UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2/A

Amendment #2

Registration Statement under the Securities Act of 1933

NSM Holdings, Inc. | ||||

(Name of small business issuer in its charter) | ||||

| Delaware | 5945 | 98-0425713 | ||

| (State or jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) | ||

Suite 210D, 8351 Alexandra Road, Richmond, British Columbia, V6X 3P3, Canada 604.671.8780 | ||||

| (Address and telephone number of principal executive offices) | ||||

Rene Daignault 1100 Melville Street, 6th Floor, Vancouver, British Columbia, V6E 4A6, Canada 604.648.0527 | ||||

| (Name, address and telephone number of agent for service) | ||||

Approximate date of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant toRule 415under the Securities Act, check the following box: [ X ]

If this Form is filed to register additional securities for an offering pursuant toRule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant toRule 462(c)under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant toRule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If delivery of the prospectus is expected to be made pursuant toRule 434, check the following box. [ ]

SB2 - -1 - A/2

CALCULATION OF REGISTRATION FEE

| Securities to be registered | Amount to be registered | Offering price per share | Aggregate offering price | Registration Fee(1) |

| shares of common stock to be offered by NSM | 2,500,000 | $0.10 | $250,000 | $31.68 |

| shares of common stock to be offered by selling stockholders | 945,000 | $0.10 | $94,500 | $11.97 |

TOTAL | 3,445,000 | $344,500 | $43.65 |

(1) Estimated solely for purposes of calculating the registration fee under Rule 457(c) of the Securities Act of 1933.

The Registrant amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant will file a further amendment that specifically states that this Registration Statement will thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement will become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SB2 - -2 - A/2

Preliminary Prospectus

NSM Holdings, Inc.

3,445,000 shares of common stock

NSM Holdings, Inc. (“NSM”) is offering up to 2,500,000 shares of common stock on a self underwritten basis. The offering price is $0.10 per share and the maximum amount to be raised is $250,000. NSM intends to offer the 2,500,000 shares through its sole officer and director to investors, both inside and outside the United States. There will be no underwriter or broker/dealer involved in the transaction and there will be no commissions paid to any individuals from the proceeds of this sale.

The offering by NSM is being conducted on a best efforts basis. There is no minimum number of shares required to be sold by NSM. All proceeds from the sale of these shares will be delivered directly to NSM and will not be deposited in any escrow account. If the entire 2,500,000 shares of common stock are sold, NSM will receive gross proceeds of $250,000 before expenses of approximately $37,600. NSM plans to end the offering on July 28, 2005. However, NSM may, at its discretion, end the offering sooner or extend the offering until October 2005. No assurance can be given on the number of shares NSM will sell or even if NSM will be able to sell any shares.

In addition, this prospectus relates to the resale of up to 945,000 shares of common stock by selling stockholders. The selling stockholders may sell their common stock from time to time in private negotiated transactions. The selling stockholders, other than NSM’s president, will offer or sell shares of NSM’s common stock at $0.10 per share unless and until the offering price is changed by subsequent amendment to this prospectus, or when NSM’s shares of common stock become listed or quoted on a securities market. Should NSM’s shares of common stock become listed or quoted, selling stockholders may then sell their shares at prevailing market prices or privately negotiated prices. NSM’s president will offer and sell his shares of common stock at $0.10 per share unless and until the offering price is changed by subsequent amendment to this prospectus. NSM will not receive any proceeds from the sale of the shares of common stock by the selling stockholder. However, NSM will pay for the expenses of this offering and the selling stockholders’ offering.

There is no public market for the shares of common stock of NSM.

A purchase of NSM’s common stock is highly speculative and investors should not purchase shares of NSM’s common stock unless they can afford to lose their entire investment. Investing in NSM’s common stock involves risks. See “Risk Factors” starting on page for factors to be considered before investing in NSM’s shares of common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. It is illegal to tell you otherwise.

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

If NSM changes the fixed offering price, it will file an amendment to the registration statement.

The date of this prospectus is __________________.

Subject to completion.

SB2 - -3 - A/2

Table of Contents

| SUMMARY OF OFFERING | 5 |

| RISK FACTORS | 6 |

| USE OF PROCEEDS | 10 |

| DETERMINATION OF OFFERING PRICE | 11 |

| DILUTION | 12 |

| PLAN OF DISTRIBUTION | 14 |

| NSM’s Offering | 14 |

| Stockholder’s Offering | 16 |

| LEGAL PROCEEDINGS | 18 |

| MANAGEMENT | 19 |

| EXECUTIVE COMPENSATION | 19 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 20 |

| PRINCIPAL STOCKHOLDERS | 20 |

| DESCRIPTION OF SECURITIES | 21 |

| DESCRIPTION OF BUSINESS | 22 |

| MANAGEMENT DISCUSSION AND ANALYSIS OR PLAN OF OPERATION | 26 |

| Plan of Operation | 29 |

| DESCRIPTION OF PROPERTY | 31 |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 31 |

| EXPERTS | 32 |

| FINANCIAL STATEMENTS | 33 |

| Audited Financial Statements as of November 30, 2004 and May 31, 2004 | 33 |

SB2 - -4 - A/2

NSM’s business

NSM is a Delaware company that operates through its wholly-owned subsidiary, Northern Star Distributors Ltd. NSM is in the e-commerce business and provides products and services for model ship enthusiasts, offering its products and services to the internet consumer through its websitewww.northernstarmall.com.

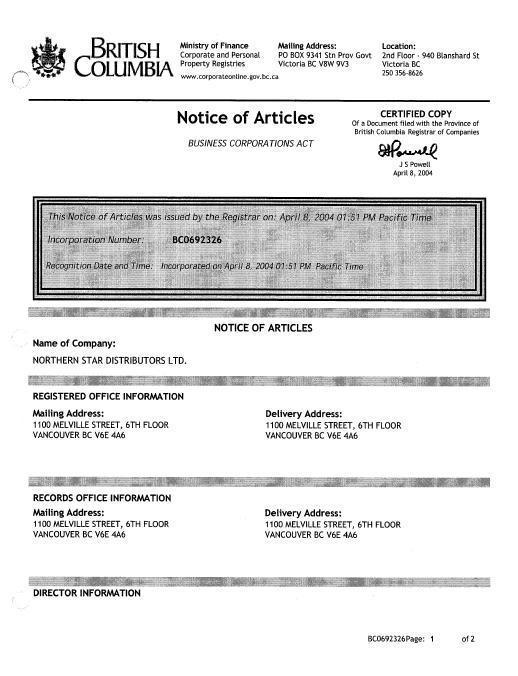

NSM is a holding company incorporated under the laws of the State of Delaware on April 8, 2004. NSM has one subsidiary, Northern Star Distributors Ltd. (“Northern Star”), which is the operating company and was incorporated under the laws of the Province of British Columbia on April 8, 2004.

NSM’s administrative and operational office is located at Suite 210D, 8351 Alexandra Road, Richmond, British Columbia, V6X 3P3, Canada, telephone (604) 681-8780. NSM’s registered statutory office is located at 2711 Centerville Road, Suite 400, Wilmington, Delaware, 19808. NSM’s fiscal year end is May 31.

The offering:Following is a brief summary of this offering:

| Securities being offered | 2,500,000 shares of common stock (maximum) offered by the Company 945,000 shares of common stock offered by the selling stockholders |

| Number of shares outstanding before the offering | 3,445,000 shares of common stock |

| Number of shares outstanding after the offering | 5,945,000 shares of common stock, assuming all offered shares are sold. |

| Offering price per share | $0.10 per share |

| Net Proceeds to NSM | $250,000, assuming all offered shares are sold |

| Use of proceeds | Project development, including projects to develop and populate the website and to increase traffic to the website Marketing, including the creation of a marketing strategy for the website and products Repayment of debt Working capital |

SB2 - -5 - A/2

Selected Financial Data (audited)

The following financial information summarizes the more complete historical, audited, and unaudited financial information provided in this registration statement.

