UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO S |

| | ECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

Or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 000-51139

TWO RIVERS WATER & FARMING COMPANY

(Exact name of registrant as specified in its charter)

| Colorado | | 13-4228144 |

| State or other jurisdiction of incorporation or organization | | I.R.S. Employer Identification No. |

| | 2000 South Colorado Boulevard, Tower 1, Suite 3100, Denver, CO 80222 | |

| | (Address of principal executive offices) (Zip Code) | |

| | | |

| | Registrant’s telephone number, including area code: (303) 222-1000 | |

| | | |

| | Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class registered | | Name of each exchange on which registered |

| Not Applicable | | Not Applicable |

| | Securities registered pursuant to Section 12(g) of the Act: | |

| | Common Stock (Title of class) | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes |_| No |X|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes |X| No |_|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes |X| No |_|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes |X| No |_|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (ss. 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. |X|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One).

| Large accelerated filer | [___] | | Accelerated filer | [___] |

Non-accelerated filer (Do not check if a smaller reporting company) | [___] | | Smaller reporting company | [X] |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes |_| No |X|

The aggregate market value of voting stock held by non-affiliates of the registrant was approximately $36,594,000 as of June 30, 2012.

There were 24,480,050 shares outstanding of the registrant's Common Stock as of March 15, 2013.

| PART I |

| | | | Page |

| | Business | 2 |

| | Risk Factors | 21 |

| | Unresolved Staff Comments | 31 |

| | Properties | 31 |

| | Legal Proceedings | 36 |

| | Mine Safety Disclosures | 36 |

| | | | |

| PART II |

| | | | |

| | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 37 |

| | Selected Financial Data | 40 |

| | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 40 |

| | Quantitative and Qualitative Disclosures About Market Risk | 52 |

| | Financial Statements and Supplementary Data | 52 |

| | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 52 |

| | Controls and Procedures | 52 |

| | Other Information | 55 |

| | | | |

| PART III |

| | | | |

| | Directors, Executive Officers, and Corporate Governance | 56 |

| | Executive Compensation | 60 |

| | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 66 |

| | Certain Relationships and Related Transactions, and Director Independence | 67 |

| | Principal Accounting Fees and Services | 68 |

| | | | |

| PART IV |

| | | | |

| | Exhibits Listing | 69 |

| | | Auditor Opinion | 71 |

| | | Financials | 72 |

| | | 70 |

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

| | Colorado Foundation for Water Education. (2009). Citizens Guide to Colorado Water Law. Denver: Colorado Foundation for Water Education. |

| | Colorado Springs Utilties . (2009). Southern Delivery System. Retrieved Feburary 17, 2012, from http://www.sdswater.org/overview.asp |

| | Colorado Water Conservation Board. (2011). Colorado's Water Supply Future. Denver: Colorado Water Conservation Board. |

| | Driscoll, G. M. (2011, January 7). Front Range Water Planning Supply Update: Increased Storage, Increased Demands, Incerased Transmountain Diversions. Carbondale: Elk Mountain Consulting. Retrieved February 17, 2012, from http://www.rwapa.org/reports/Front_Range_Water_Supply_Planning_Update_(Final)11011.pdf |

| | Finley, B. (2012, Feburary 17). The Denver Post. EPA wants further review of water diversion project to protect the Colorado River, p. 3. |

| | Grantham, J. (2011). Time to Wake Up: Days of Abundant Resources and Falling Prices are Over. GMO, LLC, GMO.com, 18. |

| | U.S. Department of the Interior Bureau of Reclamation . (2005, October ). SDS EIS Newsletter. Southern Delivery System Project, p. 5. |

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

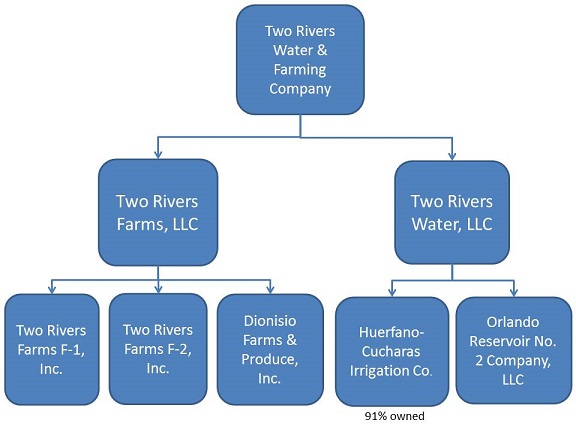

Two Rivers Water & Farming Company Corporate Organization

The Company’s organizational structure is illustrated in the above chart. Two Rivers Water & Farming Company is the parent company and owns 100% of Two Rivers Farms, LLC (“Two Rivers Farms”) and Two Rivers Water, LLC (“Two Rivers Water”). Two Rivers Farms owns 100% of Two Rivers Farms F-1, Inc., Two Rivers Farms F-2, Inc. and Dionisio Farms & Produce, Inc. Two Rivers Farms also owns unencumbered farmland that will eventually be redeveloped and brought into production. Two Rivers Water owns 91% of the Huerfano-Cucharas Irrigation Company (sometimes referred to elsewhere in this annual report as HCIC) and 100% of the Orlando Reservoir No. 2 Company LLC.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Unless the context requires otherwise, references in this document to “Two Rivers Water & Farming Company,” “Two Rivers”, “We,” “Our,” “Us” or the “Company” is to Two Rivers Water & Farming Company and its subsidiaries.

Note about Forward-Looking Statements

This Form 10-K contains forward-looking statements, such as statements relating to our financial condition, results of operations, plans, objectives, future performance and business operations. These statements relate to expectations concerning matters that are not historical facts. These forward-looking statements reflect our current views and expectations based largely upon the information currently available to us and are subject to inherent risks and uncertainties. Although we believe our expectations are based on reasonable assumptions, they are not guarantees of future performance and there are a number of important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. By making these forward-looking statements, we do not undertake to update them in any manner except as may be required by our disclosure obligations in filings we make with the Securities and Exchange Commission under the federal securities laws. Our actual results may differ materially from our forward-looking statements.

PART I

Summary

Two Rivers has developed and operates a revolutionary new water business model suitable for arid regions in the southwestern United States whereby the Company synergistically integrates irrigated farming and wholesale water distribution into one company, utilizing a practice of rotational farm fallowing. Rotational farm fallowing, as it applies to water, is a best methods farm practice whereby portions of farm acreage are temporarily fallowed in cyclic rotation to give soil an opportunity to reconstitute itself. As a result of fallowing, an increment of irrigation water can be made available for municipal use without permanently drying up irrigated farmland. Collaborative rotational farm fallowing agreements between farmers and municipalities make surplus irrigation water available for urban use during droughts and, conversely, make surplus urban water available for irrigation during relatively wet periods. The Company produces and markets high value vegetable and fodder crops on its irrigated farmland and provides wholesale water distribution through farm fallowing agreements in its initial area of focus on the Arkansas River and its tributaries on the southern Front Range of Colorado.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Two Rivers operates in the Arkansas River Basin, which includes the watershed of the two rivers for which the Company is named, the Huerfano and Cucharas Rivers. This combined watershed of the Huerfano and Cucharas Rivers encompasses approximately 1,860 square miles and extends from the eastern crest of the Continental Divide in the Spanish Peaks and Sangre de Christo Mountains to the Huerfano River’s confluence with the Arkansas River, just downstream of Pueblo, Colorado. The elevations in the two rivers’ watershed thus begin at more than 14,000 feet above sea level to approximately 4,500 feet at the confluence. As noted, the Huerfano and Cucharas Rivers are tributaries of the Arkansas River, which, in turn, is a tributary of the Mississippi River. The Arkansas River Basin is subject to legal administration under the 1948 compact between Colorado and Kansas.

