UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

[ ]REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDEDMARCH 31, 2008

OR

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ ]SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission File Number:000-50953

EVOLVING GOLD CORP.

(Exact name of Registrant as specified in its charter)

CANADA

(Jurisdiction of incorporation or organization)

725 – 666 Burrard Street

Vancouver, British Columbia, Canada V6C 2X8

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:NONE

Securities registered or to be registered pursuant to Section 12(g) of the Act:

COMMON SHARES WITHOUT PAR VALUE

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:NONE

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as

of the close of the period covered by the annual report:

77,082,448 common shares as of March 31, 2008

Indicate by check mark if the Registrant is a well known seasoned issuer as defined in Rule 405 of the Securities Act.

YES [ ] NO [X]

If this report is an annual or transition report, indicate by check mark if the Registran is not required to file reports

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES [ ] NO [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of

the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated

filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards[ ] | Other[X] |

| | by the International Accounting Standards Board | |

If “other” has been checked in response to the previous question, indicate by check mark which financial statement

item the registrant has elected to follow:

Item 17 [X] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-

2 of the Exchange Act).

YES [ ] NO [X]

- 2 -

EVOLVING GOLD CORP.

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

- 3 -

GLOSSARY

Certain terms used herein are defined as follows:

| Term | Definition |

| | |

| 2004 Plan | Stock option plan of the Company dated September 28, 2004 |

| | |

| 2007 Plan | Stock option plan of the Company dated March 14, 2007, presented to and approved by the shareholders at the September 21, 2007 shareholders’ meeting |

| | |

| adularia | A mineral, potassium feldspar |

| | |

| Ag | Silver |

| | |

| AHL | AHL Holdings Ltd. |

| | |

| Alpha Butte Property | 279 staked claims covering 2,200 hectares located 30 km southwest of the town of Winnemucca, Nevada |

| | |

| arsenopyrite | A mineral composed of arsenic, iron and sulphur |

| | |

| As | Arsenic |

| | |

| Au | Gold |

| | |

| Bald Mountain | Bald Mountain Mining Company |

| | |

| Battle Mountain Property | Approximately 1,959 claims covering 38,000 acres located near the Carlin and Getchell trends in north central Nevada |

| | |

| Bi | Bismuth |

| | |

| BLM | Bureau of Land Management, US Department of the Interior |

| | |

| breccia | A coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix |

| | |

| Carlin Agreement | The exploration lease and sublease agreement among the company, the U.S. Sub, Newmont USA Limited, Newmont, Newmont Capital Limited and Elko Land and Livestock Company, dated November 28, 2007, pursuant to which Newmont leased to the Company its interest in certain unpatented mining claims and owned fee interests, and subleased to the Company its interest in certain leased lands and leased unpatented claims in five separate “Project Areas” – Carlin, Cottonwood Creek, Susie Creek, Boulder Valley and Sheep Creeks |

| | |

| CBCA | Canada Business Corporations Act |

| | |

| chalcopyrite | A mineral composed of copper, iron and sulphur |

| | |

| clastic | Consisting of fragments of minerals, rocks, or organic structures that have been moved individually from their places of origin |

| | |

| CNQ | Canadian Quotation and Trading System |

- 4 -

| Term | Definition |

| | |

| Code | Internal Revenue Code of 1986, as amended |

| | |

| Company | Evolving Gold Corp. |

| | |

| Cu | Copper |

| | |

| Diatreme | A breccia-filled volcanic pipe that was formed by a gaseous explosion |

| | |

| EM | Electromagnetic |

| | |

| Evolving Gold | Evolving Gold Corp. |

| | |

| | |

| felsic | A mnemonic adjective derived from (fe) for feldspar, (l) for lenad or feldspathoid, and (s) for silica, and applied to light-colored rocks containing an abundance of one or all of these constituents. |

| | |

| Fisher Canyon Property | 179 unpatented lode claims covering 1,100 hectares located in the Humboldt Range in north central Nevada |

| | |

| Geocore | Geocore Exploration Inc. |

| | |

| Golden Arc | Golden Arc Mining & Refining Inc., a Nevada Corporation |

| | |

| Golden Arc Claims | The unpatented mining claims under option from Golden Arc |

| | |

| Golden Predator | Golden Predator (US) Mines Inc. |

| | |

| Golden Sands | Golden Sands Exploration Inc. |

| | |

| GOR | Gross overriding royalty |

| | |

| gpt | Grams per tonne |

| | |

| Hg | Mercury |

| | |

| induced polarization | A geophysical method used in mineral exploration |

| | |

| intrusion | A mass of igneous rock that, while molten, was forced into or between other rocks |

| | |

| IRS | Internal Revenue Service |

| | |

Malone Property

Agreement | The quitclaim deed and royalty agreement between the Company and Newmont North America Exploration Limited, dated April 17, 2006, pursuant to which the Company was granted all rights, title, estate and interest in the Malone Property, subject to a 2% NSR royalty. |

| | |

| Malone Property | 80 unpatented mineral claims covering approximately 667 hectares located in Grant County in southwest New Mexico |

- 5 -

| Term | Definition |

| | |

| Mineral Reserve | The SEC Industry Guide 7 – “Description of Property by Issuers Engaged or to beEngaged in Significant Mining Operations” defines a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: |

| | |

| (1)Proven (Measured) Reserves. Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established |

| | |

| (2)Probable (Indicated) Reserves. Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| | |

| Mineral Resource | National Instrument 43-101 of the Canadian Securities Administrators, “Standards ofDisclosure for Mineral Projects”, defines a “mineral resource” as a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| | |

| Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Resource has a lower level of confidence than that applied to an Indicated Resource. An Indicated Resource has a higher level of confidence than an Inferred Resource but has a lower level of confidence than a Measured Resource. |

| | |

| (1)Inferred Mineral Resource. An “Inferred Mineral Resource” is that part of the Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

| | |

| (2)Indicated Mineral Resource. An “Indicated Mineral Resources” is that part of the Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

- 6 -

| Term | Definition |

| | |

| (3)Measured Mineral Resource. A “Measured Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| | |

| The SEC Industry Guide 7 – “Description of Property by Issuers Engaged or to beEngaged in Significant Mining Operations” does not define or recognize resources. As used in this Annual Report, “resources” are as defined in National Instrument 43- 101. |

| | |

| Murray Property | One mineral claim totalling 2,965 acres located northeast of Yellowknife, Northwest Territories |

| | |

Murray Property

Agreement | The agreement dated June 10, 2003 made between Zimtu and Jody Dahrouge, an unrelated individual, pursuant to which Mr. Dahrouge retained a 1% NSR royalty on minerals other than diamonds and 1% GOR on diamonds from the Murray Property. |

| | |

| Newmont | Newmont Mining Corporation |

| | |

| NI 43-101 Report | A technical report prepared in accordance with National Instrument 43-101 of the Canadian Securities Administrators, “Standards of Disclosure for Mineral Projects” |

| | |

| NSR | Net smelter returns |

| | |

| Optionee | Any individual that is eligible to be granted stock options under the 2007 Plan |

| | |

| ore | The naturally occurring material from which a mineral or minerals of economic value can be extracted profitably |

| | |

| OTCBB | Over-The-Counter Bulletin Board Quotation System |

| | |

| Pb | Lead |

| | |

| PFIC | Passive foreign investment company |

| | |

| pyrite, pyrrhotite | A mineral composed of iron and sulphur |

| | |

| QEF | Qualified electing fund |

| | |

| quartz | A mineral composed of silica and oxygen |

| | |

Rattlesnake Hills Letter

Agreement | The binding letter agreement between the Company and Bald Mountain, dated January 15, 2008, pursuant to which Bald Mountain assigned to the Company its rights under the option agreement, dated December 11, 2007, between Golden Predator and Bald Mountain, which underlies the Rattlesnake Hills Option Agreement |

