|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, except per share data, unaudited) | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| OPERATING DATA: | | | | | | | | | | | |

| | | Three months ended June 30, | | Six months ended June 30, |

| | | 2014 | 2013 | | $ Chg | % Chg | | 2014 | 2013 | | $ Chg | % Chg |

| | | | | | | | | | | | | |

| | Same-community revenue | $ | 33,860 |

| $ | 33,043 |

|

| $ | 817 |

| 2.5 | % |

| $ | 69,936 |

| $ | 68,065 |

|

| $ | 1,871 |

| 2.7 | % |

| | Total community revenue | 46,309 |

| 37,335 |

|

| 8,974 |

| 24.0 | % |

| 97,020 |

| 76,788 |

|

| 20,232 |

| 26.3 | % |

| | Total revenue | 50,040 |

| 41,038 |

|

| 9,002 |

| 21.9 | % |

| 104,585 |

| 85,709 |

|

| 18,876 |

| 22.0 | % |

| |

|

|

|

| | |

|

|

|

| | |

| | Same-community net operating income | 18,713 |

| 18,245 |

|

| 468 |

| 2.6 | % |

| 39,528 |

| 38,762 |

|

| 766 |

| 2.0 | % |

| | Total community net operating income | 25,334 |

| 19,523 |

|

| 5,811 |

| 29.8 | % |

| 53,877 |

| 41,257 |

|

| 12,620 |

| 30.6 | % |

| | Total operating income (loss) | (3,651 | ) | 3,694 |

|

| (7,345 | ) | (198.8 | )% |

| 4,661 |

| 10,807 |

|

| (6,146 | ) | (56.9 | )% |

| |

|

|

|

| | |

|

|

|

| | |

| | Net income (loss) | (8,808 | ) | 3,832 |

|

| (12,640 | ) | (329.9 | )% |

| 3,258 |

| 7,141 |

|

| (3,883 | ) | (54.4 | )% |

| | Per share - basic & diluted | $ | (0.08 | ) | $ | 0.03 |

|

| $ | (0.11 | ) | (366.7 | )% |

| $ | 0.03 |

| $ | 0.06 |

|

| $ | (0.03 | ) | (50.0 | )% |

| |

|

|

|

| | |

|

|

|

| | |

| | Funds from operations (FFO) | 15,284 |

| 11,836 |

|

| 3,448 |

| 29.1 | % |

| 32,334 |

| 26,445 |

|

| 5,889 |

| 22.3 | % |

| | Per weighted average share/unit (1) | $ | 0.13 |

| $ | 0.10 |

|

| $ | 0.03 |

| 30.0 | % |

| $ | 0.28 |

| $ | 0.23 |

|

| $ | 0.05 |

| 21.7 | % |

| |

|

|

|

| | |

|

|

|

| | |

| | Core funds from operations (Core FFO) | 17,258 |

| 14,532 |

|

| 2,726 |

| 18.8 | % |

| 36,621 |

| 30,910 |

|

| 5,711 |

| 18.5 | % |

| | Per weighted average share/unit (1) | $ | 0.15 |

| $ | 0.13 |

|

| $ | 0.02 |

| 15.4 | % |

| $ | 0.31 |

| $ | 0.27 |

|

| $ | 0.04 |

| 14.8 | % |

| | | | | | | | | | | | | |

| BALANCE SHEET DATA: | | | | | | | | | | | |

| | | 6/30/2014 |

| 12/31/2013 |

| | | | | | | | | |

| | Debt to gross assets | 32.5 | % | 42.8 | % | | | | | | | | | |

| | Net debt to enterprise value | 28.5 | % | 42.5 | % | | | | | | | | | |

| | Interest coverage ratio (TTM) | 4.4 | x | 4.6 | x | | | | | | | | | |

| | Net debt to EBITDA - Adjusted (TTM) | 5.6 | x | 6.3 | x | | | | | | | | | |

| | | | | | | | | | | | | |

(1) FFO and Core FFO per share/unit were computed using weighted average shares and units outstanding, regardless of their dilutive impact. See page 4 for a detailed calculation. |

| | | | | | | | | | |

|

| | | | | | | | | | |

| (Amount in thousands, except share and per share data) | June 30, 2014 | | December 31, 2013 | |

| Assets | | (unaudited) | | | |

| | Collegiate housing properties, net (1) | | $ | 1,307,519 |

| | $ | 1,388,885 |

| |

| | Collegiate housing properties - held for sale, net (1) | | 21,166 |

| | — |

| |

| | Assets under development | | 233,441 |

| | 116,787 |

| |

| | Cash and cash equivalents | | 11,162 |

| | 22,073 |

| |

| | Restricted cash | | 14,069 |

| | 12,253 |

| |

| | Other assets | | 78,690 |

| | 70,567 |

| |

| Total assets | | $ | 1,666,047 |

| | $ | 1,610,565 |

| |

| | | | | | |

| Liabilities and equity | | | | | |

| Liabilities: | | | | | |

| | Mortgage and construction loans, net of unamortized premium | | $ | 361,173 |

| | $ | 422,681 |

| |

| | Unsecured revolving credit facility | | 66,000 |

| | 356,900 |

| |

| | Unsecured term loan | | 187,500 |

| | — |

| |

| | Accounts payable and accrued expenses | | 78,566 |

| | 67,646 |

| |

| | Deferred revenue | | 19,963 |

| | 23,498 |

| |

| Total liabilities | | 713,202 |

| | 870,725 |

| |

| | | | | | | |

| Commitments and contingencies | — |

| | — |

| |

| | | | | | | |

| Redeemable noncontrolling interests | 9,780 |

| | 9,871 |

| |

| | | | | | | |

| Equity: | | | | | |

| EdR stockholders' equity: | | | | |

| | Common stock, $0.01 par value per share, 200,000,000 shares authorized, 139,437,355 and 114,740,155 shares issued and outstanding as of June 30, 2014 and December 31, 2013, respectively | | 1,394 |

| | 1,148 |

| |

| | Preferred stock, $0.01 par value per share, 50,000,000 shares authorized, no shares issued and outstanding | | — |

| | — |

| |

| | Additional paid-in capital | | 1,027,816 |

| | 813,540 |

| |

| | Accumulated deficit | | (85,706 | ) | | (88,964 | ) | |

| | Accumulated other comprehensive loss | | (3,757 | ) | | — |

| |

| Total EdR stockholders' equity | 939,747 |

| | 725,724 |

| |

| Noncontrolling interests | 3,318 |

| | 4,245 |

| |

| Total equity | | 943,065 |

| | 729,969 |

| |

| | | | | | | |

| Total liabilities and equity | | $ | 1,666,047 |

| | $ | 1,610,565 |

| |

| | | | | | | |

| (1) Amount is net of accumulated depreciation of $216,530 and $204,181 as of June 30, 2014 and December 31, 2013, respectively. Of this amount for June 30, 2014, $9,982 relates to collegiate housing properties held for sale. |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, except per share data, unaudited) | Three months ended June 30, | | Six months ended June 30, |

