UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F: AMENDMENT #2

x REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

EVOLVING GOLD CORP.

(Exact name of Registrant as specified in its charter)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

Suite 1200, 1188 West Georgia Street

Vancouver, British Columbia, Canada V6E 4A2

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Each Class | Name of each exchange on which registered |

| NONE | NOT APPLICABLE |

Securities registered or to be registered pursuant to Section 12(g) of the Act

COMMON SHARES WITHOUT PAR VALUE

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

NONE

Number of outstanding shares of the Company's only class of capital stock as at March 31, 2004 (date of last audited financial statement herein) was 6,150,100 Common Shares Without Par Value.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES x NO ¨

Indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 x Item 18 ¨

Page 1 of 78

Index to Exhibits on Page 51 to 52

EVOLVING GOLD CORP.

FORM 20-F REGISTRATION STATEMENT

AMENDMENT #2

TABLE OF CONTENTS

2

GLOSSARY

| Term | Definition |

| | |

| adularia | A mineral, potassium feldspar |

| | |

| AHL | AHL Holdings Ltd. |

| | |

| arsenopyrite | A mineral composed of arsenic, iron and sulphur |

| | |

| Award Date | The date of the grant of a stock option in the Company |

| | |

| BLM | Bureau of Land Management, US Department of the Interior |

| | |

| brecciated | A rock consisting of angular fragments |

| | |

| CBCA | Canadian Business Corporations Act |

| | |

| chalcopyrite | A mineral composed of copper, iron and sulphur |

| | |

| CNQ | Canadian Quotation and Trading System |

| | |

| Code | Internal Revenue Code of 1986, as amended |

| | |

| Company | Evolving Gold Corp. |

| | |

| CSAMT | “Controlled Source Audio Magnetic Tellurics”, a geophysical method used in mineral exploration |

| | |

| Eligible Person | Any individual that fulfils the following criteria may be granted stock options under the Plan: (a) any full or part-time employee or officer, or insider of the Issuer or any of its subsidiaries; (b) any other person employed by a company or individual providing management services to the Issuer; (c) any other person or company engaged to provide ongoing consulting services for the Issuer or any entity controlled by the Issuer or (d) any individual engaged to provide services that promote the purchase or sale of the issued securities |

| | |

| Evolving Gold | Evolving Gold Corp. |

| | |

| fracture fillings | A fracture in rock mass filled with another material |

| | |

| galena | A mineral composed of lead and sulphur |

| | |

| Golden Sands | Golden Sands Exploration Inc. |

| | |

| Golden Arc | Golden Arc Mining & Refining Inc., a Nevada Corporation |

| | |

| Golden Arc Claims | The 37 unpatented mining claims initially staked by Golden Arc |

| | |

| GOR | Gross productions |

| | |

| induced polarization | A geophysical method used in mineral exploration |

| | |

| IRS | Internal Revenue Service |

| | |

| Issuer | Evolving Gold Corp. |

| | |

Mineral Property

Agreement | The agreement dated June 10, 2003 made between Zimtu and Jody Dahrouge, an unrelated individual, pursuant to which Mr. Dahrouge retained 1% NSR royalty on minerals other than diamonds and 1% GOR on diamonds from the Murray Property. |

| | |

| Murray Property | A property consisting of one mineral claim of 2,965 acres located 78 kilometres Northeast of Yellowknife in the Cameron River Area, Northwest Territories, Canada. |

| | |

| Murray Report | “Summary Report on the Murray Property” dated September 3, 2003 prepared by independent consulting geologist Gary Vivian, P. Eng. |

| | |

| NI 43-101 | National Instrument 43-101 “Standards of Disclosure for Mineral Projects” |

| | |

| NSR | Net smelter returns |

3

| Term | Definition |

| | |

| open space fillings | Minerals filling an open space in the earth or a rock mass. |

| | |

Option and Royalty

Agreement | The agreement dated December 3, 2004 made among the Company, Golden and AHL, as amended on January 7, 2005 and February 25, 2005, pursuant to which the Company was granted an option to acquire 100% in the Winnemucca Mountain Property. |

| | |

| Part XIII Tax | Canadian withholding tax. |

| | |

| PFIC | Passive foreign investment company |

| | |

| Plan | Stock option plan of the Company dated September 28, 2004 |

| | |

Property Option

Agreement | The agreement dated July 22, 2003 made between the Company and Zimtu pursuant to which the Company was granted an option to acquire a 70% undivided interest in the Murray Property. |

| | |

| pyrite, pyrrhotite | A mineral composed of iron and sulphur |

| | |

| QEF | Qualified electing fund |

| | |

| quartz | A mineral composed of silica and oxygen |

| | |

| Sante Fe | Sante Fe Pacific Mining Inc. |

| | |

| SFAS 123 | Statement of Financial Accounting Standards No. 123 “Accounting for Stock-Based Compensation” |

| | |

| SFAS 145 | Statement of Financial Accounting Standards no. 145 “Recission of FASB Statements No.4, 44, and 64, Amendment of FASB Statement No. 13 and Technical Corrections” |

| | |

| silica | A element, occasionally used to reer to the mineral, quartz |

| | |

| stockworks | A pattern of closely spaced fractures in rock, commonly filled with minerals of economic value |

| | |

| Tax Act | Income Tax Act (Canada) |

| | |

| Treaty | The Canada-U.S. Income Tax Convention (1980) as amended by the Protocols signed on June 14, 1983, March 28, 1984, March 17, 1995 and July 29, 1997. |

| | |

Underlying Option

Agreement | The option and royalty agreement dated March 22, 2004, made between AHL and Golden Arc. |

| | |

| U.S. Holder | A holder of common shares in the Company and is at all relevant times resident in the United States of America. |

| | |

| U.S. Taxpayer | An individual who is a citizen or resident of the United States of America or a domestic corporation. |

| | |

| veining | A fracture filled with a mineral usually of economic value |

| | |

Winnemucca

Mountain Property | A property consisting of 72 mining claims located in Humboldt County, Nevada |

| | |

| Winnemucca Option | The option granted to the Company with respect to the Winnemucca Mountain Property under the Option and Royalty Agreement |

| | |

| Zimtu | International Zimtu Technologies Inc., a related public company |

4

INTRODUCTION

Evolving Gold Corp. (“Evolving Gold”, the “Company” or the “Issuer”) was incorporated under the Canada Business Corporations Act (“CBCA”) on June 19, 2003 under the name 6109527 Canada Ltd. On September 30, 2003, the Company amended its Articles and changed its name to Evolving Gold Corp.

BUSINESS OF EVOLVING GOLD CORP.

Evolving Gold is principally a mineral company engaged in the acquisition and exploration of mineral properties. The Issuer’s properties have no known proven reserves of minerals. The Issuer does not have any commercially producing mines or sites, nor is the Issuer in the process of opening any commercial mines or sites. The Issuer has not reported any revenue from operations since incorporation. As such, the Issuer is defined as an “exploration-stage company”.

FINANCIAL AND OTHER INFORMATION

In this Registration Statement, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (“CDN$” or “$”). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

FORWARD-LOOKING STATEMENTS

This Registration Statement on Form 20-F contains forward-looking statements principally in ITEM #4, “Information on the Company” and ITEM #5, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. These statements may be identified by the use of words like “plan”, “expect”, “aim”, “believe”, “project”, “anticipate”, “intend”, “estimate”, “will”, “should”, “could” and similar expressions in connection with any discussion, expectation, or projection of future operating or financial performance, events or trends. In particular, these include statements about the Issuer’s strategy for growth, property exploration, mineral prices, future performance or results of current or anticipated mineral production, interest rates, foreign exchange rates, and the outcome of contingencies, such as acquisitions and/or legal proceedings.

Forward-looking statements are based on certain assumptions and expectations of future events that are subject to risks and uncertainties. Actual future results and trends may differ materially from historical results or those projected in any such forward-looking statements depending on a variety of factors. The material risks that could cause our future operating or financial performance to differ from our expectations are identified in Item 3 of this Form 20-F under the heading “Risk Factors.” We have obligations under the federal securities laws to disclose material progress related to previously disclosed information.

