serving as Chairman and Mr. White serving as Vice Chairman. The loan originally called for cash interest at 13% with all unpaid principal and interest payable on March 24, 2010.

On July 9, 2009, the terms of the loan was amended to provide that monthly interest payments may be made, at the election of the holder, in shares of our common stock at a 13% annual interest rate pursuant to a formula or cash at a 9% annual interest rate. In addition, the maturity date of the loan was extended to March 21, 2012.

On September 10, 2009, we entered into an agreement with Messrs. Berman, Crawford, and Lomax to convert an aggregate $1.2 million principal amount of the loan into shares of our common stock. Messrs. White and Lomax continue to hold $500,000 and $300,000 principal amounts, respectively, of the loan.

The loan contains no restrictive covenants and, following the conversion described above, is collateralized by security interests in 62 PokerPro systems. Such interests have been subordinated to the SVB Credit Facility. During 2010, we made $66,082 in aggregate interest payments in cash. 578,314 shares were issued to certain of the lenders in connection with the conversion of $1.2 million of the outstanding debt balance.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act and the rules promulgated thereunder by the SEC require our directors and officers, and beneficial owners of more than 10% of our common stock to file reports of their ownership and changes in ownership of our common stock with the SEC. SEC regulations require that they furnish us with copies of these reports. Typically, we prepare these reports on behalf of our directors and officers based on information they provide to us. Based solely on the information they provide to us and our review of their reports as filed with the SEC, we believe that all reports required by Section 16(a) of the Exchange Act required to be filed during the year ended December 31, 2010 were filed on time except that Mr. Lomax did not timely file one Form 4 and each of Messrs. Berman, Crawford, Lahti and Roberson did not timely file two Form 4s.

Report of the Audit Committee

Each member of the Audit Committee is an independent director under existing NASDAQ listing standards and SEC requirements. In addition, the Board has determined that Mr. Lahti is an “audit committee financial expert” as defined by SEC rules.

The Audit Committee has reviewed and discussed the audited financial statements with management and with McGladrey & Pullen, LLP, our independent public accounting firm. The Audit Committee has also discussed the matters required to be discussed by the Statement on Auditing Standards Number 61, as amended (Communication with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3200T with McGladrey & Pullen, LLP.

The Audit Committee has received the written disclosures and the letter from McGladrey & Pullen, LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and has discussed with McGladrey & Pullen, LLP that firm’s independence.

Based upon the discussions and review described above, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2010 that was filed with the SEC.

AUDIT COMMITTEE

Joseph J. Lahti, Chairman

Lyle A. Berman

Arthur L. Lomax

The Report of the Audit Committee does not constitute soliciting material, and shall not be deemed to be filed or incorporated by reference into any other PokerTek filing under the Securities Act of 1933, as amended, or the Exchange Act except to the extent that PokerTek specifically incorporates the Report of the Audit Committee by reference therein.

Disclosure about Fees

The following table shows the aggregate fees that we paid or accrued for the audit and other services provided by McGladrey & Pullen, LLP for fiscal years 2010 and 2009.

| | | 2010 | | | 2009 | |

| Audit Fees | | $ | 173,391 | | | $ | 161,350 | |

| Audit-Related Fees | | | - | | | | - | |

| Tax Fees | | | 24,000 | | | | 48,115 | |

| All Other Fees | | | - | | | | - | |

| Total | | $ | 197,391 | | | $ | 209,465 | |

Audit Fees. This category includes fees for (i) the audit of our annual financial statements and review of financial statements included in our quarterly reports on Form 10-Q; and (ii) services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements for the relevant fiscal years.

Audit-Related Fees: This category includes fees for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements that are not reported under the caption “Audit Fees.” We did not pay any audit-related fees to McGladrey & Pullen, LLP for the fiscal years 2010 and 2009.

Tax Fees. This category consists of professional services rendered by McGladrey & Pullen, LLP for tax compliance, planning, return preparation, research, and advice.

All Other Fees. This category includes the aggregate fees for products that are not reported under “Audit Fees,” “Audit-Related Fees,” or “Tax Fees.” We did not pay any other fees to McGladrey & Pullen, LLP for the fiscal years 2010 and 2009.

The Audit Committee has considered the compatibility of the non-audit-related services performed by and fees paid to McGladrey & Pullen, LLP in fiscal year 2010 and the proposed non-audit related services and proposed fees for fiscal year 2010 and the possible effect of the performance of such services and payment of such fees on the independence of McGladrey & Pullen, LLP. All audit and non-audit services were approved by the Audit Committee either specifically or in accordance with the Audit Committee’s pre-approval policies and procedures prior to such services being rendered.