Since beginning operations in 2009, Two Rivers has invested approximately $40,000,000 acquiring and developing irrigated farmland and the associated water rights and infrastructure. The Company has begun negotiations with Pueblo Board of Water Works and Colorado Springs Utilities to acquire, engineer and build gravel pit storage reservoirs on lands just east of the confluence of the Arkansas River and Fountain Creek in Pueblo County, Colorado. The gravel pit reservoirs will enable the exchange of trans-mountain water between the Company’s farming operations on the Bessemer Ditch and the Huerfano Cucharas Irrigation Company (HCIC) canal systems in Pueblo County. By delivering excess municipal water to the HCIC canal systems, the Company can reintroduce water onto 3,000 acres of fallow farmland it owns and as much as 20,000 additional acres of land the Company can acquire. We are beginning the acquisition and development of reservoir storage on permitted gravel pits in a strategic location just east of the convergence of the Arkansas River and Fountain Creek in the vicinity of Pueblo, Colorado. Development of these water storage reservoirs will significantly enhance our ability to implement rotational farm fallowing in conjunction with municipalities on the Arkansas River.

In 2012, Two Rivers made a significant acquisition of irrigated farmland. Two Rivers acquired Dionisio Farms & Produce (“DFP”), which consistently produces high value fruits and vegetables and animal fodder crops on 353 acres irrigated by the Bessemer Ditch off the Arkansas River. As an illustration of DFP’s ability to consistently produce crops, during the 2012 widespread United States drought and heat wave, DFP produced 200+ bushels of corn per acre, while the national average for corn production fell to 120+ bushels of corn per acre. Russ Dionisio serves as the Chief Operating Officer of Two Rivers Farms and is responsible for all farming operations of Two Rivers.

The Company owns 91% of the Huerfano Cucharas Irrigation Company and thereby controls certain water rights, water storage facilities, and diversion canals which will enable exclusive redevelopment of 20,000+ irrigable acres in an area adjacent to DFP. Through the development of new reservoirs on the Arkansas River in collaboration with other water users, Two Rivers has a unique and sustainable economic advantage and opportunity within our Southeastern Colorado sphere of farm operations. The Company’s water assets also have inherent advantages compared to other water assets which are tributary to the Arkansas River as a result of our assets’ seniority, entitlements, elevation and proximity to Front Range communities and water conveyance facilities. To capitalize on these advantages, the Company expects to build and refurbish storage reservoirs which, together with our diversion rights and facilities will allow us to store an additional 75,000 acre-feet of water (over and above the 15,000 acre-feet of currently operable water storage) in our area of operations within the next five years. The additional water storage will provide reliability during dry years and dry seasons, enabling the Company to expand our farming operations to maintain balance between irrigable land and available irrigation water. The development of much needed storage reservoirs in the area will allow the Company to offer storage to other water users in the area. Through water exchanges and other water-related transactions, the reservoirs can potentially increase and strengthen the Company’s existing water rights.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Our Business

Two Rivers has developed and operates a revolutionary new water business model suitable for arid regions in the southwestern United States whereby the Company synergistically integrates irrigated farming and wholesale water distribution into one company, utilizing a practice of rotational farm fallowing. Rotational farm fallowing, as it applies to water, is a best methods farm practice whereby portions of farm acreage are temporarily fallowed in cyclic rotation to give soil an opportunity to reconstitute itself. As a result of fallowing, an increment of irrigation water can be made available for municipal use without permanently drying up irrigated farmland. Collaborative rotational farm fallowing agreements between farmers and municipalities make surplus irrigation water available for urban use during droughts and, conversely, make surplus urban water available for irrigation during relatively wet periods. The Company produces and markets high value vegetable and fodder crops on its irrigated farmland and provides wholesale water distribution through farm fallowing agreements in its initial area of focus on the Arkansas River and its tributaries on the southern Front Range of Colorado.

Our Water Business

The Value of Water in Colorado

Along the Front Range of Colorado, water is a scarce and valuable resource. Natural precipitation varies widely throughout the year and from one year to another. Rivers, which flood with the spring melt from the mountain snowpack, may be refreshed only with the occasional thunderstorm in the heat of the summer growing season. Annual precipitation also varies between surplus and drought. Additionally, the large majority of Colorado’s population resides on the Front Range (east of the Continental Divide) while the large majority of the State’s precipitation falls on the Western Slope (west of the Divide). Over time, many communities, farms and enterprises developed trans-mountain diversions to bring more water to the Front Range. Precipitation on the Front Range, and water diverted from the Western Slope, drain to the Mississippi River through the South Platte and Arkansas Rivers. Water on the Western Slope drains through the Colorado River. All of the State’s rivers are administered pursuant to interstate compacts with neighboring states. As a result of the variability of Colorado’s hydrology, its arrangements for diversions, storage and beneficial use, and its obligations to downstream states, Colorado has developed an integrated and complex water rights administration system.

In Colorado and the Western United States, the right to use water is based on the Prior Appropriation Doctrine which is often referred to as “first in time, first in right.” Under this doctrine, water use is allocated to satisfy the oldest (“most senior”) water right before water is allocated to the next water right in historic chronology (a “junior water right” in comparison to a water right perfected earlier). Moreover, in Colorado, water rights and their relative priorities are protected by judicial decrees and are administered by the Office of the State Engineer (the “State Engineer”) within the Colorado Department of Water Resources (“DWR”). The ability to consistently irrigate farmland, and thus avoid the inconsistencies of rainfall, is therefore tied to the relative seniority of historic water rights. Two Rivers is focused on developing irrigated farmland and maximizing beneficial use of the water rights associated with that farmland.

To manage water uses according to the Prior Appropriation Doctrine, Colorado maintains both judicial oversight through regional water courts and administrative oversight through the State Engineer. Water rights claims are filed in the court, adjudicated as necessary to resolve any adverse claims, and then decreed though an enforceable judgment. The State Engineer is charged with administering the accorded priorities among the various water rights in each of the State’s river systems.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Colorado water law further recognizes two distinct but related prior appropriative rights: direct diversion rights and storage rights. Direct diversion rights permit a user in priority to divert water directly from the river for immediate beneficial use (such as irrigation); storage rights permit a user in priority to divert water from the river and impound the water in a reservoir to re-time the water for later beneficial use. Thus, in Colorado, a direct diversion right must be conveyed to an immediate use; it cannot be stored without a storage right. As a result, both types of appropriative rights are often paired, when possible, so that in priority diversion rights can be re-timed through the exercise of a companion storage right to address seasonal and year-to-year variability in natural supplies. The older the appropriation date of any water right, the more reliable is its yield; similarly, the more effectively a senior diversion right is paired with a senior storage right, the more reliable each becomes.

Administration of Water Rights

In addition to the intra-state administration of water flowing in its rivers, Colorado also has inter-state water administration responsibilities because each of its major rivers (the Colorado, the North Platte and the Arkansas) is governed as well by interstate compacts with downstream states. These compacts are subject to judicial review, interpretation and enforcement under the original jurisdiction of the U.S. Supreme Court to resolve disputes among the states. In 1948, Colorado and Kansas reached an agreement that apportioned the water of the Arkansas River; Colorado was apportioned 60% of the water while Kansas is apportioned 40% of the River’s flow (Colorado Foundation for Water Education, 2009, p. 23). In order to comply with Colorado’s obligations under the Arkansas River Compact, therefore, water rights on the Arkansas and its tributaries (including the Huerfano and Cucharas Rivers) are administered to assure the Compact-required water flows at the Colorado-Kansas state line. When necessary, Colorado’s in-state uses are curtailed, in order of priority, to assure compliance with the Compact.

The interstate compacts (beginning with the Colorado River Compact of 1922) increased Colorado’s need to husband its apportioned water to meet the needs of its growing population along the Front Range. Trans-basin diversions (primarily tunnels and canals) were developed, under the Prior Appropriation Doctrine, to divert water from one watershed for conveyance to and use in another. Mainly, water from the Colorado River Basin, west of the Continental Divide, was diverted east to meet the water needs along the earlier developing Front Range by so-called “conservancy districts”. These projects began in the 1930’s and, although many have been in operation for decades, some remain incomplete (Driscoll, 2011, p. 3). Increasingly, further trans-basin diversions are limited not only by competing appropriative water rights in the basins of origin but also by increasingly stringent environmental restrictions.

