As filed with the Securities and Exchange Commission on June 6, 2007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21631

RMK Advantage Income Fund, Inc.

(Exact name of Registrant as specified in charter)

Morgan Keegan Tower

Fifty North Front Street

Memphis, Tennessee 38103

(Address of principal executive offices) (Zip code)

Allen B. Morgan, Jr.

Morgan Keegan Tower

Fifty North Front Street

Memphis, Tennessee 38103

(Name and address of agent for service)

Registrant’s telephone number, including area code: (901) 524-4100

with copies to:

Arthur J. Brown, Esq.

Kirkpatrick & Lockhart Preston Gates Ellis LLP

1601 K Street, N.W.

Washington, D.C. 20006

Date of fiscal year end: March 31, 2007

Date of reporting period: March 31, 2007

| Item 1. | Reports to Stockholders. |

The following is a copy of the report transmitted to stockholders of RMK Advantage Income Fund, Inc. (the “Fund”) pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1):

TABLEOF CONTENTS

There is no assurance that the Funds will achieve their investment objectives. The Funds are subject to market risk, which include the possibilities that the market values of the securities owned by the Funds will decline or that the shares of the Funds will trade at lower prices in the market. Accordingly, you can lose money investing in the Funds.

| | | | |

| NOT FDIC INSURED | | MAY LOSE VALUE | | NO BANK GUARANTEE |

i

LETTER TO STOCKHOLDERS

Dear Fellow Stockholders,

We are pleased to present the enclosed combined annual report for RMK Advantage Income Fund, Inc., RMK High Income Fund, Inc., RMK Multi-Sector High Income Fund, Inc. and RMK Strategic Income Fund, Inc. (each a “Fund” and, collectively, the “Funds”). In this report, you will find information on each Fund’s investment objective and strategy and learn how your investment performed during the fiscal year ended March 31, 2007. The portfolio manager will also provide an overview of the market conditions and discuss some of the factors that affected investment performance during the reporting period. In addition, this report includes each Fund’s audited financial statements and portfolio of investments as of March 31, 2007.

As always, we appreciate your continued support of the Regions Morgan Keegan closed-end funds. We remain committed to helping you pursue your financial goals through investments in our fund family. You have our commitment to bring you the highest level of disciplined decision making and personal service to meet your financial needs. If you have any questions about the Funds, please call us toll-free at 800-564-2188.

Sincerely,

Brian B. Sullivan, CFA

President

May 21, 2007

1

RMK ADVANTAGE INCOME FUND, INC.

OBJECTIVE & STRATEGY

RMK Advantage Income Fund, Inc. seeks a high level of current income. The Fund seeks capital growth as a secondary investment objective when consistent with its primary investment objective. The Fund invests a majority of its total assets in below investment grade debt securities (commonly referred to as “junk bonds”) that offer attractive yield and capital appreciation potential. The Fund may also invest in investment grade debt securities, up to 15% of its total assets in foreign debt and foreign equity securities and up to 25% of its total assets in domestic equity securities, including common and preferred stocks. The Fund invests in a wide range of below investment grade debt securities, including corporate bonds, mortgage-backed and asset-backed securities and municipal and foreign government obligations, as well as securities of companies in bankruptcy reorganization proceedings or otherwise in the process of debt restructuring. (Below investment grade debt securities are rated Ba1 or lower by Moody’s Investors Service, Inc., BB+ or lower by Standard & Poor’s Ratings Group, comparably rated by another nationally recognized statistical rating organization or, if unrated, determined by the Fund’s investment adviser to be of comparable quality.) The Fund may use leverage through bank borrowings, reverse repurchase agreements or other transactions involving indebtedness or through the issuance of preferred stock. The Fund may leverage up to 33 1/3% of its total assets (in each case including the amount borrowed). The Fund may vary its use of leverage in response to changing market conditions.

INVESTMENT RISKS: Bond funds tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price. Bond prices and the value of bond funds decline as interest rates rise. Bonds with longer-term maturities generally are more vulnerable to interest rate risk than bonds with shorter-term maturities. Below investment grade bonds involve greater credit risk, which is the risk that the issuer will not make interest or principal payments when due. An economic downturn or period of rising interest rates could adversely affect the ability of issuers, especially issuers of below investment grade debt, to service primary obligations and an unanticipated default could cause the Fund to experience a reduction in value of its shares. The value of U.S. and foreign equity securities in which the Fund invests will change based on changes in a company’s financial condition and in overall market and economic conditions. Leverage creates an opportunity for an increased return to common stockholders, but unless the income and capital appreciation, if any, on securities acquired with leverage proceeds exceed the costs of the leverage, the use of leverage will diminish the investment performance of the Fund’s shares. Use of leverage may also increase the likelihood that the net asset value of the Fund and market value of its common shares will be more volatile, and the yield and total return to common stockholders will tend to fluctuate more in response to changes in interest rates and creditworthiness.

2

RMK ADVANTAGE INCOME FUND, INC.

MANAGEMENT DISCUSSIONOF FUND PERFORMANCE

For the six months and the fiscal year ended March 31, 2007, the Fund had a total return of (8.52)% and 1.53%, respectively, based on market price and reinvested dividends and other distributions. For the six months and the fiscal year ended March 31, 2007, the Fund had a total return of 3.24% and 6.21%, respectively, based on net asset value and reinvested dividends and other distributions. For the six months and the twelve months ended March 31, 2007, the Lehman Brothers Ba U.S. High Yield Index(1) had a total return of 5.37% and 9.71%, respectively.

Since our last report, the Fund’s market price share performance has been negatively impacted by the reduction of the monthly distribution rate from $0.15 per share to $0.14 per share. The Fund’s performance has also been negatively impacted by the recent turmoil in the mortgage market. During the months leading up to the reduction of the Fund’s distribution rate, portfolio earnings were increasingly under pressure due to consistently rising costs associated with the leverage (borrowed money) employed by the Fund and by a prolonged period of contracting credit spreads. The combination of these two market forces resulted in lower net earnings to the Fund and required a reduction in the distribution rate beginning in December 2006.

Since December, the U.S. mortgage-backed securities market has undergone serious turmoil, most notably in the sub-prime home equity arena. While this downward volatility in the mortgage-backed arena has had a negative impact on the net asset value of the Fund, it has also provided an opportunity to buy assets at considerably higher yields than have been available for more than two years. Strategically redeploying assets during this market upheaval may be difficult from a net asset value perspective for a period of time, but this is also the best opportunity we have seen in years to secure better portfolio earnings for quarters to come.

Although we made material shifts out of consumer oriented debt (home equity, credit cards), we still have a meaningful weighting. Corporate debt continues to outperform most other categories—in fact, the lower the credit rating, the more favorably it is viewed by the market. Some profit taking in this sector is probably warranted at this point in the economic cycle. It is our expectation that 2007 will prove to be a period of slower economic growth and a transition year for the Federal Reserve Board. That is, we expect the Federal Reserve Board to leave rates unchanged, perhaps through the summer; however, during the second half of this year, we expect the Federal Reserve Board to begin lowering interest rates as the

3

RMK ADVANTAGE INCOME FUND, INC.

U.S. economy experiences very sluggish growth quarters. Fixed rate securities will be a focus as will badly oversold consumer credit items.

|

|

|

James C. Kelsoe, Jr., CFA Senior Portfolio Manager Morgan Asset Management, Inc. |

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objectives. These views are subject to change at any time based upon market or other conditions, and Morgan Asset Management, Inc. disclaims any responsibility to update such views. The Fund is subject to market risk, which include the possibilities that the market values of the securities owned by the Fund will decline or that shares of the Fund will trade at lower prices in the market. Accordingly, you can lose money investing in the Fund.

INDEX DESCRIPTION

(1) | | The Lehman Brothers Ba U.S. High Yield Index is a broad-based unmanaged index of Ba fixed rate, non-investment grade debt. All bonds included in the High Yield Index must be dollar-denominated, nonconvertible, have at least one year remaining to maturity, and an outstanding par value of at least $150 million. The index is unmanaged and, unlike the Fund, is not affected by cashflows or trading and other expenses. It is not possible to invest directly in an index. |

4

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIO STATISTICS†

AS OF MARCH 31, 2007

| | |

Average Credit Quality | | BB |

Current Yield | | 10.98% |

Yield to Maturity | | 12.13% |

Duration | | 4.29 Years |

Average Effective Maturity | | 5.71 Years |

Percentage of Leveraged Assets | | 26% |

Total Number of Holdings | | 307 |

| † | | The Fund’s composition is subject to change. |

CREDIT QUALITY†

AS OF MARCH 31, 2007

| | | | | | |

| %OFDEBTSECURITIES | | %OFDEBTSECURITIES |

AAA | | 3.8% | | CCC | | 14.2% |

BBB | | 21.0% | | CC | | 2.4% |

BB | | 21.4% | | D | | 0.4% |

B | | 13.8% | | Not Rated | | 23.0% |

| | | | | | |

| | | | Total | | 100.0% |

| † | | The Fund’s composition is subject to change. |

ASSET ALLOCATION†

AS OF MARCH 31, 2007

| | |

| %OFTOTALINVESTMENTS |

Corporate Bonds | | 29.5% |

Collateralized Debt Obligations | | 24.8% |

Collateralized Mortgage Obligations | | 14.7% |

Common Stocks | | 9.1% |

Home Equity Loans | | 7.9% |

Equipment Leases | | 5.0% |

Preferred Stocks | | 3.8% |

Collateralized Loan Obligations | | 1.9% |

Certificate-Backed Obligations | | 1.0% |

Other | | 0.3% |

Short-Term Investments | | 2.0% |

| | |

Total | | 100.0% |

| † | | The Fund’s composition is subject to change. |

5

RMK ADVANTAGE INCOME FUND, INC.

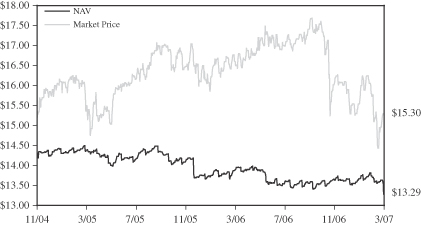

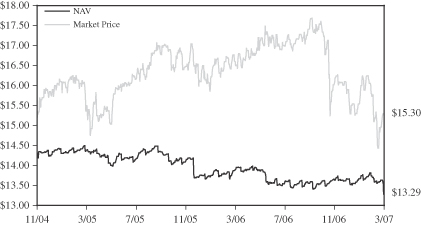

NAV & MARKET PRICE HISTORY*

The graph below illustrates the net asset value and market price history of RMK Advantage Income Fund, Inc. (NYSE: RMA) from the commencement of investment operations on November 8, 2004 to March 31, 2007.

| * | | Net asset value is calculated every day that the New York Stock Exchange is open as of the close of trading (normally 4:00 p.m. Eastern Time) by taking the closing market value of all portfolio securities, cash and other assets owned, subtracting all liabilities, then dividing the result (total net assets) by the total number of shares outstanding. The market price is the last reported price at which a share of the Fund was sold on the New York Stock Exchange. |

6

RMK ADVANTAGE INCOME FUND, INC.