5

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

1.A.1. Directors

Table No. 1 lists the names of the Directors of the Issuer as at January 31, 2005.

Table No. 1

Directors

| Name | Age | Date First Elected of Appointed |

| | | |

| Lawrence Dick(1) (2) | 52 | June 19, 2003 |

| Warren McIntyre (1) (2) | 42 | June 19, 2003 |

| Chris Osterman (1) (2) | 47 | July 15, 2004 |

| Paul Cowley, P.Geo. (2) | 48 | September 15, 2004 |

| _________________________ | | |

| (1) | Member of Audit Committee. |

| | |

| (2) | 1200-1188 West Georgia Street, Vancouver, B.C. Canada V6E 4A2 |

1.A.2. Senior Management

Table No. 2 lists the names of the Senior Management of the Company as at January 31, 2005. The Senior Management serves at the pleasure of the Board of Directors.

Table No. 2

Senior Management

| Name and Position | Age | Date of First Appointment |

| | | |

| Lawrence Dick, | 52 | June 19, 2003 |

| President and Chief Executive Officer | | |

| Warren McIntyre, Corporate Secretary | 42 | September 28, 2004 |

| and Chief Financial Officer | | |

Mr. Dick’s business functions as President and Chief Executive Officer of the Company include strategic planning, operations, financial administration, accounting, liaising with auditors-accountants-lawyers-regulatory authorities-financial community/shareholders; and preparation/payment/organization of the expenses/taxes/activities of the Company, and reporting to the Board of Directors.

Mr. McIntyre’s business functions as Chief Financial Officer include financial administration; accounting and financial statements; liaising with auditors, accountants, and financial community/shareholders; and preparation/ payment/organization of the expenses/taxes/activities of the Company. He assists in ensuring the Company’s compliance with all statutory and regulatory compliance.

Mr. McIntyre’s business functions as Corporate Secretary include attending as secretary at all meetings of the Board, shareholders and committees of the Board and entering or causing to be entered in records kept for that purpose minutes of all proceedings thereat; gives or causes to be given, as and when instructed, all notices to shareholders, Directors, officers, auditors and members of committees of the Board; is the custodian of the stamp or mechanical device generally used for affixing the corporate seal of the Company and of all books, records and instruments belonging to the Company, except when some other officer or agent has been appointed for that purpose; and in the future can have such other powers and duties as the Board of the chief executive officer may specify. Mr. McIntyre may delegate all or part of his duties as Corporate Secretary to a nominee from time to time.

6

1.B. Advisors

The Company’s Canadian Legal Counsel:

Lang Michener LLP

1500 – 1055 West Georgia Street

P.O Box 11117

Vancouver, B.C., Canada V6E 4N7

Contact: Desmond M. Balakrishnan

Telephone: 604-691-7462

Facsimile: 604-893-2373

The Company’s bank is:

Bank of Montreal

First Bank Tower, 595 Burrard Street

Vancouver, B.C. Canada V7X 1L7

Contact: Colleen Siamoto

Telephone: 604-665-2605

1.C. Auditors

The Company’s auditor is:

Amisano Hanson, Chartered Accountants

Suite 604, 750 West Pender Street

Vancouver, B.C. Canada V6C 2T7

Telephone: 604-689-0188

Facsimile: 604-689-9773

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE.

-- Not applicable. –

ITEM 3. KEY INFORMATION.

3.A.1. Selected Financial Data

3.A.2. Selected Financial Data

The selected financial data of the Company for Fiscal 2004 ended March 31 was derived from the financial statements of the Company that have been audited by Amisano Hanson, independent Chartered Accountants, as indicated in their audit reports, which are included elsewhere in this Registration Statement.

The selected financial data as at and for the nine-month period ended December 31, 2004 have been derived from the unaudited financial statements of the Issuer, included herein and, in the opinion of management include all adjustments (consisting solely of normally recurring adjustments) necessary to present fairly the information set forth therein.

The selected financial data should be read in conjunction with the financial statements and other financial information included elsewhere in this Registration Statement.

The Company has not declared any dividends since incorporation and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain all available funds for use in its operations and the expansion of its business.

Table No. 3 is derived from the financial statements of the Company, which have been prepared in accordance with Canadian Generally Accepted Accounting Principles (GAAP) and Canadian/USA Generally Accepted Auditing Standards (GAAS). All material numerical differences between Canadian GAAP and US GAAP, as applicable to the Company, are described in footnotes to the financial statements.

7

Table No. 3

Selected Financial Data

(CDN$ in 000, except per share data)

| | 9 Months | Year Ended |

| | Ended | 3/31/04 |

| | 12/31/04 | |

| CANADIAN GAAP | | |

| Revenue | Nil | Nil |

| Income (Loss) for the Period | ($39) | ($152) |

| Basic Income (Loss) Per Share | ($0.01) | N/A |

| Dividends Per Share | Nil | Nil |

| Wtg. Avg. Shares (000) | 5,310 | 0.1 |

| Period-end Shares (000) | 6,550 | 0.1 |

| | | |

| Working Capital | $22 | $127 |

| Mineral Properties | $107 | $27 |

| Long-Term Debt | Nil | Nil |

| Capital Stock | $387 | $0.1 |

| Shareholders’ Equity (Deficit) | $85 | $154 |

| Total Assets | $114 | $170 |

| | | |

| US GAAP | | |

| Net Loss | N/A | ($179) |

| Loss Per Share | N/A | N/A |

| Mineral Properties | N/A | 0 |

| Shareholders’ Equity | N/A | $127 |

| Total Assets | N/A | $143 |

| __________________________________ |

| | |

| (1) | Cumulative Net Loss since incorporation through December 31, 2004 under US GAAP was ($429,526). |

| | |

| (2) | a) Under US GAAP, options granted to non-employees as compensation for services provided are fair valued and an expense recorded.

b) Under SEC interpretation of US GAAP, all costs related to exploration-stage properties are expensed in the period incurred. |

3.A.3. Exchange Rates

In this Registration Statement, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (CDN$). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (US$).

Table No. 4 sets forth the exchange rates for the Canadian Dollar at the end of the fiscal year ended March 31, 2004 (Fiscal 2004 was the first year of operation for the Issuer) the average rates for the period, and the range of high and low rates for the period. The data for each month during the most recent nine months is also provided along with the data for the fiscal quarters ended December 31, 2004 and June 30, 2004.

For purposes of this table, the rate of exchange means the noon buying rate for cable transfers in foreign currencies by the Bank of Canada. The table sets forth the number of Canadian Dollars required under that formula to buy one U.S. Dollar. The average rate means the average of the exchange rates on the last day of each month during the period.

8

Table No. 4

U.S. Dollar/Canadian Dollar

| Period | Average | High | Low | Close |

| | | | | |

| February 2005 | 1.24 | 1.24 | 1.24 | 1.24 |

| January 2005 | 1.23 | 1.23 | 1.22 | 1.23 |

| December 2004 | 1.22 | 1.22 | 1.21 | 1.22 |

| November 2004 | 1.20 | 1.20 | 1.19 | 1.20 |

| October 2004 | 1.25 | 1.25 | 1.24 | 1.25 |

| September 2004 | 1.29 | 1.30 | 1.28 | 1.29 |

| | | | | |

| Fiscal Quarter Ended December 31, 2004 | 1.22 | 1.22 | 1.21 | 1.22 |

| Fiscal Quarter Ended June 30, 2004 | 1.36 | 1.36 | 1.35 | 1.36 |

| | | | | |

| Fiscal Year Ended March 31, 2004 | 1.35 | 1.48 | 1.27 | 1.31 |

3.B. Capitalization and Indebtedness

Table No. 5 sets forth the capitalization and indebtedness of the Company as at December 31, 2004. As at December 31, 2004, the Company had cash and cash equivalents totaling $2,697 and a net working capital deficiency of $(21,671). The Company had no significant debt outstanding as at December 31, 2004 and had issued and outstanding common shares of 6.55 million. The Company has no current indirect or contingent indebtedness.