Audit Committee Pre-Approval Policy

The Audit Committee has adopted a policy that requires the Audit Committee to pre-approve all audit and permissible non-audit services to be provided by the independent registered public accounting firm (and any non-audit service provided by any other accounting firm) prior to the performance of each such service.

PROPOSAL 2

APPROVAL OF AN AMENDMENT TO THE 2009 POKERTEK STOCK INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES OF COMMON STOCK RESERVED FOR ISSUANCE BY 500,000 SHARES

In March 2011, the Board approved an amendment to 2009 PokerTek Stock Incentive Plan (the “2009 Plan”) that increases the number of shares available for awards under the 2009 Plan by 500,000 shares (the “Plan Amendment”). The Plan Amendment is subject to shareholder approval. The Board determined that the Plan Amendment is in our best interests and recommends approval by the shareholders. A copy of the proposed Plan Amendment is attached as Appendix A to this Proxy Statement.

Background and Reason for the Proposal

As of March 31, 2011 there were only 58,486 shares available for future grants under the 2009 Plan. Accordingly, the Board believes that the Plan Amendment is necessary to provide us with enough shares to continue our program of equity-based incentive compensation. In order to continue our program of equity-based incentive compensation to attract and retain the personnel necessary for our success and to provide more flexibility to the Board, the Board has approved the Plan Amendment and recommends approval by our shareholders.

The discussion that follows is qualified in its entirety by reference to the 2009 Plan. Shareholders should refer to the 2009 Plan for more complete and detailed information about the 2009 Plan, which was filed with the SEC, on March 30, 2011, as Exhibit 4.1 to our Registration Statement on Form S-8.

The number of shares reserved for issuance under the 2009 Plan, the award limitations described above, and the terms of awards shall be adjusted in the event of an adjustment in our capital structure (due to a merger, stock split, stock dividend or similar event).

Purpose and Eligibility

The purpose of the 2009 Plan is to enable and encourage selected employees, directors and independent contractors of us and our affiliates to acquire or to increase their equity stake in us and to be able to provide them with alternative forms of equity-based interests in order to promote a closer identification of their interests with ours and those of our public shareholders, thereby further stimulating their efforts to enhance the efficiency, soundness, profitability, growth and shareholder value. At this time, approximately 31 employees, 5 directors and 5 independent contractors are eligible to be selected to participate in the 2009 Plan, although these figures are subject to change. The types and material terms of awards that may be granted under the 2009 Plan are discussed below under the heading “Awards.”

Administration; Amendment and Termination

The 2009 Plan is administered by the Board or, upon delegation, by the Compensation Committee of the Board. However, the Board has the sole authority to grant awards to directors who are not our employees or employees of any of our affiliates. The Board and the Compensation Committee are referred to in this discussion collectively as the “Administrator.” Under the terms of the 2009 Plan, the Administrator has authority to take any action with respect to the 2009 Plan and make determinations deemed necessary or advisable for administering the 2009 Plan. Without limiting the foregoing, the Administrator may also accelerate the date that any award may become exercisable, vested or earned in whole or in part without any obligation to accelerate such date with respect to any other award and may modify terms and conditions for exercise, vesting or earning of an award. In certain circumstances, the Administrator may delegate to one or more of our senior executive officers the authority to grant awards to persons who are not officers or directors for purposes of Section 16 of the Exchange Act or who are not “covered employees” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended.

The 2009 Plan may be amended, altered, suspended and/or terminated at any time by the Board, subject to the requirement that shareholders must approve any amendment to the 2009 Plan if such approval is required by applicable law, rule or regulation. In addition, the Administrator may amend, alter, suspend and/or terminate any award, prospectively or retroactively, although, generally, no such action may be taken without a participant’s consent if his rights with respect to the award would be materially adversely affected.

However, the Administrator has the unilateral authority to (i) make adjustments to the terms and conditions of awards upon the occurrence of certain unusual or nonrecurring events affecting us or any of our affiliates or our financial statements of those of any of our affiliates, and to (ii) amend the 2009 Plan and any award to the extent necessary to comply with applicable laws, rules and regulations or changes to applicable laws, rules and regulations. The Administrator also may unilaterally cause any award granted under the 2009 Plan to be canceled in consideration of an alternative award or cash payment of an equivalent cash value (as determined by the Administrator) made to the holder of such canceled award. The Administrator also may impose forfeiture, recoupment or similar restrictions upon awards or shares issued or cash paid or payable pursuant to awards. The Administrator is also empowered to reprice outstanding options without shareholder approval.