PERFORMANCE INFORMATION

| | | | | | | | | |

| | | AVERAGE ANNUAL TOTAL RETURNS | |

| AS OF MARCH 31, 2007 | | SIX

MONTHS* | | | 1

YEAR | | | COMMENCEMENT

OF INVESTMENT

OPERATIONS(1) | |

| MARKET VALUE | | (8.52 | )% | | 1.53 | % | | 13.10 | % |

| NET ASSET VALUE | | 3.24 | % | | 6.21 | % | | 8.70 | % |

LEHMAN BROTHERS BA HIGH YIELD INDEX(2) | | 5.37 | % | | 9.71 | % | | N/A | |

| * | | Not annualized for periods less than one year. |

(1) | | The Fund commenced investment operations on November 8, 2004. |

(2) | | The Lehman Brothers Ba U.S. High Yield Index is a broad-based unmanaged index of Ba fixed rate, non-investment grade debt. All bonds included in the High Yield Index must be dollar-denominated, nonconvertible, have at least one year remaining to maturity, and an outstanding par value of at least $150 million. The index is unmanaged and, unlike the Fund, is not affected by cashflows or trading and other expenses. It is not possible to invest directly in an index. |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent performance, call toll-free 800-564-2188. Total returns assume an investment at the common share market price or net asset value at the beginning of the period, reinvestment of all dividends and other distributions for the period in accordance with the Fund’s dividend reinvestment plan, and sale of all shares at the closing market price (excluding any commissions) or net asset value at the end of the period. Returns shown in the table do not reflect the deduction of taxes that a stockholder would pay on Fund distributions or on the sale of Fund shares. Mutual funds are not bank deposits or obligations, are not guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. Investment in mutual funds involves investment risk, including possible loss of principal.

7

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Asset-Backed Securities–Investment Grade–19.6% of Net Assets | | | |

| | | | Certificate-Backed Obligations (“CBO”)–0.5% | | | |

| 3,000,000 | | | | Diversified Asset Securitization Holdings III 1A A3L, 6.150% 7/5/36 (a) | | $ | 2,310,000 |

| | | | | | | |

| | | | Collateralized Debt Obligations (“CDO”)–14.2% | | | |

| 3,000,000 | | | | Broderick CDO Ltd. 2007-3A D, 9.163% 12/6/50 (a) | | | 2,940,000 |

| 3,000,000 | | | | CDO Repack SPC Ltd. 2006-BRGA, Zero Coupon Bond 12/5/51 | | | 2,820,000 |

| 1,904,039 | | | | E-Trade CDO I 2004-1A, 2.000% 1/10/40 | | | 1,690,254 |

| 2,000,000 | | | | Highland Park CDO Ltd. 2006-1A E, 7.670% 11/25/51 (a) | | | 1,870,000 |

| 3,000,000 | | | | Kodiak CDO 2006-1A G, 8.860% 8/7/37 (a) | | | 2,910,000 |

| 3,000,000 | | | | Lexington Capital Funding Ltd. 2007-3A F, 8.860% 4/10/47 (a) | | | 2,910,000 |

| 1,985,322 | | | | Millstone III-A CDO Ltd., 4.300% 7/5/46 | | | 1,905,909 |

| 3,863,717 | | | | MKP CBO I Ltd. 4A CS, 2.000% 7/12/40 (a) | | | 3,631,894 |

| 3,000,000 | | | | Newbury Street CDO Ltd. 2007-1A D, 9.100% 3/4/53 (a) | | | 2,955,000 |

| 2,000,000 | | | | Norma CDO Ltd. 2007-1A E, 9.765% 3/11/49 (a) | | | 1,800,000 |

| 6,000,000 | | | | Palmer Square 2A CN, 6.952% 11/2/45 (a) | | | 5,940,000 |

| 2,000,000 | | | | Pasa Funding Ltd. 2007-1A D, 9.324% 4/7/52 | | | 1,820,000 |

| 1,976,164 | | | | Sharps CDO 2006-1A D, 7.500% 5/8/46 (a) | | | 1,894,727 |

| 6,000,000 | | | | Taberna Preferred Funding Ltd. 2006-6A, 6.100% 12/5/36 (a) | | | 5,966,400 |

| 3,922,479 | | | | Taberna Preferred Funding Ltd. 2006-7A C1, 10.000% 2/5/37 (a) | | | 3,859,719 |

| 3,000,000 | | | | Tahoma CDO Ltd. 2006-1A D, 9.006% 6/18/47 (a) | | | 3,000,000 |

| 1,000,000 | | | | Tahoma CDO Ltd. 2007-2A D, 9.830% 9/16/47 (a) | | | 930,000 |

| 2,000,000 | | | | Trapeza CDO I LLC 2006-10A, 6.700% 6/6/41 | | | 1,840,000 |

| 1,000,000 | | | | Trapeza CDO I LLC 2006-10A D2, 8.700% 6/6/41 (a) | | | 1,022,500 |

| 3,000,000 | | | | Linker Finance PLC 16A E, 8.820% 5/19/45 (a) | | | 2,902,500 |

| 4,528,703 | | | | Witherspoon CDO Funding Ltd. 2004-1A, 7.500% 9/15/39 | | | 4,415,485 |

| | | | | | | |

| | | | | | | 59,024,388 |

| | | | | | | |

| | | | Equipment Leases–0.9% | | | |

| 3,793,301 | | | | Aviation Capital Group Trust 2005-3A C1, 8.570% 12/25/35 (a) | | | 3,869,167 |

| | | | | | | |

| | | | Home Equity Loans (Non-High Loan-To-Value)–4.0% | | | |

| 1,000,000 | | | | ACE Securities Corp. 2004-HE1 M5, 7.270% 3/25/34 | | | 870,000 |

| 7,613,000 | | | | ACE Securities Corp. 2004-HE3 M11, 8.820% 11/25/34 | | | 6,471,050 |

| 2,119,000 | | | | Asset-Backed Securities Corp. Home Equity 2005-HE1 M10, 7.967% 3/25/35 | | | 1,864,720 |

| 2,681,000 | | | | Bear Stearns Asset-Backed Securities, Inc. 2004-HE9 M7B, 9.320% 11/25/34 | | | 2,386,090 |

| 1,000,000 | | | | Fremont Home Loan Trust 2004-4 M7, 7.040% 3/25/35 | | | 930,070 |

| 612,056 | | | | Home Equity Asset Trust 2003-4 B1, 9.320% 10/25/33 | | | 597,204 |

| 2,000,000 | | | | Soundview Home Equity Loan Trust 2005-A B1, 8.320% 4/25/35 (a) | | | 1,540,000 |

| 2,000,000 | | | | Terwin Mortgage Trust 2007-3SL B3, 6.000% 5/25/38 (a) | | | 1,852,400 |

| | | | | | | |

| | | | | | | 16,511,534 |

| | | | | | | |

| | | | Total Asset-Backed Securities–Investment Grade

(cost $82,773,533) | | | 81,715,089 |

| | | | | | | |

8

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

Asset-Backed Securities–Below Investment Grade or Unrated–34.4% of

Net Assets | | | |

| | | | Certificate-Backed Obligations (“CBO”)–0.7% | | | |

| 2,000,000 | | | | Goldman Sachs Asset Management CBO II 2A D1, 11.620% 11/5/12 (a) | | $ | 2,015,620 |

| 2,451,074 | | | | Helios Series I Multi-Asset CBO, Ltd. IA C, 8.109% 12/13/36 (a) | | | 931,408 |

| | | | | | | |

| | | | | | | 2,947,028 |

| | | | | | | |

| | | | Collateralized Debt Obligations (“CDO”)–18.7% | | | |

| 2,000,000 | | | | Aardvark Asset-Backed Securities CDO 2007-1A, 10.000% 7/6/47 | | | 1,820,000 |

| 4,000,000 | | | | Acacia CDO, Ltd. 10A, 3.700% 9/7/46 (a) | | | 1,600,000 |

| 5,000,000 | | | | Aladdin CDO I Ltd. 2006-3A, 10.350% 10/31/13 (a) | | | 2,412,500 |

| 2,000,000 | | | | Alesco Preferred Funding Ltd. 13A I, 10.000% 9/23/37 | | | 1,928,900 |

| 4,000,000 | | | | Attentus CDO Ltd. 2006-2A, 10.000% 10/9/41 | | | 3,940,000 |

| 2,000,000 | | | | Attentus CDO Ltd. 2006-2A F1, 10.360% 10/9/41 (a) | | | 1,950,000 |

| 3,000,000 | | | | Attentus CDO Ltd. 2007-3A, 10.000% 10/11/42 | | | 2,760,000 |

| 3,000,000 | | | | Attentus CDO Ltd. 2007-3A F2, 9.532% 10/11/42 (a) | | | 2,947,500 |

| 1,000,000 | | | | Cairn Mezzanine Asset-Backed CDO PLC 2007-3A, 10.000% 8/13/47 | | | 670,000 |

| 1,000,000 | | | | Copper River CLO Ltd. 2006-1A E, 9.124% 1/20/21 (a) | | | 993,120 |

| 5,000,000 | | | | Dillon Read CDO Ltd. 2006-1A, 10.000% 12/5/46 (a) | | | 4,437,500 |

| 3,000,000 | | | | Diversified Asset Securitization Holdings II 1A B1, 9.712% 9/15/35 (a) | | | 1,620,000 |

| 3,000,000 | �� | | | Dryden Leveraged Loan CDO 2005-9A, 10.000% 9/20/19 | | | 2,490,000 |

| 3,000,000 | | | | Equinox Funding 1A D, 12.277% 11/15/12 (a) | | | 1,680,000 |

| 4,000,000 | | | | Global Leveraged Capital Credit Opportunity Fund 2006-1A, 10.000% 12/20/18 (a) | | | 3,996,800 |

| 2,000,000 | | | | Gulf Stream Atlantic CDO Ltd. 2007-1A, 10.000% 7/13/47 (a) | | | 1,680,000 |

| 3,825,186 | | | | Hewett’s Island CDO Ltd. 2004-1A, 12.390% 12/15/16 | | | 3,691,305 |

| 2,000,000 | | | | IXIS ABS 1 Ltd., 10.000% 12/12/46 | | | 1,560,000 |

| 2,000,000 | | | | Jazz CDO BV III-A EB, 10.571% 9/26/14 (a) | | | 2,000,000 |

| 13,000,000 | | | | Kenmore Street Synthetic CDO 2006-1A, 10.350% 4/30/14 (a) | | | 6,240,000 |

| 999,741 | | | | Knollwood CDO Ltd. 2006-2A E, 11.360% 7/13/46 (a) | | | 868,285 |

| 2,000,000 | | | | Knollwood CDO Ltd. 2006-2A SN, 15.000% 7/13/46 | | | 1,840,000 |

| 4,000,000 | | | | Kodiak CDO 2006-1A, 3.712% 8/7/37 (a) | | | 3,660,000 |

| 3,000,000 | | | | Navigare Funding CLO Ltd. 2007-2A SN, 5.360% 4/17/21 (a) | | | 2,700,000 |

| 5,000,000 | | | | OFSI Fund Ltd. 2006-1A, 2.000% 9/20/19 (a) | | | 5,053,000 |

| 2,846,176 | | | | Peritus I CDO Ltd. 2005-1A C, 9.000% 5/24/15 (a) | | | 2,800,467 |

| 2,000,000 | | | | Trapeza CDO I LLC 2006-11A, 10.000% 10/10/41 | | | 1,920,000 |

