2008 Annual Report

to Shareholders

| | |

| 1 |

| | |

| 2 |

| | |

| 4 |

| | |

| 12 |

| | |

| 13 |

| | |

| 14 |

| | |

| 15 |

| | |

| 16 |

| | |

| 17 |

| | |

| 19 |

| | |

| 56 |

| | |

| 57 |

| | |

| 57 |

To our Shareholders:

Fiscal 2008 was a challenging and eventful year for Home Federal Bancorp as management and the Board of Directors embarked on a new business strategy which was ultimately impacted by the continuing turmoil in the financial markets. In December 2007, the Board of Directors approved a strategy to diversify and grow Home Federal Bancorp through the conversion of Home Federal Mutual Holding Company, reorganization of Home Federal Bancorp as a fully-public stock holding company and the simultaneous acquisition of a local financial institution and its holding company which would have more than doubled the asset size of Home Federal Bancorp. Unfortunately, market conditions for bank and thrift stocks changed significantly after we began the stock offering process. The ongoing problems in the residential mortgage lending market depressed the securities market for most financial institutions which adversely affected our ability to complete the stock offering. Fortunately, while there continues to be instability in the mortgage lending market, our loan quality remains strong with no non-performing loans at June 30, 2008. In August 2008, we terminated the stock offering and the acquisition which was contingent on completion of the offering. As a result, our earnings for fiscal 2008 were negatively impacted by the recognition of $883,000 in merger and stock issuance expense.

Although we were not able to implement the conversion and acquisition, we remain committed to building on Home Federal Bancorp's core strengths, operating a profitable community-oriented financial institution and implementing elements of our business strategy including:

| ● | Growing and diversifying our loan portfolio by increasing our originations of commercial real estate and business loans; |

| ● | Diversifying our products and services; and |

| ● | Enhancing core earnings. |

In August 2008, we adopted our third stock repurchase program since Home Federal Bancorp's initial public offering completed in January 2005. The new repurchase plan provides for the repurchase of up to 125,000 shares, or approximately 10.0% of Home Federal Bancorp's outstanding common stock held by shareholders other than Home Federal Mutual Holding Company.

Home Federal Bancorp continues to benefit from the strong economic outlook in the Shreveport-Bossier City market area. Construction, educational and health services, information, and leisure and hospitality sectors are expected to be the primary sources for employment growth in the near future. Approximately $1.0 billion in public- and private-sector construction projects are currently planned or in process, including the construction of two steel manufacturing plants at the Port of Shreveport-Bossier, the recently completed Shreveport Convention Center and InterTech Science Park and a $500 million redevelopment project in central Shreveport. Barksdale AFB, located in Bossier Parish, employs an estimated 7,900 active duty and reserve personnel and 2,000 civilian and contract employees. The Air Force Cyberspace Command is being considered for location at Barksdale AFB. In an effort to persuade the Air Force, Bossier City officials have broken ground on a Cyber Innovation Center and National Cyber Research Park, a private/public partnership between industry, government and academia. We expect that the developments will have a significant impact on the local economy due to the high salaries associated with the engineering and technical consulting positions that will be created at the base and by its contractors.

Fiscal 2009 will present Home Federal Bancorp with new challenges; however, we are hopeful that there will be new opportunities as well. The Board of Directors, senior management and staff of Home Federal Bancorp are committed to addressing the challenges and pursuing the opportunities that lie ahead.

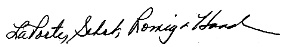

Thank you for the trust you have placed in us and your continued support.

| | | Daniel R. Herndon |

| | President and Chief Executive Officer |

| | | |

| | |

| Home Federal Bancorp, Inc. of Louisiana |

| |

SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA |

The following selected consolidated financial and other data does not purport to be complete and is qualified in its entirety by the more detailed financial information contained elsewhere herein. You should read the consolidated financial statements and related notes contained in this Annual Report.

| | | At or For the Year Ended June 30, | |

| (Dollars in Thousands, except per share data) | | | | | | |

| Selected Financial and Other Data: | | | | | | |

| Total assets | | $ | 137,715 | | | $ | 118,785 | |

| Cash and cash equivalents | | | 7,363 | | | | 3,972 | |

| Securities available for sale | | | 96,324 | | | | 83,752 | |

| Securities held to maturity | | | 1,688 | | | | 1,408 | |

| Loans held-for-sale | | | 852 | | | | 1,478 | |

| Loans receivable, net | | | 28,263 | | | | 25,211 | |

| Deposits | | | 78,359 | | | | 77,710 | |

| FHLB advances | | | 26,876 | | | | 12,368 | |

| Total Stockholders' Equity | | | 27,874 | | | | 27,812 | |

| Full service offices | | | 3 | | | | 3 | |

| | | | | | | | | |

| | | | | | | | | |

| Selected Operating Data: | | | | | | | | |

| Total interest income | | $ | 7,004 | | | $ | 6,590 | |

| Total interest expense | | | 3,968 | | | | 3,448 | |

| Net interest income | | | 3,036 | | | | 3,142 | |

| Provision for loan losses | | | -- | | | | 1 | |

| Net interest income after provision for loan losses | | | 3,036 | | | | 3,141 | |

| Total non-interest income | | | 198 | | | | 240 | |

| Total non-interest expense | | | (3,359 | ) | | | (2,417 | ) |

| (Loss) income before income taxes | | | (125 | ) | | | 964 | |

| Income tax (benefit) expense | | | (43 | ) | | | 327 | |

| Net (loss) income | | $ | (82 | ) | | $ | 637 | |

| | | | | | | | | |

Selected Operating Ratios(1): | | | | | | | | |

| Average yield on interest-earning assets | | | 5.39 | % | | | 5.69 | % |

| Average rate on interest-bearing liabilities | | | 4.00 | | | | 3.84 | |

| Average interest rate spread(2) | | | 1.39 | | | | 1.85 | |

| Net interest margin(2) | | | 2.33 | | | | 2.71 | |

| Average interest-earning assets to average interest-bearing liabilities | | | 131.06 | | | | 128.93 | |

| Net interest income after provision for loan losses to non-interest expense | | | 90.38 | | | | 129.95 | |

| Total non-interest expense to average assets | | | 2.52 | | | | 2.00 | |

| Efficiency ratio(3) | | | 103.87 | | | | 71.49 | |

| Return on average assets | | | (.06 | ) | | | .53 | |

| Return on average equity | | | (2.48 | ) | | | 2.13 | |

| Average equity to average assets | | | 24.83 | | | | 24.82 | |

| | | | | | | | | |

Asset Quality Ratios(4): | | | | | | | | |

| Non-performing loans as a percent of total loans receivable(5) | | | -- | % | | | .46 | % |

| Non-performing assets as a percent of total assets(5) | | | .04 | | | | .10 | |

| Allowance for loan losses as a percent of total loans receivable | | | .82 | | | | .92 | |

| Net charge-offs to average loans receivable | | | -- | | | | -- | |

| | | | | | | | | |

Association Capital Ratios(4): | | | | | | | | |

| Tangible capital ratio | | | 20.21 | % | | | 22.79 | % |

| Core capital ratio | | | 20.21 | | | | 22.79 | |

| Total capital ratio | | | 73.08 | | | | 80.63 | |

___________________

| (1) | With the exception of end of period ratios, all ratios are based on average monthly balances during the indicated periods. |

| (2) | Average interest rate spread represents the difference between the average yield on interest-earning assets and the average rate paid on interest-bearing liabilities, and net interest margin represents net interest income as a percentage of average interest-earning assets. |

| (3) | The efficiency ratio represents the ratio of non-interest expense divided by the sum of net interest income and non-interest income. |

| (4) | Asset quality ratios and capital ratios are end of period ratios, except for net charge-offs to average loans receivable. |

| (5) | Non-performing assets consist of non-performing loans at June 30, 2008 and 2007. Non-performing loans consist of non-accruing loans plus accruing loans 90 days or more past due. Home Federal Savings and Loan did not have any real estate owned or troubled debt restructurings at June 30, 2007. Real estate owned at June 30, 2008 amounted to $52,000. |

| Home Federal Bancorp, Inc. of Louisiana |

| |

|

| CONDITION AND RESULTS OF OPERATIONS |

General

Our profitability depends primarily on our net interest income, which is the difference between interest and dividend income on interest-earning assets, principally loans, investment securities and interest-earning deposits in other institutions, and interest expense on interest-bearing deposits and borrowings from the Federal Home Loan Bank of Dallas. Net interest income is dependent upon the level of interest rates and the extent to which such rates are changing. Our profitability also depends, to a lesser extent, on non-interest income, provision for loan losses, non-interest expenses and federal income taxes. Home Federal Bancorp, Inc. of Louisiana had a net loss of $82,000 in fiscal 2008 and net income of $637,000 in fiscal 2007.

