UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21667

Fidelity Central Investment Portfolios LLC

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | September 30 |

|

|

Date of reporting period: | March 31, 2023 |

Item 1.

Reports to Stockholders

Fidelity® Emerging Markets Equity Central Fund

Semi-Annual Report

March 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

Top Holdings (% of Fund's net assets) |

| |

| Taiwan Semiconductor Manufacturing Co. Ltd. (Taiwan, Semiconductors & Semiconductor Equipment) | 8.3 | |

| Samsung Electronics Co. Ltd. (Korea (South), Technology Hardware, Storage & Peripherals) | 5.2 | |

| Tencent Holdings Ltd. (Cayman Islands, Interactive Media & Services) | 5.1 | |

| Alibaba Group Holding Ltd. (Cayman Islands, Broadline Retail) | 3.6 | |

| HDFC Bank Ltd. (India, Banks) | 2.8 | |

| Meituan Class B (Cayman Islands, Hotels, Restaurants & Leisure) | 2.0 | |

| Sea Ltd. ADR (Cayman Islands, Entertainment) | 1.8 | |

| Reliance Industries Ltd. (India, Oil, Gas & Consumable Fuels) | 1.6 | |

| Infosys Ltd. (India, IT Services) | 1.4 | |

| Ping An Insurance Group Co. of China Ltd. (H Shares) (China, Insurance) | 1.4 | |

| | 33.2 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| Financials | 20.9 | |

| Information Technology | 19.4 | |

| Consumer Discretionary | 15.0 | |

| Communication Services | 10.3 | |

| Materials | 8.7 | |

| Consumer Staples | 6.2 | |

| Industrials | 5.1 | |

| Energy | 4.1 | |

| Health Care | 3.6 | |

| Utilities | 2.7 | |

| Real Estate | 1.6 | |

| |

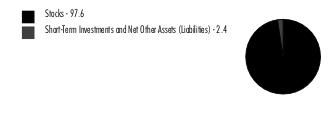

Asset Allocation (% of Fund's net assets) |

|

|

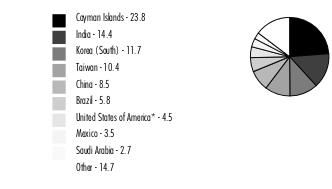

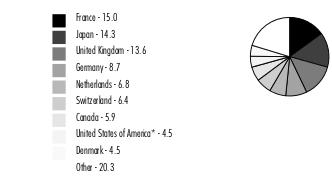

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| |

Showing Percentage of Net Assets

| Common Stocks - 95.2% |

| | | Shares | Value ($) |

| Belgium - 0.3% | | | |

| Titan Cement International Trading SA | | 462,130 | 7,267,110 |

| Bermuda - 1.1% | | | |

| China Gas Holdings Ltd. | | 3,344,400 | 4,712,043 |

| Credicorp Ltd. (United States) | | 87,209 | 11,545,600 |

| Huanxi Media Group Ltd. (a) | | 9,169,702 | 1,284,943 |

| Kerry Properties Ltd. | | 621,000 | 1,586,141 |

| Kunlun Energy Co. Ltd. | | 5,738,000 | 4,488,123 |

| Shangri-La Asia Ltd. (a) | | 1,820,000 | 1,706,417 |

TOTAL BERMUDA | | | 25,323,267 |

| Brazil - 4.2% | | | |

| Arezzo Industria e Comercio SA | | 252,164 | 3,159,730 |

| Atacadao SA | | 2,714,400 | 6,635,444 |

| Dexco SA | | 2,675,528 | 3,103,928 |

| ENGIE Brasil Energia SA | | 544,700 | 4,317,020 |

| Equatorial Energia SA | | 1,023,200 | 5,442,585 |

| Localiza Rent a Car SA | | 821,135 | 8,651,286 |

| Localiza Rent a Car SA rights 5/11/23 (a) | | 3,608 | 9,347 |

| LOG Commercial Properties e Participacoes SA | | 445,800 | 1,390,583 |

| Lojas Renner SA | | 1,476,533 | 4,827,147 |

| Multiplan Empreendimentos Imobiliarios SA | | 192,700 | 936,801 |

| Raia Drogasil SA | | 2,509,800 | 12,107,175 |

| Rede D'Oregon Sao Luiz SA (b) | | 651,550 | 2,730,405 |

| Rumo SA | | 2,250,700 | 8,370,546 |

| Suzano Papel e Celulose SA | | 1,022,300 | 8,390,668 |

| Transmissora Alianca de Energia Eletrica SA | | 523,900 | 3,600,201 |

| Vale SA sponsored ADR | | 1,392,915 | 21,980,199 |

TOTAL BRAZIL | | | 95,653,065 |

| Canada - 0.9% | | | |

| Barrick Gold Corp. | | 1,118,100 | 20,763,117 |

| Cayman Islands - 23.7% | | | |

| Akeso, Inc. (a)(b) | | 504,107 | 2,594,418 |

| Alibaba Group Holding Ltd. (a) | | 5,916,296 | 74,932,823 |

| Alibaba Group Holding Ltd. sponsored ADR (a) | | 74,688 | 7,631,620 |

| Angelalign Technology, Inc. (b) | | 88,637 | 1,317,716 |

| Antengene Corp. (a)(b) | | 558,360 | 206,987 |

| Baidu, Inc.: | | | |

| Class A (a) | | 232,648 | 4,383,386 |

| sponsored ADR (a) | | 46,025 | 6,946,093 |

| BeiGene Ltd. ADR (a) | | 20,755 | 4,473,325 |

| Bilibili, Inc. ADR (a)(c) | | 428,161 | 10,061,784 |

| BizLink Holding, Inc. | | 452,000 | 4,144,317 |

| Chailease Holding Co. Ltd. | | 2,793,038 | 20,482,148 |

| China Resources Land Ltd. | | 1,265,000 | 5,769,118 |

| Daqo New Energy Corp. ADR (a) | | 20,351 | 953,241 |

| ENN Energy Holdings Ltd. | | 485,200 | 6,650,724 |

| ESR Group Ltd. (b) | | 528,000 | 947,049 |

| Greentown China Holdings Ltd. | | 862,000 | 1,117,869 |

| Haitian International Holdings Ltd. | | 1,631,000 | 4,217,799 |

| Hansoh Pharmaceutical Group Co. Ltd. (b) | | 2,056,232 | 3,572,912 |

| Innovent Biologics, Inc. (a)(b) | | 826,719 | 3,701,853 |

| JD Health International, Inc. (a)(b) | | 242,542 | 1,804,412 |

| JD.com, Inc.: | | | |

| Class A | | 667,689 | 14,579,789 |

| sponsored ADR | | 45,571 | 2,000,111 |

| Jiumaojiu International Holdings Ltd. (b) | | 1,387,547 | 3,301,874 |

| KE Holdings, Inc. | | 900 | 5,615 |

| KE Holdings, Inc. ADR (a) | | 246,200 | 4,638,408 |

| Kuaishou Technology Class B (a)(b) | | 292,423 | 2,251,872 |

| KWG Group Holdings Ltd. (a) | | 1,027,500 | 163,617 |

| Li Auto, Inc. Class A (a) | | 54,832 | 684,536 |

| Li Ning Co. Ltd. | | 1,350,425 | 10,648,710 |

| Longfor Properties Co. Ltd. (b) | | 558,034 | 1,574,600 |

| Medlive Technology Co. Ltd. (b) | | 1,043,254 | 1,443,297 |

| Meituan Class B (a)(b) | | 2,487,077 | 45,121,088 |

| NetEase, Inc. ADR | | 87,360 | 7,726,118 |

| New Oriental Education & Technology Group, Inc. sponsored ADR (a) | | 129,853 | 5,013,624 |