| 2,000,000 | | | | Trapeza CDO I LLC 2006-11A F, 10.361% 10/10/41 | | | 2,000,000 |

| 2,000,000 | | | | Trapeza CDO I LLC 2007-12A F, 9.852% 4/6/42 (a) | | | 1,968,000 |

| 2,500,000 | | | | Tricadia CDO Ltd. 2006-5A, Zero Coupon Bond 6/19/46 (a) | | | 1,912,500 |

| 3,000,000 | | | | Tropic CDO I Corp. 2006-5A C1, 10.000% 7/15/36 | | | 2,841,000 |

| | | | | | | |

| | | | | | | 77,980,877 |

| | | | | | | |

9

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Asset-Backed Securities–Below Investment Grade or Unrated (continued) | | | |

| | | | Collateralized Loan Obligations (“CLO”)–2.5% | | | |

| 1,000,000 | | | | Flagship CLO 2005-4I, Zero Coupon Bond 6/1/17 | | $ | 903,050 |

| 2,000,000 | | | | Ocean Trails CLO 2006-1A, 10.000% 10/12/20 | | | 1,930,000 |

| 3,000,000 | | | | Rosedale CLO Ltd. I-A II, 5.146% 7/24/21 | | | 2,910,000 |

| 3,000,000 | | | | Telos CLO Ltd. 2006-1A, 10.000% 10/11/21 (a) | | | 2,955,000 |

| 2,000,000 | | | | Veritas CLO Ltd. 2006-2A, 15.000% 7/11/21 (a) | | | 1,880,000 |

| | | | | | | |

| | | | | | | 10,578,050 |

| | | | | | | |

| | | | Equipment Leases–5.7% | | | |

| 7,594,200 | | | | Aerco Limited 1X C1, 6.670% 7/15/23 | | | 1,822,607 |

| 7,123,631 | | | | Aerco Limited 2A B2, 6.370% 7/15/25 (a) | | | 2,635,744 |

| 7,247,186 | | | | Aerco Limited 2A C2, 7.370% 7/15/25 (a) | | | 2,101,684 |

| 8,250,000 | | | | Aircraft Finance Trust 1999-1A A1, 5.800% 5/15/24 (a) | | | 6,125,625 |

| 5,000,000 | | | | Airplanes Pass Through Trust 2001-1A A9, 5.870% 3/15/19 | | | 3,459,375 |

| 819,944 | | | | DVI Receivables Corp. 2001-2 A3, 3.519% 11/8/31 | | | 590,360 |

| 1,743,446 | | | | DVI Receivables Corp. 2001-2 A4, 4.613% 11/11/09 | | | 1,272,716 |

| 5,826,792 | | | | DVI Receivables Corp. 2002-1 A3A, 5.670% 6/11/10 | | | 3,029,932 |

| 3,160,472 | | | | Lease Investment Flight Trust 1 B2, 7.124% 7/15/31 | | | 916,537 |

| 4,000,000 | | | | Piper Jaffray Equipment Trust Securities 2007-1A, 6.300% 3/26/29 (a) | | | 1,780,000 |

| | | | | | | |

| | | | | | | 23,734,580 |

| | | | | | | |

| | | | Franchise Loans–0.2% | | | |

| 1,617,000 | | | | Falcon Franchise Loan LLC 2001-1 F, 6.500% 1/5/23 | | | 791,117 |

| | | | | | | |

| | | | Home Equity Loans (Non-High Loan-To-Value)–6.5% | | | |

| 2,000,000 | | | | ACE Securities Corp. 2005-HE2 B1, 8.570% 4/25/35 (a) | | | 1,420,000 |

| 3,000,000 | | | | ACE Securities Corp. 2005-HE6 B1, 8.320% 10/25/35 (a) | | | 1,980,000 |

| 2,000,000 | | | | Asset-Backed Securities Corp. Home Equity 2006-HE4 M9, 7.820% 5/25/36 (a) | | | 1,280,000 |

| 7,038,000 | | | | Equifirst Mortgage Loan Trust 2004-3 B2, 8.720% 12/25/34 (a) | | | 5,560,020 |

| 1,000,000 | | | | Equifirst Mortgage Loan Trust 2005-1 B3, 8.570% 4/25/35 (a) | | | 800,000 |

| 2,000,000 | | | | Master Asset-Backed Securities Trust 2005-FRE1 M10, 7.820% 10/25/35 (a) | | | 1,620,000 |

| 4,000,000 | | | | Meritage Asset Holdings 2005-2 N4, 7.500% 11/25/35 (a) | | | 2,200,000 |

| 2,000,000 | | | | Merrill Lynch Mortgage Investors Inc. 2005-SL1 B5, 8.820% 6/25/35 (a) | | | 1,360,000 |

| 3,000,000 | | | | Structured Asset Securities Corp. 2005-S6 B3, 7.820% 11/25/35 (a) | | | 2,486,250 |

| 4,000,000 | | | | Terwin Mortgage Trust 2005-R1, 5.000% 12/28/36 (a) | | | 720,000 |

| | | | Terwin Mortgage Trust 2005-3SL B6, 11.500% 3/25/35 interest-only strips | | | 554,695 |

| 2,032,657 | | | | Terwin Mortgage Trust 2005-7SL, 4.265% 7/25/35 (a) | | | 304,899 |

| 4,408,953 | | | | Terwin Mortgage Trust 2005-11SL B7, 5.000% 11/25/36 (a) | | | 1,454,954 |

| 6,000,000 | | | | Terwin Mortgage Trust 2006-R3, 6.290% 6/26/37 (a) | | | 2,640,000 |

| 4,092,073 | | | | Terwin Mortgage Trust 2006-1 2B5, 5.000% 1/25/37 (a) | | | 2,864,451 |

| | | | | | | |

| | | | | | | 27,245,269 |

| | | | | | | |

10

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Asset-Backed Securities–Below Investment Grade or Unrated (continued) | | | |

| | | | Manufactured Housing Loans–0.1% | | | |

| 409,376 | | | | Bombardier Capital Mortgage Securitization Corp. 2001-A M2, 8.265% 12/15/30 | | $ | 42,985 |

| | | | | | | |

| | | | Total Asset-Backed Securities–Below Investment Grade

or Unrated

(cost $166,094,793) | | | 143,319,906 |

| | | | | | | |

| Corporate Bonds–Investment Grade–3.3% of Net Assets | | | |

| | | | Finance–0.2% | | | |

| 1,000,000 | | | | ABN Amro Bank NV/London, 9.860% 11/17/09 (a) | | | 990,000 |

| | | | | | | |

| | | | Special Purpose Entities–3.1% | | | |

| 2,000,000 | | | | Canal Pointe II LLC., 5.340% 6/25/14 (a) | | | 2,000,000 |

| 3,000,000 | | | | Lincoln Park Referenced Link Notes 2001-1, 8.780% 7/30/31 (a) | | | 2,730,000 |

| 3,000,000 | | | | Pyxis Master Trust 2006-7, 10.320% 10/1/37 (a) | | | 3,000,000 |

| 5,000,000 | | | | Steers Delaware Business Trust 2007-A, 7.599% 6/20/18 (a) | | | 5,000,000 |

| | | | | | | |

| | | | | | | 12,730,000 |

| | | | | | | |

| | | | Total Corporate Bonds–Investment Grade

(cost $13,668,531) | | | 13,720,000 |

| | | | | | | |

| Corporate Bonds–Below Investment Grade or Unrated–35.8% of Net Assets | | | |

| | | | Agriculture–0.5% | | | |

| 1,950,000 | | | | Eurofresh Inc., 11.500% 1/15/13 (a) | | | 1,911,000 |

| | | | | | | |

| | | | Apparel–1.0% | | | |

| 4,216,000 | | | | Rafaella Apparel Group Inc., 11.250% 6/15/11 | | | 4,300,320 |

| | | | | | | |

| | | | Automotives–3.0% | | | |

| 3,075,000 | | | | Cooper Standard Automotive, Inc., 8.375% 12/15/14 | | | 2,575,312 |

| 2,225,000 | | | | Dana Corp., 1/15/15 in default (c) | | | 1,657,625 |

| 1,388,000 | | | | Dana Corp., 3/15/10 in default (c) | | | 1,068,760 |

| 2,600,000 | | | | Dura Operating Corp., 4/15/12 in default (c) | | | 676,000 |

| 2,550,000 | | | | Ford Motor Company, 7.450% 7/16/31 | | | 1,973,063 |

| 250,000 | | | | Ford Motor Company, 9.980% 2/15/47 | | | 228,125 |

| 4,350,000 | | | | Metaldyne Corp., 11.000% 6/15/12 | | | 4,121,408 |

| | | | | | | |

| | | | | | | 12,300,293 |

| | | | | | | |

| | | | Basic Materials–4.0% | | | |

| 4,150,000 | | | | AmeriCast Technologies Inc., 11.000% 12/1/14 (a) | | | 4,233,000 |

| 1,662 | | | | Corp Durango SA de CV, 9.500% 12/31/12 | | | 1,695 |

| 4,410,000 | | | | Edgen Acquisition Corp., 9.875% 2/1/11 | | | 4,509,225 |

| 2,300,000 | | | | Key Plastics LLC, 11.750% 3/15/13 (a) | | | 2,343,125 |

| 1,158,000 | | | | Millar Western Forest Products Ltd., 7.750% 11/15/13 | | | 1,053,780 |

| 3,525,000 | | | | Momentive Performance Materials Inc., 11.500% 12/1/16 (a) | | | 3,613,125 |

| 1,025,000 | | | | Sterling Chemicals Inc., 10.250% 4/1/15 (a) | | | 1,025,000 |

| | | | | | | |

| | | | | | | 16,778,950 |

| | | | | | | |

11

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Corporate Bonds–Below Investment Grade or Unrated (continued) | | | |

| | | | Building & Construction–0.7% | | | |

| 1,025,000 | | | | Masonite Corp., 11.000% 4/6/15 (a) | | $ | 953,250 |

| 1,375,000 | | | | Ply Gem Industries Inc., 9.000% 2/15/12 | | | 1,192,813 |

| 1,250,000 | | | | Technical Olympic USA, Inc., 10.375% 7/1/12 | | | 943,750 |

| | | | | | | |

| | | | | | | 3,089,813 |

| | | | | | | |

| | | | Communications–1.3% | | | |

| 967,000 | | | | CCH I Holdings LLC, 11.000% 10/1/15 | | | 1,003,263 |

| 4,350,000 | | | | CCH I Holdings LLC, 11.750% 5/15/14 | | | 4,165,125 |

| | | | | | | |

| | | | | | | 5,168,388 |

| | | | | | | |

| | | | Consulting Services–2.0% | | | |

| 2,175,000 | | | | MSX International Inc., 11.000% 10/15/07 | | | 2,088,000 |

| 2,650,000 | | | | MSX International Inc., 11.375% 1/15/08 | | | 2,235,540 |

| 3,925,000 | | | | MSX International Inc., 12.500% 4/1/12 (a) | | | 3,949,531 |

| | | | | | | |

| | | | | | | 8,273,071 |

| | | | | | | |

| | | | Energy–0.9% | | | |

| 3,850,000 | | | | Paramount Resources Ltd., 8.500% 1/31/13* | | | 3,840,375 |

| | | | | | | |

| | | | Entertainment–0.8% | | | |

| 2,100,000 | | | | French Lick Resorts & Casino LLC, 10.750% 4/15/14 (a) | | | 1,764,000 |

