As filed with the Securities and Exchange Commission on December 2, 2004

Registration No. 333-119729

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2/A

Amendment No. 1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SOUTHRIDGE ENTERPRISES INC.

(Name of small business issuer in its charter)

| NEVADA | 1040 | 98-0435537 |

| (State or jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

| 18523 - 98th Avenue |

| Edmonton, Alberta T5T 3E6 |

| Tel: 780-481-0109 |

| (Address and telephone number of principal executive offices) |

| Vernon Samaroo, President |

| 18523 - 98th Avenue |

| Edmonton, Alberta T5T 3E6 |

| Tel: 780-481-0109 |

| (Name, address and telephone number of agent for service) |

| with a copy to: |

| Stephen F.X. O'Neill, Esq. |

| O'NEILL LAW GROUP PLLC |

| 435 Martin Street, Suite 1010, Blaine, WA 98230 |

| Tel: 360-332-3300 |

| Approximate date of commencement of proposed sale to the public: | As soon as practicable after this Registration Statement is |

| declared effective. |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant toRule 415under the Securities Act of 1933 check the following box. x |

If this Form is filed to register additional securities for an offering pursuant toRule 462(b)under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ |

If this Form is a post-effective amendment filed pursuant toRule 462(c)under the Securities Act, check the following box and list the Securities Act registrations statement number of the earlier effective registration statement for the same offering. ¨ |

If this Form is a post-effective amendment filed pursuant toRule 462(d)under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ |

If delivery of the Prospectus is expected to be made pursuant toRule 434, please check the following box. ¨ |

| CALCULATION OF REGISTRATION FEE | ||||

| Title of Each Class of Securities to be Registered | Dollar Amount to be Registered(1) | Proposed Maximum Offering Price Per Unit(2) | Proposed Maximum Aggregate Offering Price(3) | Amount of Registration Fee(3) |

| Common Stock, par value $0.001 per share, previously issued to investors | $173,400 | $0.04 | $173,400 | $21.97 |

| (1) | Total represents 4,335,000 shares issued by Southridge Enterprises Inc. in a private placement transaction completed in August 2004 |

| (2) | This price was arbitrarily determined by Southridge Enterprises Inc. |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended (the "Securities Act"). |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission (the "SEC"), acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission (the "SEC") is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 1, 2004

PROSPECTUS

SOUTHRIDGE ENTERPRISES INC.

4,335,000 SHARES

COMMON STOCK

----------------

The selling stockholders named in this prospectus are offering the 4,335,000 shares of Southridge Enterprises Inc.'s (the "Company") common stock offered through this prospectus. The Company has set an offering price for these securities of $0.04per share of its common stock offered through this prospectus.

| Proceeds to Selling Stockholders | |||

| Offering Price | Commissions | Before Expenses and Commissions | |

| Per Share | $0.04 | Not Applicable | $0.04 |

| Total | $173,400 | Not Applicable | $173,400 |

The Company is not selling any shares of its common stock in this Offering and therefore will not receive any proceeds from this Offering.

The Company's common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.04 per share until such time as the shares of the Company's common stock are traded on the Over-The-Counter Bulletin Board (the "OTC Bulletin Board"). Although the Company intends to apply for trading of its common stock on the OTC Bulletin Board, public trading of its common stock may never materialize. If the Company's common stock becomes traded on the OTC Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling stockholders.

---------------

The purchase of the securities offered through this prospectus involves a high degree of risk. You should carefully read and consider the section of this prospectus entitled "Risk Factors" on pages 6 through 9 before buying any shares of the Company's common stock.

This Offering will terminate nine months after the accompanying registration statement is declared effective by the SEC. None of the proceeds from the sale of stock by the selling stockholders will be placed in escrow, trust or similar account.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

----------------

The Date Of This Prospectus Is: December 1, 2004

1

PROSPECTUS

SOUTHRIDGE ENTERPRISES INC.

4,335,000 SHARES

COMMON STOCK

----------------

TABLE OF CONTENTS

| Page | ||

| Summary | 4 | |

| The Offering | 5 | |

| Risk Factors | 6 | |

| 6 | ||

| 6 | ||

| 6 | ||

| 6 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| 8 | ||

| Use of Proceeds | 9 | |

2

Until ninety days after the date this registration statement is declared effective, all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

3

SUMMARY

As used in this prospectus, unless the context otherwise requires, "we", "us", "our", "our company" refers to Southridge Enterprises Inc. and its subsidiaries. All dollar amounts in this prospectus are in U.S. dollars unless otherwise stated. The following summary is not complete and does not contain all of the information that may be important to you. You should read the entire prospectus before making an investment decision to purchase our common stock.

SOUTHRIDGE ENTERPRISES INC.

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We acquired a 100% undivided interest in two mineral claims known as the "Hilltop Claims", comprised of a two unit grid claim block located on the north shore of Kamloops Lake in south-central British Columbia, Canada. Title to our mineral claims is held by our wholly owned subsidiary, Southridge Exploration Inc., the registered owner of the Hilltop Claims. Our plan of operations is to conduct mineral exploration activities on the Hilltop Claims in order to assess whether they possess commercially exploitable mineral deposits of copper and gold.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs.

Our financial information as of August 31, 2004, is summarized below:

Balance Sheet:

| August 31, 2004 (Audited) | |

| Cash | $59,643 |

| Total Assets | $59,643 |

| Liabilities | ($3,800) |

| Total Stockholders' Equity | $59,643 |

Statement of Operations and Comprehensive Income:

| August 31, 2004 (Audited) | |

| Revenue | $ -- |

| Net Loss for the Period | ($36,870) |

| Net Loss Per Common Stock | ($0.00) |

About Us

We were incorporated on May 4, 2004 under the laws of the State of Nevada. Our principal offices are located at 18523 - 98th Avenue, Edmonton, Alberta T5T 3E6. Our telephone number is (780) 481-0109.

