SUPPLEMENTAL FINANCIAL INFORMATION First Quarter Ended March 31, 2022 May 4, 2022 Exhibit 99.2

FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” (as defined in the Securities Litigation Reform Act of 1995) regarding, among other things, future events or the future financial performance of the Company, or the timing or anticipated benefits of pending acquisition of the Company by UnitedHealth Group Incorporated. Words such as “anticipate,” “expect,” “project,” “intend,” “believe,” “will,” “estimates,” “may,” “could,” “should” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. Forward-looking statements are based on information currently available to the Company and involve estimates, expectations and projections. Investors are cautioned that all such forward-looking statements are subject to risks and uncertainties, and important factors could cause actual events or results to differ materially from those indicated by such forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, those discussed and described in our most recent Annual Report on Form 10-K, including those risks described in Part I, Item 1A. Risk Factors thereof, and in other reports filed subsequently by us with the Securities and Exchange Commission and, with respect to the pending acquisition of the Company by UnitedHealth Group Incorporated, include, but are not limited to, those discussed in the preliminary proxy statement filed by the Company with the SEC on April 29, 2021. All forward-looking statements included in this document are based on information available to us on the date hereof, and the Company assumes no obligation to update any such forward-looking statements to reflect future events or circumstances, except as required by law. Non-GAAP Financial Information This presentation includes certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), including EBITDA and Adjusted EBITDA. The company uses these non-GAAP financial measures in operating its business because management believes they are less susceptible to variances in actual operating performance that can result from the excluded items. The company presents these financial measures to investors because they believe they are useful to investors in evaluating the primary factors that drive the company's operating performance. The items excluded from these non-GAAP measures are important in understanding LHC Group’s financial performance, and any non-GAAP measures presented should not be considered in isolation of, or as an alternative to, GAAP financial measures. Since these non-GAAP financial measures are not measures determined in accordance with GAAP, have no standardized meaning prescribed by GAAP and are susceptible to varying calculations, these measures, as presented, may not be comparable to other similarly titled measures of other companies. EBITDA of LHC Group is defined as net income (loss) before income tax benefit (expense), interest expense, and depreciation and amortization expense. Adjusted EBITDA of LHC Group is defined as net income (loss) before income tax expense benefit (expense), depreciation and amortization expense, and transaction costs related to previous transactions. Please visit the Investors section on our website at Investor.LHCgroup.com for additional information on LHC Group and the industry. Nasdaq: LHCG 2

TABLE OF CONTENTS BUSINESS OVERVIEW 4-9 LHC Group Overview Commentary on Q4 2021 Home Health Labor Cost per Visit Industry-Leading Quality and Patient Satisfaction 3 2022 CONSOLIDATED RESULTS 10-14 2022 Adjusted Consolidated Results Adjusted Consolidated Results – 2022 vs 2021 Adjustments to Net Income SEGMENT RESULTS 15-21 Three Months Ended Mar. 31, 2022 Adjusted Segment Results Home Health Hospice Home and Community Based Services Facility-Based Services Health Care Innovations APPENDIX 22-24 Non-GAAP Reconciliations

BUSINESS OVERVIEW

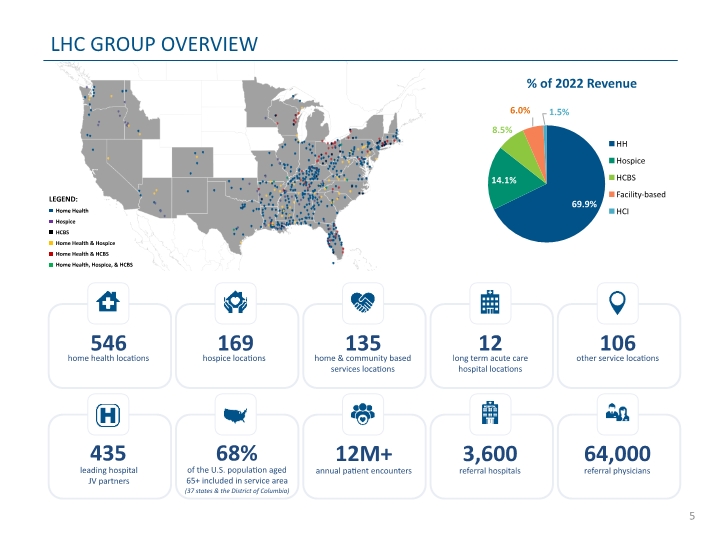

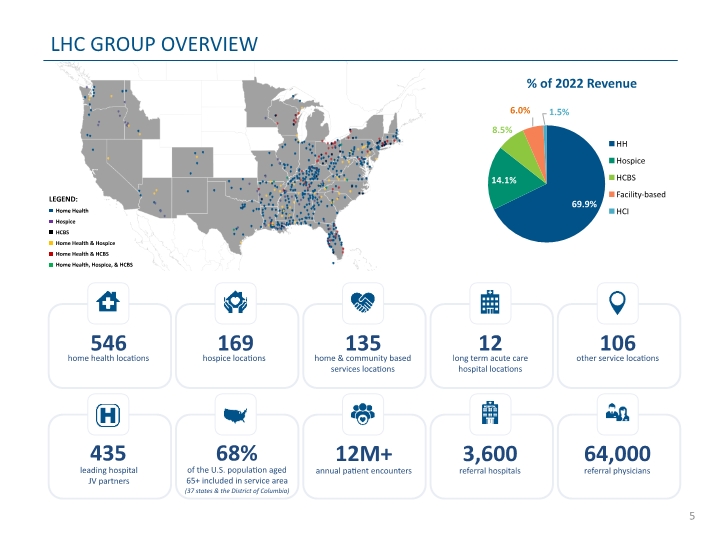

Home Health Hospice HCBS Home Health & Hospice Home Health & HCBS Home Health, Hospice, & HCBS LHC GROUP OVERVIEW LEGEND: 546 home health locations 169 hospice locations 135 home & community based services locations 12 long term acute care hospital locations 106 other service locations 435 leading hospital JV partners 68% (37 states & the District of Columbia) 12M+ annual patient encounters 3,600 referral hospitals 64,000 referral physicians of the U.S. population aged 65+ included in service area 5

