EXHIBIT 99.1

Education Realty Operating Partnership, L.P.

Table of Contents

Consolidated Financial Statements |

| |

| | Page |

| Report of Independent Registered Public Accounting Firm | |

| Consolidated Balance Sheets as of December 31, 2013 and 2012 | |

| Consolidated Statements of Operations for the years ended December 31, 2013, 2012 and 2011 | |

| Consolidated Statements of Changes in Partners' Capital and Noncontrolling Interests for the years ended December 31, 2013, 2012 and 2011 | |

| Consolidated Statements of Cash Flows for the years ended December 31, 2013, 2012 and 2011 | |

| Notes to the Consolidated Financial Statements | |

| | |

All other schedules are omitted since the required information is either not required or is not present in amounts sufficient to require submission of the schedule, or because the information required is included in the consolidated financial statements and notes thereto.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Partners of

Education Realty Operating Partnership, L.P.

Memphis, Tennessee

We have audited the accompanying consolidated balance sheets of Education Realty Operating Partnership, L.P. and subsidiaries (the “Operating Partnership”) as of December 31, 2013 and 2012, and the related consolidated statements of operations, changes in partners' capital and noncontrolling interests, and cash flows for each of the three years in the period ended December 31, 2013. These financial statements are the responsibility of the Operating Partnership's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Operating Partnership is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Operating Partnership's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of the Operating Partnership as of December 31, 2013 and 2012, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2013, in conformity with accounting principles generally accepted in the United States of America.

/s/ DELOITTE & TOUCHE LLP

Memphis, Tennessee

November 7, 2014

CONSOLIDATED BALANCE SHEETS

As of December 31,

|

| | | | | | | |

| | 2013 | | 2012 |

| | (Amounts in thousands, except unit data) |

| Assets: | |

| | |

|

| Collegiate housing properties, net | $ | 1,388,885 |

| | $ | 1,061,002 |

|

| Assets under development | 116,787 |

| | 159,264 |

|

| Corporate office furniture, net | 3,249 |

| | 3,007 |

|

| Cash and cash equivalents | 22,073 |

| | 17,039 |

|

| Restricted cash | 12,253 |

| | 6,410 |

|

| Student contracts receivable, net | 807 |

| | 708 |

|

| Receivable from managed third parties | 361 |

| | 629 |

|

| Notes receivable | 18,125 |

| | 21,000 |

|

| Goodwill and other intangibles, net | 3,822 |

| | 4,455 |

|

| Other assets | 44,203 |

| | 51,173 |

|

| Total assets | $ | 1,610,565 |

| | $ | 1,324,687 |

|

| | | | |

| Liabilities: | |

| | |

|

| Mortgage and construction loans, net of unamortized premium | $ | 422,681 |

| | $ | 398,846 |

|

| Unsecured revolving credit facility | 356,900 |

| | 79,000 |

|

| Accounts payable | 2,289 |

| | 1,749 |

|

| Accrued expenses | 65,357 |

| | 55,374 |

|

| Deferred revenue | 23,498 |

| | 17,964 |

|

| Total liabilities | 870,725 |

| | 552,933 |

|

| | | | |

| Commitments and contingencies (see Note 16) | — |

| | — |

|

| | | | |

| Redeemable limited partner units | 7,512 |

| | 7,780 |

|

| Redeemable noncontrolling interests | 2,359 |

| | 1,164 |

|

| | | | |

| Partners' capital: | | | |

| General partner - 20,760 units outstanding at both December 31, 2013 and 2012 | 190 |

| | 196 |

|

| Limited partners - 114,719,395 and 113,041,692 units issued and outstanding as of December 31, 2013 and 2012, respectively | 725,534 |

| | 757,526 |

|

| Total partners' capital | 725,724 |

| | 757,722 |

|

| Noncontrolling interests | 4,245 |

| | 5,088 |

|

| Total partners' capital | 729,969 |

| | 762,810 |

|

| Total liabilities and partners' capital | $ | 1,610,565 |

| | $ | 1,324,687 |

|

See accompanying notes to the consolidated financial statements.

CONSOLIDATED STATEMENTS OF OPERATIONS

Years Ended December 31,

|

| | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| | (Amounts in thousands, except unit and per unit data) |

| Revenues: | |

| | |

| | |

|

| Collegiate housing leasing revenue | $ | 167,476 |

| | $ | 124,087 |

| | $ | 91,517 |

|

| Third-party development consulting services | 2,989 |

| | 820 |

| | 4,103 |

|

| Third-party management services | 3,697 |

| | 3,446 |

| | 3,336 |

|

| Operating expense reimbursements | 10,214 |

| | 9,593 |

| | 8,604 |

|

| Total revenues | 184,376 |

| | 137,946 |

| | 107,560 |

|

| Operating expenses: | |

| | |

| | |

|

| Collegiate housing leasing operations | 79,957 |

| | 59,524 |

| | 44,892 |

|

| Development and management services | 6,477 |

| | 6,266 |

| | 5,506 |

|

| General and administrative | 7,678 |

| | 7,910 |

| | 6,810 |

|

| Depreciation and amortization | 48,098 |

| | 33,240 |

| | 23,858 |

|

| Ground lease expense | 7,622 |

| | 6,395 |

| | 5,498 |

|

| Reimbursable operating expenses | 10,214 |

| | 9,593 |

| | 8,604 |

|

| Total operating expenses | 160,046 |

| | 122,928 |

| | 95,168 |

|

| | | | | | |

| Operating income | 24,330 |

| | 15,018 |

| | 12,392 |

|

| | | | | | |

| Nonoperating expenses: | |

| | |

| | |

|

| Interest expense | 17,526 |

| | 14,390 |

| | 17,274 |

|

| Amortization of deferred financing costs | 1,758 |

| | 1,215 |

| | 1,197 |

|

| Loss on extinguishment of debt | — |

| | — |

| | 351 |

|

| Interest income | (447 | ) | | (283 | ) | | (175 | ) |

| Total nonoperating expenses | 18,837 |

| | 15,322 |

| | 18,647 |

|

| Income (loss) before equity in losses of unconsolidated entities, income taxes and discontinued operations | 5,493 |

| | (304 | ) | | (6,255 | ) |

| Equity in losses of unconsolidated entities | (203 | ) | | (363 | ) | | (447 | ) |

| Income (loss) before income taxes and discontinued operations | 5,290 |

| | (667 | ) | | (6,702 | ) |

| Income tax expense (benefit) | 203 |

| | (884 | ) | | (95 | ) |

| Income (loss) from continuing operations | 5,087 |

| | 217 |

| | (6,607 | ) |

| Discontinued operations: | |

| | |

| | |

|

| Income (loss) from operations of discontinued operations | (4,369 | ) | | 2,924 |

| | (6,556 | ) |

| Gain on sale of collegiate housing properties | 3,913 |

| | 5,496 |

| | 2,388 |

|

| Income (loss) from discontinued operations | (456 | ) | | 8,420 |

| | (4,168 | ) |

| Net income (loss) | 4,631 |

| | 8,637 |

| | (10,775 | ) |

| Less: Net income attributable to the noncontrolling interests | 227 |

| | 92 |

| | 188 |

|

| Net income (loss) attributable to unitholders | $ | 4,404 |

| | $ | 8,545 |

| | $ | (10,963 | ) |

| | | | | | |

| | | | | | |

| | | | | | |

|

| | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| | (Amounts in thousands, except unit and per unit data) |

| Earnings (loss) per unit information: | |

| | |

| | |

|

| Net income (loss) attributable to unitholders - basic and diluted: | |

| | |

| | |

|

| Continuing operations | $ | 0.04 |

| | $ | — |

| | $ | (0.09 | ) |

| Discontinued operations | — |

| | 0.08 |

| | (0.05 | ) |

| Net income (loss) attributable to unitholders per unit | $ | 0.04 |

| | $ | 0.08 |

| | $ | (0.14 | ) |

| | | | | | |

| Weighted average units outstanding – basic | 115,262,339 |

| | 102,109,701 |

| | 76,389,156 |

|

| Weighted average units outstanding – diluted | 115,469,596 |

| | 102,316,958 |

| | 76,389,156 |

|

| | | | | | |

| Amounts attributable to unitholders: | |

| | |

| | |

| Income (loss) from continuing operations, net of noncontrolling interests | $ | 4,857 |

| | $ | 194 |

| | $ | (6,843 | ) |

| Income (loss) from discontinued operations, net of noncontrolling interests | (453 | ) | | 8,351 |

| | (4,120 | ) |

| Net income (loss) | $ | 4,404 |

| | $ | 8,545 |

| | $ | (10,963 | ) |

See accompanying notes to the consolidated financial statements.