Accumulated April 8, 2004 to November 30, 2004 (audited) | Six month period ended November 30, 2004 | From inception to May 31, 2004 (audited) | |

Balance Sheet | |||

| Total Assets | $65,154 | $65,154 | $8,810 |

| Total Liabilities | $40,166 | $40,166 | $22,166 |

| Stockholders’ Equity (Deficit) | $24,988 | $24,988 | ($13,356) |

Income Statement | |||

| Revenue | $20,590 | $20,590 | Nil |

| Total Expenses | $47,942 | $32,086 | $15,856 |

| Net Loss | $39,390 | 23,534 | $15,856 |

Please consider the following risk factors before deciding to invest in NSM’s shares of common stock.

Risks associated with NSM:

1. NSM is an initial development stage company and may not be able to continue as a going concern and may not be able to raise additional financing.

A note provided by NSM’s independent auditors in NSM’s financial statements for the period from inception, April 8, 2004, through November 30, 2004 contains an explanatory note that indicates that NSM is an initial development stage company and its ability to continue as a going concern is dependent on continued financial support from its shareholders, raising additional capital to fund future operations and ultimately to attain profitable operations. The explanatory note states that, because of such uncertainties, there may be a substantial doubt about NSM’s ability to continue as a going concern. This note may make it more difficult for NSM to raise additional equity or debt financing needed to run its business and is not viewed favorably by analysts or investors. NSM urges potential investors to review this report before making a decision to invest in NSM.

2. NSM lacks an operating history and has losses that it expects to continue into the future. If the losses continue NSM will have to suspend operations or cease operations.

NSM was incorporated on April 8, 2004 and NSM has no significant operating history upon which an evaluation of its future success or failure can be made. NSM’s net loss since inception is $39,390. NSM’s ability to achieve and maintain profitability and positive cash flow is dependent upon its ability to generate revenues from its planned business operations and to reduce development costs.

Based upon current plans, NSM expects to incur up to $18,000 in operating losses over the next 12 to 18 months. This will happen because there are expenses associated with the development and operation of its website. NSM cannot guaranty that it will be successful in generating revenues in the future. Failure to generate revenues may cause NSM to go out of business.

SB2 - -6 - A/2

3. NSM does not have sufficient funds to complete each phase of its proposed plan of operation and as a result may have to suspend operations.

Each of the phases of NSM’s plan of operation is limited and restricted by the amount of working capital that NSM has and is able to raise from financings and generate from business operations. NSM currently does not have sufficient funds to complete each phase of its proposed plan of operation and NSM expects that it will not satisfy its cash requirements for the next 12 months. As a result, NSM may have to suspend or cease its operations on one or more phases of the proposed plan of operation. Until NSM is able to generate any consistent and significant revenue it may be required to raise additionalfunds by way of equity. At any phase, if NSM finds that it does not have adequate funds to complete a phase, it may have to suspend its operations and attempt to raise more money so it can proceed with its business operations. If NSM cannot raise the capital to proceed it may have to suspend operations until it has sufficient capital.

4. Failure to successfully compete in the e-commerce industry with established e-commerce companies may result in NSM’s inability to continue with its business operations.

There arethree prominent, established e-commerce companies thatare competitors with NSM. Each ofwww.model-ships.com andwww.shipslocker.com andwww.handcraftedmodelships.com have been in business for at least four years. Each of the competitors are private companies and as a result it is difficult for NSM to determine its competitive position among these competitors. Based on feedback from NSM’s customers, management thinks that NSMprovides a wider range of products than its competitors. NSM expects competition in this market to increase significantly as new companies enter the market and current competitors expand their online services.

If NSM is unable to develop and introduce enhanced or new technology or services quickly enough to respond to market or user requirements or to comply with emerging industry standards, or if these services do not achieve market acceptance, NSM may not be able to compete effectively.

In addition, NSM’s competitors may develop content that is better than NSM’s or that achieves greater market acceptance. It is also possible that new competitors may emerge and acquire significant market share. Competitive pressures created by any one of these companies, or by NSM’s competitors collectively, could have a negative impact on NSM’s business, results of operations and financial condition and as a result, NSM may not be able to continue with its business operations.

5. NSM is relatively new to the internet marketplace with no history of operations and, as a result, NSM’s ability to operate and compete effectively may be affected negatively.

In deciding whether to purchase NSM’s shares of common stock, and the likelihood of NSM’s success, you should consider that NSM is relatively new to the internet marketplace and has no operating history upon which to judge its current operations. As a result, you will be unable to assess NSM’s future operating performance or its future financial results or condition by comparing these criteria against its past or present equivalents.

Also, the computer and Internet industries are characterized by rapidly changing technologies, frequent introductions of new products, services, and industry standards. NSM’s future success will depend on its ability to adapt to rapidly changing technologies by continually improving the performance features and reliability of NSM’s services, as well as, the development and maintenance of the Internet’s infrastructure to cope with this increased traffic. NSM’s future success willalsodepend in large part on its ability to develop and enhance NSM’s products and services. There are significant technical risks in the development of new or enhanced services, including the risk that NSM will be unable to effectively use new technologies, adapt its services to emerging industry standards, or develop, introduce and market new or enhancedproducts andservices.

Also, if NSM is unable to develop and introduce enhanced or new products and services quickly enough to respond to market or user requirements or to comply with emerging industry standards, or if theseproducts andservices do not achieve market acceptance, NSM may not be able to compete effectively.

SB2 - -7 - A/2

6. Since NSM’s success depends upon the efforts of Zuber Jamal, the key member of its management, and its ability to attract and retain key personnel, NSM’s failure to retain key personnel will negatively effect its business.

NSM’s business is greatly dependent on the efforts of its CEO, Zuber Jamal, and on its ability to attract, motivate and retain key personnel and highly skilled technical employees. Currently, NSM does not have any employment agreement with Mr. Jamal and does not carry a key man life insurance policy on Mr. Jamal. Also, neither NSM nor Northern Star have any full time or part time employees at this time. The loss of Zuber Jamal could have a negative impact on NSM’s business, operating results and financial condition. Competition for qualified personnel is intense and NSM may not be able to hire or retain qualified personnel, which could also have a negative impact on NSM’s business.

Also, Mr. Jamal devotes only 20 hours per week to NSM’s operations, with the balance of the work week devoted to research for Microcap e-mail to al. Mr Jamal is employed by Microcap e-mail to al. to provide 20 hours of research per week. However, under the terms of employment with Microcap e-mail to al. Mr. Jamal has the discretion to work in any capacity he sees fit.

| 7. | Since NSM relies on one provider to host its website, NSM’s technical systems could fail if this service is interrupted, which in turn would have a negative impact on NSM’s business. |

Although NSM has back up facilities for its computer systems, NSM relies on one provider to host its website,www.easyasphosting.com.In the past, the website host has not failed to provide services to NSM’s systems and website. However, if NSM’s website host failed to provide service to its systems, NSM would be unable to maintain website availability. Interruptions could result from natural disasters as well as power loss, telecommunications failure and similar events. NSM’s business depends on the efficient and uninterrupted operation of its computer and communications hardware systems. Any system interruptions that cause its website to be unavailable could materially adverselyaffect its business. NSM does not currently have a formal agreement with its website host, but rather a standard monthly recurring billing relationship. Furthermore, NSM will be depending on outside expertise to maintain and expand its website design and capabilities. There is no assurance that website consultants can be retained who will understand the needs of and have the solution for a desirable, user friendly commercial website.

| 8. | NSM’s business exposes NSM to potential product liability claims, and NSM may incur substantial expenses if NSM is subject to product liability claims or litigation, which could result in a negative impact on its business. |

Products for model ship enthusiasts involves a minimal inherent risk of product liability claims and associated adverse publicity. However, NSM may be held liable if any product it sells causes injury or is otherwise found unsuitable. Currently, NSM does not carry any product liability insurance or general business coverage. A product liability claim, regardless of its merit or eventual outcome, could result in significant legal defense costs. These costs would have the effect of increasing NSM’s expenses and diverting management’s attention away from the operation of its business, and could harm NSM’s business.