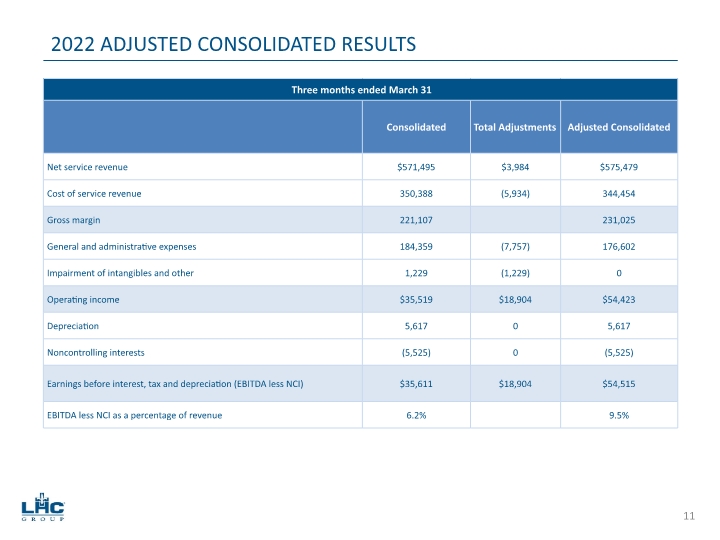

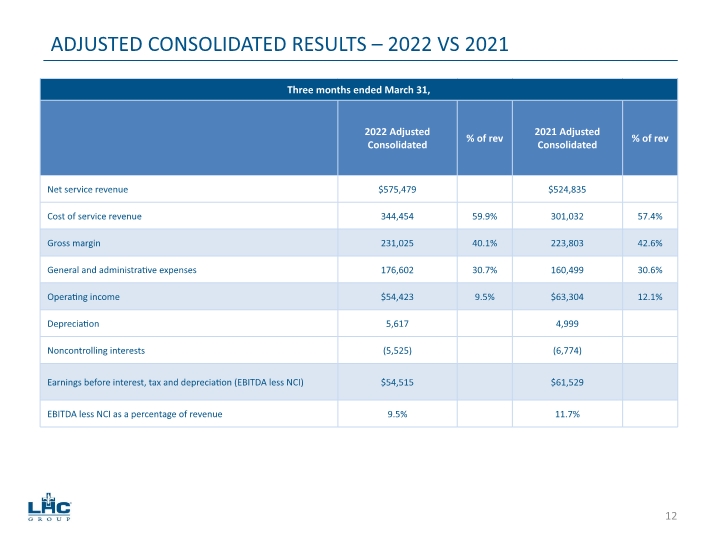

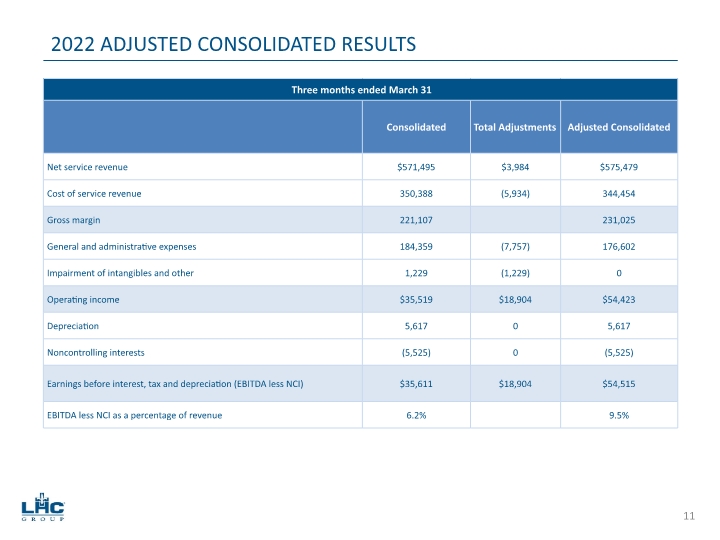

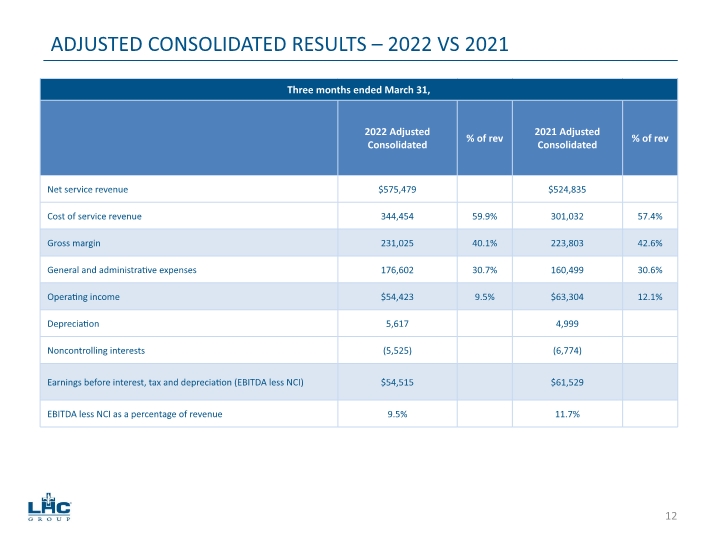

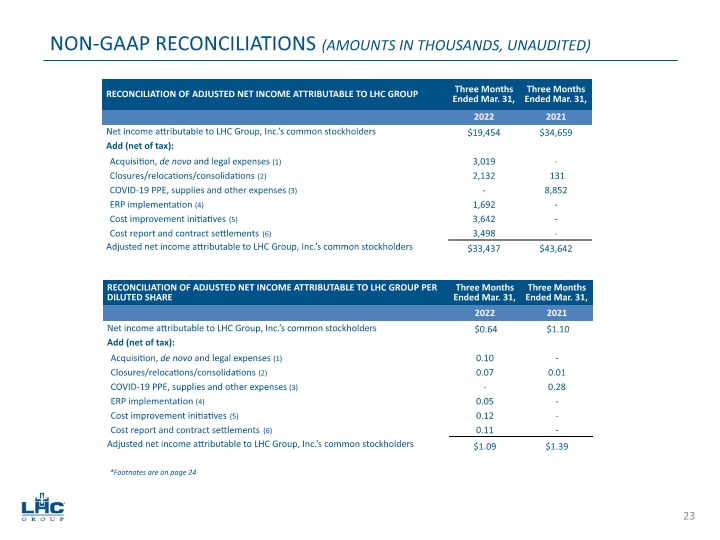

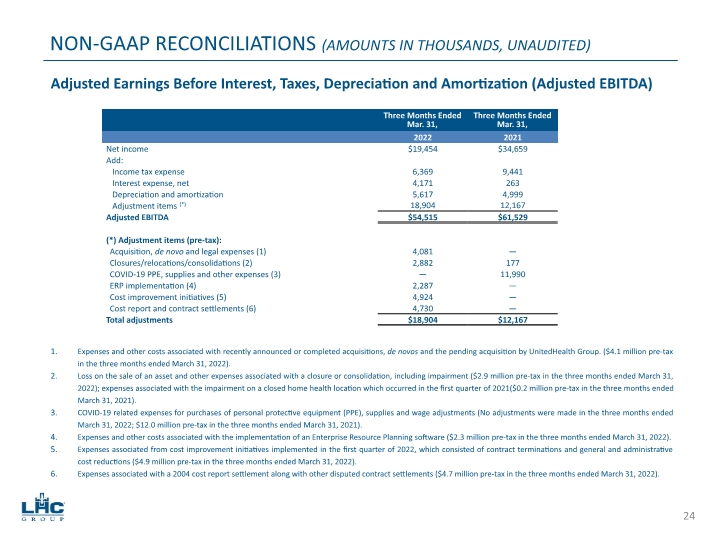

Adjusted net income attributable to LHC Group’s common stockholders was $33.4 million, or $1.09 adjusted earnings per diluted share in Q1 2022. Adjusted EBITDA was $54.5 million in Q1 2022. Higher labor costs and capacity constraints caused by the lingering impact of clinicians on quarantine caused significant headwinds for Q1 2022. The percentage of clinicians on quarantine hit an all time high in early January 2022 increasing to 6.5%. Home Health average weekly census declined to a low 83,061 during the week ended January 15, 2022 as the average percentage of clinicians quarantined increased exacerbating the normal seasonal dip in January. Despite the challenges faced in the quarter, organic growth in admissions for home health locations increased 1.6% for Q1 2022 compared to the same period in 2021. Despite the challenges faced in the quarter, organic growth in admissions for hospice increased 4% in Q1 2022 compared to the same period in 2021. Home Health average daily census of 85,347 in Q1 2022 was 1.7% higher than 83,938 in Q1 2021. Hospice average daily census of 7,065 in Q1 2022 compared to 4,411 in Q1 2021. COMMENTARY ON Q1 2022 6