4

THE OFFERING

| The Issuer: | Southridge Enterprises Inc. |

| Selling Stockholders: | The selling stockholders named in this prospectus are existing stockholders of our company who purchased shares of our common stock from us in a private placement transaction completed in August, 2004. The issuance of the shares by us to the selling stockholders was exempt from the registration requirements of the Securities Act of 1933 (the "Securities Act"). See "Selling Stockholders". |

| Securities Being Offered: | Up to 4,335,000 shares of our common stock, par value $0.001 per share. |

| Offering Price: | The offering price of the common stock is $0.04 per share. We intend to apply to the OTC Bulletin Board to allow the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934 (the "Exchange Act"). If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling stockholders. The offering price would thus be determined by market factors and the independent decisions of the selling stockholders. |

| Duration of Offering: | This offering will terminate nine months after the accompanying registration statement is declared effective by the SEC. |

| Minimum Number of Shares To Be Sold in This Offering: | None. |

| CommonStockOutstanding Before and After the Offering: | 10,335,000 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing stockholders. |

| Use of Proceeds: | We will not receive any proceeds from the sale of the common stock by the selling stockholders. |

| Risk Factors: | See "Risk Factors" and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

5

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock, when and if we trade at a later date, could decline due to any of these risks, and you may lose all or part of your investment.

We have yet to attain profitable operations and because we will need additional financing to fund our exploration activities, our accountants believe there is substantial doubt about our ability to continue as a going concern

We have incurred a net loss of $36,870 for the period from May 4, 2004 (inception) to August 31, 2004, and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral claims. These factors raise substantial doubt that we will be able to continue as a going concern.

If we do not obtain additional financing, our business will fail

Our current operating funds are sufficient to complete the proposed exploration program; however, they will be insufficient to complete the full exploration of the mineral claims and begin mining efforts should the mineral claims prove commercially viable. Therefore, we will need to obtain additional financing in order to complete our full business plan. As of the date of this prospectus, we have cash in the amount of $59,643. We currently do not have any operations and we have no income. Our plan of operations calls for significant expenses in connection with the exploration of our mineral claims. We have sufficient cash on hand to complete Phases II and III of our proposed exploration program. However, we may need additional financing to proceed past Phase III of our exploration program. We may also require additional financing if the costs of the exploration of our mineral claims are greater than anticipated. We may also require additional financing to sustain our business operations if we are not successful in earning revenues. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for the mineral property and metals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

Since this is an exploration project, we face a high risk of business failure due to our inability to predict the success of our business

We have just begun the initial stages of exploration of our mineral claims, and thus have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on May 4, 2004, and to date have been involved primarily in organizational activities, the acquisition of the mineral claims, obtaining a summary geological report and performing certain limited work on our mineral claims. We have not earned any revenues to date.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure

You should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claims may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of Phases II and III of our exploration program do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will

6

be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations.

We have no known mineral reserves and if we cannot find any we will have to cease operations

We have no mineral reserves. If we do not find a mineral reserve containing gold or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we will have to cease operations and you will lose your investment. Mineral exploration, particularly for gold, is highly speculative. It involves many risks and is often non-productive. The chances of finding reserves on our mineral properties is remote and funds expended on exploration will likely be lost.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide no assurance that we will generate any revenues or ever achieve profitability. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may have a material adverse effect on our financial position.

Because access to our mineral claims may be restricted by inclement weather, we may be delayed in our exploration

Access to the Hilltop Claims may be restricted through some of the year due to weather in the area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our exploration efforts.

The Hilltop Claims property comprises two mineral claims with a total area of 110 acres, located five miles north-northwest of the village of Tranquille on the north shore of Kamloops Lake. The claims may be reached by all-weather and gravel roads from Tranquille, which lies within the Kamloops city limits. The mainline of the Canadian National railway passes through the property. This is an essentially undeveloped area in British Columbia. The area consists of many mountains and lakes with heavy forestation. An unpaved gravel road is the only access. Winters are often severe with rain, freezing rain, wind, and snow common between November and March.

As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration program

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the Province of British Columbia as we carry out our exploration program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. Our planned exploration program does not budget for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

7

Because our executive officer does not have formal training specific to the technicalities of mineral exploration, there is a higher risk our business will fail

Mr. Vernon Samaroo our sole executive officer and director, does not have any formal training as a geologist or in the technical aspects of management of a mineral exploration company. Our management lacks technical training and experience with exploring for, starting, and operating a mine. With no direct training or experience in these areas, our management may not be fully aware of the specific requirements related to working within this industry. Our management's decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

Because our president, Mr. Vernon Samaroo, owns 58% of our outstanding common stock, investors may find that corporate decisions influenced by Mr. Samaroo are inconsistent with the best interests of other stockholders

Mr. Samaroo is our sole director and executive officer. He owns 58% of the outstanding shares of our common stock. Accordingly, he will have a significant influence in determining the outcome of major corporate transactions or other matters that require shareholder approval such as mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of Mr. Samaroo may differ from the interests of the other stockholders.

We may conduct further offerings in the future in which case your shareholdings will be diluted

We may conduct further equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. The result of this could reduce the value of your stock. If we issue additional stock, your percentage interest in us will be lower. This condition is often referred to as "dilution".

If a market for our common stock does not develop, stockholders may be unable to sell their shares

There is currently no market for our common stock and we can provide no assurance that a market will develop. We intend to apply for trading of our common stock on the OTC Bulletin Board. However, we can provide no assurance that our shares will be approved for trading on the OTC Bulletin Board or, if traded, that a public market will materialize. If our common stock is not traded on the OTC Bulletin Board or if a public market for our common stock does not develop, stockholders may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

Because our stock is a penny stock, stockholders will be more limited in their ability to sell their stock

The shares offered by this prospectus constitute a penny stock under the Exchange Act. The shares will remain classified as a penny stock for the foreseeable future. The classification as a penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares will be subject to rules 15g-1 through 15g-10 of the Exchange Act. Rather than having to comply with these rules, some broker-dealers will refuse to attempt to sell a penny stock. For a more detailed discussion of this issue see the section entitled "Market For Common Equity And Related Stockholder Matters - No Public Market for Common Stock", below.