| | 2014 | | 2013 | | $ Change | | 2014 | | 2013 | | $ Change |

| Revenues: | | | | | | | | | | | |

| Collegiate housing leasing revenue | $ | 46,309 |

| | $ | 37,335 |

| | $ | 8,974 |

| | $ | 97,020 |

| | $ | 76,788 |

| | $ | 20,232 |

|

| Third-party development services | 757 |

| | 759 |

| | (2 | ) | | 1,559 |

| | 1,150 |

| | 409 |

|

| Third-party management services | 786 |

| | 823 |

| | (37 | ) | | 1,804 |

| | 1,792 |

| | 12 |

|

| Operating expense reimbursements | 2,188 |

| | 2,121 |

| | 67 |

| | 4,202 |

| | 5,979 |

| | (1,777 | ) |

| Total revenues | 50,040 |

| | 41,038 |

| | 9,002 |

| | 104,585 |

| | 85,709 |

| | 18,876 |

|

| Operating expenses: | | | | | | | | | | | |

| Collegiate housing leasing operations | 20,975 |

| | 17,812 |

| | 3,163 |

| | 43,143 |

| | 35,531 |

| | 7,612 |

|

| Development and management services | 2,282 |

| | 1,618 |

| | 664 |

| | 4,623 |

| | 3,389 |

| | 1,234 |

|

| General and administrative | 1,677 |

| | 1,942 |

| | (265 | ) | | 3,794 |

| | 3,776 |

| | 18 |

|

| Development pursuit, acquisition costs and severance | 307 |

| | 79 |

| | 228 |

| | 308 |

| | 268 |

| | 40 |

|

| Depreciation and amortization | 14,458 |

| | 11,562 |

| | 2,896 |

| | 28,241 |

| | 22,161 |

| | 6,080 |

|

| Ground lease expense | 1,934 |

| | 2,210 |

| | (276 | ) | | 3,833 |

| | 3,798 |

| | 35 |

|

| Loss on impairment of collegiate housing properties | 9,870 |

| | — |

| | 9,870 |

| | 11,780 |

| | — |

| | 11,780 |

|

| Reimbursable operating expenses | 2,188 |

| | 2,121 |

| | 67 |

| | 4,202 |

| | 5,979 |

| | (1,777 | ) |

| Total operating expenses | 53,691 |

| | 37,344 |

| | 16,347 |

| | 99,924 |

| | 74,902 |

| | 25,022 |

|

| Operating income (loss) | (3,651 | ) | | 3,694 |

| | (7,345 | ) | | 4,661 |

| | 10,807 |

| | (6,146 | ) |

| Nonoperating expenses: | | | | | | | | | | | |

| Interest expense | 4,967 |

| | 3,855 |

| | 1,112 |

| | 10,568 |

| | 7,909 |

| | 2,659 |

|

| Amortization of deferred financing costs | 514 |

| | 410 |

| | 104 |

| | 1,017 |

| | 830 |

| | 187 |

|

| Interest income | (41 | ) | | (124 | ) | | 83 |

| | (111 | ) | | (243 | ) | | 132 |

|

| Loss on extinguishment of debt | — |

| | — |

| | — |

| | 649 |

| | — |

| | 649 |

|

| Total nonoperating expenses | 5,440 |

| | 4,141 |

| | 1,299 |

| | 12,123 |

| | 8,496 |

| | 3,627 |

|

| Income (loss) before equity in earnings (losses) of unconsolidated entities, income taxes, discontinued operations and gain on sale of collegiate housing communities | (9,091 | ) | | (447 | ) | | (8,644 | ) | | (7,462 | ) | | 2,311 |

| | (9,773 | ) |

| Equity in earnings (losses) of unconsolidated entities | (112 | ) | | (22 | ) | | (90 | ) | | (134 | ) | | (42 | ) | | (92 | ) |

| Income (loss) before income taxes, discontinued operations, and gain on sale of collegiate housing properties | (9,203 | ) | | (469 | ) | | (8,734 | ) | | (7,596 | ) | | 2,269 |

| | (9,865 | ) |

| Income tax benefit | (357 | ) | | — |

| | (357 | ) | | (312 | ) | | (237 | ) | | (75 | ) |

| Income (loss) from continuing operations | (8,846 | ) | | (469 | ) | | (8,377 | ) | | (7,284 | ) | | 2,506 |

| | (9,790 | ) |

| Income from discontinued operations | — |

| | 4,159 |

| | (4,159 | ) | | — |

| | 4,662 |

| | (4,662 | ) |

| Income (loss) before gain on sale of collegiate housing communities | (8,846 | ) | | 3,690 |

| | (12,536 | ) | | (7,284 | ) | | 7,168 |

| | (14,452 | ) |

| Gain on sale of collegiate housing communities | — |

| | — |

| | — |

| | 10,902 |

| | — |

| | 10,902 |

|

| Net income (loss) | (8,846 | ) | | 3,690 |

| | (12,536 | ) | | 3,618 |

| | 7,168 |

| | (3,550 | ) |

| Less: Net income (loss) attributable to the noncontrolling interests | (38 | ) | | (142 | ) | | 104 |

| | 360 |

| | 27 |

| | 333 |

|

| Net income (loss) attributable to EdR | $ | (8,808 | ) | | $ | 3,832 |

| | $ | (12,640 | ) | | $ | 3,258 |

| | $ | 7,141 |

| | $ | (3,883 | ) |

| | | | | | | | | | | | |

| Other comprehensive loss: | | | | | | | | | | | |

| Loss on cash flow hedging derivatives | (2,394 | ) | | — |

| | (2,394 | ) | | (3,757 | ) | | — |

| | (3,757 | ) |

| Comprehensive income (loss) | $ | (11,202 | ) | | $ | 3,832 |

| | $ | (15,034 | ) | | $ | (499 | ) | | $ | 7,141 |

| | $ | (7,640 | ) |

| | | | | | | | | | | | |

| Earnings per share information: | | | | | | | | | | | |

| Net income (loss) attributable to EdR common stockholders per share – basic and diluted | $ | (0.08 | ) | | $ | 0.03 |

| | $ | (0.11 | ) | | $ | 0.03 |

| | $ | 0.06 |

| | $ | (0.03 | ) |

| Weighted average shares of common stock outstanding – basic | 116,657 |

| | 114,452 |

| |

| | 115,833 |

| | 114,045 |

| | |

| Weighted average shares of common stock outstanding – diluted | 116,657 |

| | 114,452 |

| | | | 116,871 |

| | 115,083 |

| | |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, except per share data, unaudited) | | | | | | |

| | | | | | | | | |

| | | Three months ended June 30, | | Six months ended June 30, |

| | | 2014 | | 2013 | | $ Change | | 2014 | | 2013 | | $ Change |

| Net income (loss) attributable to EdR | $ | (8,808 | ) | | $ | 3,832 |

| | $ | (12,640 | ) | | $ | 3,258 |

| | $ | 7,141 |

| | $ | (3,883 | ) |

| | | | | | |

|

| | | | | | |

| | Gain on sale of collegiate housing assets (1) | — |

| | (3,895 | ) | | 3,895 |

| | (10,902 | ) | | (3,895 | ) | | (7,007 | ) |

| | Impairment losses | 9,870 |

| | — |

| | 9,870 |

| | 11,780 |

| | — |

| | 11,780 |

|

| | Real estate related depreciation and amortization | 14,299 |

| | 11,949 |

| | 2,350 |

| | 27,921 |

| | 23,032 |

| | 4,889 |

|

| | Equity portion of real estate depreciation and amortization on equity investees | 50 |

| | 48 |

| | 2 |

| | 99 |

| | 96 |

| | 3 |

|

| | Noncontrolling interests | (127 | ) | | (98 | ) | | (29 | ) | | 178 |

| | 71 |

| | 107 |

|

| Funds from operations ("FFO") | 15,284 |

| | 11,836 |

| | 3,448 |

| | 32,334 |

| | 26,445 |

| | 5,889 |

|

| | | | | | |

|

| | | | | | |

| FFO adjustments: | | | | |

|

| | | | | | |

| | Loss on extinguishment of debt | — |

| | — |

| | — |

| | 649 |

| | — |

| | 649 |

|

| | Acquisition costs | 22 |

| | 72 |

| | (50 | ) | | 23 |

| | 299 |

| | (276 | ) |

| | Severance costs, net of tax | 285 |

| | — |

| | 285 |

| | 285 |

| | — |

| | 285 |

|

| | Straight-line adjustment for ground leases (2) | 1,212 |

| | 1,715 |

| | (503 | ) | | 2,425 |

| | 2,807 |

| | (382 | ) |

| FFO adjustments: | 1,519 |

| | 1,787 |

| | (268 | ) | | 3,382 |

| | 3,106 |

| | 276 |

|

| | | | | | |

|

| | | | | | |

FFO on Participating Developments:(3) | | | | |

|

| | | | | | |

| | Interest on loan to Participating Development | 455 |

| | 455 |

| | — |

| | 905 |

| | 905 |

| | — |

|

| | Development fees on Participating Development, net of costs and taxes | — |

| | 454 |

| | (454 | ) | | — |

| | 454 |

| | (454 | ) |

| FFO on Participating Developments | 455 |

| | 909 |

| | (454 | ) | | 905 |

| | 1,359 |

| | (454 | ) |

| | | | | | |

|

| | | | | | |

| Core funds from operations ("Core FFO") | $ | 17,258 |

| | $ | 14,532 |

| | $ | 2,726 |

| | $ | 36,621 |

| | $ | 30,910 |

| | $ | 5,711 |

|

| | | | | | |

|

| | | | | | |

FFO per weighted average share/unit (4) | $ | 0.13 |

| | $ | 0.10 |

| | $ | 0.03 |

| | $ | 0.28 |

| | $ | 0.23 |

| | $ | 0.05 |

|

Core FFO per weighted average share/unit (4) | $ | 0.15 |

| | $ | 0.13 |

| | $ | 0.02 |

| | $ | 0.31 |

| | $ | 0.27 |

| | $ | 0.04 |

|

| | |

| |

| |

|

| | | | | | |

Weighted average shares/units (4) | 117,694 |

| | 115,489 |

| | 2,205 |

| | 116,871 |

| | 115,083 |

| | 1,788 |

|

| | | | | | | | | | | | | |

(1) The gain on sale of collegiate housing assets in 2013 is included in discontinued operations and the gain recognized in 2014 is included as gain on sale of collegiate housing communities on the Condensed Consolidated Statements of Comprehensive Income. |

(2) Represents the straight-line rent expense adjustment required by GAAP related to ground leases. As ground lease terms range from 40 to 99 years, the adjustment to straight-line these agreements becomes material to our operating results, distorting the economic results of the communities. |

(3) FFO on Participating Developments represents the economic impact of interest and fees not recognized in net income due to the Company having a participating investment in the third-party development. The adjustment for interest income is based on terms of the loan. |

