- BVFL Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

BV Financial (BVFL) DEF 14ADefinitive proxy

Filed: 1 Aug 24, 1:39pm

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ____)

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

BV Financial, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply): | |

☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i) (1) and 0-11. |

August 1, 2024

Dear Fellow Stockholder:

You are cordially invited to attend the annual meeting of stockholders of BV Financial, Inc., the holding company for BayVanguard Bank.

We will hold the meeting at the Essex Branch of BayVanguard Bank, 532 Eastern Boulevard, Essex, Maryland on Thursday, September 5, 2024 at 4:30 p.m., local time. The notice of annual meeting and the proxy statement appearing on the following pages describe the formal business to be transacted at the meeting.

It is important that your shares are represented at this meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To ensure your shares are represented, we urge you to vote promptly by completing and mailing the enclosed proxy card or by voting via the Internet or by telephone. Voting instructions appear on the enclosed proxy card. If you attend the meeting, you may vote in person even if you have previously mailed a proxy card or voted by Internet or by telephone.

We look forward to seeing you at the meeting.

Sincerely, |

|

|

|

|

|

Timothy L. Prindle |

| David M. Flair |

Co-President and Chief Executive Officer |

| Co-President and Chief Executive Officer |

BV Financial, Inc.

7114 North Point Road

Baltimore, Maryland 21219

(410) 477-5000

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE |

| 4:30 p.m., local time, Thursday, September 5, 2024 |

|

|

|

PLACE |

| 532 Eastern Boulevard, Essex, Maryland |

|

|

|

ITEMS OF BUSINESS |

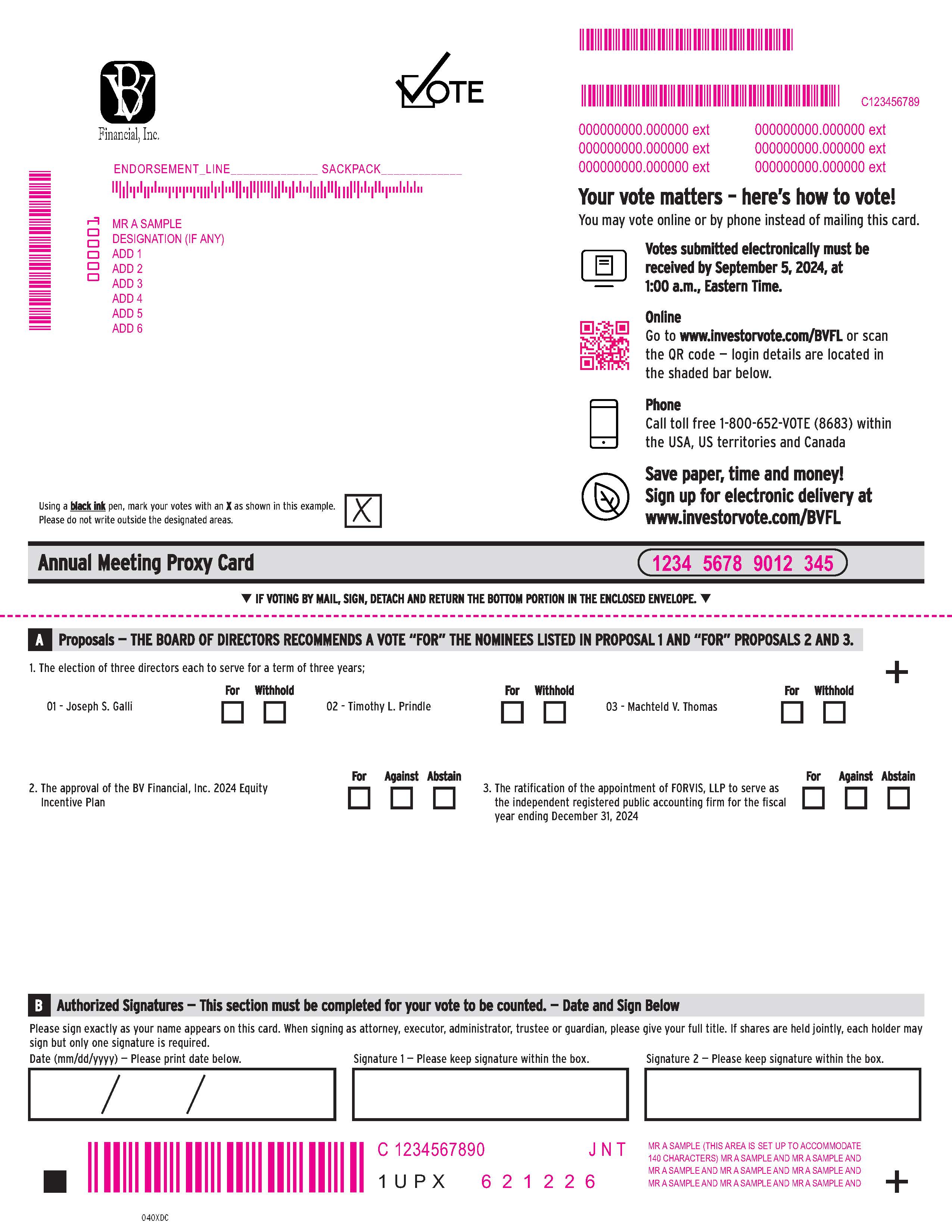

| (1) The election of three directors each to serve for a term of three years; (2) The approval of the BV Financial, Inc. 2024 Equity Incentive Plan; (3) The ratification of the appointment of FORVIS, LLP to serve as the independent registered public accounting firm for the fiscal year ending December 31, 2024; and (4) The transaction of any other business that may properly come before the meeting and any adjournment or postponement of the meeting. (Note: The Board of Directors is not aware of any other business to come before the meeting.) |

|

|

|

RECORD DATE |

| To be eligible to vote, you must have been a stockholder as of the close of business on July 19, 2024. |

|

|

|

PROXY VOTING |

| It is important that your shares be represented and voted at the meeting. You can vote your shares via the Internet, by telephone, or by mail by completing and returning the accompanying proxy card in the accompanying self-addressed envelope. Voting instructions are printed on the proxy card. You may revoke a proxy at any time before its exercise at the meeting by following the instructions in the accompanying proxy statement. BY ORDER OF THE BOARD OF DIRECTORS

Samantha M. Perouty Corporate Secretary |

Baltimore, Maryland

August 1, 2024

BV FINANCIAL, INC.

_________________________

PROXY STATEMENT

FOR

2024 ANNUAL MEETING OF STOCKHOLDERS

_________________________

GENERAL INFORMATION

BV Financial, Inc. is providing this proxy statement to you in connection with the solicitation of proxies by its Board of Directors only for use at the 2024 annual meeting of stockholders and for any adjournment or postponement of the annual meeting. In this proxy statement, we may also refer to BV Financial, Inc. as “BV Financial,” “the Company,” “we,” “our” or “us.” BayVanguard Bank is the wholly-owned subsidiary of BV Financial.

We will hold the annual meeting at 532 Eastern Boulevard, Essex, Maryland on Thursday, September 5, 2024 at 4:30 p.m., local time.

We intend to mail this proxy statement and a proxy card to stockholders of record beginning on or about August 1, 2024.

Important Notice Regarding the Availability of Proxy Materials

for the STOCKholder Meeting to Be Held on SEPTEMBER 5, 2024

This proxy statement and our Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, are available on the Internet at https://www.edocumentview.com/BVFL. The Annual Report includes our audited consolidated financial statements for the fiscal year ended December 31, 2023.