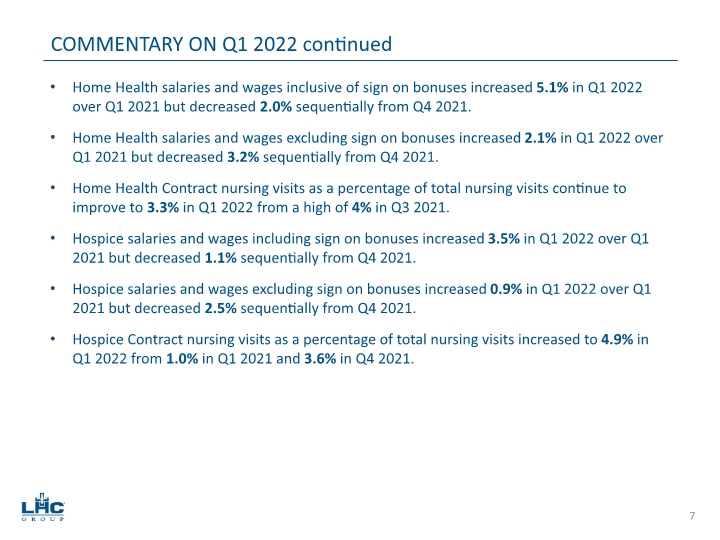

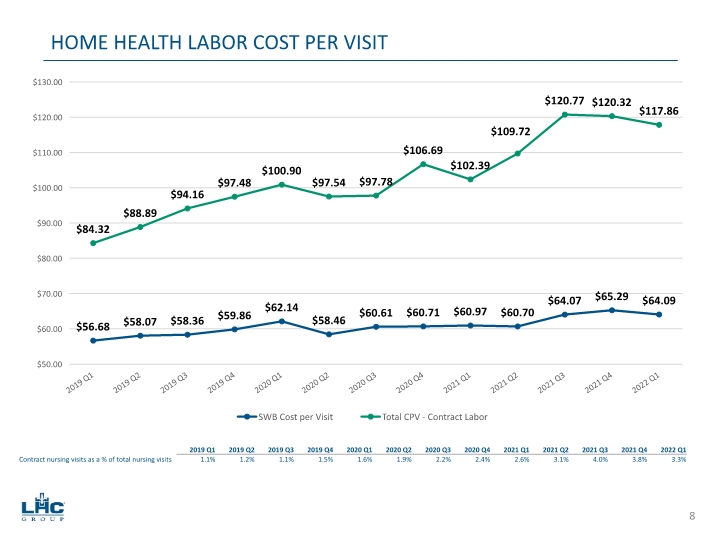

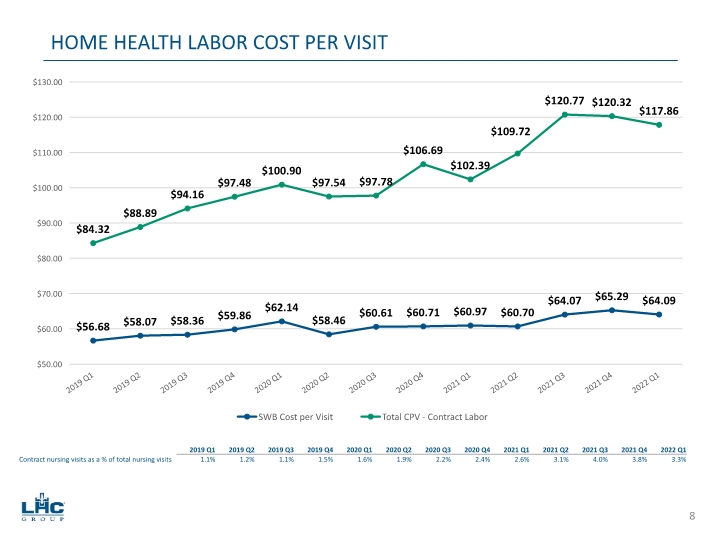

Home Health salaries and wages inclusive of sign on bonuses increased 5.1% in Q1 2022 over Q1 2021 but decreased 2.0% sequentially from Q4 2021. Home Health salaries and wages excluding sign on bonuses increased 2.1% in Q1 2022 over Q1 2021 but decreased 3.2% sequentially from Q4 2021. Home Health Contract nursing visits as a percentage of total nursing visits continue to improve to 3.3% in Q1 2022 from a high of 4% in Q3 2021. Hospice salaries and wages including sign on bonuses increased 3.5% in Q1 2022 over Q1 2021 but decreased 1.1% sequentially from Q4 2021. Hospice salaries and wages excluding sign on bonuses increased 0.9% in Q1 2022 over Q1 2021 but decreased 2.5% sequentially from Q4 2021. Hospice Contract nursing visits as a percentage of total nursing visits increased to 4.9% in Q1 2022 from 1.0% in Q1 2021 and 3.6% in Q4 2021. COMMENTARY ON Q1 2022 continued 7

HOME HEALTH LABOR COST PER VISIT 8

INDUSTRY-LEADING QUALITY AND PATIENT SATISFACTION 100% of LHC Group home health and hospice agencies are Joint Commission accredited or are in the accreditation process within 12 to 18 months after acquisition. Approximately 15% of all Medicare certified home health agencies nationwide are Joint Commission accreditation. Source: Centers for Medicare & Medicaid Services 9

