Education Realty Trust, Inc. – Investor Presentation

November 2010

GrandMarc at the Corner (at UVA)

0

(1)

Owned portfolio Including 3 joint venture communities that are also managed by the Company.

Repositioned High Quality Portfolio(1)

Currently 44 communities: over 27,800 beds

Repositioned portfolio 35 communities: over 24,000 beds

Excellent Long Term Relationships Should Lead

To Opportunities

Solid industry reputation

Extensive industry network

Over 40 years in student housing industry

Few competitors can match size and national footprint

Excellent Demographic Trends

U. S. enrollment expected to increase 1.5% annually

through 2016

External Growth Opportunities

ONE PlanSM on-campus developments for own account

Off-Campus developments for own account

Potential for acquisitions

Internal Growth Opportunities

Improve performance of current portfolio

Capital recycling program

University Towers, NC State University

The Reserve at Star Pass, University of Arizona

Leader in Collegiate Student Housing

1

Leader in Collegiate Student Housing

(1)

After repositioning transactions.

(2)

Includes joint venture properties.

Campus Creek, University of Mississippi

The Commons, University of Tennessee

Solid Capital Structure/Meaningful Capacity for

Growth (as of September 30, 2010)

Debt/Gross Assets 43%

Interest Coverage Ratio 2.2x

Net Debt to EBITDA 7.4x

Debt Financing Covered through 2011

Acquisition Capacity >$200 million (1)

Profitable Third-Party Fee Businesses

Proven third-party development business

Awarded over $1.3 billion of new on-campus

developments since 2000

Over $330 million in developments currently

under contract or recently awarded

Stable third-party management business

Multi-year contracts (typically 2-5 years)

Supports strategic relationships with universities

23 managed properties / over 11,900 beds (2)

2

Owned/JV Properties

Managed Properties

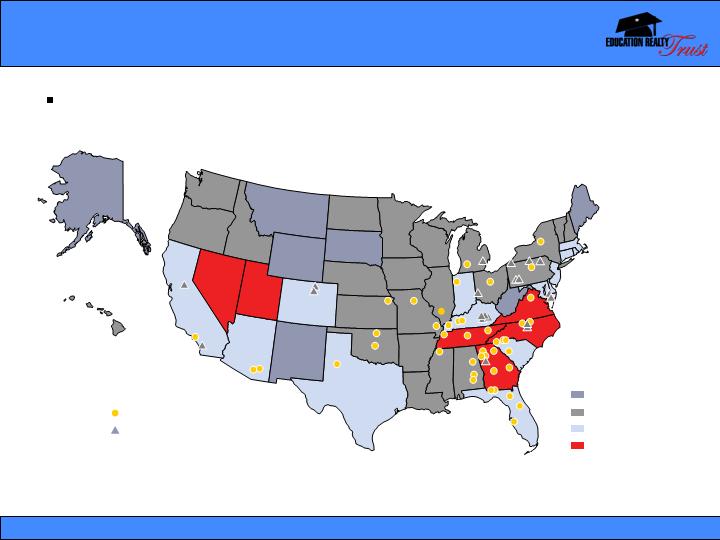

EDR is focused on key student housing markets. The strongest enrollment growth is expected in the Southeast and Southwest

regions, with a significant number of EDR’s properties located in these key areas. Approximately 67% of EDR’s EBITDA is from

properties located in states forecasted to increase enrollment by 1.25% or greater.

Market Leadership with Scale in the Student Housing Business

< 0.25%

0.25% to 1.25%

1.25% to 2%

> 2%

(increase in # of students)

High Quality Owned Portfolio

Source: Rosen Consulting LLC (March 2009).

3

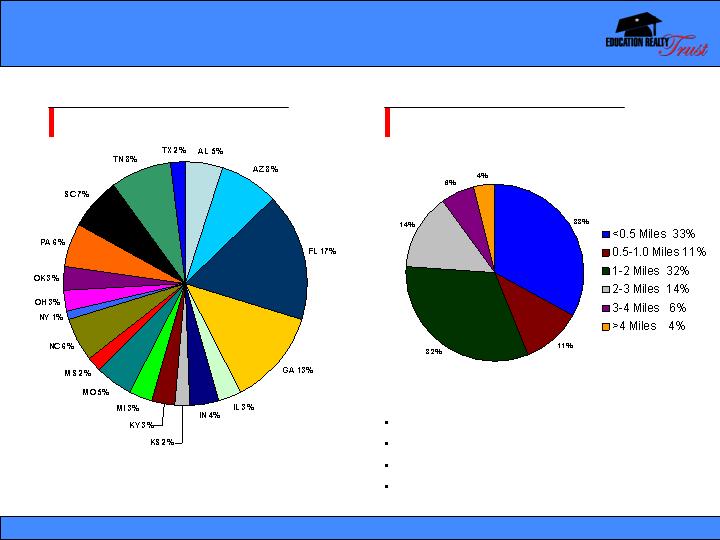

High Quality Owned Portfolio

Amenity Rich Assets with Geographic and University Diversification

Distance to Campus

EBITDA by State

Portfolio Average Distance to Campus - - 1.1 miles.