(4) FFO and Core FFO per weighted average share/unit were computed using the weighted average of all shares and partnership units outstanding, regardless of their dilutive impact. |

|

| | |

| COMMUNITY OPERATING RESULTS |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

|

| Three months ended June 30, | |

| Six months ended June 30, |

|

| 2014 | | 2013 | | $ Change | | % Change | |

| 2014 | | 2013 | | $ Change | | % Change |

| Revenues |

| |

| |

| |

| |

|

| |

| | | | |

| Same-communities | $ | 33,860 |

| | $ | 33,043 |

| | $ | 817 |

| | 2.5 | % | |

| $ | 69,936 |

| | $ | 68,065 |

| | $ | 1,871 |

| | 2.7 | % |

| New-communities (1) | 11,116 |

| | 1,310 |

| | 9,806 |

| | NM |

| |

| 22,887 |

| | 2,829 |

| | 20,058 |

| | NM |

|

| | Other-communities (3) | 1,333 |

| | 2,982 |

| | (1,649 | ) | | NM |

| | | 4,197 |

| | 5,894 |

| | (1,697 | ) | | NM |

|

| Total revenues | 46,309 |

| | 37,335 |

| | 8,974 |

| | 24.0 | % | |

| 97,020 |

| | 76,788 |

| | 20,232 |

| | 26.3 | % |

|

|

| |

| | | | | |

|

| |

| | | | |

Operating expenses (2) |

| |

| | | | | |

|

| |

| | | | |

| Same-communities | 15,147 |

| | 14,798 |

| | 349 |

| | 2.4 | % | | | 30,408 |

| | 29,303 |

| | 1,105 |

| | 3.8 | % |

| New-communities (1) | 5,008 |

| | 1,351 |

| | 3,657 |

| | NM |

| | | 10,224 |

| | 2,831 |

| | 7,393 |

| | NM |

|

| | Other-communities (3) | 820 |

| | 1,663 |

| | (843 | ) | | NM |

| | | 2,511 |

| | 3,397 |

| | (886 | ) | | NM |

|

| Total operating expenses | 20,975 |

| | 17,812 |

| | 3,163 |

| | 17.8 | % | | | 43,143 |

| | 35,531 |

| | 7,612 |

| | 21.4 | % |

|

|

| |

| | | | | |

|

| |

| | | | |

| Net operating income |

| |

| | | | | |

|

| |

| | | | |

| Same-communities | 18,713 |

| | 18,245 |

| | 468 |

| | 2.6 | % | |

| 39,528 |

| | 38,762 |

| | 766 |

| | 2.0 | % |

| New-communities (1) | 6,108 |

| | (41 | ) | | 6,149 |

| | NM |

| |

| 12,663 |

| | (2 | ) | | 12,665 |

| | NM |

|

| | Other-communities (3) | 513 |

| | 1,319 |

| | (806 | ) | | NM |

| | | 1,686 |

| | 2,497 |

| | (811 | ) | | NM |

|

| Total net operating income | $ | 25,334 |

| | $ | 19,523 |

| | $ | 5,811 |

| | 29.8 | % | |

| $ | 53,877 |

| | $ | 41,257 |

| | $ | 12,620 |

| | 30.6 | % |

| | | | | | | | | | | | | | | | | | |

| |

| |

(1) See page 18 of this supplement for a listing of which communities are categorized as same-communities and which are new-communities. |

(2) Represents community level operating expenses, excluding management fees, depreciation, amortization, ground lease expense and impairment charges, plus regional and other corporate costs of supporting the communities. |

(3) Effective January 1, 2014, the Trust adopted the new accounting guidance relating to the reporting of discontinued operations. It is anticipated that the Trust's one-off property dispositions will no longer qualify as discontinued operations. This category represents the operating results of communities sold prior to their disposition and the operating results of communities held for sale as of June 30, 2014. |

|

| | |

| SAME-COMMUNITY EXPENSES BY CATEGORY |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, except bed and per-bed data) | |

| | Three months ended June 30, 2014 | | Three months ended June 30, 2013 | | | | | |

| Amount | Per Bed | % of Total Operating Expenses | | Amount | Per Bed | | $ Change | | % Change | |

Utilities (1) | $ | 4,412 |

| $ | 219 |

| 29 | % | | $ | 4,360 |

| $ | 216 |

| | $ | 52 |

| | 1.2 | % | |

| On-Site Payroll | 2,759 |

| 137 |

| 18 | % | | 2,604 |

| 129 |

| | 155 |

| | 6.0 | % | |

General & Administrative (2) | 2,526 |

| 125 |

| 17 | % | | 2,532 |

| 126 |

| | (6 | ) | | (0.2 | )% | |

Maintenance & Repairs (3) | 1,101 |

| 55 |

| 7 | % | | 1,134 |

| 56 |

| | (33 | ) | | (2.9 | )% | |

| Marketing | 709 |

| 35 |

| 5 | % | | 792 |

| 39 |

| | (83 | ) | | (10.5 | )% | |

| Total Direct Operating Expenses | $ | 11,507 |

| $ | 571 |

| 76 | % | | $ | 11,422 |

| $ | 566 |

| | $ | 85 |

| | 0.7 | % | |

|

|

|

| |

|

| | | | | |

| Real Estate Taxes | 3,190 |

| 158 |

| 21 | % | | 2,899 |

| 144 |

| | 291 |

| | 10.0 | % | |

| Insurance | 450 |

| 22 |

| 3 | % | | 477 |

| 24 |

| | (27 | ) | | (5.7 | )% | |

| Total Fixed Operating Expenses | $ | 3,640 |

| $ | 180 |

| 24 | % | | $ | 3,376 |

| $ | 168 |

| | $ | 264 |

| | 7.8 | % | |

| Total Property Operating Expenses | $ | 15,147 |

| $ | 751 |

| 100 | % | | $ | 14,798 |

| $ | 734 |

| | $ | 349 |

| | 2.4 | % | |

|

| | | | | | | | | | |

| | Six months ended June 30, 2014 | | Six months ended June 30, 2013 | | | | | |

| | Amount | Per Bed | % of Total Operating Expenses | | Amount | Per Bed | | $ Change | | % Change | |

Utilities (1) | $ | 9,125 |

| $ | 452 |

| 30 | % | | $ | 8,754 |

| 434 |

| | $ | 371 |

| | 4.2 | % | |

| On-Site Payroll | 5,509 |

| 273 |

| 18 | % | | 5,312 |

| 263 |

| | 197 |

| | 3.7 | % | |

General & Administrative (2) | 5,026 |

| 249 |

| 17 | % | | 5,007 |

| 248 |

| | 19 |

| | 0.4 | % | |

Maintenance & Repairs (3) | 2,006 |

| 99 |

| 7 | % | | 2,078 |

| 103 |

| | (72 | ) | | (3.5 | )% | |

| Marketing | 1,588 |

| 79 |

| 5 | % | | 1,639 |

| 81 |

| | (51 | ) | | (3.1 | )% | |

| Total Direct Operating Expenses | $ | 23,254 |

| $ | 1,152 |

| 76 | % | | $ | 22,790 |

| $ | 1,129 |

| | $ | 464 |

| | 2.0 | % | |

| |

|

|

| |

|

| |

| |

| |

| Real Estate Taxes | 6,253 |

| 310 |

| 21 | % | | 5,555 |

| 275 |

| | 698 |

| | 12.6 | % | |

| Insurance | 901 |

| 45 |

| 3 | % | | 958 |

| 48 |

| | (57 | ) | | (5.9 | )% | |

| Total Fixed Operating Expenses | $ | 7,154 |

| $ | 355 |

| 24 | % | | $ | 6,513 |

| $ | 323 |

| | $ | 641 |

| | 9.8 | % | |

| Total Property Operating Expenses | $ | 30,408 |

| $ | 1,507 |

| 100 | % | | $ | 29,303 |

| $ | 1,452 |

| | $ | 1,105 |

| | 3.8 | % | |

|

| | | | | | | | | | |

| Same-community beds | 20,167 |

| | | | | | | | | | |

|

| | | | | | | | | | |

(1) Represents gross costs before recoveries and includes student amenities such as internet. | |

(2) Includes property-level general and administrative cost, dining and retail costs as well as regional and other corporate costs of supporting the communities. | |