SB2 - -8 - A/2

Risks associated with NSM’s industry:

9. Any new laws or regulations relating to the Internet or any new interpretations of existing laws could have a negative impact on NSM’s business.

Currently, other than business and operations licenses applicable to most commercial ventures, NSM is not required to obtain any governmental approval for its business operations. However, there can be no assurance that current or new laws or regulations will not, in the future, impose additional fees and taxes on NSM and its business operations. Additionally, in response to concerns regarding “spam” (unsolicited electronic messages), “pop-up” web pages and other Internet advertising, the federal government and a number of states have adopted or proposed laws and regulations that would limit the use of unsolicited Internet advertisements. While a number of factors may prevent the effectiveness of such laws and regulations, the cumulative effect may be to limit the attractiveness of effecting sales on the Internet, thus reducing the value of NSM’s business operations. Also, several telecommunications companies have petitioned the Federal Communications Commission to regulate Internet service providers and on-line service providers in a manner similar to long distance telephone carriers and to impose access fees on those companies. This could increase the cost of transmitting data over the Internet. Any new laws or regulations relating to the Internet or any new interpretations of existing laws could have a negative impact on NSM’s business and add additional costs to NSM’s business operations.

| 10. | Security of online transactions via the Internet and any security breaches will have a negative impact on NSM’s business. |

The secure transmission of confidential information over public telecommunications facilities is a significant barrier to electronic commerce and communications on the Internet. Many factors may cause compromises or breaches of security systems used by NSM and other Internet sites to protect proprietary information. A compromise of security on the Internet would materially negatively affect the use of the Internet for commerce and communications. This in turn would negatively affect NSM’s business. Circumvention of NSM’s security measures could result in misappropriation of its proprietary information or cause interruptions of NSM’s operations. Protecting against the threat of such security breaches may require NSM to expend significant amounts of capital and other resources. There can be no assurance that NSM’s security measures will prevent security breaches.

| 11. | NSM’s business will be adversely affected if the infrastructure of the Internet is unable to support demands placed on it by NSM’s business. |

The success of commercial use of the Internet depends in large part upon the development and maintenance of the Internet’s infrastructure, including the development of complementary products such as various broadband technologies. The number of users of the Internet and the amount of traffic on the Internet have grown significantly and are expected to continue to grow, placing greater demands on the Internet's infrastructure. This infrastructure may not be able to support the demands placed on it by this continued growth without its performance or reliability being decreased. Any outages or delays in services could lower the level of Internet usage. In addition, the infrastructure and complementary products and services necessary to make the Internet a viable commercial marketplace may not develop. If usage of the Internet is curtailed due to infrastructure constraints or lack of complementary products, NSM expects an adverse impact on its business and revenues. Even if such infrastructure and complementary products and services do develop, there can be no guarantee that the Internet will become a viable commercial marketplace for products and services such as those offered by NSM.

Risks associated with this offering:

| 12. | No public market for the shares of common stock and as a result you may not be able to resell your shares. |

There is currently no public market for the shares of common stock of NSM. Therefore there is no central place, such as stock exchange or electronic trading system, to resell your shares. If you want to resell your shares, you will have to locate a buyer and negotiate your own sale. There can be no assurance that a liquid public market on a stock exchange or quotation system will develop, or be sustained after the offering. The lack of a liquid public market will reduce your ability to divest an investment in NSM.

| 13. | If and when NSM’s shares of common stock are listed for trading, any sale of a significant amount of NSM’s shares of common stock into the public market may depress NSM’s stock price. |

Zuber Jamal, the sole officer and director of NSM, currently owns 3,000,000 shares of common stock, which represent 87% of the 3,445,000 issued and outstanding shares of common stock of NSM, and none have been registered for resale by Mr. Jamal as a selling shareholder. Currently, there are no shares of common stock of NSM that are freely tradeable and there are 3,445,000 shares that are subject to Rule 144. All of the issued and outstanding shares are currently restricted from trading. If NSM’s shares of common stock are listed for trading, Mr. Jamal may sell in the future, large amounts of common stock into the public market over relatively short periods of time subject to Rule 144. Any sale of a substantial amount of NSM’s common stock in the public market by Mr. Jamal may adversely affect the market price of NSM’s common stock. Such sales could create public perception of difficulties or problems with NSM’s business and may depress NSM’s stock price.

14. Because NSM’s sole officer and director will own more than 50% of the outstanding shares after this offering, he will be able to decide who will be directors and to entrench management, and you may not be able to elect any directors.

Zuber Jamal, NSM’s sole director and officer, owns 3,000,000 shares and has voting control of NSM. As a result, if Mr. Jamal does not sell any of his shares, and regardless of the number of shares you may acquire, Mr. Jamal will be able to elect all of NSM’s directors and control its operations. Also, Mr. Jamal will be able to entrench management.

Holders of NSM’s shares of common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of NSM’s directors. Mr. Jamal currently owns an aggregate 3,000,000 shares (87%) and has voting control of NSM. After the offering, assuming that all the shares offered are sold and that Mr. Jamal does not acquire an interest in any of the offered shares, Mr. Jamal will own 50.5% of the outstanding shares and will still have voting control of NSM. As a result, if Mr. Jamal does not sell any of his shares, and regardless of the number of shares you may acquire, Mr. Jamal will be able to elect all of NSM’s directors and control NSM’s business operations.

| 13. | If and when NSM’s shares of common stock are listed for trading, any sale of a significant amount of NSM’s shares of common stock into the public market may depress NSM’s stock price. |

Zuber Jamal, the sole officer and director of NSM, currently owns 3,000,000 shares of common stock, which represent 87% of the 3,445,000 issued and outstanding shares of common stock of NSM, and none have been registered for resale by Mr. Jamal as a selling shareholder. Currently, there are no shares of common stock of NSM that are freely tradeable and there are 3,445,000 shares that are subject to Rule 144. All of the issued and outstanding shares are currently restricted from trading. If NSM’s shares of common stock are listed for trading, Mr. Jamal may sell in the future, large amounts of common stock into the public market over relatively short periods of time subject to Rule 144. Any sale of a substantial amount of NSM’s common stock in the public market by Mr. Jamal may adversely affect the market price of NSM’s common stock. Such sales could create public perception of difficulties or problems with NSM’s business and may depress NSM’s stock price.

| 15. | Subscribers to this offering will pay a price per share that exceeds the value of NSM’s assets and will suffer an immediate and substantial dilution. |

Subscribers of the shares of common stock offered will suffer immediate and substantial dilution and will pay a price per share that substantially exceeds the value of NSM’s assets after deducting its liabilities. Upon completion of this offering, if 2,500,000 shares are sold, the net tangible book value of the shares to be outstanding, will be $237,388 or approximately $0.04 per share. The net tangible book value of the shares held by NSM’s existing stockholders will be increased by $0.03 per share without any additional investment on their part. You will incur an immediate dilution from $0.10 per share to $0.04 per share. If all of the 2,500,000 shares offered are sold, subscribers to this offering will have contributed 77.6% of the total amount to fund NSM since inception but will only own 42.1% of the issued and outstanding shares. See “Dilution” on page for more information.