Table No. 5

Capitalization and Indebtedness

| SHAREHOLDERS’ EQUITY | |

| 6,550,100 shares issued and outstanding (as at December 31, 2004) | $386,600 |

| Contributed Surplus | $128,165 |

| Retained Earnings (deficit) | $(429,526) |

| Net Stockholders’ Equity | $(85,239) |

| TOTAL CAPITALIZATION | 386,600 |

| | |

| Stock Options Outstanding (as at December 31, 2004) | 550,000 |

| Preference Shares Outstanding: | Nil |

| Capital Leases: | Nil |

| Guaranteed Debt | Nil |

| Secured Debt: | Nil |

3.C. Reasons For The Offer And Use Of Proceeds

--- No Disclosure Necessary ---

3.D. Risk Factors

Risks Related to the Company

Cumulative Unsuccessful Exploration Efforts By Evolving Gold Personnel Could Result In the Company Having to Cease Operations

The expenditures to be made by Evolving Gold in the exploration of its properties as described herein may not result in discoveries of mineralized material in commercial quantities. Most exploration projects do not result in the discovery of commercially mineable ore deposits and this occurrence could ultimately result in Evolving Gold having to cease operations.

9

Evolving Gold Has No Reserves on the Properties in Which It Has an Interest and If Reserves Are Not Defined the Company Could Have to Cease Operations

The properties in which Evolving Gold has an interest or the concessions in which Evolving Gold has the right to earn an interest are in the exploratory stage only and are without a known body of ore. If Evolving Gold does not ultimately find a body of ore, it would have to cease operations.

Evolving Gold Has Minimal Positive Cash Flow and No Recent History of Significant Earnings and Is Dependent Upon Public and Private Distributions of Equity to Obtain Capital in Order to Sustain Operations. Public distributions of capital result in dilution to existing shareholders

None of the Issuer’s properties have advanced to the commercial production stage and the Issuer has no history of earnings or positive cash flow from operations. The cumulative loss since the Issuer’s inception of the exploration stage, according to U.S. GAAP, is ($429,526). The Issuer does not know if it will ever generate material revenue from mining operations or if it will ever achieve self-sustaining commercial mining operations. Historically, the only source of funds available to the Issuer has been through the sale of its common shares. Any future additional equity financing would cause dilution to current stockholders. Management has no current plans to enter into any debt obligations and plans to meet all capital requirements through the issuance of the Issuer’s capital stock.

Evolving Gold currently has 550,000 share purchase options outstanding and 600,000 share purchase warrants outstanding. If all of the share purchase options and share purchase warrants were exercised, the number of common shares issued and outstanding would increase from 7,350,100 (as of February 28, 2005) to 8,500,100. This represents an increase of 17% in the number of shares issued and outstanding and would result in dilution to current shareholders.

The Risks Associated with Penny Stock Classification Could Affect the Marketability of the Common Stock of Evolving Gold And Shareholders Could Find It Difficult to Sell Their Stock

The Issuer’s stock is subject to “penny stock” rules as defined in 1934 Securities and Exchange Act rule 3a51-1. The Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. The Issuer’s common shares are subject to these penny stock rules. Transaction costs associated with purchases and sales of penny stocks are likely to be higher than those for other securities. Penny stocks generally are equity securities with a price of less than U.S. $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the Company’s common shares in the United States and shareholders may find it more difficult to sell their shares.

Evolving Gold is Dependent on Key Personnel and the Absence of Any of These Individuals Could Result in the Company Having to Cease Operations

While engaged in the business of exploiting mineral properties, the nature of Evolving Gold’s business, its ability to continue its exploration of potential exploration projects, and to build a competitive edge in the marketplace, depends, in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense and the Company may not be able to attract and retain such personnel. Evolving Gold’s growth will depend, on the efforts of its Senior Management, particularly its President and Chief Executive Officer, Lawrence Dick and its Corporate Secretary and Chief Financial Officer, Mr. Warren McIntyre. We do not carry key person insurance on senior management and other personnel.

10

Evolving Gold’s Directors may have a Conflict of Interest with the Company as such Directors or Senior Management also Serve on Boards of Companies in the same Industry as the Company

Directors of the Company also serve as directors of other similar companies involved in natural resource development. Accordingly, it may occur that properties will be offered to both the Corporation and such other companies. Furthermore, those other companies may participate in the same properties as those in which the Corporation has an interest. As a result, there may be situations which involve a conflict of interest. In that event, the directors would not be entitled to vote at meetings of directors which evoke any such conflict. The directors will attempt to avoid dealing with such other companies in situations where conflicts might arise and will at all times use their best efforts to act in the best interests of the Corporation. If the directors fail to do so, however, there could be material adverse consequences to the Corporation, its business and results of operations.

Dilution Through Employee/Director/Consultant Options Could Adversely Affect Evolving Gold’s Stockholders

Because the success of Evolving Gold is highly dependent upon its respective employees, the Company has granted to some or all of its key employees, Directors and consultants options to purchase common shares as non-cash incentives. To the extent that significant numbers of such options may be granted and exercised, the interests of the other stockholders of the Company may be diluted. There are currently 550,000 share purchase options outstanding, which, if exercised, would result in an additional 550,000 common shares being issued and outstanding. (For a breakdown of dilution, refer to the risk factor entitled: “Evolving Gold Has Minimal Positive Cash Flow and No Recent History of Significant Earnings and Is Dependent upon Public and Private Distributions of Equity to Obtain Capital in Order to Sustain Operations. Public distributions of capital result in dilution to existing shareholders”)

U.S. Investors May Not Be Able to Enforce Their Civil Liabilities against Us or Our Directors, Controlling Persons and Officers

It may be difficult to bring and enforce suits against Evolving Gold. The Issuer is a corporation incorporated in Canada under the CBCA. A majority of the Company’s directors must be residents of Canada, and all or substantial portions of their assets are located outside of the United States, predominately in Canada. As a result, it may be difficult for U.S. holders of our common shares to affect service of process on these persons within the United States or to realize in the United States upon judgments rendered against them. In addition, a shareholder should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions against us or such persons predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States, or (ii) would enforce, in original actions, liabilities against us or such persons predicated upon the U.S. federal securities laws or other laws of the United States.

However, U.S. laws would generally be enforced by a Canadian court provided that those laws are not contrary to Canadian public policy, are not foreign penal laws or laws that deal with taxation or the taking of property by a foreign government and provided that they are in compliance with applicable Canadian legislation regarding the limitation of actions. Also, a Canadian court would generally recognize a judgment obtained in a U.S. Court except, for example:

a) where the U.S. court where the judgment was rendered had no jurisdiction according to applicable Canadian law;

b) the judgment was subject to ordinary remedy (appeal, judicial review and any other judicial proceeding which renders the judgment not final, conclusive or enforceable under the laws of the applicable state) or not final, conclusive or enforceable under the laws of the applicable state;

c) the judgment was obtained by fraud or in any manner contrary to natural justice or rendered in contravention of fundamental principles of procedure;

11

d) a dispute between the same parties, based on the same subject matter has given rise to a judgment rendered in a Canadian court or has been decided in a third country and the judgment meets the necessary conditions for recognition in a Canadian court;

e) the outcome of the judgment of the U.S. court was inconsistent with Canadian public policy;

f) the judgment enforces obligations arising from foreign penal laws or laws that deal with taxation or the taking of property by a foreign government; or

g) there has not been compliance with applicable Canadian law dealing with the limitation of actions.

As a “foreign private issuer”, Evolving Gold is exempt from the Section 14 proxy rules and Section 16 of the 1934 Securities Act May Result in Shareholders Having Less Complete and Timely Data

The submission of proxy and annual meeting of shareholder information (prepared to Canadian standards) on Form 6-K may result in shareholders having less complete and timely data. The exemption from Section 16 rules regarding sales of common shares by insiders may result in shareholders having less data. This data includes:

| | 1. | Insider trading data disclosed on Canadian regulatory websites is different. |

| | 2. | U.S. companies have specified content and filing requirements regarding disclosures to shareholders for the annual meeting and Canadian regulations specify a modestly different content. |

| | 3. | Canadian interim financial statements are not necessarily prepared according U.S. GAAP. |

| | 4. | The filing deadlines for foreign private issuers are different than for U.S. issuers. |

Evolving Gold’s Possible Foreign Investment Company Status Has Consequences for U.S. Investors

Potential investors who are U.S. taxpayers should be aware that the Company could be considered a passive foreign investment company (“PFIC”) for U.S. tax purposes for the fiscal year ended March 31, 2004. If the Company is a PFIC for any year during a U.S. taxpayer’s holding period, then such U.S. taxpayer generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund (“QEF”) election or a mark-to-market election with respect to the shares of the Company. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of the Company’s net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer’s tax basis therein. See also Item 10E “United States Tax Consequences.”