(3) Includes general maintenance costs, grounds and landscaping, turn costs and life safety costs. | |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, |

| | Six months ended June 30, |

| |

| 2014 | 2013 |

| Change |

| | 2014 | 2013 |

| Change |

| |

|

|

|

|

|

| |

|

|

|

|

| |

| Occupancy |

|

|

|

|

|

| |

|

|

|

|

|

| |

| Physical | 87.6 | % | 87.3 | % |

| 30 |

| bps | | 90.3 | % | 89.5 | % |

| 80 |

| bps | |

| Economic | 85.6 | % | 84.6 | % |

| 100 |

| bps | | 88.8 | % | 87.4 | % |

| 140 |

| bps | |

|

|

|

| |

| |

|

|

| |

| |

| NarPAB | $ | 544 |

| $ | 492 |

|

| 10.6 | % |

| | $ | 563 |

| $ | 509 |

|

| 10.6 | % |

| |

| Other income per avail. bed | $ | 43 |

| $ | 40 |

|

| 7.5 | % |

| | $ | 39 |

| $ | 40 |

|

| (2.5 | )% |

| |

| RevPAB | $ | 587 |

| $ | 532 |

|

| 10.3 | % |

| | $ | 602 |

| $ | 549 |

|

| 9.7 | % |

| |

| | | | | | | | | | | | | |

| Operating expense per bed | $ | 266 |

| $ | 254 |

|

| 4.7 | % |

| | $ | 268 |

| $ | 254 |

|

| 5.5 | % |

| |

|

|

|

| |

| |

|

|

| |

| |

| Operating margin | 54.7 | % | 52.3 | % |

| 240 |

| bps | | 55.5 | % | 53.7 | % |

| 180 |

| bps | |

|

|

|

| |

| |

|

|

| |

| |

| Design Beds | 78,906 |

| 70,154 |

|

| 12.5 | % |

| | 161,172 |

| 139,934 |

|

| 15.2 | % |

| |

| | | | | | | | | | | | | |

| NOTE: Operating statistics for the prior year exclude communities classified as discontinued operations. Effective January 1, 2014, the Trust adopted the new accounting guidance relating to the reporting of discontinued operations. It is anticipated that the Trust's one-off property dispositions will no longer quality as discontinued operations. |

|

| | |

| SAME-COMMUNITY STATISTICS |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, |

|

| Six Months Ended June 30, |

| |

| 2014 | 2013 |

| Change |

|

| 2014 | 2013 |

| Change |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

| Occupancy |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Physical | 88.0 | % | 88.2 | % |

| (20 | ) | bps |

| 90.6 | % | 90.5 | % |

| 10 |

| bps | |

| Economic | 85.8 | % | 84.8 | % |

| 100 |

| bps |

| 89.3 | % | 87.8 | % |

| 150 |

| bps | |

|

|

|

| |

|

|

|

|

|

| |

| |

| NarPAB | $ | 521 |

| $ | 509 |

|

| 2.4 | % |

|

| $ | 543 |

| $ | 528 |

|

| 2.8 | % |

| |

| Other income per avail. bed | $ | 39 |

| $ | 37 |

|

| 5.4 | % |

|

| $ | 35 |

| $ | 35 |

|

| — | % |

| |

| RevPAB | $ | 560 |

| $ | 546 |

|

| 2.5 | % |

|

| $ | 578 |

| $ | 563 |

|

| 2.7 | % |

| |

| | | | | | | | | | | | | |

| Operating expense per bed | $ | 251 |

| $ | 245 |

|

| 2.4 | % |

|

| $ | 251 |

| $ | 242 |

|

| 3.8 | % |

| |

|

|

|

| |

|

|

|

|

| |

| |

| Operating margin | 55.2 | % | 55.2 | % |

| — |

| bps |

| 56.5 | % | 56.9 | % |

| (40 | ) | bps | |

|

|

|

| |

|

|

|

|

| |

| |

Design Beds (1) | 60,501 |

| 60,501 |

|

| — | % |

|

| 121,002 |

| 121,002 |

|

| — | % |

| |

| | | | | | | | | | | | | |

(1) In June 2013 we converted 64 historically double occupancy rooms at University Towers to single occupancy. This reduced design beds by 64 beds. In August, we reconfigured rooms at the Berk reducing design beds by 2. As these changes did not impact occupied beds they were made to the prior year design beds so that information between periods is comparable. | |

|

| | | | | | | | | | | | | | | | | | | | | | |

| |

|

| |

| |

| | Preleasing at July 21, | |

| |

| |

| |

| Design Beds | | % of NOI | | 2013 Opening Occupancy | | 2014 |

| 2013 | | Preleasing Ahead/(Behind) | | Projected Rate Growth | |

| |

|

| |

| |

| |

|

|

| |

| |

| |

| | Same-Communities - by Tier |

|

| |

|

| |

|

| |

|

|

| |

| |

| |

| | Prior Year Occupancy Below 90% (Tier 1) | 3,597 |

| | 12.5 | % | | 81.7 | % | | 82.6 | % |

| 66.3 | % | | 16.3 | % | | (0.6 | )% | |

| | Prior Year Occupancy 90% to 94.9% (Tier 2) | 5,992 |

| | 27.3 | % | | 92.3 | % | | 87.0 | % |

| 81.9 | % | | 5.1 | % | | 1.1 | % | |

| | Prior Year Occupancy 95% to 97.9% (Tier 3) | 5,514 |

| | 21.6 | % | | 96.4 | % | | 90.6 | % |

| 90.6 | % | | — | % | | 2.5 | % | |

| | Subtotal - Tiers 1 - 3 | 15,103 |

| | 61.4 | % | | 91.3 | % | | 87.3 | % |

| 81.4 | % | | 5.9 | % | |

| |

| | Prior Year Occupancy 98% and Above (Tier 4) | 7,755 |

| | 38.6 | % | | 99.8 | % | | 97.9 | % |

| 98.8 | % | | (0.9 | )% | | 3.1 | % | |

| | Total Same-Communities (1) | 22,858 |

| | 100.0 | % | | 94.2 | % | | 90.9 | % |

| 87.3 | % | | 3.6 | % | | 2.0 | % | |

| | Total New-Communities (1) | 6,006 |

| |

| |

| | 94.7 | % |

|

| |

| |

| |

| | Total Communities | 28,864 |

| |

|

| |

|

| | 91.7 | % |

|

|

| |

|

| |

|

| |

| |

|

|

| |

|

| |

|

| |

|

|

|

|

| |

|

| |

|

| |

| | Projected Fall Revenue: | |

|

| |

| | Based on current leasing velocity shown above and individual market conditions, we are projecting fall revenue to be up 3% to 4%, including a 1% to 2% increase in occupancy and an approximate 2% growth in net rental rates. | |

| |

| | | | |

| | | | | | | | | | | | | | | | |

| | (1) The same-community designation for leasing purposes is different than for financial statement purposes. A community is considered same-community for leasing when the Company has managed the leasing process for at least two leasing cycles, including the Fall 2014 lease cycle. New-communities include existing new communities listed on page 18 that are not ticked (1) and all more than 50% owned developments delivering in 2014, including the presale at FIU. | |

|

| | |

| SAME-COMMUNITY PRELEASING BY REGION AND DISTANCE |

|

| | | | | | | | | | | | | | | | | | | | |

|

|

| |

| |

| | Preleasing at July 21, | |

|

| |

|

|

| Design Beds | | % of NOI | | 2013 Opening Occupancy | | 2014 |

| 2013 | | Preleasing Ahead/(Behind) | | Projected Rate Growth |

|

|

| |

|

| |

|

| |

|

|

|

|

| |

|

| |

|

|

Same-Communities - by Region (1) |

|

| |

|

| |

|

| |

|

|

|

|

| |

|

| |

|

|

| Mid-Atlantic | 4,724 |

| | 28.8 | % | | 97.2 | % | | 96.8 | % |

| 94.3 | % | | 2.5 | % | | 1.7 | % |

| Midwest | 2,636 |

| | 8.9 | % | | 92.2 | % | | 83.6 | % |

| 83.0 | % | | 0.6 | % | | 2.8 | % |

| North | 2,547 |

| | 10.4 | % | | 97.0 | % | | 95.4 | % |

| 90.4 | % | | 5.0 | % | | 2.7 | % |

| South Central | 4,094 |

| | 21.7 | % | | 97.0 | % | | 95.5 | % |

| 92.9 | % | | 2.6 | % | | 3.4 | % |

| Southeast | 6,765 |

| | 20.6 | % | | 94.0 | % | | 86.1 | % |

| 85.3 | % | | 0.8 | % | | 1.5 | % |

| West | 2,092 |

| | 9.6 | % | | 81.5 | % | | 87.4 | % |

| 68.7 | % | | 18.7 | % | | (0.9 | )% |

| Total Same-Communities | 22,858 |

| | 100.0 | % | | 94.2 | % | | 90.9 | % |

| 87.3 | % | | 3.6 | % | | 2.0 | % |

|

|

| |

|

| |

|

| |

|

|

|

|

| |

|

| |

|

|

| | | | | | | | | | | | | |

| Same-Communities - by Distance from Campus |

|

| |

|

| |

|

| |

|

|

|

|

| |

|

| |

|

|

| 0-0.2 miles | 13,127 |

| | 66.6 | % | | 93.8 | % | | 92.3 | % |

| 87.5 | % | | 4.8 | % | | 1.8 | % |

| 0.21-0.49 miles | 2,144 |

| | 8.3 | % | | 91.1 | % | | 90.2 | % |

| 82.1 | % | | 8.1 | % | | (0.2 | )% |

| 0.5-0.99 miles | 2,006 |

| | 6.8 | % | | 96.1 | % | | 92.4 | % |

| 89.3 | % | | 3.1 | % | | 3.5 | % |

| 1.0-1.99 miles | 4,466 |

| | 15.2 | % | | 95.5 | % | | 85.4 | % |

| 87.3 | % | | (1.9 | )% | | 3.1 | % |

| 2.0 & > miles | 1,115 |

| | 3.1 | % | | 96.2 | % | | 95.2 | % |

| 91.0 | % | | 4.2 | % | | 1.7 | % |

| Total Same-Communities | 22,858 |

| | 100.0 | % | | 94.2 | % | | 90.9 | % |

| 87.3 | % | | 3.6 | % | | 2.0 | % |

| | | | | | | | | | | | | | |

(1) See definition of regions on page 20. |

|

| | |

| NEW SUPPLY AND ENROLLMENT - EdR MARKETS |

|

|

| New supply slowed 9% from 2014 to 2015 |

EdR Market and Revenue Growth

|

|

| *Enrollment projection represents the 4-year enrollment CAGR through 2013 for our markets. The mid-point of previously provided fall leasing guidance was used for 2014 revenue growth projections. |