2022 CONSOLIDATED RESULTS

2022 ADJUSTED CONSOLIDATED RESULTS 11

ADJUSTED CONSOLIDATED RESULTS – 2022 VS 2021 12

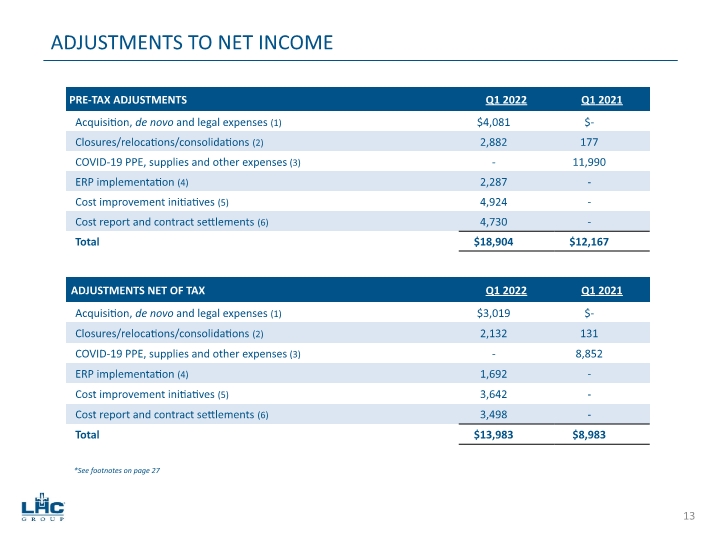

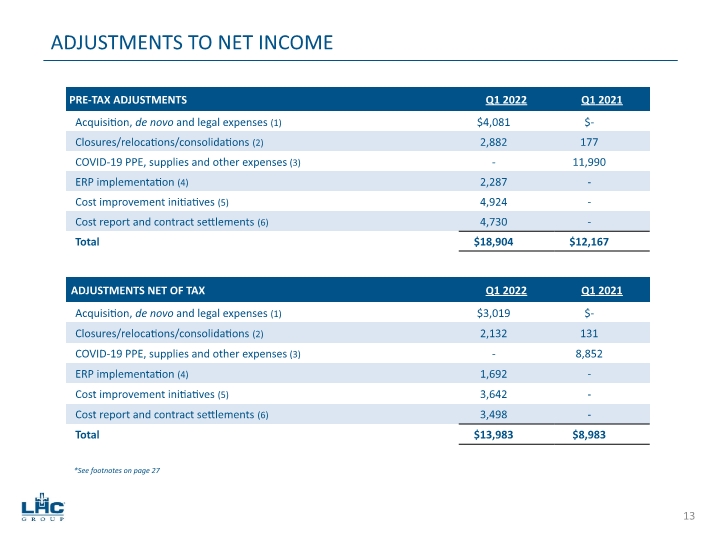

ADJUSTMENTS TO NET INCOME *See footnotes on page 27 13

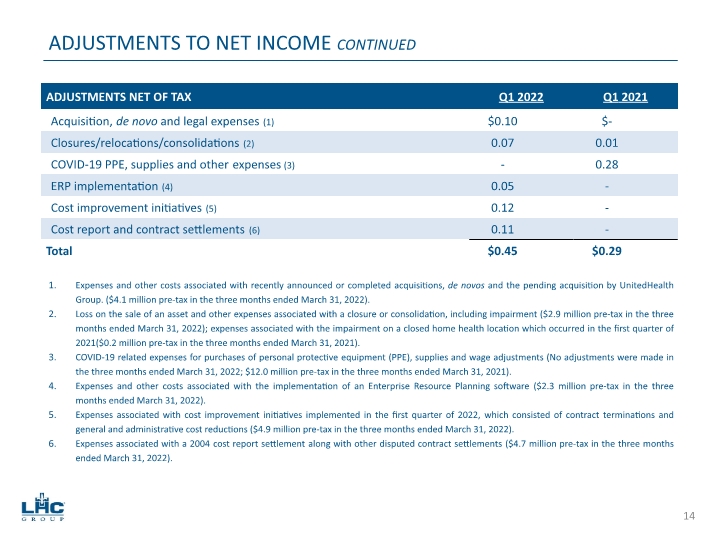

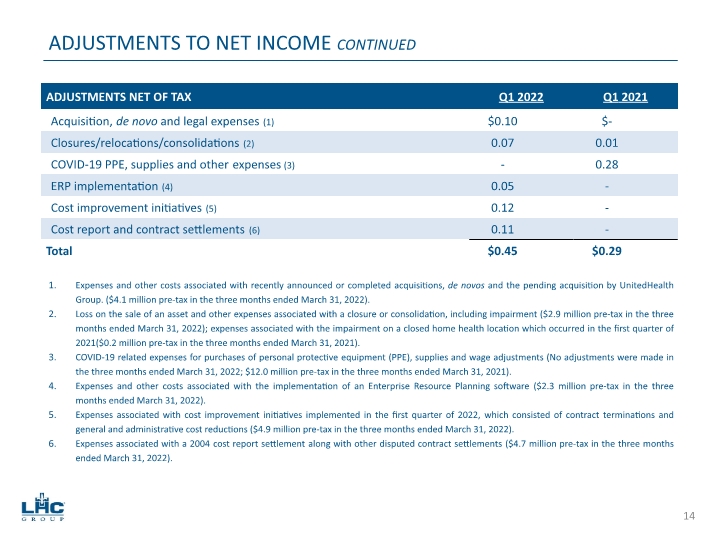

ADJUSTMENTS TO NET INCOME CONTINUED Expenses and other costs associated with recently announced or completed acquisitions, de novos and the pending acquisition by UnitedHealth Group. ($4.1 million pre-tax in the three months ended March 31, 2022). Loss on the sale of an asset and other expenses associated with a closure or consolidation, including impairment ($2.9 million pre-tax in the three months ended March 31, 2022); expenses associated with the impairment on a closed home health location which occurred in the first quarter of 2021($0.2 million pre-tax in the three months ended March 31, 2021). COVID-19 related expenses for purchases of personal protective equipment (PPE), supplies and wage adjustments (No adjustments were made in the three months ended March 31, 2022; $12.0 million pre-tax in the three months ended March 31, 2021). Expenses and other costs associated with the implementation of an Enterprise Resource Planning software ($2.3 million pre-tax in the three months ended March 31, 2022). Expenses associated with cost improvement initiatives implemented in the first quarter of 2022, which consisted of contract terminations and general and administrative cost reductions ($4.9 million pre-tax in the three months ended March 31, 2022). Expenses associated with a 2004 cost report settlement along with other disputed contract settlements ($4.7 million pre-tax in the three months ended March 31, 2022). 14