INFORMATION ABOUT VOTING

Who May Vote at the Meeting

You are entitled to vote your shares of BV Financial common stock that you owned as of the close of business on July 19, 2024. As of the close of business on that date, 11,387,723 shares of common stock were outstanding. Each share of common stock has one vote.

Our Articles of Incorporation provide that record holders of or common stock who beneficially own, either directly or indirectly, more than 10% of our outstanding shares of common stock are not entitled to any vote with respect to the shares held in excess of the 10% limit.

Ownership of Shares

You may own your shares of common stock of BV Financial in one or more of the following ways:

1

If your shares are registered directly in your name, you are the holder of record of those shares and we are sending these proxy materials directly to you. As the holder of record, you have the right to give your proxy directly to us to vote at the annual meeting or you may vote in person at the annual meeting.

If you hold your shares in “street name,” you are considered the beneficial owner of your shares and your broker, bank or other holder of record is sending these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote by completing a voting instruction form provided by your broker, bank or other holder of record that accompanies your proxy materials. Your broker, bank or other holder of record may allow you to provide voting instructions by telephone or by the Internet. Refer to the voting instruction form that accompanies your proxy materials. If you want to vote your shares of common stock held in street name in person at the annual meeting, you must obtain a written proxy in your name from the broker, bank or other holder who is the record holder of your shares.

If you own shares of common stock indirectly through the 401(k) Plan or are a participant in the ESOP, see “Participants in the ESOP and 401(k) Plan” below.

Attending the Meeting

Stockholders are invited to attend the annual meeting. If you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. Examples of proof of ownership are a recent brokerage account statement or a letter from your bank or broker.

Quorum and Vote Required

Quorum. We will have a quorum and be able to conduct the business of the annual meeting if a majority of the outstanding shares of BV Financial common stock entitled to vote, represented in person or by proxy, is present at the meeting.

Votes Required for Proposals. At this year’s annual meeting, stockholders will vote to elect three directors each to serve for a term of three years. In voting to elect the directors (Item 1), you may vote in favor of the nominees or withhold your vote as to the nominees. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the largest number of votes cast will be elected up to the maximum number of directors to be elected at the annual meeting.

In voting to approve the BV Financial, Inc. 2024 Equity Incentive Plan (Item 2) and to ratify the appointment of the independent registered public accounting firm (Item 3), you may vote in favor of the proposal, against the proposal or abstain from voting. The affirmative vote of a majority of the votes cast at the annual meeting is required to approve each of these proposals.

Broker Non-Votes; Effect of Not Casting Your Vote

If you hold your shares in street name through a broker, bank or other nominee of record, it is critical that you provide voting instructions if you want your vote to count in the election of directors (Item 1) and the approval of the BV Financial, Inc. 2024 Equity Incentive Plan (Item 2). Your broker, bank or other holder of record does not have discretion to vote your uninstructed shares with respect to these items. Therefore, if you hold your shares in street name and you do not instruct your broker or other holder of record on how to vote with respect to these items, no votes will be cast on your behalf with respect to these items. These are referred to as “broker non-votes.” Your broker, bank or other holder of record, however, does have discretion to vote any uninstructed shares on the ratification of the appointment of the independent registered public accounting firm (Item 3). If you are a stockholder of record and you do not cast your vote, no votes will be cast on your behalf on any of the items of business at the annual meeting.

How We Count the Votes

If you return valid proxy instructions or attend the meeting in person, we will count your shares to determine whether there is a quorum, even if you abstain from voting. Broker non-votes also will be counted to determine the existence of a quorum.

In the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In counting votes to approve the BV Financial, Inc. 2024 Equity Incentive Plan and to ratify the appointment of the independent registered public accounting firm, broker non-votes and abstentions will have no effect on the outcome of these votes.

2

Voting by Proxy

We are sending you this proxy statement to request that you allow your shares of Company common stock to be represented at the annual meeting by the designated proxies named by the Board of Directors. All shares of common stock represented at the annual meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by our Board of Directors.

The Board of Directors unanimously recommends a vote:

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their judgment as to how to vote your shares. This includes a motion to adjourn or postpone the annual meeting to solicit additional proxies. If the annual meeting is postponed or adjourned, your common stock may be voted by the persons named on the proxy card on the new meeting date as well, unless you have revoked your proxy. We do not know of any other matters to be presented at the annual meeting.

Voting Via the Internet or by Telephone

Instead of voting by mailing a proxy card, registered stockholders can vote their shares of BV Financial common stock via the Internet or by telephone. The Internet and telephone voting procedures are designed to authenticate stockholders’ identities, allow stockholders to provide their voting instructions and confirm that their instructions have been recorded properly. Specific instructions for Internet and telephone voting are set forth on the proxy card. The deadline for voting via the Internet or by telephone is 11:59 p.m., Eastern Time, on September 4, 2024.

Revoking Your Proxy

Whether you vote by mail or via the Internet or by telephone, if you are a registered stockholder, you may revoke your proxy by:

If you hold your shares through a bank, broker, trustee or nominee and you have instructed the bank, broker, trustee or nominee to vote your shares, you must follow the directions received from your bank, broker, trustee or nominee to change those instructions.

Participants in the ESOP and the 401(k) Plan

If you are a participant in the ESOP, you will receive a voting instruction card that reflects all the shares that you may direct the ESOP trustee to vote on your behalf under the ESOP. Under the terms of the ESOP, the ESOP trustee votes all shares held by the ESOP, but you may direct the trustee how to vote the shares of BV Financial common stock allocated to your ESOP account. The ESOP trustee will vote all unallocated shares of BV Financial common stock held by the ESOP and all allocated shares for which no voting instructions are received in the same proportion as shares for which it has received timely voting instructions.

3

If you hold shares of Company common stock in the 401(k) Plan, you will receive a voting instruction card that reflects all shares that you may direct the 401(k) Plan trustee to vote on your behalf under the 401(k) Plan. Under the terms of the 401(k) Plan, you may direct the 401(k) Plan trustee how to vote the shares allocated to your account. If the 401(k) Plan trustee does not receive your voting instructions, the 401(k) Plan trustee will be instructed to vote your shares in the same proportion as the voting instructions received from other 401(k) Plan participants.

The deadline for returning your voting instruction cards to the ESOP trustee and/or the 401(k) Plan trustee is August 29, 2024.

CORPORATE GOVERNANCE

General

The Company periodically reviews its corporate governance policies and procedures to ensure that it meets the highest standards of ethical conduct, reports results with accuracy and transparency and fully complies with the laws, rules and regulations that govern its operations. As part of this periodic corporate governance review, the Board of Directors reviews and adopts best corporate governance policies and practices for the Company.

Director Independence

The Board of Directors currently consists of ten members. The Board of Directors has determined that each of our directors, with the exception of Co-President and Chief Executive Officers, David M. Flair and Timothy L. Prindle, is “independent” as defined in the listing standards of the Nasdaq Stock Market. Messrs. Flair and Prindle are not independent because they are our executive officers. In determining the independence of directors, the Board of Directors has considered transactions, relationships and arrangements between the Company and its directors that are not required to be disclosed in this proxy statement under the heading “Other Information Relating to Directors and Executive Officers—Transactions with Related Persons.”

Board Diversity

Nasdaq’s Board Diversity Rule is a disclosure standard designed to encourage board diversity for companies and provide stakeholders with consistent, comparable disclosures concerning a company’s current board composition. The table below indicates the composition of our current Board of Directors.