Percentage of Beds having a 1 to 1 Ratio to Baths – 69%.

Average Enrollment of Universities served – 29,500.

Average Age of Communities – 10 years.

Note: Reflects impact of recent transactions

4

Recent Portfolio Repositioning

Pending Dispositions

9 communities, including 8 of the former Place

communities

$84.8 million sales price and $50.3 million in

net proceeds

Average enrollment of universities served

15,500

Acquisition of GrandMarc

At University of Virginia with enrollment of

24,400

Within 2 blocks of campus

Four years old

Average rental rate $670

Total purchase price of $45.5 million

Impact on Portfolio

Average enrollment of universities served

increases 15% to 29,500

5% improvement in average rental rate

$33.3 million reduction in mostly variable rate

debt with late 2013 and early 2014 maturities

GrandMarc at the Corner, University of Virginia

5

Supply/Demand Should Lead to Net Operating Income Growth

Industry Growth Opportunities

Supply

Constrained

Credit crisis inhibited new construction.

Decreased state appropriations limit ability for many universities to update aging and

obsolete on-campus housing.

On-Campus housing capacity as a percentage of undergraduate enrollment decreased from

32% in 1990 to 25% in 2004.

Demand for Student Housing

Increasing Enrollment – 1.5% Annually through 2016

Echo Boom generation

Increasing percentage of high school graduates choosing to attend college.

College students are taking longer to graduate.

6

External Growth Opportunities

The ONE PlanSM:

Exclusively designed for on-campus equity

ownership of student apartments

Provides EDR with attractive risk / returns due

to “best location”

Provides universities with needed new on-

campus housing while preserving capital

Increasing acceptance by universities

(Syracuse development and University of

Texas at Austin commencing construction in

2011 for delivery in 2013)

The ONE PlanSM - EDR’s On-Campus Equity Program

University Village Apartments, Syracuse University

7

External Growth Opportunities

The ONE Plan – Plus

Creative structuring similar to The ONE PlanSM

Graduate Student Housing at Johns Hopkins – 572 bed,

$61 million development on University owned land

adjacent to campus, commencing construction in 2010

for delivery in 2012

EDR provided second mortgage financing collateralized

by a replenishing cash reserve fund.