Stymied in their attempts to import additional surface water from distant watersheds, some municipalities and water providers began to rely on inherently unsustainable groundwater “mining” (depleting aquifers for current consumption at a rate in excess of the rate at which natural recharge occurs). After decades of such groundwater mining, many of the aquifers on the Front Range have been severely depleted. Some municipalities also purchased farms with water diversion rights and then ceased irrigating the farmland, transferring the water to their urban uses. Because neither the practice of groundwater mining nor the practice of “buying up and drying up” farmland is sustainable, Colorado law has placed limits and regulations on both practices.

Recognizing the need for additional water sources along the Front Range, the Colorado Water Conservation Board (“CWCB”) published its 2050 Municipal and Industrial Gap Analysis in 2011. This report estimates that the Arkansas and South Platte Basins (essentially the Front Range) will have a combined average annual supply shortage of 130,000 acre-feet1 of water by 2050 (Colorado Water Conservation Board, 2011, p. table 2.2). The difficulty and expense of incremental trans-mountain diversions coupled with the unsustainability of groundwater mining and agricultural-to-urban transfers—as documented by the CWCB—motivates Front Range water purveyors to address the projected gap and to identify and develop inherently scarce renewable sources of water.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

As early as 2005, the Colorado General Assembly created basin roundtables to convene regional water purveyors to address the looming municipal supply gap. The roundtables were charged to identify “projects and methods to meet the consumptive and non-consumptive needs of the basin.” (Colorado House Bill 05-1177). The potential solutions include Identified Plans and Process (“IPP’s”), Conservation, New Supply Development and Alternatives to Agricultural Transfers.

The Arkansas River Basin Roundtable has only a few IPPs to meet the water supply gap identified in its basin. The most significant of the Arkansas Basin IPPs is the Southern Delivery System (SDS), an $800 million, 62-mile water supply pipeline and associated pumping plants currently under construction by a consortium of four regional water purveyors including Colorado Springs. These purveyors will use a portion of the capacity in the SDS to transport water made available to each of them under their respective contracts with the United States Bureau of Reclamation (USBR). (U.S. Department of the Interior Bureau of Reclamation, 2005, p.1) The SDS connects USBR’s Pueblo Reservoir on the Arkansas River, the point of delivery under the USBR contracts, with the purveyors’ service areas. (Colorado Springs Utilities, 2009)

In order to address a portion of the identified gap between forecast supply and demand within the Arkansas Basin and to provide a substitute source of water for Front Range communities that are too reliant on depleted groundwater aquifers, the design and planning for the SDS anticipate that other water purveyors will subscribe for pipeline capacity to transport renewable water supplies to their service areas. (Recommended Terms and Conditions and Mitigation of Project Impacts, Southern Delivery System 1041 Application, March 18, 2009)

The Company has commenced discussions with some of these purveyors to determine whether the Company’s water storage and management assets can be integrated with other water resources to meet a portion of the identified gap between forecast supply and demand along the Front Range. In order to facilitate such collaborative regional water resource planning, in late 2011, the Company filed a water court case seeking authorization for routine exchanges of water between the Company’s storage facilities in the Huerfano/Cucharas watershed and the main stem of the Arkansas River. Through such exchanges, the water management infrastructure developed for and dedicated to the Company’s Farming Business could also support management of the urban water districts’ demand by delivering water to the SDS for transport to such districts’ service areas. In February of 2012, the Office of the State Engineer administratively approved such exchanges as part of the Company’s substitute water supply plan (SWSP). The SWSP is expected to remain in effect until the water court adjudicates the Company’s case. Although no water management agreement has yet been reached, the Company believes that, based on the identified demand for renewable water supplies and the availability of conveyance capacity in the SDS, we will be able to negotiate mutually satisfactory water management contracts with one or more of these purveyors.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Our Water Rights

Two Rivers Water & Farming Company owns and operates various senior water rights in the Arkansas River Basin, which we use or plan to use to irrigate our farmland. This diversified portfolio is made up of a combination of direct flow rights and storage rights.

Table 1 – Surface rights owned by the Company

| Structure | Elevation | Priority No. | Appropriation Date | Consumptive Use | Decreed Amount |

| Butte Valley Ditch | 5,909 ft | 1 | 5/15/1862 | 360 A.F. | 1.2 cfs |

| Butte Valley Ditch | 9 | 5/15/1865 | 1.8 cfs |

| Butte Valley Ditch | 86 | 5/15/1886 | 3.0 cfs |

| Butte Valley Ditch | 111 | 5/15/1886 | 3.0 cfs |

| Robert Rice Ditch | 5,725 ft | 19 | 3/01/1867 | 131 A.F. | 3.0 cfs |

| Huerfano Valley Ditch | 4,894 ft | 120 | 2/2/1888 | 2,891 A.F. | 42.0 cfs |

| Huerfano Valley Ditch | 342 | 5/1/1905 | 18.0 cfs |

| Bessemer Irrigation Company | 4,600 ft | 2 4 - 16.5 18 - 27 28 33.5 34.5 36 40 41 42.5 55 | 4/1/1861 12/1/1861 5/31/1864 6/1/1866 1/8/1867 5/31/1867 11/1/1870 12/1/1870 9/18/1873 1/1/1876 1/1/1878 5/5/1881 6/20/1881 3/1/1882 5/1/1887 | 62,029 A.F.* | 2 cfs 20 cfs 3.74 cfs 3 cfs 2.5 cfs 5.13 cfs 1.47 cfs 3.40 cfs 2 cfs 3 cfs .41 cfs 14 cfs 2 cfs 8 cfs 322 cfs |

* The Company owns .01% of the Bessemer; therefore our ownership is .01% of the consumptive use. This is computed by the Company’s ownership of approximately 183 shares divided by the total Bessemer shares outstanding of 17,980. The 62,029 A.F. is a 100 year average. The 10 year average for consumptive use is 66,566 A.F. and 5 year average is 57,362 A.F.

1 An acre-foot of water is the amount of water required to cover one acre to a depth of one foot. An acre-foot of water contains 325,851 gallons, generally considered enough water to supply two average households for a year. Annual irrigation in Southeastern Colorado consumes approximately three acre-feet of water per acre of crop.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Table 2 – Storage rights owned by the Company

| Structure | Elevation | Priority No. | Appropriation Date | Average Annual Yield | Decreed Amount (A.F.) | Operable Storage (A.F.) |

| Huerfano Valley Reservoir | 4,702 ft | 6 | 2/2/1888 | 1,424 A.F. | 2,017 | 1,000 |

| Cucharas Valley Reservoir | 5,570 ft | 66 | 3/14/1906 | 3,055 A.F. | 31,956. | 10,000 |

| Cucharas Valley Reservoir* | 5,705 ft | 66c | 3/14/1906 | 34,404 |

| Bradford Reservoir | 5,850 ft | 64.5 | 12/15/1905 | - | 6,000 | - |

| Orlando Reservoir # 2 | 5,911 ft | 349 | 12/14/1905 | 1,800 A.F. | 3,110 | 2,400 |

* A conditional right is a place holder while the engineering and construction of structures are completed to perfect a water right, in this case, to physically store the water. The conditional right establishes a seniority date but allows time for completion of the project. Conditional rights are reviewed every six years by the water court to confirm that progress is being made on the effort to perfect the right. When a conditional water right is perfected, which can be done incrementally in the case of storage, the water right becomes absolute.

Two Rivers Water, LLC (“TR Water”)

During 2011, the Company formed TR Water to secure additional water rights, rehabilitate water diversion, conveyance and storage facilities and to develop one or more special water districts.