| 1,800,000 | | | | Six Flags Inc., 9.625% 6/1/14 | | | 1,692,000 |

| | | | | | | |

| | | | | | | 3,456,000 |

| | | | | | | |

| | | | Finance–1.2% | | | |

| 1,000,000 | | | | ABN Amro Bank NV/London, 19.210% 11/17/09 (a) | | | 990,000 |

| 2,925,000 | | | | Advanta Capital Trust I, 8.990% 12/17/26 | | | 2,928,656 |

| 1,000,000 | | | | Asure Float, 11.110% 12/31/35 | | | 978,750 |

| | | | | | | |

| | | | | | | 4,897,406 |

| | | | | | | |

| | | | Food–0.5% | | | |

| 2,600,000 | | | | Merisant Co., 9.500% 7/15/13 | | | 2,106,000 |

| | | | | | | |

| | | | Garden Products–0.3% | | | |

| 1,285,000 | | | | Ames True Temper, 10.000% 7/15/12 | | | 1,246,450 |

| | | | | | | |

| | | | Health Care–0.4% | | | |

| 5,055,000 | | | | Insight Health Services Corp., 9.875% 11/1/11 | | | 1,516,500 |

| | | | | | | |

| | | | Human Resources–0.4% | | | |

| 1,700,000 | | | | Comforce Operating Inc., 12.000% 12/1/10 | | | 1,746,750 |

| | | | | | | |

| | | | Industrials–3.3% | | | |

| 3,235,000 | | | | Advanced Lighting Technologies, 11.000% 3/31/09 | | | 3,218,825 |

| 2,075,000 | | | | Coleman Cable Inc., 9.875% 10/1/12 | | | 2,147,625 |

| 3,728,000 | | | | Continental Global Group Inc., 9.000% 10/1/08 | | | 3,739,594 |

12

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Corporate Bonds–Below Investment Grade or Unrated (continued) | | | |

| | | | Industrials (continued) | | | |

| 1,825,000 | | | | Home Products International Inc., 5/15/08 in default (c) | | $ | 547,500 |

| 1,325,000 | | | | Spectrum Brands Inc., 8.500% 10/1/13 | | | 1,258,750 |

| 1,700,000 | | | | Terphane Holding Corp., 12.500% 6/15/09 (a) | | | 1,700,000 |

| 1,270,000 | | | | Trimas Corp., 9.875% 6/15/12 | | | 1,268,413 |

| | | | | | | |

| | | | | | | 13,880,707 |

| | | | | | | |

| | | | Investment Companies–0.3% | | | |

| 1,250,000 | | | | Regional Diversified Funding, 10.000% 1/25/36 (a) | | | 1,253,125 |

| | | | | | | |

| | | | Manufacturing–3.4% | | | |

| 4,500,000 | | | | BGF Industries Inc., 10.250% 1/15/09 | | | 4,539,780 |

| 3,300,000 | | | | Elgin National Industries, 11.000% 11/1/07 | | | 3,276,207 |

| 3,545,000 | | | | JB Poindexter & Co. Inc., 8.750% 3/15/14 | | | 3,305,713 |

| 4,650,000 | | | | MAAX Corp., 9.750% 6/15/12 | | | 3,185,250 |

| | | | | | | |

| | | | | | | 14,306,950 |

| | | | | | | |

| | | | Retail–1.7% | | | |

| 1,413,000 | | | | Lazydays RV Center Inc., 11.750% 5/15/12 | | | 1,448,325 |

| 4,000,000 | | | | Uno Restaurant Corp., 10.000% 2/15/11 (a) | | | 3,440,000 |

| 2,550,000 | | | | VICORP Restaurants, Inc., 10.500% 4/15/11 | | | 2,314,125 |

| | | | | | | |

| | | | | | | 7,202,450 |

| | | | | | | |

| | | | Special Purpose Entities–7.3% | | | |

| 1,875,444 | | | | Antares Fund LP, 13.413% 12/14/11 (a) | | | 2,006,725 |

| 2,500,000 | | | | Eirles Two Ltd. 262, 10.860% 8/3/21 | | | 2,500,000 |

| 3,500,000 | | | | Eirles Two Ltd. 263, 13.360% 8/3/21 (a) | | | 3,500,000 |

| 5,000,000 | | | | InCaps Funding II Ltd., Zero Coupon Bond 1/15/34 (a) | | | 2,575,000 |

| 1,545,000 | | | | Interactive Health LLC, 7.250% 4/1/11 (a) | | | 1,085,363 |

| 1,750,000 | | | | Milacron Escrow Corp., 11.500% 5/15/11 | | | 1,697,500 |

| 850,000 | | | | PCA Finance Corp., 14.000% 6/1/09 (a) | | | 858,500 |

| 2,000,000 | | | | Preferred Term Securities II, Ltd., 10.000% 5/22/33 (a) | | | 1,111,520 |

| 2,000,000 | | | | Preferred Term Securities XXI, Ltd., 10.000% 3/22/38 (a) | | | 1,941,500 |

| 4,000,000 | | | | Preferred Term Securities XXII, Ltd., 15.000% 9/22/36 (a) | | | 3,855,160 |

| 1,000,000 | | | | Preferred Term Securities XXV, Ltd., 10.000% 6/22/37 (a) | | | 990,000 |

| 2,000,000 | | | | Preferred Term Securities XVIII, Ltd., 10.000% 9/23/35 (a) | | | 1,710,000 |

| 3,800,000 | | | | Preferred Term Securities XXIII, Ltd., 15.000% 12/22/36 (a) | | | 3,610,000 |

| 2,000,000 | | | | Preferred Term Securities XXIV, Ltd., 10.000% 3/22/37 (a) | | | 1,960,000 |

| 1,000,000 | | | | Pyxis Master Trust, 10.320% 10/1/37 (a) | | | 1,000,000 |

| | | | | | | |

| | | | | | | 30,401,268 |

| | | | | | | |

| | | | Telecommunications–1.5% | | | |

| 850,000 | | | | Clearwire Corp., 11.000% 8/15/10 (a) | | | 878,688 |

| 800,000 | | | | Iridium Satellite LLC, 7/15/05 in default (c) | | | 184,000 |

13

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Corporate Bonds–Below Investment Grade or Unrated (continued) | | | |

| | | | Telecommunications (continued) | | | |

| 4,175,000 | | | | Primus Telecommunications GP, 8.000% 1/15/14 | | $ | 2,708,531 |

| 2,400,000 | | | | Securus Technologies Inc., 11.000% 9/1/11 | | | 2,364,000 |

| | | | | | | |

| | | | | | | 6,135,219 |

| | | | | | | |

| | | | Tobacco–0.6% | | | |

| 2,915,000 | | | | North Atlantic Trading Co., 9.250% 3/1/12 | | | 2,463,175 |

| | | | | | | |

| | | | Transportation–0.7% | | | |

| 3,875,000 | | | | Sea Containers Ltd., 10/15/06 in default (c)* | | | 3,216,248 |

| | | | | | | |

| | | | Total Corporate Bonds–Below Investment Grade or Unrated

($157,286,052) | | | 149,490,458 |

| | | | | | | |

| Mortgage-Backed Securities–Investment Grade–6.6% of Net Assets | | | |

| | | | Collateralized Mortgage Obligations–6.6% | | | |

| 5,000,000 | | | | Deutsche Mortgage Securities, Inc. 2006-RS1 N2, 8.570% 9/27/35 (a) | | | 5,025,000 |

| | | | Harborview Mortgage Loan Trust 2004-8 X, 1.881% 11/19/34 interest-only strips | | | 1,805,882 |

| 1,000,000 | | | | Indymac Index Corp. 2006-AR6 N2, 8.833% 6/25/46 (a) | | | 1,000,000 |

| | | | Indymac Index Mortgage Loan Trust 2005-AR10 AX, 2.218% 6/25/35 interest-only strips | | | 3,931,226 |

| | | | Master Adjustable Rate Mortgages Trust 2006-OA2 XW, 1.164% 12/25/46 interest-only strips | | | 4,626,658 |

| 3,000,000 | | | | Park Place Securities Inc. 2005-WCW2 M10, 7.820% 7/25/35 | | | 2,619,000 |

| 2,000,000 | | | | Park Place Securities Inc. 2005-WHQ3 M11, 7.820% 6/25/35 | | | 1,735,000 |

| | | | Residential Accredit Loans Inc. 2005-QO4 XIO, 2.107% 12/25/45 interest-only strips | | | 2,029,521 |

| 2,394,173 | | | | Structured Asset Investment Loan Trust 2004-7A B, 6.750% 8/27/34 (a) | | | 2,357,111 |

| | | | Washington Mutual Alternative Mortgage Pass Through Certificates 2006-AR8 CX3, 1.000% 10/25/46 interest-only strips | | | 813,132 |

| | | | Washington Mutual Alternative Mortgage Pass Through Certificates 2006-AR8 3X1, 1.400% 10/25/46 interest-only strips | | | 1,168,580 |

| | | | Washington Mutual Alternative Mortgage Pass Through Certificates 2006-AR8 3X2, 0.500% 10/25/46 interest-only strips | | | 394,979 |

| | | | | | | |

| | | | Total Mortgage-Backed Securities–Investment Grade

($31,429,526) | | | 27,506,089 |

| | | | | | | |

Mortgage-Backed Securities–Below Investment Grade or Unrated–12.9% of

Net Assets | | | |

| | | | Collateralized Mortgage Obligations–12.9% | | | |

| 1,842,000 | | | | Countrywide Alternative Loan Trust 2006-0A11 N3, 12.500% 9/25/46 (a) | | | 1,896,303 |

| 998,328 | | | | Countrywide Alternative Loan Trust 2006-OA21 B1, 7.070% 3/20/47 | | | 728,270 |