Risks Related to the Industry

Operating Hazards and Risks Associated with the Mining Industry Could Result in Evolving Gold Having to Cease Operations

Resource exploration activities generally involve a high degree of risk. Hazards such as unusual or unexpected formations and other conditions are involved. Operations in which the Issuer has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration for precious and base metals, any of which could result in work stoppages, damage to or destruction of exploration facilities, damage to life and property, environmental damage and legal liability for any or all damage. Evolving Gold may become subject to liability for cave-ins and other hazards for which it cannot insure or against which it may elect not to insure where premium costs are disproportionate to the Company’s perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration activities and could force Evolving Gold to cease operations.

12

The Amount of Capital Necessary to Meet All Environmental Regulations Associated with the Exploration Programs of the Issuer Could Be In An Amount Great Enough to Force Evolving Gold to Cease Operations

The current and anticipated future operations of the Issuer, including further exploration activities require permits from various Federal and Provincial governmental authorities in Canada. (Evolving Gold has the required permissions to enable it to engage in exploration work consisting of rock sampling and geophysical mapping. This work will be carried out on the Murray Property on or before July 22, 2005 weather permitting.) Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, mine safety and other matters. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations by the Company.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in resource exploration may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations.

Environmental regulations which impact work on the Murray Property include filing a safety plan, a spill contingency plan and an emergency evacuation procedure. Management intends to complete this within the next 90 days in order to allow personnel to do further work on the Murray Property.

Large increases in capital expenditures resulting from any of the above factors could force Evolving Gold to cease operations.

Mineral Prices May Not Support Corporate Profit for Evolving Gold

The resource exploration industry is intensely competitive and even if commercial quantities of mineral resources are found (which is not guaranteed), a profitable market may not exist for the sale. If a profitable market does not exist, Evolving Gold may have to cease operations.

ITEM 4. INFORMATION ON THE COMPANY

4.A. History of the Company

Incorporation and Name Changes

The Company was incorporated under the CBCA on June 19, 2003 as 6109527 Canada Ltd. On September 30, 2003, the Company changed its name to Evolving Gold Corp. The Company’s registered office is c/o its solicitors, Lang Michener LLP, 1500 – 1055 West Georgia Street, PO Box 11117, Vancouver, British Columbia, Canada, V6E 4N7, telephone number (604) 689-9111. The Company’s principal place of business is Suite 1200, 1188 West Georgia Street, Vancouver, British Columbia, V6E 4A2, telephone number (604) 685-6375 and facsimile number (604) 669-2960. Evolving Gold’s website address is www.evolvinggold.com and e-mail address is info@evolvinggold.com. The Company’s contact person is Mr. Lawrence Dick, President and Chief Executive Officer. The Issuer’s fiscal year ends March 31.

The Company received a final receipt for its initial prospectus offering and became a reporting issuer in the Provinces of Alberta, British Columbia and Ontario, Canada on May 14, 2004. On June 9, 2004, the Company received the approval of the Canadian Trading and Quotation System Inc. (the “CNQ”) for the listing of its common shares on the CNQ, under stock symbol “GOLD”. The Company officially began trading on the CNQ on June 14, 2004.

The Issuer has unlimited common shares without par value authorized. As at March 31, 2004, the end of the Company’s most recent fiscal year, there were 100 common shares issued and outstanding. As at December 31, 2004, the end of the Company’s most recently completed fiscal quarter, there were 6,550,100 common shares issued and outstanding. As of February 25, 2005, there were 6,750,100 common shares issued and outstanding.

13

Financings

The Company has financed its operations through funds raised in loans, public/private placements of common shares, shares issued for property, shares issued in debt settlements, and shares issued upon exercise of stock options and share purchase warrants. The following table shows the monies raised by the Company as at February 28, 2005:

| Nature of Share Issuance | Number of Shares | Amount |

| | | |

| Issue of Common Shares (1) | 100 | $100 |

| Exercise of Special Warrants (2) | 5,750,000 | $286,500 |

| Exercise of Special Warrants (3) | 200,000 | $10,000 |

| Exercise of Special Warrants (4) | 200,000 | $10,000 |

| Issue of Common Shares (5) | 400,000 | $80,000 |

| Issue of Common Shares (6) | 600,000 | $96,000 |

| Issue of Common Shares (7) | 200,000 | $40,000 |

| Total | 7,350,100 | $522,600.00 |

| ___________________________________ | | |

| (1) | These shares were issued to Alicia Cumming and Zimtu, the founders of the Issuer. |

| (2) | The Company issued 1,400,000 Series “A” Special Warrants at $0.01 per warrant for proceeds of $14,000. The Company issued 3,250,000 Series “B” Special Warrants at $0.05 per warrant for total proceeds of $162,500. The Company issued 1,100,000 Series “F” Special Warrants at $0.10 per warrant for total proceeds of $110,000. Each Series “A”, “B” and “F” Special Warrant is exchangeable into one common share of the Company on or before the fifth day after the regulatory authorities of British Columbia, Alberta and Ontario issue a final receipt for a prospectus. The final receipt was issued on May 14, 2004 and all “A”, “B” and “F” Special Warrants were exercised. |

| (3) | These Series “L” Special Warrants were issue at $0.05 per warrant for proceeds of $10,000 in September 2003 pursuant to an agreement for services with the Issuer’s Canadian legal counsel, Mr. Bruce Bragagnolo. |

| (4) | These Series “P” Special Warrants were issued at $0.05 per warrant for proceeds of $10,000 in September 2003 pursuant to an agreement to purchase the Murray Property. These Special Warrants have not been exercised as at January 31, 2005. |

| (5) | Pursuant to the acquisition of the Winnemucca Mountain Property, the Company issued 100,000 common shares to Golden Arc Mining and Refining Inc. (“Golden Arc”), 200,000 common shares to Golden Sands Exploration Inc. (“Golden Sands”)and 100,000 common shares with respect to finder’s fees on December 10, 2004, each share was issued at $0.20 per share. |

| (6) | These shares were issued at $0.16 per share for proceeds of $96,000 on January 10, 2005. |

| (7) | Pursuant to the acquisition of the Winnemucca Mountain Property, the Company issued 200,000 common shares to Gold Sands at a deemed price of $0.20 per share on February 25, 2005. |

Capital Expenditures

Fiscal Year

| Fiscal 2004 (First year of operations) | None |

| Fiscal 2005 to date | None |

14

4.B. BUSINESS OVERVIEW

Historical Corporate Development

The Company’s principal business since its incorporation has been the acquisition, and exploration of natural resource properties with the goal of placing into production any properties warranting such.

On July 22, 2003, the Company entered into a Property Option Agreement (the “Property Option Agreement”) with International Zimtu Technologies Inc. (“Zimtu”) pursuant to which the Company was granted an option to acquire a 70% undivided interest in in a mineral property located in the Cameron River Area of the Northwest Territories, Canada, which is known as the Murray Property (the “Murray Property”). At the time of the Property Option Agreement was entered into, the Company was a wholly owned subsidiary of Zimtu and as such, may be considered to be a party not dealing at arm’s length with Zimtu because of the common management. The Murray Property was originally staked by Jody Dahrouge and sold to Zimtu for the $13,200 cost of staking and a 1% royalty. The Company is exploring for gold on the Murray Property. The Murray Property is in a preliminary stage of exploration and does not have a known commercial body of ore or minerals.