SB2 - -9 - A/2

| 16. | “Penny Stock” rules may make buying or selling NSM’s shares of common stock difficult, and severely limit the market and liquidity of the shares of common stock. |

Trading in NSM’s shares of common stock is subject to certain regulations adopted by the SEC commonly known as the “penny stock” rules. If and when NSM’s shares of common stock are listed for trading, Zuber Jamal believes that trading will begin in the $1.00 per share range. If this is the case, then the shares will trigger and be subject to the “penny stock” rules. These rules govern how broker-dealers can deal with their clients and “penny stocks”. The additional burdens imposed upon broker-dealers by the “penny stock” rules may discourage broker-dealers from effecting transactions in NSM’s securities, which could severely limit their market price and liquidity of NSM’s securities. See “Penny Stock rules” on page for more details.

The following table shows the intended use of the proceeds of this offering, depending upon the number of shares sold. The offering is being made on a self-underwritten basis for a maximum of 2,500,000 shares of common stock. The offering price per shares is $0.10. The table below sets forth the use of proceeds if 20%, 40%, 60% and 100% of the offering is sold

Gross offering proceeds | ||||

| Shares sold | 500,000 | 1,000,000 | 1,500,000 | 2,500,000 |

| Gross proceeds | $50,000 | $100,000 | $150,000 | $250,000 |

| Offering expenses | $37,600 | $37,600 | $37,600 | $37,600 |

| Net proceeds | $12,400 | $62,400 | $112,400 | $212,400 |

The net proceeds will be used as follows: | ||||

| Project development | $8,400 | $25,000 | $50,000 | $110,000 |

| Marketing | $nil | $25,000 | $40,000 | $55,000 |

| Debt repayment | $4,000 | $10,000 | $15,000 | $25,000 |

| Working capital | $nil | $2,400 | $7,400 | $22,400 |

The estimated offering expenses are comprised of: SEC filing fee - $100; transfer agent fees - $1,000; printing expenses - $500; EDGAR filing fees - $1,000; accounting and consulting fees - $10,000; and legal fees - $25,000.

Project development costs are comprised of website upgrades, server upgrades and unique online content.

Marketing costs are comprised of online marketing charges, bulk directed email marketing to authorized users, PDF catalog development and some print marketing for the wholesale market.

Debt repayment in the past has been comprised primarily of repayment to Zuber Jamal for management fees that had accrued and subsequently have been repaid. Currently, NSM has no debt due and owing. However, if NSM is unable to pay Mr. Jamal his monthly management fee in the future, NSM will accrue the management fee as a debt to be repaid in the future. Such a debt will be non-interest bearing, unsecured and have no specific terms of repayment. NSM may use the proceeds from this offering to pay that debt.

The projected expenditures shown above are only estimates or approximations and do not represent a firm commitment by NSM. To the extent that the proposed expenditures are insufficient for the purposes indicated, supplemental amounts required may be drawn from other categories of estimated expenditures, if available. Conversely, any amounts not expended as proposed will be used for general working capital.

NSM will amend the registration statement by post-effective amendment if there are any material changes to the use of proceeds as described above.

NSM cannot be more specific about the application of the net proceeds for project development, because NSM does not know how much funds will be needed to develop a project. If NSM attempted to be too specific, every time an event occurred that would change its allocation, NSM would have to amend this registration statement. Zuber Jamal believes that the process of amending the registration statement would take an inordinate amount of time and not be in your best interest in that NSM would have to spend money for legal fees that could be spent on project development.

SB2 - -10 - A/2

Working capital is the cost related to operating NSM’s office. It is comprised of telephone service, mail, stationary, administrative salaries, accounting, acquisition of office equipment and supplies, which NSM has estimated at $12,000 for one year and expenses of filing reports with the SEC, which NSM has estimated at $20,000 for one year.

NSM will not receive any proceeds from the sale of shares of NSM’s common stock being offered by the selling security holders. If NSM fails to sell sufficient shares of common stock to cover the expenses of this offering, NSM’s President, Zuber Jamal, has agreed to advance funds necessary to pay all offering expenses.

There is no established market price for NSM’s common stock. NSM has arbitrarily determined the initial public offering price of the shares of common stock at $0.10 per share. NSM’s sole director considered several factors in such determination, including the following:

o prevailing market conditions, including the history and prospects for the industry in which NSM competes;

o NSM’s future prospects; and

o NSM’s capital structure.

Therefore, the public offering price of the shares of common stock does not necessarily bear any relationship to established valuation criteria and may not be indicative of prices that may prevail at any time or from time to time in the future. Additionally, because NSM has no significant operating history and has not generated any revenues to date, the price of its shares of common stock is not based on past earnings, nor is the price of the shares of common stock indicative of current market value for the assets owned by NSM. No valuation or appraisal has been prepared for NSM’s business and potential business expansion. You cannot be sure that a public market for any of NSM’s securities will develop and continue or that the shares of common stock will ever trade at a price higher than the offering price in this offering.

NSM is also registering for resale on behalf of selling security holders up to 945,000 shares of common stock. The shares of common stock offered for resale may be sold in a secondary offering by the selling security holders by means of this prospectus. The shares will be sold at a price of $0.10 per share. NSM will not participate in the resale of shares by selling security holders.

Holders

As at January 28, 2005, NSM had 3,445,000 shares of common stock issued and outstanding and 27 beneficial shareholders.

Dividends

NSM has never paid cash dividends on its capital stock. NSM currently intends to retain any profits it earns to finance the growth and development of its business. NSM does not anticipate paying any cash dividends in the foreseeable future.

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of NSM’s arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by NSM’s existing stockholders.

As of November 30, 2004, the net tangible book value of NSM’s shares of common stock was $24,988 or $0.01 per share based upon 3,445,000 shares outstanding.

Upon completion of this offering, if 2,500,000 shares are sold, the net tangible book value of the shares to be outstanding, will be $237,388 or approximately $0.04 per share. The net tangible book value of the shares held by NSM’s existing stockholders will be increased by $0.03 per share without any additional investment on their part. You will incur an immediate dilution from $0.10 per share to $0.04 per share.

SB2 - -11 - A/2

Upon completion of this offering, if 1,500,000 shares are sold, the net tangible book value of the shares to be outstanding, will be $137,388 or approximately $0.03 per share. The net tangible book value of the shares held by NSM’s existing stockholders will be increased by $0.02 per share without any additional investment on their part. You will incur an immediate dilution from $0.10 per share to $0.03 per share.

Upon completion of this offering, if 1,000,000 shares are sold, the net tangible book value of the shares to be outstanding, will be $87,388 or approximately $0.02 per share. The net tangible book value of the shares held by NSM’s existing stockholders will be increased by $0.01 per share without any additional investment on their part. You will incur an immediate dilution from $0.10 per share to $0.02 per share.

Upon completion of this offering, if 500,000 shares are sold, the net tangible book value of the shares to be outstanding, will be $37,388 or approximately $0.01 per share. The net tangible book value of the shares held by NSM’s existing stockholders will remain the same. You will incur an immediate dilution from $0.10 per share to $0.01 per share.

After completion of this offering, if all of the 2,500,000 shares offered are sold, this will represent approximately 42.1% of the total number of shares then outstanding for which the subscribers will have made a cash investment of $250,000, or $0.10 per share. NSM’s existing stockholders will own approximately 57.9% of the total number of shares then outstanding, for which they have made contributions of cash and services totaling $64,378 or approximately $0.01 per share.

After completion of this offering, if only 1,500,000 shares are sold, this will represent approximately 30.3% of the total number of shares then outstanding for which the subscribers will have made a cash investment of $150,000, or $0.10 per share. NSM’s existing stockholders will own approximately 69.7% of the total number of shares then outstanding, for which they have made contributions of cash and services totaling $64,378 or approximately $0.01 per share.