Total Number of Directors | 10 | |||

Gender | Female | Male | Non-Binary | Did Not Disclose |

Directors | 1 | 9 | ||

Number of Directors who identify in any of the categories below: | ||||

African American or Black | 1 | |||

Alaskan Native or American Indian | ||||

Asian | ||||

Hispanic or Latinx | ||||

Native Hawaiian or Pacific Islander | ||||

White | 1 | 7 | ||

Two or More Races or Ethnicities | ||||

LBGTQ+ | ||||

Did not disclose demographic background | 1 | |||

4

Board Leadership Structure and Board’s Role in Risk Oversight

The Board of Directors has determined that the separation of the offices of Chairperson of the Board and Co-President and Chief Executive Officers enhances Board independence and oversight. Moreover, the separation of these offices allows the Co-President and Chief Executive Officers to better focus on their growing responsibilities of managing the daily operations of the Company and BayVanguard Bank, while allowing the Chairperson of the Board to lead the Board of Directors in its fundamental role of providing advice to, and independent oversight of, management. Gary T. Amereihn serves as the Chairperson of the Board, and he is considered independent under the listing standards of the Nasdaq Stock Market.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face several risks, including credit risk, interest rate risk, liquidity risk, operational risk, strategic risk and reputation risk. Management is responsible for the day-to-day management of risks the Company faces, while the Board of Directors, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. Senior management also attends Board meetings and is available to address any questions or concerns raised by the Board of Directors on risk management and any other matters.

Committees of the Board of Directors

We conduct business through meetings of our board of directors and its committees. The board of directors of BV Financial has established standing committees, including a Compensation Committee, an Audit Committee and a Governance and Nominating Committee. Each of these committees operates under a written charter, which governs its composition, responsibilities and operations. The charters of all three committees are available in BV Financial Inc. Policies and Charters portion of the Investor Relations section of BayVanguard Bank’s website (www.bayvanguard.com).

The table below sets forth the directors of each of the listed standing committees. Each member of each committee meets the Nasdaq and the Securities and Exchange Commission independence requirements for such committee. The Board of Directors has determined that Mr. Baldwin qualifies as an “audit committee financial expert” as such term is defined by the rules and regulations of the Securities and Exchange Commission.

Audit Committee |

| Compensation Committee |

| Governance and Nominating Committee |

William Streett Baldwin* |

| Gary T. Amereihn* |

| Joshua W. Posnick* |

William B. Crompton |

| William Streett Baldwin |

| Brian McHale |

Machteld V. Thomas |

| Joseph S. Galli |

| Machteld V. Thomas |

* Denotes Chairperson

Audit Committee. The Audit Committee meets periodically with the independent registered public accounting firm and management to review accounting, auditing, internal control structure and financial reporting matters. The Board of Directors has determined that William Streett Baldwin, a certified public accountant, is an “audit committee financial expert” as that term is defined in the rules and regulations of the Securities and Exchange Commission. The report of the Audit Committee required by the rules and regulations of the Securities and Exchange Commission is included in this proxy statement. See “Report of the Audit Committee.” The Audit Committee met five times in 2023.

Compensation Committee. The Compensation Committee approves the compensation objectives for the Company and BayVanguard Bank, establishes the compensation for the Company’s and the Bank’s senior management and conducts the performance review of the Co-President and Chief Executive Officers. The Compensation Committee reviews all components of compensation, including salaries, cash incentive plans, long-term incentive plans and various employee benefit matters. The Compensation Committee is also responsible for administering the Company’s equity plans and approving grants under such plans. The Compensation Committee also considers the appropriate levels and form of director compensation and makes recommendations to the Board of Directors regarding director compensation. The Compensation Committee met three times in 2023.

Governance and Nominating Committee. The Governance and Nominating Committee assists the Board of Directors in: (1) identifying individuals qualified to become Board members, consistent with criteria approved by the Board; (2) recommending to the Board the director nominees for the next annual meeting; (3) implementing policies and practices relating to corporate governance, including implementation of and monitoring adherence to corporate governance guidelines; (4) leading the Board in its annual review of the Board’s performance; and (5) recommending director nominees for each committee. The Governance and Nominating Committee met one time in 2023

5

Considerations Respecting Director Nominees and Candidates

Minimum Qualifications for Director Nominees. The Governance and Nominating Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. A candidate must meet the eligibility requirements set forth in our Bylaws, which include an age limitation provision and a requirement that the candidate has not been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements set forth in any Board of Directors or committee governing documents.

If a candidate is deemed eligible for election to the Board of Directors, the Governance and Nominating Committee will then evaluate the following criteria in selecting nominees:

The Governance and Nominating Committee will also consider any other factors it deems relevant, including diversity, competition, size of the Board of Directors and regulatory disclosure obligations.

When nominating an existing director for re-election to the Board of Directors, the Governance and Nominating Committee will consider and review an existing director’s attendance and performance at Board meetings and at meetings of committees on which he or she serves; length of Board service; the experience, skills and contributions that the existing director brings to the Board; and independence.

Director Nomination Process. The process that the Governance and Nominating Committee follows to identify and evaluate individuals to be nominated for election to the Board of Directors is as follows:

For purposes of identifying nominees for the Board of Directors, the Governance and Nominating Committee relies on personal contacts of the committee members and other members of the Board of Directors, as well as its knowledge of members of the communities BayVanguard Bank serves. The Board of Directors will also consider director candidates recommended by stockholders according to the policy and procedures set forth below. The Governance and Nominating Committee has not used an independent search firm to identify nominees.

In evaluating potential nominees, the Governance and Nominating Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the criteria set forth above. If such individual fulfills these criteria, the Governance and Nominating Committee will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the prospective nominee and the contributions he or she would make to the Board.

Consideration of Director Candidates Recommended by Stockholders. The Governance and Nominating Committee will consider director candidates recommended by stockholders who appear to be qualified to serve on our Board of Directors. However, the Governance and Nominating Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Governance and Nominating Committee does not perceive a need to increase the size of the Board of

6

Directors. To avoid the unnecessary use of the Governance and Nominating Committee’s resources, the Governance and Nominating Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders. To submit a recommendation of a director candidate to the Governance and Nominating Committee, a stockholder should submit the following information in writing, addressed to the Chairman of the Governance and Nominating Committee, care of the Corporate Secretary, at our main office:

For a director candidate to be considered for nomination at an annual meeting of stockholders, the Governance and Nominating Committee must receive the recommendation at least 120 calendar days before the date of our proxy statement for the previous year’s annual meeting, advanced by one year.

Board and Committee Meetings

The business of BV Financial and BayVanguard Bank is conducted through meetings and activities of their respective Board of Directors and committees. During the year December 31, 2023, the Board of Directors of BV Financial held eleven meetings and the Board of Directors of BayVanguard Bank held twelve meetings. No director attended fewer than 75% of the total meetings of the Board of Directors and of the committees on which that director served.

Director Attendance at Annual Meeting

While BV Financial has no formal policy on director attendance at annual meetings of stockholders, directors are encouraged to attend. Eight of the then ten current directors attended the annual meeting of stockholders held on May 4, 2023.

Code of Ethics for Senior Officers

We maintain a Code of Ethics for Senior Officers, which includes the Company’s Co-Chief Executive Officers, Chief Financial Officer and Controller. The Code of Ethics for Senior Officers addresses conflicts of interest, the treatment of confidential information, and compliance with applicable laws, rules and regulations. In addition, it is designed to deter wrongdoing and promote honest and ethical conduct, the avoidance of conflicts of interest, full and accurate disclosure and compliance with all applicable laws, rules and regulations. The Code of Ethics for Senior Officers is available in the BV Financial Inc. Policies and Charters portion of the Investor Relations section of BayVanguard Bank’s website (www.bayvanguard.com). Any amendments to and waivers from the Code of Ethics for Senior Officers will be disclosed in the Investor Relations section of BayVanguard Bank’s website.