Under the terms of the Property Option Agreement, the Company agreed to acquire all of Zimtu’s right, title and interest in and to the Murray Property and assume all liabilities and obligations in respect thereof in consideration for $17,000 cash in the signing of the Agreement (paid) and the issuance of 200,000 of the Series “P” Special Warrants to Zimtu (issued). The Company must also incur $250,000 in exploration expenditures on the Murray Property as follows: $15,000 on or before December 1, 2004, $85,000 on or before July 22, 2005 and $150,000 on or before July 22, 2006. Zimtu is to receive a royalty equal to 1% of the net smelter returns (“NSR”) on minerals other than diamonds and 1% of the gross productions (“GOR”) of diamonds from the Murray Property. The Company can purchase one half of each royalty for $500,000. With respect to the $15,000 exploration expenditure to be made on or before December 1, 2004, the Company has contributed $6,225.50 with the remainder payment extended to on or before July 22, 2005.

Zimtu acquired the Murray Property pursuant to a Mineral Property Agreement dated June 10, 2003 between Zimtu and Jody Dahrouge. Under this agreement, Mr. Dahrouge will retain a 1% NSR royalty on mineral other than diamonds and 1% GOR royalty on diamonds from the MurrayProperty. Zimtu had the right to purchase one half of the NSR royalty and one half of the GOR royalty from Mr. Dahrouge for $500,000 each.

Using the funds raised in its special warrant offering, the Company’s business objective is to conduct further exploration on the Murray Property and compile that information in an effort to further define the mineralization potential of the Murray Property. The Company planned an initial exploration program to be complied by October 2004 but due to poor weather conditions, such work has been postponed to early 2005. Additional work on the Murray Property will be contingent upon successful results being obtained from the preliminary exploration program.

On December 3, 2004, the Company entered into the Option and Royalty Agreement, as amended on January 7, 2005 and as further amended on February 25, 2005, pursuant to which the Company was granted an option (the “Winnemucca Option”) to acquire a 100% interest in 62 unpatented mining claims (subsequently increased to 72 unpatented mining claims) located in Humboldt County, Nevada. In order to exercise the Winnemucca Option, the Company must incur exploration expenditures of US$4,000,000, make aggregate cash payments to Golden Sands of US$70,000 at various times on or before March 31, 2005 and issue and deliver 1,800,000 shares in the capital of the Company as more particularly described in Item 4D, “The Winnemucca Mountain Property”.

During Fiscal 2005, to date, the Issuer has concentrated the majority of its efforts on exploration work on the Murray Property. The Issuer is an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on its properties. Further evaluation will be required on the Murray Property and Winnemucca Mountain Property before a final evaluation as to the economics and legal feasibility of both properties is determined.

15

Plan Of Operations

Source of Funds for Fiscal 2004/2005

The Issuer’s primary source of funds since incorporation has been through the issuance of common shares. The Issuer had a working capital balance of $127,482 at March 31, 2004, the Company’s last completed fiscal year end. As at December 31, 2004, the Issuer had a negative working capital balance of $27,761.

Use of Funds for Fiscal 2004/2005

During Fiscal 2005 and Fiscal 2006, respectively, the Issuer estimates that it will expend $120,000 and $150,000 on general/administrative expenses including property evaluation costs and $150,000 and $300,000 on property acquisition/exploration expenses.

Anticipated Changes to Facilities/Employees

Management of the Issuer anticipates that there will be no changes to either facilities or employees in the near future.

United States vs. Foreign Sales/Assets

The Issuer has had no revenue during the past fiscal year. As at December 31, 2004, the Issuer’s assets were located in Canada.

Material Effects of Government Regulations

The current and anticipated future operations of the Issuer, including further exploration activities, require permits from various Canadian Federal and Provincial governmental authorities. Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, well safety and other matters. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on the Issuer and cause increases in capital expenditures which could result in a cessation of operations by the Issuer. The Issuer has had no material costs related to compliance and/or permits in recent years, and anticipates no material costs in the next year.

Seasonality

Dependency upon Patents/Licenses/Contracts/Processes

Sources/Availability of Raw Materials

--- No Disclosure Necessary ---

4.C. Organization Structure

The Issuer was incorporated under the CBCA on June 19, 2003 under the name “6109527 Canada Ltd.” The Issuer has no subsidiaries.

4.D. Property, Plant and Equipment

The Issuer subleases its office space pursuant to the terms of a written lease agreement at Suite 1200, 1188 West Georgia Street, Vancouver, British Columbia, Canada V6E 4A2. The term of the lease is five (5) years with monthly rental payments of $1,000. The lease expires in September 2008.

The Issuer currently a property interest created pursuant to the Property Option Agreement with and Option and Royalty Agreement with Golden Sands and AHL.

16

It is important to note that even if the Issuer completes its exploration programs on its properties and is successful in identifying mineral deposits, a substantial amount of capital (approximately $500,000), over the next 3 years, will still have to be spent on each deposit on further drilling and engineering studies before management will know that the Issuer has a commercially viable mineral deposit on the Murray Property.

The Murray Property

The Murray Property is without known reserves and the work being done by the Issuer is exploratory in nature. The Issuer’s interest in the Murray Property stemmed from earlier exploration work, as described below, that was done in the area.

Acquisition of Interest

On July 22, 2003, the Issuer entered into the Property Option Agreement with Zimtu, a related public company, pursuant to which the Company granted an option to acquire a 70% undivided interest in the Murray Property. At the time of the Property Option Agreement the Issuer was a wholly owned subsidiary of Zimtu. Zimtu is currently a major shareholder of the Issuer, owning 5.5% of the outstanding shares.

Under the terms of the Property Option Agreement the Issuer acquired all of Zimtu’s right, title and interest in and to the Murray Property and assumed all liabilities and obligations in respect thereof in consideration for $17,000 cash on the signing of the Property Option Agreement and the issuance of 200,000 Special Warrants to Zimtu. The Issuer must also incur $250,000 in exploration expenditures on the Murray Property as follows: $15,000 on or before December 1, 2004; $85,000 on or before July 22, 2005; and, $150,000 on or before July 22, 2006. If these expenditures are not made by the Issuer, it will forfeit its interest in the Murray Property. Zimtu is to receive a royalty equal to 1% of the net smelter returns (“NSR”) on minerals other than diamonds and 1% of the gross production (“GOR”) of diamonds from the Murray Property. There is no assurance that any production will ever occur on this property and there are currently no known reserves on the Murray Property. The Issuer has the right to purchase one half of each royalty for $500,000. In the event that Evolving Gold fails to make these payments, it would have to forfeit the Murray Property. Pursuant to exploration expenditures to be made on or before December 1, 2004, the Issuer has made a deposit of $6,226.50 with the remainder payment extended to July 22, 2005.

Zimtu acquired the Murray Property pursuant to a Mineral Property Agreement dated June 10, 2003 between Zimtu and Jody Dahrouge, an unrelated individual (the “Mineral Property Agreement”). Under the Mineral Property Agreement, Mr. Dahrouge will retain a 1% NSR royalty on minerals other than diamonds and 1% GOR royalty on diamonds from the Murray Property. (There is no assurance that any production will ever occur on this property and there are currently no known reserves on the Murray Property.) Zimtu has the right to purchase one half of the NSR royalty and one half of the GOR royalty from Mr. Dahrouge for $500,000 each.