- 7 -

| Term | Definition |

| | |

| Rattlesnake Hills Option | The exclusive option, to earn up to a 100% interest in the Rattlesnake Hills Property located in Natrona County, Wyoming, granted by Golden Predator to the U.S. Sub pursuant to the Rattlesnake Hills Option Agreement |

| | |

Rattlesnake Hills Option

Agreement | The property option between the Company, the U.S. Sub and Golden Predator, dated January 16, 2008, pursuant to which the Company was granted the Rattlesnake Hills Option |

| | |

| Rattlesnake Hills Property | 127 unpatented lode claims and approximately 276 hectares of Wyoming State lease lands located in Natrona County, Wyoming |

| | |

| Rights Plan | The shareholder rights plan of the Company, which was adopted by the board of directors on January 23, 2008 and was approved by shareholder of the Company at a Special Meeting on March 20, 2008 |

| | |

| Sb | Antimony |

| | |

| SEC | The U.S. Securities and Exchange Commission |

| | |

| SEDAR | The electronic filing system for the disclosure of documents of public companies and mutual funds in Canada |

| | |

| Shares | Common shares in the capital of the Company |

| | |

| Siesta Property | 638 claims situated in the Slumbering Hills area of Humboldt County, Nevada |

| | |

| silica | A element, occasionally used to refer to the mineral, quartz |

| | |

| silicification | The introduction of, or replacement by, silica, generally resulting in the formation of fine-grained quartz, chalcedony, or opal, which may fill pores and replace existing minerals |

| | |

| stockworks | A pattern of closely spaced fractures in rock, commonly filled with minerals |

| | |

| stratigraphic | Pertaining to the composition, sequence, and correlation of stratified rocks (rocks formed, arranged, or laid down in layers or strata) |

| | |

| Tax Act | Income Tax Act(Canada) |

| | |

| Treaty | The Canada-U.S. Income Tax Convention (1980) as amended by the Protocols signed on June 14, 1983, March 28, 1984, March 17, 1995 and July 29, 1997 |

| | |

| TSX-V | TSX Venture Exchange |

| | |

| U.S. Holder | A holder of common shares of the Company resident in the United States of America |

| | |

| U.S. Sub | Evolving Gold Corp., which was incorporated pursuant to the laws of the State of Nevada and is a wholly-owned subsidiary of the Company |

| | |

| U.S. Taxpayer | An individual who is a citizen or resident of the United States of America or a domestic corporation in the United States |

- 8 -

| Term | Definition |

| | |

| Underlying Option Agreement | The option and royalty agreement dated March 22, 2004, made between AHL and Golden Arc |

| | |

| Veining | A fracture filled with mineral matter |

| | |

| VLF-EM survey | Very low frequency electromagnetic survey |

| | |

| Winnemucca Agreement | The agreement dated December 3, 2004 made among the Company, Golden and AHL, as amended on January 7, 2005, February 25, 2005, April 21, 2005, January 26, 2006, April 27, 2006, June 16, 2006 and as amended and restated on July 7, 2006 and April 11, 2007 pursuant to which the Company was granted an option to acquire a 100% interest in the Winnemucca Property subject to 2% NSR royalty |

| | |

| Winnemucca Property | A property consisting of 266 mining claims located in Humboldt County, Nevada |

| | |

| Winnemucca Option | The option granted to the Company with respect to the Winnemucca Mountain Property under the Winnemucca Option and Royalty Agreement |

| | |

| Zimtu | International Zimtu Technologies Inc., a related public company |

| | |

| Zn | Zinc |

- 9 -

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF

INFERRED RESOURCES AND INDICATED MINERAL RESOURCES

The SEC permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this Annual Report, such as “inferred resources”, “indicated resources” and “measured resources” that the SEC guidelines strictly prohibit U.S. registered companies from including in their filings with the SEC.

This Annual Report uses the term “inferred resources”. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. Inferred resources have a great amount of uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases.U.S. investors are cautioned not to assume that part or all of an inferred resource exists, or is economically or legally mineable.

This Annual Report also uses the term “indicated mineral resources”. We advise U.S. investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it.U.S. investors are cautioned not to assume that any part or all of the mineral deposits in this category will ever be converted into reserves.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” within the meaning of federal securities laws. You can identify these statements by forward-looking words such an “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will,” and “would” or similar words. Forward-looking statements are not guarantees of future performance and involve substantial risks and uncertainties. You should read statements that contain these words carefully because they discuss our future expectations, contain projections of our future results of operations or of our financial position, or state other forward-looking information. We believe that it is important to communicate our future expectations to our shareholders. However, there may be events in the future that we are not able to predict accurately or control. Therefore, these statements should not be regarded as a representation by us that any of our objectives or plans will be achieved or that any of our operating expectations will be realized. Our revenues and results of operations are difficult to forecast and could differ materially from those projected in the forward-looking statements contained in this Annual Report.

The factors listed below in the section captioned “Risk Factors,” as well as any cautionary language in this Annual Report, provide examples of risks, uncertainties, and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. You should be aware that the occurrence of the events described in these risk factors and elsewhere in this Annual Report could have a material adverse effect on our business, results of operations and financial position. We undertake no obligation to release publicly the results of any future revisions we may make to forward-looking statements to reflect events after the date hereof, or to reflect the occurrence of unanticipated events.

__________________________________

Unless the context otherwise requires in this Annual Report, all references to “Evolving Gold”, the “Company”, “we”, “us”, and “our” refer to Evolving Gold Corp. and its subsidiaries. All dollar amounts set forth in this Annual Report are in Canadian dollars, except where otherwise indicated.

- 10 -

PART I

ITEM 1. Identity of Directors, Senior Management and Advisors

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable.

Not applicable.

ITEM 3. KEY INFORMATION.

3.A. Selected Financial Data

The following selected financial data is derived from the audited financial statements of the Company for the last five fiscal years ended March 31, 2008 and should be read together with the sections of this Annual Report entitled, “Information on the Company” and “Operating and Financial Review and Prospects”. The financial statements are presented in Canadian dollars and have been prepared in accordance with CDN GAAP. Note 13 to the financial statements provides a summary of the material differences between Canadian GAAP and US GAAP

Table No. 1

Selected Financial Data

(CDN$ in 000, except per share data)

| | | Year Ended March 31 | |

| | | | | | | | | | | | | | | | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| CANADIAN GAAP | | | | | | | | | | | | | | | |

| Revenue | | Nil | | | Nil | | | Nil | | | Nil | | | Nil | |

| Net Loss for the Year | $ | (8,742 | ) | $ | (831 | ) | $ | (591 | ) | $ | (402 | ) | $ | (152 | ) |

| Basic and Diluted Loss Per Share | $ | (0.21 | ) | $ | (0.07 | ) | $ | (0.07 | ) | $ | 0.07 | | | N/A | |

| Dividends Per Share | | Nil | | | Nil | | | Nil | | | Nil | | | Nil | |

| Weighted Avg. Shares (000) | | 41,403 | | | 11,582 | | | 8,505 | | | 5,601 | | | 0.1 | |

| Period-end Shares (000) | | 77,082 | | | 12,530 | | | 10,269 | | | 7,350 | | | 0.1 | |

| | | | | | | | | | | | | | | | |

| Working Capital | $ | 24,391 | | | ($177 | ) | $ | 121 | | $ | (144 | ) | $ | 127 | |

| Mineral Properties | $ | 8,824 | | $ | 1,114 | | $ | 737 | | $ | 216 | | $ | 27 | |