After completion of this offering, if only 1,000,000 shares are sold, this will represent approximately 22.5% of the total number of shares then outstanding for which the subscribers will have made a cash investment of $100,000, or $0.10 per share. NSM’s existing stockholders will own approximately 77.5% of the total number of shares then outstanding, for which they have made contributions of cash and services totaling $64,378 or approximately $0.01 per share.

After completion of this offering, if only 500,000 shares are sold, this will represent approximately 12.7% of the total number of shares then outstanding for which the subscribers will have made a cash investment of $50,000, or $0.10 per share. NSM’s existing stockholders will own approximately 87.3% of the total number of shares then outstanding, for which they have made contributions of cash and services totaling $64,378 or approximately $0.01 per share.

The following table compares the differences of a subscriber’s investment in NSM’s shares of common stock with the investment of its existing stockholders.

Existing stockholders if all 2,500,000 shares sold

| Offering price per share | $0.10 |

| Net tangible book value per share before offering | $0.01 |

| Net tangible book value after offering | $0.04 |

Increase to present stockholders in net tangible book value per share after offering | $0.03 |

| Capital contributions | $ 250,000 |

| Number of shares before the offering held by existing stockholders | 3,445,000 |

| Number of shares outstanding after offering | 5,945,000 |

| Percentage of existing stockholders’ ownership after offering | 57.9% |

SB2 - -12 - A/2

Subscribers of shares in this offering if all 2,500,000 shares sold

| Offering price per share | $0.10 |

| Dilution per share | $0.06 |

| Capital contributions | $ 250,000 |

| Number of shares before the offering held by existing stockholders | 3,445,000 |

| Number of shares outstanding after the offering | 5,945,000 |

| Percentage of subscribers’ ownership after offering | 42.1% |

Subscribers of shares in this offering if only 1,500,000 shares sold

| Offering price per share | $0.10 |

| Dilution per share | $0.07 |

| Capital contributions | $ 150,000 |

| Number of shares before the offering held by existing stockholders | 3,445,000 |

| Number of shares outstanding after the offering | 4,945,000 |

| Percentage of subscribers’ ownership after offering | 30.3% |

Subscribers of shares in this offering if only 1,000,000 shares sold

| Offering price per share | $0.10 |

| Dilution per share | $0.08 |

| Capital contributions | $ 100,000 |

| Number of shares before the offering held by existing stockholders | 3,445,000 |

| Number of shares outstanding after the offering | 4,445,000 |

| Percentage of subscribers’ ownership after offering | 22.5% |

Subscribers of shares in this offering if only 500,000 shares sold

| Offering price per share | $0.10 |

| Dilution per share | $0.09 |

| Capital contributions | $ 50,000 |

| Number of shares before the offering held by existing stockholders | 3,445,000 |

| Number of shares outstanding after the offering | 3,945,000 |

SB2 - -13 - A/2

| Percentage of subscribers’ ownership after offering | 12.7% |

The shares offered for sale by the selling security holders are already issued and outstanding and, therefore, do not contribute to dilution.

NSM’s Offering

NSM is offering up to 2,500,000 shares of common stock on a self-underwritten basis. The offering price is $0.10 per share. There is no minimum number of shares of common stock that must be sold on behalf of NSM in order to accept funds and consummate investor purchases.

NSM will sell the shares in this offering through Zuber Jamal, its president and sole director. Mr. Jamal will not receive any commission from the sale of any shares. Mr. Jamal will not register as broker/dealers under Section 15 of the Securities Exchange Act of 1934 in reliance upon Rule 3a4-1. Rule 3a4-1 sets forth those conditions under which persons associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker/dealer. The conditions are that

1. The person is not statutory disqualified, as that term is defined in Section 3(a)(39) of the Exchange Act, at the time of his participation;

2. The person is not compensated in connection with his participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities;

3. The person is not at the time of their participation, an associated person of a broker/dealer;

4. The person meets the conditions of Paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that he (A) primarily performs, or is intended primarily to perform at the end of the offering, substantial duties for or on behalf of the issuer otherwise than in connection with transactions in securities; and (B) is not a broker or dealer, or an associated person of a broker or dealer, within the preceding twelve (12) months; and (C) do not participate in selling and offering of securities for any issuer more than once every 12 months other than in reliance on Paragraphs (a)(4)(I) or (a)(4)(iii).

Mr. Jamal is not statutorily disqualified, is not being compensated, and is not associated with a broker/dealer. Mr. Jamal is and will continue to be NSM’s president and its sole director at the end of the offering and has not been during the last twelve months, and is currently not, a broker/dealers or associated with a broker/dealers. Mr. Jamal has not during the last twelve months and will not in the next twelve months offer or sell securities for another issuer.

Only after NSM’s registration statement is declared effective by the SEC, does NSM intend to advertise, through tombstones, and hold investment meetings in various states where the offering will be registered. NSM will not utilize the Internet to advertise its offering. Mr. Jamal, on behalf of NSM, will also distribute the prospectus to potential investors at the meetings and to business associates and friends and relatives who are interested in NSM and a possible investment in the offering.

NSM intends to sell its shares both inside and outside the United States of America in jurisdictions where the sale of such shares is not prohibited and in compliance with the applicable laws of those jurisdictions.

Section 15(g) of the Exchange Act

NSM’s shares of common stock are covered by Section 15(g) of the Securities Exchange Act of 1934, and Rules 15g-1 through 15g-6 promulgated thereunder. These rules impose additional sales practice requirements on broker/dealers who sell NSM’s securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). While Section 15(g) and Rules 15g-1 through 15g-6 apply to broker/dealers, they do not apply to NSM.

SB2 - -14 - A/2

Rule 15g-1 exempts a number of specific transactions from the scope of the penny stock rules.

Rule 15g-2 declares unlawful broker/dealer transactions in penny stocks unless the broker/dealer has first provided to the customer a standardized disclosure document.

Rule 15g-3 provides that it is unlawful for a broker/dealer to engage in a penny stock transaction unless the broker/dealer first discloses and subsequently confirms to the customer current quotation prices or similar market information concerning the penny stock in question.

Rule 15g-4 prohibits broker/dealers from completing penny stock transactions for a customer unless the broker/dealer first discloses to the customer the amount of compensation or other remuneration received as a result of the penny stock transaction.

Rule 15g-5 requires that a broker dealer executing a penny stock transaction, other than one exempt under Rule 15g-1, disclose to its customer, at the time of or prior to the transaction, information about the sales persons compensation.

Rule 15g-6 requires broker/dealers selling penny stocks to provide their customers with monthly account statements.

Again, the foregoing rules apply to broker/dealers. The rules do not apply to NSM in any manner whatsoever. The application of the penny stock rules may affect your ability to resell your shares.

Offering Period and Expiration Date

This offering will start on the date of this prospectus and continue for a period of six months. NSM may extend the offering period for an additional 90 days, unless the offering is completed or otherwise terminated by NSM.

Procedures for subscribing

If you decide to subscribe for any shares in this offering, you must

1. complete, sign and deliver a subscription agreement, and

2. deliver a check or certified funds to NSM for acceptance or rejection.

All checks for subscriptions must be made payable to “NSM Holdings, Inc.”.

Right to reject subscriptions

NSM has the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by NSM to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours after NSM receives them.

Stockeholder's Offering

The following table sets forth the number of shares that may be offered for sale from time to time by the selling stockholders. The shares offered for sale constitute all of the shares known to us to be beneficially owned by the selling stockholders. None of the selling stockholders has held any position or office with us, except as specified in the following table. Other than the relationships described below, none of the selling stockholders had or have any material relationship with us.