The Huerfano-Cucharas Irrigation Company (“HCIC”)

In order to supply its farms with irrigation water, the Company began to acquire shares in the HCIC Company, a historic mutual ditch company formed by area farmers in order to develop and put to use their water rights on the two rivers. At the time HCIC was formed in 1944, the water in the two rivers was continuously augmented by groundwater pumped from coal mines that operated in the watershed. The augmented and natural flow of the rivers, along with the water rights and facilities of HCIC Company were sufficient to provide reliable irrigation water for the shareholders and their expanding farm enterprises. However, in the years following World War II, the mines began to cease production and, therefore, stopped pumping groundwater out of the mine shafts and into the river channels. As a result of the reduction in downstream flow in the rivers, the extent of farming in the watershed could no longer be reliably irrigated. In some years, crops failed for lack of late summer irrigation water and, over time, once thriving farms withered. Because of such failures and the reduced flow in the rivers, the shareholders of HCIC were unable or unwilling to adequately maintain the water diversion, conveyance and storage facilities. Therefore, at the time the Company decided to invest in the Huerfano/Cucharas watershed, the shares in HCIC had become less valuable and the residual farming in the area had reverted primarily to pasture and dry grazing.

Beginning in 2009, the Company systematically acquired shares in HCIC and, as of December 31, 2010, had acquired 91% of the shares, which it continues to own. The shares were acquired from willing sellers in a series of arm’s length, negotiated transactions for cash, promissory notes, and the Company’s common shares. As the controlling shareholder, the Company currently operates HCIC and has undertaken a long-term program to refurbish and restore the historic water management facilities. Based on management’s estimate of value, which included management’s consideration of an independent appraisal, we determined that the Company’s interest in HCIC had a book value, measured through fair value accounting, of $24,196,000, on December 31, 2011. HCIC’s assets, liabilities and results are consolidated in the Company’s financial statements.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Orlando Reservoir No. 2 Company, LLC (“Orlando”)

Orlando is a Colorado limited liability company originally formed to divert water from the Huerfano River, for storage in the Orlando Reservoir to be re-timed and used for irrigation of farmland in Huerfano and Pueblo Counties. At the time the Company began investing in the Huerfano/Cucharas watershed, Orlando owned the historic diversion structure, a conveyance system and a reservoir and also owned a small amount of irrigable farmland. However, the water facilities were in deteriorated condition. Beginning in January, 2011, through a series of transactions, the latest of which closed on September 7, 2011, the Company acquired 100% ownership of Orlando (through its wholly-owned subsidiary, TR Water) for a combination of cash, stock and seller-financing. Promptly following the acquisition, the Company began the program for refurbishing the facilities to restore their operating efficiency. The stated purchase price for Orlando was $3,450,000; however, for reporting the financial statements dated September 30, 2011 (and pending the results of an independent appraisal), the purchase price was computed as $3,156,750 based on cash paid, the seller carry-back note and 650,000 of the Company’s common shares issued to the seller. The purchase price was allocated $3,000,000 to water assets and $100,000 to farm land. The Company also recorded a forgiveness of debt of $384,000, which was computed as the difference between the cash paid plus the Company’s stock issued to the sellers plus the new seller carry back note less the previous note owed to the seller.

Following the purchase of Orlando and considering the refurbishment already underway, the Orlando was independently appraised as of January 16, 2012 at $5,195,000, considering agricultural irrigation as its highest and best use. The gain from the bargain purchase of $1,736,000 was allocated $1,520,000 to water assets and $216,000 to land.

The Orlando assets include not only the reservoir, but also the senior-most direct flow water right on the Huerfano River (the #1 priority), along with the #9 priority and miscellaneous junior water rights. These water rights are now integrated with the Company’s other water rights on the Huerfano and Cucharas River to optimize the natural water supply. In addition, the water storage rights, and the physical storage reservoirs, are critical to water supply reliability in the watershed, because the storage system allows the natural spring runoff from snowmelt to be captured and re-timed for delivery to irrigate crops throughout the growing season. Coupled with the Company’s distribution facilities and farmland, these water diversion and storage rights increase the reliability of water supplies to irrigate and grow our crops.

Dionisio Farms & Produce, Inc. (“DFP”)

As part of the purchase of DFP, the Company acquired 146 shares in the Bessemer Irrigating Ditch Company, which manages and administers the water rights in the Bessemer Ditch. The Bessemer Ditch holds very senior water rights on the Arkansas River. The Bessemer Ditch has sustained the Dionisio farm operations for more than 60 years, through all hydrological and weather cycles.

The Company’s purchase of DFP is further described herein under the heading “Our Farming”.

Storage Reservoirs and Infrastructure

As part of its comprehensive water and farming system, the Company owns and operates storage reservoirs and ditches. Reservoirs allow water owners to store their water and plan the water’s distribution throughout the growing season. Currently, the Company owns reservoirs associated with HCIC and Orlando, but is also planning to develop additional reservoirs in strategic locations in the Arkansas River watershed. The Company is also acquiring land that can be utilized for significant water storage reservoirs. The development of much needed storage reservoirs in the area will allow the Company to offer storage to other water users in the area. Through water exchanges and other water-related transactions, the reservoirs can potentially increase and strengthen the Company’s existing water rights.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

On December 31, 2012, the Company acquired land just downstream of the confluence of the Arkansas River and Fountain Creek. This land includes permitted gravel pits which the Company expects to convert to water storage reservoirs. The Company is planning to build a 30,000 AF storage project at this property that would be developed in conjunction with existing water users. This reservoir will support farming operations on the Arkansas River undertaken by us and by others.

The storage reservoirs and infrastructure associated with HCIC and the Orlando are described above under the headings “The Huerfano-Cucharas Irrigation Company” and “Orlando Reservoir No. 2 Company, LLC”.

All of the Two Rivers’ reservoirs are used for irrigation in a similar manner to other reservoirs in the region, with the exception of Pueblo Reservoir which was also constructed for flood control. Direct flow rights are generally senior to most storage rights but typically do not divert early in the spring when storage rights fill. The Arkansas River below Pueblo Reservoir also operates a Winter Storage Program that re-allocates winter direct flow rights to storage in reservoirs from November 15 to March 15 each year. The Bessemer Ditch has the ability to store water in the Pueblo Reservoir through the Winter Storage Program.

Because the Company’s water rights and operating structures are located at succeeding elevations in the watershed, the system moves water supplies from point of diversion, through storage, to place of use primarily by means of gravity, making the Company’s system far more economical to operate than systems requiring energy to pump water for beneficial use.

In order to use these rights and structures most efficiently, the Company has planned and begun to implement a program of renovation and integration. For example, the Company began construction of new outlet works for the 1905 Orlando Reservoir in November of 2011. The work was completed and successfully tested in February of 2012, approximately a year after the Company’s acquisition. Also in February of 2012, the Company commenced re-construction of the diversion structure, which takes water from the Huerfano River for storage in the Orlando reservoir, and to irrigate the Company’s nearby farmland. Pictures of the recent projects are posted on the Company’s website, http://www.2riverswater.com/projects.html. Additional water facility renovation projects are planned on a phased basis as necessary to provide reliable irrigation for the Company’s expanding farming operations.

As of the date of this report, the Company has the operable right to store approximately 15,000 acre-feet of water within the Huerfano and Cucharas Rivers watershed in three separate reservoirs. When the Company’s reservoirs on the Huerfano and Cucharas Rivers are fully restored, we will have the operable capacity and legal right to store in excess of 70,000 acre-feet of water. Similarly, based on its portfolio of water rights, some of which are more senior than others, the Company has the right to divert from the natural flows of the two rivers in excess of 90 cubic feet per second. Seasonal variability in the natural flow of the rivers, as well as the priorities of other water users in the system, limits the Company’s ability to divert the decreed amounts of water on a continuous basis. The Company’s current water rights produce a long-term historic average annual diversion of approximately 15,000 acre-feet of water which provides approximately 10,000 acre-feet of consumptive use at the plant.