| PagSeguro Digital Ltd. (a)(c) | | 1,151,227 | 9,866,015 |

| Parade Technologies Ltd. | | 14,000 | 483,317 |

| Pdd Holdings, Inc. ADR (a) | | 273,508 | 20,759,257 |

| Sea Ltd. ADR (a)(c) | | 475,711 | 41,172,787 |

| Shenzhou International Group Holdings Ltd. | | 651,056 | 6,834,102 |

| Silergy Corp. | | 380,173 | 6,018,554 |

| StoneCo Ltd. Class A (a) | | 859,248 | 8,197,226 |

| Sunny Optical Technology Group Co. Ltd. | | 664,822 | 8,041,484 |

| Tencent Holdings Ltd. | | 2,379,471 | 116,283,139 |

| Tongdao Liepin Group (a) | | 742,500 | 974,248 |

| Trip.com Group Ltd. ADR (a) | | 609,669 | 22,966,231 |

| Uni-President China Holdings Ltd. | | 4,558,400 | 4,599,107 |

| Wuxi Biologics (Cayman), Inc. (a)(b) | | 1,768,044 | 10,946,246 |

| Xinyi Solar Holdings Ltd. | | 56,000 | 67,130 |

| XP, Inc. Class A (a) | | 1,072,483 | 12,730,373 |

| Zai Lab Ltd. (a) | | 1,180,580 | 3,934,382 |

TOTAL CAYMAN ISLANDS | | | 538,936,451 |

| Chile - 0.5% | | | |

| Banco de Chile | | 124,833,700 | 12,123,893 |

| China - 8.2% | | | |

| Ant International Co. Ltd. Class C (a)(d)(e) | | 436,400 | 672,056 |

| Beijing Enlight Media Co. Ltd. (A Shares) | | 1,750,899 | 2,268,117 |

| BYD Co. Ltd. (H Shares) | | 492,847 | 14,497,663 |

| C&S Paper Co. Ltd. (A Shares) | | 2,058,500 | 3,624,854 |

| China Communications Services Corp. Ltd. (H Shares) | | 7,190,000 | 3,535,510 |

| China Construction Bank Corp. (H Shares) | | 34,852,000 | 22,556,038 |

| China Life Insurance Co. Ltd. (H Shares) | | 8,794,000 | 14,451,471 |

| China Merchants Shekou Industrial Zone Holdings Co. Ltd. (A Shares) | | 441,600 | 873,171 |

| China Petroleum & Chemical Corp. (H Shares) | | 20,096,000 | 11,878,551 |

| China Tower Corp. Ltd. (H Shares) (b) | | 13,867,114 | 1,678,207 |

| China Vanke Co. Ltd. (H Shares) | | 1,351,700 | 2,131,753 |

| Daqin Railway Co. Ltd. (A Shares) | | 7,717,656 | 8,086,459 |

| Flat Glass Group Co. Ltd. | | 577,312 | 1,654,737 |

| Gemdale Corp. (A Shares) | | 1,184,677 | 1,443,966 |

| Haier Smart Home Co. Ltd. | | 2,143,400 | 6,711,577 |

| Haier Smart Home Co. Ltd. (A Shares) | | 211,600 | 698,137 |

| Kweichow Moutai Co. Ltd. (A Shares) | | 27,400 | 7,240,977 |

| LONGi Green Energy Technology Co. Ltd. | | 147,100 | 865,939 |

| OPT Machine Vision Tech Co. Ltd. | | 8,460 | 170,108 |

| Ping An Insurance Group Co. of China Ltd. (H Shares) | | 4,939,000 | 31,951,446 |

| Proya Cosmetics Co. Ltd. (A Shares) | | 381,106 | 10,095,939 |

| Shenzhen Mindray Bio-Medical Electronics Co. Ltd. (A Shares) | | 177,373 | 8,051,133 |