7

Employee, Officer and Director Hedging

The Company does not have anti-hedging policies or procedures that are applicable to its directors, executive officers or employees who are not executive officers and as such, hedging transactions are not prohibited.

Report of the Audit Committee

BV Financial’s management is responsible for BV Financial’s internal controls and financial reporting process. Our independent registered public accounting firm is responsible for performing an independent audit of our financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles in the United States of America. The Audit Committee oversees BV Financial’s internal controls and financial reporting process on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and with the independent registered public accounting firm. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the Public Company Accounting Oversight Board (United States) Auditing Standard No. 1301, Communications with Audit Committees, which include the quality, and not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board and has discussed with the independent registered public accounting firm the firm’s independence from the Company and its management. In concluding that the independent registered public accounting firm is independent, the Audit Committee considered, among other factors, whether any non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with the independent registered public accounting firm the overall scope and plans for their audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal control over financial reporting and the overall quality of its financial reporting process.

In performing these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm who, in their report, express an opinion on the conformity of the Company’s consolidated financial statements to accounting principles generally accepted in the United States of America. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal control over financial reporting designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that the Company’s consolidated financial statements are presented in accordance with accounting principles generally accepted in the United States of America, that the audit of the consolidated financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board or that the independent registered public accounting firm is in fact “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for filing with the Securities and Exchange Commission. The Audit Committee has appointed, subject to stockholder ratification, FORVIS, LLP to serve as the independent registered public accounting firm for the fiscal year ending December 31, 2024.

Audit Committee of the Board of Directors

of

BV Financial, Inc.

William Streett Baldwin, Chairman

William B. Crompton

Machteld V. Thomas

8

DIRECTORS’ COMPENSATION

The following table sets forth for the year ended December 31, 2023 certain information as to the total compensation we paid to our non-employee directors. Neither Mr. Flair nor Mr. Prindle received any compensation in his capacity as a director during the fiscal year ended December 31, 2023.

Director Compensation Table for the Year Ended December 31, 2023 |

| |||||||||||

Name |

| Fees |

|

| Stock |

|

| Total |

| |||

Gary T. Amereihn |

|

| 28,000 |

|

|

| 27,891 |

|

|

| 55,891 |

|

William Streett Baldwin |

|

| 27,000 |

|

|

| 10,471 |

|

|

| 37,471 |

|

P. David Bramble |

|

| 8,250 |

|

|

| — |

|

|

| 8,250 |

|

William B. Crompton, III |

|

| 25,500 |

|

|

| 20,741 |

|

|

| 46,241 |

|

Joseph S. Galli |

|

| 14,400 |

|

|

| 20,471 |

|

|

| 35,141 |

|

Kim C. Liddell(2) |

|

| 6,750 |

|

|

| 14,157 |

|

|

| 20,907 |

|

Brian K. McHale |

|

| 14,000 |

|

|

| 25,471 |

|

|

| 39,471 |

|

Joshua W. Posnick |

|

| 12,000 |

|

|

| 10,471 |

|

|

| 22,471 |

|

Michael L. Snyder(3) |

|

| 6,000 |

|

|

| 19,271 |

|

|

| 25,271 |

|

Machteld V. Thomas |

|

| 16,900 |

|

|

| 4,730 |

|

|

| 21,630 |

|

Director Supplemental Retirement Agreement. BayVanguard Bank maintains an amended and restated supplemental director retirement agreement with Mr. McHale to provide certain payments to him upon his retirement or to his beneficiary if he dies under certain circumstances. Under the agreement, Mr. McHale is entitled to a retirement benefit equal to $6,100 per year, payable in monthly installments for ten years commencing within 30 days following his separation from service on or after attaining age 70. If Mr. McHale terminates service with BayVanguard Bank before age 70 for reasons other than cause, he is entitled to receive the accrued liability balance, payable in an unreduced lump sum within 30 days following his separation from service. If Mr. McHale dies while actively serving as a member of the board of directors, all of his accrued liability account will be paid to his beneficiary within 30 days following his death in an unreduced lump sum. If he dies during the installment payout of benefits, the remaining installments will be paid monthly to his beneficiary. If Mr. McHale separates from service following a change in control (as defined in the agreement), Mr. McHale will receive benefits under the plan as if he had retired from BayVanguard Bank upon attainment of age 70.

9

Stock Ownership

The following table provides the beneficial ownership of shares of common stock of BV Financial held by our directors and executive officers, individually and as a group, and all individuals known to management to own more than 5% of our common stock at July 19, 2024. For purposes of this table, a person is deemed to be the beneficial owner of any shares of common stock over which he has, or shares, directly or indirectly, voting or investment power or as to which he or she has the right to acquire beneficial ownership at any time within 60 days after July 19, 2024. The mailing address for each of our directors and executive officers is 7114 North Point Road, Baltimore, Maryland 21219.

| Number |

|

|

| Percent |

| |||

5% Beneficial Owners: |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||

Alliance Bernstein, L.P. |

|

| 1,048,206 |

| (1) |

|

| 9.21 | % |

501 Commerce Street |

|

|

|

|

|

|

| ||

Nashville, TN 37203 |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||

Newtyn Management LLC |

|

| 1,000,000 |

| (1) |

|

| 8.79 | % |

60 East 42nd Street, Suite 960 |

|

|

|

|

|

|

| ||

New York, New York 10022 |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

| ||

BayVanguard Bank Employee Stock Ownership Plan |

|

| 868,516 |

| (2) |

|

| 7.63 | % |

7114 North Point Road |

|

|

|

|

|

|

| ||

Baltimore, Maryland 21219 |

|

|

|

|

|

|

| ||

| Number of Shares |

|

|

| Percent |

| |||

Directors: |

|

|

|

|

|

|

| ||

Gary T. Amereihn |

|

| 49,961 |

| (2) |

| * |

| |

William Streett Baldwin |

|

| 57,950 |

|

|

| * |

| |

P. David Bramble |

|

| 12,934 |

| (3) |

| * |

| |

William B. Crompton, III |

|

| 42,291 |

| (4) |

| * |

| |

David M. Flair |

|

| 120,692 |

| (5) |

|

| 1.06 | % |

Joseph S. Galli |

|

| 171,630 |

| (6) |

|

| 1.50 | % |

Brian K. McHale |

|

| 23,723 |

| (7) |

| * |

| |

Timothy L. Prindle |

|

| 270,716 |

| (8) |

|

| 2.37 | % |

Joshua W. Posnick |

|

| 9,965 |

|

|

| * |

| |

Machteld V. Thomas |

|

| 34,904 |

| (9) |

| * |

| |

|

|

|

|

|

|

|

| ||

Executive Officers Who Are Not Directors: |

|

|

|

|

|

|

| ||

Michael J. Dee |

|

| 65,560 |

| (10) |

| * |

| |

Gregory J. Olinde |

|

| 6,950 |

| (11) |

| * |

| |

All directors, nominees and executive officers as a group |

|

| 887,859 |

|

|

|

| 7.76 | % |

* Less than 1%.

10

Items OF BUSINESS to be Voted on by STOCKHOLDERs

Item 1 — Election of Directors

BV Financial’s Board of Directors consists of ten members. The Board of Directors is divided into three classes with three-year staggered terms, with approximately one-third of the directors elected each year. The nominees for election at this year’s annual meeting are Joseph S. Galli, Timothy L. Prindle and Machteld V. Thomas. Each nominee currently serves as a director of BV Financial and BayVanguard Bank.