14

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

Mortgage-Backed Securities–Below Investment Grade or Unrated

(continued) | | | |

| | | | Collateralized Mortgage Obligations (continued) | | | |

| 998,328 | | | | Countrywide Alternative Loan Trust 2006-OA21 B2, 7.070% 3/20/47 | | $ | 579,998 |

| 1,835,825 | | | | Countrywide Alternative Loan Trust 2006-OA21 B3, 7.070% 3/20/47 (a) | | | 453,742 |

| 3,000,000 | | | | First Franklin Mortgage Loan Asset-Backed Certificates 2005-FFH3 B4, 7.320% 9/25/35 (a) | | | 1,920,000 |

| 3,000,000 | | | | Greenwich Structured Adjustable Rate Mortgage Products 2005-3A N2, 2.000% 6/27/35 (a) | | | 1,935,000 |

| 8,000,000 | | | | Greenwich Structured Adjustable Rate Mortgage Products 2005-4A N-2, Zero Coupon Bond 7/27/45 (a) | | | 4,600,000 |

| 3,949,937 | | | | Harborview Mortgage Loan Trust 2006-4 B11, 7.070% 5/19/47 (a) | | | 2,429,211 |

| 2,000,000 | | | | Harborview Corp. 2006-8A N5, Zero Coupon Bond 7/21/36 (a) | | | 827,500 |

| 2,000,000 | | | | Harborview Corp. 2006-14 N3, 8.350% 3/19/38 (a) | | | 1,845,320 |

| 1,000,000 | | | | Harborview Corp. 2006-14 N4, 8.350% 3/19/38 (a) | | | 841,880 |

| 6,000,000 | | | | Harborview Corp. 2006-14 PS, Zero Coupon Bond 12/19/36 | | | 1,116,600 |

| 1,000,000 | | | | Indymac Index Corp. 2006-AR6 N3, 8.833% 6/25/46 (a) | | | 943,500 |

| 5,000,000 | | | | Long Beach Asset Holdings Corp. 2005-WL1 N4, 7.500% 6/25/45 (a) | | | 4,050,000 |

| 1,297,929 | | | | Long Beach Mortgage Loan Trust 2001-3 M3, 8.133% 9/25/31 | | | 311,503 |

| 4,000,000 | | | | Long Beach Mortgage Loan Trust 2005-WL2 B3, 7.820% 8/25/35 (a) | | | 2,651,920 |

| 2,000,000 | | | | Long Beach Mortgage Loan Trust 2005-2 B2, 8.070% 4/25/35 (a) | | | 1,500,000 |

| 2,043,150 | | | | Park Place Securities Inc. 2005-WCW1 B, 5.000% 9/25/35 (a) | | | 1,884,806 |

| 3,000,000 | | | | Park Place Securities Inc. 2005-WCW3, 7.820% 8/25/35 (a) | | | 2,220,000 |

| 3,000,000 | | | | Park Place Securities Inc. 2005-WHQ1 M10, 7.820% 3/25/35 (a) | | | 2,497,500 |

| 1,000,000 | | | | Park Place Securities Inc. 2005-WHQ4, 7.820% 9/25/35 (a) | | | 700,000 |

| 5,250,000 | | | | Residential Asset Mortgage Products Inc. 2005-RS4 B2, 8.320% 4/25/35 (a) | | | 4,305,000 |

| 3,938,000 | | | | Residential Asset Mortgage Products Inc. 2005-RS4 B3, 8.320% 4/25/35 (a) | | | 3,032,260 |

| 1,128,127 | | | | Sasco Trust 2004-6XS B, 5.000% 3/28/34 (a) | | | 1,054,799 |

| 1,000,000 | | | | Sharp SP I LLC Trust 2006-A HM3 N3, 12.500% 10/25/46 (a) | | | 1,000,000 |

| 2,000,000 | | | | Soundview Home Equity Loan Trust 2005-1 B3, 8.570% 4/25/35 (a) | | | 1,560,000 |

| 2,591,000 | | | | Soundview Home Equity Loan Trust 2005-2 B3, 8.320% 7/25/35 (a) | | | 2,072,800 |

| 1,306,593 | | | | Soundview Home Equity Loan Trust 2005-B M14, 7.650% 5/25/35 (a) | | | 128,660 |

| 2,569,722 | | | | Structured Asset Securities Corp. 2004-S2 B, 6.000% 6/25/34 (a) | | | 2,470,300 |

| 1,634,605 | | | | Structured Asset Securities Corp. 2004-S4 B3, 5.000% 12/25/34 (a) | | | 524,774 |

| 2,000,000 | | | | Structured Asset Securities Corp. 2005-AR1 B2, 7.320% 9/25/35 (a) | | | 1,510,000 |

| | | | | | | |

| | | | Total Mortgage-Backed Securities–Below Investment Grade

or Unrated

(cost $57,388,982) | | | 53,591,646 |

| | | | | | | |

15

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount/

Shares | | | | Description | | Value (b) |

| | | | | | | |

| Municipal Securities–0.2% of Net Assets | | | |

| 1,250,000 | | | | Pima County Arizona Industrial Development Authority Health Care, 11/15/32 in default (c) | | $ | 787,500 |

| | | | | | | |

| | | | Total Municipal Securities

(cost $784,521) | | | 787,500 |

| | | | | | | |

| Common Stocks–12.0% of Net Assets | | | |

| 42,200 | | | | Alpha Natural Resources, Inc. (c) | | | 659,586 |

| 20,500 | | | | American Capital Strategies, Ltd. | | | 908,355 |

| 12,100 | | | | Anadarko Petroleum Corporation | | | 520,058 |

| 16,300 | | | | Aqua America, Inc. | | | 365,935 |

| 69,600 | | | | Aries Maritime Transport Limited | | | 571,416 |

| 24,200 | | | | AVX Corporation | | | 367,840 |

| 9,600 | | | | BJ Services Company | | | 267,840 |

| 20,100 | | | | Brookdale Senior Living, Inc. | | | 897,666 |

| 32,600 | | | | BRT Realty Trust | | | 984,194 |

| 42,300 | | | | Cascade Microtech, Inc. (c) | | | 602,775 |

| 63,400 | | | | CastlePoint Holdings, Ltd. | | | 1,036,590 |

| 6,300 | | | | Cemex, S.A. de C.V. | | | 206,325 |

| 121,000 | | | | Cirrus Logic, Inc. (c) | | | 926,860 |

| 41,200 | | | | Citizens Communications Company | | | 615,940 |

| 20,200 | | | | Companhia de Saneamento Basico do Estado de São Paulo | | | 682,558 |

| 102,900 | | | | Compass Diversified Trust | | | 1,725,633 |

| 13,000 | | | | Consolidated Communications Holdings, Inc. | | | 258,570 |

| 39,200 | | | | Cypress Sharpridge (a) | | | 401,800 |

| 9,600 | | | | Cytec Industries Inc. | | | 539,904 |

| 60,800 | | | | Eddie Bauer Holdings, Inc. (c) | | | 691,296 |

| 1,300 | | | | Edison International | | | 63,869 |

| 11,900 | | | | Enterprise Products Partners L.P. | | | 378,420 |

| 154,600 | | | | Evergreen Energy Inc. (c) | | | 1,015,722 |

| 8,400 | | | | FairPoint Communications, Inc. | | | 161,364 |

| 26,300 | | | | Famous Dave’s of America, Inc. (c) | | | 475,767 |

| 57,300 | | | | Fording Canadian Coal Trust | | | 1,266,330 |

| 123,100 | | | | Hawaiian Holdings, Inc. (c) | | | 387,765 |

| 14,400 | | | | Helix Energy Solutions Group, Inc. (c) | | | 536,976 |

| 8,600 | | | | Horizon Offshore, Inc. (c) | | | 124,356 |

| 87,200 | | | | Infocrossing, Inc. (c) | | | 1,296,664 |

| 74,400 | | | | InPhonic, Inc. (c) | | | 810,960 |

| 111,695 | | | | Intermet Corporation (c) | | | 893,560 |

| 6,400 | | | | Iowa Telecommunications Services, Inc. | | | 128,000 |

| 9,900 | | | | Kinder Morgan Energy Partners, L.P. | | | 521,532 |

| 30,200 | | | | KKR Financial Corp. | | | 828,386 |

| 3,900 | | | | L-3 Communications Holdings, Inc. | | | 341,133 |

| 33,600 | | | | LJ International Inc. (c) | | | 341,376 |

16

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

| Shares | | | | Description | | Value (b) |

| | | | | | | |

| Common Stocks (continued) | | | |

| 135,300 | | | | Luminent Mortgage Capital, Inc. | | $ | 1,209,582 |

| 32,100 | | | | Macquarie Infrastructure Company Trust | | | 1,261,530 |

| 4,600 | | | | Magellan Midstream Partners, L.P. | | | 215,280 |

| 15,000 | | | | McDermott International, Inc. (c) | | | 734,700 |

| 21,000 | | | | MCG Capital Corporation | | | 393,960 |

| 240,500 | | | | Meruelo Maddux Properties, Inc. (c) | | | 2,104,375 |

| 13,000 | | | | Mittal Steel Company N.V. | | | 687,570 |

| 27,700 | | | | Motorola, Inc. | | | 489,459 |

| 39,600 | | | | Nam Tai Electronics, Inc. | | | 512,820 |

| 134,000 | | | | Ness Technologies, Inc. (c) | | | 1,712,520 |

| 36,800 | | | | New York Community Bancorp, Inc. | | | 647,312 |

| 60,600 | | | | NNN Realty Advisors (a) | | | 612,060 |

| 6,400 | | | | Oceaneering International, Inc. (c) | | | 269,568 |

| 51,000 | | | | Optimal Group Inc. (c) | | | 427,890 |

| 33,527 | | | | Owens Corning (c) | | | 1,068,170 |

| 34,300 | | | | Parametric Technology Corporation (c) | | | 651,700 |

| 3,600 | | | | Peabody Energy Corporation | | | 144,864 |

| 19,600 | | | | PeopleSupport, Inc. (c) | | | 224,420 |

| 59,700 | | | | PetroQuest Energy, Inc. (c) | | | 697,893 |

| 667 | | | | Providence Washington Insurance Companies (c) | | | 67 |

| 47,800 | | | | Quintana Maritime Limited | | | 658,206 |

| 21,500 | | | | Regal Entertainment Group | | | 427,205 |

| 58,400 | | | | Resource Capital Corp. | | | 942,576 |

| 5,700 | | | | RTI International Metals, Inc. (c)(d) | | | 518,757 |

| 18,000 | | | | Sanderson Farms, Inc. | | | 667,080 |

| 23,100 | | | | Sasol Limited | | | 763,455 |

| 14,990 | | | | Ship Finance International Limited | | | 411,175 |

| 44,700 | | | | Spansion Inc. (c) | | | 544,893 |

| 85,300 | | | | Star Asia Fin Ltd. | | | 853,000 |

| 63,777 | | | | Star Gas Partners, L.P. (c) | | | 249,368 |

| 4,300 | | | | Superior Energy Services, Inc. (c) | | | 148,221 |

| 38,367 | | | | Taiwan Semiconductor Manufacturing Company Ltd. | | | 412,445 |

| 82,170 | | | | Technology Investment Capital Corp. | | | 1,389,495 |

| 18,300 | | | | Tenaris S.A. | | | 839,970 |

| 8,700 | | | | The Home Depot, Inc. | | | 319,638 |

| 60,700 | | | | The Wet Seal, Inc. (c) | | | 397,585 |

| 7,100 | | | | Valero Energy Corporation | | | 457,879 |

| 5,500 | | | | Valero L.P. | | | 366,300 |

| 13,500 | | | | Williams Partners L.P. | | | 644,355 |

| 87,300 | | | | Windstream Corporation | | | 1,282,437 |

| 25,600 | | | | Zoltek Companies, Inc. (c)(d) | | | 894,208 |

| | | | | | | |

| | | | Total Common Stocks

(cost $48,549,373) | | | 50,057,309 |

| | | | | | | |

17

RMK ADVANTAGE INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | | |

| Shares | | | | Description | | Value (b) | |

| | | | | | | | |

| Preferred Stocks–5.0% of Net Assets | | | | |

| 4,000 | | | | Baker Street Funding (a) | | $ | 3,880,000 | |

| 1,000 | | | | Baker Street Funding 2006-1 (a) | | | 940,000 | |

| 3,000 | | | | Credit Genesis CLO 2005 (a) | | | 2,970,000 | |

| 2,000 | | | | Centurion VII | | | 1,515,000 | |

| 9 | | | | Harborview 2006-8 (c) | | | 1 | |

| 2,000 | | | | Hewett’s Island II (a) | | | 1,980,000 | |

| 67,000 | | | | Indymac Indx CI-1 Corp. (a) | | | 1,820,858 | |

| 2,000 | | | | Marquette Park CLO Ltd. (a) | | | 1,920,000 | |

| 2,975 | | | | Motient Corporation | | | 2,380,000 | |

| 20,000 | | | | Mountain View Funding (a) | | | 1,760,000 | |

| 2,000 | | | | WEBS CDO 2006-1 PS | | | 1,800,000 | |

| | | | | | | | |

| | | | Total Preferred Stocks

(cost $21,107,484) | | | 20,965,859 | |

| | | | | | | | |

| Eurodollar Time Deposits–2.6% of Net Assets | | | | |

| | | | State Street Bank & Trust Company Eurodollar time deposits dated March 30, 2007 4.050% maturing at $10,898,361 on April 2, 2007. | | | 10,895,909 | |