The 15,000 acre-feet average is based on a 50+ year period of record and also relies on historic studies of these rights by a variety of engineers at various times. It is common practice within the water industry in Colorado to use long periods of time to create reliable averages of water flow. The Company believes that using averages relating to only recent years can be misleading. If one of those years was particularly dry or wet, it would skew the averages. For example, in four out of the last ten years, there has been an extreme drought in the Western United States and in the Arkansas River watershed, our area of operations. Due to this drought condition, our flow averages for the most recent ten, five and three fiscal years are 8,200 AF, 10,500 AF and 10,400 AF, respectfully. A similar request for the same averages for the decade beginning in 1980 would be about approximately 15,900 AF, 18,500 AF and 17,200 AF.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

“Consumptive use” is the term for the portion of a water diversion right that is actually consumed by its beneficial use. Where the beneficial use is agricultural irrigation, consumptive use represents the amount of water consumed by the irrigated crop or evaporated on the farm. After deducting consumptive use from the amount of water diverted and applied to irrigation, the remainder is described as “return flow” to the system. Such return flows are generally subject to appropriation downstream. Only the consumptive use portion of a given water right is subject to transfer (that is, a change in the point of diversion, place of use, or purpose of use). Therefore, water rights are often assigned monetary value based on the consumptive use portion. Although consumptive use varies by crop, rainfall, temperature and other factors, in Southeastern Colorado, crops generally consume about two acre-feet of applied water for each acre planted. In order to provide that amount of consumptive use water, an irrigator must generally apply three acre feet of water (allowing for predictable return flow equal to about one-third of the applied water). The Company measures its water rights both in terms of the amount of the diversion or storage right, as the case may be, but also in terms of the historic consumptive use.

Other Water Transactions and Matters

On September 20, 2011, the Company entered into a five-year lease with the Pueblo Board of Water Works for 500 acre-feet of water to be delivered annually by PBWW to the Company. The Company planned to use the water to support farming but also to demonstrate the ability to store such water in the Company’s reservoirs through a judicially-approved exchange. In late 2011, the Company filed two water court cases (District Court, Water Division 2, Colorado) designed to improve the overall efficiency of the Company’s emerging system (including the ability to exchange water between the Arkansas River and the Company’s storage reservoirs).

The first water court case, designated 11CW94, seeks approval of the Company’s plan to divert and store water even when its rights are not in priority by replacing the water downstream pursuant to the PBWW lease. Although the water court’s ultimate approval to routinely carry out such an exchange awaits the completion of the judicial process, the State Engineer administratively granted a temporary substitute water supply plan (“SWSP”) implementing such an exchange during the interim until the case is adjudicated. Under the SWSP, the Company will be allowed to capture Huerfano River water for upstream storage and later use, even when our rights are not in priority. To avoid injury to senior water rights which have priority over the Company’s rights during the period of the exchange, the PBWW will release water pursuant to the replacement water contract upon the order of the Company. By means of such exchanges, the Company plans to eventually integrate its water supply system with the overall water use and delivery systems served by the Arkansas River and its tributaries.

The second water court case, 11CW96, seeks changes to the place of use and point of diversion for the Robert Rice Ditch (Water Right No. 19). The proposed changes would not only increase the flexibility of the Company’s water system but would also make Company water available to augment supplies for the Huerfano County town of Gardner. The second water court case seeks to allow the Robert Rice Ditch direct diversion water right to be moved to storage in the Orlando Reservoir under the Company’s storage right so that the water can be re-timed and used more efficiently to irrigate the Company’s farmland or, alternatively, to augment well depletions along the Arkansas River and its tributaries.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Our Farming Business

In furtherance of developing irrigated farmland, the Company has engaged in both: 1) acquiring farmland that is currently producing crops supported by relatively secure water rights; and 2) acquiring farmland that has not been productive for many years, but maintains significant water rights. Presently, we are focused on acquiring farmland which is proximate to our integrated water system and farmland which has directly associated senior water rights. By capturing water in our reservoirs and releasing it later for irrigation purposes we expect to ameliorate the inconsistencies of seasonal and annual water availability to our farms.

The Company currently owns approximately 5,210 gross acres, but not all of those acres have yet been brought into production. During 2012, the Company produced cash crops from 482 acres of irrigated farmland. Farming production is discussed below under the heading “Two Rivers Farms, LLC”. Subject to the availability of capital, the Company expects to acquire and develop in excess of 20,000 acres of high yield irrigated along the Arkansas River in Colorado within the next five years.

The Company’s current crop production consists of human-consumption produce (including cabbage, squash, and pumpkins), animal fodder crops (sorghum), and exchange traded grains (corn). The Company expects to increase the variety of crops we produce as we expand our farming operations, improve our water system and secure contracts with purchasers.

In the early 1900’s in Southeastern Colorado, the farming and mining industries were connected. Mining used significant amounts of water to extract and wash the mined aggregate. In many cases, it was also necessary to pump groundwater out of the mines to keep the mine shafts from filling. In both cases, the extracted mineral rich water was drained to the Huerfano and Cucharas Rivers. This continuous artificial augmentation of the flow in the two rivers created an opportunity for farmers downstream to capture and store that water in reservoirs and to distribute it to their fields through a series of ditches.

However, when the region’s mining business faded in the late 1950’s, it was no longer necessary to extract water from the mine shafts so that the mines could be worked. Thus, the artificial augmentation of the natural flow of the rivers ceased. As a result, many farmers who had relied on junior water rights to extend their farming operations lost the opportunity to consistently irrigate their fields. With less water and more variability of flows based on natural hydrography, fewer farms survived to support the mutual irrigation efforts and the remaining farms withered as the water management facilities deteriorated for lack of maintenance, renewal and replacement.

The Company saw the opportunity to apply modern agronomy and sufficient capital to redevelop the main ditch system (still owned and operated in its reduced state by HCIC and other ditch systems (including Orlando) to deliver sufficient water to revitalize a portion of the neglected farmlands. The Company commenced a systematic program to:

| · | purchase and redevelop available farmland by deep-plowing the fields, laser-leveling the planting areas (to optimize plant absorption and minimize runoff), installing irrigation facilities, and applying fertilizers, |

| · | purchase a suite of water rights (including both diversion rights and storage rights), |

| · | refurbish the historic ditch systems and reservoirs to restore and upgrade their efficiency, |

| · | re-establish a sustainable and profitable farming enterprise which could achieve the scale required by modern farming methods and which could put the revived water supply to consistent beneficial use, |

| · | develop a customer base to consistently buy the farms’ output at prices sufficient to generate profits, and |

| · | build a reliable, integrated water supply system capable of flexibly serving both agricultural and urban needs. |

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

In redeveloping our farmland, we deploy state-of-the-art methods and equipment with the aim of optimizing product yield, water efficiencies, and labor inputs.

Two Rivers Farms, LLC (“Farms”)

In order to put its water rights and facilities to productive use, the Company formed Farms to manage farms in proximity to our water distribution facilities and has undertaken a program of redeveloping the land, introducing modern agricultural and water management practices including deep plowing, laser leveling and installing efficient irrigation facilities.

During the 2010 growing season, approximately 400 acres of the Company’s land were farmed, primarily for wheat and feed corn, to determine the fertility of the soil and the most efficient and cost effective means of irrigation.

During 2011, the Company developed innovative ways to add irrigable acreage. As a result, the Company developed 533 acres in 2011. These additions increased the Company’s farmable acreage to 713. However, because of the extensive drought in the area Farms did not produce a 2011 crop.