| Sinopec Engineering Group Co. Ltd. (H Shares) | | 4,756,500 | 2,363,132 |

| Sinopharm Group Co. Ltd. (H Shares) | | 844,109 | 2,553,866 |

| TravelSky Technology Ltd. (H Shares) | | 2,167,000 | 4,046,959 |

| Tsingtao Brewery Co. Ltd. (H Shares) | | 1,179,800 | 12,880,274 |

| Venus MedTech Hangzhou, Inc. (H Shares) (a)(b) | | 601,941 | 825,091 |

| WuXi AppTec Co. Ltd. (H Shares) (b) | | 293,884 | 3,077,398 |

| Zhuzhou CRRC Times Electric Co. Ltd. (H Shares) | | 1,370,400 | 5,961,752 |

TOTAL CHINA | | | 186,846,281 |

| Cyprus - 0.0% | | | |

| Fix Price Group Ltd. GDR (Reg. S) (a)(e) | | 365,722 | 135,072 |

| TCS Group Holding PLC GDR (a)(e) | | 292,174 | 366,547 |

TOTAL CYPRUS | | | 501,619 |

| Germany - 0.1% | | | |

| Delivery Hero AG (a)(b) | | 92,843 | 3,158,590 |

| Greece - 0.5% | | | |

| Alpha Bank SA (a) | | 5,655,601 | 6,900,187 |

| Piraeus Financial Holdings SA (a) | | 1,530,900 | 3,316,371 |

TOTAL GREECE | | | 10,216,558 |

| Hong Kong - 1.9% | | | |

| AIA Group Ltd. | | 1,316,200 | 13,803,461 |

| China Jinmao Holdings Group Ltd. | | 1,376,000 | 268,192 |

| China Merchants Holdings International Co. Ltd. | | 2,598,392 | 3,985,355 |

| China Overseas Land and Investment Ltd. | | 1,143,960 | 2,763,026 |

| China Resources Beer Holdings Co. Ltd. | | 1,582,666 | 12,701,813 |

| Guangdong Investment Ltd. | | 4,700,000 | 4,807,832 |

| Lenovo Group Ltd. | | 750,626 | 812,790 |

| Sino-Ocean Group Holding Ltd. | | 4,778,500 | 541,773 |

| Sinotruk Hong Kong Ltd. | | 1,563,500 | 2,429,929 |

TOTAL HONG KONG | | | 42,114,171 |

| Hungary - 0.1% | | | |

| Richter Gedeon PLC | | 130,548 | 2,729,486 |

| India - 14.3% | | | |

| Apollo Hospitals Enterprise Ltd. | | 118,559 | 6,236,429 |

| Bajaj Auto Ltd. | | 32,000 | 1,514,070 |

| Bajaj Finance Ltd. | | 214,548 | 14,724,278 |

| Bandhan Bank Ltd. (a)(b) | | 1,923,000 | 4,598,405 |

| Bharat Electronics Ltd. | | 5,772,800 | 6,872,154 |

| Bharti Airtel Ltd. | | 523,156 | 4,771,940 |

| Campus Activewear Ltd. | | 323,900 | 1,316,248 |

| CE Info Systems Ltd. (a) | | 79,145 | 959,591 |

| Divi's Laboratories Ltd. | | 75,381 | 2,596,187 |

| Embassy Office Parks (REIT) | | 297,200 | 1,129,539 |

| HDFC Bank Ltd. (a) | | 3,220,282 | 63,352,711 |

| HDFC Standard Life Insurance Co. Ltd. (b) | | 1,967,828 | 11,969,275 |

| Hindustan Aeronautics Ltd. | | 48,200 | 1,606,404 |

| Indraprastha Gas Ltd. | | 991,420 | 5,182,696 |

| Infosys Ltd. | | 260,309 | 4,551,988 |

| Infosys Ltd. sponsored ADR | | 1,612,655 | 28,124,703 |

| ITC Ltd. | | 3,607,587 | 16,883,082 |

| JK Cement Ltd. | | 379,998 | 13,561,988 |

| Larsen & Toubro Ltd. | | 504,716 | 13,325,478 |

| Mahanagar Gas Ltd. | | 328,270 | 3,934,183 |

| Manappuram General Finance & Leasing Ltd. | | 1,985,357 | 2,999,545 |

| Maruti Suzuki India Ltd. | | 69,062 | 6,985,630 |

| NTPC Ltd. | | 3,505,599 | 7,485,851 |

| Oberoi Realty Ltd. | | 102,766 | 1,057,102 |

| Oil & Natural Gas Corp. Ltd. | | 3,316,300 | 6,113,011 |

| One97 Communications Ltd. (a) | | 630,425 | 4,906,936 |

| Petronet LNG Ltd. | | 1,051,968 | 2,935,303 |

| Power Grid Corp. of India Ltd. | | 3,008,405 | 8,284,149 |

| Reliance Industries Ltd. | | 1,251,297 | 35,587,694 |

| Shree Cement Ltd. | | 33,027 | 10,549,056 |

| Sona Blw Precision Forgings Ltd. (b) | | 384,600 | 1,942,219 |

| SRF Ltd. | | 129,443 | 3,810,254 |

| Sun Pharmaceutical Industries Ltd. | | 159,199 | 1,907,973 |

| Tata Motors Ltd. (a) | | 218,011 | 1,123,456 |

| Tata Steel Ltd. | | 9,523,100 | 12,168,078 |

| Torrent Pharmaceuticals Ltd. | | 150,488 | 2,819,362 |

| Vijaya Diagnostic Centre Pvt Ltd. | | 176,644 | 843,210 |

| Zomato Ltd. (a) | | 12,455,863 | 7,790,584 |

TOTAL INDIA | | | 326,520,762 |

| Indonesia - 2.4% | | | |

| PT Bank Central Asia Tbk | | 36,817,924 | 21,540,109 |

| PT Bank Rakyat Indonesia (Persero) Tbk | | 71,486,755 | 22,650,779 |

| PT Dayamitra Telekomunikasi Tbk | | 5,635,300 | 265,140 |

| PT Sumber Alfaria Trijaya Tbk | | 33,079,800 | 6,364,578 |

| PT United Tractors Tbk | | 1,521,500 | 2,956,871 |

TOTAL INDONESIA | | | 53,777,477 |

| Japan - 0.3% | | | |

| Z Holdings Corp. | | 2,368,698 | 6,716,329 |

| Korea (South) - 11.4% | | | |

| Coway Co. Ltd. | | 102,080 | 4,104,872 |

| Hyundai Fire & Marine Insurance Co. Ltd. | | 294,180 | 7,609,926 |

| Jeisys Medical, Inc. (a) | | 213,507 | 1,416,416 |

| Kakao Corp. | | 202,670 | 9,563,173 |

| Kakao Pay Corp. (a) | | 53,606 | 2,302,828 |

| KB Financial Group, Inc. | | 310,612 | 11,302,817 |

| Kia Corp. | | 232,747 | 14,472,269 |

| Korea Zinc Co. Ltd. | | 370 | 156,847 |

| L&F Co. Ltd. | | 5,500 | 1,328,510 |

| LG Chemical Ltd. | | 9,690 | 5,302,263 |

| LG Corp. | | 97,892 | 6,210,640 |

| NAVER Corp. | | 33,770 | 5,272,139 |

| NCSOFT Corp. | | 4,997 | 1,426,768 |

| POSCO | | 84,851 | 23,918,516 |

| S-Oil Corp. | | 72,860 | 4,471,672 |

| Samsung Biologics Co. Ltd. (a)(b) | | 15,245 | 9,207,238 |

| Samsung Electronics Co. Ltd. | | 2,397,692 | 118,135,325 |

| Samsung SDI Co. Ltd. | | 26,857 | 15,200,127 |

| SK Hynix, Inc. | | 255,876 | 17,446,937 |

TOTAL KOREA (SOUTH) | | | 258,849,283 |

| Luxembourg - 0.4% | | | |

| Adecoagro SA | | 31,704 | 256,485 |

| Globant SA (a) | | 30,577 | 5,014,934 |

| Tenaris SA sponsored ADR | | 172,300 | 4,896,766 |

TOTAL LUXEMBOURG | | | 10,168,185 |

| Mauritius - 0.0% | | | |

| Jumo World Ltd. (a)(e) | | 161 | 152,090 |

| Mexico - 3.5% | | | |

| CEMEX S.A.B. de CV sponsored ADR (a) | | 3,417,300 | 18,897,669 |

| Corporacion Inmobiliaria Vesta S.A.B. de CV | | 1,494,300 | 4,696,016 |

| Grupo Aeroportuario del Pacifico S.A.B. de CV Series B | | 440,096 | 8,562,822 |

| Grupo Aeroportuario del Sureste S.A.B. de CV Series B sponsored ADR | | 25,962 | 7,956,574 |

| Grupo Aeroportuario Norte S.A.B. de CV | | 320,800 | 3,583,097 |

| Grupo Financiero Banorte S.A.B. de CV Series O | | 2,970,532 | 25,040,167 |

| Wal-Mart de Mexico SA de CV Series V | | 2,998,300 | 11,984,881 |

TOTAL MEXICO | | | 80,721,226 |

| Netherlands - 0.1% | | | |

| CTP BV (b) | | 85,985 | 1,111,549 |

| X5 Retail Group NV GDR (Reg. S) (a)(e) | | 450,200 | 93,997 |

| Yandex NV Series A (a)(e) | | 475,848 | 1,632,083 |

TOTAL NETHERLANDS | | | 2,837,629 |

| Panama - 0.2% | | | |

| Copa Holdings SA Class A (c) | | 46,960 | 4,336,756 |

| Philippines - 0.3% | | | |

| Ayala Land, Inc. | | 4,402,800 | 2,161,377 |

| SM Investments Corp. | | 225,000 | 3,699,272 |

TOTAL PHILIPPINES | | | 5,860,649 |

| Poland - 0.5% | | | |

| CD Projekt RED SA | | 133,433 | 3,438,067 |

| Dino Polska SA (a)(b) | | 74,467 | 6,747,143 |

TOTAL POLAND | | | 10,185,210 |

| Russia - 0.0% | | | |

| Gazprom OAO sponsored ADR (Reg. S) (a)(e) | | 782,800 | 178,823 |

| LSR Group OJSC (a)(e) | | 6,300 | 7,594 |

| LUKOIL PJSC sponsored ADR (a)(e) | | 176,600 | 49,958 |

| Novatek PJSC GDR (Reg. S) (a)(e) | | 46,200 | 11,803 |

| Sberbank of Russia (e) | | 794,750 | 5,855 |

| Sberbank of Russia sponsored ADR (a)(e) | | 1,468,992 | 26,148 |

| Severstal PAO GDR (Reg. S) (a)(e) | | 433,400 | 10,233 |

TOTAL RUSSIA | | | 290,414 |

| Saudi Arabia - 2.7% | | | |

| Al Rajhi Bank | | 1,033,515 | 20,236,927 |

| Alinma Bank | | 1,420,900 | 11,147,802 |

| Bupa Arabia for Cooperative Insurance Co. | | 221,850 | 10,271,873 |

| Saudi Arabian Oil Co. (b) | | 153,140 | 1,317,746 |

| The Saudi National Bank | | 1,578,900 | 19,285,655 |

TOTAL SAUDI ARABIA | | | 62,260,003 |

| Singapore - 0.3% | | | |

| First Resources Ltd. | | 6,169,000 | 7,321,027 |

| South Africa - 2.5% | | | |

| Capitec Bank Holdings Ltd. | | 133,699 | 12,672,983 |

| Discovery Ltd. (a) | | 1,427,800 | 11,182,629 |

| Impala Platinum Holdings Ltd. | | 1,868,900 | 17,196,399 |

| Naspers Ltd. Class N | | 58,290 | 10,800,809 |

| Pick 'n Pay Stores Ltd. | | 2,019,308 | 4,793,943 |

TOTAL SOUTH AFRICA | | | 56,646,763 |

| Taiwan - 10.4% | | | |

| ASPEED Tech, Inc. | | 12,663 | 1,102,016 |

| eMemory Technology, Inc. | | 87,975 | 5,400,049 |

| MediaTek, Inc. | | 710,313 | 18,362,893 |

| Novatek Microelectronics Corp. | | 93,707 | 1,327,811 |

| Realtek Semiconductor Corp. | | 269,745 | 3,433,259 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | | 10,789,457 | 188,539,326 |