Third party development fees and 10 year management

agreement

Off-Campus Developments for Own Account

University of Connecticut – 501 bed, $45 million

development adjacent to campus, commencing

construction in 2011 for delivery in 2012 and 2013

Pursuing numerous joint ventures with local and regional

developers

Potential for Acquisitions

Highly fragmented sector, ownership by small local

property owners/operators

Industry contacts and network will provide opportunities

Sources of acquisitions

Overleveraged acquirers

Overleveraged local or regional developers

Financial institutions

Institutions divesting from student housing business

Operating business; no “brand” support

Ability to move quickly versus lesser capitalized buyers

Acquisition capacity after repositioning >$200 million

Johns Hopkins

8

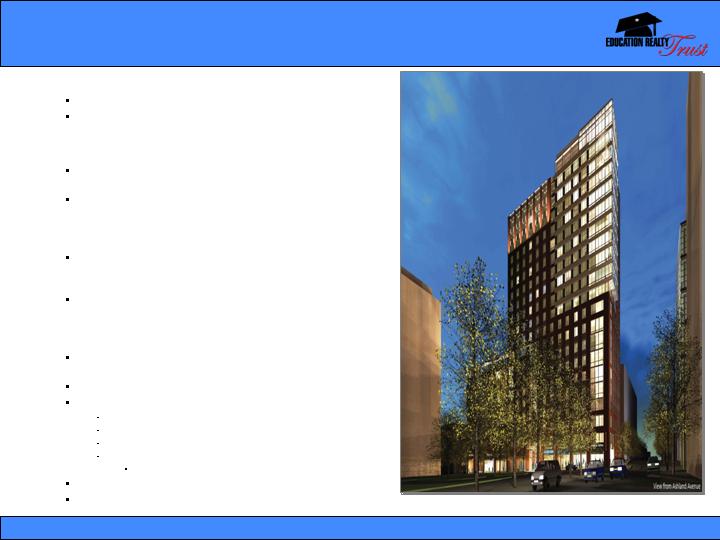

Awarded project in July 2010

Currently negotiating ground lease

$64 million total project cost

Approximately 612 beds in 16 story high rise

collegiate community

Construction expected to start summer 2011

Anticipated opening in summer 2013

EDR will own and manage the asset subject to a

ground lease

The University of Texas at Austin

ONE PlanSM Project at the University of Texas

9

Entered Development agreement September 2010

Two phases of collegiate housing with total cost of

approximately $45 million

290 units of studio, one, two and three bedroom

apartments

Part of $220 million mixed use town center next to

the University

Construction expected to start in 2011

Opening of Phase I expected for 2012 and Phase II

in 2013

EDR will own and manage the collegiate housing

component of the development

The project will establish an urban, community-

focused college town center for UConn and the city

of Mansfield

STORRS Center, University of Connecticut

Owned Development at the University of Connecticut

10

Improve Performance of Current Portfolio

Reorganized and restructured

New Senior Vice President of Operations Christine

Richards

Streamlined and refocused operating group

Reallocated non operational support functions from

operating group (i.e. capital project management)

Improving certain key functions such as corporate

marketing leader

Reviewing other processes to drive efficiency and

effectiveness

Focused on Technology enhancements

Improved lease tracking and monitoring to maximize

not only occupancy but also rate

Upgraded property websites

Favorable Supply/Demand Characteristics

in Many Markets

11

Solid Capital Structure

Debt to Gross Assets 43%

Net Debt to EBITDA 7.4x

Interest Coverage Ratio 2.2x

Debt Financing Covered through 2011

Acquisition Capacity >$200 million

Meaningful Capacity for Growth

Notes:

Maturity in 2011 relates to a construction loan that has a two year extension option which the Company expects to exercise.

Financial data as of September 30, 2010

Acquisition capacity is after repositioning transactions.

Debt Maturities

12

Near-Term Outlook and 2010 Forecast

2010-2011 Lease Term Opening

2.3% improvement in occupancy; rates up

approximately 2%

Pricing power slightly better than prior year

Expect positive leasing for 2011/2012

Developments for Own Account

ONE PlanSM on-campus development near the

core of campus at the University of Texas at Austin

Off-Campus development adjacent to the

University of Connecticut

Third Party Fee Development

Credit markets improving

Began construction in 2010

Johns Hopkins

SUNY ESF

East Stroudsburg University

Mansfield University of Pennsylvania

Improved volume of requests for proposals being

received from universities

Acquisition Potential

$150 million acquisition capacity

Recently closed $45.5 million purchase of

GrandMarc

Seeing more volume of opportunities and uptick in

deals closing

The Commons on Kinnear, Ohio State University

The Reserve on Perkins, Oklahoma State University

13

Investment Highlights

Repositioned High Quality Portfolio

Excellent Long Term Relationships Should Lead To

Opportunities

Excellent Demographic Trends

External Growth Opportunities

ONE PlanSM On-Campus Development for Own Account

ONE Plan - Plus On-Campus Development

Off-Campus Developments for Own Account

Potential for Acquisitions

Internal Growth Opportunities

Improve Performance of Current Portfolio

Reinvigorate Capital Recycling Program

Solid Capital Structure / Meaningful Capacity for

Growth

Profitable Third-Party Fee Businesses

The Reserve on West 31st, Kansas University

14

Forward Looking Statements

This presentation includes certain statements, estimates and projections provided by EDR’s management with

respect to the anticipated future performance of EDR, including “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such statements, estimates and projections reflect various assumptions by EDR’s management

concerning anticipated results and have been included solely for illustrative purposes.

Forward-looking statements can be identified by the use of the words “anticipate,” “believe,” “expect,” “intend,”

“may,” “might,” “plan,” “estimate,” “project,” “should,” “will,” “result,” and similar expressions. No representations are

made as to the accuracy of such statements, estimates or projections, which necessarily involve known and

unknown risks, uncertainties and other factors that, in some ways, are beyond management’s control. Such factors

include the risk factors discussed in the Company’s registration statement on Form S-3, annual report on Form 10-K

for the year ended December 31, 2009, and quarterly report on Form 10-Q for the period ended September 30,

2010, each as filed with the SEC. These risk factors include, but are not limited to risks and uncertainties inherent in

the national economy, the real estate industry in general, and in our specific markets; legislative or regulatory

changes including changes to laws governing REITS; our dependence on key personnel; rising insurance rates and

real estate taxes; changes in GAAP; and our continued ability to successfully lease and operate our properties.

Accordingly, actual results may vary materially from the projected results contained herein and you should not rely

on any forward-looking statements made herein or made in connection with this presentation. The Company shall

have no obligation or undertaking to update or revise any forward-looking statements to reflect any change in

Company expectations or results, or any change in events.

15