The Board of Directors intends to vote the proxies solicited by it in favor of the election of the nominees named above. If the nominees are unable to serve, the persons named in the proxy card will vote your shares to approve the election of any substitute proposed by the Board of Directors. Alternatively, the Board of Directors may adopt a resolution to reduce the size of the Board of Directors. At this time, the Board of Directors knows of no reason why any of the nominees might be unable to serve.

The Board of Directors unanimously recommends a vote “FOR” each of the nominees for director.

Information regarding the Board of Directors’ nominees and the directors continuing in office is provided below. Unless otherwise stated, each individual has held his or her current occupation for the last five years. The indicated age for each individual is as of December 31, 2023. The indicated period for service as a director includes service as a director of BayVanguard Bank. There are no family relationships among the directors.

Director Nominees for Term Expiring in 2027

Joseph S. Galli. For over 30 years, Mr. Galli has been an Executive Vice President of The Bernstein Companies, which is an owner, developer, investor and manager of commercial, residential, industrial and hotel properties in the Mid-Atlantic region of the United States. Within The Bernstein Companies, Mr. Galli is a managing director of Consortium Capital, which is a series of real estate equity funds that invest in commercial real estate throughout the Mid-Atlantic. Mr. Galli is also the Chairman of the Government Relations Committee for the Washington, D.C. chapter of Autism Speaks. Mr. Galli’s experience and long-standing involvement in our local community provides the Board with business management skills and knowledge regarding real estate and business matters in our market area. Age 60. Director since 2015.

Timothy L. Prindle. Mr. Prindle was elected as the Co-President and Chief Executive Officer and a member of the Board of Directors of Bay-Vanguard M.H.C., BV Financial and BayVanguard Bank in 2019. Previously he served as President and Chief Executive Officer of Kopernik Bank since 2012 before it was acquired by BayVanguard in 2019. Mr. Prindle began his career as a Bank Examiner at the Office of Thrift Supervision. In addition to his wide range of management experience and leadership skills, Mr. Prindle’s strong regulatory background and his knowledge and understanding of the financial, economic and regulatory environments make him a valuable asset to the Board. Age 38. Director since 2019.

Machteld V. Thomas. Ms. Thomas served as the President and Chief Executive Officer of North Arundel Savings Bank for 14 years before its acquisition by BV Financial in 2021 and is now retired. Ms. Thomas serves on the board of directors of Bello Machre, a nonprofit that offers care and support for children and adults with developmental disabilities. Ms. Thomas’ past service as a chief executive officer of a financial institution and her participation in the communities we serve brings an extensive knowledge of the financial, economic and regulatory challenges we face as well as knowledge of the local economy and business opportunities for BayVanguard Bank. Age 69. Director since 2022.

11

Directors Continuing in Office with Terms Expiring in 2025

William Streett Baldwin. For over 20 years, Mr. Baldwin has been a director of Ellin & Tucker, Chartered, a business consulting and certified public accounting firm located in Baltimore, Maryland. Mr. Baldwin is a certified public accountant and is a member of the American Institution of Certified Public Accountants and the Maryland Association of Certified Public Accountants. Through his experience as a certified public accountant and his strong risk assessment, financial reporting and internal control expertise, as well as extensive knowledge of accounting and regulatory issues, Mr. Baldwin provides an understanding of public accounting and financial matters to the Board. Age 61. Director since 2012.

William B. Crompton, III. Mr. Crompton served as a Director of Kopernik Bank from 2017 until its acquisition by BV Financial in 2019. Mr. Crompton retired from the Office of the Comptroller of the Currency in 2015. Mr. Crompton had held managerial positions in the Office of the Comptroller of the Currency, Office of Thrift Supervision and Federal Home Loan Bank System for over 30 years. With his background of directly working in and managing the examination and supervision of financial institutions at several bank regulatory agencies, Mr. Crompton provides the Board with extensive knowledge regarding regulatory matters and the financial and economic challenges confronting banks. Age 70. Director since 2019.

David M. Flair. Mr. Flair became the Chief Executive Officer of BV Financial and BayVanguard in 2013 and was also named President of BV Financial and BayVanguard in 2014. Mr. Flair was hired as the Chief Financial Officer of BV Financial and BayVanguard in 2012 and served in that role until 2014. Mr. Flair served as the Chief Financial Officer of Advance Bank in Baltimore, Maryland, beginning in 2006 and was also appointed as a director and named the Acting Chief Executive Officer of Advance Bank before his departure in 2012. Mr. Flair is a certified public accountant and was a partner with Anderson Associates LLP and Beard Miller Company LLP for almost 20 years before joining Advance Bank. In addition to his wide range of management experience and leadership skills, Mr. Flair’s strong financial background and his knowledge and understanding of the financial, economic and regulatory environments make him a valuable asset to the Board. Age 60. Director since 2012.

Joshua W. Posnick. Since 2022, Mr. Posnick has been Senior Managing Director of Capital Markets for Mill Creek Residential, a real estate development and management company, located in Washington, D.C. From 2018 until 2022, Mr. Posnick was Managing Director of Development in the Mid-Atlantic region for Mill Creek Residential. Mr. Posnick provides the Board with business management skills and knowledge regarding real estate and business matters in our market area. Age 38. Director since 2019.

Directors Continuing in Office with Terms Expiring in 2026

Gary T. Amereihn. Mr. Amereihn retired from Kopernik Bank in 2019 as part of BayVanguard Bank’s acquisition of Kopernik Bank, having served as Kopernik Bank’s Chairman, Chief Executive Officer and Chief Financial Officer from 1992 to 2019. Mr. Amereihn serves as the Chairman of the Board of BV Financial and BayVanguard Bank. Mr. Amereihn’s past service as a chairman, chief executive officer and chief financial officer of a financial institution and his participation in the communities we serve brings an extensive knowledge of the financial, economic and regulatory challenges we face as well as knowledge of the local economy and business opportunities for BayVanguard Bank. Age 69. Director since 2019.

Brian K. McHale. Mr. McHale has been a Steamship Clerk with International Longshoremen’s Association Local 953 located in Baltimore, Maryland since 1972 and until 2014 was a state delegate to the Maryland General Assembly. Mr. McHale’s long-standing involvement in our local community brings knowledge of the local economy and business opportunities to BayVanguard Bank. His leadership skills and knowledge of the financial, economic and regulatory challenges we face make him well suited to serve on the Board. Age 69. Director since 1987.

P. David Bramble. Mr. Bramble has been a managing partner at MCB Real Estate, LLC (“MCB”) since 2005 and has been working in real estate investment for over 20 years. He dedicates his time to sourcing and capitalizing transactions and overseeing project underwriting and execution. Prior to MCB, Mr. Bramble served as the director of commercial lending for a regionally based full-service lending firm –Madison Funding – which he co- founded in 2000. Prior to that, Mr. Bramble worked for the law firm of Steptoe & Johnson LLP where he provided corporate and real estate advisory services. Mr. Bramble serves as the Chairman of the Board of Lendistry, a fintech enabled CDFI focused on providing small business capital to underserved communities nationwide. He serves on the investment committee and board of the Robert W. Deutsch Foundation, which invests in innovative people, projects, and ideas that improve the quality of life in Baltimore. He also serves on the boards of Johns Hopkins Bayview Hospital, Ronald McDonald House, UPENN Institute for Urban Research and the Baltimore Tree Trust. The Board believes that Mr. Bramble provides the Board with extensive knowledge regarding financial, economic and legal matters and knowledge of our market area due to his long-standing involvement in our local community. Age 46. Director since 2023.

12

Executive Officers Who Are Not Directors

The following sets forth information regarding our executive officers who are not directors. Age information is as of December 31, 2023.

Michael J. Dee. Mr. Dee has been our Senior Vice President and Chief Financial Officer since 2014 and became our Executive Vice President and Chief Financial Officer in 2019. Age 63.