Historically, our business has consisted primarily of originating single-family real estate loans secured by property in our market area. Typically, single-family loans involve a lower degree of risk and carry a lower yield than commercial real estate, construction, commercial business and consumer loans. Our loans are primarily funded by certificates of deposit, which typically have a higher interest rate than passbook accounts. The combination of these factors has resulted in low interest rate spreads and returns on equity. Due to the low interest rate environment, a significant amount of our loans have been refinanced in recent years. Rather than reinvest the proceeds from these refinancings in long-term, low yielding loans, we have invested in marketable securities in order to position ourselves more favorably for a rising interest rate environment. Because investment securities generally yield less than loans, however, our net interest margin has been further pressured and our net interest income has remained stable at $3.0 million for fiscal 2008 and $3.1 million for fiscal 2007. Although we may attempt to diversify into greater consumer and commercial lending in the future in order to improve the yield on our portfolio, we presently anticipate that our lending business will continue to consist primarily of originating single-family mortgages funded through deposits.

During fiscal 2008, Home Federal Bancorp entered into an Agreement and Plan of Merger with First Louisiana Bancshares, Inc., pursuant to which Home Federal Bancorp would acquire First Louisiana Bancshares and its wholly-owned subsidiary, First Louisiana Bank. Simultaneously with the adoption of the Agreement and Plan of Merger, Home Federal Mutual Holding Company adopted a Plan of Conversion and Reorganization whereby Home Federal Mutual Holding Company would convert from the mutual holding company form of organization to the fully public stock holding company form of organization and offer shares of a new holding company to its members and the general public in a subscription and community offering. At the close of the offering period in August 2008, the orders received were not sufficient to reach the required minimum of the offering range. As a result, Home Federal Bancorp's second-step conversion and offering terminated and, as of August 14, 2008, Home Federal Bancorp and First Louisiana Bancshares mutually agreed to terminate the Agreement and Plan of Merger. Completion of the merger was contingent on completion of the second-step conversion. During fiscal 2008, Home Federal Bancorp incurred related merger and stock issuance expenses of $883,000.

Home Federal Bancorp's operations and profitability are subject to changes in interest rates, applicable statutes and regulations and general economic conditions, as well as other factors beyond our control.

Forward-Looking Statements Are Subject to Change

We make certain statements in this document as to what we expect may happen in the future. These statements usually contain the words "believe," "estimate," "project," "expect," "anticipate," "intend" or similar expressions. Because these statements look to the future, they are based on our current expectations and beliefs. Actual results or events may differ materially from those reflected in the forward-looking statements. You should be aware that our current expectations and beliefs as to future events are subject to change at any time, and we can give you no assurances that the future events will actually occur.

Critical Accounting Policies

In reviewing and understanding financial information for Home Federal Bancorp, you are encouraged to read and understand the significant accounting policies used in preparing our consolidated financial statements. These policies are described in Note 1 of the notes to our consolidated financial statements included in this Annual Report. Our accounting and financial reporting policies conform to accounting principles generally accepted in the United States of America and to general practices within the banking industry. Accordingly, the consolidated financial statements require certain estimates, judgments, and assumptions, which are believed to be reasonable, based upon the information available. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the periods presented. The following accounting policies comprise those that management believes are the most critical to aid in fully understanding and evaluating our reported financial results. These policies require numerous estimates or economic assumptions that may prove inaccurate or may be subject to variations which may significantly affect our reported results and financial condition for the period or in future periods.

| Home Federal Bancorp, Inc. of Louisiana |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL |

| CONDITION AND RESULTS OF OPERATIONS |

Allowance for Loan Losses. We have identified the evaluation of the allowance for loan losses as a critical accounting policy where amounts are sensitive to material variation. The allowance for loan losses is established through a provision for loan losses charged to earnings. Loans are charged against the allowance for loan losses when management believes that the collectability of the principal is unlikely. Subsequent recoveries are added to the allowance. The allowance is an amount that management believes will cover known and inherent losses in the loan portfolio, based on evaluations of the collectability of loans. The evaluations take into consideration such factors as changes in the types and amount of loans in the loan portfolio, historical loss experience, adverse situations that may affect the borrower's ability to repay, estimated value of any underlying collateral, estimated losses relating to specifically identified loans, and current economic conditions. This evaluation is inherently subjective as it requires material estimates including, among others, exposure at default, the amount and timing of expected future cash flows on impacted loans, value of collateral, estimated losses on our commercial and residential loan portfolios and general amounts for historical loss experience. All of these estimates may be susceptible to significant changes as more information becomes available.

While management uses the best information available to make loan loss allowance evaluations, adjustments to the allowance may be necessary based on changes in economic and other conditions or changes in accounting guidance. Historically, our estimates of the allowance for loan loss have not required significant adjustments from management's initial estimates. In addition, the Office of Thrift Supervision, as an integral part of their examination processes, periodically reviews our allowance for loan losses. The Office of Thrift Supervision may require the recognition of adjustments to the allowance for loan losses based on their judgment of information available to them at the time of their examinations. To the extent that actual outcomes differ from management's estimates, additional provisions to the allowance for loan losses may be required that would adversely impact earnings in future periods.

Income Taxes. Deferred income tax assets and liabilities are determined using the liability (or balance sheet) method. Under this method, the net deferred tax asset or liability is determined based on the tax effects of the temporary differences between the book and tax bases of the various assets and liabilities and gives current recognition to changes in tax rates and laws. Realizing our deferred tax assets principally depends upon our achieving projected future taxable income. We may change our judgments regarding future profitability due to future market conditions and other factors. We may adjust our deferred tax asset balances if our judgments change.

Changes in Financial Condition

Home Federal Bancorp's total assets increased $18.9 million, or 15.9%, to $137.7 million at June 30, 2008 compared to $118.8 million at June 30, 2007. This increase was primarily due to an increase in available-for-sale securities of $12.6 million, an increase in cash and cash equivalents of $3.4 million, and an increase in loans receivable and loans held-for-sale of $2.4 million, compared to the prior year period.

Securities available for sale increased $12.6 million, or 15.0%, from $83.8 million at June 30, 2007 to $96.3 million at June 30, 2008. This increase resulted primarily from the investment of Federal Home Loan Bank borrowings. During the past two years, we have experienced significant loan prepayments due to the heavy volume of loan refinancing. However, when interest rates were at their cyclical lows, management was reluctant to invest in long-term, fixed rate mortgage loans for the portfolio and instead sold the majority of the long-term, fixed rate mortgage loan production. We have attempted to strengthen our interest-rate risk position and favorably structure our balance sheet to take advantage of a rising rate environment by purchasing investment securities classified as available for sale.

Home Federal Bancorp, Inc. of Louisiana |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL |

| CONDITION AND RESULTS OF OPERATIONS |

Cash and cash equivalents increased $3.4 million, or 85.3%, from $4.0 million at June 30, 2007 to $7.4 million at June 30, 2008. The increase in cash and cash equivalents was attributable primarily to the growth in our deposits, funding through advances from the Federal Home Loan Bank, and cash received associated with our proposed stock issuance. These inflows of cash and cash equivalents were partially offset by the acquisition of investment securities and the funding of our loan growth. In August 2008, the proposed stock issuance was terminated and $8.1 million in cash subscription orders were returned to subscribers.