Awards

The 2009 Plan authorizes the grant of awards including: (i) stock options in the form of incentive stock options and nonqualified stock options; (ii) SARs; (iii) restricted awards in the form of restricted stock awards and restricted stock units; (iv) performance awards in the form of performance shares and performance units; (v) phantom stock awards; and (vi) dividend equivalent awards. A summary of the material terms of each type of award is provided below.

Options. The 2009 Plan authorizes the grant of both incentive options and nonqualified options, both of which are exercisable for shares of our common stock (although incentive options may only be granted to our employees or of a related corporation). The option price must be no less than the fair market value per share of our common stock on the date of grant (or 110% of the fair market value per share of our common stock with respect to incentive options granted to an employee who is a 10% shareholder), except in the case of options which may be assumed or substituted in a merger or similar transaction. Generally, unless an individual award agreement provides otherwise, the option price may be paid in the form of cash or cash equivalent. In addition, where permitted by the Administrator and applicable laws, rules and regulations, payment may also be made: (i) by delivery (by either actual delivery or attestation) of shares of our common stock owned by the participant; (ii) by shares of our common stock withheld upon exercise; (iii) as long as a public market for our common stock exists, by delivery to us of written notice of exercise and delivery to a broker of written notice of exercise and irrevocable instructions to promptly deliver to us the amount of sale or loan proceeds to pay the option price; (iv) by such other payment methods as may be approved by the Administrator and which are acceptable under applicable laws, rules and regulations; or (v) by any combination of these methods. The term of an option and the period or periods during which, and conditions pursuant to which, an option may be exercised will be determined by the Administrator, although the option term may not exceed 10 years (or five years with respect to incentive options granted to an employee who is a 10% shareholder). Any option not exercised before expiration of the option period will terminate. Options generally are subject to certain restrictions on exercise if the participant terminates employment or service. Subject to the terms of the 2009 Plan, the Administrator may also authorize the grant of substitute or assumed options of an acquired entity.

Stock Appreciation Rights (“SARs”). Under the terms of the 2009 Plan, SARs may be granted to the holder of an option (a “related option”) with respect to all or a portion of the shares of our common stock subject to the related option (a “related SAR”) or may be granted separately to an eligible individual (a “freestanding SAR”). The consideration to be received by the holder of an SAR may be paid in cash, whole shares of our common stock (valued at fair market value on the date of the SAR exercise), or a combination thereof, as determined by the Administrator. Upon the exercise of an SAR, the holder of an SAR is entitled to receive payment from us in an amount determined by multiplying (i) the difference between the fair market value per share of our common stock on the date of exercise over the base price per share of such SAR by (ii) the number of shares of our common stock with respect to which the SAR is being exercised. The base price may be no less than 100% of the fair market value per share of our common stock on the date the SAR is granted (except in the case of certain substituted or assumed SARs in a merger or similar transaction).

SARs are exercisable according to the terms established by the Administrator and stated in the applicable award agreement. Upon the exercise of a related SAR, the related option is deemed to be canceled to the extent of the number of shares of our common stock for which the related SAR is exercised. No SAR may be exercised more than 10 years after it was granted, or such shorter period as may apply to with respect to a particular SAR. Each award agreement will state the extent to which a holder may have the right to exercise an SAR following termination of the holder’s employment or service with us or an affiliate, as determined by the Administrator.

Restricted Awards. Subject to the limitations of the 2009 Plan, the Administrator may grant restricted awards to such eligible individuals in such numbers, upon such terms and at such times as the Administrator determines. Restricted awards may be in the form of restricted stock awards and/or restricted stock units that are subject to certain conditions which must be met in order for the restricted award to vest and be earned (in whole or in part) and no longer subject to forfeiture. Restricted stock awards may be payable in whole shares of our common stock. Restricted stock units may be payable in cash or whole shares of our common stock, or partly in cash and partly in whole shares of our common stock, as determined by the Administrator.