CONSOLIDATED STATEMENTS OF CHANGES IN PARTNERS' CAPITAL AND NONCONTROLLING INTERESTS

Years Ended December 31,

(Amounts in thousands, except unit data) |

| | | | | | | | | | | | | | | | | | | | | |

| | General Partner | | Limited Partners | | Noncontrolling Interests | | Total |

| | Units | | Amount | | Units | | Amount |

| Balance as of December 31, 2010 | 20,760 |

| | $ | 205 |

| | 58,636,296 |

| | $ | 324,538 |

| | $ | — |

| | $ | 324,743 |

|

| Issuance of units in exchange for contributions of gross equity offering proceeds | — |

| | — |

| | 32,996,205 |

| | 275,622 |

| | — |

| | 275,622 |

|

| Offering costs and underwriters discount paid on behalf of the Trust | — |

| | — |

| | — |

| | (11,288 | ) | | — |

| | (11,288 | ) |

| Vesting of restricted stock and restricted stock units | — |

| | — |

| | 44,280 |

| | 360 |

| | — |

| | 360 |

|

| Conversion of PIUs | — |

| | — |

| | — |

| | 1 |

| | — |

| | 1 |

|

| Amortization of restricted stock awards | — |

| | — |

| | 103,147 |

| | 1,165 |

| | — |

| | 1,165 |

|

| Distributions | — |

| | (5 | ) | | — |

| | (17,717 | ) | | — |

| | (17,722 | ) |

| Contributions from noncontrolling interests | — |

| | — |

| | — |

| | — |

| | 1,487 |

| | 1,487 |

|

| Net income (loss) | — |

| | (1 | ) | | — |

| | (11,013 | ) | | — |

| | (11,014 | ) |

| Balance as of December 31, 2011 | 20,760 |

| | 199 |

| | 91,779,928 |

| | 561,668 |

| | 1,487 |

| | 563,354 |

|

| Issuance of units in exchange for contributions of gross equity offering proceeds | — |

| | — |

| | 20,987,826 |

| | 229,219 |

| | — |

| | 229,219 |

|

| Offering costs and underwriters discount paid on behalf of the Trust | — |

| | — |

| | — |

| | (8,954 | ) | | — |

| | (8,954 | ) |

| Vesting of restricted stock awards and restricted stock units | — |

| | — |

| | 32,286 |

| | 360 |

| | — |

| | 360 |

|

| Amortization of restricted stock awards | — |

| | — |

| | 241,652 |

| | 768 |

| | — |

| | 768 |

|

| Distributions | — |

| | (7 | ) | | — |

| | (33,952 | ) | | — |

| | (33,959 | ) |

| Return of equity to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (349 | ) | | (349 | ) |

| Contributions from noncontrolling interests | — |

| | — |

| | — |

| | — |

| | 4,039 |

| | 4,039 |

|

| Net income (loss) | — |

| | 4 |

| | — |

| | 8,417 |

| | (89 | ) | | 8,332 |

|

| Balance as of December 31, 2012 | 20,760 |

| | 196 |

| | 113,041,692 |

| | 757,526 |

| | 5,088 |

| | 762,810 |

|

| Issuance of units in exchange for contributions of gross equity offering proceeds | — |

| | — |

| | 1,575,713 |

| | 17,177 |

| | — |

| | 17,177 |

|

| Offering costs and underwriters discount paid on behalf of the Trust | — |

| | — |

| | — |

| | (492 | ) | | — |

| | (492 | ) |

| Vesting of restricted stock awards and restricted stock units | — |

| | — |

| | 33,180 |

| | 360 |

| | — |

| | 360 |

|

| Amortization of restricted stock awards | — |

| | — |

| | 68,810 |

| | 1,337 |

| | — |

| | 1,337 |

|

| Distributions | — |

| | (9 | ) | | — |

| | (48,001 | ) | | — |

| | (48,010 | ) |

| Return of equity to noncontrolling interests | — |

| | — |

| | — |

| | — |

| | (795 | ) | | (795 | ) |

| Contributions from noncontrolling interests | — |

| | — |

| | — |

| | — |

| | 69 |

| | 69 |

|

| Purchase of noncontrolling interests | — |

| | — |

| | — |

| | (6,693 | ) | | (175 | ) | | (6,868 | ) |

| Net income | — |

| | 3 |

| | — |

| | 4,320 |

| | 58 |

| | 4,381 |

|

| Balance as of December 31, 2013 | 20,760 |

| | $ | 190 |

| | 114,719,395 |

| | $ | 725,534 |

| | $ | 4,245 |

| | $ | 729,969 |

|

See accompanying notes to the consolidated financial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31,

|

| | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| | (Amounts in thousands) |

| Operating activities: | |

| | |

| | |

|

| Net income (loss) | $ | 4,631 |

| | $ | 8,637 |

| | $ | (10,775 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |

| | |

| | |

|

| Depreciation and amortization | 48,098 |

| | 33,240 |

| | 23,858 |

|

| Depreciation included in discontinued operations | 1,767 |

| | 4,634 |

| | 5,697 |

|

| Deferred tax expense (benefit) | (260 | ) | | 1,043 |

| | (197 | ) |

| Loss on disposal of assets | 12 |

| | 99 |

| | 22 |

|

| Gain on sale of collegiate housing properties in discontinued operations | (3,913 | ) | | (5,496 | ) | | (2,388 | ) |

| Noncash rent expense related to the straight-line adjustment for long-term ground leases | 5,255 |

| | 4,364 |

| | 4,208 |

|

| Loss on impairment of collegiate housing properties included in discontinued operations | 5,001 |

| | — |

| | 7,859 |

|

| Loss on extinguishment of debt | — |

| | — |

| | 351 |

|

| Loss on extinguishment of debt included in discontinued operations | — |

| | — |

| | 406 |

|

| Amortization of deferred financing costs | 1,758 |

| | 1,215 |

| | 1,197 |

|

| Amortization of deferred financing costs included in discontinued operations | — |

| | — |

| | 48 |

|

| Loss on interest rate cap | — |

| | — |

| | 5 |

|

| Amortization of unamortized debt premiums | (776 | ) | | (80 | ) | | (390 | ) |

| Distributions of earnings from unconsolidated entities | 71 |

| | 195 |

| | 264 |

|

| Noncash compensation expense related to stock-based incentive awards | 2,127 |

| | 2,041 |

| | 1,502 |

|

| Equity in losses of unconsolidated entities | 203 |

| | 363 |

| | 447 |

|

| Change in operating assets and liabilities (net of acquisitions): | | | | | |

|

| Student contracts receivable | (315 | ) | | (19 | ) | | (239 | ) |

| Management fees receivable | 268 |

| | 304 |

| | (406 | ) |

| Other assets | 17,009 |

| | (9,009 | ) | | (1,497 | ) |

| Accounts payable and accrued expenses | (8,846 | ) | | 5,721 |

| | 1,451 |

|

| Deferred revenue | 5,317 |

| | 4,142 |

| | 2,614 |

|

| Net cash provided by operating activities | 77,407 |

| | 51,394 |

| | 34,037 |

|

| Investing activities: | |

| | |

| | |

|

| Property acquisitions, net of cash acquired | (109,482 | ) | | (239,065 | ) | | (156,463 | ) |

| Purchase of corporate furniture and fixtures | (787 | ) | | (3,106 | ) | | (173 | ) |

| Restricted cash | (5,843 | ) | | (1,584 | ) | | (35 | ) |

| Insurance proceeds received on property losses | 16,860 |

| | 3,900 |

| | — |

|

| Investment in collegiate housing properties | (17,183 | ) | | (22,599 | ) | | (22,129 | ) |

| Proceeds from sale of collegiate housing properties | 40,256 |

| | 67,261 |

| | 73,821 |

|

| Notes receivable | (125 | ) | | — |

| | — |

|

| Repayment on notes receivable | 3,000 |

| | 1,800 |

| | 75 |

|

| Loans to developments | — |

| | (3,000 | ) | | (8,128 | ) |

| Earnest money deposits | (125 | ) | | (3,000 | ) | | (75 | ) |

| Investment in assets under development | (215,409 | ) | | (157,840 | ) | | (46,966 | ) |

| Distributions from unconsolidated entities in excess of earnings | — |

| | 82 |

| | 285 |

|

| Investments in unconsolidated entities | (9,475 | ) | | (11,797 | ) | | (25 | ) |

| Net cash used in investing activities | (298,313 | ) | | (368,948 | ) | | (159,813 | ) |

|

| | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| | (Amounts in thousands) |

| Financing activities: | |

| | |

| | |

|

| Payment of mortgage and construction notes | (97,931 | ) | | (79,185 | ) | | (58,225 | ) |