Loans receivable, net increased $3.1 million, or 12.3%, from $25.2 million at June 30, 2007 to $28.3 million at June 30, 2008. The increase in loans receivable, net was attributable primarily to an increase in one-to-four family residential loans of $2.0 million, and an increase in mortgage loans secured by other properties of $1.2 million. The increase in one-to-four family residential loans was primarily due to the purchase of first mortgage loans originated by another mortgage loan company. The purchased loans are from a mortgage originator located in Arkansas and are secured by one-to-four-family residential properties in predominantly rural areas of Louisiana and Arkansas, and to a lesser extent, Texas and Mississippi. While the purchased loans are originated as fixed rate loans, Home Federal receives an adjustable rate of interest. Under the terms of the loan agreements, the seller retains servicing rights and agrees to repurchase any loan that becomes more than 90 days delinquent for as long as such loans are outstanding. At June 30, 2008, the balance of purchased loans approximated $10.5 million, including $10.3 million of loans from the mortgage originator in Arkansas.

Total liabilities increased $18.8 million, or 20.7%, from $91.0 million at June 30, 2007 to $109.8 million at June 30, 2008 due primarily to an increase of $14.5 million, or 117.3%, in FHLB advances and an increase in escrow deposits of $3.6 million representing funds received in the proposed stock issuance, which was subsequently terminated. Deposits increased $649,000 during the year ended June 30, 2008. The increase in deposits was attributable primarily to increases in our Passbook Savings Accounts as well as increases in non-interest bearing and NOW accounts, partially offset by decreases in money market accounts and certificates of deposit. Certificates of deposit decreased $895,000, or 1.4%, from $63.0 million at June 30, 2007 to $62.1 million at June 30, 2008.

Stockholders' equity increased $62,000, or 0.2%, to $27.9 million at June 30, 2008 due primarily to a decrease of $207,000 in the company's accumulated other comprehensive loss, and the vesting of restricted stock awards of $156,000. These equity increases were partially offset by a net loss of $82,000 for the year ended June 30, 2008, and dividends of $296,000 paid during the year ended June 30, 2008. The change in accumulated other comprehensive income was primarily due to the change in net unrealized loss on securities available for sale due to recent minor declines in interest rates. The net unrealized loss on securities available for sale is affected by interest rate fluctuations. Generally, an increase in interest rates will have an adverse impact while a decrease in interest rates will have a positive impact.

Average Balances, Net Interest Income, and Yields Earned and Rates Paid. The following table shows for the periods indicated the total dollar amount of interest from average interest-earning assets and the resulting yields, as well as the interest expense on average interest-bearing liabilities, expressed both in dollars and rates, and the net interest margin. Tax-exempt income and yields have not been adjusted to a tax-equivalent basis. All average balances are based on monthly balances. Management does not believe that the monthly averages differ significantly from what the daily averages would be.

| Home Federal Bancorp, Inc. of Louisiana |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL |

| CONDITION AND RESULTS OF OPERATIONS |

| | | | | | | |

| | | | | | | | | | |

| | | Yield/Rate | | | Average | | | | | | Average | | | Average | | | | | | Average | |

| | | (Dollars in Thousands) | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | | | | |

| Investment securities | | | 4.96 | % | | $ | 94,775 | | | $ | 4,780 | | | | 5.04 | % | | $ | 86,552 | | | $ | 4,550 | | | | 5.26 | % |

| Loans receivable | | | 6.78 | | | | 28,698 | | | | 2,072 | | | | 7.22 | | | | 23,680 | | | | 1,739 | | | | 7.34 | |

| Interest-earning deposits | | | 2.22 | | | | 6,564 | | | | 152 | | | | 2.32 | | | | 5,633 | | | | 301 | | | | 5.35 | |

| Total interest-earning assets | | | 5.26 | % | | | 130,037 | | | | 7,004 | | | | 5.39 | | | | 115,865 | | | | 6,590 | | | | 5.69 | % |

| Non-interest-earning assets | | | | | | | 3,367 | | | | | | | | | | | | 4,875 | | | | | | | | | |

| Total assets | | | | | | $ | 133,404 | | | | | | | | | | | $ | 120,740 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Savings accounts | | | .50 | % | | | 4,546 | | | | 22 | | | | .49 | % | | $ | 4,630 | | | | 23 | | | | .49 | % |

| NOW accounts | | | .17 | | | | 7,176 | | | | 16 | | | | .22 | | | | 6,983 | | | | 15 | | | | .21 | |

| Money market accounts | | | .40 | | | | 2,999 | | | | 12 | | | | .40 | | | | 3,030 | | | | 12 | | | | .40 | |

| Certificate accounts | | | 4.33 | | | | 63,893 | | | | 2,985 | | | | 4.67 | | | | 60,344 | | | | 2,710 | | | | 4.49 | |

| Total deposits | | | 3.42 | | | | 78,614 | | | | 3,035 | | | | 3.86 | | | | 74,987 | | | | 2,760 | | | | 3.68 | |

| FHLB advances | | | 4.27 | | | | 20,602 | | | | 933 | | | | 4.53 | | | | 14,883 | | | | 688 | | | | 4.63 | |

| Total interest-bearing liabilities | | | 3.63 | % | | | 99,216 | | | | 3,968 | | | | 4.00 | % | | | 89,870 | | | $ | 3,448 | | | | 3.84 | % |

| Non-interest-bearing liabilities | | | | | | | 1,058 | | | | | | | | | | | | 899 | | | | | | | | | |

| Total liabilities | | | | | | | 100,274 | | | | | | | | | | | | 90,769 | | | | | | | | | |

| Total Stockholders' Equity(1) | | | | | | | 33,130 | | | | | | | | | | | | 29,971 | | | | | | | | | |

| Total liabilities and equity | | | | | | $ | 133,404 | | | | | | | | | | | $ | 120,740 | | | | | | | | | |

| Net interest-earning assets | | | | | | $ | 30,821 | | | | | | | | | | | $ | 25,995 | | | | | | | | | |

| Net interest income; average interest rate spread(2) | | | | | | | | | | $ | 3,036 | | | | 1.39 | % | | | | | | $ | 3,142 | | | | 1.85 | % |

| Net interest margin(3) | | | | | | | | | | | | | | | 2.33 | % | | | | | | | | | | | 2.71 | % |

| Average interest-earning assets to average interest-bearing liabilities | | | | | | | | | | | | | | | 131.06 | % | | | | | | | | | | | 128.93 | % |

___________________

| (1) | Includes retained earnings and accumulated other comprehensive loss. |

| (2) | Interest rate spread represents the difference between the weighted-average yield on interest-earning assets and the weighted-average rate on interest-bearing liabilities. |

| (3) | Net interest margin is net interest income divided by net average interest-earning assets. |

| Home Federal Bancorp, Inc. of Louisiana |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL |

| CONDITION AND RESULTS OF OPERATIONS |

Rate/Volume Analysis. The following table describes the extent to which changes in interest rates and changes in volume of interest-related assets and liabilities have affected Home Federal Bancorp's interest income and interest expense during the periods indicated. For each category of interest-earning assets and interest-bearing liabilities, information is provided on changes attributable to (i) changes in volume (change in volume multiplied by prior year rate), (ii) changes in rate (change in rate multiplied by current year volume), and (iii) total change in rate and volume. The combined effect of changes in both rate and volume has been allocated proportionately to the change due to rate and the change due to volume.

| | | | | | | |

| | | Increase (Decrease) Due to | | | Total Increase | | | Increase (Decrease) Due to | | | Total Increase | |

| | | | | | | | | | | | | | | | | | | |

| | | (In Thousands) | |

| Interest income: | | | | | | | | | | | | | | | | | | |

| Investment securities | | $ | (203 | ) | | $ | 433 | | | $ | 230 | | | $ | 220 | | | $ | 291 | | | $ | 511 | |

| Loans receivable, net | | | (35 | ) | | | 368 | | | | 333 | | | | 69 | | | | 250 | | | | 319 | |

| Interest-earning deposits | | | (199 | ) | | | 50 | | | | (149 | ) | | | 67 | | | | 29 | | | | 96 | |

| Total interest-earning assets | | | (437 | ) | | | 851 | | | | 414 | | | | 356 | | | | 570 | | | | 926 | |

| Interest expense: | | | | | | | | | | | | | | | | | | | | | | | | |

| Savings accounts | | | - | | | | (1 | ) | | | (1 | ) | | | 1 | | | | (2 | ) | | | (1 | ) |

| NOW accounts | | | 1 | | | | - | | | | 1 | | | | -- | | | | (1 | ) | | | (1 | ) |

| Money market accounts | | | - | | | | - | | | | - | | | | -- | | | | (2 | ) | | | (2 | ) |

| Certificate accounts | | | 115 | | | | 160 | | | | 275 | | | | 507 | | | | 149 | | | | 656 | |

| Total deposits | | | 116 | | | | 159 | | | | 275 | | | | 508 | | | | 144 | | | | 652 | |

| FHLB advances | | | (20 | ) | | | 265 | | | | 245 | | | | 169 | | | | 194 | | | | 363 | |

| Total interest-bearing liabilities | | | 96 | | | | 424 | | | | 520 | | | | 677 | | | | 338 | | | | 1,015 | |

| (Decrease) Increase in net interest income | | $ | (533 | ) | | $ | 427 | | | $ | (106 | ) | | $ | (321 | ) | | $ | 232 | | | $ | (89 | ) |