During 2012, the Company farmed 482 acres as detailed below.

| | Dionisio (1) | Butte Valley (2) | Farms F-1 (3) | Not Assigned (4) |

| Acres in Production | 353 | 129 | None | None |

| Crops | Cabbage, corn, squash, pumpkin | Sorghum | None | None |

| Revenue | $ 922 | $ 57 | $ -0- | $ -0- |

| Direct cost of revenue | $ 555 | $ 113 | $ 316 | $140 |

| Gross Profit | $ 367 | $ (56) | $ (316) | $(140) |

| | (1) TR Bessemer operated the Dionisio Farm (DFP) for the 2012 growing season. In 2013, these amounts will be reported under DFP. In 2012, the yield per acre was as follows: corn: 203 bushels; cabbage 53,500 pounds; squash 21,000 pounds, and pumpkins 50 bins. |

| | (2) Butte Valley planted sorghum to maintain the soil and provide some revenue based on the limited water available. |

| | (3) There was no planting in F-1 due to the severe drought. |

| | (4) Represents general direct cost that was not assigned to a particular farm |

Dionisio Farms & Produce, Inc. (“DFP”)

In 2012, the Company acquired Dionisio Farms and Produce, LLC (an unrelated party) in a two stage transaction. On June 15, 2012, the Company acquired certain land and water rights from Dionisio Farms and Produce, LLC and its affiliated entities. The Company purchased 146 acres of irrigable farmland, and the accompanying 146 shares of the Bessemer Ditch Irrigation Company, a senior water right holder on the main stem of the Arkansas River, and two supplemental ground water wells. Further, the Company entered into leases for an additional 279 irrigable acres, of which 83 acres are subject to a 20 year lease. The 20-year lease has five year renewals. The rate is $185/acre or $15,000 per year. Dionisio has been producing vegetable crops for over 60 years and has well-established commercial relationships for the sale and distribution of its crops. The Company is operating these acquired assets under the Dionisio name and entered into employment agreements with members of the Dionisio family to maintain the experience and skill in producing and marketing of the vegetable crops.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Commencing in October 2012, DFP offered its preferred shares to accredited investors in a private placement. This offering, 2,500,000 shares at $2.00/share, closed in February 2013 and generated net proceeds (after offering costs) of $4,621,000. Proceeds of the offering were used as follows:

| · | Reimbursement to the Company of $630,000 for the Dionisio first closing in June, 2012, net of bank financing; |

| · | Second stage of the Dionisio purchase transaction in November, 2012 of $900,000 which is net of seller carry back; |

| · | Purchase of a neighboring farm (36 acres) for $56,000 plus debt assumption and new debt, |

| · | Loan to the Company of $1,000,000; and |

| · | The remainder of $2,035,000 as working capital and reserves. |

On November 2, 2012, the Company completed its acquisition of DFP and its affiliated entities through the payment of $900,000 and a seller carry-back promissory note of $600,000 (“Seller Note”). The Seller Note is due in five years, carries interest at 6% payable quarterly. Principal of the Seller Note is due at maturity. The Seller Note is secured by certain farm equipment that was purchased in this transaction.

Two Rivers Farms F-1, Inc. (“F-1”) and Two Rivers Farms F-2, Inc. (“F-2”)

F-1

On January 21, 2011 the Company formed F-1, then a limited liability company, to hold certain farming assets and as an entity to raise debt financing for the Company’s expansion of the farming business. In February 2011, F-1 sold $2,000,000 in 5% per annum, 3-year Series A convertible promissory notes that, as a class, also participate in 1/3 of the crop profit from the related land. Proceeds from these notes were used to acquire and improve irrigation systems, pay for the farmland and retire seller carry-back debt from the purchase of HCIC. This allowed water available through HCIC to be used to irrigate the F-1 farms without encumbrance.

In December 2012, F-1 offered the holders of the Series A convertible debt the opportunity to convert their debt into preferred shares of F-1 (which converted from an LLC to a corporation) and receive warrants to purchase common shares of the Company. Each preferred share can be converted into one share of common stock of Two Rivers. For every two preferred shares in F-1, one warrant to purchase one common share of the Company was also issued. The warrant expires December 31, 2017 and can be exercised at $3 per common share of Two Rivers. As of December 31, 2012, we received from the Series A debt holders the intent, subject to a final review of all transactional and legal documents, to convert $1,975,000 of the debt thereby leaving $25,000 of the originally issued Series A convertible debt and accrued interest of $86,000 as outstanding as of December 31, 2012.

As part of the debt conversion, Two Rivers Farms F-1, LLC converted into a corporation and authorized and issued a series of preferred shares designated as Series F-1-A Convertible Preferred Stock (“F-1 Preferred”)

The F-1 Preferred includes two dividends: (1) Cumulative 8% Annual Dividend; and (2) 25% Annual Net Profits Participation Dividend. Under the Cumulative 8% Annual Dividend, holders of the F-1 Preferred will be entitled to receive an annual dividend, when and if declared by F-1’s Board of Directors, at the rate of 8% per annum. Under the 25% Annual Net Profits Participation Dividend, F-1 Preferred holders will be entitled to receive an annual cumulative dividend, when and if declared, on a pro rata basis, equal to 25%, on a fully converted basis, of the Annual Net Profit. Annual Net Profit is defined as the Company’s earnings (as defined by U.S. GAAP) less interest payments and the 8% dividend set forth above and estimated income taxes owed.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

While the F-1 Preferred are outstanding, F-1 covenants, that unless it has the affirmative vote of its shareholders owning, in aggregate, not less than two-thirds (2/3) of the outstanding F-1 Preferred: (1) not to incur any debt other than regular trade payables arising in day-to-day operations of F-1; (2) not to transfer or sell assets (including to an affiliate or related person or entity); (3) to plan, operate, and manage its farmland, water rights, and produce business to optimize long-term farm yields and meet its financial, regulatory, and contractual obligations and objectives; (4) to observe all financial covenants; (5) to maintain independent books and records of its assets, liabilities, and operations separate from the books and records of the Company; (6) to make its books and records available for inspection by any holder of the F-1 Preferred (including such holder’s agent or representative) upon reasonable notice and conditions; (7) to segregate in a separate account net revenues from operations sufficient to pay when due: (i) the Cumulative 8% Preferred Dividend and (ii) 25% of its Annual Net Profit to pay when due the Profit Participation; (8) to include in its annual budget the Cumulative 8% Preferred Dividend and the Profit Participation; (9) to place on its Board agenda proposed actions (with appropriate supporting materials) related to (i) the timely declaration and payment of the Cumulative 8% Preferred Dividend and (ii) calculation and payment resolution for the Profit Participation; and (10) to limit the number of its Directors to three.

Additionally, while the F-1 Preferred are outstanding, the Company covenants: (1) to use its best efforts to list its common stock on a national securities exchange promptly following achieving listing eligibility criteria; (2) to file on a timely basis all reports, notices, audits and other documents required to maintain its compliance with the Securities Exchange Act of 1934; (3) to notice, convene and conduct its annual meeting of shareholders not later than June 15 of each year; (4) prior to the initial issuance of the F-1 Preferred, to appoint three directors to F-1’s Board of Directors, one of whom will be designated to represent the interests of the holders of the F-1 Preferred (the “PS Director”). The PS Director will have the same rights and duties as each of the other directors of F-1, and the Board of Directors shall act by majority vote; (5) coincident with its annual meeting each year, to conduct an election among holders of the Preferred Shares for the purpose of electing the PS Director; (6) to cause its independent public accounting firm to audit and issue its opinion with respect to the adequacy of the F-1’s financial reports; (7) to file a registration statement on or before July 1, 2013 with the SEC for the resale of the following securities: (a) for the Company’s common stock issuable on conversion of the F-1 Preferred to common stock of the Company; and (b) for the common stock of the Company issuable upon exercise of the warrants; and (8) to certify at least annually that, to the Company’s actual knowledge, neither F-1 nor the Company is in breach of these covenants.

Upon certain events of default under the F-1 Preferred, F-1 Preferred shareholders can cause a replacement of a member of the F-1 Board of Directors. The Conversion Agreement with F-1 debtholders is attached as an exhibit to this to this annual report on Form 10-K.