SEGMENT RESULTS

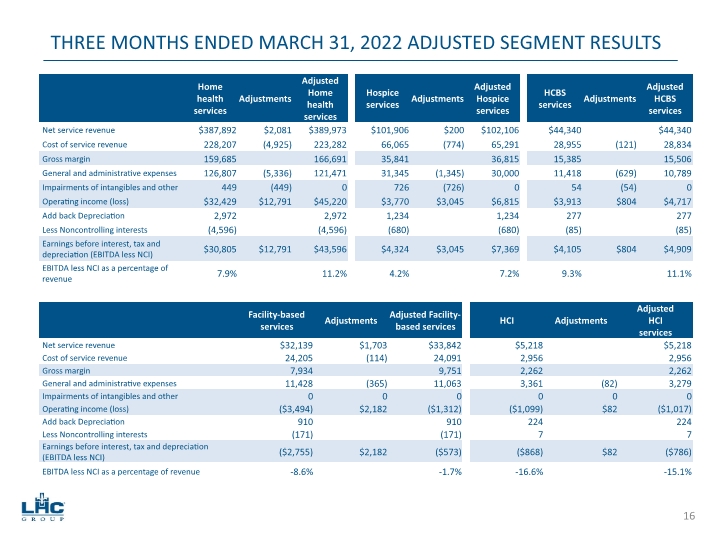

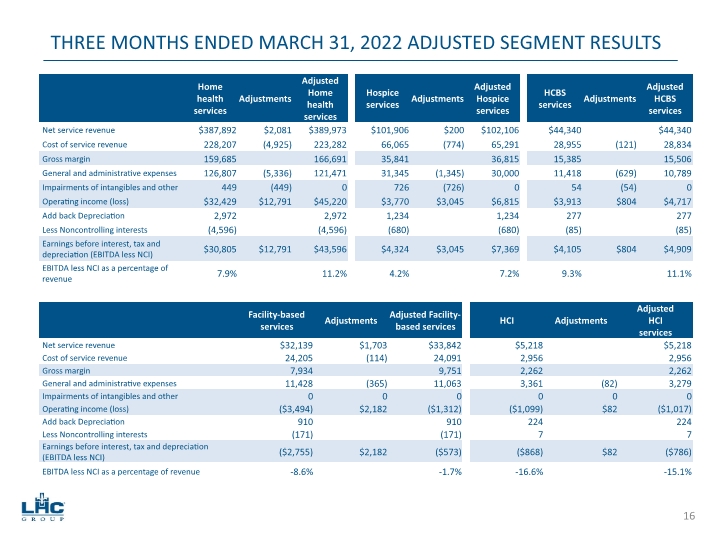

THREE MONTHS ENDED MARCH 31, 2022 ADJUSTED SEGMENT RESULTS 16

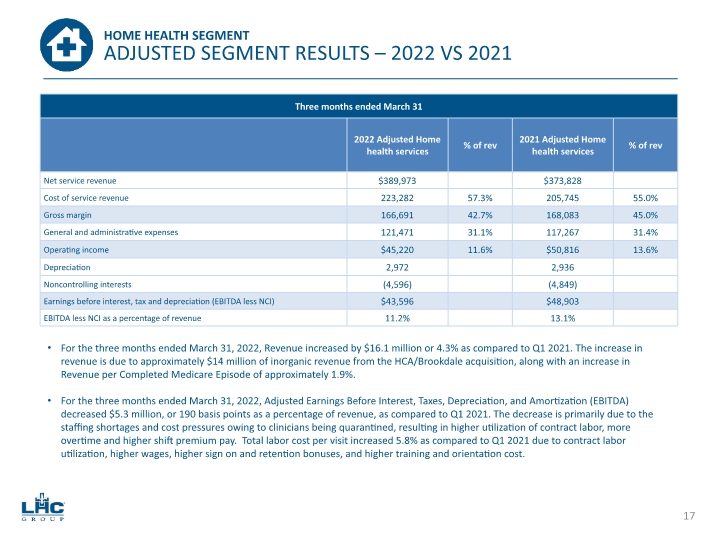

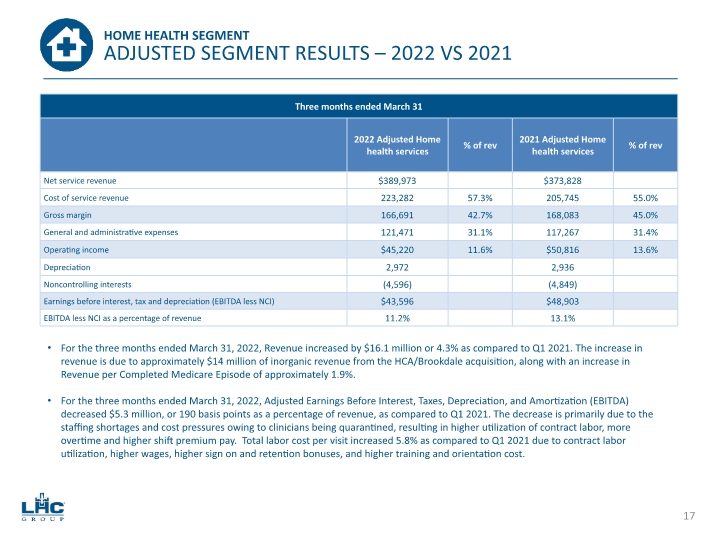

HOME HEALTH SEGMENT ADJUSTED SEGMENT RESULTS – 2022 VS 2021 For the three months ended March 31, 2022, Revenue increased by $16.1 million or 4.3% as compared to Q1 2021. The increase in revenue is due to approximately $14 million of inorganic revenue from the HCA/Brookdale acquisition, along with an increase in Revenue per Completed Medicare Episode of approximately 1.9%. For the three months ended March 31, 2022, Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) decreased $5.3 million, or 190 basis points as a percentage of revenue, as compared to Q1 2021. The decrease is primarily due to the staffing shortages and cost pressures owing to clinicians being quarantined, resulting in higher utilization of contract labor, more overtime and higher shift premium pay. Total labor cost