Comparison of Operating Results for the Years Ended June 30, 2008 and 2007

General. The Company incurred a net operating loss of $82,000 for the year ended June 30, 2008, reflecting a decrease in net income of $719,000 compared to net income of $637,000 for the year ended June 30, 2007. This decrease was due to small decreases in non-interest income and net interest income, and a large increase in non-interest expense resulting from the charge-off of conversion and merger expenses amounting to $883,000.

Net Interest Income. Net interest income amounted to $3.0 million for fiscal year 2008 compared to $3.1 million for fiscal year 2007. The decrease was due primarily to the increase in interest expense incurred on deposit accounts and advances from the Federal Home Loan Bank, partially offset by an increase in total interest income.

The average interest rate spread declined from 1.85% for fiscal 2007 to 1.39% for fiscal 2008 while the average balances of net interest-earning assets increased from $26.0 million to $30.8 million during the same periods. The percentage of average interest-earning assets to average interest-bearing liabilities increased to 131.06% for fiscal 2008 compared to 128.93% for fiscal 2007. The decrease in the average interest rate spread reflects the low interest rate environment and management's decision to temporarily invest in lower rate securities available for sale rather than long-term, fixed rate residential mortgage loans. Additionally, Home Federal Bancorp's average cost of funds increased 16 basis points in fiscal 2008 compared to fiscal 2007 as the Federal Reserve was aggressively raising short-term rates. Competition for deposits in our market area led us to increase the average rates paid on certificates of deposit 18 basis points in fiscal 2008 compared to fiscal 2007. Net interest margin declined to 2.33% in fiscal 2008 compared to 2.71% for fiscal 2007.

Interest income increased $414,000, or 6.3%, to $7.0 million for fiscal 2008 compared to fiscal 2007. Such increase was primarily due to an increase in the average balance of all interest earning assets. The decrease in average yields on interest earning assets reflects falling interest rates in general during fiscal 2008. The increase in the average balance of investment securities was due to the investment of proceeds from Federal Home Loan Bank borrowings in investment securities classified as available-for-sale. The increase in the average balance of loans receivable was primarily due to the purchase of mortgage loans originated by a third party mortgage company. Our agreement with the mortgage company provides that they will retain servicing and are required to repurchase such loans for as long as such loans are outstanding if they are not performing according to their terms.

| Home Federal Bancorp, Inc. of Louisiana |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL |

| CONDITION AND RESULTS OF OPERATIONS |

Interest expense increased $520,000, or 15.1%, to $4.0 million for fiscal 2008 compared to fiscal 2007 primarily as a result of increases in the average rate paid, the average balance of certificate accounts and the average Federal Home Loan Bank borrowings.

Provision for Loan Losses. The allowance for loan losses is established through a provision for loan losses charged to earnings as losses are estimated to have occurred in our loan portfolio. Loan losses are charged against the allowance when management believes the uncollectability of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the allowance.

The allowance for loan losses is evaluated on a regular basis by management and is based upon management's periodic review of the collectability of the loans in light of historical experience, the nature and volume of the loan portfolio, adverse situations that may affect the borrower's ability to repay, estimated value of the underlying collateral and prevailing economic conditions. The evaluation is inherently subjective as it requires estimates that are susceptible to significant revision as more information becomes available.

A loan is considered impaired when, based on current information or events, it is probable that we will be unable to collect the scheduled payments of principal and interest when due according to the contractual terms of the loan agreement. When a loan is impaired, the measurement of such impairment is based upon the fair value of the collateral of the loan. If the fair value of the collateral is less than the recorded investment in the loan, we will recognize the impairment by creating a valuation allowance with a corresponding charge against earnings.

An allowance is also established for uncollectible interest on loans classified as substandard. Substandard loans are those loans which are in excess of ninety days delinquent. The allowance is established by a charge to interest income equal to all interest previously accrued and income is subsequently recognized only to the extent that cash payments are received. When, in management's judgment, the borrower's ability to make interest and principal payments is back to normal, the loan is returned to accrual status.

A minimal provision was made to the allowance in fiscal 2007. No provision was made to the allowance in fiscal 2008 because the allowance was maintained at a level believed, to the best of management's knowledge, to cover all known and inherent losses in the loan portfolio, both probable and reasonable.

Non-Interest Income. Non-interest income amounted to $198,000 for the year ended June 30, 2008, a decrease of $42,000, or 17.5%, compared to non-interest income of $240,000 for the year ended June 30, 2007. Such decrease was due to a $19,000 decrease in gain on sale of securities, and a $26,000 decrease in other non-interest income, partially offset by a $3,000 increase in gain on sale of loans.

Non-Interest Expense. Non-interest expense increased $940,000, or 38.9%, due primarily to the charge-off of $883,000 in conversion and merger expense, in addition to normal increases in compensation, benefits and other expenses.

Provision For Income Tax Expense. The provision for income taxes amounted to $327,000 for the fiscal year ended June 30, 2007. For the fiscal year ended June 30, 2008, the Company realized a net deferred tax benefit of $43,000. The Company's effective tax rate was 33.9% for both fiscal 2008 and 2007.

Exposure to Changes in Interest Rates

The Company's ability to maintain net interest income depends upon our ability to earn a higher yield on interest-earning assets than the rates we pay on deposits and borrowings. The Company's interest-earning assets consist primarily of securities available-for-sale and long-term residential mortgage loans which have fixed rates of interest. Consequently, our ability to maintain a positive spread between the interest earned on assets and the interest paid on deposits and borrowings can be adversely affected when market rates of interest rise. Although

| Home Federal Bancorp, Inc. of Louisiana |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL |

| CONDITION AND RESULTS OF OPERATIONS |

long-term, fixed-rate mortgage loans made up a significant portion of our interest-earning assets at June 30, 2008, we sold a substantial amount of our loans and maintained a significant portfolio of securities available-for-sale during the past few years in order to better position Home Federal Bancorp for a rising rate environment. At June 30, 2008 and 2007, securities available-for-sale amounted to $96.3 million and $83.8 million, respectively, or 69.94% and 70.60%, respectively, of total assets at such dates. Although this asset/liability management strategy has adversely impacted short-term net income, it provides us with greater flexibility to reinvest such assets in higher-yielding single-family, consumer and commercial business loans in a rising interest rate environment.

Quantitative Analysis. The Office of Thrift Supervision provides a quarterly report on the potential impact of interest rate changes upon the market value of portfolio equity. Management reviews the quarterly reports from the Office of Thrift Supervision which show the impact of changing interest rates on net portfolio value. Net portfolio value is the difference between incoming and outgoing discounted cash flows from assets, liabilities, and off-balance sheet contracts.

Net Portfolio Value. Our interest rate sensitivity is monitored by management through the use of a model which internally generates estimates of the change in our net portfolio value ("NPV") over a range of interest rate scenarios. NPV is the present value of expected cash flows from assets, liabilities, and off-balance sheet contracts. The NPV ratio, under any interest rate scenario, is defined as the NPV in that scenario divided by the market value of assets in the same scenario. The following table sets forth our NPV as of June 30, 2008.