As our business assets and our directors and officers are located outside of the United States, investors may be limited in their ability to enforce civil actions against our assets or our directors and officers

Our company's business assets are located in Canada and our directors and officers are residents of Canada. Consequently, it may be difficult for United States investors to effect service of process within the

8

United States upon our assets or our directors or officers, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under U.S. Federal Securities Laws. A judgment of a U.S. court predicated solely upon such civil liabilities may not be enforceable in Canada by a Canadian court if the U.S. court in which the judgment was obtained had jurisdiction, as determined by the Canadian court, in the matter. There is substantial doubt whether an original action could be brought successfully in Canada against any of our assets or our directors and officers predicated solely upon such civil liabilities.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling stockholders.

DETERMINATION OF OFFERING PRICE

The $0.04 per share offering price of our common stock was determined based on our internal assessment of what the market would support. However, the selection of this particular price was influenced by the last sales price from our most recent private offering of 4,335,000 shares of our common stock which was completed on August 10, 2004 at a price of $0.02 per share. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value.

We intend to apply to the OTC Bulletin Board for the trading of our common stock upon our becoming a reporting entity under the Exchange Act. We intend to file a registration statement under the Exchange Act concurrently with the effectiveness of the registration statement of which this prospectus forms a part. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling stockholders named in this prospectus. The offering price would thus be determined by market factors and the independent decisions of the selling stockholders named in this prospectus.

DILUTION

The common stock to be sold by the selling stockholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing stockholders.

SELLING STOCKHOLDERS

The selling stockholders named in this prospectus are offering all of the 4,335,000 shares of common stock offered through this prospectus. The selling stockholders acquired the 4,335,000 shares of common stock offered through this prospectus from us in an offering that was exempt from registration under Regulation S of the Securities Act and completed on August 10, 2004.

The following table provides as of November 26, 2004information regarding the beneficial ownership of our common stock held by each of the selling stockholders, including:

| 1. | the number of shares beneficially owned by each prior to this Offering; |

| 2. | the total number of shares that are to be offered by each; |

| 3. | the total number of shares that will be beneficially owned by each upon completion of the Offering; |

| 4. | the percentage owned by each upon completion of the Offering; and |

| 5. | the identity of the beneficial holder of any entity that owns the shares. |

9

| Name Of Selling Stockholder (1) | Beneficial Ownership Before Offering(1) | Number of Shares Being Offered | Beneficial Ownership After Offering(1) | ||

| Number of Shares | Percent (2) | Number of Shares | Percent (2) | ||

| Anita Blythe Abriotti | 90,000 | * | 90,000 | NIL | 0% |

| Dixie Ashton | 25,000 | * | 25,000 | NIL | 0% |

| Ray Ashton | 25,000 | * | 25,000 | NIL | 0% |

| Maria Basaraba | 75,000 | * | 75,000 | NIL | 0% |

| Chasity Beausoleil | 100,000 | * | 100,000 | NIL | 0% |

| Justin Beausoleil | 50,000 | * | 50,000 | NIL | 0% |

| Marc Beausoleil | 50,000 | * | 50,000 | NIL | 0% |

| Nicole Beausoleil | 50,000 | * | 50,000 | NIL | 0% |

| Darrell Berard | 50,000 | * | 50,000 | NIL | 0% |

| John Cline | 125,000 | 1.21% | 125,000 | NIL | 0% |

| Karen Cline | 125,000 | 1.21% | 125,000 | NIL | 0% |

| Rebecca Cline | 25,000 | * | 25,000 | NIL | 0% |

| Amber Dryhorub | 125,000 | 1.21% | 125,000 | NIL | 0% |

| Alva Dunleavey | 25,000 | * | 25,000 | NIL | 0% |

| Daniel Duthler | 15,000 | * | 15,000 | NIL | 0% |

| Gary Duthler | 150,000 | 1.45% | 150,000 | NIL | 0% |

| Selikke Duthler | 15,000 | * | 15,000 | NIL | 0% |

| Tony Duthler | 15,000 | * | 15,000 | NIL | 0% |

| Gillean Fordd | 15,000 | * | 15,000 | NIL | 0% |

| Claudia Ganz | 125,000 | 1.21% | 125,000 | NIL | 0% |

| Gwen Hall | 250,000 | 2.42% | 250,000 | NIL | 0% |

| Howard Kennedy | 100,000 | * | 100,000 | NIL | 0% |

| Kevin Kennedy | 25,000 | * | 25,000 | NIL | 0% |

| Sara Leenheer | 50,000 | * | 50,000 | NIL | 0% |

| Rene Lessard | 50,000 | * | 50,000 | NIL | 0% |

| Anthony W. Loo | 75,000 | * | 75,000 | NIL | 0% |

| Charlotte Loo | 75,000 | * | 75,000 | NIL | 0% |

| Florence MacAskill | 75,000 | * | 75,000 | NIL | 0% |

| Paul W. MacAskill | 75,000 | * | 75,000 | NIL | 0% |

| Karen MacDonald | 100,000 | * | 100,000 | NIL | 0% |

| Rob Machuk | 150,000 | 1.45% | 150,000 | NIL | 0% |

| Sue Merta | 10,000 | * | 10,000 | NIL | 0% |

| Jo-Anne Middleton | 100,000 | * | 100,000 | NIL | 0% |

| Glenn Mudryk | 190,000 | 1.84% | 190,000 | NIL | 0% |

10

| Name Of Selling Stockholder (1) | Beneficial Ownership Before Offering(1) | Number of Shares Being Offered | Beneficial Ownership After Offering(1) | ||

| Number of Shares | Percent (2) | Number of Shares | Percent (2) | ||

| Carolyn Murphy | 25,000 | * | 25,000 | NIL | 0% |

| Jonn Murphy | 25,000 | * | 25,000 | NIL | 0% |

| Mark Murphy | 25,000 | * | 25,000 | NIL | 0% |

| Cameron Nedelec | 50,000 | * | 50,000 | NIL | 0% |

| Tammy Patterson | 250,000 | 2.42% | 250,000 | NIL | 0% |

| Michelle Radostits | 300,000 | 2.90% | 300,000 | NIL | 0% |

| Paul Radostits | 100,000 | * | 100,000 | NIL | 0% |

| Penny Radostits | 50,000 | * | 50,000 | NIL | 0% |

| Malonie K. Raynier | 25,000 | * | 25,000 | NIL | 0% |

| Melissa Raynier | 10,000 | * | 10,000 | NIL | 0% |

| Perry Sawchuk | 50,000 | * | 50,000 | NIL | 0% |

| Joan Shapka | 400,000 | 3.87% | 400,000 | NIL | 0% |

| Ward Snell | 100,000 | * | 100,000 | NIL | 0% |

| Mike Sorochan | 250,000 | 2.42% | 250,000 | NIL | 0% |

| Pirooz Taef | 75,000 | * | 75,000 | NIL | 0% |

| TOTAL | 4,335,000 | 41.9% | 4,335,000 | NIL | 0% |

Notes

| * | Represents less than 1% |

| (1) | The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling stockholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. |

