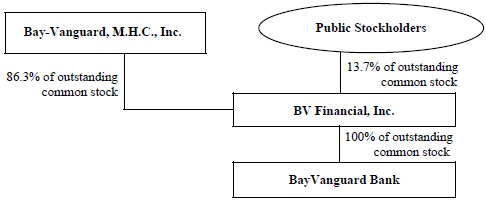

In February 2019, we acquired Kopernik Bank, a Maryland-chartered mutual savings bank headquartered in Baltimore, Maryland, which added $139.4 million in assets, $93.0 million in deposits, and $41.2 million in stockholders’ equity. The acquisition of Kopernik Bank enhanced our market share in the Baltimore market, and provided BayVanguard Bank with additional capital to engage in further strategic transactions. In connection with the acquisition of Kopernik Bank, BV Financial issued 4,099,822 shares of common stock to Bay-Vanguard, M.H.C. As part of the transaction, BV Financial and Bay-Vanguard, M.H.C. each converted from a federally chartered savings and loan holding company to a Maryland-chartered bank holding company.

In March 2020, we acquired Madison Bank, a Maryland-chartered stock savings bank headquartered in Forest Hill, Maryland, which added $144.9 million in assets, $94.8 million in deposits, and $29.9 million in stockholders’ equity. The acquisition of Madison Bank increased our market presence in our existing market area.

In October 2020, we acquired 1880 Bank, a Maryland-chartered commercial bank headquartered in Cambridge, Maryland, which added $413.0 million in assets, $362.9 million in deposits, and $53.9 million in stockholders’ equity. The acquisition of 1880 Bank expanded our market area to include the Eastern Shore of Maryland. Our acquisition of 1880 Bank was funded, in part, by BV Financial’s issuance of $35.0 million of its 4.875% fixed-to-floating rate subordinated notes with a maturity date of December 2030.

In January 2022, we acquired North Arundel Savings Bank, a Maryland-charted mutual savings bank located in Pasadena, Maryland, which added $47.8 million in assets, $40.8 million in deposits, and $5.5 million in stockholders’ equity. The acquisition of North Arundel Savings Bank increased our market presence in the Baltimore market. In connection with the acquisition of North Arundel Savings Bank, BV Financial issued 251,004 shares of common stock to Bay-Vanguard, M.H.C.

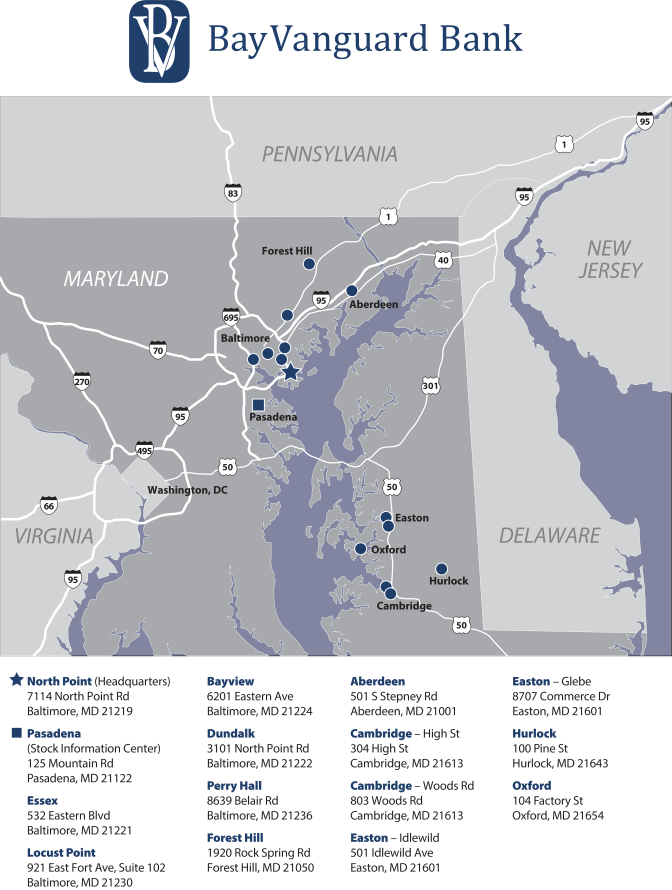

Market Area

We conduct our operations from our main office, 14 branch offices and one standalone interactive teller machine (“ITM”), all of which are located in the Baltimore market (Baltimore City, Anne Arundel, Baltimore and Harford Counties, Maryland) and Dorchester and Talbot Counties, Maryland on the Eastern Shore of Maryland. Out of 24 counties in Maryland, Baltimore County is the third most populous with a population of approximately 854,000 and Baltimore City is the fifth most populous with a population of approximately 570,000 (combined the two would rank as the most populous county). This is compared with populations of approximately 596,500 for Anne Arundel County, 265,000 for Harford County, 37,500 for Talbot County, 32,500 for Dorchester County and 6.2 million for the entire state.

The economy in our primary market area has benefited from being varied and diverse, with a broad economic base. Baltimore County has a median household income of approximately $88,500, Baltimore City has a median household income of approximately $56,000, Anne Arundel County has a median household income of approximately $114,000, Harford County has a median household income of approximately $104,500, Talbot County has a median household income of approximately $80,500 and Dorchester County has a median household income of approximately $61,000. The median household income for Maryland is approximately $96,000 and the median household income is approximately $73,500 for the United States. As of December 2022, the unemployment rate was 3.2% for Baltimore County, 4.4% for Baltimore City, 2.6% for Anne Arundel County, 2.8% for Harford County, 3.3% for Talbot County, and 3.6% for Dorchester County, compared to 4.0% for Maryland and a national rate of 3.5%.

Competition

We face competition within our market area both in making loans and attracting deposits. Our market area has a concentration of financial institutions that include large money center and regional banks, community banks and credit unions. We also face competition from savings institutions, mortgage banking firms, consumer finance companies, financial technology or “fintech” companies and credit unions and, with respect to deposits, from money market funds, brokerage firms, mutual funds and insurance companies. Based on FDIC data at June 30, 2022 (the latest date for which information is available), we had 0.34% of the FDIC-insured deposit market share in the Baltimore Metropolitan Statistical Area, making us the 21st largest out of 41 banks operating in the Baltimore Metropolitan Statistical Area, and 31.7% and 7.2% of the FDIC-insured deposit market share in Dorchester County and Talbot County, respectively, making us first out of seven banks and fourth out of nine banks in those counties. Money center banks, such as Bank of America, JP Morgan Chase, Wells Fargo and Citi, and large regional banks, such as TD Bank, M&T Bank and PNC Bank, have a significant presence in our market area.

67