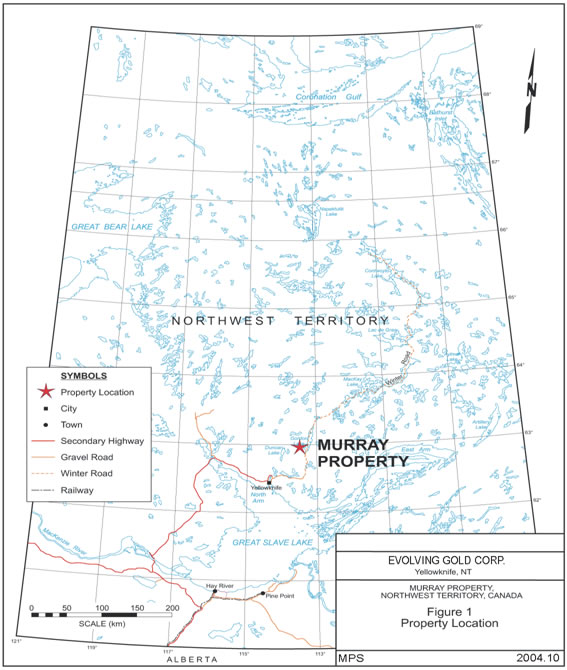

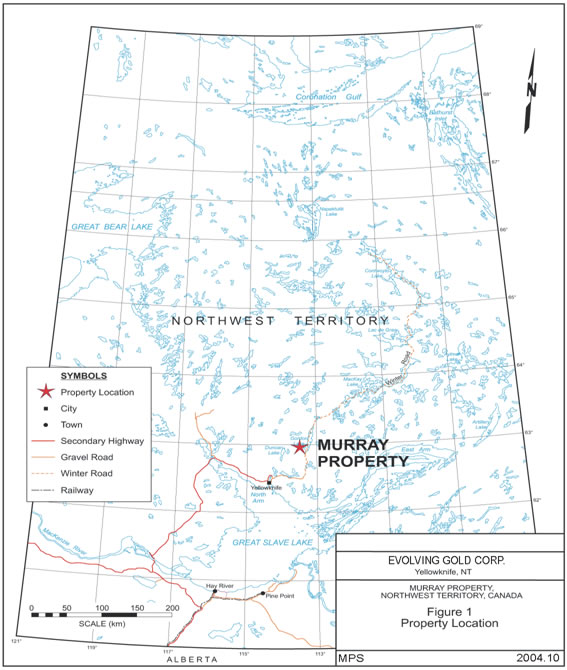

Location

The Murray Property consists of one mineral claim totalling 2,965 acres and is located 78 kilometres northeast of Yellowknife, Northwest Territories. It is three kilometres west of Gordon Lake. See map attached (page 18).

Accessibility, Climate, Infrastructure and Physiography

The Murray Property is approximately 78 kilometers northeast of Yellowknife in the Northwest Territories (Figure 1). The current winter road to the Diavik and Ekati diamond mines and the Lupin gold mines passes within five kilometers east of the Murray Property, at Gordon Lake.

During summer months, access to the Murray Property is by floatplane or helicopter. During winter months access is by ski-equipped aircraft, helicopter or snowmobile from Gordon Lake. Yellowknife is the closest community and offers a complete range of supplies and services for the mineral exploration industry.

17

History and Previous Work

The Gordon Lake area, within which the Murray Property lies, has a history of exploration of about 70 years. Exploration of this region is considered sporadic, with long periods of inactivity punctuated by a few months of intense exploration.

Exploration on the Murray Property has been restricted to an initial trenching program in the late 1930’s to early 1940’s, and minor sampling programs in the 1980’s. No geophysical surveys have been recorded.

18

After the staking of the PAN claims in the late 1930’s, the Consolidated Mining and Smelting Company of Canada, an unrelated company, excavated numerous trenches and pits throughout the Murray Property area. As well, a shallow exploration shaft was sunk. Subsequent exploration by North Star Mines, an unrelated company, resulted in the excavation of at least one new trench. Since virtually all of the excavation took place over 60 years ago, the current state of the trenches and pits is questionable.

Most early analysis from the Murray Property consisted of analyses for precious metals (gold and silver), with occasional analyses for base metals. Geochemical analyses were typically for gold on whole rock (vein and wallrock) samples. Thirty-three samples collected by Nickerson (1972) were analyzed for gold and silver at the Federal Assay Office in Yellowknife.

Mineralization

A commonality of most of the showings containing gold at and near the Murray Property is quartz veining, open space and fracture fillings, replacement bodies, stockworks and silica flooding of the host rock. Gold occurs as native gold and may be associated with sulphide minerals such as arsenopyrite, pyrrhotite, pyrite, chalcopyrite and galena. The gold-bearing veins occur in structures of varying ages, suggesting multiple mineralization events, as opposed to a single mineralization episode. Quartz is most often dense blue-grey, but has also been observed as clear to milky white. The quartz is typically massive and is occasionally brecciated.

The following five zones on the Murray Property are of current interest to management:

The No. 1 Zone is the westernmost zone at the Murray Property. Large amounts of quartz at the No. 1 Zone are found as veins and replacement bodies.

The No. 3 Zone is northeast of the other zones and parallels a shear zone. This zone is composed of massive blue-gray quartz and quartz stockwork replacement bodies.

The No. 5 Zone is located to the southwest of the No. 3 Zone. Massive quartz veins or replacement fillings within host rock, which is combined with silica, characterize this zone.

Quartz veins and stringers in silicified wallrock are prevalent at the No. 6 Zone, which is located directly east of the No. 1 Zone.

Management believes that the No. 7 Zone, which is south of the other zones, may contain significant gold mineralization. (This has not been proven to date and is based on visual observation by management.) Mineralization is contained within a 0.5 to 2.5 foot wide by 30 foot long quartz-filled fracture that is perpendicular to the strike of the surrounding rock.

Planned Work Program by the Issuer

To date, the Issuer has completed no work, other than minor exploration work on the Murray Property to fulfill the terms of the Option Property Agreement. Management commissioned and received an independent technical report on the Murray Property, in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The “Summary Report on the Murray Property” dated September 3, 2003 (the “Murray Report”) was prepared by independent consulting geologist Gary Vivian, P. Eng.

The Issuer planned to engage in exploration work on the Murray Property through the end of calendar 2004 with a budget of $15,000, however, due to unfavourable weather conditions, the Issuer has deferred such exploration expenditures until the first quarter of 2005. An initial work program will consist of geologic mapping and rock sampling over a three week period. The success of this initial phase of work will be evaluated based on the assays returned from the sampling, and the surface and subsurface continuity of the mineralized zone based on the geologic mapping. Should these factors indicate that there is not a clearly defined target on the Murray Property, and then no additional funds would be expended on exploration. However should, significant gold grades over or along a geological or geophysical feature be encountered, then a drilling program would be called for to test the gold grades in the subsurface. There is no detailed plan of exploration beyond this point. The total meterage of holes to be drilled cannot be estimated until the basic first phase of sampling and geological and geophysical mapping is complete, however combined drilling and assaying costs will run between $150 and $200 per meter, and an initial drilling program consisting of 1000 meters would not be unreasonable. If positive assay results are obtained then additional drilling programs and cost expenditures would be necessary. In vein deposits, such as the Murray Property, a final drill hole pattern on 50 meter vertical and horizontal intervals, and possibly less would be required to define a mineral reserve. Decision points may occur after or during the drilling program as to whether the Murray Property has a reasonable chance of outlining ore. The probability of an individual prospect ever having reserves that meet the requirements of Industry Guide 7 is remote, there is always a high probability that the properties of Evolving Gold do not contain reserves, and any funds spent on exploration will probably be lost. Even if ultimately successful in outlining a sufficient tonnage and grade of mineralization, extensive engineering studies are required to determine whether the mineralization would constitute an ore reserve.

19

Mr. Gary J. Vivian, B.S., M.S. Geology, will conduct the initial geological mapping and sampling on behalf of Evolving Gold. Mr. Vivian graduated with a Master of Science degree from the University of Alberta in 1987 and had worked as a geologist with Noranda Exploration Company Ltd. for nine years. Since 1988 he has worked with Aurora Geosciences, Ltd., a geological consulting company of which he is a full partner.

The Winnemucca Mountain Property

The Winnemucca Mountain Property is without known reserves and the work being done by the Issuer is exploratory in nature. The Company’s interest in the Winnemucca Mountain Property also stems from previous exploration work described below.