| Uni-President Enterprises Corp. | | 4,349,000 | 10,251,525 |

| Wistron Corp. | | 833,000 | 1,143,471 |

| Wiwynn Corp. | | 169,974 | 6,288,207 |

| Yageo Corp. | | 72,575 | 1,261,511 |

TOTAL TAIWAN | | | 237,110,068 |

| Thailand - 0.8% | | | |

| Carabao Group PCL (For. Reg.) | | 2,768,800 | 7,803,894 |

| Land & House PCL (For. Reg.) | | 5,110,600 | 1,478,626 |

| PTT Global Chemical PCL (For. Reg.) | | 6,629,700 | 8,921,205 |

| Supalai PCL (For. Reg.) | | 1,343,800 | 876,585 |

TOTAL THAILAND | | | 19,080,310 |

| United Kingdom - 1.5% | | | |

| Antofagasta PLC | | 657,350 | 12,820,439 |

| Helios Towers PLC (a) | | 1,389,200 | 1,789,121 |

| OPT Machine Vision Tech Co. Ltd. ELS (UBS AG London Branch Bank Warrant Programme) Class A warrants 2/21/25 (a)(b) | | 86,000 | 1,736,744 |

| Prudential PLC | | 1,248,398 | 17,092,612 |

TOTAL UNITED KINGDOM | | | 33,438,916 |

| United States of America - 2.1% | | | |

| Dlocal Ltd. (a) | | 164,511 | 2,668,368 |

| FirstCash Holdings, Inc. | | 125,272 | 11,947,191 |

| Legend Biotech Corp. ADR (a) | | 34,226 | 1,650,378 |

| Li Auto, Inc. ADR (a)(c) | | 738,260 | 18,419,587 |

| MercadoLibre, Inc. (a) | | 9,100 | 11,994,346 |

TOTAL UNITED STATES OF AMERICA | | | 46,679,870 |

| TOTAL COMMON STOCKS (Cost $2,079,441,282) | | | 2,168,586,575 |

| | | | |

| Preferred Stocks - 2.4% |

| | | Shares | Value ($) |

| Convertible Preferred Stocks - 0.5% | | | |

| Cayman Islands - 0.1% | | | |

| Creditas Financial Solutions Ltd. Series F (a)(d)(e) | | 4,374 | 1,095,468 |

| China - 0.3% | | | |

| ByteDance Ltd. Series E1 (a)(d)(e) | | 30,246 | 6,403,381 |

| dMed Biopharmaceutical Co. Ltd. Series C (a)(d)(e) | | 52,588 | 466,456 |

| | | | 6,869,837 |

| India - 0.1% | | | |

| Meesho Series F (a)(d)(e) | | 33,863 | 2,343,320 |

TOTAL CONVERTIBLE PREFERRED STOCKS | | | 10,308,625 |

| Nonconvertible Preferred Stocks - 1.9% | | | |

| Brazil - 1.6% | | | |

| Companhia de Transmissao de Energia Eletrica Paulista (PN) (a) | | 658,900 | 2,817,106 |

| Metalurgica Gerdau SA (PN) | | 5,192,700 | 12,120,005 |

| Petroleo Brasileiro SA - Petrobras: | | | |

| (PN) sponsored ADR (non-vtg.) | | 1,152,400 | 10,694,272 |

| sponsored ADR | | 979,700 | 10,218,271 |

| | | | 35,849,654 |

| Korea (South) - 0.3% | | | |

| Hyundai Motor Co. Series 2 | | 94,887 | 6,983,455 |

| United States of America - 0.0% | | | |

| Gupshup, Inc. (a)(d)(e) | | 44,950 | 702,569 |

TOTAL NONCONVERTIBLE PREFERRED STOCKS | | | 43,535,678 |

| TOTAL PREFERRED STOCKS (Cost $48,745,689) | | | 53,844,303 |

| | | | |

| Government Obligations - 0.1% |

| | | Principal Amount (f) | Value ($) |

| United States of America - 0.1% | | | |

U.S. Treasury Bills, yield at date of purchase 4.47% to 4.63% 4/6/23 to 5/11/23 (Cost $3,124,794) | | 3,140,000 | 3,125,359 |

| | | | |

| Money Market Funds - 4.9% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 4.86% (g) | | 44,613,568 | 44,622,490 |

| Fidelity Securities Lending Cash Central Fund 4.87% (g)(h) | | 66,658,812 | 66,665,478 |

| TOTAL MONEY MARKET FUNDS (Cost $111,287,585) | | | 111,287,968 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 102.6% (Cost $2,242,599,350) | 2,336,844,205 |

NET OTHER ASSETS (LIABILITIES) - (2.6)% | (59,634,025) |

| NET ASSETS - 100.0% | 2,277,210,180 |

| | |

Security Type Abbreviations

| ELS | - | EQUITY-LINKED SECURITY |

Categorizations in the Schedule of Investments are based on country or territory of incorporation.

Legend

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $128,884,334 or 5.7% of net assets. |

| (c) | Security or a portion of the security is on loan at period end. |

| (d) | Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $11,683,250 or 0.5% of net assets. |

| (f) | Amount is stated in United States dollars unless otherwise noted. |

| (g) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (h) | Investment made with cash collateral received from securities on loan. |

| Additional information on each restricted holding is as follows: |

| Security | Acquisition Date | Acquisition Cost ($) |

| Ant International Co. Ltd. Class C | 5/16/18 | 1,663,286 |

| | | |

| ByteDance Ltd. Series E1 | 11/18/20 | 3,314,181 |

| | | |

| Creditas Financial Solutions Ltd. Series F | 1/28/22 | 1,377,733 |

| | | |

| dMed Biopharmaceutical Co. Ltd. Series C | 12/01/20 | 746,915 |

| | | |

| Gupshup, Inc. | 6/08/21 | 1,027,791 |

| | | |

| Meesho Series F | 9/21/21 | 2,596,355 |

| | | |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.86% | 23,156,025 | 566,891,774 | 545,425,309 | 807,446 | - | - | 44,622,490 | 0.1% |

| Fidelity Securities Lending Cash Central Fund 4.87% | 9,615,779 | 275,118,709 | 218,069,010 | 160,579 | - | - | 66,665,478 | 0.2% |

| Total | 32,771,804 | 842,010,483 | 763,494,319 | 968,025 | - | - | 111,287,968 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of March 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Equities: | | | | |