| (2) | Applicable percentage of ownership is based on 10,335,000 common shares outstanding as of November 26, 2004, plus any securities held by such security holder exercisable for or convertible into common shares within sixty (60) days after the date of this prospectus, in accordance with Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. |

None of the selling stockholders:

| (i) | has had a material relationship with us other than as a stockholder at any time within the past three years; or | |

| (ii) | has ever been one of our officers or directors. | |

11

PLAN OF DISTRIBUTION

This prospectus is part of a registration statement that enables the selling stockholders to sell their shares on a continuous or delayed basis for a period of nine months after this registration statement is declared effective. The selling stockholders may sell some or all of their common stock in one or more transactions, including block transactions:

| 1. | On such public markets as the common stock may from time to time be trading; |

| 2. | In privately negotiated transactions; |

| 3. | Through the writing of options on the common stock; |

| 4. | In short sales; or |

| 5. | In any combination of these methods of distribution. |

The sales price to the public is fixed at $0.04 per share until such time as the shares of our common stock are traded on the OTC Bulletin Board. Although we intend to apply for trading of our common stock on the over-the-counter bulletin board, public trading of our common stock may never materialize. If our common stock becomes traded on the OTC Bulletin Board, then the sales price to the public will vary according to the selling decisions of each selling stockholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

| 1. | The market price of our common stock prevailing at the time of sale; |

| 2. | A price related to such prevailing market price of our common stock; or |

| 3. | Such other price as the selling stockholders determine from time to time. |

The selling stockholders named in this prospectus may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as agent may receive a commission from the selling stockholders, or, if they act as agent for the purchaser of such common stock, from such purchaser. The selling stockholders will likely pay the usual and customary brokerage fees for such services.

We can provide no assurance that all or any of the common stock offered will be sold by the selling stockholders named in this prospectus.

The estimated costs of this offering are $27,022. We are bearing all costs relating to the registration of the common stock. The selling stockholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling stockholders named in this prospectus must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of the common stock. The selling stockholders and any broker-dealers who execute sales for the selling stockholders may be deemed to be an "underwriter" within the meaning of the Securities Act in connection with such sales. In particular, during such times as the selling stockholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

| 1. | Not engage in any stabilization activities in connection with our common stock; |

| 2. | Furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required by such broker or dealer; and |

12

| 3. | Not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

If an underwriter is selected in connection with this offering, an amendment will be filed to identify the underwriter, disclose the arrangements with the underwriter, and we will file the underwriting agreement as an exhibit to this prospectus.

The selling stockholders should be aware that the anti-manipulation provisions of Regulation M under the Exchange Act will apply to purchases and sales of shares of common stock by the selling stockholders, and that there are restrictions on market-making activities by persons engaged in the distribution of the shares. Under Regulation M, the selling stockholders or their agents may not bid for, purchase, or attempt to induce any person to bid for or purchase, shares of our common stock while such Selling Stockholder is distributing shares covered by this prospectus. Accordingly, the selling stockholders are not permitted to cover short sales by purchasing shares while the distribution is taking place. The selling stockholders are advised that if a particular offer of common stock is to be made on terms constituting a material change from the information set forth above with respect to the Plan of Distribution, then, to the extent required, a post-effective amendment to the accompanying registration statement must be filed with the SEC.

LEGAL PROCEEDINGS

We are not currently a party to any legal proceedings.

Our agent for service of process in Nevada is Cane & Associates LLP of 3273 East Warm Springs Road, Las Vegas, Nevada 89120.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Our executive officers and directors and their respective ages and titles as of November 26, 2004 are as follows:

| Name of Director | Age | Position |

| Vernon Samaroo | 52 | President, Secretary and Treasurer |

Set forth below is a brief description of the background and business experience of our sole executive officer and director:

Vernon Samaroo, is our President, Secretary, Treasurer and sole director. Mr. Samaroo has been our sole director and officer since our inception on May 4, 2004. Mr. Samaroo was educated in the UK, where he spent 20 years working in the Financial Services Industry specializing in personal Portfolio Management for the retired and semi-retired market. Mr. Samaroo moved to Canada in 1989 and developed New Media Technology launching Canada's first International Multimedia magazine together with an International Multimedia Exhibition and Conference. In 1995 he was nominated for an ASTEC (Alberta Science and Technology) award in recognition of his work in this field.

Mr. Samaroo worked as a marketing manager, for Power Industry Ltd. from April 1996 to Dec 1999, and was responsible for developing and managing all aspects of the company's marketing and promotion activities and also the development and training of its sales force. Power Industry Ltd. is a wholesale manufacturer of computer systems. Its primary marketplace is the educational sector. Mr. Samaroo was a project manager for CKUA Radio from January 2000 to Dec 2000, and was responsible for the development of interactive website incorporating e-commerce capabilities and internet broadcasting, and developing web advertising sales process. CKUA Radio is one of Canada's oldest public broadcasters and has an international audience.

13

From February 2001 to present, Mr. Samaroo has been employed as a real estate advisor with 20/20 Properties Inc., and is responsible for the sales of investment real estate to established clientele and also for developing new client base. 20/20 Properties Inc. is a Canadian based real estate investment organization

Mr. Samaroo provides his services on a part-time basis as required for our business. Mr. Samaroo presently commits approximately 6-8 hours per week to our business.