Selling Stockholder | Shares Owned before Offering | Shares to be Offered | Shares Owned after Offering |

Zuber Jamal(1) | 3,000,000 | 500,000 | 2,500,000 |

| Raymond Allen | 17,000 | 17,000 | 0 |

| Robert Bell | 13,000 | 13,000 | 0 |

| Marilyn Cardinal | 9,000 | 9,000 | 0 |

| Scott Crawford | 18,500 | 18,500 | 0 |

| Fayyaz Fatehali | 19,500 | 19,500 | 0 |

| Thomas Fong | 50,000 | 50,000 | 0 |

| Bahadurali Jamal | 15,500 | 15,500 | 0 |

| Shahnaz Jamal | 9,500 | 9,500 | 0 |

| Rod Jao | 50,000 | 50,000 | 0 |

| Achim Klor | 14,000 | 14,000 | 0 |

| Andrea Klor | 15,000 | 15,000 | 0 |

| Kim Sterling-Klor | 11,500 | 11,500 | 0 |

| Marilyn Klor | 16,000 | 16,000 | 0 |

| Dr. Nigel Liang | 18,000 | 18,000 | 0 |

| Scott Masse | 18,000 | 18,000 | 0 |

| Rebecca Novis | 19,000 | 19,000 | 0 |

| Rakesh Patel | 12,000 | 12,000 | 0 |

| Elizabeth Reddick | 10,000 | 10,000 | 0 |

| Stan Romphf | 11,000 | 11,000 | 0 |

| Susan Carol Shannon | 12,000 | 12,000 | 0 |

| Joan Skerry | 20,000 | 20,000 | 0 |

| Michael Skerry | 15,000 | 15,000 | 0 |

| Wendy Watkins | 10,500 | 10,500 | 0 |

| Geoffrey Watkins | 10,000 | 10,000 | 0 |

| Wayne Yak | 14,000 | 14,000 | 0 |

| Audra Yap | 17,000 | 17,000 | 0 |

(1) Mr. Jamal is the sole director and the officer of NSM.

SB2 - -15 - A/2

All shares are beneficially owned by the registered shareholders. The registered shareholders each have the sole voting and dispositive power over their shares. There are no voting trusts or pooling arrangements in existence and no group has been formed for the purpose of acquiring, voting or disposing of the security.

None of the selling stockholders are broker-dealers or affiliates of a broker-dealer. Each of the selling stockholders acquired their shares in a non-public offering that satisfied the provisions of Regulations S. Each of the selling stockholders also agreed, as set out in their respective subscription agreement and as evidenced by the legend on their respective share certificates, that they would not, within one (1) year after the original issuance of those shares, resell or otherwise transfer those shares except pursuant to an effective registration statement, or outside the United States in an offshore transaction in compliance with Rule 904, or pursuant to any other exemption from registration pursuant to the Securities Act, if available.

SB2 - -16 - A/2

Plan of Distribution

The fixed offering price will be $0.10 per share. This offering price will remain fixed until and unless NSM’s shares of common stock are quoted or listed on a specified market. Non-affiliate selling stockholders will make their resales at the fixed price until NSM’s shares of common stock are quoted or listed on a specified market. Affiliate selling stockholders will make their resales at the fixed price for the duration of the offering. The shares will not be sold in an underwritten public offering. If the fixed price changes, NSM will file a post-effective amendment reflecting the change.

The shares may be sold directly or through brokers or dealers. The methods by which the shares may be sold include:

• purchases by a broker or dealer as principal and resale by such broker or dealer for its account;

• ordinary brokerage transactions and transactions in which the broker solicits purchasers; and

• privately negotiated transactions.

NSM will not receive any of the proceeds from the sale of the shares being offered by the selling stockholders.

Brokers and dealers engaged by selling stockholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from selling stockholders (or, if any such broker-dealer acts as agent for the purchaser of such shares, from such purchaser) in amounts to be negotiated. Broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share, and, to the extent such broker-dealer is unable to do so acting as agent for a selling stockholder, to purchase as principal any unsold shares at the price required to fulfill the broker-dealer commitment to such selling stockholder. Broker-dealers who acquire shares as principal may resell those shares from time to time in the over-the-counter market or otherwise at prices and on terms then prevailing or then related to the then-current market price or in negotiated transactions and, in connection with such resales, may receive or pay commissions.

The selling stockholders and any broker-dealers participating in the distributions of the shares may be deemed to be “underwriters” within the meaning of Section 2(11) of the Securities Act of 1933. Any profit on the sale of shares by the selling stockholders and any commissions or discounts given to any such broker-dealer may be deemed to be underwriting commissions or discounts. The shares may also be sold pursuant to Rule 144 under the Securities Act of 1933 beginning one year after the shares were issued.

NSM has filed the Registration Statement, of which this prospectus forms a part, with respect to the sale of the shares by the selling stockholders. There can be no assurance that the selling stockholders will sell any or all of their offered shares.

Under the Securities Exchange Act of 1934 and the regulations thereunder, any person engaged in a distribution of the shares of NSM’s common stock offered by this prospectus may not simultaneously engage in market making activities with respect to NSM’s common stock during the applicable “cooling off” periods prior to the commencement of such distribution. Also, the selling security holders are subject to applicable provisions which limit the timing of purchases and sales of NSM’s common stock by the selling security holders.

Regulation M, and Rules 100 through 105 under Regulation M, govern the activities of issuers, underwriters, and other persons participating in a securities offering and contain provisions designed to eliminate the risks of illegal manipulation of the market price of securities by those persons.

Regulation M proscribes certain activities that offering participants could use to manipulate the price of an offered security. Regulation M contains six rules covering the following activities during a securities offering: (1) activities by underwriters or other persons who are participating in a distribution (i.e. distribution participants) and their affiliated purchasers; (2) activities by the issuer or selling security holder and their affiliated purchasers; (3) NASDAQ passive market making; (4) stabilization, transactions to cover syndicate short positions, and penalty bids; and (5) short selling in advance of a public offering. Of particular importance to the selling stockholders, and potential purchasers of their shares being offered for resale, are Rule 102 and Rule 104.

SB2 - -17 - A/2

Rule 102 applies only during a “restricted period” that commences one or five business days before the day of the pricing of the offered security and continues until the distribution is over. Rule 102 covers issuers, selling stockholders, and related persons. The rule allows issuers and selling stock holders to engage in market activities prior to the applicable restricted period. During the restricted period, Rule 102 permits bids and purchases of odd-lots, transactions in connection with issuer plans, and exercises of options or convertible securities by the issuer’s affiliated purchasers, and transactions in commodity pool or limited partnership interests during distributions of those securities.

Rule 104 regulates stabilizing and other activities related to a distribution. Rule 104 allows underwriters to initiate and change stabilizing bids based on the current price in the principal market (whether U.S. or foreign), as long as the bid does not exceed the offering price. Also, by providing for greater disclosure and record keeping of transactions that can influence market prices immediately following an offering, Rule 104 addresses the fact that underwriters now engage in substantial syndicate-related market activity, and enforce penalty bids in order to reduce volatility in the market for the offered security.

NSM has informed the selling stockholders that, during such time as they may be engaged in a distribution of any of the shares NSM is registering by this Registration Statement, they are required to comply with Regulation M. Regulation M specifically prohibits stabilizing that is the result of fraudulent, manipulative, or deceptive practices.

Selling stockholders and distribution participants are required to consult with their own legal counsel to ensure compliance with Regulation M.

NSM is not aware of any pending litigation or legal proceedings and none is contemplated or threatened.

Each of NSM’s directors is elected by the stockholders to a term of one year and serves until his or her successor is elected and qualified. Each of NSM’s officers is appointed by the board of directors to a term of one year and serves until his successor is duly appointed and qualified, or until he is removed from office. The board of directors has no nominating, auditing or compensation committees.