Acquisition of Interest

On December 3, 2004, the Company entered into the Option and Royalty Agreement, as amended on January 7, 2005 and as further amended on February 25, 2005, pursuant to which the Company was granted the Winnemucca Option to acquire a 100% interest in 62 unpatented mining claims (subsequently increased to 72 unpatented mining claims as discussed further below) located in Humboldt County, Nevada (the “Winnemucca Mountain Property”). In order to exercise the Winnemucca Option, the Company must incur exploration expenditures of US$4,000,000, make aggregate cash payments to Golden Sands of US$70,000 at various times on or before March 31, 2005 and issue and deliver 1,800,000 shares in the capital of the Company as follows:

| (a) | Cash Payments |

| | » | US$30,000 on or before January 7, 2005 (paid); |

| | » | US$40,000 on or before March 31, 2005; |

| | |

| (b) | Share Issuances |

| | » | Issue 100,000 shares in the name of Golden Arc and deliver to Golden Sands on signing the agreement (issued); |

| | » | Issue 200,000 shares to Golden Sands on or before December 15, 2004 (issued); |

| | » | Issue 200,000 shares to Golden Sands on or before February 25, 2005 (issued); |

| | » | Issue and deliver 400,000 shares to Golden Sands on or before August 31, 2005; |

| | » | Issue and deliver 400,000 shares to Golden Sands on or before August 31, 2006; |

| | » | Issue and deliver 500,000 shares to Golden Sands on or before December 31, 2007; |

| | | |

| (c) | Exploration Expenditures |

| | » | Incur as exploration expenditures on or before December 31, 2005, an amount not less than 70% of the total funds raised by the Company on or before October 31, 2005; |

| | » | Incur exploration expenditures of US$1,000,000 on or before December 31, 2006; |

| | » | Cumulative exploration expenditures of US$2,000,000 on or before December 31, 2007; |

| | » | Cumulative exploration expenditures of US$2,000,000 on or before December 31, 2008. |

A finder’s fee of 100,000 common shares in the capital of the Company was issued in connection with the acquisition of the Winnemucca Mountain Property in December 2004.

20

Under the Option and Royalty Agreement, any unpatented or patented mining claims located within three miles of the subject claims acquired or located would, at the option of the other parties, form part of the subject claims. Since entering into the Option and Royalty Agreement, ten additional claims have been staked on behalf of Golden Sands with the result that there are now 72 unpatented subject claims in total.

The Winnemucca Mountain Property is subject to a 2% NSR royalty. The Company has the right to purchase the royalty relating to the first 37 unpatented mining claims (the “Golden Arc Claims”) listed in the table below and any other unpatented mining claims which may become subject to the option and royalty agreement (the “Underlying Option Agreement”) dated March 22, 2004 between AHL and Golden Arc for US$1,000,000 for each of the two percentage royalty points. The Company is required to pay, in addition to the mentioned option payments due March 31, 2005, advance royalty payments of US$10,000 by December 3, 2005, the first anniversary of the Option and Royalty Agreement, US$10,000 by December 3, 2006. the second anniversary of the Option and Royalty Agreement and US$20,000 by December 3, 2007, the third anniversary of the Option and Royalty Agreement and each successive anniversary until production commences at which time the obligation to pay advance royalty payments will terminate. The total of the advance royalty payments is to be deducted from the total amount of NSR royalty payable under the Winnemucca Option Agreement.

Mineral Claims

The Winnemucca Mountain Property consists of 72 unsurveyed contiguous mining claims covering approximately 560 hectares on Lands administered by the Bureau of Land Management (“BLM”), US Department of the Interior.

These claims have been recorded with the BLM as follows(1)

| Claim Name | BLM Serial No. | Registered Owner(3) | Location | Expiry Date(4) |

| | | Date | |

| The Golden Arc Claims | | | | |

| WM #1 | NMC 733156 | AHL Holdings Ltd. | 01/04/1996 | Sept. 1,2005 |

| WM #2 | NMC 405978 | Arctic Precious Metals (2) | 04/11/1987 | Sept. 1,2005 |

| WM #3 | NMC 733157 | AHL Holdings Ltd. | 01/04/1996 | Sept. 1,2005 |

| WM #4 | NMC 405980 | Arctic Precious Metals (2) | 04/11/1987 | Sept. 1,2005 |

| WM #5 | NMC 733158 | AHL Holdings Ltd. | 01/04/1996 | Sept. 1,2005 |

| WM #6 | NMC 405982 | Arctic Precious Metals (2) | 04/11/1987 | Sept. 1,2005 |

| WM #8 | NMC 405983 | Arctic Precious Metals (2) | 04/11/1987 | Sept. 1,2005 |

| WM #10 | NMC 405984 | Arctic Precious Metals (2) | 04/11/1987 | Sept. 1,2005 |

| Golden West #6 | NMC 733140 | AHL Holdings Ltd. | 01/02/1996 | Sept. 1,2005 |

| Golden West #7 | NMC 733141 | AHL Holdings Ltd. | 01/02/1996 | Sept. 1,2005 |

| Golden West #8 | NMC 733142 | AHL Holdings Ltd. | 01/02/1996 | Sept. 1,2005 |

| Golden West #9 | NMC 733143 | AHL Holdings Ltd. | 01/02/1996 | Sept. 1,2005 |

| Golden West #10 | NMC 733144 | AHL Holdings Ltd. | 01/02/1996 | Sept. 1,2005 |

| Golden West #11 | NMC 733145 | AHL Holdings Ltd. | 01/02/1996 | Sept. 1,2005 |

| Golden West #12 | NMC 733146 | AHL Holdings Ltd. | 01/02/1996 | Sept. 1,2005 |

| Golden West #13 | NMC 733147 | AHL Holdings Ltd. | 01/02/1996 | Sept. 1,2005 |

| Golden West #14 | NMC 733148 | AHL Holdings Ltd. | 01/03/1996 | Sept. 1,2005 |

| Golden West #15 | NMC 733149 | AHL Holdings Ltd. | 01/03/1996 | Sept. 1,2005 |

| Golden West #16 | NMC 733150 | AHL Holdings Ltd. | 01/03/1996 | Sept. 1,2005 |

| _________________ | | | | |

(1) Claim data on the Winnemucca Mountain Property have been provided to the author of the report by AHL. The author of the report has not independently reviewed or verified any of the claim details. Therefore, the author of the report has no opinion on the validity of the claims. Claim posts placed before 2004 may have been destroyed by range fires.

(2) Under the terms of the Underlying Option Agreement, Golden Arc was required to have the title to all mineral claims subject to that agreement transferred to AHL As of the date of the report, all of such transfers except five have been completed and AHL has advised the Company that it reasonably believes that the last five transfers will be effected shortly.

(3) If the option contained in the Underlying Option Agreement is not exercised, then AHL is required to return title to the Golden Arc Claims to Golden Arc.

21

| Claim Name | BLM Serial No. | Registered Owner | Location Date | Expiry Date |

| Golden West #17 | NMC 733151 | AHL Holdings Ltd. | 01/03/1996 | Sept. 1, 2005 |

| Golden West #18 | NMC 733152 | AHL Holdings Ltd. | 01/03/1996 | Sept. 1, 2005 |

| Golden West #19 | NMC 733153 | AHL Holdings Ltd. | 01/03/1996 | Sept. 1, 2005 |

| Gold West Frac A | NMC 733154 | AHL Holdings Ltd. | 01/03/1996 | Sept. 1, 2005 |

| Gold West Frac B | NMC 733155 | AHL Holdings Ltd. | 01/03/1996 | Sept. 1, 2005 |

| T & C #1 | NMC 479032 | AHL Holdings Ltd. | 05/08/1988 | Sept. 1, 2005 |

| T & C #2 | NMC 479033 | AHL Holdings Ltd. | 05/08/1988 | Sept. 1, 2005 |

| T & C #3 | NMC 479034 | AHL Holdings Ltd. | 05/08/1988 | Sept. 1, 2005 |

| TJ #12 | NMC 155540 | AHL Holdings Ltd. | 04/02/1980 | Sept. 1, 2005 |

| TJ #14 | NMC 733159 | AHL Holdings Ltd. | 01/04/1996 | Sept. 1, 2005 |

| TJ #15 | NMC 733160 | AHL Holdings Ltd. | 01/04/1996 | Sept. 1, 2005 |

| TJ #16 | NMC 155544 | AHL Holdings Ltd. | 04/04/1980 | Sept. 1, 2005 |

| TJ #17 | NMC 155545 | AHL Holdings Ltd | 04/04/1980 | Sept. 1, 2005 |

| TJ #18 | NMC 155546 | AHL Holdings Ltd | 04/04/1980 | Sept. 1, 2005 |

| TJ #19 | NMC 155547 | AHL Holdings Ltd. | 04/04/1980 | Sept. 1, 2005 |

| TJ #29 | NMC 155557 | AHL Holdings Ltd. | 04/04/1980 | Sept. 1, 2005 |

| TJ #30 | NMC 155558 | AHL Holdings Ltd. | 04/17/1980 | Sept. 1, 2005 |

| TJ#34 | NMC 155562 | AHL Holdings Ltd. | 04/17/1980 | Sept. 1, 2005 |

| The Additional Claims (5) | | | | |

| WM#101 | NMC 887954 | AHL Holdings Ltd. | 11/10/2004 | Sept. 1, 2005 |

| WM#102 | NMC 887954 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#103 | NMC 887956 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#104 | NMC 887957 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#105 | NMC 887958 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#106 | NMC 887959 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#107 | NMC 887960 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#108 | NMC 887961 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#109 | NMC 887962 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#110 | NMC 887963 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#111 | NMC 887964 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#112 | NMC 887965 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#113 | NMC 887966 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#114 | NMC 887967 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#115 | NMC 887968 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#116 | NMC 887969 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#117 | NMC 887970 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#118 | NMC 887971 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#119 | NMC 887972 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#120 | NMC 887973 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#121 | NMC 887974 | AHL Holdings Ltd | 11/13/2004 | Sept. 1, 2005 |