| Long-Term Debt | | Nil | | | Nil | | | Nil | | | Nil | | | Nil | |

| Capital Stock | $ | 35,502 | | $ | 2,408 | | $ | 1,714 | | $ | 499 | | $ | 0.1 | |

| Shareholders’ Equity (Deficit) | $ | 33,396 | | $ | 959 | | $ | 859 | | $ | 72 | | $ | 154 | |

| Total Assets | $ | 34,217 | | $ | 1,248 | | $ | 966 | | $ | 223 | | $ | 170 | |

| | | | | | | | | | | | | | | | |

| US GAAP | | | | | | | | | | | | | | | |

| Net Loss | $ | (16,453 | ) | $ | (1,376 | ) | $ | (1,112 | ) | $ | (591 | ) | $ | (179 | ) |

| Loss Per Share (basic and diluted) | $ | (0.40 | ) | $ | (0.12 | ) | $ | (0.13 | ) | $ | (0.11 | ) | | N/A | |

| Mineral Properties | | Nil | | $ | 11 | | | Nil | | | Nil | | | Nil | |

| Shareholders’ Equity | $ | 24,571 | | $ | (155 | ) | $ | 122 | | $ | (144 | ) | $ | 127 | |

| Total Assets | $ | 25,392 | | $ | 134 | | $ | 229 | | $ | 7 | | $ | 143 | |

___________________________

| (1) | Cumulative Net Loss since incorporation through March 31, 2008 under US GAAP was $19,542,999. |

| | |

| (2) | Under US GAAP, options granted to non-employees as compensation for services provided are fair valued as an expense recorded. |

- 11 -

| (3) | Under US GAAP, all costs related to exploration stage properties are expensed in the period incurred, except for mineral property acquisition costs which are considered tangible assets and must be initially capitalized and then evaluated periodically for impairment. |

During the year ended March 31, 2007 Management began to aggressively focus on the acquisition and development of prospective mineral properties and, in accordance with this objective, in the fiscal 2008 year, acquired seven new mineral properties. In order to fund exploration on these properties the Company also successfully raised funds from several private placements during the 2008 year. Commensurate with this increase in mineral properties and the increase in working capital, the Net Loss for 2008 fiscal year also reflected a significant increase due to general and administrative expenses.. In addition Net Loss also includes write-downs of previously deferred exploration expenditures for fiscal 2008, 2007 and 2006 and stock-based compensation charges also primarily incurred in these years.

Total assets as at March 31, 2008 dramatically increased commensurate with cash and shares issued for the acquisition of, and deferred exploration costs incurred for, the various mineral property interests. In addition, capital derived from several private placements of shares, the exercise of options and conversion of warrants has increased the balance of assets, offset by amounts required for administrative purposes.

Exchange Rates

The exchange rate between the Canadian dollar and the U.S. dollar was CDN$1.0114 per US$1.00 as of July 24, 2008. The following tables set forth: (i) the average exchange rate for the financial years-ended March 31, 2008, 2007, 2006, 2005 and 2004, calculated by using the average of the exchange rates on the last day of each month during the period; and (ii) the high and low for each month during the previous six months, each based on the noon rate of exchange for conversion of Canadian dollars into U.S. dollars, as certified for customs purposes by the Federal Reserve Bank of New York.

Table No. 2

Exchange Rates

| March 31, 2008 | | March 31, 2007 | | March 31, 2006 | | March 31, 2005 | | March 31, 2004 |

| | | | | | | | | |

| 1.025425 | | 1.35167 | | 1.189167 | | 1.273533 | | 1.34915 |

| | June | | May | | April | | March | | February | | January |

| | 2008 | | 2008 | | 2008 | | 2008 | | 2008 | | 2008 |

| | | | | | | | | | | | |

| High | 1.0282 | | 1.0187 | | 1.0268 | | 1.0275 | | 1.0188 | | 1.0294 |

| | | | | | | | | | | | |

| Low | 1.0011 | | 0.9840 | | 1.0021 | | 0.9841 | | 0.9717 | | 0.9905 |

3.B. Capitalization and Indebtedness

Not applicable.

3.C. Reasons For The Offer and Use Of Proceeds

Not applicable

3.D. Risk Factors

Before making an investment decision, you should carefully consider the risks and uncertainties described below as well as the other information contained and incorporated by reference in this Annual Report. These risks and uncertainties are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. If any of such

- 12 -

risks actually occur, our business, prospects, financial condition, cash flows and operating results could be materially harmed.

Risks Related to the Company

Cumulative unsuccessful exploration efforts by Company personnel could result in the company having to cease operations.

The expenditures to be made by the Company in the exploration of its properties as described herein may not result in discoveries of mineralized material in commercial quantities. Most exploration projects do not result in the discovery of commercially mineable ore deposits and this occurrence could ultimately result in the Company having to cease operations.

The Company has no reserves on the properties in which it has an interest and if reserves are not defined the company would have to cease operations.

The properties in which the Company has an interest or the concessions in which the Company has the right to earn an interest are in the exploratory stage only and are without a known body of ore. There can be no assurance that any minerals will be found on any of the Company’s properties. If the Company does not ultimately find a body of ore, it would have to cease operations.

Even if the Company identifies mineral deposits, a substantial amount of capital will have to be spent before management will know if the Company has a commercially viable mineral deposit on each of its properties.

Even if the Company completes its exploration programs on its properties and is successful in identifying mineral deposits, a substantial amount of capital will still have to be spent over the next 2 years on each deposit on further drilling and engineering studies before management will know if the Company has a commercially viable mineral deposit on each of the properties. No assurance can be provided that commercially viable mineral deposits will be located on any of the Company’s properties.

The Company has minimal positive cash flow and no recent history of significant earnings and is dependent upon public and private distributions of equity to obtain capital in order to sustain operations. Public distributions of equity result in dilution to existing shareholders.

None of the Company’s properties have advanced to the commercial production stage and the Company has no history of earnings or positive cash flow from operations. The cumulative net loss since the Company’s inception under US GAAP is $19,542,999. The Company does not know if it will ever generate material revenue from mining operations or if it will ever achieve self-sustaining commercial mining operations. The Company will require significant additional financing to pursue its business plans. Historically, the only source of funds available to the Company has been through the sale of its common shares. Any future additional equity financing would cause dilution to current stockholders. Management has no current plans to enter into any debt obligations and plans to meet all capital requirements through the issuance of the Company’s capital stock. However, there can be no assurance that it will obtain any such financing.

The Company currently has 7,208,500 share purchase options outstanding and 30,040,819 share purchase warrants outstanding. If all of the share purchase options and share purchase warrants were exercised, the number of common shares issued and outstanding would increase from 78,590,217 to 115,839,536.

The risks associated with penny stock classification could affect the marketability of the common stock of the Company and shareholders could find it difficult to sell their stock.

The Company’s stock is subject to “penny stock” rules as defined in 1934 Securities and Exchange Act rule 3a51-1. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. The Company’s common shares are subject to these penny stock rules. Transaction costs associated with purchases and sales of penny stocks are likely to be higher than those for other securities. Penny stocks generally are equity

- 13 -

securities with a price of less than U.S. $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from such rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the Company’s common shares in the United States and shareholders may find it more difficult to sell their shares.

The Company is dependent on key personnel and the absence of any of these individuals could result in the Company having to cease operations.

While engaged in the business of exploiting mineral properties, the nature of the Company’s business, its ability to continue its exploration of potential exploration projects, and to build a competitive edge in the marketplace, depends, in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense and the Company may not be able to attract and retain such personnel. The Company’s growth will depend, on the efforts of its Senior Management, particularly its Chief Executive Officer, Robert Bick, its Chief Financial Officer, Vitaly Melnikov and its President, Dr. Quinton Hennigh. We do not carry key person insurance on senior management and other personnel.