The names, addresses, ages and positions of NSM’s sole officers and director is set forth below:

Name and Address | Age | Positions |

Jamal Zuber 10941 - 168th Street Surrey, British Columbia V4N 5H6 Canada | 35 | - President, secretary, treasurer and sole member ofNSM’s board of directors - President, secretary and sole member of the board of directors of Northern Star Distributors Ltd. |

Background of sole officers and director

Zuber Jamal - sole director and president - Mr. Jamal has been NSM’s president and sole director since inception of NSM and is expected to hold those offices/positions until the next annual meeting of NSM’s stockholders. Since 1999 Mr. Jamal has been an associate of Microcap E-mail to. al, a venture capital firm. In 1991, Mr. Jamal obtained his Bachelor of Arts in Economics from the University of Western Ontario.

Conflicts of interest

NSM thinks that Zuber Jamal may be subject to conflicts of interest because he may not be able to devote all his time to NSM’s operations. Mr. Jamal devotes 20 hours a week to NSM’s operations. Mr. Jamal has no other obligations that prevent him from devoting his full time to NSM’s operations, with the exception that Mr. Jamal is employed by Microcap E-mail to al. to do 20 hours of research per week. However, under the terms of employment with Microcap e-mail to al. Mr. Jamal has the discretion to work in any capacity he sees fit.

SB2 - -18 - A/2

Compensation was paid to NSM’s sole executive officer and director as follows:

Summary Compensation Table | ||||||||

| Annual Compensation | Long Term Compensation Awards | Payouts | ||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (I) |

Name and Principal Position | Year | Salary ($) | Bonus ($) | Other Annual Compensation ($) | Restricted Stock Award(s) ($) | Securities Underlying Options / SAR’s (#) | LTIP Payouts ($) | All Other Compensation ($) |

Zuber Jamal President & Director April 2004 to present | 2004 2003 2002 | $2,478 n/a n/a | nil n/a n/a | nil n/a n/a | nil n/a n/a | nil n/a n/a | nil n/a n/a | $2,500(1) n/a n/a |

(1) NSM issued 2,500,000 shares of common stock to Mr. Jamal for services valued at $2,500.

There are no management agreements, plans or arrangements in which NSM compensates its sole officer with the exception that NSM has agreed to pay Mr. Jamal a management fee of $500 per month for operational expertise. If NSM is unable to pay Mr. Jamal this monthly fee on a timely manner, then Mr. Jamal has agreed that such fee can be accrued and paid at a later date, as NSM has done in the past with Mr. Jamal. Such a debt will be non-interest bearing, unsecured and have no specific terms of repayment. As of today, no fees are owed to Mr. Jamal and no fees have accrued.

Indemnification

The Delaware General Corporation Law permits indemnification of directors, officers, and employees of corporations under certain conditions subject to certain limitations. Part 6 of NSM’s By-laws provides that NSM may indemnify an officer or director who is made a party to any proceeding, including a law suit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in NSM’s best interest and has satisfied the applicable standard of conduct required to be satisfied under the Delaware General Corporation Law. NSM may advance expenses incurred in defending a proceeding, but only upon receipt by NSM of an undertaking, by or on behalf of such director, officer, employee, or agent, to repay all amounts so advanced unless it will ultimately be determined that such person is entitled to be indemnified under the By-laws or otherwise. To the extent that the officer or director is successful on the merits in a proceeding as to which he is to be indemnified, NSM must indemnify him against all expenses incurred, including attorney’s fees. NSM will indemnify any such person seeking indemnification in connection with a proceeding initiated by such person only if such proceeding was specifically authorized by the board of directors of NSM. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Delaware.

Regarding indemnification for liabilities arising under the Securities Act of 1933 that may be permitted to directors or officers under Delaware law, NSM is informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

Related Transactions

No member of management, executive officer or security holder has had any direct or indirect interest in any transaction to which NSM was a party to that exceeded $60,000 in total.

SB2 - -19 - A/2

Transactions with Promoters

Zuber Jamal is the sole promoter of NSM. Mr. Jamal is the only person who has taken an initiative in founding and organizing NSM’s business. Mr. Jamal has not received anything of value from NSM, nor is Mr. Jamal entitled to receive anything of value from NSM, for services provided as a promoter.

The following table sets forth, as of the date of this prospectus, the total number of shares of common stock owned beneficially by each of NSM’s directors, officers and key employees, individually and as a group, and the sole owners of 5% or more of NSM’s total outstanding shares. The stockholder listed below has direct ownership of his shares and possesses sole voting and dispositive power with respect to the shares.

| Title of class | Name and address of beneficial owner | Number of shares beneficially owned(1) | Percent of class(2) |

| Shares of common stock | Zuber Jamal 10941 - 168 Street Surrey, British Columbia V4N 5H6 Canada | 3,000,000 | 87.10% |

All officers and directors as a group (1 person) | 3,000,000 | 87.10% |

| (1) | The listed beneficial owner has no right to acquire any shares within 60 days of the date of this Form SB-2 from options, warrants, rights, conversion privileges or similar obligations. |

| (2) | Based on 3,445,000 shares of common stock issued and outstanding as of the date of this Form SB |

Common stock

NSM’s authorized capital stock consists of 100,000,000 shares of common stock with a par value $0.001 per share and 5,000 shares of preferred stock with a par value of $0.001 per share. The holders of NSM’s common stock:

| • | have equal ratable rights to dividends from funds legally available if and when declared by NSM’s board of directors; |

| • | are entitled to share ratably in all of NSM’s assets available for distribution to holders of common stock upon liquidation, dissolution or winding up of NSM’s affairs; |

| • | do not have preemptive, subscription or conversion rights; |

| • | do not have any provisions for redemption, purchase for cancellation, surrender or sinking or purchase funds or rights; and |

| • | are entitled to one non-cumulative vote per share on all matters on which stockholders may vote. |

All shares of common stock now outstanding are fully paid for and non-assessable. Currently, there are no preferred shares outstanding.

No shareholder approval is required for the issuance of NSM’s securities, including shares of common stock, shares of preferred stock, stock options and share purchase warrants.

There is no provision in NSM’s charter or by-laws that would delay, defer or prevent a change in control, with the exception of By-law 57 that provides that if NSM is not a reporting company with its shares listed for trading then no shares can be transferred without the consent of the directors expressed by a resolution of the board of directors. Also, the board of directors are not required to give any reason for refusing to consent to any such proposed transfer. This provision will no longer be in effect once NSM becomes a reporting company and its shares are listed for trading.

NSM’s Certificate of Incorporation and By-laws and the applicable statutes of the State of Delaware provide a more complete description of the rights and liabilities of holders of NSM’s capital stock. Provisions as to the modifications, amendments or variation of such rights or provisions are contained in the Delaware General Corporation Law and NSM’s By-laws.

SB2 - -20 - A/2

Non-cumulative voting

Holders of shares of NSM’s common stock do not have cumulative voting rights, which means that the holders of more than 50% of the outstanding shares, voting for the election of directors, can elect all of the directors to be elected, if they so choose, and, in that event, the holders of the remaining shares will not be able to elect any of NSM’s directors.

Cash dividends

As of the date of this prospectus, NSM has not paid any cash dividends to stockholders. The declaration of any future cash dividend will be at the discretion of NSM’s board of directors and will depend upon NSM’s earnings, if any, its capital requirements and financial position, its general economic conditions, and other pertinent conditions. It is NSM’s present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in its business operations.

Preferred Stock

NSM’s Certificate of Incorporation provides that its board of directors has the authority to divide the preferred stock into series and, within the limitations provided by Delaware statute, to fix by resolution the voting power, designations, preferences, and relative participation, special rights, and the qualifications, limitations or restrictions of the shares of any series so established. As NSM’s board of directors has authority to establish the terms of, and to issue, the preferred stock without stockholder approval, the preferred stock could be issued to defend against any attempted takeover of NSM. The relative rights and privileges of holders of common stock may be adversely affected by the rights of holders of any series of preferred stock that NSM may designate and issue in the future.