|

| | |

| OWNED COMMUNITY PROJECTED 2015 NEW SUPPLY AND DEMAND INFORMATION |

|

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Owned Community Projected 2015 New Supply and Demand Information by Region | | |

| | | | | | | | | | | | |

Region (4) | Owned Beds (3) | | Percentage of Owned Beds | | EdR NOI % (1) | | Enrollment Growth 3 Year CAGR - Universities Served | | 2015 New Supply % | | Variance |

| West | 3,227 |

| | 10 | % | | 12 | % | | 1.9 | % | | 0.3 | % | | 1.6 | % |

| Mid Atlantic | 6,201 |

| | 19 | % | | 25 | % | | 0.8 | % | | 2.6 | % | | (1.8 | )% |

| North | 3,707 |

| | 11 | % | | 10 | % | | 0.3 | % | | 1.8 | % | | (1.5 | )% |

| South Central | 9,342 |

| | 29 | % | | 33 | % | | 2.0 | % | | 2.4 | % | | (0.4 | )% |

| Southeast | 7,307 |

| | 23 | % | | 15 | % | | 1.4 | % | | 1.5 | % | | (0.1 | )% |

| Midwest | 2,636 |

| | 8 | % | | 6 | % | | 2.2 | % | | 4.3 | % | | (2.1 | )% |

| Total | 32,420 |

| | 100 | % | | 101 | % | | 1.4 | % | | 1.8 | % | | (0.4 | )% |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Region (4) | Anticipated 2015 Enrollment Growth (2) | | 2015 Supply Growth | | Variance | | | | | | |

| West | 2,749 |

| | 637 |

| | (2,112 | ) | | | | | | |

| Mid Atlantic | 1,269 |

| | 4,534 |

| | 3,265 |

| | | | | | |

| North | 2,031 |

| | 4,087 |

| | 2,056 |

| | | | | | |

| South Central | 2,671 |

| | 4,207 |

| | 1,536 |

| | | | | | |

| Southeast | 3,208 |

| | 4,082 |

| | 874 |

| | | | | | |

| Midwest | 2,053 |

| | 4,064 |

| | 2,011 |

| | | | | | |

| Total | 13,981 |

| | 21,611 |

| | 7,630 |

| | | | | | |

| | | | | | | | | | | | |

| NOTE: Schedule represents all markets served by EdR communities and includes all announced 2014 and 2015 developments. Data was obtained from the National Center for Education Statistics, Axiometrics and local market data. |

| |

(1) Includes 2014 and 2015 development deliveries, the planned acquisition of The District on Apache at Arizona State University and the presale at Florida International University (see page 14). NOI is based on current 2014 forecasted net operating income with annualization for 2014 developments and acquisitions and proforma NOI for 2015 developments. |

(2) Extrapolated from 2013 enrollment statistics from Nation Center of Education Statistics using the previous 3-year enrollment growth percentage. |

(3) Total Owned Beds reported herein include Total Communities design beds on page 9 of 28,864 plus 1,610 of beds related to the 2015 deliveries at the University of Kentucky, 390 beds for 2015 delivery at the University of Connecticut, 656 beds for 2015 delivery at the University of Louisville, and 900 beds related to the planned acquisition at Arizona State University in 2014 (see page 14). |

(4) See definition of regions on page 20. |

|

| | |

| OWNED COMMUNITY PROJECTED 2015 NEW SUPPLY AND DEMAND INFORMATION

|

|

| | | | | |

| | | | | | |

| | | | | | |

| Projected 2015 New Supply Sorted by Percentage Increase | | |

| | | | | | |

| New Supply Growth | University Markets | EdR Bed Count | Pro Forma EdR NOI %(1) |

| 0% | 11 | 28% | 8,428 | 26% | 27% |

| 0.1% to 1.0% | 5 | 12% | 2,661 | 8% | 7% |

| 1.0% - 3.0% | 10 | 25% | 11,249 | 35% | 35% |

| 3.0% - 5.0% | 10 | 25% | 7,254 | 22% | 23% |

| > 5.0% | 4 | 10% | 2,828 | 9% | 8% |

| Total | 40 | 100% | 32,420 | 100% | 100% |

| | | | | | |

| | | | | | |

| University Markets with > 5% Increase in 2015 New Supply |

| | | | |

|

| | | | |

| University | New Supply Increase | Pro Forma EdR NOI % | | | |

| University of Louisville | 8.4% | 2.4% | | | |

| Saint Louis University | 7.3% | 1.1% | | | |

| University of Oklahoma | 6.8% | 1.1% | | | |

| University of Mississippi | 6.5% | 3.3% | | | |

| | | 7.9% | | | |

| | | | | | |

| NOTE: Schedule represents all markets served by EdR communities and includes all announced 2014 developments. Data was obtained from the National Center for Education Statistics, Axiometrics and local market data. |

| |

(1) Includes 2014 and 2015 development deliveries, the planned acquisition of The District on Apache at Arizona State University and the presale at Florida International University (see page 14). NOI is based on current 2014 forecasted net operating income with annualization for 2014 developments and acquisitions and proforma NOI for 2015 developments. |

|

| | |

| OWNED DEVELOPMENT SUMMARY |

|

| | | | | | | | | | | | | | | |

| (Amounts in thousands except bed counts) | | | | | | | | |

| | | | | | | | | | | |

| Active Projects | | | | | | | | |

| | Project | Project Type | Bed Count | Estimated Start Date | Anticipated Completion Date | Total Project Development Cost | EdR's Ownership Percentage | EdR's Share of Development Cost | EdR's Share of Development Cost to be Funded | |

| | University of Colorado - The Lotus | Wholly Owned | 195 |

| In progress | Summer 2014 | 20,830 |

| 100 | % | 20,830 |

| — |

| |

| | University of Kentucky - Haggin Hall | ONE Plan (1) | 396 |

| In progress | Summer 2014 | 23,802 |

| 100 | % | 23,802 |

| 3,835 |

| |

| | University of Kentucky - Champions Court I | ONE Plan (1) | 740 |

| In progress | Summer 2014 | 45,924 |

| 100 | % | 45,924 |

| 2,759 |

| |

| | University of Kentucky - Champions Court II | ONE Plan (1) | 427 |

| In progress | Summer 2014 | 23,808 |

| 100 | % | 23,808 |

| 1,022 |

| |

| | University of Kentucky - Woodland Glen I & II | ONE Plan (1) | 818 |

| In progress | Summer 2014 | 44,491 |

| 100 | % | 44,491 |

| 4,022 |

| |

| | University of Minnesota - The Marshall | Joint Venture (2) | 994 |

| In progress | Summer 2014 | 94,044 |

| 50 | % | 47,022 |

| — |

| (2) |

| | Duke University - 605 West | Joint Venture | 384 |

| In progress | Summer 2014 | 46,133 |

| 90 | % | 41,520 |

| 4,725 |

| |

| | University of Connecticut - The Oaks on the Square Ph III | Wholly Owned | 116 |

| In progress | Summer 2014 | 12,819 |

| 100 | % | 12,819 |

| 1,584 |

| |

| | Total - 2014 Deliveries | | 4,070 |

| | | 311,851 |

| | 260,216 |

| 17,947 |

| |

| | | | | | | | | | | |

| | University of Kentucky - Woodland Glen III, IV & V | ONE Plan (1) | 1,610 |

| In progress | Summer 2015 | 101,172 |

| 100 | % | 101,172 |

| 67,648 |

| |

| | University of Georgia - Georgia Heights | Joint Venture (2) | 292 |

| In progress | Summer 2015 | 55,615 |

| 50 | % | 27,808 |

| 4,665 |

| (2) |

| | University of Connecticut - The Oaks on the Square Ph IV | Wholly Owned | 390 |

| In progress | Summer 2015 | 45,000 |

| 100 | % | 45,000 |

| 44,771 |

| |

| | University of Louisville - The Retreat at Louisville | Joint Venture | 656 |

| In Progress | Summer 2015 | 45,000 |

| 75 | % | 33,750 |

| 33,750 |

| |

| | Total - 2015 Deliveries | | 2,948 |

|

|

| 246,787 |

|

| 207,730 |

| 150,834 |

| |

| | | | | | | | | | | |

| | University of Kentucky - Limestone Park I & II | ONE Plan (1) | 1,141 |

| In progress | Summer 2016 | 83,911 |

| 100 | % | 83,911 |

| 81,272 |

| |

| | Total - 2016 Deliveries | | 1,141 |

| | | 83,911 |

| | 83,911 |

| 81,272 |

| |

| | Total Active Projects | | 8,159 |

| | | 642,549 |

| | 551,857 |

| 250,053 |

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Pre-sale | | | | | | | | |

| | Project | Project Type | Bed Count | Estimated Start Date | Anticipated Completion Date | Purchase Price | | | | |