Change in Interest Rates In Basis Points | | | | | | NPV as % of Portfolio | |

| | | | | | | | | | | | | | | | |

| | | | (Dollars in Thousands) | |

| 300 | | | $ | 17,024 | | | $ | (10,297 | ) | | | (37.69 | )% | | | 13.69 | % | | | (5.85 | )% |

| 200 | | | | 20,517 | | | | (6,803 | ) | | | (24.90 | ) | | | 15.84 | | | | (3.69 | ) |

| 100 | | | | 23,925 | | | | (3,396 | ) | | | (12.43 | ) | | | 17.77 | | | | (1.76 | ) |

| Static | | | | 27,321 | | | | -- | | | | -- | | | | 19.53 | | | | -- | |

| (50) | | | | 28,963 | | | | 1,642 | | | | 6.01 | | | | 20.33 | | | | .80 | |

| (100) | | | | 30,497 | | | | 3,177 | | | | 11.63 | | | | 21.03 | | | | 1.50 | |

Qualitative Analysis. Our ability to maintain a positive "spread" between the interest earned on assets and the interest paid on deposits and borrowings is affected by changes in interest rates. Our fixed-rate loans generally are profitable if interest rates are stable or declining since these loans have yields that exceed our cost of funds. If interest rates increase, however, we would have to pay more on our deposits and new borrowings, which would adversely affect our interest rate spread. In order to counter the potential effects of dramatic increases in market rates of interest, we have underwritten our mortgage loans to allow for their sale in the secondary market. Total loan originations amounted to $18.5 million for both fiscal 2008 and 2007, while loans sold amounted to $13.6 million and $12.4 million during the same respective periods. More significantly, we have invested excess funds from loan payments and prepayments and loan sales in investment securities classified as available for sale. As a result, Home Federal Bancorp is not as susceptible to rising interest rates as it would be if its interest-earning assets were primarily comprised of long-term fixed rate mortgage loans. With respect to its floating or adjustable rate loans, Home Federal Bancorp writes interest rate floors and caps into such loan documents. Interest rate floors limit our interest rate risk by limiting potential decreases in the interest yield on an adjustable rate loan to a certain level. As a result, we receive a minimum yield even if rates decline farther and the interest rate on the particular loan would otherwise adjust to a lower amount. Conversely, interest rate ceilings limit the amount by which the yield on an adjustable rate loan may increase to no more than six percentage points over the rate at the time of origination. Finally, we intend to place a greater emphasis on shorter-term consumer loans and commercial business loans in the future.

Home Federal Bancorp, Inc. of Louisiana |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL |

| CONDITION AND RESULTS OF OPERATIONS |

Liquidity and Capital Resources

Home Federal Bancorp maintains levels of liquid assets deemed adequate by management. Our liquidity ratio averaged 95.4% for the quarter ended June 30, 2008. We adjust our liquidity levels to fund deposit outflows, repay our borrowings and to fund loan commitments. We also adjust liquidity as appropriate to meet asset and liability management objectives.

Our primary sources of funds are deposits, amortization and prepayment of loans and mortgage-backed securities, maturities of investment securities and other short-term investments, loan sales and earnings and funds provided from operations. While scheduled principal repayments on loans and mortgage-backed securities are a relatively predictable source of funds, deposit flows and loan prepayments are greatly influenced by general interest rates, economic conditions and competition. We set the interest rates on our deposits to maintain a desired level of total deposits. In addition, we invest excess funds in short-term interest-earning accounts and other assets, which provide liquidity to meet lending requirements. Our deposit accounts with the Federal Home Loan Bank of Dallas amounted to $2.1 million and $21,000 at June 30, 2008 and 2007, respectively.

A significant portion of our liquidity consists of securities classified as available-for-sale and cash and cash equivalents. Our primary sources of cash are net income, principal repayments on loans and mortgage-backed securities and increases in deposit accounts. If we require funds beyond our ability to generate them internally, we have borrowing agreements with the Federal Home Loan Bank of Dallas which provide an additional source of funds. At June 30, 2008, we had $26.9 million in advances from the Federal Home Loan Bank of Dallas and had $80.7 million in additional borrowing capacity.

At June 30, 2008, the Company had outstanding loan commitments of $104,000 to originate loans. At June 30, 2008, certificates of deposit scheduled to mature in less than one year, totaled $41.5 million. Based on prior experience, management believes that a significant portion of such deposits will remain with us, although there can be no assurance that this will be the case. In addition, the cost of such deposits could be significantly higher upon renewal, in a rising interest rate environment. We intend to utilize our high levels of liquidity to fund our lending activities. If additional funds are required to fund lending activities, we intend to sell our securities classified as available-for-sale as needed.

Home Federal Savings and Loan is required to maintain regulatory capital sufficient to meet tangible, core and risk-based capital ratios of at least 1.5%, 3.0% and 8.0%, respectively. At June 30, 2008, Home Federal Savings and Loan exceeded each of its capital requirements with ratios of 20.21%, 20.21% and 73.08%, respectively.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements, as defined by Securities and Exchange Commission rules, and have not had any such arrangements during the two years ended June 30, 2008. See Notes 8 and 15 to the Notes to Consolidated Financial Statements contained in this Annual Report.

Impact of Inflation and Changing Prices

The consolidated financial statements and related financial data presented herein regarding Home Federal Bancorp have been prepared in accordance with accounting principles generally accepted in the United States of America which generally require the measurement of financial position and operating results in terms of historical dollars, without considering changes in relative purchasing power over time due to inflation. Unlike most industrial companies, virtually all of our assets and liabilities are monetary in nature. As a result, interest rates generally have a more significant impact on Home Federal Bancorp's performance than does the effect of inflation. Interest rates do not necessarily move in the same direction or in the same magnitude as the prices of goods and services, since such prices are affected by inflation to a larger extent than interest rates.

Report of Independent Registered Public Accounting Firm

To the Board of Directors

Home Federal Bancorp, Inc.

of Louisiana and Subsidiary

Shreveport, Louisiana

We have audited the accompanying consolidated balance sheets of Home Federal Bancorp, Inc. of Louisiana (the Company) and its wholly-owned subsidiary as of June 30, 2008 and 2007, and the related consolidated statements of operations, comprehensive income, changes in stockholders' equity, and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Home Federal Bancorp, Inc. of Louisiana and its wholly-owned subsidiary, Home Federal Savings and Loan Association, as of June 30, 2008 and 2007, and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

A Professional Accounting Corporation

Metairie, Louisiana

September 26, 2008

HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY

Consolidated Balance Sheets

June 30, 2008 and 2007

| | | 2008 | | | 2007 | |

| | | (In Thousands) | |

| Assets | | | | | | |

| Cash and Cash Equivalents (Includes Interest-Bearing Deposits with Other Banks of $4,957 and $3,025 for 2008 and 2007, Respectively) | | $ | 7,363 | | | $ | 3,972 | |

| Securities Available-for-Sale | | | 96,324 | | | | 83,752 | |

| Securities Held-to-Maturity | | | 1,688 | | | | 1,408 | |

| Loans Held-for-Sale | | | 852 | | | | 1,478 | |

| Loans Receivable, Net | | | 28,263 | | | | 25,211 | |

| Accrued Interest Receivable | | | 550 | | | | 499 | |

| Premises and Equipment, Net | | | 880 | | | | 923 | |

| Deferred Tax Asset | | | 1,691 | | | | 1,476 | |

| Foreclosed Real Estate | | | 52 | | | | - | |

| Other Assets | | | 52 | | | | 66 | |

| | | | | | | | | |

| Total Assets | | $ | 137,715 | | | $ | 118,785 | |

| | | | | | | | | |

| | | | | | | | | |

| Liabilities and Stockholders' Equity | |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Deposits | | $ | 78,359 | | | $ | 77,710 | |

| Advances from Borrowers for Taxes and Insurance | | | 177 | | | | 196 | |

| Advances from Federal Home Loan Bank of Dallas | | | 26,876 | | | | 12,368 | |

| Stock Purchase Deposit Escrow | | | 3,575 | | | | - | |

| Other Accrued Expenses and Liabilities | | | 854 | | | | 699 | |

| | | | | | | | | |

| | | | 109,841 | | | | 90,973 | |

| Total Liabilities | | | | | | | | |

| | | | | | | | | |

| Equity | | | | | | | | |

| Preferred Stock - No Par Value; 2,000,000 Shares Authorized;None Issued and Outstanding | | | - | | | | - | |

| Common Stock - $.01 Par Value; 8,000,000 Shares Authorized;3,558,958 Shares Issued; 3,383,287 Shares Outstanding at June 30, 2008 and 3,387,202 Shares Outstanding at June 30, 2007 | | | 14 | | | | 14 | |

| Additional Paid-In Capital | | | 13,567 | | | | 13,509 | |

| Treasury Stock, at Cost - 175,671 Shares at June 30, 2008; 171,756 Shares at June 30, 2007 | | | (1,809 | ) | | | (1,771 | ) |

| Unearned ESOP Stock | | | (940 | ) | | | (997 | ) |

| Unearned RRP Trust Stock | | | (395 | ) | | | (551 | ) |

| Retained Earnings | | | 20,071 | | | | 20,449 | |

| Accumulated Other Comprehensive Loss | | | (2,634 | ) | | | (2,841 | ) |

| | | | | | | | | |

| Total Stockholders' Equity | | | 27,874 | | | | 27,812 | |

| | | | | | | | | |

| Total Liabilities and Stockholders' Equity | | $ | 137,715 | | | $ | 118,785 | |

| | | | | | | | | |

See accompanying notes to consolidated financial statements.

HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY

Consolidated Statements of Operations

For the Years Ended June 30, 2008 and 2007

| | | 2008 | | | 2007 | |

| | | (In Thousands, Except Per Share Data) | |

| Interest Income | | | | | | |

| Loans, Including Fees | | $ | 2,072 | | | $ | 1,739 | |

| Investment Securities | | | 243 | | | | 285 | |

| Mortgage-Backed Securities | | | 4,537 | | | | 4,265 | |

| Other Interest-Earning Assets | | | 152 | | | | 301 | |

| | | | | | | | | |

| Total Interest Income | | | 7,004 | | | | 6,590 | |

| | | | | | | | | |

| Interest Expense | | | | | | | | |

| Deposits | | | 3,035 | | | | 2,760 | |

| Federal Home Loan Bank Borrowings | | | 933 | | | | 688 | |

| | | | | | | | | |

| Total Interest Expense | | | 3,968 | | | | 3,448 | |

| | | | | | | | | |

| Net Interest Income | | | 3,036 | | | | 3,142 | |

| | | | | | | | | |

| Provision for Loan Losses | | | - | | | | 1 | |

| | | | | | | | | |

Net Interest Income after Provision for Loan Losses | | | 3,036 | | | | 3,141 | |

| | | | | | | | | |

| Non-Interest Income | | | | | | | | |

| Gain on Sale of Loans | | | 6 | | | | 3 | |

| Gain on Sale of Securities | | | 149 | | | | 168 | |

| Other Income | | | 43 | | | | 69 | |

| | | | | | | | | |

| Total Non-Interest Income | | | 198 | | | | 240 | |

| | | | | | | | | |

| Non-Interest Expense | | | | | | | | |

| Compensation and Benefits | | | 1,572 | | | | 1,487 | |

| Occupancy and Equipment | | | 168 | | | | 178 | |

| Data Processing | | | 69 | | | | 73 | |

| Audit and Examination Fees | | | 121 | | | | 142 | |

| Merger and Stock Issuance Costs | | | 883 | | | | - | |

| Deposit Insurance Premiums | | | 9 | | | | 9 | |

| Legal Fees | | | 74 | | | | 66 | |

| Franchise and Bank Shares Tax | | | 141 | | | | 158 | |

| Other Expense | | | 322 | | | | 304 | |

| | | | | | | | | |

| Total Non-Interest Expense | | | 3,359 | | | | 2,417 | |

| | | | | | | | | |

| (Loss) Income Before Income Taxes | | | (125 | ) | | | 964 | |

| | | | | | | | | |

| Provision for Income Tax (Benefit) Expense | | | (43 | ) | | | 327 | |

| | | | | | | | | |

| Net (Loss) Income | | $ | (82 | ) | | $ | 637 | |

| | | | | | | | | |

| (Loss) Earnings Per Share | | | | | | | | |

| Basic | | $ | (0.03 | ) | | $ | 0.19 | |

| Diluted | | $ | (0.03 | ) | | $ | 0.19 | |

| | | | | | | | | |

See accompanying notes to consolidated financial statements.

HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY

Consolidated Statements of Comprehensive Income

For the Years Ended June 30, 2008 and 2007

| | | 2008 | | | 2007 | |

| | | (In Thousands) | |

| | | | | | | |

| Net (Loss) Income | | $ | (82 | ) | | $ | 637 | |

| | | | | | | | | |

| Other Comprehensive Income, Net of Tax | | | | | | | | |

| Unrealized Holding Gains Arising During the Period | | | 425 | | | | 496 | |

| Reclassification Adjustment for Gains Included in Net Income | | | (218 | ) | | | (221 | ) |

| | | | | | | | | |

| Total Other Comprehensive Income | | | 207 | | | | 275 | |

| | | | | | | | | |

| Total Comprehensive Income | | $ | 125 | | | $ | 912 | |

| | | | | | | | | |

__________________________________________________________________________________________________________________

See accompanying notes to consolidated financial statements

HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY

Consolidated Statements of Changes in Stockholders' Equity

For the Years Ended June 30, 2008 and 2007

| | | Common Stock | | | Additional Paid-in Capital | | | Unearned ESOP Stock | | | Retained Earnings | | | Accumulated Other Comprehensive Loss | | | Unearned RRP Trust Stock | | | Treasury Stock | | | Total Stockholders'Equity | |

| | | | | | | | | (In Thousands) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance - July 1, 2006 | | $ | 14 | | | $ | 13,445 | | | $ | (1,054 | ) | | $ | 20,149 | | | $ | (3,116 | ) | | $ | (688 | ) | | $ | (211 | ) | | $ | 28,539 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ESOP Compensation Earned | | | - | | | | 2 | | | | 57 | | | | - | | | | - | | | | - | | | | - | | | | 59 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distribution of RRP Trust Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | 137 | | | | - | | | | 137 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends Paid | | | - | | | | - | | | | - | | | | (337 | ) | | | - | | | | - | | | | - | | | | (337 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options Vested | | | - | | | | 62 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 62 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisition of Treasury Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (1,560 | ) | | | (1,560 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | | | - | | | | - | | | | - | | | | 637 | | | | - | | | | - | | | | - | | | | 637 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Comprehensive Income, Net of Applicable Deferred Income Taxes | | | - | | | | - | | | | - | | | | - | | | | 275 | | | | - | | | | - | | | | 275 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance - June 30, 2007 | | | 14 | | | | 13,509 | | | | (997 | ) | | | 20,449 | | | | (2,841 | ) | | | (551 | ) | | | (1,771 | ) | | | 27,812 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ESOP Compensation Earned | | | - | | | | (4 | ) | | | 57 | | | | - | | | | - | | | | - | | | | - | | | | 53 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distribution of RRP Trust Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | 156 | | | | - | | | | 156 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends Paid | | | - | | | | - | | | | - | | | | (296 | ) | | | - | | | | - | | | | - | | | | (296 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stock Options Vested | | | - | | | | 62 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 62 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acquisition of Treasury Stock | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | (38 | ) | | | (38 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Loss | | | - | | | | - | | | | - | | | | (82 | ) | | | - | | | | - | | | | - | | | | (82 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other Comprehensive Income, Net of Applicable Deferred Income Taxes | | | - | | | | - | | | | - | | | | - | | | | 207 | | | | - | | | | - | | | | 207 | |

| Balance - June 30, 2008 | | $ | 14 | | | $ | 13,567 | | | $ | (940 | ) | | $ | 20,071 | | | $ | (2,634 | ) | | $ | (395 | ) | | $ | (1,809 | ) | | $ | 27,874 | |