General

NSM Holdings, Inc. (“NSM”) is a holding company incorporated under the laws of the State of Delaware on April 8, 2004. NSM has one subsidiary, Northern Star Distributors Ltd. (“Northern Star”), which is the operating company and was incorporated under the laws of the Province of British Columbia on April 8, 2004. Northern Star is a wholly-owned subsidiary of NSM.

NSM maintains its statutory registered agent’s office at 2711 Centerville Road, Suite 400, Wilmington, Delaware, 19808 and its business office is located at Suite 210D, 8351 Alexandra Road, Richmond, British Columbia, V6X 3P3, Canada. NSM’s office telephone number is (604) 681-8780.

NSM is in the e-commerce business and provides products and services for model ship enthusiasts, offering unique products to the internet consumer through its website www.northernstarmall.com. NSM operates through Northern Star.The website offers products and services for the model ship enthusiast, specifically wooden ship builders. The core products include model ship kits, micro tools, limited-edition prints, books and magazines based on the model ship genre. The website currently offers a host of marine themed products and memorabilia. The products are priced competitively, relative to NSM’s competitors, and offered through a website on a secure server offering privacy, ease of order and quick delivery. The website is fully functional and operational. Northern Star inventories a selection of its products and has arrangements with suppliers and manufacturers for others wherebycertain suppliers will ship directly to the customer without having the item sent to NSM’s offices.

Products and Services

NSM will provide marine hobby products through its website. Currently the products offered through the website are:

lModel ship kits: These products are from various manufacturers around the globe, with a focus on European kit suppliers.

SB2 - -21 - A/2

lMicro tools: NSM supplies tools such as Proxxon (similar to the Dremel brand and line), which specifically cater to model builders.

lLimited edition prints:NSM sells nautical themed artwork created by Robin Brooks of the United Kingdom, including hand painted artwork of ships, and prints and lithographs.

NSM plans to provide a hobby website that provides specialty kits, marine antiquities, marine prints, and any other marine hobby items that will educate and target the sophisticated hobby market.

NSM strives to provide a level of customer service that gives a caring human element to any transaction that requires the customer to speak with NSM and potentially creates a long-term customer with each website visitor. NSM wants potential customers to perceive the website as a preferred source of unique maritime products packaged and delivered in a professional, authoritative and efficient manner.

NSM confirms that it has no major customers at this time.

Distribution of Products and Services

The main modes of distribution of NSM’s products are (1) NSM’s website, (2) strategic alliances, (3) direct wholesaling to retailers, and (4) the use of Ebay.com, all as described in more detail below:

The main modes of distribution of NSM’s products are (1) NSM’s website, (2) strategic alliances, (3) direct wholesaling to retailers, and (4) the use of Ebay.com, all as described in more detail below:

1) northernstarmall.com Website

For any early stage company it would be financially impossible for NSM to provide brick and mortar locations to all customers in all regions. Due to the specialty products that NSM provides and the diverse locations that customers live, very few cities would have enough customers to warrant a retail location. The nature of NSM’s products, the demographics of potential customers, and their need to source specific marine items makes e-commerce a very suitable mode of providing product information to NSM’s customers and promoting distribution and sales of NSM’s products.

The products and their detailed features are described in detail in the professionally designedwww.northernstarmall.com website. The products are offered through a simple “point and click” interface and transaction secure website accepting the usual modes of secured credit card payments. Coupled with contact information, a privacy policy and a 100% satisfaction guarantee the website offers all the safety and ease of a professionally designed e-commerce website. NSM has adopted a policy of a 24-hour turnaround period from receipt of order to shipping of the product through established couriers like FedEx and UPS. NSM plans to establish a customer service line via a toll-free phone line during business hours to answer customer queries

2) Strategic Alliances

NSM intends on developing strategic alliances to market its maritime products by taking advantage of museums and existing brick and mortar stores and leverage on its existing retail distribution channels. The Maritime Museum and the Model Ship Museum, both located in Vancouver, British Columbia, are two examples of successful relationships that have been developed. The previous management of NSM established the relationships with both the museums in approximately 2002. Zuber Jamal believes that these relationships are successful because the standards of workmanship required and requested by the museums are very high and the museums have allowed NSM’s products to go on sale in their stores, which in turn provides a form of advertisement for NSM’s products. Zuber Jamal believes that nautical connoisseurs will be more apt to purchase from a company that carries this legitimacy. Currently, NSM does not have a formal agreement with any strategic alliance partner, including the museums.

Also, Zuber Jamal and NSM’s technical team are developing marketing strategies with various strategic sites on the internet that would drive traffic towww.northernstarmall.com. The relationships may be from reciprocal hyperlinks, banner ads or profiles on these sites. Currently, NSM has identified some suitable strategic partners for its products and services but has yet to finalize the terms of such a partnership. NSM will pay these strategic partners for placement in the majority of cases and for “click-through” traffic.

3) Direct Wholesaling to Retailers

NSM is presently meeting with retailers in the Vancouver, British Columbia marketplace and in the United States to have its products placed in retail environments. NSM is initially targeting hobby stores, marine museum shops, higher-end toy stores, and independent retailers. The margins on these sales for the kit products range from 10% to 50% with bulk orders demanding greater sales discounts.

SB2 - -22 - A/2

4) eBay.com

Zuber Jamal has concluded that eBay.com is a valid method by which to sell NSM’s products on a retail basis. NSM will set a floor or reserve price on any item and if the item is not sold, NSM will list it for sale on eBay.com. The reserve price will not be set at a lower that retail price quoted on NSM’s website. eBay will be used for inventory that is over one year old and has not moved off NSM’s shelves. Currently, NSM has no inventory that is more than one year old. In the past, NSM has also used eBay selectively for products that were not selling on the main site.

NSM’s revenues generated from business operations is derived from website (30%), strategic alliances (5%), and direct wholesaling to retailers (60%), and eBay (5%).

NSM intends to negotiate distribution relationships with suppliers whereby NSM will negotiate a “drop shipment” arrangement with suppliers and manufacturers for other products whereby certain suppliers will ship directly to NSM’s customer without having the item sent to NSM’s offices, which in turn saves storage space and shipping costs.

Market

The target market for NSM’s products and services will be a customer base of mature consumers that desire the best quality marine products for their hobbies. The consumer will tend to be very educated in their body of knowledge of the genre, and usually know specifically what they are searching for. Also, NSM intends to target the potential market of museums, educational institutions, and the gift market. Finally, there is an entire demographic category that NSM also plans to address the radio controlled ship market.

Ships and marine history and warfare have made a distinct impact to virtually every region on the planet, and, as such, global culture has been affected by past maritimers. Zuber Jamal believes that NSM’s website will attract a broad range of nationalities due to its broad variety of items and its common cross-cultural appeal. It is the intention of NSM to impart a sense of maritime history to the enthusiast in an educative and informative way through its website and its products

Internet consumers and businesses hoping to attract business through internet presence.

NSM uses general information available via the internet, trade shows, business sources, business periodicals and the media to ascertain the size of the nautical hobby market. From the size of the suppliers that NSM uses and the number of suppliers NSM utilizes, Zuber Jamal estimates the size of the market NSM is targeting on a global basis is approximately $500 million.

Principal Suppliers

NSM is not dependent on any single supplier for its products. NSM’s products are supplied by a variety of manufactures and suppliers from Europe and the United States. Any relationship NSM has with its suppliers is strictly a supplier/purchaser relationship, which does not require a formal agreement.

Competition