| Borrowings under mortgage and construction loans | 90,123 |

| | 71,156 |

| | 12,558 |

|

| Debt issuance costs | (4,578 | ) | | (1,026 | ) | | (1,527 | ) |

| Debt extinguishment costs | — |

| | — |

| | (562 | ) |

| Borrowings on line of credit | 302,033 |

| | 141,000 |

| | — |

|

| Repayments of line of credit | (24,133 | ) | | (62,000 | ) | | (3,700 | ) |

| Proceeds from issuance of units in exchange for contributions | 17,144 |

| | 228,590 |

| | 275,599 |

|

| Payment of offering costs and underwriters discount on behalf of the Trust | (492 | ) | | (8,954 | ) | | (11,288 | ) |

| Purchase and return of equity to noncontrolling interests | (7,664 | ) | | (349 | ) | | — |

|

| Contributions from noncontrolling interests | 1,197 |

| | 4,039 |

| | — |

|

| Distributions paid on unvested restricted stock awards | (80 | ) | | (61 | ) | | (50 | ) |

| Distributions paid to unitholders | (47,930 | ) | | (33,898 | ) | | (17,672 | ) |

| Distributions paid to noncontrolling interests | (449 | ) | | (532 | ) | | (502 | ) |

| Repurchases of units and payments of restricted stock awards tax withholding | (1,300 | ) | | — |

| | — |

|

| Net cash provided by financing activities | 225,940 |

| | 258,780 |

| | 194,631 |

|

| Net (decrease) increase in cash and cash equivalents | 5,034 |

| | (58,774 | ) | | 68,855 |

|

| Cash and cash equivalents, beginning of period | 17,039 |

| | 75,813 |

| | 6,958 |

|

| Cash and cash equivalents, end of period | $ | 22,073 |

| | $ | 17,039 |

| | $ | 75,813 |

|

| | | | | | |

| Supplemental disclosure of cash flow information: | |

| | |

| | |

|

| Interest paid | $ | 23,060 |

| | $ | 18,402 |

| | $ | 19,526 |

|

| Income taxes paid | $ | 542 |

| | $ | 76 |

| | $ | 339 |

|

| | | | | | |

| Supplemental disclosure of noncash activities: | |

| | |

| | |

|

| Redemption of redeemable limited partner units | $ | — |

| | $ | 606 |

| | $ | — |

|

| Stock-based compensation | $ | 2,127 |

| | $ | 2,041 |

| | $ | 1,453 |

|

| Capital expenditures in accounts payable and accrued expenses related to developments | $ | 15,425 |

| | $ | 20,028 |

| | $ | 7,049 |

|

| Mortgage and construction loans assumed in connection with property acquisitions | $ | 32,420 |

| | $ | 48,451 |

| | $ | 36,930 |

|

See accompanying notes to the consolidated financial statements.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. Organization and description of business

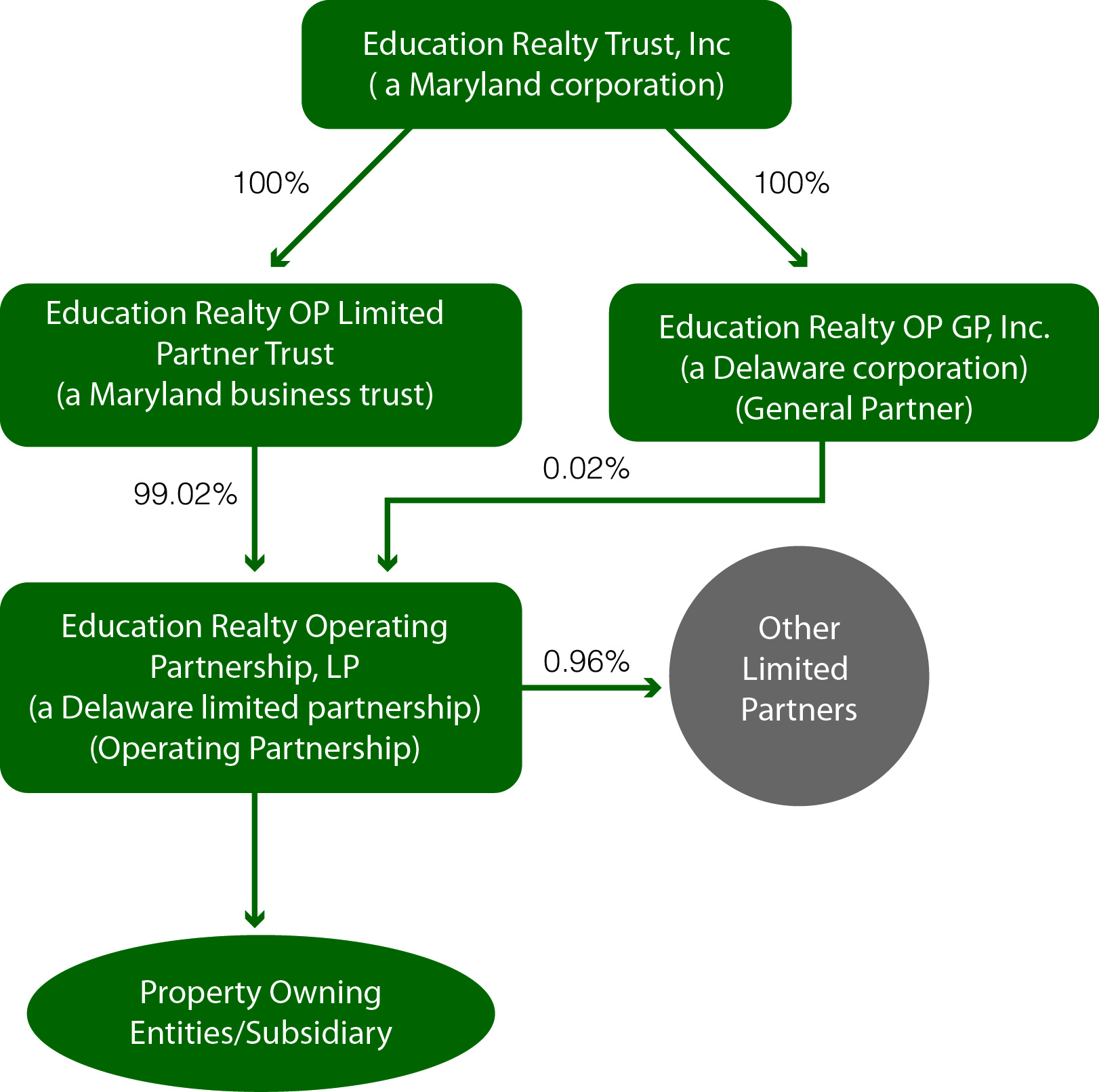

Education Realty Operating Partnership, LP ("EROP", or the "Operating Partnership") is a Delaware limited partnership that was organized by Education Realty Trust, Inc. (the "Trust") to own and operate our business. The general partner of EROP is Education Realty OP GP, Inc. ("OP GP"), an entity that is wholly owned by the Trust. The limited partners of EROP are Education Realty OP Limited Partner Trust, a wholly owned subsidiary of the Trust, and other limited partners consisting of current and former members of management and non-affiliated third parties. The OP GP, as the sole general partner of the Operating Partnership, has the responsibility and discretion in the management and control of the Operating Partnership, and the limited partners of the Operating Partnership, in such capacity, have no authority to transact business for, or participate in the management activities of the Operating Partnership.

Interests in EROP are represented by Operating Partnership Units ("OP units"). The Operating Partnership's net income is allocated to the partners based on their respective percentage interests. Distributions are made in accordance with the terms of the Amended and Restated Agreement of Limited Partnership of Education Realty Operating Partnership, LP (the "Operating Partnership Agreement"), on a per unit basis that is equal to the dividend per share on the Trust's common stock, which is publicly traded on the New York Stock Exchange ("NYSE") under the ticker symbol "EDR". Below is the legal structure of the Trust and Operating Partnership, as of December 31, 2013:

EROP owns, directly or indirectly, interests in collegiate housing communities located on or near major universities in the United States. EROP also provides real estate facility management, development and other advisory services through the following subsidiaries:

| |

| • | EDR Management Inc. ("Management Company"), a Delaware corporation collegiate housing management activities; and |

| |

| • | EDR Development LLC ("Development Company"), a Delaware limited liability company providing development consulting services for third party collegiate housing communities. |

EROP is subject to the risks involved with the ownership and operation of residential real estate near major universities throughout the United States. The risks include, among others, those associated with the changes in the demand for housing by the students at the related universities, competition for tenants, creditworthiness of tenants, changes in tax laws, interest rate levels, the availability of financing and potential liability under environmental and other laws.