F-2

On April 5, 2011 the Company formed F-2, then a limited liability company, to hold certain farming and water assets and as an entity to raise additional debt for the Company’s expansion of the farming business. During the summer of 2011, F-2 sold $5,332,000 in 6% per annum, 3-year Series B convertible promissory notes that, as a class, also participate in 10% of the crop revenue from the related lands. Further, for each $2.50 borrowed, the lender received a warrant to purchase one common share of the Company’s stock at $2.50. These warrants expired on December 31, 2012. Proceeds from these notes were used to acquire the Orlando and additional farmland and to install irrigation systems.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

In December 2012, F-2 offered the holders of the Series B convertible debt the opportunity to convert their debt into preferred shares of F-2 (which converted from an LLC to a corporation) and receive warrants to purchase common shares of the Company. Each preferred share in F-2 can be converted into one share of common stock of Two Rivers. For every two preferred shares, a warrant to purchase one common share of the Company was also issued. The warrant expires December 31, 2017 and can be exercised at $3 per common share of Two Rivers. As of December 31, 2012, we received from the Series B debt holders the intent, subject to a final review of all transactional and legal documents, to convert $5,107,000 of the debt thereby leaving $225,000 of the originally issued Series B convertible debt and accrued interest of $194,000 as outstanding as of December 31, 2012.

As part of the debt conversion, Two Rivers Farms F-2, LLC converted into a corporation and authorized and issued a series of preferred shares designated as Series F-2-B Convertible Preferred Stock (“F-2 Preferred”)

The F-2 Preferred includes two dividends: (1) Cumulative 8% Annual Dividend; and (2) 25% Annual Net Profits Participation Dividend. Under the Cumulative 8% Annual Dividend, holders of the F-2 Preferred will be entitled to receive an annual dividend, when and if declared by F-2’s Board of Directors, at the rate of 8% per annum. Under the 25% Annual Net Profits Participation Dividend, F-2 Preferred holders will be entitled to receive an annual cumulative dividend, when and if declared, on a pro rata basis, equal to 25%, on a fully converted basis, of the Annual Net Profit. Annual Net Profit is defined as the Company’s earnings (as defined by U.S. GAAP) less interest payments and the 8% dividend set forth above and estimated income taxes owed.

While the F-2 Preferred are outstanding, F-2 covenants, that unless it has the affirmative vote of its shareholders owning, in aggregate, not less than two-thirds (2/3) of the outstanding F-2 Preferred: (1) not to incur any debt other than regular trade payables arising in day-to-day operations of F-2; (2) not to transfer or sell assets (including to an affiliate or related person or entity); (3) to plan, operate, and manage its farmland, water rights, and produce business to optimize long-term farm yields and meet its financial, regulatory, and contractual obligations and objectives; (4) to observe all financial covenants; (5) to maintain independent books and records of its assets, liabilities, and operations separate from the books and records of the Company; (6) to make its books and records available for inspection by any holder of the F-2 Preferred (including such holder’s agent or representative) upon reasonable notice and conditions; (7) to segregate in a separate account net revenues from operations sufficient to pay when due: (i) the Cumulative 8% Preferred Dividend and (ii) 25% of its Annual Net Profit to pay when due the Profit Participation; (8) to include in its annual budget the Cumulative 8% Preferred Dividend and the Profit Participation; (9) to place on its Board agenda proposed actions (with appropriate supporting materials) related to (i) the timely declaration and payment of the Cumulative 8% Preferred Dividend and (ii) calculation and payment resolution for the Profit Participation; and (10) to limit the number of its Directors to three.

Additionally, while the F-2 Preferred are outstanding, the Company covenants: (1) to use its best efforts to list its common stock on a national securities exchange promptly following achieving listing eligibility criteria; (2) to file on a timely basis all reports, notices, audits and other documents required to maintain its compliance with the Securities Exchange Act of 1934; (3) to notice, convene and conduct its annual meeting of shareholders not later than June 15 of each year; (4) prior to the initial issuance of the F-2 Preferred, to appoint three directors to F-2’s Board of Directors, one of whom will be designated to represent the interests of the holders of the F-2 Preferred (the “PS Director”). The PS Director will have the same rights and duties as each of the other directors of F-2, and the Board of Directors shall act by majority vote; (5) coincident with its annual meeting each year, to conduct an election among holders of the Preferred Shares for the purpose of electing the PS Director; (6) to cause its independent public accounting firm to audit and issue its opinion with respect to the adequacy of the F-2’s financial reports; (7) to file a registration statement on or before July 1, 2013 with the SEC for the resale of the following securities: (a) for the Common Stock issuable on conversion of the F-2 Preferred in the event of conversion shares to common stock of the Company; and (b) for the common stock of the Company issuable upon exercise of the warrants; and (8) to certify at least annually that, to the Company’s actual knowledge, neither F-2 nor the Company is in breach of these covenants.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Upon certain events of default under the F-2 Preferred, F-2 Preferred shareholders can cause a replacement of a member of the F-2 Board of Directors. The Conversion Agreement with F-2 is attached as an exhibit to this to this annual report on Form 10-K.

Both F-1 and F-2 lease their farmland and farming assets to Farms as the operator of the Company’s farming activities.

Other Farming

Approximately 1,500 acres of irrigable farmland in the Butte Valley acquired by the Company in connection with the Orlando purchase (the “Lascar-Butte Acres”) is subject to a conditional right to a repurchase by the sellers. The repurchase option is for $1.00 but is only effective on or after September 7, 2021 and only if the sellers have previously offered to purchase from the Company at least 2,500 SFE (single family equivalent) water service connections and tendered payment of a $6,500 Water Resource Fee per SFE connection pursuant to an agreement. Under that repurchase scenario, the Company would have already begun providing tap water service to the Lascar-Butte Acres and received a minimum of $16,250,000 in Water Resource Fees from sellers in exchange for the service connections. Also, the sellers of Orlando had the right, subject to certain conditions, to repurchase Lascar-Butte Acres for $3,000,000. However, as noted below, the repurchase right has been terminated based on actions of the Company to rehabilitate Orlando facilities and a portion of the associated farmland.

In 2011 and 2012, the Company made substantial improvements to the Lascar-Butte Acres to restore the farmable land and enhance the associated water rights. These improvements include but are not limited to installing an irrigation system, rebuilding the outlet works and diversion structure at the Orlando Reservoir, rebuilding the Orlando Ditch, laser leveling the farm land, purchasing nearby land, making filings with the water courts to enhance the water rights, and planting sorghum for harvest. These improvements allowed the Company to commence farming on the Lascar-Butte Acres in 2012 with a crop of sorghum.

Through December 31, 2012, the Company had expended in excess of $2,380,000 in rebuilding and preparing the Lascar-Butte Acres for farming and developing the associated water rights. The Company believes these substantial improvements satisfy certain obligations under the Orlando acquisition agreements and terminate the seller’s option to re-purchase the Lascar-Butte Acres. The seller had an option to repurchase the Lascar-Butte Acres by September 7, 2013, if the Company did not use its best efforts to complete substantial improvements to the Lascar-Butte Acres, or if the Company did not commence farming on Lascar-Butte Acres.

Other Matters

Bridge Loan Debt Conversion to Preferred Stock

During the quarter ended March 31, 2012, the Company closed a short-term bridge financing (the “Bridge Loan”) in the total amount of $3,994,000. The Company’s CEO participated as a lender in the Bridge Loan in the amount of $994,000. The Bridge Loan pays monthly interest at 12% per annum with $200,000 due on October 31, 2012 and the remainder was to be due on May 31, 2013. The Bridge Loan holders also received one share of the Company’s stock for each $10 of Bridge Loan participation. Participants in the Bridge Loan have the option of converting the principal into the Company’s common stock at the price offered in a take-out equity financing which the Company plans to complete. In conjunction with the closing of the Bridge Loan, the Company issued 400,000 shares of its common stock to the Bridge Loan holders. The fair value of the shares issued was determined to be $602,000, which is recorded as a debt discount to be amortized on a straight-line basis over the term of the related Bridge Loan.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

In October 2012, the Company obtained extensions to May 31, 2013 on $3,794,000 of the principal. In exchange for these extensions, the terms remain the same and the Company will issue the note holders restricted stock of the Company computed by multiplying the face amount of the note by 10% and dividing by $1.75 (per share). These shares were issued in the quarter ending December 31, 2012 and the cost was fully amortized from November 1, 2012 to December 31, 2012. The fair value of the shares issued was determined to be $271,000, which is recorded as a debt discount to be amortized on a straight-line basis over the term of the related Bridge Loan.