| WM#122 | NMC 887975 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#123 | NMC 887976 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#124 | NMC 887977 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#125 | NMC 887978 | AHL Holdings Ltd | 11/10/2004 | Sept. 1, 2005 |

| WM#126 | NMC 887979 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

| WM#127 | NMC 887980 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

| WM#128 | NMC 887981 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

(4) In order to maintain the mineral claims comprising the Winnemucca Mountain Property in good standing, the Company must pay to the BLM a maintenance fee of US$135 per mineral claim prior to September 1,2005 and, in each successive year, the Company must pay the County in which the mining claims are located (the Humboldt County) a yearly fee prior to November 1 and file a form called an “Intent to Hold”. If the Company fails to duly pay such fees and file such form, then the mining claims will lapse and the Company will lose all interest that it has in these mining claims.

(5) The WM 101-125 claims and WM 126-135 claims were staked directly by AHL in November 2004 and December 2004, respectively. The WM101-135 claims were recorded with the BLM on January 20, 2005.

22

| Claim Name | BLM Serial No. | Registered Owner | Location Date | Expiry Date |

| WM#129 | NMC 887982 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

| WM#130 | NMC 887983 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

| WM#131 | NMC 887984 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

| WM#132 | NMC 887985 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

| WM#133 | NMC 887986 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

| WM#134 | NMC 887987 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

| WM#135 | NMC 887988 | AHL Holdings Ltd | 12/10/2004 | Sept. 1, 2005 |

Location, Accessibility, Climate, Local Resources, Infrastructure and Physiography

The Winnemucca Mountain Property is located in northwestern Nevada, approximately 6 kilometers northwest of the municipality of Winnemucca. The property is within the Winnemucca Mountain Mining District of Humboldt County. The claims are situated on certain sections of the west flank of the Winnemucca Mountain. A map showing the location of and access to the Winnemucca Mountain Property is attached on page 24.

The Winnemucca Mountain Property is accessible from State Route 49, a graded gravel road from Winnemucca to Jungo. The claims that comprise the Winnemucca Mountain Property lie in an irregular, northerly trending block along the western flanks of Winnemucca Mountain. The mountain slopes are generally moderate along the west side of the claims, steepening on the east and in drainages. Pediment and alluvium cover is extensive, particularly in the western, or lower, part of the property where a classic bajada is developed. Within the claims, elevations range from approximately 1435 meters in the southwest corner to nearly 2000 meters in the east. The area is devoid of trees, and vegetation consists of sagebrush and sparse grass. The climate in southern Humboldt County is arid with annual rainfall averaging 20 cm (8 inches; Winnemucca Chamber of Commerce Website) and snowfall of 38 cm (16 inches; Nevada Climate Summaries Website). The area is characterized by hot summers and short, cold winters.

History and Previous Work

Gold and silver were first discovered in the Winnemucca Mining District in 1863 and several smelters were constructed along the Humboldt River during the 1860’s. In late 1988, Santa Fe Pacific Mining, Inc. (now Newmont Mining Corporation) (“Santa Fe”) entered into a joint venture with Arctic Precious Metals Inc. with respect to the Winnemucca Mountain Property and became operator. Previous exploration work performed by Santa Fe focused on the pediment-covered Swordfish Zone. Between 1988 and 1990, Santa Fe conducted geological mapping, rock sampling, trenching, CSAMT, induced polarization geophysical surveys, collected 286 auger hole bedrock samples and completed a total of 18,260 meters (52,470.8 feet) in 73 reverse circulation drill holes. In 1994, Anvil Resources Ltd. acquired the Winnemucca Mountain Property, became project operator and performed internal compilation work, prepared topographic base map and collected surface samples to confirm previous gold tenors. An induced polarization (IP) survey conducted in 1996 confirmed that resistivity highs correlated well with known mineralized areas and delineated two new target zones. There has been no record of exploration work since 1996.

Present Condition and Current State of Exploration

The Winnemucca Mountain Property is undeveloped and does not contain any open-pit or underground mines. There is no plant or equipment located on the property. No reserves have identified on the mineral claims that comprise the Winnemucca Mountain Property.

23

Mineralization

The Winnemucca Mountain Property and surrounding area has had a long history of mineral exploration. As a result, gold occurrences and targets have been identified at several areas within the current property boundaries. Types of gold-bearing occurrences identified to date on the Winnemucca Mountain Property are: quartz stockworks in hornfelsed intrusive contact zones, quartz veins, volcanic breccias, and quartz-calcite veins.

Gold mineralization at the Swordfish Zone occurs within a northeast-trending, low sulfide, quartz-adularia vein-type system. Santa Fe completed 73 reverse circulation drill holes, nearly all of which were focused on the Swordfish

24

Zone. Near the end of Santa Fe’s tenure on the Winnemucca Mountain Property, gold mineralization was found approximately 500 meters northeast of the Swordfish Zone, at what is now called the SF Extension Zone. This intercept has never been followed up by further drilling, and has been interpreted by the Company to indicate that the Swordfish Zone may be much more extensive than previously indicated, and that higher gold grades may occur in structurally-controlled zones northeast of Swordfish. The SF Extension, and beyond to the northeast, is a high-priority drill target for the Company.

In addition to the Swordfish and SF Extension areas, additional exploration targets have been identified and are comprised of multiple outcropping vein-style occurrences reported to carry anomalous gold values that have yet to be explored in detail.

Planned Work Program by the Issuer

The Company has obtained a geological report on the Winnemucca Mountain Property prepared by Harmen J. Keyser, Professional Geologist dated January 20, 2005. The geological report has been prepared in accordance with the requirements of National Instrument Policy 43-101. The geological report recommends the completion of a two stage exploration program on the Winnemucca Mountain Property, with the first stage consisting geochemical sampling, geophysical surveying and geological mapping, and the second stage consisting of a drilling program. The Company plans to complete the recommended two-stage work program during the 2005 spring and summer months. The first stage of the work program is estimated to cost US$100,000 and will include: obtaining all missing exploration data from prior operators for thorough compilation and review of existing exploration data and acquire additional land if necessary; mapping the Winnemucca Mountain Property and surrounding areas with special attention paid to understanding structure and investigate outcropping gold mineralization reported in the eastern part of the property; a complete reconnaissance scale soil sampling with more detailed sampling in the area of the Swordfish and other potential targets; and carrying out CSAMT and/or induced polarization surveying as orientation and reconnaissance in the known Swordfish zone and other potential targets and expand the survey area if positive results are obtained. If geological evaluation of the first stage of the work-program indicates that the second stage of the exploration program is warranted and the Company is able to obtain additional financing, the Company will proceed to the second stage of the work program, estimated to cost US$300,000, to continue exploration by reverse circulation drilling.

To satisfy exploration expenditure obligations under the Option and Royalty Agreement and to effect the planned two-stage work-program, the Company must raise approximately US$571,429 in total (US$142,857 for first stage and US$428,571 for the second stage). The Company plans to raise funds for the work-program through equity financing. There is no assurance that the Company will be able to raise the funds necessary to proceed with the second stage of the exploration program even if the second stage of the exploration program is recommended.

Compliance With Government Regulation

Murray Property