The Company’s directors may have a conflict of interest with the Company as such directors or senior management also serve on boards of companies in the same industry as the Company.

Directors of the Company also serve as directors of other similar companies involved in natural resource development. Accordingly, it may occur that properties will be offered to both the Company and such other companies. Furthermore, those other companies may participate in the same properties as those in which the Company has an interest. As a result, there may be situations which involve a conflict of interest. In that event, the directors would not be entitled to vote at meetings of directors which evoke any such conflict. The directors will attempt to avoid dealing with such other companies in situations where conflicts might arise and will at all times use their best efforts to act in the best interests of the Company. If the directors fail to do so, however, there could be material adverse consequences to the Company, its business and results of operations.

Dilution through employee/director/consultant options could adversely affect the Company’s stockholders.

Because the success of the Company is highly dependent upon its respective employees, the Company has granted to some or all of its key employees, directors and consultants options to purchase common shares as non-cash incentives. To the extent that significant numbers of such options may be granted and exercised, the interests of the other stockholders of the Company may be diluted. As of July 24, 2008, there are 7,208,500share purchase options outstanding, which, if exercised, would result in an additional 7,208,500 Shares being issued and outstanding. (For a breakdown of dilution, refer to the risk factor entitled: “The Company Has Minimal Positive Cash Flow and No Recent History of Significant Earnings and Is Dependent upon Public and Private Distributions of Equity to Obtain Capital in Order to Sustain Operations. Public distributions of capital result in dilution to existing shareholders.”)

- 14 -

U.S. Investors may not be able to enforce their civil liabilities against us or our directors, controlling persons and officers.

It may be difficult to bring and enforce suits against the Company. The Company is a corporation incorporated in Canada under the CBCA. A majority of the Company’s directors must be residents of Canada, and all or substantial portions of their assets are located outside of the United States, predominately in Canada. As a result, it may be difficult for U.S. holders of our common shares to affect service of process on these persons within the United States or to realize in the United States upon judgments rendered against them. In addition, a shareholder should not assume that the courts of Canada (i) would enforce judgments of U.S. courts obtained in actions against us or such persons predicated upon the civil liability provisions of the U.S. federal securities laws or other laws of the United States, or (ii) would enforce, in original actions, liabilities against us or such persons predicated upon the U.S. federal securities laws or other laws of the United States.

However, U.S. laws would generally be enforced by a Canadian court provided that those laws are not contrary to Canadian public policy, are not foreign penal laws or laws that deal with taxation or the taking of property by a foreign government and provided that they are in compliance with applicable Canadian legislation regarding the limitation of actions. Also, a Canadian court would generally recognize a judgment obtained in a U.S. Court except, for example:

a) where the U.S. court where the judgment was rendered had no jurisdiction according to applicable Canadian law;

b) the judgment was subject to ordinary remedy (appeal, judicial review and any other judicial proceeding which renders the judgment not final, conclusive or enforceable under the laws of the applicable state) or not final, conclusive or enforceable under the laws of the applicable state;

c) the judgment was obtained by fraud or in any manner contrary to natural justice or rendered in contravention of fundamental principles of procedure;

d) a dispute between the same parties, based on the same subject matter has given rise to a judgment rendered in a Canadian court or has been decided in a third country and the judgment meets the necessary conditions for recognition in a Canadian court;

e) the outcome of the judgment of the U.S. court was inconsistent with Canadian public policy;

f) the judgment enforces obligations arising from foreign penal laws or laws that deal with taxation or the taking of property by a foreign government; or

g) there has not been compliance with applicable Canadian law dealing with the limitation of actions.

As a “foreign private issuer”, the Company is exempt from the Section 14 proxy rules and Section 16 of the 1934 Securities Act may result in shareholders having less complete and timely data.

The submission of proxy and annual meeting of shareholder information (prepared to Canadian standards) on Form 6-K may result in shareholders having less complete and timely data. The exemption from Section 16 rules regarding sales of common shares by insiders may result in shareholders having less data. This data includes:

1. Insider trading data disclosed on Canadian regulatory websites is different.

2. U.S. companies have specified content and filing requirements regarding disclosures to shareholders for the annual meeting and Canadian regulations specify a modestly different content.

3. Canadian interim financial statements are not necessarily prepared according to U.S. GAAP.

4. The filing deadlines for foreign private issuers are different than for U.S. issuers.

- 15 -

The Company’s possible foreign investment company status has consequences for U.S. Investors.

Potential investors who are U.S. taxpayers should be aware that the Company could be considered a PFIC for U.S. tax purposes for the fiscal year ended March 31, 2008. If the Company is a PFIC for any year during a U.S. taxpayer’s holding period, then such U.S. taxpayer generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a QEF election or a mark-to-market election with respect to the shares of the Company. In certain circumstances, the sum of the tax and the interest charge may exceed the amount of the excess distribution received, or the amount of proceeds of disposition realized, by the taxpayer. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of the Company’s net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. A U.S. taxpayer who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer’s tax basis therein. See also Item 10E “Taxation – United States Federal Income Tax Consequences.”

Risks Related to the Industry

Operating hazards and risks associated with the mining industry could result in the Company having to cease operations.

Resource exploration activities generally involve a high degree of risk. Hazards such as unusual or unexpected formations and other conditions are involved. Operations in which the Company has a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration for precious and base metals, any of which could result in work stoppages, damage to or destruction of exploration facilities, damage to life and property, environmental damage and legal liability for any or all damage. The Company may become subject to liability for cave-ins and other hazards for which it cannot insure or against which it may elect not to insure where premium costs are disproportionate to the Company’s perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration activities and could force the Company to cease operations.

The amount of capital necessary to meet all environmental regulations associated with the exploration programs of the Company could be in an amount great enough to force the Company to cease operations.

The current and anticipated future operations of the Company, including further exploration activities require permits from various Federal and Provincial governmental authorities in Canada and the United States. (The Company has the required permissions to enable it to engage in exploration work consisting of rock sampling and geophysical mapping.) Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, mine safety and other matters. Unfavourable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations by the Company.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in resource exploration may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations.

Large increases in capital expenditures resulting from any of the above factors could force the Company to cease operations.

- 16 -

Mineral prices may not support corporate profit for the Company.

The resource exploration industry is intensely competitive and even if commercial quantities of mineral resources are found (which is not guaranteed), a profitable market may not exist for the sale. If a profitable market does not exist, the Company may have to cease operations.

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

General

The Company was incorporated under the CBCA on June 19, 2003 as 6109527 Canada Ltd. On September 30, 2003, the Company changed its name to Evolving Gold Corp. The Company’s registered office is located at 1500 – 1055 West Georgia Street, PO Box 11117, Vancouver, British Columbia, Canada, V6E 4N7. The Company’s principal place of business is located at 725 - 666 Burrard Street, Vancouver, British Columbia, V6C 2X8, its telephone number is (604) 685-6375 and its facsimile number is (604) 909-1163. The Company’s website address iswww.evolvinggold.com and its e-mail address isinfo@evolvinggold.com. The Company became a reporting issuer in the Provinces of Alberta, British Columbia and Ontario on May 14, 2004. On June 14, 2004, the Company officially began trading on the CNQ under stock symbol “GOLD”. On July 28, 2005, the Company began trading on the OTCBB exchange in the United States under the stock symbol “EVOGF”. On June 13, 2007, the Company began trading on the TSX-V under the stock symbol “EVG”. The Company continues to be listed for trading on the OTCBB exchange, but ceased to be listed for trading on the CNQ on June 13, 2007 when the Company graduated to the TSX-V. Effective August 13, 2007 the Company became listed on the Frankfurt Stock Exchange under the stock symbol “EV7”.