In December 2012, the Company offered the holders of the Bridge Loan convertible debt the opportunity to convert their debt into preferred shares of the Company and receive warrants to purchase common shares of the Company. The Company created a series of preferred stock designated as Series BL. Each share of the Series BL can be converted into one share of common stock of Two Rivers. For every two shares of the Series BL, a warrant to purchase one common share of the Company was also issued. The warrant expires December 31, 2017 and can be exercised at $3 per common share of Two Rivers. As of December 31, 2012, we received from the Bridge Loan debt holders the intent, subject to a final review of all transactional and legal documents, to convert $3,794,000 which represents conversion of the entire Bridge Loan debt.

As part of the debt conversion, the Company authorized and issued a series of preferred shares designated as Series BL Convertible Preferred Stock (“BL Preferred”).

The BL Preferred include two dividends: (1) Cumulative 8% Annual Dividend; and (2) 10% Annual Net Profits Participation Dividend. Under the Cumulative 8% Annual Dividend, holders of the BL Preferred will be entitled to receive an annual dividend, when and if declared by the Company’s Board of Directors, at the rate of 8% per annum. Under the 10% Annual Net Profits Participation Dividend, BL Preferred holders will be entitled to receive an annual cumulative dividend, when and if declared, on a pro rata basis, equal to 10%, on a fully converted basis, of the Annual Net Profit. Annual Net Profit is defined as the Company’s earnings (as defined by U.S. GAAP) less interest payments and the 8% dividend set forth above and an estimate of income taxes owed.

While the BL Preferred are outstanding, the Company covenants, that unless it has the affirmative vote of its shareholders owning, in aggregate, not less than two-thirds (2/3) of the outstanding BL Preferred: (1) not to incur any debt other than regular trade payables arising in day-to-day operations of the Company; and (2) not to transfer or sell assets (including to an affiliate or related person or entity); (3) to plan, operate, and manage its farmland, water rights, and produce business to optimize long-term farm yields and meet its financial, regulatory, and contractual obligations and objectives; (4) to observe all financial covenants; (5) to maintain independent books and records of its assets, liabilities, and operations; (6) to make its books and records available for inspection by any holder of the Preferred Shares (including such holder’s agent or representative) upon reasonable notice and conditions; (7) to segregate in a separate account net revenues from operations sufficient to pay when due: (i) the Cumulative 8% Preferred Dividend and (ii) 10% of its Annual Net Profit to pay when due the Profit Participation; (8) to include in its annual budget the Cumulative 8% Preferred Dividend and the Profit Participation; and (9) to place on its Board agenda proposed actions (with appropriate supporting materials) related to (i) the timely declaration and payment of the Cumulative 8% Preferred Dividend and (ii) calculation and payment resolution for the Profit Participation; (10) to use its best efforts to list its common stock on a national securities exchange promptly following achieving listing eligibility criteria; (11) to file on a timely basis all reports, notices, audits and other documents required to maintain its compliance with the Securities Exchange Act of 1934; (12) to notice, convene and conduct its annual meeting of shareholders not later than June 15 of each year; (13) to cause its independent public accounting firm to audit and issue its opinion with respect to the adequacy of the Company’s financial reports; (14) to file a registration statement on or before July 1, 2013 with the SEC for the resale of the following securities: (a) for the Common Stock issuable on conversion of the Preferred underlying the Conversion Shares; and (b) for the Common Stock issuable upon exercise of the Warrants; and (15) to certify at least annually that, to the Company’s actual knowledge, the Company is not in breach of a these covenants.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Corporate Evolution

Prior to 2009, the Company was named Navidec Financial Services, Inc. (“Navidec”) and had been engaged in mortgage lending and other enterprises unrelated to its current lines of business. Navidec was incorporated in the state of Colorado on December 20, 2002. On July 28, 2009, Navidec formed a wholly-owned Colorado corporation for the purpose of acquiring farm and water assets in the Huerfano/Cucharas watershed. On November 19, 2009, with shareholder approval, Navidec changed its name to Two Rivers Water Company. On December 11, 2012, with shareholder approval, the Company changed its name to Two Rivers Water & Farming Company.

Discontinued Operations

In early 2009, the Company (then named Navidec Financial Services, Inc.) discontinued its short-term real estate lending and development in order to focus all its efforts on the irrigated farming and water business. The wind down of discontinued operations was completed by December 31, 2011.

Competition

The rights to use water in Colorado have been fully appropriated to beneficial uses (such as agriculture irrigation and municipal and industrial applications) under court decrees and state regulation according to the prevailing Prior Appropriation Doctrine in which more senior (older) water rights take precedence in times of shortage over junior (newer) water rights. Notwithstanding significant conservation, growth in Colorado with related incremental demands for water has made the rights to divert, convey, store and use water relatively scarce and valuable. There is significant competition for the acquisition and beneficial use of historic water rights. Many competitors for the acquisition of such rights have significantly greater financial resources, technical expertise and managerial capabilities than the Company and, consequently, we could be at a competitive disadvantage in assembling, developing and deploying water assets required to support our businesses. Competitors' resources could overwhelm our efforts and cause adverse consequences to our operational performance. To mitigate such competitive risks, the Company concentrates its efforts in the Huerfano and Cucharas Rivers watershed where its local knowledge and control of a portfolio of water rights, storage facilities, distribution canals and productive farmland create a somewhat protected geographic niche. To further mitigate competitive risk, the Company strives to actively engage with both the farming and the water communities in Southeastern Colorado to explore strategies for cooperatively addressing challenges and opportunities faced by those communities—particularly to address the 130,000 acre-foot shortfall in water supplies on the Front Range, without taking valuable farmland out of production.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Employees

At December 31, 2012, the Company and its subsidiaries employed 12 full-time employees. None of these employees is covered by a collective bargaining agreement. The Chief Executive Officer and the Chief Financial Officer have entered into employment agreements with Two Rivers Water & Farming Company. We consider our relationship with our employees to be good.

Available Information

The Company’s common stock is traded on the Over the Counter Market under the symbol “TURV.” Our Annual Report on Form 10-K, as well as our quarterly reports on Form 10-Q and current reports on Form 8-K are required to be filed with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended, and they can be found on the Edgar database at www.sec.gov. In addition, our SEC reports are available free of charge from the Company upon written request to Wayne Harding, CFO, Two Rivers Water & Farming Company, Tower 1 Suite 3100, 2000 South Colorado Blvd., Denver, CO 80222, or you may retrieve investor information by going to the Company’s website at www.2riverswater.com.

Two Rivers Water & Farming Company -- 2012 Annual Report and 10K

Risk Factors Related to Forward Looking Statements

This Annual Report on Form 10-K include forward-looking statements within the meaning of the federal securities laws. These statements relate to, among other items, net sales, earnings, revenue, gross profit, profitability, financial conditions, results of operations, cash flows, capital expenditures and other financial matters. These statements also relate to our business strategy, goals and expectations concerning our market position and future operations. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements are often characterized by the use of words such as “believe”, “expect”, “anticipate”, “estimate”, “intend”, “plan”, “target”, “likely”, “may”, “will”, “would”, “could”, “predict”, “project”, and similar expressions or phrases, or the negative of those expressions or phrases.