__________________________________________________________________________________________________________________

See accompanying notes to consolidated financial statements

HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY

Consolidated Statements of Cash Flows

For the Years Ended June 30, 2008 and 2007

| | | 2008 | | | 2007 | |

| | | (In Thousands) | |

| Cash Flows from Operating Activities | | | | | | |

| Net (Loss) Income | | $ | (82 | ) | | $ | 637 | |

| Adjustments to Reconcile Net (Loss) Income to Net Cash Provided by (Used in) Operating Activities | | | | | | | | |

| Net Amortization and Accretion on Securities | | | (182 | ) | | | (168 | ) |

| Amortization of Deferred Loan Fees | | | (20 | ) | | | (17 | ) |

| Provision for Loan Losses | | | - | | | | 1 | |

| Depreciation of Premises and Equipment | | | 55 | | | | 61 | |

| Gain on Sale of Securities | | | (149 | ) | | | (168 | ) |

| ESOP Compensation Expense | | | 53 | | | | 59 | |

| Deferred Income Tax (Benefit) | | | (321 | ) | | | (21 | ) |

| Stock Option Expense | | | 62 | | | | 62 | |

| Recognition and Retention Plan Expense | | | 150 | | | | 134 | |

| Changes in Assets and Liabilities | | | | | | | | |

| Origination and Purchase of Loans Held-for-Sale | | | (12,985 | ) | | | (13,835 | ) |

| Sale and Principal Repayments of Loans Held-for-Sale | | | 13,611 | | | | 12,356 | |

| Accrued Interest Receivable | | | (51 | ) | | | (34 | ) |

| Other Operating Assets | | | 14 | | | | 11 | |

| Other Operating Liabilities | | | 158 | | | | 156 | |

| | | | | | | | | |

| Net Cash Provided by (Used in) Operating Activities | | | 313 | | | | (766 | ) |

| | | | | | | | | |

| Cash Flows from Investing Activities | | | | | | | | |

| Loan Originations and Principal Collections, Net | | | 330 | | | | 1,459 | |

| Purchases of Loans | | | (3,455 | ) | | | (5,797 | ) |

| Deferred Loan Fees Collected | | | 42 | | | | 10 | |

| Acquisition of Premises and Equipment | | | (12 | ) | | | (37 | ) |

| Activity in Available-for-Sale Securities | | | | | | | | |

| Proceeds from Sales of Securities | | | 15,507 | | | | 19,086 | |

| Proceeds from Maturity of Securities | | | - | | | | 2,000 | |

| Principal Payments on Mortgage-Backed Securities | | | 11,582 | | | | 10,977 | |

| Purchases | | | (39,017 | ) | | | (31,378 | ) |

| Activity in Held-to-Maturity Securities | | | | | | | | |

| Principal Payments on Mortgage-Backed Securities | | | 138 | | | | 155 | |

| Purchases | | | (416 | ) | | | (130 | ) |

| | | | | | | | | |

| Net Cash Used in Investing Activities | | | (15,301 | ) | | | (3,655 | ) |

__________________________________________________________________________________________________________________

See accompanying notes to consolidated financial statements

HOME FEDERAL BANCORP, INC. OF LOUISIANA

AND SUBSIDIARY

Consolidated Statements of Cash Flows (Continued)

For the Years Ended June 30, 2008 and 2007

| | | 2008 | | | 2007 | |

| | | (In Thousands) | |

| Cash Flows from Financing Activities | | | | | | |

| Net Increase in Deposits | | | 650 | | | | 6,431 | |

| Proceeds from Advances from Federal Home Loan Bank | | | 18,700 | | | | 7,250 | |

| Repayment of Advances from Federal Home Loan Bank | | | (4,192 | ) | | | (8,299 | ) |

| Dividends Paid | | | (296 | ) | | | (337 | ) |

| Acquisition of Treasury Stock | | | (38 | ) | | | (1,560 | ) |

| Net Decrease in Advances from Borrowers for Taxes and Insurance | | | (20 | ) | | | (22 | ) |

| Stock Purchase Deposit Escrow | | | 3,575 | | | | - | |

| | | | | | | | | |

| Net Cash Provided by Financing Activities | | | 18,379 | | | | 3,463 | |

| | | | | | | | | |

| Net Increase (Decrease) in Cash and Cash Equivalents | | | 3,391 | | | | (958 | ) |

| | | | | | | | | |

| Cash and Cash Equivalents, Beginning of Year | | | 3,972 | | | | 4,930 | |

| | | | | | | | | |

| Cash and Cash Equivalents, End of Year | | $ | 7,363 | | | $ | 3,972 | |

| | | | | | | | | |

| Supplemental Cash Flow Information | | | | | | | | |

| Interest Paid on Deposits and Borrowed Funds | | $ | 3,930 | | | $ | 3,439 | |

| Income Taxes Paid | | | 252 | | | | 352 | |

| Market Value Adjustment for Gain (Loss) on Securities Available-for-Sale | | | 314 | | | | 417 | |

| | | | | | | | | |

| Non-Cash Investing Activity | | | | | | | | |

| Loans Transferred to Foreclosed Real Estate During the Year | | | 52 | | | | - | |

__________________________________________________________________________________________________________________

See accompanying notes to consolidated financial statements

| HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY |

| |

| Notes to the Consolidated Financial Statements |

| Note 1. | Summary of Significant Accounting Policies |

Nature of Operations

On January 18, 2005, Home Federal Savings and Loan Association (the Association) completed its reorganization to the mutual holding company form of organization and formed Home Federal Bancorp, Inc. of Louisiana (the Company) to serve as the stock holding company for the Association. In connection with the reorganization, the Company sold 1,423,583 shares of its common stock in a subscription and community offering at a price of $10.00 per share. The Company also issued 60% of its outstanding common stock in the reorganization to Home Federal Mutual Holding Company of Louisiana, or 2,135,375 shares.

The Association is a federally chartered, stock savings and loan association and is subject to federal regulation by the Federal Deposit Insurance Corporation and the Office of Thrift Supervision. The Association provides financial services to individuals, corporate entities and other organizations through the origination of loans and the acceptance of deposits in the form of passbook savings, certificates of deposit, and demand deposit accounts. Services are provided by three offices, all of which are located in Shreveport, Louisiana.

The Association is subject to competition from other financial institutions, and is also subject to the regulations of certain Federal and State agencies and undergoes periodic examinations by those regulatory authorities.

Basis of Presentation and Consolidation

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiary, Home Federal Savings and Loan Association. All significant intercompany balances and transactions have been eliminated.

Use of Estimates

In preparing consolidated financial statements in conformity with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the Consolidated Balance Sheets and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change in the near term relate to the allowance for loan losses and deferred taxes.

Significant Group Concentrations of Credit Risk

Most of the Company's activities are provided to customers of the Association by three offices, all of which are located in the city of Shreveport, Louisiana. The area served by the Association is primarily the Shreveport-Bossier City metropolitan area; however, loan and deposit customers are found dispersed in a wider geographical area covering much of northwest Louisiana.

| HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY |

| |

| Notes to the Consolidated Financial Statements |

| Note 1. | Summary of Significant Accounting Policies (Continued) |

Cash and Cash Equivalents

For purposes of the Consolidated Statements of Cash Flows, cash and cash equivalents include cash on hand, balances due from banks, and federal funds sold, all of which mature within ninety days.

At June 30, 2008 and 2007, cash and cash equivalents consisted of the following:

| | | 2008 | | | 2007 | |

| (In Thousands) | | | | | | |

| Cash on Hand | | $ | 314 | | | $ | 198 | |

| Demand Deposits at Other Institutions | | | 4,214 | | | | 770 | |

| Federal Funds Sold | | | 2,835 | | | | 3,004 | |

| | | | | | | | | |

| Total | | $ | 7,363 | | | $ | 3,972 | |

Securities

The Company classifies its debt and equity investment securities into one of three categories: held-to-maturity, available-for-sale, or trading. Investments in non-marketable equity securities and debt securities, in which the Company has the positive intent and ability to hold to maturity, are classified as held-to-maturity and carried at cost, adjusted for amortization of the related premiums and accretion of discounts, using the interest method. Investments in debt securities that are not classified as held-to-maturity and marketable equity securities that have readily determinable fair values are classified as either trading or available-for-sale securities.

Securities that are acquired and held principally for the purpose of selling in the near term are classified as trading securities. Investments in securities not classified as trading or held-to-maturity are classified as available-for-sale.