2. Summary of significant accounting policies

Basis of presentation and principles of consolidation

The accompanying consolidated financial statements have been prepared on the accrual basis of accounting in conformity with accounting principles generally accepted in the United States (“GAAP”). The accompanying consolidated financial statements of the Operating Partnership represent the assets and liabilities and operating results of the Operating Partnership and its majority owned subsidiaries.

All intercompany balances and transactions have been eliminated in the accompanying consolidated financial statements.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates and assumptions are used by management in determining the recognition of third-party development consulting services revenue under the percentage of completion method, useful lives of collegiate housing assets, the valuation of goodwill, the initial valuations and underlying allocations of purchase price in connection with collegiate housing property acquisitions, the determination of fair value for impairment assessments and in the recording of the allowance for doubtful accounts. Actual results could differ from those estimates.

Cash and cash equivalents

All highly-liquid investments with a maturity of three months or less when purchased are considered cash equivalents. Restricted cash is excluded from cash for the purpose of preparing the consolidated statements of cash flows. The Operating Partnership maintains cash balances in various banks. At times, the amounts of cash may exceed the amount the Federal Deposit Insurance Corporation (“FDIC”) insures. As of December 31, 2013, the Operating Partnership had $12.0 million cash on deposit that was uninsured by the FDIC or in excess of the FDIC limits.

Restricted cash

Restricted cash includes escrow accounts held by lenders for the purpose of paying taxes, insurance, principal and interest and funding capital improvements.

Distributions

The Operating Partnership pays regular quarterly cash distributions to unitholders. These distributions are determined quarterly by the general partner and are generally equal to the dividend per share of the Trust’s common stock. The dividends at the Trust level are determined quarterly by the Board of Directors (“Board”) of the Trust.

Notes receivable

On August 26, 2013, EROP provided a $0.5 million promissory loan to College Park Apartments, Inc. ("CPA"), EROP's partner in the unconsolidated joint venture University Village-Greensboro LLC (see Note 8), at an interest rate of 10% per annum and a maturity date of August 1, 2020. Under the loan, CPA can make one draw per calendar quarter and has borrowed $0.1 million as of December 31, 2013. The loan is secured by CPA's interest in the joint venture.

During the year ended December 31, 2012, EROP entered into a mezzanine loan and purchase option agreement with Landmark Properties Holdings, LLC ("Landmark") for the purpose of developing a cottage-style collegiate housing community at Pennsylvania State University in State College, Pennsylvania. A construction loan was used to fund 80% of the development, and once completed, the community will be wholly owned by Landmark. EROP provided $3.0 million of mezzanine financing at an interest rate of 10% per annum and was granted an option to purchase the community in 2013, 2014 or 2015. As described in Note 5, in September 2013, EROP exercised the purchase option and acquired the collegiate housing community known as The Retreat at State College. The mezzanine loan was secured by 100% of Landmark's equity interest in this development and Landmark's equity interest in the joint venture in the collegiate housing property near The University of Mississippi campus and was repaid during closing of the acquisition. As of December 31, 2012, the mezzanine financing had a balance of $3.0 million and was recorded in notes receivable in the accompanying consolidated balance sheet.

On July 14, 2010, EROP entered into definitive agreements for the development, financing and management of a $60.7 million, 20-story, 572-bed graduate collegiate housing complex at the Science + Technology Park at Johns Hopkins Medical Institute. EROP developed and manages the building, which was constructed on land owned by Johns Hopkins University and leased to a subsidiary of East Baltimore Development, Inc., a nonprofit partnership of private and public entities dedicated to Baltimore’s urban revitalization. Under terms of the agreements, EROP (a) received development and construction oversight fees and reimbursement of pre-development expenses, (b) invested in the form of an $18.0 million second mortgage, (c) will earn a $3.0 million fee for providing a repayment guarantee of the construction first mortgage and (d) received a 10-year management contract. As of December 31, 2013 and 2012, the note receivable for the second mortgage had a balance of $18.0 million and is recorded in notes receivable in the accompanying consolidated balance sheets. EROP does not have an ownership interest in any form that would require consolidation. Due to its financing commitments to the project along with other factors, EROP will not recognize the development services revenue, guarantee fee revenue and interest income earned on the second mortgage until the second mortgage is repaid, and EROP no longer has a substantial continuing financial involvement. If the construction loan and second mortgage had been repaid prior to December 31, 2013, EROP would have recognized development services revenue net of costs of $2.6 million (including participation in cost savings of $0.8 million), guarantee fee revenue of $3.0 million and interest income of $5.6 million since the commencement of the project. See Note 18 regarding subsequent events.

Collegiate housing properties

Land, land improvements, buildings and improvements, and furniture, fixtures and equipment are recorded at cost. Buildings and improvements are depreciated over 15 to 40 years, land improvements are depreciated over 15 years and furniture, fixtures, and equipment are depreciated over 3 to 7 years. Depreciation is computed using the straight-line method for financial reporting purposes over the estimated useful life.

Acquired collegiate housing communities’ results of operations are included in EROP’s results of operations from the respective dates of acquisition. Appraisals, estimates of cash flows and other valuation techniques are used to allocate the purchase price of acquired property between land, land improvements, buildings and improvements, furniture, fixtures and equipment and identifiable intangibles such as amounts related to in-place leases. Acquisition costs are expensed as incurred and are included in general and administrative expenses in the accompanying consolidated statements of operations.

Management assesses impairment of long-lived assets to be held and used whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Management uses an estimate of future undiscounted cash flows of the related asset based on its intended use to determine whether the carrying value is recoverable. If EROP determines that the carrying value of an asset is not recoverable, the fair value of the asset is estimated and an impairment loss is recorded to the extent the carrying value exceeds estimated fair value. Management estimates fair value using

discounted cash flow models, market appraisals if available, and other market participant data.

When a collegiate housing property has met the criteria to be classified as held for sale, the fair value less cost to sell such asset is estimated. If the fair value less cost to sell the asset is less than the carrying amount of the asset, an impairment charge is recorded for the estimated loss. Depreciation expense is no longer recorded once a collegiate housing property has met the held for sale criteria. Operations of collegiate housing properties that are sold or classified as held for sale are recorded as part of discontinued operations for all periods presented. During the years ended December 31, 2013, 2012 and 2011, 12 properties were classified as part of discontinued operations in the accompanying consolidated statements of operations for all periods presented. All 12 of these properties were sold by December 31, 2013 (see Note 5).

Deferred financing costs

Deferred financing costs represent costs incurred in connection with acquiring debt facilities. The deferred financing costs incurred for years ended December 31, 2013, 2012 and 2011 were $4.6 million, $0.9 million and $1.7 million, respectively, and are being amortized over the terms of the related debt using a method that approximates the effective interest method. Amortization expense totaled $1.8 million, $1.2 million, and $1.2 million for the years ended December 31, 2013, 2012 and 2011, respectively. As of December 31, 2013 and 2012, accumulated amortization totaled $7.0 million and $5.7 million, respectively. Deferred financing costs, net of amortization, are included in other assets in the accompanying consolidated balance sheets (see Note 7).

Common stock issued by the Trust and related offering costs

The Trust is structured as an umbrella partnership REIT ("UPREIT") and contributes all proceeds from its various equity offerings to EROP. In return for those contributions, the Trust (through Education Realty OP Limited Partner Trust) receives OP units equal to the number of shares of common stock the Trust issued in the equity offering. As stipulated in the Operating Partnership Agreement, proceeds from equity offerings are deemed to be contributed to the Operating Partnership at the gross amount with EROP incurring expenses related to the underwriters commission and other offering costs. Accordingly, proceeds from common stock issuances contributed to EROP in exchange for OP Units are presented gross on the condensed consolidated statement of cash flows and in the condensed consolidated statement of changes in partners' capital and noncontrolling interest. They payment of offering costs by EROP on behalf of the Trust is considered a distribution.

On August 14, 2012, the Trust completed a follow-on offering of 17.3 million shares of its common stock, which included 2.3 million shares purchased by the underwriters pursuant to an option to purchase additional shares. The Trust received approximately $180.9 million in net proceeds from the offering after deducting the underwriting discount and other offering expenses. The Trust contributed the proceeds to EROP in exchange for units and EROP used the net proceeds to repay the unsecured revolving credit facility (see Note 10) and to fund the acquisition of The Province at East Carolina University, The District on 5th serving the University of Arizona, Campus Village serving Michigan State University, The Province at Kent State serving Kent State University and The Suites at Overton Park and The Centre at Overton Park both serving Texas Tech University (see Note 4).