Gregory J. Olinde. Mr. Olinde has been our Executive Vice President and Chief Credit Officer and Delmarva Market President since 2020. Mr. Olinde was Executive Vice President, Chief Credit Officer for 1880 Bank from 2013 to 2020, when 1880 was acquired by BayVanguard Bank. Age 56.

Rose M. Searcy. Ms. Searcy has been with the Bank since 1992 and became our Executive Vice President, Human Resources in 2021. Age 50.

Item 2 — Approval of BV Financial, Inc. 2024 Equity Incentive Plan

Overview

The Company’s Board of Directors unanimously recommends that stockholders approve the BV Financial, Inc. 2024 Equity Incentive Plan (referred to in this proxy statement as the “2024 Equity Plan” or the “Plan”). Our Board of Directors unanimously approved the 2024 Equity Plan on July 18, 2024. The 2024 Equity Plan will become effective on September 5, 2024 (the “Plan Effective Date”) if stockholders approve the Plan on that date. No awards have been made under the 2024 Equity Plan. However, initial awards to be granted to our non-employee directors are set forth in the Plan document and will be self-executing on the day following the approval of the Plan by stockholders. In addition, upon stockholder approval of the 2024 Equity Plan, no further grants will be made under either the BV Financial, Inc. 2017 Stock Option Plan (the “2017 Stock Option Plan”) or the BV Financial, Inc. 2021 Equity Incentive Plan (the “2021 Equity Plan”). However, both of those plans will remain in existence solely to administer awards outstanding under the plans as of September 5, 2024.

No awards may be granted under the 2024 Equity Plan after the day immediately before the tenth anniversary of the Plan Effective Date. However, awards outstanding under the 2024 Equity Plan at that time will continue to be governed by the 2024 Equity Plan and the award agreements under which they were granted.

Best Practices

The 2024 Equity Plan reflects the following equity compensation plan best practices:

13

The full text of the 2024 Equity Plan is attached as Appendix A to this proxy statement, and the description of the 2024 Equity Plan is qualified in its entirety by reference to Appendix A.

Why The Company Believes You Should Approve the 2024 Equity Plan

Our Board of Directors believes that equity-based incentive awards will play a key role in the success of the Company by encouraging and enabling employees, officers and non-employee directors of the Company and its subsidiaries, including BayVanguard Bank (as used in this section, the Company, BayVanguard Bank and their respective subsidiaries are collectively referred to as, the “Company”), upon whose judgment, initiative and efforts the Company has depended and continues to largely depend for the successful conduct of its business, to acquire an ownership stake in the Company, thereby stimulating their efforts on behalf of the Company and strengthening their desire to remain with the Company. The details of the key design elements of the 2024 Equity Plan are set forth in the section entitled “Plan Summary,” below.

We view the ability to use Company common stock as part of our compensation program as an important component to our future success because we believe it will enhance a pay-for-performance culture that is an important element of our overall compensation philosophy. Equity-based compensation will further align the compensation interests of our employees and directors with the investment interests of our stockholders to promote a focus on long-term value creation through time-based and/or performance-based vesting criteria.

If the 2024 Equity Plan is not approved by stockholders, the Company will have to rely on the limited shares available under the 2021 Equity Plan, as well as the cash component of its employee compensation program to attract new employees and to retain our existing employees, which may not align our employees’ interests with the investment interests of the Company’s stockholders. In addition, this could be a competitive disadvantage for key talent, which could impede our future growth plans and other strategic priorities. The inability to provide equity-based awards would likely increase cash compensation expense over time and use up cash that might be better utilized if reinvested in the Company’s business or returned to the Company’s stockholders.

Equity Awards Will Enable Us to Better Compete for Talent in Our Marketplace. Most of our competitors offer equity-based compensation to their employees and non-employee directors. We view the ability to offer equity-based compensation as important to our ability to compete for talent within our highly competitive talent marketplace.

Equity-Based Incentive Plans are Routinely Adopted by Financial Institutions Following Conversions. A substantial majority of financial institutions that complete a mutual-to-stock conversion, including a second-step conversion, have adopted equity-based compensation plans to attract, retain and reward qualified personnel and management.

Our Share Reserve is Generally Consistent with Banking Regulations and Industry Standards Disclosed in Connection with our Stock Offering. The number of restricted stock awards (including RSUs) and stock options that we may grant under the 2024 Equity Plan, measured as a percentage of total outstanding shares sold in the second-step conversion, is consistent with that which was disclosed in connection with our stock offering in the offering prospectus. The share pool under the 2024 Equity Plan represents 14% of the 9,798,980 shares of the Company common stock sold in the second-step conversion, of which a number equal to 4% of the shares sold in the stock offering (“4% Limit”) will be available to grant as awards of restricted stock and/or RSUs (collectively, or separately, sometimes referred to herein as “full value awards”) and a number equal to 10% of shares sold in the stock offering (“10% Limit”) is comprised of stock options (the “stock option award pool”). This share reserve size, including the limits on award types described

14

above, is also consistent with the amounts permitted under federal banking regulations for equity plans adopted within the first year following a mutual to stock conversion or second-step conversion. Although we are not bound by these regulatory limits because we are implementing our plan more than one year following the completion of our second-step conversion, we have generally determined to maintain the size of the share reserve at these limits.

Determination of Shares Available under the 2024 Equity Plan

The Company is requesting approval of a pool of shares of its common stock (referred to in this proxy statement as the “share reserve” or “share pool”) for awards under the 2024 Equity Plan, subject to adjustment as described in the 2024 Equity Plan. The shares of common stock to be issued by the Company under the 2024 Equity Plan will be currently authorized but unissued shares or shares that may subsequently be acquired by the Company, including shares that may be purchased on the open market or in private transactions.

In determining the size of the share pool under the 2024 Equity Plan, the Company considered a number of factors, including: (1) industry practices related to the adoption of equity-based incentive plans by recently converted institutions; (2) applicable banking regulations related to the adoption of equity-based incentive plans; and (3) guidelines issued by proxy advisory firms with respect to equity-based incentive plans, including the potential cost and dilution to stockholders associated with the share pool.

The Company disclosed to stockholders in its prospectus for its second-step conversion that it expected to adopt an equity incentive plan that, if adopted within the first year following the second-step conversion, would include restricted stock awards and stock options equal to 4% and 10%, respectively, of the total shares issued in connection with the offering. Based on these percentages and the 9,798,980 shares sold in the offering, the total amount of shares available for issuance under the equity incentive plan is 1,371,857. As noted, this is the same number of shares we would be permitted to issue under applicable federal regulations if our equity plan had been implemented within the one-year period following our second-step conversion. Even though we are implementing the 2024 Equity Plan more than one year after our offering, we have determined to maintain the size of the 2024 Equity Plan at the amount disclosed in our offering prospectus.

Application of Share Pool. The Company has determined that of the shares available under the Plan, 391,959 shares may be issued as restricted stock or restricted stock units, including performance shares and performance share units (representing the 4% Limit described above) and 979,898 shares may be issued upon the exercise of stock options (representing the 10% Limit described above).

Current Stock Price. The closing price of the Company common stock on the NASDAQ Capital Market on July 19, 2024, was $13.50 per share.

Plan Summary

The following summary of the material terms of the 2024 Equity Plan is qualified in its entirety by reference to the full text of the 2024 Equity Plan, which is attached as Appendix A to this proxy statement.

Purpose of the 2024 Equity Plan. The purpose of the 2024 Equity Plan is to promote the long-term financial success of the Company and its subsidiaries, including BayVanguard Bank, by providing a means to attract, retain and reward individuals who contribute to that success and to further align their interests with those of the Company stockholders through the ownership of shares of Company common stock and/or through compensation tied to the value of the Company’s common stock.