Trading account and available-for-sale securities are carried at fair value. Unrealized holding gains and losses on trading securities are included in earnings while net unrealized holding gains and losses on available-for-sale securities are excluded from earnings and reported in other comprehensive income. Purchase premiums and discounts are recognized in interest income using the interest method over the term of the securities. Declines in the fair value of held-to-maturity and available-for-sale securities below their cost that are deemed to be other than temporary are reflected in earnings as realized losses. In estimating other-than-temporary impairment losses, management considers (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Company to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value. Gains and losses on the sale of securities are recorded on the trade date and are determined using the specific identification method.

| HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY |

| |

| Notes to the Consolidated Financial Statements |

| Note 1. | Summary of Significant Accounting Policies (Continued) |

Loans Held for Sale

Loans originated and intended for sale in the secondary market are carried at the lower of cost or estimated fair value in the aggregate. Net unrealized losses, if any, are recognized through a valuation allowance by charges to income.

Loans

Loans receivable are stated at unpaid principal balances, less allowances for loan losses and unamortized deferred loan fees. Net non-refundable fees (loan origination fees, commitment fees, discount points) and costs associated with lending activities are being deferred and subsequently amortized into income as an adjustment of yield on the related interest earning assets using the interest method. Interest income on contractual loans receivable is recognized on the accrual method. Unearned discount on property improvement and automobile loans is deferred and amortized on the interest method over the life of the loan.

Allowance for Loan Losses

The allowance for loan losses is established as losses are estimated to have occurred through a provision for loan losses charged to earnings. Loan losses are charged against the allowance when management believes the uncollectibility of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the allowance.

The allowance for loan losses is evaluated on a regular basis by management and is based upon management's periodic review of the collectibility of the loans in light of historical experience, the nature and volume of the loan portfolio, adverse situations that may affect the borrower's ability to repay, estimated value of the underlying collateral and prevailing economic conditions. The evaluation is inherently subjective, as it requires estimates that are susceptible to significant revision as more information becomes available.

A loan is considered impaired when, based on current information or events, it is probable that the Association will be unable to collect the scheduled payments of principal and interest when due according to the contractual terms of the loan agreement. When a loan is impaired, the measurement of such impairment is based upon the fair value of the collateral of the loan. If the fair value of the collateral is less than the recorded investment in the loan, the Association will recognize the impairment by creating a valuation allowance with a corresponding charge against earnings.

An allowance is also established for uncollectible interest on loans classified as substandard. Substandard loans are those which are in excess of ninety days delinquent. The allowance is established by a charge to interest income equal to all interest previously accrued and income is subsequently recognized only to the extent that cash payments are received. When, in management's judgment, the borrower's ability to make periodic interest and principal payments is back to normal, the loan is returned to accrual status.

| HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY |

| |

| Notes to the Consolidated Financial Statements |

| Note 1. | Summary of Significant Accounting Policies (Continued) |

Allowance for Loan Losses (Continued)

It should be understood that estimates of future loan losses involve an exercise of judgment. While it is possible that in particular periods, the Company may sustain losses, which are substantial relative to the allowance for loan losses, it is the judgment of management that the allowance for loan losses reflected in the accompanying statements of condition is adequate to absorb possible losses in the existing loan portfolio.

Off-Balance Sheet Credit Related Financial Instruments

In the ordinary course of business, the Association has entered into commitments to extend credit. Such financial instruments are recorded when they are funded.

Foreclosed Assets

Assets acquired through, or in lieu of, loan foreclosure are held for sale and are carried at the lower of cost or current fair value minus estimated cost to sell as of the date of foreclosure. Cost is defined as the lower of the fair value of the property or the recorded investment in the loan. Subsequent to foreclosure, valuations are periodically performed by management and the assets are carried at the lower of carrying amount or fair value less cost to sell.

Premises and Equipment

Land is carried at cost. Buildings and equipment are carried at cost less accumulated depreciation computed on the straight-line method over the estimated useful lives of the assets. Estimated useful lives are as follows:

| Buildings and Improvements | 10 - 40 Years |

| Furniture and Equipment | 3 - 10 Years |

Income Taxes

The Company and its wholly-owned subsidiary file a consolidated Federal income tax return on a fiscal year basis. Each entity will pay its pro-rata share of income taxes in accordance with a written tax-sharing agreement.

Deferred income tax assets and liabilities are determined using the liability (or balance sheet) method. Under this method, the net deferred tax asset or liability is determined based on the tax effects of the temporary differences between the book and tax bases of the various assets and liabilities and gives current recognition to changes in tax rates and laws.

While the Association is exempt from Louisiana income tax, it is subject to the Louisiana Ad Valorem Tax, commonly referred to as the Louisiana Shares Tax, which is based on stockholders' equity and net income.

Earnings per Share

Earnings per share are computed based upon the weighted average number of common shares outstanding during the year.

| HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY |

| |

| Notes to the Consolidated Financial Statements |

| Note 1. | Summary of Significant Accounting Policies (Continued) |

Non-Direct Response Advertising

The Company expenses all advertising costs, except for direct-response advertising, as incurred. In the event the Company incurs expense for material direct-response advertising, it will be amortized over the estimated benefit period. Direct-response advertising consists of advertising whose primary purpose is to elicit sales to customers who could be shown to have responded specifically to the advertising and results in probable future benefits. For the years ended June 30, 2008 and 2007, the Company did not incur any amount of direct-response advertising.

Comprehensive Income

Accounting principles generally require that recognized revenue, expenses, gains and losses be included in net income. Although certain changes in assets and liabilities, such as unrealized gains and losses on available-for-sale securities, are reported as a separate component of the equity section of the Consolidated Balance Sheets, such items, along with net income, are components of comprehensive income.

The components of other comprehensive income and related tax effects are as follows:

| | | 2008 | | | 2007 | |

| (In Thousands) | | | | | | |

| | | | | | | |

| Unrealized Holding Gains on Available-for-Sale Securities | | $ | 644 | | | $ | 751 | |

| Reclassification Adjustment for Gains Realized in Income | | | (330) | | | | (334 | ) |

| | | | | | | | | |

| Net Unrealized Gains | | | 314 | | | | 417 | |

| Tax Effect | | | (107) | | | | (142 | ) |

| | | | | | | | | |

| Net-of-Tax Amount | | $ | 207 | | | $ | 275 | |

The components of accumulated other comprehensive income, included in Stockholders' Equity, are as follows:

| | | 2008 | | | 2007 | |

| (In Thousands) | | | | | | |

| Net Unrealized Loss on Securities Available-for-Sale | | $ | (3,991 | ) | | $ | (4,305 | ) |

| Tax Effect | | | 1,357 | | | | 1,464 | |

| | | | | | | | | |

| Net-of-Tax Amount | | $ | (2,634 | ) | | $ | (2,841 | ) |

| HOME FEDERAL BANCORP, INC. OF LOUISIANA AND SUBSIDIARY |

| |

| Notes to the Consolidated Financial Statements |

| Note 1. | Summary of Significant Accounting Policies (Continued) |

Recent Accounting Pronouncements

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. This Statement defines fair value, establishes a framework for measuring fair value in generally accepted accounting principles, and expands disclosures about fair value measurements. This Statement is effective for financial statements issued for fiscal years beginning after November 15, 2007.

In September 2006, the FASB issued SFAS No. 158, Employers' Accounting for Defined Benefit Pension and Other Postretirement Plans (as amended). This Statement improves financial reporting by requiring an employer to recognize the overfunded or underfunded status of a defined benefit postretirement plan (other than a multiemployer plan) as an asset or liability in its statement of financial position and to recognize changes in that funded status in the year in which the changes occur through comprehensive income. This Statement also requires an employer to measure the funded status of a plan as of the date of its year-end statement of financial position. An employer with publicly traded equity securities shall initially apply the requirement to recognize the funded status of a benefit plan as of the end of the fiscal year ending after December 31, 2006. The requirement to measure plan assets and benefit obligations as of the date of the employer's fiscal year-end statement of financial position is effective for fiscal years ending after December 31, 2008.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities (as amended). This Statement permits entities to choose to measure many financial instruments and certain other items at fair value. The objective is to provide entities with the opportunity to mitigate volatility in reported earnings caused by measuring related assets and liabilities differently without having to apply complex hedge accounting provisions. This Statement is effective as of the beginning of an entity's first fiscal year that begins after November 15, 2007.