On September 20, 2011, the Trust entered into the 2011 equity distribution agreement. Pursuant to the terms and conditions of the agreements, the Trust could issue and sell shares of its common stock having an aggregate offering amount of up to $50 million. As of December 31, 2012, the Trust had sold 4.8 million shares of common stock under the 2011 equity distribution program for net proceeds of approximately $49.2 million and reached the aggregate offering amount of $50 million. On May 22, 2012, the Trust entered into two additional equity distribution agreements similar to the previous agreement discussed above. Under the 2012 agreements, the Trust could issue and sell shares of its common stock having an aggregate offering amount of $50 million. As of December 31, 2013, the Trust had sold 1.6 million shares of common stock under the 2012 agreements for net proceeds of approximately $17.8 million. The Trust contributed the proceeds to EROP and EROP used the net proceeds to repay debt, fund its development pipeline, fund acquisitions and for general corporate purposes. See Note 18 regarding subsequent events pertaining to equity offerings.

On May 19, 2010, the Trust’s stockholders approved the Education Realty Trust, Inc. Employee Stock Purchase Plan (the “ESPP”) which became effective on July 1, 2010. Pursuant to the ESPP, all employees of EROP are eligible to make periodic purchases of the Trust's common stock through payroll deductions. Subject to the discretion of the compensation committee

of the Board, the purchase price per share of common stock purchased by employees under the ESPP is 85% of the fair market value on the applicable purchase date. The Trust reserved 300,000 shares of common stock for sale under the ESPP. The aggregate cost of the ESPP (generally the 15% discount on the shares purchased) is recorded by EROP as a period expense as the employees receiving the benefit are employees of EROP. For the years ended December 31, 2013, 2012 and 2011, total compensation expense relating to the ESPP was $31.2 thousand, $25.3 thousand, and $24.3 thousand, respectively.

Debt premiums

Differences between the estimated fair value of debt and the principal value of debt assumed in connection with collegiate housing property acquisitions are amortized over the term of the related debt as an offset to interest expense using the effective interest method. As of December 31, 2013 and 2012, EROP had net unamortized debt premiums of $2.3 million and $3.1 million, respectively. These amounts are included in mortgage and construction loans in the accompanying consolidated balance sheets.

Income taxes

The Trust qualifies as a REIT under the Code and is generally not subject to federal, state and local income taxes on any of its taxable income that it distributes if it distributes at least 90% of its REIT taxable income for each tax year to its stockholders and meets certain other requirements. If the Trust fails to qualify as a REIT for any taxable year, the Trust will be subject to federal, state and local income taxes (including any applicable alternative minimum tax) on its taxable income. EROP is bound by the terms of the Amended and Restated Agreement of Limited Partnership to ensure that the Trust continues to qualify as a REIT.

The Operating Partnership is generally not liable for federal corporate income taxes as income or loss is reported in the tax returns of its partners. EROP has elected, however, to treat certain subsidiaries, including the Management Company, as taxable REIT subsidiaries, which are taxed as C Corporations for federal, state and local income taxes. The Management Company provides management services, and through the Development Company, provides development services to properties owned by EROP as well as third-parties. Deferred tax assets and liabilities are recognized based on the difference between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted tax rates in effect in the years in which those temporary differences are expected to reverse.

EROP had no unrecognized tax benefits as of December 31, 2013, 2012 and 2011. As of December 31, 2013, EROP did not expect to record any unrecognized tax benefits. EROP, and its subsidiaries, file federal and state income tax returns. As of December 31, 2013, open tax years generally included tax years for 2010, 2011, and 2012. EROP’s policy is to include interest and penalties related to unrecognized tax benefits in general and administrative expenses. As of December 31, 2013, 2012 and 2011, EROP had no interest or penalties recorded related to unrecognized tax benefits.

Noncontrolling interests

As of December 31, 2013, EROP had entered into three joint venture agreements to develop, own and manage properties near Arizona State University - Downtown Phoenix (Roosevelt Point), The University of Mississippi (The Retreat at Oxford) and Duke University (605 West). EROP is deemed to be the primary beneficiary of these communities; therefore, EROP accounts for the joint ventures using the consolidation method of accounting. EROP's joint venture partners' investments in 605 West met the requirements to be classified outside of permanent equity and is therefore classified as redeemable noncontrolling interests in the accompanying consolidated balance sheets and net income attributable to noncontrolling interest in the accompanying consolidated statement of operations due to the partner's ability to put their ownership interests to EROP as stipulated in the operating agreements. EROP's joint venture partners’ investments in the Arizona State University - Downtown Phoenix joint venture and The University of Mississippi joint ventures are accounted for as noncontrolling interests in the accompanying consolidated balance sheets and statements of changes in partners' capital and noncontrolling interests and net income attributable to noncontrolling interests in the accompanying consolidated statements of operations.

The units of the limited partnership of University Towers Operating Partnership, LP (“University Towers Operating

Partnership Units”) and profits interest units (“PIUs”) (see Note 9) are referred to as noncontrolling interests. EROP follows the guidance issued by the Financial Accounting Standards Board (“FASB”) regarding the classification and measurement of redeemable securities. The University Towers Operating Partnership Units are redeemable at the option of the holder and they participate in net income and distributions. Accordingly, EROP has determined that the University Towers Operating Partnership Units meet the requirements to be classified outside of permanent equity and are therefore also classified as redeemable noncontrolling interests in the accompanying consolidated balance sheets and net income attributable to noncontrolling interests in the accompanying consolidated statements of operations.

The value of redeemable noncontrolling interests is reported at the greater of fair value or historical cost at the end of each reporting period. As of December 31, 2013, EROP reported the redeemable noncontrolling interests at historical cost, which was greater than fair value.

Below is a table summarizing the activity of redeemable noncontrolling interests for the years ended December 31, 2013 and 2012 (in thousands):

|

| | | |

| Balance, December 31, 2011 | $ | 1,151 |

|

| Net income | 181 |

|

| Distributions | (168 | ) |

| Balance, December 31, 2012 | $ | 1,164 |

|

| Net income | 168 |

|

| Contributions from redeemable noncontrolling interests | 1,127 |

|

| Distributions | (100 | ) |

| Balance, December 31, 2013 | $ | 2,359 |

|

Redeemable Limited Partner Units

EROP classifies the portion of OP units that EROP is required, either by contract or securities law, to deliver registered shares of common stock of the Trust or cash, at the general partner's discretion, to the exchanging OP unitholder as redeemable limited partner units in the mezzanine section of the accompanying consolidated balance sheets. The redeemable limited partner units are reported at the greater of fair value or historical cost at the end of each reporting period. As of December 31, 2013, EROP reported the redeemable limited partner units at historical cost, which was greater than fair value. During the year ended December 31, 2012, 43,832 Operating Partnership Units were redeemed for 43,832 shares of common stock of the Trust.

Below is a table summarizing the activity of redeemable limited partners' capital for the years ended December 31, 2013 and 2012 (in thousands):

|

| | | |

| Balance, December 31, 2011 | $ | 8,625 |

|

| Net income | 124 |

|

| Distributions | (362 | ) |

| Conversion of redeemable limited partner units into shares of EDR common stock | (607 | ) |

| Balance, December 31, 2012 | $ | 7,780 |

|

| Net income | 81 |

|

| Distributions | (349 | ) |

| Balance, December 31, 2013 | $ | 7,512 |

|

The value of redeemable limited partner units is reported at the greater of fair value or historical cost at the end of each reporting period. As of December 31, 2013, EROP reported the redeemable limited partner units at historical cost, which was greater than fair value.

Earnings per unit

Basic earnings per unit is calculated by dividing net earnings available to unitholders by the weighted average number of units outstanding. Diluted earnings per unit is calculated similarly, except that it includes the dilutive effect of the assumed exercise of potentially dilutive securities. EROP follows the authoritative guidance regarding the determination of whether certain instruments are participating securities.