| | | | | | | | |

| | | | Total Investments–132.4% of Net Assets

(cost $589,978,706) | | | 552,049,765 | |

| | | | | | | | |

| | | | Other Assets and Liabilities, net–(32.4%) of Net Assets | | | (135,051,124 | ) |

| | | | | | | | |

| | | | Net Assets | | $ | 416,998,641 | |

| | | | | | | | |

| | | | Call Options Written

3/31/2007 | | | | |

Number

of Contracts | | | | Common Stocks/Expiration Date/Exercise Price | | Value (b) | |

| 30 | | | | RTI International Metals, Inc./April 2007/95 | | | 6,150 | |

| 34 | | | | Zoltek Companies, Inc./April 2007/35 | | | 5,100 | |

| | | | | | | | |

| | | | Total Call Options Written

(Premiums Received $13,753) | | $ | 11,250 | |

| | | | | | | | |

| (a) | | Securities sold within the terms of a private placement memorandum, exempt from registration under Rule 144A under the Securities Act of 1933, as amended, and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to valuation policies and procedures adopted by the Board of Directors, these issues have been determined to be liquid by Morgan Asset Management, Inc., the Fund’s investment adviser. |

| (b) | | See Note 2 of accompanying Notes to Financial Statements regarding investment valuations. |

| (c) | | Non-income producing securities. |

| (d) | | A portion or all of the security is pledged as collateral for call options written. |

| * | | These securities are classified as Yankee Bonds, which are U.S. dollar denominated bonds issued in the United States by a foreign entity. |

All of the Fund’s investment securities, other than equity securities, are pledged as collateral under the line of credit.

The Notes to the Financial Statements are an integral part of, and should be read in conjunction with, the Financial Statements.

18

[THIS PAGE INTENTIONALLY LEFT BLANK]

19

RMK HIGH INCOME FUND, INC.

OBJECTIVE & STRATEGY

RMK High Income Fund, Inc. seeks a high level of current income. The Fund seeks capital growth as a secondary investment objective when consistent with its primary investment objective. The Fund invests a majority of its total assets in below investment grade debt securities (commonly referred to as “junk bonds”) that offer attractive yield and capital appreciation potential. The Fund may also invest in investment grade debt securities, up to 15% of its total assets in foreign debt and foreign equity securities and up to 25% of its total assets in domestic equity securities, including common and preferred stocks. The Fund invests in a wide range of below investment grade debt securities, including corporate bonds, mortgage-backed and asset-backed securities and municipal and foreign government obligations, as well as securities of companies in bankruptcy reorganization proceedings or otherwise in the process of debt restructuring. (Below investment grade debt securities are rated Ba1 or lower by Moody’s Investors Service, Inc., BB+ or lower by Standard & Poor’s Ratings Group, comparably rated by another nationally recognized statistical rating organization or, if unrated, determined by the Fund’s investment adviser to be of comparable quality.) The Fund may use leverage through bank borrowings, reverse repurchase agreements or other transactions involving indebtedness or through the issuance of preferred shares. The Fund may leverage up to 33 1/3% of its total assets (in each case including the amount borrowed). The Fund may vary its use of leverage in response to changing market conditions.

INVESTMENT RISKS: Bond funds tend to experience smaller fluctuations in value than stock funds. However, investors in any bond fund should anticipate fluctuations in price. Bond prices and the value of bond funds decline as interest rates rise. Bonds with longer-term maturities generally are more vulnerable to interest rate risk than bonds with shorter-term maturities. Below investment grade bonds involve greater credit risk, which is the risk that the issuer will not make interest or principal payments when due. An economic downturn or period of rising interest rates could adversely affect the ability of issuers, especially issuers of below investment grade debt, to service primary obligations and an unanticipated default could cause the Fund to experience a reduction in value of its shares. The value of U.S. and foreign equity securities in which the Fund invests will change based on changes in a company’s financial condition and in overall market and economic conditions. Leverage creates an opportunity for an increased return to common stockholders, but unless the income and capital appreciation, if any, on securities acquired with leverage proceeds exceed the costs of the leverage, the use of leverage will diminish the investment performance of the Fund’s shares. Use of leverage may also increase the likelihood that the net asset value of the Fund and market value of its common shares will be more volatile, and the yield and total return to common stockholders will tend to fluctuate more in response to changes in interest rates and credit worthiness.

20

RMK HIGH INCOME FUND, INC.

MANAGEMENT DISCUSSIONOF FUND PERFORMANCE

For the six months and the fiscal year ended March 31, 2007, the Fund had a total return of (12.71)% and (3.26)%, respectively, based on market price and reinvested dividends and other distributions. For the six months and the twelve months ended March 31, 2007, the Fund had a total return of 2.56% and 6.05%, respectively, based on net asset value and reinvested dividends and other distributions. For the six months and the twelve months ended March 31, 2007, the Lehman Brothers Ba U.S. High Yield Index(1) had a total return of 5.37% and 9.71%, respectively.

Since our last report, the Fund’s market price share performance has been negatively impacted by the reduction of the monthly distribution rate from $0.15 per share to $0.14 per share. The Fund’s performance has also been negatively impacted by the recent turmoil in the mortgage market. During the months leading up to the reduction of the Fund’s distribution rate, portfolio earnings were increasingly under pressure due to consistently rising costs associated with the leverage (borrowed money) employed by the Fund and by a prolonged period of contracting credit spreads. The combination of these two market forces resulted in lower net earnings to the Fund and required a reduction in the distribution rate beginning in December 2006.

Since December, the U.S. mortgage-backed securities market has undergone serious turmoil, most notably in the sub-prime home equity arena. While this downward volatility in the mortgage-backed arena has had a negative impact on the net asset value of the Fund, it has also provided an opportunity to buy assets at considerably higher yields than have been available for more than two years. Strategically redeploying assets during this market upheaval may be difficult from a net asset value perspective for a period of time, but this is also the best opportunity we have seen in years to secure better portfolio earnings for quarters to come.

Although we made material shifts out of consumer oriented debt (home equity, credit cards), we still have a meaningful weighting. Corporate debt continues to outperform most other categories—in fact, the lower the credit rating, the more favorably it is viewed by the market. Some profit taking in this sector is probably warranted at this point in the economic cycle. It is our expectation that 2007 will prove to be a period of slower economic growth and a transition year for the Federal Reserve Board. That is, we expect the Federal Reserve Board to leave rates unchanged, perhaps through the summer; however, during the second half of this year, we expect the Federal Reserve Board to begin lowering interest rates as the

21

RMK HIGH INCOME FUND, INC.

U.S. economy experiences very sluggish growth quarters. Fixed rate securities will be a focus as will badly oversold consumer credit items.

|

|

|

James C. Kelsoe, Jr., CFA Senior Portfolio Manager Morgan Asset Management, Inc. |

Market forecasts provided in this report may not necessarily come to pass. There is no assurance that the Fund will achieve its investment objectives. These views are subject to change at any time based upon market or other conditions, and Morgan Asset Management, Inc. disclaims any responsibility to update such views. The Fund is subject to market risk, which include the possibilities that the market values of the securities owned by the Fund will decline or that shares of the Fund will trade at lower prices in the market. Accordingly, you can lose money investing in the Fund.

INDEX DESCRIPTION

(1) | | The Lehman Brothers Ba U.S. High Yield Index is a broad-based unmanaged index of Ba fixed rate, non-investment grade debt. All bonds included in the High Yield Index must be dollar-denominated, nonconvertible, have at least one year remaining to maturity, and an outstanding par value of at least $150 million. The index is unmanaged and, unlike the Fund, is not affected by cashflows or trading and other expenses. It is not possible to invest directly in an index. |

22

RMK HIGH INCOME FUND, INC.

PORTFOLIO STATISTICS†

AS OF MARCH 31, 2007

| | |

Average Credit Quality | | BB |

Current Yield | | 11.05% |

Yield to Maturity | | 12.05% |

Duration | | 4.26 Years |

Average Effective Maturity | | 5.68 Years |

Percentage of Leveraged Assets | | 27% |

Total Number of Holdings | | 310 |

| † | | The Fund’s composition is subject to change. |

CREDIT QUALITY†

AS OF MARCH 31, 2007

| | | | | | |

| %OFDEBTSECURITIES | | %OFDEBTSECURITIES |

AAA | | 4.5% | | CCC | | 14.8% |

BBB | | 20.5% | | CC | | 2.7% |

BB | | 20.4% | | D | | 0.4% |

B | | 13.9% | | Not Rated | | 22.8% |

| | | | | | |

| | | | Total | | 100.0% |

| † | | The Fund’s composition is subject to change. |

ASSET ALLOCATION†

AS OF MARCH 31, 2007

| | |

| %OFTOTALINVESTMENTS |

Corporate Bonds | | 31.1% |

Collateralized Debt Obligations | | 25.8% |

Collateralized Mortgage Obligations | | 15.3% |

Common Stocks | | 9.2% |

Equipment Leases | | 5.2% |

Home Equity Loans | | 4.4% |

Preferred Stocks | | 3.8% |

Collateralized Loan Obligations | | 1.9% |

Certificate-Backed Obligations | | 0.8% |

Other | | 0.6% |

Short-Term Investments | | 1.9% |

| | |

Total | | 100.0% |

| † | | The Fund’s composition is subject to change. |

23

RMK HIGH INCOME FUND, INC.

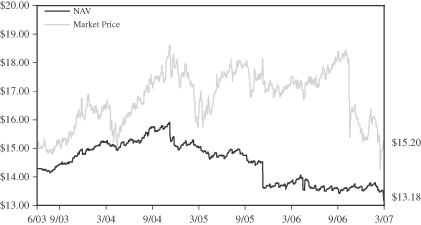

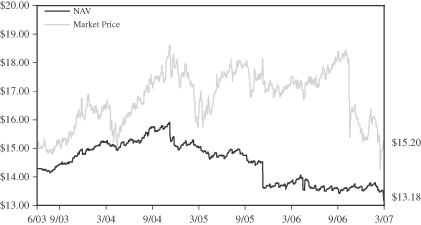

NAV & MARKET PRICE HISTORY*

The graph below illustrates the net asset value and market price history of RMK High Income Fund, Inc. (NYSE: RMH) from the commencement of investment operations on June 24, 2003 to March 31, 2007.

| * | | Net asset value is calculated every day that the New York Stock Exchange is open as of the close of trading (normally 4:00 p.m. Eastern Time) by taking the closing market value of all portfolio securities, cash and other assets owned, subtracting all liabilities, then dividing the result (total net assets) by the total number of shares outstanding. The market price is the last reported price at which a share of the Fund was sold on the New York Stock Exchange. |

24

RMK HIGH INCOME FUND, INC.