| | Florida International University - 109 Tower | Presale | 542 |

| In progress | Summer 2014 | 43,500 |

| | | | |

| | | |

| | |

|

|

| | | |

| | | | | | | | | | | |

| | (1) The On-Campus Equity Plan, or The ONE Plan SM, is our equity program for universities, which allows universities to use EdR's equity and financial stability to develop and revitalize campus housing while preserving their credit capacity for other campus projects. The ONE Plan SM offers one service provider and one equity source to universities seeking to modernize on-campus housing to meet the needs of today's students. |

| | (2) These projects are not majority owned. As such, they will not be consolidated and we will recognize our portion of profits through equity in earnings on the income statement. Also as a result, the costs to be funded only represent EdR’s remaining required equity contribution. |

|

| | |

| THIRD-PARTY DEVELOPMENT SUMMARY |

|

| | | | | | | | | | | | | | |

| (Amounts in thousands except bed counts) | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| THIRD-PARTY PROJECTS | | | | | | | | |

| Project | Bed Count | Estimated Start Date | Anticipated Completion Date | Project Development Cost | Total Project Fees | Fees Earned Prior Year (1) | Fees Earned Six Months Ended June 30, 2014 (1) | Remaining Fees to Earn |

| West Chester University of Pennsylvania Phase II | 653 |

| In progress | Summer 2014 | 56,639 |

| 1,499 |

| 934 |

| 412 |

| 153 |

|

| Wichita State University - Shocker Hall | 784 |

| In progress | Summer 2014 | 60,034 |

| 1,902 |

| 614 |

| 960 |

| 328 |

|

| Clarion University of Pennsylvania | 728 |

| Spring 2014 | Fall 2015 | 55,104 |

| 2,092 |

| — |

| 152 |

| 1,940 |

|

| East Stroudsburg University - Pennsylvania Ph II | 488 |

| Spring 2015 | Summer 2016 | TBD |

| TBD |

| — |

| — |

| — |

|

| Total | 2,653 |

|

|

| 171,777 |

| 5,493 |

| 1,548 |

| 1,524 |

| 2,421 |

|

| |

| NOTE: The initiation and completion of an awarded project that has not begun construction is contingent upon execution of transactional documents, including such items as development agreements and ground leases, and obtaining financing. |

| | | | | | | | | |

(1) Amount may not tie to third-party development services revenue on the statement of operations as this schedule only includes fees earned on projects that are in progress or recently completed. |

| | | | | | | | | |

|

| | | | | | | | | | | | | |

| | | | | | | | |

| as of June 30, 2014 | | | | | Principal Outstanding (5) | Weighted Average Interest Rate (5) | Average Term to Maturity (5) (in years) |

| (dollars in thousands) | | | | |

| | | | | |

| Total Debt to Gross Assets | | | | |

Debt (1) | $ | 612,773 |

| | | Fixed Rate - Mortgage Debt (1) | $ | 225,097 |

| 5.6 | % | 2.8 |

|

Gross Assets (2) | 1,882,577 |

| | | Variable Rate - Mortgage Debt | 34,000 |

| 2.3 | % | 2.0 |

|

| Debt to Gross Assets | 32.5 | % | | | Variable Rate - Construction Debt | 100,176 |

| 2.3 | % | 1.1 |

|

| | | | | Fixed Rate - 5 Yr. Unsecured Term Loan (5) | 65,000 |

| 3.0 | % | 4.5 |

|

| Net Debt to Enterprise Value | | | | Fixed Rate - 7 Yr. Unsecured Term Loan (5) | 122,500 |