The following is a summary of the elements used in calculating basic and diluted earnings per unit:

|

| | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| Numerator - basic and diluted earnings per unit (in thousands): | | | | | |

| Income (loss) from continuing operations | $ | 5,087 |

| | $ | 217 |

| | $ | (6,607 | ) |

| Income from continuing operations attributable to noncontrolling interests | (227 | ) | | (92 | ) | | (188 | ) |

| Income (loss) from continuing operations attributable to unitholders | 4,860 |

| | 125 |

| | (6,795 | ) |

| Income (loss) from discontinued operations | (456 | ) | | 8,420 |

| | (4,168 | ) |

| Net income (loss) attributable to unitholders | $ | 4,404 |

| | $ | 8,545 |

| | $ | (10,963 | ) |

|

| | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| Denominator: | | | | | |

| Weighted average units outstanding | 114,431,996 |

| | 101,243,974 |

| | 75,485,418 |

|

| Redeemable OP units | 830,343 |

| | 865,727 |

| | 903,738 |

|

| Weighted average units outstanding - basic | 115,262,339 |

| | 102,109,701 |

| | 76,389,156 |

|

| | | | | | |

| Redeemable noncontrolling units | 207,257 |

| | 207,257 |

| | — |

|

| Weighted average units outstanding - diluted | 115,469,596 |

| | 102,316,958 |

| | 76,389,156 |

|

For the year ended December 31, 2011, the following potentially dilutive securities were outstanding but were not included in the computation of diluted earnings per unit because the effects of their inclusion would be anti-dilutive:

|

| | |

| | 2011 |

| University Towers Operating Partnership Units | 207,257 |

|

Repairs, maintenance and major improvements

The costs of ordinary repairs and maintenance are charged to operations when incurred. Major improvements that extend the life of an asset are capitalized and depreciated over the remaining useful life of the asset. Planned major repair, maintenance and improvement projects are capitalized when performed. In some circumstances, the lenders require EROP to maintain a reserve account for future repairs and capital expenditures. These amounts are classified as restricted cash in the accompanying consolidated balance sheets as the funds are not available for use.

Goodwill and other intangible assets

Goodwill is tested annually for impairment as of December 31, and is tested for impairment more frequently if events and circumstances indicate that the assets might be impaired. An impairment loss is recognized to the extent that the carrying amount exceeds the asset’s fair value. The accumulated impairment loss recorded by EROP as of December 31, 2008 was $0.4 million. No additional impairment has been recorded through December 31, 2013. The carrying value of goodwill was $3.1 million as of December 31, 2013 and 2012, of which $2.1 million was recorded on the management services segment and $0.9 million was recorded on the development consulting services segment. Goodwill is not subject to amortization.

Other intangible assets generally include in-place leases acquired in connection with acquisitions and are amortized over the estimated life of the lease/contract term. The carrying value of other intangible assets was $0.8 million and $1.4 million as of December 31, 2013 and 2012, respectively.

Investment in unconsolidated entities

EROP accounts for its investments in unconsolidated joint ventures using the equity method whereby the costs of an investment are adjusted for EROP’s share of earnings of the respective investment reduced by distributions received. The earnings and distributions of the unconsolidated joint ventures are allocated based on each owner’s respective ownership interests. These investments are classified as other assets or accrued expenses, depending on whether the distributions exceed EROP’s contributions and share of earnings in the joint ventures, in the accompanying consolidated balance sheets (see Note 8). As of December 31, 2013, EROP had investments in the following unconsolidated joint ventures that are accounted for under the equity method:

| |

| • | 1313 5th Street MN Holdings, LLC, a Delaware limited liability company, 50% owned by the Operating Partnership; |

| |

| • | West Clayton Athens GA Owner, LLC, a Delaware limited liability company, 50% owned by the Operating Partnership; |

| |

| • | Elauwit Networks, a South Carolina limited liability company, 10% owned by the Operating Partnership; and |

| |

| • | University Village-Greensboro LLC, a Delaware limited liability company, 25% owned by the Operating Partnership. |

As of December 31, 2012, EROP had investments in the following unconsolidated joint ventures that are accounted for under the equity method:

| |

| • | 1313 5th Street MN Holdings, LLC, a Delaware limited liability company, 50% owned by the Operating Partnership; |

| |

| • | Elauwit Networks, a South Carolina limited liability company, 10% owned by the Operating Partnership; and |

| |

| • | University Village-Greensboro LLC, a Delaware limited liability company, 25% owned by the Operating Partnership. |

Comprehensive income

EROP follows the authoritative guidance issued by the FASB relating to the reporting and display of comprehensive income and its components. For all periods presented, comprehensive income (loss) is equal to net income (loss).

Revenue recognition

EROP recognizes revenue related to leasing activities at the collegiate housing communities owned by EROP, management fees related to managing third-party collegiate housing communities, development consulting fees related to the general oversight of third-party collegiate housing development and operating expense reimbursements for payroll and related expenses incurred for third-party collegiate housing communities managed by EROP.

Collegiate housing leasing revenue — Collegiate housing leasing revenue is comprised of all activities related to leasing and operating the collegiate housing communities and includes revenues from leasing apartments by the bed, food services, parking lot rentals and providing certain ancillary services. This revenue is reflected in collegiate housing leasing revenue in the accompanying consolidated statements of operations. Students are required to execute lease contracts with payment schedules that vary from semester to monthly payments. Generally, EROP requires each executed leasing contract to be accompanied by a signed parental guarantee. Receivables are recorded when billed. Revenues and related lease incentives and nonrefundable application and service fees are recognized on a straight-line basis over the term of the contracts. At certain collegiate housing facilities, EROP offers parking lot rentals to the tenants. The related revenues are recognized on a straight-line basis over the term of the related agreement.

Due to the nature of EROP’s business, accounts receivable result primarily from monthly billings of student rents. Payments are normally received within 30 days. Balances are considered past due when payment is not received on the contractual due date. Allowances for uncollectible accounts are established by management when it is determined that collection is doubtful. Such allowances are reviewed periodically based upon experience.

The following table reconciles the allowance for doubtful accounts as of and for the years ended December 31, 2013, 2012 and 2011 (in thousands):

|

| | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| Balance, beginning of period | $ | 142 |

| | $ | 133 |

| | $ | 129 |

|

| Provision for uncollectible accounts | 1,379 |

| | 1,128 |

| | 1,079 |

|

| Deductions | (1,425 | ) | | (1,119 | ) | | (1,075 | ) |

| Balance, end of period | $ | 96 |

| | $ | 142 |

| | $ | 133 |

|

Third-party development services revenue — EROP provides development consulting services in an agency capacity with third parties whereby the fee is determined based upon the total construction costs. Total fees vary from 3 – 5% of the total estimated costs, and EROP typically receives a portion of the fees up front. These fees, including the up-front fee, are recognized using the percentage of completion method in proportion to the contract costs incurred by the owner over the course of construction of the respective projects. Occasionally, the development consulting contracts include a provision whereby EROP can participate in project savings resulting from successful cost management efforts. These revenues are recognized once all contractual terms have been satisfied and no future performance requirements exist. This typically occurs after construction is complete. For the years ended December 31, 2013, 2012 and 2011, there was $0.8 million, $0.2 million and $0.5 million of revenue recognized, respectively, related to cost savings agreements on development projects. For 2013 and 2012, this amount of participation in cost savings was attributable to the participating development at the Johns Hopkins Medical Institute.

Third-party management services revenue — EROP enters into management contracts to manage third-party collegiate housing communities. Management revenues are recognized when earned in accordance with each management contract. Incentive management fees are recognized when the incentive criteria have been met.

Operating expense reimbursements — EROP pays certain payroll and related costs to operate third-party collegiate housing communities that are managed by EROP. Under the terms of the related management agreements, the third-party property owners reimburse these costs. The amounts billed to the third-party owners are recognized as revenue.

Costs related to development consulting services

Costs associated with the pursuit of third-party development consulting contracts are expensed as incurred, until such time that management has been notified of a contract award. At such time, the reimbursable costs are recorded as receivables and are reflected as other assets in the accompanying consolidated balance sheets (see Note 7).

Costs directly associated with internal development projects are capitalized as part of the cost of the project.

Advertising expense

Advertising expenses are charged to income during the period incurred. EROP does not use direct response advertising. Advertising expense was $4.6 million, $3.2 million and $2.5 million for the years ended December 31, 2013, 2012 and 2011, respectively.

Segment information

EROP discloses certain operating and financial data with respect to separate business activities within its enterprise. EROP has identified three reportable business segments: collegiate housing leasing, collegiate housing development consulting services and collegiate housing management services.

Stock-based compensation

On May 4, 2011, the Trust’s stockholders approved the Education Realty Trust, Inc. 2011 Omnibus Equity Incentive Plan (the “2011 Plan”). The 2011 Plan replaced the Education Realty Trust, Inc. 2004 Incentive Plan (“2004 Plan”) in its entirety. The

2011 Plan is described more fully in Note 9. EROP recognizes compensation costs related to share-based payments in the accompanying consolidated financial statements in accordance with authoritative guidance. This requires compensation costs to be recognized in the financial statements of a subsidiary to ensure the user of the financial statements understands all of the subsidiary's cost of doing business. Although the 2011 Plan was established by the Trust, the intent was to provide incentive to the management employees of EROP and therefore the related compensation costs have been reflected in the accompanying consolidated statements of operations and were treated as capital contributions in the accompanying consolidated statement of changes in partners' capital and noncontrolling interests.