Mr. Samaroo does not have formal training as a geologist or in the technical or managerial aspects of management of a mineral exploration company. His prior managerial and consulting positions have not been in the mineral exploration industry. Accordingly, we will have to rely on the technical services of others to advise us on the managerial aspects specifically associated with a mineral exploration company. We do not have any employees who have professional training and experience in the mining industry. We rely on our independent geological consultant, W.G. Timmins, P.Eng., to make recommendations to us on work programs on our property, to hire appropriately skilled persons on a contract basis to complete work programs and to supervise, review, and report on such programs to us.

Compensation

We do not pay to our directors or officers any salary or consulting fee. We anticipate that compensation may be paid to officers in the event that we decide to proceed with additional exploration programs beyond the second stage program. We do not pay to our directors any compensation for each director serving as a director on our board of directors.

We conduct our business through agreements with consultants and arms-length third parties. Currently, we have no formal agreements. Our verbal agreement with our geologist includes his reviewing all of the results from the exploratory work performed upon the site and making recommendations based on those results in exchange for payments equal to the usual and customary rates received by geologists performing similar consulting services. Additionally, we have a verbal agreement with our outside auditors to perform requested accounting functions at their normal and customary rates.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our stockholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Significant Employees

We have no significant employees other than our sole officer and director. We conduct our business through agreements with consultants and arms-length third parties.

Committees of the Board Of Directors

Our audit committee presently consists of our sole director and officer. We do not have a compensation committee, nominating committee, an executive committee of our board of directors, stock plan committee or any other committees.

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of November 26, 2004 by: (i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities, (ii) our sole director, and (iii) our named executive officer. Unless otherwise indicated, the stockholders listed possess sole voting and investment power with respect to the shares shown.

| Title of Class | Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percentage of Common Stock(1) |

| Common Stock | Vernon Samaroo President, Secretary and Treasurer Director 18523 98thAvenue Edmonton, Alberta Canada T5T 3E6 | 6,000,000 Direct | 58% |

| (1) | Applicable percentage of ownership is based on 10,335,000 shares of common stock issued and outstanding as of November 26, 2004, together with securities exercisable or convertible into shares of common stock within 60 days of November 26, 2004 for each stockholder. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock subject to securities exercisable or convertible into shares of common stock that are currently exercisable or exercisable within 60 days of November 26, 2004 are deemed to be beneficially owned by the person holding such options for the purpose of computing the percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

DESCRIPTION OF SECURITIES

General

Our authorized capital stock consists of 100,000,000 shares of common stock, with a par value of $0.001 per share, and 100,000,000 shares of preferred stock, with a par value of $0.001 per share. As of November 26, 2004, there were 10,335,000 shares of our common stock issued and outstanding that were held of record by fifty (50) registered stockholders. We have not issued any shares of preferred stock.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided in any resolution adopted by our board of directors with respect to any series of preferred stock, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing one-percent (1%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our board of directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefor. See "Dividend Policy".

15

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our board of directors, upon liquidation, dissolution or winding up of our company, the holders of shares of our common stock will be entitled to receive pro rata all assets of our company available for distribution to such holders.

In the event of any merger or consolidation of our company with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash).

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

Our board of directors is authorized by our articles of incorporation to divide the authorized shares of our preferred stock into one or more series, each of which shall be so designated as to distinguish the shares of each series of preferred stock from the shares of all other series and classes. Our board of directors is authorized, within any limitations prescribed by law and our Articles of Incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of preferred stock including but not limited to the following:

| (a) | the rate of dividend, the time of payment of dividends, whether dividends are cumulative, and the date from which any dividends shall accrue; | |

| (b) | whether shares may be redeemed, and, if so, the redemption price and the terms and conditions of redemption; | |

| (c) | the amount payable upon shares of preferred stock in the event of voluntary or involuntary liquidation; | |

| (d) | sinking fund or other provisions, if any, for the redemption or purchase of shares of preferred stock; | |

| (e) | the terms and conditions on which shares of preferred stock may be converted, if the shares of any series are issued with the privilege of conversion; | |

| (f) | voting powers, if any, provided that if any of the preferred stock or series thereof shall have voting rights, such preferred stock or series shall vote only on a share for share basis with our common stock on any matter, including but not limited to the election of directors, for which such preferred stock or series has such rights; and | |

| (g) | subject to the above, such other terms, qualifications, privileges, limitations, options, restrictions, and special or relative rights and preferences, if any, of shares or such series as our board of directors may, at the time so acting, lawfully fix and determine under the laws of the State of Nevada. | |

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

16

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover laws

Nevada revised statutes sections 78.378 to 78.3793 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in our company or any of its parents or subsidiaries. Nor was any such person connected with our company or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

EXPERTS

Lang Michener LLP has provided an opinion on the validity of our common stock.

Telford Sadovnick PLLC, our independent certified public accountants, have audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Telford Sadovnick PLLC has presented their report with respect to our audited financial statements. The report of Telford Sadovnick PLLC is included in reliance upon their authority as experts in accounting and auditing.

17

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Our articles of incorporation provide that we will indemnify an officer, director, or former officer or director, to the full extent permitted by law. We have been advised that in the opinion of the SEC indemnification for liabilities arising under the Securities Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court's decision.

Reports to Security Holders

At this time, we are not required to provide annual reports to security holders. However, stockholders and the general public may view and download copies of all of our filings with the SEC, including annual reports, quarterly reports, and all other reports required under the Exchange Act, by visiting the SEC site (http://www.sec.gov) and performing a search of our electronic filings. We plan to register as a reporting company under the Exchange Act concurrent with the effectiveness of this registration statement. Thereafter, annual reports will be delivered to security holders as required or they will be available online.

ORGANIZATION WITHIN LAST FIVE YEARS

We were incorporated on May 4, 2004 under the laws of the State of Nevada.