On January 24, 2008, the Company announced a proposed dividend-in-kind transaction involving the transfer of the Carlin Properties, discussed in more detail below, into a new company, subject to the Carlin Agreement. The Company is currently evaluating its options with respect to this transaction. For more information about the proposed transaction please refer to the news release dated January 24, 2008 that is attached as Exhibit 99.15 to the Company’s Form 6-K for July 2008, which was filed with the SEC and can be viewed at www.sec.gov.

The Company is a Canadian-based precious mineral exploration company engaged in the acquisition and exploration of natural resource properties. Currently its focus is on projects in the Southwestern United States, particularly Nevada, with additional properties in New Mexico and Wyoming. The Company continues to emphasize the exploration of properties where management believes there is potential for the discovery of high grade deposits.

Even if the Company completes its exploration programs on its properties and is successful in identifying mineral deposits, a substantial amount of capital will still have to be spent over the next 2 years on each deposit on further drilling and engineering studies before management will know if the Company has a commercially viable mineral deposit on each of the properties. No assurance can be provided that commercially viable mineral deposits will be located on any of the Company’s properties.

Past Property Interests

Murray Property

On July 22, 2003, the Company entered into the Murray Property Agreement with Zimtu, pursuant to which the Company was granted an option to acquire a 70% undivided interest in the Murray Property. At the date of the Murray Property Agreement, the Company was a wholly owned subsidiary of Zimtu. Currently Zimtu owns less than 3% of the outstanding shares of the Company. The Murray Property consists of one mineral claim totaling 2,965 acres and is located 78 kilometres northeast of Yellowknife, Northwest Territories.

- 17 -

The Company terminated its option on the Murray Property in 2007 and accordingly wrote-off $11,825 in expenditures related to this property.

Voisey Bay Labrador Property

On May 4, 2005 the Company entered into an option agreement with Geocore, whereby the Company was granted an option to earn up to an 80% interest in two blocks, comprising 192 claims, in Geocore’s Voisey Bay area property in Labrador. A first option, for the purchase of a 60% interest, was exercised in exchange for $35,000, and the obligation to incur $200,000 in exploration expenditures by October 31, 2006 with cumulative exploration costs of $500,000 incurred by October 31, 2007.

During the 2007 fiscal year the Company terminated this option agreement and accordingly wrote-off $80,170 in expenditures related to this property.

Winnemucca Property

Effective December 3, 2004, the Company entered into an option agreement with Golden Sands and Golden Sands’ subsidiary company, AHL, to acquire unpatented mineral claims located in Humboldt County, Nevada. A finder’s fee of 100,000 Shares was issued in connection with the acquisition of the Winnemucca Property in December 2004. The December 3, 2004 option agreement was subsequently amended on January 7, 2005, February 25, 2005, April 21, 2005, January 26, 2006, April 27, 2006 and June 16, 2006, and further amended and restated July 7, 2006, and subsequently amended April 11, 2007 and October 17, 2007 (the “Winnemucca Agreement”). Under the Winnemucca Agreement, any unpatented or patented mining claims located within three miles of the subject claims acquired or located would, at the option of the other parties, form part of the subject claims. Since December 3, 2004, when there were 62 unpatented mineral claims the subject of the Winnemucca Agreement, 204 additional claims were staked by AHL and the Company, resulting in a total of 266 unpatented claims the subject of the Winnemucca Agreement.

In order to exercise the Winnemucca Option, the Company was required to make aggregate cash payments to Golden Sands of US$80,000 (paid), issue and deliver 1,800,000 shares (issued) in the capital of the Company (“Shares”), incur exploration expenditures of US$4,000,000, pay various costs related to amending the Winnemucca Agreement, and prepare a NI 43-101 Report, which was prepared and dated October 29, 2006.

The Winnemucca Property was subject to a 2% royalty and advance royalty payments, of which US$20,000 was paid.

In September, 2005 the Company signed a letter of intent with Meridian Gold Inc. regarding an option by Meridian Gold Inc. to acquire, directly or indirectly, an undivided 70% interest in the Winnemucca Option. An earn-in agreement was subsequently signed on July 31, 2006 to formalize this arrangement under which Meridian Gold Inc. assigned their interest to Meridian Minerals Corp. Under the terms of the agreement, Meridian Minerals Corp. could earn a 70% interest in the Winnemucca Property by making a total contribution of US$500,000 in staged cash payments to the Company by December 31, 2008 (US$160,000 was received as of December 31, 2007), and incurring total exploration expenditures of US$4,000,000 by December 31, 2008.

In December 2007, Meridian Gold Inc. terminated the earn-in agreement and, in February 2008, the Company decided to terminate the Winnemucca Agreement and wrote off CDN$1,235,889 in deferred expenditures relating to the Winnemucca Property.

Rye Patch Property

During the year ended March 31, 2008 the Company acquired, by staking, an interest in this Nevada property but after reviewing the results from a sampling program, subsequently decided not to pursue development. Accordingly CDN$49,199 of costs incurred to date on this property were written down to nil.

- 18 -

Current Property Interests

Malone Property

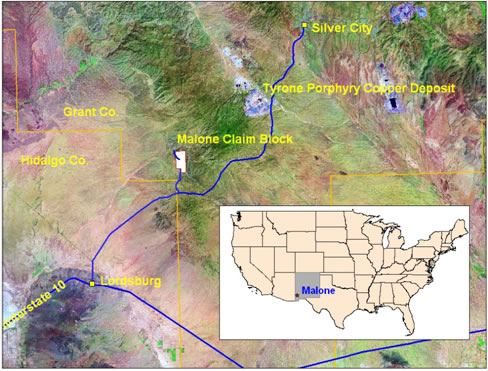

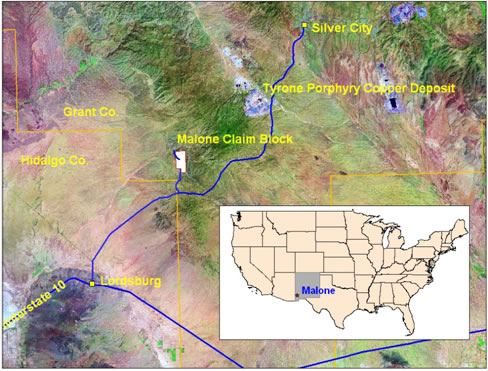

On April 17, 2006, the Company entered into a quitclaim deed and royalty agreement with Newmont North America Exploration Limited (the “Malone Agreement”), pursuant to which the Company was granted all rights, title, estate and interest in 80 unpatented mineral claims covering 665 hectares located in Grant County in southwest New Mexico in exchange for payment of US$10,000 (paid) and an additional US$10,000 payable in one year (paid). The agreement is subject to a 2% NSR royalty

Siesta Property

The Company’s interest in the Siesta group is comprised of 702 unpatented mining claims covering approximately 5,870 hectares situated in the Slumbering Hills area of Humboldt County, Nevada.

Alpha Butte Property

With respect to its interest in Alpha Butte, the Company has staked and retained 62 claims covering approximately 550 hectares located 30 kilometres southwest of the town of Winnemucca in Nevada

Fisher Canyon Property

The Company’s interest in the Fisher Canyon property presently consists of 79 unpatented lode mining claims staked by the company covering approximately 670 hectares of property located near the Relief Canyon and Florida Canyon areas in Nevada

In February 2008, the Company signed a Letter of Intent with an individual to acquire an undivided 100% interest in and to 12 unpatented mining claims near the Fisher Canyon Property in exchange for US$8,000 on March 7, 2008 (paid), US$12,000 on March 7, 2009 and US$20,000 on March 7, 2010. The Company will also pay an NSR on production of 3% to the individual and has the exclusive right and option to purchase 50% of the royalty for US$150,000 within three years of the Letter of Intent.