Administration of the 2024 Equity Plan. The 2024 Equity Plan will be administered by the Compensation Committee or such other committee consisting of at least two “Disinterested Board Members” defined as directors who, with respect to the Company or any subsidiary: (1) are not current employees; (2) are not former employees who continue to receive compensation (other than through a tax-qualified plan); (3) are not officers at any time in the past three years; (4) do not receive compensation for which disclosure would be required pursuant to Item 404 of Regulation S-K in accordance with the proxy solicitation rules of the Securities and Exchange Commission; and (5) do not possess an interest in any other transaction and/or are engaged in a business relationship for which disclosure would be required under Item 404(a) of Regulation S-K. To the extent permitted by law, the Committee may also delegate its authority, including its authority to grant awards, to one or more persons who are not members of the Company’s Board of Directors, except that no such delegation will be permitted with respect to awards to officers who are subject to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

15

Eligible Participants. Employees, non-employee members of the Boards of Directors of the Company and its subsidiaries, including BayVanguard Bank, and service providers of the Company and its subsidiaries will be eligible for selection by the Committee for the grant of awards under the 2024 Equity Plan. As of June 30, 2024, approximately 116 employees of the Company and its subsidiaries and eight non-employee members of the Company’s Board of Directors would be eligible for awards under the 2024 Equity Plan.

Types of Awards. The 2024 Equity Plan provides for the grant of restricted stock, RSUs, non-qualified stock options (also referred to as “NQSOs”), and incentive stock options (also referred to as “ISOs”), any or all of which can be granted with performance-based vesting conditions. ISOs may be granted only to employees of the Company’s subsidiaries and affiliates.

Restricted Stock and Restricted Stock Units. A restricted stock award is a grant of common stock to a participant for no consideration, or such minimum consideration as may be required by applicable law. Restricted stock awards under the 2024 Equity Plan will be granted only in whole shares of common stock and will be subject to vesting conditions and other restrictions established by the Committee consistent with the 2024 Equity Plan. Prior to the awards vesting, unless otherwise determined by the Committee, the recipient of a restricted stock award may exercise voting rights with respect to the common stock subject to the award. Cash dividends declared on unvested restricted stock awards will be withheld by the Company and distributed to a participant at the same time the underlying restricted stock vests to the participant. Stock dividends on shares of restricted stock will be subject to the same vesting conditions as those applicable to the restricted stock on which the dividends were paid.

Restricted stock units are similar to restricted stock awards in that the value of an RSU is denominated in shares of common stock. However, unlike a restricted stock award, no shares of stock are transferred to the participant until certain requirements or conditions associated with the award are satisfied. A participant who receives an RSU award will not possess voting rights but may accrue dividend equivalent rights to the extent provided in the award agreement evidencing the award. If dividend equivalent rights are granted with respect to an RSU award, the dividend equivalent rights will be withheld by the Company and will not be distributed before the underlying RSU settles. At the time of settlement, restricted stock units can, at the discretion of the Committee, be settled in Company common stock or in cash. The same limitation on the number of shares that are available to be granted as restricted stock awards available under the 2024 Equity Plan, referred to above as the 4% Limit, also applies to RSUs.

The Committee will specify the terms applicable to a restricted stock award or an RSU award in the award agreement including the number of shares of restricted stock or number of RSUs, as well as any restrictions applicable to the restricted stock or RSU, such as continued service or achievement of performance goals, the length of the restriction period and the circumstances under which the vesting of such award will accelerate.

Stock Options. A stock option gives the recipient the right to purchase shares of common stock at a specified price (referred to as the “exercise price”) for a specified period of time. The exercise price may not be less than the fair market value of the common stock on the date of grant. “Fair Market Value” for purposes of the 2024 Equity Plan means, if the common stock of the Company is listed on a securities exchange, the closing sales price of the common stock on that date, or, if the common stock is not traded on that date, then the closing price of the common stock on the immediately preceding trading date. If the common stock is not traded on a securities exchange, the Committee will determine the Fair Market Value in good faith and on the basis of objective criteria consistent with the requirements of the Internal Revenue Code of 1986, as amended (the “Code”). Under the Plan, no stock option can be exercised more than ten years after the date of grant and the exercise price of a stock option must be at least equal to the fair market value of a share on the date of grant of the option. However, with respect to an ISO granted to an employee who is a stockholder holding more than 10% of the Company’s total voting stock, the ISO cannot be exercisable more than five years after the date of grant and the exercise price must be at least equal to 110% of the fair market value of a share on the date of grant. Stock option awards will be subject to vesting conditions and restrictions as determined by the Committee and set forth in the applicable award agreement.

Grants of stock options under the 2024 Equity Plan will be either ISOs or NQSOs. ISOs have certain tax advantages and must comply with the requirements of Code Section 422. Only employees will be eligible to receive ISOs. One of the requirements to receive favorable tax treatment available to ISOs under the Code is that the 2024 Equity Plan must specify, and the Company stockholders must approve, the number of shares available to be issued as ISOs. As a result, to provide flexibility to the Committee, the 2024 Equity Plan provides that all the stock options may be issued as ISOs. ISOs cannot be granted under the 2024 Equity Plan after July 18, 2034. Dividend equivalents rights will not be paid with respect to awards of stock options.

Shares of common stock purchased upon the exercise of a stock option must be paid for in full at the time of exercise: (1) either in cash or with stock valued at fair market value as of the day of exercise; (2) by a “cashless exercise” through a third party; (3) by a net settlement of the stock option using a portion of the shares obtained on exercise in payment of the exercise price; (4) by personal, certified or cashiers’ check; (5) by other property deemed acceptable by the Committee; or (6) by a combination of the foregoing.

16

Performance Awards. The Committee will specify the terms of any performance awards issued under the 2024 Equity Plan in the accompanying award agreements. Any award granted under the Plan, including stock options, restricted stock (referred to herein as a “performance share”) and restricted stock units (referred to herein as a “performance share unit”) may be granted subject to the satisfaction of performance conditions determined by the Committee. A performance share or performance share unit will have an initial value equal to the fair market value of a share on the date of grant. In addition to any non-performance terms applicable to the performance share or performance share unit, the Committee will set one or more performance goals that, depending on the extent to which they are met, will generally determine the number of performance shares or performance share units that will vest in the participant (unless subject to further time-based vesting conditions). The Committee may provide for payment of earned performance share units in cash, shares of the Company’s common stock, or a combination thereof. The Committee will also specify any restrictions applicable to the performance share or performance share unit award such as continued service, the length of the restriction period (subject to the one-year minimum described above) and whether any circumstances, such as death, disability, or involuntary termination in connection with or following a change in control, shorten or terminate the restriction period.

Performance Measures. A performance objective may be described in terms of Company-wide objectives or objectives that are related to a specific subsidiary or business unit of the Company, and may be measured relative to a peer group, an index or business plan and based on absolute measures or changes in measures. An award may provide that partial achievement of performance measures results in partial payment or vesting of an award. Achievement of the performance measures may be measured over more than one period or fiscal year. In establishing performance measures applicable to a performance-based award, the Committee may provide for the exclusion of the effects of certain items, including but not limited to: (1) extraordinary, unusual, and/or nonrecurring items of gain or loss; (2) gains or losses on the disposition of a business; (3) dividends declared on the Company’s stock; (4) changes in tax or accounting principles, regulations or laws; or (5) expenses incurred in connection with a merger, branch acquisition or similar transaction. Moreover, if the Committee determines that a change in the business, operations, corporate structure or capital structure of the Company or the manner in which the Company or its subsidiaries conducts its business or other events or circumstances render current performance measures to be unsuitable, the Committee may modify the performance measures, in whole or in part, as the Committee deems appropriate.