Communication Services | 236,308,835 | 77,323,240 | 150,950,131 | 8,035,464 |

Consumer Discretionary | 343,070,850 | 127,152,841 | 213,574,689 | 2,343,320 |

Consumer Staples | 144,325,622 | 74,510,677 | 69,585,876 | 229,069 |

Energy | 91,310,741 | 39,005,606 | 52,064,551 | 240,584 |

Financials | 479,746,209 | 203,584,731 | 273,843,314 | 2,318,164 |

Health Care | 79,302,164 | 41,823,378 | 37,012,330 | 466,456 |

Industrials | 107,908,629 | 63,963,905 | 43,944,724 | - |

Information Technology | 439,127,271 | 44,669,019 | 393,755,683 | 702,569 |

Materials | 200,937,974 | 122,539,534 | 78,388,207 | 10,233 |

Real Estate | 38,670,070 | 29,636,495 | 9,025,981 | 7,594 |

Utilities | 61,722,513 | 36,835,634 | 24,886,879 | - |

|

| Government Obligations | 3,125,359 | - | 3,125,359 | - |

|

| Money Market Funds | 111,287,968 | 111,287,968 | - | - |

| Total Investments in Securities: | 2,336,844,205 | 972,333,028 | 1,350,157,724 | 14,353,453 |

| Statement of Assets and Liabilities |

| | | | March 31, 2023 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $64,209,768) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $2,131,311,765) | $ | 2,225,556,237 | | |

Fidelity Central Funds (cost $111,287,585) | | 111,287,968 | | |

| | | | | |

| | | | | |

| Total Investment in Securities (cost $2,242,599,350) | | | $ | 2,336,844,205 |

| Foreign currency held at value (cost $8,230,719) | | | | 7,318,887 |

| Receivable for investments sold | | | | 6,646,965 |

| Receivable for fund shares sold | | | | 14,380 |

| Dividends receivable | | | | 6,473,648 |

| Interest receivable | | | | 2,987 |

| Distributions receivable from Fidelity Central Funds | | | | 262,668 |

| Other receivables | | | | 138,758 |

Total assets | | | | 2,357,702,498 |

| Liabilities | | | | |

| Payable to custodian bank | $ | 1,170,730 | | |

| Payable for investments purchased | | 7,557,966 | | |

| Payable for fund shares redeemed | | 1,685,382 | | |

| Other payables and accrued expenses | | 3,413,090 | | |

| Collateral on securities loaned | | 66,665,150 | | |

| Total Liabilities | | | | 80,492,318 |

| Net Assets | | | $ | 2,277,210,180 |

| Net Assets consist of: | | | | |

| Paid in capital | | | $ | 2,344,048,251 |

| Total accumulated earnings (loss) | | | | (66,838,071) |

| Net Assets | | | $ | 2,277,210,180 |

Net Asset Value , offering price and redemption price per share ($2,277,210,180 ÷ 11,822,758 shares) | | | $ | 192.61 |

| Statement of Operations |

| | | | Six months ended March 31, 2023 (Unaudited) |

| Investment Income | | | | |

| Dividends | | | $ | 20,451,700 |

| Non-Cash dividends | | | | 5,151,599 |

| Interest | | | | 35,291 |

| Income from Fidelity Central Funds (including $160,579 from security lending) | | | | 968,025 |

| Income before foreign taxes withheld | | | $ | 26,606,615 |

| Less foreign taxes withheld | | | | (2,783,841) |

| Total Income | | | | 23,822,774 |

| Expenses | | | | |

| Custodian fees and expenses | $ | 183,721 | | |

| Independent trustees' fees and expenses | | 3,533 | | |

| Interest | | 5,814 | | |

| Total Expenses | | | | 193,068 |

| Net Investment income (loss) | | | | 23,629,706 |

| Realized and Unrealized Gain (Loss) | | | | |

| Net realized gain (loss) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers (net of foreign taxes of $972,609) | | (70,744,442) | | |

| Foreign currency transactions | | 68,840 | | |

| Futures contracts | | 1,900,291 | | |

| Total net realized gain (loss) | | | | (68,775,311) |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investment Securities: | | | | |

| Unaffiliated issuers(net of increase in deferred foreign taxes of $109,895) | | 317,065,894 | | |

| Assets and liabilities in foreign currencies | | (263,603) | | |

| Total change in net unrealized appreciation (depreciation) | | | | 316,802,291 |

| Net gain (loss) | | | | 248,026,980 |

| Net increase (decrease) in net assets resulting from operations | | | $ | 271,656,686 |

| Statement of Changes in Net Assets |

| |

| | Six months ended March 31, 2023 (Unaudited) | | Year ended September 30, 2022 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 23,629,706 | $ | 50,153,926 |

| Net realized gain (loss) | | (68,775,311) | | (70,415,223) |

| Change in net unrealized appreciation (depreciation) | | 316,802,291 | | (732,341,671) |

| Net increase (decrease) in net assets resulting from operations | | 271,656,686 | | (752,602,968) |

| Distributions to shareholders | | (28,227,343) | | (175,351,726) |

| Affiliated share transactions | | | | |

| Proceeds from sales of shares | | 432,839,775 | | 889,582,434 |

| Reinvestment of distributions | | 28,227,343 | | 175,351,726 |

| Cost of shares redeemed | | (199,350,257) | | (267,629,838) |

Net increase (decrease) in net assets resulting from share transactions | | 261,716,861 | | 797,304,322 |

| Total increase (decrease) in net assets | | 505,146,204 | | (130,650,372) |

| | | | | |

| Net Assets | | | | |

| Beginning of period | | 1,772,063,976 | | 1,902,714,348 |

| End of period | $ | 2,277,210,180 | $ | 1,772,063,976 |

| | | | | |

| Other Information | | | | |

| Shares | | | | |

| Sold | | 2,270,756 | | 4,216,200 |

| Issued in reinvestment of distributions | | 149,974 | | 743,918 |

| Redeemed | | (1,118,570) | | (1,290,658) |

| Net increase (decrease) | | 1,302,160 | | 3,669,460 |

| | | | | |

Financial Highlights

| Fidelity® Emerging Markets Equity Central Fund |

| |

| | Six months ended (Unaudited) March 31, 2023 | | Years ended September 30, 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

Selected Per-Share Data | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 168.44 | $ | 277.72 | $ | 237.14 | $ | 210.61 | $ | 220.61 | $ | 246.26 |

| Income from Investment Operations | | | | | | | | | | | | |

Net investment income (loss) A,B | | 2.26 | | 5.84 | | 5.06 | | 3.85 | | 7.79 C | | 5.11 |

| Net realized and unrealized gain (loss) | | 24.71 | | (90.17) | | 40.55 | | 28.57 | | 1.52 | | (14.13) |

| Total from investment operations | | 26.97 | | (84.33) | | 45.61 | | 32.42 | | 9.31 | | (9.02) |

| Distributions from net investment income | | (2.80) | | (6.45) | | (5.03) | | (5.52) | | (4.54) | | (4.95) |

| Distributions from net realized gain | | - | | (18.50) | | - | | (.37) | | (14.76) | | (11.68) |

| Total distributions | | (2.80) | | (24.95) | | (5.03) | | (5.89) | | (19.31) D | | (16.63) |

| Net asset value, end of period | $ | 192.61 | $ | 168.44 | $ | 277.72 | $ | 237.14 | $ | 210.61 | $ | 220.61 |

Total Return E,F | | 16.05% | | (32.96)% | | 19.17% | | 15.71% | | 5.22% | | (4.20)% |

Ratios to Average Net Assets B,G,H | | | | | | | | | | | | |

| Expenses before reductions | | .02% I | | .02% | | .03% | | .05% | | .06% | | .07% |

| Expenses net of fee waivers, if any | | .02% I | | .02% | | .03% | | .05% | | .06% | | .07% |

| Expenses net of all reductions | | .02% I | | .02% | | .03% | | .05% | | .06% | | .07% |

| Net investment income (loss) | | 2.44% I | | 2.68% | | 1.74% | | 1.76% | | 3.73% C | | 2.07% |

| Supplemental Data | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | $ | 2,277,210 | $ | 1,772,064 | $ | 1,902,714 | $ | 1,986,807 | $ | 1,779,865 | $ | 663,813 |

Portfolio turnover rate J | | 48% I | | 58% | | 68% | | 50% | | 60% | | 65% |

A Calculated based on average shares outstanding during the period.