| 4.0 | % | 6.5 |

|

Net Debt (1) | $ | 601,611 |

| | | Variable Rate - Unsecured Revolving Credit Facility | 66,000 |

| 1.6 | % | 3.5 |

|

Market Equity (3) | 1,509,974 |

| | | Debt (1) / Weighted Average | $ | 612,773 |

| 3.8 | % | 3.5 |

|

| Enterprise Value | $ | 2,111,585 |

| | | Less Cash | 11,162 |

| | |

| | | | | Net Debt | $ | 601,611 |

| | |

| Net Debt to Enterprise Value | 28.5 | % | | | | | | |

| | | | | Interest Coverage (TTM) | 4.4 | x | | |

| | | | | Net Debt to EBITDA - Adjusted (TTM) (4) | 5.6 | x | | |

| | | | | Variable Rate Debt to Total Debt | 32.7 | % | | |

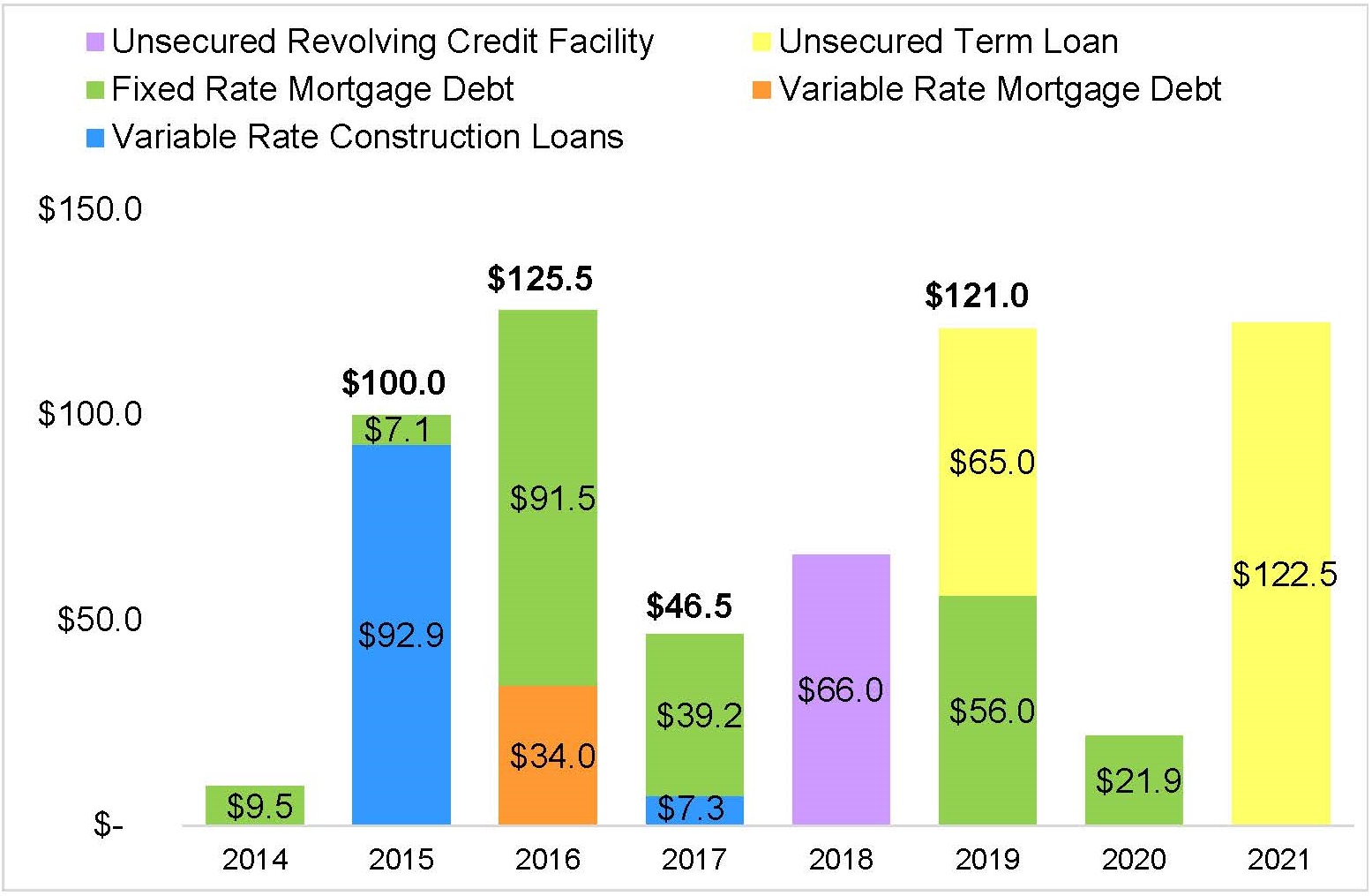

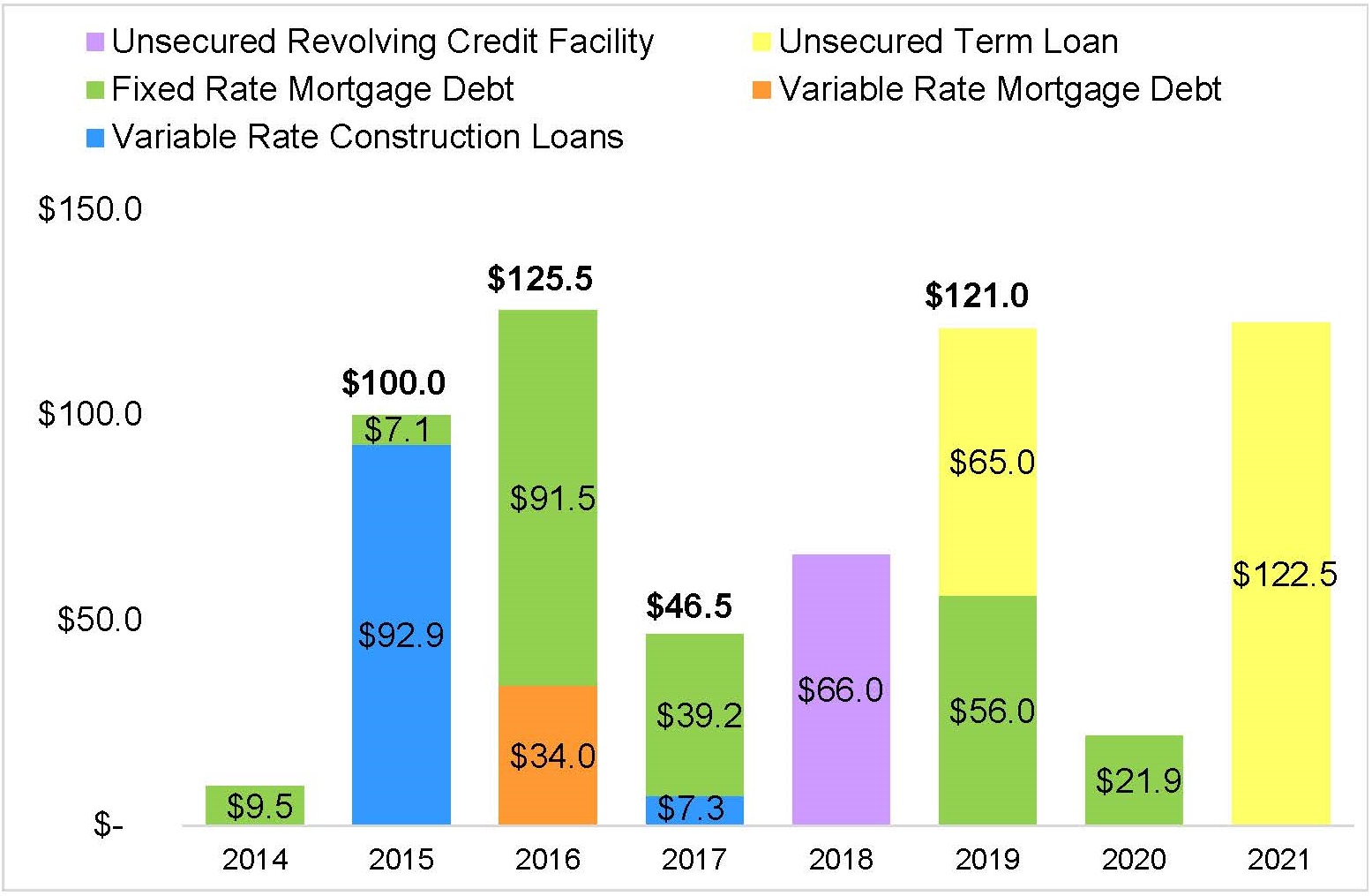

| Debt Maturity Schedule (in millions) | | |

| | |

|

| | | | | | | | | | | | | | | | |

Weighted Average Interest Rate of Debt Maturing Each Year (5) |

| | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 |

| Fixed Rate Mortgage Loans | | 4.9% | | 5.0% | | 5.5% | | 5.5% | | —% | | 6.0% | | 5.7% | | —% |

| | | | | | | | | | | | | | | | | |

| Total Debt | | 4.9% | | 2.5% | | 4.6% | | 5.0% | | 1.6% | | 4.4% | | 5.7% | | 4.0% |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

(1) Excludes unamortized debt premium of $1.9 million as of June 30, 2014. |

(2) Excludes accumulated depreciation of $216.5 million as of June 30, 2014 including $10.0 million related to held for sale assets. |

(3) Market equity includes 139,555,846 shares of the Company's common stock and 1,037,600 Operating Partnership units and is calculated using $10.74 per share, the closing price of the Company's common stock on June 30, 2014. |

(4) Net Debt to EBITDA - Adjusted is calculated to normalize the impact of non-producing construction debt. In the calculation, Net Debt is total debt less cash and excludes non-producing debt related to assets under development at time of calculation. EBITDA is Proforma Adjusted EBITDA, which includes proforma adjustments to reflect all acquisitions and development assets that are opened as if such had occurred at the beginning of the 12 month period being presented. |

(5) In connection with the term loans, the Trust entered into interest rate swaps to effectively fix the interest rate on the term loans. The weighted average interest rates reflect the swapped (fixed) rate plus the current margin. |

|

| | | | | | | | |

| Amounts in thousands, except share and per share data | | Year ending December 31, 2014 |

| (Unaudited) | | Low End | | High End |

| | | | | |

| Net income attributable to EdR | | $ | 28,135 |

| | $ | 31,999 |

|

| | | | | |

| Gain on sale of collegiate housing assets | | (19,078) |

| | (19,078) |

|

| Impairment losses | | 11,780 |

| | 11,780 |

|

| Real estate related depreciation and amortization | | 58,373 |

| | 58,373 |

|

| Equity portion of real estate depreciation and amortization on equity investees | | 198 |

| | 198 |

|

| Noncontrolling interests | | 513 |

| | 513 |

|

| FFO | | $ | 79,921 |

| | $ | 83,785 |

|

| FFO adjustments: | | | | |

| Loss on extinguishment of debt | | 649 |

| | 649 |

|

Straight-line adjustment for ground leases (1) | | 4,835 |

| | 4,835 |

|

| Acquisition costs | | 23 |

| | 23 |

|

| Severance costs, net of tax | | 285 |

| | 285 |

|

| FFO adjustments | | 5,792 |

| | 5,792 |

|

| | | | | |

FFO on Participating Developments: (2) | | | | |

| Interest on loan to Participating Development | | (5,582 | ) | | (5,582 | ) |

| Development fees on Participating Development, net of costs and tax | | (1,560 | ) | | (1,560 | ) |

| FFO on Participating Developments | | (7,142 | ) | | (7,142 | ) |

| | | | | |

| Core FFO | | $ | 78,571 |

| | $ | 82,435 |

|

| | | | | |

FFO per weighted average share/unit (3) | | $ | 0.62 |

| | $ | 0.65 |

|

| | | | | |

Core FFO per weighted average share/unit (3) | | $ | 0.61 |

| | $ | 0.64 |

|

| | | | | |

Weighted average shares/units (3) | | 128,805 |

| | 128,805 |

|

| | | | | |

| (1) Represents the straight-line rent expense adjustment required by GAAP related to ground leases. As ground lease terms range from 40 to 99 years, the adjustment to straight-line these agreements becomes material to our operating results, distorting the economic results of the communities. |

| (2) FFO on participating developments represents the economic impact of interest and fees not recognized in net income due to the Company having a participating investment in the third-party development. The adjustment for development fees is recognized under the same percentage of completion method of accounting used for third-party development fees. The adjustment for interest income is based on terms of the loan. |

| (3) FFO and Core FFO per weighted average share/unit were computed using the weighted average of all shares and operating partnership units outstanding, regardless of their dilutive impact. |