The Administrator has authority to determine the restriction period for each restricted award and will determine the conditions that must be met in order for a restricted award to be granted or to vest or be earned (in whole or in part). These conditions may include (but are not limited to) payment of a stipulated purchase price, attainment of performance objectives, continued service or employment for a certain period of time (or a combination of attainment of performance objectives and continued service), retirement, displacement, disability, death or any combination of conditions. In the case of restricted awards based upon performance criteria, or a combination of performance criteria and continued service, the Administrator will determine the performance objectives to be used in valuing restricted awards, which will be based upon those corporate, business unit or division and/or individual performance factors and criteria as the Administrator may deem appropriate; provided, however, that, for awards intended to meet the requirements of Section 162(m) of the Internal Revenue Code of 1986, as amended, such performance factors must be limited to one or more of the specified factors described under the heading “Performance-Based Compensation—Code Section 162(m) Requirements” below.

The Administrator will determine whether and to what degree restricted awards have vested and been earned and are payable and the forms and terms of payment of restricted awards. If a participant’s employment or service is terminated for any reason and all or any part of a restricted award has not vested or been earned pursuant to the terms of the 2009 Plan and the individual award agreement, the award will be forfeited (unless the Administrator determines otherwise).

Performance Awards. Subject to the limitations of the 2009 Plan, the Administrator may grant performance awards to participants in such amounts, upon such terms and conditions and at such times as the Administrator determines. Performance awards may be in the form of performance shares and/or performance units. An award of a performance share is a grant of a right to receive shares of our common stock or the cash value thereof, or a combination thereof (as determined in the Administrator’s discretion), which is contingent upon the achievement of performance or other objectives during a specified period and which has a value on the date of grant equal to the fair market value per share of our common stock. An award of a performance unit is a grant of a right to receive shares of our common stock, a designated dollar value amount of common stock, or a combination thereof (as determined in the Administrator's discretion) which is contingent upon the achievement of performance or other objectives during a specified period, and which has an initial value established by the Administrator at the time of grant.

The Administrator will determine the performance period for a performance award and the conditions that must be satisfied in order for a performance award to be granted or to vest or be earned (in whole or in part). In the case of a performance award based upon specified performance objectives, the Administrator will determine the performance objectives to be used in valuing performance awards, which will be based upon those corporate, business unit or division and/or individual performance factors and criteria as the Administrator may deem appropriate; provided, however, that, for awards intended to meet the requirements of Section 162(m) of the Internal Revenue Code of 1986, as amended, such performance factors must be limited to one or more of the specified factors described under the heading “Performance-Based Compensation—Code Section 162(m) Requirements” below.

The Administrator will determine whether and to what degree performance awards have been earned and are payable and the terms of performance awards. If a participant’s employment or service is terminated for any reason and all or any part of a performance award has not been earned pursuant to the terms of the 2009 Plan and the individual award agreement, the award will be forfeited (unless the Administrator determines otherwise).

Phantom Stock Awards. Subject to the limitations of the 2009 Plan, the Administrator may grant phantom stock awards to such eligible individuals in such numbers, upon such terms and at such times as the Administrator determines. An award of phantom stock is an award of a number of hypothetical share units with respect to shares of our common stock, with a value per unit based on the fair market value per share of our common stock.

The Administrator will determine whether and to what degree phantom stock awards have vested and are payable. Upon vesting of all or part of a phantom stock award and satisfaction of other terms and conditions as determined by the Administrator, the holder of a phantom stock award will be entitled to a payment of an amount equal to the fair market value of one share of our common stock with respect to each phantom stock unit which is being settled. The Administrator may determine the forms and terms of payment of phantom stock awards in accordance with the 2009 Plan.

Dividend and Dividend Equivalents. The Administrator may provide that awards granted under the 2009 Plan earn dividends or dividend equivalents. Such dividends or dividend equivalents may be paid currently or may be credited to a participant’s account, subject to such restrictions and conditions as the Administrator may establish.

Change in Control

Upon a change in control event (as defined in the 2009 Plan), and unless otherwise provided in individual award agreements or other agreements between a participant and us, awards generally will become fully exercisable, vested, earned and payable to the fullest extent of the original grant of the applicable award. However, the Administrator may determine that any or all awards will not vest or become exercisable on an accelerated basis if we (or the surviving or acquiring corporation, as the case may be) has taken such action, including but not limited to the assumption of awards granted under the 2009 Plan or the grant of substitute awards (in either case, with substantially similar terms or equivalent economic benefits as awards granted under the 2009 Plan), as the Administrator determines to be equitable or appropriate to protect the rights and interests of participants under the 2009 Plan.

Transferability