B Net investment income (loss) is affected by the timing of the declaration of dividends by any underlying mutual funds or exchange-traded funds (ETFs). Net investment income (loss) of any mutual funds or ETFs is not included in the Fund's net investment income (loss) ratio.

C Net investment income per share reflects one or more large, non-recurring dividend(s) which amounted to $2.72 per share. Excluding such non-recurring dividend(s), the ratio of net investment income (loss) to average net assets would have been 2.43%.

D Total distributions per share do not sum due to rounding.

E Total returns for periods of less than one year are not annualized.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

I Annualized.

J Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

For the period ended March 31, 2023

1. Organization.

Fidelity Emerging Markets Equity Central Fund (the Fund) is a fund of Fidelity Central Investment Portfolios LLC (the LLC) and is authorized to issue an unlimited number of shares. Shares of the Fund are only offered to other investment companies and accounts managed by Fidelity Management & Research Company LLC (FMR), or its affiliates (the Investing Funds). The LLC is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Delaware Limited Liability Company. The Fund's investments in emerging markets can be subject to social, economic, regulatory, and political uncertainties and can be extremely volatile.

2. Investments in Fidelity Central Funds.

Funds may invest in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Schedule of Investments lists any Fidelity Central Funds held as an investment as of period end, but does not include the underlying holdings of each Fidelity Central Fund. An investing fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

Based on its investment objective, each Fidelity Central Fund may invest or participate in various investment vehicles or strategies that are similar to those of the investing fund. These strategies are consistent with the investment objectives of the investing fund and may involve certain economic risks which may cause a decline in value of each of the Fidelity Central Funds and thus a decline in the value of the investing fund.

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

A Expenses expressed as a percentage of average net assets and are as of each underlying Central Fund's most recent annual or semi-annual shareholder report.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds which contain the significant accounting policies (including investment valuation policies) of those funds, and are not covered by the Report of Independent Registered Public Accounting Firm, are available on the Securities and Exchange Commission website or upon request.

3. Significant Accounting Policies.

The Fund is an investment company and applies the accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 Financial Services - Investment Companies . The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The Fund's Schedule of Investments lists any underlying mutual funds or exchange-traded funds (ETFs) but does not include the underlying holdings of these funds. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Directors (the Board) has designated the Fund's investment adviser as the valuation designee responsible for the fair valuation function and performing fair value determinations as needed. The investment adviser has established a Fair Value Committee (the Committee) to carry out the day-to-day fair valuation responsibilities and has adopted policies and procedures to govern the fair valuation process and the activities of the Committee. In accordance with these fair valuation policies and procedures, which have been approved by the Board, the Fund attempts to obtain prices from one or more third party pricing services or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with the policies and procedures. Factors used in determining fair value vary by investment type and may include market or investment specific events, transaction data, estimated cash flows, and market observations of comparable investments. The frequency that the fair valuation procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee manages the Fund's fair valuation practices and maintains the fair valuation policies and procedures. The Fund's investment adviser reports to the Board information regarding the fair valuation process and related material matters.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - unadjusted quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing service on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, ETFs and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing services or from brokers who make markets in such securities. U.S. government and government agency obligations are valued by pricing services who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing services. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The aggregate value of investments by input level as of March 31, 2023 is included at the end of the Fund's Schedule of Investments.

Foreign Currency. Certain Funds may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received, and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and include proceeds received from litigation. Commissions paid to certain brokers with whom the investment adviser, or its affiliates, places trades on behalf of a fund include an amount in addition to trade execution, which may be rebated back to a fund. Any such rebates are included in net realized gain (loss) on investments in the Statement of Operations. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain. Funds may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. Any withholding tax reclaims income is included in the Statement of Operations in foreign taxes withheld. Any receivables for withholding tax reclaims are included in the Statement of Assets and Liabilities in dividends receivable.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expenses included in the accompanying financial statements reflect the expenses of that fund and do not include any expenses associated with any underlying mutual funds or exchange-traded funds. Although not included in a fund's expenses, a fund indirectly bears its proportionate share of these expenses through the net asset value of each underlying mutual fund or exchange-traded fund. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests. The Fund is subject to a tax imposed on capital gains by certain countries in which it invests. An estimated deferred tax liability for net unrealized appreciation on the applicable securities is included in Other payables and accrued expenses on the Statement of Assets & Liabilities.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to futures contracts, foreign currency transactions, certain foreign taxes, passive foreign investment companies (PFIC) and losses deferred due to wash sales and excise tax regulations.

As of period end, the cost and unrealized appreciation (depreciation) in securities, and derivatives if applicable, for federal income tax purposes were as follows:

| Gross unrealized appreciation | $372,656,474 |

| Gross unrealized depreciation | (320,245,122) |

| Net unrealized appreciation (depreciation) | $52,411,352 |

| Tax cost | $2,284,432,853 |

The Fund elected to defer to its next fiscal year approximately $58,826,413 of capital losses recognized during the period November 1, 2021 to September 30, 2022.

Restricted Securities (including Private Placements). Funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time-consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities held at period end is included at the end of the Schedule of Investments, if applicable.

4. Derivative Instruments.

Risk Exposures and the Use of Derivative Instruments. The Fund's investment objectives allow for various types of derivative instruments, including futures contracts. Derivatives are investments whose value is primarily derived from underlying assets, indices or reference rates and may be transacted on an exchange or over-the-counter (OTC). Derivatives may involve a future commitment to buy or sell a specified asset based on specified terms, to exchange future cash flows at periodic intervals based on a notional principal amount, or for one party to make one or more payments upon the occurrence of specified events in exchange for periodic payments from the other party.

Derivatives were used to increase returns and to manage exposure to certain risks as defined below. The success of any strategy involving derivatives depends on analysis of numerous economic factors, and if the strategies for investment do not work as intended, the objectives may not be achieved.

Derivatives were used to increase or decrease exposure to the following risk(s):

| | |

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

Funds are also exposed to additional risks from investing in derivatives, such as liquidity risk and counterparty credit risk. Liquidity risk is the risk that a fund will be unable to close out the derivative in the open market in a timely manner. Counterparty credit risk is the risk that the counterparty will not be able to fulfill its obligation to a fund. Counterparty credit risk related to exchange-traded contracts may be mitigated by the protection provided by the exchange on which they trade.

Investing in derivatives may involve greater risks than investing in the underlying assets directly and, to varying degrees, may involve risk of loss in excess of any initial investment and collateral received and amounts recognized in the Statement of Assets and Liabilities. In addition, there may be the risk that the change in value of the derivative contract does not correspond to the change in value of the underlying instrument.

Futures Contracts. A futures contract is an agreement between two parties to buy or sell a specified underlying instrument for a fixed price at a specified future date. Futures contracts were used to manage exposure to the stock market.

Upon entering into a futures contract, a fund is required to deposit either cash or securities (initial margin) with a clearing broker in an amount equal to a certain percentage of the face value of the contract. Futures contracts are marked-to-market daily and subsequent daily payments are made or received by a fund depending on the daily fluctuations in the value of the futures contracts and are recorded as unrealized appreciation or (depreciation). This receivable and/or payable, if any, is included in daily variation margin on futures contracts in the Statement of Assets and Liabilities. Realized gain or (loss) is recorded upon the expiration or closing of a futures contract. The net realized gain (loss) and change in net unrealized appreciation (depreciation) on futures contracts during the period is presented in the Statement of Operations.