18

GLOSSARY OF TECHNICAL TERMS

The following defined technical terms are used in our prospectus:

| Alkaline | A metal in groups 1A of the periodic table. |

| Assay | A chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained. |

| Batholith | An intrusion, usually granitic, which has a large exposed surface area and no observable bottom. Usually associated with orogenic belts. |

| Cenozoic era | An era spanning 65 million to 3 million years before the present time. Includes the Paleogene and Neogene Periods. |

| Comagmatic | Said of igneous rocks that have a common set of chemical and mineralogic features and thus are regarded as having been derived from a common parent magma. |

| Diamond drill(ing) | A rotary type of rock drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of long hollow rods through which water or other fluid is pumped to the cutting face as a lubricant. The drill cuts a core of rock that is recovered in long cylindrical sections, two centimetres or more in diameter. |

| Fault | A break in the Earth's crust caused by tectonic forces which have moved the rock on one side with respect to the other; faults may extend many kilometres, or be only a few centimetres in length; similarly, the movement or displacement along the fault may vary widely. |

| Feldspar | A group of rock-forming minerals. |

| Fracture | A break in the rock, the opening of which affords the opportunity for entry of mineral-bearing solutions. A "cross fracture" is a minor break extending at more-or-less right angles to the direction of the principal fractures. |

| Igneous | A type of rock which has been formed by the consolidation of magma, a molten substance from the earth's core. |

| Intermontane belt | A region of low topographic and structural relief with mainly subgreenschist metamorphic grade rocks exposed across its entire width. |

| Intrusive | A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface. |

| Iron mask batholith | A subvolcanic multiple intrusion which is comagmatic and coeval with the Nicola Rocks. |

| Jurassic | Second Period of Mesozoic Era. Covered span of time between 190 - 135 million years before the present time. |

| Mesozoic | One of the eras of geologic time. It includes the Triassic, Jurassic and Cretaceous periods. |

| Mineralization | The concentration of metals and their chemical compounds within a body of rock. |

| Nicola group | A thick, late Triassic volcanic assemblage hosting mineral occurrences. |

| Neogene | Second Period in the Cenozoic Era. Saw North and South Americas connected. |

| Ore | A mixture of minerals and gangue from which at least one metal can be extracted at a profit. |

| Paleogene | First Period in Cenozioc Era. |

| Paleozoic | Rocks that were laid down during the Paleozoic Era (between 67 and 507 million years before the present time). |

19

| Plugs | A common name for a small offshoot from a larger batholith. |

| Pluton | Body of rock exposed after solidification at great depth. |

| Quartz | A mineral whose composition is silicon dioxide. A crystalline form of silica. |

| Reserve | For the purposes of this prospectus: that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves consist of: |

(1) Proven (Measured) Reserves.Reserves for which: (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. | |

(2) Probable (Indicated) Reserves.Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. | |

| Sedimentary | A type of rock which has been created by the deposition of solids from a liquid. |

| Structural | Pertaining to geologic structure. |

| Tectonics | Dealing with broad architecture of the outer part of the Earth (i.e. regional assembling of structural or deformational features). |

| Tertiary | The first period of the Cenozoic Era. |

| Triassic | The system of strata that was deposited between 210 and 250 million years before the present time. |

| Vein | An occurrence of ore with an irregular development in length, width and depth usually from an intrusion of igneous rock. |

| Volcanics | Volcanically formed rocks. |

20

DESCRIPTION OF BUSINESS

Forward-Looking Statements

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described under the heading "Risk Factors" and elsewhere in this prospectus.

In General

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We acquired a 100% undivided interest in two mineral claims known as the "Hilltop Claims", comprised of a two unit grid claim block located on the north shore of Kamloops Lake in south-central British Columbia, Canada. Title to our mineral claims is held by our wholly owned subsidiary, Southridge Exploration Inc., the registered owner of the Hilltop Claims. Our plan of operations is to conduct mineral exploration activities on the Hilltop Claims in order to assess whether they possess commercially exploitable mineral deposits of copper and gold.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that a commercially viable mineral deposit exists on our mineral claims or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final evaluation as to the economic and legal feasibility is required to determine whether our mineral claims possess commercially exploitable mineral deposits of copper and gold. See "Item 2. Management's Discussion and Analysis or Plan of Operation - Plan of Operation".

Acquisition of the Hilltop Claims

We purchased the Hilltop Claims property in an arms-length transaction from Larry Sostad for cash consideration of $3,000 pursuant to a purchase agreement dated May 17, 2004. We assigned all of our interest in the Hilltop Claims to our subsidiary Southridge Exploration Inc. (the "BC Subsidiary") pursuant to an assignment agreement with our BC Subsidiary dated July 19, 2004.

Description of Property and Location of Hilltop Mineral Claims

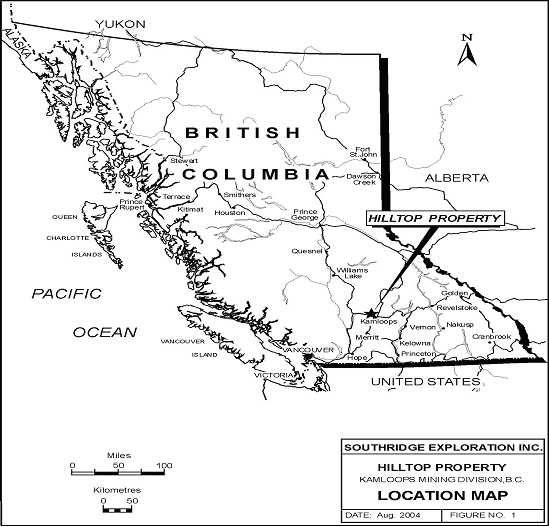

The Hilltop Claims property is comprised of two mineral claims with a total area of approximately 110 acres, located on the north shore of Kamloops Lake in south-central British Columbia, Canada, see "Figure 1" below.

We obtained information on the area from the British Columbia Department of Mines and Geological Consultants in 2004. We believed the timing was opportune at that time to obtain this property at the price paid. The Hilltop Claims are recorded with the Ministry of Energy and Mines, Province of British Columbia, Canada under the following name, tag and tenure numbers:

Name of Mineral Claim | Tag Number | Tenure Number | Expiry Date |

| HILLTOP 1 | 700347M | 409257 | March 20, 2005 |

| HILLTOP 2 | 700348M | 409258 | March 20, 2005 |

Title to the property is held in the name of our subsidiary. The Province of British Columbia owns the land covered by the mineral claims. To our knowledge, there are no aboriginal land claims that might affect our

21

title to our mineral claims or the Province's title of the property. There is no viable way for us to determine what claims, if any, certain aboriginal groups may make.