Rattlesnake Hills Property

In January 2008, the Company and the U.S. Sub entered into a property option agreement (the “Rattlesnake Hills Option Agreement”) with Golden Predator (US) Mines Inc. (“Golden Predator”) and a binding letter agreement (the “Rattlesnake Hills Letter Agreement”) with Bald Mountain Mining Company (‘Bald Mountain”).

Pursuant to the Rattlesnake Hills Option Agreement, the U.S. Sub was granted an exclusive option (the “Rattlesnake Hills Option”) to earn up to a 100% interest in the Rattlesnake Hills Property located in Natrona County, Wyoming. In order to exercise the Rattlesnake Hills Option, the Company must issue 3,000,000 Shares to Golden Predator (1,000,000 Shares have been issued as of the date of this Annual Report) over two years, and the Company must incur exploration expenditures totalling US$5,000,000 in stages on or before August 14, 2010 (CDN$58,450 has been incurred as of March 31, 2008). Golden Predator retained a 0.5% NSR royalty in respect of the Rattlesnake Hills Property and the Company retained the right to buy back 0.25% of that NSR royalty for US$375,000. The Rattlesnake Hills Property is subject to a 4% NSR royalty payable to the underlying owners. In addition, Golden Predator retained the right to purchase up to 10% of any Shares offered by the Company during the term of the Rattlesnake Hills Option Agreement, with Golden Predator’s purchase subject to the same terms and conditions as other purchaser participating in the offering.

Pursuant to the Rattlesnake Hills Letter Agreement, Bald Mountain assigned to the Company its rights under the option agreement, dated December 11, 2007, between Golden Predator and Bald Mountain, which underlies the Rattlesnake Hills Option Agreement. In consideration for this assignment, the Company paid Bald Mountain US$200,000 and issued 400,000 Shares to Bald Mountain.

- 19 -

A finder’s fee, by way of 75,000 Shares, was paid in connection with the Company’s acquisition of its interest in the Rattlesnake Hills Property.

Subsequent to entering into the Rattlesnake Hills Option Agreement and the Rattlesnake Hills Letter Agreement, the Company acquired, through staking and filing 35 unpatented claims, resulting in an additional 283 hectares (700 acres), thereby increasing its total Rattlesnake Hills Property land position to approximately 1,618 hectares (4,000 acres).

North Carlin District

On November 28, 2007, the Company entered into an exploration lease and sublease agreement (the “Carlin Agreement”) with Newmont USA Limited, Newmont Mining Corporation (“Newmont”),Newmont Capital Limited, Elko Land and Livestock Company and the U.S. Sub. Pursuant to the Carlin Agreement, Newmont leased to the Company its interest in certain unpatented mining claims and owned fee interests and subleased to the Company its interest in certain leased lands and leased unpatented claims, subject to a back-in right. The Carlin Agreement covers five separate “Project Areas” – Carlin, Cottonwood Creek, Susie Creek, Boulder Valley and Sheep Creeks. The Sheep Creeks Project Area includes approximately 38,000 acres (1,959 claims) that was staked by the Company (the “Battle Mountain Property”) and approximately 10,500 acres of Newmont-held surface and minerals fee land. The Boulder Valley Project Area includes approximately 1,846 acres (94 claims) that was staked by Newmont and approximately 11,000 acres of Newmont-held surface and minerals fee land. The Carlin Project Area includes approximately 1,750 acres ( 92 claims) that was staked by the Company, approximately 3,075 acres (150 claims) that was staked by Newmont, and approximately 6,250 acres of Newmont-held surface and minerals fee land. The Cottonwood Creek Project Area includes approximately 2,135 acres (111 claims) that was staked by Newmont. There are no land holdings for the Susie Creek at this time.

Under the Carlin Agreement, the Company is required to make exploration expenditures within each Project Area, with the exception of Susie Creek, in the aggregate amount of US$3,500,000 over a period of five years for a total of US$14,000,000, with 70% of such expenditures in direct drilling costs and an initial $200,000 expenditure in each Project Area. In the event Newmont or the Company acquires any interest in minerals within the Susie Creek Project Area, the Company is required to incur US$3,500,000 in exploration expenditures over a similar five year period from the acquisition date then determined. As of March 31, 2008, CDN$3,067,430 had been incurred in exploration costs. Beginning on the sixth anniversary of the Carlin Agreement, the Company is required to spend at least $750,000 in exploration expenditures in each Project Area or pay Newmont a rental of $10 per acre for such Project Area, escalating at 5% per year.

The Carlin Agreement contains provisions for a 2% NSR on precious metals and 5% gross production royalty on coal, oil, gas and other hydrocarbons and geothermal resources applicable to certain properties. With respect to each Project Area, Newmont retained an option to enter into one or more joint ventures with the Company and earn a 51% interest in the Project Area by expending 200% of the exploration expenditures made by the Company, and an additional 19% interest (for a total undivided interest of 70%) by expending an additional 150% of the exploration expenditures made by the Company.

Jake Creek Mineral Property

In late December, 2007 the Company acquired by staking approximately 427 claims totalling 8,700 acres several kilometres northwest of the Sheep Creeks mineral property in north-central Nevada.

For more information on the Company’s current properties of interest, please refer to Item 4.B. “Business Overview” and Item 4.D. “Property, Plants and Equipment,” below.

Capital Expenditures

During the year ended March 31, 2008, the Company paid US$10,000 to extend certain terms of the Winnemucca Agreement, US$10,000 in compliance with the terms of the Malone Property Agreement, US$8,000 as part of the interest in the Cottonwood Creek Project Area and US$200,000 together with $19,523 in legal costs were also

- 20 -

incurred to acquire the Rattlesnake Hills Option. In addition, the Company incurred $5,398,736 in deferred exploration expenses relating to its various mineral property interests and paid a total of $212,249 for office furnishings and equipment required for new offices for both the Canadian and US operations, and two vehicles and geological equipment used for exploration purposes. With respect to the mineral property interests, $1,285,088 in deferred expenditures have been written down to nil in the year ended March 31, 2008 including the Winnemucca write down of $1,235,889 and the Rye Patch write down of $49,199. These expenditures were all financed from working capital. The Company also issued common shares with a fair value of $400,000 and $2,950,000 with respect to the Winnemucca Option and Rattlesnake Option, respectively.

During the year ended March 31, 2007, the Company paid US$10,000 for advance royalty payments with respect to the Winnemucca Option and US$10,000 in compliance with the terms of the Malone Property Agreement. The Company also issued common shares with a fair value of $184,000 with respect to the Winnemucca Option, incurred $767,588 in deferred exploration expenses relating to its various property options and paid legal costs of $83,939 which were recorded as part of resource property acquisition cost. Reclamation deposits of $18,982 and office furnishings and equipment totalling $23,106 were also acquired during the year.

During the year ended March 31, 2006, the Company paid $35,000 in compliance with the terms of the Voisey Bay Option. The Company also issued common shares with a fair value of $244,000 and paid cash of US$50,000 on account of the Winnemucca Option as well as paying US$10,000 for advance royalty payments payable pursuant to the terms of the Winnemucca Agreement. The Company also incurred $173,466 in geological consulting, staking and recording and field expenses related to its various property options and paid legal costs of $39,596, which were recorded as part of the resource property acquisition cost.

Takeover Offers

We are not aware of any indication of any public takeover offers by third parties in respect of our common shares during our last and current financial years.