Any open futures contracts at period end are presented in the Schedule of Investments under the caption "Futures Contracts". The notional amount at value reflects each contract's exposure to the underlying instrument or index at period end, and is representative of volume of activity during the period unless an average notional amount is presented. Any securities deposited to meet initial margin requirements are identified in the Schedule of Investments. Any cash deposited to meet initial margin requirements is presented as segregated cash with brokers for derivative instruments in the Statement of Assets and Liabilities.

5. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities, U.S. government securities and in-kind transactions, as applicable, are noted in the table below.

| | Purchases ($) | Sales ($) |

| Fidelity Emerging Markets Equity Central Fund | 691,544,411 | 454,321,148 |

6. Fees and Other Transactions with Affiliates.

Management Fee and Expense Contract. Fidelity Management & Research Company LLC (the investment adviser) provides the Fund with investment management services. The Fund does not pay any fees for these services. Pursuant to the Fund's management contract, the investment adviser receives a monthly management fee that represents a portion of the management fees it receives from the Investing Funds. In addition, under an expense contract, the investment adviser also pays all other expenses of the Fund, excluding custody fees, the compensation of the independent Directors, and certain miscellaneous expenses such as proxy and shareholder meeting expenses.

Brokerage Commissions. A portion of portfolio transactions were placed with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were as follows:

| | Amount |

| Fidelity Emerging Markets Equity Central Fund | $5,411 |

Interfund Lending Program. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the Fund, along with other registered investment companies having management contracts with FMR, or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the Fund to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. Activity in this program during the period for which loans were outstanding was as follows:

| | Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense |

Fidelity Emerging Markets Equity Central Fund | Borrower | $ 25,746,500 | 4.07% | $ 5,814 |

Interfund Trades. Funds may purchase from or sell securities to other Fidelity Funds under procedures adopted by the Board. The procedures have been designed to ensure these interfund trades are executed in accordance with Rule 17a-7 of the 1940 Act. Any interfund trades are included within the respective purchases and sales amounts shown in the Purchases and Sales of Investments note. Interfund trades during the period are noted in the table below.

| | Purchases ($) | Sales ($) | Realized Gain (Loss) ($) |

| Fidelity Emerging Markets Equity Central Fund | 6,415,515 | 11,197,541 | (1,816,020) |

7. Security Lending.

Funds lend portfolio securities from time to time in order to earn additional income. Lending agents are used, including National Financial Services (NFS), an affiliate of the investment adviser. Pursuant to a securities lending agreement, NFS will receive a fee, which is capped at 9.9% of a fund's daily lending revenue, for its services as lending agent. A fund may lend securities to certain qualified borrowers, including NFS. On the settlement date of the loan, a fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of a fund and any additional required collateral is delivered to a fund on the next business day. A fund or borrower may terminate the loan at any time, and if the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, a fund may apply collateral received from the borrower against the obligation. A fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. Any loaned securities are identified as such in the Schedule of Investments, and the value of loaned securities and cash collateral at period end, as applicable, are presented in the Statement of Assets and Liabilities. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Affiliated security lending activity, if any, was as follows:

| | Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End |

| Fidelity Emerging Markets Equity Central Fund | $ 17,174 | $ 210 | $- |

8. Other.

A fund's organizational documents provide former and current directors and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the fund. In the normal course of business, a fund may also enter into contracts that provide general indemnifications. A fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against a fund. The risk of material loss from such claims is considered remote.

At the end of the period, mutual funds managed by the investment adviser or its affiliates were the owners of record of all of the outstanding shares of the Fund.

9. Risk and Uncertainties.

Many factors affect a fund's performance. Developments that disrupt global economies and financial markets, such as pandemics, epidemics, outbreaks of infectious diseases, war, terrorism, and environmental disasters, may significantly affect a fund's investment performance. The effects of these developments to a fund will be impacted by the types of securities in which a fund invests, the financial condition, industry, economic sector, and geographic location of an issuer, and a fund's level of investment in the securities of that issuer. Significant concentrations in security types, issuers, industries, sectors, and geographic locations may magnify the factors that affect a fund's performance.

As a shareholder, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments or redemption proceeds, as applicable and (2) ongoing costs, which generally include management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2022 to March 31, 2023). |

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class/Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. If any fund is a shareholder of any underlying mutual funds or exchange-traded funds (ETFs) (the Underlying Funds), such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses incurred presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. If any fund is a shareholder of any Underlying Funds, such fund indirectly bears its proportional share of the expenses of the Underlying Funds in addition to the direct expenses as presented in the table. These fees and expenses are not included in the annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | Annualized Expense Ratio- A | | Beginning Account Value October 1, 2022 | | Ending Account Value March 31, 2023 | | Expenses Paid During Period- C October 1, 2022 to March 31, 2023 |

| | | | | | | | | | |

| Fidelity® Emerging Markets Equity Central Fund | | | | .0199% | | | | | | |

| Actual | | | | | | $ 1,000 | | $ 1,160.50 | | $ .11 |

Hypothetical- B | | | | | | $ 1,000 | | $ 1,024.83 | | $ .10 |

| |

A Annualized expense ratio reflects expenses net of applicable fee waivers.

B 5% return per year before expenses

C Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 182/ 365 (to reflect the one-half year period). The fees and expenses of any Underlying Funds are not included in each annualized expense ratio.

The Securities and Exchange Commission adopted Rule 22e-4 under the Investment Company Act of 1940 (the Liquidity Rule) to promote effective liquidity risk management throughout the open-end investment company industry, thereby reducing the risk that funds will be unable to meet their redemption obligations and mitigating dilution of the interests of fund shareholders.

The Fund has adopted and implemented a liquidity risk management program (the Program) reasonably designed to assess and manage the Fund's liquidity risk and to comply with the requirements of the Liquidity Rule. The Fund's Board of Trustees (the Board) has designated the Fund's investment adviser as administrator of the Program. The Fidelity advisers have established a Liquidity Risk Management Committee (the LRM Committee) to manage the Program for each of the Fidelity Funds. The LRM Committee monitors the adequacy and effectiveness of implementation of the Program and on a periodic basis assesses each Fund's liquidity risk based on a variety of factors including (1) the Fund's investment strategy, (2) portfolio liquidity and cash flow projections during normal and reasonably foreseeable stressed conditions, (3) shareholder redemptions, (4) borrowings and other funding sources and (5) certain factors specific to ETFs including the effect of the Fund's prices and spreads, market participants, and basket compositions on the overall liquidity of the Fund's portfolio, as applicable.

In accordance with the Program, each of the Fund's portfolio investments is classified into one of four defined liquidity categories based on a determination of a reasonable expectation for how long it would take to convert the investment to cash (or sell or dispose of the investment) without significantly changing its market value.

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

Liquidity classification determinations take into account a variety of factors including various market, trading and investment-specific considerations, as well as market depth, and generally utilize analysis from a third-party liquidity metrics service.

The Liquidity Rule places a 15% limit on a fund's illiquid investments and requires funds that do not primarily hold assets that are highly liquid investments to determine and maintain a minimum percentage of the fund's net assets to be invested in highly liquid investments (highly liquid investment minimum or HLIM). The Program includes provisions reasonably designed to comply with the 15% limit on illiquid investments and for determining, periodically reviewing and complying with the HLIM requirement as applicable.

At a recent meeting of the Fund's Board of Trustees, the LRM Committee provided a written report to the Board pertaining to the operation, adequacy, and effectiveness of the Program for the period December 1, 2021 through November 30, 2022. The report concluded that the Program is operating effectively and is reasonably designed to assess and manage the Fund's liquidity risk.