PERFORMANCE INFORMATION

| | | | | | | | | |

| | | AVERAGE ANNUAL TOTAL RETURNS | |

| AS OF MARCH 31, 2007 | | SIX MONTHS* | | | 1 YEAR | | | COMMENCEMENT

OF INVESTMENT

OPERATIONS(1) | |

| MARKET VALUE | | (12.71 | )% | | (3.26 | )% | | 14.74 | % |

| NET ASSET VALUE | | 2.56 | % | | 6.05 | % | | 11.83 | % |

LEHMAN BROTHERS BA HIGH YIELD INDEX(2) | | 5.37 | % | | 9.71 | % | | N/A | |

| * | | Not annualized for periods less than one year. |

(1) | | The Fund commenced investment operations on June 24, 2003. |

(2) | | The Lehman Brothers Ba U.S. High Yield Index is a broad-based unmanaged index of Ba fixed rate, non-investment grade debt. All bonds included in the High Yield Index must be dollar-denominated, nonconvertible, have at least one year remaining to maturity, and an outstanding par value of at least $150 million. The index is unmanaged and, unlike the Fund, is not affected by cashflows or trading and other expenses. It is not possible to invest directly in an index. |

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund performance changes over time and current performance may be lower or higher than what is stated. For the most recent performance, call toll-free 800-564-2188. Total returns assume an investment at the common share market price or net asset value at the beginning of the period, reinvestment of all dividends and other distributions for the period in accordance with the Fund’s dividend reinvestment plan, and sale of all shares at the closing market price (excluding any commissions) or net asset value at the end of the period. Returns shown in the table do not reflect the deduction of taxes that a stockholder would pay on Fund distributions or on the sale of Fund shares. Mutual funds are not bank deposits or obligations, are not guaranteed by any bank and are not insured or guaranteed by the U.S. government, the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. Investment in mutual funds involves investment risk, including possible loss of principal.

25

RMK HIGH INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Asset-Backed Securities–Investment Grade–16.2% of Net Assets | | | |

| | | | Certificate-Backed Obligations (“CBO”)–0.5% | | | |

| 2,000,000 | | | | Diversified Asset Securitization Holdings III 1A A3L,

6.150% 7/5/36 (a) | | $ | 1,540,000 |

| | | | | | | |

| | | | Collateralized Debt Obligations (“CDO”)–13.1% | | | |

| 2,000,000 | | | | Broderick CDO Ltd. 2007-3A D, 9.163% 12/6/50 (a) | | | 1,960,000 |

| 2,000,000 | | | | CDO Repack SPC Ltd. 2006-BRGA, Zero Coupon Bond 12/5/51 | | | 1,880,000 |

| 1,904,039 | | | | E-Trade CDO I 2004-1A, 2.000% 1/10/40 | | | 1,690,254 |

| 1,000,000 | | | | Highland Park CDO Ltd. 2006-1A E, 7.670% 11/25/51 (a) | | | 935,000 |

| 3,000,000 | | | | Kodiak CDO 2006-1A G, 8.860% 8/7/37 (a) | | | 2,910,000 |

| 3,000,000 | | | | Lexington Capital Funding Ltd. 2007-3A F, 8.860% 4/10/47 (a) | | | 2,910,000 |

| 2,000,000 | | | | Linker Finance PLC 16A E, 8.820% 5/19/45 (a) | | | 1,935,000 |

| 1,985,322 | | | | Millstone III-A CDO Ltd., 4.300% 7/5/46 | | | 1,905,909 |

| 1,931,858 | | | | MKP CBO I Ltd. 4A CS, 2.000% 7/12/40 (a) | | | 1,815,946 |

| 1,000,000 | | | | Newbury Street CDO Ltd. 2007-1A D, 9.100% 3/4/53 (a) | | | 985,000 |

| 2,000,000 | | | | Norma CDO Ltd. 2007-1A E, 9.765% 3/11/49 (a) | | | 1,800,000 |

| 3,000,000 | | | | Palmer Square 2A CN, 6.952% 11/2/45 (a) | | | 2,970,000 |

| 1,000,000 | | | | Pasa Funding Ltd. 2007-1A D, 9.324% 4/7/52 | | | 910,000 |

| 1,976,164 | | | | Sharps CDO 2006-1A D, 7.500% 5/8/46 (a) | | | 1,894,726 |

| 4,000,000 | | | | Taberna Preferred Funding Ltd. 2006-6A, 6.100% 12/5/36 (a) | | | 3,977,600 |

| 2,941,859 | | | | Taberna Preferred Funding Ltd. 2006-7A C1, 10.000% 2/5/37 (a) | | | 2,894,789 |

| 2,000,000 | | | | Tahoma CDO Ltd. 2006-1A D, 9.006% 6/18/47 (a) | | | 2,000,000 |

| 1,000,000 | | | | Tahoma CDO Ltd. 2007-2A D, 9.830% 9/16/47 (a) | | | 930,000 |

| 2,000,000 | | | | Trapeza CDO I LLC 2006-10A D2, 8.700% 6/6/41 (a) | | | 2,045,000 |

| 1,500,000 | | | | Trapeza CDO I LLC 2006-10A, 6.700% 6/6/41 | | | 1,380,000 |

| | | | | | | |

| | | | | | | 39,729,224 |

| | | | | | | |

| | | | Equipment Leases–0.9% | | | |

| 2,844,976 | | | | Aviation Capital Group Trust 2005-3A C1, 8.570% 12/25/35 (a) | | | 2,901,875 |

| | | | | | | |

| | | | Home Equity Loans (Non-High Loan-To-Value)–1.7% | | | |

| 1,000,000 | | | | Asset-Backed Securities Corp. Home Equity 2005-HE1 M10,

7.967% 3/25/35 | | | 880,000 |

| 1,000,000 | | | | Fremont Home Loan Trust 2004-4 M7, 7.040% 3/25/35 | | | 930,070 |

| 306,028 | | | | Home Equity Asset Trust 2003-4 B1, 9.320% 10/25/33 | | | 298,602 |

| 2,000,000 | | | | Soundview Home Equity Loan Trust 2005-A B1, 8.320% 4/25/35 (a) | | | 1,540,000 |

| 1,500,000 | | | | Terwin Mortgage Trust 2007-3SL B3, 6.000% 5/25/38 (a) | | | 1,389,300 |

| | | | | | | |

| | | | | | | 5,037,972 |

| | | | | | | |

| | | | Total Asset-Backed Securities–Investment Grade

(cost $51,258,130) | | | 49,209,071 |

| | | | | | | |

26

RMK HIGH INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

Asset-Backed Securities–Below Investment Grade or Unrated–35.1%

of Net Assets | | | |

| | | | Certificate-Backed Obligations (“CBO”)–0.5% | | | |

| 1,000,000 | | | | Goldman Sachs Asset Management CBO II 2A D1, 11.620%

11/5/12 (a) | | $ | 1,007,810 |

| 1,634,050 | | | | Helios Series I Multi-Asset CBO, Ltd. IA C, 8.109% 12/13/36 (a) | | | 620,939 |

| | | | | | | |

| | | | | | | 1,628,749 |

| | | | | | | |

| | | | Collateralized Debt Obligations (“CDO”)–21.3% | | | |

| 1,000,000 | | | | Aardvark Asset-Backed Securities CDO 2007-1A, 10.000% 7/6/47 | | | 910,000 |

| 2,000,000 | | | | Acacia CDO, Ltd. 10A, 3.700% 9/7/46 (a) | | | 800,000 |

| 3,000,000 | | | | Aladdin CDO I Ltd. 2006-3A, 10.350% 10/31/13 (a) | | | 1,447,500 |

| 1,000,000 | | | | Alesco Preferred Funding Ltd.13A I, 10.000% 9/23/37 | | | 964,450 |

| 2,000,000 | | | | Attentus CDO Ltd. 2006-2A F1, 10.360% 10/9/41 (a) | | | 1,950,000 |

| 3,000,000 | | | | Attentus CDO Ltd. 2006-2A, 10.000% 10/9/41 | | | 2,955,000 |

| 3,000,000 | | | | Attentus CDO Ltd. 2007-3A F2, 9.532% 10/11/42 (a) | | | 2,947,500 |

| 3,000,000 | | | | Attentus CDO Ltd. 2007-3A, 10.000% 10/11/42 | | | 2,760,000 |

| 1,000,000 | | | | Cairn Mezzanine Asset-Backed CDO PLC 2007-3A, 10.000% 8/13/47 | | | 670,000 |

| 5,000,000 | | | | Commodore CDO I Ltd. 1A C, 8.110% 2/28/37 (a) | | | 1,950,000 |

| 1,000,000 | | | | Copper River CLO Ltd. 2006-1A E, 9.124% 1/20/21 (a) | | | 993,120 |

| 4,000,000 | | | | Dillon Read CDO Ltd. 2006-1A, 10.000% 12/5/46 (a) | | | 3,550,000 |

| 3,000,000 | | | | Diversified Asset Securitization Holdings II 1A B1, 9.712% 9/15/35 (a) | | | 1,620,000 |

| 3,000,000 | | | | Dryden Leveraged Loan CDO 2005-9A, 10.000% 9/20/19 | | | 2,490,000 |

| 3,000,000 | | | | Equinox Funding 1A D, 12.277% 11/15/12 (a) | | | 1,680,000 |

| 3,000,000 | | | | Global Leveraged Capital Credit Opportunity Fund 2006-1A, 10.000% 12/20/18 (a) | | | 2,997,600 |

| 1,000,000 | | | | Gulf Stream Atlantic CDO Ltd. 2007-1A, 10.000% 7/13/47 (a) | | | 840,000 |

| 1,000,000 | | | | 801 Grand CDO 2006-1 LLC, 11.350% 9/20/16 (a) | | | 1,005,000 |

| 2,868,890 | | | | Hewett’s Island CDO Ltd. 2004-1A, 12.390% 12/15/16 | | | 2,768,479 |

| 1,000,000 | | | | IXIS ABS 1 Ltd., 10.000% 12/12/46 | | | 780,000 |

| 2,000,000 | | | | Jazz CDO BV III-A EB, 10.571% 9/26/14 (a) | | | 2,000,000 |

| 12,000,000 | | | | Kenmore Street Synthetic CDO 2006-1A, 10.350% 4/30/14 (a) | | | 5,760,000 |

| 999,741 | | | | Knollwood CDO Ltd. 2006-2A E, 11.360% 7/13/46 (a) | | | 868,285 |

| 2,000,000 | | | | Knollwood CDO Ltd. 2006-2A SN, 15.000% 7/13/46 | | | 1,840,000 |

| 4,000,000 | | | | Kodiak CDO 2006-1A, 3.712% 8/7/37 (a) | | | 3,660,000 |

| 2,000,000 | | | | Navigare Funding CLO Ltd. 2007-2A SN, 5.360% 4/17/21 (a) | | | 1,800,000 |

| 3,000,000 | | | | OFSI Fund Ltd. 2006-1A, 2.000% 9/20/19 (a) | | | 3,031,800 |

| 1,897,451 | | | | Peritus I CDO Ltd. 2005-1A C, 9.000% 5/24/2015 (a) | | | 1,866,978 |