Fair value measurements

EROP follows the guidance contained in FASB ASC 820, Fair Value Measurements and Disclosures. Fair value is generally defined as the exit price at which an asset or liability could be exchanged in a current transaction between willing unrelated parties, other than in a forced liquidation or sale. The guidance establishes a fair value hierarchy, giving the highest priority to quoted prices in active markets and the lowest priority to unobservable data, and requires disclosures for assets and liabilities measured at fair value based on their level in the hierarchy.

The fair value framework requires the categorization of assets and liabilities into three levels based upon the assumptions used to value the assets or liabilities. Level 1 provides the most reliable measure of fair value, whereas Level 3 generally requires significant management judgment. The three levels are defined as follows:

| |

| • | Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities at the measurement date. |

| |

| • | Level 2 - Observable inputs other than those included in Level 1, for example, quoted prices for similar assets or liabilities in active markets or quoted prices for identical assets or liabilities in inactive markets. |

| |

| • | Level 3 - Unobservable inputs reflecting management's own assumption about the inputs used in pricing the asset or liability at the measurement date. |

Non-financial assets measured at fair value on a nonrecurring basis consist of real estate assets and investments in partially owned entities that have been written-down to estimated fair value when it has been determined that asset values are not recoverable. The fair values of these assets are determined using discounted cash flow models, market appraisals if available, and other market participant data. Note 6 provides details for the impairment charges recorded during the year ended December 31, 2013. Non-financial assets impaired during the year ended December 31, 2013 were disposed of during the year they were written down to estimated fair value. No non-financial assets were written down during the year ended December 31, 2012.

Financial assets and liabilities that are not measured at fair value in our consolidated financial statements include mezzanine notes receivable and debt. Estimates of the fair values of these instruments are based on our assessments of available market information and valuation methodologies, including discounted cash flow analyses.

The table below summarizes the carrying amounts and fair values of these financial instruments as of December 31, 2013 and 2012 (in thousands):

|

| | | | | | | | | | | | | | | | | |

| | | As of December 31, 2013 |

| | | | | Estimated Fair Value |

| | | Carrying value | | Level 1 | | Level 2 | | Level 3 | |

| Mezzanine notes receivable | | $ | 18,125 |

| | $ | — |

| | $ | 19,330 |

| | $ | — |

| |

| Unsecured revolving credit facility | | 356,900 |

| | — |

| | 356,900 |

| | — |

| |

| Variable rate mortgage and construction loans | | 193,381 |

| | — |

| | 193,381 |

| | — |

| |

| Fixed rate mortgage and construction loans | | 227,009 |

| | — |

| | 239,162 |

| | — |

| |

|

| | | | | | | | | | | | | | | | | |

| | | As of December 31, 2012 |

| | | | | Estimated Fair Value |

| | | Carrying value | | Level 1 | | Level 2 | | Level 3 | |

| Mezzanine notes receivable | | $ | 21,000 |

| | $ | — |

| | $ | 23,772 |

| | $ | — |

| |

| Unsecured revolving credit facility | | 79,000 |

| | — |

| | 79,000 |

| | — |

| |

| Variable rate mortgage and construction loans | | 125,436 |

| | — |

| | 125,436 |

| | — |

| |

| Fixed rate mortgage and construction loans | | 270,342 |

| | — |

| | 290,409 |

| | — |

| |

EROP discloses the fair value of financial instruments for which it is practicable to estimate. EROP does not hold or issue financial instruments for trading purposes. EROP considers the carrying amounts of cash and cash equivalents, restricted cash, student contracts receivable, accounts payable and accrued expenses to approximate fair value due to the short maturity of these instruments. The carrying value of restricted cash approximates its fair value based on the nature of our assessment of the ability to recover these amounts. Due to the short-term nature of these investments, Level 1 and Level 2 inputs are utilized to estimate the fair value of these financial instruments.

Recent accounting pronouncements

In August 2014, the FASB issued Accounting Standards Update ("ASU") 2014-15, "Presentation of Financial Statements - Going Concern (Subtopic 205-40)" ("ASU 2014-15"). ASU 2014-15 provides guidance on management’s responsibility in evaluating whether there is substantial doubt about a company’s ability to continue as a going concern and related footnote disclosures. For each reporting period, management will be required to evaluate whether there are conditions or events that raise substantial doubt about a company’s ability to continue as a going concern within one year from the date the financial statements are issued. ASU 2014-15 is effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. Early application is permitted. EROP does not expect ASU 2014-15 to have a material impact on EROP's consolidated financial statements.

In May 2014, the FASB issued ASU 2014-09, "Revenue from Contracts with Customers (Topic 606)" ("ASU 2014-09"). The guidance outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes most current revenue recognition guidance, including the guidance on real estate derecognition for most transactions. ASU 2014-09 provides that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. ASU 2014-09 is effective for annual reporting periods beginning after December 15, 2016, and interim periods within those years and permits the use of either the retrospective or cumulative effect transition method. EROP is currently evaluating the provisions of this guidance.

In April 2014, the FASB ASU 2014-08, "Presentation of Financial Statements (Topic 205) and Property, Plant and Equipment (Topic 360) - Reporting Discontinued Operations and Disclosures of Disposals of Components of an

Entity" ("ASU 2014-08"). ASU 2014-08 changes the threshold for disclosing discontinued operations and the related disclosure requirements. Pursuant to ASU 2014-08, only disposals representing a strategic shift, such as a major line of business, a major geographical area or a major equity investment, should be presented as a discontinued operation. The guidance will be applied prospectively to new disposals and new classifications of disposal groups as held for sale after the effective date. ASU 2014-08 is effective for annual periods beginning on or after December 15, 2014 with early adoption permitted but only for disposals or classifications as held for sale which have not been reported in financial statements previously issued or available for issuance. EROP adopted ASU 2014-08 as of January 1, 2014.

In February 2013, the FASB updated the guidance related to Liabilities to provide guidance for the recognition, measurement and disclosure of obligations resulting from joint and several liability arrangements for which the total amount of the obligation within the scope of this guidance is fixed at the reporting date. The updated guidance requires the entity to measure these obligations as the sum of the amount the reporting entity agreed to pay on the basis of its arrangement among its co-obligors and any additional amount the reporting entity expects to pay on behalf of its co-obligors. The updated guidance also requires an entity to disclose the nature and amount of the obligation as well as other information. The guidance is effective for financial statements issued for fiscal years and interim periods beginning after December 15, 2013. The adoption is not expected to have a material impact on EROP's consolidated financial statements.

In December 2011, the FASB updated the guidance related to Property, Plant and Equipment – Real Estate Sales to eliminate diversity in practice regarding whether in-substance real estate should be derecognized when the parent ceases to have a controlling financial interest in a subsidiary that is in-substance real estate because of a default of the subsidiary on its nonrecourse debt. The updated guidance clarifies that the accounting for such transactions is based on substance rather than form, and a reporting entity generally would not satisfy the requirements to derecognize the in-substance real estate before the legal transfer of the real estate to the lender and the extinguishment of the related nonrecourse debt. The guidance is effective for financial statements issued for fiscal years and interim periods beginning after June 15, 2012. The adoption had no material impact on EROP’s consolidated financial statements.

3. Income taxes

Deferred income taxes result from temporary differences between the carrying amounts of assets and liabilities of the taxable REIT subsidiaries ("TRSs") for financial reporting purposes and the amounts used for income tax purposes. Significant components of the deferred tax assets and liabilities as of December 31, 2013 and 2012, respectively, are as follows (in thousands):

|

| | | | | | | |

| | 2013 | | 2012 |

| Deferred tax assets: | |

| | |

|

| Deferred revenue | $ | 1,022 |

| | $ | 717 |

|

| Accrued expenses | 252 |

| | 159 |

|

| Straight line rent | 366 |

| | 69 |

|

| Restricted stock amortization | 85 |

| | — |

|

| Net operating loss carryforward | 418 |

| | — |

|

| Total deferred tax assets | 2,143 |

| | 945 |

|

| Deferred tax liabilities: | | | |

| Depreciation and amortization | (634 | ) | | (493 | ) |

| Restricted stock amortization | — |

| | (63 | ) |

| Total deferred tax liabilities | (634 | ) | | (556 | ) |

| Net deferred tax assets | $ | 1,509 |

| | $ | 389 |

|

Significant components of income tax expense (benefit) for the years ended December 31, 2013, 2012 and 2011, respectively, are as follows (in thousands):