|

| | |

| COMMUNITY LISTING - OWNED |

|

| | | | | | | | | | | | | | | | |

| Name |

| Primary University Served |

| Acquisition / Development Date |

| # of Beds |

| Name |

| Primary University Served |

| Acquisition / Development Date |

| # of Beds |

| Players Club |

| Florida State University |

| Jan ’05 |

| 336 |

| | Irish Row |

| University of Notre Dame |

| Nov '11 |

| 326 |

|

| The Commons |

| Florida State University |

| Jan ’05 |

| 732 |

| | GrandMarc at Westberry Place (ONE Plan) |

| Texas Christian University |

| Dec '11 |

| 562 |

|

| University Towers |

| North Carolina State University |

| Jan ’05 |

| 889 |

| | The Reserve on Stinson |

| University of Oklahoma |

| Jan '12 |

| 612 |

|

| The Reserve on Perkins |

| Oklahoma State University |

| Jan ’05 |

| 732 |

| | Campus West (ONE Plan) |

| Syracuse University |

| Aug '12 |

| 313 |

|

| The Pointe |

| Pennsylvania State University |

| Jan ’05 |

| 984 |

| | East Edge |

| University of Alabama |

| Aug '12 |

| 774 |

|

| Commons on Kinnear |

| The Ohio State University |

| Jan ’05 |

| 502 |

| | The Province |

| East Carolina University |

| Sept '12 |

| 728 |

|

| The Lofts |

| University of Central Florida |

| Jan ’05 |

| 730 |

| | The District on 5th |

| University of Arizona |

| Oct '12 |

| 764 |

|

| The Reserve at Athens |

| University of Georgia |

| Jan ’05 |

| 612 |

| | Campus Village |

| Michigan State University |

| Oct '12 |

| 355 |

|

| The Reserve at Columbia |

| University of Missouri |

| Jan ’05 |

| 676 |

| | The Province |

| Kent State University |

| Nov '12 |

| 596 |

|

| The Pointe at South Florida |

| University of South Florida |

| Jan ’05 |

| 1,002 |

| | The Suites at Overton Park |

| Texas Tech University |

| Dec '12 |

| 465 |

|

| Commons at Knoxville |

| University of Tennessee |

| Jan ’05 |

| 708 |

| | The Centre at Overton Park |

| Texas Tech University |

| Dec '12 |

| 400 |

|

| Campus Creek |

| University of Mississippi |

| Feb ’05 |

| 636 |

| | | | | | | | |

| Campus Lodge |

| University of Florida |

| Jun ’05 |

| 1,115 |

| | | | Total Same-Communities | | | | 20,167 |

|

| Cape Trails |

| Southeast Missouri State University |

| Jan ’06 |

| 360 |

| | | | | | | | |

| Carrollton Crossing |

| University of West Georgia |

| Jan ’06 |

| 336 |

| | The Lotus |

| University of Colorado, Boulder |

| Nov '11 |

| 40 |

|

| River Pointe |

| University of West Georgia |

| Jan ’06 |

| 504 |

| | The Oaks on the Square (1) |

| University of Connecticut |

| Aug '12, Aug ' 13 |

| 503 |

|

| The Avenue at Southern |

| Georgia Southern University |

| Jun ’06 |

| 624 |

| | 3949 (1) |

| Saint Louis University |

| Aug '13 |

| 256 |

|

| The Reserve at Saluki Pointe |

| Southern Illinois University |

| Aug '08, Aug '09 |

| 768 |

| | Central Hall I & II (ONE Plan) |

| University of Kentucky |

| Aug '13 |

| 601 |

|

| University Village on Colvin (ONE Plan) |

| Syracuse University |

| Aug '09 |

| 432 |

| | 2400 Nueces (ONE Plan) (1) |

| University of Texas at Austin |

| Aug '13 |

| 655 |

|

| GrandMarc at The Corner |

| University of Virginia |

| Oct '10 |

| 641 |

| | Roosevelt Point (1) |

| Arizona State University - Downtown Phoenix |

| Aug '13 |

| 609 |

|

| Wertland Square |

| University of Virginia |

| Mar ’11 |

| 152 |

| | The Retreat at Oxford (1) |

| University of Mississippi |

| Aug '13 |

| 668 |

|

| Jefferson Commons |

| University of Virginia |

| Mar ’11 |

| 82 |

| | The Retreat at State College |

| Pennsylvania State University |

| Sept '13 |

| 587 |

|

| The Berk |

| University of California, Berkeley |

| May ’11 |

| 165 |

| | The Cottages on Lindberg |

| Purdue University |

| Sept '13 |

| 745 |

|

| University Village Towers |

| University of California, Riverside |

| Sept '11 |

| 554 |

| | The Varsity |

| University of Michigan |

| Dec '13 |

| 415 |

|

| | | | | | | | | | | Total New-Communities | | | | 5,079 |

|

| | | | | | | | | | | Total Owned-Communities | | | | 25,246 |

|

| | | | | | | | | | | | | | | |

(1) The same-community designation for leasing purposes is different than for financial statement purposes. This community is considered same-community for purposes of leasing, as the Company has managed the leasing process for the 2013/2014 lease cycle and is managing the leasing process for the 2014/2015 lease cycle. |

|

| | | | |

| Executive Management |

| | |

| Randy Churchey | Chief Executive Officer | | |

| Tom Trubiana | Chief Investment Officer | |

| Christine Richards | Chief Operating Officer | | |

| J. Drew Koester | Chief Accounting Officer | | |

|

|

| | |

| Corporate Headquarters | Investor Relations | | |

| EdR | ICR, LLC | | |

| 999 South Shady Grove Road, Suite 600 | Brad Cohen | | |

| Memphis, TN 38120 | (203) 682-8211 | | |

| (901) 259-2500 |

| | |

|

|

| | |

| Covering Analysts |

|

|

|

| Firm | Analyst | Contact # | Email |

| Bank of America - Merrill | Jana Galan | (646) 855-3081 | jana.galan@baml.com |

| Green Street Advisors | Dave Bragg | (949) 706-8142 | dbragg@greenstreetadvisors.com |

| Hilliard Lyons | Carol Kemple | (502) 588-1839 | ckemple@hilliard.com |

| J.P. Morgan Securities Inc. | Anthony Paolone | (212) 622-6682 | anthony.paolone@jpmorgan.com |

| KeyBanc Capital Markets | Karin A. Ford | (917) 368-2293 | kford@keybanccm.com |

| MLV & Co., LLC | Ryan Meliker | (212) 542-5872 | rmeliker@mlvco.com |

| Robert W. Baird & Co., Inc. | Paula Poskon | (571) 203-1677 | pposkon@rwbaird.com |

| Sandler O'Neill + Partners, L.P. | Alex Goldfarb | (212) 466-7937 | agoldfarb@sandleroneill.com |

| Stifel Nicolaus & Company Inc. | Rod Petrik | (443) 224-1306 | rpetrik@stifel.com |

| UBS Securities | Ross Nussbaum | (212) 713-2484 | ross.nussbaum@ubs.com |

| Wunderlich Securities | Craig Kucera | (540) 277-3366 | ckucera@wundernet.com |

|

| | | | | |

| | Design beds | | | |

| |

| Represents the sum of the monthly design beds in the portfolio during the period. |

| | | | | | |

| | Economic occupancy | | | |

| |

| Represents the effective occupancy calculated by taking net apartment rent accounted for on a GAAP basis for the respective period divided by potential rent for the respective period. |

| | | | | | |

| | FFO | | | |

| |

| Funds from operations as defined by the National Association of Real Estate Investment Trusts. |

| | | | | | |

| | GAAP | | | |

| |

| U.S. generally accepted accounting principles. |

| | | | |

| | Net apartment rent per available bed (NarPAB) | | |

| |

| Represents GAAP net apartment rent for the respective period divided by the sum of the design beds in the portfolio for each month included in the period reported. |

| | | | |

| | Net debt to EBITDA - adjusted | | |

| | | Net debt to EBITDA - adjusted is calculated to normalize the impact of non-producing construction debt. In the calculation, net debt is total debt less cash and excludes non-producing debt related to assets under development at time of calculation. EBITDA is Pro Forma Adjusted EBITDA, which includes proforma adjustments to reflect all acquisitions and development assets that are opened as if such had occurred at the beginning of the 12 month period being presented. |

| | | | | | |

| | Operating expense per bed | | | |

| |

| Represents community-level operating expenses excluding management fees, depreciation and amortization. |

| | | | |

| | Other income per available bed | | | |

| |

| Represents other GAAP-based income for the respective period divided by the sum of the design beds in the portfolio for each of the included months. Other income includes service/application fees, late fees, termination fees, parking fees, transfer fees, damage recovery, utility recovery, and other misc. |

| | | | | | |

| | Physical occupancy | | | |

| |

| Represents a weighted average of the month end occupancies for each month included in the period reported. |

| | | | | | |

| | Regional Definitions | | | |

| | | Regions are defined as follows: Mid-Atlantic: North Carolina, Pennsylvania, Connecticut, New York, Virginia; Midwest: Oklahoma, Missouri, Kansas, Minnesota; North: Michigan, Ohio, Indiana, Illinois; South Central: Texas, Tennessee, Mississippi, Kentucky; Southeast: Florida, South Carolina, Alabama, Georgia; West: Arizona, California, Colorado |

| | | | | | |

| | Revenue per available bed (RevPAB) | | | |

| |

| Represents total revenue (net apartment rent plus other income) for the respective period divided by the sum of the design beds in the portfolio for each month included in the period reported. |

| | | | | | |

| | Revenue per occupied bed (RevPOB) | | | |

| | | Represents total revenue (net apartment rent plus other income) for the respective period divided by the sum of occupied beds in the portfolio for each month included in the period reported. |

| | | | | | |

| | Same community | | | |

| |

| Includes communities that have been owned for more than a year as of the beginning of the current fiscal year. |

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

Statements about the Company’s business that are not historical facts are “forward-looking statements,” which relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements are based on current expectations. You should not rely on our forward-looking statements because the matters that they describe are subject to known and unknown risks and uncertainties that could cause the Company’s business, financial condition, liquidity, results of operations, Core FFO, FFO and prospects to differ materially from those expressed or implied by such statements. Such risks are set forth under the captions “Risk Factors,” “Forward-Looking Statements” and "Management’s Discussion and Analysis of Financial Condition and Results of Operations” (or similar captions) in our most recent Annual Report on Form 10-K and our quarterly reports on Form 10-Q, and as described in our other filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date on which they are made, and, except as otherwise may be required by law, the Company undertakes no obligation to update publicly or revise any guidance or other forward-looking statement, whether as a result of new information, future developments, or otherwise except as required by law.