In order to maintain our mineral claims in good standing, we must complete exploration work on the mineral claims and file confirmation of the completion of work on the mineral claims with the applicable mining recording office of the British Columbia Ministry of Energy and Mines. The completion of mineral exploration work or payment in lieu of exploration work in any year will extend the existence of our mineral claims for one additional year. As our mineral claims are effective until March 20, 2005, we must file confirmation of the completion of exploration work in the minimum amount of approximately $77 per unit or make a payment in lieu or exploration work in the minimum amount by March 20, 2005. The fee amount increases from approximately $77 per unit, per year in the first three years to approximately $154 per unit, per year afterwards, up to ten years. The Hilltop Claims are two units in size, therefore the work requirement for the next year is $154. If we fail to complete the minimum required amount of exploration work or fail to make a payment in lieu of this exploration work, then our mineral claims will lapse on March 20, 2005, and we will lose all interest that we have in these mineral claims. We are the legal owner of the Hilltop Claims and no other person or entity has any interest in our mineral claims.

Figure 1

Location of Claim

22

Location, Climate, Infrastructure and Access

The Hilltop Claims property is located five miles north-northwest of the village of Tranquille on the north shore of Kamloops Lake (actually part of the Thompson River). The claims may be reached by all-weather and gravel roads from Tranquille, which lies within the Kamloops, British Columbia city limits. The mainline of the Canadian National railway passes through the property.

The city of Kamloops served by both the Canadian National and Canadian Pacific Railways, the Trans Canada Highway and an airport with numerous flights per day from Vancouver and Calgary, is a thriving community with a population of some 170,000. All modern facilities and services are locally available. Kamloops is situated about 250 miles northeast of the city of Vancouver, B.C.

The region lies within the dry belt of British Columbia having only about ten inches of rainfall per year. Lower slopes of valleys are open and covered with sagebrush while lower slopes of the hills are open and park-like forested. Upper slopes are more densely forested with coniferous trees. Elevations in the area of the property range from approximately 1200 feet A.S.L. at lake level to 2000 feet A.S.L. at the northern boundary.

Our mineral claims presently do not have any mineral reserves. The property that is the subject to our mineral claims is undeveloped and does not contain any open-pit or underground mines. There is no plant or equipment located on the property that is the subject of the mineral claim. Power is readily available from nearby transmission lines. Water in sufficient quantities for drilling is available from nearby streams and lakes. Power sources for the Hilltop Claims property presently consist of portable generators brought onto the property.

Property Geology

The property is located in the southern part of the Quesnel Trough which is a subdivision of the Intermontane Structural Belt of British Columbia. The Quesnel Trough consists of predominantly Lower Mesozoic volcanic and related intrusive rocks underlain by Paleozoic sedimentary rocks.

The Iron Mask Batholith is a multiphase alkaline pluton localized along the south side of a regional northwest trending fault. Several copper occurrences are found throughout the pluton. Surrounding volcanic rocks of the Nicola Group are thought to be comagmatic with the Iron Mask Batholith. Tertiary volcanic and sedimentary rocks of the Kamloops group unconformably overlay both the Nicola Group and the Iron Mask Batholith.

The most northerly exposure of the Iron Mask Batholith (Cherry Creek phase) occurring north of Kamloops Lake underlies the property. Exposures of volcanic rocks from the Nicola and Kamloops Groups are also present.

Previous explorations have identified six major rock types present on and in proximity to the property. Rock types in the field are at times difficult to recognize due to very fine grain size or potassium feldspar alteration. Jointing and block faulting is prevalent.

History of Exploration

The Hilltop Claims cover ground that has been explored since the early 1900's and resulted in underground exploratory workings and the discovery of mineralized zones. A soil geochemical anomaly measuring some 600 feet by 3000 feet containing copper values has been outlined on the Frederick Zone which co-relates with a high magnetic anomaly adjacent to a magnetic low response.

A 1989 reverse circulation drilling program indicated the presence of a 150 foot wide mineralized zone containing approximately 0.16% copper. One hole is reported to contain an intersection of 20 feet assaying 0.35% copper and gold values on the eastern extension.

23

A reverse circulation drill hole in 1991 intersected two zones of 0.14% copper and gold values over 60 feet and 0.11% copper across 70 feet.

Although exploratory work on the claims conducted by prior owners has indicated some potential showings of mineralization, we are uncertain as to the reliability of these prior exploration results and thus we are uncertain as to whether a commercially viable mineral deposit exists on our mineral claims. Further exploration of these mineral claims is required before a final determination as to their viability can be made.

Mineralization

Exploration work on the Hilltop Claims has resulted in the delineation of the Frederick Zone as a zone of mineralization. In addition, other showings of mineralization have been observed which warrant further exploration. Prior drilling results have indicated that the mineral zones vary in grade from low grade mineralization near surface to higher grade mineralization to depth.

A continuing exploration program of geological, geochemical and geophysical surveys is recommended by our geologist to delineate potentially economic mineral zones. The recommended exploration is discussed in further detail below under the heading "Current State of Exploration".

Recommendations of Geological Report and the Geological Exploration Program

We engaged W.G. Timmins, P.Eng., to prepare a geological evaluation report on the Hilltop Claims. Mr. Timmins is a consulting professional engineer in the Geological Section of the Association of Professional Engineers and Geoscientists of the Province of British Columbia, Canada.

The work completed by Mr. Timmins in preparing the geological report consisted of the review of geological data from previous exploration. The acquisition of this data involved the research and investigation of historic files to locate and retrieve data information acquired by previous exploration companies in the area of the mineral claims. The work involved in this data acquisition included report reproduction and compilation of pre-existing information.

We received the geological evaluation report on the Hilltop Claims entitled "Report on the Hilltop Claims" prepared by Mr. Timmins on August 10, 2004. The geological report summarizes the results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of the prior exploration. The geological report also gives conclusions regarding potential mineralization of the mineral claims and recommends a further geological exploration program on the mineral claims.