4.B. Business Overview

Business Strategy and Principal Activities

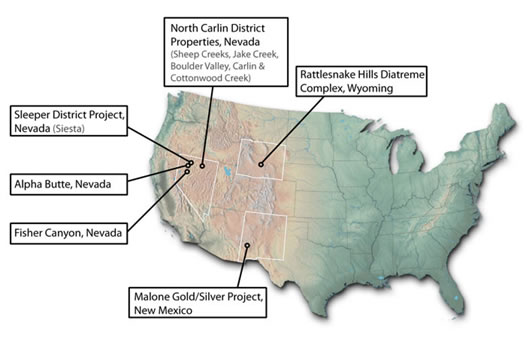

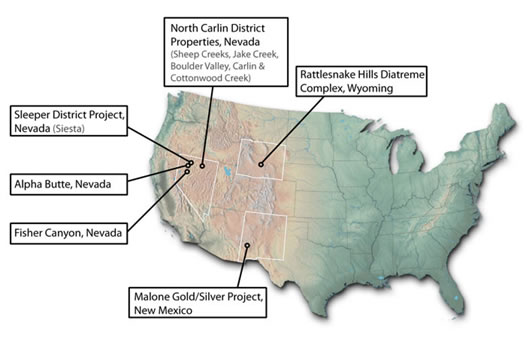

Since its incorporation, the Company’s principal business has been the acquisition and exploration of natural resource properties, with the goal of placing into production any properties so warranting. Currently, the Company’s focus is on projects in Southwestern United States, particularly Nevada with additional properties located in New Mexico and Wyoming. The Company continues to emphasize the development of properties where management believes there is potential for the discovery of high grade deposits (Figure 1). Currently the Company is exploring ten separate mineral properties, primarily in known, producing gold trends in Nevada including undertaking a drilling program on the Boulder Valley, Sheep Creeks, Malone, Siesta and Fisher Canyon prospects. Please refer to the above descriptions of mineral properties for more detailed explanations of the current and planned exploration of each property. The Company’s primary properties are the Malone Property and the Rattlesnake Hills Property.

- 21 -

Figure 1: Properties Location Map

Malone Property

On April 17, 2006, the Company entered into the Malone Agreement with Newmont North America Exploration Limited whereby the Company was granted all rights, title, estate and interest in 80 unpatented mineral claims located in Grant County in southwest New Mexico, in exchange for payment of US$20,000 (paid). The Malone Agreement is subject to a 2% NSR royalty. By June, 2007, the Company had completed detailed mapping, surveying and sampling of this property. A diamond drill program was initiated in October 2007 and was completed on January 2, 2008. The diamond drilling totaled 950 meters in 10 holes, to depths of up to 183 meters. All ten holes encountered significant gold and silver mineralization. Better intercepts include 17.6 m grading 0.48 grams per tonne (“gpt”) gold and 41 gpt silver in MAL-04, 5.5 m grading 1.53 gpt gold, and 164 gpt silver in MAL-06, 12.7 m grading 0.58 gpt gold and 57 gpt silver in MAL-07. The Company has incurred deferred exploration costs of $448,548 on the Malone Property during the year ended March 31, 2008, which included $158,713 for drilling, $87,067 for geological consulting, $138,032 for permits, staking and recording, and $64,736 for field and other expenses.

Technical Report -In March 2007, a NI 43-101 Report, prepared by Gerald E. Ray, Ph.D. as the qualified person and dated as at February 20, 2007, on the Malone Property was filed on SEDAR. The NI 43-101 Report was subsequently amended as at May 23, 2007 and filed on SEDAR in June 2007.

The Company plans to continue to conduct a success-contingent exploration program in late calendar 2008 in an effort to detect both high grade veins and lower grade bulk tonnage deposits amenable to open pit mining. Drilling will target areas of newly discovered disseminated gold and silver mineralization encountered during the 2007 drill program and will have an anticipated budget of approximately US$300,000.

Rattlesnake Hills Property

In January 2008, the Company and the U.S. Sub entered into the Rattlesnake Hills Option Agreement with Golden Predator and the Rattlesnake Hills Letter Agreement with Bald Mountain. Pursuant to the Rattlesnake Hills Option Agreement, the U.S. Sub was granted the Rattlesnake Hills Option. In order to exercise the Rattlesnake Hills Option, the Company must issue 3,000,000 Share to Golden Predator (1,000,000 Shares have been issued as of the

- 22 -

date of this Annual Report) over two years and the Company must incur exploration expenditures totaling US$5,000,000 in stages on or before August 14, 2010. As at March 31, 2008, $58,450 in geological consulting and field expenses had been incurred with respect to the Rattlesnake Hills Property.

Golden Predator retained a 0.5% NSR royalty in respect of the Rattlesnake Hills Property and the Company retained the right to buy back 0.25% of that NSR royalty for US$375,000. The Rattlesnake Hills Property is subject to a 4% NSR royalty payable to the underlying owners. In addition, Golden Predator retained the right to purchase up to 10% of any Shares offered by the Company during the term of the Rattlesnake Hills Option Agreement, with Golden Predator’s purchase subject to the same terms and conditions as other purchaser participating in the offering.

Pursuant to the Rattlesnake Hills Letter Agreement, Bald Mountain assigned to the Company its rights under the option agreement, dated December 11, 2007, between Golden Predator and Bald Mountain, which underlies the Rattlesnake Hills Option Agreement. In consideration for this assignment, the Company paid Bald Mountain US$200,000 and issued 400,000 Shares to Bald Mountain.

A finder’s fee, by way of 75,000 Shares, was paid in connection with the Company’s acquisition of its interest in the Rattlesnake Hills Property.

Subsequent to entering into the Rattlesnake Hills Option Agreement and the Rattlesnake Hills Letter Agreement, the Company acquired, through staking and filing on 35 unpatented claims, resulting in an additional 283 hectares (700 acres), thereby increasing its total Rattlesnake Hills Property land position to approximately 1,618 hectares (4,000 acres).

Technical Report – In October 2007, a NI 43-101 Report, prepared by Gerald E. Ray, Ph.D. as the qualified person and dated as at October 3, 2007, on the Rattlesnake Hills Property was filed on SEDAR. The NI 43-101 Report was subsequently amended as at December 7, 2007, January 29, 2008 and February 15, 2008, and filed on SEDAR in December 2007, February 2008, and February 2008, respectively.

The Rattlesnake Hills area is host to an alkaline volcanic center comprised of over 40 intrusions and diatremes. Gold mineralization was discovered here in the late 1980’s by American Copper and Nickel Corporation and was subsequently drilled by Newmont Corporation. Gold is closely associated with alkaline volcanic rocks. The Rattlesnake Hills project is the focus of an extensive drill campaign planned by the Company to test three sizeable targets evident on the property. A total of approximately 7,000 m of diamond drilling is planned. Two drills began operating on June 21, 2008 and have currently produced approximately 1,300 m of core with assays expected by September, 2008. It is the Company’s intention to conduct sufficient drilling this season to enable it to formally evaluate historic resources found on the property and results from this first phase of drilling will determine the future level of drilling and other exploration work to be performed.. A budget of approximately US$2,400,000 has been allocated to the property.

Siesta Property

The Company’s interest in the Siesta group is comprised of 702 unpatented mining claims covering 5,870 hectares situated in the Slumbering Hills area of Humboldt County, Nevada. During the year ended March 31, 2008, Evolving conducted systematic geophysical surveys of this claim group, and undertook a concurrent geochemical survey with the objective of defining drill targets. Two reverse circulation drills drilled a total of 34 exploration holes at Siesta between January and May, 2008, testing geophysical anomalies. The holes averaged a depth of 200 meters. Twenty-nine of these holes failed to encounter the favourable rocks known to host gold mineralization in the region. Five holes intersected Miocene age felsic volcanic rocks known to host gold deposits at the adjoining Sleeper and Sandman properties. Clay alteration and minor silicification were present over narrow intervals in these holes. Anomalous gold values ranging from 0.01 -0.25 gpt are associated with these altered zones As at March 31, 2008, the Company had incurred $1,166,046 in deferred exploration expenditures for the fiscal year including drilling of $461,050, geophysical and geological studies of $222,926, staking and recording of $372,741, geological consulting of $44,445 and field and other expenses of $64,884.