per visit increased 5.8% as compared to Q1 2021 due to contract labor utilization, higher wages, higher sign on and retention bonuses, and higher training and orientation cost. 17

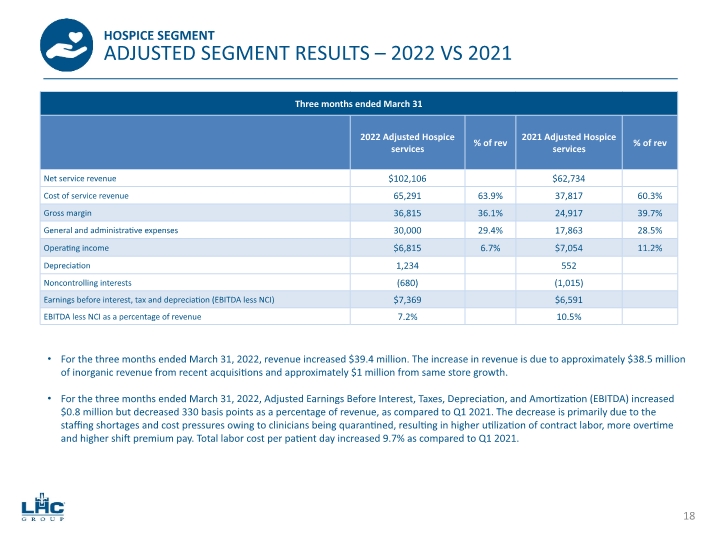

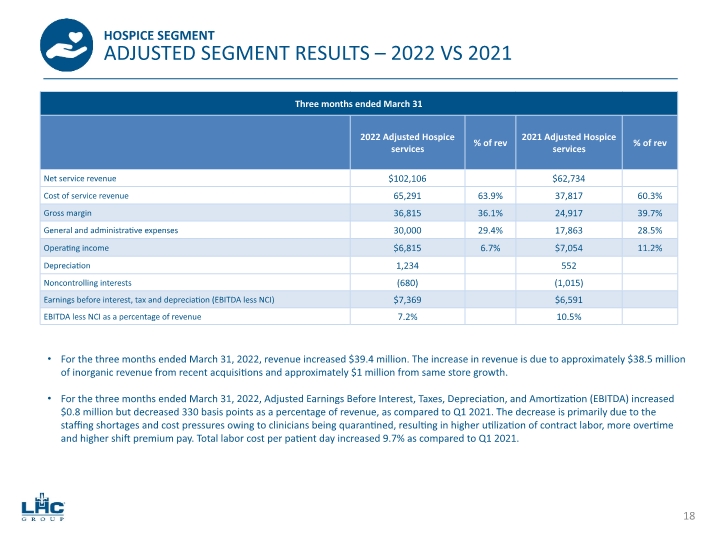

For the three months ended March 31, 2022, revenue increased $39.4 million. The increase in revenue is due to approximately $38.5 million of inorganic revenue from recent acquisitions and approximately $1 million from same store growth. For the three months ended March 31, 2022, Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) increased $0.8 million but decreased 330 basis points as a percentage of revenue, as compared to Q1 2021. The decrease is primarily due to the staffing shortages and cost pressures owing to clinicians being quarantined, resulting in higher utilization of contract labor, more overtime and higher shift premium pay. Total labor cost per patient day increased 9.7% as compared to Q1 2021. 18 HOSPICE SEGMENT ADJUSTED SEGMENT RESULTS – 2022 VS 2021