|

| | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| Deferred: | |

| | |

| | |

|

| Federal | $ | (296 | ) | | $ | 895 |

| | $ | (169 | ) |

| State | 36 |

| | 148 |

| | (28 | ) |

| Deferred expense (benefit) | (260 | ) | | 1,043 |

| | (197 | ) |

| Current: | |

| | |

| | |

|

| Federal | 312 |

| | (1,326 | ) | | (199 | ) |

| State | 151 |

| | (601 | ) | | 301 |

|

| Current (benefit) expense | 463 |

| | (1,927 | ) | | 102 |

|

| Total expense (benefit) | $ | 203 |

| | $ | (884 | ) | | $ | (95 | ) |

TRS losses subject to tax consisted of $0.2 million, $1.9 million and $0.9 million for the years ended December 31, 2013, 2012 and 2011, respectively. The reconciliation of income tax attributable to income before noncontrolling interests computed at the U.S. statutory rate to income tax provision is as follows (in thousands):

|

| | | | | | | | | | | |

| | 2013 | | 2012 | | 2011 |

| Tax provision at U.S. statutory rates on TRS income subject to tax | $ | 15 |

| | $ | (566 | ) | | $ | (293 | ) |

| State income tax, net of federal benefit | 126 |

| | (312 | ) | | 319 |

|

| Other | 62 |

| | (6 | ) | | (121 | ) |

| Tax expense (benefit) | $ | 203 |

| | $ | (884 | ) | | $ | (95 | ) |

4. Acquisition and development of real estate investments

During the year ended December 31, 2013, EROP completed the following three collegiate housing property acquisitions:

|

| | | | | | | | | | | | |

| Name | | Primary University Served | | Acquisition Date | | # of Beds | | # of Units | | Contract Price (in thousands) |

| The Cottages on Lindberg | | Purdue University West Lafayette, Indiana | | Aug 2013 | | 745 |

| | 193 |

| | $36,000 |

| The Retreat at State College | | Pennsylvania State University State College, Pennsylvania | | Sept 2013 | | 587 |

| | 138 |

| | $56,189 |

| The Varsity | | University of Michigan Ann Arbor, Michigan | | Dec 2013 | | 415 |

| | 181 |

| | $53,950 |

Combined acquisition costs for these purchases were $0.4 million and are included in general and administrative expenses in the accompanying consolidated statement of operations for the year ended December 31, 2013. EROP funded these acquisitions with assumed debt of $32.4 million and proceeds from draws on the Trust's Fourth Amended Revolver (as defined below). A summary follows of the fair values of the assets acquired and the liabilities assumed as of the dates of the acquisitions (in thousands):

|

| | | | | | | | | | | | | | | |

| | The Cottages on Lindberg | | The Retreat at State College | | The Varsity | | Total |

| Collegiate housing properties | $ | 35,704 |

| | $ | 55,812 |

| | $ | 53,630 |

| | $ | 145,146 |

|

| Other assets | 347 |

| | 442 |

| | 481 |

| | 1,270 |

|

| Current liabilities | (689 | ) | | (405 | ) | | (449 | ) | | (1,543 | ) |

| Mortgage debt | — |

| | — |

| | (32,420 | ) | | (32,420 | ) |

| Total net assets acquired | $ | 35,362 |

| | $ | 55,849 |

| | $ | 21,242 |

| | $ | 112,453 |

|

The difference between the collegiate housing property acquisition contract prices of $146.1 million and the total net assets acquired of $112.5 million is $1.2 million of net assets purchased or liabilities assumed and $32.4 million of assumed debt (see Note 10). In the accompanying consolidated statements of cash flows, we have excluded from cash outflows for the 2013 acquisitions $3.0 million of cash paid as a deposit for The Varsity acquisition during 2012.

The amounts of the 2013 acquisitions’ revenue and net income included in EROP’s accompanying consolidated statement of operations for the year ended December 31, 2013, and the unaudited pro forma revenue and net income had the acquisition date been January 1, 2012, are as follows:

|

| | | | | | | | | | | |

| | Revenue | | Net income | | Net income attributable to unitholders per unit - basic and diluted |

| | (in thousands) | | |

| Actual from date of acquisition – 12/31/13 | $ | 3,221 |

| | $ | 911 |

| | $ | 0.01 |

|

2013 supplemental pro forma for 1/1/13 – 12/31/13(1) | $ | 187,961 |

| | $ | 4,841 |

| | $ | 0.04 |

|

2012 supplemental pro forma for 1/1/12 – 12/31/12(1) | $ | 139,714 |

| | $ | 9,229 |

| | $ | 0.09 |

|

| |

| (1) | Supplemental pro forma earnings for the year ended December 31, 2013 were adjusted to exclude $0.4 million of acquisition-related costs incurred in 2013. Supplemental pro forma earnings for the year ended December 31, 2012 were adjusted to include these charges. As The Retreat at State College and The Varsity opened for the 2013/2014 lease year, the supplemental pro forma revenue and net income for the periods above do not include full years of operations for these acquisitions. |

During the year ended December 31, 2012, EROP completed the following seven collegiate housing property acquisitions:

|

| | | | | | | | | | | | | | |

| Name | | Primary University Served | | Acquisition Date | | # of Beds | | # of Units | | Contract Price (in thousands) |

The Reserve on Stinson (1) | | University of Oklahoma Norman, Oklahoma | | Jan 2012 | | 612 |

| | 204 |

| | $ | 22,954 |

|

| The Province | | East Carolina University Greenville, North Carolina | | Sept 2012 | | 728 |

| | 235 |

| | $ | 50,000 |

|

| The District on 5th | | University of Arizona Tucson, Arizona | | Oct 2012 | | 764 |

| | 208 |

| | $ | 66,442 |

|

Campus Village (2) | | Michigan State University East Lansing, Michigan | | Oct 2012 | | 355 |

| | 106 |

| | $ | 20,900 |

|

| The Province | | Kent State University Kent, Ohio | | Nov 2012 | | 596 |

| | 246 |

| | $ | 45,000 |

|

| The Suites at Overton Park | | Texas Tech University Lubbock, Texas | | Dec 2012 | | 465 |

| | 298 |

| | $ | 37,000 |

|

| The Centre at Overton Park | | Texas Tech University Lubbock, Texas | | Dec 2012 | | 400 |

| | 278 |

| | $ | 37,000 |

|

(1) EROP had a 10% equity investment in the entity that previously owned The Reserve on Stinson collegiate housing community and also managed the property prior to the acquisition.

(2) EROP entered into a 32-year ground lease, with the option to extend the lease 20 additional years subject to certain conditions, which requires an increase in annual rent expense to be determined on predetermined adjustment dates based on the consumer price index for the life of the lease.

Combined acquisition costs for these purchases were $1.1 million and are included in general and administrative expenses in the accompanying consolidated statement of operations for the year ended December 31, 2012. EROP funded these acquisitions with assumed debt of $48.5 million and existing cash, including cash proceeds generated by the August 2012 equity offering (see Note 2) and sales of collegiate housing properties (see Note 5). A summary follows of the fair values of the assets acquired and the liabilities assumed as of the dates of the acquisitions (in thousands):

|

| | | | | | | | | | | | | | | | | | | |

| | The Province at East Carolina | | The District on 5th | | The Suites and Centre at Overton Park | | Other | | Total |

| Collegiate housing properties | $ | 49,609 |

| | $ | 65,997 |

| | $ | 76,678 |

| | $ | 88,129 |

| | $ | 280,413 |

|

| Other assets | 502 |

| | 475 |

| | 4,830 |

| | 971 |

| | 6,778 |

|

| Current liabilities | (531 | ) | | (545 | ) | | (1,651 | ) | | (1,356 | ) | | (4,083 | ) |

| Mortgage debt | — |

| | — |

| | (51,625 | ) | | — |

| | (51,625 | ) |

| Total net assets acquired | $ | 49,580 |

| | $ | 65,927 |

| | $ | 28,232 |

| | $ | 87,744 |

| | $ | 231,483 |

|

The difference between the collegiate housing property acquisition contract prices of $279.3 million and the total net assets acquired of $231.5 million is $48.5 million of debt assumed in connection with the acquisition of the Suites at Overton Park and the Centre at Overton Park collegiate housing properties (see Note 4) and $0.7 million of net assets purchased or liabilities assumed in addition to fixed assets and debt.

The amounts of the 2012 acquisitions' revenue and net income included in EROP's accompanying consolidated statement of operations for the year ended December 31, 2012, and the unaudited pro forma revenue and net income (loss) had the acquisition date been January 1, 2011, are as follows:

|

| | | | | | | | | | | |

| | Revenue | | Net income (loss) | | Net income (loss) attributable to unitholders per unit - basic and diluted |

| | (in thousands) | | |

| Actual from date of acquisition – 12/31/12 | $ | 7,830 |

| | $ | 1,549 |

| | $ | 0.02 |

|

2012 supplemental pro forma for 1/1/12 – 12/31/12(1) | $ | 150,370 |

| | $ | 10,568 |

| | $ | 0.10 |

|