The Committee will specify the period over which the performance goals for a particular award will be measured and will determine whether the applicable performance goals have been met with respect to a particular award following the end of the applicable performance period. Notwithstanding anything to the contrary in the Plan, performance measures relating to any award granted under the Plan will be modified, to the extent applicable, to reflect a change in the outstanding shares of stock of the Company by reason of any stock dividend or stock split, or a corporate transaction, such as a merger of the Company into another corporation, any separation of a corporation or any partial or complete liquidation by the Company or a subsidiary.

Individual Limits. The Board of Directors has chosen to adopt the overall limitations set forth in federal regulations for individual and aggregate awards to employees and non-employee directors under equity plans adopted within the first year after a mutual to stock conversion or second-step conversion. The Committee will determine the individuals to whom awards will be granted, the number of shares subject to an award, and the other terms and conditions of an award, subject to the limits set forth herein. Subject to adjustment as described in the 2024 Equity Plan:

17

Non-Employee Director Grants. Subject to approval of the 2024 Equity Plan, each non-employee director of the Company will receive a grant of shares of restricted stock and stock options as set forth in the tables below. If the 2024 Equity Plan is approved, these grants will be self-executing and will be deemed to be granted on the day following the approval of the 2024 Equity Plan by the Company’s stockholders.

Restricted Stock Awards |

| |||||||

Name of Non-Employee Director |

| Dollar |

|

| Number |

| ||

Gary T. Amereihn |

|

| 198,423 |

|

|

| 14,698 |

|

William Streett Baldwin |

|

| 198,423 |

|

|

| 14,698 |

|

P. David Bramble |

|

| 198,423 |

|

|

| 14,698 |

|

William B. Crompton, III |

|

| 198,423 |

|

|

| 14,698 |

|

Joseph S. Galli |

|

| 198,423 |

|

|

| 14,698 |

|

Brian K. McHale |

|

| 198,423 |

|

|

| 14,698 |

|

Joshua W. Posnick |

|

| 198,423 |

|

|

| 14,698 |

|

Machteld V. Thomas |

|

| 198,423 |

|

|

| 14,698 |

|

Non-Employee Directors as a Group (8 persons) |

|

| 1,587,384 |

|

|

| 117,584 |

|

Stock Option Awards |

| |||

Name of Non-Employee Director |

| Number |

| |

Gary T. Amereihn |

|

| 36,746 |

|

William Streett Baldwin |

|

| 36,746 |

|

P. David Bramble |

|

| 36,746 |

|

William B. Crompton, III |

|

| 36,746 |

|

Joseph S. Galli |

|

| 36,746 |

|

Brian K. McHale |

|

| 36,746 |

|

Joshua W. Posnick |

|

| 36,746 |

|

Machteld V. Thomas |

|

| 36,746 |

|

Non-Employee Directors as a Group (8 persons) |

|

| 293,968 |

|

The Committee determined to grant these one-time awards in this amount, in part, in recognition of the significant efforts and dedication of each such director, including in connection with the Company’s second-step conversion. Although the grants are, in part, in recognition of past service, the initial awards to directors will vest in equal annual installments over a period of four years from the date of grant, subject to the directors continued service to the Company during that time, subject to acceleration due to death, disability, involuntary termination of service in connection with a change in control or other circumstance which, in the discretion of the Committee, would warrant acceleration.

Employee Grants. At the present time, no specific determination has been made as to the grant or allocation of awards to officers and employees. However, the Committee intends to grant equity awards to senior executives and will meet after stockholder approval is received to determine the specific terms of the awards, including the allocation of awards to officers and employees.

Certain Restrictions with Respect to Awards. No dividend equivalent rights will be granted or paid with respect to any stock option. Additionally, no dividends or dividend equivalent rights will be paid on unvested awards contemporaneously with dividends paid on shares of the Company’s common stock. Instead, any dividends (or dividend equivalent rights, to the extent granted), with respect to an unvested award will be accumulated or deemed reinvested until such time as the underlying award becomes vested (including, where applicable, upon the achievement of performance goals).

The Committee will establish the vesting schedule or market or performance conditions of each award at the time of grant. However, at least 95% of the awards will vest no earlier than one year after the date of grant, unless accelerated due to death, disability or an involuntary termination of service at or following a change in control.

18

Adjustments. The Committee will make equitable adjustments in the number and class of securities available for issuance under the 2024 Equity Plan (including under any awards then outstanding), the number and type of securities subject to the individual limits set forth in the 2024 Equity Plan, and the terms of any outstanding award, as it determines are necessary and appropriate, to reflect any merger, reorganization, consolidation, recapitalization, reclassification, stock split, reverse stock split, spin-off combination, exchange of shares, distribution to stockholders (other than an ordinary cash dividend), or similar corporate transaction or event.

Termination of Service. Subject to certain exceptions, generally, if a participant ceases to perform services for the Company and its subsidiaries for any reason: (1) a participant will immediately forfeit any restricted stock, RSUs, performance shares and performance share units that were not vested on the date of termination; (2) all of the participant’s stock options that were exercisable on the date of termination will remain exercisable for, and will otherwise terminate at the end of, the term of the stock option; and (3) all of the participant’s stock options that were not exercisable on the date of termination will be forfeited immediately upon termination. In the event of a participant’s termination of service due to death, disability (as defined in the Plan) or involuntary termination at or following a change in control, the participant or the participant’s beneficiary, as applicable, has up to the remaining term of the stock options to exercise outstanding stock options. If a participant is terminated for cause (as defined in the Plan), all of the participant’s unexercised stock options (whether or not vested), and all restricted stock and RSUs that have not vested, will expire and be forfeited. Unless the Committee specifies otherwise in the award agreement, the 2024 Equity Plan provides that a participant will vest in his or her dividends upon termination of the participant’s service due to death, disability, involuntary termination without cause or resignation for “good reason” (as defined in the Plan) at or following a change in control.

Change in Control. Unless the Committee provides otherwise in the award agreement, any time-based vesting requirement applicable to an award will be deemed satisfied in full if (1) both a change in control occurs and a participant has an involuntary termination of service (including a resignation for good reason) with the Company or (2) the surviving entity in the change in control does not assume or replace the award with a comparable award issued by the surviving entity. With respect to an award that is subject to one or more performance objectives, unless the Committee specifies otherwise in the award agreement, in the event of a change in control and involuntary termination of service (including a resignation for good reason) or in the event that the surviving entity fails to assume or replace the award with a comparable award issued by the surviving entity, achievement of the performance objective will be deemed achieved at the greater of target or the actual level of performance measured as of the most recent completed fiscal quarter.

Transferability. Generally, awards granted under the 2024 Equity Plan are not transferable prior to death, except in limited circumstances with respect to stock options. Unless otherwise determined by the Committee, stock options, including ISOs, are transferable to certain grantor trusts established by the participant in which the participant is the sole beneficiary or between spouses’ incident to divorce, in the latter case, however, any ISOs so transferred will become NQSOs. In the Committee’s sole discretion, an individual may transfer non-qualified stock options to certain family members or to a trust or partnership established for the benefit of such family member or to a charitable organization, in each case, provided no consideration is paid to the participant in connection with the transfer. However, a participant may designate a beneficiary to exercise stock options or receive any rights that may exist upon the participant’s death with respect to awards granted under the 2024 Equity Plan. Any transferee is subject to the terms and conditions of the Plan and applicable award agreement.