- 23 -

The Company intends to review drill data coming in from its recently completed drill program and decide on future plans by late 2008.

Fisher Canyon Property

The Company’s interest in the Fisher Canyon Property consists of 79 unpatented mining claims staked by the Company covering approximately 670 hectares located in the Humboldt Range in north central Nevada. In February, 2008, the Company signed a Letter of Intent with an individual to acquire an undivided 100% interest in and to 12 unpatented mining claims near Fisher Canyon property in exchange for US$8,000 on March 7, 2008 (paid), US$12,000 on March 7, 2009 and US$20,000 on March 7, 2010. The Company will also pay an NSR on production of 3% to the individual and has the exclusive right and option to purchase 50% of the royalty for US$150,000 within three years of the Letter of Intent. During the year ended March 31, 2008 the Company conducted further geochemical and geophysical surveys on this property, completed the initial reconnaissance drilling phase as well as a second reverse circulation drilling program completed in December, 2007. The December drilling program totalled 971 meters in thirteen holes, each ranging from 40 to 137 meters in depth with twelve of the thirteen holes encountering gold values. Mineralized drill intervals ranged up to 25.91 meters grading 0.87 grams per tonne (“gpt”) gold including 7.62 meters grading 1.66 gpt gold from the reverse circulation drilling program.

Once the new results are interpreted the Company plans to carry out a more comprehensive drilling program over a broader area of the Fisher Canyon Property.

For the year ended March 31, 2008 the Company incurred deferred exploration expenditures of $428,893 including $269,759 for drilling, $41,275 for staking and recording and $117,859 for geological consulting, field and other expenses. The Company plans to conduct further exploratory drilling on additional targets on the property in late 2008. A budget of approximately US$400,000 is planned for second phase drilling.

Alpha Butte Property

The Company’s interest in the Alpha Butte Property consists of 62 staked claims covering 450 hectares located 30 km southwest of the town of Winnemucca, Nevada. The Company is currently concentrating its efforts on the Fisher Canyon and Siesta Properties but plans to continue surface mapping and sampling of this property with the objective of defining drill targets over the next year. As at March 31, 2008, deferred exploration expenditures of $91,606 have been incurred including $72,921 of exploration expenditures incurred in the current year primarily for staking.

The Company intends to conduct further prospecting on the property in late 2008.

North Carlin District

On November 28, 2007, the Company entered into the Carlin Agreement with Newmont USA Limited, Newmont, Newmont Capital Limited, Elko Land and Livestock Company and the U.S. Sub. Pursuant to the Carlin Agreement, Newmont leased to the Company its interest in certain unpatented mining claims and owned fee interests and subleased to the Company its interest in certain leased lands and leased unpatented claims, subject to a back-in right. The Carlin Agreement cover five separate “Project Areas” – Carlin, Cottonwood Creek, Susie Creek, Boulder Valley and Sheep Creeks. The Sheep Creeks Project Area includes the Battle Mountain Property (approximately 38,000 acres (1,959 claims) that was staked by the Company) and approximately 10,500 acres of Newmont-held surface and minerals fee land. The Boulder Valley Project Area includes approximately 1,846 acres (94 claims) that was staked by Newmont and approximately 11,000 acres of Newmont-held surface and minerals fee land. The Carlin Project Area includes approximately 1,750 acres ( 92 claims) that was staked by the Company, approximately 3,075 acres (150 claims) that was staked by Newmont, and approximately 6,250 acres of Newmont-held surface and minerals fee land. The Cottonwood Creek Project Area includes approximately 2,135 acres (111 claims) that was staked by Newmont. There are no land holdings for the Susie Creek at this time.

- 24 -

Under the Carlin Agreement, the Company is required to make exploration expenditures within each Project Area, with the exception of Susie Creek, in the aggregate amount of US$3,500,000 over a period of five years for a total of US$14,000,000, with 70% of such expenditures in direct drilling costs and an initial $200,000 expenditure in each Project Area

Beginning on the sixth anniversary of the Carlin Agreement, the Company is required to spend at least $750,000 in exploration expenditures in each Project Area or pay Newmont a rental of $10 per acre for such Project Area, escalating at 5% per year. The Carlin Agreement contains provisions for a 2% NSR on precious metals and 5% gross production royalty on coal, oil, gas and other hydrocarbons and geothermal resources applicable to certain properties.

With respect to each Project Area, Newmont retained an option to enter into one or more joint ventures with the Company and earn a 51% interest in the Project Area by expending 200% of the exploration expenditures made by the Company, and an additional 19% interest (for a total undivided interest of 70%) by expending an additional 150% of the exploration expenditures made by the Company.

Subsequent to entering into the Carlin Agreement, the Company acquired, by staking and filing on, 427 mining claims covering 8,600 acres (the “Jake Creek Project”) between the Carlin and Getchell Gold trends in north-central Nevada.

A total of $62,088 of deferred exploration costs have been incurred for the Carlin and Cottonwood Project Areas, which are in early stages of exploration. The Boulder Valley Project Area had a total of $419,723 in deferred exploration costs incurred on it for the current fiscal year comprised of $349,609 in drilling, and $70,114 in other expenses. During fiscal 2008, $2,585,619 in deferred exploration was incurred with respect to the Sheep Creeks Project Area, comprised of $1,490,517 in drilling, $580,304 in staking and recording, $171,233 in licenses and fees, $126,769 in geological consulting, $117,629 in geophysical and geological studies and $99,167 in field and other expenses.

With respect to the Sheep Creeks Mineral Property (RC-001) was terminated after reaching a depth of 463 meters due to technical problems. Assays from the lower portion of this hole averaged 0.22 gpt gold over approximately 128 m, a non-economic yet geologically significant discovery. This mineralization is associated with elevated levels of the typical pathfinder elements (As, Sb, Hg and Tl) associated with large gold deposits of the region. Because of these results, a diamond drill rig was mobilized to the site on January 7, 2008. An attempt was made (RCC-001) to twin the initial reverse circulation drill hole, but due to technical reasons, failed at about 372 m depth. A second core hole (RCC-002) was attempted approximately 125 meters southwest of the original RC-001 hole and was drilled to about 581 m depth. After completion of RCC-002, a second attempt (RCC-003) was made to twin the original reverse circulation hole, but was terminated (at 399 m) when seasonal flooding from snow melt made the site inaccessible from late March to early June. Upon regaining access to the site, core drilling resumed on June 2, 2008. Three more holes, RCC-004 (788 m deep), RCC-005 (failed at 133 m) and RCC-006 (currently in progress) have been undertaken. Results from the two failed twin holes, RCC-001 and RCC-003, confirm results from the original reverse circulation hole. Beginning at approximately 300 m, gold values are typically 0.1 -0.3 gpt in each hole with one spike of 1 m grading 4.8 gpt gold in RCC-001. Hole RCC-002 encountered numerous 1-50 m intervals grading 0.1 to 1.2 gpt gold beginning at about 280 m to its terminus at 581 m. This hole provides further confirmation that a large mineralized system has been encountered. Assays from the final three hole should be returned by late August, 2008 at which time the project will be evaluated for future work. Additional drilling is expected to test this and other areas on this very large property.