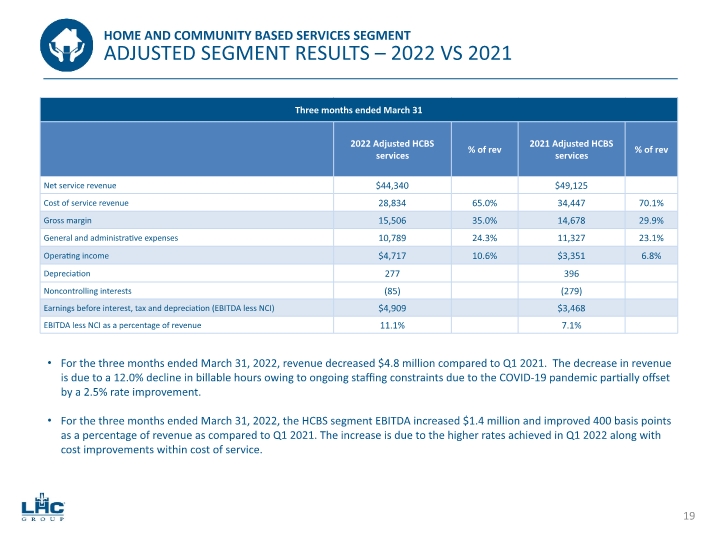

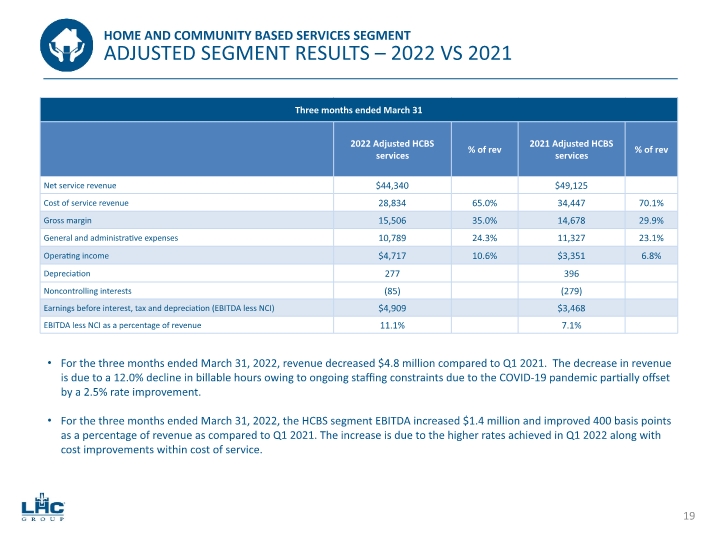

For the three months ended March 31, 2022, revenue decreased $4.8 million compared to Q1 2021. The decrease in revenue is due to a 12.0% decline in billable hours owing to ongoing staffing constraints due to the COVID-19 pandemic partially offset by a 2.5% rate improvement. For the three months ended March 31, 2022, the HCBS segment EBITDA increased $1.4 million and improved 400 basis points as a percentage of revenue as compared to Q1 2021. The increase is due to the higher rates achieved in Q1 2022 along with cost improvements within cost of service. 19 HOME AND COMMUNITY BASED SERVICES SEGMENT ADJUSTED SEGMENT RESULTS – 2022 VS 2021

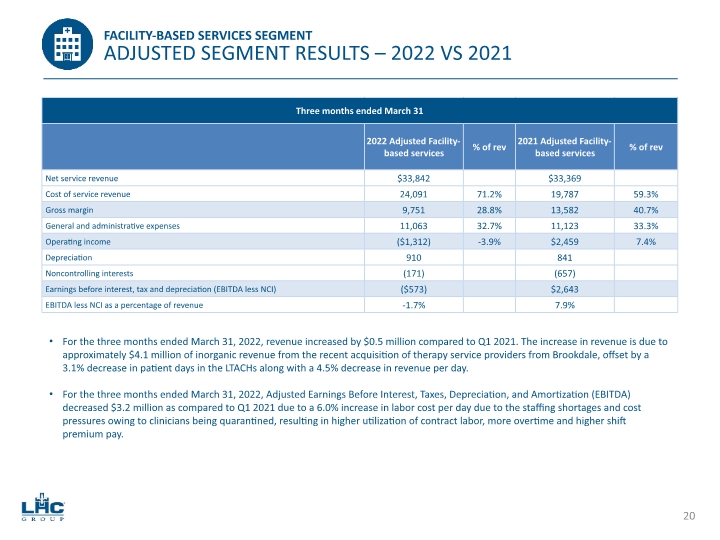

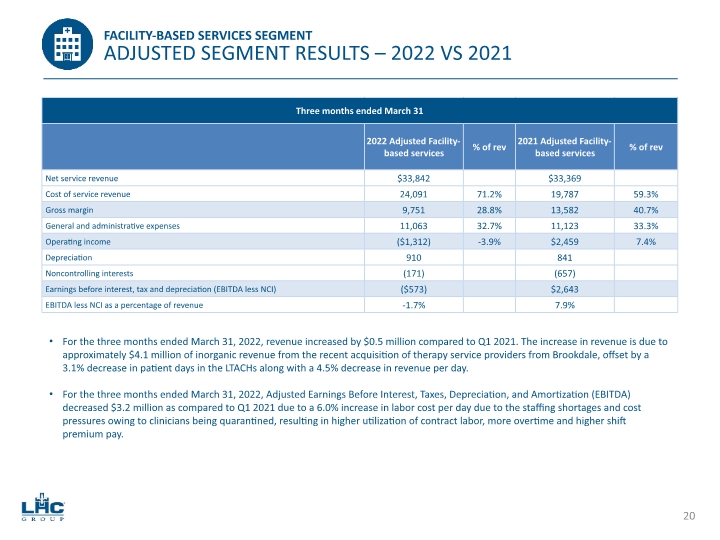

For the three months ended March 31, 2022, revenue increased by $0.5 million compared to Q1 2021. The increase in revenue is due to approximately $4.1 million of inorganic revenue from the recent acquisition of therapy service providers from Brookdale, offset by a 3.1% decrease in patient days in the LTACHs along with a 4.5% decrease in revenue per day. For the three months ended March 31, 2022, Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) decreased $3.2 million as compared to Q1 2021 due to a 6.0% increase in labor cost per day due to the staffing shortages and cost pressures owing to clinicians being quarantined, resulting in higher utilization of contract labor, more overtime and higher shift premium pay. 20 FACILITY-BASED SERVICES SEGMENT ADJUSTED SEGMENT RESULTS – 2022 VS 2021