1.876936.114

EMQ-SANN-0523

Fidelity® Real Estate Equity Central Fund

Semi-Annual Report

March 31, 2023

Contents

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2023 FMR LLC. All rights reserved.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

Top Holdings (% of Fund's net assets) |

| |

| Prologis (REIT), Inc. | 14.1 | |

| Equinix, Inc. | 10.3 | |

| CubeSmart | 7.1 | |

| Mid-America Apartment Communities, Inc. | 5.4 | |

| Ventas, Inc. | 5.0 | |

| Essex Property Trust, Inc. | 4.1 | |

| Welltower, Inc. | 3.9 | |

| Equity Lifestyle Properties, Inc. | 3.9 | |

| Invitation Homes, Inc. | 3.7 | |

| Alexandria Real Estate Equities, Inc. | 3.6 | |

| | 61.1 | |

| |

| Market Sectors (% of Fund's net assets) |

| |

| REITs - Warehouse/Industrial | 18.6 | |

| REITs - Diversified | 18.5 | |

| REITs - Apartments | 16.3 | |

| REITs - Storage | 10.4 | |

| REITs - Health Care | 10.3 | |

| |

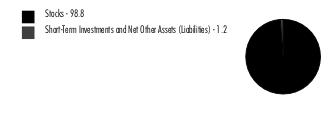

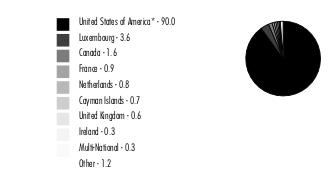

Asset Allocation (% of Fund's net assets) |

|

|

Showing Percentage of Net Assets

| Common Stocks - 98.8% |

| | | Shares | Value ($) |

| Commercial Services & Supplies - 0.7% | | | |

| REITs - Diversified - 0.7% | | | |

| The GEO Group, Inc. (a)(b) | | 898,100 | 7,086,009 |

| Equity Real Estate Investment Trusts (REITs) - 96.9% | | | |

| REITs - Apartments - 16.3% | | | |

| Essex Property Trust, Inc. | | 190,219 | 39,782,402 |

| Invitation Homes, Inc. | | 1,136,704 | 35,499,266 |

| Mid-America Apartment Communities, Inc. | | 343,100 | 51,821,824 |

| UDR, Inc. | | 725,382 | 29,784,185 |

| | | | 156,887,677 |

| REITs - Diversified - 17.8% | | | |

| Crown Castle International Corp. | | 99,400 | 13,303,696 |

| Digital Realty Trust, Inc. | | 93,700 | 9,211,647 |

| Equinix, Inc. | | 138,238 | 99,675,128 |

| Lamar Advertising Co. Class A | | 275,300 | 27,499,717 |

| Outfront Media, Inc. | | 151,400 | 2,457,222 |

| VICI Properties, Inc. | | 591,531 | 19,295,741 |

| | | | 171,443,151 |

| REITs - Health Care - 10.3% | | | |

| CareTrust (REIT), Inc. | | 675,400 | 13,224,332 |

| Ventas, Inc. | | 1,116,094 | 48,382,675 |

| Welltower, Inc. | | 522,666 | 37,469,926 |

| | | | 99,076,933 |

| REITs - Hotels - 4.2% | | | |

| Host Hotels & Resorts, Inc. | | 610,600 | 10,068,794 |

| Ryman Hospitality Properties, Inc. | | 344,700 | 30,929,931 |

| | | | 40,998,725 |

| REITs - Management/Investment - 1.1% | | | |

| LXP Industrial Trust (REIT) | | 1,055,637 | 10,883,617 |

| REITs - Manufactured Homes - 3.9% | | | |

| Equity Lifestyle Properties, Inc. | | 557,400 | 37,418,262 |

| REITs - Office Property - 3.6% | | | |

| Alexandria Real Estate Equities, Inc. | | 275,180 | 34,559,856 |

| REITs - Shopping Centers - 5.0% | | | |

| SITE Centers Corp. | | 2,033,900 | 24,976,292 |

| Urban Edge Properties (b) | | 1,555,700 | 23,428,842 |

| | | | 48,405,134 |

| REITs - Single Tenant - 5.7% | | | |

| Four Corners Property Trust, Inc. | | 1,064,900 | 28,603,214 |

| Spirit Realty Capital, Inc. | | 654,300 | 26,067,312 |

| | | | 54,670,526 |

| REITs - Storage - 10.4% | | | |

| CubeSmart | | 1,487,019 | 68,730,018 |

| Public Storage | | 103,800 | 31,362,132 |

| | | | 100,092,150 |

| REITs - Warehouse/Industrial - 18.6% | | | |

| EastGroup Properties, Inc. | | 145,700 | 24,087,124 |

| Prologis (REIT), Inc. | | 1,089,537 | 135,941,530 |

| Terreno Realty Corp. | | 293,916 | 18,986,974 |

| | | | 179,015,628 |

TOTAL EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS) | | | 933,451,659 |

| IT Services - 0.1% | | | |

| Internet Services & Infrastructure - 0.1% | | | |

| Cyxtera Technologies, Inc. Class A (a)(b) | | 1,742,327 | 532,107 |

| Real Estate Management & Development - 1.1% | | | |

| Real Estate Operating Companies - 0.2% | | | |

| WeWork, Inc. (a)(b) | | 2,251,600 | 1,750,169 |

| Real Estate Services - 0.9% | | | |

| CBRE Group, Inc. (a) | | 124,000 | 9,028,440 |

TOTAL REAL ESTATE MANAGEMENT & DEVELOPMENT | | | 10,778,609 |

| TOTAL COMMON STOCKS (Cost $891,853,849) | | | 951,848,384 |

| | | | |

| Money Market Funds - 0.8% |

| | | Shares | Value ($) |

| Fidelity Cash Central Fund 4.86% (c) | | 4,548,301 | 4,549,211 |

| Fidelity Securities Lending Cash Central Fund 4.87% (c)(d) | | 2,597,559 | 2,597,819 |

| TOTAL MONEY MARKET FUNDS (Cost $7,147,030) | | | 7,147,030 |

| | | | |

| TOTAL INVESTMENT IN SECURITIES - 99.6% (Cost $899,000,879) | 958,995,414 |

NET OTHER ASSETS (LIABILITIES) - 0.4% | 4,177,082 |

| NET ASSETS - 100.0% | 963,172,496 |

| | |

Legend

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

Affiliated Central Funds

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.86% | 11,883,685 | 152,522,765 | 159,857,239 | 214,176 | - | - | 4,549,211 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.87% | 21,869,667 | 44,260,297 | 63,532,145 | 97,951 | - | - | 2,597,819 | 0.0% |

| Total | 33,753,352 | 196,783,062 | 223,389,384 | 312,127 | - | - | 7,147,030 | |

| | | | | | | | | |

Amounts in the dividend income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line item in the Statement of Operations, if applicable.

Amounts in the dividend income column for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Amounts included in the purchases and sales proceeds columns may include in-kind transactions, if applicable.

Investment Valuation

The following is a summary of the inputs used, as of March 31, 2023, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: |

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | | | | |

|

| Common Stocks | 951,848,384 | 951,848,384 | - | - |

|

| Money Market Funds | 7,147,030 | 7,147,030 | - | - |

| Total Investments in Securities: | 958,995,414 | 958,995,414 | - | - |

| Statement of Assets and Liabilities |

| | | | March 31, 2023 (Unaudited) |

| | | | | |

| Assets | | | | |

| Investment in securities, at value (including securities loaned of $2,056,885) - See accompanying schedule: | | | | |

Unaffiliated issuers (cost $891,853,849) | $ | 951,848,384 | | |

Fidelity Central Funds (cost $7,147,030) | | 7,147,030 | | |

| | | | | |

| | | | | |