| 2,000,000 | | | | Trapeza CDO I LLC 2006-11A F, 10.361% 10/10/41 | | | 2,000,000 |

| 2,000,000 | | | | Trapeza CDO I LLC 2006-11A, 10.000% 10/10/41 | | | 1,920,000 |

| 2,000,000 | | | | Trapeza CDO I LLC 2007-12A F, 9.852% 4/6/42 (a) | | | 1,968,000 |

| 2,000,000 | | | | Tropic CDO I Corp. 2006-5A C1, 10.000% 7/15/36 | | | 1,894,000 |

| | | | | | | |

| | | | | | | 64,687,712 |

| | | | | | | |

27

RMK HIGH INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Asset-Backed Securities–Below Investment Grade or Unrated (continued) | | | |

| | | | Collateralized Loan Obligations (“CLO”)–2.5% | | | |

| 1,000,000 | | | | Flagship CLO 2005-4I, Zero Coupon Bond 6/1/17 | | $ | 903,050 |

| 1,000,000 | | | | Ocean Trails CLO 2006-1A, 10.000% 10/12/20 | | | 965,000 |

| 2,000,000 | | | | Rosedale CLO Ltd. I-A II, 5.146% 7/24/21 | | | 1,940,000 |

| 2,000,000 | | | | Telos CLO Ltd. 2006-1A, 10.000% 10/11/21 (a) | | | 1,970,000 |

| 2,000,000 | | | | Veritas CLO Ltd. 2006-2A, 15.000% 7/11/21 (a) | | | 1,880,000 |

| | | | | | | |

| | | | | | | 7,658,050 |

| | | | | | | |

| | | | Commercial Loans–0.4% | | | |

| 1,967,335 | | | | Lehman Brothers-UBS Commercial Mortgage Trust 2001-C7 S,

5.868% 11/15/33 | | | 1,144,300 |

| | | | | | | |

| | | | Equipment Leases–6.0% | | | |

| 6,750,400 | | | | Aerco Limited 1X C1, 6.670% 7/15/23 | | | 1,620,096 |

| 7,123,631 | | | | Aerco Limited 2A B2, 6.370% 7/15/25 (a) | | | 2,635,744 |

| 6,930,122 | | | | Aerco Limited 2A C2, 7.370% 7/15/25 (a) | | | 2,009,735 |

| 6,000,000 | | | | Aircraft Finance Trust 1999-1A A1, 5.800% 5/15/24 (a) | | | 4,455,000 |

| 3,000,000 | | | | Airplanes Pass Through Trust 2001-1A A9, 5.870% 3/15/19 | | | 2,075,625 |

| 728,839 | | | | DVI Receivables Corp. 2001-2 A3, 3.519% 11/8/31 | | | 524,764 |

| 1,022,822 | | | | DVI Receivables Corp. 2001-2 A4, 4.613% 11/11/09 | | | 746,660 |

| 3,809,825 | | | | DVI Receivables Corp. 2002-1 A3A, 5.670% 6/11/10 | | | 1,981,109 |

| 2,370,355 | | | | Lease Investment Flight Trust 1 B2, 7.124% 7/15/31 | | | 687,403 |

| 3,517,584 | | | | Pegasus Aviation Lease Securitization 2001-1A B1, Zero Coupon Bond 5/10/31 (a) | | | 17,588 |

| 1,758,792 | | | | Pegasus Aviation Lease Securitization 2001-1A B2, Zero Coupon Bond 5/10/31 (a) | | | 8,794 |

| 3,000,000 | | | | Piper Jaffray Equipment Trust Securities 2007-1A, 6.300% 3/26/29 (a) | | | 1,335,000 |

| | | | | | | |

| | | | | | | 18,097,518 |

| | | | | | | |

| | | | Franchise Loans–0.2% | | | |

| 1,000,000 | | | | Falcon Franchise Loan LLC 2001-1 F, 6.500% 1/5/23 | | | 489,250 |

| | | | | | | |

| | | | Home Equity Loans (Non-High Loan-To-Value)–4.2% | | | |

| 1,500,000 | | | | ACE Securities Corp. 2005-HE2 B1, 8.570% 4/25/35 (a) | | | 1,065,000 |

| 2,000,000 | | | | ACE Securities Corp. 2005-HE6 B1, 8.320% 10/25/35 (a) | | | 1,320,000 |

| 2,000,000 | | | | ACE Securities Corp. 2005-SL1 B1, 6.000% 6/25/35 (a) | | | 940,000 |

| 540,704 | | | | Ameriquest Mortgage Securities Inc. 2003-8 MV6, 8.797% 10/25/33 | | | 253,822 |

| 544,329 | | | | Amresco Residential Securities Mortgage Loan Trust 1999-1 B, 9.320% 11/25/29 | | | 524,833 |

| 2,000,000 | | | | Asset-Backed Securities Corp. Home Equity 2006-HE4 M9, 7.820% 5/25/36 (a) | | | 1,280,000 |

| 1,000,000 | | | | Equifirst Mortgage Loan Trust 2005-1 B3, 8.570% 4/25/35 (a) | | | 800,000 |

| 3,000,000 | | | | Meritage Asset Holdings 2005-2 N4, 7.500% 11/25/35 (a) | | | 1,650,000 |

| 2,000,000 | | | | Merrill Lynch Mortgage Investors Inc. 2005-SL1 B5, 8.820% 6/25/35 (a) | | | 1,360,000 |

28

RMK HIGH INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Asset-Backed Securities–Below Investment Grade or Unrated (continued) | | | |

| | | | Home Equity Loans (Non-High Loan-To-Value) (continued) | | | |

| 3,000,000 | | | | Terwin Mortgage Trust 2005-R1, 5.000% 12/28/36 (a) | | $ | 540,000 |

| | | | Terwin Mortgage Trust 2005-3SL B6, 11.500% 3/25/35 interest-only strips | | | 221,878 |

| 1,767,528 | | | | Terwin Mortgage Trust 2005-7SL, 4.265% 7/25/35 (a) | | | 265,129 |

| 2,645,372 | | | | Terwin Mortgage Trust 2005-11SL B7, 5.000% 11/25/36 (a) | | | 872,973 |

| 4,000,000 | | | | Terwin Mortgage Trust 2006-R3, 6.290% 6/26/37 (a) | | | 1,760,000 |

| | | | | | | |

| | | | | | | 12,853,635 |

| | | | | | | |

| | | | Total Asset-Backed Securities–Below Investment Grade or Unrated

(cost $125,405,748) | | | 106,559,214 |

| | | | | | | |

| Corporate Bonds–Investment Grade–3.9% of Net Assets | | | |

| | | | Finance–0.3% | | | |

| 1,000,000 | | | | ABN Amro Bank NV/London, 9.860% 11/17/09 (a) | | | 990,000 |

| | | | | | | |

| | | | Special Purpose Entities–3.6% | | | |

| 2,000,000 | | | | Canal Pointe II LLC., 5.340% 6/25/14 (a) | | | 2,000,000 |

| 2,000,000 | | | | Lincoln Park Referenced Link Notes 2001-1, 8.780% 7/30/31 (a) | | | 1,820,000 |

| 3,000,000 | | | | Pyxis Master Trust 2006-7, 10.320% 10/1/37 (a) | | | 3,000,000 |

| 4,000,000 | | | | Steers Delaware Business Trust 2007-A, 7.599% 6/20/18 (a) | | | 4,000,000 |

| | | | | | | |

| | | | | | | 10,820,000 |

| | | | | | | |

| | | | Total Corporate Bonds–Investment Grade

(cost $11,776,097) | | | 11,810,000 |

| | | | | | | |

| Corporate Bonds–Below Investment Grade or Unrated–37.7% of Net Assets | | | |

| | | | Agriculture–0.5% | | | |

| 1,525,000 | | | | Eurofresh Inc., 11.500% 1/15/13 (a) | | | 1,494,500 |

| | | | | | | |

| | | | Apparel–1.1% | | | |

| 3,258,000 | | | | Rafaella Apparel Group Inc., 11.250% 6/15/11 | | | 3,323,160 |

| | | | | | | |

| | | | Automotive–3.2% | | | |

| 2,375,000 | | | | Cooper Standard Automotive, Inc., 8.375% 12/15/14 | | | 1,989,063 |

| 1,750,000 | | | | Dana Corp., 1/15/15 in default (c) | | | 1,303,750 |

| 1,125,000 | | | | Dana Corp., 3/15/10 in default (c) | | | 866,250 |

| 1,975,000 | | | | Dura Operating Corp., 4/15/12 in default (c) | | | 513,500 |

| 1,950,000 | | | | Ford Motor Company, 7.450% 7/16/31 | | | 1,508,813 |

| 175,000 | | | | Ford Motor Company, 9.980% 2/15/47 | | | 159,688 |

| 3,475,000 | | | | Metaldyne Corp., 11.000% 6/15/12 | | | 3,292,389 |

| | | | | | | |

| | | | | | | 9,633,453 |

| | | | | | | |

| | | | Basic Materials–4.4% | | | |

| 3,225,000 | | | | AmeriCast Technologies Inc., 11.000% 12/1/14 (a) | | | 3,289,500 |

| 1,715 | | | | Corp Durango SA de CV, 9.500% 12/31/12 | | | 1,749 |

29

RMK HIGH INCOME FUND, INC.

PORTFOLIOOF INVESTMENTS

MARCH 31, 2007

| | | | | | | |

Principal

Amount | | | | Description | | Value (b) |

| | | | | | | |

| Corporate Bonds–Below Investment Grade or Unrated (continued) | | | |

| | | | Basic Materials (continued) | | | |

| 3,625,000 | | | | Edgen Acquisition Corp., 9.875% 2/1/11 | | $ | 3,706,563 |

| 1,700,000 | | | | Key Plastics LLC, 11.750% 3/15/13 (a) | | | 1,731,875 |

| 1,075,000 | | | | Millar Western Forest Products Ltd., 7.750% 11/15/13 | | | 978,250 |

| 2,700,000 | | | | Momentive Performance Materials Inc., 11.500% 12/1/16 (a) | | | 2,767,500 |

| 750,000 | | | | Sterling Chemicals Inc., 10.250% 4/1/15 (a) | | | 750,000 |

| | | | | | | |

| | | | | | | 13,225,437 |

| | | | | | | |

| | | | Building & Construction–0.8% | | | |

| 750,000 | | | | Masonite Corp., 11.000% 4/6/15 (a) | | | 697,500 |

| 1,050,000 | | | | Ply Gem Industries Inc., 9.000% 2/15/12 | | | 910,875 |

| 925,000 | | | | Technical Olympic USA, Inc., 10.375% 7/1/12 | | | 698,375 |

| | | | | | | |

| | | | | | | 2,306,750 |

| | | | | | | |

| | | | Communications–1.5% | | | |

| 771,000 | | | | CCH I Holdings LLC, 11.000% 10/1/15 | | | 799,913 |

| 3,850,000 | | | | CCH I Holdings LLC, 11.750% 5/15/14 | | | 3,686,375 |

| | | | | | | |

| | | | | | | 4,486,288 |

| | | | | | | |

| | | | Consulting Services–2.0% | | | |

| 2,125,000 | | | | MSX International Inc., 11.000% 10/15/07 | | | 2,040,000 |