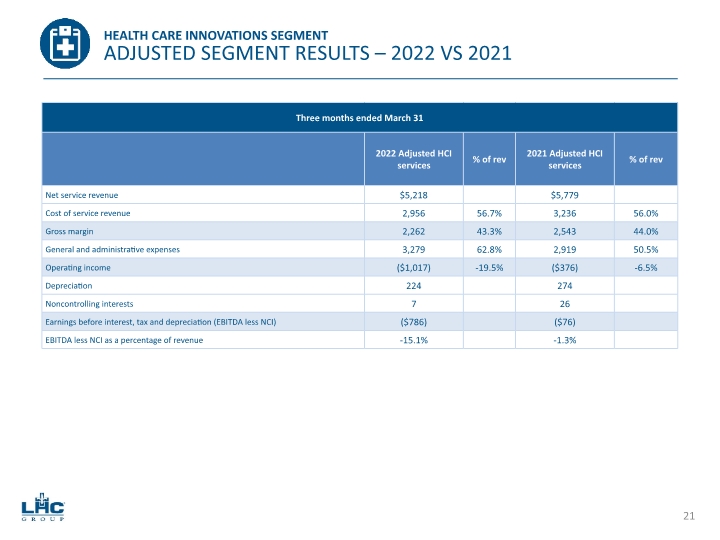

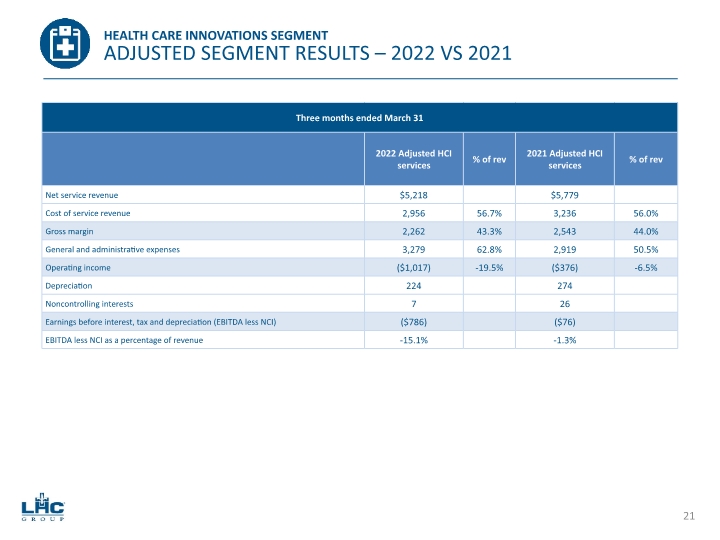

21 HEALTH CARE INNOVATIONS SEGMENT ADJUSTED SEGMENT RESULTS – 2022 VS 2021

APPENDIX

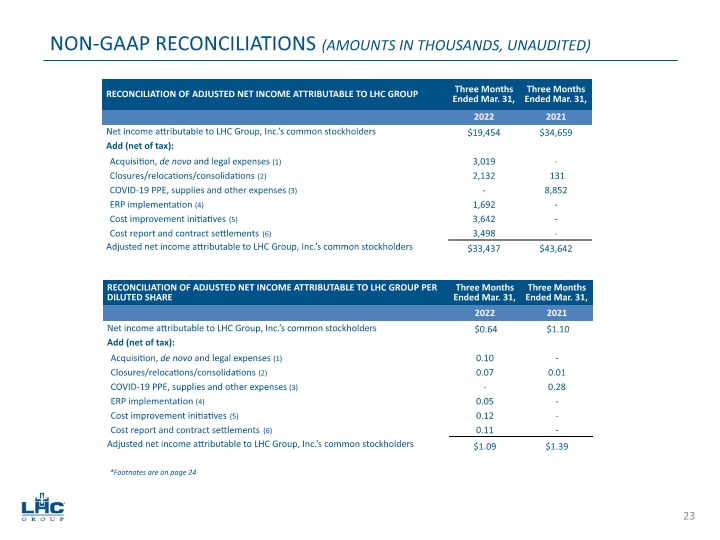

NON-GAAP RECONCILIATIONS (AMOUNTS IN THOUSANDS, UNAUDITED) *Footnotes are on page 24 23

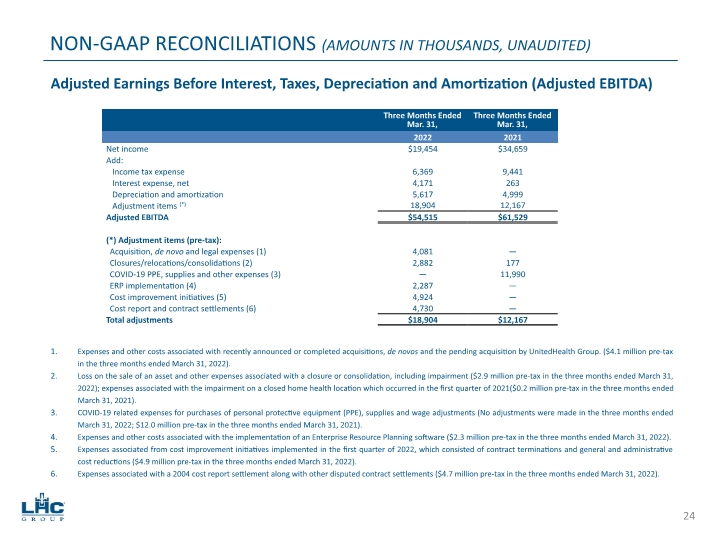

NON-GAAP RECONCILIATIONS (AMOUNTS IN THOUSANDS, UNAUDITED) Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) Expenses and other costs associated with recently announced or completed acquisitions, de novos and the pending acquisition by UnitedHealth Group. ($4.1 million pre-tax in the three months ended March 31, 2022). Loss on the sale of an asset and other expenses associated with a closure or consolidation, including impairment ($2.9 million pre-tax in the three months ended March 31, 2022); expenses associated with the impairment on a closed home health location which occurred in the first quarter of 2021($0.2 million pre-tax in the three months ended March 31, 2021). COVID-19 related expenses for purchases of personal protective equipment (PPE), supplies and wage adjustments (No adjustments were made in the three months ended March 31, 2022; $12.0 million pre-tax in the three months ended March 31, 2021). Expenses and other costs associated with the implementation of an Enterprise Resource Planning software ($2.3 million pre-tax in the three months ended March 31, 2022). Expenses associated from cost improvement initiatives implemented in the first quarter of 2022, which consisted of contract terminations and general and administrative cost reductions ($4.9 million pre-tax in the three months ended March 31, 2022). Expenses associated with a 2004 cost report settlement along with other disputed contract settlements ($4.7 million pre-tax in the three months ended March 31, 2022). 24