In his geological report, Mr. Timmins, recommended that a three phase exploration program, at an approximate cost of $60,200, be undertaken on the property to assess its potential to host copper and gold mineralization, with a fourth phase of diamond drilling and/or mechanical trenching subject to positive results from earlier exploratory work. The four phase program consists of the following:

Phase | Exploration Program | Status | Cost |

| Phase I | Confirmation of past results by blast trenching and sampling and relocation of mineralized zones and structural features. | Completed. | $4,800 |

| Phase II | Compilation and correlation of all data and reconnaissance soil geochemical sampling and geological mapping. | Expected to be commenced in the Spring of 2005. | $5,400 |

24

Phase | Exploration Program | Status | Cost |

| Phase III | Detailed rock and soil sampling and electromagnetic and magnetometer surveys prior to the fourth phase of diamond drilling selected targets. | To be completed in mid 2005 to early 2006 based on results of Phase II. | $5,000 |

| Phase IV | Subject to positive results from the previous phases, mechanical trenching and/or diamond drilling. | To be completed in mid 2006 based on results of Phase III. | $45,000 |

| TOTAL | $60,200 | ||

Phase I of our exploration program was completed in early September, 2004 and we received a report on Phase I from our consulting geologist containing his conclusions on the results of Phase I on October 29, 2004. The Phase I exploratory program was conducted over a period of three days and consisted of confirmation of past results by blast trenching and sampling and relocation of mineralized zones and structural features. The second phase consisting of compilation and correlation of all data and reconnaissance soil geochemical sampling and geological mapping is anticipated to commence in the spring of 2005. To date we have expended $7,800 on exploration of our mineral claims.

The phased program of exploration activities is intended to generate and prioritize targets to test by trenching or drilling. The initial exploration activities on the Hilltop Claims (grid establishment, geological mapping, soil sampling, geophysical surveys) do not involve ground disturbance and as a result do not require a work permit. Any follow-up trenching and/or drilling will require permits, applications for which will be submitted well in advance of the planned work.

Our cash on hand to date is $59,643. We have sufficient cash on hand to pay the costs of Phase II and III of our proposed exploration program. However, we may require additional financing in order to proceed with any additional work beyond Phase III of our exploration program. We presently do not have any arrangements for additional financing for exploration work beyond Phase III of our exploration program, and no potential lines of credit or sources of financing are currently available for the purpose of proceeding with exploration work beyond Phase III of our exploration program.

The geological review and interpretations required in Phase II of the exploration program will be comprised of reviewing the data acquired and analyzing this data to assess the potential mineralization of the mineral claims. Geological review entails the geological study of an area to determine the geological characteristics, identification of rock types and any obvious indications of mineralization. The purpose of undertaking the geological review is to determine if there is sufficient indication of mineralization to warrant additional exploration. Positive results at each stage of the exploration program would be required to justify continuing with the next stage. Such positive results would include the identification of the zones of mineralization.

Current State of Exploration

We have only recently commenced exploration of the Hilltop Claims and this exploration is currently in the preliminary stages. Our planned exploration program is exploratory in nature and no mineral reserves may ever be found.

25

The results of the geological report on the Hilltop Claims prepared by our geological consultant, Mr. Timmins, indicated that there are soil geochemical anomalies in a mineralized zone located within the Frederick Zone on the Hilltop property. The report concluded that positive results from prior exploration work indicates potential for the discovery of economic copper-gold deposits, and recommended a four phase geological exploration program on the mineral claims.

Phase I of our exploration program was completed in early September, 2004. The Phase I exploratory program was conducted over a period of three days and consisted of confirmation of past results by blast trenching and sampling and relocation of mineralized zones and structural features. We received a report on Phase I from our consulting geologist on October 29, 2004.

Pursuant to his Phase I report, our consulting geologist reported that the work conducted in Phase I of the exploration program successfully relocated the mineralized zones, past drill hole sites, and adits. Phase I reconnaissance geological investigation together with blast trenching and check sampling has confirmed the occurrence of copper and gold mineralization values. The Frederick Zone has been outlined and the drilled area within it is reported to contain a 150 foot wide zone with copper and anomalous gold values. The two old adits were also located and found to be caved at the portals. Check samples obtained from the outcrop areas and blast trenches near the old aidts indicate copper and anomalous gold values verifying the occurrence of copper-gold values in the zone. Blast trenching exposed copper mineralization consisting of malachite and chalcopyrite and pyrite.

The Phase I report recommended that we carry out Phase II of our planned exploration program and that we acquire additional mineral claims to the west of the Hilltop 1 and 2 claims. The second phase of our exploration program consisting of compilation and correlation of all data and reconnaissance soil geochemical sampling and geological mapping is anticipated to commence in the Spring of 2005. To date, we have expended $7,800 on exploration of our mineral claims.

Compliance with Government Regulation

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the Province of British Columbia. The main agency that governs the exploration of minerals in the Province of British Columbia, Canada, is the Ministry of Energy and Mines.

The Ministry of Energy and Mines manages the development of British Columbia's mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Ministry regulates and inspects the exploration and mineral production industries in British Columbia to protect workers, the public and the environment.

The material legislation applicable to us is the Mineral Tenure Act, administered by the Mineral Titles Branch of the Ministry of Energy and Mines, and the Mines Act, as well as the Health, Safety and Reclamation Code and the Mineral Exploration Code.

The Mineral Tenure Act and its regulations govern the procedures involved in the location, recording and maintenance of mineral titles in British Columbia. The Mineral Tenure Act also governs the issuance of leases which are long term entitlements to minerals.

All mineral exploration activities carried out on a mineral claim or mining lease in British Columbia must be in compliance with the Mines Act. The Mines Act applies to all mines during exploration, development, construction, production, closure, reclamation and abandonment. It outlines the powers of the Chief Inspector of Mines, to inspect mines, the procedures for obtaining permits to commence work in, on or about a mine and other procedures to be observed at a mine. Additionally, the provisions of the Health, Safety and Reclamation Code for mines in British Columbia contain standards for employment, occupational health and safety, accident investigation, work place conditions, protective equipment, training programs, and site supervision. Also, the Mineral Exploration Code contains standards for exploration activities including construction and maintenance, site preparation, drilling, trenching and work in and about a water body.

26